10 Best Car Insurance Companies for Nissans in 2025 (Check Out the Top Providers)

The best car insurance companies for Nissans are the providers Progressive, Geico, and State Farm, providing premium coverage starting at just $76 monthly. Each provider excels in extensive service, affordability, and the most ideal benefits, making them the best match for Nissan owners seeking reliable insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about life insurance when he got his first policy for his own family. He has been featured as a life insurance expert speaker at agent conventions and in top publications. As an independent licensed life insurance agent, he has helped clients nationwide to secure affordable coverage while making the...

Licensed Insurance Agent

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Nissans

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Nissans

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsThe best car insurance companies for Nissans are Progressive, Geico, and State Farm, renowned for their comprehensive coverage and excellent customer service.

If you own a Nissan, you need car insurance. Some people may find it difficult or intimidating to shop for coverage, but car insurance for a Nissan is often simple and easy to find.

Our Top 10 Picks: Best Car Insurance Companies for Nissans

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | A+ | Online Convenience | Progressive | |

| #2 | 15% | A++ | Military Savings | Geico | |

| #3 | 20% | B | Add-on Coverage | State Farm | |

| #4 | 10% | A++ | Accident Forgiveness | Travelers | |

| #5 | 10% | A+ | Customizable Polices | Allstate | |

| #6 | 5% | A+ | Cheap Rates | Nationwide |

| #7 | 10% | A++ | Usage Discount | USAA | |

| #8 | 10% | A | Many Discounts | Farmers | |

| #9 | 10% | A | Student Savings | Liberty Mutual |

| #10 | 10% | A | Local Agents | American Family |

When you shop for car insurance for Nissans, you should compare car insurance quotes from several companies.

Comparing quotes will help you find the best car insurance company for Nissans in your area that offers the coverage you want at the best price. Enter your ZIP code now.

- Progressive excels in Nissans car insurance with excellent coverage options

- Tailored plans meet Nissans owners’ specific needs

- Focuses on affordability and comprehensive protection

#1 – Progressive: Top Overall Pick

- Best Car Insurance Companies

- Best Nissan Versa Note Car Insurance Quotes (2025)

- Best Nissan Van Car Insurance Quotes (2025)

- Best Nissan Truck Car Insurance Quotes (2025)

- Best Nissan Titan XD Car Insurance Quotes (2025)

- Best Nissan Stanza Car Insurance Quotes (2025)

- Best Nissan Rogue Sport Car Insurance Quotes (2025)

- Best Nissan Rogue Select Car Insurance Quotes (2025)

- Best Nissan Rogue Hybrid Car Insurance Quotes (2025)

- Best Nissan Quest Car Insurance Quotes (2025)

- Best Nissan Pulsar Car Insurance Quotes (2025)

- Best Nissan Pathfinder Hybrid Car Insurance Quotes (2025)

- Best Nissan NX Car Insurance Quotes (2025)

- Best Nissan NV200 Car Insurance Quotes (2025)

- Best Nissan NV Passenger Car Insurance Quotes (2025)

- Best Nissan NV Cargo Car Insurance Quotes (2025)

- Best Nissan Murano CrossCabrio Car Insurance Quotes (2025)

- Best Nissan Leaf Plus Car Insurance Quotes (2025)

- Best Nissan Kicks Car Insurance Quotes (2025)

- Best Nissan Axxess Car Insurance Quotes (2025)

- Best Nissan 350Z Car Insurance Quotes (2025)

- Best Nissan 300ZX Car Insurance Quotes (2025)

- Best Nissan 240SX Car Insurance Quotes (2025)

- Best Nissan 200SX Car Insurance Quotes (2025)

- Best Nissan Maxima Car Insurance Quotes (2025)

- Best Nissan Versa Car Insurance Quotes (2025)

- Best Nissan Xterra Car Insurance Quotes (2025)

- Best Nissan Titan Car Insurance Quotes (2025)

- Best Nissan Rogue Car Insurance Quotes (2025)

- Best Nissan Armada Car Insurance Quotes (2025)

- Best Nissan Sentra Car Insurance Quotes (2025)

- Best Nissan Leaf Car Insurance Quotes (2025)

- Best Nissan Pathfinder Car Insurance Quotes (2025)

- Best Nissan 370Z Car Insurance Quotes (2025)

- Best Nissan Frontier Car Insurance Quotes (2025)

- Best Nissan Juke Car Insurance Quotes (2025)

- Best Car Insurance Company for Nissan

Pros

- Competitive Pricing: Progressive offers affordable rates starting at $76 monthly, making it a cost-effective option for Nissan owners. The 10% multi-vehicle discount further reduces costs, making Progressive one of the best car insurance companies for Nissans.

