Best North Carolina Car Insurance (2025)

North Carolina auto insurance rates average $66 per month while North Carolina minimum auto insurance requirements are 30/60/25 for bodily injury and property damage. The best auto insurance company in North Carolina for cheap auto insurance rates is Liberty Mutual, but you can compare North Carolina auto insurance quotes to find affordable coverage.

Read moreFree Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated life insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the ...

Licensed Insurance Agent

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- North Carolina minimum car insurance requirements are 30/60/25 for bodily injury and property damage

- North Carolina car insurance rates average $66 per month

- To find cheap North Carolina auto insurance, compare multiple North Carolina auto insurance quotes

New York Statistics Summary

| NEW YORK STATISTICS | DETAILS |

|---|---|

| Miles of Roadway | Total in State: 114,365 Vehicle Miles Driven: 127,230 |

| Vehicles | Registered: 10,283,907 Stolen: 15,313 |

| State population | 19,542,209 |

| Most popular vehicle | Rogue |

| Uninsured Motorists | 6.1% State Rank: 50 |

| Total Driving Fatalities | 2008-2017 Speeding: 3,461 Drunk Driving: 3,278 |

| Average Annual Premiums | Liability: $784.98 Collision: $358.45 Comprehensive: $156.66 |

| Cheapest Providers | Geico and USAA |

North-Carolina-Statistics-Summary

| North Carolina Statistics Summary | Details |

|---|---|

| Annual Road Miles | Total in State: 106,334 Vehicle Miles Drive: 111,879,000 |

| Vehicles Registered | 7,682,387 |

| State Population | 10,383,620 |

| Most Popular Vehicle | Ford F-150 |

| Uninsured Motorists | 6.5% State Rank: 48th |

| Total Driving Fatalities | Speeding: 423 Drunk Driving: 354 |

| Average Annual Premiums | Liability: $359.42 Collision: $293.59 Comprehensive: $136.08 |

| Cheapest Provider | Liberty Mutual |

North Carolina has a rich history, but for modern residents daily life has a few requirements such as car insurance. If you’re looking for the best auto insurance for North Carolina, we can help.

North Carolina was originally part of the Carolina colony, which was formed from land south of Virginia in 1663. English King Charles II named it after his father, Charles I, and granted the land to friends who helped restore the monarchy.

Over the next 50 years, settlers moved to Carolina from other colonies, and landowners brought slaves to work their farms. By 1712, the population was large enough to create two colonies: North Carolina and South Carolina.

Transportation has played a vital role in North Carolina’s development. Before the Civil War, the state built “plank roads,” an early, wooden roadway, to ease horse and buggy travel and improve the economy. They competed with rail travel, which was faster, and many of the roads ended up being destroyed in the war.

North Carolinians are lucky to have a modern interstate highway system that takes them where they need to go. Drivers nowadays need to register and plate their cars and carry a license and insurance.

If you’re looking for help shopping for the right car insurance, you’ve come to the right place. This complete guide to North Carolina car insurance covers North Carolina auto insurance rates, companies, and the factors that set prices, laws, and traffic statistics.

If you’re ready to roll, let’s get started. And to start comparing North Carolina auto insurance quotes, enter your ZIP code.

Read more: South Carolina Car Insurance Laws

North Carolina Auto Insurance Coverage & Rates

A major factor in car insurance buyers’ minds is how much they’ll pay for premiums. Depending on the coverage and the company, they can be costly. But, if you drive without insurance, you risk paying a higher price in the form of fines or an arrest on your record.

So, in this section, we’ll inform you of the state car insurance requirements and additional liability you need to drive in North Carolina.

Read on to find out more about the coverage you must buy.

North Carolina Auto Insurance Requirements and Minimum Coverage

In North Carolina, the driver who is at fault for an accident must pay for any damage or injuries they caused.

North Carolina auto insurance limits need a minimum coverage of the following minimum amounts:

Minimum-Car-Insurance-Requirements-in-North-Carolina

| Minimum Requirements | Cost |

|---|---|

| Body Injury Liability - One Person | $30,000 |

| Body Injury Liability - Two or More People | $60,000 |

| Property Damage | $25,000 |

Though the state ranks 48th nationwide for uninsured motorists according to the Insurance Information Institute, equal to 6.5 percent of the state population, you must buy the minimum liability insurance. It will cover you and the other party in case you’re in an accident that causes bodily injuries or property damage.

We recommend you buy more than the minimum liability required in case you face high costs. If your insurance doesn’t cover everything, you will pay out of pocket.

This law firm video goes over the state-required coverage:

Forms of Financial Responsibility

If you have auto liability insurance in North Carolina, that will serve as your proof of financial responsibility. Under North Carolina auto insurance regulations, other acceptable forms of proof of insurance include:

- An FS-1 form from your insurance agent certifying that you’re insured

- An insurance binder

If you cancel your insurance or let it lapse, your insurer must notify the state Division of Motor Vehicles (DMV). If the DMV finds out your insurance has lapsed, it will ask your insurer to confirm you have coverage.

The Tarheel State doesn’t allow a grace period for insurance lapses. These are the penalties for a lapse in coverage:

- First time: $50 fine

- Second time: $100 fine

- Subsequent times: $150 fine

- Restoration fee for license plate: $50 fee

Next, let’s explore how much of North Carolinians’ earnings go to car insurance.

Premiums as a Percentage of Income

Disposable income (DPI) is the amount of money you have left to spend after you’ve paid taxes. In 2017, the average North Carolina resident had a DPI of $35,099.

With average annual premiums that cost $768.28, North Carolinians spend 2.2 percent of their total DPI on car insurance — that’s equal to $64 of their total monthly income.

From 2012 – 2014, car insurance rates in North Carolina increased by 12 percent, or $48.

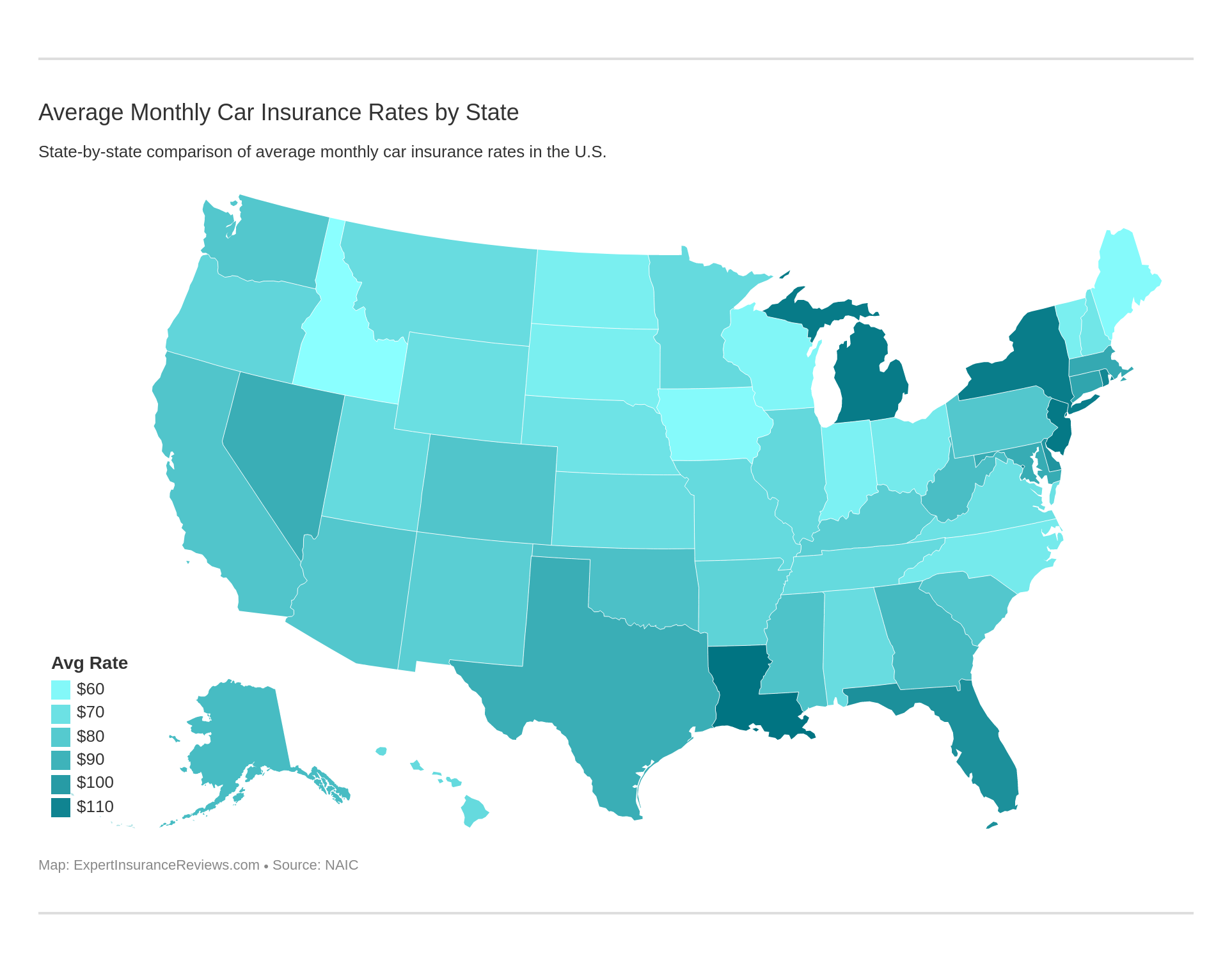

North Carolina has among the lowest car insurance rates nationwide. Drivers in neighboring states South Carolina, Georgia, Virginia, and Tennessee pay an average of $100 – $200 more yearly. Like North Carolina residents, in recent years, they also saw slight rises in their insurance costs.

Average Monthly Car Insurance Rates in NC (Liability, Collision, Comprehensive)

Below are the average costs of the four main types of car insurance coverage:

- liability car insurance,

- collision car insurance,

- comprehensive car insurance, and

- full coverage car insurance (a combination of the prior three).

Core-Car-Insurance-Coverage-Costs-in-North-Carolina

| Core Car Insurance Coverage Costs in North Carolina | Cost |

|---|---|

| Liability | $359.42 |

| Collision | $293.59 |

| Comprehensive | $136.08 |

| Combined | $789.09 |

The data above, from 2015, comes from the National Association of Insurance Commissioners (NAIC), which is based on the state-mandated requirements.

