Best Washington DC Car Insurance (2025)

You can easily discover the best Washington DC car insurance for just $181 a month. Erie, State Farm, and Geico stand out as the top choices for those seeking the cheapest car insurance rates in Washington DC. To find the best Washington DC car insurance, obtain quotes from the top DC companies and compare.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Angie Watts

Licensed Real Estate Agent

Angie Watts is a licensed real estate agent with Florida Executive Realty. Specializing in residential properties since 2015, Angie is a real estate writer who published a book educating homeowners on how to make the most money when they sell their homes. Her goal is to educate and empower both home buyers and sellers so they can have a stress-free shopping and/or selling process. She has studi...

Licensed Real Estate Agent

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Washington D.C. Stats Summary

| Washington D.C. Statistics Summary | Details |

|---|---|

| Road Miles | Total in State: 1,507 Vehicle Miles Driven: 355.7 billion |

| Vehicles | Registered: 318,515 Stolen: 3,264 |

| State Population | 702,455 |

| Most Popular Vehicle | Honda Civic |

| Uninsured Motorists | 15.6% State Rank: 10 |

| Total Driving Fatalities | 2008-2017 Speeding: 110 Drunk Driving: 82 |

| Annual Average Premiums | Collision: $449.27 Comprehensive: $230.25 Liability: $628.09 |

| Cheapest Providers | USAA CIC & GEICO |

Washington D.C., the nation’s capital. There’s more to see and do in 68 square miles than you could likely ever fully experience. History? Check. Museums? Check. Food? There are delicious eats everywhere you turn. Shopping? Get out your wallet. Luxury lifestyle spots? It has those too.

Washington D.C. is not technically a state. Instead, it’s a territory, and many of the area’s residents don’t live in Washington D.C. proper, but in the surrounding areas. This means there is heavy commuting in and out of the District of Columbia.

While the district is known for having a number of alternative forms of transportation like the Metro, Uber, and more, many residents still choose to drive, as do many of the visitors to the area.

The area sees not just local drivers, but also millions of visiting drivers every year. Whether you’re a resident or just visiting the nation’s capital, you need to make sure you have the right insurance coverage so you are legal on the road and have the financial protection you need.

Ready to start looking for the right insurance coverage for your lifestyle? Research is your best friend when figuring out the most cost-effective coverage mix for your needs.

We know this can be overwhelming. Google will show you hundreds, if not thousands, of results for anything you search. How do you filter the information down to what’s relevant for your life?

Don’t worry, we’ve put together everything you need to make the right decision for your coverage. Keep reading to learn more.

Washington D.C. Car Insurance Coverage and Rates

It’s not always easy to figure out which car insurance company and coverage type are right for you. Where do you even start? If you watch television or listen to the radio, every car insurance company has the best, most affordable, most comprehensive coverage. How do you get through the noise to figure out what actually is best for you?

Choosing the right coverage mix and insurance company is a personal decision. Only you can decide what best fits your needs. But how do you even know what to consider when making this decision?

We know how overwhelming this can be. So to make it easier for you, we’ve compiled (and explained) key data and information you need on insurance providers in the district, coverage types you can buy, laws that both the insurance companies and you must follow, and more.

Using that information, you can make an informed decision on your car insurance coverage.

Ready to get started? Let’s begin with the basics. What’s a fair price? How is that price derived? Are all insurance coverage costs the same? Take a look at this table to find out an average cost for all coverage types for residents in Washington D.C. versus the rest of the country.

