Best Alaska Car Insurance (2025)

Despite having relatively high coverage requirements, Alaska car insurance rates average $117 per month. Although there are dangerous driving conditions during winter, low population density keeps Alaska car insurance quotes low. To find the best Alaska car insurance, compare multiple companies.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced life insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for life insurance with the most affordable term life insurance, permanent life insurance, no medical exam life insurance, and burial insurance. Not only does he strive to provide consumers with t...

Licensed Insurance Agent

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Alaska Statistics Summary | Stats |

|---|---|

| Road Miles | 15,728 |

| Registered Vehicles | 768,343 |

| Vehicle Thefts | 1,739 |

| State Population | 737,438 |

| Most Popular Vehicle | Ford F150 |

| Uninsured Motorists | 15.40% |

| Driving Fatalities | Speeding: 26 DUI: 22 Total: 79 |

| Average Annual Premiums | Liability: $539.68 Collision: $350.81 Comprehensive: $137.26 Total: $1,027.75 |

| Cheapest Provider | State Farm |

- Alaska car insurance requirements include a 50/25/50 liability plan

- The typical driver pays $117 for car insurance in Alaska, which is much lower than the national average

- To find the cheapest car insurance in Alaska, make sure to look for discounts, keep your driving record clean, and compare multiple quotes

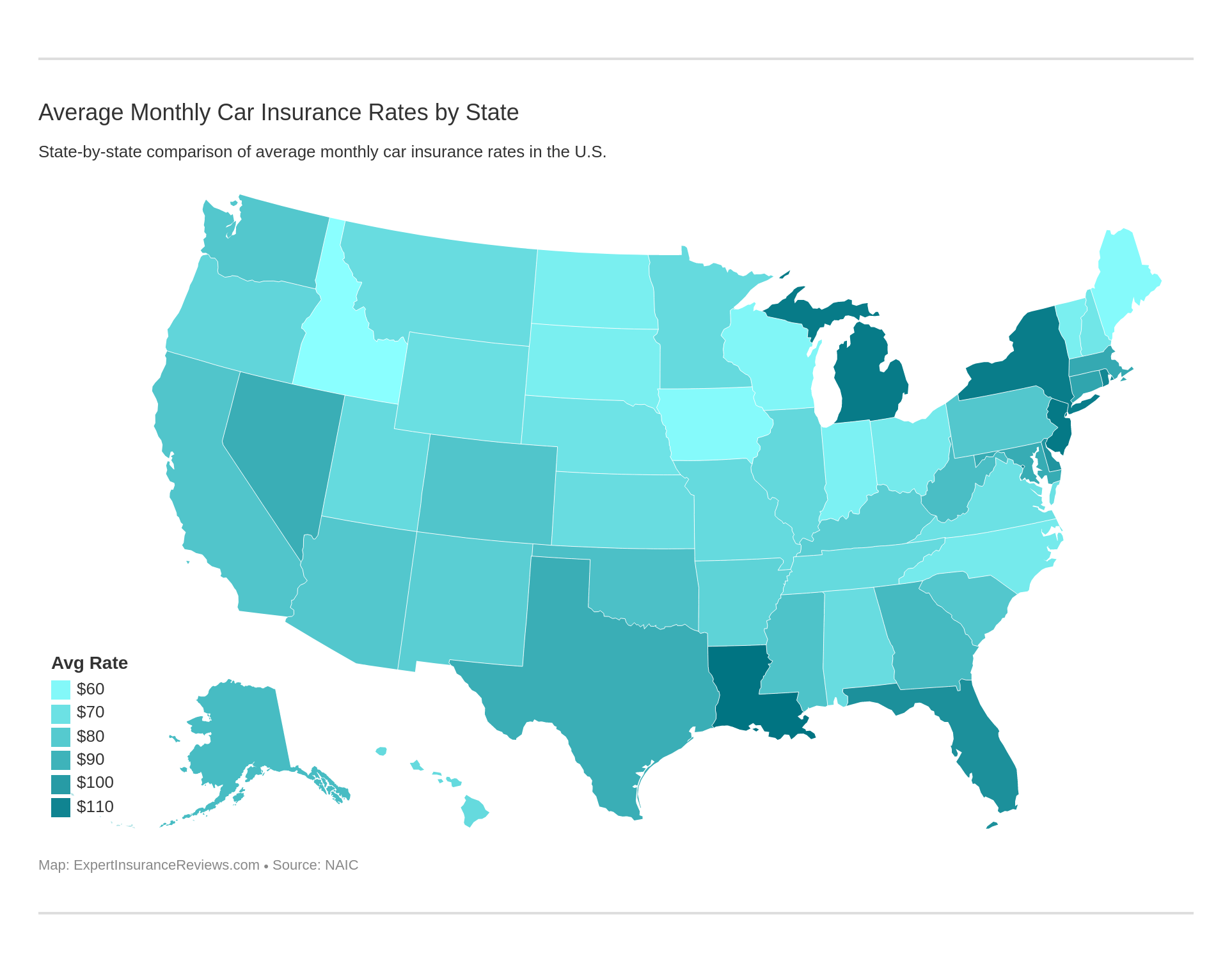

Despite rising rates in most of the country, finding cheap car insurance in Alaska is usually simple. With an average monthly price of only $117, Alaska car insurance rates are well below what the typical American pays for coverage.

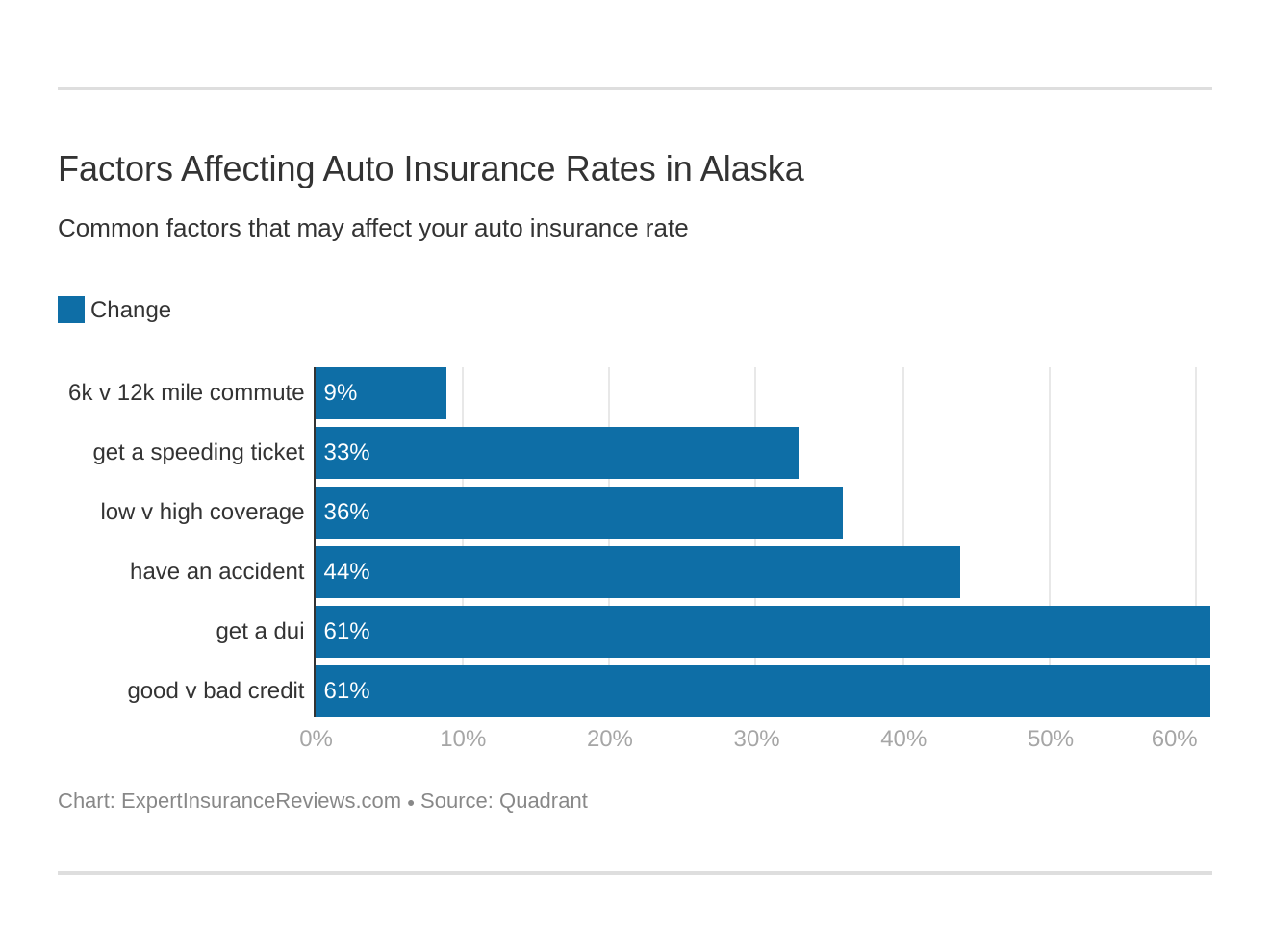

There are several reasons why the average driver sees lower Alaska car insurance costs, but the primary factors are low population density, rural roads, and less traffic. However, your rates also depend on your unique situation, so you might see higher rates. Factors like your age, ZIP code, and driving history play a significant role in Alaska car insurance quotes.

Read on to learn where to find the best Alaska car insurance, including which companies might have the lowest rates for you. Then, compare Alaska car insurance quotes from multiple companies to find the best policy for your vehicle.

Alaska Car Insurance Coverage and Rates

Alaska requires that everyone be financially responsible for injuries and damage they might cause as a result of a car accident. Car insurance policies meet this requirement while also offering drivers a lot of other coverage options.

Between liability limits and coverage for your car when you’re at fault, in the event it’s stolen, and for things like roadside breakdowns, a car insurance policy can be confusing.

What do you have to carry? Which options should you add to your policy? How much can you expect to pay, and what’s a good deal on your coverage?

We will answer all of those questions and more to help you buy car insurance with confidence.

We’ll cover the legal requirements and also look at what options are available to customize your policy. We’ll also look at how Alaska car insurance rates stack up and what you can expect to pay based on who you are and where you live.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Alaska Car Insurance Requirements

Alaska’s minimum coverage for car insurance is quite a bit higher than average. In fact, Alaska’s bodily injury liability limits are double the average; only Maine has limits that are as high.

By law, all drivers in Alaska must carry:

- Bodily Injury Liability limits of $50,000 per person and $100,000 per incident

- Property Damage Liability in the amount of $25,000

Because it’s a fault state, Alaska doesn’t require drivers to carry any no-fault coverage.

