Great American Life Insurance Company Review & Complaints: Life Insurance (2025)

Great American Life Insurance Company, formerly United Teachers Associates, offers term, whole, and universal life insurance and UTA LTC 20 premiums. Great American Life Insurance costs are as low as $13.38/mo for term policies and the BBB has an A+ Great American Life Insurance Company rating.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Laura D. Adams

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Insurance & Finance Analyst

UPDATED: Feb 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Feb 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Great American Company/United Teacher Associates Overview

| Key Info | Company Specifics |

|---|---|

| Year Founded | 1872 |

| Current Executives | Co-CEO – Carl H. Lindner III Co-CEO – S. Craig Lindner |

| Number of Employees | 4,318 |

| Total Sales / Total Assets | $530,000,000 / $63,456,000,000 |

| HQ Address | 301 E. Fourth St. Cincinnati, Ohio 45202 |

| Phone Number | 1-800-854-3649 |

| Company Website | www.greatamericaninsurancegroup.com |

| Premiums Written – Individual Life | $6,800,000,000 |

| Financial Standing | + 4.2% |

| Best For | Annuities |

At the time of conducting this review on United Teacher Associates insurance company, we haven’t uncovered any indications suggesting that United Teacher Associates functions as an autonomous entity. If you’ve come across this article, it’s likely you’re exploring or already seeking a policy with the UTA LTC 20 premiums. However, there’s noteworthy information that might be viewed positively or negatively based on your perspective, particularly concerning Washington Nat Prem Debit, whole life insurance companies, and obtaining whole life insurance quotes.

United Teacher Associates, as it was formerly known, has been acquired by the more popular Great American Financial Resources Inc. If you’re pursuing a new policy, this is good news because Great American life insurance (review below) has the experience and assets as one of the best insurance companies around.

In this evaluation, we’ll delve into Great American Life Insurance Company’s ratings, policies, and customer feedback, aiming to reassure both past and potential customers of UTA LTC 20 that their voluntary term life insurance is reliable.

Ready to see what you could pay for a Great American insurance company policy and learn more about UTA LTC 20 premiums? Before diving into our United Teacher Associates insurance company review, use our FREE quote tool to get an idea of what your life insurance rates might be.

Shopping for Great American Life Insurance Quotes

If you’re curious about the average cost of a Great American long-term care policy, rest assured that if you’re young and healthy, your policy through Vantis Life Insurance reviews will be very affordable. However, the typical Great American life insurance rates will increase as you get older.

Outside of the obvious health benefits, taking better care of your body and eating right will help you get the best rates that you can.

Average Great American Life Insurance Rates by Age

Curious about the typical Great American rates by age? You’ll automatically save much more the sooner that you apply for your policy. Great American’s rates for non-smokers are unavailable online, as it is mainly a group insurer.

Average Annual Term Life Insurance Rates for Non-Smokers by Age

($100,000/10-Year Policy)

| Non-Smoker's Age | Average Annual Rates for a Male | Average Annual Rates for a Female |

|---|---|---|

| 25 | $178.54 | $160.57 |

| 35 | $185.04 | $165.91 |

| 45 | $267.89 | $240.25 |

| 55 | $524.95 | $406.94 |

| 65 | $1,273.12 | $880.66 |

As evident, the average yearly life insurance cost is quite reasonable — even for seniors — as long as you can refrain from using tobacco and nicotine products, despite any potential North American Senior Benefits complaints.

Read more: Best Life Insurance Policies for Tobacco Chewers

Don’t believe us? See the following table for what you could expect to pay for the same policy if you were classified as a smoker.

Monthly Term Life Insurance Rates for Smokers by Age ($100,000/10-Year Policy)

| Smoker's Age | Monthly Rates for a Male | Monthly Rates for a Female |

|---|---|---|

| 25 | $27 | $21 |

| 35 | $30 | $24 |

| 45 | $53 | $41 |

| 55 | $114 | $83 |

| 65 | $270 | $186 |

As you can see, you can expect to pay twice as much as someone in the same age group who doesn’t smoke. If you’re wondering, “can my doctor tell my insurance I smoke?” you’d be better off just being honest with your insurance provider about your smoking habits.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Great American’s Life Insurance Policies

Deciding what type of policy to get relies heavily on what kind of life you have and what is most important to you and your family. For instance, if you’re trying to help your parents, you may look for life insurance policies for parents or for seniors.

