10 Best Car Insurance Companies for Chevrolets in 2025 (Find the Top Providers Here)

Geico, USAA, and State Farm top the list of the best car insurance companies for Chevrolets, offering the best and cheapest rates. Geico stands out with minimum monthly rates starting at $35, while USAA and State Farm excel in customer satisfaction and comprehensive coverage for Chevrolets.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Chevrolet

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Chevrolet

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews

Geico, USAA, and State Farm top the list of the best car insurance companies for Chevrolets, excelling in affordability, coverage options, and customer satisfaction.

Our free online comparison tool above allows you to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – Geico: Top Overall Pick

Pros

- Bundling Policies: Geico offers significant discounts for bundling multiple insurance policies for Chevrolets, making it cost-effective.

- Multi-Vehicle Discount: Chevrolet owners can benefit from a 25% discount when insuring multiple vehicles under Geico.

- Affordable Premiums: Geico is known for offering some of the most competitive rates, making it a cost-effective option for Chevrolet owners. Learn more in our article called”Geico Insurance Review & Complaints.”

Cons

- Limited Coverage Options: Geico’s policy options for Chevrolets might be less comprehensive compared to other insurers.

- Customer Service: Some Chevrolet owners report less personalized customer service experiences with Geico.

#2 – USAA: Best for Military Benefits

Pros

- Military Discounts: USAA provides substantial discounts for military members insuring Chevrolets, making it an excellent choice for service members.

- Comprehensive Coverage: USAA offers extensive coverage options tailored specifically to the needs of Chevrolet owners.

- High A.M. Best Rating: USAA holds an A++ rating, ensuring strong financial reliability and stability for insuring Chevrolets.Unlock details in our article called “USAA Insurance Review & Complaints.”

Cons

- Eligibility Restrictions: Only military members and their families can access USAA’s policies, limiting availability for many Chevrolet owners.

- Fewer Local Offices: The limited number of local offices may inconvenience Chevrolet owners who prefer face-to-face service.

#3 – State Farm: Best for Complete Coverages

Pros

- Bundling Policies: State Farm offers significant discounts for bundling multiple policies, providing Chevrolet owners with cost savings. Discover more about offerings in our “State Farm Insurance Review & Complaints: Car Insurance.”

- High Low-Mileage Discount: Chevrolet owners who drive less can receive substantial discounts with State Farm’s low-mileage program.

- Wide Coverage: State Farm provides a variety of coverage options tailored to meet the diverse needs of Chevrolet owners.

Cons

- Wide Coverage for Chevrolets: State Farm offers a broad range of coverage options tailored to meet the diverse needs of Chevrolet owners.

- Extensive Agent Network for Chevrolets: State Farm has a large network of agents, making it easy for Chevrolet owners to get personalized assistance and support.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#4 – Amica: Best for Claims Satisfaction

Pros

- Bundling Policies: Amica offers a 25% discount for bundling multiple insurance policies, making it affordable for Chevrolet owners.

- High Claims Satisfaction: Amica is renowned for high claims satisfaction among Chevrolet owners, ensuring a hassle-free claims process. Discover insights in our article called “What is a car insurance claim?“

- A+ Rating: With an A+ rating from A.M. Best, Amica ensures strong financial stability and reliability for Chevrolet insurance.

Cons

- Higher Premiums: Amica’s premiums for Chevrolets can be higher compared to other insurers, potentially affecting affordability.

- Limited Availability: Amica’s insurance policies are not available in all regions, restricting access for some Chevrolet owners.

#5 – Erie: Best for Regional Coverage

Pros

- Bundling Policies: Erie provides a 10% discount for bundling multiple policies, benefiting Chevrolet owners. Learn more in our article called “Erie Insurance Review & Complaints: Auto, Home, Life, Marine & Business Insurance.”

- Regional Expertise: Erie offers tailored coverage options for Chevrolets in specific regions, ensuring localized expertise.

- High A.M. Best Rating: Erie holds an A+ rating, indicating strong financial health and reliability for insuring Chevrolets.

Cons

- Limited Availability: Erie’s insurance policies are only available in certain regions, limiting access for some Chevrolet owners.