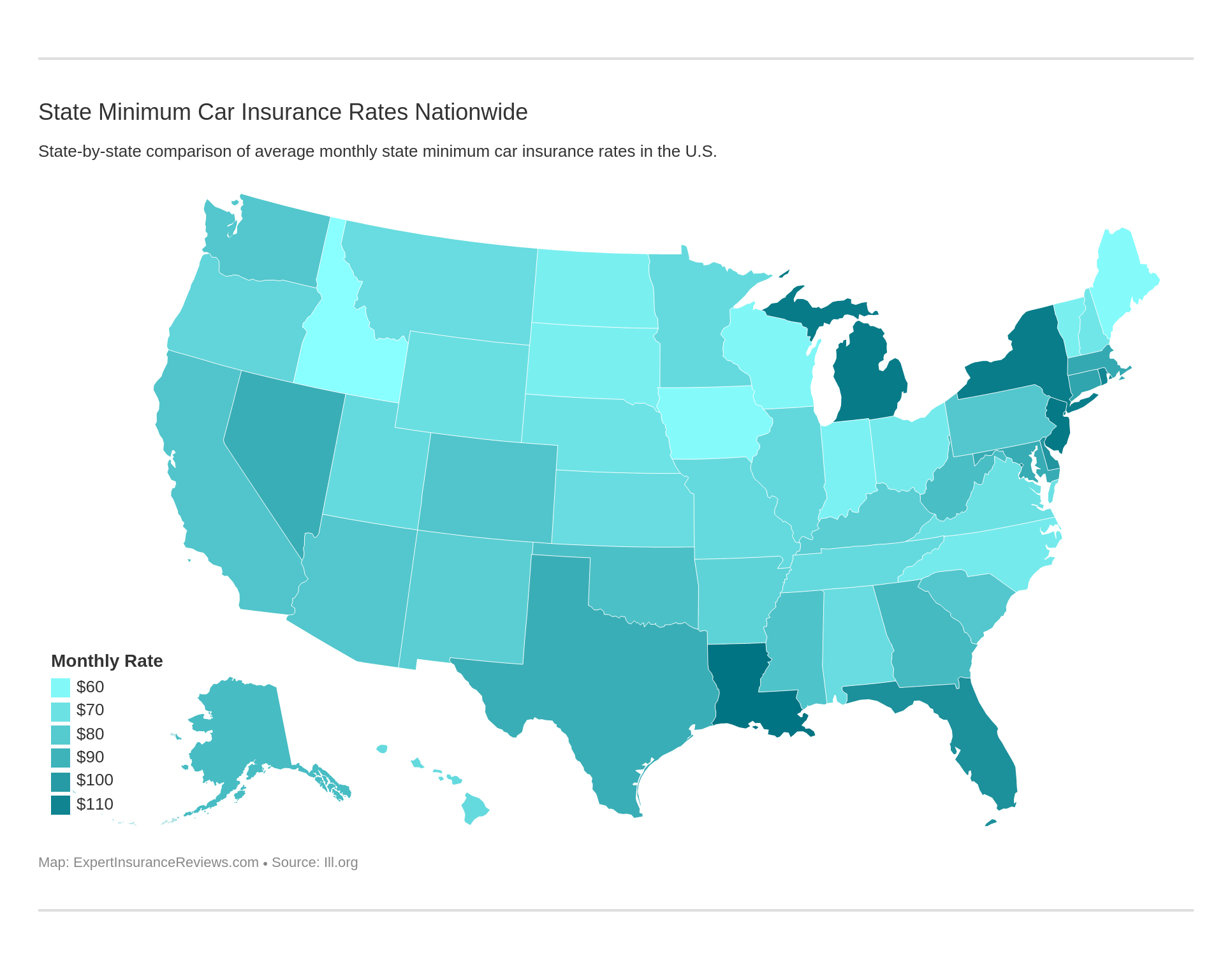

Minimum coverage costs vary from state to state.

Forms of Financial Responsibility

A car insurance policy is the main form of financial responsibility in Alaska, but there are other ways to stay in compliance with the law.

Self-insurance is permitted, but only for those who own a fleet of 25 or more vehicles.

For someone with considerably fewer cars in the driveway, there is the option of a surety bond. The bond has to be in an amount that meets both the bodily injury and property damage liability requirements. That adds up to $125,000.

Premiums as a Percentage of Income

Over the past three years, Alaskans have spent less than the average percentage of their income on car insurance. This is thanks to both a higher-than-average amount of disposable income and lower-than-average car insurance premiums.

| Alaska Average Premium and Percentage of Income | Average Annual Premium | Average Disposable Income | Premiums as Percentage of Income |

|---|---|---|---|

| 2012 | Alaska: $1,053.54 Countrywide: $924.45 | Alaska: $48,465.00 Countrywide: $39,473.00 | Alaska: 2.17% Countrywide: 2.34% |

| 2013 | Alaska: $1,058.15 Countrywide: $950.92 | Alaska: $46,858.00 Countrywide: $39,192.00 | Alaska: 2.26% Countrywide: 2.43% |

| 2014 | Alaska: $1,050.09 Countrywide: $981.77 | Alaska: $49,756.00 Countrywide: $40,859.00 | Alaska: 2.11% Countrywide: 2.40% |

It’s hard to compare Alaska to any other state since it has no direct neighbors. The nearest state geographically is Washington, which has very similar numbers to Alaska’s – in fact, in 2014 Washington drivers also spent 2.11 percent of their income on car insurance.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Average Monthly Car Insurance Rates in AK (Liability, Collision, Comprehensive)

Core coverage is the basics of a full coverage insurance policy. That can be broken down into three main parts – liability, collision, and comprehensive. Here’s how Alaska’s rates for these coverages compare to the national average.

| Coverage Type | Annual Costs in 2015 (Alaska) | Annual Costs in 2015 (National) |

|---|---|---|

| Liability | $539.68 | $538.73 |

| Collision | $350.81 | $322.61 |

| Comprehensive | $137.26 | $148.04 |

| Combined | $1,027.75 | $1,009.38 |

Overall, Alaska’s rates are a little higher than the national average.

Liability and comprehensive coverage are both a little cheaper than the national average, but a higher cost for collision puts the final total at a higher rate.

Additional Liability

There are two types of additional liability coverage available to drivers in Alaska. These aren’t required by law but can help provide additional protection to drivers.

Medical Payments coverage (MedPay) provides a benefit to you and anyone injured in your vehicle, regardless of who is at fault in the accident.

Uninsured and Underinsured Motorist Liability is available for both bodily injury and property damage. It covers you if you’re in an accident with a driver that doesn’t have insurance, or doesn’t have enough insurance.

15.4 percent of drivers in Alaska are uninsured. The state ranks at number 11 for uninsured drivers.

Even if a driver does have insurance, it might not be sufficient. When the cost of an accident goes beyond the liability limits of the at-fault driver, underinsured motorist coverage kicks in to make up the difference.

Loss ratios are a measure of how insurance companies are doing in terms of paying out claims. A high loss ratio means they’re paying out a lot, while a low one means they aren’t paying out as much as they should.

If a loss ratio is at 100 percent or higher, that means the companies are paying out more than they are taking in from premiums, putting them at risk of financial problems.

| Loss Ratio | 2015 |

|---|---|

| Medical Payments (MedPay) | 83.07 |

| Uninsured/Underinsured Motorist | 50.91 |

Above you can see that Alaska’s overall loss ratio for MedPay claims is a bit on the high side. On the other hand, Uninsured and Underinsured Motorist loss ratios are a bit low.

Add-ons, Endorsements, and Riders

It’s up to individual insurance companies to decide what additional coverage they want to offer beyond the basics.

Here’s a list of the many add-ons that are available. Not all insurance companies will offer the full list.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance

Most major insurance companies offer some form of usage-based insurance program. These allow you to earn a discount based on your driving habits.

Currently, only a few true pay-per-mile programs exist, and none of them are offered in Alaska.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

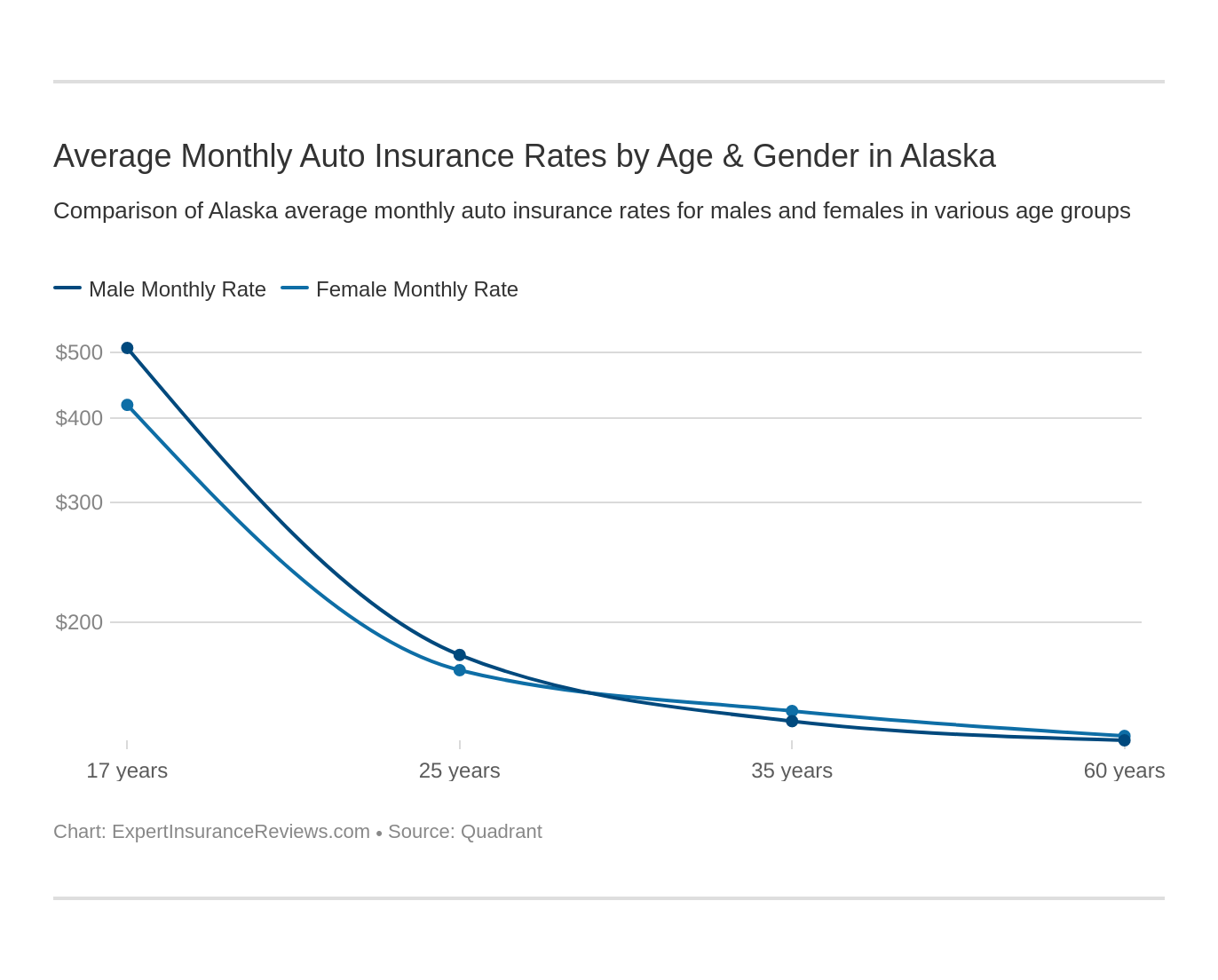

Average Car Insurance Rates by Age & Gender in AK

Gender and age are two of the factors that can affect how much you pay for car insurance. Here’s a look at average rates for male and female drivers in several age groups.

| Company | Married 35-year old female annual rates | Married 35-year old male annual rates | Married 60-year old female annual rates | Married 60-year old male annual rates | Single 17-year old female annual rates | Single 17-year old male annual rates | Single 25-year old female annual rates | Single 25-year old male annual rates |

|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $2,133.71 | $2,133.71 | $2,037.18 | $2,037.18 | $5,100.22 | $6,679.06 | $2,407.00 | $2,634.39 |

| Geico General | $2,118.66 | $2,053.39 | $1,999.69 | $1,902.76 | $4,667.64 | $5,955.63 | $2,094.53 | $2,247.33 |

| Progressive Direct | $1,846.21 | $1,631.16 | $1,551.21 | $1,588.18 | $6,507.31 | $7,248.95 | $2,075.99 | $2,053.77 |

| State Farm Mutual Auto | $1,340.30 | $1,340.30 | $1,200.62 | $1,200.62 | $4,158.63 | $5,390.65 | $1,578.13 | $1,615.68 |

| USAA | $1,439.39 | $1,435.84 | $1,341.61 | $1,334.71 | $4,660.59 | $5,168.23 | $2,065.08 | $2,188.18 |

Seventeen-year-old drivers are the most expensive to insure regardless of gender. That’s because they are inexperienced and have the highest risk of an accident.