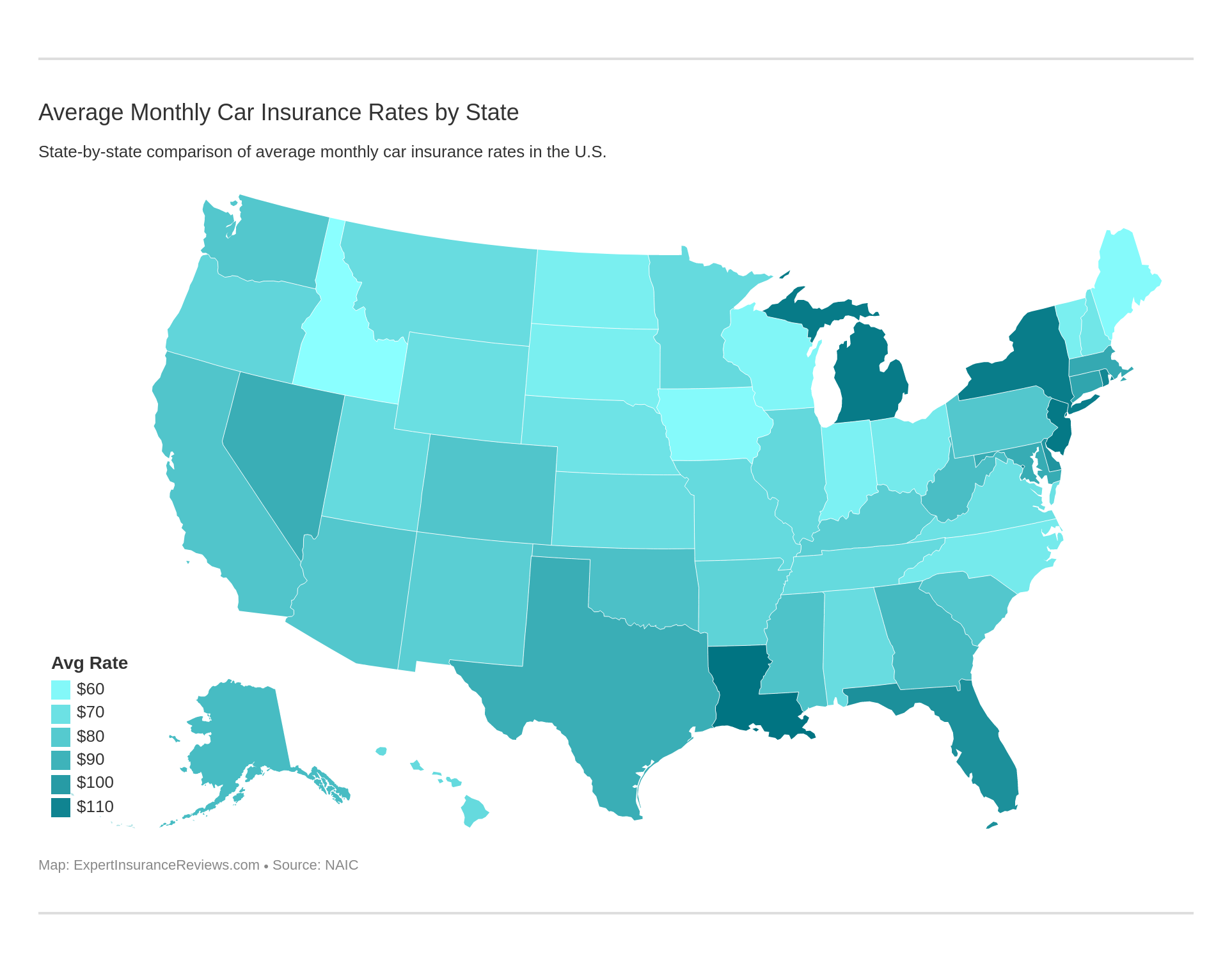

Washington D.C. All Coverage Types Average

| Washington D.C. Average | National Average | Percent Difference |

|---|---|---|

| $2,174 | $1,474 | 47.49% |

As you can see, the national average for insurance in the above table is $1,474, compared to the Washington D.C. average of $2,174.

In other words, if you live in the District of Columbia, you pay around 47 percent more for car insurance coverage than drivers across the country. Why is the district average so much higher than the national average?

Keep reading to find out more information on how this rate is derived, what factors insurance companies consider, and why you can expect to pay so much more if you live in Washington D.C.

