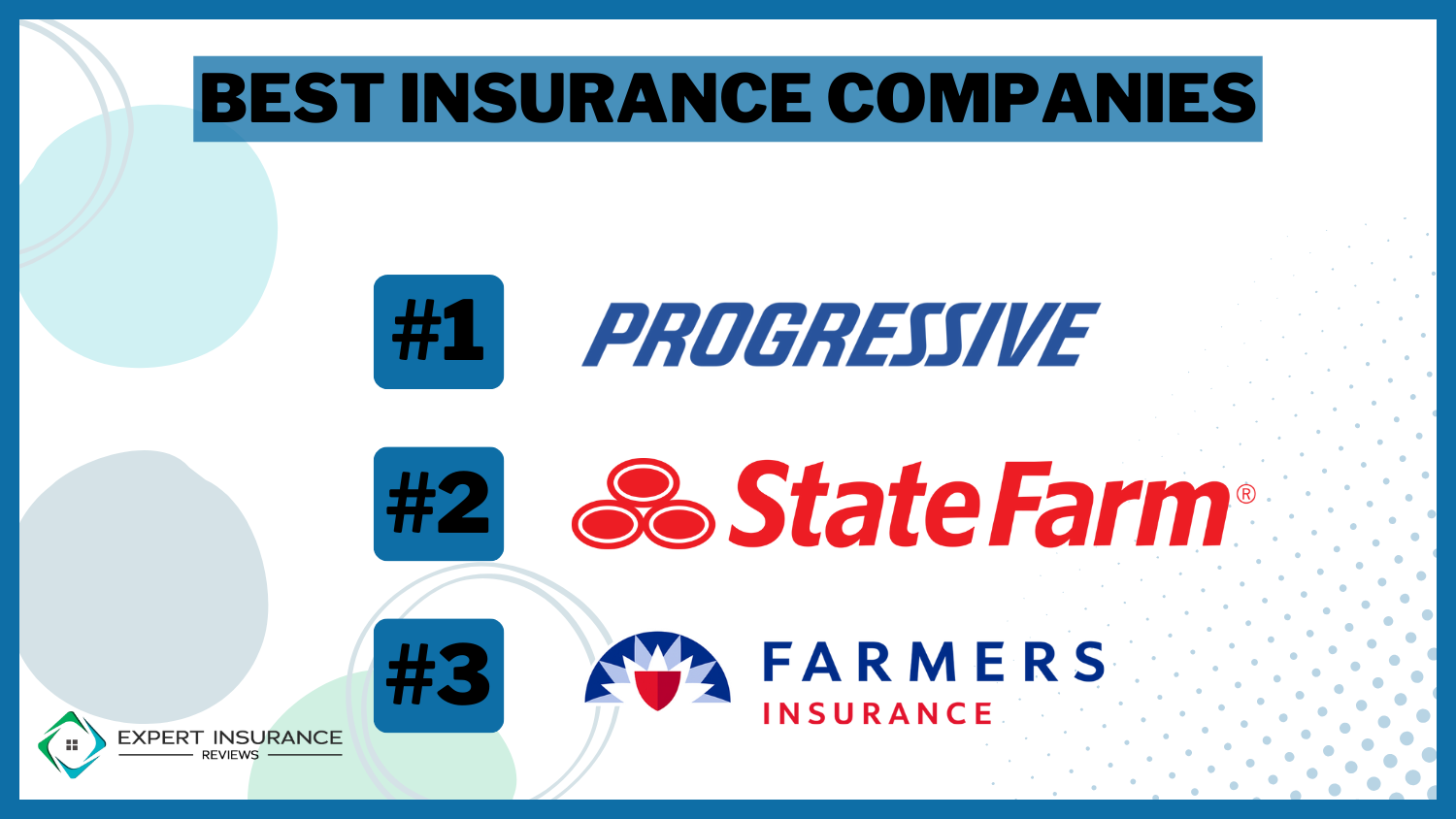

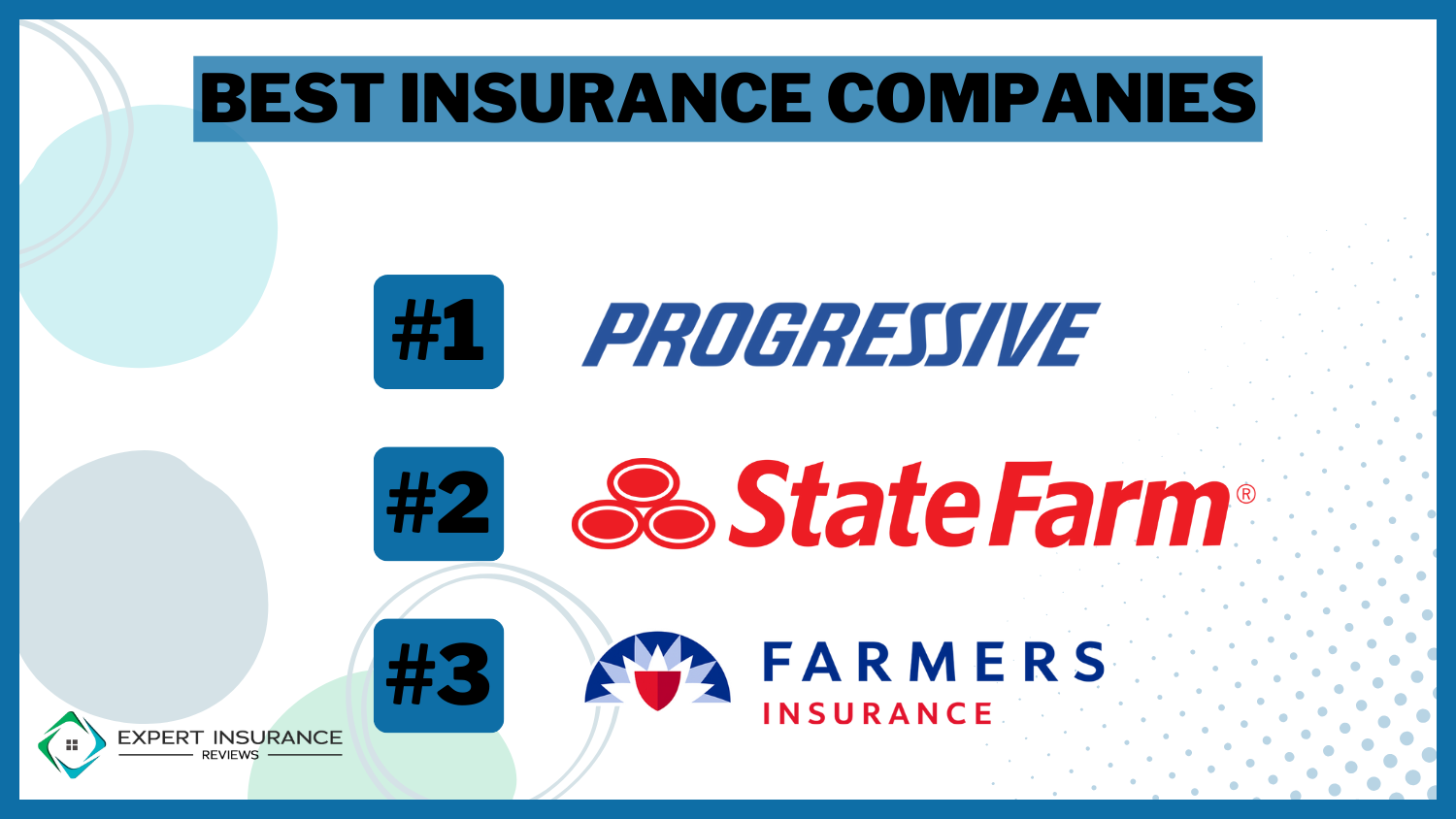

9 Best Insurance Companies in 2025 (Check Out These Providers)

The best insurance companies are Progressive, State Farm, and Farmers, offering full coverage plans as low as $86 per month. Highlighting comprehensive coverage and competitive rates, their emphasis on affordability and reliability makes them appealing options for individuals seeking financial security.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Licensed Insurance Agent

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Best Insurance Companies

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 3,072 reviews

3,072 reviewsCompany Facts

Full Coverage for Best Insurance Companies

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviewsThe best insurance companies that stand out are Progressive, State Farm, and Farmers, each offering full coverage plans starting as low as $86 per month.

These companies are lauded for their comprehensive coverage and competitive rates, making them ideal for individuals seeking financial security without compromising on quality.

Enter your ZIP code below to compare rates from the top providers near you.

Liberty Mutual, in particular, is highlighted for its exceptional full coverage auto insurance and high customer satisfaction ratings, making it a standout choice.

Our Top 9 Picks: Best Insurance Companies

| Company | Rank | Good Driver Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 30% | A+ | Customizable Premiums | Progressive | |

| #2 | 25% | B | Young Drivers | State Farm | |

| #3 | 30% | A | Essential Workers | Farmers | |

| #4 | 40% | A+ | Flexible Policies | Nationwide |

| #5 | 26% | A++ | Digital Experience | Geico | |

| #6 | 25% | A+ | Usage-Based Savings | Allstate | |

| #7 | 30% | A++ | Military Families | USAA | |

| #8 | 30% | A | Roadside Assistance | AAA |

| #9 | 25% | A | Customer Satisfaction | American Family |

By comparing quotes from these leading providers, consumers can ensure they secure the best possible insurance tailored to their needs and budget.

