Allstate Auto Insurance Review & Complaints: Auto Insurance (2025)

Allstate insurance has average rates of $175, but the rate can vary based on factors like driving record, credit history, coverage level, and more. We’ll look at Allstate’s history, their policy offerings, and their reputation, as well as where they stand when it comes to premiums.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed life insurance agent with 23 years of experience helping people protect their families and businesses with term life insurance. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

UPDATED: Jun 20, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Jun 20, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Your one-stop online insurance guide. Get free quotes now! Secured with SHA-256 Encryption

| Allstate Overview | Details |

|---|---|

| Year Founded | 1931 |

| Current Executives | Tom Wilson - Chair, President, CEO Mario Rizzo - Executive VP, CFO |

| Number of Employees | 42,900 |

| Total Assets (2017) | $112.422 billion |

| HQ Address | 2775 Sanders Rd. Northbrook, IL 60062 |

| Phone Number | 1-877-810-2920 |

| Company Website | www.allstate.com |

| Premiums Written (Auto, 2017) | $21,430,405 |

| Loss Ratio | 59.51% |

| Best For | Drivers with a clean record |

Allstate is one of the biggest and best-known car insurance companies in the United States and operates across the country. They have a long history and were originally a part of retail giant Sears Roebuck.

Allstate’s logo and “You’re in good hands” slogan have earned them major brand recognition, and they rank as the fourth largest car insurance company by market share in the nation. A lot of Americans do feel they’re in good hands with Allstate, but how can you know if they’re the right choice for your car insurance needs?

We’ll take an in-depth look at Allstate’s history, their policy offerings, and their reputation, as well as where they stand when it comes to premiums.

Read on for everything you need to know about one of the most recognized brands in car insurance.

If you are ready to find a more affordable insurance companies for auto, we can help. Enter your ZIP code above to review auto insurance coverage options from the largest insurance companies in your area.

What Are Allstate Ratings?

Insurance companies make all kinds of promises, but company ratings provided by trusted third-party sources can get to the truth. How does Allstate rank? Let’s take a look.

| Ratings Agency | Rating |

|---|---|

| A.M. Best | A+ |

| Better Business Bureau | A+ |

| Moody's | A3 |

| S&P | AA- |

| NAIC Complaint Index | 1.28 |

| JD Power | Claims Satisfaction 3/5 Shopping Study 2/5 |

| Consumer Reports | 88 |

AM Best, Moody’s, and Standard & Poors (S&P) ratings all relate to Allstate’s financial stability. High ratings from these sources tell consumers they shouldn’t have any trouble paying their claims. All of Allstate’s financial ratings are good.

The Better Business Bureau, J.D. Power, and Consumer Reports all provide ratings based on multiple areas of consumer satisfaction, including complaints and customer surveys. Each grade is the result of the combined ratings from a variety of factors.

J.D. Power also assesses companies based on their regional performance. According to the results from two national surveys, Allstate’s complaints performance falls below the industry average.

The Consumer Reports score represents an overall score out of 100. Consumer Affairs reviews for Allstate insurance are 81 percent one-star, negative reviews. Geico, is at 40 percent. By comparison, number one auto insurance company State Farm has a 77 percent negative review ratio.

When reading reviews it is a good idea to take into consideration that more people take to the Internet to review an insurance company when they are angry than when all is well, which can skew these numbers.

The NAIC complaint index gives the number of complaints compared to the number of policies the company has in force. Allstate comes in a little above the national average of 1.16.

Read more: What do I need to do to cancel my car insurance policy with Allstate?

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

What’s the Company History?

Allstate was founded in 1931 by retailer Sears Roebuck, with auto insurance policies sold through direct mail, a method that fell right in line with Sears’ catalog sales approach. The name Allstate came from the brand of tires Sears had been selling since 1925, but it would eventually be better known as an insurance company.

In 1993 Sears sold off part of the company, and Allstate launched its IPO. By 1995 they were officially operating as an independent company. The next year they moved into the internet age with the launch of allstate.com.

Over the years a number of property and casualty products were added to the lineup; in addition to auto insurance, Allstate offers home, business, and specialty vehicle coverage among other products.

Today they’re the largest publicly traded insurance company in the U.S. and rank as the fourth-largest property & casualty insurance company.

In 2017, Allstate ranked at number 79 on the Fortune 500. Other companies under Allstate’s banner are:

- Encompass Insurance Company

- Allstate Fire and Casualty Insurance Company

- Allstate Insurance Company

- Allstate Life Insurance Company

- Allstate Property and Casualty Insurance Company

- Allstate New Jersey Property and Casualty Insurance Company

- Allstate New Jersey Insurance Company

- Allstate Life Insurance Company of New York

- Castle Key Insurance Company

- Castle Key Indemnity Company

- Allstate Texas Lloyd’s

- Allstate County Mutual Insurance Company

- American Heritage Life Insurance Company

- Allstate Insurance Company of Canada

What’s the Market Share?

In 2017, Allstate was the fourth largest car insurance company in America, with a market share of 9.26 percent.

That’s a drop out of the third place spot they had previously held with 9.70 percent of the share in 2016 and 10.03 percent in 2015.

Allstate’s steady decline saw them overtaken by Progressive’s steady increase in market share over the same time period. Why? Possible reasons include Progressive’s low rates and modern approach that may appeal to a new generation.

How Are Allstate Products Sold?

Allstate operates on a captive agent system, which means their products are exclusively sold by Allstate insurance agents. While Allstate offers comprehensive online services for quoting and purchasing car insurance, you will still be assigned to a local agent who will manage your account and may reach out to you occasionally.

Allstate products can also be purchased over the phone; a local agent can assist you in obtaining coverage without the need to visit the office.

Alternatively, you can opt to buy insurance in person from an agent. Utilize the agent locator Allstate tool to find an Allstate car insurance near and obtain an Allstate car insurance quotes. Additionally, read Allstate car insurance reviews to gain further insight into their offerings

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

What Kind of Commercials does Allstate Feature?

Since the 1950’s Allstate has been using the “You’re in good hands” slogan to advertise their products, and although they have changed the logo somewhat, the slogan remains the same.

Allstate’s commercials have featured spokesperson Dennis Haysbert since 2003. Haysbert was, up until then, probably best known for playing the President of the United States in Fox’s hit drama 24. He’s now better known as the Allstate guy, making promises on Allstate’s behalf with the slogan “That’s Allstate’s stand” and asking “Are you in good hands?”