- High Financial Strength: Progressive’s A+ A.M. Best rating assures strong financial stability, beneficial for Nissan claims, ensuring reliable payouts. This stability is crucial for Nissan owners seeking dependable coverage.

- Wide Range of Discounts: Significant discounts available, including safe driver and multi-policy discounts, which can substantially lower premiums. These discounts are particularly advantageous for Nissan drivers looking for the best car insurance companies. Learn more about coverage options and monthly rates in our article titled “Progressive Insurance Review & Complaints.”

Cons

- Limited Local Agents: There is a limited availability of local agents for in-person assistance, which may be inconvenient for some Nissan owners who prefer face-to-face interactions. This limitation can affect those who value personalized service in the best car insurance companies for Nissans.

- Higher Rates for High-Risk Drivers: Progressive may not offer the lowest rates for high-risk drivers compared to other insurers, potentially increasing costs for these drivers. This can be a drawback for Nissan owners with less favorable driving records.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#2 – Geico: Best for Military Savings

Pros

- Competitive Pricing: Geico offers some of the cheapest rates, with a 15% multi-vehicle discount that helps lower costs for Nissan owners. This discount is especially valuable for those insuring multiple Nissan vehicles.

- High Financial Strength: Geico’s A++ A.M. Best rating assures strong financial stability, beneficial for Nissan claims. This high rating ensures that Geico can handle claims effectively, giving Nissan owners peace of mind.

- Military Savings: Geico provides substantial discounts for military personnel, which is an added benefit for service members driving Nissans. This specialized discount enhances Geico’s appeal for military families. Read more in our full review on our article titled “Geico Insurance Review & Complaints.”

Cons

- Limited Coverage Options: Geico may not offer as many specialized coverage options as some other insurers, which could be a limitation for those seeking extensive protection for their Nissans. This can impact Nissan owners looking for more tailored insurance solutions.

- Customer Service Inconsistencies: Some reviews indicate varying levels of customer service quality, which might affect Nissan owners during claims. Inconsistent service experiences can be a concern for those valuing reliable support in the best car insurance companies for Nissans.

#3 – State Farm: Best for Add-on Coverage

Pros

- Comprehensive Add-on Coverage: State Farm offers a variety of add-on coverage options, including rental car reimbursement and roadside assistance, which can be tailored to Nissan owners’ needs. This flexibility allows for customized policies that enhance protection.

- Discount Opportunities: State Farm offers various discount opportunities, such as multi-policy, safe driver, and vehicle safety discounts. Nissan owners can take advantage of these discounts to lower their premiums, especially if their vehicle is equipped with advanced safety features.

- Strong Local Presence: With numerous local agents available, State Farm offers personalized service that can be particularly beneficial for Nissan owners seeking direct assistance. The extensive network of agents enhances the company’s accessibility. For more information, read our article titled “State Farm Insurance Review & Complaints: Car Insurance.”

Cons

- Higher Premiums for Some Drivers: State Farm’s rates might be higher for certain drivers compared to competitors, which could affect those with less favorable driving records. This can be a downside for Nissan owners seeking the most affordable rates.

- A.M. Best Rating: With a B rating from A.M. Best, State Farm’s financial strength is not as high as some competitors, potentially raising concerns for Nissan owners about claims reliability. This lower rating may influence decisions for those prioritizing financial stability.

#4 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness Program: Travelers’ accident forgiveness program is a standout feature, protecting Nissan owners from premium increases after their first accident. This program can be especially valuable for drivers who want to avoid rate hikes after an incident.

- Strong Financial Stability: Travelers holds an A++ A.M. Best rating, indicating robust financial strength to handle claims effectively for Nissan owners. This high rating underscores Travelers’ ability to provide reliable coverage.

