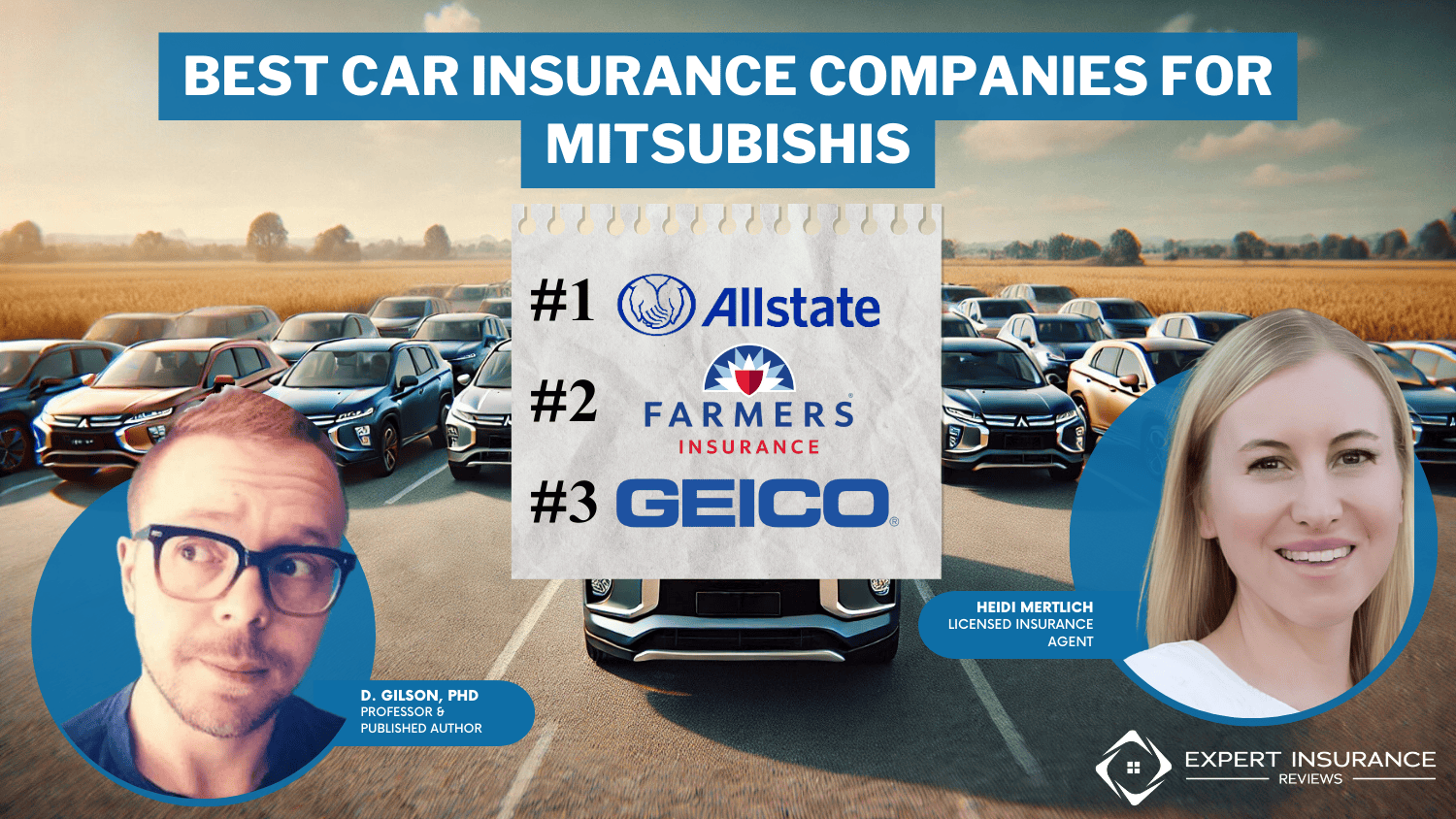

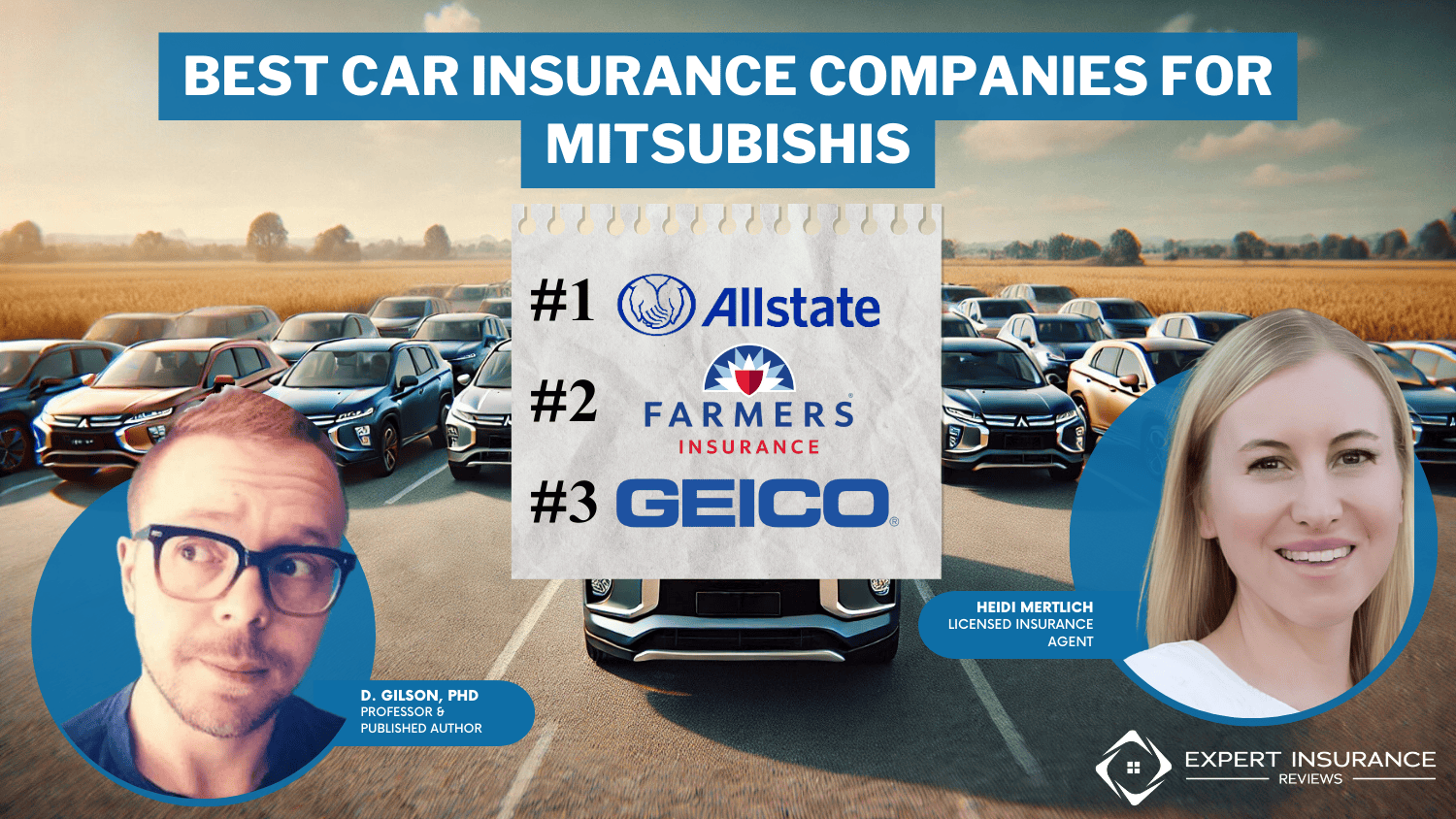

10 Best Car Insurance Companies for Mitsubishis in 2025 (See the Top Providers Here)

Allstate, Farmers, and Geico are the best car insurance companies for Mitsubishis, with rates starting as low as $59 per month. Allstate is a top pick for its valuable add-ons, while Farmers provides great safety discounts. Geico offers flexible coverage options, making it ideal for Mitsubishi owners.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated life insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the ...