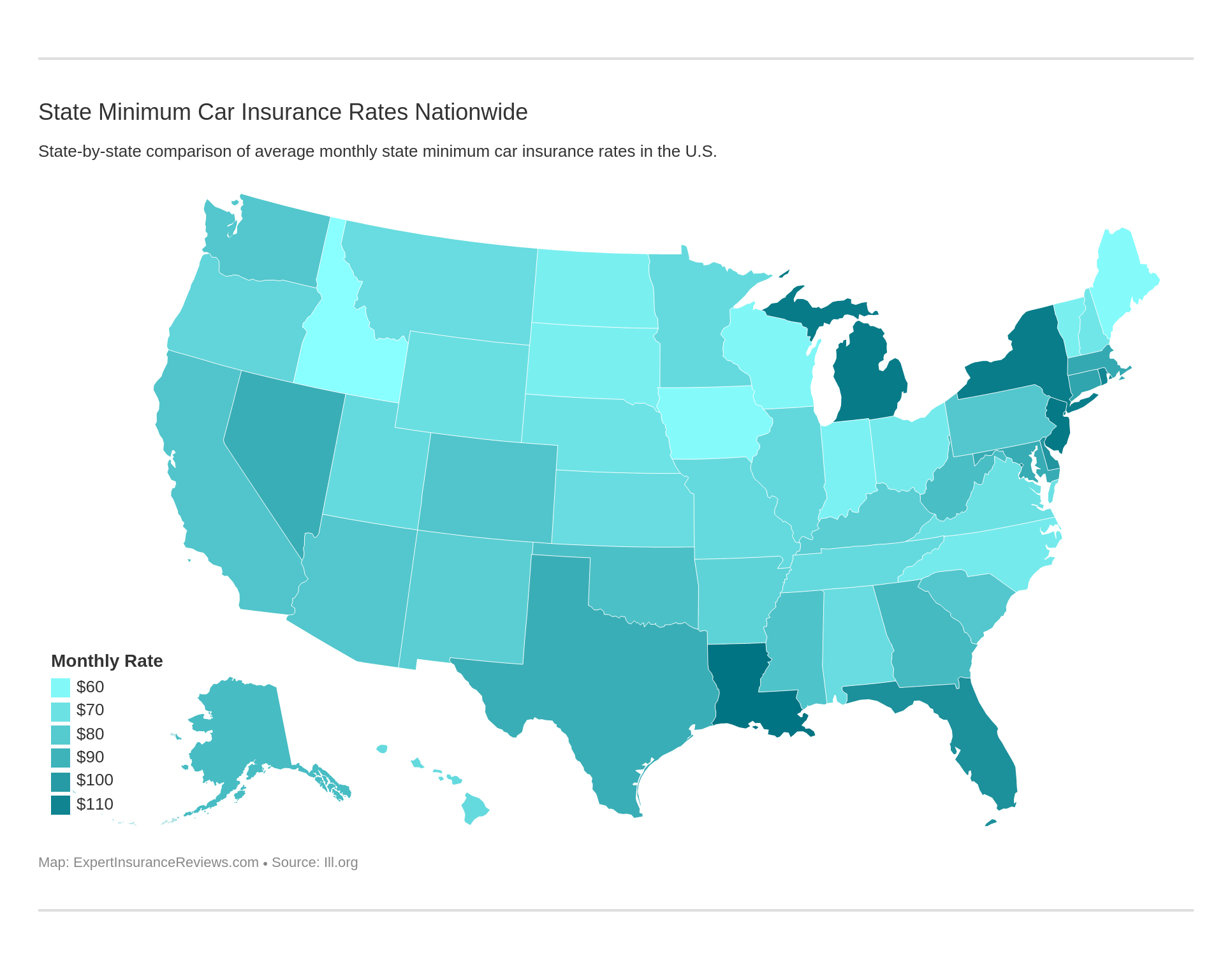

Washington D.C. Minimum Coverage

If you live anywhere in the United States, you are likely required to maintain a minimum insurance coverage level of some amount. Most states have a set requirement every driver must have to register a vehicle and legally drive. This helps to protect all drivers financially if an accident occurs.

The nation’s capital is no exception. Check out this table to see what you have to maintain to drive legally in the District of Columbia.

D.C. Minimum Coverage

| Required Insurance | Minimum Limits |

|---|---|

| Bodily Injury | $25,000 per person $50,000 per accident |

| Property Damage Liability | $10,000 |

| Uninsured Motorst Bodiliy Injury | $25,000 per person $50,000 per accident |

| Uninusred Motorist Property Damage | $5,000 subject to $200 deductible |

As you can see in the above table, in addition to what is typically included in minimum liability coverage (bodily injury and property damage liabilities), drivers in the district must also buy uninsured motorist coverage.

This isn’t always a state requirement, but given that Washington D.C. is 15th in the nation for uninsured motorists, it should come as no surprise.

Washington D.C. also maintains a no-fault system, which means your insurance company compensates you for any damages that result from an accident, no matter who is at fault.

This means your insurance coverage needs to protect you from whatever might happen to you on the road because you’ll file a claim with your insurance company, rather than the at-fault driver’s insurance.

Washington D.C. is one of only three states in the country that does NOT allow electronic proof of insurance, so make sure you have your physical insurance card with you any time you’re driving in the area.

Check out the next few sections to learn more about coverage options beyond the minimum to ensure that you have the level of financial protection you need.

Forms of Financial Responsibility

Proof of financial responsibility is a way to demonstrate that when an accident occurs, you have the financial resources to cover damages. For most states, the primary method to provide proof of financial responsibility is through your car insurance coverage.

Some states also allow drivers to provide proof of financial responsibility by submitting large amounts of funds (usually at least $40,000) to the state, to be held in case of an accident. However, this is not the case in Washington D.C.

The only acceptable form of financial responsibility in Washington D.C. is car insurance.

As noted in the previous section, the only acceptable form of proof of insurance in the nation’s capital is a physical insurance card. Electronic forms of proof of insurance are not considered valid.