- Comprehensive Coverage Options: Travelers offers a wide range of coverage options, including custom policies that cater to the specific needs of Nissan drivers. This versatility ensures that Nissan owners can find suitable protection. Find out in our article titled “Travelers Insurance Review & Complaints: Home, Auto & Boat Insurance.”

Cons

- Higher Premiums for Younger Drivers: Travelers may have higher premiums for younger drivers, which could be a disadvantage for younger Nissan owners. This can make insurance less affordable for younger policyholders.

- Limited Discounts for Low-Risk Drivers: Travelers might offer fewer discounts for low-risk drivers compared to other insurers, potentially resulting in higher rates for those with clean records. This limitation can be a drawback for Nissan owners seeking extensive savings.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#5 – Allstate: Best for Customizable Policies

Pros

- Customizable Coverage Options: Allstate provides a wide range of customizable policy options, allowing Nissan owners to tailor their coverage to their specific needs. This flexibility is ideal for those seeking personalized insurance solutions.

- 10% Multi-Vehicle Discount: Allstate offers a 10% discount for insuring multiple vehicles, which can help Nissan owners save on their premiums when covering more than one car. This discount is beneficial for families or individuals with multiple Nissans.

- Excellent Roadside Assistance: Allstate’s roadside assistance program includes features like towing and lockout services, adding extra convenience for Nissan drivers. This comprehensive support enhances Allstate’s appeal as a top insurance choice. Find more information about Allstate’s rates in our “Allstate Auto Insurance Review & Complaints.”

Cons

- Higher Premiums for Some Drivers: Allstate’s premiums may be higher for certain drivers, particularly those with a less favorable driving history. This could be a concern for Nissan owners looking for competitive rates.

- Mixed Customer Service Reviews: Customer service reviews for Allstate can be mixed, with some policyholders reporting less-than-ideal experiences. Inconsistent service may affect Nissan owners during claims or policy inquiries.

#6 – Nationwide: Best for Cheap Rates

Pros

- Affordable Premiums: Nationwide is known for offering competitive rates, making it a great option for Nissan owners looking for affordable insurance. Lower premiums can be particularly attractive to budget-conscious drivers.

- 5% Multi-Vehicle Discount: Nationwide provides a 5% discount for insuring multiple vehicles, which helps Nissan owners save when they have more than one car. This discount can be a significant cost saver for households with multiple Nissans.

- Strong Customer Service: Nationwide has a reputation for good customer service, ensuring that Nissan owners receive reliable support when needed. Positive service experiences contribute to Nationwide’s standing as a top insurer. Find out if Nationwide might have the lowest rates for you in our article titled “Nationwide Insurance Review & Complaints.”

Cons

- Limited High-Risk Driver Discounts: Nationwide may offer fewer discounts for high-risk drivers, which could affect those with less favorable driving records. This limitation can impact Nissan owners with a history of accidents or violations.

- A.M. Best Rating: Nationwide’s A+ rating from A.M. Best is strong but lower than some competitors, which might raise concerns about the insurer’s financial stability for claims. This could be a consideration for those prioritizing financial reliability.

#7 – USAA: Best for Usage Discounts

Pros

- 10% Usage Discount: USAA offers a 10% discount for low-mileage drivers, which can be advantageous for Nissan owners who drive less frequently. This discount rewards safe driving habits and reduced road exposure.

- A++ A.M. Best Rating: USAA’s A++ rating from A.M. Best highlights its strong financial stability, ensuring reliable claims handling for Nissan owners. This high rating underscores the insurer’s ability to manage large claims effectively.

- Military Discounts: USAA provides significant discounts for military personnel, making it a great choice for service members driving Nissans. These specialized savings add extra value for those in the military. Find out why USAA ranks among the cheapest providers in our article titled “USAA Insurance Review & Complaints: Life, Home, & Auto Insurance.”

Cons

- Limited Availability: USAA is only available to military members and their families, which restricts access for other Nissan owners. This exclusivity limits the insurer’s reach to a broader audience.

