Best Rhode Island Car Insurance (2025)

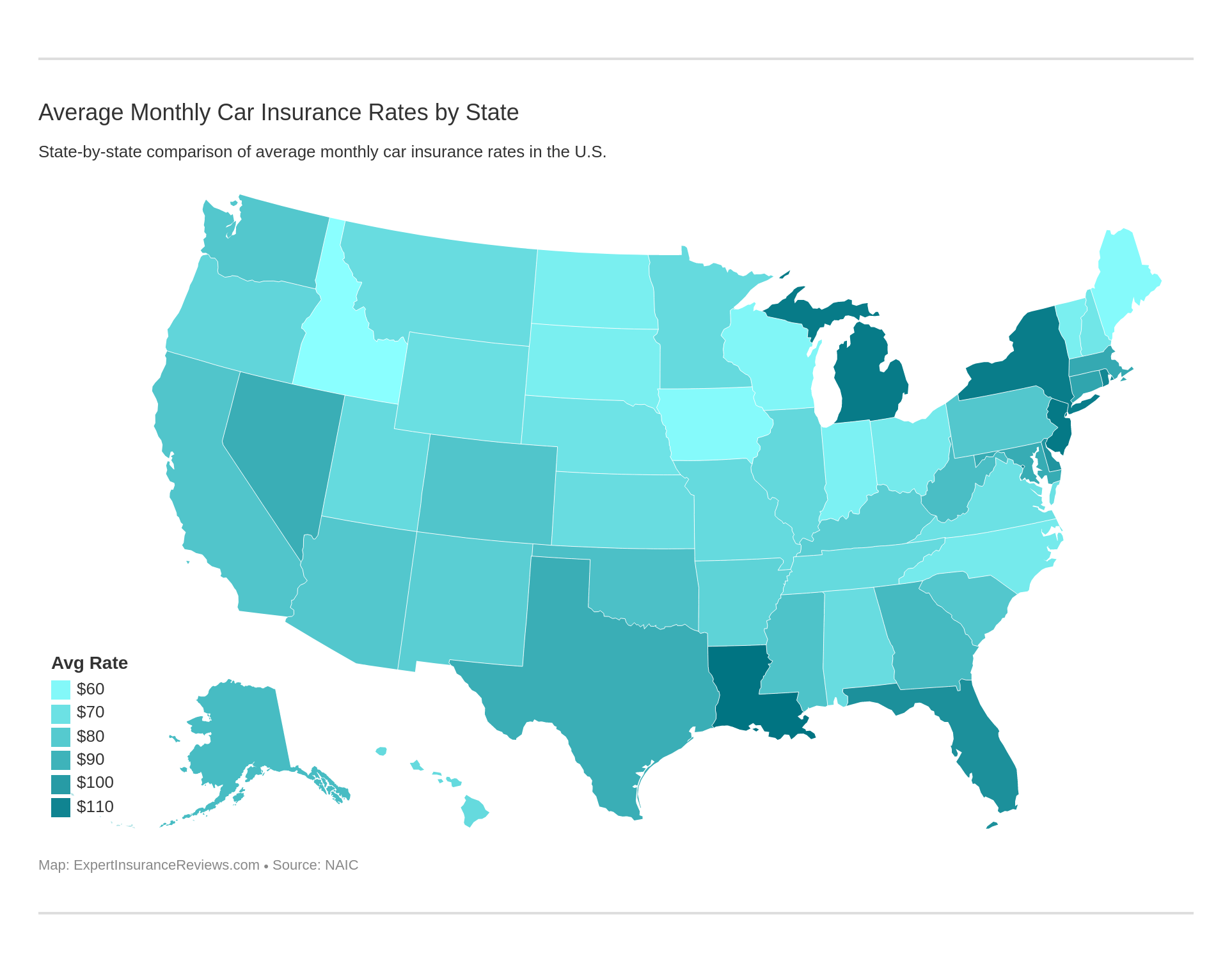

Rhode Island is the smallest state in the U.S., but it doesn't have the smallest car insurance rate. The average cost of car insurance in Rhode Island is $109 a month. We review state car insurance requirements, additional coverages, rates, and car insurance companies to help you find the best Rhode Island car insurance.

Read moreFree Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Diego Anderson

Licensed Real Estate Agent

Diego Anderson is a Real Estate Agent based in the Bay Area of California. Having received his Real Estate License at the age of 18, he wasted no time learning the ins and outs of the industry. With a focus on residential dual agency, he has a passion for supporting and educating families on their home buying and selling decisions. He is no stranger to new builds and new developments. He also r...

Licensed Real Estate Agent

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Rhode Island Stats Summary

| Summary | Stats |

|---|---|

| Miles of Roadway | 6,046 |

| Vehicles Registered | 843,346 |

| Rhode Island's Population | 1,057,315 |

| Most Popular Vehicle in Rhode Island | Toyota RAV4 |

| Uninsured/Underinsured % & State Rank | 15.20%, Rank 13 |

| Total Vehicle Fatalities | DUI Fatalities: 20 Speeding Fatalities: 27 |

| Average Monthly Premiums | Liability: $60 Collision: $31 Comprehensive: $10 |

| Cheapest Car Insurance Providers | State Farm, USAA |

Rhode Island is one of the states with the fewest miles of roadway in the U.S. Despite being ranked 13 in uninsured/underinsured motorists, this state has a great outlook on minimizing vehicle fatalities throughout the year.

But how much is car insurance in Rhode Island? Is it just as expensive as states with larger cities? We’ll explore that and more in this Rhode Island car insurance guide.

This guide includes Rhode Island’s cheapest car insurance premiums, some popular car insurance companies in Rhode Island, laws that help you become a safer driver, and a few reports to alert you on the risks of driving in Rhode Island.

Ready to compare rates? Just enter your ZIP code in our FREE tool on this page on your way to getting the best car insurance in Rhode Island.

Rhode Island Car Insurance Coverage and Rates

If you’re just moving to Rhode Island and shopping for car insurance, you’re probably curious about the cost of car insurance. Don’t worry, we have you covered. This section will explain the minimum coverage you’ll need to be insured, forms of responsibility, and how yearly premiums affect your income.

Rhode Island Car Culture

In 1904, Rhode Island was the first state to issue a speeding ticket. The driver in this legendary event was guilty of driving at 15 mph. Also, the first traffic law was written in 1678, but it only applied to horses.

There weren’t any cars at that time. In the late nineteenth century, Cranston would see the first car race on a track in 1896. In 1899, the first vehicle parade took place in Newport.

Rhode Island Minimum Coverage

Do you need car insurance in Rhode Island? Yes, like most states, it’s a requirement. The minimum required coverage in Rhode Island is liability coverage. Liability coverage is as follows:

- $25,000 per person and $50,000 per accident for bodily injury (BI)

- $25,000 per accident for property damage (PD)

- $25,000 per person and $50,000 per accident for uninsured/underinsured motorist bodily jury

Uninsured/underinsured motorist bodily injury is required if you purchase BI coverage in limits higher than the minimum. Ask your car insurance agent about this. It makes a difference if an accident exceeds the BI and PD minimum coverage amounts listed above.

Read more:

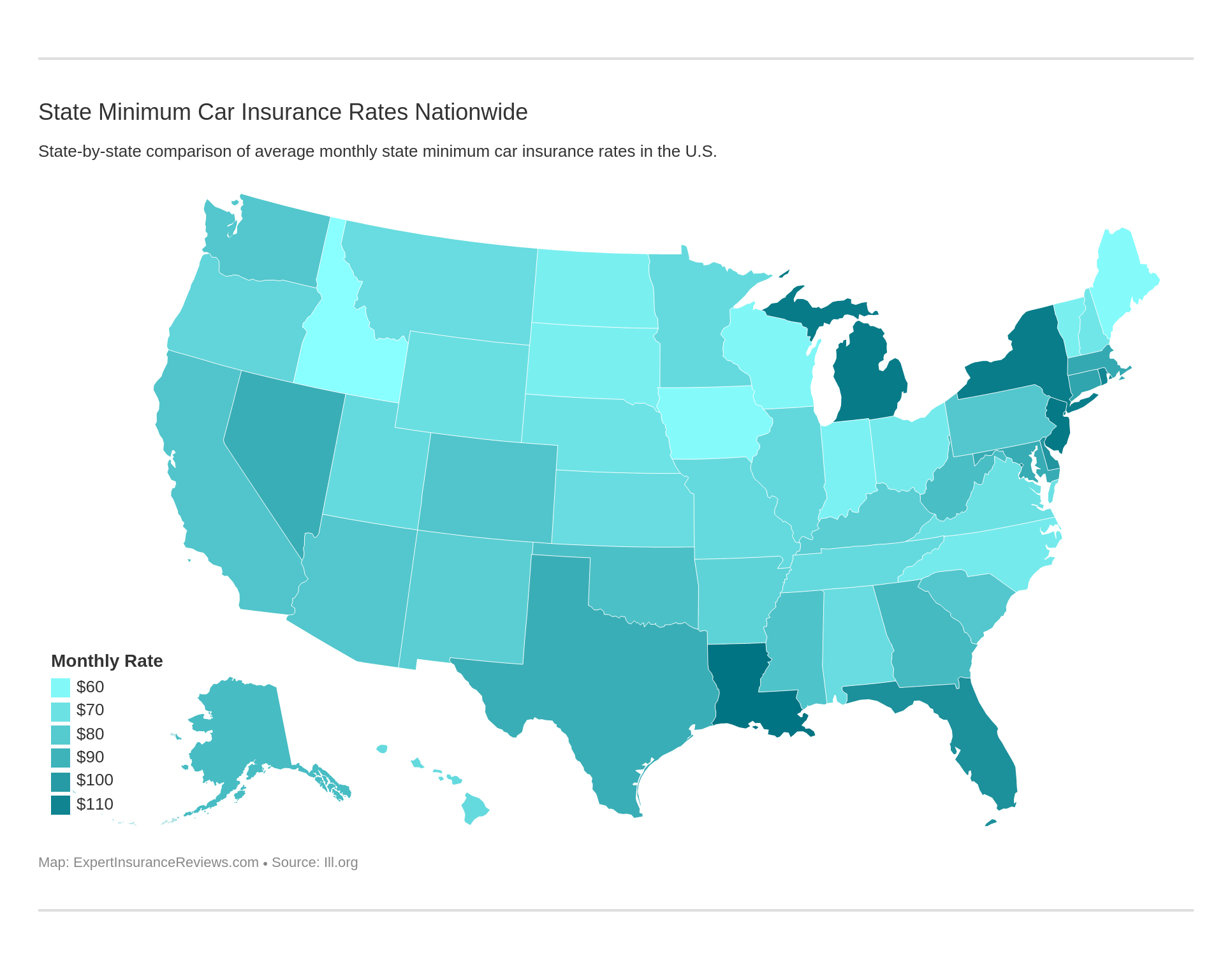

Though it’s cheap overall, some states charge more for minimum coverage.

Forms of Financial Responsibility

When you go to the DMV, they may ask you for a collection of information (such as a social security number, driver’s license, or birth certificate) to prove your identity. Along with that, you’ll need proof of insurance. Proof of insurance is known as a form of financial responsibility.