Premiums as a Percentage of Income

You already know that insurance is required to drive in the District of Columbia. And insurance costs money. As you saw earlier, on average, residents of Washington D.C. pay almost double the national average for car insurance coverage.

But what does this look like for your income? How much of your disposable income will you need to save to pay your car insurance premiums?

Take a look at this table to see the percentage of disposable income the average resident of Washington D.C. spends on car insurance, compared to the national average.

Washington D.C. Premiums as a Percentage of Income

| Annual Average | 2012 | 2013 | 2014 |

|---|---|---|---|

| Washington D.C. Average | 2.26% | 2.33% | 2.21% |

| National Average | 2.34% | 2.43% | 2.40% |

| Percent Difference | -3% | -4% | -8% |

Based on the difference in cost between car insurance coverage for residents of the nation’s capital and the national average, you might expect that the percent of disposable income spent on car insurance for Washington D.C. residents would be higher than the national average. However, it is actually less.

Across the three years shown above, Washington D.C. residents spend about 5 percent less of their disposable income on car insurance than the national average.

This means that while the dollar amount average spent on car insurance coverage is double the national average, the income in the Washington D.C. area is higher than the average income across the country.

Next, let’s take a look at how Washington D.C. compares to its neighbors. This table contrasts disposable income allocated for car insurance for Washington D.C., Maryland, Virginia, West Virginia, Pennsylvania, and Delaware.

D.C. Premiums as a percentage of income neighbors

| State | 2012 | 2013 | 2014 |

|---|---|---|---|

| Virginia | 1.79% | 1.91% | 1.90% |

| Washington D.C. | 2.26% | 2.33% | 2.21% |

| Maryland | 2.26% | 2.35% | 2.34% |

| Pennsylvania | 2.26% | 2.35% | 2.24% |

| Delaware | 2.97% | 3.05% | 3.02% |

| West Virginia | 3.18% | 3.26% | 3.20% |

As you can see, residents of Washington D.C. spend less than or equal amounts of their disposable income as compared to most of their neighbors. Only drivers in Virginia spend less of their disposable income on car insurance than drivers in the district.

Average Monthly Car Insurance Rates in Washington D.C. (Liability, Collision, Comprehensive)

Since Washington D.C. operates under a no-fault system, minimum liability coverage is likely not enough, as your insurance company will be responsible for paying out any claims. With this in mind, what other coverage options do you have?

We’re glad you asked.

Core coverage includes collision, comprehensive, and combined or full coverage options.

As always, price can be a defining factor in your decision-making process. How much can you expect to pay for these core coverage options? The data below compares the average costs for each of the different coverage types in Washington D.C. to the national average cost.

Washington D.C. Core Coverage

| Coverage Type | 2011-2015 Average Cost in Washington D.C. | 2011-2015 National Average Cost | Percent Difference |

|---|---|---|---|

| Liability | $628.09 | $516.39 | 21.63% |

| Collission | $449.27 | $299.73 | 49.89% |

| Comprehensive | $230.25 | $138.87 | 65.80% |

| Full/Combined | $1,307.62 | $954.99 | 36.92% |

When you look at this table, please keep in mind that the data (from the National Association of Insurance Commissioners, or NAIC) is based on the minimum insurance coverage requirements in Washington D.C.

The key takeaway is that you can use these numbers to start forming a picture of what baseline insurance costs look like, so you can determine what a fair price is for your coverage needs.

Additional Liability

In addition to core coverage, you can include additional liability coverage in your insurance policy. There are two or three primary forms of additional liability coverage you can buy.

We say two or three because uninsured/underinsured motorist coverage is often considered additional liability coverage. However, in Washington D.C. it is mandatory as a part of the minimum liability coverage required by the local government.

Uninsured/underinsured motorist coverage keeps you financially safe if you are in an accident with an uninsured driver. Currently, 15.6 percent of drivers in the nation’s capital are uninsured (making the district 10th in the nation for uninsured drivers), which may provide some insight into why this coverage is mandatory.

The other two additional liability coverage options you can buy are described below.

- Medical Payments (MedPay) – provides additional coverage for medical costs that aren’t covered by your core insurance coverage (for both you and anyone listed on your policy).

- Personal Injury Protection (PIP) – provides additional coverage for medical costs that aren’t already covered by your core insurance coverage (for you and anyone involved in an accident, no matter who is at fault).

You need to know all the options available to you for car insurance coverage so you can determine which coverage mix best fits your lifestyle.

However, to make a truly informed decision on your car insurance coverage, you’ll need to know more than just what options are available to you. You want to know that your insurance company is capable and willing to pay out claims on those options.