In 2010 Allstate brought a little humor into their commercials with “Mayhem”, a personification of impending disaster. Actor Dean Winters plays the troublemaking role of the many hazards that can result in the need for an insurance claim.

While Mayhem amuses audiences, Haysbert remains the serious side of Allstate, returning in a new series of commercials that started in 2018.

What is the Community Service like?

Allstate gives back to the communities they serve on both a national level and locally.

The Allstate Foundation was created in 1952 and operates several different programs including:

- The Good Starts Young initiative to provide in-school and after-school support to students

- The Purple Purse domestic violence campaign to provide financial independence to victims

- The Nonprofit Leadership Center

- The Helping Hands program for local agents and employees volunteering in their communities

According to the Foundation website, Allstate agents and employees have volunteered more than 1.5 million hours since 2011, and the Good Starts Young program has raised more than $10 million.

What is Allstate Position for the Future?

Allstate’s market share has been decreasing over the past few years, likely due to the lower prices available from direct-buy companies like Progressive and Geico.

Their financial ratings remain strong, however, and they have stayed on top of changing trends in the car insurance industry; Allstate is the only major insurance company offering a pay-per-mile service, for example (although it’s not yet available nationwide).

They’ve also got a hand in the direct-buy market through subsidiary Esurance.

Allstate looks like a solid bet to remain one of the top car insurance companies in the nation for the foreseeable future.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

What’s it like Working at Allstate?

The average age of Allstate’s employees is 35, with an average tenure of 2.9 years, according to a ranking of Fortune 500 companies done by Payscale, a workplace data collection company.

36 percent of employees surveyed had a high level of job satisfaction, and 58 percent low job satisfaction.

Surveyed employees rated Allstate at a 3.4 out of five in terms of satisfaction, which is the same rating earned by major competitor State Farm.

Over at Glassdoor, Allstate employees rank the company at 3.5 out of five and praise Allstate for a good work/life balance. 75 percent of the employees surveyed have a positive impression of the CEO.

Have They got any Awards and Accolades?

Allstate regularly makes the list of top companies for workplace diversity from several sources. For 2018 they earned the following accolades, among others:

- Human Rights Campaign Best Places to Work for LGBTQ Equality

- Diversity Inc.’s Top 50 Companies for Diversity

- Diversity Best Practices Inclusion Index

They also repeatedly land on the lists of best companies for women and win military-friendly employer awards from sources like Working Mother Magazine and Military Friendly.

Allstate has also been named one of the world’s most ethical companies for five years straight by the Ethisphere Institute.

What Are Their Products and Services?

Although they are known primarily as an auto insurance company, Allstate sells nearly every type of personal lines policy as well as a good range of Allstate commercial insurance. This allows them to cover all the needs of a single individual under one banner, which adds a convenience factor as well as the selling point of multi-policy discounts.

- Auto Insurance – Allstate’s flagship product and the majority of their policy sales, auto insurance policies come with all the standard features as well as a long list of add-ons and discounts. Among the options is the “Your Choice Auto” upgrade options, which gives you several trendy add-ons including “Accident Forgiveness” and “Safe Driving Bonus” for an extra cost. The “Platinum” option comes with the most options, and it costs more as a result.

- Homeowner’s Insurance – Homeowner’s policies from Allstate provide standard structure and personal property coverage. They also write landlord policies, renter’s insurance, and condo insurance, covering a range of home types.

- Motorcycle Insurance – Allstate isn’t well known for motorcycle coverage, mainly because they don’t advertise it as heavily as main competitor Geico. They do in fact write comprehensive policies and offer a list of available discounts and add-ons like New Motorcycle Replacement, similar to what’s available from their auto policies.

- Life Insurance – Several of Allstate’s subsidiaries, depending on where you live, write life insurance in the usual forms: term, whole, and universal.

- Recreational, Off-road, and Boat Insurance – Allstate writes policies for a wide variety of different toys, from RVs to ATVs and including boats, snowmobiles, and more.

- Business Insurance – Among the businesses Allstate covers are retail, service, insurance contractors, medical, and wholesale. They provide a range of coverage including business property, liability, and commercial auto.

- Financial Products – Financial products include annuities, IRAs, mutual funds, and college savings plans provided through several of Allstate’s subsidiaries.

- Supplemental Health Insurance – Although Allstate doesn’t write full health insurance plans, they do offer a variety of products to provide extended coverage. These include disability, critical illness, cancer care, and accident protection.

This incredibly diverse list of coverage makes Allstate a convenient location for one-stop insurance shopping. Multi-policy discounts are one of the most attractive features of large companies with multiple product lines as well, which is a major draw for a lot of insurance shoppers.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

How to Get Cheap Car Insurance Rates

Allstate’s rates for car insurance vary greatly from state to state as well as based on your driving record, credit history, coverage level, and other factors.

We’ve gathered some rates for comparison.

What Are the Rates By State?

The data below shows rates for Allstate compared to the average rate in each state.

Allstate Average Annual Car Insurance Rates By State Compared to Average

| State | State's Average Annual Rates | Allstate Average Annual Rates | Higher/Lower Than State Average By $ | Higher/Lower Than State Average By % |