- Review Directory

- eRenterPlan Renters Insurance Review (2025)

- UnitedHealthcare Short-Term Insurance Review (2025)

- Aetna Dental Insurance Review (2025)

- Tokio Marine HCC Insurance Review & Complaints: Travel Insurance (2025)

- HTH Worldwide Insurance Review & Complaints: Travel Insurance (2025)

- April International Travel Insurance Review & Complaints: Travel Medical Insurance (2025)

- Trawick International Insurance Review & Complaints: Travel Insurance (2025)

- Tin Leg Insurance Review & Complaints: Travel Insurance (2025)

- Medjet Assist Insurance Review & Complaints: Medical Evacuation Insurance (2025)

- Allianz Global Assistance Insurance Review & Complaints: Travel Insurance (2025)

- Travel Guard Insurance Review & Complaints: Travel Insurance (2025)

- Progressive Mobile App Review (See What Users Have to Say in 2025)

- Life Insurance Companies

- Best Whole Life Insurance Companies

- Best Term Life Insurance Companies

- Best No-Exam Life Insurance Companies

- Big Lou Life Insurance Review & Complaints (2025)

- Foresters Financial Final Expense Insurance Review & Complaints: Life & Retirement Insurance (2025)

- CNO Financial Group Insurance Review & Complaints: Life Insurance (2025)

- Lincoln Heritage Life Insurance Review & Complaints (2025)

- Nassau RE Life Insurance Review & Complaints (2025)

- Accordia Life Insurance Review & Complaints (2025)

- Great Western Insurance Review & Complaints (2025)

- AARP Life Insurance Program from New York Life Insurance Company Review (2025)

- Nassau Re Insurance Review & Complaints (2025)

- WAEPA Insurance Review & Complaints: Life Insurance (2025)

- FEGLI Insurance Review & Complaints (2025)

- Investor’s Heritage Life Insurance Review & Complaints: Life Insurance (2025)

- Aflac Insurance Review & Complaints: Accident, Life & Illness Insurance (2025)

- Aetna Final Expense Insurance: Complete Guide & Review (2025)

- TruStage Insurance Review & Complaints (2025)

- Ladder Life Insurance Review & Complaints: Life Insurance (2025)

- Settlers Life Insurance Review & Complaints: Final Expense Insurance (2025)

- Nassau Re Final Expense Insurance Review & Complaints: Life Insurance (2025)

- Liberty Bankers Life Insurance Company Review & Complaints (2025)

- United Home Life Insurance Company Review & Complaints: Final Expense Insurance (2025)

- Prosperity Life Insurance Final Expense Review & Complaints: Life Insurance (2025)

- Americo Final Expense Insurance Review & Complaints: Life Insurance (2025)

- American Amicable Final Expense Insurance Review & Complaints: Life Insurance (2025)

- Voya Financial Insurance Review & Complaints: Life & Retirement Insurance (2025)

- United Heritage Insurance Review & Complaints: Car, Life & Homeowners Insurance (2025)

- United American Insurance Company Review & Complaints: Life & Health Insurance (2025)

- Security Mutual Life Insurance Review & Complaints: Life Insurance (2025)

- Pioneer American Insurance Company Review & Complaints: Life Insurance (2025)

- Vantis Life Insurance Review & Complaints: Life Insurance (2025)

- Great American Life Insurance Company Review & Complaints: Life Insurance (2025)

- Symetra Life Insurance Company Review & Complaints: Life Insurance (2025)

- SBLI Insurance Review & Complaints: Life Insurance (2025)

- Navy Mutual Insurance Review & Complaints: Life Insurance (2025)

- National Life Group Insurance Review & Complaints: Life Insurance & Annuities (2025)

- Pride Life Insurance Review & Complaints: Life Insurance (2025)

- Primerica Insurance Review & Complaints: Life Insurance (2025)

- Mutual of Omaha Insurance Review & Complaints: Life Insurance (2025)

- Reliance Standard Insurance Review & Complaints: Life & Health Insurance (2025)

- Knights of Columbus Insurance Review & Complaints: Life Insurance (2025)

- Colonial Life Insurance Review & Complaints: Life & Health Insurance (2025)

- Banner Life Insurance Review & Complaints (2025)

- Christian Fidelity Life Insurance Company Medicare Insurance Review & Complaints: Health Insurance (2025)

- Family Life Insurance Company Review & Complaints: Medicare (2025)

- Equitable Life Medicare Insurance Review & Complaints: Life & Health Insurance (2025)

- Old American Insurance Company Review & Complaints: Life Insurance (2025)

- AXA Life Insurance Review & Complaints (2025)

- Principal Financial Group Insurance Review & Complaints: Life Insurance (2025)

- Lincoln Financial Group Insurance Review & Complaints: Life Insurance (2025)

- Guardian Life Insurance Review & Complaints: Life, Disability & Dental Insurance (2025)

- Genworth Financial Insurance Review & Complaints: Long-term Care & Mortgage Insurance (2025)

- Colonial Penn Insurance Review & Complaints: Life Insurance (2025)

- United National Life Insurance Review & Complaints (2025)

- Standard Life and Accident Insurance Company Review & Complaints: Life & Health Insurance (2025)

- New Era Life Insurance Review & Complaints: Life, Accident & Dental Insurance (2025)

- Old Surety Life Insurance Company Review & Complaints: Life Insurance (2025)

- GCU Insurance Review & Complaints: Life, Annuities & Medicare Supplement Insurance (2025)

- Loyal Christian Benefit Association Insurance Review & Complaints: Medicare & Life Insurance (2025)

- Bankers Fidelity Life Insurance Company Review & Complaints: Life & Medicare Supplement Insurance (2025)

- Oxford Life Insurance Company Review & Complaints: Life, Medical Supplement Insurance & Annuities (2025)

- Family Life Insurance Company

- MONY Life Insurance Review & Complaints (2025)

- Veterans Group Life Insurance Review & Complaints: Life Insurance (2025)

- Royal Neighbors of America Insurance Review & Complaints: Life Insurance (2025)

- The IHC Group Insurance Review & Complaints (2025)

- Modern Woodmen of America Insurance Review & Complaints: Life Insurance (2025)

- Security National Life Insurance Review & Complaints: Funeral & Final Expense Insurance (2025)

- Western & Southern Life Insurance Review & Complaints: Life Insurance & Annuities (2025)

- Pioneer Security Life Insurance Review & Complaints: Life Insurance (2025)

- Midland National Life Insurance Review & Complaints: Life Insurance (2025)

- Manhattan Life Insurance Review & Complaints:Medicare (2025)

- WoodmenLife Insurance Review & Complaints: Life Insurance & Annuities (2025)

- Sagicor Life Insurance Company Review & Complaints: Life Insurance (2025)

- Boston Mutual Life Insurance Review & Complaints: Life Insurance (2025)

- Pan-American Life Insurance Review & Complaints: Life, Health & Accident Insurance (2025)

- OneAmerica Insurance Review & Complaints: Life Insurance (2025)

- Atlanta Life Insurance Review & Complaints: Life & Business Insurance (2025)

- Foresters Financial Insurance Review & Complaints: Life Insurance (2025)

- Family Heritage Life Insurance Review & Complaints: Life & Health Insurance (2025)

- Mutual of America Insurance Review & Complaints: Life Insurance (2025)

- American General Life Insurance Review & Complaints: Life Insurance (2025)

- AIG Insurance Review & Complaints: Life, Travel, & Business Insurance (2025)

- Thrivent Financial Insurance Review & Complaints: Life & Supplemental Insurance (2025)

- Northwestern Mutual Insurance Review & Complaints: Life, Disability & Long-term Care Insurance (2025)

- TIAA-CREF Insurance Review & Complaints: Life Insurance & Annuities (2025)

- Prudential Insurance Review & Complaints: Life Insurance (2025)

- Allianz Life Insurance Review & Complaints: Life Insurance (2025)

- Sun Life Financial Insurance Review & Complaints: Life, Disability & Dental Insurance (2025)

- MetLife Insurance Review & Complaints: Life, Home & Auto Insurance (2025)

- Globe Life Insurance Review & Complaints: Life Insurance (2025)

- Transamerica Insurance Review & Complaints: Life Insurance (2025)

- Great-West Financial Insurance Review & Complaints: Life Insurance (2025)

- North American Company Insurance Review & Complaints: Life & Retirement Insurance (2025)

- Physicians Mutual Insurance Review & Complaints: Life and Health Insurance (2025)

- Minnesota Life Insurance Review & Complaints: Life Insurance (2025)

- Bankers Life Insurance Review & Complaints: Life Insurance (2025)

- The Standard Insurance Review & Complaints: Business & Disability Insurance (2025)

- Gerber Life Insurance Review & Complaints: Life Insurance (2025)

- Penn Mutual Life Insurance Review & Complaints: Life Insurance (2025)

- Monumental Life Insurance Review & Complaints: Life Insurance (2025)

- American Income Life Insurance Review & Complaints (2025)

- American Fidelity Assurance Insurance Review & Complaints: Health & Life Insurance (2025)

- Pacific Life Insurance Review & Complaints: Life Insurance (2025)

- Jackson National Life Insurance Company Review & Complaints (2025)

- Business Insurance Companies

- Everything You Need to Know About MMG Insurance in 2025

- CNA Insurance Review & Complaints: Commercial Insurance (2025)

- Berkley Southeast Insurance Group Insurance Review & Complaints: Commercial Insurance (2025)

- Berkshire Hathaway Homestate Insurance Review & Complaints: Commercial Auto, Property and Casualty & Worker’s Compensation Insurance (2025)

- Berkley Oil & Gas Insurance Review & Complaints: Commercial Insurance (2025)

- Meadowbrook Insurance Group Review & Complaints: Business Insurance (2025)

- Markel Insurance Review & Complaints: Personal & Commercial Insurance (2025)

- Arch Insurance Review & Complaints: Business Insurance (2025)

- 1st Guard Insurance Review & Complaints: Trucking Insurance (2025)

- Amerisure Insurance Review & Complaints: Commercial Insurance (2025)

- Colony Specialty Insurance Review & Complaints: Commercial Insurance (2025)

- Lancer Insurance Company Review & Complaints: Business Insurance (2025)

- Canal Insurance Company Review & Complaints: Commercial Truck Insurance (2025)

- AmTrust Financial Insurance Review & Complaints: Business Insurance (2025)

- Great American Insurance Review & Complaints: Commercial, Agricultural & Personal Insurance (2025)

- Northland Insurance Review & Complaints: Commercial Car Insurance (2025)

- K&K Insurance Review & Complaints: Sports & Recreation Insurance (2025)

- Church Mutual Insurance Company Review & Complaints: Commercial Insurance (2025)

- Scottsdale Insurance Review & Complaints: Commercial & Home Insurance

- Auto Insurance Companies

- AssuranceAmerica Insurance Review & Complaints: Car Insurance (2025)

- AARP Auto Insurance Program from The Hartford Review (2025)

- USAA Insurance Review & Complaints: Life, Home, & Auto Insurance (2025)

- Universal Insurance Company Insurance Review & Complaints: Auto & Motorcycle Insurance (2025)

- Indiana Farmers Mutual Insurance Review & Complaints: Auto, Home, Farm & Business Insurance (2025)

- Geico vs. Liberty Mutual Car Insurance: Expert Recommended (2025)

- Elephant Insurance Review & Complaints: Car Insurance (2025)

- Electric Insurance Review & Complaints: Home & Auto Insurance (2025)