Likewise, if you want protection for the absolute worst, you can get additional coverage that adds your children to the policy at an increased cost.

Great American sells life insurance to individuals as well as property insurance to businesses to ensure that those companies don’t have to handle the whole loss of their property.

Term Life Insurance

Term life insurance is based on the idea that you’ll only need insurance for a portion of your life. For instance, those just starting out with a young family may want to take out a 20- or 30-year term life policy to cover any expenses their family may need, at least until they have grown into stable adults.

For the life of the policy, you’ll pay equal premiums, and if you die during the term, you’ll know exactly how much your beneficiaries will receive from the death benefit.

Because of this hassle-free schedule, this is often referred to as the easiest way to get coverage without having to understand a lot about finances.

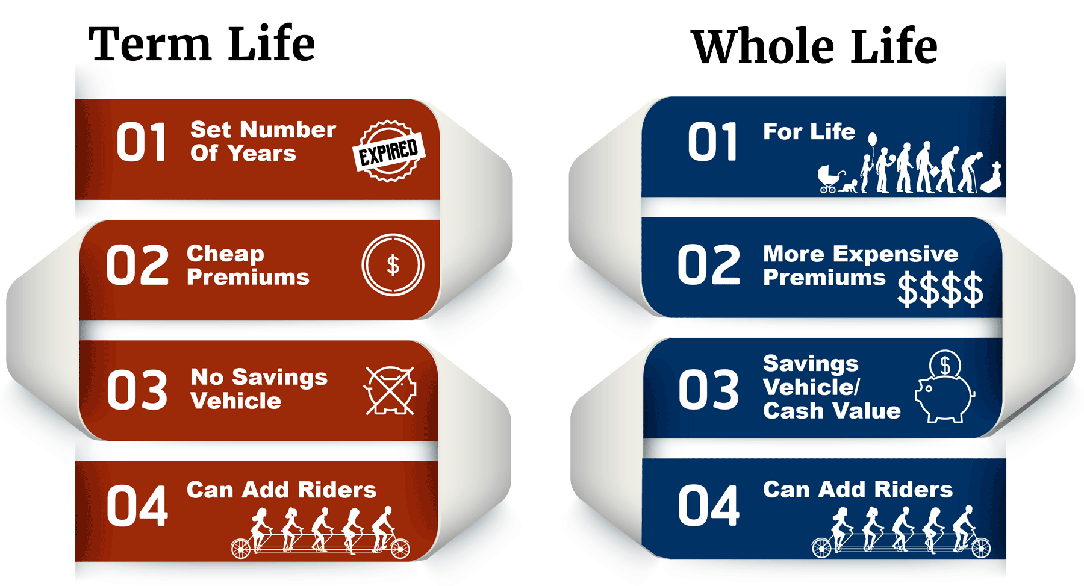

Take a look at the advantages and disadvantages of term life insurance.

Whole Life Insurance

Whole life insurance is exactly what it sounds like: insurance for your entire life. As long as you pay your premiums, you’ll be insured from the day you sign your policy until the day you die. Compare the similarities and differences between term and whole life insurance so you can understand life insurance completely.

Like term life, these types of policies also offer riders that can help provide a portion of the death benefit upfront so that you don’t have to take the brunt of long-term care or medical expenses. This policy will also offer equal premiums for the life of the policy. However, it’s more expensive. That’s because this policy comes with a savings type account called cash value.

This cash value is sometimes invested and can be loaned against later in life to help cover any expenses you’d like. In some cases, the cash value will be invested at an increasing percentage to give you a maximum return. Read more about term life insurance and cash value to learn about this relationship.