As a general rule, young male drivers are more expensive than females since statistically speaking, they’re a higher-risk group. The gender gap isn’t as large in Alaska, however, as in many other states.

The rate gap decreases a lot after age 25, and some companies show no gender difference from age 35 on.

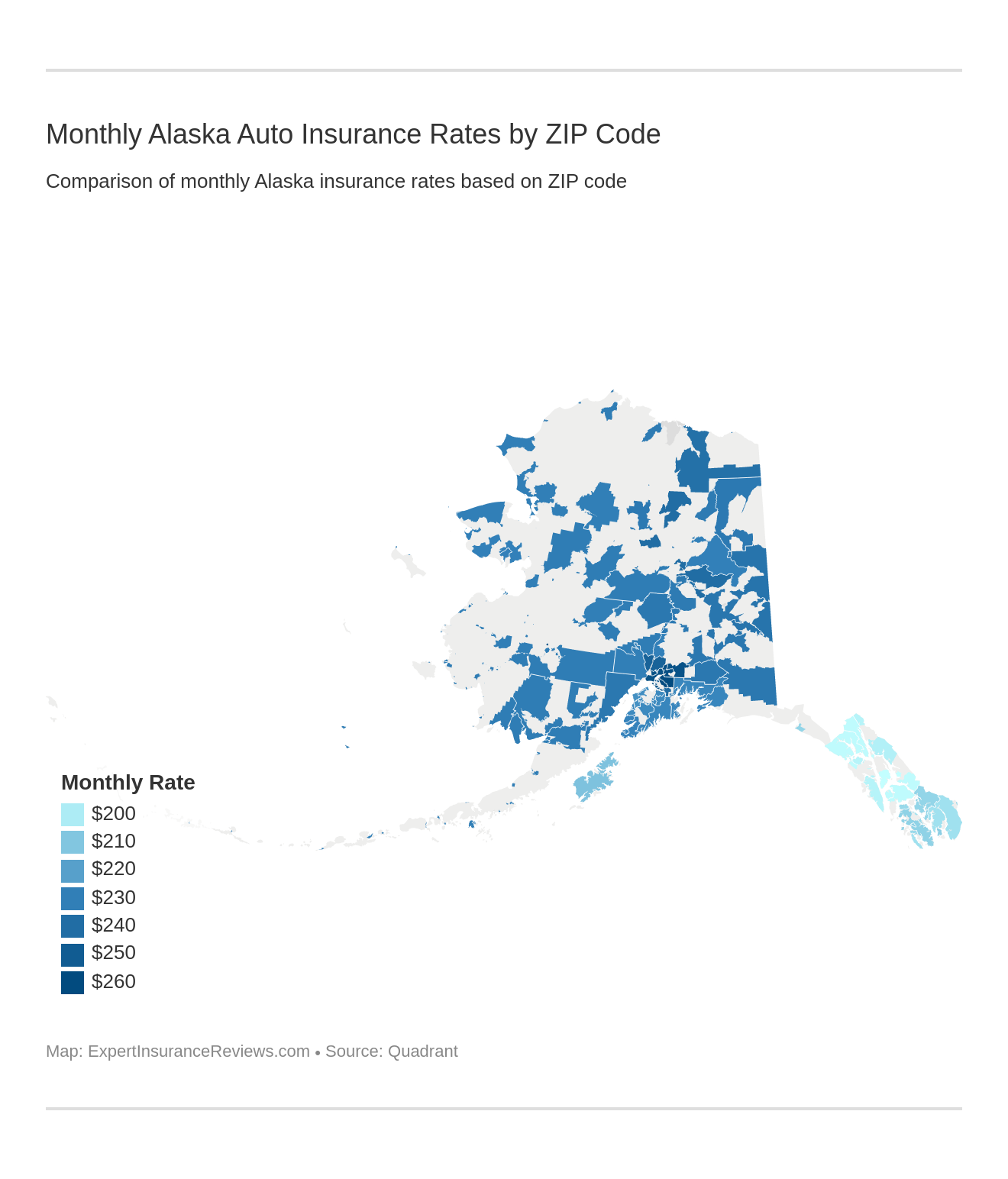

Cheapest Rates By Zip Code

Where you live can also impact what you pay. Search the table below to see how your zip code stacks up.

The most expensive zip codes in Alaska are all located in the city of Anchorage, while the cheapest zip codes are in the southern part of the state, on the islands near Juneau.

