Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – Geico: Best for Online Convenience

Pros

- Effortless Digital Savings: Geico offers 10% rebate for low-mileage Subaru owners. Read “How do I file a car insurance claim with Erie?” for more insights.

- Top Financial Stability: Geico holds an A++ rating from A.M. Best, ensuring reliable coverage for Subaru vehicles.

- Seamless Digital Experience: Geico’s online features enable quick policy adjustments and claims, simplifying insurance management for Subaru owners.

Cons

- Discounts May Lag Behind: Geico offers a 10% rebate for low mileage on Subarus, but may not be competitive.

- Coverage Constraints: Geico’s Subaru insurance may be less flexible than other insurers, limiting customization.

#2 – Allstate: Best for Customized Policies

Pros

- Personalized Savings for Subaru: Allstate offers a 12% rebate for low-mileage Subaru owners. Learn more in our guide “Allstate Auto Insurance Review & Complaints.”

- Solid Financial Health: Allstate holds an A+ rating from A.M. Best, ensuring reliable coverage for Subaru owners.

- Highly Adaptable Coverage Options: Allstate provides customizable policy choices for Subaru owners to meet their needs.

Cons

- Discounts May Fall Short: Subaru’s 12% rebate may be less favorable than higher discounts from other providers.

- Possible Premium Costs: Allstate’s customization options may result in higher premiums for Subaru insurance.

#3 – USAA: Best for Military Members

Pros

- Exclusive Military Rebates: USAA offers 10% rebate for low-mileage Subaru drivers. Discover more in our guide, “USAA Insurance Review & Complaints.

- Outstanding Financial Security: USAA holds an A++ rating from A.M. Best, ensuring top financial stability for Subaru insurance policies.

- Specialized Military Coverage: USAA policies meet the unique needs of military personnel, offering benefits tailored for active and retired Subaru owners.

Cons

- Eligibility Limitations: 10% low mileage rebate is for military only.

- Coverage Scope: USAA serves military well but offers less for non-military Subaru owners.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#4 – State Farm: Best for Financial Strength

Pros

- Stable Savings: State Farm gives 8% rebate for low mileage Subaru drivers. Access detailed insights in our guide titled, “State Farm Insurance Review & Complaints.”

- Robust Financial Backing: With a B rating from A.M. Best, State Farm provides reliable financial stability for Subaru policies.

- Extensive Coverage Choices: State Farm supports a variety of coverage options, appealing to Subaru owners seeking tailored solutions.

Cons

- Lower Discount Rate: The 8% rebate may be less competitive than other providers’ higher discounts, reducing savings.

- Potential Premium Costs: State Farm’s premiums for Subaru coverage may be higher than those of some competitors, affecting affordability.

#5 – Travelers: Best for Industry Experience

Pros

- Generous Subaru Rebates: Travelers offers a 14% rebate for low-mileage Subaru owners, showcasing significant savings.

- Excellent Financial Rating: With an A++ from A.M. Best, Travelers ensures reliable coverage and financial stability. Read our article, “Travelers Insurance Review & Complaints.”

- Expert Coverage Solutions: Travelers provides comprehensive insurance tailored for Subaru owners, ensuring thorough coverage and support.

Cons

- Discount Comparisons: Subaru’s 14% low-mileage rebate is good but may not be the most competitive.

- Coverage Specifics: Travelers’ coverage options for Subaru may lack specialization compared to competitors.

#6 – American Family: Best for Discount Availability

Pros

- Accessible Subaru Rebates: American Family offers a 9% rebate for low-mileage Subaru drivers. Uncover details in our guide titled, “American Family Insurance Review & Complaints.”

- Reliable Financial Standing: With an A rating from A.M. Best, American Family provides dependable coverage for Subaru owners.

- Varied Discount Programs: American Family offers diverse discount options for Subaru drivers to maximize savings and address various needs.

Cons

- Discount Competition: Subaru’s 9% low mileage rebate may not be as competitive as other insurers’ rates.

- Potential Premium Differences: American Family’s Subaru premiums could exceed some competitors based on coverage.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for Add-On Coverages

Pros

- Customizable Add-On Features: Liberty Mutual offers various add-ons for Subaru, enhancing insurance plans to meet specific needs.

- 11% Low Mileage Rebate: Subaru drivers can receive an 11% rebate for low mileage with Liberty Mutual, providing significant savings.

- Strong Financial Rating: Liberty Mutual holds an A rating from A.M. Best, ensuring financial stability for Subaru insurance. Gain insights from our guide “Liberty Mutual Insurance Review & Complaints.”

Cons

- Potential Cost of Add-Ons: Adding coverages may raise total Subaru insurance premiums with Liberty Mutual.

- Discount Comparison: The 11% low mileage Subaru rebate may not be the best, affecting overall savings.

#8 – Progressive: Best for Roadside Assistance

Pros

- Comprehensive Roadside Support: Progressive offers excellent roadside assistance for Subaru owners, ensuring quick emergency help.

- 8% Rebate for Low Mileage: Subaru drivers enjoy an 8% rebate on low mileage with Progressive, leading to lower insurance premiums.

- A+ Financial Rating: Progressive’s A+ A.M. Best grade ensures reliable Subaru coverage. To learn more, visit our guide titled, “Progressive Insurance Review & Complaints.”

Cons

- Discount Limitations: The 8% low mileage rebate on Subaru insurance may not match offers from other providers.

- Focus on Roadside Assistance: Progressive shines in roadside assistance, but coverage options for Subaru may lack competitiveness.