Universal Life Insurance

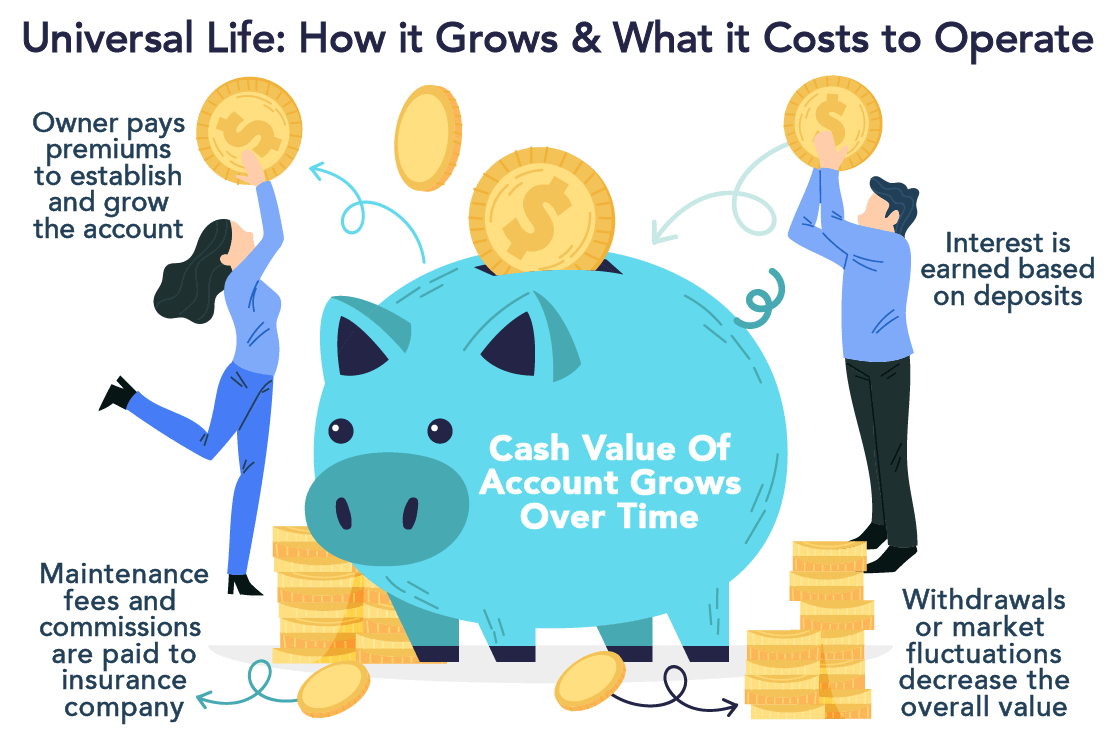

Universal life insurance is like a whole life policy in that it accrues cash value. This cash value is placed in an investment product that will allow you to accrue extra wealth.

Premiums are flexible with this type of policy, but the more you pay, the higher your investment and the bigger the death benefit you’ll receive when you pass away. In contrast, paying the minimum will leave only enough for the bare essentials and little to no addition to your investment. Nonetheless, this flexibility will help should you face any unexpected problems.

Burial & Final Expense Insurance

This insurance is also exactly how it sounds. For a much more affordable price, you can get just enough of a death benefit to pay for your final expenses. Since you won’t be receiving a larger death benefit, your premiums will be much more affordable.

This is also a good policy for those who aren’t worried about their family’s finances but don’t want a huge impact when they pass.

Other Life Insurance Products

Variable life insurance is a policy that allows you to invest a part of your monthly premiums into a variety of sub-accounts. There are two main options when investing in a variable life insurance policy. These include:

- Traditional

- Indexed

A traditional universal life policy invests the policyholders’ cash value in an internal account that has a guaranteed positive increase. This is a much safer option compared to something independent of the insurer.

However, with an indexed policy, the cash value will be invested in the stock market where it may not always have an increase, but you may also get more than was possible with the traditional policy. Indexed universal life insurance pros and cons are important to understand.

An annuity is a life insurance product that will have the insurance company pay out a stream of payments to you. This can be funded by a single premium or by a series of premiums for the annuity to pay out later.

Life Insurance Riders

A life insurance rider or endorsement is an add-on to a policy that will give you extra coverage for an additional cost. For example, if you got a rider that covered your child, you would receive a predetermined amount if the worst were to happen. (For more information, read our “Long-Term Care (LTC) Life Insurance Rider: An Expert Guide“).

Another option is to get a rider that will cover you should you become terminally ill during the policy. If you received such a diagnosis from your doctor, you could be given a portion of the death benefit upfront.