| Zipcode | Annual Average |

|---|---|

| 99504 | $3,132.74 |

| 99567 | $3,124.36 |

| 99577 | $3,111.36 |

| 99508 | $3,101.13 |

| 99645 | $3,091.71 |

| 99502 | $3,086.19 |

| 99507 | $3,083.15 |

| 99518 | $3,080.49 |

| 99503 | $3,074.51 |

| 99599 | $3,074.51 |

| 99501 | $3,074.22 |

| 99513 | $3,074.22 |

| 99529 | $3,074.22 |

| 99652 | $3,072.96 |

| 99654 | $3,072.96 |

| 99515 | $3,072.50 |

| 99517 | $3,068.87 |

| 99530 | $3,068.87 |

| 99674 | $3,060.28 |

| 99516 | $3,056.41 |

| 99540 | $3,026.69 |

| 99505 | $3,012.68 |

| 99506 | $2,988.70 |

| 99688 | $2,957.31 |

| 99694 | $2,957.31 |

| 99587 | $2,894.79 |

| 99701 | $2,885.50 |

| 99714 | $2,880.20 |

| 99712 | $2,876.34 |

| 99790 | $2,876.34 |

| 99703 | $2,876.16 |

| 99519 | $2,853.72 |

| 99716 | $2,848.08 |

| 99775 | $2,836.65 |

| 99693 | $2,833.93 |

| 99732 | $2,828.96 |

| 99738 | $2,828.96 |

| 99764 | $2,828.96 |

| 99776 | $2,828.96 |

| 99780 | $2,828.96 |

| 99705 | $2,827.17 |

| 99731 | $2,824.49 |

| 99737 | $2,824.49 |

| 99744 | $2,816.00 |

| 99702 | $2,812.87 |

| 99743 | $2,811.56 |

| 99682 | $2,809.91 |

| 99723 | $2,808.39 |

| 99709 | $2,808.39 |

| 99586 | $2,807.55 |

| 99566 | $2,803.40 |

| 99573 | $2,803.40 |

| 99588 | $2,803.40 |

| 99623 | $2,800.27 |

| 99755 | $2,798.16 |

| 99726 | $2,795.61 |

| 99740 | $2,795.61 |

| 99788 | $2,795.61 |

| 99733 | $2,794.05 |

| 99777 | $2,792.81 |

| 99729 | $2,791.41 |

| 99760 | $2,789.17 |

| 99759 | $2,785.45 |

| 99758 | $2,784.76 |

| 99569 | $2,782.22 |

| 99559 | $2,781.80 |

| 99609 | $2,781.80 |

| 99680 | $2,781.80 |

| 99690 | $2,781.80 |

| 99722 | $2,781.61 |

| 99781 | $2,781.61 |

| 99641 | $2,780.70 |

| 99679 | $2,780.70 |

| 99789 | $2,779.85 |

| 99765 | $2,778.82 |

| 99580 | $2,778.06 |

| 99782 | $2,777.14 |

| 99552 | $2,776.74 |

| 99557 | $2,776.74 |

| 99575 | $2,776.74 |

| 99637 | $2,776.74 |

| 99681 | $2,776.74 |

| 99757 | $2,776.10 |

| 99660 | $2,775.31 |

| 99548 | $2,774.57 |

| 99549 | $2,774.57 |

| 99565 | $2,774.57 |

| 99579 | $2,774.57 |

| 99648 | $2,774.57 |

| 99768 | $2,773.31 |

| 99791 | $2,773.31 |

| 99558 | $2,773.22 |

| 99745 | $2,773.22 |

| 99774 | $2,773.22 |

| 99683 | $2,773.04 |

| 99555 | $2,772.87 |

| 99670 | $2,772.79 |

| 99583 | $2,772.52 |

| 99649 | $2,772.50 |

| 99546 | $2,772.23 |

| 99628 | $2,771.83 |

| 99636 | $2,771.83 |

| 99590 | $2,771.15 |

| 99665 | $2,771.15 |

| 99724 | $2,771.15 |

| 99746 | $2,771.15 |

| 99576 | $2,770.80 |

| 99678 | $2,770.80 |

| 99704 | $2,770.55 |

| 99691 | $2,770.51 |

| 99547 | $2,770.44 |

| 99720 | $2,770.11 |

| 99571 | $2,769.72 |

| 99747 | $2,768.66 |

| 99553 | $2,768.36 |

| 99638 | $2,768.36 |

| 99561 | $2,768.35 |

| 99578 | $2,768.35 |

| 99589 | $2,768.35 |

| 99614 | $2,768.35 |

| 99651 | $2,768.35 |

| 99656 | $2,768.35 |

| 99748 | $2,768.35 |

| 99564 | $2,768.34 |

| 99756 | $2,768.06 |

| 99613 | $2,767.91 |

| 99602 | $2,767.62 |

| 99767 | $2,767.62 |

| 99622 | $2,766.81 |

| 99591 | $2,766.60 |

| 99606 | $2,766.27 |

| 99625 | $2,766.27 |

| 99640 | $2,766.27 |

| 99647 | $2,766.27 |

| 99653 | $2,766.27 |

| 99554 | $2,765.86 |

| 99563 | $2,765.86 |

| 99581 | $2,765.86 |

| 99585 | $2,765.86 |

| 99657 | $2,765.86 |

| 99662 | $2,765.86 |

| 99750 | $2,765.86 |

| 99751 | $2,765.86 |

| 99761 | $2,765.86 |

| 99766 | $2,765.86 |

| 99770 | $2,765.86 |

| 99773 | $2,765.86 |

| 99621 | $2,765.55 |

| 99630 | $2,765.55 |

| 99634 | $2,765.55 |

| 99668 | $2,765.55 |

| 99627 | $2,765.27 |

| 99675 | $2,765.27 |

| 99620 | $2,763.78 |

| 99632 | $2,763.78 |

| 99666 | $2,763.78 |

| 99763 | $2,763.78 |

| 99667 | $2,763.76 |

| 99658 | $2,763.47 |

| 99626 | $2,762.74 |

| 99650 | $2,762.74 |

| 99727 | $2,762.74 |

| 99736 | $2,762.74 |

| 99721 | $2,761.70 |

| 99749 | $2,761.70 |

| 99786 | $2,761.70 |

| 99741 | $2,761.39 |

| 99661 | $2,761.00 |

| 99612 | $2,760.52 |

| 99604 | $2,759.63 |

| 99752 | $2,757.55 |

| 99551 | $2,757.14 |

| 99684 | $2,755.14 |

| 99742 | $2,755.14 |

| 99769 | $2,755.14 |

| 99772 | $2,755.14 |

| 99659 | $2,754.67 |

| 99671 | $2,754.67 |

| 99607 | $2,754.35 |

| 99655 | $2,754.35 |

| 99754 | $2,753.07 |

| 99771 | $2,753.07 |

| 99784 | $2,752.03 |

| 99778 | $2,751.55 |

| 99633 | $2,750.95 |

| 99739 | $2,749.95 |

| 99676 | $2,748.05 |

| 99685 | $2,747.41 |

| 99753 | $2,746.84 |

| 99762 | $2,746.84 |

| 99783 | $2,746.84 |

| 99785 | $2,746.84 |

| 99730 | $2,746.75 |

| 99692 | $2,744.61 |

| 99603 | $2,737.91 |

| 99663 | $2,737.91 |

| 99556 | $2,730.16 |

| 99574 | $2,729.94 |

| 99677 | $2,729.94 |

| 99664 | $2,723.28 |

| 99686 | $2,721.92 |

| 99568 | $2,714.65 |

| 99639 | $2,710.25 |

| 99572 | $2,709.97 |

| 99610 | $2,709.61 |

| 99605 | $2,706.57 |

| 99631 | $2,706.57 |

| 99545 | $2,699.37 |

| 99672 | $2,697.41 |

| 99611 | $2,691.18 |

| 99669 | $2,682.68 |

| 99550 | $2,529.87 |

| 99608 | $2,529.87 |

| 99615 | $2,529.87 |

| 99624 | $2,529.87 |

| 99643 | $2,529.87 |

| 99644 | $2,529.87 |

| 99926 | $2,490.80 |

| 99925 | $2,490.45 |

| 99921 | $2,484.84 |

| 99689 | $2,473.28 |

| 99903 | $2,472.61 |

| 99929 | $2,471.16 |

| 99923 | $2,468.39 |

| 99922 | $2,465.25 |

| 99919 | $2,456.86 |

| 99927 | $2,455.82 |

| 99901 | $2,438.02 |

| 99918 | $2,438.02 |

| 99928 | $2,438.02 |

| 99801 | $2,391.42 |

| 99811 | $2,391.42 |

| 99821 | $2,391.42 |

| 99835 | $2,371.90 |

| 99836 | $2,371.90 |

| 99825 | $2,370.52 |

| 99840 | $2,370.50 |

| 99827 | $2,357.96 |

| 99826 | $2,355.81 |

| 99824 | $2,351.46 |

| 99833 | $2,351.30 |

| 99830 | $2,348.31 |

| 99832 | $2,348.31 |

| 99841 | $2,348.31 |

| 99829 | $2,348.11 |

| 99820 | $2,335.97 |

Cheapest Rates By City

A city can be made up of a lot of different zip codes with different rates. Here’s how those average out.

| City | Annual Average |

|---|---|

| ANGOON | $2,335.97 |

| HOONAH | $2,348.11 |

| KAKE | $2,348.31 |

| PELICAN | $2,348.31 |

| TENAKEE SPRINGS | $2,348.31 |

| PETERSBURG | $2,351.30 |

| DOUGLAS | $2,351.46 |

| GUSTAVUS | $2,355.81 |

| HAINES | $2,357.96 |

| SKAGWAY | $2,370.50 |

| ELFIN COVE | $2,370.52 |

| PORT ALEXANDER | $2,371.90 |

| SITKA | $2,371.90 |

| AUKE BAY | $2,391.43 |

| JUNEAU | $2,391.43 |

| COFFMAN COVE | $2,438.02 |

| KETCHIKAN | $2,438.02 |

| WARD COVE | $2,438.02 |

| POINT BAKER | $2,455.82 |

| THORNE BAY | $2,456.86 |

| HYDABURG | $2,465.25 |

| HYDER | $2,468.39 |

| WRANGELL | $2,471.16 |

| MEYERS CHUCK | $2,472.61 |

| YAKUTAT | $2,473.27 |

| CRAIG | $2,484.84 |

| KLAWOCK | $2,490.45 |

| METLAKATLA | $2,490.80 |

| KARLUK | $2,529.87 |

| KODIAK | $2,529.87 |

| LARSEN BAY | $2,529.87 |

| OLD HARBOR | $2,529.87 |

| OUZINKIE | $2,529.87 |

| PORT LIONS | $2,529.87 |

| SOLDOTNA | $2,682.68 |

| KENAI | $2,691.18 |

| STERLING | $2,697.41 |

| KONGIGANAK | $2,699.37 |

| HOPE | $2,706.57 |

| MOOSE PASS | $2,706.57 |

| KASILOF | $2,709.61 |

| COOPER LANDING | $2,709.97 |

| NINILCHIK | $2,710.25 |

| CLAM GULCH | $2,714.65 |

| VALDEZ | $2,721.92 |

| SEWARD | $2,723.28 |

| CORDOVA | $2,729.94 |

| TATITLEK | $2,729.94 |

| ANCHOR POINT | $2,730.16 |

| HOMER | $2,737.91 |

| SELDOVIA | $2,737.91 |

| DUTCH HARBOR | $2,744.61 |

| CENTRAL | $2,746.75 |

| BREVIG MISSION | $2,746.84 |

| KOYUK | $2,746.84 |

| NOME | $2,746.84 |

| WALES | $2,746.84 |

| UNALASKA | $2,747.41 |

| TALKEETNA | $2,748.05 |

| ELIM | $2,749.95 |

| NAKNEK | $2,750.95 |

| TELLER | $2,751.55 |

| WHITE MOUNTAIN | $2,752.03 |

| KOYUKUK | $2,753.07 |

| SHAKTOOLIK | $2,753.07 |

| KALSKAG | $2,754.35 |

| QUINHAGAK | $2,754.35 |

| SAINT MICHAEL | $2,754.67 |

| STEBBINS | $2,754.67 |

| GAMBELL | $2,755.14 |

| SAVOONGA | $2,755.14 |

| SHISHMAREF | $2,755.14 |

| UNALAKLEET | $2,755.14 |

| AKIACHAK | $2,757.15 |

| KOTZEBUE | $2,757.55 |

| HOOPER BAY | $2,759.63 |

| KING COVE | $2,760.52 |

| SAND POINT | $2,761.00 |

| GALENA | $2,761.39 |

| AMBLER | $2,761.70 |

| ANAKTUVUK PASS | $2,761.70 |

| KIANA | $2,761.70 |

| BUCKLAND | $2,762.74 |

| DEERING | $2,762.74 |

| LOWER KALSKAG | $2,762.74 |

| PILOT STATION | $2,762.74 |

| SAINT MARYS | $2,763.47 |

| SKWENTNA | $2,763.76 |

| KOTLIK | $2,763.78 |

| MOUNTAIN VILLAGE | $2,763.78 |

| NOORVIK | $2,763.78 |

| NUNAM IQUA | $2,763.78 |

| MC GRATH | $2,765.27 |

| TAKOTNA | $2,765.27 |

| KWETHLUK | $2,765.55 |

| MEKORYUK | $2,765.55 |

| NAPAKIAK | $2,765.55 |

| SLEETMUTE | $2,765.55 |

| ALAKANUK | $2,765.86 |

| CHEVAK | $2,765.86 |

| EMMONAK | $2,765.86 |

| KIVALINA | $2,765.86 |

| KOBUK | $2,765.86 |

| MARSHALL | $2,765.86 |

| NOATAK | $2,765.86 |

| POINT HOPE | $2,765.86 |

| RUSSIAN MISSION | $2,765.86 |

| SCAMMON BAY | $2,765.86 |

| SELAWIK | $2,765.86 |

| SHUNGNAK | $2,765.86 |

| ILIAMNA | $2,766.27 |

| LEVELOCK | $2,766.27 |

| NONDALTON | $2,766.27 |

| PEDRO BAY | $2,766.27 |

| PORT ALSWORTH | $2,766.27 |

| SAINT GEORGE ISLAND | $2,766.60 |

| KWIGILLINGOK | $2,766.81 |

| HOLY CROSS | $2,767.62 |

| RAMPART | $2,767.62 |

| KING SALMON | $2,767.91 |

| MANLEY HOT SPRINGS | $2,768.06 |

| CHIGNIK | $2,768.34 |

| CHEFORNAK | $2,768.35 |

| EEK | $2,768.35 |

| GOODNEWS BAY | $2,768.35 |

| KALTAG | $2,768.35 |

| KIPNUK | $2,768.35 |

| PLATINUM | $2,768.35 |

| RED DEVIL | $2,768.35 |

| AKUTAN | $2,768.36 |

| NIKOLSKI | $2,768.36 |

| KAKTOVIK | $2,768.66 |

| COLD BAY | $2,769.72 |

| ALLAKAKET | $2,770.11 |

| ATKA | $2,770.44 |

| NIKOLAI | $2,770.51 |

| CLEAR | $2,770.55 |

| DILLINGHAM | $2,770.80 |

| TOGIAK | $2,770.80 |

| BEAVER | $2,771.15 |

| GRAYLING | $2,771.15 |

| HUSLIA | $2,771.15 |

| SHAGELUK | $2,771.15 |

| MANOKOTAK | $2,771.83 |

| NEW STUYAHOK | $2,771.83 |

| ADAK | $2,772.23 |

| PILOT POINT | $2,772.50 |

| FALSE PASS | $2,772.52 |

| SOUTH NAKNEK | $2,772.79 |

| ALEKNAGIK | $2,772.87 |

| TRAPPER CREEK | $2,773.04 |

| ANVIK | $2,773.22 |

| HUGHES | $2,773.22 |

| STEVENS VILLAGE | $2,773.22 |

| ATQASUK | $2,773.31 |

| RUBY | $2,773.31 |

| CHIGNIK LAGOON | $2,774.57 |

| CHIGNIK LAKE | $2,774.57 |

| EGEGIK | $2,774.57 |

| PERRYVILLE | $2,774.57 |

| PORT HEIDEN | $2,774.57 |

| SAINT PAUL ISLAND | $2,775.31 |

| LAKE MINCHUMINA | $2,776.11 |

| AKIAK | $2,776.74 |

| ANIAK | $2,776.74 |

| CROOKED CREEK | $2,776.74 |

| TOKSOOK BAY | $2,776.74 |

| TUNUNAK | $2,776.74 |

| WAINWRIGHT | $2,777.14 |

| EKWOK | $2,778.06 |

| NULATO | $2,778.82 |

| NUIQSUT | $2,779.85 |

| NUNAPITCHUK | $2,780.70 |

| TULUKSAK | $2,780.70 |

| ARCTIC VILLAGE | $2,781.61 |

| VENETIE | $2,781.61 |

| BETHEL | $2,781.80 |

| KASIGLUK | $2,781.80 |

| NIGHTMUTE | $2,781.80 |

| TUNTUTULIAK | $2,781.80 |

| CLARKS POINT | $2,782.22 |

| MINTO | $2,784.76 |

| POINT LAY | $2,785.45 |

| NENANA | $2,789.17 |

| CANTWELL | $2,791.40 |

| TANANA | $2,792.81 |

| CIRCLE | $2,794.05 |

| BETTLES FIELD | $2,795.61 |

| CHALKYITSIK | $2,795.61 |

| FORT YUKON | $2,795.61 |

| DENALI NATIONAL PARK | $2,798.16 |

| #N/A | $2,800.27 |

| CHITINA | $2,803.40 |

| COPPER CENTER | $2,803.40 |

| GLENNALLEN | $2,803.40 |

| GAKONA | $2,807.55 |

| BARROW | $2,808.39 |

| TYONEK | $2,809.91 |

| HEALY | $2,811.56 |

| EIELSON AFB | $2,812.87 |

| ANDERSON | $2,816.00 |

| DELTA JUNCTION | $2,824.49 |

| FORT GREELY | $2,824.49 |

| NORTH POLE | $2,827.17 |

| CHICKEN | $2,828.96 |

| EAGLE | $2,828.96 |

| NORTHWAY | $2,828.96 |

| TANACROSS | $2,828.96 |

| TOK | $2,828.96 |

| WHITTIER | $2,833.94 |

| TWO RIVERS | $2,848.08 |

| FAIRBANKS | $2,856.65 |

| FORT WAINWRIGHT | $2,876.16 |

| SALCHA | $2,880.21 |

| GIRDWOOD | $2,894.79 |

| HOUSTON | $2,957.31 |

| WILLOW | $2,957.31 |

| JBER | $3,000.69 |

| INDIAN | $3,026.70 |

| SUTTON | $3,060.28 |

| ANCHORAGE | $3,065.05 |

| BIG LAKE | $3,072.96 |

| WASILLA | $3,072.96 |

| PALMER | $3,091.71 |

| EAGLE RIVER | $3,111.36 |

| CHUGIAK | $3,124.36 |

The cities with the cheapest rates are in the same area where we found the cheapest zip codes. Anchorage, however, doesn’t make the top five most expensive in spite of being home to the most expensive zip codes.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Best Car Insurance Companies in Alaska

Alaska drivers have a lot of choices, with plenty of car insurance companies offering coverage.