- eFinancial Insurance Review & Complaints: Life, Auto & Home Insurance (2025)

- DTRIC Insurance Review & Complaints: Auto, Home, Umbrella & Commercial Insurance (2025)

- Donegal Insurance Group Review & Complaints: Home, Auto, Boat, Umbrella & Business Insurance (2025)

- Co-Operators General Insurance Review & Complaints: Auto, Home, Life & Business Insurance (2025)

- Alliance United Insurance Review & Complaints: Car Insurance (2025)

- Aspire Insurance Review & Complaints: Car Insurance (2025)

- SafeAuto Insurance Review & Complaints: Car Insurance (2025)

- Encova Insurance Company Review & Complaints: Auto, Homeowners & Life Insurance (2025)

- Harley Davidson Insurance Review & Complaints: Car Insurance (2025)

- Troubleshooting Why Your Allstate App is Not Working

- Stonewood Car Insurance Services Review & Complaints (2025)

- Shipt Car Insurance: What To Know & How To Save (2025)

- Automobile Club of Southern California Life Insurance Review & Complaints (2025)

- Inshur Car Insurance Review & Complaints (2025)

- Best Car Insurance Company That Only Goes Back Five Years (2025)

- Best Car Insurance Company That Offers Car and Trucking Insurance (2025)

- Noblr Insurance Review & Complaints (2025)

- Root Insurance Review & Complaints (2025)

- 10 Best Car Insurance Companies That Accept Discover Card in 2025 (Top Providers Ranked)

- Best Bodily Injury Liability (BIL) Coverage Car Insurance Company (2025)

- Best Car Insurance Company for Paying Claims (2025)

- USAA SafePilot: Complete Guide & Review (2025)

- Caviar Courier Car Insurance: What to Know & How to Save (2025)

- Geico DriveEasy: Complete Guide & Review (2025)

- Farmers Signal: Complete Guide & Review (2025)

- American Family KnowYourDrive: Complete Guide & Review (2025)

- Travelers vs. USAA Car Insurance: Expert Recommended (2025)

- State Farm vs. USAA Car Insurance: Expert Recommended (2025)

- State Farm vs. Travelers Car Insurance: Expert Recommended (2025)

- Geico vs. USAA Car Insurance: Expert Recommended (2025)

- Progressive vs. USAA Car Insurance: Expert Recommended (2025)

- Geico vs. Nationwide Car Insurance: Expert Recommended (2025)

- Geico vs. Travelers Car Insurance: Expert Recommended (2025)

- Geico vs. Progressive Car Insurance: Expert Recommended (2025)

- Liberty Mutual vs. Travelers Car Insurance: Expert Recommended (2025)

- Liberty Mutual vs. Nationwide Car Insurance: Expert Recommended (2025)

- Liberty Mutual vs. Progressive Car Insurance: Expert Recommended (2025)

- Travelers vs. Progressive Car Insurance: Expert Recommended (2025)

- Nationwide vs. USAA Car Insurance: Expert Recommended (2025)

- Liberty Mutual vs. USAA Car Insurance: Expert Recommended (2025)

- Nationwide vs. Travelers Car Insurance: Expert Recommended (2025)

- Nationwide vs. State Farm Car Insurance: Expert Recommended (2025)

- Farmers vs. Travelers Car Insurance: Expert Recommended (2025)

- Farmers vs. State Farm Car Insurance: Expert Recommended (2025)

- Farmers vs. Progressive Car Insurance: Expert Recommended (2025)

- Allstate vs. USAA Car Insurance: Expert Recommended (2025)

- Farmers vs. Liberty Mutual Car Insurance: Expert Recommended (2025)

- Farmers vs. Geico Car Insurance: Expert Recommended (2025)

- Progressive vs. State Farm Car Insurance: Expert Recommended (2025)

- Nationwide vs. Progressive Car Insurance: Expert Recommended (2025)

- Farmers vs. USAA Car Insurance: Expert Recommended (2025)

- Allstate vs. American Family Car Insurance: Expert Recommended (2025)

- American Family Insurance vs. USAA Car Insurance: Expert Recommended (2025)

- American Family Insurance vs. Progressive Car Insurance: Expert Recommended (2025)

- American Family Insurance vs. Farmers Car Insurance: Expert Recommended (2025)

- Farm Family Insurance Review & Complaints: Auto, Home & Life Insurance (2025)

- West Bend Mutual Insurance Review & Complaints: Auto, Home & Business Insurance (2025)

- United Equitable Insurance Review & Complaints: Auto Insurance (2025)

- Victoria Insurance Review & Complaints: Auto Insurance (2025)

- 21st Century Insurance Company Review & Complaints: Auto, Life & Home Insurance (2025)

- First American Insurance Review & Complaints: Property, Auto & Umbrella Insurance (2025)

- Anchor General Insurance Company Review & Complaints: Auto Insurance (2025)

- Cincinnati Insurance Review & Complaints: Auto, Home, Life & Business Insurance (2025)

- Granwest Insurance Review & Complaints: Property & Casualty Insurance (2025)

- Safeway Insurance Review & Complaints: Auto Insurance (2025)

- Best Texas Car Insurance (2025)

- Tesla Insurance Review & Complaints: Car Insurance (2025)

- Sentry (Dairyland) Insurance Review & Complaints: Commercial Insurance (2025)

- Horace Mann Insurance Review & Complaints: Auto, Home & Life Insurance (2025)

- PEMCO Insurance Review & Complaints: Auto, Boat, Umbrella & Home Insurance (2025)

- Plymouth Rock Assurance Insurance Review & Complaints: Auto & Home Insurance (2025)

- California Casualty Insurance Review & Complaints: Auto & Home Insurance (2025)

- Island Insurance Company Review & Complaints: Auto, Home & Business Insurance (2025)

- Pekin Insurance Review & Complaints: Home, Auto & Life Insurance (2025)

- Omni Insurance Group Insurance Review & Complaints: Auto Insurance (2025)

- Tower Group Insurance Review & Complaints: Auto & Home Insurance (2025)

- Repwest Insurance Company Review & Complaints: Moving & Storage Insurance (2025)

- Grange Insurance Association Review & Complaints: Auto, Home, & Farm Insurance (2025)

- Stonewood Insurance Review & Complaints: Car Insurance (2025)

- Frankenmuth Insurance Review & Complaints: Auto, Home & Life Insurance (2025)

- Esurance Insurance Review & Complaints: Auto & Home Insurance (2025)

- New York Central Mutual Insurance Review & Complaints: Car, Homeowners & Property Insurance (2025)

- Mercury Insurance Group Review & Complaints: Auto & Home Insurance (2025)

- Titan Insurance Review & Complaints: Auto Insurance (2025)

- Pioneer State Mutual Insurance Company Review & Complaints: Auto, Home & Business Insurance (2025)

- Wisconsin Mutual Insurance Company Review & Complaints: Auto, Home, Farm & Business Insurance (2025)

- Foremost Insurance Company Review & Complaints: Home, Car, & Recreational Vehicle Insurance (2025)

- InsureMax Insurance Company Review & Complaints: Car Insurance (2025)

- Key Insurance Company Insurance Review & Complaints: Auto Insurance (2025)

- Austin Mutual Insurance Company Review & Complaints: Auto, Home, Commercial & Agribusiness Insurance (2025)

- Northern Neck Insurance Company Review & Complaints: Auto & Home Insurance (2025)

- Mendota Insurance Company Review & Complaints: Auto Insurance (2025)

- Best Car Insurance Company for a Low Budget (2025)

- Brethren Mutual Insurance Company Review & Complaints: Home, Auto, Business & Farm Insurance (2025)

- Celina Insurance Group Review & Complaints: Auto, Home, Business, & Farm Insurance (2025)

- Norfolk and Dedham Group Insurance Review & Complaints: Car, Commercial & Homeowners Insurance (2025)

- Arbella Insurance Review & Complaints: Auto, Home & Business Insurance (2025)

- Stillwater Insurance Group (Fidelity) Insurance Review & Complaints: Home, Auto & Business Insurance (2025)

- National General Insurance Review & Complaints (2025)

- Central Mutual Insurance Review & Complaints: Home, Auto & Business Insurance (2025)

- Ameriprise Insurance Review & Complaints: Auto, Home, Life & Health Insurance (2025)

- 1st Auto and Casualty Insurance Review & Complaints: Auto Insurance (2025)

- United Home Insurance Review & Complaints: Home & Auto Insurance (2025)

- Oregon Mutual Insurance Review & Complaints: Auto, Home & Business Insurance (2025)

- New London County Mutual Insurance Review & Complaints: Auto, Home & Commercial Insurance (2025)

- All Star General Insurance Review & Complaints: Auto Insurance (2025)

- Hochheim Prairie Insurance Review & Complaints: Auto, Home,Business & Farm Insurance (2025)

- Rockingham Insurance Review & Complaints: Home, Auto, Farm & Business Insurance (2025)

- Agricultural Workers Mutual Insurance Review & Complaints: Auto & Farm Insurance (2025)

- The ACE Group Insurance Review & Complaints: Auto, Home, Umbrella & Business (2025)

- Brotherhood Mutual Insurance Company Review & Complaints: Church Insurance (2025)

- Haulers Insurance Company Review & Complaints (2025)

- Goodville Mutual Insurance Review & Complaints: Property & Casualty Insurance (2025)

- GoAuto Insurance Review & Complaints: Car Insurance (2025)

- MiddleOak Insurance Review & Complaints: Property & Casualty Insurance (2025)

- Maryland Auto Insurance (MAIF) Insurance Review & Complaints (2025)

- Primero Insurance Review & Complaints: Car Insurance (2025)

- Discovery Insurance Company Review & Complaints: Auto Insurance (2025)

- Acceptance Auto Insurance Review & Complaints: Auto, Motorcycle & Renter’s Insurance (2025)

- Founders Insurance Review & Complaints: Auto, Home, & Commercial Auto Insurance (2025)

- Fred Loya Insurance Review & Complaints: Car Insurance (2025)

- Indiana Farm Bureau Insurance Review & Complaints: Home, Auto & Life Insurance (2025)

- Country Financial Insurance Review & Complaints: Auto, Home, Life & Farm Insurance (2025)

- Peak Property & Casualty Insurance Review & Complaints: Car, Airplane, & Home Insurance (2025)

- Preferred Mutual Insurance Company Review & Complaints: Auto, Home & Commercial Insurance (2025)