How to Get a Quote Online with Great American

With the current digital age and the social isolation that has come with it lately, more people than ever are wondering how to get life insurance quotes online. And Great American Insurance’s online presence is strong.

All you have to do is locate the “Submit-A-Quote” form on the Great American website and fill it out in your browser or by hand. The form includes a few voluntary questions about risk in your life. Once you have filled out the form, print if necessary, and mail the form to:

301 E. 4th St.

Cincinnati, OH 45202

After that, you can expect an agent to get back to you as soon as they evaluate your answers.

Read more: Great American Insurance Review & Complaints: Commercial, Agricultural & Personal Insurance

Canceling Your Life Insurance Policy

You can cancel your policy at any time you wish. All it usually requires is a few phone calls and the right paperwork. There is an abundance of reasons to want to cancel your policy. Whether you don’t want to pay the premiums, you found a better deal, or you’re leaving a company and are unable to take the policy with you, canceling your policy only takes a few short steps. (For more information, read our “How to Cancel Your Whole Life Insurance Policy“).

How to Cancel

To cancel your policy with Great American, you just need to reach out via mail or phone with the appropriate information about your policy. In fact, if you cancel within 30 days of your initial start date. As a policyholder, you’ll have access to a customer portal where you can find the forms needed to cancel your policy.

If you’d rather discuss your cancellation options over the phone, you can contact Great American customer service at 1 (800) 545-4269. They can give you further information about canceling your policy.

Great American’s Programs

Great American has committed itself to do the utmost to ensure that its customers are both happy and healthy for many days to come. They also have special programs dedicated to informing potential insurance agents about what it takes to perform well in the industry, and more importantly, with Great American.

Design of Website/App

Great American’s website is easy to navigate, with sections at the top of their homepage for different types of users such as individuals and employers, and an area for you to learn how to file a claim. Each section has unique tools and forms that can help you find the answers you need.

Great American doesn’t have any apps, so all online interactions will have to be done through the client portal on their website.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

About Great American Life Insurance

Great American Life Insurance started out as United Teacher Associates. United Teacher Associates’ history reached its end after it operated out of its Texas headquarters for nearly 60 years. In 2015, the company was acquired by diversified holding company HC2 Holdings, along with another insurance company called Continental General Insurance, or CGI.

Since the time of our last review, the company no longer operates a website, and search results bring very little in the way of information regarding its fate. After some digging, we were able to discover that United Teacher Associates was merged into Continental General in 2017. Then they would sell a portion of all of their United Teacher Associates insurance company to Cigna. Read our Cigna insurance review for more information on that company.

The Continental General insurance company no longer has its own website, and search results are limited. It seems that the company has been sold off, as neither it nor United Teacher Associates Insurance Company appears on the HC2 Holdings website. Instead, information about the CGI Cigna premium policy is available directly from Cigna.

United Teacher Associates was bought by the Great American Life Insurance company in 1999.

It does appear that United Teacher Associates no longer writes new business under their previous company name. Great American’s headquarters is currently located at 301 E. Fourth Street, Cincinnati, OH 45202.

Great American’s Ratings

An insurer without oversight would not be accountable for their financial decisions as they may make decisions that are unhelpful to their policyholders. Thanks to these rating companies, clients can be fully informed about an insurer’s responsibility to their clients.

The Better Business Bureau (BBB) is one of the more popular business rating agency sites. As opposed to the finance-based A.M Best, the BBB focuses on customer experiences and how a business treats the people they do business with. There are sections for formal and informal complaints that give a better view of the problems customers face.

Great American has an A+ rating with the BBB, which is the best rating available. This shows that Great American places a lot of stock in taking care of their customers.

Moody’s rates an insurer on their credit history and the likelihood that they will have troubles in the near future. They look at both short- and long-term credit history. Great American has an A1 rating with Moody’s and a stable credit outlook. The A1 rating is fairly positive and is indicative of very few financial problems over the company’s history.

The Standard & Poor’s (S&P) rating definitions are separated into general-purpose and special-purpose ratings. Like the other rating services, they use a letter scale to indicate an insurer’s financial reliability. Great American’s financial strength ratings with S&P are an A+, which is on the better side of average.

