Nationwide Insurance Review & Complaints: Auto, Home, Health & Pet Insurance (2025)

Nationwide Mutual Insurance is part of a group of companies operating under the Nationwide name. They offer almost every type of insurance and financial service on the market. They are one of the few companies that write their own pet insurance policies.

Read moreFree Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Licensed Insurance Agent

UPDATED: Jun 20, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Jun 20, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

hide

| Nationwide Overview | Details |

|---|---|

| Year Founded | 1925 |

| Current Executives | Steve Rasmussen, CEO |

| Number of Employees | 32,110 |

| Total Assets (2017) | $230.6 billion |

| HQ Address | One Nationwide Plaza Columbus, Ohio |

| Phone Number | 1-877 On Your Side (1-877-669-6877) |

| Company Website | www.nationwide.com |

| Premiums Written (Auto, 2017) | $7,341,476 |

| Loss Ratio | 66.16% |

| Best For | Bundling coverage |

Car insurance is a pretty big part of their operations, with the company ranking at number eight for market share in 2017.

In addition to auto and home insurance, Nationwide also offers life insurance for those consumers interested in providing financial security to their loved ones.

Like other insurance giants, Nationwide had humble beginnings and grew over 85 years to become a household name. In addition to auto insurance, they write specialty vehicle, home insurance, life, and a lot of other types of coverage.

They’re one of the few major companies that actually write their own pet insurance policies. They also offer a range of financial services.

Nationwide’s promise is that they are “on your side”, which is what you want from your insurance company. Unfortunately, what we hope for is not always the true customer experience.

How can you know that Nationwide will give you the coverage you need and really be there for you when you have to use that coverage?

Choosing an insurance company can feel like a big gamble, and it’s easier when you know the horse you’re betting on.

We have gathered all the information you need about Nationwide to get a good idea of where they stand as a company.

Here you will get the lowdown on Nationwide’s track record including ratings from top agencies and customer complaints. We’ll also cover what they offer on their policies and how much they charge compared to other companies.

Are Nationwide’s ratings positive?

Below you’ll find ratings for Nationwide from a variety of respected and trusted sources. These cover the company’s financial stability, customer ratings, and other consumer surveys. Check out the ratings and then read on for details on what each of them means to you as a potential customer.

Nationwide Insurance Ratings

| Ratings Agency | Ratings |

|---|---|

| A.M. Best | A+ |

| Better Business Bureau | A+ |

| Moody's | A1 |

| S&P | A+ |

| NAIC Complaint Index | 0.44 |

| JD Power | Claims Satisfaction 3/5 Shopping Study 2/5 |

| Consumer Reports | 88 |

| Consumer Affairs | 2/5 85 reviews |

AM Best, the best-known of financial rating companies, gives Nationwide financial strength rating A+, or Superior rating for financial outlook.

What that means to you is that Nationwide is on solid financial footing and can be expected to stay that way. They should have no difficulty fulfilling their financial obligations – paying your claims, that is.

The Better Business Bureau (BBB) gives companies a score based on a number of factors. These include the number of complaints filed against the company as well as their response to and settling of complaints. Nationwide has the top score, an A+.

Both Moody’s and Standard and Poor’s (S&P) give Nationwide high ratings for financial stability and creditworthiness; again, this tells you as a potential customer that this company isn’t likely to go out of business and leave you without coverage.

The National Association of Insurance Commissioners (NAIC) complaint index is derived from comparing the number of complaints against a company to their share of the auto insurance market in the U.S.

The national average is 1.16, and Nationwide falls well below that at 0.44. That means they have fewer complaints than other companies based on the amount of car insurance they sell.

J.D. Power is one of the best-known names in consumer satisfaction surveys, and they do two national-level surveys each year as well as a regional survey of overall satisfaction.

In the national survey for 2018, Nationwide was rated two out of five (below average) on the insurance shopping study, and three out of five (average) on the claims satisfaction study.

Read more:

- How do I file a car insurance claim with Nationwide?

- What information do I need to file a car insurance claim with Nationwide?

Nationwide’s performance varies across the regional surveys, but they didn’t earn the top spot in any one area.

Consumer Reports, another well-known consumer survey source, gave Nationwide 88 on its 100-point scale. That puts them on par with competitors like Liberty Mutual and Allstate, both of which also earned 88 points.

Finally, Consumer Affairs – a customer review and rating site – has 85 starred reviews of Nationwide in the past year, with 58 of those being one-star reviews. While that sounds bad, it’s actually a small number of complaints for the size of the company.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

What is Nationwide’s history?

In 1925, the Ohio Farm Bureau created Nationwide as the Farm Bureau Mutual Automobile Insurance Company. It sold its first policy in 1926. The company expanded beyond Ohio quickly, serving six states by 1928. They expanded to a total of 12 states, along with the District of Columbia, by 1943.

By 1955 the company had expanded west, adding 20 more states to its service area, and made a name change to reflect their growth. It officially became known as Nationwide Insurance.

Expansion and acquisitions over the following decades made Nationwide one of the largest insurance groups in the country. They added Nationwide Financial in 1997 and opened Nationwide Bank 10 years later, in 2007.

In 2018 Nationwide ranked at number 67 on the Fortune 500 list, making them one of the biggest insurance companies in the nation. They continue to operate as a mutual insurance company.

In 2015, Nationwide had a 3.74 percent share of the national auto insurance market. That share dropped to 3.56 percent in 2016, and dropped again to 3.17 percent in 2017.

That’s a steady decline in market share, although Nationwide has held onto the number eight spot throughout those three years. It’s come during a time when direct-buy companies like Geico and Progressive have seen a lot of growth, which has affected a lot of companies.

What is the sales approach?

For a long time, Nationwide operated through a blend of both independent agents and captive agents. In 2018, however, they announced a shift away from captive agents entirely, which is expected to be completed by 2020.

That means that in the future all Nationwide agents will be independent. That can be a good thing for consumers since the agent doesn’t work solely for one customer and can provide a range of options.

Nationwide also offers the option to purchase a car insurance policy directly online as well as over the phone.

Does it make commercials?

Nationwide’s jingle is pretty famous and has been around a long time. The slogan “Nationwide is on your side” was introduced in 1965 and turned into a jingle in 1969.

It has since been performed by a variety of people, most recently Tori Kelly.

Another well-known performer on the commercials is country musician Brad Paisley. He is joined by NFL quarterback Peyton Manning, Jr. in a series of amusing commercials called “The Jingle Sessions”. These commercials depict the two working on new songs for Nationwide.

https://youtu.be/8OUZtYmFpsY

While they often move into humor, Nationwide’s commercials generally focus on the company’s slogan promise – to be there for customers.

