Best Kentucky Car Insurance (2025)

Kentucky auto insurance rates average $78 per month for full coverage while Kentucky minimum car insurance requirements are 25/50/25 for bodily injury and property damage. You can save money on your Kentucky car insurance by choosing the minimum amount of coverage required by Kentucky car insurance laws.

Read moreFree Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michael Vereecke

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many different insurance providers, which gives him unique insight into the insurance market...

Commercial Lines Coverage Specialist

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Kentucky Statistics Summary | Details |

|---|---|

| Miles of Roadway | 79,857 |

| # of Registered Vehicles | 4,040,964 |

| Population | 4,468,402 |

| Most Popular Vehicle | Ford F150 |

| Uninsured/Underinsured & Rank | 12 % / Rank 26 |

| Speeding Fatalities | 111 |

| DUI Fatalities | 137 |

| Liability Average | $519 |

| Collision Average | $255 |

| Comprehensive Average | $130 |

| Cheapest Insurance Companies | State Farm, USAA |

Kentucky is home to the most beautiful landscape in the U.S. To drive in the state, however, you’ll need car insurance.

As you go through our Kentucky car insurance guide, you’ll develop budget ideas, receive driver’s license details, a clearer picture of Kentucky driving laws, and traffic information. If you want to start comparing car insurance premiums now, use our free tool in the box above.

Kentucky Car Insurance Coverage and Rates

Before we move forward is a short video on the type of car insurance that’s available in Kentucky.

Shopping for car insurance can be a challenge. A few factors many motorists consider is the cost of car insurance and what car insurance covers.

This car insurance guide will explain how you, the motorist, can determine which car insurance option is best for you. As you browse through each section in this guide, think about what rate meets your budget while providing adequate coverage.

Forms of Financial Responsibility

Forms of financial responsibility are any document, identification card, or statement that shows that a motorist has car insurance.

When you get pulled over by law enforcement or go to your local Department of Motor Vehicles (DMV), they’ll ask for proof of insurance.

The documents, even a binder containing your initial policy, is considered a form of financial responsibility.

Registration is another item of financial responsibility proving that the motorist has paid the necessary taxes to continue riding on state roadways.

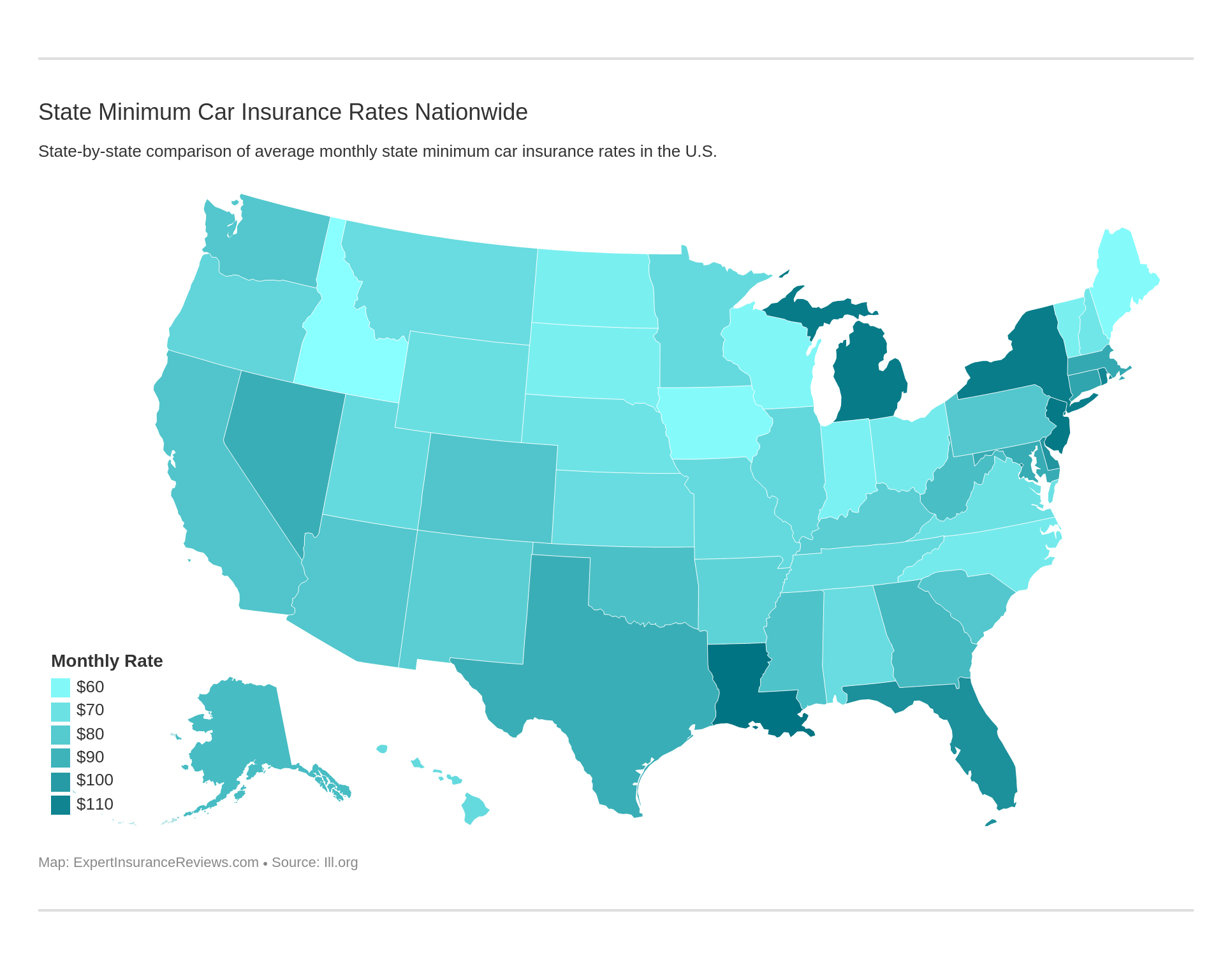

Here’s how the cost of minimum coverage varies from state to state.

Premiums as a Percentage of Income

You’ve probably noticed the dollar amounts in the table and may have assumed that the amount in the tables above is what policyholders pay monthly. No.

The amounts are average annual rates. In other words, these are dollar amounts estimated by the year. Car insurance companies split up the policy in monthly installments, quarterly installs, and bi-annual installments.

The table we’re presenting here shows how average annual rates from car insurance affect annual income. We’ve compared stats from Kentucky to Tennessee and the national average.

| States | Full Coverage 2014 | Disposable Income 2014 | Insurance as % of Income 2014 | Full Coverage 2013 | Disposable Income 2013 | Insurance as % of Income 2013 | Full Coverage 2012 | Disposable Income 2012 | Insurance as % of Income 2012 |

|---|---|---|---|---|---|---|---|---|---|

| Kentucky | $917 | $33,237 | 2.76% | $905 | $31,951 | 2.83% | $888 | $32,202 | 2.76% |

| Tennessee | $856 | $36,909 | 2.32% | $829 | $35,668 | 2.33% | $795 | $35,916 | 2.21% |

| Countrywide | $982 | $40,859 | 2.40% | $951 | $39,192 | 2.43% | $924 | $39,473 | 2.34% |

Kentucky’s average annual rate for full coverage comes close to the national average rate. What’s different from the national average and Tennessee is that the percentage of income is nearly three percent in Kentucky.

Average Monthly Car Insurance Rates in KY (Liability, Collision, Comprehensive)

Understanding core coverage is simple. Core coverage is the list of options a motorist has when they are approved for a policy with a car insurance company. The minimum is liability car insurance coverage. There are two additional coverages that can be added to your car insurance policy: collision and comprehensive car insurance.

Collision car insurance is additional protection in case liability insurance doesn’t cover additional property damage costs.

Comprehensive car insurance covers damages from weather conditions, objects damaging your vehicle, damages after your vehicle is stolen, and sometimes replacing a damaged windshield. Finally, full coverage is a combination of liability, collision, and comprehensive coverage.

Here are the average annual rates for each.

| Coverage Type | Annual Rates |

|---|---|

| Liability | $519 |

| Collision | $255 |

| Comprehensive | $130 |

| Full | $904 |

Full coverage is the sum of liability, collision, and comprehensive coverage. Therefore, a motorist’s estimated annual cost for car insurance would be $904. If you divide $904 by 12, you’ll see the estimated monthly premium at $75.33 per month.

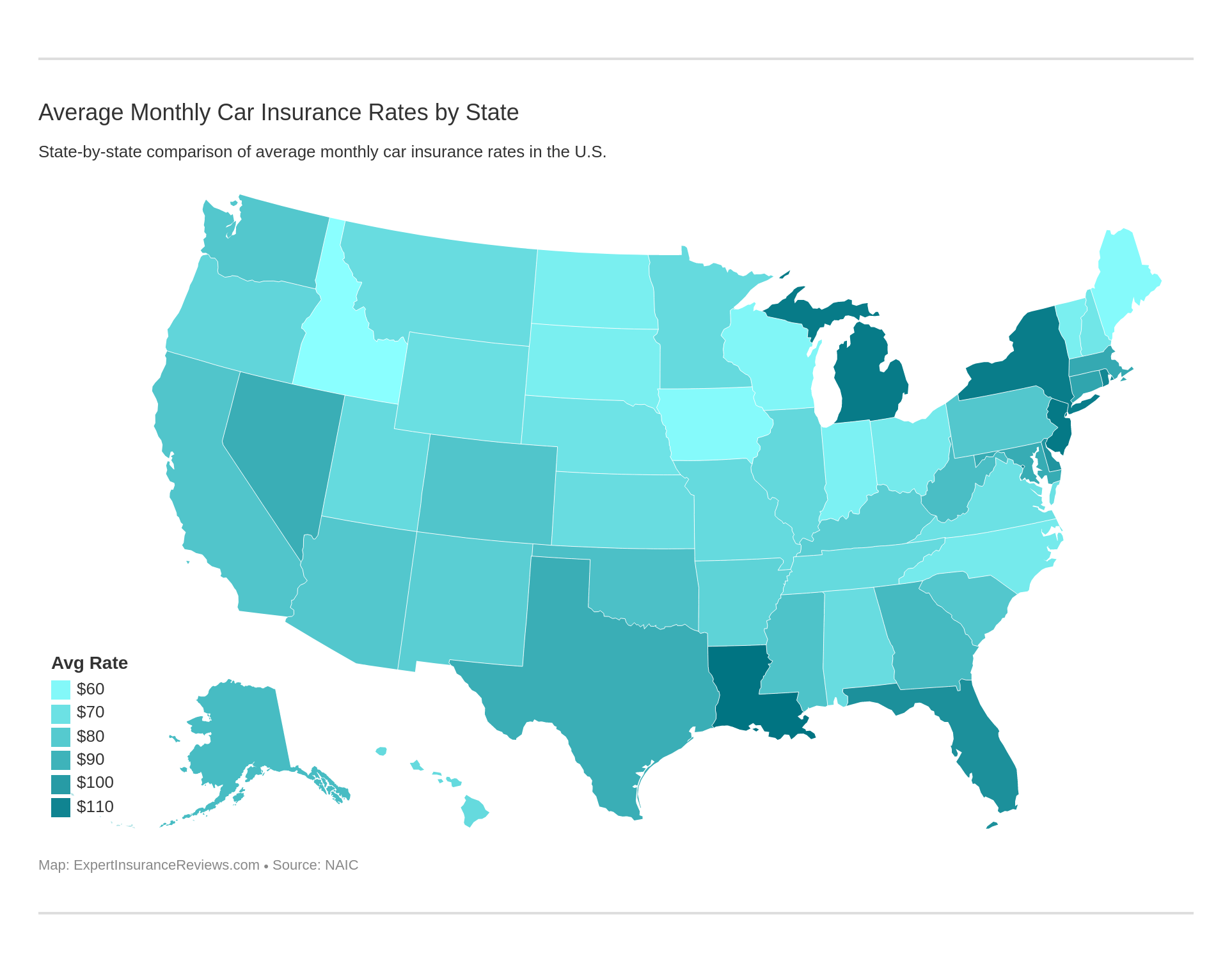

Here’s how that compares to the rest of the nation.

Additional Liability

There are more coverages a motorist can add to their car insurance policy. In some states, these added coverages are required. Additional liability can be Medical Payment coverage (MedPay), Personal Injury Protection coverage (PIP), and Uninsured/Underinsured Motorist coverage (UUM).

The State of Kentucky does not require motorists to have additional liability coverage.

MedPay pays medical bills for you or another motorist in case there were bodily injuries in the event of a car accident. Although minimum coverage can cover medical payments, MedPay comes in handy when minimum coverage can’t cover medical expenses.

Personal Injury Protection compensates policyholders’ medical bills and lost wages regardless of who’s at fault.

Uninsured/Underinsured Motorist insurance is a safeguard coverage that pays for expenses when another motorist is not insured or underinsured.

This table shows the loss ratio of Kentucky insurers.

| Additional Liability Coverage Type | 2015 | 2014 | 2013 |

|---|---|---|---|

| Medical Payments (MedPay) | 76.75 | 74.70 | 74.89 |

| Personal Injury Protection (PIP) | 68.27 | 65.03 | 57.17 |

| Uninsured/Underinsured (UUM) | 76.49 | 77.87 | 75.75 |

The loss ratio explains what car insurance companies pay out (claims) and how much they earn. In other words, for every $100 that they make, the loss ratio is what they spend from it. For example, the loss ratio for PIP in 2015 was 68.27 percent. That means for every $100 a company earned, they paid out $68.27.

Loss ratios fairly close to 100 indicate that car insurance companies are paying out filed claims. Loss ratios that are too low are signs that the car insurance company isn’t paying out many claims. Finally, a loss ratio that’s too close or exceeds 100 means the car insurance company isn’t earning money.

Add-ons, Endorsements, and Riders

Guaranteed Auto Protection (GAP) – Car insurance that pays the difference between the value or actual cash value of a damaged or stolen vehicle and the amount owed on the car, usually under a loan or lease.

Personal Umbrella Policy (PUP) – This car insurance option provides a stack of high limits of liability to protect an insured motorist against a catastrophic liability loss such as bodily injury, property damage, personal injury, and even libel.