Overall, Great American has a pretty good rating with most companies, excluding the highest rating with the BBB. While this may not look ideal to most, you’re most likely not going to have many financial problems with this insurer as they have plenty of assets to keep themselves afloat.

Great American’s Market Share

A company’s market share is the number of consumers they have within their industry. The higher the percentage, the more policies they have and the more money coming in.

Great American is one of the leading life insurers in the country, with a market share of 0.88 percent in 2018, according to the Insurance Information Institute. While that may not seem like much, they are still one of the leading insurers in America.

Hard to believe? See the chart below for a breakdown of the top 10 insurers by market share in 2018 plus Great American.

Great American Life Insurance Market Share vs. Top 10 Life Insurance Companies

| Companies | Market Share |

|---|---|

| Northwestern | 6.4% |

| Metlife | 6.0% |

| New York Life | 5.7% |

| Prudential | 5.6% |

| Lincoln National | 5.4% |

| MassMutual | 4.2% |

| Aegon | 2.9% |

| John Hancock | 2.8% |

| State Farm | 2.8% |

| Minnesota Mutual | 2.7% |

| Great American | 0.9% |

When you look at Great American’s market share compared to the competition, it’s clear that while they may not be in the top 10, they may find themselves as a top contender in the coming years.

Great American’s Online Presence

In this digital age, staying connected to your audience is imperative to keeping their attention. To this end, insurance companies are using social media to connect on a more personal level to their clients. The insurance company’s strategy is to use social media posts to place itself in your mind as you scroll through your feed.

You can find Great American on Twitter, @GAIGroup, posting inspirational messages and information about their accomplishments and new features they offer. You can also find them sharing similar messages on their company page on Facebook.

You can also find Great America on LinkedIn, posting about new career opportunities and advice for prospective insurance agents. You may be able to find answers to questions such as, “how do insurance brokers and agents make money?”

Great American’s Commercials

Insurance companies’ TV commercials are usually sad, boring, or both. However, Great American is giving you the numbers in a no-nonsense approach to show that they are among the best insurers around.

https://www.youtube.com/watch?v=RlK5uubmyL8

As a company that has stayed strong for over a century, Great American isn’t afraid to make sure that everyone knows they are committed to their clients and to beating the competition.

Great American also has a strong recruitment presence on YouTube, both showcasing the benefits of working in the insurance agency and encouraging future job seekers to consider working for the Great American family. See the video below to find out why Great American thinks insurance is a great field to work in.

https://www.youtube.com/watch?v=WDoXs5b8MkE&list=PL88nW6gzhsa7d68qqB4gMbE6J7HJ-Z6nm

Those currently working in the insurance industry encourage their peers to keep an open mind and be ready for whatever may happen, as you shouldn’t expect a boring day on the job.

For those who are considering a position with Great American, they encourage prospective applicants to apply to this unique opportunity with their “Be Here Be Great” campaign, as seen below.

https://youtu.be/OTQr42Ah6iY

In this video playlist, you’ll find that many of the employees of Great American find their jobs to be both challenging and fun, and encourage anyone who is curious to apply and try it out for themselves.

Great American in the Community

Great American takes pride in being a business that helps the community. They’ve focused their efforts to help provide for several causes such as performing arts, religious services, and youth engagement programs, among many others.

Whether it’s running a charity marathon or donating blood at a Red Cross drive, Great American’s employees have proven they are dedicated to helping their communities prosper.

Companies that do good for their communities, such as providing for those who need it most, will stick out in their consumers’ minds long after the hard times have passed.

Great American’s Employees

Great American’s employee reviews are mostly positive. Many employees praise the work-life balance and the benefits, as well as the ability for upward mobility.

Great American takes pride in informing the public about their health, and through their employees’ volunteer efforts and donations, they’ve been able to help people live healthier lives.

Pros & Cons of Great American Life Insurance

The pros and cons of a life insurance company depend on what kind of policies they offer and their interactions with their customers. The pros and cons of life insurance policies depend on the features and riders that that individual insurer offers. Here is an overview of the best and worse that Great American brings to the table:

Pros & Cons of Great American Life Insurance

| Pros | Cons |

|---|---|

| Leader in life and health insurance market | Decline in annuities recently |

| Strong financial ratings | Not enough communication about the types of coverage offered |

| Good customer service | Few programs for clients |

Most of the reviews regard Great American’s customer service as some of the best they’ve encountered, a necessity for life insurance.