|---|---|---|---|---|

| Alaska | $3,421.51 | $3,145.31 | -$276.21 | -8.78% |

| Alabama | $3,566.96 | $3,311.52 | -$255.44 | -7.71% |

| Arkansas | $4,124.98 | $5,150.03 | $1,025.05 | 19.90% |

| Arizona | $3,770.97 | $4,904.10 | $1,133.13 | 23.11% |

| California | $3,688.93 | $4,532.96 | $844.03 | 18.62% |

| Colorado | $3,876.39 | $5,537.17 | $1,660.78 | 29.99% |

| Connecticut | $4,618.92 | $5,831.60 | $1,212.68 | 20.80% |

| District of Columbia | $4,439.24 | $6,468.92 | $2,029.68 | 31.38% |

| Delaware | $5,986.32 | $6,316.06 | $329.74 | 5.22% |

| Florida | $4,680.46 | $7,440.46 | $2,760.00 | 37.09% |

| Georgia | $4,966.83 | $4,210.70 | -$756.13 | -17.96% |

| Hawaii | $2,555.64 | $2,173.49 | -$382.15 | -17.58% |

| Iowa | $2,981.28 | $2,965.86 | -$15.42 | -0.52% |

| Idaho | $2,979.09 | $4,088.76 | $1,109.67 | 27.14% |

| Illinois | $3,305.48 | $5,204.41 | $1,898.93 | 36.49% |

| Indiana | $3,414.97 | $3,978.81 | $563.84 | 14.17% |

| Kansas | $3,279.62 | $4,010.23 | $730.61 | 18.22% |

| Kentucky | $5,195.40 | $7,143.92 | $1,948.52 | 27.28% |

| Louisiana | $5,711.34 | $5,998.79 | $287.45 | 4.79% |

| Maine | $2,953.28 | $3,675.59 | $722.31 | 19.65% |

| Maryland | $4,582.70 | $5,233.17 | $650.47 | 12.43% |

| Massachusetts | $2,678.85 | $2,708.53 | $29.68 | 1.10% |

| Michigan | $10,498.64 | $22,902.59 | $12,403.95 | 54.16% |

| Minnesota | $4,403.25 | $4,532.01 | $128.76 | 2.84% |

| Missouri | $3,328.93 | $4,096.15 | $767.22 | 18.73% |

| Mississippi | $3,664.57 | $4,942.11 | $1,277.54 | 25.85% |

| Montana | $3,220.84 | $4,672.10 | $1,451.26 | 31.06% |

| North Carolina | $3,393.11 | $7,190.43 | $3,797.32 | 52.81% |

| North Dakota | $4,165.84 | $4,669.31 | $503.47 | 10.78% |

| Nebraska | $3,283.68 | $3,198.83 | -$84.85 | -2.65% |

| New Hampshire | $3,151.77 | $2,725.01 | -$426.77 | -15.66% |

| New Jersey | $5,515.21 | $5,713.58 | $198.36 | 3.47% |

| New Mexico | $3,463.64 | $4,200.65 | $737.01 | 17.55% |

| Nevada | $4,861.70 | $5,371.62 | $509.92 | 9.49% |

| New York | $4,289.88 | $4,740.97 | $451.08 | 9.51% |

| Ohio | $2,709.71 | $3,197.22 | $487.51 | 15.25% |

| Oklahoma | $4,142.33 | $3,718.62 | -$423.70 | -11.39% |

| Oregon | $3,467.77 | $4,765.95 | $1,298.18 | 27.24% |

| Pennsylvania | $4,034.50 | $3,984.12 | -$50.38 | -1.26% |

| Rhode Island | $5,003.36 | $4,959.45 | -$43.91 | -0.89% |

| South Carolina | $3,781.14 | $3,903.43 | $122.29 | 3.13% |

| South Dakota | $3,982.27 | $4,723.72 | $741.45 | 15.70% |

| Tennessee | $3,660.89 | $4,828.85 | $1,167.96 | 24.19% |

| Texas | $4,043.28 | $5,485.44 | $1,442.16 | 26.29% |

| Utah | $3,611.89 | $3,566.42 | -$45.47 | -1.27% |

| Virginia | $2,357.87 | $3,386.80 | $1,028.93 | 30.38% |

| Vermont | $3,234.13 | $3,190.38 | -$43.75 | -1.37% |

| Washington | $3,059.32 | $3,540.52 | $481.20 | 13.59% |

| West Virginia | $2,595.36 | $3,820.68 | $1,225.32 | 32.07% |

| Wisconsin | $3,606.06 | $4,854.41 | $1,248.35 | 25.72% |

| Wyoming | $3,200.08 | $4,373.93 | $1,173.85 | 26.84% |

Allstate’s highest rates based on this data are found in Michigan, where they come in at near 55 percent above average. That’s saying something given the fact that Michigan has the most expensive car insurance premiums in the nation.

The cheapest state to choose Allstate as your insurer is Georgia, where they come in nearly 18 percent below average.

What Are the Rates Compared to Other Insurance Providers?

Here’s a state-by-state look at how Allstate stacks up to nine other top insurance companies in terms of rates.

Top Providers Average Monthly Premiums Compared by State

| State | U.S. Average |  |  | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Alaska | $103 | $97 | $76 | $135 | $65 | $108 | $105 | $127 | $164 | $93 |

| Alabama | $105 | $112 | $89 | $108 | $108 | $96 | $105 | $133 | $162 | $79 |

| Arkansas | $116 | $131 | $91 | $162 | $80 | $128 | $137 | $165 | $99 | $111 |

| Arizona | $112 | $84 | $65 | $180 | $81 | $116 | $114 | $135 | $178 | $104 |

| California | $140 | $132 | $101 | $199 | $108 | $142 | $138 | $167 | $216 | $122 |

| Colorado | $115 | $120 | $94 | $166 | $94 | $107 | $118 | $163 | $92 | $114 |

| Connecticut | $123 | $133 | $62 | $196 | $91 | $112 | $125 | $151 | $201 | $83 |

| District of Columbia | $129 | $115 | $69 | $241 | $111 | $172 | $115 | $139 | $180 | $102 |

| Delaware | $156 | $90 | $101 | $207 | $116 | $144 | $130 | $157 | $494 | $82 |

| Florida | $142 | $153 | $89 | $183 | $99 | $103 | $188 | $227 | $161 | $166 |

| Georgia | $132 | $115 | $61 | $165 | $107 | $152 | $124 | $149 | $263 | $110 |

| Hawaii | $83 | $78 | $59 | $118 | $64 | $84 | $82 | $99 | $128 | $72 |

| Iowa | $86 | $75 | $81 | $126 | $65 | $73 | $95 | $82 | $116 | $92 |

| Idaho | $77 | $91 | $57 | $128 | $53 | $82 | $93 | $92 | $79 | $57 |

| Illinois | $92 | $89 | $47 | $176 | $64 | $93 | $114 | $117 | $76 | $87 |

| Indiana | $92 | $69 | $63 | $140 | $71 | $97 | $107 | $79 | $183 | $69 |

| Kansas | $111 | $127 | $75 | $160 | $81 | $92 | $114 | $144 | $174 | $87 |

| Kentucky | $145 | $111 | $80 | $236 | $98 | $184 | $164 | $197 | $168 | $139 |

| Louisiana | $173 | $161 | $141 | $206 | $124 | $181 | $176 | $212 | $274 | $156 |