Rental Reimbursement – A car insurance coverage with additional coverage in case a motorist has paid additional costs for a car rental.

Emergency Roadside Assistance – Most car insurance companies provide this. This is a car insurance coverage perk that sends out locksmiths and towtrucks in case a motorist is stranded on a roadway. Most insurance companies don’t require a deductible.

Mechanical Breakdown Insurance – Often referred to as Equipment Breakdown Insurance, this car insurance endorsement is for loss due to mechanical or electrical breakdown of a motor vehicle.

Non-Owner Car Insurance – Simply put, this is car insurance coverage for a motorist who has liability insurance but does not own a car.

Modified Car Insurance Coverage – High-performance parts and custom paint jobs are covered by Modified Car insurance coverage. Alert your car insurance company that your car is custom-built.

Classic Car Insurance – Classic cars can be treasures to gear-heads. The parts are just as rare and require costly repair if damaged. Classic Car Insurance covers those high costs.

Pay-As-You-Drive or Usage-Based Car Insurance – Car insurance coverage that’s determined by how much you drive your car.

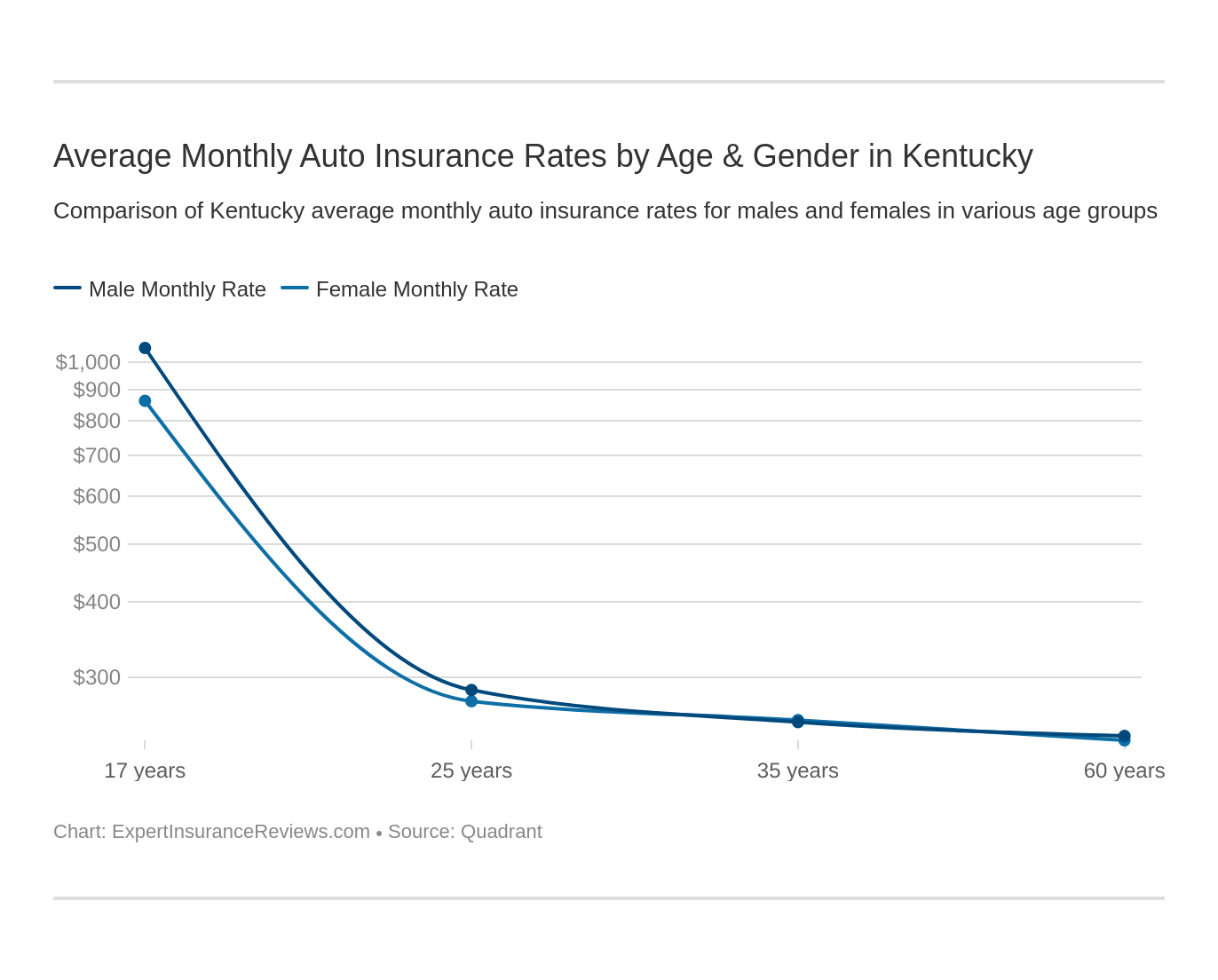

Average Car Insurance Rates by Age & Gender in KY

Age, gender, and marital status can determine how much you’ll pay for car insurance rates per year. The reasons for these rates are based on statistical information collected each year. Let’s look at some data that’s already been collected for you and see what your estimate would likely be based on age, gender, and marital status.

| Company | Single 17-year old female annual rates | Single 17-year old male annual rates | Single 25-year old female annual rates | Single 25-year old male annual rates | Married 35-year old female annual rates | Married 35-year old male annual rates | Married 60-year old female annual rates | Married 60-year old male annual rates |

|---|---|---|---|---|---|---|---|---|

| Allstate | $15,246.63 | $17,008.49 | $4,461.82 | $4,687.35 | $4,071.95 | $4,017.67 | $3,708.46 | $3,948.99 |

| GEICO | $7,644.91 | $9,029.89 | $3,057.23 | $2,637.75 | $3,752.09 | $3,471.17 | $3,923.45 | $3,552.25 |

| SAFECO Ins Co of IL | $13,306.20 | $14,712.30 | $3,363.97 | $3,478.61 | $3,231.71 | $3,507.83 | $2,759.05 | $3,088.10 |

| Nationwide | $8,821.28 | $10,924.10 | $4,475.85 | $4,664.48 | $3,944.67 | $3,921.87 | $3,563.85 | $3,709.70 |

| Progressive | $13,086.14 | $14,834.10 | $3,266.78 | $3,326.24 | $2,630.46 | $2,493.44 | $2,369.27 | $2,374.60 |

| State Farm | $6,057.12 | $7,621.54 | $2,389.96 | $2,643.11 | $2,146.67 | $2,146.67 | $1,914.73 | $1,914.73 |

| Travelers | $13,524.14 | $21,804.08 | $2,862.77 | $3,307.23 | $2,737.32 | $2,786.72 | $2,693.47 | $2,697.68 |

| USAA | $5,187.97 | $5,460.08 | $2,447.73 | $2,681.40 | $1,936.64 | $1,940.60 | $1,749.37 | $1,779.35 |

Kentucky has some of the highest car insurance rates. For 17-year-old males and females, the annual rate is estimated at over $10,000. Based on the table, single males pay a considerable amount compared to single female drivers. Allstate and State Farm appear to charge the same rate for married 35-year-old females and males.

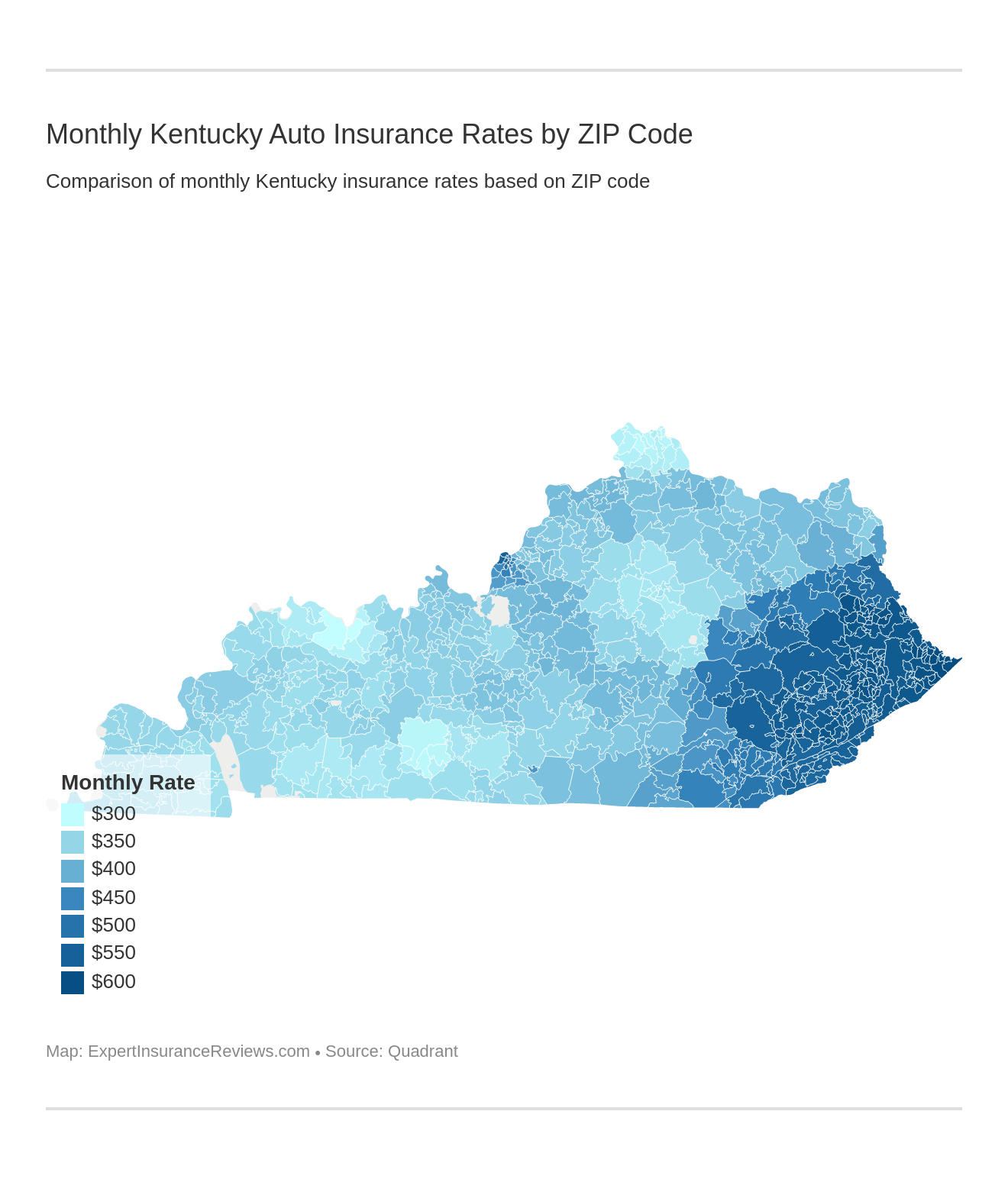

Cheapest Rates by Kentucky ZIP Code

This is the most comprehensive table in this guide. Each company estimates annual premiums by ZIP code.

Type in your ZIP code to see the annual average in your local area.

| Zipcode | Annual Average | Allstate P&C | GEICO General | SAFECO Ins Co of IL | Nationwide Mutual | Progressive Direct | State Farm Mutual Auto | Travelers Home & Marine Ins Co | USAA |

|---|---|---|---|---|---|---|---|---|---|

| 41542 | $7,400.56 | $9,325.93 | $5,389.80 | $8,923.18 | $7,751.63 | $10,347.14 | $4,000.25 | $9,873.28 | $3,593.27 |

| 40844 | $7,317.50 | $10,817.28 | $5,389.80 | $6,896.71 | $7,741.01 | $10,347.14 | $4,278.19 | $9,882.63 | $3,187.20 |

| 41558 | $7,283.52 | $9,326.13 | $5,389.80 | $9,178.35 | $7,751.63 | $9,091.55 | $3,778.83 | $10,158.57 | $3,593.27 |

| 41524 | $7,275.01 | $9,326.23 | $5,389.80 | $9,178.35 | $7,751.63 | $9,087.24 | $4,000.25 | $9,873.28 | $3,593.27 |

| 41535 | $7,270.10 | $9,326.04 | $5,389.80 | $9,178.35 | $7,751.63 | $8,762.94 | $4,000.25 | $10,158.57 | $3,593.27 |

| 41566 | $7,251.41 | $9,326.19 | $5,389.80 | $9,178.35 | $7,751.63 | $9,132.80 | $3,765.99 | $9,873.28 | $3,593.27 |

| 41547 | $7,246.33 | $9,326.26 | $5,389.80 | $9,178.35 | $7,751.63 | $8,987.16 | $4,000.25 | $9,743.96 | $3,593.27 |

| 41528 | $7,245.89 | $9,326.13 | $5,389.80 | $9,178.35 | $7,751.63 | $9,024.73 | $3,829.94 | $9,873.28 | $3,593.27 |

| 41567 | $7,244.84 | $9,326.06 | $5,389.80 | $9,178.35 | $7,751.63 | $9,088.83 | $3,757.47 | $9,873.28 | $3,593.27 |

| 41519 | $7,238.28 | $9,326.05 | $5,389.80 | $9,178.35 | $7,751.63 | $8,771.70 | $3,736.89 | $10,158.57 | $3,593.27 |

| 41543 | $7,238.19 | $9,326.07 | $5,389.80 | $9,178.35 | $7,751.63 | $9,035.63 | $3,757.47 | $9,873.28 | $3,593.27 |

| 41568 | $7,228.16 | $9,326.30 | $5,389.80 | $9,178.35 | $7,751.63 | $8,995.38 | $3,846.58 | $9,743.96 | $3,593.27 |

| 41544 | $7,221.29 | $9,326.09 | $5,389.80 | $9,178.35 | $7,751.63 | $9,022.22 | $3,765.05 | $9,743.96 | $3,593.27 |

| 41553 | $7,220.98 | $9,326.22 | $5,389.80 | $9,178.35 | $7,751.63 | $9,002.91 | $3,781.73 | $9,743.96 | $3,593.27 |