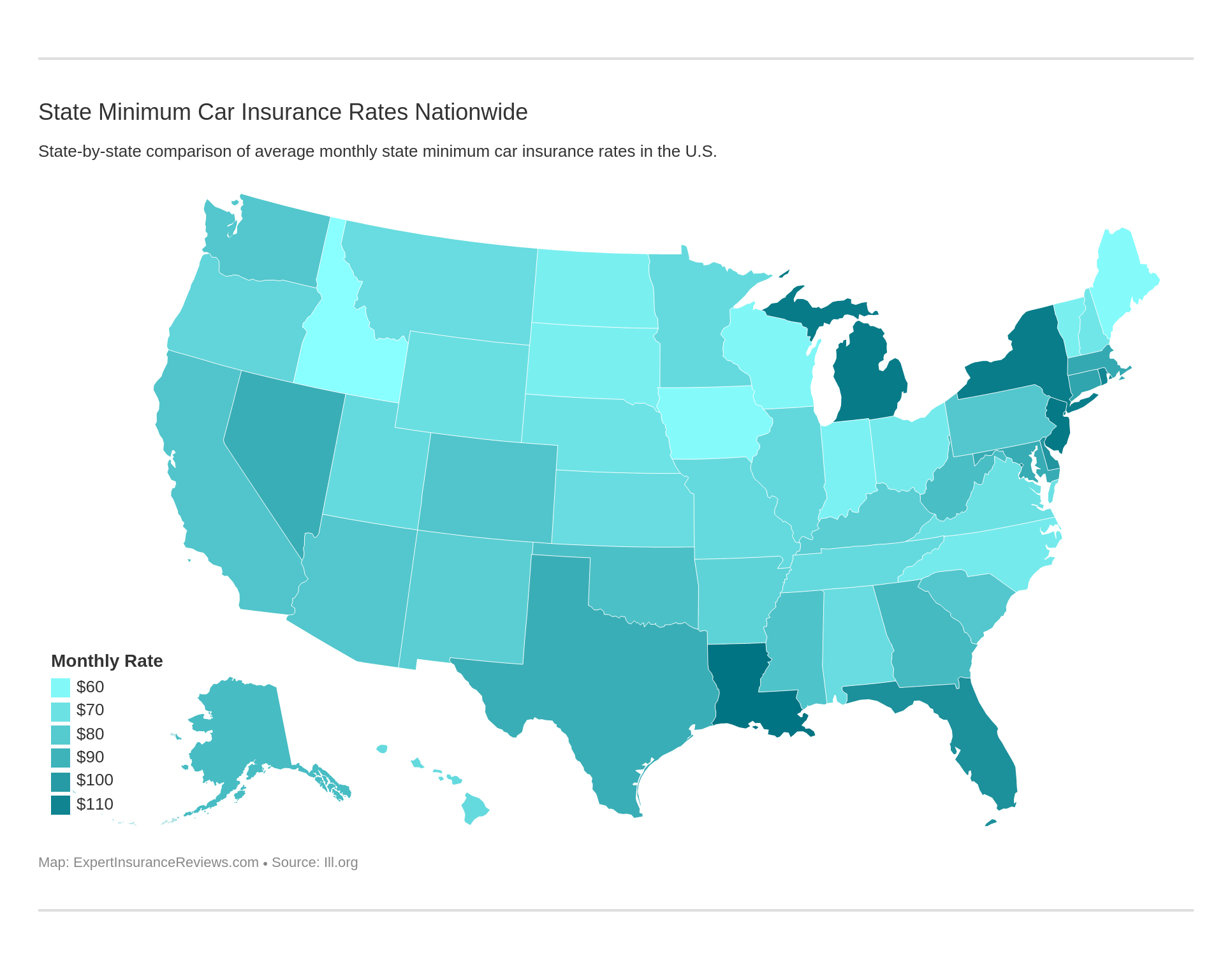

Take a look at how North Carolina’s rates compare to the rest of the nation.

Expect rates to increase in 2019 and beyond.

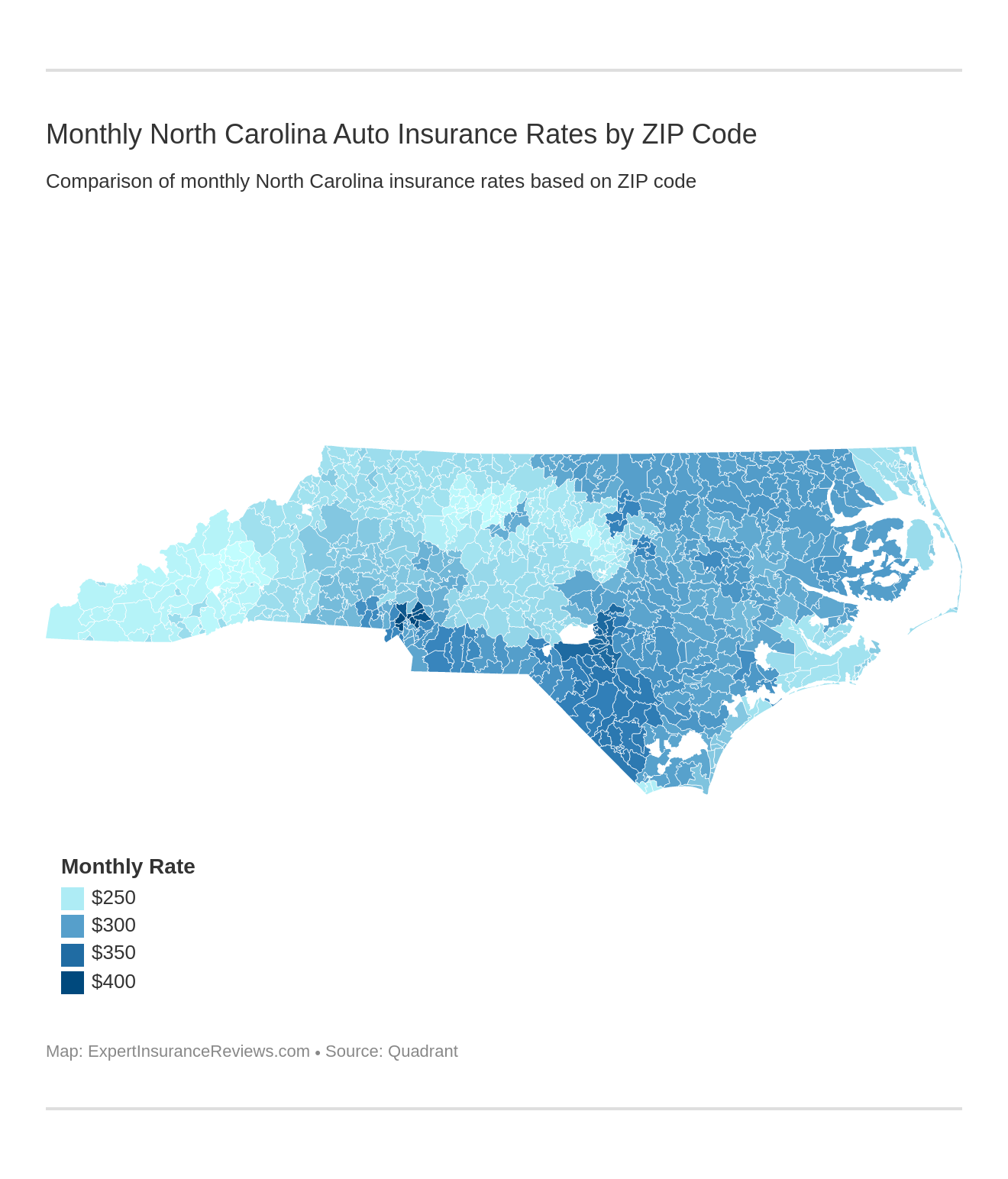

Let’s zoom in and compare how average rates vary by ZIP code.

Now, we’ll go over more options for liability coverage.

Additional Liability

As we mentioned, North Carolina drivers must carry uninsured motorist coverage. You can also choose to buy MedPay or medical payments insurance. Regardless of fault, it will pay for treatment for bodily injuries and funeral expenses. Find out the best Medical Payments (MedPay) car insurance companies.

The loss ratios below for these additional coverages show whether insurance companies pay their claims. A ratio under 100 percent indicates they do. If they’re well below 100 percent, they may not pay enough claims. A loss ratio of over 100 percent means the company loses money on claims.

Loss Ratios North Carolina

| Loss Ratio | 2012 | 2013 | 2014 |

|---|---|---|---|

| Medical Payments (Med Pay) | 81% | 81% | 79% |

| Uninsured/Underinsured Motorist | 53% | 56% | 53% |

Add-Ons, Endorsements, & Riders

The following are more types of coverage you can add to a basic car insurance policy in North Carolina:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-as-You-Drive or Usage-Based Car Insurance

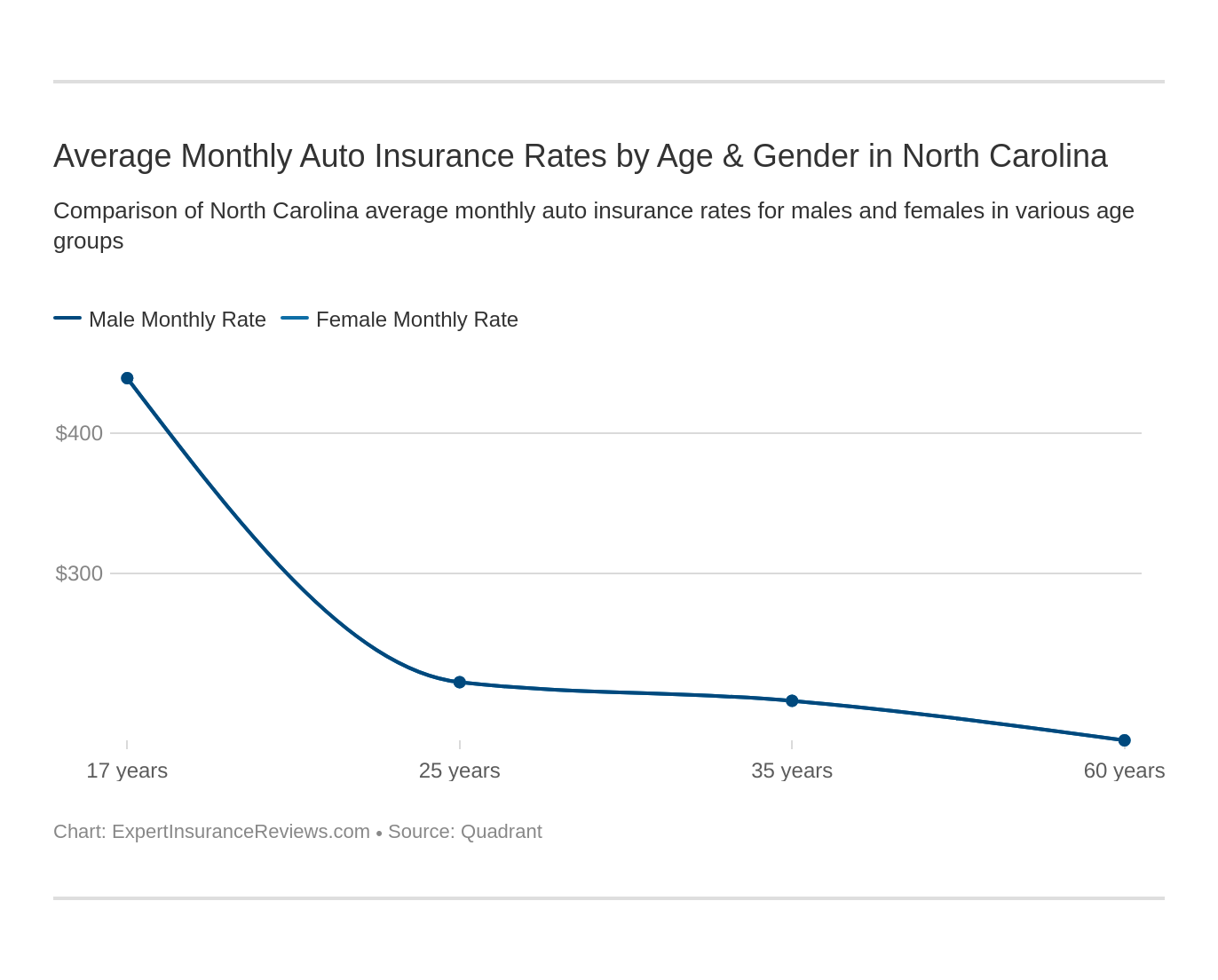

Average Auto Insurance Rates by Age & Gender in NC

North Carolina is among a handful of states that have banned the practice of basing insurance rates on gender.