- Grinnell Mutual Insurance Review & Complaints: Auto, Home, Business & Farm Insurance (2025)

- Badger Mutual Insurance Review & Complaints: Auto, Home & Business Insurance (2025)

- Patriot Insurance Review & Complaints: Auto, Home, Life & Business Insurance (2025)

- Premier Insurance Group Review & Complaints: Auto, Home, Life & Commercial Insurance (2025)

- American Underwriters Insurance Review & Complaints: Auto Insurance (2025)

- Bolt Insurance Review & Complaints: Car, Home & Business Insurance (2025)

- Dairyland Insurance Review & Complaints: Auto & Motorcycle Insurance (2025)

- CUNA Mutual Insurance Review & Complaints: Life, Home, Auto & Supplemental Health Insurance (2025)

- Armed Forces Insurance Review & Complaints: Home, Auto & Business Insurance (2025)

- Germania Insurance Review & Complaints: Life, Home & Auto Insurance (2025)

- Direct General Insurance Review & Complaints: Auto & Life Insurance (2025)

- Alfa Insurance Review & Complaints: Home, Auto & Life Insurance (2025)

- American Access Casualty Company Insurance Review & Complaints: Auto Insurance (2025)

- A Abana Car Insurance Review & Complaints: Auto Insurance (2025)

- Safeco Insurance Review & Complaints: Auto, Home, Renter’s, Boat, Motorcycle & Umbrella Insurance (2025)

- Vern Fonk Insurance Review & Complaints: Home, Auto & Commercial Insurance (2025)

- Commerce (MAPFRE) Insurance Review & Complaints: Auto, Home, Life & Business Insurance (2025)

- New Jersey Manufacturers Insurance Review & Complaints: Worker’s Compensation, Auto & Home Insurance (2025)

- GuideOne Insurance Review & Complaints: Auto, Home, Life, Church, Senior Living & School Insurance (2025)

- Windhaven Auto Insurance Review & Complaints: Auto Insurance (2025)

- United Fire Group Insurance Review & Complaints: Auto, Home, Business, & Life Insurance (2025)

- GAINSCO Insurance Review & Complaints: Auto Insurance (2025)

- Imperial Fire & Casualty Insurance Review & Complaints: Auto, Home & Flood Insurance (2025)

- Farm Bureau Insurance Review & Complaints: Auto, Home, Life, Health, & Farm Insurance (2025)

- Integrity Insurance Review & Complaints: Auto, Home, Life, & Business Insurance (2025)

- Main Street America Group Insurance Review & Complaints: Personal & Commercial Insurance (2025)

- Hallmark Insurance Company Review & Complaints: Auto & Home Insurance (2025)

- Agency Insurance Company Review & Complaints: Auto Insurance (2025)

- Penn National Insurance Review & Complaints: Home, Auto & Business Insurance (2025)

- Allied Insurance Review & Complaints: Auto, Home, Powersports, Life & Business Insurance (2025)

- Kemper Specialty Insurance Review & Complaints: Auto, Home, Life & Health Insurance (2025)

- Mutual of Enumclaw Insurance Review & Complaints: Auto, Home, Commercial, Boat & Farm Insurance (2025)

- Kingsway Financial Services Insurance Review & Complaints: High-risk Auto Insurance (2025)

- Wawanesa Insurance Review & Complaints: Life, Home & Auto Insurance (2025)

- Infinity Auto Insurance Review & Complaints: Auto, Home & Life Insurance (2025)

- Selective Insurance Review & Complaints: Auto, Home & Business Insurance (2025)

- QBE Insurance Review & Complaints: Commercial, Auto & Home Insurance (2025)

- Western National Insurance Review & Complaints: Home & Auto Insurance

- Ohio Mutual Insurance Review & Complaints: Auto, Home & Business Insurance (2025)

- Hagerty Insurance Review & Complaints: Auto, Boat & Business Insurance (2025)

- Acuity Insurance Review & Complaints: Auto, Home & Business Insurance (2025)

- EMC Insurance Review & Complaints: Business, Auto, Home & Motorcycle Insurance (2025)

- Chubb Insurance Company Review & Complaints: Auto, Home, and Business Insurance (2025)

- State Auto Insurance Review & Complaints (2025)

- The General Insurance Review & Complaints: Car Insurance (2025)

- Grange Insurance Review & Complaints: Auto, Home, Life, & Business Insurance (2025)

- American Modern Insurance Review & Complaints: Homeowners Insurance (2025)

- Bristol West Insurance Review & Complaints: Auto Insurance (2025)

- Auto-Owners Insurance Review & Complaints: Auto, Home, Life, Retirement & Business Insurance (2025)

- Pure Insurance Review & Complaints: Home & Auto Insurance (2025)

- Shelter Insurance Review & Complaints: Auto, Home, Life & Business Insurance (2025)

- Utica National Insurance Group Insurance Review & Complaints: Car, Homeowners & Commercial Insurance (2025)

- The Hartford Insurance Review & Complaints: Car, Life & Business Insurance (2025)

- The Hanover Insurance Group Review & Complaints: Auto, Home & Business Insurance (2025)

- Encompass Insurance Review & Complaints: Auto & Home Insurance (2025)

- Kentucky Farm Bureau Insurance Review & Complaints: Home, Life, Auto, Farm, Business & Health Insurance (2025)

- Travelers Insurance Review & Complaints: Home, Auto & Boat Insurance (2025)

- AAA Insurance Review & Complaints: Auto, Home, Life, Travel & Wedding Insurance (2025)

- Westfield Insurance Review & Complaints: Auto, Home & Business Insurance (2025)

- Erie Insurance Review & Complaints: Auto, Home, Life, Marine & Business Insurance (2025)

- American Family Insurance Review & Complaints: Auto, Home & Life Insurance (2025)

- Progressive Insurance Review & Complaints: Auto Insurance (2025)

- Liberty Mutual Insurance Review & Complaints: Property & Casualty Insurance (2025)

- Allstate Auto Insurance Review & Complaints: Auto Insurance (2025)

- State Farm Insurance Review & Complaints: Car Insurance (2025)

- Geico Insurance Review & Complaints (2025)

- Farmers Insurance Review & Complaints: Home, Business & Auto Insurance (2025)

- Nationwide Insurance Review & Complaints: Auto, Home, Health & Pet Insurance (2025)

- Homeowners Insurance Companies

- Concord Group Insurance Review & Complaints: Auto, Homeowners & Life Insurance (2025)

- State Farm Insurance Review & Complaints: Mobile Home (2025)

- Universal Property and Casualty Insurance Review & Complaints (2025)

- UPC Insurance Review & Complaints: Home, Condo, Fire, Renter’s, Flood & Commercial Property Insurance (2025)

- American Traditions Insurance Review & Complaints: Homeowners Insurance (2025)

- Allstate Insurance Review & Complaints: Appliance Insurance (2025)

- Kingstone Insurance Review & Complaints: Homeowners Insurance (2025)

- Frontline Insurance Company Review & Complaints: Home & Property Insurance (2025)

- Citizens Insurance Review & Complaints: Property Insurance (2025)

- CSAA Insurance Review & Complaints: Homeowners Insurance (2025)

- Hippo Insurance Review & Complaints: Homeowners Insurance (2025)

- Nationwide Insurance Review & Complaints: Homeowners Insurance (2025)

- Sagesure Insurance Review & Complaints: Homeowners Insurance (2025)

- PEMCO Insurance Review & Complaints: Earthquake Insurance (2025)

- State Farm Insurance Review & Complaints: Mobile Home Insurance (2025)

- Olympus Insurance Review & Complaints: Home Insurance (2025)

- Allstate Home Insurance Review & Complaints: Home Insurance (2025)

- Homeowners of America Insurance Company Review & Complaints: Home Insurance (2025)

- SafePoint Insurance Review & Complaints: Home & Commercial Insurance (2025)

- American Strategic Insurance (ASI) Review & Complaints (2025)

- Security First Insurance Company Review & Complaints: Homeowner’s Insurance (2025)

- Prepared Insurance Company Review & Complaints: Home, Condo, Dwelling Fire & Renter’s Insurance (2025)

- People’s Trust Insurance Company Review & Complaints: Home Insurance (2025)

- Federated National Insurance Company Review & Complaints (2025)

- American Bankers Insurance Company Review & Complaints: Home Insurance (2025)

- American Reliable Insurance Review & Complaints: Home & Motorcycle Insurance (2025)

- Occidental Fire & Casualty Company Insurance Review & Complaints: Home & Flood Insurance (2025)

- RLI Insurance Review & Complaints: Business, Personal & Surety Bonds (2025)

- Florida Family Insurance Review & Complaints: Homeowner’s Insurance (2025)

- Aegis Security Insurance Company Review & Complaints: Home & Health Insurance (2025)

- Avatar Insurance Review & Complaints: Home Insurance (2025)

- Centauri Insurance Review & Complaints: Home, Dwelling Fire, Condo, Tenant’s Insurance (2025)

- Pacific Specialty Insurance Review & Complaints: Property & Powersports Insurance (2025)

- Florida Peninsula Insurance Company Review & Complaints: Home, Condo, Renter’s & Flood Insurance (2025)

- American Integrity Insurance Group Review & Complaints: Home, Dwelling Fire, Condo, Flood Insurance (2025)

- Heritage Insurance Review & Complaints: Home, Condo, Dwelling Fire & Commercial Insurance (2025)

- Tower Hill Insurance Group Review & Complaints: Home, Renter’s & Commercial Insurance (2025)

- The Andover Companies Insurance Review & Complaints: Home & Business Insurance (2025)

- Wellington Insurance Review & Complaints: Home Insurance (2025)

- Multi-Insurance Companies

- PEMCO Insurance of Seattle Review & Complaints: Car & Homeowners Insurance (2025)

- Charter Oak Fire Insurance Company Review & Complaints: Property & Auto Insurance (2025)

- Vermont Mutual Insurance Review & Complaints: Car & Homeowners Insurance (2025)

- Securian Retirement Plans: Complete Guide & Review (2025)

- Securian 401(K): Complete Guide & Review (2025)

- United Security Health and Casualty Insurance Review & Complaints: Health & Auto Insurance (2025)

- Zurich Insurance Group Insurance Review & Complaints: Auto & Life Insurance (2025)

- Columbia Insurance Group Insurance Review & Complaints: Auto, Commercial & Farm Insurance (2025)

- Darrell Grenz Insurance Review & Complaints: Home, Auto, Life, Health & Business Insurance (2025)