- Discounts: Erie offers fewer discount options for Chevrolet owners compared to other insurers, potentially impacting savings.

#6 – Auto-Owners: Best for Personal Service

Pros

- Bundling Policies: Auto-Owners offers a 10% discount for bundling multiple policies, providing Chevrolet owners with savings. See more details on our guide titled “Auto-Owners Insurance Review & Complaints: Auto, Home, Life, Retirement & Business Insurance.”

- High A.M. Best Rating: Auto-Owners holds an A++ rating, ensuring excellent financial stability and reliability for insuring Chevrolets.

- Personal Service: Known for providing highly personalized customer service tailored to Chevrolet owners’ needs.

Cons

- Limited Discounts: Compared to other insurers, Auto-Owners offers fewer discount opportunities for Chevrolet owners.

- Availability: Auto-Owners’ insurance policies are not available in all regions, limiting access for some Chevrolet owners.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#7 – The Hartford: Best for AARP Programs

Pros

- Bundling Policies: The Hartford offers a 25% discount for bundling multiple policies, providing significant savings for Chevrolet owners.

- High A.M. Best Rating: The Hartford holds an A+ rating, ensuring financial reliability and stability for insuring Chevrolets. More information is available about this provider in our article called “The Hartford TrueLane: Complete Guide & Review.”

- AARP Benefits: Special programs and discounts are available for AARP members with Chevrolets, enhancing value.

Cons

- Eligibility Restrictions: Some of The Hartford’s best benefits are available only to AARP members, limiting access for Chevrolet owners who are not members.

- Higher Premiums: Despite the discounts, The Hartford’s premiums might be higher compared to some competitors for Chevrolet vehicles.

#8 – American Family: Best for Coverage Options

Pros

- Bundling Policies: American Family offers a 20% discount for bundling multiple policies, providing savings for Chevrolet owners. Delve into our evaluation of “American Family Insurance Review & Complaints: Auto, Home & Life Insurance.”

- A Rating: American Family’s A rating from A.M. Best ensures financial stability and reliability for Chevrolet insurance.

- Customizable Coverage: Offers a variety of customizable coverage options tailored to the needs of Chevrolet owners.

Cons

- Limited Availability: American Family’s insurance policies are not available in all regions, restricting access for some Chevrolet owners.

- Customer Service: Some Chevrolet owners report less personalized customer service experiences with American Family.

#9 – Progressive: Best for Online Tools

Pros

- Bundling Policies: Progressive offers a 12% discount for bundling multiple policies, benefiting Chevrolet owners.

- High A.M. Best Rating: Progressive holds an A+ rating, indicating financial stability and reliability for insuring Chevrolets. If you want to learn more about the company, head to our article called “Progressive Insurance Review & Complaints.”

- Online Tools: Extensive online tools and resources make managing Chevrolet policies easy and convenient.

Cons

- Customer Service: Some Chevrolet owners report less personalized customer service experiences with Progressive.

- Higher Premiums: Progressive’s premiums for Chevrolets can be higher compared to other insurers, impacting affordability.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#10 – Nationwide: Best for Comprehensive Coverage

Pros

- Bundling Policies: Nationwide offers a 20% discount for bundling multiple policies, providing savings for Chevrolet owners. Access comprehensive insights into our article called “Nationwide Insurance Review & Complaints: Auto, Home, Health & Pet Insurance.”

- High A.M. Best Rating: Nationwide holds an A+ rating, ensuring financial stability and reliability for insuring Chevrolets.

- Comprehensive Coverage: Wide range of comprehensive coverage options tailored to the needs of Chevrolet owners.

Cons

- Higher Rates: Nationwide’s rates for Chevrolets can be higher compared to other insurers, impacting affordability.

- Discounts: Limited discount opportunities available for Chevrolet owners compared to other insurers.

Chevrolet Insurance Rates: Compare Monthly Costs by Coverage Level

When choosing car insurance for your Chevrolet, understanding coverage rates is crucial. The monthly costs vary by provider and coverage level, reflecting different levels of protection and policy features. See more details on our “How Much Home Insurance To Buy: An Expert Guide.”