These documents are important in case you’re involved in a car accident or if you’re pulled over by law enforcement. Proof of insurance can be a billing statement, a car insurance card, and car registration. Some states allow electronic forms of financial responsibility.

As a rule of thumb, have a physical and electronic copy of forms of financial responsibility.

Premiums as a Percentage of Income

Car insurance premiums can be expensive. But how expensive are they? Some car insurance policyholders pay their car insurance premiums every month. The total amount of premiums at the end of the year is the annual premium. You’ll see annual premiums throughout this guide.

How do annual premiums affect your annual salary? We’ve collected some data describing the percentage of income affected by car insurance premiums.

Rhode Island Insurance as a Percentage of Income

| States | Full Coverage 2023 | Disposable Income 2023 | Insurance as % of Income 2023 | Full Coverage 2022 | Disposable Income 2022 | Insurance as % of Income 2022 | Full Coverage 2021 | Disposable Income 2021 | Insurance as % of Income 2021 |

|---|---|---|---|---|---|---|---|---|---|

| Rhode Island | $105 | $42,585 | 2.95% | $101 | $41,139 | 2.94% | $98 | $41,492 | 2.83% |

| Delaware | $101 | $40,256 | 3.02% | $99 | $38,879 | 3.05% | $96 | $38,893 | 2.97% |

| Maine | $57 | $37,049 | 1.86% | $56 | $35,588 | 1.90% | $56 | $35,993 | 1.85% |

| Countrywide | $82 | $40,859 | 2.40% | $79 | $39,192 | 2.43% | $77 | $39,473 | 2.34% |

According to the data table above, Rhode Island’s 2015 percentage of income projection is a percent higher than the national average. Also, it’s nearly $600 more than Maine’s full coverage in 2014.

Use the free tool below to calculate premiums as a percent of your personal income.

CalculatorPro

Average Monthly Car Insurance Rates in RI (Liability, Collision, Comprehensive)

Core coverage is what you’ll likely be presented with when you’re shopping for car insurance premiums.

Liability, collision, comprehensive, and full (combined) coverages are options you can choose from when negotiating your policy.

Since liability is the minimum requirement, you’ll have the option to add collision and comprehensive. Full coverage is a combination of liability, collision, and comprehensive. The data listed below shows the average car insurance in Rhode Island for these core coverages and across the U.S.

Rhode Island Core Coverage

| Core Coverage | Cost of Coverage |

|---|---|

| Liability | $60 |

| Collision | $31 |

| Comprehensive | $10 |

| Total | $101 |

The full coverage price is the combined price of the required coverage and two optional supplemental coverages. You’re welcome to add collision or comprehensive if you want to curve the price of your premium.

Additional Liability

Sometimes, the minimum liability coverage is not enough to cover damages and/or injuries. Additional car insurance liabilities are personal injury protection (PIP), medical payments (MedPay), and uninsured/underinsured motorist coverage (UUM).

MedPay is coverage that pays for medical and funeral expenses associated with car insurance. These expenses include EMT fees, ambulance fees, dental fees, and funeral fees. It’s available with car insurance policies and covers expenses for the policyholder, passengers, and family members driving the insured vehicle at the time of a car accident.

PIP is a “no-fault” car insurance coverage.

Under “no-fault” rules, PIP pays out claims regardless of who is at fault. PIP covers injury costs that come directly from the accident. The difference is PIP is more thorough and compensates you for lost wages. PIP car insurance is more expensive than MedPay.

Uninsured/underinsured motorist (UUM or UM or UIM) coverage protects motorists from damages in a car accident caused by an at-fault motorist who has no liability coverage or has less than the required liability coverage to cover the damages. UUM/UM/UIM covers hit-and-run accidents, also.

Now that you know what additional liabilities are, let’s look at how they perform in Rhode Island. One of the ways to determine the performance of additional liabilities is the loss ratio.

The loss ratio is the amount of money car insurance companies (or car insurance providers) earn and lose throughout the year. For example, if a car insurance company earns $100 and has a loss ratio of 60%, that means they spent $60 for every $100 they earned.

Loss ratios between 60 and 80% show a good standing because it’s a sign that companies or averages in that state payout claims and earns money in the process.

Loss ratios close to or exceeding 100 show that companies are not earning money or companies earning less than average money.

The data table in this section will show the loss ratios of additional liabilities in Rhode Island.

Rhode Island Additional Liability Loss Ratio

| Uninsured/Underinsured Motorist (UUM) | 62.21% | 69.97% | 68.69% |

|---|---|---|---|

| Personal Injury Protection (PIP) | - | - | - |

| Medical Payments (MedPay) | 102.79% | 92.78% | 99.95% |

You noticed that there’s no PIP data for Rhode Island. Rhode Island is not a “no-fault” state.

The loss ratio for MedPay was a little over 102% in 2015. This means that most car insurance companies in Rhode Island spent more money than they earned when they paid out MedPay claims to policyholders.

Read more:

- Understanding Full Coverage Car Insurance

- Best Personal Injury Protection (PIP) Car Insurance Company

- Best Medical Payments (MedPay) Coverage Car Insurance Company

Add-ons, Endorsements, and Riders

- Guaranteed Auto Protection (GAP) – This is car insurance that pays the difference between the actual cash value of a damaged or stolen vehicle.

- Personal Umbrella Policy (PUP) – This car insurance option provides a stack of high limits of liability to protect an insured motorist against a catastrophic liability loss such as bodily injury, property damage, personal injury, and even libel.

- Rental Reimbursement – A car insurance coverage with additional coverage in case a motorist has paid additional costs for a car rental.

- Emergency Roadside Assistance – Most car insurance companies provide this. This car insurance coverage sends out locksmiths and tow trucks if a motorist is stranded on a roadway. Most insurance companies don’t require a deductible.

- Mechanical Breakdown Insurance (MBI) – Often referred to as Equipment Breakdown Insurance, this car insurance endorsement is for loss due to mechanical or electrical breakdown of a motor vehicle.

- Non-Owners Car Insurance – Simply put, this is car insurance coverage for a motorist who has liability insurance but does not own a car.

- Modified Car Insurance Coverage – Modified car insurance covers the cost of high-performance parts and custom paint jobs. Alert your car insurance company that your car is custom-built.

- Classic Car Insurance – Classic cars can be treasures for car enthusiasts and collectors. The parts are just as rare and require costly repair if damaged. Classic Car Insurance covers those high costs.

- Pay-As-You-Drive or Usage-Based Insurance – Car insurance coverage that is determined by how much you drive your car.

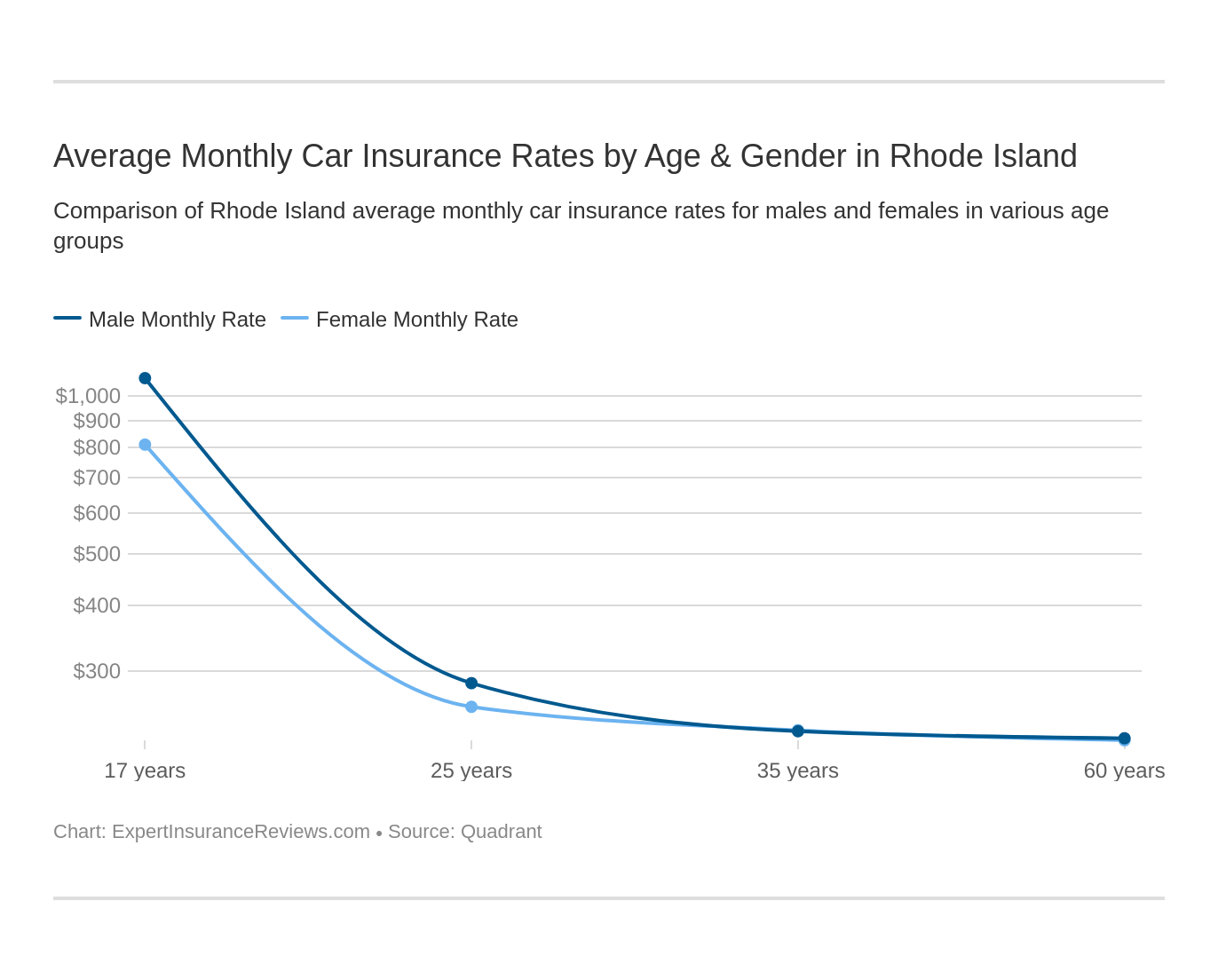

Average Car Insurance Rates by Age & Gender in RI

Your age, gender, and marital status will determine how much you pay for car insurance premiums. But how come? One word: Risk.

Statistics show males have a higher risk because they are likely to be involved in car accidents, speeding, and DUI convictions.

Also, men are likely to take more risks. Younger drivers take more risks as well. Older drivers pay cheaper rates.

Let’s look at the data for those rates below.

Rhode Island Age, Gender, & Marital Status Monthly Rates

| Company | Single 17-Year Old Female | Single 17-Year Old Male | Single 25-Year Old Female | Single 25-Year Old Male | Married 35-Year Old Female | Married 35-Year Old Male | Married 60-Year Old Female | Married 60-Year Old Male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $579 | $684 | $348 | $360 | $333 | $327 | $330 | $345 |

| Geico | $872 | $1,140 | $289 | $302 | $279 | $286 | $286 | $280 |

| Liberty Mutual | $801 | $1,250 | $331 | $450 | $331 | $331 | $315 | $315 |

| Nationwide | $625 | $805 | $284 | $309 | $239 | $243 | $210 | $223 |

| Progressive | $990 | $1,113 | $270 | $276 | $221 | $210 | $204 | $202 |

| State Farm | $350 | $467 | $140 | $167 | $127 | $127 | $112 | $112 |

| Travelers | $1,447 | $2,288 | $144 | 160.00 | $140 | $142 | $143 | $142 |

| USAA | $804 | $919 | $237 | $249 | $173 | $171 | $166 | $163 |

Single, 17-year-old males and females pay thousands of dollars more per year on car insurance. Senior drivers pay less money on annual premiums.