We use what is called loss ratio data provided by the NAIC to find out if companies are both willing and able to pay out on insurance claims for the additional liability coverage we’ve just discussed. It’s also an indicator of whether a company is paying out on too many claims.

Loss ratio is calculated by dividing the number of claims an insurance provider pays out on by their paid premiums. You want your insurance company to be in a healthy range for loss ratio, because this indicates they pay out a reasonable number of claims (not too many and not too few).

Typically the preferred range for a company’s loss ratio is between 60 and 80 percent. If a company’s loss ratio is above this range, they’re paying out too many claims and are losing money, and if their loss ratio is below this range, they’re not paying out on enough claims.

To understand the loss ratio for additional liability coverage in Washington D.C., we’ve collected NAIC data on personal injury protection, uninsured/underinsured motorist, and MedPay coverage. Check out the table below to learn more.

Washington D.C. Additional Liability Loss Ratio

| Loss Ratio | 2013 | 2014 | 2015 |

|---|---|---|---|

| Uninsured/Underinsured Motorist | 71.24% | 82.17% | 78.76% |

| Personal Injury Protection | 84.37% | 53.66% | 63.98% |

| MedPay | 85.86% | 54.31% | 27.40% |

Uninsured/underinsured motorist coverage and personal injury protection (PIP) both have reasonably healthy loss ratios across the three years shown in the table (although in 2014, PIP was a bit low). However, MedPay is dramatically different across the three years. In 2013, the loss ratio was a little high, but still reasonably healthy.

In 2014, the loss ratio dropped 30 percent and was on the low side, but was still close to healthy. However, in 2015, the loss ratio was significantly lower than healthy, indicating that companies were not paying out enough claims in this area.

Add-ons, Endorsements, and Riders

Now that you know your core and additional liability coverage options, what if you realize you still need something more? There are some extra options you can consider and discuss with your insurance agent. These add-ons, endorsements, and riders are described below:

- Guaranteed Auto Protection (GAP) – covers the gap between what your car is worth and what you still owe on your loan.

- Personal Umbrella Policy (PUP) – provides protection if you’re ever faced with a lawsuit as a result of your part in a car accident.

- Rental Reimbursement – provides coverage if you have to rent a car if yours is damaged in an accident and is unavailable to drive while it is being repaired.

- Emergency Roadside Assistance – provides coverage for various roadside needs, such as a flat tire or towing.

- Mechanical Breakdown Insurance – provides repair coverage, often beyond what is covered by your vehicle’s warranty.

- Non-Owner Car Insurance – provides insurance coverage when you don’t own a car.

- Modified Car Insurance Coverage – provides coverage for vehicles with special modifications (ex. wheels/tires, specialty paint jobs, spoilers, etc.).

- Classic Car Insurance – provides coverage for vehicles that are collector’s items.

- Pay-As-You-Drive or Usage-Based Insurance – insurance coverage that is specifically focused on individual driving habits.