- Homesite Insurance Review & Complaints: Life, Auto & Home Insurance (2025)

- AMA Insurance Review & Complaints: Auto, Home, Life & Health Insurance (2025)

- Federated Insurance Review & Complaints: Business, Home, Auto & Life Insurance (2025)

- 21st Century Mobile App: Complete Guide & Review (2025)

- Allstate Mobile App: Complete Guide & Review (2025)

- State Farm Mobile App: Complete Guide & Review (2025)

- Geico Mobile App: Complete Guide & Review (2025)

- Review Directory

- Health Insurance Companies

- Unum Insurance Review & Complaints: Health & Life Insurance (2025)

- Emblem Health Insurance Review & Complaints (2025)

- eHealthInsurance Review & Complaints (2025)

- Dean Health Plan Insurance Review & Complaints: Health Insurance (2025)

- Guarantee Trust Life Insurance Review & Complaints: Life & Health Insurance (2025)

- Washington National Insurance Review & Complaints: Life & Supplemental Health Insurance (2025)

- Conseco Insurance Review & Complaints: Life & Health Insurance (2025)

- Combined Insurance Review & Complaints: Health & Life Insurance (2025)

- State Mutual Insurance Medicare Review & Complaints: Health Insurance (2025)

- Physicians Plus Insurance Review & Complaints: Medicare Supplement Insurance (2025)

- Capital District Physician’s Health Plan (CDCHP) Medicare Insurance Review & Complaints: Health Insurance (2025)

- Kaiser Permanente Medicare Insurance Review & Complaints: Health Insurance (2025)

- WellCare Medicare Insurance Review & Complaints: Health Insurance (2025)

- Highmark Medicare Insurance Review & Complaints: Health Insurance (2025)

- Bankers Fidelity Medicare Insurance Review & Complaints: Medicare Supplement Insurance (2025)

- Bankers Life Insurance Review & Complaints: Medicare Insurance (2025)

- CareSource Medicare Insurance Review & Complaints: Health Insurance (2025)

- Dean Health Plan Medicare Insurance Review & Complaints: Health Insurance (2025)

- Fallon Community Health Plan Insurance Review & Complaints: Health & Medicare Supplement Insurance (2025)

- Geisinger Health Plan Medicare Insurance Review & Complaints: Health Insurance (2025)

- Tufts Health Plan Medicare Review & Complaints: Health Insurance (2025)

- Capital Health Plan Medicare Insurance Review & Complaints: Health Insurance (2025)

- MVP Healthcare Medicare Insurance Review & Complaints: Health Insurance (2025)

- Sentinel Security Life Medicare Insurance Review & Complaints: Health Insurance (2025)

- LCBA Medicare Insurance Review & Complaints: Health Insurance (2025)

- Everence Medicare Insurance Review & Complaints: Health Insurance (2025)

- Manhattan Life Medicare Review: Medicare Supplement Insurance

- QualChoice Medicare Insurance Review & Complaints: Health Insurance (2025)

- Golden Rule Insurance Review & Complaints: Health Insurance (2025)

- AMA Insurance Medicare Review & Complaints: Health Insurance (2025)

- Horizon Medicare Insurance Review & Complaints: Health Insurance (2025)

- Pekin Medicare Insurance Review & Complaints: Health Insurance (2025)

- United American Medicare Insurance Review & Complaints: Health Insurance (2025)

- Wellmark Medicare Insurance Review & Complaints: Health Insurance (2025)

- Anthem Medicare Insurance Review & Complaints: Health Insurance (2025)

- Gundersen Health Plan Medicare Insurance Review & Complaints: Health Insurance (2025)

- CommunityCare Medicare Insurance Review & Complaints: Health Insurance (2025)

- GlobeCare Medicare Insurance Review & Complaints: Life Insurance (2025)

- Central States Indemnity (CSI) Medicare Insurance Review & Complaints: Health Insurance (2025)

- American Republic Insurance Company Medicare Review & Complaints: Health Insurance (2025)

- Combined Insurance Medicare Review & Complaints: Health Insurance (2025)

- IAC Medicare Insurance Review & Complaints: Health Insurance (2025)

- Country Financial Medicare Insurance Review & Complaints: Health Insurance (2025)

- Kemper/Reserve National Insurance Review & Complaints: Health & Life insurance (2025)

- Greek Catholic Union Medicare Insurance Review & Complaints: Health Insurance (2025)

- Capital Blue Medicare Insurance Review & Complaints: Health Insurance (2025)

- Heartland National Medicare Insurance Review & Complaints: Medicare Supplement Insurance (2025)

- Thrivent Financial Medicare Insurance Review & Complaints: Health Insurance (2025)

- Wisconsin Physicians Service (WPS) Insurance Review & Complaints: Medicare & Health Insurance (2025)

- Premera Blue Cross Medicare Insurance Review & Complaints: Health Insurance (2025)

- Harvard Pilgrim Health Care Medicare Review & Complaints: Health Insurance (2025)

- Farm Bureau Insurance Review & Complaints: Medicare (2025)

- Health Net Insurance Review & Complaints: Health Insurance (2025)

- Humana Medicare Insurance Review & Complaints: Health Insurance (2025)

- USAA Medicare Insurance Review & Complaints: Home, Auto & Medicare Supplement Insurance (2025)

- Blue Cross Blue Shield Medicare Insurance Review & Complaints: Health Insurance (2025)

- Colonial Penn Medicare Insurance Review & Complaints: Health Insurance (2025)

- State Farm Insurance Review & Complaints: Medicare (2025)

- Cigna Medicare Insurance Review & Complaints: Health Insurance (2025)

- Avera Medicare Insurance Review & Complaints: Health Insurance (2025)

- Mutual of Omaha Medicare Insurance Review & Complaints: Health Insurance (2025)

- Aetna Insurance Review & Complaints: Medicare (2025)

- GeoBlue Travel Insurance Review & Complaints: Health Insurance (2025)

- Standard Life and Accident Medicare Insurance Review & Complaints: Health Insurance (2025)

- Physicians Mutual Insurance Review & Complaints: Medicare Insurance (2025)

- Old Surety Life Insurance Company Review & Complaints: Medicare & Life Insurance (2025)

- New Era Life Insurance Medicare Review & Complaints: Health Insurance (2025)

- Guarantee Trust Life Insurance Medicare Review & Complaints: Health Insurance (2025)

- Cigna Insurance Review & Complaints: Health & Life Insurance (2025)

- CareSource Insurance Review & Complaints: Health Insurance (2025)

- MercyCare Health Insurance Review & Complaints: Health Insurance (2025)

- QualChoice Health Insurance Review & Complaints: Health Insurance (2025)

- Premera Blue Cross Insurance Review & Complaints: Health Insurance (2025)

- WPS Health Insurance Review & Complaints: Health Insurance (2025)

- Presbyterian Healthcare Insurance Review & Complaints: Health Insurance (2025)

- PreferredOne Insurance Review & Complaints: Health Insurance (2025)

- PacificSource Health Plans Insurance Review & Complaints: Health Insurance (2025)

- HealthPartners Insurance Review & Complaints: Health Insurance (2025)

- Fallon Health Insurance Review & Complaints: Health Insurance (2025)

- Sharp Insurance Review & Complaints: Health Insurance (2025)

- New Mexico Health Connections Insurance Review & Complaints: Health Insurance (2025)

- Unity Health Insurance Review & Complaints (2025)

- Quartz Insurance Review & Complaints: Health Insurance (2025)

- Scott & White Health Plan Insurance Review & Complaints: Health Insurance (2025)

- Walmart Insurance Review & Complaints: Health Insurance (2025)

- SelectHealth Insurance Review & Complaints: Health Insurance (2025)

- IlliniCare Health Insurance Review & Complaints: Health Insurance (2025)

- MVP Health Care Insurance Review & Complaints: Health Insurance (2025)

- Moda Health Insurance Review & Complaints (2025)

- UniCare Insurance Review & Complaints: Health Insurance (2025)

- Tufts Health Plan Insurance Review & Complaints (2025)

- Innovation Health Insurance Review & Complaints (2025)

- Optima Health Insurance Review & Complaints (2025)

- Providence Health Plan Insurance Review & Complaints: Health Insurance (2025)

- FirstCare Insurance Review & Complaints: Health Insurance (2025)

- American Republic Insurance Company Review & Complaints: Health & Life Insurance (2025)

- Avera Health Plans Insurance Review & Complaints: Health Insurance (2025)

- Asuris Northwest Health Insurance Review & Complaints: Health Insurance (2025)

- Molina Healthcare Review & Complaints: Health, Medicare & Medicaid Insurance (2025)

- Harvard Pilgrim Health Care Insurance Review & Complaints (2025)

- GEHA Insurance Review & Complaints: Health Insurance (2025)

- Medica Insurance Review & Complaints: Health & Medicare Insurance (2025)

- ConnectiCare Insurance Review & Complaints: Health Insurance (2025)

- Highmark Health Insurance Review & Complaints: Health Insurance (2025)

- Humana Insurance Review & Complaints: Health Insurance (2025)

- BridgeSpan Health Insurance Review & Complaints: Health Insurance (2025)

- Coventry Health Care Insurance Review & Complaints (2025)

- Oscar Health Insurance Review & Complaints: Health Insurance (2025)

- Blue Cross Blue Shield Insurance Review & Complaints: Health Insurance (2025)

- Kaiser Permanente Insurance Review & Complaints: Health Insurance (2025)

- Aetna Insurance Review & Complaints: Health Insurance (2025)

- Amerigroup Insurance Medicare Insurance Review & Complaints: Health Insurance (2025)

- AmeriHealth Insurance Review & Complaints: Health Insurance (2025)

- American National (ANICO) Insurance Review & Complaints: Life, Health & Disability Insurance (2025)

- UCT Medicare Insurance Review & Complaints: Health Insurance (2025)

- First United American Medicare Insurance Review & Complaints: Life, Accident & Health Insurance (2025)

- Land of Lincoln Health Insurance Review & Complaints: Health Insurance (2025)

- Pet Insurance Companies

- Embrace Pet Insurance Review & Complaints: Pet Insurance (2025)

- 24PetWatch Insurance Review & Complaints: Pet Insurance (2025)

- ASPCA Pet Health Insurance Review & Complaints: Pet Insurance (2025)

- Pets Best Insurance Review & Complaints: Pet Insurance (2025)

- Healthy Paws Pet Insurance Review & Complaints (2025)

- Nationwide Pet Insurance Review & Complaints: Pet Insurance (2025)

- Brokerage and Retirement Companies

- Progressive, State Farm, and Farmers offer top-tier insurance plans

- Liberty Mutual stands out for its full coverage auto insurance

- Comparing quotes helps consumers find the best insurance options

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Car Insurance Costs

The average cost of car insurance varies significantly based on several factors, such as driving records and coverage level. For example, drivers with bad records or who choose full coverage pay higher rates than drivers with a clean record or who choose minimum coverage.