Chevrolet Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

American Family $52 $122

Amica $50 $120

Auto-Owners $48 $116

Erie $42 $110

Geico $40 $105

Nationwide $53 $118

Progressive $47 $112

State Farm $45 $115

The Hartford $55 $125

USAA $35 $100

Insurance rates for Chevrolets show significant variation across providers and coverage types. Geico offers the most affordable full coverage at $105 per month, while USAA provides the lowest rate for minimum coverage at $35. For comprehensive protection, Amica and Auto-Owners offer competitive rates at $120 and $116, respectively.

On the higher end, The Hartford’s full coverage is the most expensive at $125, with American Family and Nationwide also presenting higher premiums. These rates underscore the importance of comparing options to find the best fit for your Chevrolet’s insurance needs.

Understanding Chevrolet Car Insurance

The right type of car insurance provides financial protection in the event that you are involved in an auto accident. It covers bodily injury, property damage, and other financial losses related to a claim. Car insurance also covers when someone files a lawsuit against you as a result of an auto accident.

Car insurance coverage is extremely important since it can help protect your finances and provide peace of mind in case something unexpected happens while on the road.

Without the right policy, drivers are at risk of paying out-of-pocket expenses for expensive repairs or medical bills from an auto accident. Additionally, most states have car insurance requirements before you can legally drive on the road or register your car.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Chevrolet Car Insurance Costs

Generally speaking, more expensive vehicles tend to be more costly to insure due to their higher replacement costs. The age and condition of your car also affect how much it will cost to insure it.

The cost of insuring a Chevrolet typically costs around $143 monthly or $1,726 per year. Still, your Chevrolet insurance rates will depend on several factors, including the type of vehicle, the coverage limits you choose, and where you live, since local laws and regulations affect premiums.

Your personal driving history is another factor that affects car insurance rates. For example, you may be eligible for lower premiums if you have a good driving record with no accidents or moving violations in the past few years.

Geico’s substantial bundling discounts help Chevrolet owners save more on their overall insurance costs.

Jeff Root Licensed Insurance Agent

Finally, the amount of coverage you select can significantly impact how much you pay for car insurance. Choosing higher coverage limits will cost more but provide greater financial protection in case of an accident.

Ultimately, the best way to find out how much it would cost to insure a Chevrolet is to shop around and get quotes from several different companies. This will help you find a policy that fits your budget and provides the right amount of coverage for your needs.

Most Affordable Chevrolet Car Insurance Rates by Model

Chevrolet offers a wide range of vehicles to suit any lifestyle:

- For those looking for reliable, stylish transportation, Chevrolet’s lineup includes everything from the Spark mini-car to the full-size Tahoe SUV.

- For drivers needing rugged reliability, Chevrolet has pickup trucks like the Silverado and Colorado.

- For performance enthusiasts, Chevrolet produces muscle cars like the Camaro and Corvette and sporty compacts like the Sonic and Cruze.

Chevrolet also provides drivers with a selection of electric and hybrid vehicles, including the Bolt EV, Volt plug-in hybrid, and Malibu Hybrid. These efficient cars provide an eco-friendly alternative to traditional gasoline engines while still delivering excellent performance and a comfortable ride.

However, EV car insurance rates are higher than for traditional gas models. See how Chevrolet car insurance costs compare by model:

Chevrolet Auto Insurance Monthly Rates by Model & Coverage Type

| Vehicle Model | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Chevrolet Spark | $22 | $44 | $47 | $131 |