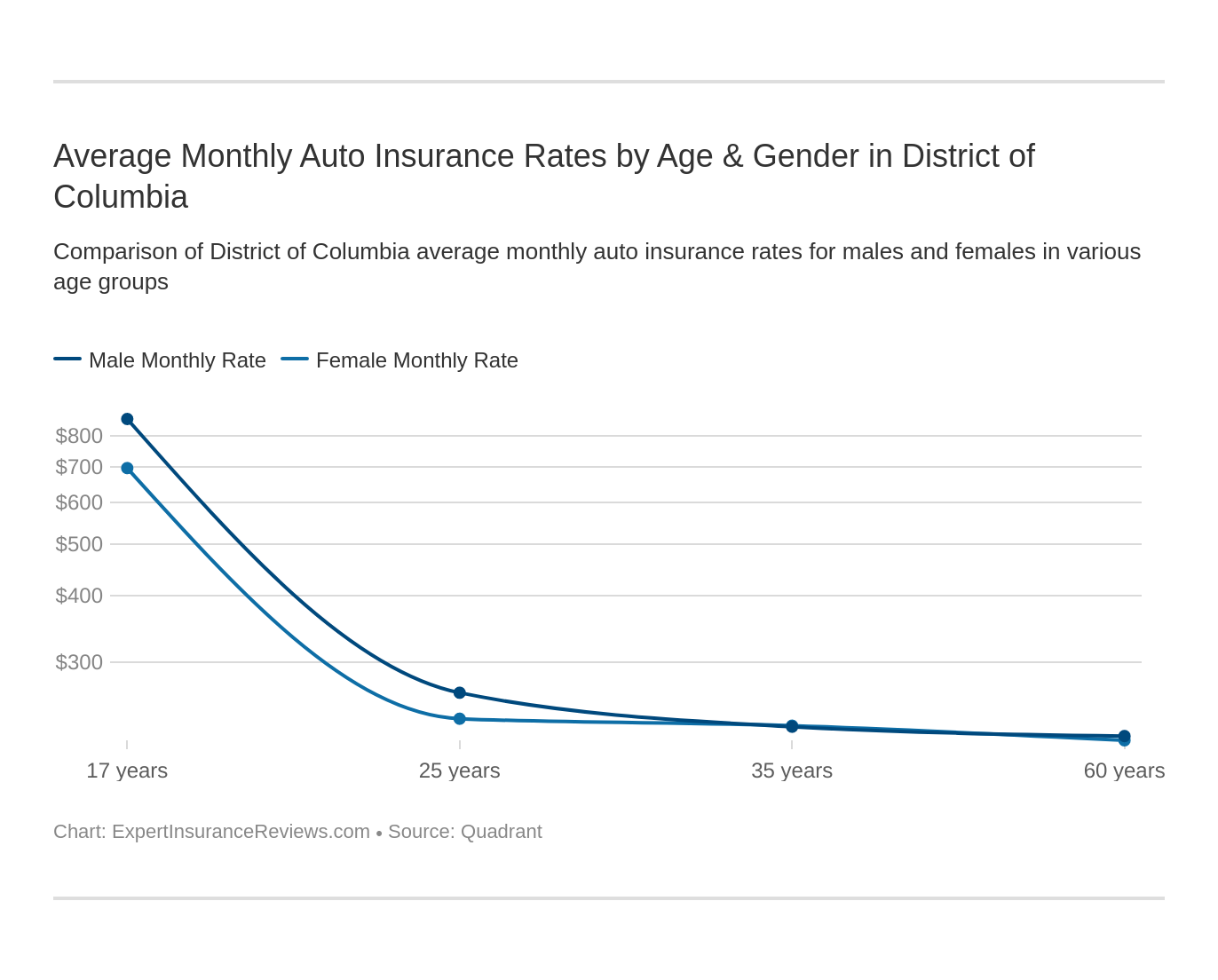

Average Car Insurance Rates by Age & Gender in Washington D.C.

Car insurance companies in Washington D.C. can still use gender to adjust your insurance rates, even though it is controversial. Some states such as California and Hawaii have made it illegal.

Eventually, the District of Columbia may follow suit. However, even if the laws do not change, insurance companies may need to begin reconsidering this practice in the near future, as the district is one of several places in the country that allow drivers to choose a third, gender-neutral option on their driver’s license.

Let’s take a look at data from Washington D.C. on insurance rates for both men and women at different ages and with different marital statuses to see if gender actually affects insurance rates in your area.

| Company | Single 17-Year Old Female Annual Rates | Single 17-Year Old Male Annual Rates | Single 25-Year Old Female Annual Rates | Single 25-Year Old Male Annual Rates | Married 35-Year Old Female Annual Rates | Married 35-Year Old Male Annual Rates | Married 60-Year Old Female Annual Rates | Married 60-Year Old Male Annual Rates |

|---|---|---|---|---|---|---|---|---|

| USAA CIC | $5,047.10 | $6,001.61 | $1,891.88 | $2,086.10 | $1,419.48 | $1,434.98 | $1,367.92 | $1,394.43 |

| GEICO General | $6,282.32 | $7,523.64 | $2,606.50 | $2,076.67 | $2,782.63 | $2,626.29 | $2,949.59 | $2,694.87 |

| State Farm Mutual Auto | $7,573.00 | $10,041.93 | $2,714.97 | $2,989.94 | $2,445.38 | $2,445.38 | $2,190.89 | $2,190.89 |

| NICOA | $7,768.94 | $9,857.18 | $3,851.14 | $4,139.93 | $3,437.91 | $3,453.36 | $3,102.55 | $3,180.87 |

| Progressive Direct | $10,819.70 | $12,660.17 | $3,064.98 | $3,231.19 | $2,626.08 | $2,537.25 | $2,386.96 | $2,435.74 |

| Allstate P&C | $12,590.85 | $15,874.46 | $4,059.66 | $4,403.29 | $3,732.35 | $3,880.10 | $3,440.27 | $3,770.41 |

As the data in the table shows, both age and gender can have a significant effect on your insurance rates in Washington D.C. However, not all insurance companies weigh these factors the same.

For example, State Farm Mutual Auto’s insurance rates for 17-year-old males are about 33 percent higher than their rates for females of the same age. By contrast, Progressive’s rates for 17-year-old males is 17 percent higher than for females.