| Maine | $101 | $95 | $72 | $143 | $78 | $103 | $99 | $120 | $155 | $88 |

| Maryland | $129 | $121 | $135 | $201 | $107 | $106 | $116 | $140 | $181 | $103 |

| Massachusetts | $80 | $94 | $37 | $108 | $59 | $87 | $84 | $117 | $120 | $61 |

| Michigan | $238 | $152 | $99 | $406 | $209 | $257 | $204 | $335 | $424 | $183 |

| Minnesota | $124 | $101 | $90 | $160 | $67 | $87 | $93 | $108 | $375 | $94 |

| Missouri | $102 | $98 | $90 | $148 | $85 | $66 | $106 | $135 | $129 | $114 |

| Mississippi | $105 | $120 | $72 | $147 | $82 | $96 | $120 | $145 | $119 | $88 |

| Montana | $107 | $171 | $82 | $154 | $70 | $88 | $125 | $164 | $59 | $111 |

| North Carolina | $86 | $32 | $69 | $169 | $77 | $111 | $82 | $99 | $82 | $99 |

| North Dakota | $124 | $110 | $61 | $136 | $76 | $77 | $145 | $107 | $398 | $88 |

| Nebraska | $104 | $95 | $92 | $125 | $69 | $77 | $112 | $130 | $179 | $102 |

| New Hampshire | $86 | $63 | $50 | $128 | $59 | $77 | $77 | $93 | $198 | $68 |

| New Jersey | $138 | $93 | $74 | $157 | $113 | $119 | $115 | $231 | $279 | $136 |

| New Mexico | $105 | $86 | $90 | $158 | $69 | $96 | $103 | $131 | $161 | $91 |

| Nevada | $114 | $82 | $110 | $165 | $103 | $112 | $140 | $155 | $111 | $91 |

| New York | $138 | $96 | $78 | $147 | $137 | $164 | $137 | $165 | $200 | $175 |

| Ohio | $82 | $85 | $59 | $120 | $70 | $114 | $62 | $96 | $106 | $63 |

| Oklahoma | $118 | $110 | $109 | $135 | $91 | $122 | $118 | $136 | $184 | $105 |

| Oregon | $102 | $78 | $93 | $153 | $75 | $111 | $106 | $111 | $141 | $97 |

| Pennsylvania | $112 | $148 | $68 | $148 | $76 | $86 | $108 | $131 | $219 | $75 |

| Rhode Island | $143 | $116 | $125 | $189 | $76 | $190 | $151 | $183 | $235 | $103 |

| South Carolina | $117 | $105 | $79 | $133 | $88 | $118 | $118 | $166 | $185 | $105 |

| South Dakota | $109 | $105 | $57 | $136 | $67 | $76 | $151 | $113 | $230 | $97 |

| Tennessee | $102 | $92 | $78 | $144 | $72 | $118 | $102 | $86 | $184 | $88 |

| Texas | $133 | $121 | $105 | $201 | $90 | $154 | $176 | $137 | $178 | $101 |

| Utah | $96 | $95 | $73 | $117 | $103 | $93 | $105 | $115 | $119 | $88 |

| Virginia | $81 | $61 | $69 | $103 | $63 | $86 | $83 | $100 | $129 | $73 |

| Vermont | $93 | $181 | $38 | $142 | $87 | $77 | $85 | $103 | $100 | $75 |

| Washington | $80 | $60 | $75 | $114 | $69 | $70 | $91 | $102 | $92 | $81 |

| West Virginia | $94 | $94 | $62 | $123 | $58 | $226 | $63 | $109 | $84 | $72 |

| Wisconsin | $116 | $110 | $83 | $162 | $79 | $104 | $115 | $139 | $196 | $102 |

| Wyoming | $104 | $106 | $111 | $155 | $82 | $114 | $111 | $130 | $75 | $98 |

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

What Are the Rates By Commute?

As you can see below, on average Allstate’s rates aren’t that different for a longer commute.

| Commute Type | Allstate Average Rate |

|---|---|

| 10-mile, 6,000 miles annually | $4,841.71 |

| 25-mile, 12,000 miles annually | $4,934.20 |

What Are the Rates By Coverage Level?

A lot of people decide how much coverage to carry based on how much it costs. Below you’ll see rates for three levels of coverage from Allstate. You’ll spend a little over $500 more a year to go from low to high coverage.

| Coverage Level | Average Allstate Rate |

|---|---|

| Low | $4,628.03 |

| Medium | $4,896.81 |

| High | $5,139.02 |

What Are the Rates By Credit History?

According to Experian, the average credit score in the United State is 675.

Not all states allow the use of credit scores in calculating car insurance rates, but most do. Here’s a look at how Allstate’s rates change based on your credit history.

Allstate Average Monthly Rates by Credit History

| Credit History | Allstate Average Rates |

|---|---|

| Poor | $540.89 |

| Fair | $381.76 |

| Good | $321.64 |

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

What Are the Rates By Driving Record?

Your driving record is one of the biggest factors used to calculate rates. A driver will a clean record will always get a better rate than someone with a ticket or an at-fault accident.

We’ve compared average rates from Allstate for four common scenarios. You can see that a DUI is the most expensive of the scenarios, and will cost you quite a bit more than either a speeding ticket or an accident.

| Driving Record | Allstate Average Rate |

|---|---|

| Clean Record | $3,819.90 |

| 1 Speeding Ticket | $4,483.51 |

| 1 Accident | $4,987.68 |

| 1 DUI | $6,260.73 |

What Are the Coverages Offered?

Allstate offers a pretty comprehensive auto insurance program, with all of the basics covered as well as plenty of options including money-saving programs.

What Types of Coverage Does Allstate Offer?

Allstate offers all of the legally-required liability and no-fault insurance coverage in every state. Depending on your state that may include at various minimum coverage levels:

- Bodily Injury Liability

- Property Damage Liability

- Personal Injury Protection (PIP)

- Medical Payments (Med Pay)

- Uninsured/Uniderinsured Motorist Bodily Injury

- Uninsured/Underinsured Motorist Property Damage

In addition to liability coverage, there are quite a few options that you can add to your policy at Allstate.