#9 – Farmers: Best for Safe-Driving Discounts

Pros

- Safe-Driving Rewards: Farmers gives Subaru owners a 12% rebate for maintaining a clean driving record. For details, see our guide, “Farmers Insurance Review & Complaints.”

- A Rating for Financial Stability: Farmers holds an A rating from A.M. Best, ensuring reliable coverage for Subaru vehicles.

- Diverse Coverage Options: Farmers provides various coverage options tailored to Subaru owners’ unique insurance needs.

Cons

- Discount Competitiveness: Farmers’ 12% safe-driving rebate may not be as competitive as higher discounts from others.

- Potential Premium Costs: Subaru premiums with Farmers may remain high, impacting overall affordability.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#10 – Nationwide: Best for Vanishing Deductible

Pros

- Innovative Deductible Feature: Nationwide offers a vanishing deductible for Subaru drivers, reducing costs over time.

- 10% Low Mileage Rebate: Subaru owners get a 10% rebate for low mileage with Nationwide, lowering insurance costs.

- Strong Financial Foundation: Nationwide holds an A+ rating from A.M. Best for Subaru policies. For further details, see our guide titled “Nationwide Insurance Review & Complaints.”

Cons

- Potential Deductible Costs: Vanishing deductible may raise initial costs with Nationwide, based on policy and claims.

- Discount Comparison: The 10% low mileage rebate on Subaru insurance may be less competitive than other providers.

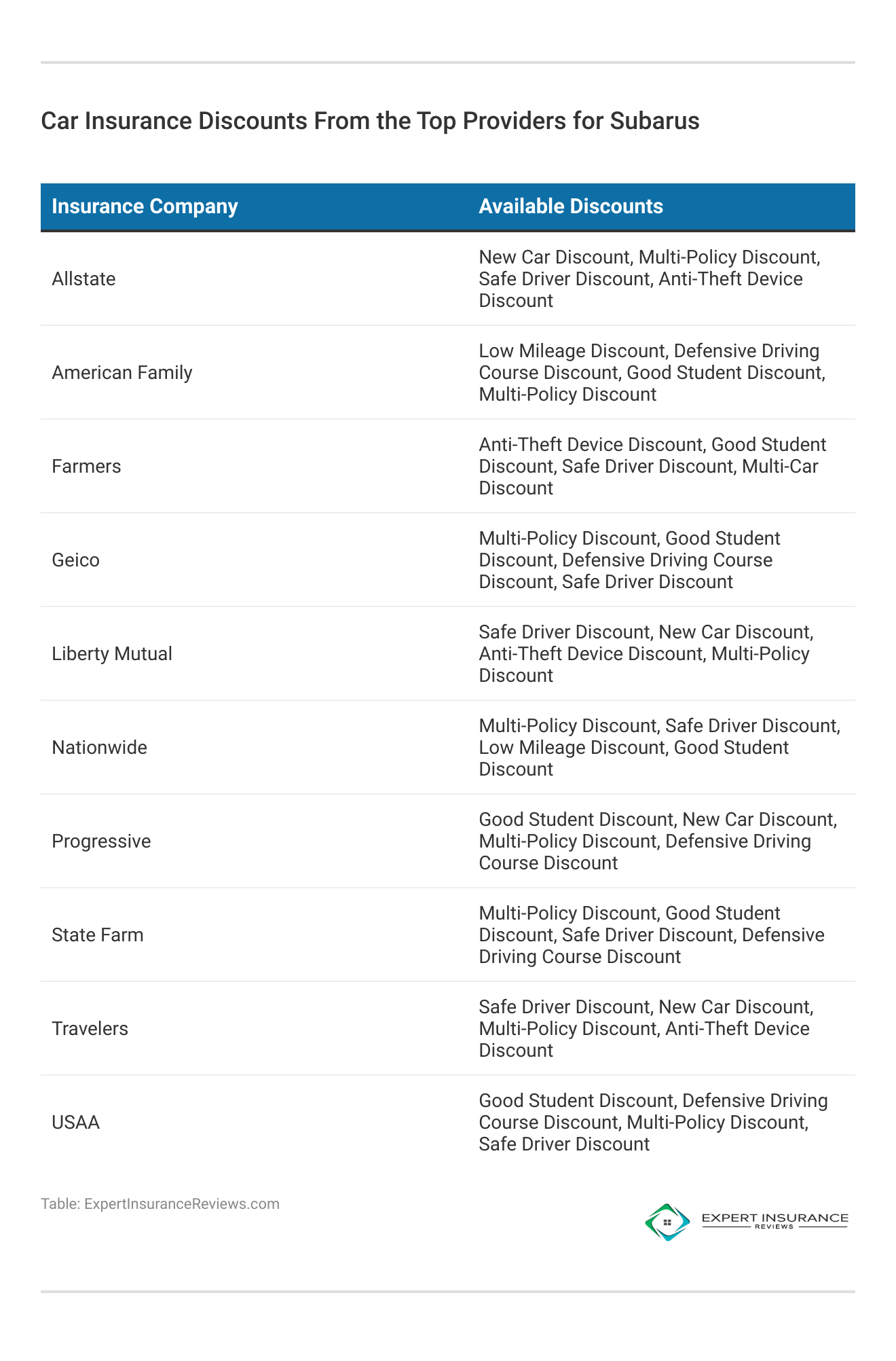

Subaru Insurance Rates: Comparing Coverage Costs by Provider

When evaluating Subaru car insurance, coverage rates vary significantly between providers and coverage levels. The table illustrates the monthly premiums for minimum and full coverage options across several top insurers. Discover more by exploring our in-depth guide titled, “Best Car Insurance Company for a Low Budget.”