For 17-year-old drivers, on average across all the companies listed, males pay about 23 percent more in insurance coverage than females do. However, this trend is not as significant as you age.

By the time they turn 25, males will pay an average of 3 percent more for car insurance than females will. Both USAA and State Farm charge about 10 percent more for car insurance if you are male. However, if you are a 25-year-old male insured by Geico, you’re in luck. You’ll pay about 20 percent less for insurance than female drivers of the same age.

At 35, the gender gap is almost eradicated. On average, men actually pay about a half of a percent less for insurance coverage than women do at 35. State Farm’s rates are identical for men and women age 35, and Geico and Progressive charge 35-year-old men about 6 and 3 percent less for insurance coverage, respectively.

The Quadrant data we’ve just analyzed includes rates for high-risk drivers, drivers with liability coverage only, and drivers who have additional, optional coverage. This ensures that the numbers are reflective of the majority of drivers in Washington D.C.

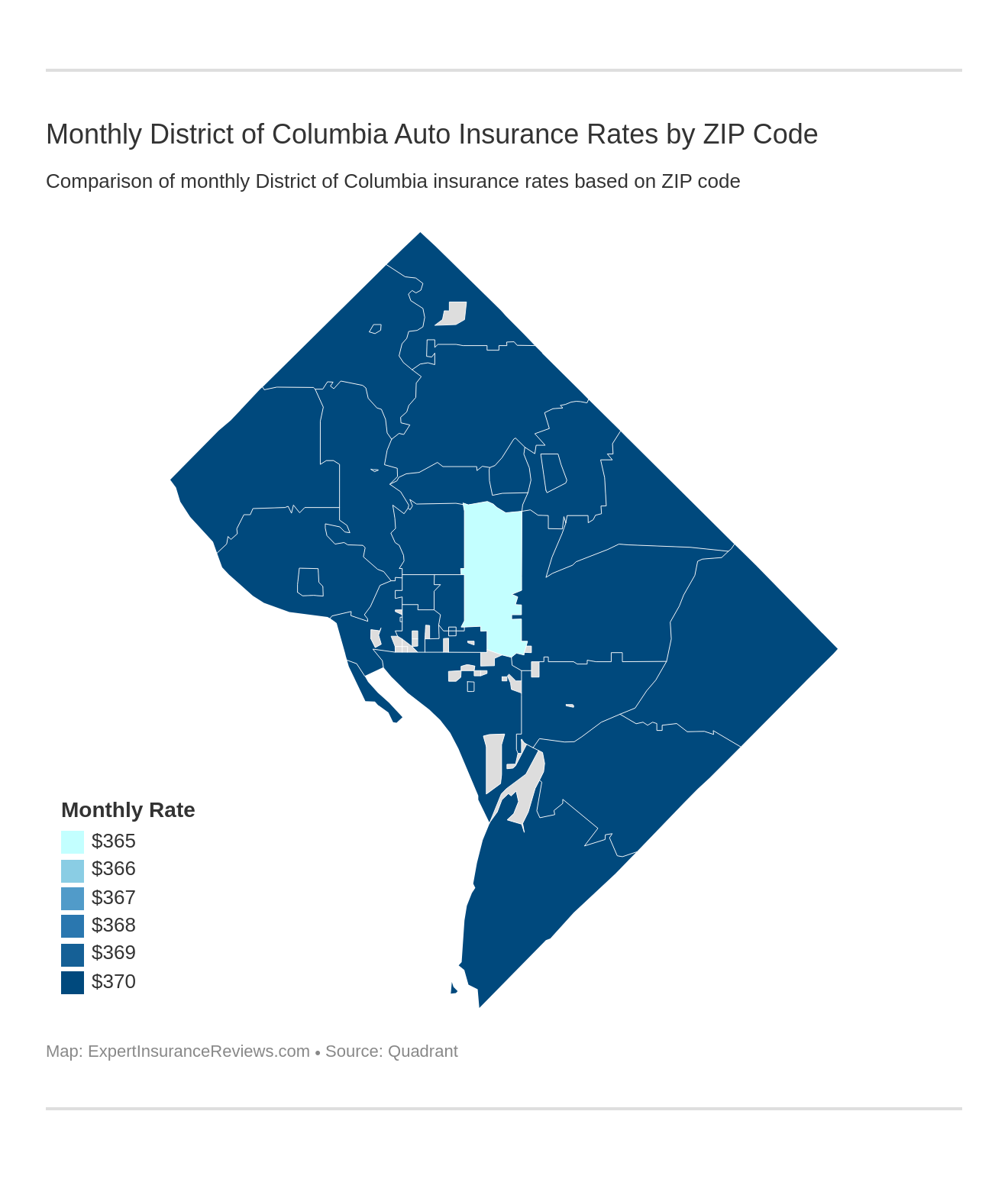

Cheapest Rates by ZIP Code

Another factor insurance companies consider when adjusting your rates is where you live. Why is this something insurance companies consider? At a minimum, they need to know what crime rates look like to better understand the risks you may face in your area.