We’ve partnered with Quadrant to bring you the data below. It’s based on coverage the state population has purchased and includes rates for high-risk drivers and those who choose to buy more than the state minimum. It also includes other types of insurance the state doesn’t require.

| Company | Married 35-year old female annual rates | Married 35-year old male annual rates | Married 60-year old female annual rates | Married 60-year old male annual rates | Single 17-year old female annual rates | Single 17-year old male annual rates | Single 25-year old female annual rates | Single 25-year old male annual rates |

|---|---|---|---|---|---|---|---|---|

| Allstate P&C | $5,499.72 | $5,499.72 | $4,516.40 | $4,516.40 | $13,137.37 | $13,137.37 | $5,608.24 | $5,608.24 |

| Geico Govt Employees | $2,521.28 | $2,474.28 | $2,482.19 | $2,437.32 | $4,603.65 | $4,563.43 | $2,212.08 | $2,199.26 |

| Liberty Mutual | $1,823.22 | $1,823.22 | $1,886.88 | $1,886.88 | $3,197.53 | $3,197.53 | $1,823.22 | $1,823.22 |

| Nationwide Mutual | $2,431.91 | $2,431.91 | $2,431.91 | $2,431.91 | $4,096.41 | $4,096.41 | $2,431.91 | $2,431.91 |

| Progressive Premier | $1,785.15 | $1,785.15 | $1,623.93 | $1,623.93 | $4,132.18 | $4,132.18 | $1,989.17 | $1,989.17 |

| State Farm Mutual Auto | $2,692.15 | $2,692.15 | $2,327.42 | $2,327.42 | $3,966.45 | $3,966.45 | $3,328.58 | $3,328.58 |

| Standard Fire Ins Co | $2,665.43 | $2,665.43 | $2,644.05 | $2,644.05 | $4,485.32 | $4,485.32 | $2,735.84 | $2,735.84 |

Except for the Geico Government Employees plan, rates are the same for males and females. Understandably, insurers charge less experienced drivers, 17-year-olds, higher premiums than other age groups. Interestingly, unlike other states, rates don’t vary much in North Carolina from ages 25 – 60. After age 17, Nationwide charges everyone the same rates. Read Nationwide insurance review & complaints to learn more about the company.

Best Auto Insurance Companies in North Carolina

You might not always shop for car insurance by rate, but also by the company. With the many providers available, you can struggle to find the best company for your insurance needs.

This section is here to help you. We’ll cover the financial strength of the top insurers, company complaints, reviews, and how their rates vary by different insurance risks.

Keep reading to learn more.

The Largest Companies’ Financial Rating

A.M. Best ranks companies based on their financial strength. And, as we discussed above, loss ratio is part of that. These are their ratings for some of the best car insurance companies.

North-Carolina-Car-Insurance-Financial-Ratings

| Insurance Company | A.M. Best |

|---|---|

| B | |

| A+ |

| A++ | |

| North Carolina Farm Bureau Group | A |

| Amtrust NGH Group | Not Rated |

| A+ | |

| A++ | |

| A+ | |

| A+ |

| A |

State Farm, Geico, and USAA garnered the highest rating of “A++.” These insurers also have good loss ratios, which is a major sign of their long-term financial stability.

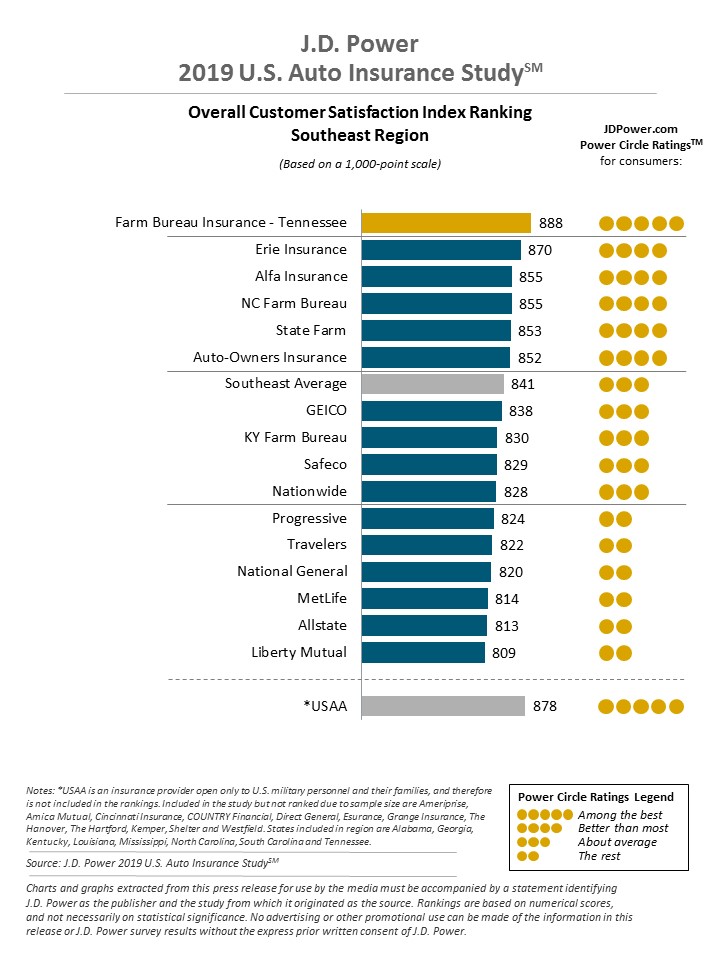

Companies with Best Ratings

J.D. Power’s U.S. Auto Insurance Study measures car insurance customers’ overall satisfaction. Here’s how they ranked insurers in the Southeast Region:

Among North Carolina–based insurers, Erie Insurance ranked highest with four “power circles,” which means that it’s “better than most.” See Erie insurance reviews and complaints for more information.

Companies with Most Complaints in North Carolina

No company is perfect, so you can expect some complaints here and there. But lots of complaints may be a cause for concern. The national average complaint ratio is 1.20. If your car insurance company has a score lower than that, it doesn’t see many complaints.

Complaint Ratios - North Carolina

| Company Name | Complaint Ratio |

|---|---|

| 0.44 | |

| 0.28 |

| 0.62 | |

| 0.66 |

| 0 | |

| 0.5 | |

| 0.94 | |

| 0.75 | |

| 0.7 |

| 5.95 |

Only one company, Liberty Mutual, received more complaints than average in the Tarheel State. If you need to make a complaint, you can file a claim with the state online.

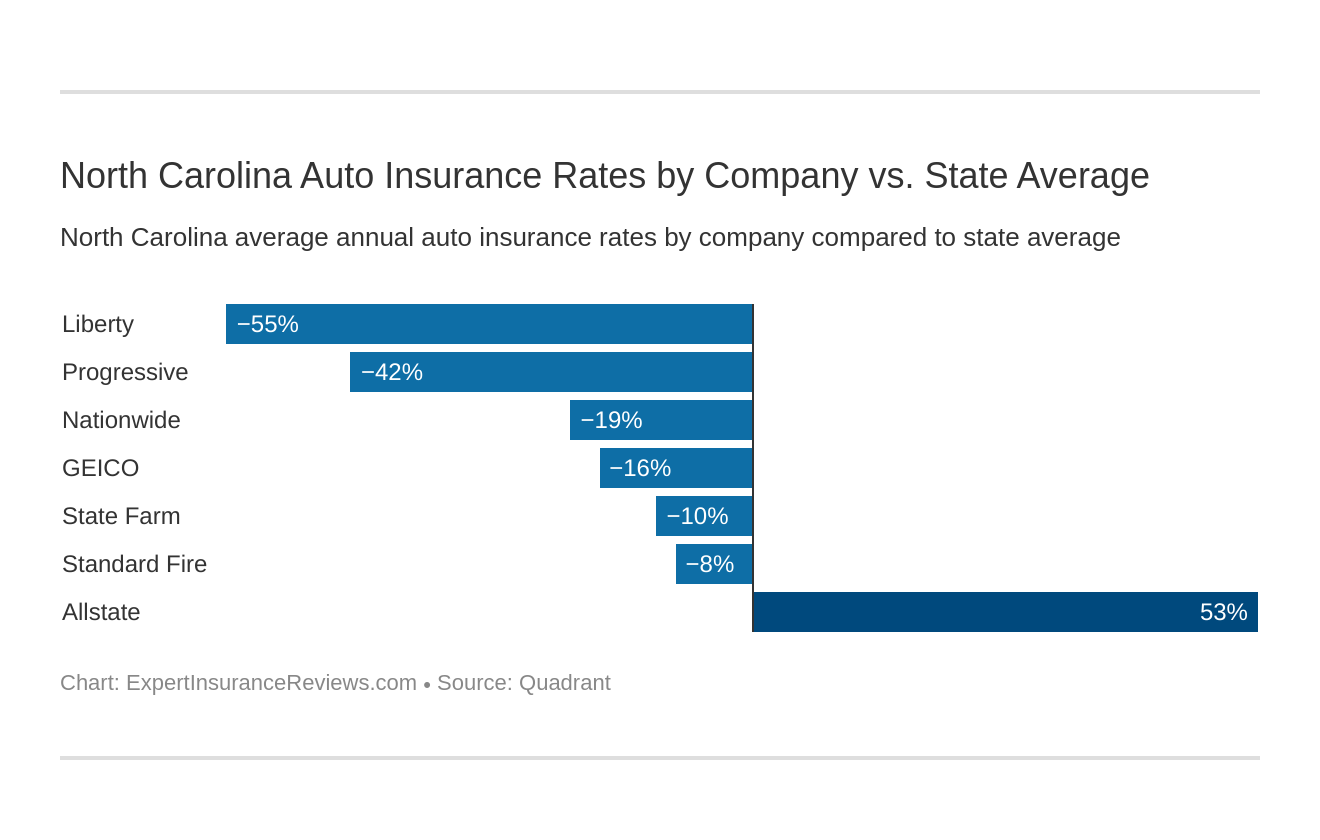

Cheapest Car Insurance Companies in North Carolina

Below are rates for the top insurers compared to the state average prices.

1290-Cheapest-Car-Insurance-Companies-in-North-Carolina-2019-09-30.csv

| Company | Average Annual Rates |

|---|---|

| $7,190.43 | |

| $2,936.69 | |

| $2,182.71 |

| $2,848.04 |

| $2,382.61 | |

| $3,078.65 | |

| $3,132.66 |

Liberty Mutual has the cheapest annual rates, while Allstate has the highest — a difference of $5,000.

Commute Rates by Companies

How far you commute regularly also factors into your car insurance costs. Let’s see how much they can vary for 10-mile versus 25-mile commutes.

Coverage Level for Commute Rates - North Carolina

| Company | Commute and Annual Mileage (in miles) | Annual Average |

|---|---|---|

| 10 miles commute. 6000 annual mileage. | $7,190.43 | |

| 25 miles commute. 12000 annual mileage. | $7,190.43 | |

| 10 miles commute. 6000 annual mileage. | $3,132.66 | |

| 25 miles commute. 12000 annual mileage. | $3,132.66 | |

| 25 miles commute. 12000 annual mileage. | $3,093.71 | |

| 10 miles commute. 6000 annual mileage. | $3,063.59 | |

| 10 miles commute. 6000 annual mileage. | $2,936.69 | |

| 25 miles commute. 12000 annual mileage. | $2,936.69 | |

| 10 miles commute. 6000 annual mileage. | $2,848.03 |

| 25 miles commute. 12000 annual mileage. | $2,848.03 |

| 10 miles commute. 6000 annual mileage. | $2,382.61 | |

| 25 miles commute. 12000 annual mileage. | $2,382.61 | |

| 10 miles commute. 6000 annual mileage. | $2,182.71 |

| 25 miles commute. 12000 annual mileage. | $2,182.71 |

Liberty Mutual, again, offers the cheapest rates.