- Higher Premiums for High-Risk Drivers: USAA’s rates may be higher for high-risk drivers compared to some competitors, which could affect those with a less favorable driving history. This can impact Nissan owners with a history of claims or violations.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#8 – Farmers: Best for Many Discounts

Pros

- Wide Range of Discounts: Farmers offers a variety of discounts, including those for safe driving, bundling policies, and installing safety features. Nissan owners can benefit from these multiple discounts to reduce their premiums.

- 10% Multi-Vehicle Discount: Farmers provides a 10% discount for insuring multiple vehicles, which can help Nissan owners save when covering more than one car. This discount supports families or individuals with multiple Nissans.

- Customizable Coverage Options: Farmers allows for significant customization of coverage options, catering to the unique needs of Nissan drivers. This flexibility ensures that policies can be tailored to individual preferences. Find more details in our article titled “Farmers Insurance Review & Complaints.”

Cons

- Higher Rates for Certain Drivers: Farmers may have higher rates for drivers with less favorable records, which could be a drawback for Nissan owners with a history of accidents or traffic violations. This might result in less competitive premiums.

- Mixed Customer Service Reviews: Some policyholders report mixed experiences with Farmers’ customer service, which can affect Nissan owners during claims or policy inquiries. Inconsistent service quality can be a concern for those seeking reliable support.

#9 – Liberty Mutual: Best for Student Savings

Pros

- Student Discounts: Liberty Mutual offers discounts specifically for students, including those with good grades. This can be advantageous for Nissan owners who are students or have student drivers.

- 10% Multi-Vehicle Discount: Liberty Mutual provides a 10% discount for insuring multiple vehicles, which helps Nissan owners save on their premiums when covering more than one car. This discount benefits families or individuals with multiple Nissans.

- Flexible Coverage Options: Liberty Mutual allows for a high degree of customization in coverage, catering to the specific needs of Nissan drivers. This flexibility helps ensure that policies align with individual requirements. To see monthly premiums and honest rankings, read our article titled “Liberty Mutual vs. Nationwide Car Insurance.”

Cons

- Premiums May Be Higher: Liberty Mutual’s premiums can be higher compared to some competitors, particularly for drivers with less favorable records. This might be a drawback for Nissan owners seeking the most affordable rates.

- Customer Service Inconsistencies: Customer service reviews for Liberty Mutual can be inconsistent, with some policyholders reporting dissatisfaction. This variability may impact Nissan owners during the claims process or when needing assistance.

#10 – American Family: Best for Local Agents

Pros

- Local Agent Expertise: American Family boasts a network of local agents who provide personalized service and tailored insurance solutions for Nissan owners. This local presence ensures that drivers receive individualized attention.

- 10% Multi-Vehicle Discount: American Family offers a 10% discount for insuring multiple vehicles, which can benefit Nissan owners with more than one car. This discount helps reduce overall insurance costs for households with multiple Nissans.

- Comprehensive Coverage Options: American Family provides a range of coverage options, including add-ons and specialized policies for Nissan drivers. This variety allows for a customizable insurance experience. Read more through our American Family insurance review.

Cons

- Limited Online Tools: American Family’s digital tools and online management options may be less advanced compared to some competitors. This could be a limitation for Nissan owners who prefer robust online services.

- Higher Rates for Some Drivers: American Family may have higher rates for certain drivers, particularly those with a history of claims or violations. This could affect Nissan owners looking for the most cost-effective insurance options.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Options for Best Nissan Car Insurance

Each state in the U.S., aside from New Hampshire and Virginia, has minimum car insurance requirements before drivers can take to the streets or register their vehicle. Therefore, as you search for Nissan insurance providers, all the companies you consider must sell at least liability insurance that meets your state’s requirements.

The types of liability insurance required in most states include:

- Property Damage Liability: Covers you if you cause an accident and damage someone’s vehicle or other personal property.

- Bodily Injury Liability: Covers you if you cause an accident and one or more people are injured. Find the best bodily injury liability car insurance companies.

The amount of property damage and bodily injury liability coverage you need on your Nissan depends on where you live.