| 41861 | $7,198.39 | $9,326.25 | $5,389.80 | $8,883.00 | $8,131.63 | $8,383.90 | $4,278.19 | $10,158.57 | $3,035.80 |

| 41810 | $7,193.17 | $9,325.93 | $5,389.80 | $8,806.65 | $7,751.63 | $10,347.14 | $4,000.25 | $8,686.32 | $3,237.61 |

| 41531 | $7,177.02 | $9,326.06 | $5,389.80 | $9,178.35 | $7,751.63 | $8,675.65 | $3,757.47 | $9,743.96 | $3,593.27 |

| 41564 | $7,174.13 | $9,326.06 | $5,389.80 | $9,178.35 | $7,751.63 | $8,409.70 | $4,000.25 | $9,743.96 | $3,593.27 |

| 41859 | $7,162.04 | $9,326.25 | $5,389.80 | $8,554.35 | $8,131.63 | $8,421.70 | $4,278.19 | $10,158.57 | $3,035.80 |

| 41555 | $7,127.30 | $9,326.13 | $5,389.80 | $8,093.38 | $7,751.63 | $8,948.17 | $3,757.47 | $10,158.57 | $3,593.27 |

| 41214 | $7,125.42 | $10,629.49 | $5,389.80 | $8,729.80 | $7,784.77 | $7,207.78 | $4,000.25 | $9,894.25 | $3,367.20 |

| 41554 | $7,117.75 | $9,326.11 | $5,389.80 | $8,093.38 | $7,751.63 | $9,099.82 | $3,755.53 | $10,158.57 | $3,367.20 |

| 41862 | $7,107.14 | $9,326.21 | $5,389.80 | $8,883.00 | $8,131.63 | $7,766.47 | $4,165.60 | $10,158.57 | $3,035.80 |

| 41650 | $7,102.07 | $9,326.06 | $5,389.80 | $8,883.00 | $7,751.63 | $8,535.76 | $4,000.25 | $9,894.25 | $3,035.80 |

| 41612 | $7,098.25 | $9,326.22 | $5,389.80 | $8,883.00 | $7,751.63 | $8,525.99 | $4,000.25 | $9,873.28 | $3,035.80 |

| Zipcode | Annual Average | Allstate P&C | GEICO General | SAFECO Ins Co of IL | Nationwide Mutual | Progressive Direct | State Farm Mutual Auto | Travelers Home & Marine Ins Co | USAA |

|---|---|---|---|---|---|---|---|---|---|

| 42303 | $3,562.72 | $4,894.74 | $4,177.89 | $4,267.76 | $3,174.52 | $3,372.89 | $2,328.08 | $3,880.49 | $2,405.40 |

| 42301 | $3,571.06 | $4,962.27 | $4,177.89 | $4,267.76 | $3,174.52 | $3,265.90 | $2,304.98 | $3,792.76 | $2,622.36 |

| 41042 | $3,667.47 | $5,169.31 | $3,607.82 | $4,671.32 | $3,295.40 | $3,880.07 | $2,432.31 | $3,846.10 | $2,437.41 |

| 42104 | $3,669.25 | $5,090.36 | $4,157.73 | $3,952.91 | $3,991.16 | $3,550.29 | $2,243.85 | $3,879.21 | $2,488.47 |

| 42101 | $3,691.47 | $5,132.74 | $4,157.73 | $4,003.44 | $3,991.16 | $3,779.35 | $2,271.88 | $3,706.98 | $2,488.47 |

| 42103 | $3,701.92 | $4,955.63 | $4,157.73 | $3,952.91 | $3,991.16 | $3,623.22 | $2,265.74 | $3,950.71 | $2,718.29 |

| 41075 | $3,704.38 | $5,266.80 | $3,564.80 | $4,662.19 | $3,295.40 | $3,630.90 | $2,325.07 | $4,480.98 | $2,408.90 |

| 41017 | $3,708.93 | $5,213.30 | $3,607.82 | $4,705.18 | $3,295.40 | $3,922.88 | $2,596.52 | $3,705.32 | $2,625.00 |

| 41073 | $3,717.46 | $5,324.49 | $3,564.80 | $4,792.75 | $3,295.40 | $4,128.84 | $2,406.29 | $3,818.18 | $2,408.90 |

| 41076 | $3,732.13 | $5,285.03 | $3,777.08 | $5,060.59 | $3,295.40 | $3,704.06 | $2,311.51 | $3,934.80 | $2,488.60 |

| 42274 | $3,743.65 | $5,090.36 | $4,157.73 | $4,079.66 | $3,991.16 | $3,578.91 | $2,281.94 | $4,214.74 | $2,554.68 |

| 41051 | $3,746.40 | $5,205.18 | $3,777.08 | $4,479.45 | $3,578.03 | $3,874.43 | $2,507.44 | $3,924.62 | $2,625.00 |

| 41005 | $3,753.36 | $5,257.11 | $3,930.87 | $4,679.08 | $3,295.40 | $4,046.37 | $2,422.85 | $4,141.93 | $2,253.31 |

| 41018 | $3,759.97 | $5,195.10 | $3,607.82 | $4,679.05 | $3,295.40 | $3,800.94 | $2,456.10 | $4,588.23 | $2,457.16 |

| 42376 | $3,763.32 | $5,362.88 | $4,177.89 | $4,739.30 | $3,174.52 | $3,373.38 | $2,365.74 | $4,296.93 | $2,615.92 |

| 41071 | $3,770.88 | $5,267.71 | $3,564.80 | $4,805.39 | $3,295.40 | $4,169.20 | $2,385.68 | $3,995.49 | $2,683.35 |

| 41048 | $3,772.80 | $5,374.44 | $3,930.87 | $4,408.36 | $3,295.40 | $3,875.79 | $2,526.28 | $4,333.89 | $2,437.41 |

| 42355 | $3,773.20 | $5,078.68 | $4,177.89 | $4,421.67 | $3,174.52 | $3,477.97 | $2,448.24 | $4,790.72 | $2,615.92 |

| 42122 | $3,780.86 | $5,090.46 | $4,157.73 | $3,952.91 | $3,991.16 | $3,627.27 | $2,331.38 | $4,710.39 | $2,385.58 |

| 41074 | $3,782.52 | $5,580.14 | $3,564.80 | $4,674.83 | $3,295.40 | $4,129.47 | $2,416.64 | $4,189.95 | $2,408.90 |

| 41085 | $3,788.09 | $5,285.03 | $3,777.08 | $5,060.59 | $3,295.40 | $3,833.36 | $2,325.00 | $4,239.68 | $2,488.60 |

| 41080 | $3,789.43 | $5,285.00 | $3,930.87 | $4,679.08 | $3,295.40 | $3,964.92 | $2,602.70 | $4,304.17 | $2,253.31 |

| 41015 | $3,796.57 | $5,250.89 | $3,777.08 | $5,060.59 | $3,295.40 | $3,923.59 | $2,568.22 | $4,118.41 | $2,378.38 |

| 41091 | $3,805.01 | $5,179.68 | $3,930.87 | $4,637.12 | $3,578.03 | $4,137.15 | $2,394.69 | $4,250.58 | $2,331.94 |

| 41001 | $3,816.37 | $5,303.71 | $3,930.87 | $4,580.14 | $3,578.03 | $4,058.63 | $2,427.24 | $4,103.96 | $2,548.39 |

The only car insurance provider with premiums under $3,000 is USAA. USAA is only available to military personnel, active members of the U.S. military, and immediate family of military members.

Cheapest Rates by Kentucky Cities

Some counties and small towns share the same zip codes, so let’s broaden the spectrum just a little and look at the annual coverage rates by city.

| City | Annual Average |

|---|---|

| OWENSBORO | $3,566.89 |

| FLORENCE | $3,667.47 |

| BOWLING GREEN | $3,687.55 |

| FORT THOMAS | $3,704.38 |

| FT MITCHELL | $3,708.93 |

| BELLEVUE | $3,717.46 |

| ROCKFIELD | $3,743.65 |

| INDEPENDENCE | $3,746.40 |

| BURLINGTON | $3,753.36 |

| ERLANGER | $3,759.98 |

| UTICA | $3,763.32 |

| HEBRON | $3,772.81 |

| MACEO | $3,773.20 |

| ALVATON | $3,780.86 |

| DAYTON | $3,782.52 |

| SILVER GROVE | $3,788.09 |

| PETERSBURG | $3,789.43 |

| LATONIA | $3,796.57 |

| UNION | $3,805.01 |

| ALEXANDRIA | $3,816.37 |

| PHILPOT | $3,822.12 |

| CALIFORNIA | $3,833.23 |

| MORNING VIEW | $3,846.10 |

| MELBOURNE | $3,846.51 |

| HENDERSON | $3,847.99 |

| City | Annual Average |

|---|---|

| LOOKOUT | $7,400.56 |

| HOSKINSTON | $7,317.50 |

| RANSOM | $7,283.52 |

| FEDSCREEK | $7,275.01 |

| HUDDY | $7,270.11 |

| STEELE | $7,251.41 |

| MAJESTIC | $7,246.33 |

| FREEBURN | $7,245.89 |

| STONE | $7,244.84 |

| CANADA | $7,238.28 |

| MC ANDREWS | $7,238.19 |

| STOPOVER | $7,228.16 |

| MC CARR | $7,221.29 |

| PHELPS | $7,220.98 |

| RAVEN | $7,198.39 |

| CROMONA | $7,193.17 |

| HARDY | $7,177.02 |

| SIDNEY | $7,174.13 |

| DEMA | $7,162.04 |

| PINSONFORK | $7,127.30 |

| DEBORD | $7,125.42 |

| PHYLLIS | $7,117.75 |

| TOPMOST | $7,107.14 |

| MELVIN | $7,102.07 |

| BYPRO | $7,098.25 |

The city with the cheapest average annual rate is Owensboro, and the most expensive city is Lookout.

Best Car Insurance Companies in Kentucky

Car insurance companies are rated on their performance by agencies that record customer satisfaction throughout the year. We’ll look at two of those agencies and they rate car insurance companies in Kentucky. Of course, all car insurance companies in Kentucky may not make the list.

Largest Companies Financial Rating

A.M. Best is one of the insurance rating agencies that grade car insurance companies’ overall financial performance, market share, and loss ratio. Here are there results.

Top Agencies' Monthly Financial Rankings

| Insurance Company | A.M. Best | Premiums Written | Market Share | Loss Ratio |

|---|---|---|---|---|

| A+ | $83,243.00 | 0.95% | 4.64% | |

| A+ | $96,155.00 | 1.10% | 5.41% |

| A | $16,014.00 | 0.18% | 6.18% | |

| A++ | $58,908.00 | 0.67% | 6.19% | |

| A | $35,342.00 | 0.40% | 5.09% |

| A+ | $65,509.00 | 0.75% | 5.00% |

| A+ | $72,965.00 | 0.83% | 4.88% | |

| B | $148,326.00 | 1.70% | 5.31% | |

| A++ | $27,997.00 | 0.32% | 5.20% | |

| A++ | $24,957.00 | 0.29% | 6.00% |

All of the car insurance companies with the exception of GEICO have an “A” or higher rating, which indicates excellent or superior ability to meet insurance obligations. For a full summary of how A.M. Best rates car insurance companies, visit their financial strength rating publication.

Companies with the Best Rating

J.D. Power rates a car insurance company’s overall customer satisfaction. Their rating is based on a 1,000 point scale and their circle rating system. Here J.D. Power’s results.

| Company | Points (based on a 1,000-point scale) | Circle Ratings |

|---|---|---|

| Alfa Insurance | 829 | 3 |

| Allstate | 830 | 3 |

| Auto-Owners Insurance | 842 | 4 |

| Farm Bureau Insurance - Tennessee | 884 | 5 |

| GEICO | 839 | 3 |

| KY Farm Bureau | 824 | 3 |

| Liberty Mutual | 814 | 2 |

| MetLife | 796 | 2 |

| National General | 810 | 2 |

| Nationwide | 823 | 3 |

| NC Farm Bureau | 839 | 3 |

| Progressive | 830 | 3 |

| Safeco | 820 | 3 |

| State Farm | 821 | 3 |

| Travelers | 822 | 3 |

| USAA* | 894 | 5 |

| Southeast Region | 832 | 3 |

Read more: What types of car insurance coverage does National General offer?

J.D. Power rates car insurance companies by region. In the southeast, the best customer satisfaction would go to USAA followed by Farm Bureau Insurance – Tennessee, and GEICO. The Southeast Region, in its entirety, scored 832 and three circles. This means most consumers are moderately satisfied with their car insurance company.