Is it involved in the community?

Nationwide is engaged in a variety of charitable activities, both on a corporate level and through employee volunteers.

The Nationwide Foundation was established in 1959 and provides grants to nonprofits as well as sponsorships to nonprofit events. Since 2000, Nationwide reports for than $467 million in funding to nonprofits through the foundation.

Nationwide also partners with The United Way, The American Red Cross, and Feeding America. Their Community Connect program helps employees to take on and complete volunteer projects.

In 2007, Nationwide donated $50 million to the Columbus Children’s Hospital, which was renamed Nationwide Children’s Hospital in response to the gift. The company continues to support the hospital with annual gifts.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

What is Nationwide’s position for the future?

Despite a decline in its market share over the past few years, Nationwide is a huge and very strong company. There’s no reason to think they won’t continue to succeed in the future.

Along with the move into independent agents, Nationwide may also increase its online sales presence. Both of these moves could see the company bounce back in terms of market share.

What are Nationwide employee demographics?

One of the things that makes an insurance company a good place to do business with is that it’s a good place to work. In this section, we will look at the company’s employees and workplace experience.

According to Payscale, Nationwide has an average employee age of 36 years old, and the average tenure is 4.7 years. The site’s survey reports that 68 percent of employees cited high job satisfaction.

Payscale’s survey ranked Nationwide at a 3.6 out of five overall for workplace satisfaction. That ranks them above State Farm, the biggest auto insurance company in the nation, which earned 3.4.

Glassdoor shows similar numbers, with Nationwide ranking there at a 3.5 out of five for satisfied employees.

Great Place to Work’s survey resulted in an overall 88 percent of employees saying Nationwide is, in fact, a great place to work. That’s backed by the company’s ranking on the Fortune 100 Best Places to Work two years running, in 2018 and 2019.

While the largest portion of the workforce (26 percent) has been with the company for two to five years, Nationwide has a strong 15 percent of their employees with the company for more than 20 years.

What are its awards and accolades?

As we just mentioned, Nationwide has been named twice in a row to the Fortune list of the 100 Best Places to Work.

In 2018, they also made People’s list of Companies that Care. They were also named to Fortune’s Best Places to Work lists for Millennials, for Women, and for Diversity.

They’ve also picked up several other diversity awards. They have been named among the best places to work for Latinos and Latinas, won the Catalyst award for the advancement of female employees, and named a top place to work for diversity by Black Enterprise magazine.

They have earned a spot on the Human Rights Campaign’s 100 percent Corporate Equality Index for fourteen straight years.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Can you get cheap Nationwide car insurance rates?

We’d all prefer to choose the best insurance company regardless of their rates. Most people, however, have a budget to deal with and need to find the right balance of reputation and cost. So now that we’ve looked at Nationwide’s ratings, how do they stack up for price?

All insurance company rates vary based on factors like where you live, your age, gender, and driving record, and more. We’ll take a look at average Nationwide car insurance’s rates for a variety of scenarios, and compare them to other companies, too.

What are Nationwide policy rates by state?

The table below shows Nationwide’s average rates in each of the states where they write auto insurance, and how they compare to that state’s average rate. Nationwide is not available in four states: Alaska, Hawaii, Louisiana, and Maine.

Nationwide Average Monthly Car Insurance Rates per State

| State | Average Monthly Rates | Higher or Lower than Average Monthly State Rates | Percent Higher or Lower than Average Monthly State Rates |

|---|---|---|---|

| Alabama | $221.89 | -$75.36 | -2.11% |

| Arkansas | $321.82 | -$21.93 | -0.53% |

| Arizona | $291.34 | -$22.91 | -0.61% |

| California | $387.77 | $80.36 | 2.18% |

| Colorado | $311.62 | -$11.41 | -0.29% |

| Connecticut | $306.03 | -$78.88 | -1.71% |

| District of Columbia | $404.08 | $34.15 | 0.77% |

| Delaware | $360.85 | -$138.01 | -2.31% |

| Florida | $361.63 | -$28.41 | -0.61% |

| Georgia | $540.41 | $126.51 | 2.55% |

| Iowa | $227.95 | -$20.49 | -0.69% |

| Idaho | $252.68 | $4.43 | 0.15% |

| Illinois | $225.98 | -$49.47 | -1.50% |

| Indiana | -- | -- | -- |

| Kansas | $206.30 | -$67.00 | -2.04% |

| Kentucky | $458.60 | $25.65 | 0.49% |

| Maryland | $242.97 | -$138.92 | -3.03% |

| Massachusetts | -- | -- | -- |

| Michigan | $527.28 | -$347.61 | -3.31% |

| Minnesota | $243.87 | -$123.06 | -2.80% |

| Missouri | $188.78 | -$88.63 | -2.66% |

| Mississippi | $229.71 | -$75.67 | -2.07% |

| Montana | $289.86 | $21.45 | 0.67% |

| North Carolina | $237.34 | -$45.42 | -1.34% |

| North Dakota | $213.36 | -$133.79 | -3.21% |

| Nebraska | $217.00 | -$56.65 | -1.73% |

| New Hampshire | $207.59 | -$55.06 | -1.75% |

| New Jersey | -- | -- | -- |

| New Mexico | $292.87 | $4.23 | 0.12% |

| Nevada | $289.76 | -$115.38 | -2.37% |

| New York | $334.41 | -$23.08 | -0.54% |

| Ohio | $275.07 | $49.27 | 1.82% |

| Oklahoma | -- | -- | -- |

| Oregon | $264.74 | -$24.25 | -0.70% |

| Pennsylvania | $233.36 | -$102.84 | -2.55% |

| Rhode Island | $367.47 | -$49.48 | -0.99% |

| South Carolina | $302.12 | -$12.97 | -0.34% |

| South Dakota | $228.14 | -$103.72 | -2.60% |

| Tennessee | $285.41 | -$19.66 | -0.54% |

| Texas | $322.30 | -$14.64 | -0.36% |

| Utah | $248.88 | -$52.11 | -1.44% |

| Virginia | $172.75 | -$23.74 | -1.01% |

| Vermont | $177.35 | -$92.16 | -2.85% |

| Washington | $177.49 | -$77.46 | -2.53% |

| West Virginia | -- | -- | -- |

| Wisconsin | $435.42 | $134.91 | 3.74% |

| Wyoming | $265.60 | -$1.07 | -0.03% |

| Average | $265.60 | -$39.47 | -1.08% |

Notable exceptions are Wisconsin – the most expensive state at 30 percent above average – and California at just over 20 percent more than average.