Nissan Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $93 | $179 |

| American Family | $96 | $187 |

| Farmers | $83 | $182 |

| Geico | $95 | $193 |

| Liberty Mutual | $91 | $175 |

| Nationwide | $86 | $173 |

| Progressive | $76 | $190 |

| State Farm | $84 | $170 |

| Travelers | $88 | $187 |

| USAA | $79 | $167 |

In addition, some states require more coverage, including:

- Personal Injury Protection (PIP): PIP coverage helps with medical bills, lost wages, and funeral costs associated with a covered accident. Find the best personal injury protection car insurance companies.

- Medical Payments (MedPay): MedPay helps with medical bills like visits to the doctor and hospital stays. Find the best medical payments car insurance companies.

- Uninsured/Underinsured Motorist Coverage: If another driver causes an accident but does not carry proper insurance, uninsured/underinsured motorist coverage pays for the damage. Find the best uninsured motorist coverage car insurance companies.

Even if your state does not require PIP, MedPay, or uninsured/underinsured motorist coverage, you should consider adding these coverages to your car insurance policy if it’s available.

Full Coverage Options for Nissan Insurance

Nissan owners can purchase full coverage for their vehicles. Doing so may equip you with the coverage you need for peace of mind behind the wheel. If you don’t buy full coverage car insurance, you’ll have to pay out of pocket if you cause an accident and your vehicle sustains damage.

A full coverage policy for a Nissan includes the following types of car insurance coverage:

- Collision Insurance: Collision insurance pays for damage to your vehicle if you cause an accident. Collision will cover your Nissan up to its actual cash value (ACV). Find the best collision car insurance companies.

- Comprehensive Insurance: Comprehensive car insurance pays if theft, vandalism, wild animals, or inclement weather damage your Nissan. Find the best comprehensive coverage car insurance companies.

With collision and comprehensive coverage added to your policy, you’ll be covered if you cause an accident or if someone or something damages your car. If you drive a new or expensive Nissan or have a loan or lease on your vehicle, you may need a full coverage policy.

Nissan Car Insurance Add-ons

The best car insurance companies for Nissan offer add-on options to further customize your policy. With add-on insurance, you can choose from unique coverage options based on your unique needs and lifestyle.

Some of the most common add-on coverage options for a Nissan include:

- Emergency Roadside Assistance: Auto insurance with roadside assistance helps if you have a flat tire, need lockout services, run out of fuel, or need a tow.

- Gap Insurance: If your new Nissan is damaged, and you still have a loan or lease on the vehicle, gap insurance pays the difference between what you owe on the vehicle and its actual cash value.

- New Car Replacement: If your new Nissan is totaled, new car replacement pays for the vehicle to be replaced with the same make and model.

- Rideshare Coverage: Drivers for companies like Uber and Lyft often need additional rideshare or food delivery car insurance to ensure they’re protected.

- Rental Car Reimbursement: Your insurance company will pay you back for any money spent on rental cars while your vehicle is in the shop after a covered accident.

If you have a brand-new Nissan, gap insurance or new car replacement will help cover out-of-pocket costs after a claim.

In addition, anyone who works for a rideshare service should purchase additional coverage so they are not liable for an accident during work hours.

You can speak with any company that offers the add-on coverages you need to see how much they will cost and learn more about your options. Find out how much car insurance you need.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