Generally, annual commute distance have little to no effect on your rates at all.

Coverage Level Rates by Companies

Let’s see how rates vary among the top insurers for high, medium, and low coverage.

Coverage-Level Rates-in-North-Carolina

| Company | Coverage Type | Annual Average |

|---|---|---|

| High | $7,473.78 | |

| Medium | $7,164.38 | |

| Low | $6,933.13 | |

| High | $3,279.91 | |

| High | $3,221.52 | |

| Medium | $3,116.45 | |

| High | $3,080.53 | |

| Medium | $3,063.31 | |

| Low | $3,001.62 | |

| High | $2,978.58 |

| Low | $2,951.13 | |

| Medium | $2,926.41 | |

| Medium | $2,834.35 |

| Low | $2,803.12 | |

| Low | $2,731.17 |

| High | $2,517.70 | |

| Medium | $2,368.67 | |

| High | $2,300.51 |

| Low | $2,261.45 | |

| Medium | $2,169.37 |

| Low | $2,078.26 |

With most of the companies (except Progressive), there’s only a $200 difference between the highest and lowest coverage.

Credit History Rates by Companies

Your credit score also affects your rates. Often, the higher your score, the less you’ll pay. The average credit score nationwide is 675. North Carolina came close, at a “devilish” 666.

Credit-History-Rates-in-North-Carolina

| Company | Credit History | Annual Average |

|---|---|---|

| Poor | $1,800.00 | |

| Fair | $1,560.00 | |

| Good | $1,320.00 | |

| Poor | $1,560.00 | |

| Poor | $1,824.00 | |

| Poor | $1,620.00 | |

| Fair | $1,584.00 | |

| Good | $1,344.00 | |

| Fair | $1,380.00 | |

| Fair | $1,464.00 |

| Good | $1,224.00 |

| Poor | $1,704.00 |

| Fair | $1,320.00 | |

| Good | $1,140.00 | |

| Poor | $1,656.00 | |

| Fair | $1,416.00 | |

| Fair | $1,440.00 |

| Good | $1,200.00 |

| Poor | $1,680.00 |

| Good | $1,080.00 | |

| Good | $1,176.00 |

Nationwide and Liberty Mutual were the only top insurers who didn’t use credit history to determine their rates.

Driving Record Rates by Companies

Your driving record is one of the most crucial factors in your insurance premiums.

Driving-Record-Rates-in-North-Carolina

| Company | Driving Record | Annual Average |

|---|---|---|

| With 1 DUI | $12,757.11 | |

| With 1 accident | $6,855.02 | |

| With 1 DUI | $5,926.55 | |

| With 1 DUI | $5,836.08 | |

| With 1 DUI | $5,666.30 | |

| With 1 DUI | $5,390.16 |

| With 1 speeding violation | $5,262.09 | |

| With 1 DUI | $5,173.29 | |

| With 1 DUI | $4,095.53 |

| Clean record | $3,887.51 | |

| With 1 accident | $2,448.95 | |

| With 1 speeding violation | $2,400.64 | |

| With 1 accident | $2,371.17 | |

| With 1 speeding violation | $2,371.17 | |

| With 1 accident | $2,336.01 | |

| With 1 speeding violation | $2,167.56 | |

| With 1 accident | $2,164.71 |

| With 1 speeding violation | $2,164.71 |

| Clean record | $1,844.98 | |

| Clean record | $1,672.56 |

| With 1 accident | $1,668.53 |

| With 1 speeding violation | $1,668.53 |

| Clean record | $1,645.72 | |

| With 1 accident | $1,642.22 | |

| With 1 speeding violation | $1,590.55 | |

| Clean record | $1,576.88 | |

| Clean record | $1,298.25 |

| Clean record | $1,124.37 |

Insurers tend not to raise rates much for a minor infraction, such as speeding. But, with one DUI, they can increase by thousands of dollars. With Allstate, that amounts to $8,000.

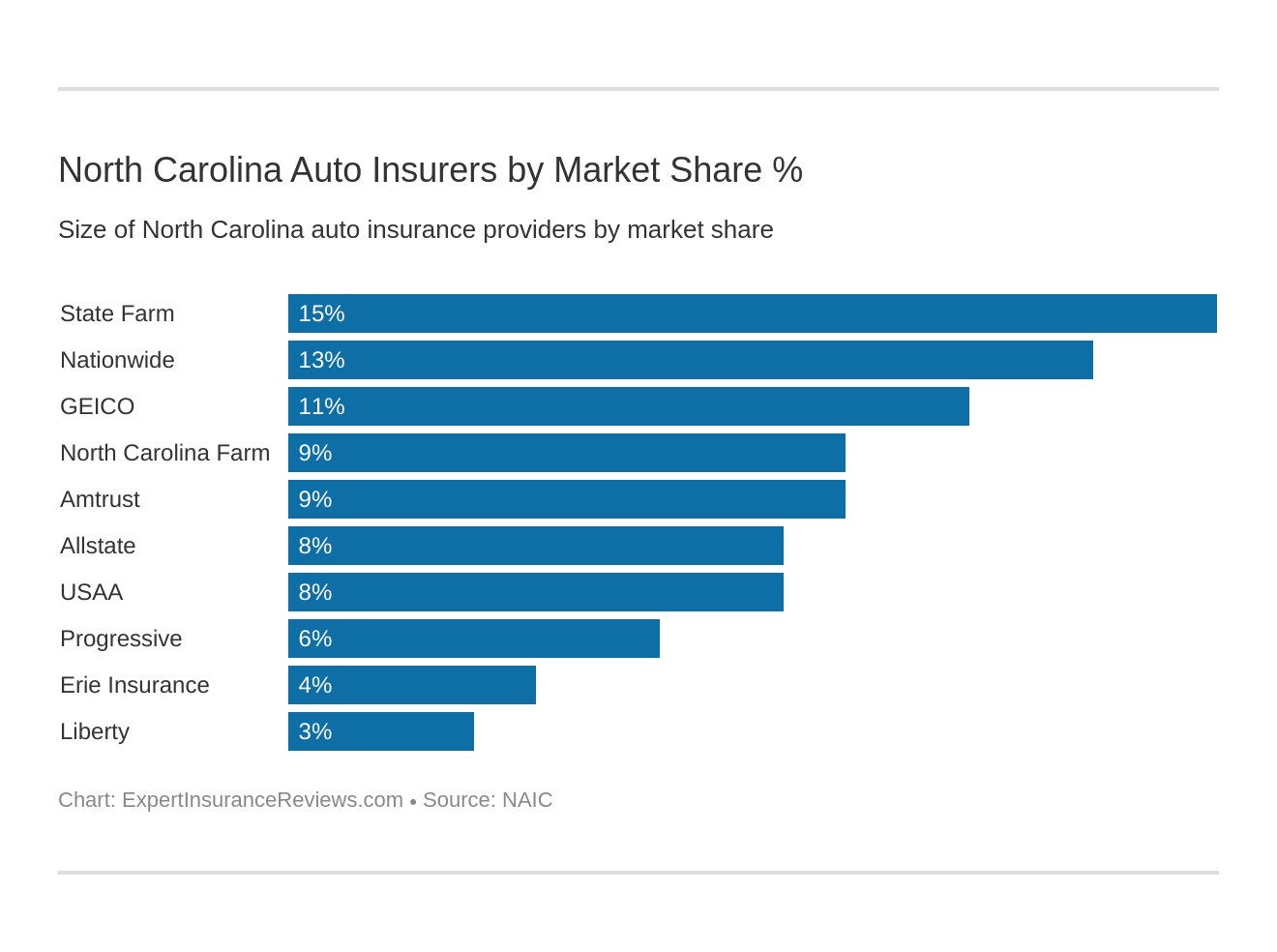

Largest Auto Insurance Companies in North Carolina

Here’s how the top insurers compare by market share and direct premiums written.

Largest-Car-Insurance-Companies-in-North-Carolina,/strong>

| Company | Premiums Written | Market Share |

|---|---|---|

| $915,686 | 15.30% | |

| $760,136 | 12.70% |

| $670,830 | 11.21% | |

| $558,355 | 9.46% |

| $558,355 | 9.33% | |

| $503,501 | 8.41% | |

| $449,687 | 7.51% | |

| $338,265 | 5.65% | |

| $226,829 | 3.79% |

| $175,250 | 2.93% |

State Farm, Nationwide, and Geico write the most premiums. See State Farm insurance review and Geico insurance reviews & complaints to learn more about these companies.

Number of Insurers by State

Domestic insurers were formed in North Carolina law, while foreign insurers were founded out of state. Out of a total of 911 insurers who operate in the Tarheel State, 56 are domestic and 855 are foreign.

Your one-stop online insurance guide. Get free quotes now! Secured with SHA-256 Encryption

North Carolina Laws

Now that you know how to find the best insurance at the best price, we’ll switch gears and explore state laws.

North Carolina State Laws

With the many laws that have been enacted, it can be hard to sort through the ones that apply to car insurance and driving. And it can be confusing to determine which ones apply to you.

But, we’ve done all the research for you. You’ll find everything you must know about North Carolina car insurance laws here

Keep reading to stay informed.

North Carolina Auto Insurance Laws

In this section, we’ll go over what sets North Carolina car insurance rates and the laws governing windshield replacement, high-risk drivers, and fraud.

How State Laws for Insurance are Determined

The North Carolina Department of Insurance sets insurance rates based on the National Association of Insurance Commissioners’ standards.

Regarding form filings, insurance companies must get prior approval from the state insurance commissioner or 80 days must have passed after filing.

Windshield Coverage

If your windshield cracks or breaks, it can be frustrating.

Fortunately, in North Carolina, you can choose your windshield repair vendor. The vendor must use aftermarket parts equal to the original manufacturer’s parts.

Insurers may also offer zero-deductible policies for windshield glass replacement. Comprehensive coverage, which covers damage from “Acts of God” such as vandalism, theft, fire, and natural disasters, can also cover windshield replacement.

High-Risk Insurance

If you’ve been convicted of several offenses, such as driving without insurance or a DUI, insurance companies may consider you a “high risk” to insure. That can make it harder to get insured in the open marketplace.

In North Carolina, you don’t have to file an SR-22, a DMV form that shows you carry the state-required minimum liability insurance.

“High-risk” drivers can find insurance through the North Carolina Reinsurance Facility. This organization offers insurers a way to share the risk associated with your policy among a pool of companies, but you may end up paying more for insurance compared to standard premiums. Find out the best car insurance companies for high-risk drivers.

Read more: Does my car insurance cover damage caused by a DUI or other criminal activity?

Low-Cost Insurance

Though North Carolina has a program to help high-risk drivers, it doesn’t have one for low-income drivers.

California, Hawaii, and New Jersey are the only states with government-funded programs to help low-income drivers pay for their car insurance.

Automobile Insurance Fraud in North Carolina

Misrepresenting facts on insurance claims, submitting false claims, and faking accidents are among the most common forms of car insurance fraud.