This table details the average monthly rates for a driver with a clean driving record from top companies:

Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $61 | $160 |

| American Family | $44 | $117 |

| Farmers | $53 | $139 |

| Geico | $30 | $80 |

| Liberty Mutual | $68 | $174 |

| Nationwide | $44 | $115 |

| Progressive | $39 | $105 |

| State Farm | $33 | $86 |

| Travelers | $37 | $99 |

| USAA | $22 | $59 |

| U.S. Average | $45 | $119 |

Read More: Farmers vs. Travelers Car Insurance: Expert Recommended

While USAA has the cheapest rates, only military members and their families are eligible for coverage. Geico and State Farm tend to be the most affordable companies that offer coverage to all drivers.

However, these rates are just averages and vary greatly. Therefore, shopping around is the only way to find the cheapest rates available since rates differ by company.

Finding the Best Insurance Company

Every company has been screened and selected based on specific criteria for many types of insurance. Keep reading to learn more about eight of the 10 best insurance companies in the U.S., including some of the best new insurance companies.

This review is for the best insurance companies for consumers rather than for the best insurance companies to work for, so it’s a great place to start your insurance shopping.

Those looking for the best insurance companies for home and auto, including for young drivers or for speeding tickets, read on.

Read More: Best Business and Business Car Insurance Quotes

The Best Company for Auto Insurance

Who are the best companies for auto insurance? To determine the best auto insurance companies, we provide insurance reviews and looked at a number of factors, including availability, size, rates, customer service, and more.

Our research shows Liberty Mutual. They offer the best full coverage insurance and is one of the top 10 insurance carriers in the country. Learn more in our Liberty Mutual auto insurance review.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Why Liberty Mutual is Recommended for Auto Insurance

Liberty Mutual is a top insurance provider for cars in the United States and consistently ranks high in customer satisfaction.

Customer Satisfaction

As one of the top 10 largest auto insurance companies, Liberty Mutual is sometimes able to use its scale to keep rates below average.

Individuals can compare car insurance quote directly from their website, over the phone, or through licensed insurance agents. Liberty Mutual can also provide insurance for homeowners, renters, and motorcycle owners, which makes it a great choice for anyone looking at multiple lines of coverage.

Liberty Mutual’s Rates by State

Liberty Mutual is available in most states. Take a look at this table to see the average rates for each state.

Liberty Mutual Minimum Coverage Car Insurance Monthly Rates by State vs. Average

| State | Liberty Mutual | State Average |

|---|---|---|

| Alabama | $162 | $110 |

| Alaska | $164 | $108 |

| Arizona | $178 | $117 |

| Arkansas | $99 | $123 |

| California | $216 | $147 |

| Colorado | $92 | $119 |

| Connecticut | $201 | $128 |

| Delaware | $494 | $169 |

| Florida | $161 | $152 |

| Georgia | $263 | $138 |

| Hawaii | $128 | $87 |

| Idaho | $79 | $81 |

| Illinois | $76 | $96 |

| Indiana | $183 | $98 |

| Iowa | $116 | $89 |

| Kansas | $174 | $117 |

| Kentucky | $168 | $153 |

| Louisiana | $274 | $181 |

| Maine | $155 | $106 |

| Maryland | $181 | $134 |

| Massachusetts | $120 | $85 |

| Michigan | $424 | $252 |

| Minnesota | $375 | $131 |

| Mississippi | $119 | $110 |

| Missouri | $129 | $108 |

| Montana | $59 | $114 |

| Nebraska | $179 | $109 |

| Nevada | $111 | $119 |

| New Hampshire | $198 | $91 |

| New Jersey | $279 | $146 |

| New Mexico | $161 | $109 |

| New York | $200 | $144 |

| North Carolina | $82 | $91 |

| North Dakota | $398 | $133 |

| Ohio | $106 | $86 |

| Oklahoma | $184 | $123 |

| Oregon | $141 | $107 |

| Pennsylvania | $219 | $118 |

| Rhode Island | $235 | $152 |

| South Carolina | $185 | $122 |

| South Dakota | $230 | $115 |

| Tennessee | $184 | $107 |

| Texas | $178 | $140 |

| Utah | $119 | $101 |

| Vermont | $100 | $99 |

| Virginia | $129 | $85 |

| Washington | $92 | $84 |

| Washington D.C. | $180 | $138 |

| West Virginia | $196 | $121 |

| Wisconsin | $84 | $99 |

| Wyoming | $75 | $109 |

As you can see, rates vary by state and coverage levels. Liberty Mutual also takes into consideration a number of personal factors that will affect your specific rates.

Read More: Best Car Insurance by State

Liberty Mutual’s Auto Insurance Ratings

Various companies provide information on customer satisfaction, complaints, etc. for companies in the insurance industry. Take a look at this table to see what J.D. Power has to say about Liberty Mutual’s customer service.

Liberty Mutual J.D. Power Customer Satisfaction Score by Region

| Region/State | Score (out of 1,000) | JD Power Circle Rating (5 pt scale) |

|---|---|---|

| California | 808 | 3 |

| Central Region | 811 | 2 |

| Florida | 827 | 3 |

| Mid-Atlantic | 817 | 2 |

| New England | 808 | 2 |

| New York | 819 | 3 |

| North Central Region | 802 | 2 |

| Northwest Region | 792 | 2 |

| Southeast Region | 809 | 2 |

| Southwest Region | 813 | 3 |

| Texas | 802 | 2 |

AM Best looks at financial ratings for companies, which provide an indication of the financial stability and outlook of those companies. AM Best currently rates Liberty Mutual as an A, which indicates a stable outlook and is a good sign of financial strength.

Read More: What documentation do I need to file a car insurance claim with Liberty Mutual?

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

The Most Popular Auto Insurance Companies in America

Liberty Mutual is our pick for the best car insurer, but it’s far from the only auto insurer.

The two biggest companies are State Farm and Geico. By direct premiums written, the next largest auto insurers are Progressive, Allstate, and USAA.

Read More: Best Car Insurance Companies

Companies That Offer Auto Insurance Discounts

One important thing to look at here is how many companies offer auto insurance policy discounts for your insurance premiums. You can see these discount opportunities in the table below.

Car Insurance Discount Savings Potential by Provider

| Discount Name |  |  | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Adaptive Cruise Control | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% |

| Adaptive Headlights | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% |

| Anti-lock Brakes | 10% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | NA | NA |

| Anti-Theft | 10% | 5% | NA | 23% | 20% | 25% | 5% | 15% | NA | NA |

| Claim Free | 35% | 5% | 5% | 26% | 5% | 10% | 5% | 15% | 23% | 12% |

| Continuous Coverage | NA | 5% | 5% | NA | 5% | 5% | 5% | 5% | 15% | 5% |

| Daytime Running Lights | 2% | NA | 5% | 3% | 5% | 5% | 5% | 5% | NA | NA |

| Defensive Driver | 10% | 10% | 5% | 5% | 10% | 5% | 10% | 5% | 10% | 3% |

| Distant Student | 35% | 5% | 5% | 5% | 5% | 10% | 5% | NA | 7% | NA |

| Driver's Ed | 10% | 5% | 5% | 5% | 10% | 5% | 10% | 15% | 8% | 3% |

| Driving Device/App | 20% | 40% | 5% | 5% | 30% | 40% | 20% | 50% | 30% | 5% |

| Early Signing | 10% | 5% | 5% | 5% | 5% | 8% | 5% | 5% | 10% | 12% |

| Electronic Stability Control | 2% | 5% | 5% | 5% | 5% | NA | 5% | 5% | 5% | 5% |

| Emergency Deployment | 5% | 5% | 5% | 25% | 5% | 5% | NA | 5% | 5% | 5% |

| Engaged Couple | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% |

| Family Legacy | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 10% |

| Family Plan | 5% | 5% | 5% | 5% | 25% | 25% | 5% | 5% | 5% | 5% |

| Farm Vehicle | 10% | 5% | 5% | NA | 5% | 5% | NA | 5% | 5% | 5% |

| Fast 5 | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% |

| Federal Employee | 5% | 5% | NA | 12% | 10% | 5% | NA | 5% | 5% | 5% |

| Forward Collision Warning | 5% | 5% | 5% | 5% | 5% | NA | 5% | 5% | 5% | 5% |

| Full Payment | 10% | 5% | 5% | NA | $50 | 5% | 5% | 5% | 8% | 5% |

| Further Education | 5% | 5% | NA | NA | 10% | 15% | NA | 5% | NA | 5% |

| Garaging/Storing | 5% | 5% | 5% | NA | 5% | 5% | 5% | 5% | NA | 90% |

| Good Credit | NA | 5% | 5% | 5% | NA | 5% | NA | 5% | 5% | 5% |

| Good Student | 20% | 5% | NA | 15% | 23% | 10% | 5% | 25% | 8% | 3% |

| Green Vehicle | 10% | 5% | 5% | 5% | 10% | 5% | 5% | 5% | 10% | 5% |

| Homeowner | 5% | 5% | 5% | NA | 5% | 5% | 5% | 3% | 5% | 5% |

| Lane Departure Warning | 5% | 5% | 5% | 5% | NA | 5% | 5% | 5% | 5% | 5% |

| Life Insurance | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% |

| Low Mileage | NA | 5% | NA | 5% | NA | NA | 5% | 30% | NA | NA |

| Loyalty | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% |

| Married | 5% | 5% | 5% | 5% | NA | NA | 5% | NA | 5% | 5% |

| Membership/Group | 5% | 5% | 5% | NA | 10% | 7% | NA | 5% | NA | 5% |

| Military | NA | 5% | 5% | 15% | 4% | 5% | NA | NA | 5% | 5% |

| Military Garaging | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 15% |

| Multiple Drivers | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% |

| Multiple Policies | 10% | 29% | 5% | 10% | 20% | 10% | 12% | 17% | 13% | 5% |

| Multiple Vehicles | NA | 5% | 5% | 25% | 10% | 20% | 10% | 20% | 8% | NA |

| New Address | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% |

| New Customer/New Plan | 5% | 5% | 5% | 5% | NA | 5% | 5% | 5% | 5% | 5% |

| New Graduate | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% |

| New Vehicle | 30% | 5% | 5% | 15% | 5% | NA | 5% | 40% | 10% | 12% |

| Newly Licensed | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% |

| Newlyweds | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% |

| Non-Smoker/Non-Drinker | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% |