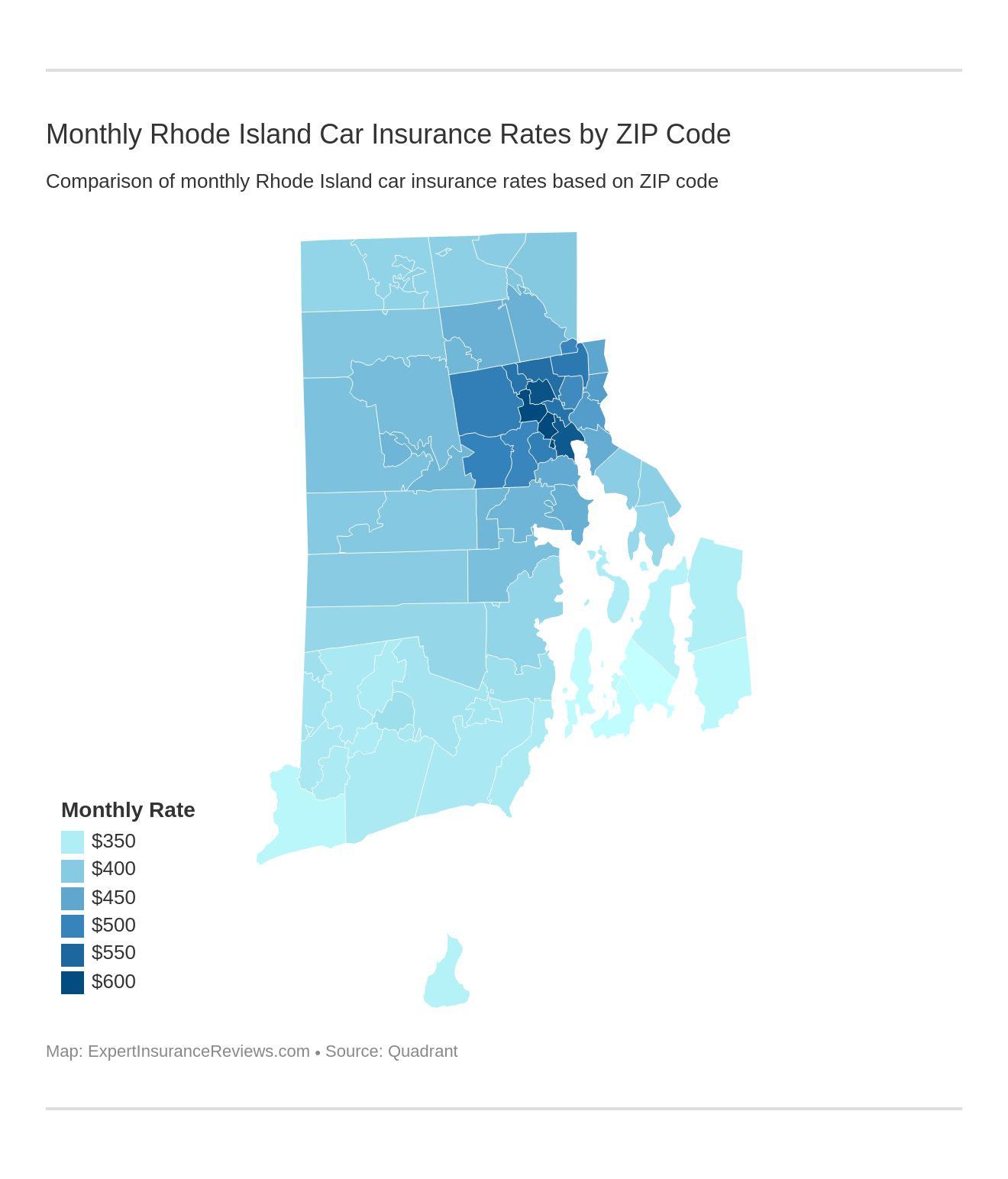

Cheapest Rates by Rhode Island ZIP Code

Where you live can determine the price of annual premiums. For this data, we’ll examine the premiums based on ZIP code.

This extensive table lists the premiums from the largest companies in Rhode Island. Click the up and down arrows to see the lowest and highest rates available in Rhode Island.

Rhode Island Most Expensive Monthly Rates by Zip Codes

| Zipcode | U.S Average | Allstate | Geico | Liberty Mutual | Nationwide | Progressive | State Farm | Travelers | USAA |

|---|---|---|---|---|---|---|---|---|---|

| 2907 | $605 | $548 | $770 | $748 | $532 | $589 | $241 | $964 | $448 |

| 2909 | $603 | $550 | $770 | $748 | $579 | $589 | $241 | $922 | $425 |

| 2908 | $588 | $561 | $770 | $748 | $532 | $589 | $241 | $840 | $425 |

| 2905 | $577 | $569 | $626 | $748 | $532 | $503 | $241 | $912 | $483 |

| 2904 | $539 | $480 | $669 | $748 | $478 | $568 | $241 | $701 | $425 |

| 2903 | $530 | $568 | $447 | $748 | $532 | $503 | $241 | $789 | $411 |

| 2911 | $528 | $481 | $626 | $630 | $478 | $568 | $228 | $764 | $453 |

| 2860 | $519 | $475 | $638 | $536 | $454 | $553 | $228 | $828 | $438 |

| 2912 | $515 | $481 | $447 | $748 | $478 | $553 | $241 | $764 | $411 |

| 2918 | $510 | $429 | $770 | $748 | $367 | $589 | $241 | $574 | $358 |

| 2910 | $509 | $467 | $626 | $630 | $469 | $503 | $228 | $717 | $432 |

| 2919 | $508 | $486 | $626 | $630 | $457 | $439 | $228 | $727 | $475 |

| 2921 | $503 | $495 | $626 | $589 | $469 | $503 | $228 | $700 | $418 |

| 2920 | $498 | $497 | $626 | $589 | $469 | $503 | $228 | $654 | $418 |

| 2863 | $498 | $476 | $638 | $536 | $446 | $553 | $228 | $684 | $422 |

| 2906 | $490 | $487 | $447 | $748 | $480 | $422 | $241 | $684 | $411 |

| 2914 | $465 | $442 | $503 | $536 | $402 | $590 | $228 | $629 | $390 |

| 2916 | $465 | $457 | $638 | $536 | $362 | $422 | $228 | $685 | $393 |

| 2861 | $452 | $448 | $508 | $536 | $446 | $422 | $228 | $612 | $416 |

| 2888 | $446 | $440 | $464 | $536 | $391 | $503 | $228 | $634 | $369 |

| 2915 | $444 | $427 | $503 | $536 | $362 | $422 | $228 | $682 | $390 |

| 2889 | $440 | $435 | $464 | $536 | $391 | $503 | $228 | $597 | $367 |

| 2917 | $438 | $429 | $476 | $479 | $367 | $590 | $228 | $574 | $358 |

| 2823 | $437 | $429 | $626 | $479 | $356 | $439 | $241 | $564 | $361 |

| 2865 | $436 | $441 | $496 | $504 | $360 | $439 | $228 | $627 | $391 |

Rhode Island Least Expensive Monthly Rates by Zip Code

| Zipcode | U.S Average | Allstate | Geico | Liberty Mutual | Nationwide | Progressive | State Farm | Travelers | USAA |

|---|---|---|---|---|---|---|---|---|---|

| 2842 | $326 | $326 | $324 | $437 | $289 | $333 | $170 | $428 | $298 |

| 2840 | $329 | $327 | $324 | $437 | $293 | $333 | $170 | $472 | $280 |

| 2835 | $331 | $326 | $324 | $436 | $289 | $333 | $170 | $487 | $280 |

| 2841 | $333 | $339 | $324 | $437 | $293 | $333 | $170 | $472 | $298 |

| 2837 | $336 | $335 | $324 | $436 | $311 | $373 | $170 | $456 | $280 |

| 2891 | $338 | $354 | $344 | $479 | $308 | $333 | $174 | $402 | $311 |

| 2871 | $343 | $345 | $340 | $436 | $336 | $333 | $170 | $491 | $291 |

| 2807 | $344 | $350 | $344 | $479 | $285 | $333 | $174 | $486 | $299 |

| 2878 | $348 | $339 | $340 | $437 | $321 | $373 | $170 | $500 | $307 |

| 2872 | $352 | $345 | $324 | $436 | $336 | $422 | $170 | $491 | $291 |

| 2894 | $353 | $357 | $378 | $479 | $318 | $333 | $174 | $451 | $337 |

| 2836 | $355 | $325 | $378 | $479 | $318 | $333 | $174 | $494 | $337 |

| 2898 | $355 | $367 | $378 | $479 | $318 | $333 | $174 | $457 | $337 |

| 2882 | $355 | $354 | $413 | $459 | $309 | $333 | $170 | $475 | $330 |

| 2808 | $355 | $373 | $378 | $479 | $302 | $333 | $174 | $486 | $318 |

| 2813 | $356 | $384 | $413 | $479 | $302 | $333 | $174 | $429 | $332 |

| 2879 | $357 | $362 | $413 | $459 | $309 | $333 | $170 | $477 | $330 |

| 2832 | $357 | $360 | $378 | $479 | $313 | $333 | $174 | $485 | $337 |

| 2804 | $358 | $362 | $378 | $479 | $313 | $333 | $174 | $485 | $337 |

| 2875 | $360 | $370 | $378 | $479 | $302 | $333 | $174 | $527 | $320 |

| 2881 | $362 | $347 | $413 | $459 | $309 | $439 | $170 | $436 | $320 |

| 2833 | $363 | $362 | $378 | $479 | $313 | $333 | $174 | $527 | $337 |

| 2892 | $364 | $367 | $413 | $459 | $309 | $333 | $174 | $533 | $320 |

| 2873 | $371 | $365 | $378 | $479 | $358 | $333 | $174 | $528 | $350 |

| 2812 | $372 | $356 | $378 | $479 | $302 | $439 | $174 | $507 | $337 |

Locate your ZIP code by using the search box in the top-right of the table. The lowest rates in the table are roughly $3500 and less than $10,000. These are averages based on estimates from each company. The averages may be different as you shop for car insurance companies, but the estimates here are close to what you’ll pay per year.

Cheapest Rates by Rhode Island Cities

We can narrow our search by city in Rhode Island. Car insurance companies charge different rates based on the ZIP code of their policyholders.

The same goes for each city. Some ZIP codes are in the same city. We’ve averaged the ZIP codes together and concentrated your search into the least expensive and most expensive cities in a data table. Sort these tables by clicking the up and down triangles to see what are the cheapest car insurance rates in Rhode Island by city.