Licensed Insurance Agent

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

3,072 reviews

3,072 reviewsCompany Facts

Full Coverage for Mitsubishis

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Mitsubishis

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsThe best car insurance companies for Mitsubishis are Allstate, Farmers, and Geico, with rates as low as $59 per month. They offer an excellent mix of individualized benefits, cost, and coverage.

Mitsubishi rates are average, but drivers can still save by shopping around for quotes. Finding the correct rate nowadays means doing a little shopping plus a little homework.

Our Top 10 Company Picks: Best Car Insurance Companies for Mitsubishis

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 9% | A+ | Add-on Coverages | Allstate | |

| #2 | 8% | A | Safety Discounts | Farmers | |

| #3 | 11% | A++ | Coverage Options | Geico | |

| #4 | 10% | A+ | Competitive Rates | Progressive | |

| #5 | 7% | A | Customer Service | American Family | |

| #6 | 6% | A++ | Military Savings | USAA | |

| #7 | 8% | A | Multi-Policy Discounts | Liberty Mutual |

| #8 | 10% | B | Personalized Service | State Farm | |

| #9 | 9% | A++ | Bundling Policies | Travelers | |

| #10 | 6% | A+ | Vanishing Deductible | Nationwide |

It’s best to begin the search by gathering as many quotes as possible. You may need liability coverage, full coverage car insurance, or more.

Let’s discuss some of the options you might like to consider, and then we’ll see how much you should expect to pay for the best Mitsubishi car insurance policies. Enter your ZIP code to begin comparing quotes.

- Find the best car insurance companies for Mitsubishis with tailored coverage

- Allstate leads with top add-on coverages and high customer satisfaction

- Compare options to fit Mitsubishi drivers’ needs

- Best Car Insurance Companies

- Best Mitsubishi Vanwagon Car Insurance Quotes (2025)

- Best Mitsubishi Sigma Car Insurance Quotes (2025)

- Best Mitsubishi Raider Car Insurance Quotes (2025)

- Best Mitsubishi Precis Car Insurance Quotes (2025)

- Best Mitsubishi Montero Sport Car Insurance Quotes (2025)

- Best Mitsubishi Montero Car Insurance Quotes (2025)

- Best Mitsubishi Mirage G4 Car Insurance Quotes (2025)

- Best Mitsubishi Mighty Max Pickup Car Insurance Quotes (2025)

- Best Mitsubishi Lancer Sportback Car Insurance Quotes (2025)

- Best Mitsubishi i-MiEV Car Insurance Quotes (2025)

- Best Mitsubishi Expo Car Insurance Quotes (2025)

- Best Mitsubishi Eclipse Spyder Car Insurance Quotes (2025)

- Best Mitsubishi Eclipse Cross Car Insurance Quotes (2025)

- Best Mitsubishi Diamante Car Insurance Quotes (2025)

- Best Mitsubishi 3000GT Car Insurance Quotes (2025)

- Best Mitsubishi Outlander Car Insurance Quotes (2025)

- Best Mitsubishi Outlander Sport Car Insurance Quotes (2025)

- Best Mitsubishi Lancer Car Insurance Quotes (2025)

- Best Mitsubishi Lancer Evolution Car Insurance Quotes (2025)

- Best Mitsubishi Endeavor Car Insurance Quotes (2025)

- Best Mitsubishi Eclipse Car Insurance Quotes (2025)

#1 – Allstate: Top Overall Pick

Pros

- Comprehensive Add-on Coverages: Allstate is an excellent choice for Mitsubishis, offering add-ons like rental reimbursement and roadside assistance for added security.

- Strong Financial Stability: With an A+ A.M. Best rating, Allstate is a reliable option for Mitsubishi owners, ensuring timely and complete claim payments.