| Occasional Operator | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | NA |

| Occupation | NA | 5% | NA | NA | 10% | 15% | 5% | 5% | NA | 5% |

| On-Time Payments | 5% | 5% | NA | 5% | 5% | 5% | 5% | 5% | 15% | 5% |

| Online Shopper | 5% | 5% | 5% | 5% | 5% | 5% | 7% | 5% | 5% | 5% |

| Paperless Documents | 10% | 5% | NA | 5% | 5% | 5% | $50 | 5% | 5% | 5% |

| Paperless/Auto Billing | 5% | 5% | NA | 5% | 5% | $30 | 5% | $20 | 3% | 3% |

| Passive Restraint | 30% | 30% | NA | 40% | NA | 20% | 5% | 40% | NA | NA |

| Recent Retirees | 5% | 5% | 5% | 5% | 4% | 5% | 5% | 5% | 5% | 5% |

| Renter | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% |

| Roadside Assistance | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% |

| Safe Driver | 45% | 5% | NA | 15% | 5% | 35% | 31% | 15% | 23% | 12% |

| Seat Belt Use | 5% | 5% | 5% | 15% | 5% | 5% | NA | 5% | 5% | 5% |

| Senior Driver | 10% | 5% | NA | 5% | 5% | 5% | 5% | 5% | 5% | NA |

| Stable Residence | 5% | 5% | 5% | 5% | 5% | NA | 5% | 5% | 5% | 5% |

| Students & Alumni | 5% | 5% | 5% | NA | 10% | 7% | NA | 5% | 5% | 5% |

| Switching Provider | 5% | NA | 5% | 10% | 5% | 10% | 5% | NA | 5% | 5% |

| Utility Vehicle | 15% | 5% | 5% | NA | 5% | 5% | NA | 5% | 5% | 5% |

| Vehicle Recovery | 10% | 5% | 5% | 15% | 35% | 25% | 5% | 5% | NA | NA |

| VIN Etching | 5% | 5% | 5% | 5% | 5% | NA | 5% | 5% | NA | NA |

| Volunteer | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% |

| Young Driver | 5% | 5% | 5% | 5% | NA | 5% | 5% | 5% | 5% | $75 |

Though most major insurers offer a variety of discounts, they can vary as you can see.

Read More:

-

- All Star General Insurance Review & Complaints: Auto Insurance

- Ameriprise Insurance Review & Complaints: Auto, Home, Life & Health Insurance

- Country Financial Insurance Review & Complaints: Auto, Home, Life & Farm Insurance

- Direct General Insurance Review & Complaints: Auto & Life Insurance

- Liberty Mutual RightTrack: Complete Guide & Review

The Best Home Insurance Company: Liberty Mutual

Our research indicates Liberty Mutual is one of the best insurance providers for home insurance coverage and is one of the top 10 insurance carriers in the country. Keep reading to learn more.

Reasons to Choose Liberty Mutual for Home Insurance

Why is Liberty Mutual on our list of top insurance companies twice? They are one of the largest home insurance companies in the country and provide coverage in all 50 states.

In addition to homeowners’ coverage, they provide most other types of protection a person may need, making them a good choice for anyone looking to keep all their insurance products with one company.

They are set up as a mutual insurance business, which means the policyholders are technically the owners of the company. Profits from the business are issued back to the policyholders by way of reduced insurance rates or dividends.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Liberty Mutual’s Home Insurance Ratings

To learn more about Liberty Mutual Home Insurance, we took a look at the National Association of Insurance Commissioners complaint information.

Liberty Mutual Home Insurance Complaint Data

| Summary | 2021 | 2022 | 2023 |

|---|---|---|---|

| Total Number of Complaints | 120 | 135 | 150 |

| Annual Premiums | $1,200,000,000 | $1,250,000,000 | $1,300,000,000 |

| Share of Premiums U.S. Market | 1.2% | 1.25% | 1.3% |

| Share of Complaints in the U.S. Market | 1.1% | 1.15% | 1.2% |

| Complaint Index | 0.92 | 0.92 | 0.92 |

Average complaints in the U.S. are represented by the number one, so Liberty Mutual has a higher than average number of complaints, but their complaints have been steadily decreasing for the past three years, which is a good sign.

The Best Life Insurance Company: Ladder

Our research indicates Ladder is a great option for life insurance, with a unique new approach that provides customers with a positive experience.

Reasons to Choose Ladder for Life Insurance

Ladder made our list of best insurance companies because they are putting a new spin on life insurance with a direct-to-consumer approach that makes the buying process a breeze, with the added benefit of low rates.

The company specializes in term life, which is what we recommend here at Expert Insurance Reviews. In addition, Ladder is backed by two of the biggest names in the field, Hanover Re and Fidelity Security Life Insurance Company. If you are considering life insurance, start here.

Ladder’s Life Insurance Ratings

Ladder is a new insurer, so there isn’t much data available for customer reviews from insureds or review companies. However, as we noted above, they are backed by Fidelity Security Life Insurance, which is highly rated among consumers.

Read More: Ladder Life Insurance Review & Complaints: Life Insurance

The Best Health Insurance Company: HealthSherpa

HealthSherpa is a good option for health insurance brokers. Keep reading to find out more.

Speak with a Health Insurance Specialist

(844) 334-6350

Speak with a Medicare Supplement Insurance Specialist

(844) 611-2338

Reasons to Choose HealthSherpa for Health Insurance

As a part of our best health insurance reviews, we considered HealthSherpa. In our HealthSherpa reviews, we found it is a full-service broker that provides numerous for individuals and families looking to purchase health insurance.

Their website is easy to use, and the policy premiums are the same price as purchasing directly from an insurance carrier.

We recommend using a broker when shopping for health insurance because it makes the process much easier when comparing features and prices between the available plans.

Read More: Average Health Insurance Cost per Month

HealthSherpa’s Insurance Ratings

HealthSherpa has a 4.1 out of five-star customer rating, but like some of the other companies we’ve reviewed here, it’s new enough that there is limited consumer data.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

The Best Pet Insurance Company: Healthy Paws

We know pet insurance is important. You love your pets and want to ensure they have the coverage necessary for whatever may come their way. HealthPaws is a good option for this coverage. Read on to find out why.

Reasons to Choose Healthy Paws for Pet Insurance

Healthy Paws Pet Insurance is one of the top-rated insurance companies, which covers everything that matters, including injuries, illnesses, genetic conditions, and emergency care.

Read more: Healthy Paws Pet Insurance Review & Complaints

With unlimited lifetime benefits, you can cover your pet with a top customer-rated pet insurance plan. Get a free quote and let Healthy Paws pay your vet bills while you care for your pet.

Healthy Paws’ Pet Insurance Ratings

Healthy Paws is accredited by the BBB and has a customer rating of four out of five stars. The company is also rated A+ by BBB, which is the highest rating BBB provides.

The Best Travel Insurance Company: Travelex

When you’re traveling, you want to make sure you’re covered, and you probably know that your existing coverage may not apply, so travel insurance may be something to consider. Travelex is a solid provider. Take a moment to read the next few sections for more.

Reasons to Choose Travelex for Travel Insurance

Travelex offers a number of comprehensive travel insurance products that can accommodate a range of travelers.

Whether you are looking for protection while you are on a quick solo trip abroad, or will be traveling with your entire family for an extended period of time, Travelex has a policy right for you.

Travelex’s Insurance Ratings

Travelex has an A+ rating, both of which are strong indicators of the company being an excellent choice for coverage.

Read More: Travel Insurance Coverage: An Expert Guide

The Best Business Insurance Company: Hiscox Insurance

What are the best commercial insurance companies? Who has the best commercial insurance? We did not conduct business insurance reviews for Australia or the UK, (like UK ChoiceQuote insurance reviews), instead, we focused on companies in the U.S. For this USA business insurance review, we suggest Hiscox Insurance.

Reasons to Choose Hiscox for Business Insurance

In our Hiscox business insurance review, we found that Hiscox Insurance can provide businesses with a wide range of for all their insurance needs.

They offer General Liability, Business Property, Workers Compensation, Commercial Auto, Business Umbrella, and Errors & Omissions. Their quoting process is quick and straightforward. They are in the top 10 business insurance companies in the United States, and their policy terms are easy to understand.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Hiscox’s Business Insurance Ratings

Hiscox is not currently accredited by BBB, but they do have an A+ rating. We were also able to find complaint index rating information from the NAIC. Take a look.

Hiscox Business Insurance Complaint Data

| Summary | 2021 | 2022 | 2023 |

|---|---|---|---|

| Total Number of Complaints | 45 | 50 | 55 |

| Annual Premiums | $500,000,000 | $520,000,000 | $540,000,000 |

| Share of Premiums U.S. Market | 0.5% | 0.52% | 0.54% |

| Share of Complaints in the U.S. Market | 0.4% | 0.45% | 0.5% |

| Complaint Index | 0.8 | 0.87 | 0.93 |

The number of complaints has decreased over the past three years, and between 2017 and 2018 the complaint index decreased significantly. Additionally, the annual premiums for the company have increased. All of these are positive signs.

Key considerations for Your Policy

What is the top insurance company?

Through our best insurance company reviews, we’ve provided information on eight of the top 10 insurance companies in the United States for various coverage types including home, auto, life, pet (focused on personal coverage, rather than pet business insurance reviews), travel, and more to help you determine which insurance company is best.

Whether you’re looking for the best insurance companies in California or elsewhere, you should be able to find the answer here.

To find the best insurance policies to fit your needs, you should compare rates and make sure you have the right type of coverage for your needs, whether that includes liability insurance, property insurance, personal injury protection, comprehensive coverage, or more. Shopping around is a great way to find affordable coverage that is unique to your situation.

You can use our tool to get some of the best online insurance quotes. Expert Insurance Reviews by various insurance companies can help you decide which options are best for your lifestyle. Only you can answer the question of which insurance company is best for your budget, needs, and lifestyle.