- Collision Coverage

- Comprehensive Coverage

- Rental Reimbursement

- Roadside Assistance

- Personal Property Protection

- Sound System Coverage

- Personal Umbrella

These coverages will vary by state depending on local laws and coverage requirements.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

What are the Bundling Options?

Allstate offers a discount to customers with more than one type of policy in force.

The auto and home bundle includes homeowners, condo owners, and renter’s insurance discounts.

Allstate also has a bundling discount for customer with both an auto and life insurance policy.

What is the Area of Operation?

Allstate is an international company operating in several countries and in all parts of the United States.

They write auto insurance in all 50 states and the District of Columbia.

Are There any Additional Options?

Beyond the basics, Allstate has a lot of options available, including a variety of trendy new choices. Most, but not all, are available in all states. Allstate’s website doesn’t always make it clear which states are excluded from those not offered everywhere.

Drivewise is Allstate’s usage-based insurance program. In most states, it runs entirely on an app, although some states still use a plug-in device (Alaska, Indiana, and Florida). The program gathers information about driving habits and uses it to calculate a policy discount. Unlike many such programs, Drivewise runs continually, calculating a new discount amount every six months and applying it at renewal.

https://youtu.be/oYWf8XEdpa0

Allstate Rewards is a rewards program that can be used with or without Drivewise. It runs through the Allstate app and allows drivers to gather points in return for completing activities and challenges. Rewards is an unusual program in that you don’t actually have to be an Allstate customer to use it. Points can be redeemed for gift cards to a variety of retailers.

Milewise is another kind of usage-based program that’s a lot more unusual. It’s a pay-per-mile program, and aside from subsidiary Esurance, Allstate is the only major insurance company to offer it. The program is aimed at low-mileage drivers and charges premiums based on the actual miles driven rather than an overall monthly rate.

Currently, the Milewise program is only offered in a dozen states (DC, DE, ID, IL, IN, MD, NJ, OH, OR, TX, VA, and WA) but the company plans expansion.

Accident Forgiveness is an add-on that is fairly common in the insurance industry after becoming a trend a while back. Allstate’s program promises no rate increase after your first accident, even if the accident was your fault.

New Car Replacement can be added to the policy if the vehicle is two years old or less. This option provides full replacement cost for the vehicle if it’s totaled in an accident, rather than just paying the depreciated value.

Allstate rewards safe drivers with two add-on programs. The Safe Driving Bonus is a cash-back reward given every six months on renewal to drivers who have had no claims in the previous term. Deductible Rewards reduces your collision deductible by $100 just for signing up and then takes off another $100 every year the driver is claim-free, up to $500.

Ride For Hire is Allstate’s rideshare driver program. It provides coverage on top of a personal auto insurance policy for those driving for companies like Uber or Lyft. The terms vary by state and the program is designed to meet the specific state laws for rideshare driver liability.

Allstate TrueCar is a car buying service that assists customers with the purchase of a new vehicle through a network of certified dealers. The program promises price reductions on car purchases both new and used, along with added benefits for buying through TrueCar.

Included at no extra cost with every Allstate policy is their Preferred Repair Services, which connects the insured with a repair shop that’s part of the Good Hands Network.

The system provides help not only with collision repairs but also with mechanical breakdown issues. Online system Open bay allows customers to search for a reputable mechanic nearby and book appointments for Allstate free quote online.

Read more: Allstate App for Android: Complete Guide & Review

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

What Kind of Discounts are Offered?

Allstate is known for having a lot of discount options available on their car insurance programs.

We’ve already mentioned a few of the options, such as bundling and the Drivewise program, but there are plenty more. Here’s a look at the options and how much you can save.

Available Allstate Discounts

| Discount | Percentage Off (up to) | Details/Requirements |

|---|---|---|

| New Car | 15% | Current model year or one year older |

| Anti-lock Brakes | 10% | Vehicles with anti-lock brakes |

| Anti-theft Device | 10% | Vehicles equipped with qualifying anti-theft device |

| EZ Pay Plan | 5% | Set up automatic withdrawal of premium payments |

| eSmart | 10% | Sign up for online policy management |

| Full Pay | 10% | Pay full term premium up front |

| Early Signing Discount | 10% | Sign policy documents at least seven days before effective date |

| Responsible Payer | 5% | No cancellation notices for non-payment in past year |

| Auto and Home | 10% off auto 25% off home | Have both auto and home in force with Allstate |

| Auto and Life | Not stated | Have both auto and life in force with Allstate |

| Smart Student | 35% | Must meet one of these: -Student under 25 with good grades -Complete teenSMART program -Student more than 100 miles away at school |

| Safe Driving Bonus Check | 5% | Safe Driving Bonus every six months without an accident |

| DriveWise | 3% for signing up 15% (up to) earned cash back rewards | Must install and use the DriveWise app (plug-in device in some states) |

| 55 and Retired | 10% | Drivers over age 55 and who are retired |

| Farm Vehicle | 10% | For vehicles primarily used in farming activities |

| Green Car | 10% | Vehicles qualified as "green" |

| Passive Restraint | 30% | Vehicles with factory airbags and seatbelts |

There are a number of sources listing other discounts offered by Allstate, but we weren’t able to confirm them. These include a military discount, discount for switching to Allstate, and affinity discounts for occupations or group membership.

While the site doesn’t list a first responder discount, Allstate auto insurance quoting system does ask if you’re a former or current firefighter, police officer, or EMT – which hints that there may be a discount not advertised.

Perhaps most surprising is the lack of a military discount, since Allstate has received repeated accolades as a military-friendly company.

Notable among Allstate’s discounts are the many options that are really very easy to qualify for, like early signing and responsible payment discounts.

Both auto pay and full payment options can earn you a discount too, which provides multiple ways to pay and still save some money on premiums.

How to Make a Claim

Allstate’s website offers a straightforward and informative claims section that will walk policyholders through the steps. All necessary contact information is readily available, including the Allstate phone number for claims and customer service. The Allstate claims phone number is easy to find on their site, ensuring quick access to assistance.

If you encounter any Allstate insurance complaints or have questions about your Allstate claims status, their Allstate customer service team is available to help. You can also inquire about Allstate windshield claim procedures and get the necessary Allstate windshield claim phone number for expedited assistance.

We’ll take a look at the claims options after a quick look at the financial side of Allstate’s claims department.