- Attractive Bundling Discounts: Allstate offers a 9% bundling discount, making it cost-effective for Mitsubishi owners who combine auto insurance with home or renters policies.

Cons

- Higher Premiums for Some Drivers: Allstate may have higher premiums for drivers with less-than-perfect records, which could be a downside for some Mitsubishi owners.

- Mixed Customer Service Reviews: As stated in our Allstate insurance review, some customers have reported inconsistent service, which might be frustrating during the claim process.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#2 – Farmers: Best for Safety Discounts

Pros

- Exceptional Safety Discounts: Farmers offer safety discounts, particularly for Mitsubishi models with advanced safety features, making them affordable for safety-conscious owners.

- Customized Coverage Options: Farmers provides tailored coverage options specifically to Mitsubishi drivers, ensuring comprehensive, collision, or liability coverage as needed.

- A-Rated Financial Strength: Farmers A rating from A.M. Best highlights its reliability, ensuring efficient and fair claims handling, as demonstrated in our Farmers insurance review.

Cons

- Limited Availability of Local Agents: Farmers have a more limited network of local agents, which may be inconvenient for those who prefer face-to-face interactions.

- Higher Costs for Newer Models: Farmers may charge higher premiums for insuring newer Mitsubishi models, potentially affecting budget-conscious customers.

#3 – Geico: Best for Coverage Options

Pros

- Comprehensive Coverage Options: Geico offers extensive coverage options with tailored solutions to meet the needs of Mitsubishi drivers.

- A++ Financial Rating: Geico’s A++ rating from A.M. Best guarantees solid financial stability and quick claims payouts. Explore more about this in our Geico insurance review.

- User-Friendly Mobile App: Geico’s highly-rated app simplifies policy management and claims filing for Mitsubishi owners.

Cons

- Limited Availability of Local Agents: Geico’s focus on online services and fewer local agents might be inconvenient for those who prefer personal interactions.

- Potentially Higher Rates for High-Risk Drivers: Geico might charge higher premiums for Mitsubishi drivers with accident or violation histories, which could be a drawback.

#4 – Progressive: Best for Competitive Rates

Pros

- Competitive Rates: Progressive offers attractive rates, allowing Mitsubishi owners to save on premiums with its pricing strategies.

- A+ Financial Stability: With an A+ rating from A.M. Best, Progressive is a financially stable option, ensuring reliable claim payments for Mitsubishi drivers.

- 10% Bundling Discount: Progressive provides a 10% discount for bundling policies, making it a strong choice for consolidating insurance needs.

Cons

- Potentially Higher Rates for Specific Models: As stated in our Progressive insurance review, it may charge more for specific Mitsubishi models, which could be a drawback.

- Mixed Customer Service Experiences: Some customers report inconsistent experiences with Progressive’s customer service, which could be a concern for those considering their coverage.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#5 – American Family: Best for Customer Service

Pros

- Excellent Customer Service: Mitsubishi owners receive personalized support and quick responses. Uncover more by reviewing our article, “American Family Insurance Review.”

- Tailored Coverage for Families: Offers family-friendly coverage, including discounts for multiple vehicles and teen drivers, as one of the best car insurance companies for Mitsubishis.

- A-Rated Financial Strength: The American Family has an A rating from A.M. Best, which ensures financial stability and efficient claims handling.

Cons

- Limited Availability in Some States: Despite being one of the best car insurance companies for Mitsubishis, American Family’s coverage is limited and not available in all states.

- Higher Premiums for Younger Drivers: Premiums may be higher for younger Mitsubishi drivers, making it less affordable for this group.

#6 – USAA: Best for Military Savings

Pros

- Military Savings: As discussed in our USAA insurance review, it provides exclusive discounts for military members and families, making it a top choice among Mitsubishi insurers.

- Top Financial Rating: With an A++ rating from A.M. Best, USAA stands out as a financially secure option among the best car insurance companies for Mitsubishis.

- Outstanding Customer Service: USAA is praised for its excellent customer service, ensuring Mitsubishi owners receive prompt and courteous support.