Companies with the Most Complaints in Kentucky

Car insurance companies are not without fault. Any good car insurance company will have its share of consumer complaints. Complaints open an opportunity to improve policies or customer-company relations.

| Company | National Median Complaint Ratio | Company Complaint Ratio 2017 | Total Complaints 2017 |

|---|---|---|---|

| Acuity | 1.00 | 0.26 | 5 |

| Alfa | 1.00 | 0.16 | 1 |

| Allstate | 1.00 | 0.50 | 163 |

| American Family | 1.00 | 0.79 | 73 |

| Amica | 1.00 | 0.46 | 52 |

| Amtrust | 1.00 | 0.00 | 2 |

| Arbella | 1.00 | 1.33 | 48 |

| Auto Club Enterprises | 1.00 | 0.69 | 18 |

| Auto-Owners | 1.00 | 0.53 | 31 |

| Automobile Club | 1.00 | 0.78 | 9 |

| Bear River | 1.00 | 0.00 | 0 |

| Center | 1.00 | 0.00 | 0 |

| Co Operative | 1.00 | 0.00 | 0 |

| Consumers | 1.00 | 0.10 | 5 |

| Country | 1.00 | 0.44 | 15 |

| CSAA | 1.00 | 3.97 | 6 |

| De Smet | 1.00 | 0.00 | 0 |

| Erie | 1.00 | 0.70 | 22 |

| Farm Bureau | 1.00 | 0.37 | 2 |

| Farmers | 1.00 | 0.00 | 0 |

| Farmers | 1.00 | 0.59 | 7 |

| Frankenmuth | 1.00 | 0.27 | 4 |

| Georgia Farm Bureau | 1.00 | 0.00 | 0 |

| Goauto | 1.00 | 1.93 | 25 |

| Government Employees | 1.00 | 0.68 | 333 |

| Grange | 1.00 | 0.62 | 10 |

| Grinnell | 1.00 | 0.07 | 1 |

| Hartford Fire | 1.00 | 4.68 | 9 |

| Horace Mann | 1.00 | 0.79 | 11 |

| IMT | 1.00 | 3.45 | 2 |

| Indiana Farm Bureau | 1.00 | 0.00 | 0 |

| Infinity Prop | 1.00 | 2.03 | 45 |

| Iowa Farm Bureau | 1.00 | 0.77 | 32 |

| Island | 1.00 | 0.00 | 0 |

| J. Whited | 1.00 | 7.43 | 253 |

| Kentucky Farm Bureau | 1.00 | 0.02 | 1 |

| Liberty | 1.00 | 5.95 | 222 |

| Mapfre | 1.00 | 6.25 | 27 |

| Mercury | 1.00 | 0.56 | 3 |

| Metropolitan | 1.00 | 1.30 | 70 |

| Michigan Farm Bureau | 1.00 | 0.26 | 8 |

| Mountain West Farm | 1.00 | 1.47 | 10 |

| MS & AD | 1.00 | 0.00 | 0 |

| Nationwide | 1.00 | 0.28 | 25 |

| New Jersey Manufacturers | 1.00 | 0.03 | 3 |

| Nodak | 1.00 | 0.00 | 0 |

| North Carolina Farm Bureau | 1.00 | 0.66 | 33 |

| NYCM | 1.00 | 0.71 | 3 |

| Oklahoma Farm Bureau | 1.00 | 0.21 | 2 |

| Palisades | 1.00 | 0.39 | 3 |

| Pemco Mut Ins Co | 1.00 | 0.14 | 4 |

| Plymouth Rock | 1.00 | 1.16 | 37 |

| Progressive | 1.00 | 0.75 | 120 |

| QBE | 1.00 | 32.86 | 4 |

| Safety | 1.00 | 0.00 | 0 |

| Safeway | 1.00 | 1.60 | 30 |

| Sentry | 1.00 | 6.53 | 1 |

| Shelter | 1.00 | 0.61 | 47 |

| Southern Farm Bureau | 1.00 | 0.00 | 3 |

| State Auto | 1.00 | 1.74 | 23 |

| State Farm | 1.00 | 0.44 | 1482 |

| Tennessee Farmers | 1.00 | 0.67 | 39 |

| Texas Farm Bureau | 1.00 | 0.16 | 3 |

| The Hanover | 1.00 | 2.43 | 16 |

| Tiptree Fin | 1.00 | 0.55 | 2 |

| Tokio Marine Holdings | 1.00 | 0.71 | 1 |

| Travelers | 1.00 | 0.09 | 2 |

| United Serv Automobile | 1.00 | 0.74 | 296 |

| Vermont | 1.00 | 0.26 | 2 |

| Virginia Farm Bureau | 1.00 | 0.69 | 1 |

| West Bend | 1.00 | 0.33 | 6 |

| Westfield | 1.00 | 0.75 | 7 |

Read more:

- Acuity Insurance Review & Complaints: Auto, Home & Business Insurance

- Alfa Insurance Review & Complaints: Home, Auto & Life Insurance

- Arbella Insurance Review & Complaints: Auto, Home & Business Insurance

- Central Mutual Insurance Review & Complaints: Home, Auto & Business Insurance

- GoAuto Insurance Review & Complaints: Car Insurance

- Plymouth Rock Assurance Insurance Review & Complaints: Auto & Home Insurance

- Grinnell Mutual Insurance Review & Complaints: Auto, Home, Business & Farm Insurance

State Farm has the most complaints with over 1482 complaints in 2017. Several companies have no complaints. To see which companies have no complaints sort the table, click the down arrow on the right side of Total Complaints 2017.

Cheapest Car Insurance Companies in Kentucky

Let’s compare the cheapest rates by the company.

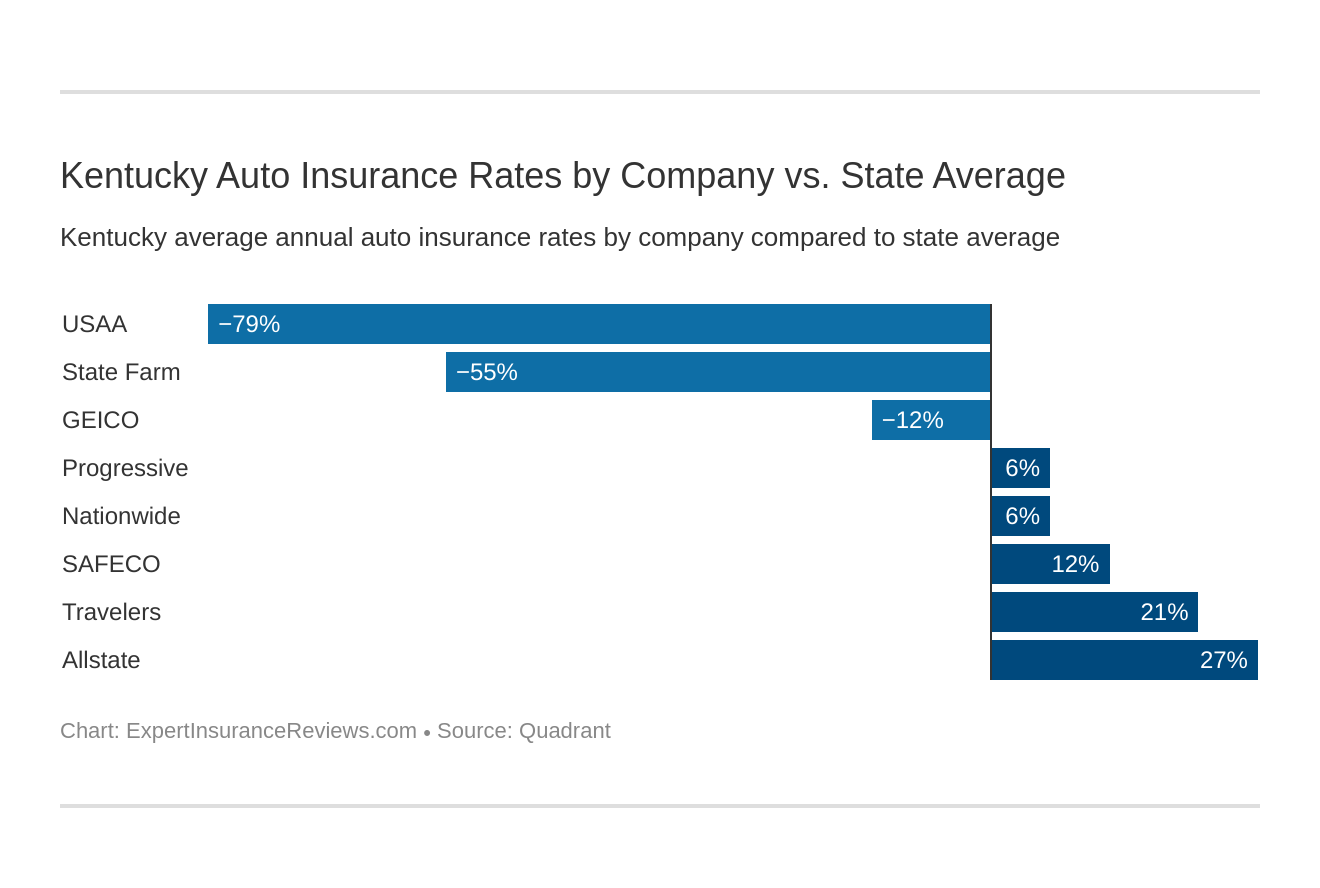

| Company | Annual Average | Compared to State Average | Compared to State Average % |

|---|---|---|---|

| Allstate | $7,144 | $1,949 | 27.28% |

| GEICO | $4,634 | -$562 | -12.12% |

| Nationwide | $5,503 | $308 | 5.59% |

| Progressive | $5,548 | $352 | 6.35% |

| SAFECO | $5,931 | $736 | 12.40% |

| State Farm | $3,354 | -$1,841 | -54.89% |

| Travelers | $6,552 | $1,356 | 20.70% |

| USAA | $2,898 | -$2,298 | -79.28% |

The negative values represent the values less than the state average. For example, State Farm car insurance rates in Kentucky is $1,841 less than the Kentucky average annual rate. When measured by percentage, State Farm is 55 percent less than the Kentucky average annual rate.

Commute Rates by Companies

Car insurance rates can be determined by the number of estimated miles you’ll drive throughout the year.

| Company | 10 miles commute. 6,000 annual mileage. | 25 miles commute. 12,000 annual mileage. |

|---|---|---|

| Allstate | $7,144 | $7,144 |

| Travelers | $6,552 | $6,552 |

| Liberty Mutual | $5,931 | $5,931 |

| Progressive | $5,548 | $5,548 |

| Nationwide | $5,503 | $5,503 |

| GEICO | $4,591 | $4,677 |

| State Farm | $3,270 | $3,438 |

| USAA | $2,790 | $3,006 |

Most companies charge the same rate despite how many miles you travel during the year. GEICO, State Farm, and USAA, are the only companies in the table with rates depending on how much travel throughout the year.

Coverage Level Rates by Companies

Car insurance companies have different coverage rates. In other words, liability may be considered a low coverage rate for car insurance policyholders. Medium coverage could be a combination of liability and collision. And high level or full coverage is the complete insurance policy.

| Company | Annual Average with Low Coverage | Annual Average with Medium Coverage | Annual Average with High Coverage |

|---|---|---|---|

| Allstate | $6,432 | $7,101 | $7,898 |

| GEICO | $4,293 | $4,613 | $4,994 |

| Liberty Mutual | $5,605 | $5,888 | $6,300 |

| Nationwide | $5,426 | $5,530 | $5,554 |

| Progressive | $5,072 | $5,457 | $6,113 |

| State Farm | $3,152 | $3,348 | $3,563 |

| Travelers | $6,208 | $6,578 | $6,869 |

| USAA | $2,760 | $2,891 | $3,043 |

Low coverage rates are the cheapest in the table, however, a motorist may be able to save more money if they switch to medium or high coverage. How so?

Take Nationwide for example. The low, medium and high coverage are separated by an amount less than $200. It may be more efficient to spend those extra dollars to make sure you’re covered completely.

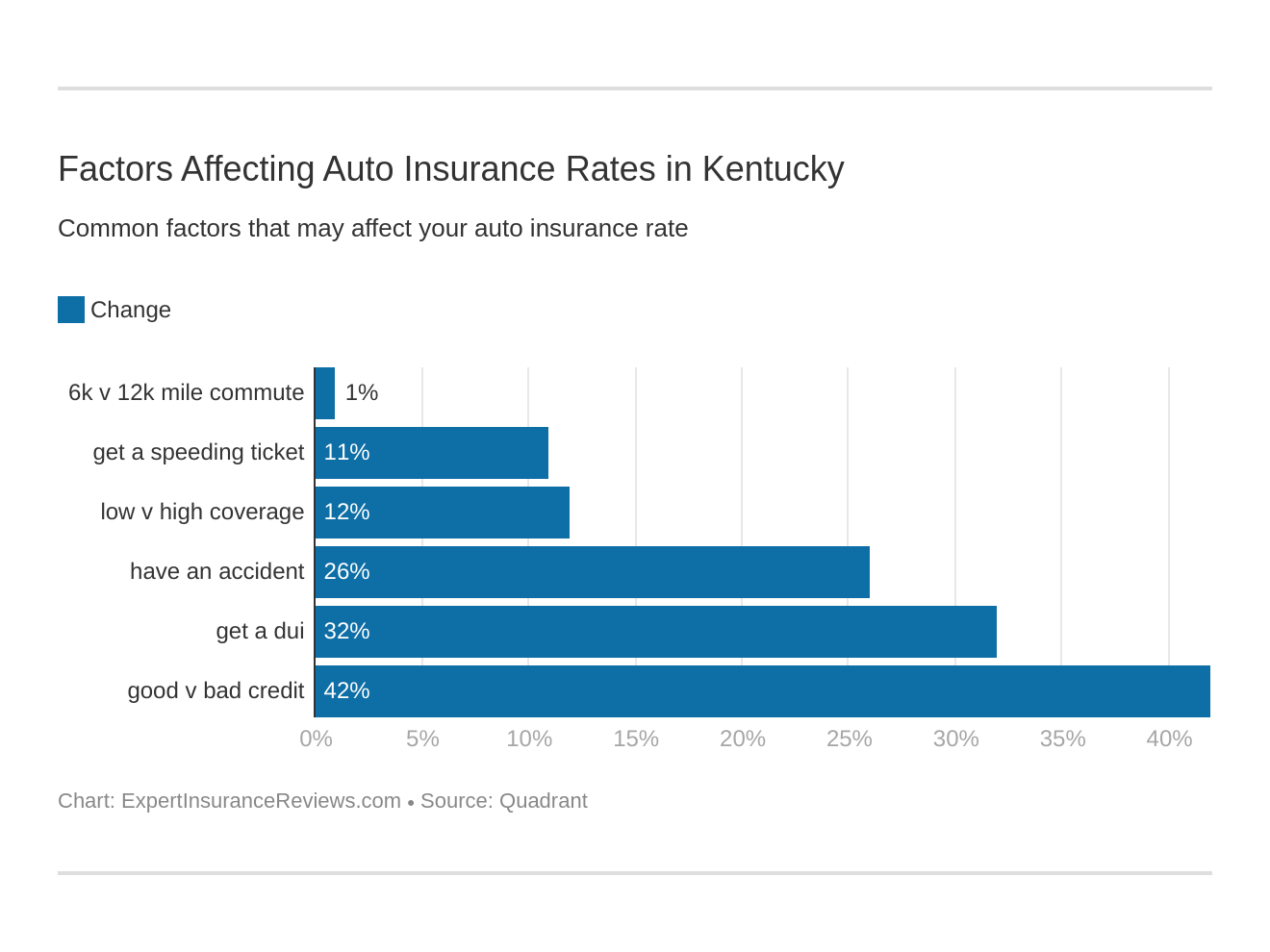

Credit History Rates by Companies

There are two ways a car insurance company reviews your credit.