| Chevrolet Colorado | $25 | $44 | $37 | $122 |

| Chevrolet Sonic | $26 | $52 | $42 | $136 |

| Chevrolet Trax | $28 | $47 | $37 | $128 |

| Chevrolet Impala | $28 | $53 | $37 | $134 |

| Chevrolet Equinox | $31 | $53 | $37 | $137 |

| Chevrolet Cruze | $31 | $59 | $37 | $143 |

| Chevrolet Malibu | $32 | $53 | $37 | $138 |

| Chevrolet Silverado | $32 | $56 | $42 | $148 |

| Chevrolet Traverse | $34 | $47 | $32 | $126 |

| Chevrolet Tahoe | $34 | $53 | $37 | $140 |

| Chevrolet Suburban | $34 | $53 | $37 | $140 |

| Chevrolet Camaro | $35 | $59 | $37 | $147 |

| Chevrolet Silverado 2500HD | $36 | $69 | $42 | $165 |

| Chevrolet Silverado 3500HD | $40 | $66 | $42 | $166 |

| Chevrolet Corvette | $48 | $90 | $27 | $176 |

| Chevrolet Volt | $36 | $76 | $42 | $169 |

As you can see, sports cars like the Corvette, with their powerful engines and agile handling, have higher rates than other models. However, a Chevy Silverado comes with the highest rates. Compare Silverado 1500 car insurance quotes.

Finding the Best Car Insurance Company for Chevrolets

The best car insurance company for insuring a Chevrolet depends on your individual needs and preferences. Many reputable insurers offer competitive rates and coverages, so it is important to research before selecting a policy.