The cheapest place to have Nationwide is Michigan, where rates are 65 percent below average. Midwest states like Minnesota and North Dakota are on the cheap side as well, along with Maryland and Vermont.

Surprisingly, Nationwide is about 17 percent above average in the company’s home state, Ohio.

What are the rates compared to top companies?

This table will show you average rates by state for the top ten car insurance companies in the country, one of which is Nationwide.

| State | Average Annual Premiums | Allstate | American Family | Farmers | Geico | Liberty Mutual | Nationwide | Progressive | State Farm | Travelers | USAA |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Alabama | $3,566.96 | $3,311.52 | Data Not Available | $4,185.80 | $2,866.60 | $4,005.48 | $2,662.66 | $4,450.52 | $4,798.15 | $3,697.80 | $2,124.09 |

| Arkansas | $4,124.98 | $5,150.03 | Data Not Available | $4,257.87 | $3,484.63 | Data Not Available | $3,861.79 | $5,312.09 | $2,789.03 | $5,973.33 | $2,171.06 |

| Arizona | $3,770.97 | $4,904.10 | Data Not Available | $5,000.08 | $2,264.71 | Data Not Available | $3,496.08 | $3,577.50 | $4,756.25 | $3,084.74 | $3,084.29 |

| California | $3,688.93 | $4,532.96 | Data Not Available | $4,998.78 | $2,885.65 | $3,034.42 | $4,653.19 | $2,849.67 | $4,202.28 | $3,349.54 | $2,693.87 |

| Colorado | $3,876.39 | $5,537.17 | $3,733.02 | $5,290.24 | $3,091.69 | $2,797.74 | $3,739.47 | $4,231.92 | $3,270.77 | Data Not Available | $3,338.87 |

| Connecticut | $4,618.92 | $5,831.60 | Data Not Available | Data Not Available | $3,073.66 | $7,282.87 | $3,672.34 | $4,920.35 | $2,976.24 | $6,004.29 | $3,190.00 |

| District of Columbia | $4,439.24 | $6,468.92 | Data Not Available | Data Not Available | $3,692.81 | Data Not Available | $4,848.98 | $4,970.26 | $4,074.05 | Data Not Available | $2,580.44 |

| Delaware | $5,986.32 | $6,316.06 | Data Not Available | Data Not Available | $3,727.29 | $18,360.02 | $4,330.21 | $4,181.83 | $4,466.85 | $4,182.36 | $2,325.98 |

| Florida | $4,680.46 | $7,440.46 | Data Not Available | Data Not Available | $3,783.63 | $5,368.15 | $4,339.60 | $5,583.30 | $3,397.67 | Data Not Available | $2,850.41 |

| Georgia | $4,966.83 | $4,210.70 | Data Not Available | Data Not Available | $2,977.20 | $10,053.44 | $6,484.90 | $4,499.22 | $3,384.88 | Data Not Available | $3,157.46 |

| Iowa | $2,981.28 | $2,965.86 | $3,021.81 | $2,435.72 | $2,296.16 | $4,415.28 | $2,735.44 | $2,395.50 | $2,224.51 | $5,429.38 | $1,852.57 |

| Idaho | $2,979.09 | $4,088.76 | $3,728.79 | $3,168.28 | $2,770.68 | $2,301.51 | $3,032.19 | Data Not Available | $1,867.96 | $3,226.29 | $1,877.61 |

| Illinois | $3,305.48 | $5,204.41 | $3,815.31 | $4,605.20 | $2,779.16 | $2,277.65 | $2,711.81 | $3,536.65 | $2,344.88 | $2,499.76 | $2,770.21 |

| Indiana | $3,414.97 | $3,978.81 | $3,679.68 | $3,437.55 | $2,261.07 | $5,781.35 | Data Not Available | $3,898.00 | $2,408.94 | $3,393.75 | $1,630.86 |

| Kansas | $3,279.62 | $4,010.23 | $2,146.40 | $3,703.77 | $3,220.65 | $4,784.42 | $2,475.59 | $4,144.38 | $2,720.00 | $4,341.43 | $2,382.61 |

| Kentucky | $5,195.40 | $7,143.92 | Data Not Available | Data Not Available | $4,633.59 | $5,930.97 | $5,503.23 | $5,547.63 | $3,354.32 | $6,551.68 | $2,897.89 |

| Maryland | $4,582.70 | $5,233.17 | Data Not Available | Data Not Available | $3,832.63 | $9,297.55 | $2,915.69 | $4,094.86 | $3,960.87 | Data Not Available | $2,744.14 |

| Massachusetts | $2,678.85 | $2,708.53 | Data Not Available | Data Not Available | $1,510.17 | $4,339.35 | Data Not Available | $3,835.11 | $1,361.86 | $3,537.94 | $1,458.99 |

| Michigan | $10,498.64 | $22,902.59 | Data Not Available | $8,503.60 | $6,430.11 | $20,000.04 | $6,327.38 | $5,364.55 | $12,565.52 | $8,773.97 | $3,620.00 |

| Minnesota | $4,403.25 | $4,532.01 | $3,521.29 | $3,137.45 | $3,498.54 | $13,563.61 | $2,926.49 | Data Not Available | $2,066.99 | Data Not Available | $2,861.60 |

| Missouri | $3,328.93 | $4,096.15 | $3,286.90 | $4,312.19 | $2,885.33 | $4,518.67 | $2,265.35 | $3,419.14 | $2,692.91 | Data Not Available | $2,525.78 |

| Mississippi | $3,664.57 | $4,942.11 | Data Not Available | Data Not Available | $4,087.21 | $4,455.94 | $2,756.53 | $4,308.85 | $2,980.48 | $3,729.32 | $2,056.13 |

| Montana | $3,220.84 | $4,672.10 | Data Not Available | $3,907.55 | $3,602.35 | $1,326.11 | $3,478.26 | $4,330.76 | $2,417.74 | Data Not Available | $2,031.89 |

| North Carolina | $3,393.11 | $7,190.43 | Data Not Available | Data Not Available | $2,936.69 | $2,182.71 | $2,848.03 | $2,382.61 | $3,078.65 | $3,132.66 | Data Not Available |

| North Dakota | $4,165.84 | $4,669.31 | $3,812.40 | $3,092.49 | $2,668.24 | $12,852.83 | $2,560.35 | $3,623.06 | $2,560.53 | Data Not Available | $2,006.80 |