The first is your credit score, and the second is your insurance credit score (reputation). Insurance credit score judges a policyholder.

If you were known for missing premium payments or your policy was canceled with a previous car insurance provider, a car insurance company may estimate a higher than average rate.

However, if a car insurance provider wants your credit score, here are some average annual rates you can face based on credit.

| Company | Annual Average with Poor Credit | Annual Average with Fair Credit | Annual Average with Good Credit |

|---|---|---|---|

| Allstate | $9,533.35 | $6,508.38 | $5,390.03 |

| GEICO | $7,618.30 | $3,803.71 | $2,478.76 |

| Liberty Mutual | $8,498.13 | $5,201.15 | $4,093.63 |

| Nationwide | $6,719.07 | $5,248.71 | $4,541.89 |

| Progressive | $6,192.39 | $5,408.23 | $5,042.27 |

| State Farm | $4,832.88 | $2,933.18 | $2,296.89 |

| Travelers | $7,311.83 | $6,182.66 | $6,160.53 |

| USAA | $4,306.41 | $2,416.87 | $1,970.40 |

With poor credit, the estimated price for car insurance will be expensive. Even those with fair credit will see a hefty price tag for car insurance.

Driving Record Rates by Companies

A driving record could determine how much your annual rates will be, also. Driving records with accidents, DUIs, or speeding violations could increase your coverage rates. The information below will show you estimated rates for a clean record, a DUI record, a car accident on your record, and a speeding violation on your record.

| Group | Clean Record | With 1 Accident | With 1 DUI | With 1 Speeding Violation |

|---|---|---|---|---|

| Allstate | $5,911 | $7,725 | $8,261 | $6,679 |

| GEICO | $2,766 | $4,913 | $7,467 | $3,388 |

| Liberty Mutual | $4,938 | $7,618 | $5,913 | $5,255 |

| Nationwide | $4,358 | $5,663 | $7,184 | $4,808 |

| Progressive | $4,580 | $6,816 | $5,224 | $5,570 |

| State Farm | $3,079 | $3,630 | $3,354 | $3,354 |

| Travelers | $5,703 | $5,869 | $8,514 | $6,121 |

| USAA | $2,182 | $3,088 | $3,694 | $2,628 |

Motorists are almost rewarded for a clean driving record. Once a motorist has a car accident or has a driving violation, car insurance companies will likely increase their premiums. Ask your car insurance provider about the accident or traffic violation forgiveness perk.

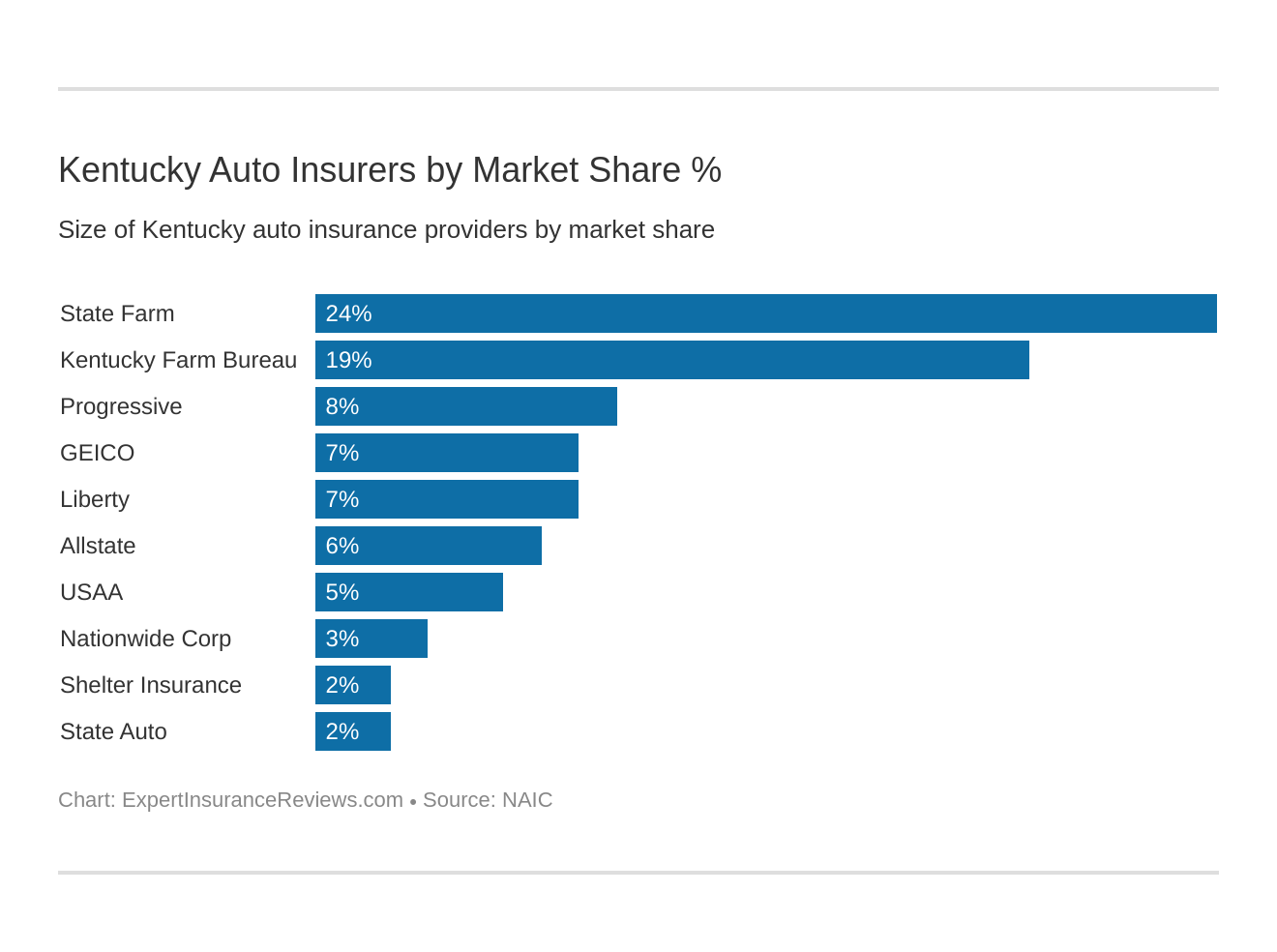

Largest Car Insurance Companies in Kentucky

The information below is a more concentrated view of Kentucky’s car insurance companies. It measures the size of a car insurance company by direct premiums written, loss ratio and market share in Kentucky.

| Rank | Company Group/group/code Company Name | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|---|

| 6 | Allstate | $190,422 | 50.09% | 6.28% |

| 4 | GEICO | $212,468 | 74.56% | 7.01% |

| 2 | Kentucky Farm Bureau | $566,603 | 75.94% | 18.70% |

| 5 | Liberty Mutual | $206,822 | 59.60% | 6.82% |

| 8 | Nationwide | $88,331 | 57.90% | 2.91% |

| 3 | Progressive | $240,000 | 58.90% | 7.92% |

| 9 | Shelter Insurance | $57,753 | 63.96% | 1.91% |

| 10 | State Auto Mutual | $56,056 | 72.38% | 1.85% |

| 1 | State Farm | $714,964 | 65.70% | 23.59% |

| 7 | USAA* | $152,259 | 76.42% | 5.02% |

| State Totals | $3,030,463 | 67.00% | 100.00% |

State Farm and the Kentucky Farm Bureau are the largest car insurance companies in Kentucky with a percentage between 64 and 76 percent. (For more information, read our “Kentucky Farm Bureau Insurance Review & Complaints: Home, Life, Auto, Farm, Business & Health Insurance“).

Number of Insurers in Kentucky

Insurers are technically a company that covers a motorist in case of a car accident or other related event that causes property damage or injury.

Insurers create insurance quotes, sell policies, manage claims filed by policyholders, and provide coverage through financial compensation if necessary.

There are two types of insurers: domestic and foreign. Domestic insurers follow the laws of in-state law. Foreign insurers follow the laws of out-state law,

Kentucky Number of Insurers

| Insurer Type | # of Insurers |

|---|---|

| Domestic | 7 |

| Foreign | 990 |

| Total | 997 |

Foreign insurers greatly outnumber domestic insurers in Kentucky.

Your one-stop online insurance guide. Get free quotes now! Secured with SHA-256 Encryption

Kentucky State Laws

No one can memorize all the laws of Kentucky. It goes without saying, but there are several laws you should be familiar with as a Kentucky motorist.

Kentucky Car Insurance Laws

Car insurance laws have their own section in most U.S. laws across the nation. Some laws are broad, meaning they share the same principles as other states in the nation. Some laws are specific to Kentucky. In this section, we’ll talk about those car insurance laws.

How Kentucky Laws for Insurance are Determined

The National Association of Insurance Commissioners reported Kentucky’s current law as a flex-rating. This allows an insurer to adjust its rates unless the percentage change is above a certain margin.

Windshield Coverage

One of Kentucky’s car insurance laws says that any car insurance policy that offers comprehensive coverage shall provide coverage for repair or a replacement of damaged safety equipment without any deductible. (For more information, read our “Does my car insurance cover damage to my windshield?“).

If your windshield is damaged, your car insurance company without charging the policyholder a deductible.

High-Risk Insurance

Motorists who are unable to find car insurance through normal means will have to get high-risk car insurance.

In Kentucky, the high-risk insurance option is a program called the Kentucky Automobile Insurance Plan (KYAIP or KAIP). Anyone with a record of traffic violations, car accidents or DUIs are considered high-risk drivers. A high-risk driver can eligible only after each option car insurance option has been exhausted.

KYAIP is not a car insurance provider. The program assigns a motorist to a provider that offers a policy for the high-risk driver. The rates for each policy varies.

Low-Cost Insurance

There isn’t a program designed for low-cost car insurance. The best method to find cheap car insurance is to browse through the estimates in this guide to find the most cost-efficient option. So far, we’ve seen annual premiums for minimum coverage at $500 or more. The more you need, the more you’ll pay for coverage.

Automobile Insurance Fraud in Kentucky

Car insurance fraud is collecting any claim from an insurance company under false pretenses. Dan Carman, a law attorney of Lexington, Kentucky stated:

“Under Kentucky law, someone convicted of a ‘fraudulent insurance act’ where the value of the fraud is $500 or less is guilty of a misdemeanor which can result in a prison sentence of up to one year or a fine of up to $1,000, or both, plus be ordered to pay restitution.

“If the value of the fraud is more than $500, the crime is a felony which can result in a prison sentence of from one to five years, a fine of up to $10,000 or both, plus restitution.

“If one is found guilty of engaging in a criminal syndicate (a group of five or more people working together to promote or engage in a fraudulent insurance act) or acts to facilitate insurance fraud by such a syndicate, he or she could be sentenced to prison for 10 to 20 years, pay a fine of $10,000, or both, plus be ordered to pay restitution.”

Car insurance fraud is not a victimless crime, and the state of Kentucky pursues all cases of insurance fraud.

To report any occurrences of fraud, contact the Kentucky Insurance Department’s fraud division.

Phone : 502-564-1461

Fax : 502-564-1464

Mailing : 909 Leawood Dr., P.O. Box 4050, Frankfort, Kentucky 40604-4050

Email : Insurance Fraud Investigation

Statute of Limitations

The statute of limitations is the duration in which policyholders can file a claim or pursue a legal case against another driver. Most claims and legal pursuits involve bodily injury, medical bills and property damage.

Always consult an attorney when you’re not sure about how to go about filing a claim or pursuing a legal case. This video will provide some insight on how to proceed.

The statute of limitations of Kentucky property damage and bodily injury are as follows:

- one year for bodily or personal injury

- two years for property damage

If you want to pursue a case or file a claim in the state of Kentucky, do it as soon as possible. The statute of limitations begins the moment the event happens not the moment you report it.

Kentucky’s Specific Laws

Kentucky has a number of sensible vehicle laws. One of Kentucky’s laws can be a bit laughable, though. Did you know it’s illegal to hunt or shoot game outside the window of a moving vehicle? If you’re shooting at a whale while the vehicle is moving, it’s legal.

Kentucky Vehicle Licensing Laws

Licenses for motorists is verification of driving mastery. It shows that you understand the rules of the road, traffic laws, and the financial responsibility of maintaining car insurance and everyday car use.

In this section, we will explore how to obtain a Real ID, how to obtain a license in Kentucky for new residents and teen drivers, and how to reinstate your license.

The cost for a Kentucky’s driver’s license is $43. After issuing a renewed driver’s license, the Kentucky motorist will pay at least $20 for a renewed driver’s license.

Real ID

Kentucky shares the Real ID requirement as other states do. In October 2020, a standard driver’s license won’t meet federal guidelines. The REAL ID Act requires Kentucky residents to have a Real ID to board U.S. domestic flights or enter select federal facilities.

According to the Kentucky DMV website, new security standards for identity credentials were recommended by the 9/11 Commission to prevent the fraudulent use and reproduction of licenses and IDs.

For now, Kentucky residents are able to use their current driver’s license to board domestic flights and enter federal facilities.

Penalties for Driving without Insurance

You are required by Kentucky state law to carry proof of car insurance in your vehicle. If you do not have proof of car insurance, a penalty of $500 or more plus court costs between $150 and $200 will be issued. In addition, Kentucky officials can cancel your registration.

Insurers are required to provide a list of insured drivers. If the state of Kentucky does not receive notification that you have insurance, you will be sent a notice to provide proof of car insurance coverage in the next 30 days. If you fail to provide proof of car insurance in that time period, your registration will be canceled until you can provide proof.

Teen Driver Laws

Parents or legal guardians must decide when their teen is ready to drive. Drivers under 18 can’t apply for a permit or license without the signature of a parent or guardian.

Parents and legal guardians must sign an application form, accepting the responsibility that the parent and legal guardian is jointly liable with the applicant for any damages.

All applications must completed at the Circuit Court Clerk’s office so that an official can witness the signature and verify guardianship. Also, parents and legal guardians must provide a birth certificate or guardianship papers signed by a judge.