How to Add a Vehicle to My Allstate Insurance

Adding a car to Allstate insurance is a straightforward process that can typically be done through your Allstate agent or online through your account. If you want to add a car to your Allstate policy, you’ll need the vehicle’s make, model, year, and VIN, as well as details about your driving history.

Once the information is provided, Allstate will generate a quote and adjust your existing policy to include the new vehicle.

To add a vehicle to your Allstate insurance, contact your Allstate agent or log into your Allstate online account. You will be asked to provide the vehicle’s information and your coverage preferences.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

What is the Number of Written Premiums and Loss Ratios?

Data from the NAIC shows that Allstate’s direct premiums written have increased year over year from 2015 through 2017. During that same time period, loss ratios have steadily declined.

A loss ratio quantifies how much an insurance company is paying out in claims compared to how much they’re taking in from premiums.

A loss ratio over 100 percent means the company is paying out more than they’re making, while a loss ratio that’s too low means the company isn’t paying out as much as they should be.

The industry average loss ratio for 2017 was 68.79 percent. Allstate has been consistently paying out claims at a rate lower than the average.

For 2017, they were almost a full ten percent below the national average.

| Allstate Premiums and Loss Ratio | 2015 | 2016 | 2017 |

|---|---|---|---|

| Direct Premiums Written | $20,036,973 | $20,813,858 | $21,430,405 |

| Loss Ratio | 65.22% | 64.75% | 59.51% |

What does it mean for a policyholder? Allstate may be denying claims or paying out less than they should be on valid claims.

There’s no concern, however, regarding Allstate’s financial stability given the fact that they’re bringing in more in premiums than they’re paying out on claims.

What Are the Methods of Making a Claim?

Allstate offers a variety of ways to make a claim.

- Since they’re a captive agent company, the first option is to call your insurance agent directly.

- You can also call the 24/7 claims line at 1-800-ALLSTATE to get your claim started.

- If you prefer a more technology-based approach, there are several options. Allstate claims can be filed online two ways; if you have an existing account on the website, you can log in and file the claim from there. If you don’t have an account, there’s an online claims form that can be used without the need to log in.

- Finally, claims can be filed from your smartphone using the Allstate mobile app. (For more information, read our “Allstate Mobile App: Complete Guide & Review“). This app allows the user not only to file a claim but also to upload photos of the accident scene and damage directly with the QuickFoto claim system.

Allstate’s website offers a straightforward claims section with readily available contact information, including the Allstate phone number for claims and customer service, including 24 hour car insurance phone numbers.

If you come across any issues with Allstate insurance or need information regarding your claims status, you can reach out to the Allstate customer service team. They can be contacted via the Allstate contact number and are based at the Allstate corporate office.

Allstate offers a Claim Satisfaction Guarantee. If you’re not satisfied with the claims experience and meet all of the qualification requirements, Allstate will refund you the full six-month term premium of your policy. A letter has to be sent out detailing your complaint within 180 days of the claim payment.

As with most programs, the guarantee isn’t available in all states, but you can see a list of which ones are included here.

How To Get a Quote Online

Allstate puts their online quoting system front and center, right on the main page of the website, so it’s not hard to find.

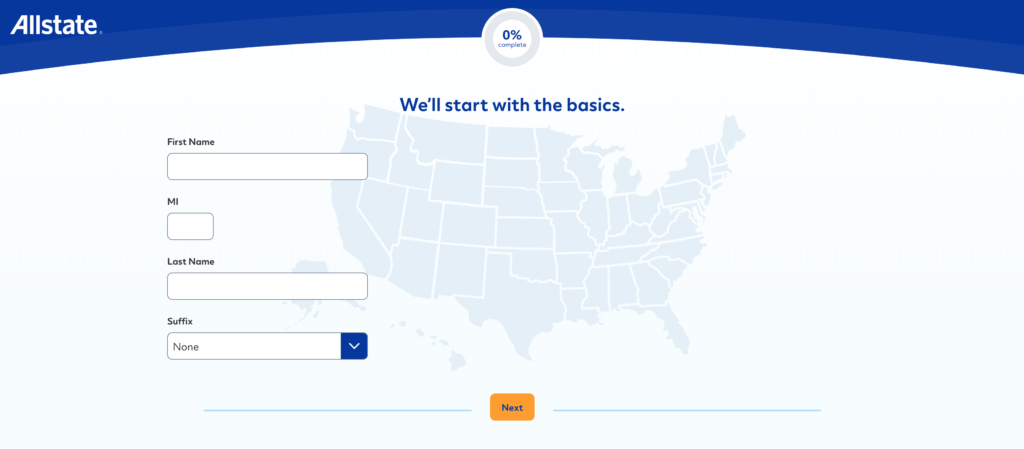

The first step is to select Auto and enter your zip code. From there, you’ll be asked to enter some basic personal information, starting with your name.

The following screens will ask for your date of birth, gender, and your home address. You’ll also be asked about your spouse, if you have one, and need to enter an email address to continue.

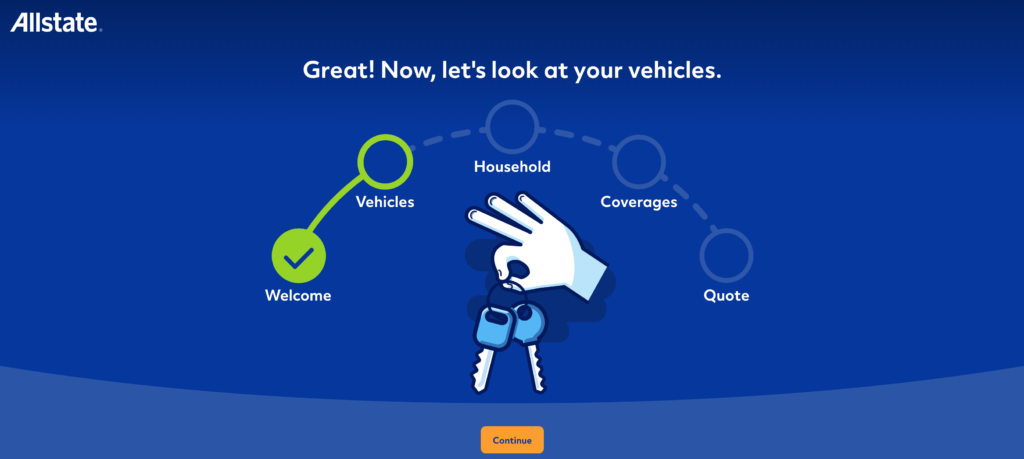

The next steps will ask questions about your vehicles and driving record.