You want to make sure you don’t overpay for coverage, but at the same time, you want to be sure you’re getting a good value for your insurance dollar.

It’s hard to tell which quote is a great deal and which is cheap for a reason. You don’t have the time to research every company along with comparing their rates to find out which company is best.

We’ll help you narrow down your choices with a look at the top car insurance companies and what you can expect from them.

In the next section, we will cover insurance rates for a variety of different situations. We’ll go over the company ratings and complaints, and which companies are trusted by the most Alaskans.

The Largest Companies’ Financial Rating

Your insurance company’s financial rating might seem like it’s not relevant to you, but it’s actually important. A solid financial rating means the insurance company will be able to meet all of its obligations. And those obligations are your claims.

AM Best is a financial rating company that gives each insurance company a letter grade for financial stability.

Alaska Financial Ratings for the 10 Largest Companies

| Provider | A.M. Best |

|---|---|

| B | |

| A++ | |

| A++ | |

| A+ | |

| A+ | |

| A |

| Country Insurance & Financial Service Group | A+ |

| A+ |

| Tiptree Financial Group | A- |

| Horace Mann Group | A |

All of the top ten companies have good ratings. A and A- are considered to be Excellent, while A+ and A++ are considered to be Superior.

Companies With The Best Ratings

J.D. Power doesn’t have regional ratings for insurance companies in Alaska, but some of the top companies in the state do rank well in the national surveys.

USAA earned a rating of four out of five on the national Auto Insurance Shopping Survey. They also earned five out of five for claims satisfaction. That makes them the best rated of the top 10. Read our USAA insurance review to learn more.

State Farm, Geico, Progressive, and Allstate all ranked at three out of five on the claims satisfaction survey. Their ratings were the same in the shopping study. Three out of five is considered average.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Companies With the Most Complaints in Alaska

The Alaska Division of Insurance delivers an annual report that lists complaints about the top property & casualty insurance companies. They don’t break them down by line of business, so it’s important to note that these complaint numbers may be for more than auto insurance.

These are the property and casualty companies with five or more complaints in 2018. Listed are the number of complaints and the percentage of the total.

| Company | Number of Complaints (2018) | Percentage of Total Complaints |

|---|---|---|

| Allstate | 8 | 6.8% |

| Progressive | 6 | 5.1% |

| State Farm | 7 | 5.9% |

| USAA | 6 | 5.1% |

| Berkshire Hathaway (Geico) | 13 | 11% |

Geico carried the largest portion of the total complaints with 11 percent.

Where to Buy Cheap Alaska Car Insurance

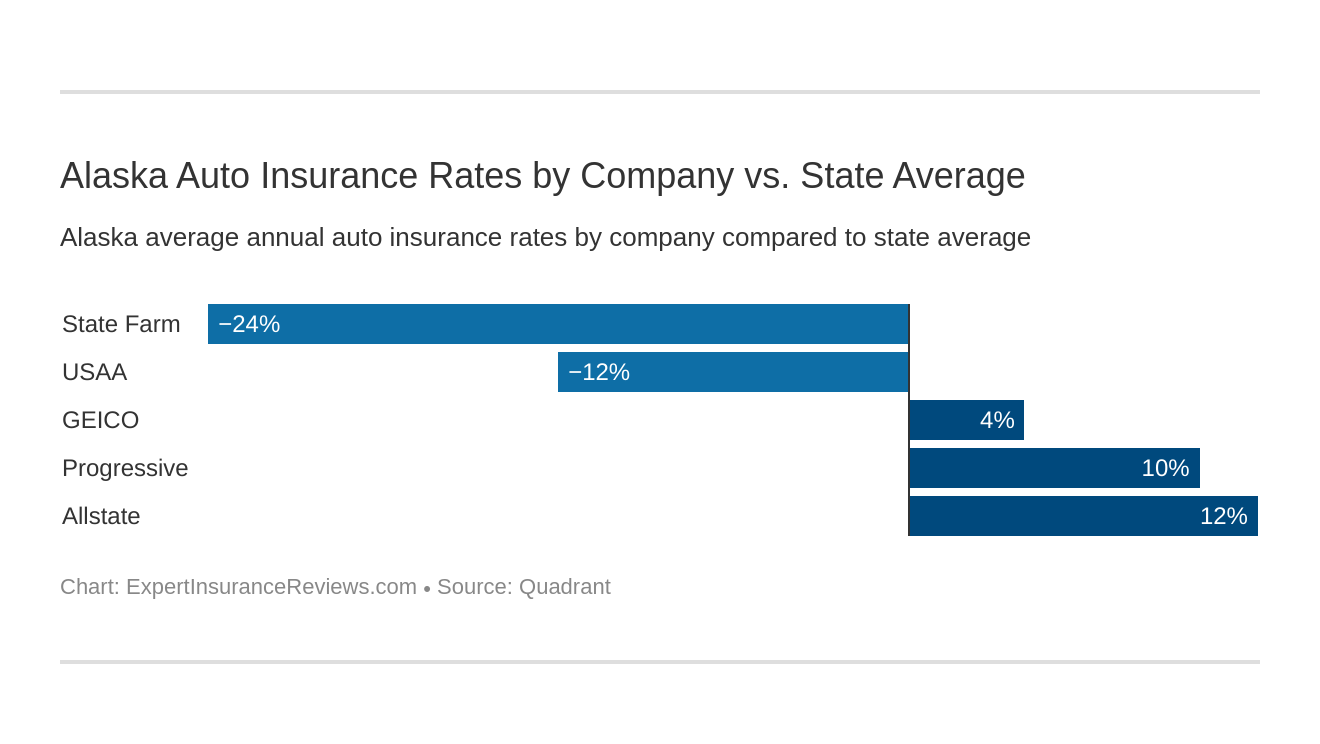

State Farm has the cheapest rates in Alaska among the top five. USAA is the only other top company to come in below average.

| Company | Annual Average | Compared to State Average ($) | Compared to State Average (%) |

|---|---|---|---|

| Allstate F&C | $3,145.31 | $391.22 | 12.44% |

| Geico General | $2,879.95 | $125.87 | 4.37% |

| Progressive Direct | $3,062.85 | $308.76 | 10.08% |

| State Farm Mutual Auto | $2,228.12 | -$525.97 | -23.61% |

| USAA | $2,454.20 | -$299.88 | -12.22% |

Commute Rates By Company

Although commute distance can affect rates, there isn’t much difference between our two samples. In fact, at Progressive, there is no difference at all.

| Company | 10 miles commute. 6000 annual mileage. | 25 miles commute. 12000 annual mileage. |

|---|---|---|

| Allstate | $3,083.83 | $3,206.78 |

| Geico | $2,843.44 | $2,916.47 |

| Progressive | $3,062.85 | $3,062.85 |

| State Farm | $2,166.89 | $2,289.34 |

| USAA | $2,412.02 | $2,496.39 |

Commute distance is not the only thing that will affect your rates.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Coverage Level Rates By Company

The reason most people skimp on coverage is to save money. As you can see below, however, it doesn’t always cost that much more to get better coverage. At Allstate, for example, you’ll pay less than $20 a month extra to jump from low to high coverage.

| Company | Annual Rates with Low Coverage | Annual Rates with Medium Coverage | Annual Rates with High Coverage |

|---|---|---|---|

| Allstate | $3,163.60 | $3,244.05 | $3,386.12 |

| Farmers | $3,947.19 | $4,123.31 | $4,459.72 |

| Geico | $2,691.69 | $2,847.91 | $3,064.88 |

| Liberty Mutual | $5,051.39 | $5,267.49 | $5,558.30 |

| Nationwide | $2,643.86 | $2,633.00 | $2,693.25 |

| Progressive | $3,721.57 | $4,039.29 | $4,463.45 |

| State Farm | $3,895.87 | $4,089.03 | $4,324.68 |

| Travelers | $3,514.54 | $3,769.91 | $3,804.37 |

| USAA | $2,146.16 | $2,197.54 | $2,293.51 |

Credit History Rates By Company

Your credit history has a bigger impact on rates than the other factors we have considered so far. At top insurance company State Farm the difference between poor and good credit is a cost of nearly $1,500 a year.

| Company | Annual Rates with Poor Credit | Annual Rates with Fair Credit | Annual Rates with Good Credit |

|---|---|---|---|

| Allstate | $3,717.53 | $2,961.29 | $2,757.09 |

| Geico | $3,273.06 | $2,845.02 | $2,521.78 |

| Progressive | $3,344.30 | $2,992.23 | $2,852.01 |

| State Farm | $3,082.77 | $1,992.76 | $1,608.81 |

| USAA | $3,341.50 | $2,189.01 | $1,832.10 |

Driving Record Rates By Company

Another big factor in deciding what you pay for insurance is your driving record. Drivers with a clean record will always get the lowest rates. From there, insurance companies can differ quite a bit in terms of what type of violation hurts rates the most.

Take a look at how rates compare for a few common situations.

| Company | Clean Record | 1 Speeding Ticket | 1 Accident | 1 DUI |

|---|---|---|---|---|

| Allstate | $2,510.60 | $2,987.51 | $3,541.27 | $3,541.83 |

| Geico | $2,058.90 | $2,096.36 | $3,044.11 | $4,320.46 |

| Progressive | $2,740.77 | $3,086.55 | $3,512.71 | $2,911.35 |

| State Farm | $2,031.37 | $2,228.13 | $2,424.84 | $2,228.13 |

| USAA | $1,928.44 | $2,182.92 | $2,473.74 | $3,231.71 |

As you can see, a DUI has the same rate as an accident with Allstate, while the DUI has a much higher rate at Geico. Progressive, meanwhile, has the highest rate for an accident.