A parent or legal guardian has the right to withdraw their responsibility at any time. Withdrawal of responsibility form must be completed and submitted to the Circuit Court Clerk’s office. Once this is received and entered, the minor’s permit or license will be canceled until another application form is signed and submitted to the Circuit Clerk’s office.

Underaged Kentucky drivers must go through three phases of licensing: Learner’s Permit, Intermediate License, and finally, a Full Unrestricted License.

Before a teen driver can participate in the intermediate license phase, the parent or legal guardian must document and sign a driving log and verification form proving the teen driver has completed 60 hours of day driving practice and 10 hours of nighttime driving.

Once a teen has passed the learner’s permit phase and intermediate license phase, they’ll ready to move onto the driver education program. Teen drivers whose permits were issued under the age of 18 are required to complete a driver education program before they can move on to the full unrestricted licensing phase.

When a teen driver passes the written test, the licensed DMV examiner will forward the driver’s results to the Division of Driver Licensing to enroll in an education course in their county. These free tests are provided by the Transportation Cabinet of Kentucky. The courses last about four hours.

Older Driver License Renewal Procedures

Although many other states have specific requirements for senior drivers, the senior drivers living in the State of Kentucky have no additional requirements to renew their driver’s license.

New Residents

Any motorist who plans on living in Kentucky must obtain a Kentucky’s driver’s license within 30 days of obtaining residency in the state.

You must be a U.S. citizen to get residency in Kentucky. Drivers have to be at least 16 years old to transfer their license, also. Drivers under the age of 18 must provide a School Compliance Verification Form signed by the out-of-state driving school.

New residents must get their license from the Circuit Court Clerk’s office, which is Kentucky’s version of a state’s DMV. Be sure to bring your out-of-state driver’s license, social security card, and birth certificate to verify your identity.

If your driver’s license is current, meaning it’s not expired or suspended, you will not be required to take any tests.

However, if your license has been expired for more than a year you will have to take the written and vision tests. Also, you must provide your current driving record or letter of clearance from your former home state.

College students are allowed to drive with their out-of-state driver’s license. The requirements for college students is that they must be enrolled as a full-time or part-time student at a college, university, or technical college. Also, they must have a student identity card to verify that they’re a student.

License Renewal Procedures

The application for a renewed driver’s license is every four years and within 30 days after the birth date of the driver.

Drivers under 21 will be issued a driver’s license that’s valid until the driver turns 21. The applicant must apply for a renewal within 30 days of their 21st birthday.

Military personnel on active duty may renew their driver’s licenses by mail.

Negligent Operator Treatment System (NOTS)

Kentucky has the point system to track the negligent driver’s activity. The point system starts every Kentucky motorists with no points.

Each time a Kentucky motorist violates the law or has a car accident, points are added to the license. The Kentucky Circuit Court Clerk’s office provided how these points are accumulated which are listed in the table below.

| Points | Violation Type |

|---|---|

| 0 | 10 mph or less over? speed limit on limited access highway? |

| 0 | 15 mph or more in CMV (?out-of-state conviction-listed as serious offense only-no points) |

| 3 | 11-15 mph over speed limit on limited access highway |

| 3 | 15 mph or less over speed limit on any non-limited access highway |

| 3 | 15 mph over ?speed limit in CMV (commercial motor vehicle) |

| 3 | Stop Violation (electric signal, railroad crossing, stop sign) |

| 3 | Failure to Yield |

| 3 | Wrong Way on One-Way Street |

| 3 | Too Fast for Conditions |

| 3 | Too Slow for Conditions |

| 3 | Improper Driving |

| 3 | Improper Start |

| 3 | Improper Turn |

| 3 | Failure to Illuminate Headlights |

| 3 | Careless Driving |

| 3 | Failure to Dim Headlights |

| 3 | Improper Lane Usage |

| 3 | Improper Use Left Lane/Limited Access Highway |

| 3 | Failure to comply with Instructional Permit Requirements/Regulations |

| 3 | Failure to yield right-of-way to Funeral Procession |

| 3 | Any Other Moving Hazardous Violations |

| 3 | Texting while driving |

| 4 | Reckless Driving |

| 4 | Following Too Closely |

| 4 | Driving on Wrong Side of Roadway |

| 4 | Changing Drivers in a Moving Vehicle |

| 4 | Vehicle Not Under Control |

| 4 | Failure to Yield to Emergency Vehicle |

| 5 | Improper Passing |

| 6 | 16-25 mph over speed limit on any road or highway |

| 6 | Commission of Moving Hazardous Violation Involving an Accident |

| 6 | Combination of any Two or More Moving Hazardous Violations in Any One Continuous Occurrence |

| 6 | Failure to Stop for School or Church Bus |

| Hearing-Possible Suspension | 26 mph over speed limit on any road or highway |

| Hearing-Possible Suspension | Attempting to elude police officer |

| Hearing-Possible Suspension | Racing |

There is a range of violations that can cause you to gain points on your driver’s license. Sort through the point values by using the up and down triangles to see the most points you can earn from a single violation.

Rules of the Road

It’s important to know the rules of the road. Although some of the rules for roadways are nearly the same in other states, there are some differences. In this section, we’ll explore some of those differences Kentucky has.

Fault vs. No-Fault

Simply put, Kentucky is a “choice-no-fault” state. A choice-no-fault state means all car insurance covers things such as medical bills, lost wages and other expenses that are the result of a car accident.

No matter who is at fault for the car accident or whether you choose to have full coverage car insurance or minimum liability coverage. It’s required by the state for you to include Kentucky no-fault insurance coverage in your insurance policy.

However, motorists in Kentucky have the option to choose because Kentucky does not require motorists to carry additional liability coverages on their policies. Even though it’s not required, motorists should consider adding additional liability coverages like PIP to their policy. It’s better to be safe than sorry.

Seat Belt and Car Seat Laws

Kentucky has strict a seat belt law like many other states in the U.S. All persons in a motor vehicle must be in a seat belt. Violators of this law could be fined for each violation in the vehicle.

The primary law for a child car seat is every child less than 40 inches in height must be secured in a federally approved car seat.

Keep Right and Move Over Laws

There are keep right laws in Kentucky. Slower traffic should keep right on the road. Traffic in the left lanes should be utilizing those lanes for passing or turning left. On highways, the left lanes, or express lanes, are for faster traffic.

Kentucky law requires all motorists that approach a stationary emergency vehicle that’s displaying flashing lights, including towing and recovery vehicles, traveling in the same direction, to vacate the lane closest if safe and possible to do so, or slow to a speed safe for the road conditions, weather, and traffic conditions.

Speed Limits

With multiple types of terrain in Kentucky, there will different speed limits along the state’s roadways and highways.

The speed limit for rural, urban, and limited access roads in Kentucky is 65 mph. On some rural roads, the speed limit can reach up to 70 mph. The variation and below-average speed limits protect motorists in case of weather conditions and elevation of roadways.

Ridesharing

Ridesharing has become a new way to commute across cities across the world. Rideshare companies like Uber and Lyft require all their drivers to have car insurance coverage that aligns with or exceeds the minimum coverages (liability) mandated by state law.

Many drivers opt-out of obtaining their commercial driver’s license (CDL). Allstate, Erie, State Farm, and USAA allow ridesharer’s to enroll in policies for ridesharing purposes.

Automation on the Road

Automation on the road has become popular in the last few years. As cars become more energy-efficient, innovators have found ways to get motor vehicles to move on their own. Although these vehicles are not totally autonomous (able to move on their own without a controller), some states in the U.S. have been testing automation on the road.

Starting in March 2018, Kentucky allowed commercial vehicles to “operate in a platoon.” The carrier must provide a notification to the Department of Vehicles and the Kentucky State Police Department.

It takes up to 30 days to review the notification. After that time, the DVR will approve or reject the notification. The bill requires a driver with a CDL must operate the vehicle and each vehicle displays a mark stating that it’s part of the platoon.

Safety Laws

Safety laws are the most vital laws for motorists. Violating them can land a motorist in prison in addition to stiff fines. Let’s examine the laws involving alcohol, marijuana, and distracted driving.

DUI Laws

Kentucky is strict on motorists who commit DUI. The table below will show the various consequences of driving under the influence of alcohol.

| DUI Offense | Revocation | Imprisonment | Fine | Other |

|---|---|---|---|---|

| 1st DUI | 30-120 days | 2-30 days | $200-$500 | 90 days of alcohol or substance abuse program; possible 48 hours-30 days of community labor |

| 2nd DUI | 12-18 month suspension | 7 days-6 months | $350-$500 | 1 year alcohol or substance abuse treatment; 10 days-6 months community labor |

| 3rd DUI | 24-36 months | 30 days-12 months | $500-$1000 | 1 year alcohol or substance abuse treatment; 10 days-12 months community labor |

| 4th DUI | 60 month suspension | 120 day w/o probation min | 1 year alcohol or substance abuse treatment |

It’s important to understand that Kentucky has washout law. A washout law is when state courts forgive a DUI after ten years. However, the motorist who has the DUI cannot commit any more DUIs within that 10-year period. Committing a DUI within a 10-year period will add another offense to your criminal record.

Marijuana-Impaired Driving Laws

Marijuana has not been decriminalized in Kentucky yet. CBD oil is legal, and there’s some ambiguity surround medicinal marijuana.

There’s isn’t any law against marijuana-impaired drivers, but a law enforcement officer may stop a motorist who is under the influence of marijuana or other drugs. Any influence that impairs a driver could be a violation of safety laws in Kentucky. It’s safer to drive sober.

Distracted Driving Laws

There’s a ton of awareness on distracted driving. Many law enforcement officials and advocates against distracted driving are pushing for laws across the U.S. to ban cellphone use while driving.

Kentucky, at the moment, does not have a handheld ban for adults. However, drivers under the age of 18 are banned from using handheld devices while driving. All drivers are banned from texting and driving in the State of Kentucky.

Driving in Kentucky

Now that you’ve seen the general laws of Kentucky, let’s explore how driving is for Kentucky motorists. This section will cover some of the reasons for costly premiums from car insurance companies. From thefts to crash fatalities, driving in Kentucky has its rewards and its pitfalls.

Vehicle Theft in Kentucky

Vehicle theft is extremely inconvenient for a motorist. Car insurance companies urge policyholders to add comprehensive coverage to their policies to compensate for a vehicle that can be stolen and later damaged.

In Kentucky, there are ten vehicle models that were stolen more than any other vehicle. The table shows the top ten vehicles below.

| Rank | Car Make/Model | Year of Make/Model | # of Thefts |

|---|---|---|---|

| 1 | Chevrolet Pickup (Full Size) | 1998 | 250 |

| 2 | Ford Pickup (Full Size) | 2001 | 241 |

| 3 | Toyota Camry | 1999 | 178 |

| 4 | Chevrolet Impala | 2005 | 118 |

| 5 | Toyota Corolla | 2014 | 110 |

| 6 | Honda Accord | 1997 | 108 |

| 7 | Ford Explorer | 2000 | 99 |

| 8 | Ford Taurus | 2002 | 94 |

| 9 | Dodge Pickup (Full Size) | 2001 | 93 |

| 10 | Chevrolet Pickup (Small Size) | 2000 | 79 |

Pickup trucks were the biggest targets for thieves in Kentucky. Even the ninth and tenth rank were pickup trucks.

Vehicle Theft by City

We’ve seen the top vehicles that are likely stolen in Kentucky. Now, let’s look at thefts by city.