According to the Insurance Information Institute (III), insurance applicants, policyholders, third-party claimants, and insurance professionals are among those who commit fraud.

Insurance fraud is a crime in the Tarheel State. The North Carolina Department of Insurance’s Criminal Investigations Division handles car insurance fraud claims. In 2016 alone, the unit investigated 4,523 fraud claims, a 2 percent decrease from the prior year. It also made 233 arrests and 153 convictions for insurance fraud.

You can report fraud in the following ways:

- An online form

- Email: [email protected]

- Phone: (919) 715-1156

Statute of Limitations

The statute of limitations is the time you have left to file a legal claim. In North Carolina, drivers have three years to file a personal injury or a property damage insurance claim or lawsuit.

Evidence can degrade and witnesses can be hard to keep track of over time, so it’s best to file sooner rather than later.

North Carolina Vehicle Licensing Laws

To register and drive a vehicle in North Carolina, you must carry insurance and a license. Let’s go over the vehicle licensing laws in the Tarheel State.

REAL ID

Starting on Oct. 1, 2020, federal agencies will enforce the REAL ID Act. They will require a REAL ID, U.S. passport, or other federally-approved identification to board commercial flights and enter secure federal buildings.

The North Carolina REAL ID Act–compliant driver’s license is just like a traditional license or ID but has a star at the top. Driver’s licenses and IDs without a gold star are marked “Not for Federal Identification.” The N.C. REAL ID is optional.

You may need a REAL ID, however, to board a commercial domestic flight, visit military bases, courthouses, and other federal facilities. To apply for one, you must go to the North Carolina DMV and provide additional documents with your traditional license or ID:

- One document (with full name) proving your identity and date of birth

- One document (with full name and full Social Security number) confirming your social security number

- Two documents (with current physical address) proving your North Carolina residency

- For non-U.S. citizens, one document (with full name) proving your legal presence/lawful status

- If applicable, one or more documents verifying any name change

The video below from the NC DMV explains REAL ID:

Penalties for Driving Without Insurance

There is more to not having insurance in North Carolina than a cancellation fee. Whenever law enforcement pulls you over, you must show your license, registration, and insurance.

As we mentioned before, in North Carolina, you must carry proof of insurance or financial responsibility with you at all times. If you can’t, you’ll face the following penalties:

- First offense: $50 civil penalty; license/registration suspension for 30 days and $50 reinstatement fee; 45-day probation

- Second offense: $100 civil penalty; license/registration suspension for 30 days and $50 reinstatement fee; 45-day probation.

- Third and subsequent offenses: $150 civil penalty; license/registration suspension for 30 days and $50 reinstatement fee; 45-day probation.

Teen Driver Laws

In North Carolina, teens must go through a graduated licensing program that grants them a permit before they qualify for a full license.

Below are the state requirements for getting a learner’s permit.

Teen Driver Laws - North Carolina

| Restrictions | Limit | Minimum Age Restrictions are lifted |

|---|---|---|

| Nighttime Driving | 11 p.m.-5 a.m. | 12 months after initial license (min. age: 17) |

| Passengers | No passenger under 20 (limited exception with family) | 12 months after initial license (min. age: 17) |

Also, it’s illegal for drivers younger than age 18 to text or use a cellphone. If they’re caught in the act, they will pay a $25 fine.

Older Driver License Renewal Procedures

According to the Insurance Institute for Highway Safety, older drivers must meet these guidelines to renew their licenses:

- License renewal: Every five years for drivers age 66 and older

- Proof of vision is required at every renewal

- The DMV allows mail or online renewal at every other renewal

New Residents

If you’ve moved from out of state, you must apply for a North Carolina driver’s license at a DMV office within 60 days after you establish your residency.

You may not have to undergo driving or written tests if you have a license valid in another state.

To apply for a North Carolina license, you must bring the following documents. If your legal name doesn’t match the name on your documents, you must provide proof of the name change, such as a certified marriage license, a divorce decree, or documents from the courts or Register of Deeds.

- An out-of-state license or one document (with your full name) proving your identity and date of birth

- A social security card or another document proving your social security number

- One document verifying your physical address in North Carolina (two are required if you’re getting an NC REAL ID)

- For individuals not born in the U.S., one document (with your full name) proving your legal presence/lawful status

- A document proving liability insurance coverage from a provider licensed to do business in North Carolina

License Renewal Procedures

The North Carolina DMV will send you a renewal card 60 days before your license expires, but you can renew your license 180 days before your license expires so it does not affect your car insurance.

To renew your license, you must have a current or expired license. If you don’t have those, you must present two forms of identification.

The IIHS reports that renewal is every eight years for drivers younger than age 66, and you may renew online at every other renewal. Vision tests are mandatory for all in-person renewals. Drivers under age 66 may renew their licenses remotely at every other renewal period.

Negligent Operator Treatment System (NOTS)

North Carolina’s Safe Driver Incentive Plan (SDIP) promotes safe driving through a points system that increases insurance costs for traffic violations. The more severe the violation or accident, the more points you may receive.

For example, one point may raise your insurance rates by 30 percent. The North Carolina Department of Insurance provides more information about points it assigns for each violation and the insurance rate increases.

Rules of the Road

Below you’ll find yet more information about driving laws. These laws regulate seat belt and car seat use, when you should keep right and move over, speed limits, ridesharing, and automation.

Fault vs. No-Fault

In North Carolina, whoever caused an accident or is “at fault” must pay bodily injury and property damages.

For accident claims, the Tarheel State follows a rule of pure contributory negligence, which assigns a percentage of fault to each party involved. It means that when someone shares any responsibility for damages, they can’t get compensation.

So, if one party is one percent responsible — and the other party was 99 percent at-fault — they can’t get compensation. You must be found free of fault to get a payout from the other driver’s insurance.

Seat Belt & Car Seat Laws

North Carolina requires everyone who rides in a car to buckle up. This law is under primary enforcement. So, if a police officer catches you without a seat belt on, you will pay a minimum $25 fine for a first offense.

Children aged seven or younger and who weigh less than 80 pounds must be in a car seat. Children aged four or younger who weigh less than 40 pounds must be in a rear seat.

Riding in the cargo area of a truck is against the law for passengers 15 or younger unless they’re belted or with a supervising adult. Riding in the back is allowed in emergencies, if the vehicle is used in farming, or if the truck has “permanent overhead structures.”

The news report below goes over North Carolina’s safety belt laws:

Keep Right & Move Over Laws

North Carolina bans vehicles traveling slower than the speed limit from driving in the left lane.

As for its “move over” laws, drivers must slow down or move to the closest lane when they approach a stationary emergency vehicle displaying flashing lights. This law includes towing and recovery vehicles, utility vehicles, municipal vehicles, and road maintenance vehicles.

Speed Limits

In North Carolina, the speed limit is 70 miles per hour on rural interstates, urban interstates, and other limited-access roads. All other roads have a limit of 55 miles per hour.

Ridesharing

In 2015, North Carolina enacted a law to regulate ridesharing services. These are the requirements for drivers:

- Transportation network company (TNC) drivers or the TNC itself must have insurance that meets certain requirements, including coverage of at least $1,500,000 for death, injury, or property damage from an accident that occurs while a driver is on the job.

- Rideshare drivers’ vehicles must undergo a safety inspection yearly.

- Drivers must provide their photo, license plate number, vehicle description, and location on a map to customers who request a ride.

- Drivers must be age 19 or older.

- TNC drivers must pass local and national criminal background checks.

- Drivers may not qualify to drive if they don’t have a valid driver’s license, proof of financial responsibility, or registration for the vehicle.

- Registered sex offenders can’t drive for TNCs.

- People with three or more moving violations or a major violation in the past three years can’t drive for a TNC in North Carolina.

- Those who have been convicted in the past seven years of driving while impaired, fraud, sexual offenses, or other crimes can’t drive for TNCs.

- Drivers must collect fees through the rideshare service’s online app only.

Not every insurance company that operates in the Tarheel State offers ridesharing insurance. Farmers and Liberty Mutual are two who do.

Automation on the Road

An autonomous vehicle controls every aspect of driving on the road. Depending on the level of a vehicle’s automation, North Carolina requires autonomous vehicle drivers to have a license. The operator doesn’t have to be in the car. The state requires owners to carry liability insurance.

This law firm video reveals more details about North Carolina’s autonomous vehicle laws:

Safety Laws

Below are more regulations controlling safe driving in North Carolina: DUI laws, marijuana laws, and distracted driving laws.

DUI Laws

Driving while under the influence is a serious offense. North Carolina classifies a blood alcohol concentration (BAC) of 0.08 or over as driving while intoxicated.

For this misdemeanor, the state has five levels of convictions:

North-Carolina-DUI-Penalties

| North Carolina DWI Categories | Level V (Least Serious) | Level IV | Level III | Level II |

|---|---|---|---|---|

| North Carolina Penalties | up to $200, 24 hours-60 days jail OR with suspended sentence, 24 hours in jail, 24 hours community service or no driving for 30 days | up to $500, 48 hours-120 days jail OR with suspended sentence, 48 hours in jail, 48 hours community service or no driving for 60 days | up to $1000, 72 hours-6 months jail OR with suspended sentence, 72 hours in jail, 72 hours community service or no driving for 90 days | up to $2000, 7 days-1 year, minimum sentense cannot be suspended |

| Level I (Most Serious) | Habitual DWI/Felony DWI | All Offenders | Governor's DWI Initiaitve | Factors Involved in Sentencing |

| up to $4000, 30 days-2 years, minimum sentence cannot be suspended | 3 prior convictions in 7 years: minimum active jail term of 1 year - not suspendable. Offenders must attend substance abuse program while in jail or as condition of parole. | Must complete substance abuse assessment and comply with any recommended treatment as condition for restored license. | If person receives DWI charged while license is revoked for DWI, vehicle may be seized at time of arrest. If court convicts offender, judge will order vehicle to be forfeited and given to the school board to be used or sold for profit. | Grossly Aggravating Factors, Aggravating Factors, Mitigating Factors |

North Carolina considers drivers who have three DWI convictions over seven years to be habitual offenders. They face a mandatory one-year jail sentence.

This law firm video also explains the five levels of DUI charges in the Tarheel State:

It’s best to think before you drink. To protect yourself and others, don’t drink and drive.

Marijuana-Impaired Driving Laws

North Carolina doesn’t have a marijuana-specific drugged driving law. Overall, marijuana — even for medicinal use — is illegal in the Tarheel State. Offenders who possess a small amount of marijuana won’t face jail time for a first offense.

Distracted Driving Laws

According to AAA, North Carolina bans texting and emailing while driving. Limited learner’s permit and provisional driver’s license holders and drivers under age 18 can’t use cell phones while they drive. School bus drivers also can’t use cell phones on the road.

Driving in North Carolina

When you take the wheel in the Tarheel State or even simply own a vehicle, some risks are involved. For instance, someone could steal your car or rear-end you in traffic. The number of hazards can be alarming.

The statistics below remind everyone of the importance of being careful. You’ll learn a lot about the state of vehicle theft in North Carolina, and the average amount of fatal accidents that happen there. The figures are sobering, yet enlightening.

If you’re ready, read on to find out more.

Vehicle Theft in North Carolina

Some cars are more likely to be stolen than others. Below are the most popular stolen vehicles. Did your car make the list?