| Nebraska | $3,283.68 | $3,198.83 | $2,215.13 | $3,997.29 | $3,837.49 | $6,241.52 | $2,603.94 | $3,758.01 | $2,438.71 | Data Not Available | $2,330.78 |

| New Hampshire | $3,151.77 | $2,725.01 | Data Not Available | Data Not Available | $1,615.02 | $8,444.41 | $2,491.10 | $2,694.45 | $2,185.46 | Data Not Available | $1,906.96 |

| New Jersey | $5,515.21 | $5,713.58 | Data Not Available | $7,617.00 | $2,754.94 | $6,766.62 | Data Not Available | $3,972.72 | $7,527.16 | $4,254.49 | Data Not Available |

| New Mexico | $3,463.64 | $4,200.65 | Data Not Available | $4,315.53 | $4,458.30 | Data Not Available | $3,514.38 | $3,119.18 | $2,340.66 | Data Not Available | $2,296.77 |

| Nevada | $4,861.70 | $5,371.62 | $5,441.18 | $5,595.56 | $3,662.09 | $6,201.55 | $3,477.14 | $4,062.57 | $5,796.34 | $5,360.41 | $3,069.07 |

| New York | $4,289.88 | $4,740.97 | Data Not Available | Data Not Available | $2,428.24 | $6,540.73 | $4,012.93 | $3,771.15 | $4,484.58 | $4,578.79 | $3,761.69 |

| Ohio | $2,709.71 | $3,197.22 | $1,515.17 | $3,423.01 | $1,867.19 | $4,429.74 | $3,300.89 | $3,436.96 | $2,507.88 | $3,135.16 | $1,478.46 |

| Oklahoma | $4,142.33 | $3,718.62 | Data Not Available | $4,142.40 | $3,437.34 | $6,874.62 | Data Not Available | $4,832.35 | $2,816.80 | Data Not Available | $3,174.15 |

| Oregon | $3,467.77 | $4,765.95 | $3,527.28 | $3,753.52 | $3,220.12 | $4,334.55 | $3,176.83 | $3,629.13 | $2,731.48 | $2,892.19 | $2,587.15 |

| Pennsylvania | $4,034.50 | $3,984.12 | Data Not Available | Data Not Available | $2,605.22 | $6,055.20 | $2,800.37 | $4,451.00 | $2,744.23 | $7,842.47 | $1,793.37 |

| Rhode Island | $5,003.36 | $4,959.45 | Data Not Available | Data Not Available | $5,602.63 | $6,184.12 | $4,409.63 | $5,231.09 | $2,406.51 | $6,909.45 | $4,323.98 |

| South Carolina | $3,781.14 | $3,903.43 | Data Not Available | $4,691.85 | $3,178.01 | Data Not Available | $3,625.49 | $4,573.08 | $3,071.34 | Data Not Available | $3,424.77 |

| South Dakota | $3,982.27 | $4,723.72 | $4,047.47 | $3,768.80 | $2,940.29 | $7,515.99 | $2,737.66 | $3,752.81 | $2,306.23 | Data Not Available | Data Not Available |

| Tennessee | $3,660.89 | $4,828.85 | Data Not Available | $3,430.07 | $3,283.42 | $6,206.69 | $3,424.96 | $3,656.91 | $2,639.30 | $2,738.52 | $2,739.28 |

| Texas | $4,043.28 | $5,485.44 | $4,848.72 | Data Not Available | $3,263.28 | Data Not Available | $3,867.55 | $4,664.69 | $2,879.94 | Data Not Available | $2,487.89 |

| Utah | $3,611.89 | $3,566.42 | $3,698.77 | $3,907.99 | $2,965.57 | $4,327.76 | $2,986.57 | $3,830.10 | $4,645.83 | Data Not Available | $2,491.10 |

| Virginia | $2,357.87 | $3,386.80 | Data Not Available | Data Not Available | $2,061.53 | Data Not Available | $2,073.00 | $2,498.58 | $2,268.95 | Data Not Available | $1,858.38 |

| Vermont | $3,234.13 | $3,190.38 | Data Not Available | Data Not Available | $2,195.71 | $3,621.08 | $2,128.21 | $5,217.14 | $4,382.84 | Data Not Available | $1,903.55 |

| Washington | $3,059.32 | $3,540.52 | $3,713.02 | $2,962.00 | $2,568.65 | $3,994.73 | $2,129.84 | $3,209.52 | $2,499.78 | Data Not Available | $2,262.16 |

| West Virginia | $2,595.36 | $3,820.68 | Data Not Available | Data Not Available | $2,120.80 | $2,924.39 | Data Not Available | Data Not Available | $2,126.32 | Data Not Available | $1,984.62 |

| Wisconsin | $3,606.06 | $4,854.41 | $1,513.27 | $3,777.49 | $3,926.20 | $6,758.85 | $5,224.99 | $3,128.91 | $2,387.53 | Data Not Available | $2,975.74 |

| Wyoming | $3,200.08 | $4,373.93 | Data Not Available | $3,069.35 | $3,496.56 | $1,989.36 | $3,187.20 | $4,401.17 | $2,303.55 | Data Not Available | $2,779.53 |

Nationwide’s rates are lower than other big companies in a lot of states. They even manage to out price low-cost insurance leaders GEICO and Progressive in some states.

What are auto insurance rates by commute?

Nationwide isn’t one of the insurance companies where you need to worry about a longer commute impacting rates. There is little difference in these comparison rates.

| Commute Type | Nationwide Average Rate |

|---|---|

| 10-mile, 6,000 miles annually | $3,437.33 |

| 25-mile, 12,000 miles annually | $3,462.67 |

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

What are auto insurance rates by coverage level?

Nationwide is a company where you can afford a higher level of coverage. The numbers below show minimal increases even between low and high levels.

| Coverage Level | Average Nationwide Rate |

|---|---|

| Low | $3,394.83 |

| Medium | $3,449.80 |

| High | $3,505.37 |

What are auto insurance rates by credit history?

While people with poor credit pay double what those with good credit score pay at many companies, Nationwide’s average rates don’t jump quite as much.

| Credit History | Nationwide Average Rates |

|---|---|

| Poor | $4,083.29 |

| Fair | $3,254.83 |

| Good | $2,925.94 |

What are auto insurance rates by driving record?