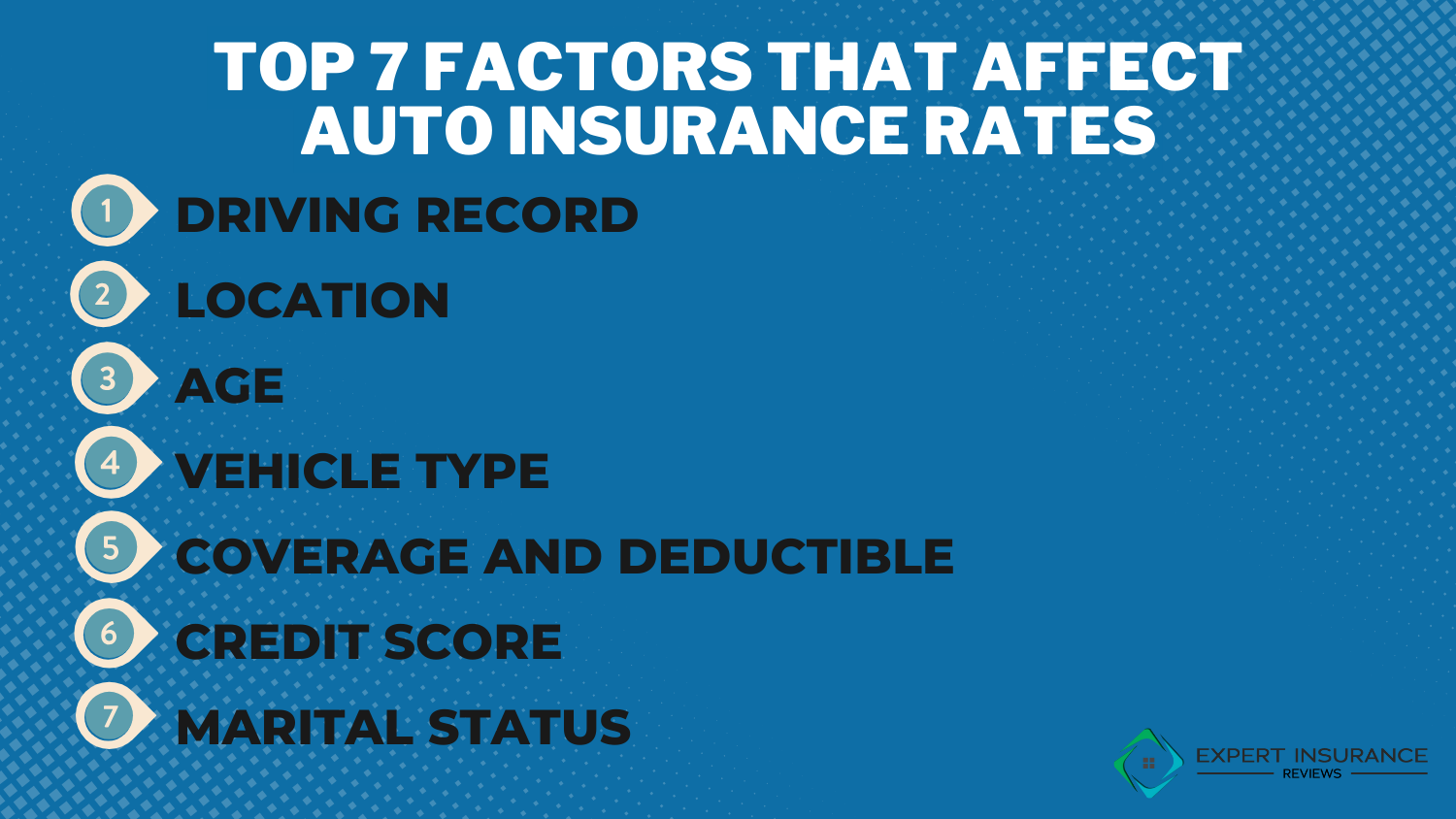

Nissan Car Insurance Rates

Nissan car insurance costs depend on the model you drive. Some Nissan models are less expensive to insure than others.

It’s a good idea to learn more about your specific Nissan model to know how much you’ll pay for car insurance. Use our table below to compare Nissan car insurance quotes by vehicle:

As you shop for affordable coverage, remember to compare Nissan auto insurance quotes from several companies. You may get rates from one company that are much higher than another based on discounts, coverage options, and more. Start comparing quotes now in our expert guide to finding the best car insurance for a Nissan Armada. Enter your ZIP code now to begin.

Choosing the Best Car Insurance Company for Nissans

You can’t stop at coverage and price to choose the best company for your Nissan car insurance. You must also assess each company’s financial strength, customer service, and claims handling.

Each insurance company’s financial strength is important when paying out on claims. For example, if you buy a cheap car insurance policy with a company that doesn’t have good financial strength, you may find that the company cannot pay for repairs to your vehicle when you’re in an accident.

In addition to a company’s financial strength, research each company’s customer service ratings and reviews. If a company has a great customer service department, you will not have to worry if you’re in an accident, need assistance, or have questions. On the other hand, if the customer service is not helpful, you may wish you had a different company altogether.