Vehicle-Thefts-in-North-Carolina

| Vehicle | Year | Thefts |

|---|---|---|

| Honda Accord | 1997 | 609 |

| Ford Pickup (Full Size) | 2004 | 424 |

| Chevrolet Pickup (Full Size) | 2003 | 370 |

| Honda Civic | 2000 | 350 |

| Toyota Camry | 2014 | 291 |

| Nissan Altima | 2015 | 249 |

| Jeep Cherokee/Grand Cherokee | 1999 | 203 |

| Chevrolet Impala | 2006 | 194 |

| Toyota Corolla | 2014 | 190 |

| Ford Explorer | 2003 | 185 |

The 1997 Honda Accord — one of the most attractive makes and models to thieves nationwide — and the 2004 full-size Ford pickup topped the list.

Vehicle Theft by City

These are the Federal Bureau of Investigation (FBI)’s 2017 figures for vehicle thefts that occurred in North Carolina cities in 2017.

| City | Motor vehicle theft |

|---|---|

| Aberdeen | 6 |

| Albemarle | 31 |

| Angier | 4 |

| Apex | 14 |

| Archdale | 9 |

| Asheboro | 77 |

| Asheville | 324 |

| Atlantic Beach | 2 |

| Ayden | 7 |

| Bailey | 1 |

| Banner Elk | 0 |

| Beaufort | 2 |

| Beech Mountain | 0 |

| Belhaven | 2 |

| Belmont | 21 |

| Benson | 9 |

| Bessemer City | 6 |

| Beulaville | 0 |

| Biltmore Forest | 1 |

| Biscoe | 2 |

| Black Mountain | 9 |

| Blowing Rock | 2 |

| Boone | 12 |

| Brevard | 9 |

| Bunn | 0 |

| Burgaw | 6 |

| Burlington | 112 |

| Burnsville | 3 |

| Butner | 5 |

| Carrboro | 15 |

| Carthage | 4 |

| Cary | 72 |

| Chapel Hill | 53 |

| Charlotte-Mecklenburg | 2,622 |

| Clayton | 19 |

| Cleveland | 3 |

| Clinton | 19 |

| Columbus | 3 |

| Concord | 65 |

| Conover | 13 |

| Cramerton | 3 |

| Creedmoor | 4 |

| Davidson | 5 |

| Dobson | 4 |

| Drexel | 3 |

| Duck | 0 |

| Durham | 762 |

| Eden | 27 |

| Edenton | 3 |

| Elizabeth City | 25 |

| Elkin | 13 |

| Elon | 1 |

| Emerald Isle | 8 |

| Erwin | 4 |

| Fairmont | 7 |

| Farmville | 5 |

| Fayetteville | 415 |

| Fletcher | 10 |

| Fuquay-Varina | 21 |

| Garner | 43 |

| Gastonia | 262 |

| Gibsonville | 7 |

| Goldsboro | 60 |

| Granite Falls | 17 |

| Greensboro | 846 |

| Greenville | 104 |

| Havelock | 10 |

| Haw River | 4 |

| Henderson | 41 |

| Hendersonville | 35 |

| Hertford | 3 |

| Hickory | 178 |

| Highlands | 0 |

| High Point | 280 |

| Hillsborough | 7 |

| Holly Ridge | 4 |

| Holly Springs | 8 |

| Hope Mills | 11 |

| Hudson | 6 |

| Huntersville | 36 |

| Indian Beach | 0 |

| Jacksonville | 52 |

| Jefferson | 1 |

| Jonesville | 6 |

| Kannapolis | 70 |

| Kernersville | 50 |

| Kill Devil Hills | 11 |

| King | 5 |

| Kings Mountain | 1 |

| Kinston | 34 |

| Kitty Hawk | 3 |

| Knightdale | 16 |

| Lake Lure | 1 |

| Laurel Park | 1 |

| Leland | 6 |

| Lenoir | 49 |

| Lincolnton | 17 |

| Long View | 32 |

| Louisburg | 4 |

| Maiden | 3 |

| Manteo | 2 |

| Marion | 35 |

| Mars Hill | 0 |

| Marshville | 3 |

| Matthews | 51 |

| Maxton | 7 |

| Mayodan | 2 |

| Maysville | 0 |

| Mebane | 19 |

| Mint Hill | 30 |

| Mocksville | 12 |

| Mooresville | 33 |

| Morehead City | 9 |

| Morrisville | 8 |

| Mount Airy | 47 |

| Mount Holly | 11 |

| Mount Olive | 3 |

| Murfreesboro | 2 |

| Murphy | 8 |

| Nags Head | 2 |

| New Bern | 15 |

| Newport | 1 |

| Newton | 21 |

| North Wilkesboro | 5 |

| Oak Island | 7 |

| Oxford | 18 |

| Pinebluff | 2 |

| Pinehurst | 2 |

| Pine Knoll Shores | 0 |

| Pine Level | 0 |

| Pineville | 41 |

| Pittsboro | 4 |

| Plymouth | 5 |

| Raeford | 5 |

| Ramseur | 4 |

| Reidsville | 36 |

| Richlands | 2 |

| Roanoke Rapids | 25 |

| Robbins | 0 |

| Robersonville | 1 |

| Rockingham | 25 |

| Rockwell | 4 |

| Rocky Mount | 120 |

| Rolesville | 7 |

| Rowland | 2 |

| Rutherfordton | 3 |

| Selma | 11 |

| Shallotte | 5 |

| Siler City | 10 |

| Smithfield | 14 |

| Snow Hill | 0 |

| Southern Pines | 6 |

| Spencer | 6 |

| Spruce Pine | 2 |

| Stallings | 9 |

| Surf City | 1 |

| Swansboro | 1 |

| Sylva | 9 |

| Tabor City | 9 |

| Tarboro | 10 |

| Thomasville | 68 |

| Trent Woods | 1 |

| Troutman | 4 |

| Troy | 5 |

| Tryon | 1 |

| Valdese | 4 |

| Wadesboro | 15 |

| Wake Forest | 15 |

| Warsaw | 3 |

| Washington | 18 |

| Waxhaw | 2 |

| Waynesville | 34 |

| Weaverville | 1 |

| Weldon | 3 |

| Wendell | 4 |

| West Jefferson | 1 |

| Whispering Pines | 0 |

| Whiteville | 16 |

| Wilkesboro | 7 |

| Williamston | 14 |

| Wilmington | 281 |

| Windsor | 0 |

| Winterville | 2 |

| Woodfin | 6 |

| Wrightsville Beach | 1 |

| Yadkinville | 5 |

| Youngsville | 2 |

| Zebulon | 5 |

Not surprisingly, the most populated areas, including Greensboro and Charlotte-Mecklenburg, had the most thefts.

Road Fatalities in North Carolina

Here, we’ll explore fatal crashes on the road and potential contributing factors, including weather and light conditions, speeding, and alcohol impairment. This data comes from the National Highway Traffic Safety Administration (NHTSA).

But first, let’s see which North Carolina highway is the deadliest.

Most Fatal Highway in North Carolina

According to Geotab, in North Carolina, over 200 fatal crashes occurred along I-95, including the Dick Fleming Freeway, a memorial to a local businessman.

Fatal Crashes by Weather Condition & Light Condition

The table below shows how many fatal accidents happened in different weather and light conditions in the Tarheel State.

Weather-and-Light-Conditions-in-North-Carolina

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 619 | 132 | 384 | 47 | 2 | 1,184 |

| Rain | 38 | 18 | 31 | 7 | 0 | 94 |

| Snow/Sleet | 4 | 1 | 2 | 2 | 0 | 9 |

Most of the fatalities occurred in normal daylight conditions.

Fatalities (All Crashes) by County

Let’s see how many fatal crashes took place in each North Carolina county.

Fatalities - All Crashes by County - North Carolina

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Mecklenburg County | 67 | 69 | 80 | 103 | 114 |

| Guilford County | 44 | 57 | 57 | 59 | 66 |

| Robeson County | 42 | 32 | 53 | 38 | 53 |

| Wake County | 73 | 63 | 65 | 81 | 53 |

| Cumberland County | 53 | 40 | 43 | 43 | 43 |

| Forsyth County | 27 | 34 | 40 | 42 | 42 |

| Harnett County | 27 | 23 | 23 | 22 | 34 |

| Buncombe County | 35 | 29 | 36 | 25 | 32 |

| Johnston County | 28 | 36 | 27 | 34 | 32 |

| Durham County | 25 | 26 | 25 | 22 | 31 |

Many of the fatalities occurred in more populated counties, such as Mecklenberg.

Traffic Fatalities

These numbers reveal how many traffic deaths happened in rural versus urban areas of North Carolina.

Traffic-Fatalities-in-North-Carolina-Rural-vs.-Urban

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Rural | 1,010 | 964 | 945 | 835 | 901 | 861 | 896 | 910 | 902 | 903 |

| Urban | 418 | 349 | 375 | 394 | 398 | 426 | 388 | 468 | 543 | 509 |

Rural areas had 1,000 more accidents than urban areas.

Fatalities by Person Type

These are the fatalities by type of vehicle and transportation used in North Carolina.

Fatalities-by-Person-Type-in-North-Carolina

| Person | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Passenger Car | 533 | 517 | 605 | 582 | 581 |

| Light Truck - Pickup | 149 | 152 | 154 | 177 | 151 |

| Light Truck - Utility | 146 | 144 | 149 | 184 | 170 |

| Light Truck - Van | 43 | 52 | 39 | 55 | 51 |

| Light Truck - Other | 1 | 0 | 1 | 1 | 3 |

| Large Truck | 16 | 20 | 19 | 20 | 29 |

| Bus | 0 | 0 | 0 | 4 | 0 |

| Motorcyclists | 189 | 190 | 192 | 185 | 176 |

| Pedestrian | 174 | 172 | 182 | 200 | 198 |

| Bicyclist and Other Cyclist | 22 | 19 | 23 | 17 | 29 |

Passenger cars were involved in the most accidents, while pedestrian deaths placed a distant second.

Fatalities by Crash Type

This is more information about the types of vehicles and the accidents that led to fatalities from 2013 – 2017.

Fatalities-by-Crash-Type-in-North-Carolina

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Single Vehicle | 743 | 756 | 751 | 819 | 765 |

| Involving a Large Truck | 139 | 121 | 129 | 152 | 164 |

| Involving Speeding | 413 | 497 | 547 | 566 | 423 |

| Involving a Rollover | 311 | 336 | 332 | 361 | 360 |

| Involving a Roadway Departure | 775 | 771 | 803 | 889 | 798 |

| Involving an Intersection (or Intersection Related) | 239 | 230 | 256 | 245 | 268 |

During that five-year timeframe, most of the crashes involved single vehicles and roadway departures.

Five-Year Trend For the Top 10 Counties

These are the numbers of fatalities in the most populated North Carolina counties from 2013 – 2017.

5-Year-Trend-for-the-Top-Ten-Counties-in-North-Carolina

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Mecklenburg County | 67 | 69 | 80 | 103 | 114 |

| Guilford County | 44 | 57 | 57 | 59 | 66 |

| Robeson County | 42 | 32 | 53 | 38 | 53 |

| Wake County | 73 | 63 | 65 | 81 | 53 |

| Cumberland County | 53 | 40 | 43 | 43 | 43 |

| Forsyth County | 27 | 34 | 40 | 42 | 42 |

| Harnett County | 27 | 23 | 23 | 22 | 34 |

| Buncombe County | 35 | 29 | 36 | 25 | 32 |

| Johnston County | 28 | 36 | 27 | 34 | 32 |

| Durham County | 25 | 26 | 25 | 22 | 31 |

As the data shows, the higher the population in certain counties, the more traffic fatalities tend to occur.