This is why shopping around is so important – even with a DUI, you may get a much better rate from one company than from another. Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

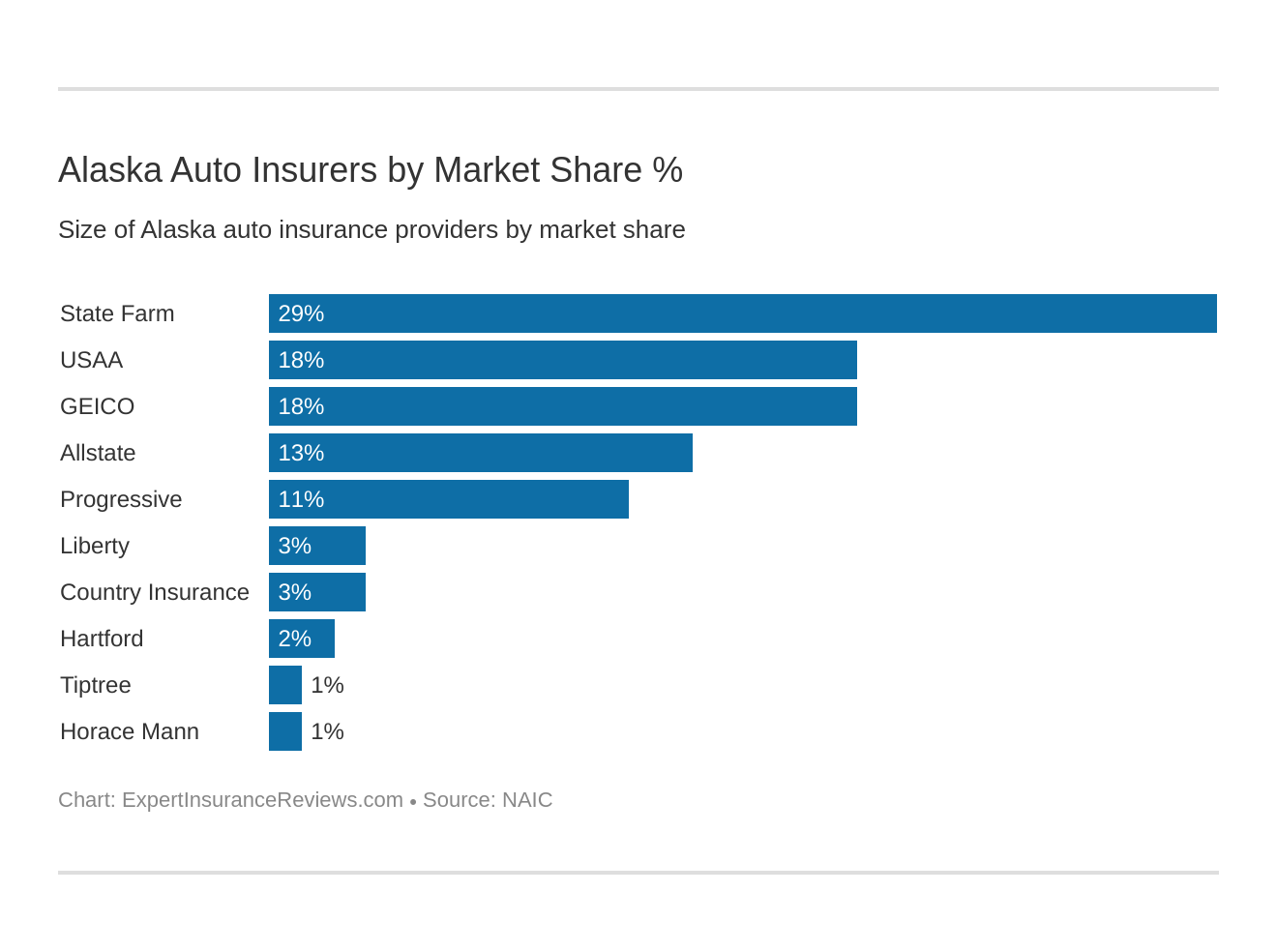

Largest Car Insurance Companies in Alaska

State Farm is the largest car insurance company in Alaska and in the entire United States, too.

It’s not surprising that USAA is the second largest, given that 12.5 percent of the adult population in the state is a Veteran, according to the National Conference of State Legislatures. That’s the highest of any state. Another 2.31 percent of the population is active duty military.

| Company | Direct Premiums Written | Market Share |

|---|---|---|

| State Farm Group | $133,816 | 28.55% |

| USAA Group | $83,687 | 17.86% |

| Geico | $82,637 | 17.63% |

| Allstate Insurance Group | $59,507 | 12.70% |

| Progressive Group | $50,922 | 10.86% |

| Liberty Mutual Group | $16,337 | 3.49% |

| Country Insurance & Financial Service Group | $14,042 | 3.00% |

| Hartford Fire & Casualty Group | $10,332 | 2.20% |

| Tiptree Financial Group | $4,938 | 1.05% |

| Horace Mann Group | $4,748 | 1.01% |

Alaska also has some smaller insurance companies in the top ten, including educator-focused Horace Mann.

Number of Insurers in Alaska

There are only four domestic insurance companies selling auto insurance in Alaska. That means that the company has its headquarters in Alaska.

Foreign insurers are those with their headquarters in other states. 397 of those operate in Alaska.

That’s a total of 401 property and casualty insurance companies.

Alaska State Laws

What laws in Alaska apply to drivers, vehicles, and insurance? Let’s run down the ones you really need to know.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Introduction to State Laws

If legal language makes your eyes glaze over, you’re not alone. There are a lot of laws on the books and the statues are not the most entertaining thing to read. You do need to know which laws apply to you on the road, but it would be a lot easier if someone simplified them for you.

In this section we’ll cover Alaska laws regarding car insurance, vehicle and driver licensing, and a few important regulations for the road.

Car Insurance Laws

First, we will cover the laws regarding car insurance in Alaska.

How State Laws for Car Insurance Are Determined

Laws governing car insurance must pass through the Alaska State Legislature. Title 21 of the Alaska statutes covers general insurance laws, while laws governing financial responsibility laws are found in the Motor Vehicles statues in Title 28.

Alaska uses both prior approval and file and use systems for insurance company rate filing. Insurance companies can select which approach to use but have to inform the Department of Insurance ahead of filing.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Windshield Coverage

Alaska doesn’t have any specific laws on the books regarding how car insurance companies handle windshield coverage. Some companies may offer specific add-on coverage for auto glass that allows for the deductible to be waived or reduced for windshield repair.

It’s up to the insurance company whether they will use OEM or aftermarket parts for windshield replacement.

High-Risk Insurance

If you don’t have the best driving record, you’ll pay more for your car insurance. But when your driving record starts to look really bad, that’s when you might find yourself classified as high risk.

High-risk drivers not only pay a lot more for car insurance, but they may find themselves turned down by the standard insurers. Non-standard insurance companies then take up the slack, insuring drivers the others won’t. But there are some drivers whose record is a problem even on the non-standard market.

For high-risk drivers that have been turned down repeatedly on the voluntary market, the state offers assistance. The Alaska Automobile Insurance Plan (AK AIP) helps high-risk drivers to get coverage.

It’s part of the Western Association of Automobile Insurance Plans and operates as a high-risk pool. Drivers that qualify for the plan will be assigned to an insurance company. That insurance company is then required to offer the driver a policy, and the rate has to fit within plan guidelines.

This doesn’t mean it’s a cheap way to get coverage if you are a high-risk driver. Plan policies will still be expensive compared to a standard insurer. AK AIP is considered a last resort for those who can’t get coverage anywhere else.

Find out the best car insurance companies for high-risk drivers.

Low-Cost Insurance

Given the already reasonable rates for Alaska auto insurance compared to the rest of the nation, it’s not really surprising that the state doesn’t offer a low-cost insurance program.

The best way to get a lower rate on your car insurance is to shop around.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Automobile Insurance Fraud in Alaska

Insurance fraud is a crime in Alaska and is investigated by the Fraud Bureau, a part of the Division of Insurance.

Fraud can be classified as either a misdemeanor or as a felony depending on the type of crime. Alaska’s statues outline the types of crime that fits under each category and the penalty.

| Crime Classification | Example Acts | Imprisonment | Fine |

|---|---|---|---|

| Class B Misdemeanor | Knowingly providing false statements on an insurance application | Up to 90 days | Up to $2,000 |

| Class A Misdemeanor | -Fraudulent act under $500 -Operating without a license -Providing compensation to non-agents/brokers Forgery in the third degree | Up to one year | Up to $10,000 |

| Class C Felony | -Fraudulent acts $500 up to $10,000 -Two inconsistent sworn statements -Removing a report -Deliberate Frauds | Up to five years | Up to $50,000 |

| Class B Felony | -Fraudulent acts over $10,000 -False sworn statements -Operating without a solicitation license | Up to 10 years | Up to $100,000 |

The penalties for insurance fraud vary by the severity of the crime; above are some sample acts of fraud, how they are classified, and the potential penalty.

Statute of Limitations

In Alaska, there is a statute of limitations on injury claims of two years.

Property damage claims have a statute of limitations that is three times as long. The limit is six years.

State Specific Laws

Alaska has enacted a law called Unfair Claims Settlement Acts and Practices that regulates insurance claims procedures. Under this law, claims investigations must be concluded within 30 working days, or the insured must be notified in writing of the reason for the delay.

After that, they have to notify you every 45 days of delays.

Outside the realm of insurance, there are a few state laws regarding the roads that are worth noting. While we’ll get to more road laws later, here are some unusual ones.

First, it’s legal to camp by the side of the road in Alaska, so feel free to pull that RV over wherever you can safely park and settle in for the night.

Second, the signs along some sections of Alaska’s highways asking you to turn on your headlights aren’t a suggestion. Failure to do so actually means you are breaking the law.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Vehicle Licensing Laws

Licensing of vehicles and drivers in Alaska is handled by the DMV. There are a variety of laws and procedures to know about.

Real ID

Alaska is complaint with the Real ID law that requires a higher level of security on a drivers license used for airline travel and select other purposes, including entering military bases.

You are not required to obtain a Real ID driver license if you don’t plan to travel, or if you have another acceptable document, such as a passport. Bear in mind that your old Alaska license will not be accepted by TSA after October 1, 2020, and plan accordingly.

In order to get a Real ID, you will need to apply in person and bring the appropriate documents. You will need each of the following:

- Proof of Identity

- Proof of U.S. Citizenship, Permanent Residency, or other Lawful Status

- Proof of Social Security Number

- Proof of Name Change (if applicable)

- 2 Documents Verifying Alaska Residency

For more information on acceptable documentation, visit Alaska’s Real ID checklist page.

Penalties for Driving Without Insurance

Driving without insurance in Alaska is illegal, and could get you into some big trouble. That’s not just because you’ll have no coverage in an accident – there are penalties if you’re caught by authorities.

There is a $500 fine for driving without insurance in Alaska. Additionally, your license may be suspended.

For a first offense, your license can be suspended for 90 days.

For a second offense, that suspension will be longer – a full year. And if you are in an accident without insurance, the suspension becomes three years.

You will have 30 days to present proof of insurance after a traffic stop and avoid the fine and suspension. If you don’t, you will be convicted. After a conviction for driving uninsured, you will need an SR-22.

An SR-22 is a financial responsibility filing provided by your insurance company to the DMV. It certifies that you are in compliance with the law.

You are required to present proof of insurance on demand when asked by law enforcement.

At a traffic stop or the scene of an accident, you can provide proof of insurance either with a paper copy or electronic copy of your insurance card. If you don’t have it on you when involved in a crash, you can complete an insurance certification either on paper or online.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Teen Driver Laws

Alaska uses a multi-stage graduated licensing system for teen drivers to ease them into the responsibility of driving. This Graduated Driver Licensing (GDL) program helps teens learns skills while keeping them safe with common restrictions like a curfew.

| Type of License | Minimum Age | Requirements | Restrictions |

|---|---|---|---|

| Instruction Permit | 14 | Parental consent Pass knowledge test Pass vision test | May only drive with a licensed driver 21 or older in the passenger seat |

| Provisional License | 16 | Six months with instruction permit 40 hours of practice with a driver 21 or older, 10 of which were in inclement conditions Pass road test | No passengers under 21 except siblings No driving between 1 and 5 a.m. (except with a driver over 21 or for employment) |

| Full License | 18 | None | None |

Older Driver License Renewal Procedures

Older drivers in Alaska follow the same license renewal cycle as all drivers in the state and must renew every five years.

Drivers 69 and older, however, must renew in person and will be required to pass a vision test at each renewal.

New Residents

If you are new to the northernmost state, you have 90 days to get an Alaska drivers license.

Drivers with a valid license from another U.S. state or from Canada will need to do the following:

- Surrender their current license

- Pass a written knowledge test

- Pass a vision test

- Pass a drug and alcohol awareness test when you reach 21 years of age

- Provide proof of legal name, Alaska address, social security number, and date of birth

If you hold a valid license from another country, you will also be required to pass a road test.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

License Renewal Procedures

Once you hold a full Alaska license, you will need to renew it every five years.

Drivers under 69 can renew either online or by mail every second time. When you renew in person you will be required to provide proof of adequate vision.

If you wish to upgrade to a Real ID, you will need to go in person regardless of whether you renewed in person previously.

Negligent Operator Treatment System

Alaska uses a points system to monitor and discipline drivers with violations of the rules of the road.