Lastly, pay attention to how well each company handles claims from its policyholders. Read our expert reviews on the best insurance companies to learn how customers from different insurers feel about their experience after filing a claim. Doing so could help you learn which companies to pursue and which to avoid.

Find the Best Car Insurance Company for Nissans Today

If you own a Nissan, you need car insurance for your vehicle. Fortunately, finding the best car insurance company for your Nissan doesn’t have to be difficult. You can compare coverage types and policies to determine what insurance you need on your Nissan and how much you will pay for coverage.

Some Nissan owners may want a simple, minimum coverage policy for their vehicles. A minimum liability-only policy can help you drive legally in your state, and your monthly rates will be less expensive. Still, many drivers may decide they need full coverage on their Nissans for added protection.

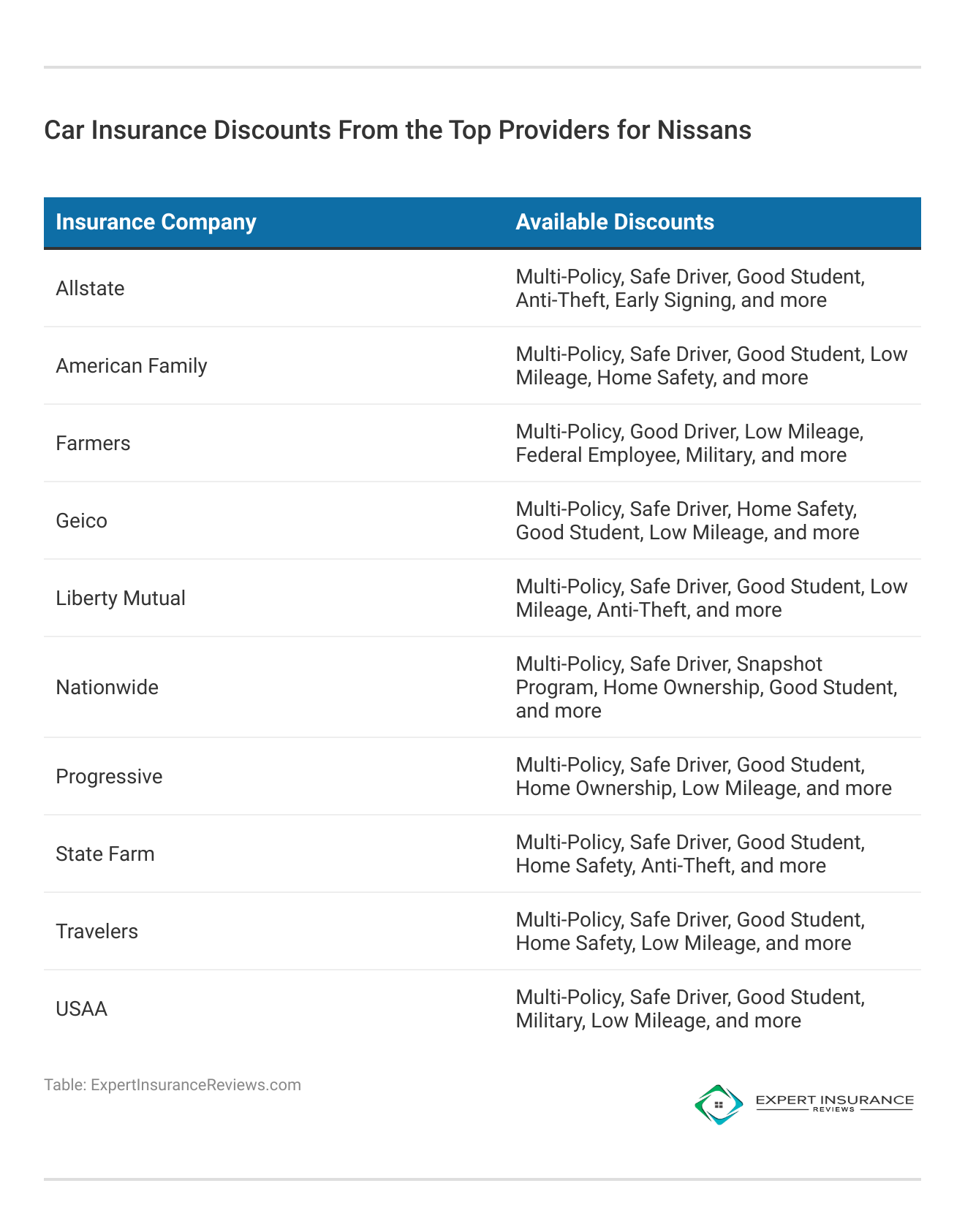

Speak with a representative from any company you're considering to learn whether you qualify for discounts on Nissan auto insurance coverage. Discounts could help you save up to 25% on your insurance rates.Ty Stewart Licensed Insurance Agent

You can also consider add-on coverage options to customize your Nissan auto insurance policy. Once you know what kind of coverage you want, find and compare quotes from different companies in your area. Comparing quotes can help you save money on your car insurance and avoid paying too much for coverage.

Don’t forget to compare quotes from the best car insurance companies for Nissan at least once a year, even if you’re happy with your coverage. You never know if another company will offer better coverage at a more affordable rate. Enter your ZIP code now to begin.

Frequently Asked Questions

What is the average cost of Nissan car insurance?

Nissan car insurance costs average $76 annually or $96 per month. However, the cost can vary based on the Nissan model and year, your age, gender, location, credit score, and driving history.

What type of Nissan car insurance do you need?

Your Nissan car insurance policy should at least meet the minimum requirements in your state. The types of liability insurance required in most states include property damage liability and bodily injury liability. Enter your ZIP code now.

Should you get full coverage Nissan car insurance?

If you drive a new or expensive Nissan or have a loan or lease on your vehicle, you may need a full coverage policy to meet car insurance requirements.

This type of policy includes collision and comprehensive coverage, which covers damages to your vehicle caused by accidents, theft, vandalism, wild animals, or inclement weather.

Ensuring you meet these car insurance requirements helps protect your investment and satisfy lender or leasing agreements.