Rhode Island Most Expensive Average Rates by City

| City | Monthly Rates |

|---|---|

| Providence | $551 |

| North Providence | $528 |

| Johnston | $508 |

| Cranston | $503 |

| Central Falls | $498 |

| Pawtucket | $485 |

| East Providence | $465 |

| Rumford | $465 |

| Riverside | $444 |

| Warwick | $439 |

| Smithfield | $438 |

| Fiskeville | $437 |

| Lincoln | $436 |

| Clayville | $431 |

| West Warwick | $430 |

| Hope | $430 |

| Greenville | $428 |

| Harmony | $428 |

| North Scituate | $420 |

| East Greenwich | $417 |

| Peace Dale | $415 |

| Foster | $414 |

| Albion | $411 |

| Chepachet | $407 |

| Manville | $407 |

Rhode Island Least Expensive Average Rate by City

| City | Monthly Rates |

|---|---|

| Middletown | $326 |

| Jamestown | $331 |

| Newport | $331 |

| Little Compton | $336 |

| Westerly | $338 |

| Portsmouth | $343 |

| Block Island | $344 |

| Tiverton | $348 |

| Prudence Island | $352 |

| Wood River Junction | $353 |

| Kenyon | $355 |

| Wyoming | $355 |

| Narragansett | $355 |

| Bradford | $355 |

| Charlestown | $356 |

| Wakefield | $357 |

| Hope Valley | $357 |

| Ashaway | $358 |

| Shannock | $360 |

| Kingston | $362 |

| Hopkinton | $363 |

| West Kingston | $364 |

| Rockville | $371 |

| Carolina | $372 |

| Saunderstown | $372 |

The cheapest rate in Rhode Island is in Middleton, which has an annual premium of $3908. The most expensive city is Providence, Rhode Island with an annual premium of $6,610.

Best Rhode Island Car Insurance Companies

To find the best rate, you’ll have to find the car insurance provider that’s right for you. We’re here to help you with that.

First, we’ll roll through some ratings from third-party agencies that rate each car insurance company based on financial standing, consumer feedback, and rates based on different factors such as driving record, coverage level, and commute miles per year.

Largest Companies Financial Rating

Third-party agencies can inform you about the company’s financial standing in the car insurance market. A.M. Best, an agency that grades financial ratings of car insurance companies, released data grading the largest car insurance companies in the U.S.

A.M. defines financial ratings as an opinion of a car insurance company’s financial strength and willingness to meet its insurance policy and contract obligations.

Many of these companies are based in Rhode Island. Let’s examine their financial ratings below.

Top Agencies' Monthly Financial Rankings

| Insurance Company | A.M. Best | Premiums Written | Market Share | Loss Ratio |

|---|---|---|---|---|

| A+ | $83,243.00 | 0.95% | 4.64% | |

| A+ | $96,155.00 | 1.10% | 5.41% |

| A | $16,014.00 | 0.18% | 6.18% | |

| A++ | $58,908.00 | 0.67% | 6.19% | |

| A | $35,342.00 | 0.40% | 5.09% |

| A+ | $65,509.00 | 0.75% | 5.00% |

| A+ | $72,965.00 | 0.83% | 4.88% | |

| B | $148,326.00 | 1.70% | 5.31% | |

| A++ | $27,997.00 | 0.32% | 5.20% | |

| A++ | $24,957.00 | 0.29% | 6.00% |

Most of the companies listed are rated as “A” through “A++.” That means most of the companies rated in the table have an excellent and superior rating according to A.M. Best.

Companies with the Best Rating

J.D. Power is an agency that rates companies. Let’s review car insurance companies’ overall satisfaction among their consumers.

| Company | Points (based on a 1,000-point scale) | Circle Ratings |

|---|---|---|

| Allstate | 834 | 4 |

| Amica Mutual | 879 | 5 |

| Arbella | 800 | 2 |

| GEICO | 827 | 3 |

| Liberty Mutual | 809 | 3 |

| MAPFRE Insurance | 811 | 3 |

| MetLife | 803 | 2 |

| Nationwide | 817 | 3 |

| Plymouth Rock Assurance | 804 | 2 |

| Progressive | 826 | 3 |

| Safeco | 796 | 2 |

| Safety Insurance | 813 | 3 |

| State Farm | 838 | 4 |

| The Hanover | 795 | 2 |

| Travelers | 804 | 2 |

| USAA* | 893 | 5 |

| New England Region | 821 | 3 |

Read more:

- Arbella Insurance Review & Complaints: Auto, Home & Business Insurance

- Plymouth Rock Assurance Insurance Review & Complaints: Auto & Home Insurance

Rhode Island is part of a region in the U.S. called the New England Region. The companies listed in the J.D. Power data table are in the New England region. Amica Mutual and USAA appear to be the companies with the most satisfaction among policyholders. See our USAA insurance review for more.

USAA is only available to military members and their immediate families. It’s not available to all voluntary car insurance shoppers.

For the most part, the New England region has maintained a moderate rating among consumers, as shown in the circle ratings in the data table.

Companies with the Most Complaints in Rhode Island

Customer satisfaction isn’t the only factor measured for car insurance companies. Complaints are a big part of any great car insurance company. Complaints identify errors that car insurance companies can fix, improve policies, and enhance customer relations.

Here’s some data that points out the number of complaints about major car insurance companies in Rhode Island.

| Company | Complaint index | Rank |

|---|---|---|

| Allstate | 0.69 | 3 |

| Amica Mutual | 0.67 | 2 |

| GEICO | 0.92 | 5 |

| Metropolitan | 1.23 | 7 |

| Nationwide | 0.43 | 1 |

| Progressive | 0.91 | 4 |

| USAA | 1.15 | 6 |

The highest complaint index in the data is Metropolitan and USAA. Nationwide has the lowest number of complaints in Rhode Island. In other states, Nationwide is subject to as many complaints as Metropolitan and USAA. Learn more with our Nationwide insurance review.

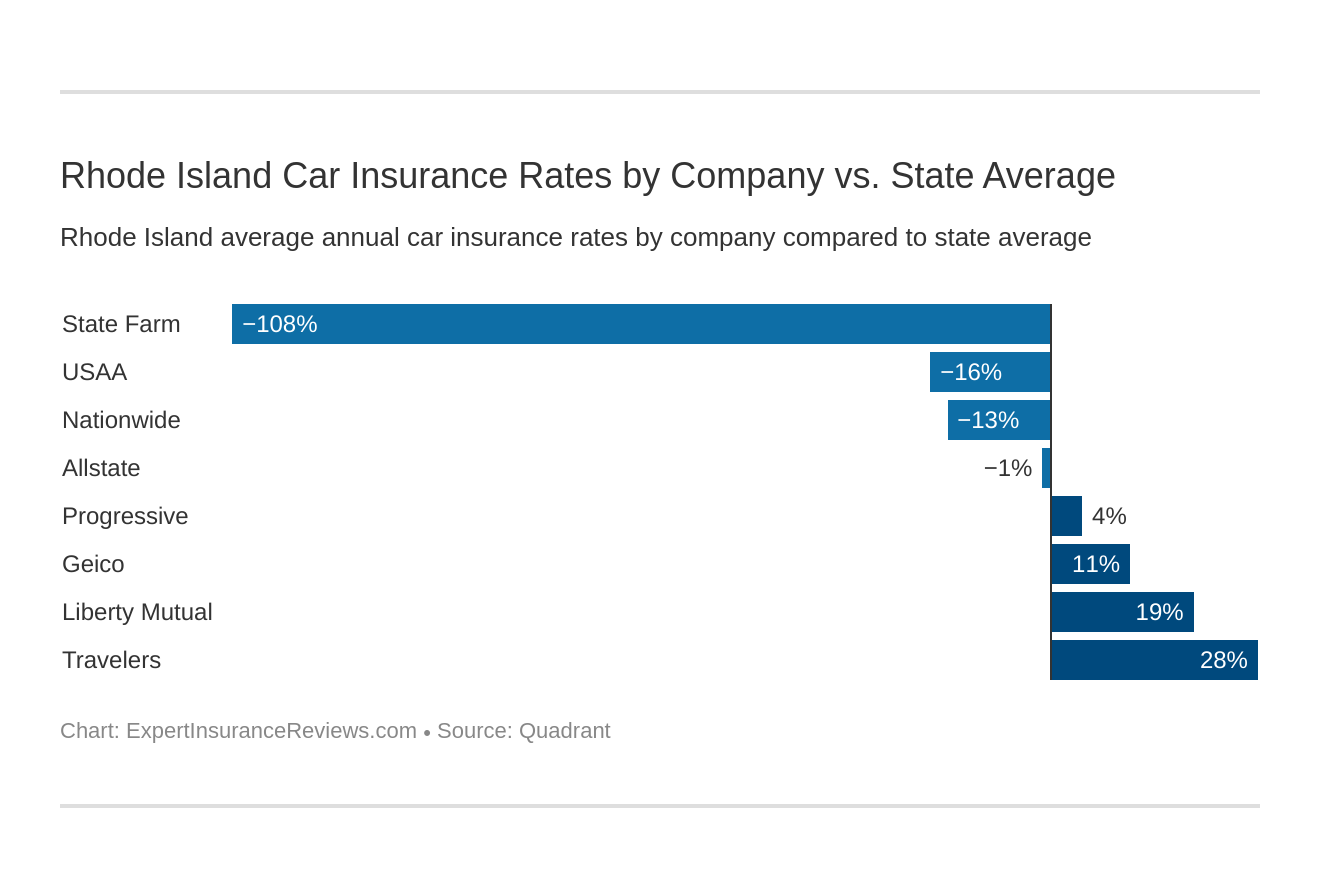

Cheapest Companies in Rhode Island

As you close in on affordable car insurance rates, you’ll want to find which companies have them. The data we have here shows the largest companies in Rhode Island.

In addition to the average rate of each company as it relates to the averages in the state.

Rhode Island Company Average Rates

| Company | Monthly Rates | Compared to State Average | Compared to State Average % |

|---|---|---|---|

| Allstate | $413 | -$4 | -0.89% |

| Geico | $467 | $50 | 10.70% |

| Liberty Mutual | $515 | $98 | 19.09% |

| Nationwide | $367 | -$49 | -13.46% |

| Progressive | $436 | $19 | 4.35% |

| State Farm | $201 | -$216 | -107.91% |

| Travelers | $576 | $159 | 27.59% |

| USAA | $360 | -$57 | -15.71% |

The annual premium for State Farm insurance is $2,598 less than the state average. Travelers insurance, however, has an annual rate that’s nearly 30% more than Rhode Island’s average annual rate.

Commute Rates by Companies

Car insurance premiums can be issued based on how much you drive your car per year. This instance becomes important because the car insurance provider we’ll need to assess the risk based on how much you use your vehicle. We separated the annual commute mileage as 6,000 and 12,000 annual mileage.

| Company | 10 miles commute. 6,000 annual mileage. | 25 miles commute. 12,000 annual mileage. |

|---|---|---|

| Allstate | $4,924 | $4,994 |

| GEICO | $5,488 | $5,716 |

| Liberty Mutual | $5,983 | $6,384 |

| Nationwide | $4,409 | $4,409 |

| Progressive | $5,231 | $5,231 |

| State Farm | $2,333 | $2,479 |

| Travelers | $6,909 | $6,909 |

| USAA | $4,282 | $4,365 |

Despite the annual commute mileage, some car insurance companies charged policyholders the same amount, while the majority increased the annual rates based on annual commute mileage.