Cons

- Eligibility Restrictions: USAA’s coverage is limited to military members and their families, reducing its accessibility for non-military Mitsubishi owners.

- Higher Premiums for Non-Military Drivers: Non-military drivers might find USAA’s rates less competitive, making it less appealing for those outside the military community.

#7 – Liberty Mutual: Best for Multi-Policy Discounts

Pros

- Great Multi-Policy Discounts: Liberty Mutual offers an 8% discount for bundling multiple policies, which can help you save on auto and home insurance.

- Flexible Coverage Options: Liberty Mutual offers customizable policies That cater to the unique needs of Mitsubishi drivers. Tailor your coverage for better protection.

- Excellent Accident Forgiveness Program: Liberty Mutual’s accident forgiveness program ensures rates don’t increase after your first accident.

Cons

- Higher Premiums for Add-Ons: Liberty Mutual may charge higher premiums for additional coverage options, which can increase overall costs for some drivers.

- Mixed Customer Satisfaction: Liberty Mutual has received mixed reviews, particularly about claims handling. Gain further insight with our Liberty Mutual insurance review.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#8 – State Farm: Best for Personalized Service

Pros

- Personalized Service: State Farm provides highly personalized service, and Mitsubishi owners can customize their policies with local agents.

- Competitive Bundling Discounts: State Farm offers a 10% discount for bundling policies, which can help you save on multiple insurance policies.

- Wide Network of Agents: With an extensive network of agents nationwide, State Farm is highly accessible, and Mitsubishi owners can easily find in-person assistance.

Cons

- Higher Rates for High-Risk Drivers: State Farm may have higher premiums for Mitsubishi drivers with a history of accidents or violations. Learn more in our State Farm insurance review.

- Limited Online Tools: State Farm’s online tools and mobile app may lack advanced features, which could be a drawback for tech-savvy drivers.

#9 – Travelers: Best for Bundling Policies

Pros

- Excellent Bundling Policies: Travelers offers a 9% discount for bundling, benefiting Mitsubishi owners with savings on both auto and home insurance.

- Robust Customization Options: Travelers provides customizable coverage, allowing Mitsubishi owners to tailor their insurance to specific needs.

- Generous Accident Forgiveness: Their accident forgiveness program prevents rate hikes after a first accident. Our article, “Travelers Insurance Review,” covers this in more detail.

Cons

- Limited Local Agents: Travelers have fewer local agents, which might be inconvenient for those preferring face-to-face service.

- Potentially Higher Rates for Certain Models: Travelers may charge more to insure some Mitsubishi models, affecting cost-effectiveness.

#10 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible Program: Nationwide’s vanishing deductible program allows Mitsubishi owners to lower their deductibles over time for safe driving.

- A+ Financial Rating: Nationwide’s A+ rating from A.M. Best indicates solid financial stability, ensuring reliable claim handling. Read more in our Nationwide insurance review.

- Robust Customer Support: Nationwide’s dependable customer support provides prompt and practical assistance, enhancing the experience for Mitsubishi owners.

Cons

- Higher Rates for High-Risk Drivers: Nationwide might charge higher premiums for drivers with a poor driving history, which could be a downside for those with higher risk profiles.

- Limited Coverage in Some Areas: Nationwide’s coverage may not be available in all regions, potentially limiting access for some Mitsubishi owners.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Comparing Coverage Options for Your Mitsubishi

Your car is more than a mere automobile. It’s an asset and a valuable one at that. Apart from your home, it’s possibly the next most expensive item you own, meaning insuring it correctly is a must.

Mitsubishi Car Insurance Monthly Rates by Providers & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $72 | $146 | |

| $66 | $140 | |

| $78 | $155 | |

| $61 | $136 | |

| $72 | $152 |

| $69 | $144 |

| $59 | $133 | |

| $73 | $151 | |

| $75 | $159 | |

| $61 | $132 |

Insurance companies offer many types of car insurance coverage, and you may need some, if not all, of them. Let’s cover a few:

- Liability Coverage: Required in most states, liability coverage is the foundation of all car insurance policies. Whether you cause an accident, a pileup, run over a neighbor’s mailbox, or cause injuries to another party, your vehicle’s liability coverage protects you in some of the most common — and worst — situations.