| Cities | Motor Vehicle Theft |

|---|---|

| Adairville | 0 |

| Alexandria | 14 |

| Anchorage | 0 |

| Ashland | 53 |

| Audubon Park | 10 |

| Augusta | 0 |

| Barbourville | 19 |

| Bardstown | 43 |

| Beattyville | 6 |

| Beaver Dam | 3 |

| Bellevue | 11 |

| Benton | 3 |

| Berea | 36 |

| Bloomfield | 1 |

| Bowling Green | 177 |

| Brandenburg | 9 |

| Brownsville | 1 |

| Burnside | 2 |

| Cadiz | 4 |

| Calvert City | 3 |

| Campbellsville | 27 |

| Carlisle | 1 |

| Carrollton | 6 |

| Catlettsburg | 6 |

| Cave City | 4 |

| Central City | 0 |

| Clinton | 0 |

| Cloverport | 1 |

| Coal Run Village | 0 |

| Cold Spring | 3 |

| Columbia | 7 |

| Corbin | 34 |

| Covington | 138 |

| Cumberland | 0 |

| Cynthiana | 9 |

| Danville | 17 |

| Dawson Springs | 6 |

| Dayton | 11 |

| Dry Ridge | 8 |

| Eddyville | 0 |

| Edgewood | 9 |

| Edmonton | 5 |

| Elizabethtown | 56 |

| Elkton | 1 |

| Elsmere | 13 |

| Eminence | 1 |

| Erlanger | 29 |

| Eubank | 0 |

| Falmouth | 2 |

| Ferguson | 1 |

| Flatwoods | 3 |

| Flemingsburg | 2 |

| Florence | 50 |

| Fort Mitchell | 3 |

| Fort Thomas | 11 |

| Fort Wright | 7 |

| Frankfort | 86 |

| Franklin | 23 |

| Fulton | 3 |

| Georgetown | 79 |

| Glasgow | 42 |

| Graymoor-Devondale | 7 |

| Grayson | 6 |

| Greensburg | 1 |

| Greenville | 5 |

| Hardinsburg | 1 |

| Harlan | 1 |

| Harrodsburg | 24 |

| Hartford | 3 |

| Hazard | 11 |

| Henderson | 69 |

| Highland Heights | 6 |

| Hillview | 15 |

| Hodgenville | 5 |

| Hopkinsville | 47 |

| Horse Cave | 0 |

| Hurstbourne Acres | 1 |

| Hyden | 0 |

| Independence | 14 |

| Indian Hills | 2 |

| Irvine | 4 |

| Irvington | 2 |

| Jackson | 10 |

| Jamestown | 2 |

| Jeffersontown | 84 |

| Jenkins | 0 |

| Junction City | 0 |

| La Grange | 8 |

| Lakeside Park-Crestview Hills | 2 |

| Lancaster | 4 |

| Lawrenceburg | 16 |

| Lebanon | 13 |

| Lebanon Junction | 2 |

| Leitchfield | 15 |

| Lewisport | 0 |

| Lexington | 1,273 |

| London | 42 |

| Louisa | 4 |

| Louisville Metro2 | 3,864 |

| Loyall | 0 |

| Ludlow | 7 |

| Madisonville | 18 |

| Manchester | 6 |

| Marion | 4 |

| Mayfield | 21 |

| Maysville | 17 |

| Middlesboro | 24 |

| Monticello | 4 |

| Morehead | 6 |

| Morganfield | 2 |

| Morgantown | 5 |

| Mount Sterling | 14 |

| Mount Vernon | 6 |

| Mount Washington | 17 |

| Muldraugh | 1 |

| Munfordville | 3 |

| Murray | 21 |

| Newport | 51 |

| Nicholasville | 51 |

| Oak Grove | 19 |

| Olive Hill | 0 |

| Owensboro | 243 |

| Owenton | 0 |

| Owingsville | 3 |

| Paducah | 89 |

| Paintsville | 4 |

| Paris | 17 |

| Park Hills | 3 |

| Pikeville | 9 |

| Pineville | 3 |

| Pioneer Village | 5 |

| Prestonsburg | 8 |

| Princeton | 13 |

| Prospect | 2 |

| Providence | 2 |

| Raceland | 2 |

| Radcliff | 48 |

| Ravenna | 1 |

| Richmond | 111 |

| Russell | 1 |

| Russell Springs | 5 |

| Russellville | 10 |

| Salyersville | 0 |

| Scottsville | 13 |

| Sebree | 0 |

| Shelbyville | 26 |

| Shepherdsville | 38 |

| Shively | 128 |

| Simpsonville | 3 |

| Smiths Grove | 0 |

| Somerset3 | 25 |

| Southgate | 7 |

| South Shore | 0 |

| Springfield | 2 |

| Stanford | 12 |

| Stanton | 3 |

| St. Matthews | 57 |

| Sturgis | 2 |

| Taylor Mill | 10 |

| Taylorsville | 0 |

| Tompkinsville | 0 |

| Uniontown | 3 |

| Vanceburg | 1 |

| Versailles | 25 |

| Villa Hills | 2 |

| Vine Grove | 7 |

| Warsaw | 1 |

| West Buechel | 12 |

| West Liberty | 3 |

| West Point | 2 |

| Whitesburg | 1 |

| Wilder | 2 |

| Williamsburg | 5 |

| Williamstown | 5 |

| Wilmore | 9 |

| Winchester | 81 |

The data reflects vehicle theft totals in 2017. Louisville Metro2, as described in the table, had 3,864 thefts which are the most thefts in the state of Kentucky. There were no vehicle thefts in 23 counties. Click the down arrow on the far right to sort the table to lowest to highest to see the 23 counties.

Road Fatalities in Kentucky

Fatalities on the roadway are unexpected occurrences we all wish to avoid. Unfortunately, fatal car accidents happen daily.

Those accidents are recorded in databases for statistical purposes and general information to keep you, the motorist, informed. As you read through this section, you’ll see crash fatalities by weather and light conditions, speeding, and fatal crashes involving alcohol-impaired drivers.

Most Fatal Highway in Kentucky

According to Geotab, the most dangerous highway in Kentucky is U.S. Route 62. U.S. Route 62 connects to Mexico and Canada. An estimated 11 fatal crashes a year occur on the highway.

Fatal Crashes by Weather Conditions and Light Conditions

Weather and light conditions contribute to fatal crashes. The table below will show details on how weather and light conditions caused fatal crashes.

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 324 | 66 | 192 | 24 | 0 | 606 |

| Rain | 50 | 11 | 29 | 6 | 0 | 96 |

| Snow/Sleet | 7 | 0 | 0 | 0 | 0 | 7 |

| Other | 0 | 1 | 8 | 1 | 0 | 10 |

| Unknown | 0 | 1 | 1 | 0 | 0 | 2 |

| TOTAL | 381 | 79 | 230 | 31 | 0 | 721 |

More fatal crashes occurred when weather conditions were normal, daylight conditions. The second most fatal was dark or nighttime conditions.

Fatalities (All Crashes) by County

Here’s a comprehensive table that covers all the crash totals by county.

Kentucky 2014-2018 Fatalities All Crashes

| County Name | Fatalities (2014) | Fatalities Per 100,000 Population (2014) | Fatalities (2015) | Fatalities Per 100,000 Population (2015) | Fatalities (2016) | Fatalities Per 100,000 Population (2016) | Fatalities (2017) | Fatalities Per 100,000 Population (2017) | Fatalities (2018) | Fatalities Per 100,000 Population (2018) |

|---|---|---|---|---|---|---|---|---|---|---|

| Adair County | 6 | 31.14 | 6 | 31.30 | 7 | 36.34 | 6 | 31.10 | 2 | 10.41 |

| Allen County | 2 | 9.75 | 5 | 24.18 | 5 | 24.11 | 7 | 33.46 | 6 | 28.41 |

| Anderson County | 4 | 18.30 | 3 | 13.70 | 6 | 27.09 | 5 | 22.20 | 3 | 13.24 |

| Ballard County | 3 | 36.63 | 2 | 24.34 | 6 | 74.58 | 2 | 24.93 | 2 | 25.07 |

| Barren County | 9 | 20.91 | 11 | 25.25 | 9 | 20.55 | 9 | 20.54 | 8 | 18.11 |

| Bath County | 1 | 8.24 | 6 | 49.18 | 3 | 24.50 | 2 | 16.16 | 1 | 8.08 |

| Bell County | 3 | 10.77 | 7 | 25.56 | 8 | 29.38 | 11 | 40.89 | 4 | 15.06 |

| Boone County | 5 | 3.96 | 15 | 11.74 | 14 | 10.84 | 19 | 14.55 | 9 | 6.84 |

| Bourbon County | 4 | 19.93 | 8 | 39.64 | 6 | 29.78 | 7 | 34.77 | 5 | 24.77 |

| Boyd County | 6 | 12.29 | 5 | 10.31 | 4 | 8.31 | 6 | 12.56 | 4 | 8.47 |

| Boyle County | 7 | 23.48 | 4 | 13.44 | 6 | 20.04 | 8 | 26.70 | 1 | 3.32 |

| Bracken County | 2 | 23.93 | 6 | 72.39 | 1 | 11.95 | 1 | 12.08 | 2 | 24.27 |

| Breathitt County | 12 | 89.75 | 2 | 14.96 | 8 | 60.69 | 6 | 46.40 | 6 | 47.15 |

| Breckinridge County | 7 | 35.20 | 4 | 20.01 | 4 | 20.01 | 7 | 34.74 | 1 | 4.90 |

| Bullitt County | 11 | 14.09 | 12 | 15.25 | 12 | 15.15 | 10 | 12.46 | 12 | 14.80 |

| Butler County | 5 | 39.26 | 6 | 47.12 | 4 | 31.54 | 4 | 31.25 | 2 | 15.66 |

| Caldwell County | 3 | 23.34 | 6 | 47.05 | 6 | 47.48 | 3 | 23.66 | 0 | 0.00 |

| Calloway County | 9 | 23.40 | 6 | 15.52 | 7 | 18.06 | 5 | 12.87 | 2 | 5.11 |

| Campbell County | 7 | 7.64 | 8 | 8.70 | 15 | 16.29 | 10 | 10.81 | 10 | 10.74 |

| Carlisle County | 3 | 60.45 | 1 | 20.59 | 1 | 20.89 | 2 | 41.43 | 2 | 41.92 |

| Carroll County | 3 | 27.89 | 6 | 56.07 | 5 | 47.02 | 3 | 27.96 | 3 | 27.94 |

| Carter County | 5 | 18.17 | 7 | 25.51 | 2 | 7.33 | 9 | 33.10 | 3 | 11.11 |

| Casey County | 4 | 25.34 | 5 | 31.75 | 2 | 12.68 | 5 | 31.66 | 2 | 12.59 |

| Christian County | 7 | 9.54 | 8 | 10.94 | 12 | 16.70 | 11 | 15.44 | 19 | 26.51 |

| Clark County | 7 | 19.65 | 5 | 14.02 | 7 | 19.52 | 8 | 22.26 | 9 | 24.83 |

| Clay County | 6 | 28.44 | 9 | 42.88 | 7 | 33.91 | 2 | 9.87 | 2 | 9.95 |

| Clinton County | 3 | 29.37 | 2 | 19.63 | 2 | 19.59 | 2 | 19.53 | 3 | 29.39 |

| Crittenden County | 4 | 43.59 | 3 | 32.72 | 1 | 10.95 | 4 | 44.34 | 3 | 33.65 |

| Cumberland County | 3 | 44.60 | 1 | 14.83 | 0 | 0.00 | 3 | 44.80 | 1 | 15.02 |

| Daviess County | 8 | 8.12 | 15 | 15.07 | 20 | 19.99 | 9 | 8.95 | 9 | 8.90 |

| Edmonson County | 3 | 24.98 | 2 | 16.67 | 1 | 8.28 | 2 | 16.33 | 3 | 24.44 |

| Elliott County | 0 | 0.00 | 0 | 0.00 | 1 | 13.35 | 2 | 26.64 | 2 | 26.64 |

| Estill County | 2 | 13.85 | 1 | 6.96 | 1 | 6.98 | 2 | 14.06 | 4 | 28.17 |

| Fayette County | 28 | 8.98 | 27 | 8.54 | 50 | 15.64 | 35 | 10.86 | 32 | 9.88 |

| Fleming County | 0 | 0.00 | 1 | 6.86 | 3 | 20.72 | 1 | 6.93 | 2 | 13.86 |

| Floyd County | 7 | 18.42 | 15 | 39.96 | 8 | 21.63 | 11 | 30.34 | 9 | 25.11 |

| Franklin County | 2 | 4.02 | 1 | 2.00 | 10 | 19.88 | 10 | 19.80 | 2 | 3.94 |

| Fulton County | 3 | 47.87 | 1 | 15.95 | 0 | 0.00 | 2 | 32.24 | 1 | 16.34 |

| Gallatin County | 2 | 23.19 | 2 | 23.25 | 3 | 34.44 | 6 | 68.61 | 5 | 56.61 |

| Garrard County | 1 | 5.89 | 6 | 34.86 | 3 | 17.25 | 1 | 5.72 | 4 | 22.78 |

| Grant County | 5 | 20.15 | 3 | 12.13 | 3 | 12.04 | 3 | 12.00 | 1 | 3.98 |

| Graves County | 8 | 21.29 | 8 | 21.49 | 10 | 26.90 | 9 | 24.21 | 11 | 29.48 |

| Grayson County | 7 | 26.85 | 10 | 38.25 | 9 | 34.50 | 11 | 41.88 | 13 | 49.39 |

| Green County | 3 | 27.18 | 5 | 45.57 | 1 | 9.10 | 3 | 27.11 | 2 | 18.10 |

| Greenup County | 7 | 19.29 | 3 | 8.34 | 2 | 5.59 | 7 | 19.72 | 3 | 8.51 |

| Hancock County | 2 | 23.03 | 0 | 0.00 | 2 | 22.91 | 3 | 34.18 | 2 | 22.84 |

| Hardin County | 16 | 14.74 | 22 | 20.69 | 16 | 14.95 | 16 | 14.78 | 22 | 19.94 |

| Harlan County | 11 | 39.26 | 3 | 10.90 | 7 | 25.92 | 1 | 3.74 | 5 | 18.93 |

| Harrison County | 4 | 21.47 | 1 | 5.37 | 1 | 5.39 | 4 | 21.36 | 1 | 5.33 |

| Hart County | 6 | 32.41 | 5 | 27.15 | 8 | 43.16 | 3 | 15.99 | 6 | 31.74 |

| Henderson County | 5 | 10.77 | 3 | 6.47 | 9 | 19.44 | 2 | 4.35 | 10 | 21.93 |

| Henry County | 4 | 25.71 | 5 | 32.11 | 8 | 50.49 | 1 | 6.25 | 2 | 12.42 |

| Hickman County | 3 | 64.13 | 0 | 0.00 | 0 | 0.00 | 1 | 22.11 | 3 | 67.86 |

| Hopkins County | 10 | 21.66 | 12 | 26.04 | 13 | 28.49 | 4 | 8.82 | 7 | 15.53 |

| Jackson County | 4 | 30.05 | 2 | 15.01 | 3 | 22.45 | 7 | 52.16 | 1 | 7.44 |

| Jefferson County | 78 | 10.24 | 85 | 11.11 | 99 | 12.90 | 107 | 13.89 | 76 | 9.86 |

| Jessamine County | 8 | 15.72 | 11 | 21.23 | 7 | 13.41 | 3 | 5.63 | 7 | 12.98 |

| Johnson County | 3 | 12.90 | 7 | 30.26 | 2 | 8.75 | 3 | 13.29 | 5 | 22.34 |

| Kenton County | 9 | 5.51 | 17 | 10.36 | 9 | 5.47 | 17 | 10.28 | 16 | 9.64 |

| Knott County | 3 | 18.80 | 0 | 0.00 | 3 | 19.35 | 1 | 6.54 | 5 | 33.06 |

| Knox County | 5 | 15.84 | 9 | 28.59 | 4 | 12.70 | 5 | 15.88 | 7 | 22.36 |

| Larue County | 3 | 21.25 | 4 | 28.33 | 8 | 57.05 | 3 | 21.11 | 2 | 13.98 |

| Laurel County | 10 | 16.69 | 8 | 13.35 | 11 | 18.31 | 18 | 29.85 | 20 | 32.97 |