No matter what company you’re considering, Nationwide customers can expect that a driver with a clean record will get the best price. But from there, companies vary quite a bit in terms of what they charge for tickets, accidents, and other violations. Here’s what Nationwide charges on average for a clean record and four different scenarios.

| Driving Record | Nationwide Average Rate |

|---|---|

| Clean Record | $2,746.18 |

| 1 Speeding Ticket | $3,113.68 |

| 1 Accident | $3,396.95 |

| 1 DUI | $4,543.20 |

Nationwide’s rates don’t take much of a hike for a speeding ticket, but a DUI is going to result in a pretty big increase.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

What insurance products and coverages are offered?

All insurance companies offer the basics – what you need to be on the road legally. When it comes to coverage options, there are some standard inclusions there too. There are also common and not-so-common options that may or may not be available depending on the company.

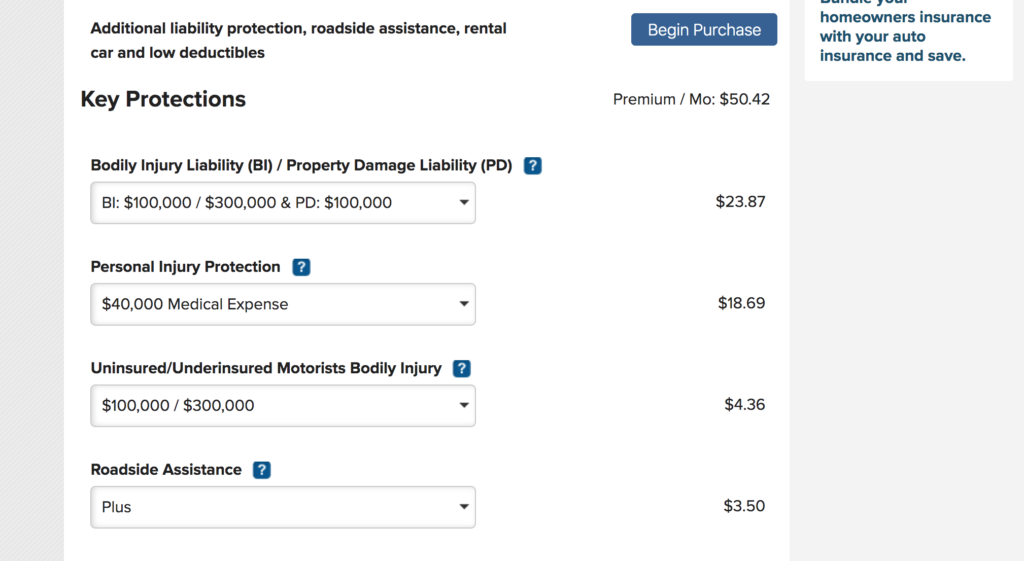

What are the offered types of coverage?

Nationwide operates in many states, each with its own laws regarding insurance. Depending on where you live, you will need to carry a minimum policy that includes some or all of these basics:

- Bodily Injury Liability

- Property Damage Liability

- Personal Injury Protection (PIP)

- Medical Payments (MedPay)

- Uninsured/Underinsured Motorist Bodily Injury

- Uninsured/Underinsured Motorist Property Damage

Even if your state’s laws don’t require all of these, they are worth considering as options. Adding liability coverage can help create a comprehensive policy and protect you financially from an accident.

Nationwide offers these options, which vary by state:

- Collision

- Comprehensive coverage

- Roadside Assistance

- Rental Car Reimbursement

- Gap Coverage

- Total Loss Deductible Waiver

- Accident Forgiveness

There are some other things you can add to your policy as well, which we’ll look at shortly.

Can you bundle?

Nationwide offers a lot of different products, which makes bundling with them a true one-stop shopping experience.

Discounts are available for bundling auto with a homeowners insurance policy, renters, life insurance, and boat insurance. There are other combinations that can also earn you a discount, such as bundling a motorcycle policy with a home or renters policy.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

What is its area of operation?

Nationwide auto insurance is available in 46 states as well as the District of Columbia.

They don’t currently offer car insurance in Alaska, Louisiana, Maine, and Hawaii.

What additional options are available??

Nationwide has a few other options available that can add value to your policy as well as reduce your costs.

Vanishing Deductible is an optional program that reduces your deductible by $100 each year that you remain accident-free.

The first $100 credit is applied 30 days after the option is added to the policy, and each year an additional $100 credit is given. The maximum credit is $500, which could be the entire deductible depending on your policy.

Smart Ride is Nationwide’s usage-based program. It uses a plug-in device to record driving habits for a period of four to six months. The data is used to calculate a discount. There is an initial discount just for signing up, which will be replaced with your calculated discount at the end of the program.

Smart Ride records similar information to most such programs: braking, acceleration, time of day, and miles driven. It also records time spent idling, which is an unusual factor to consider.

Nationwide also integrates its Smart Ride program with Amazon Alexa.

Nationwide offers BonusDrive, a cash-back incentive program for those buying a new car. The program gives the insured $500 cash back when they purchase a new vehicle from a specific list of car companies.

In addition to the cash back, Nationwide has an Auto Shopping Service to help with the purchase of a new or used vehicle. Run by TrueCar, which is used by several major insurance companies, the plan offers discounted prices and other benefits. (For more information, read our “Best Car Insurance Company for a Used Vehicle“).

The On Your Side Repair Network is Nationwide’s preferred repair shop program. Repairs done by a participating shop are guaranteed for as long as you own the vehicle.

Nationwide recently launched Smart Miles, their pay-per-mile program, making them one of only a handful of insurance companies to offer it. It’s currently available only in Illinois.

It’s worth noting that Nationwide doesn’t currently offer car insurance coverage for rideshare drivers. However, in March 2019, they announced plans to work on an on-demand insurance plan for rideshare drivers in association with Slice Labs. That coverage is not yet available at the time of this review.

What discounts are offered?

Nationwide offers a lot of different discounts to help bring down insurance premiums. Here’s a list of what’s available, how to qualify, and what the discount might be.

| Discount | Percentage Off (up to) | Details/Requirements |

|---|---|---|

| Anti-theft Device | Varies | Vehicles equipped with qualifying anti-theft device |

| Easy Pay Plan | Not stated, one-time discount | Set up automatic withdrawal of premium payments |

| Paperless Billing | Not stated | Sign up for online policy management |

| Safe Driver | 10% | Discounted rate after five years with a clean record |

| 55+ Defensive Driving Course | 5% | Drivers over age 55 and complete a defensive driving course. |

| Multi-Car | 20% | Insure more than one vehicle with Nationwide |

| Good Student | Not stated | Students ages 16-24, enrolled in high school or college, with a B average or better. |

| Auto and Home | 20% off total (both policies) | Have both auto and home (homeowners or renters) in force with Nationwide |

| Auto and Life | Not stated | Have both auto and life in force with Nationwide |

| Auto and Boat | Not stated | Have both auto and boat insurance in force with Nationwide |

| Affinity Group | Varies | Members of affinity groups such as alumni organizations, special interest groups, and professional associations |

| SmartRide | 10% for signing up 40% (up to) after program ends | Must install and use the Smart Ride plug-in device for four to six months |

| Vehicle Safety Device | Varies | Varied discounts for safety equipment such as anti-lock brakes, airbags, and electronic stability control |

Nationwide doesn’t provide a lot of information in terms of how much each discount is, probably because it does vary from state to state.