- Comprehensive Car Insurance Coverage: Comprehensive coverage may very well be a necessity to protect your assets. In today’s economy, windshields commonly cost about $1,000 to replace, and many states waive car insurance deductibles for windshield repair/replacement.

- Collision Coverage: Suppose you still have payments to make, whether loan or lease. Your lienholder/lessee will require comprehensive and collision coverage to protect their investment. If it’s paid off, neither is needed, but both are worth looking into.

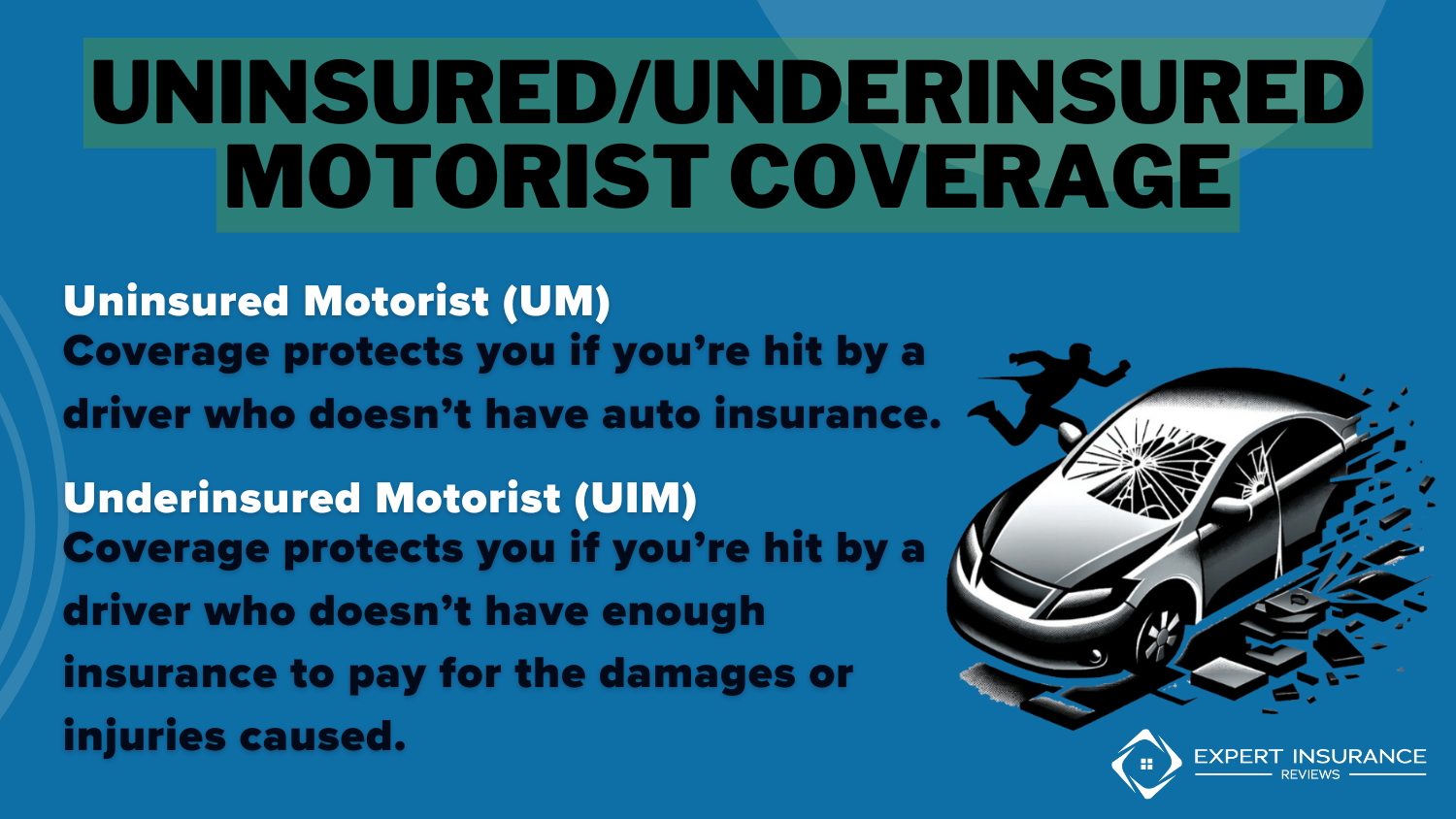

- Underinsured Coverage: This largely unknown coverage could be a lifesaver under the right circumstances. In many states, the required liability coverage one needs to drive covers far less in property damage than would be necessary to replace your vehicle.

- Roadside Assistance: This is a relatively cheap option at most insurance companies, but it may help you evade the costliest claims. Abandoning a vehicle raises the chances of vandalism and theft, so a few extra bucks a year may protect your purchase and give you peace of mind.

Comparing Rates and Coverage Options for Mitsubishis

As a brand, Mitsubishi drivers can expect to pay a little more than average in general maintenance and an insurance rate slightly above average. The difference likely won’t be enough to break the bank, but it’ll be noticeable.

Still, it’s worth remembering that the vehicle you drive is only a single factor in your cost. Your age, driving history, credit score, insurance history, location, and other personal information also contribute to the picture.

Car Insurance Discounts From the Top Providers for Mitsubishi

| Insurance Company | Available Discounts |

|---|---|

| Safe Driver Discount, Multi-Policy Discount, Anti-Theft Device Discount, New Car Discount | |

| Good Student Discount, Multi-Policy Discount, Low Mileage Discount, Defensive Driving Course Discount | |

| Multi-Car Discount, Anti-Theft Device Discount, Good Student Discount, Safe Driver Discount | |

| Good Student Discount, Anti-Theft Device Discount, Defensive Driving Course Discount, Multi-Policy Discount | |

| Multi-Policy Discount, Anti-Theft Device Discount, New Car Discount, Safe Driver Discount |

| Good Student Discount, Multi-Policy Discount, Anti-Theft Device Discount, Safe Driver Discount |