Learn More About the Best Auto Insurance Companies

Still have questions about the best auto insurance company, who has the best insurance, and the best insurance to have? Read through the frequently asked questions below to learn more while you’re insurance shopping.

How to Start Your Search

Use your ZIP code to get a free quote from some of the best insurance companies in the country. This will help you find out who has the cheapest business insurance policies and which of the best auto coverage insurance companies offer the coverage types you need.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Case Study: Empowering Individuals and Communities With Essential Insurance Solutions

This section presents a series of case studies that highlight the critical role of insurance in various aspects of life, from personal to business needs. By examining real-life scenarios, we aim to empower individuals and communities with the knowledge they need to make informed decisions about their insurance solutions.

- Case Study #1 – Car Insurance: Best Insurance Companies: Reviews & Complaints can provide a case study on car insurance to help users understand the importance of choosing the right provider. This case study can emphasize the significance of reliable customer service and prompt claim settlements when choosing the best car insurance company.

- Case Study #2 – Home Insurance: To illustrate the value of comprehensive home insurance, Best Insurance Companies: Reviews & Complaints can present a case study about a homeowner who experienced significant property damage due to a natural disaster.

- Case Study #3 – Life Insurance: Best Insurance Companies: Reviews & Complaints can showcase a case study on life insurance to demonstrate the benefits of this type of coverage. The case study can focus on a family that experienced the untimely death of a breadwinner.

- Case Study #4 – Commercial Insurance: For businesses seeking the best commercial insurance coverage, Best Insurance Companies: Reviews & Complaints can present a case study featuring a small business that suffered a significant loss due to a fire or theft incident.

By learning from these real-life examples, you can make better-informed decisions to safeguard your future with the essential insurance solutions that best meet your needs.

Best Claims Process

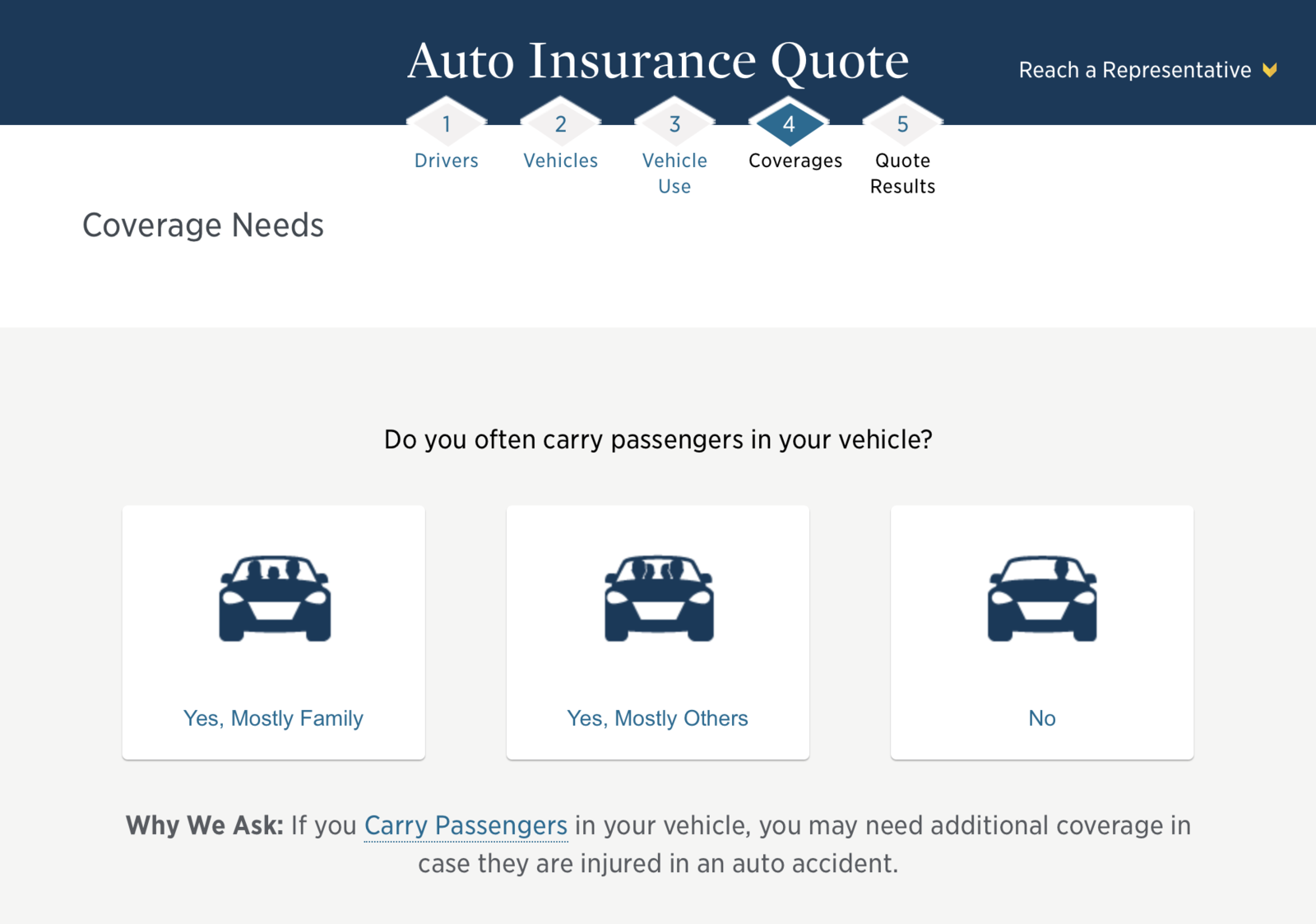

Ease of Filing a Claim (Online, Over the Phone, Mobile Apps)

When it comes to filing a claim with insurance companies reviewed, customers have the convenience of multiple channels. These insurers offer easy online claim filing options through their websites or mobile apps, allowing policyholders to initiate the claims process with just a few clicks.

Additionally, many of them provide dedicated customer support hotlines for those who prefer filing claims over the phone. This accessibility ensures that policyholders can report incidents promptly, streamlining the claims process.

Average Claim Processing Time

One of the crucial factors in evaluating insurance companies is the average claim processing time. Customers want swift and efficient claims handling. In our reviews, we have examined the claim processing times of various insurers. Policyholders can expect varying processing times depending on the complexity of the claim and the insurer’s internal procedures.

Timely claim processing is a critical aspect of customer satisfaction, and our reviews provide insights into which companies excel in this regard.

Read More: How long do you have to file a life insurance claim?

Customer Feedback on Claim Resolutions and Payouts

Customer feedback on claim resolutions and payouts is an essential component of our insurance company reviews. We gather insights from policyholders who have experienced the claims process firsthand. This feedback sheds light on the fairness, transparency, and efficiency of the claims settlement process.

It helps prospective customers make informed decisions by understanding how an insurer handles claims, including the speed of payouts and the overall satisfaction of policyholders.

Best Digital and Technological Features

Mobile App Features and Functionality.

In the digital age, insurance companies are leveraging mobile apps to enhance customer experience. Our reviews delve into the features and functionality of these mobile apps offered by insurance providers. These apps often allow customers to manage their policies, file claims, view policy documents, and even access roadside assistance services.

We assess the user-friendliness, reliability, and availability of these apps to help customers determine which insurers offer the most convenient mobile experiences.

Read More: Progressive Mobile App: Complete Guide & Review

Online Account Management Capabilities

Online account management is a crucial aspect of modern insurance services. Insurance companies provide customers with the ability to manage their policies, view billing statements, make payments, and update personal information through online portals. We evaluate the effectiveness and user-friendliness of these online account management capabilities.

Understanding how well an insurer facilitates self-service options can be instrumental in choosing the right insurance provider.

Digital Tools and Resources

Insurance companies are increasingly offering digital tools and resources to educate and assist their customers. These tools can include calculators, educational articles, and resources for risk assessment.

In our reviews, we assess the availability and usefulness of these digital tools, helping customers identify insurers that go the extra mile in providing valuable information and resources to help them make informed decisions about their insurance needs.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Best Car Insurance: An Expert Guide

The best car insurance varies by driver. Factors like age, driving record, and coverage determine rates. Drivers should compare coverages, rates, and discounts with multiple companies to find the best auto insurance that meets their needs.

Car insurance isn’t one size fits all. Each insurance company offers different coverages, rates, and discounts, and the best policy for you depends on how much car insurance you need. So, the best car insurance for you might not be the same as your neighbor’s.

Determining the best auto insurance will take some research. However, we’ve made it as easy as possible for you to find what you need.

This guide will discuss how to get the best car insurance and which company may fit your needs.

Finding the Best Car Insurance

Unfortunately, there isn’t one answer. Instead, your situation determines the best car insurance, such as minimum or full coverage, multiple policies, or an SR-22. In addition, whether you need a company with low rates, numerous coverage options, excellent customer service, or streamlined service determines which company is the best for you.

However, the best insurance companies provide the coverage you need at low rates, with discounts and other advantages.

The first step to finding the best car insurance is determining your coverage needs.

Heidi Mertlich LICENSED INSURANCE AGENT

Do you want the cheapest coverage available? Or are you willing to pay higher rates for the most protection or excellent customer service?

Then, compare multiple car insurance companies to find the coverage you want. Don’t forget to look at available discounts as well, since these can change which company is the cheapest.

Factors Affect Car Insurance Rates

Your car insurance company looks at personal factors to determine your car insurance rates. Factors that affect car insurance rates while each company typically uses the same characteristics, how they weigh them differs.

Factors that affect car insurance rates include:

- Age: Young and inexperienced drivers pay the highest car insurance rates. As drivers age, they gain the experience to avoid accidents and take fewer risks. As a result, rates decrease.

- Driving Record: Your driving record indicates whether or not you are a risky driver. Drivers with accidents, tickets, and DUIs pay much higher rates than drivers with clean records.

- Coverage: More coverage means higher rates. However, you have fewer out-of-pocket costs with higher coverage if your vehicle is damaged.

- Vehicle: New and expensive vehicles have higher car insurance rates since they cost more to repair or replace. Although new technology makes repairs more costly, most insurers offer discounts for safety features.

- Credit Score: Statistically, drivers with a lower credit score are more likely to file a claim instead of paying for repairs themselves. On the other hand, drivers with a high score file fewer claims.

Since each driver’s personal factors differ, the best car insurance company also differs. For example, the best car insurance companies for accidents may not be the best for drivers with a clean record.

How Your Driving Record Affect Car Insurance Rates