Great American Life Insurance Company Claims Process

Ease of Filing a Claim (Online, Over the Phone, Mobile Apps)

Great American Life Insurance Company offers a convenient and user-friendly claims process for policyholders. They provide multiple channels for filing claims, including online submission, phone assistance, and mobile apps for added convenience. Policyholders can choose the method that suits them best, making the claims process accessible and hassle-free.

Average Claim Processing Time

The average claim processing time at Great American Life Insurance Company is known for its efficiency. Policyholders can expect timely responses and quick resolution of their claims, helping them navigate challenging times with peace of mind.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback regarding claim resolutions and payouts at Great American Life Insurance Company has generally been positive. Policyholders appreciate the company’s commitment to fair and prompt settlements, ensuring that beneficiaries receive their due benefits when they need them the most.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Great American Life Insurance Company Digital and Technological Features

Mobile App Features and Functionality

Great American Life Insurance Company offers a mobile app with robust features and functionality. Policyholders can manage their accounts, access policy details, make premium payments, and even initiate the claims process directly from the app. The user-friendly interface enhances the overall customer experience.

Online Account Management Capabilities

The company’s online account management capabilities provide policyholders with easy access to their policies and account information. Customers can log in to their accounts through the company’s website, where they can view policy documents, update personal information, and review billing statements.

Digital Tools and Resources

Great American Life Insurance Company offers a range of digital tools and resources to help policyholders make informed decisions. These include online calculators, educational materials, and informative articles about insurance products. These resources empower customers to better understand their coverage and options.

These digital and technological features contribute to Great American Life Insurance Company’s reputation for providing a modern and customer-centric insurance experience.

Great American Life Insurance: The Bottom Line

If you found this article looking for United Teacher Associates’ life insurance, you may be disappointed to find that they were purchased by another company called Great American. However, Great American, as a leader in the life and property insurance business, may have the coverage you need.

Great American has a strong history of securing the financial well-being of their clients.

If you work at one of Great American’s partnered employers, you can discuss with your employer about your property protection options.

Ready to see your rates with top companies? Now that you’ve finished this Great American Life Insurance review, use our free quote tool to find your life insurance rates now.

About the Former United Teachers Associates

United Teacher Associates (UTA) operated out of its Texas headquarters for nearly 60 years. In 2016, the company was acquired by diversified holding company HC2 Holdings, Inc. as follows:

- Continental LTC., Inc. (CLT), a subsidiary of Continental insurance Group, Ltd. (CIG), acquired UTA and Continental General Insurance Company (CGIC) in 2016.

- UTA’s union with CGIC was finalized on December 31, 2016, impacting UTA employee benefits significantly.

- CGIC became the insurance subsidiary of CLI at this same time.

- CIG is the insurance unit of HC2 Holdings.

UTA no longer maintains an active website, and it has ceased writing any new business. If you need assistance or information regarding UTA’s services, you can contact their phone number directly. Additionally, for inquiries related to UTA health insurance policies or other insurance offerings, reaching out to their customer service team via phone is recommended.

CIG currently provides long-term care, life, annuity, and other accident and health coverage to approximately 132,000 individuals through CGI. It does not appear to be writing any new business.

As of its 2019 annual report, HC2 Holdings has seven major operating segments: construction, marine services, energy, telecommunications, insurance, life sciences, and broadcasting. Insurance is its third-most profitable segment, after construction and telecommunications, respectively.

Frequently Asked Questions

What is Great American Life Insurance Company?

Great American Life Insurance Company is a reputable insurance company that provides various life insurance products and services. They offer a range of coverage options to meet the needs of individuals and families, including term life insurance, whole life insurance, universal life insurance, and indexed universal life insurance.

What are the advantages of choosing Great American Life Insurance Company?

Great American Life Insurance Company offers several advantages, including:

- Financial stability: Great American Life Insurance Company is known for its strong financial ratings and stability, providing policyholders with peace of mind.