While we did see discounts like those for a new car, early signing, and homeowner listed elsewhere as being available from Nationwide, those discounts aren’t among the ones listed on the company’s website. Early signing does show up during the quote process, which tells us the list of discounts on the website is incomplete.

Notably absent from Nationwide’s list are a military discount and any sort of green vehicle discount. They do offer more bundling discounts than some other insurance companies, but it’s not clear how much it will really reduce your car insurance rate.

A lot of Nationwide’s discounts are focused on safe driving habits, which makes the company a good choice for those with a clean record and willing to do things like take a defensive driving course and enroll in the usage-based program.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

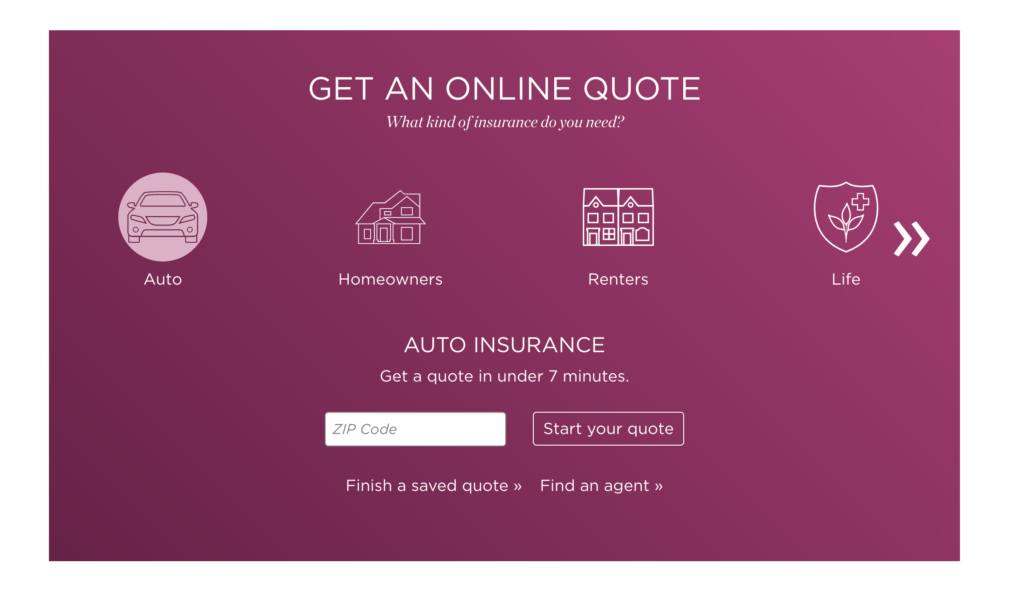

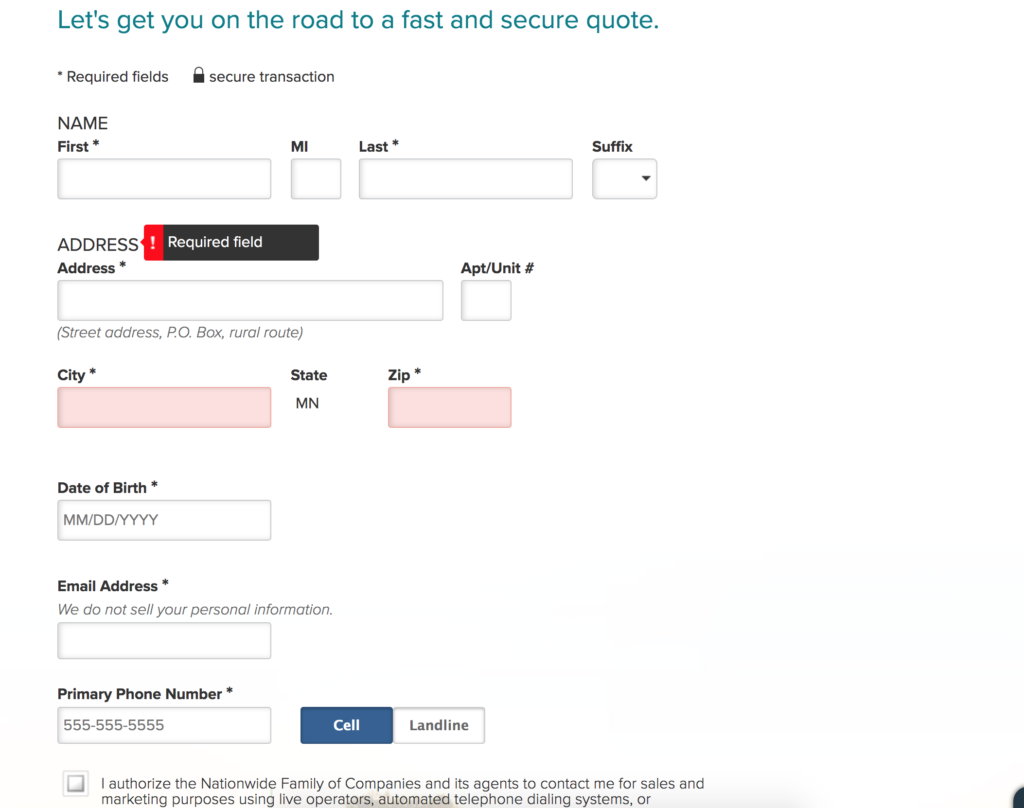

How can I get a quote online?