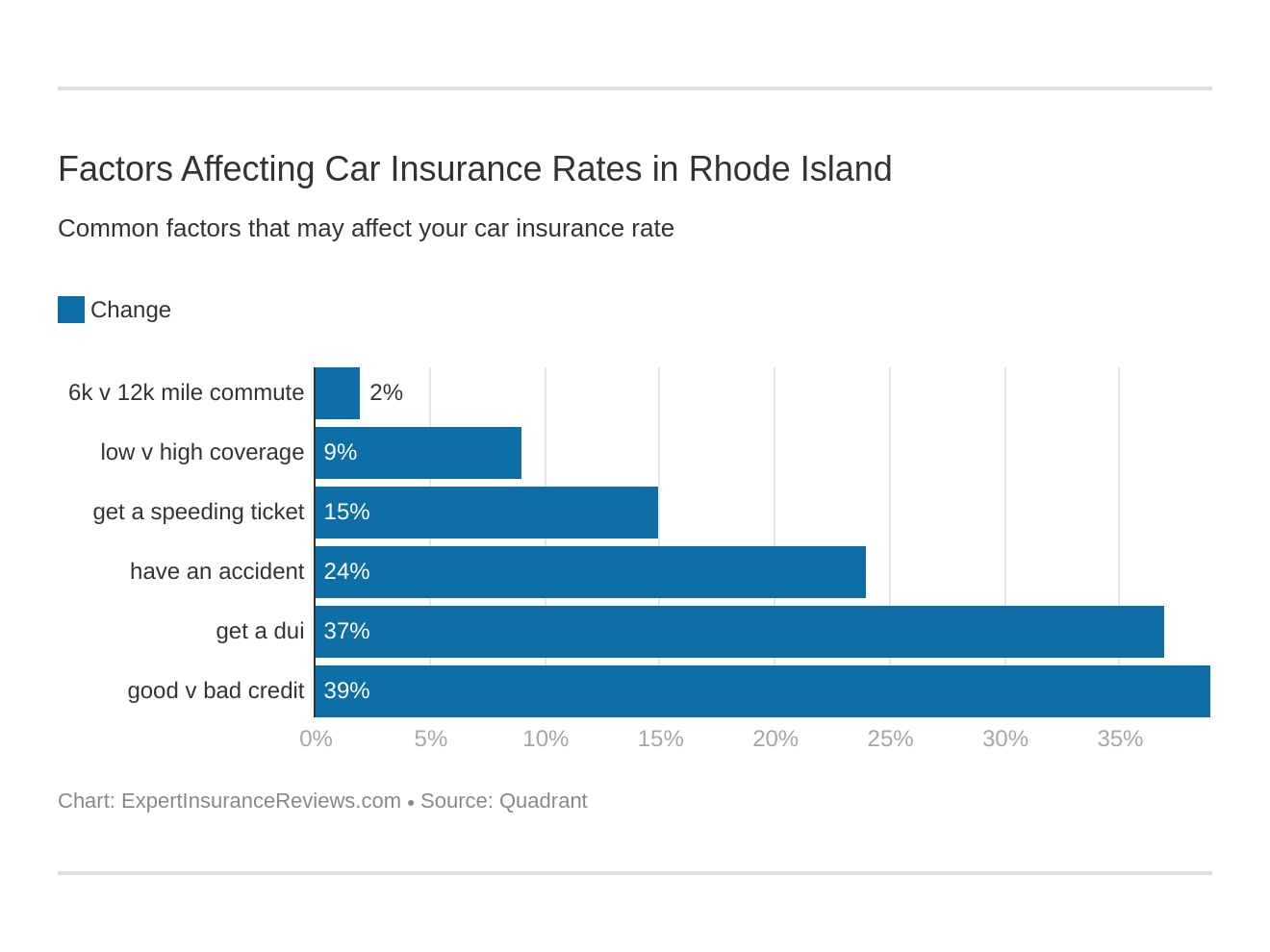

Commute distance is not the only factor to affect your rates.

Coverage Level Rates by Companies

Maximizing your coverage can be expensive. Coverage level rates vary for each company and each state. Rhode Island is one of the states with higher-than-average premiums, so you may want to estimate the coverage level you need as you think of a policy that’s best for you.

Low coverage rates are likely the minimum requirements. Medium coverage is minimum coverage, such as liability with a few added perks like collision or comprehensive coverage. Finally, high coverage is the full coverage rate that goes beyond the minimum requirements. Let’s look at those rates in the data table below.

Rhode Island Monthly Rates by Coverage Level

| Company | Low Coverage | Medium Coverage | High Coverage |

|---|---|---|---|

| Allstate | $391 | $412 | $436 |

| Geico | $444 | $466 | $491 |

| Liberty Mutual | $484 | $512 | $550 |

| Nationwide | $354 | $370 | $379 |

| Progressive | $409 | $433 | $465 |

| State Farm | $190 | $200 | $212 |

| Travelers | $556 | $585 | $586 |

| USAA | $344 | $361 | $377 |

Once you sort the table from cheapest to most expensive, you’ll see State Farm has the cheapest rates in Rhode Island. USAA is the second cheapest company, as shown in the data. Don’t hesitate to ask car insurance companies for a discount. Get more info in our State Farm insurance review.

Credit History Rates by Companies

One of the most important factors in determining car insurance rates is your credit history. Car insurance companies may look at your credit report. The better your credit, the lower the annual premium will be.

Rhode Island Monthly Rates by Credit History

| Company | Poor Credit | Fair Credit | Good Credit |

|---|---|---|---|

| Allstate | $519 | $398 | $323 |

| Geico | $523 | $454 | $424 |

| Liberty Mutual | $678 | $450 | $418 |

| Nationwide | $426 | $351 | $325 |

| Progressive | $488 | $425 | $395 |

| State Farm | $269 | $182 | $150 |

| Travelers | $604 | $563 | $561 |

| USAA | $535 | $304 | $243 |

Policyholders with poor credit are likely to pay $2,000 more for car insurance. Several companies bring down coverage rates if your credit is fair or good.

Driving Record Rates by Companies

All motorists should strive to have a clean driving record. It’s costly to tack on traffic and criminal offenses to your driving record. Car insurance companies are likely to crank up your annual rates for a bad driving record. Let’s review how driving records affect your annual rates.

Rhode Island Monthly Rates by Driving Record

| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Allstate | $354 | $421 | $479 | $547 |

| Geico | $302 | $397 | $789 | $479 |

| Liberty Mutual | $477 | $552 | $555 | $666 |

| Nationwide | $340 | $373 | $405 | $405 |

| Progressive | $356 | $564 | $400 | $555 |

| State Farm | $186 | $244 | $186 | $186 |

| Travelers | $516 | $534 | $666 | $789 |

| USAA | $262 | $355 | $547 | $400 |

There appears to be some leniency for one DUI offense and one speeding violation at State Farm because there isn’t an increase in annual rates after the offense.

The rest of the companies in Rhode Island increase annual rates if you have received a speeding violation, DUI conviction, or a car accident. Lately, car insurance companies have been issuing clauses in their policies known as accident forgiveness. Ask the car insurance company if that perk is available.

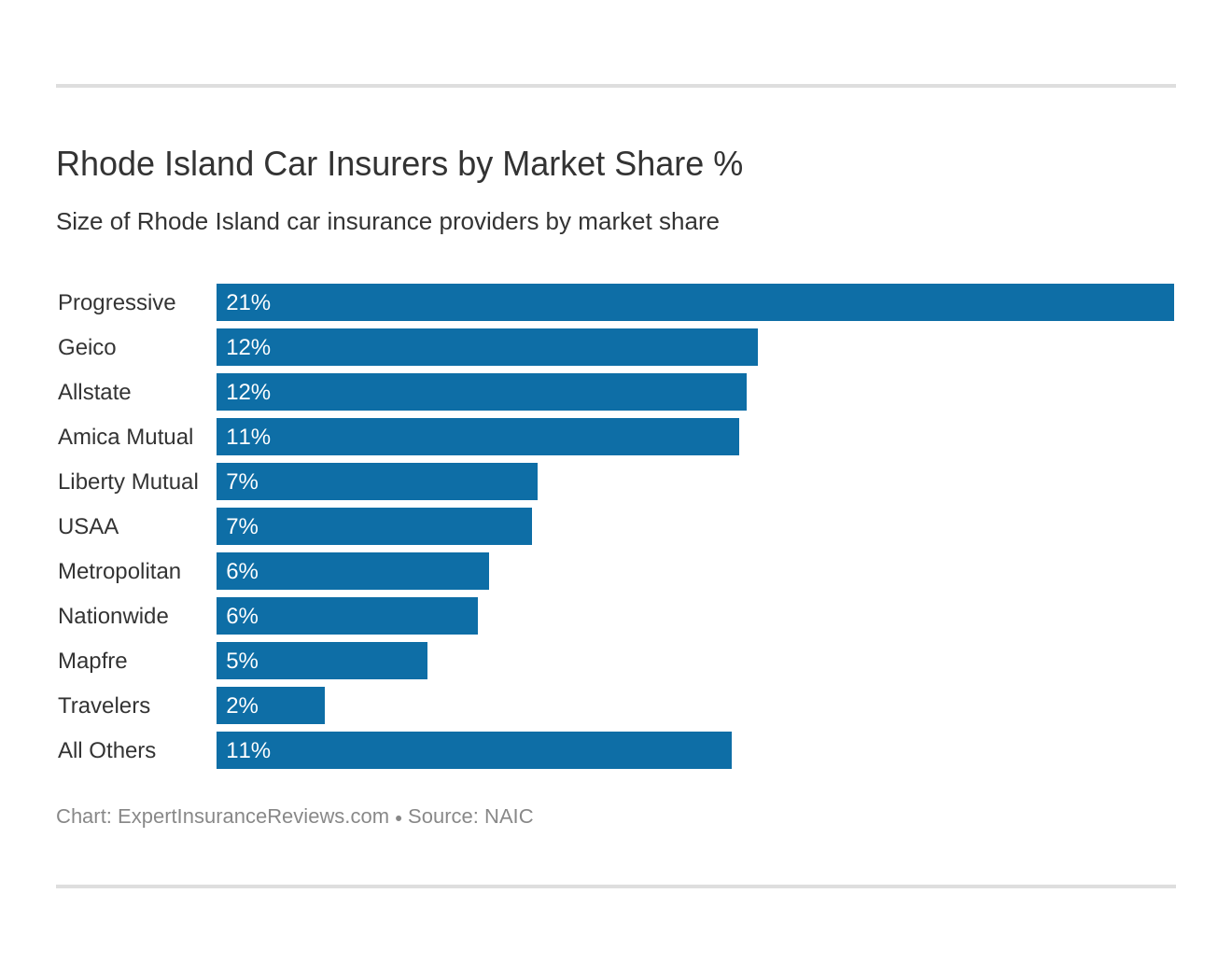

Largest Car Insurance Companies in Rhode Island

Most of the largest companies were mentioned in the A.M. Best and J.D. Power data tables, but let’s narrow it down to Rhode Island. We’ll look at direct premiums, loss ratio, and market share.

We talked about the loss ratio, but we didn’t mention market share or direct premiums.