- Diverse product offerings: They provide a wide range of life insurance products to suit different needs and preferences.

- Flexibility: Great American Life Insurance Company offers flexible policy options, allowing policyholders to customize coverage to their specific requirements.

- Competitive rates: They strive to offer competitive rates in the life insurance market, making their products accessible to a broad range of individuals.

- Customer service: Great American Life Insurance Company is committed to providing excellent customer service and support to policyholders.

How can I obtain a quote for life insurance from Great American Life Insurance Company?

To obtain a quote for life insurance from Great American Life Insurance Company, you can visit their official website or contact their customer service directly. They will guide you through the process of getting a quote based on your personal information, coverage needs, and any additional factors that may influence the cost of your policy.

Does Great American Life Insurance Company offer customizable insurance policies?

Great American Life Insurance Company often provides options for customization within their life insurance policies. These may include choosing the coverage amount, policy duration, and additional riders or benefits to suit individual needs.

How long has Great American Life Insurance Company been in business?

Great American Life Insurance Company has been in operation for several decades. The exact number of years may vary, so it is recommended to verify the company’s establishment date through their official sources.

What is United Teachers Associates Insurance Company?

United Teachers Associates Insurance Company is an insurance provider that offers various insurance products, including life insurance and long-term care insurance.

What are the reviews for Continental General Insurance Company long-term care policies?

Reviews for Continental General Insurance Company’s long-term care policies can be found online on various review platforms or through customer testimonials.

How can I access the United Teachers Associates provider portal?

The platform known as the United Teachers Associates insurance company provider portal serves as a centralized hub for healthcare providers to access pertinent information and oversee their engagements with the United Teachers Associates Insurance Company.

How can I contact United Teachers Associates Insurance Company?

You can contact United Teachers Associates Insurance Company at 800-854-3649 for inquiries, policy assistance, or claims-related issues. If you need assistance with United Teachers Association claims address, they can provide the necessary information as well.

What are the advantages of insurance?

The advantages of insurance include financial protection against unexpected events, peace of mind, and assistance with medical expenses or property damage.

Are there any reviews for American Financial Resources Inc.?

Reviews for American Financial Resources Inc. can be found on review websites, forums, or through customer feedback.

What are the reviews from teachers for American Reading Company?

American Reading Company’s reviews from teachers can be found on platforms like Glassdoor, Indeed, or through testimonials on the company’s website.

Can I find reviews for Associates Insurance Group online?

Reviews for Associates Insurance Group can be found on review websites, social media platforms, or through customer testimonials.

What is Banner Life’s premium debit policy?

Banner Life’s premium debit policy allows policyholders to pay their premiums through automatic deductions from their bank accounts.

What are the benefits of a term life insurance policy?

The benefits of a term life insurance policy include affordability, flexibility, and coverage for a specific period.

What is considered the best insurance policy in Pakistan?

The best insurance policy in Pakistan depends on individual needs, budget, and coverage requirements. It’s recommended to compare policies from different insurers to find the best fit.

What is the phone number for CGI Cigna Premium services?

CGI Cigna Premium services can be contacted through their customer service hotline or online portal for assistance with policy-related queries or claims.

What are the cons of insurance?

The cons of insurance may include high premiums, limited coverage options, and the potential for denied claims.

Is there a credit associates BBB review available?

The BBB may have a review available for Credit Associates, providing insight into the company’s customer service and business practices.

What is Great American Life Insurance?

Great American Life Insurance offers various insurance products, including term life, whole life, and universal life insurance policies.

How can I reach Great American Annuity customer service?

Great American Annuity customer service can be reached through their hotline or online portal for assistance with annuity-related inquiries or issues.

What are the ratings for Great American Family?

Great American Family ratings may vary depending on customer feedback, industry reviews, and financial ratings.

What is Great American Finance Holdings LLC?

Great American Finance Holdings LLC is a diversified holding company with various subsidiaries, including insurance and financial services providers.

Are there any new york life TV commercials?

New York Life TV commercials may be available on television networks, online streaming platforms, or the company’s official website.

What are the complaints against Northwestern Mutual Indexed Universal Life policies?

Complaints against Northwestern Mutual Indexed Universal Life policies may include issues with policy performance, fees, or customer service.