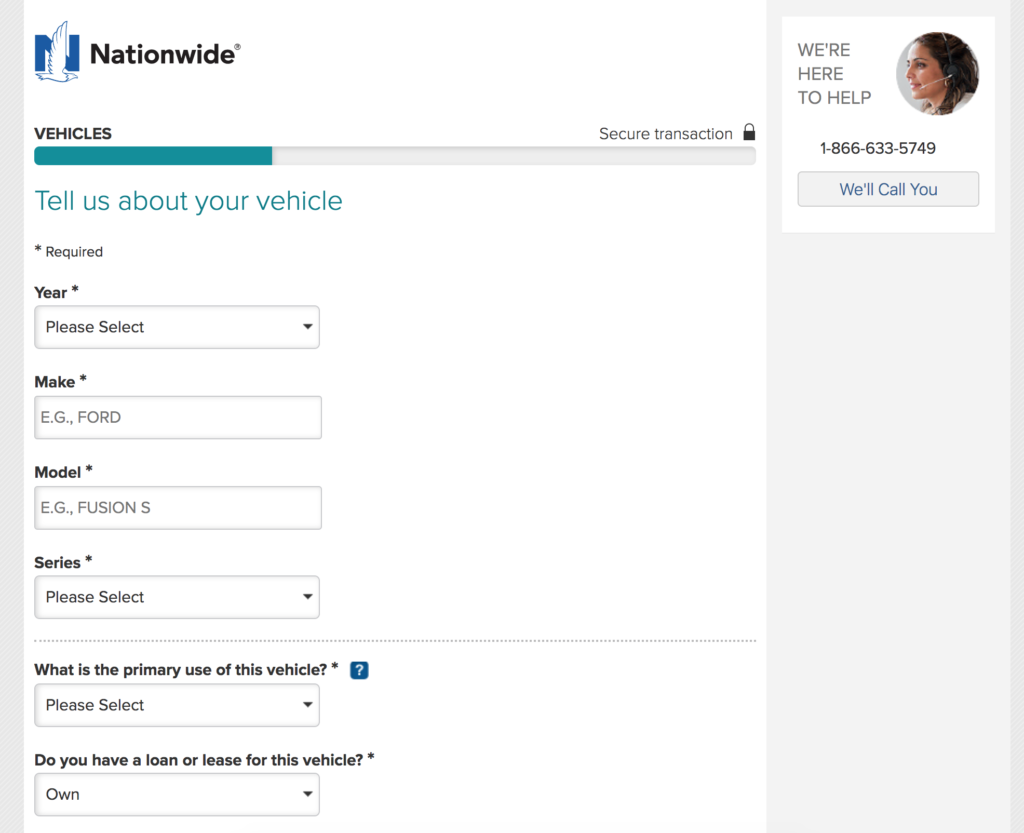

The entire process of quoting and purchasing a policy can be done online on Nationwide’s site. The front page of the website includes a quote box.

After you enter your zip code, you’ll need to enter all of your contact information, including home address, email address, and phone number. They’ll ask you to check off a box giving permission for Nationwide to contact you for a variety of purposes including marketing, but you don’t have to check this to continue.

If you don’t want to deal with solicitation, leave the box unchecked, and continue with the quote.

The next section will pull up available records for vehicles at your address, and also give you the opportunity to add vehicles that aren’t listed.

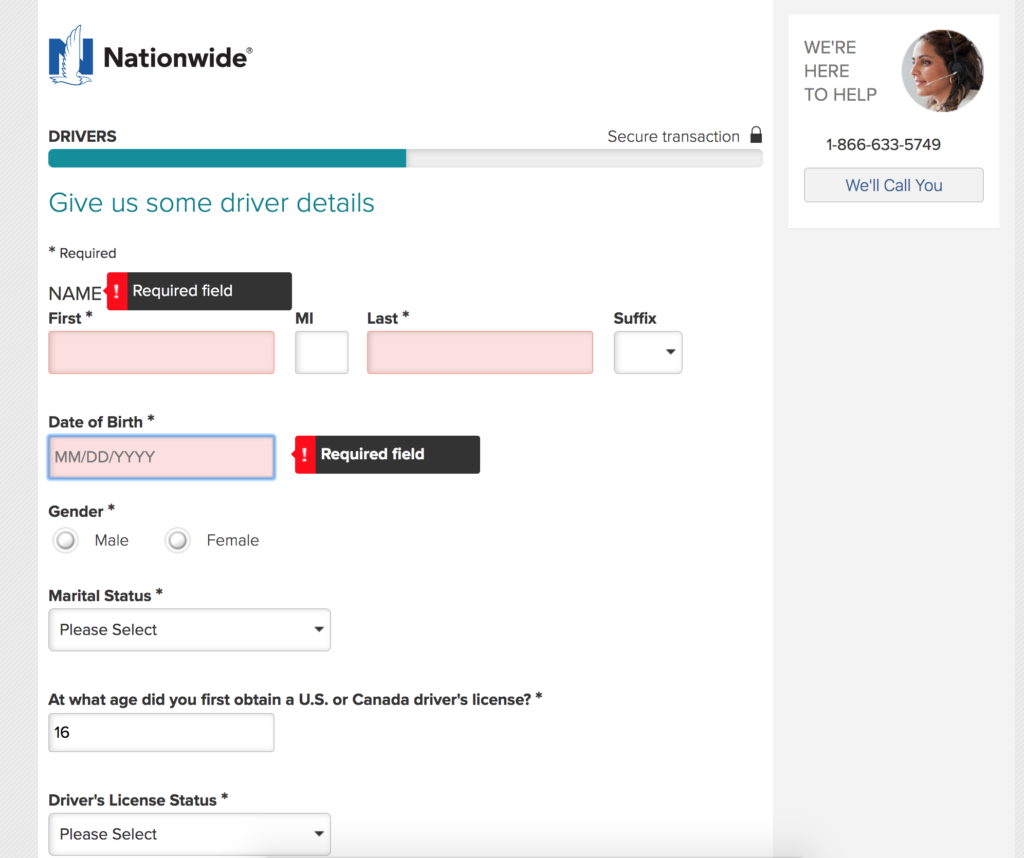

After adding vehicle information, the next section will ask for driver details.

The following steps will cover previous/current insurance information and go over the discounts for which you might qualify. Finally, you will receive quotes.

In this section, you can adjust the coverage you want in order to finalize the quotes based on your chosen limits and deductibles.

You will need these items to get a quote from Nationwide.

| Information | Required/Not Required |

|---|---|

| Driver's License Number | Not required |

| Social Security Number | Not required |

| Phone Number | Required |

| Email Address | Required |

| Vehicle Identification Number | Not required |

The table above applies to the quote process – if you want to apply for coverage, all of the above will be required.

Are Nationwide’s website and app easy to use?

Nationwide’s website is easy to navigate, with top-level menus offering quick access to the most commonly needed information. That includes product information, claims, and contact information.

The repeated moving images on the front page have the potential to make it slower to load if you’re not on a strong internet connection and make the page feel a little less clean.