Can I get add-on coverage for your Nissan car insurance?

Yes, the best car insurance companies for Nissans offer add-on options such as emergency roadside assistance, gap insurance, new car replacement, rideshare coverage, and rental car reimbursement.

Can I get discounts on Nissan car insurance?

Yes, you can save money on Nissan car insurance by asking for discounts such as safety features, defensive driver, good student, affiliation, loyalty, multi-car, and multi-policy. Enter your ZIP code now to begin.

Which insurance company offers the best multi-vehicle discount for Nissan owners?

State Farm offers the highest multi-vehicle discount at 20%, making it a great choice for Nissan owners with multiple vehicles. By bundling multiple cars, you can significantly reduce your overall insurance costs.

Additionally, State Farm provides comprehensive options, including full coverage car insurance, which ensures that all your vehicles are well-protected against various risks.

What is the key benefit of Progressive for Nissan drivers, according to the article?

Progressive is highlighted for its online convenience, allowing Nissan owners to manage their policies and claims easily online. Additionally, it offers a 10% multi-vehicle discount to help lower premiums.

How does Geico’s financial strength impact Nissan owners?

Geico has an A++ A.M. Best rating, indicating excellent financial stability which ensures reliable claims handling for Nissan owners. This high rating provides peace of mind knowing the company can cover claims effectively. Enter your ZIP code now to begin.

Which insurer is noted for providing substantial student discounts?

Liberty Mutual is noted for offering significant student discounts, which can be advantageous for young Nissan drivers. This helps reduce premiums for students while they gain experience behind the wheel.

Additionally, understanding the different types of car insurance coverage offered by Liberty Mutual can further aid in finding the best policy for young drivers.

With options ranging from liability to comprehensive and collision coverage, Liberty Mutual provides various ways to tailor a policy to meet the needs of inexperienced drivers.

What are the potential drawbacks of Farmers’ insurance for Nissan owners?

Farmers insurance may have limited specialized coverage options for Nissans compared to other insurers. Additionally, while it offers many discounts, some customers report variability in customer service quality.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about life insurance when he got his first policy for his own family. He has been featured as a life insurance expert speaker at agent conventions and in top publications. As an independent licensed life insurance agent, he has helped clients nationwide to secure affordable coverage while making the...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.