What are the differences between Power Term and Precision Term Life Insurance?

Power Term and Precision Term Life Insurance differ in terms of coverage options, premium rates, and policy features.

Are there any reviews for Pride of America employees?

Reviews for Pride of America employees can provide insight into the company’s workplace culture, employee benefits, and satisfaction.

What are the benefits of State Life Insurance policies?

The benefits of State Life Insurance policies include financial protection, investment opportunities, and tax benefits.

Are there any reviews available for State Life Insurance Pakistan?

Reviews for State Life Insurance Pakistan can be found on review websites, social media platforms, or through customer testimonials.

Is there a BBB review for The Credit Pros?

The BBB may have a review available for The Credit Pros, offering insights into the company’s credit repair services and customer satisfaction.

How can I pay United GRPW Premium?

United GRPW Premium can be paid through various methods, including online payments, bank transfers, or through the company’s billing portal.

What is United Teachers Association insurance, and how does it differ from other life insurance policies?

United Teachers Association insurance, now part of Great American Life Insurance Company, offers life insurance policies tailored to the needs of educators. These policies may include benefits such as coverage for educators’ unique financial needs and options for retirement planning.

What are the benefits of a life insurance policy, and why is it important to have one?

The benefits of a life insurance policy are manifold. Firstly, it provides financial protection for your loved ones in the event of your death, ensuring they have funds to cover expenses such as mortgage payments, education costs, and daily living expenses. Additionally, life insurance can serve as an investment tool, offering tax-deferred growth and potentially serving as a source of retirement income

Can you provide CIG insurance reviews and ratings to help me make an informed decision about their policies?

CIG Insurance reviews can provide valuable insights into the quality of their insurance products and customer service. It’s essential to read reviews from multiple sources to get a comprehensive understanding of customers’ experiences with CIG Insurance.

What is the Cigna Loyal Premium phone number for inquiries and customer support regarding insurance policies?

You can typically find the Cigna Loyal Premium phone number on their official website or within your Continental General Insurance Company Cigna policy documents. Calling this number will connect you with customer service representatives who can assist with inquiries about your policy, premiums, claims, and more.

How do Continental Care Insurance reviews reflect the quality of their services and policies?

Continental Care Insurance reviews can vary depending on customers’ experiences with their policies and services. It’s advisable to read a range of reviews to gauge overall customer satisfaction and identify any recurring issues or concerns.

Are there any Continental General Insurance Company long term care forms available online for easy access?

Continental General Insurance Company may provide long-term care forms online for policyholders’ convenience. These forms may include documents related to policy updates, claims submission, beneficiary changes, and other administrative tasks.

Where can I find Continental General Insurance Company phone number for assistance with policy-related queries?

- The Continental General Insurance Company phone number can usually be found on their official website or on your insurance policy documents. Contacting this number will connect you with customer service representatives who can assist with policy-related queries, claims, billing, and more.

What do customers say about Continental General Insurance Company reviews, and how does it impact their reputation in the industry?

Continental General Insurance Company reviews can offer valuable insights into the company’s reputation, customer service quality, claims process, and overall satisfaction levels among policyholders. It’s essential to consider both positive and negative reviews to make an informed decision about insurance providers.

Can you provide insights into Continental Health Insurance reviews and how they compare to other insurance providers?

Continental Health Insurance reviews can provide valuable insights into the company’s policies, customer service, claims process, and overall satisfaction levels among policyholders. Reading a variety of reviews can help you gauge the company’s reputation and suitability for your insurance needs.

Are there any complaints about Good Teacher Life reviews BBB, and how are they addressed by the company?

Complaints about Good Teacher Life reviews BBB may vary, and it’s essential to investigate the nature of these complaints to understand their significance. The company’s response to complaints and their efforts to address customer concerns can provide valuable insights into their commitment to customer satisfaction.

Is The Great American Services legit, and what factors contribute to their credibility in the insurance industry?

The Great American Services is a reputable insurance provider with a long-standing history of providing quality insurance products and services. Their legitimacy is supported by positive customer reviews, industry ratings, and their commitment to ethical business practices.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Laura D. Adams

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Insurance & Finance Analyst

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.