Fatalities Involving Speeding by County

Speed is among the many factors involved in crash deaths.

Fatalities-Involving-Speeding-by-County-in-North-Carolina

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Alamance | 11 | 2 | 6 | 4 | 8 |

| Alexander | 5 | 2 | 2 | 0 | 1 |

| Alleghany | 0 | 0 | 1 | 0 | 1 |

| Anson | 1 | 4 | 0 | 1 | 0 |

| Ashe | 0 | 0 | 1 | 1 | 0 |

| Avery | 1 | 0 | 0 | 2 | 0 |

| Beaufort | 0 | 1 | 1 | 2 | 1 |

| Bertie | 3 | 4 | 3 | 2 | 4 |

| Bladen | 3 | 1 | 1 | 6 | 3 |

| Brunswick | 4 | 4 | 4 | 5 | 8 |

| Buncombe | 9 | 8 | 15 | 8 | 9 |

| Burke | 2 | 6 | 2 | 5 | 2 |

| Cabarrus | 8 | 4 | 13 | 12 | 5 |

| Caldwell | 2 | 5 | 5 | 6 | 2 |

| Camden | 0 | 0 | 0 | 0 | 0 |

| Carteret | 2 | 2 | 2 | 4 | 1 |

| Caswell | 1 | 2 | 4 | 4 | 3 |

| Catawba | 3 | 11 | 5 | 5 | 4 |

| Chatham | 3 | 2 | 3 | 8 | 3 |

| Cherokee | 1 | 1 | 5 | 1 | 1 |

| Chowan | 0 | 1 | 0 | 2 | 3 |

| Clay | 1 | 0 | 1 | 0 | 1 |

| Cleveland | 1 | 9 | 8 | 18 | 2 |

| Columbus | 6 | 5 | 2 | 7 | 6 |

| Craven | 3 | 6 | 6 | 8 | 2 |

| Cumberland | 15 | 14 | 14 | 25 | 13 |

| Currituck | 2 | 1 | 0 | 1 | 1 |

| Dare | 1 | 1 | 1 | 0 | 0 |

| Davidson | 13 | 12 | 14 | 17 | 12 |

| Davie | 1 | 3 | 2 | 5 | 5 |

| Duplin | 2 | 9 | 4 | 3 | 0 |

| Durham | 6 | 11 | 11 | 10 | 17 |

| Edgecombe | 1 | 6 | 7 | 5 | 2 |

| Forsyth | 11 | 12 | 10 | 14 | 11 |

| Franklin | 3 | 2 | 1 | 5 | 5 |

| Gaston | 6 | 15 | 12 | 14 | 10 |

| Gates | 2 | 2 | 3 | 1 | 1 |

| Graham | 2 | 2 | 2 | 2 | 0 |

| Granville | 3 | 5 | 2 | 4 | 7 |

| Greene | 1 | 1 | 4 | 0 | 1 |

| Guilford | 13 | 27 | 25 | 26 | 19 |

| Halifax | 4 | 5 | 6 | 2 | 8 |

| Harnett | 13 | 11 | 13 | 9 | 14 |

| Haywood | 1 | 3 | 3 | 4 | 2 |

| Henderson | 2 | 9 | 3 | 4 | 2 |

| Hertford | 1 | 0 | 3 | 5 | 1 |

| Hoke | 2 | 2 | 12 | 6 | 9 |

| Hyde | 0 | 0 | 1 | 0 | 1 |

| Iredell | 4 | 6 | 8 | 7 | 3 |

| Jackson | 1 | 4 | 3 | 5 | 3 |

| Johnston | 10 | 11 | 17 | 14 | 9 |

| Jones | 0 | 0 | 0 | 2 | 1 |

| Lee | 8 | 2 | 7 | 2 | 10 |

| Lenoir | 0 | 2 | 2 | 2 | 1 |

| Lincoln | 4 | 1 | 9 | 6 | 4 |

| Macon | 1 | 5 | 3 | 2 | 2 |

| Madison | 0 | 4 | 2 | 3 | 3 |

| Martin | 0 | 2 | 2 | 3 | 2 |

| Mcdowell | 2 | 4 | 3 | 1 | 3 |

| Mecklenburg | 28 | 19 | 44 | 49 | 41 |

| Mitchell | 1 | 0 | 1 | 0 | 0 |

| Montgomery | 2 | 3 | 1 | 4 | 2 |

| Moore | 3 | 13 | 5 | 9 | 3 |

| Nash | 4 | 13 | 9 | 9 | 5 |

| New Hanover | 5 | 8 | 8 | 6 | 4 |

| Northampton | 0 | 1 | 1 | 1 | 1 |

| Onslow | 10 | 12 | 16 | 6 | 5 |

| Orange | 11 | 5 | 7 | 3 | 4 |

| Pamlico | 2 | 2 | 3 | 1 | 0 |

| Pasquotank | 0 | 2 | 1 | 1 | 0 |

| Pender | 7 | 8 | 6 | 0 | 5 |

| Perquimans | 0 | 0 | 1 | 0 | 0 |

| Person | 2 | 4 | 2 | 1 | 2 |

| Pitt | 7 | 5 | 7 | 4 | 2 |

| Polk | 2 | 4 | 2 | 1 | 0 |

| Randolph | 8 | 10 | 14 | 9 | 7 |

| Richmond | 4 | 0 | 1 | 7 | 3 |

| Robeson | 19 | 20 | 18 | 20 | 20 |

| Rockingham | 2 | 5 | 6 | 9 | 2 |

| Rowan | 11 | 8 | 6 | 7 | 3 |

| Rutherford | 4 | 6 | 2 | 3 | 2 |

| Sampson | 5 | 0 | 7 | 7 | 2 |

| Scotland | 3 | 3 | 6 | 1 | 3 |

| Stanly | 5 | 5 | 3 | 5 | 3 |

| Stokes | 2 | 3 | 3 | 4 | 2 |

| Surry | 4 | 6 | 5 | 2 | 2 |

| Swain | 2 | 0 | 0 | 2 | 0 |

| Transylvania | 1 | 4 | 2 | 0 | 6 |

| Tyrrell | 0 | 0 | 0 | 0 | 0 |

| Union | 1 | 5 | 8 | 7 | 11 |

| Vance | 6 | 4 | 2 | 4 | 2 |

| Wake | 29 | 21 | 24 | 33 | 6 |

| Warren | 0 | 1 | 0 | 3 | 3 |

| Washington | 0 | 0 | 0 | 1 | 1 |

| Watauga | 2 | 1 | 6 | 4 | 1 |

| Wayne | 5 | 7 | 6 | 11 | 5 |

| Wilkes | 1 | 5 | 5 | 3 | 3 |

| Wilson | 5 | 4 | 4 | 4 | 8 |

| Yadkin | 4 | 5 | 4 | 1 | 1 |

| Yancey | 1 | 1 | 2 | 4 | 1 |

Fortunately, there were few crash deaths among the North Carolina counties.

Fatalities in Crashes Involving an Alcohol-Impaired Driver by County

Another major contributor to North Carolina’s crash deaths is alcohol consumption.

Fatalities-Involving-Alcohol-Impaired-Driving-by-County-in-North-Carolina

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Alamance | 6 | 3 | 6 | 4 | 10 |