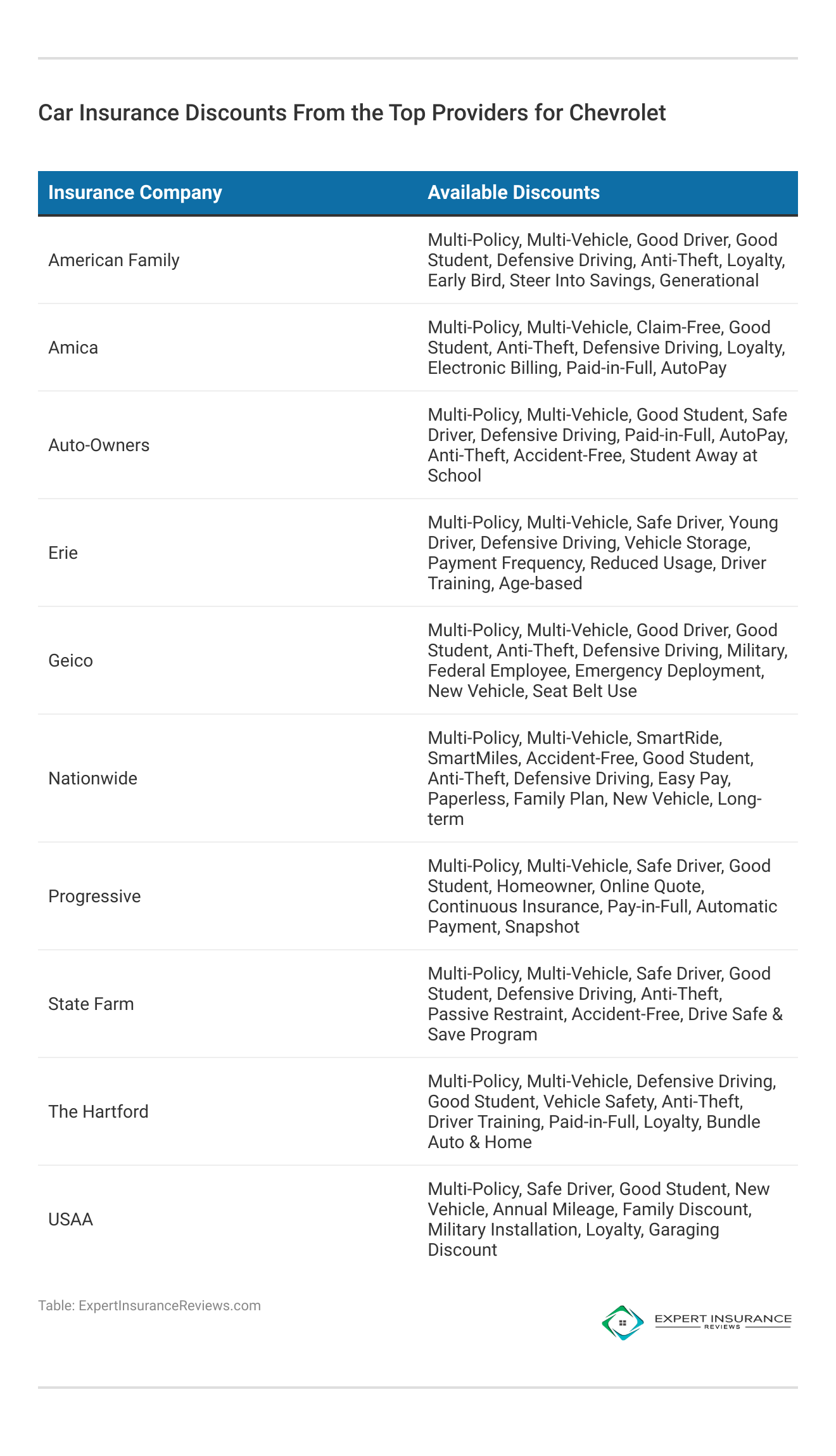

When shopping around for car insurance, look for companies with strong financial ratings from A.M. Best or Standard & Poor’s, as well as ones that have good customer service ratings. Also, consider the best car insurance discounts each provider offers to get the most value out of your coverage.

It’s wise to get quotes from several different insurers to compare prices and determine which can provide you with the best coverage at the lowest cost. Don’t be afraid to shop around to find the best policy for you. Doing so could save you money and provide peace of mind knowing that you have the right protection in place.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Why Choosing the Best Chevrolet Car Insurance Matters

Buying car insurance for a Chevrolet provides financial protection in case of an accident and will help save money in the long run by covering costly repairs and medical bills that may arise from an auto incident.

Additionally, some states require drivers to carry minimum levels of auto insurance in order to be legally allowed to drive on the road. Speak with your insurance provider about the best coverage options for your situation and budget. They can help you pick out the perfect plan that will provide adequate coverage without breaking the bank.

At the end of the day, having car insurance is essential for any driver, especially when driving a Chevrolet. Not only does it provide financial protection in case of an accident, but it also helps minimize stress by knowing that you have a reliable safety net in place.

See more details on our article called “Defensive Driver Car Insurance Discount.”

How to Save Money With the Best Car Insurance Company for Chevrolets

You can take several steps to save money on Chevrolet insurance, including:

- Consider Raising Your Deductible: Higher car insurance deductibles come with lower premiums, so increasing your deductible could lead to significant savings over time.

- Bundling Policies: Many insurers offer discounts if you purchase multiple coverages from them (e.g., bundling auto and home insurance). The discount can be so large that bundling insurance policies can save a lot of money.

- Ask for Discounts: Look into discount programs offered by insurers, such as usage-based or loyalty rewards programs. Some providers may even offer reduced rates for drivers who maintain good credit scores or take defensive driving courses.

Finally, be sure to review your policy at least once a year to ensure that it still meets your needs so you’re always getting the best deal. Comparing quotes from different providers and looking into discounts could help you find an affordable policy that fits your budget.

The History of Chevrolet

Chevrolet is a brand of automobiles that has become synonymous with American values, innovation, and style. Founded in 1911 by Louis Chevrolet and William C. Durant, the company quickly made its mark on the auto industry by introducing classic models such as the Suburban and Corvair.

Today, Chevrolet continues to be an iconic brand that offers a wide range of vehicles to suit every lifestyle and budget. From reliable sedans like the Impala to powerful pickup trucks like the Silverado, there’s something for everyone at Chevrolet.

The company also has a long history of producing performance vehicles like the Camaro and Corvette, as well as electric cars like the Bolt EV. Check out insurance savings in our complete article called “Best Ford Focus Electric Car Insurance Quotes.”

From advanced safety features such as forward collision alert and rear vision camera to cutting-edge infotainment systems like Chevrolet MyLink, Chevy vehicles provide drivers with all the tools they need for a connected driving experience.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Choose the Best Car Insurance Company for Chevrolets

Even if you have a Chevy car warranty, you need car insurance as well. When looking for car insurance for a Chevrolet, it is important to compare rates from multiple providers. Depending on your needs and budget, different insurers may better suit you than others. Discover more about offerings in our article called “Average Cost of Car Insurance by Age.”

Geico’s affordable premiums ensure you get great value for your Chevrolet insurance.

Kristine Lee Licensed Insurance Agent

Ultimately, getting the best rate possible when purchasing car insurance for a Chevrolet will depend on thoroughly researching your options. By considering factors such as age and safety features, drivers can ensure they get the best deal possible on their car insurance policy.