| Lawrence County | 1 | 6.29 | 1 | 6.30 | 3 | 18.94 | 6 | 38.13 | 10 | 64.22 |

| Lee County | 4 | 58.86 | 1 | 14.83 | 1 | 15.17 | 1 | 15.17 | 1 | 14.22 |

| Leslie County | 0 | 0.00 | 5 | 46.97 | 2 | 19.18 | 4 | 38.80 | 1 | 9.86 |

| Letcher County | 4 | 17.12 | 4 | 17.36 | 3 | 13.19 | 4 | 17.91 | 5 | 22.83 |

| Lewis County | 2 | 14.53 | 4 | 29.41 | 5 | 37.11 | 3 | 22.46 | 4 | 30.17 |

| Lincoln County | 3 | 12.28 | 9 | 36.97 | 2 | 8.20 | 10 | 40.82 | 8 | 32.46 |

| Livingston County | 2 | 21.44 | 4 | 43.08 | 2 | 21.75 | 2 | 21.59 | 3 | 32.46 |

| Logan County | 3 | 11.18 | 4 | 14.95 | 1 | 3.75 | 4 | 14.81 | 6 | 22.23 |

| Lyon County | 0 | 0.00 | 4 | 48.13 | 4 | 49.48 | 5 | 61.63 | 1 | 12.49 |

| Madison County | 10 | 11.48 | 19 | 21.53 | 10 | 11.16 | 10 | 10.96 | 6 | 6.50 |

| Magoffin County | 4 | 30.81 | 5 | 39.12 | 4 | 31.58 | 5 | 39.88 | 2 | 16.18 |

| Marion County | 3 | 15.73 | 6 | 31.22 | 4 | 20.89 | 6 | 31.06 | 8 | 41.23 |

| Marshall County | 14 | 45.17 | 16 | 51.51 | 5 | 15.99 | 11 | 35.13 | 5 | 16.03 |

| Martin County | 1 | 7.99 | 1 | 8.13 | 1 | 8.36 | 1 | 8.70 | 2 | 17.66 |

| Mason County | 5 | 29.17 | 0 | 0.00 | 2 | 11.64 | 4 | 23.22 | 3 | 17.49 |

| Mccracken County | 4 | 6.12 | 15 | 23.08 | 15 | 22.96 | 11 | 16.82 | 9 | 13.77 |

| Mccreary County | 4 | 22.32 | 3 | 16.78 | 6 | 34.20 | 7 | 40.18 | 1 | 5.74 |

| Mclean County | 0 | 0.00 | 1 | 10.62 | 2 | 21.39 | 2 | 21.69 | 4 | 43.23 |

| Meade County | 6 | 20.62 | 7 | 25.23 | 7 | 25.01 | 10 | 35.59 | 5 | 17.41 |

| Menifee County | 1 | 15.88 | 1 | 15.71 | 3 | 46.55 | 4 | 61.86 | 2 | 31.00 |

| Mercer County | 5 | 23.39 | 4 | 18.69 | 5 | 23.32 | 5 | 23.16 | 1 | 4.59 |

| Metcalfe County | 6 | 60.07 | 2 | 20.17 | 4 | 39.97 | 0 | 0.00 | 3 | 29.91 |

| Monroe County | 0 | 0.00 | 1 | 9.42 | 1 | 9.49 | 1 | 9.42 | 1 | 9.33 |

| Montgomery County | 2 | 7.31 | 10 | 36.25 | 4 | 14.45 | 5 | 17.89 | 7 | 24.82 |

| Morgan County | 0 | 0.00 | 1 | 7.54 | 2 | 15.09 | 1 | 7.57 | 0 | 0.00 |

| Muhlenberg County | 2 | 6.39 | 2 | 6.40 | 6 | 19.26 | 12 | 38.81 | 10 | 32.49 |

| Nelson County | 5 | 11.14 | 15 | 33.25 | 13 | 28.57 | 14 | 30.69 | 13 | 28.35 |

| Nicholas County | 4 | 56.73 | 3 | 42.49 | 2 | 28.24 | 3 | 42.03 | 5 | 69.77 |

| Ohio County | 4 | 16.70 | 3 | 12.49 | 9 | 37.27 | 4 | 16.57 | 6 | 24.91 |

| Oldham County | 9 | 14.07 | 1 | 1.55 | 3 | 4.59 | 5 | 7.52 | 12 | 18.05 |

| Owen County | 3 | 28.17 | 2 | 18.64 | 3 | 28.15 | 4 | 37.07 | 5 | 45.96 |

| Owsley County | 2 | 44.40 | 2 | 44.97 | 3 | 67.07 | 0 | 0.00 | 1 | 22.36 |

| Pendleton County | 1 | 6.91 | 2 | 13.82 | 2 | 13.73 | 3 | 20.61 | 3 | 20.65 |

| Perry County | 9 | 32.67 | 5 | 18.29 | 14 | 51.62 | 7 | 26.44 | 6 | 23.00 |

| Pike County | 21 | 33.36 | 14 | 22.66 | 16 | 26.48 | 12 | 20.39 | 21 | 35.96 |

| Powell County | 5 | 40.47 | 5 | 40.89 | 9 | 73.43 | 2 | 16.23 | 7 | 56.26 |

| Pulaski County | 11 | 17.22 | 14 | 21.92 | 16 | 24.99 | 9 | 13.98 | 12 | 18.57 |

| Robertson County | 0 | 0.00 | 0 | 0.00 | 0 | 0.00 | 0 | 0.00 | 0 | 0.00 |

| Rockcastle County | 3 | 17.83 | 5 | 29.53 | 3 | 17.78 | 9 | 53.71 | 4 | 23.88 |

| Rowan County | 3 | 12.37 | 3 | 12.17 | 7 | 28.64 | 7 | 28.50 | 5 | 20.34 |

| Russell County | 8 | 44.97 | 2 | 11.31 | 6 | 33.77 | 2 | 11.27 | 4 | 22.45 |

| Scott County | 12 | 23.43 | 9 | 17.26 | 9 | 16.85 | 5 | 9.13 | 6 | 10.71 |

| Shelby County | 7 | 15.48 | 8 | 17.41 | 12 | 25.66 | 4 | 8.42 | 8 | 16.49 |

| Simpson County | 4 | 22.51 | 6 | 33.50 | 7 | 38.88 | 3 | 16.57 | 2 | 10.79 |

| Spencer County | 1 | 5.64 | 3 | 16.68 | 2 | 10.97 | 5 | 27.07 | 3 | 15.96 |

| Taylor County | 2 | 7.89 | 6 | 23.45 | 6 | 23.58 | 3 | 11.74 | 9 | 35.23 |

| Todd County | 2 | 16.08 | 6 | 48.19 | 4 | 32.38 | 1 | 8.20 | 6 | 48.74 |

| Trigg County | 1 | 7.08 | 3 | 21.10 | 3 | 20.97 | 6 | 41.60 | 5 | 34.15 |

| Trimble County | 5 | 57.22 | 1 | 11.43 | 4 | 46.43 | 1 | 11.68 | 2 | 23.49 |

| Union County | 0 | 0.00 | 1 | 6.68 | 9 | 60.83 | 3 | 20.49 | 2 | 13.79 |

| Warren County | 17 | 14.01 | 13 | 10.48 | 23 | 18.18 | 26 | 20.16 | 13 | 9.90 |

| Washington County | 4 | 33.59 | 4 | 33.27 | 4 | 32.95 | 4 | 33.50 | 1 | 8.28 |

| Wayne County | 3 | 14.55 | 12 | 58.23 | 9 | 43.43 | 0 | 0.00 | 3 | 14.66 |

| Webster County | 3 | 22.72 | 3 | 22.77 | 3 | 22.71 | 4 | 30.60 | 1 | 7.63 |

| Whitley County | 9 | 25.11 | 10 | 27.68 | 13 | 36.01 | 7 | 19.38 | 10 | 27.59 |

| Wolfe County | 2 | 27.57 | 4 | 55.21 | 6 | 83.41 | 3 | 41.41 | 8 | 111.47 |

| Woodford County | 5 | 19.54 | 3 | 11.60 | 5 | 19.15 | 2 | 7.58 | 6 | 22.61 |

Nine counties didn’t have any crash fatalities in 2014. Robertson County was one of few counties in Kentucky that didn’t have any crash fatalities in a 5-year trend.

Traffic Fatalities

Traffic fatalities are separated into two types: rural and urban. In Kentucky, we’ll see how each type is affected by traffic fatalities.

| Traffic Fatality Type | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|---|---|

| Total (C-1) | 791 | 760 | 720 | 746 | 638 | 672 | 761 | 834 | 782 | 724 |

| Rural | 645 | 551 | 559 | 582 | 494 | 517 | 593 | 607 | 510 | 515 |

| Urban | 146 | 208 | 161 | 164 | 144 | 155 | 168 | 226 | 271 | 208 |

| Unknown | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 1 | 1 | 1 |

Even though more vehicles can be seen in urban areas, there were more rural traffic fatalities than urban traffic fatalities.

Fatalities by Person Type

With all the crash fatalities, which vehicle was most likely involved in a car accident in Kentucky. The NHTSA defines this as person type. The details on that information are provided below.

Kentucky Fatalities by Person Type - *Sum of Percents May Not = 100 Due to Individual Cell Rounding

| Person Type | # of Fatalities in 2014 | %* of Fatalities in 2014 | # of Fatalities in 2015 | %* of Fatalities in 2015 | # of Fatalities in 2016 | %* of Fatalities in 2016 | # of Fatalities in 2017 | %* of Fatalities in 2017 | # of Fatalities in 2018 | %* of Fatalities in 2018 |

|---|---|---|---|---|---|---|---|---|---|---|

| Passenger Car | 278 | 41 | 314 | 41 | 353 | 42 | 326 | 42 | 288 | 40 |

| Light Truck - Pickup | 115 | 17 | 120 | 16 | 115 | 14 | 126 | 16 | 116 | 16 |

| Light Truck - Utility | 84 | 13 | 99 | 13 | 88 | 11 | 90 | 12 | 89 | 12 |

| Light Truck - Van | 21 | 3 | 25 | 3 | 32 | 4 | 32 | 4 | 21 | 3 |

| Light Truck - Other | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 |

| Large Truck | 9 | 1 | 9 | 1 | 17 | 2 | 10 | 1 | 17 | 2 |

| Other/Unknown Occupants | 17 | 3 | 24 | 3 | 23 | 3 | 15 | 2 | 12 | 2 |

| Total Occupants | 524 | 78 | 591 | 78 | 628 | 75 | 600 | 77 | 543 | 75 |

| Total Motorcyclists | 86 | 13 | 91 | 12 | 111 | 13 | 90 | 12 | 95 | 13 |

| Pedestrian | 57 | 8 | 67 | 9 | 81 | 10 | 83 | 11 | 73 | 10 |

| Bicyclist and Other Cyclist | 4 | 1 | 7 | 1 | 9 | 1 | 7 | 1 | 10 | 1 |

| Other/Unknown Nonoccupants | 1 | 0 | 5 | 1 | 5 | 1 | 2 | 0 | 3 | 0 |

| Total Nonoccupants | 62 | 9 | 79 | 10 | 95 | 11 | 92 | 12 | 86 | 12 |

| Total | 672 | 100 | 761 | 100 | 834 | 100 | 782 | 100 | 724 | 100 |

*Sum of Percents May Not = 100 Due to Individual Cell Rounding

The total number of crash fatalities spiked in 2016 with 628 total fatalities. The most deaths occurred in passenger cars.

Fatalities by Crash Type

This table is more concentrated than the previous one. The totals span over five years.

Kentucky Fatalities by Crash Type

| Crash Type | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Total Fatalities (All Crashes)* | 672 | 761 | 834 | 782 | 724 |

| - (1) Single Vehicle | 395 | 400 | 451 | 413 | 387 |

| - (2) Involving a Large Truck | 68 | 81 | 106 | 91 | 106 |

| - (3) Involving Speeding | 125 | 140 | 138 | 138 | 111 |

| - (4) Involving a Rollover | 200 | 229 | 216 | 203 | 169 |

| - (5) Involving a Roadway Departure | 456 | 499 | 529 | 472 | 437 |

| - (6) Involving an Intersection (or Intersection Related) | 119 | 122 | 152 | 179 | 138 |

*A Fatality Can Be in More Than One Category. Therefore the Sum of the Individual Cells Will Not Equal the Total Due to Double Counting

Most crash fatalities were in 2016, and these crashes were under type 4 or vehicles that departed the roadway upon crashing.

5-Year Trend for the Top 10 Kentucky Counties

Which ten counties had the most fatal crashes? Let’s examine them in the table below.

| Rank | County | Fatalities per 100,000 Population (2014) | Fatalities per 100,000 Population (2015) | Fatalities per 100,000 Population (2016) | Fatalities per 100,000 Population (2017) | Fatalities per 100,000 Population (2018) |

|---|---|---|---|---|---|---|

| 1 | Wolfe County | 27.57 | 55.21 | 83.41 | 41.41 | 111.47 |

| 2 | Nicholas County | 56.73 | 42.49 | 28.24 | 42.03 | 69.77 |

| 3 | Hickman County | 64.13 | 0.00 | 0.00 | 22.11 | 67.86 |

| 4 | Lawrence County | 6.29 | 6.30 | 18.94 | 38.13 | 64.22 |

| 5 | Gallatin County | 23.19 | 23.25 | 34.44 | 68.61 | 56.61 |

| 6 | Powell County | 40.47 | 40.89 | 73.43 | 16.23 | 56.26 |

| 7 | Grayson County | 26.85 | 38.25 | 34.50 | 41.88 | 49.39 |

| 8 | Todd County | 16.08 | 48.19 | 32.38 | 8.20 | 48.74 |

| 9 | Breathitt County | 89.75 | 14.96 | 60.69 | 46.40 | 47.15 |

| 10 | Owen County | 28.17 | 18.64 | 28.15 | 37.07 | 45.96 |

| Sub Rate 1.* | Top Ten Counties | 56.04 | 52.81 | 59.99 | 50.19 | 57.70 |

| Sub Rate 2.** | All Other Counties | 14.17 | 16.06 | 17.60 | 16.69 | 15.08 |

| Total Rate | All Counties | 15.22 | 17.19 | 18.79 | 17.56 | 16.20 |

Despite being number nine on the list, Breathitt County had the most fatalities per 100,000 population in 2014. Hickman County was the only county to not see any fatality rates in 2015 and 2016.

Fatalities Involving Speeding by County

Speeding caused a number of fatal crashes. Let’s look at how speeding affected Kentucky motorists.