| Multi-Policy Discount, New Car Discount, Defensive Driving Course Discount, Good Student Discount | |

| Good Student Discount, Multi-Policy Discount, Defensive Driving Course Discount, Safe Driver Discount | |

| Safe Driver Discount, Multi-Policy Discount, New Car Discount, Anti-Theft Device Discount | |

| Defensive Driving Course Discount, Good Student Discount, Safe Driver Discount, Multi-Policy Discount |

Coverage options and discounts vary between providers, so it’s essential to compare all available car insurance quotes and review them carefully before deciding. You can also explore different methods to cut costs.

Vehicles with advanced safety features, like many Mitsubishis, often qualify for safety discounts. If your Mitsubishi has anti-theft technology, you should also receive discounts for it. Bundling multiple vehicles with the same company can lead to significant multi-car discounts.

Additionally, combining different types of policies, such as homeowners, renters, or life insurance, can also lower your premiums.

Many insurers offer car insurance discounts for updated driver training courses, including online options. Usage-based discounts are available for those who allow monitoring of their driving habits through a device or app.

Once you’ve considered these factors, the next step is to compare quotes to find the best rates. Enter your ZIP code to begin comparing insurance quotes from various providers.

Selecting the Best Insurance Company for Your Mitsubishi

Who should you choose to insure your Mitsubishi? In truth, the best may vary from place to place or person to person. While price is naturally a determining factor, it should never be the sole measure. Check around to see who has the best ratings and allow those to factor in.

Schimri Yoyo Licensed Agent & Financial Advisor

If you prefer interacting face-to-face, opt for an agent. However, you might wonder whether to choose a captive agent or an independent agent.

What is the difference between a captive and independent car insurance agent? Captive agents can quote you from a single company, while independent agents can quote you from various companies at once. Plus, they serve as your face-to-face contact in the event of an emergency, claim, or crisis.