Each violation is assigned a points value between 2-10, and they can accumulate, resulting in a potential license suspension. Your license will be suspended with no option for a work hardship license if you reach:

- 12 points in 12 months

- 18 points in 24 months

If you have a provisional license, you can only accumulate half the number of points before being required to take a driver improvement course. Fully licensed drivers can also take a defensive driving course in return for a reduction of the number of points; this can also be done by simply driving violation-free.

You’ll get a warning letter if you’re halfway to a license suspension, which is a good time to look into that defensive driving course to reduce your points.

Rules of the Road

Here’s an overview of the must-know rules of the road for drivers in Alaska.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Fault Vs. No-Fault

Alaska is a fault state, which means you are responsible for damages in an accident where you are found at fault.

If you are at fault in the accident, your car insurance will pay out for injuries and property damage up to the limits you’ve chosen on your policy.

You are responsible for damages above and beyond your policy limits.

If you have a legal minimum policy and the property damage totals $50,000 in an accident, your policy will only pay the $25,000 in property damage liability you chose. You’re responsible for the other $25,000.

Alaska uses a system known as pure comparative fault to determine what is owed to an injured party. That means that if the other driver bears any portion of the fault for the accident, their damages are reduced accordingly.

For example, if the damages in an accident total $100,000, but the fault is determined to be 80 percent on one driver and 20 percent on the other, the injured party can receive compensation, but it’s reduced by that 20 percent. So, the total payable is $80,000 in this case.

Seat Belts and Car Seat Laws

Seat belt and car seat laws are in place to protect passengers and reduce the risk of injury in a crash.

In Alaska, all passengers (and the driver) over the age of 16 must wear a seatbelt in every seat, front and back. Passengers 15 and under are subject to the child restraint laws.

| Restraint Type | Age | Weight/Height |

|---|---|---|

| Rear-facing car seat | Up to 12 months old | 20 lbs or under |

| Car seat (facing either direction) | One to three years | More than 20 lbs |

| Booster seat | Four years to seven years | Over 20 lbs but less than 65 lbs 57 inches or shorter |

| Adult Belt Permissible | Eight years and up | Recommended but not law: 65 lbs or more 57" or higher |

These are the legal requirements, but they aren’t necessarily the best or safest for your child. Check out the American Academy of Pediatrics car seat recommendations for more information on keeping kids safer in the car.

Keep Right And Move Over Laws

In Alaska, it is illegal to drive in the left lane if you driving slower than the speed limit. The two main exceptions to this are when passing, or when preparing for a left turn. It’s also permissible in a few other situations, such as when there is a roadway obstruction.

When passing an emergency vehicle on the side of the road with lights flashing, drivers are required to change lanes away from the stopped vehicle when safe and possible to do so, or to slow down as they pass.

Finally, you are required to move over or even pull over for traffic behind you and allow them to pass if several cars are lined up behind you and you are holding up traffic.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Speed Limits

Alaska’s speed limit is 65 on rural interstates and on other limited access roads.

The speed limit is 55 on urban interstates and other roads.

Speed limits within urban areas can vary. Always obey the posted limit and remember it can change in construction zones.

Ridesharing

Ridesharing became legal in Alaska in 2017, but insurance coverage for drivers remains limited. Currently, only Allstate and Geico offer a rideshare endorsement on a personal insurance policy in Alaska.

Your personal insurance company will refuse to cover you if you are driving for a rideshare service when an accident happens. They could also non-renew your policy if they find out you’re rideshare driving without notifying them.

To get covered properly, you need either a rideshare endorsement or a separate commercial policy.

Uber and Lyft do offer coverage to their drivers, but there is a coverage gap during what is known as period one of ridesharing.

Here’s what the three periods look like:

- Period 1: App is on, but you don’t have a ride request yet. Your personal policy does not provide coverage unless you have a rideshare endorsement. Company insurance from services like Uber and Lyft insurance covers only basic liability.

- Period 2: You have accepted a ride request and are on your way to pick up a passenger. The rideshare company coverage is in force, not your personal policy.

- Period 3: Passengers are in your car. The rideshare company’s policy is in force, not your personal insurance.

As you can see, in period one you have no coverage for excess liability or for your own vehicle in an at-fault accident.

Automation On The Road

Alaska has yet to pass any legislation regarding autonomous vehicles, unlike some other states where they are already road-legal.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Safety Laws

This last section deals with Alaska laws to keep drivers safe and in control on the road.

DUI Laws

Alaska law doesn’t take a DUI lightly. If you’re convicted you will face hefty fines as well as jail time.

| Penalty Type | First Offense | Second Offense | Third Offense | Fourth and Subsequent Offenses |

|---|---|---|---|---|

| Fine | $1500 fine $200 license reinstatement fee | $3000 fine $500 license reinstatement fee | $4000 fine | $10,000 fine |

| Imprisonment | Minimum of 72 consecutive hours | Minimum of 20 days | Minimum of 60 days | Minimum of 120 days |

| License Suspension | 90 days | One year | Three years | Five years |

| SR-22 Requirement | Five years | 10 years | 20 years | Lifetime |

| Ignition Interlock Device (IID) | One year | Two years | Three years | Three years |

Marijuana Impaired Driving Laws

Although recreational use of marijuana has been legal in Alaska since 2015, it’s still illegal to drive after using it.

Alaska law treats driving high the same as driving drunk, and the same penalties apply. There is no legal limit for THC in a person’s system, but law enforcement can arrest you based on perceived impairment.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Distracted Driving Laws

Alaska has no laws regarding making phone calls or any other use of your cell phone while driving, but texting while driving is against the law.

The penalties for texting while driving are very harsh. It’s not just a ticket. Depending on the situation, these are the penalties you could face:

- Texting while driving is a misdemeanor that carries a fine of up to $10,000 and up to a year in prison

- If a collision happens due to texting while driving resulting in injury, it’s a Class C felony carrying a fine of up to $50,000 and five years in prison

- If anyone is seriously injured in the accident, it becomes a Class B felony with fines up to $100,000 and 10 years in prison

- If someone is killed, the driver will be charged with a Class A felony and face fines of up to $250,000 and 20 years in prison

Driving in Alaska

Driving in Alaska is like no other state. With remote roads leading to places that don’t have roads at all and a lot of winter driving conditions, it can be dangerous.

What are the real risks of driving in Alaska? What is a serious problem and what is just hyped up by media attention? It can be hard to make sense of all the statistics and news stories.

In this section, we’ll run down the facts on driving in Alaska.

We’ll cover vehicle thefts, fatal crashes, and even the risks of teen drivers under the influence.

Vehicle Theft in Alaska

We did mention Alaska is truck country, so it’s no surprise that the top three most stolen vehicles are all full-size pickups. While the most popular model year is listed, the number of thefts includes all model years.

| Make/Model | Most Commonly Stolen Model Year | Number of Thefts |

|---|---|---|

| Chevrolet Pickup (Full Size) | 2003 | 147 |

| Ford Pickup (Full Size) | 2004 | 95 |

| GMC Pickup (Full Size) | 1997 | 58 |

| Honda Civic | 2000 | 56 |

| Honda Accord | 1993 | 46 |

| Dodge Pickup (Full Size) | 1998 | 44 |

| Ford Explorer | 1994 | 31 |

| Jeep Cherokee/Grand Cherokee | 1999 | 28 |

| Ford Pickup (Small Size) | 2000 | 22 |

| Chevrolet Pickup (Small Size) | 1998 | 20 |

The vast majority of vehicle thefts in 2017 took place in Anchorage, according to FBI data. You can see how other cities compare in the table below.

| City | Motor vehicle theft |

|---|---|

| Anchorage | 3,104 |

| Bethel | 12 |

| Bristol Bay Borough | 9 |

| Cordova | 2 |

| Craig | 1 |

| Dillingham | 8 |

| Fairbanks | 208 |

| Haines | 0 |

| Homer | 9 |

| Juneau | 95 |

| Kenai | 40 |

| Ketchikan | 18 |

| Kodiak | 11 |

| Kotzebue | 21 |

| Nome | 3 |

| North Pole | 2 |

| North Slope Borough | 10 |

| Palmer | 17 |

| Petersburg | 2 |

| Seward | 4 |

| Sitka | 6 |

| Skagway | 1 |

| Soldotna | 12 |

| Unalaska | 2 |

| Valdez | 3 |

| Wasilla | 47 |

| Wrangell | 5 |

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Road Fatalities in Alaska

There were a total of 79 fatal crashes in Alaska in 2017 according to the National Highway Traffic Safety Administration (NHTSA). We’ll take a look at what factors were involved in those crashes, including when and where they happened, and driver impairment or error.

Fatalities By Road Conditions

Below are the numbers for fatal crashes based on the time of day and the weather when they occurred. Most of the crashes happened in normal weather conditions, and a little less than half during daylight hours.

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 28 | 13 | 14 | 4 | 0 | 59 |

| Rain | 0 | 2 | 0 | 0 | 1 | 3 |

| Snow/Sleet | 3 | 1 | 6 | 0 | 0 | 10 |

| Other | 0 | 0 | 0 | 0 | 0 | 0 |

| Unknown | 1 | 0 | 0 | 0 | 2 | 3 |

| TOTAL | 32 | 16 | 20 | 4 | 3 | 75 |

Fatalities By County

Here is fatal crash data for 2017 broken down by county.

| County | 2017 Fatalities |

|---|---|

| Aleutians East Borough | 0 |

| Aleutians West Census Area | 0 |

| Anchorage Borough | 18 |

| Bethel Census Area | 4 |

| Bristol Bay Borough | 0 |

| Denali Borough | 4 |

| Dillingham Census Area | 0 |

| Fairbanks North Star Borough | 12 |

| Haines Borough | 0 |

| Juneau Borough | 1 |

| Kenai Peninsula Borough | 6 |

| Ketchikan Gateway Borough | 1 |

| Kodiak Island Borough | 0 |

| Lake And Peninsula Borough | 0 |

| Matanuska-Susitna Borough | 21 |

| Nome Census Area | 4 |

| North Slope Borough | 1 |

| Northwest Arctic Borough | 1 |

| Prince Of Wales-Outer Ketchikan | |

| Census Area | 2 |

| Sitka Borough | 0 |

| Skagway-Hoonah-Angoon Census Area | 1 |

| Skagway-Yakutat-Angoon Census Area | 0 |

| Southeast Fairbanks Census Area | 1 |

| Valdez-Cordova Census Area | 0 |

| Wade Hampton Census Area | 1 |

| Wrangell-Petersburg Census Area | 0 |

| Yakutat Borough | 0 |

| Yukon-Koyukuk Census Area | 1 |

Most of the fatal crashes happened in a few counties.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Rural Vs. Urban Fatality Rates

Of the fatal crashes in 2017, 45 happened in rural areas and 33 in urban areas. One is listed as unknown.

Fatalities By Person Type

Most of the fatal crashes involved occupants of enclosed vehicles.

| Person Type | Number |

|---|---|

| Occupants (Enclosed Vehicles) | 56 |

| Motorcyclists | 6 |

| Pedestrians | 14 |

| Bicyclists and other cyclists | 1 |

Fatalities By Crash Type

More than half of the fatal crashes were single-vehicle, and again more than half involved a roadway departure.

| Crash Type | Number |

|---|---|

| Single Vehicle | 51 |

| Involving a Large Truck | 5 |

| Involving Speeding | 26 |

| Involving a Rollover | 20 |

| Involving a Roadway Departure | 48 |

| Involving an Intersection (or Intersection Related) | 18 |

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Five-Year Trend For The Top 10 Counties

Most counties have seen an increase in fatalities, but it’s notable that after peaking in 2015, Anchorage Borough’s rate has dropped two years in a row.