Direct premiums are the total premiums received before the reinsurance process. Also, direct premiums represent the growth company’s insurance business and their affiliated companies during a given period.

Market share is a car insurance company’s percentage of an industry’s total sales.

Check out these factors in the table below.

| Rank | Company | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|---|

| 3 | Allstate | $107,256 | 62.08% | 11.63% |

| 4 | Amica | $105,708 | 63.36% | 11.47% |

| 2 | GEICO | $109,611 | 79.71% | 11.89% |

| 5 | Liberty Mutual | $65,124 | 65.17% | 7.06% |

| 9 | Mapfre | $42,523 | 63.64% | 4.61% |

| 7 | Metropolitan | $55,075 | 57.15% | 5.97% |

| 8 | Nationwide | $52,881 | 63.34% | 5.74% |

| 1 | Progressive | $193,720 | 65.71% | 21.01% |

| 10 | Travelers | $21,853 | 54.69% | 2.37% |

| 6 | USAA* | $63,851 | 78.38% | 6.93% |

Progressive insurance had the highest increase with over 20% in market share and $193,720 in direct premiums.

Number of Insurers in Rhode Island

Insurers are another name for car insurance companies. There are two types of insurers: domestic and foreign. Domestic insurers follow the state law of your home state. Foreign insurers follow the state law of another state. In Rhode Island, there are 22 domestic insurers and 727 foreign insurers bringing the total number of insurers to 749.

Your one-stop online insurance guide. Get free quotes now! Secured with SHA-256 Encryption

Rhode Island State Laws

Laws are very important in keeping motorists safe on the road and ensuring car insurance companies are following state insurance laws. This section will go in detail on some of the car insurance laws, vehicle licensing laws, and rules on the road.

Rhode Island Car Insurance Laws

It’s important to know some car insurance laws. Knowing car insurance laws can prepare you for deductibles you may not have been aware of before receiving a policy. (For more information, read our “Rhode Island Car Insurance Laws“).

Perhaps, you’re a high-risk driver searching for insurance, or maybe you’re searching for an even lower car insurance rate. We’ve compiled some helpful information to prepare you for the next step.

How Rhode Island Laws for Insurance are Determined

Rhode Island is considered a Flex Rating state, which means car insurance companies can adjust the rate of premiums without going over a certain limit. The NAIC lists that limit as “+/- 5 percent”. Exceeding the 5% can cause an audit by agencies that have the authority to reprimand car insurance companies for going over the limit.

Windshield Coverage

You may have to pay a deductible to your car insurance company if you live in Rhode Island. Car insurance companies in Rhode Island are not required by law to waive deductibles for windshields. However, they offer zero deductibles under comprehensive coverage.

If your windshield needs to be replaced, car insurance companies may use aftermarket parts that are equal in quality and type if the car is 30 months old or less. The policyholder is notified and must give written consent that they accept the replacement windshield.

High-Risk Insurance

DUI convictions, speeding violations, and car accidents are factors that will get you denied when searching for car insurance coverage. When you search for car insurance, the law considers this as searching for car insurance voluntarily. Some drivers are too high of a risk to insure and have an SR22 status on their driving record.

After all voluntary car insurance options have been exhausted, the car insurance law of Rhode Island suggests motorists enroll in the Rhode Island Automobile Insurance Plan (RI AIP).

To be eligible for RI AIP, you must meet the following conditions upon receiving a RI AIP application:

You must provide confirmation that you have applied to several car insurance companies in the last 60 days but have been denied coverage.

When your application is submitted and approved, it enters the assigned risk pool. RI AIP then assigns you to a car insurance company. The car insurance companies in the risk pool are the same as those on the voluntary market.

Your assigned car insurance company issues a policy. The coverage received through the program will be the same as other drivers in Rhode Island, but the difference is that your coverage rates will be more expensive.

After three years, RI AIP recipients can search for car insurance through a voluntary car insurance market. If the voluntary car insurance market still considers you a high-risk driver, resubmit an application to RI AIP.

Low-Cost Insurance

State-sponsored car insurance is a resourceful tool for low-income U.S. citizens who can’t afford voluntary car insurance. Unfortunately, state-issued car insurance is only available in California, Hawaii, and New Jersey. If you can’t afford car insurance, talk to different car insurance companies about discounts.

Since Rhode Island car insurance is higher than the national average, don’t be shy in asking providers what discounts they offer. You could lower your car insurance rate by up to 30%.

Kristen Gryglik Licensed Insurance Agent

Car Insurance Fraud in Rhode Island

Car insurance frauds come in two types: hard frauds or soft frauds.

Hard frauds are crimes like fabricating claims or faking a car accident. Some scammers attempt to reduce premium rates by committing soft frauds such as underestimating mileage or giving car insurance companies the wrong ZIP code to lower annual rate.

Committing any type of fraud is a crime in Rhode Island.

Statute of Limitations in Rhode Island

The statute of limitations is the duration in which you can file a claim or pursue legal action against an at-fault driver or company. The statute of limitations begins when the event happens, not when it’s reported.

In Rhode Island, the statute of limitations for personal injury (PI) is three years. For property damage, however, the statute of limitations is 10 years.

Rhode Island’s Specific Laws

Rhod Island shares the same laws as many other states, but there is one law that makes this state unique to others. An interesting law of Rhode Island is that it’s illegal to drive with a beer in your car even if it’s sealed.

Rhode Island Vehicle Licensing Laws

Licensing laws are straight forward. Any motorist who wants to drive on a roadway anywhere in the U.S. must have a driver’s license. How to get a driver’s license varies for each state, but the process comes with driving practice, taking knowledge and vision tests, and proof of car insurance.

This sub-section will explore all the things you’ll need to do and what you’ll need to know to obtain a Rhode Island driver’s license.

REAL ID

State governments have been urging residents in their respective states to get a REAL ID. REAL ID has been around since 2005. It was a measure to counter those who use fake IDs. By October 2020, Rhode Islanders will require a REAL ID to get on domestic flights or enter federal facilities.

If you have a passport already or don’t have any reason to enter a federal facility, you may not need to need a REAL ID.

Here’s a short video of a report about REAL IDs in Rhode Island.

Penalties for Driving without Insurance

Law enforcement and state courts are strict on motorists who try to evade being insured.

Driving without car insurance carries stiff fines and possible misdemeanor charges.

Here’s how much you can expect to pay in fines if you drive without car insurance:

- First Offense: A fine of $100 to $500. Your license and registration will be suspended for up to three months. It will cost $30 to $50 to get them reinstated.

- Second Offense: A fine of $500. Your license and registration will be suspended for up to six months. The cost of reinstatement is $30 to $50.

Don’t take a chance. Your car could be impounded in addition to fines and/or criminal charges.

Teen Driver Laws

Teen driving laws are very elaborate procedures. Listed below are the requirements for teens who want to get a driver’s license in Rhode Island.

| STAGES | AGE | REQUIREMENTS | RESTRICTION |

|---|---|---|---|

| Driver’s Education | Minimum 15 years, 10 months | Complete a 33-hour driver’s education course certified and approved by the Rhode Island Community College | Only drive a dual-control vehicle with an instructor |

| Limited Instruction Permit | Minimum 16 years | Pass a vision exam pass a test on traffic laws | |

| Parents or guardians also required to attend a short course on driver education | Teen only authorized to drive with an adult in the front seat who is 21 years or older and who has held a driver’s license for at least 5 years | ||

| Limited Provisional License | Minimum 16 years, 6 months | Teen must have held the Limited Instruction Permit for a minimum of six months | |

| Have to submit an affidavit signed by a parent or legal guardian indicating a minimum 50 hours of supervised driving with a minimum of ten hours of night driving | |||

| Pass a driving test | May drive unsupervised except between 1:00 AM-5:00 AM | ||

| In the first 12 months, the teen driver can't have more than one passenger who is younger than 21 years | |||

| Full License | Minimum 17 years | A Teen can apply for a full license if the teen has held the Limited Provisional License for a minimum 12 months and has no traffic or seat belt violation | N/A |

Parents and legal guardians must be present when teens under 18 are getting learner permits and conditional licenses. This process can be just as stressful as getting car insurance and getting your license from the DMV.

Older Driver License Renewal Procedures

Senior drivers who are over the age of 75 have to renew their driver’s licenses every two years. This differs from other states which require seniors to renew every four years at 65 years of age and older. Every time a senior driver goes to renew their license, they must take a vision test or have a copy of an adequate vision test.

New Residents of Rhode Island

If you are seeking residency in Rhode Island, you will require a Rhode Island driver’s license. To qualify for a driver’s license in Rhode Island, you’ll need to:

- Give your old state driver’s license to Rhode Island DMV officials. It cannot be expired for longer than one year.

- Show proof of residency in Rhode Island.

- Have your Social Security Number.

- Pay a new license fee, which is $39.50

If your license has expired for more than a year when you surrender it to DMV officials in Rhode Island, they may administer a computerized road test and a vision test.

License Renewal Procedures

Rhode Island’s DMV has made it convenient for licensed drivers to renew their licenses online. You’ll need your credit or debit card to pay for the license renewal fee. If you can’t renew it online, you can always visit any DMV branch or AAA office in Rhode Island.

Rhode Island drivers have to renew their licenses every five years. The fee to renew your Rhode Island license is $62.50.

Negligent Operator Treatment System (NOTS)

Driving erratically in a purposeful manner will likely result in a criminal charge. It’s often referred to as reckless driving or driving recklessly, which means a driver ignores the safety and endangers the public by unsafely operating a motor vehicle.

Negligent driving is one of the main causes of road fatalities in the U.S.

State courts and law enforcement crackdown on violators harshly. The first reckless driving conviction is a misdemeanor. A motorist convicted of reckless driving could serve up to one year in jail and/or a $500 fine.

Another conviction of reckless driving will be considered a felony and carries a sentence of up to five years in jail and/or a fine of $5,000.

Rules of the Road in Rhode Island

Roadway laws are designed to motorists safe as they commute home, to work, or anywhere they wish to go. Violators of roadway laws are punished, sometimes severely if the violation is bad enough. This is another sub-section you may want to bookmark if you’re thinking of taking up residency in Rhode Island.

Fault vs. No-Fault

We mentioned earlier in the guide that Rhode Island is not a “no-fault” state. It’s an “at-fault” state. You’re required to purchase liability coverage. This mandatory coverage would provide cover for a third party’s bodily injuries and property damage expenses if you were at fault in a car accident.

Seat Belt and Car Seat Laws

The seat belt of Rhode Island has been in effect since June 18, 1991. It is under primary enforcement law, which means law enforcement can pull you over if you or other passengers don’t have their seat belts secured.

All persons 18 and older must be fastened into a seat belt when a motor vehicle is on the roadway. The maximum penalty for not wearing a seat is a fine of $40.

For child safety seat laws, the law is as follows:

- Children younger than two or weighing less than 30 pounds must be in a rear-facing child restraint safety seat.

- Children 7 years old and younger, less than 57 inches, and weigh less than 80 pounds must be in a child safety seat.

Children who are 7 years old and younger who weigh 80 pounds or more and are at least 57 inches tall can use an adult seat belt. Any child 8-17 can use an adult seat belt as well.