Other companies prefer to operate without local agents at all. This may save on expenses, but if you’re an in-person customer, it may not be worth the headache. If, however, you prefer to do your business online or via an app, the reverse could be true.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Essential Insights on Mitsubishi Car Insurance

In today’s auto market, all claims are costlier than usual and perhaps more expensive than ever. Prices are on the rise, and quality vehicles are becoming scarce. In today’s economy, insurance is about more than simply a bottom line.

It’s worth finding an insurer who meets your car insurance requirements and provides you with the peace of mind you’re paying for. For Mitsubishi owners, it’s crucial to explore the best car insurance companies for Mitsubishis to ensure you’re getting the best coverage and value.

If you’re concerned that your current insurer doesn’t have you covered, do yourself a favor and look for cheap Mitsubishi car insurance quotes. Enter your ZIP code to begin comparing insurance quotes from various providers.

Frequently Asked Questions

What factors make Mitsubishi car insurance rates higher than average?

Mitsubishi insurance can be pricier due to less common parts and repair needs, often exceeding even some premium brands. This scarcity can affect repair speed and costs, so comparing quotes is essential to find the best rate.

What impacts the insurance cost for a 2022 Mitsubishi Mirage?

The cost of insuring a Mirage varies widely, influenced by factors like driver history, location, and chosen coverage. While full coverage often exceeds $200 monthly, personalized quotes can uncover savings. Enter your ZIP code to begin comparing quotes from different providers.

Do I need comprehensive coverage for my Mitsubishi car?

Comprehensive car insurance coverage is not required by law, but it can be a good option for Mitsubishi car owners who want added protection against theft, vandalism, and other non-collision damage. If you have a newer or more expensive Mitsubishi model, comprehensive coverage may be a good investment.

How do I get the best Mitsubishi car insurance quotes?

The best way to get Mitsubishi car insurance quotes is to shop around and compare rates from different insurance providers.

You can also consider factors like your driving record, the make and model of your Mitsubishi car, and the coverage options you need to find the best insurance policy for your needs.

What factors affect the cost of Mitsubishi car insurance?

The cost of Mitsubishi car insurance can depend on a variety of factors, including the model and year of your car, your driving record, your age and gender, your location, and the coverage options you choose.

It’s important to consider these factors when getting insurance quotes and finding the best policy for your needs. Enter your ZIP code to begin comparing quotes from different providers.

Which insurance companies offer the best discounts for Mitsubishi drivers?

Geico and Liberty Mutual are among the best car insurance companies for Mitsubishis, offering significant discounts such as bundling and safe driving discounts. Geico, for instance, provides an 11% bundling discount, while Liberty Mutual offers 8% for multi-policy discounts.

See our extensive resource, “How To Save Money by Bundling Insurance Policies,” for more information.”

What types of coverage are essential for a Mitsubishi Outlander?

For a Mitsubishi Outlander, consider comprehensive coverage to protect against non-collision damages like theft or natural disasters, and liability coverage to meet legal requirements. Uninsured motorist coverage is also beneficial to protect against hit-and-run incidents or uninsured drivers.

What are the top insurance companies for older Mitsubishi models?

For older Mitsubishi models, consider companies like Farmers, which is known for safety discounts, or State Farm, which excels in personalized service. Both companies are among the best car insurance companies for Mitsubishis and offer tailored policies that could benefit drivers with older vehicles.

How can I reduce my Mitsubishi car insurance premium?

To reduce your Mitsubishi car insurance premium, consider bundling your auto policy with other types of insurance, like homeowners or renters. Additionally, maintaining a clean driving record and taking advantage of discounts for safety features can further lower your rates.

Does my Mitsubishi qualify for a safe driving discount?

If your Mitsubishi has advanced safety features and you maintain a clean driving record, you may qualify for a safe driving discount. Companies like Farmers and Geico offer discounts specifically designed for drivers who prioritize safety. Enter your ZIP code to begin comparing quotes from different providers.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated life insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.