You can enter vehicle information manually, or have the system search records to find vehicles registered to you.

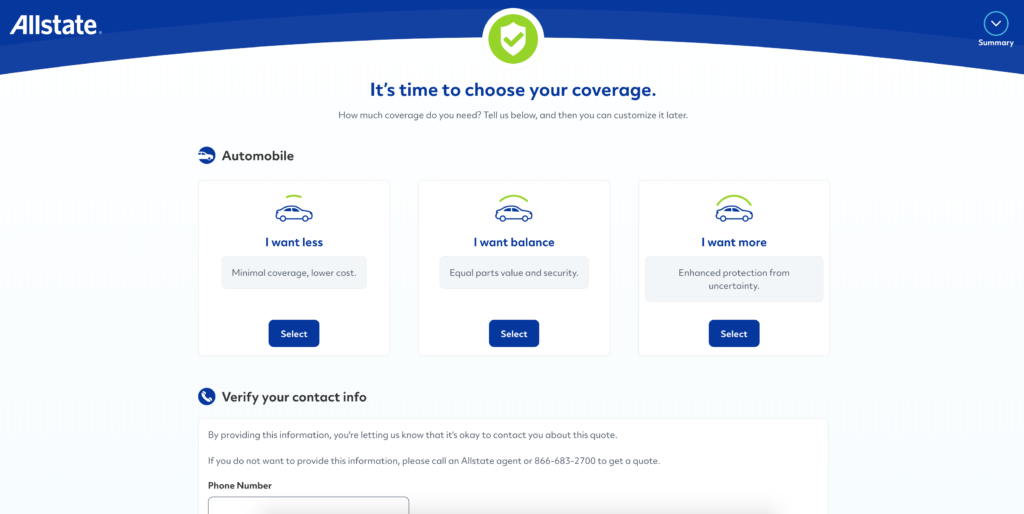

After answering questions about your vehicles, drivers, driving history, and how your cars are used, Allstate will take you to the coverage section.

This section allows you to choose the coverage options you want for each vehicle.

In this final step, you will be asked to provide a phone number and agree that it’s ok for an Allstate agent to contact you about your auto quote.

If you don’t want to enter your phone number, you will be directed to contact an agent, and won’t be able to continue or complete the quoting process online.

After entering your phone number and choosing your coverage you will get the quote details, which can be saved and retrieved at any time. The quote will also be sent to you via email.

Here’s a breakdown of what personal information Allstate requires for an online quote.

| Information | Required/Not Required |

|---|---|

| Driver's License Number | Not required |

| Social Security Number | Not required |

| Phone Number | Required |

| Email Address | Required |

| Vehicle Identification Number | Not required |

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

How does the Design of Website/App Look like?

Allstate’s website is clean, well organized, and makes it easy to find the information you are seeking. Dropdown menus give quick access to quoting, policy and coverage information, claims information, and a variety of tools and resources.

Aside from all of the information aimed at making you the newest Allstate insured, the website is full of helpful articles and videos aimed at educating visitors about things like insurance options, road safety, and how to save money.

Allstate Insurance is now offering several useful mobile apps. AllstateSM Mobile is the choice for policy holders, but its usefulness can be extended with Digital Locker© to create a home inventory, Drivewise© Mobile to check how safely you are driving and to monitor teen driving, GoodRide© for planning trips and keeping track of maintenance and repairs, plus a dedicated Allstate Motor Club app to request roadside assistance quickly.

What’s the Device Availability?

What’s the Device Availability?

Allstate mobile apps are available as free downloads at Google Play and iTunes.

Allstate Mobile—iPhone, iPod Touch, Android.

Digital Locker—iPhone, iPod Touch, Android, Web.

Drivewise Mobile—iPhone and Android.

GoodRide—iPhone and Android.

Motor Club—iPhone only.

What Are the App Features?

Allstate Mobile is a valuable app for policy holders. You can view your policy and agent information; even email it from within the app. Unlike some apps, Allstate allows a variety of policy types including info on mobile home, boat, and even specialty auto policies.

It offers a checklist of steps if you are involved in an accident, including the ability to record driver and witness information, capture photos on the scene, and begin a claim using Quick Foto ClaimSM.

You can also request emergency roadside service if that is included in your policy (not Motor Club). Those enrolled in Drivewise can also check their performance. One useful feature is a parking locator to find your parked car. And of course, you can always pay your Allstate bill.

- Digital Locker — This app allows you to store photos and information on personal property—such as purchase date and price—in a cloud so that it is accessible from both your mobile device and the web.

- Drivewise Mobile — This app is designed to compete with Progressive’s innovative SnapShot program to lower your rate with safe driving. To use it, you must be an Allstate customer enrolled in the Drivewise or Star Driver (teens) program.

- GoodRide — Designed for motorcyclists, this app allows you to plan a ride, log your route, time, and miles plus add comments and photos, share your ride on Facebook and Twitter, and keep a log of repairs and routine maintenance, and for customers, Roadside Assistance service.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

What Are the Google Play / iTunes / Amazon Reviews?

- Allstate Mobile — 3.5 stars for current version on iTunes; 4.2 rating at Google Play. Allstate claim complaints include crashes and lost data. The newest version will not work on older Android versions.

- Digital Locker — 2.5 stars on iTunes; 3.7 rating at Google Play. Android users report frequent crashing with latest update. Even with a good phone, the picture quality can be an issue.

- Drivewise — 2.5 stars on iTunes; 3.1 rating at Google Play. Android and iPhone users complain that either the app doesn’t capture data or is always on and the GPS use drains the battery.

- GoodRide — 3.5 stars at iTunes; 3.8 rating at Google Play. Most reviews complain the new update does not sync from start of the ride to the end, so data is often lost, including maintenance records.

Pros:

- Record witness and driver information after an accident

- Store Photos of personal property with Digital Locker

- Report/ submit a claim

Cons:

- Complaints of App draining device batteries

- No digital ID card

Allstate Mobile—if you are an Allstate policy holder, there is no reason not to have this app on your phone. Although it can be buggy, it will do a reasonable job of helping you with a potential accident claim, and that is reason enough to have it.