| Alexander | 2 | 2 | 2 | 1 | 0 |

| Alleghany | 1 | 0 | 0 | 0 | 0 |

| Anson | 1 | 3 | 0 | 0 | 2 |

| Ashe | 1 | 0 | 0 | 3 | 1 |

| Avery | 1 | 0 | 1 | 0 | 0 |

| Beaufort | 3 | 2 | 0 | 1 | 1 |

| Bertie | 0 | 2 | 3 | 3 | 3 |

| Bladen | 5 | 0 | 0 | 6 | 4 |

| Brunswick | 5 | 5 | 4 | 5 | 11 |

| Buncombe | 4 | 9 | 5 | 9 | 7 |

| Burke | 3 | 3 | 1 | 3 | 4 |

| Cabarrus | 3 | 5 | 8 | 9 | 3 |

| Caldwell | 1 | 5 | 6 | 5 | 3 |

| Camden | 0 | 0 | 0 | 0 | 1 |

| Carteret | 1 | 2 | 1 | 0 | 1 |

| Caswell | 1 | 2 | 2 | 3 | 2 |

| Catawba | 6 | 10 | 8 | 5 | 6 |

| Chatham | 5 | 1 | 2 | 3 | 5 |

| Cherokee | 3 | 1 | 3 | 1 | 3 |

| Chowan | 0 | 1 | 0 | 1 | 1 |

| Clay | 0 | 0 | 1 | 1 | 0 |

| Cleveland | 3 | 6 | 5 | 13 | 4 |

| Columbus | 8 | 5 | 2 | 7 | 4 |

| Craven | 5 | 3 | 3 | 6 | 1 |

| Cumberland | 15 | 11 | 12 | 17 | 11 |

| Currituck | 0 | 2 | 1 | 0 | 1 |

| Dare | 0 | 1 | 0 | 0 | 1 |

| Davidson | 6 | 8 | 9 | 10 | 8 |

| Davie | 0 | 2 | 1 | 2 | 2 |

| Duplin | 3 | 5 | 3 | 2 | 1 |

| Durham | 4 | 11 | 6 | 7 | 12 |

| Edgecombe | 3 | 2 | 3 | 4 | 5 |

| Forsyth | 8 | 12 | 10 | 18 | 12 |

| Franklin | 2 | 1 | 3 | 5 | 6 |

| Gaston | 3 | 10 | 10 | 8 | 5 |

| Gates | 0 | 1 | 1 | 0 | 1 |

| Graham | 0 | 0 | 1 | 0 | 0 |

| Granville | 3 | 4 | 3 | 3 | 3 |

| Greene | 2 | 0 | 2 | 0 | 1 |

| Guilford | 14 | 14 | 19 | 20 | 26 |

| Halifax | 5 | 4 | 5 | 1 | 5 |

| Harnett | 9 | 6 | 8 | 7 | 7 |

| Haywood | 0 | 2 | 0 | 3 | 2 |

| Henderson | 1 | 3 | 0 | 2 | 3 |

| Hertford | 1 | 0 | 1 | 4 | 4 |

| Hoke | 1 | 3 | 8 | 5 | 6 |

| Hyde | 0 | 0 | 1 | 0 | 0 |

| Iredell | 7 | 8 | 4 | 8 | 8 |

| Jackson | 2 | 2 | 1 | 2 | 2 |

| Johnston | 6 | 5 | 6 | 12 | 12 |

| Jones | 0 | 0 | 0 | 1 | 0 |

| Lee | 7 | 1 | 7 | 2 | 4 |

| Lenoir | 4 | 1 | 2 | 3 | 1 |

| Lincoln | 6 | 2 | 7 | 4 | 5 |

| Macon | 1 | 3 | 0 | 2 | 1 |

| Madison | 1 | 1 | 1 | 2 | 2 |

| Martin | 1 | 1 | 2 | 1 | 0 |

| Mcdowell | 1 | 2 | 1 | 0 | 0 |

| Mecklenburg | 26 | 25 | 29 | 39 | 40 |

| Mitchell | 0 | 0 | 0 | 0 | 0 |

| Montgomery | 1 | 2 | 1 | 2 | 3 |

| Moore | 2 | 9 | 7 | 7 | 5 |

| Nash | 7 | 8 | 4 | 9 | 4 |

| New Hanover | 5 | 8 | 6 | 6 | 5 |

| Northampton | 1 | 2 | 1 | 1 | 3 |

| Onslow | 9 | 6 | 12 | 4 | 7 |

| Orange | 6 | 3 | 7 | 4 | 3 |

| Pamlico | 0 | 0 | 2 | 1 | 0 |

| Pasquotank | 0 | 1 | 0 | 2 | 0 |

| Pender | 7 | 6 | 5 | 3 | 3 |

| Perquimans | 1 | 0 | 1 | 0 | 0 |

| Person | 2 | 4 | 2 | 1 | 1 |

| Pitt | 4 | 4 | 10 | 4 | 4 |

| Polk | 0 | 0 | 1 | 1 | 0 |

| Randolph | 4 | 9 | 7 | 5 | 6 |

| Richmond | 4 | 4 | 0 | 2 | 1 |

| Robeson | 13 | 9 | 16 | 9 | 16 |

| Rockingham | 3 | 1 | 2 | 5 | 4 |

| Rowan | 9 | 5 | 4 | 7 | 3 |

| Rutherford | 2 | 5 | 1 | 0 | 2 |

| Sampson | 4 | 4 | 8 | 3 | 5 |

| Scotland | 1 | 3 | 2 | 3 | 4 |

| Stanly | 5 | 1 | 2 | 5 | 1 |

| Stokes | 4 | 1 | 2 | 4 | 2 |

| Surry | 2 | 4 | 5 | 5 | 1 |

| Swain | 0 | 1 | 0 | 0 | 0 |

| Transylvania | 1 | 0 | 1 | 0 | 2 |

| Tyrrell | 0 | 0 | 0 | 0 | 0 |

| Union | 5 | 6 | 5 | 8 | 8 |

| Vance | 5 | 4 | 5 | 4 | 2 |

| Wake | 29 | 19 | 18 | 27 | 19 |

| Warren | 0 | 1 | 1 | 3 | 2 |

| Washington | 0 | 0 | 0 | 0 | 0 |

| Watauga | 2 | 2 | 5 | 2 | 2 |

| Wayne | 8 | 4 | 5 | 6 | 5 |

| Wilkes | 2 | 3 | 3 | 3 | 3 |

| Wilson | 6 | 3 | 5 | 7 | 8 |

| Yadkin | 0 | 1 | 3 | 4 | 2 |

| Yancey | 0 | 0 | 2 | 0 | 0 |

Unfortunately, in some counties, such as Alamance and Brunswick, alcohol-related crash deaths rose in recent years.

Teen Drinking & Driving

Let’s look at underage drinking trends in North Carolina.

Teen-Drinking-and-Driving-in-North-Carolina

| Teens and Drunk Driving | Details |

|---|---|

| Alcohol-Impaired Driving Fatalities Per one million people | 1.5 |

| Higher/Lower Than National Average (1.2) | Higher |

| DUI Arrests (Under 18 years old) | 201 |

| DUI Arrests (Under 18 years old) Total Per Million People | 87.44 |

The state ranks in the middle nationwide — 24th — for its underage drinking rates.

EMS Response Time

These are the EMS response times for crashes in rural and urban areas.

EMS-Response-Times-in-North-Carolina-Rural-vs-Urban

| Region Type | Time of Crash to EMS Notification | EMS Notification to EMS Arrival | EMS Arrival at Scene to Hospital Arrival | Time of Crash to Hospital Arrival |

|---|---|---|---|---|

| Rural | 6 minutes | 10 minutes | 41 minutes | 48 minutes |

| Urban | 3 minutes | 8 minutes | 29 minutes | 37 minutes |

Response times in rural parts of North Carolina, unfortunately, were higher than those in cities and suburbs. This may be due to difficulties getting to more remote areas.

Transportation in North Carolina

The below information from Data USA reveals how many cars North Carolinians own on average, the forms of transportation they take in their commutes and the average length of those commutes.

The gray bars represent the U.S. and the orange ones show the Tarheel State.

Car Ownership

Data from Census.gov shows how many cars the average North Carolina household owns, commute time, and commuter transportation. More than 40 percent of North Carolinians own two cars, which is slightly more than the national average.

Commute Time

North Carolinians have a shorter commute time (23.1 minutes) than the average U.S. driver (25.5 minutes). Just over 2 percent of residents have a “super commute” of 90 minutes or more, which is below the national average.

Commuter Transportation

Now, let’s see which forms of transportation North Carolina residents prefer for their commutes. Most North Carolinians drive alone, which is higher than the U.S. average.

Traffic Congestion

The INRIX Global Traffic scorecard reports that Greensboro and Charlotte have the highest traffic congestion in the Tarheel State. The traffic monitor ranks them 209th and 91st worldwide, respectively, for the worst traffic.

Greensboro drivers lose an average of 43 hours weekly in traffic congestion, while Charlotte’s citizens nearly double that figure at 95 hours a week.

In the morning, Greensboro drivers spend 11 percent more time on their commutes. Toward the evening, that travel time increases to 17 percent. This costs drivers an average of $598 yearly.

Drivers in Charlotte spend 28 percent more time in their morning commutes. By the evening, that figure rises to 48 percent. That translates to $1,332 in transportation-related costs yearly.

How’s that for drive-time?

Ready to buy North Carolina car insurance? Start comparing car insurance rates today to find affordable North Carolina auto insurance near you.

Frequently Asked Questions

What types of car insurance coverage are required in North Carolina?

In North Carolina, drivers are required to have liability insurance coverage, which includes bodily injury and property damage liability. The minimum liability coverage limits are 30/60/25, which means $30,000 per person for bodily injury, $60,000 per accident for bodily injury, and $25,000 per accident for property damage.

What are the other types of car insurance coverage available in North Carolina?

Besides liability coverage, North Carolina drivers can purchase collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, medical payments coverage, and rental car coverage.

How much does car insurance cost in North Carolina?

The cost of car insurance in North Carolina varies depending on several factors, such as your driving record, age, location, coverage level, and deductible. On average, the annual premium for car insurance in North Carolina is $783.

How can I get the best car insurance rates in North Carolina?

You can get the best car insurance rates in North Carolina by shopping around and comparing multiple insurance providers. Also, make sure to maintain a clean driving record, pay your bills on time, and take advantage of discounts, such as safe driver discounts, multi-vehicle discounts, and bundling discounts.

What is the penalty for driving without car insurance in North Carolina?

Driving without car insurance in North Carolina is illegal and can lead to severe penalties and fines. The first offense may result in a fine of up to $150, while subsequent offenses may result in a fine of up to $500 and suspension of your driver’s license.

What should I do if I’m in a car accident in North Carolina?

If you’re in a car accident in North Carolina, you should call 911 immediately if anyone is injured or if there is significant damage to the vehicles. You should also exchange information with the other driver, such as names, contact information, and insurance information. Then, report the accident to your insurance provider as soon as possible and provide them with all the necessary information.

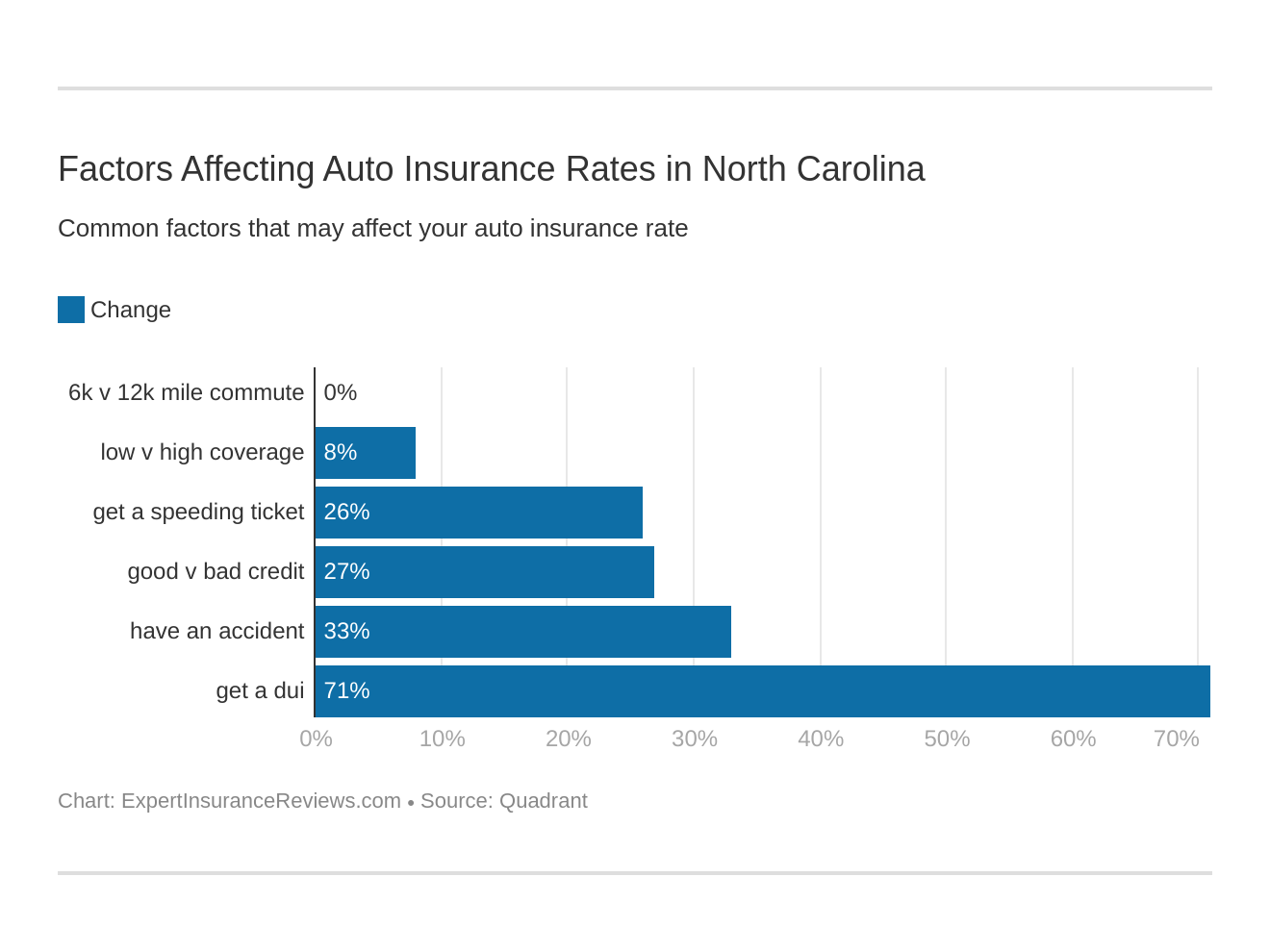

What factors can affect my car insurance rates in North Carolina?

Several factors can affect your car insurance rates in North Carolina, such as your driving record, age, location, credit score, coverage level, and deductible.

Can I customize my car insurance policy in North Carolina?

Yes, you can customize your car insurance policy in North Carolina to fit your specific needs and budget. You can choose the coverage level, deductible, and optional add-ons, such as roadside assistance and rental car coverage.

How do I file a claim for car insurance in North Carolina?

To file a claim for car insurance in North Carolina, contact your insurance provider as soon as possible and provide them with all the necessary information about the accident or incident. They will guide you through the claim process and help you get the compensation you deserve.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated life insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.