Keep Right and Move Over Laws

The keep right laws are universal: Keep right so traffic driving at a higher rate of speed can pass by. This is particularly a courtesy on the highway and much safer for motorists who don’t have to keep going around you to move through traffic.

Rhode Island state law does require motorists who are approaching stationary emergency vehicles (including roadside assistance) that display flashing lights, to vacate to the closest and safest lane.

Speed Limits

Rhode Island is a small state with minimal rural and urban space, so the speed limits in the state are going to be lower than average. For Rhode Island rural interstates, the speed limit will reach about 65 mph. Urban interstates and other limited roads have a speed limit of 55 mph. Rhode Island is second in lower-than-average speed limits for its roadways.

Ridesharing

Ridesharing has taken the U.S. by storm. Anywhere there’s a smartphone or internet access, a rideshare app is sure to be somewhere close by.

Ridesharing is popular among the younger generations, and car insurance companies are bustling with more and more rideshare providers every day. Geico and Liberty Mutual are two companies in Rhode Island that offer car insurance to rideshare drivers. It may not be a bad idea to ask for a discount.

Automation on the Road

Innovation is another wave that’s hit motor vehicles these last few years. Many states across the U.S. have been testing automated driving on their roadways. Automation on the road involves the use of cameras, sensors, self-driving, and radars.

There’s no law on automation on Rhode Island’s roadways, and there hasn’t been any approved automation testing either. Give it a little more time, and Rhode Island will be joining other states in innovative testing of automated systems on roadways.

Safety Laws

Violating safety laws because you were distracted or impaired comes with hefty fines and jail time. Car insurance companies will increase your annual premiums if you violate safety laws. Some may even drop your policy altogether. We’ll examine some of the safety laws and their penalties.

DUI Laws

DUIs can dampen your driving record. It’s one of the causes that will drive up rates and revoke a driver’s license. If you are convicted of DUI, here are some of the consequences you could face.

| Offense | ALS or Revocation | Imprisonment | Fine | Other |

|---|---|---|---|---|

| 1st Offense | 60 days - 18 months | no minimum, but up to 1 year or 10-60 hours community service | $100-$500 +$500 to hwy assessment fund | possible attendance to treatment program; SR-22 insurance |

| 2nd Offense | 1-2 years | 10 days - 1 year | $400 | mandatory alcohol treatment program, IID for 1-2 years |

| 3rd Offense | 2-3 years | 1-5 years | $400-$5000 +$500 to hwy assessment fund | vehicle may be seized or forfeited, mandatory treatment program, IID for 2 years |

Between jail time and paying fines, it’s no day at the fair when violating safety laws. Drinking and driving are never worth any cost.

Marijuana-Impaired Driving Laws

Only five states have a zero-tolerance law for marijuana-impaired drivers. Rhode Island is one of those states. Drivers who are impaired by the use of marijuana (THC) or other metabolites will be arrested, fined, and possibly convicted for DWI (driving while impaired).

Distracted Driving Laws

No motorist is allowed to text and drive on the roadways of Rhode Island. All drivers, including adult drivers and bus drivers, are banned from using handheld devices while driving a motor vehicle, also. Teens under the age of 18 are banned from using cellphones or any other device while driving. Bus drivers can only use devices only during emergencies.

Driving in Rhode Island

There are only five counties in Rhode Island. Commuting motorists can travel through the entire state within hours, but the risks of driving are still the same as many other states. That’s what we’ll review in this section is more crime data, fatal crash reports from NHTSA, EMS response time, and commute data in Rhode Island.

Vehicle Theft in Rhode Island

Although Rhode Island is a small state, the residents still fall prey to vehicle thieves. We’ve collected vehicle theft data of the top vehicles stolen in Rhode Island. The thefts are ranked by the number of thefts. Check out the data below for more details.

| Rank | Make/Model | Vehicle Year | # of Thefts |

|---|---|---|---|

| 1 | Honda Accord | 1997 | 101 |

| 2 | Honda Civic | 1998 | 95 |

| 3 | Toyota Camry | 2014 | 69 |

| 4 | Nissan Maxima | 2000 | 45 |

| 5 | Toyota Corolla | 2014 | 40 |

| 6 | Nissan Altima | 2013 | 38 |

| 7 | Ford Pickup (Full Size) | 2003 | 36 |

| 8 | Jeep Cherokee/Grand Cherokee | 1999 | 32 |

| 9 | Honda CR-V | 1999 | 27 |

| 10 | Toyota Avalon | 2000 | 18 |

The top vehicle stolen in Rhode Island is a ’97 Honda Accord with 101 thefts. Honda-RV and the Toyota Avalon had the lowest number of thefts on the list.

Vehicle Theft by City

What about the cities? When we broaden the spectrum, we’re able to see the thefts of all cities in Rhode Island. Examine the data below and sort through it using the up and down triangles to see the lowest and highest values.

| City | Vehicle Thefts |

|---|---|

| Barrington | 0 |

| Bristol | 6 |

| Burrillville | 2 |

| Central Falls | 62 |

| Charlestown | 4 |

| Coventry | 20 |

| Cranston | 91 |

| Cumberland | 21 |

| East Greenwich | 2 |

| East Providence | 46 |

| Foster | 1 |

| Glocester | 7 |

| Hopkinton | 7 |

| Jamestown | 1 |

| Johnston | 36 |

| Lincoln | 25 |

| Little Compton | 0 |

| Middletown | 14 |

| Narragansett | 4 |

| Newport | 27 |

| New Shoreham | 1 |

| North Kingstown | 8 |

| North Providence | 33 |

| North Smithfield | 11 |

| Pawtucket | 191 |

| Portsmouth | 6 |

| Providence | 580 |

| Richmond | 0 |

| Scituate | 3 |

| Smithfield | 5 |

| South Kingstown | 5 |

| Tiverton | 17 |

| Warren | 7 |

| Warwick | 61 |

| Westerly | 13 |

| West Greenwich | 2 |

| West Warwick | 28 |

| Woonsocket | 78 |

There were 580 vehicle thefts in Providence, Rhode Island, which is the highest number of thefts in the state. Barrington, Little Compton, and Richmond tied for the lowest thefts with zero thefts recorded.

Road Fatalities in Rhode Island

Fatalities are the worst-case scenario in car accidents. Unfortunately, they happen unexpectedly. Crash and traffic fatalities are some of the reasons why law enforcement, state courts, and car insurance companies are strict on motorists who violate the law. This sub-section displays the number of fatalities caused by crashes and traffic.

Most Fatal Highway in Rhode Island

The deadliest highway in Rhode Island is Interstate 95, which had 39 fatal car accidents in the last decade. Interstate 95 is a mainline highway that travels through the east coast.

Fatal Crashes by Weather Conditions and Light Conditions

Sometimes weather and light conditions can affect a motorist’s driving. Snow, ice, and rain are some of the conditions that can cause an accident. Here’s some data that shows weather and light conditions.

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 29 | 24 | 13 | 2 | 1 | 69 |

| Rain | 2 | 1 | 1 | 1 | 0 | 5 |

| Snow/Sleet | 0 | 1 | 0 | 0 | 0 | 1 |

| Other | 1 | 0 | 0 | 0 | 0 | 1 |

| Unknown | 0 | 0 | 0 | 0 | 0 | 0 |

| TOTAL | 32 | 26 | 14 | 3 | 1 | 76 |

According to the data, there were more fatal crashes in normal weather and light conditions. The most fatal crashes occurred during daylight and nighttime (lighted).

Fatalities (All Crashes) by County

Let’s look at all five counties and how they were affected by fatal crashes. Here are their numbers.

| County | Fatalities (2014) | Fatalities (2015) | Fatalities (2016) | Fatalities (2017) | Fatalities (2018) | Fatalities per 100k Population (2014) | Fatalities per 100k Population (2015) | Fatalities per 100k Population (2016) | Fatalities per 100k Population (2017) | Fatalities per 100k Population (2018) |

|---|---|---|---|---|---|---|---|---|---|---|

| Bristol County | 2 | 1 | 1 | 1 | 2 | 4.08 | 2.04 | 2.05 | 2.05 | 4.11 |

| Kent County | 9 | 7 | 9 | 17 | 12 | 5.47 | 4.27 | 5.5 | 10.39 | 7.32 |

| Newport County | 5 | 1 | 2 | 3 | 4 | 6 | 1.2 | 2.4 | 3.61 | 4.85 |

| Providence County | 29 | 26 | 28 | 49 | 34 | 4.58 | 4.1 | 4.41 | 7.72 | 5.35 |

| Washington County | 6 | 10 | 11 | 14 | 6 | 4.75 | 7.92 | 8.72 | 11.08 | 4.76 |

Providence, Rhode Island is the largest city in the state. With the majority of the state’s population in Providence, you’re likely to see more crashes in Providence County.

Traffic Fatalities

Traffic fatalities can be identified as traffic collisions. Let’s review the numbers from 2009 to 2018.

| Traffic Fatalities | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|---|---|

| Total (C-1) | 83 | 67 | 66 | 64 | 65 | 51 | 45 | 51 | 84 | 59 |

| Rural | 19 | 15 | 7 | 10 | 5 | 6 | 7 | 10 | 19 | 15 |

| Urban | 64 | 52 | 59 | 54 | 60 | 45 | 38 | 41 | 65 | 43 |

| Unknown | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 |

The highest fatalities occurred in 2017 with 65 fatalities in urban areas of Rhode Island.

Fatalities by Person Type

Person type reflects the type of vehicle that crashed in a fatal car accident. The data table elaborates using the numbers below.

| Person Type | # in 2014 | % in 2014 | # in 2015 | % in 2015 | # in 2016 | % in 2016 | # in 2017 | % in 2017 | # in 2018 | % in 2018 |

|---|---|---|---|---|---|---|---|---|---|---|

| Passenger Car | 17 | 33 | 18 | 40 | 19 | 37 | 35 | 42 | 18 | 31 |

| Light Truck - Pickup | 3 | 6 | 3 | 7 | 4 | 8 | 4 | 5 | 4 | 7 |

| Light Truck - Utility | 3 | 6 | 5 | 11 | 6 | 12 | 6 | 7 | 8 | 14 |

| Light Truck - Van | 1 | 2 | 1 | 2 | 0 | 0 | 4 | 5 | 0 | 0 |

| Large Truck | 1 | 2 | 1 | 2 | 1 | 2 | 1 | 1 | 0 | 0 |

| Other/Unknown Occupants | 1 | 2 | 0 | 0 | 0 | 0 | 0 | 0 | 2 | 3 |

| Light Truck - Other | 0 | 0 | 0 | 0 | 1 | 2 | 0 | 0 | 0 | 0 |

| Pedestrian | 14 | 27 | 8 | 18 | 14 | 27 | 21 | 25 | 7 | 12 |

| Other/Unknown Nonoccupants | 1 | 2 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 2 |

| Bicyclist and Other Cyclist | 0 | 0 | 0 | 0 | 2 | 4 | 2 | 2 | 1 | 2 |

| Total | 51 | 100 | 45 | 100 | 51 | 100 | 84 | 100 | 59 | 10 |

| Total Motorcyclists | 10 | 20 | 9 | 20 | 4 | 8 | 11 | 13 | 18 | 31 |

| Total Nonoccupants | 15 | 29 | 8 | 18 | 16 | 31 | 23 | 27 | 9 | 15 |

| Total Occupants | 26 | 51 | 28 | 62 | 31 | 61 | 50 | 60 | 32 | 54 |

The most fatalities were in 2015 which involved passenger cars. Pedestrian numbers are second in fatalities by person type.