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Matanuska-Susitna Borough | 11 | 14 | 15 | 20 | 21 |

| Anchorage Borough | 17 | 25 | 26 | 21 | 18 |

| Fairbanks North Star Borough | 7 | 11 | 9 | 8 | 12 |

| Kenai Peninsula Borough | 4 | 6 | 6 | 11 | 6 |

| Bethel Census Area | 1 | 1 | 2 | 1 | 4 |

| Denali Borough | 1 | 4 | 0 | 1 | 4 |

| Nome Census Area | 0 | 1 | 0 | 0 | 4 |

| Prince Of Wales-Outer Ketchikan Census Area | 1 | 0 | 1 | 1 | 2 |

| Juneau Borough | 0 | 2 | 0 | 1 | 1 |

| Ketchikan Gateway Borough | 0 | 0 | 0 | 1 | 1 |

Fatalities Involving Speeding By County

Take a look at how speeding was involved in fatal crashes in each county.

| County | 2017 Speeding Fatalities |

|---|---|

| Aleutians East Borough | 0 |

| Aleutians West Census Area | 0 |

| Anchorage Borough | 3 |

| Bethel Census Area | 3 |

| Bristol Bay Borough | 0 |

| Denali Borough | 2 |

| Dillingham Census Area | 0 |

| Fairbanks North Star Borough | 5 |

| Haines Borough | 0 |

| Juneau Borough | 0 |

| Kenai Peninsula Borough | 4 |

| Ketchikan Gateway Borough | 0 |

| Kodiak Island Borough | 0 |

| Lake And Peninsula Borough | 0 |

| Matanuska-Susitna Borough | 4 |

| Nome Census Area | 3 |

| North Slope Borough | 0 |

| Northwest Arctic Borough | 0 |

| Prince Of Wales-Outer Ketchikan Census Area | 1 |

| Sitka Borough | 0 |

| Skagway-Hoonah-Angoon Census Area | 0 |

| Skagway-Yakutat-Angoon Census Area | 0 |

| Southeast Fairbanks Census Area | 0 |

| Valdez-Cordova Census Area | 0 |

| Wade Hampton Census Area | 1 |

| Wrangell-Petersburg Census Area | 0 |

| Yakutat Borough | 0 |

| Yukon-Koyukuk Census Area | 0 |

Fatalities Involving an Alcohol-Impaired Drive By County

How many DUI fatalities happened in your county? Check the table below.

| County | 2017 DUI Fatalities |

|---|---|

| Bethel Census Area | 2 |

| Aleutians East Borough | 0 |

| Aleutians West Census Area | 0 |

| Anchorage Borough | 5 |

| Bristol Bay Borough | 0 |

| Denali Borough | 1 |

| Dillingham Census Area | 0 |

| Fairbanks North Star Borough | 1 |

| Haines Borough | 0 |

| Juneau Borough | 1 |

| Kenai Peninsula Borough | 0 |

| Ketchikan Gateway Borough | 0 |

| Kodiak Island Borough | 0 |

| Lake And Peninsula Borough | 0 |

| Matanuska-Susitna Borough | 6 |

| Nome Census Area | 4 |

| North Slope Borough | 0 |

| Northwest Arctic Borough | 0 |

| Prince Of Wales-Outer Ketchikan Census Area | 1 |

| Sitka Borough | 0 |

| Skagway-Hoonah-Angoon Census Area | 0 |

| Skagway-Yakutat-Angoon Census Area | 0 |

| Southeast Fairbanks Census Area | 0 |

| Valdez-Cordova Census Area | 0 |

| Wade Hampton Census Area | 1 |

| Wrangell-Petersburg Census Area | 0 |

| Yakutat Borough | 0 |

| Yukon-Koyukuk Census Area | 0 |

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Teen Drinking and Driving

Alaska is a little above the national average for DUI fatalities involved drivers 21 and under. The state falls under the national average, however, for DUI arrests under 18.

| Teens and Drunk Driving | Alaska | National Average |

|---|---|---|

| Under 21 Alcohol-Impaired Driving Fatalities Per 100K of the Population | 1.4 | 1.2 |

| DUI Arrests (Under 18 Years Old) | 31 | 102.82 |

| DUI Arrests (Under 18 Years Old) Total Per Million People | 165.49 | 94.84 |

EMS Response Time

Average EMS response time for urban and rural areas is shown below. The much longer response time for rural areas is not surprising given the size of the state and how remote some areas are.

| Crash Location | Time of Crash to EMS Notification | EMS Notification to EMS Arrival | EMS Arrival at Scene to Hospital Arrival | Time of Crash to Hospital Arrival |

|---|---|---|---|---|

| Rural | 4.65 | 21.60 | 44.60 | 58.83 |

| Urban | 1.21 | 6.59 | 24.15 | 31.40 |

Transportation

Sure, there are a lot of places you can’t reach by car in Alaska, but that doesn’t mean people don’t get around in their vehicles.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

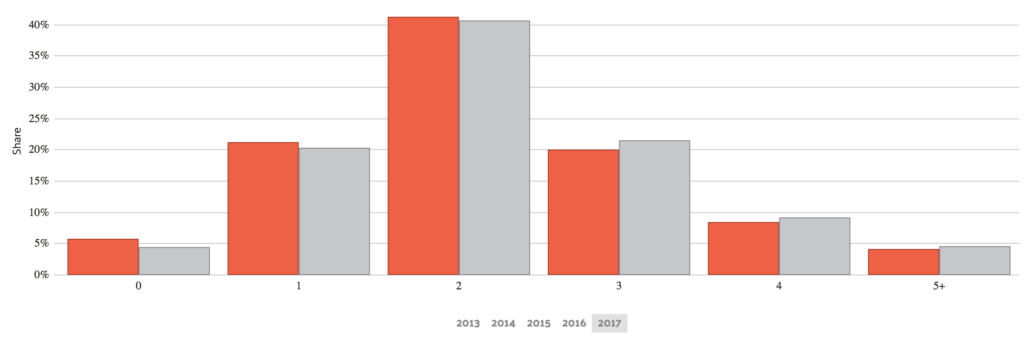

Car Ownership

Alaska is pretty close to the national averages for car ownership, with most households owning two vehicles.

Commute Time

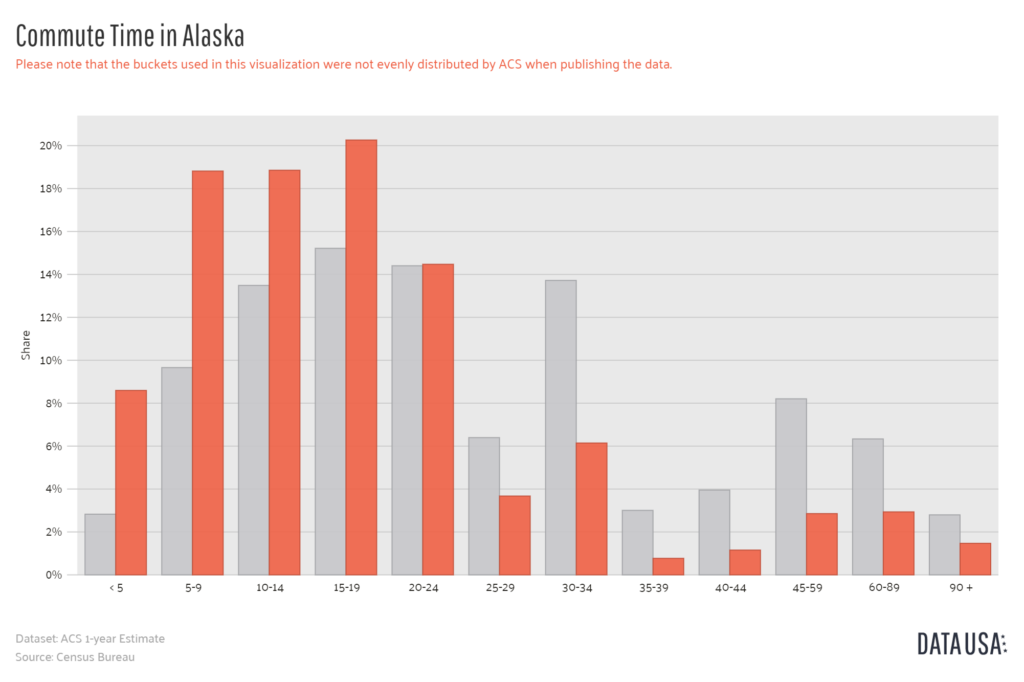

The average commute time in Alaska is well below the national average of 25.5 minutes, coming in at 18.7 minutes. Alaska does have a higher than the average number of drivers with “super commutes” of more than 90 minutes.

That’s not surprising given the size of the state and the central location of most commerce.

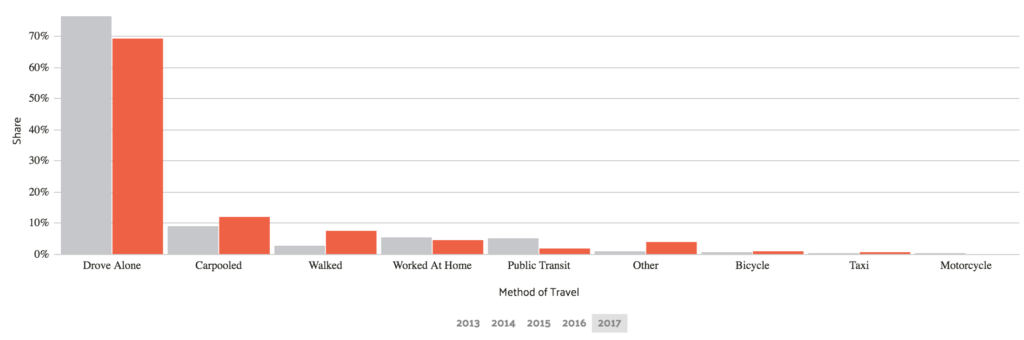

Commuter Transportation

Almost 70 percent of Alaskans drive to work alone, higher than the national average.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Traffic Congestion in Alaska

Traffic isn’t something most people picture when they think of Alaska. While there is some traffic to be found during rush hour in Anchorage and some of the other big cities, none of them even rank on national traffic surveys.

One of Alaska’s biggest traffic issues has been the commute into Anchorage from surrounding areas. That’s being addressed with the building of six-lane highways to reduce the bottlenecks coming in and out of the city.

Still, Alaskans can rest easy knowing they won’t even face commutes like those found to the south.

Want to rest easy knowing you have the best rate on your car insurance? Start shopping around by entering your zip code below right now.

Frequently Asked Questions

What is the best car insurance in Alaska?

The best car insurance in Alaska depends on several factors, such as your budget, driving history, and coverage needs. However, some of the top car insurance companies in Alaska are State Farm, GEICO, Progressive, Allstate, and USAA.

What types of car insurance coverage are available in Alaska?

The types of car insurance coverage available in Alaska are liability insurance, uninsured/underinsured motorist coverage, personal injury protection (PIP), comprehensive insurance, and collision insurance.

How much car insurance coverage should I get in Alaska?

The amount of car insurance coverage you need in Alaska depends on various factors, such as the value of your vehicle, your budget, and your risk tolerance. However, it is recommended that you have at least the minimum required liability insurance coverage in Alaska, which is 50/100/25 ($50,000 per person for bodily injury, $100,000 per accident for bodily injury, and $25,000 for property damage).

How can I find the cheapest car insurance in Alaska?

To find the cheapest car insurance in Alaska, you can shop around and compare quotes from multiple insurance companies. You can also consider raising your deductible, reducing your coverage limits, and taking advantage of discounts offered by insurance companies.

Are there any car insurance discounts available in Alaska?

Yes, there are several car insurance discounts available in Alaska, such as safe driver discounts, multi-car discounts, multi-policy discounts, good student discounts, and military discounts. Be sure to ask your insurance company about available discounts to see if you qualify.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced life insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for life insurance with the most affordable term life insurance, permanent life insurance, no medical exam life insurance, and burial insurance. Not only does he strive to provide consumers with t...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.