Information on products and services is easy to locate. There is also a range of articles available on the site covering useful topics from car seat safety to preparing for a teen driver.

Overview

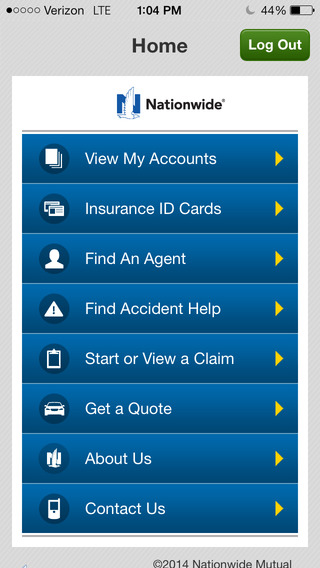

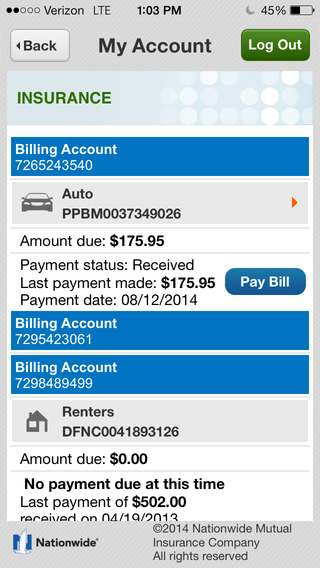

Nationwide’s Mobile app appears to have been created out of necessity rather than from creative genius. It does provide some basic utility, unfortunately, much of which can be lost due to poor user experience.

To be clear, Nationwide has two (2) mobile applications. Nationwide Mobile is a downloadable to manage insurance policies, including paying bills, locating local agents and receiving rate quotes. Nationwide Bank is their app used for mobile banking via Nationwide’s banking services.

They are both free to download.

What is the device availability?

Both the Nationwide Mobile and Nationwide Bank apps are available for Apple and Android products. They can be downloaded for these devices from the App Store and Google Play respectively.

Specifically the apps work on iPhone, iPad, Android smartphones, and tablets.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

What are the app features?

What is Nationwide mobile?

Nationwide has done an OK job of bringing practicality and ease of use to end users. Without having an account with Nationwide I am able to get a quote from my phone, browse local insurance agents, and gather general information about the company.

Let’s take a look at what someone with a Nationwide account can do with this downloadable:

- Get a quote

- View/edit account details

- View electronic insurance cards

- Locate an agent

- Find accident help

- Call a tow truck

- Find a repair shop

- Accident checklist

- Start or view a claim

- Start a new auto claim

- Continue an auto claim

- Start a new life claim

What is Nationwide Bank?

Like Nationwide’s insurance mobile application used to manage your policy, the Nationwide Bank app gives people access to bank account information on the go.

My question is why two different apps?

With the Nationwide Bank® mobile app you can:

- Deposit checks with eDeposit

- Pay bills

- Check account balances

- View transaction history

- Transfer funds

- Find ATMs

Google Play/ iTunes Reviews

Google Play rates the Nationwide Mobile app at 3.8 stars out of 5 based upon 837 reviews. iTunes rates it a bit lower at 3 stars based upon a much greater sample size of 3,552 reviews.

Google Play rates Nationwide Bank® just about the same as the mobile policy app at 3.6 stars, however, this is based only on 82 reviews. iTunes has even fewer reviews at just 32 with a combined rating of 2 stars.

Pros

- Functional

- Easy to use

Cons

- Slow

- Very Basic

- Uninspired

Nationwide hasn’t really done anything special here. They just seem to be lacking any creative focus. Insurance and banking are pretty boring by themselves, and these apps are a reflection of that.

That being said, these apps will help you manage your insurance policy and/or banking with Nationwide just fine.

| Pros | Cons |

|---|---|

| Choice of an agent or buying coverage directly. | Customer satisfaction ratings are average to below average |

| One-stop shopping with lots of bundling options | No rideshare insurance available |

| Rates are below average in most states | Fewer add-on options than many other companies |

We might not have answered all of your questions about Nationwide’s auto insurance, so here are a few more questions and their answers. If your answer still isn’t here, head over to Nationwide’s auto insurance page for more information.

Does choosing an agent versus buying directly change the price? No. Quoted prices are the same whether you have an agent help you with your insurance or buy it yourself directly. Quotes can change, however, based on information discovered after the quote, like a ticket you forgot to mention.

Can using Smart Ride increase my rates? No. There are some usage-based programs where the data gathered can result in an increase in rates. Nationwide, however, will only use the data to calculate a discount.

Will Smart Miles be available in other states? Yes. Nationwide plans to roll the program out in other states throughout 2019, but which states will be included isn’t known just yet.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

What is it like filing a claim for Nationwide Insurance?

Nationwide’s On Your Side Claims Services promises to handle your auto claim quickly, efficiently, and with as little hassle for you as possible.

There are several ways to file a claim:

- Online on the Nationwide site

- Over the phone at 1-800-421-3535

- By contacting your agent, if you have one

- Using the Nationwide app

Both the app and your customer account on the website include claim status tracking.

There are a separate claim phone number and online report form for auto glass-only claims. That number is 1-800-890-1375. Safelite, a national glass repair and replacement company that works with most of the major insurance companies, handles auto glass claims.

Frequently Asked Questions

What types of insurance does Nationwide offer?

Nationwide offers a range of insurance products, including auto insurance, home insurance, health insurance, and pet insurance.

How can I file a complaint about Nationwide Insurance?

If you have a complaint about Nationwide Insurance, you can contact their customer service department directly. They typically have a dedicated phone line or email address for complaints. Alternatively, you can reach out to your state’s insurance regulatory authority to file a complaint.

What should I do if I’m not satisfied with my Nationwide Insurance policy?

If you’re not satisfied with your Nationwide Insurance policy, you can contact their customer service department to discuss your concerns. They may be able to offer solutions or make adjustments to meet your needs. If you’re still not satisfied, you can consider switching to a different insurance provider that better suits your requirements.

Are there any common complaints about Nationwide Insurance?

While experiences may vary, some common complaints about Nationwide Insurance include difficulties with claims processing, premium increases, and customer service issues. It’s important to note that these complaints do not reflect everyone’s experience and that Nationwide Insurance has many satisfied customers as well.

How can I find reviews about Nationwide Insurance?

You can find reviews about Nationwide Insurance by searching online on websites that specialize in insurance reviews or consumer feedback. These platforms often provide insights and opinions from policyholders who have had experiences with Nationwide Insurance.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.