Fatalities by Crash Type

Fatalities can be separated by crash type. Crash types tell us how the vehicle was involved in the crash rather than what the person was driving. We’ve collected more crash data from NHTSA. The fatality numbers are listed below.

| Crash Type | # of Fatalities (2014) | # of Fatalities (2015) | # of Fatalities (2016) | # of Fatalities (2017) | # of Fatalities (2018) |

|---|---|---|---|---|---|

| Single Vehicle | 39 | 27 | 36 | 58 | 37 |

| Involving a Large Truck | 2 | 1 | 2 | 8 | 2 |

| Involving Speeding | 13 | 20 | 23 | 41 | 27 |

| Involving a Rollover | 7 | 12 | 11 | 11 | 10 |

| Involving a Roadway Departure | 24 | 23 | 23 | 48 | 33 |

| Involving an Intersection | 10 | 7 | 8 | 13 | 12 |

| Total Fatalities (All Crashes)* | 51 | 45 | 51 | 84 | 59 |

Based on the crash type data, 2017 was the deadliest year for crash fatalities. The most fatalities occurred with single-vehicle drivers.

Five-Year Trend for the Top Five Rhode Island Counties

Expert Insurance Reviews usually covers the top ten counties in this sub-section, but Rhode Island has five counties. Therefore, we will present you with crash fatality data concerning the five counties of Rhode Island.

| Rank | County | Fatalities (2014) | Fatalities (2015) | Fatalities (2016) | Fatalities (2017) | Fatalities (2018) | % of Total (2014) | % or Total (2015) | % of Total (2016) | % of Total (2017) | % of Total (2018) |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Providence County | 29 | 26 | 28 | 49 | 34 | 57 | 58 | 55 | 58 | 59 |

| 2 | Kent County | 9 | 7 | 9 | 17 | 12 | 18 | 16 | 18 | 20 | 21 |

| 3 | Washington County | 6 | 10 | 11 | 14 | 6 | 12 | 22 | 22 | 17 | 10 |

| 4 | Newport County | 5 | 1 | 2 | 3 | 4 | 10 | 2 | 4 | 4 | 7 |

| 5 | Bristol County | 2 | 1 | 1 | 1 | 2 | 4 | 2 | 2 | 1 | 3 |

| Sub Total 1.* | Top Ten Counties | 51 | 45 | 51 | 84 | 58 | 100 | 100 | 100 | 100 | 100 |

| Total | All Counties | 51 | 45 | 51 | 84 | 58 | 100 | 100 | 100 | 100 | 100 |

Bristol County had the lowest fatality rate in a 5-year trend.

Fatalities Involving Speeding by County

Speeding is another factor that can cause a fatal accident. We’ve narrowed NHTSA crash results and concentrated on speeding fatalities. The data table for these results is listed below.

| County | Fatalities (2014) | Fatalities (2015) | Fatalities (2016) | Fatalities (2017) | Fatalities (2018) | Fatalities per 100k Population (2014) | Fatalities per 100k Population (2015) | Fatalities per 100k Population (2016) | Fatalities per 100k Population (2017) | Fatalities per 100k Population (2018) |

|---|---|---|---|---|---|---|---|---|---|---|

| Bristol County | 1 | 0 | 0 | 1 | 1 | 2.04 | 0 | 0 | 2.05 | 2.06 |

| Kent County | 2 | 4 | 5 | 6 | 5 | 1.22 | 2.44 | 3.06 | 3.67 | 3.05 |

| Newport County | 0 | 1 | 1 | 2 | 0 | 0 | 1.2 | 1.2 | 2.41 | 0 |

| Providence County | 7 | 10 | 12 | 21 | 16 | 1.11 | 1.58 | 1.89 | 3.31 | 2.52 |

| Washington County | 3 | 5 | 5 | 11 | 5 | 2.37 | 3.96 | 3.96 | 8.7 | 3.96 |

Newport County had the lowest speeding fatalities and lowest fatalities per 100,000 population.

Fatalities in Crashes Involving an Alcohol-Impaired Driver by County

Alcohol-impaired fatalities are preventable. It’s up to individuals to drink responsibly. When motorists aren’t sober, they risk causing an accident.

Sometimes, these accidents have fatal results. Although Rhode Island as a minimal count of fatalities involving alcohol-impaired drivers, it still has occurred. Listed below are more data that shows the fatality rate of alcohol-impaired drivers by county.

| County | Fatalities (2014) | Fatalities (2015) | Fatalities (2016) | Fatalities (2017) | Fatalities (2018) | Fatalities per 100k Population (2014) | Fatalities per 100k Population (2015) | Fatalities per 100k Population (2016) | Fatalities per 100k Population (2017) | Fatalities per 100k Population (2018) |

|---|---|---|---|---|---|---|---|---|---|---|

| Bristol County | 0 | 0 | 0 | 1 | 1 | 0 | 0 | 0 | 2.05 | 2.06 |

| Kent County | 4 | 2 | 4 | 7 | 5 | 2.43 | 1.22 | 2.44 | 4.28 | 3.05 |

| Newport County | 1 | 0 | 0 | 0 | 1 | 1.2 | 0 | 0 | 0 | 1.21 |

| Providence County | 7 | 11 | 11 | 16 | 11 | 1.11 | 1.74 | 1.73 | 2.52 | 1.73 |

| Washington County | 4 | 5 | 4 | 10 | 3 | 3.17 | 3.96 | 3.17 | 7.91 | 2.38 |

Bristol and Newport County had the lowest fatality rates involving alcohol-impaired drivers. Providence County had the most fatalities involving alcohol-impaired drivers.

Teen Drinking and Driving

There’s a zero-tolerance for underage drinking and driving. Rhode Island ranks as the 37th in DUI arrests of teens. Let’s look at some 2017 data that goes more in-depth with teen DUI arrest data and compare it to national numbers.

| 2017 Arrest Data | Rhode Island | National |

|---|---|---|

| Under 18: Driving under the influence | 5 | 5,135 |

| Total: Driving under the influence | 1,788 | 1,017,808 |

| Under 18: Liquor laws | 68 | 29,073 |

| Total: Liquor laws | 394 | 234,899 |

| Under 18: Drunkenness | 0 | 3,805 |

| Total: Drunkenness | 0 | 376,433 |

The total number of DUI teen arrests in Rhode Island is five. Rhode Island has performed well in minimizing teen DUIs.

EMS Response Time

Emergency responders often battle traffic as they respond to emergencies, especially deadly crashes. But what’s the average time it takes for emergency responders to arrive? To get a glimpse of those arrival times, examine the data below.

| Location | Time of Crash to EMS Notification (in minutes) | EMS Notification to EMS Arrival (in minutes) | EMS Arrival at Scene to Hospital Arrival (in minutes) | Time of Crash to Hospital Arrival (in minutes) |

|---|---|---|---|---|

| Urban | 7 | 6 | 26 | 36 |

| Rural | 3 | 8 | 39 | 48 |

Urban and Rural times have great differences. The time of the crash to EMS notification time in urban areas is four minutes more than in rural areas. EMS notification to EMS arrival takes six minutes for urban areas and eight minutes for rural areas. It’s a bit polarizing. Rural area EMS officials respond slower to car accidents based on the data.

Transportation

Rhode Island is as hectic as any other state. Commutes in comparison to the U.S. average commute may be shorter when you consider the coverage miles of Rhode Island. Let’s look at the details below to get a definitive answer.

Car Ownership

Families living in the same household are likely to own more than one car. Most of Rhode Island’s residents own two cars, which is 42%. Twenty-two percent of Rhode Islanders own one car. About 3% of people own five or more cars.

Commute Time

Even though Rhode Island has five counties, the average commute time in Rhode Island is 24 minutes. The national average for commute times is 26 minutes.

But most Rhode Island worker has super commutes, which means they are likely to drive more than 90 minutes to get to work. That’s an indicator that some Rhode Island residents work out of the state.

Commuter Transportation

Because of super commutes and the average commute time in Rhode Island, most residents drive alone to work. Data USA reported that an estimated 79.4% of Rhode Islanders drive alone to work. Approximately 5% of residents worked from home.

Traffic Congestion in Rhode Island

TomTom, a website that follows the traffic forecast of popular cities across the world, provided an extensive report on traffic conditions in Rhode Island in the past year (2018).

The congestion level in Providence, Rhode Island increased by 1%, bringing the congestion level to 19% in 2018. For highways, traffic congestion was 14%, and non-highways were at 22%.

During the morning peak hours, such as 8 a.m. morning traffic, traffic congestion peaks at 30%. By 5 p.m., traffic congestion levels rise by 13%, totaling congestion levels to 43%.

When you’re in peak traffic, it will take additional time to get to work. TomTom estimates that morning peak times add nine minutes to the average commute time while evening peak times add 13 minutes to the average commute time.

In a state where car insurance premiums are higher than the national average, you may feel trapped by high prices. Your chances for affordable coverage are better when your credit is fair or good, and when your driving record is clean. Ask car insurance companies about discounts when adding different perks to your policy.

If you’re a new resident of Rhode Island, be sure to get your driver’s license as soon as possible. Proactive approaches to attaining a license will help you in the long run, and it leaves room to fix any errors you may run into.

Ultimately, this guide to the best car insurance in Rhode Island is designed to help you find the cheapest car insurance rates and the best companies that provide substantial policies. These facts, tips, and general information serve as a road map, we’re just pointing to various directions you can go.

Ready to compare rates? Just enter your ZIP code in our FREE tool below. Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Frequently Asked Questions

What are the minimum car insurance requirements in Rhode Island?

In Rhode Island, drivers are required to carry liability insurance with the following minimum coverage limits: $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $25,000 for property damage per accident.

What other types of car insurance should I consider in Rhode Island?

In addition to liability insurance, Rhode Island drivers may want to consider adding collision coverage, which can help pay for repairs to your own vehicle after an accident, and comprehensive coverage, which can help pay for non-collision related damages such as theft or vandalism.

What factors should I consider when choosing a car insurance provider in Rhode Island?

When choosing a car insurance provider in Rhode Island, consider factors such as the company’s reputation, customer service, pricing, coverage options, and any discounts that may be available.

What are some of the best car insurance companies in Rhode Island?

Some of the top car insurance companies in Rhode Island include Amica, USAA, and Allstate. Other companies to consider include State Farm, Liberty Mutual, and Geico insurance.

How can I save money on car insurance in Rhode Island?

To save money on car insurance in Rhode Island, consider bundling your auto policy with other types of insurance, such as homeowners or renters insurance.

You may also be able to save by choosing a higher deductible, taking advantage of discounts for safe driving or multiple policies, or shopping around and comparing rates from multiple insurers.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Diego Anderson

Licensed Real Estate Agent

Diego Anderson is a Real Estate Agent based in the Bay Area of California. Having received his Real Estate License at the age of 18, he wasted no time learning the ins and outs of the industry. With a focus on residential dual agency, he has a passion for supporting and educating families on their home buying and selling decisions. He is no stranger to new builds and new developments. He also r...

Licensed Real Estate Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.