See if you’re getting the best deal on car insurance by entering your ZIP code below.

Frequently Asked Questions

Is car insurance for a Chevrolet expensive?

Chevrolet car insurance costs depend on the type of vehicle and its age, as well as driver history, credit score, and the area you drive the vehicle. However, Chevrolet car insurance rates average $143 per month, which is close to the national average.

Explore our comprehensive resource titled “Best Car Insurance for a Bad Driving Record.”

How much does Chevrolet car insurance cost?

Chevrolet auto insurance costs an average of $143 per month for full coverage and $38 for liability-only. However, quotes can vary depending on your driving record and other factors.

Is insurance for a Chevrolet Silverado expensive?

Silverados are generally more expensive to insure than other Chevrolet vehicles due to their size and power. The cost of insuring a Silverado will depend on the age and safety features of the vehicle, as well as other factors, such as credit score and driving history.

Are there any specific discounts available for Chevrolet owners?

Many companies offer Chevrolet insurance discounts, such as discounts for safety features (such as airbags and anti-lock brakes), discounts for good driving habits, and discounts for bundling your car insurance with other insurance policies (such as homeowners or renters insurance).

Who are the top 5 insurance companies for Chevrolets?

The top 5 insurance companies for Chevrolets, based on market share and average costs for full and minimum coverage, are State Farm (editor’s choice), Geico (affordable), Progressive (low rates for high-risk drivers), Allstate (reliable), and USAA (low rates for military members).

For additional details, explore our comprehensive resource titled “Defensive Driver Car Insurance Discount.”

What is the best car insurance you can buy for Chevrolets?

The best car insurance companies for Chevrolets in 2024 are State Farm (4.3 stars) for local agencies, Travelers (4.2 stars) for personalized coverage, USAA (4.2 stars) for military members, Nationwide (4.0 stars) for discounts, and Liberty Mutual (3.8 stars) for bundling products.

Which insurance cover is best for Chevrolets?

Comprehensive insurance cover is the best option for Chevrolets, as it provides the broadest protection. This coverage includes theft, hijacking, damages due to accidents, fire, explosion, and natural disasters like hail and floods, ensuring extensive protection for your vehicle.

What is the most trusted insurance brand for Chevrolets?

The most trusted car insurance brands for Chevrolets are Geico for availability, Erie for customer satisfaction, Nationwide for pay-per-mile coverage, Auto-Owners for liability-only insurance, State Farm for bundling, American Family for discounts, and Progressive for high-risk drivers.

What is the highest car insurance cost for Chevrolets?

Average car insurance costs by state for Chevrolets range from $25.25 to $686 per month, depending on coverage and location. New York has the highest average rates at $686 per month for full coverage and $207.50 per month for minimum coverage, highlighting the significant variation in insurance costs.

To find out more, explore our guide titled “Understanding Full Coverage Car Insurance.”

What is the best insurance for old Chevrolets?

The best classic car insurance companies for old Chevrolets include The Hagerty Group, which has a rating of 5 out of 5, State Farm with a rating of 3 out of 5, Safeco Insurance rated 2 out of 5, Heacock Classic Insurance with a rating of 4.5 out of 5, and American Collectors Insurance, all providing specialized coverage for vintage vehicles.

What type of insurance is most important for Chevrolets?

Auto liability coverage is the most important type of insurance for Chevrolets. This coverage is essential as it protects you from financial loss if you are found responsible for an accident, covering the costs of property damage and medical expenses for the other party involved.

Which car insurance group is the cheapest for Chevrolets?

Group 1 car insurance is the cheapest option for Chevrolets. This group typically includes vehicles that are less expensive to insure due to factors like lower repair costs and better safety features.

Which is the most expensive form of car insurance for Chevrolets?

Comprehensive insurance is the most expensive form of coverage for Chevrolets, but it provides peace of mind by covering a wide range of potential incidents, including collisions, fire, theft, and other unforeseen circumstances.

To learn more, explore our comprehensive resource on “Does car insurance cover a stolen car?”

What color Chevrolet is the most expensive to insure?