Digital Locker—although policy holders may find this app advantageous, most users will find an app such as Encircle will have great support and better features.

Drivewise—although the app seems to have some problems with data capture and battery use, Allstate does offer a potential 10% discount for using it. On the other hand, if you sign up and the app doesn’t work well, the chance of a discount diminishes.

GoodRide—the idea behind GoodRide is excellent, but the actual execution has been less than sterling. Via Michelin may be a better option. As always, though, Allstate’s developers seem to be making an effort to improve the stability of this app.

Allstate Auto Insurance Claims Process

Ease of Filing a Claim

Filing an insurance claim with Allstate is a straightforward process that provides policyholders with multiple convenient options. Whether you prefer to file a claim online, over the phone, or via mobile apps, Allstate has you covered. Their user-friendly online platform allows you to initiate a claim from the comfort of your home. You can also call their dedicated claims hotline for personalized assistance.

Average Claim Processing Time

Allstate aims to provide efficient and timely claim processing to ensure you get the assistance you need when you need it most. The average claim processing time can vary depending on the complexity of the claim and the specific circumstances involved. However, Allstate’s commitment to customer service means they work diligently to process claims as quickly as possible.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback is a valuable indicator of an insurance company’s performance in handling claims. Allstate has garnered both praise and criticism for their claim resolutions and payouts. Some customers have reported satisfaction with the smooth and fair handling of their claims, while others may have experienced challenges or disputes.

It’s essential to consider individual experiences and gather insights from various sources, such as customer reviews and ratings, to form an informed opinion about Allstate’s claim resolution process. This can help you assess whether Allstate aligns with your expectations and needs as a policyholder.

Allstate Auto Insurance Digital and Technological Features

Mobile App Features and Functionality

Allstate offers a comprehensive mobile app with a range of features designed to enhance the overall customer experience. The mobile app allows you to access your policy information, make payments, and even file claims directly from your smartphone or tablet. You can also use the app to request roadside assistance, view your digital ID card, and track the progress of your claims.

Online Account Management Capabilities

Managing your insurance policy online has never been easier with Allstate’s robust online account management capabilities. Through their website, you can log in to your account to review policy details, update personal information, and make changes to your coverage.

This digital platform provides policyholders with convenient self-service options, reducing the need for phone calls or in-person visits to an agent’s office.

Digital Tools and Resources

Allstate recognizes the importance of providing policyholders with valuable digital tools and resources. These tools can include insurance calculators, coverage guides, and educational materials to help you make informed decisions about your insurance needs.

Additionally, Allstate may offer online resources to help you better understand insurance terms, navigate the claims process, and explore ways to save on your premiums.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

What Are the Pros and Cons?

What does all of this information add up to? Is Allstate a good choice for your car insurance? Let’s break it down to the pros and cons of Allstate car insurance.

| Pros | Cons |

|---|---|

| Lots of discounts that are easy to qualify for | Above average pricing in most states |

| Cutting edge programs like pay-per-mile and rideshare coverage | Not all programs are offered in all states |

| Local agent service plus easy web and mobile access | Online quoting will lead to agent solicitation by phone |

| Solid financial ratings | Consumer satisfaction ratings are below average |

Compare rates from multiple auto insurance providers near you by using our free tool below.

Frequently Asked Questions

What are Allstate auto sales?

Allstate auto sales refer to the process of purchasing or leasing a vehicle through Allstate’s automotive division.

How can I get a car quote from Allstate?

You can get Allstate car quote by visiting their website, calling their customer service number, or contacting a local Allstate agent.

Does Allstate offer Commercial insurance?

Yes, Allstate Commercial insurance products protect businesses, including liability, property, and workers’ compensation insurance.

What is Allstate customer service?

Allstate customer service encompasses assistance provided to policyholders, including claims support, policy inquiries, and account management.

What is Allstate’s customer service number?

Allstate’s customer service number is 1-877-810-2920. You can contact them for assistance with insurance-related questions or issues.

What does Allstate fire and casualty insurance cover?

Allstate fire and casualty insurance provide coverage for damages and losses caused by fire, theft, vandalism, and other covered perils.

Where is Allstate headquarters located?

Allstate’s headquarters address is 2775 Sanders Rd. Northbrook, IL 60062.

How are Allstate Home Insurance reviews?

Allstate Home Insurance reviews can be found online or through customer feedback platforms, providing insights into customer experiences and satisfaction levels.

What is Allstate Umbrella Policy?

Allstate Umbrella Policy is an additional liability insurance coverage that provides extra protection beyond the limits of your primary policies, such as auto or home insurance.

What are the differences between Allstate vs State Farm?

Allstate and State Farm are both major insurance companies, but they may differ in terms of coverage options, pricing, customer service, and discounts. It’s recommended to compare quotes and policies to determine which company best meets your insurance needs.

Does Allstate handle claims well?

Are you wondering, how long does Allstate take to respond to a claim? This depends on your unique situation, but Allstate has favorable reviews on claim processing.

Is Allstate better than Geico?

Who is Allstate’s biggest competitor? Geico is Allstate’s closest competition in terms of market share.

Why is Allstate car insurance so expensive?

While Allstate’s car insurance can seem expensive to some customers, the reasons for this can vary based on Allstate’s specific practices and offerings.

Does Allstate deny claims?

Yes, Allstate, like any insurance company, can deny claims under certain circumstances. While Allstate strives to handle claims fairly and efficiently, there are situations where a claim may be denied.

Is Allstate the most expensive car insurance?

Allstate is known for offering a range of coverage options and a high level of customer service, which can sometimes lead to higher premiums. However, whether Allstate is the most expensive car insurance provider depends on a variety of factors specific to each driver and location.

Who is cheaper, Allstate or Progressive?

Progressive’s average rates are lower than Allstate’s average rates, but rates vary based on several factors.

What is the most trusted car insurance company?

Here are five of the most trusted car insurance companies:

- State Farm

- Geico

- USAA

- Progressive

- Allstate

Why choose Allstate?

Have you been asking around about Allstate insurance? Choosing Allstate ultimately depends on your personal priorities and what you’re looking for in an insurance provider. It’s important to compare Allstate’s offerings with other providers to determine which one best meets your needs and budget.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed life insurance agent with 23 years of experience helping people protect their families and businesses with term life insurance. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

What’s the Device Availability?

What’s the Device Availability?