The color of your Chevrolet does not affect your insurance rate. Insurance companies determine rates based on other factors such as the car’s age, location, usage, and the driver’s record.

Who pays the most for Chevrolet car insurance?

Men typically pay more for Chevrolet car insurance compared to women. This difference is due to various risk factors considered by insurance companies, including driving behavior and accident statistics.

Ready to find cheaper car insurance coverage? Enter your ZIP code below to begin.

Which insurance is best for a Chevrolet after 5 years?

For Chevrolets that are five years old, a zero-depreciation add-on cover is the best option. This coverage enhances a basic comprehensive car insurance policy by covering repair and depreciation costs, ensuring you receive a higher claim amount.

What is the most basic car insurance for Chevrolets?

The most basic car insurance for Chevrolets includes liability protection, which is required by most states. This coverage protects you financially if you cause an accident, and states may also require uninsured/underinsured motorist protection and comprehensive coverage.

Learn more by reading our guide titled “What is uninsured motorist coverage?”

Which insurance company has the highest claims paid for Chevrolets?

In terms of the number of policies settled during 2022-23, Max Life Insurance has the highest claim settlement ratio of 99.51% for Chevrolets. HDFC Life Insurance follows closely with a 99.39% claim settlement ratio, indicating strong reliability in claims processing.

What is the best car insurance coverage to have for Chevrolets?

The best car insurance coverage for Chevrolets includes carrying the highest amount of liability coverage you can afford, typically 100/300/100. Additionally, comprehensive, collision, and gap coverage are recommended to fully protect your vehicle from various risks.

What is the best car insurance company for bundling policies for Chevrolets?

State Farm is the best car insurance company for bundling policies for Chevrolets. They offer significant discounts when you combine multiple insurance policies, making it a cost-effective option for Chevrolet owners seeking comprehensive coverage and savings.

Which car insurance company offers the best customer service for Chevrolets?

Amica is renowned for offering the best customer service for Chevrolet owners. Their high claims satisfaction rating and personalized support ensure that you receive excellent service throughout your insurance experience.

Access comprehensive insights into our guide titled “How long do you have to file a life insurance claim?”

What car insurance company has the best regional coverage for Chevrolets?

Erie Insurance provides the best regional coverage for Chevrolets, especially in areas where they operate. Their tailored policies and strong local presence make them a reliable choice for comprehensive regional car insurance coverage.

What car insurance company offers the best personal service for Chevrolets?

Auto-Owners Insurance is known for offering the best personal service for Chevrolets. Their agents provide individualized attention and customized insurance solutions, ensuring that each Chevrolet owner’s specific needs are met.

Which car insurance company is best for AARP members with Chevrolets?

The Hartford is the best car insurance company for AARP members with Chevrolets. They offer specialized programs and discounts for AARP members, making it an attractive option for senior Chevrolet owners looking for tailored coverage and benefits.

Take the first step toward cheaper car insurance rates. Enter your ZIP code below to see how much you could save.

What car insurance company offers the most coverage options for Chevrolets?

American Family Insurance stands out for offering the most coverage options for Chevrolets. Their extensive range of policy options allows Chevrolet owners to customize their insurance to suit their unique needs and preferences.

Which car insurance company has the best online tools for Chevrolets?

Progressive is the best car insurance company for Chevrolets when it comes to online tools. Their robust digital platform makes it easy for Chevrolet owners to manage their policies, file claims, and access a wealth of resources and information online.

Which car insurance company provides the most comprehensive coverage for Chevrolets?

Nationwide offers the most comprehensive coverage for Chevrolets. Their policies include a wide array of protections, ensuring that Chevrolet owners are fully covered against various risks and potential damages.

What is the best car insurance for high-risk Chevrolet drivers?

Progressive is the best car insurance company for high-risk Chevrolet drivers. They offer competitive rates and specialized policies that cater to drivers with higher risk profiles, providing necessary coverage while keeping premiums manageable.

Which car insurance company offers the highest discounts for Chevrolets?

Geico offers the highest discounts for Chevrolets, with up to 25% savings on multi-vehicle policies. Their affordable premiums and extensive discount options make them a top choice for Chevrolet owners seeking to reduce their insurance costs.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.