One way insurance companies can determine premium rates based on where you live is to look at ZIP codes and the crime rates associated with each, and adjust accordingly. However, Washington D.C. is a little different. Check out these tables (the 25 most and 25 least expensive ZIP codes in the area) to see what we mean.

The 25 most expensive ZIP codes in Washington D.C. for car insurance rates:

| Zip Code | City | Average Annual Rates by Zip Code | Most Expensive Company | Most Expensive Annual Rates | 2nd Most Expensive Company | 2nd Most Expensive Annual Rates | Cheapest Company | Cheapest Annual Rates | 2nd Cheapest Company | 2nd Cheapest Annual Rates |

|---|---|---|---|---|---|---|---|---|---|---|

| 20002 | WASHINGTON | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

| 20003 | WASHINGTON | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

| 20004 | WASHINGTON | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

| 20005 | WASHINGTON | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

| 20006 | WASHINGTON | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

| 20007 | WASHINGTON | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

| 20008 | WASHINGTON | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

| 20009 | WASHINGTON | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

| 20010 | WASHINGTON | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

| 20011 | WASHINGTON | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

| 20012 | WASHINGTON | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

| 20015 | WASHINGTON | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

| 20016 | WASHINGTON | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

| 20017 | WASHINGTON | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

| 20018 | WASHINGTON | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

| 20019 | WASHINGTON | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

| 20020 | WASHINGTON | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

| 20024 | WASHINGTON | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

| 20026 | WASHINGTON | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

| 20032 | WASHINGTON | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

| 20036 | WASHINGTON | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

| 20037 | WASHINGTON | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

| 20045 | WASHINGTON | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

| 20052 | WASHINGTON | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

| 20057 | WASHINGTON | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

The 25 cheapest ZIP codes in Washington D.C. for car insurance rates:

| Zip Code | City | Average Annual Rates by Zip Codes | Most Expensive Company | Most Expensive Annual Rates | 2nd Most Expensive Company | 2nd Most Expensive Annual Rates | Cheapest Company | Cheapest Annual Rates | 2nd Cheapest Company | 2nd Cheapest Annual Rates |

|---|---|---|---|---|---|---|---|---|---|---|

| 20001 | WASHINGTON | $4,383.61 | Allstate | $6,468.92 | Nationwide | $4,848.99 | USAA | $2,580.44 | GEICO | $3,692.81 |

| 20002 | WASHINGTON | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

| 20003 | WASHINGTON | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

| 20004 | WASHINGTON | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

| 20005 | WASHINGTON | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

| 20006 | WASHINGTON | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

| 20007 | WASHINGTON | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

| 20008 | WASHINGTON | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

| 20009 | WASHINGTON | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

| 20010 | WASHINGTON | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

| 20011 | WASHINGTON | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

| 20012 | WASHINGTON | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

| 20015 | WASHINGTON | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

| 20016 | WASHINGTON | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

| 20017 | WASHINGTON | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

| 20018 | WASHINGTON | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

| 20019 | WASHINGTON | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

| 20020 | WASHINGTON | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

| 20024 | WASHINGTON | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

| 20026 | WASHINGTON | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

| 20032 | WASHINGTON | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

| 20036 | WASHINGTON | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

| 20037 | WASHINGTON | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

| 20045 | WASHINGTON | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

| 20052 | WASHINGTON | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

According to the Quadrant data in the above tables, the ZIP codes across the district all have the same average rates, except for ZIP code 20001, which is slightly lower than the rest. This may be due to the geographic and population size of the area, compared to states throughout the country.

Cheapest Rates by City

The next step is often to look at averages by city, so you can find out what rates to expect in your area, and how you compare to other areas in your state.

However, again, Washington D.C. is a little different, because, while it is not a city, it is also not a state. The nation’s capital is technically a territory and only has one region (the Washington Navy Yard) that is city-like within the borders of the district.

The most expensive cities in Washington D.C.:

| Rank | City | Average by City | Most Expensive Company | Most Expensive Rates | 2nd Most Expensive Company | 2nd Most Expensive Rates | Cheapest Company | Cheapest Rates | 2nd Cheapest Company | 2nd Cheapest Rates |

|---|---|---|---|---|---|---|---|---|---|---|

| 1. | Washington Navy Yard | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

| 2. | Washington | $4,439.00 | Allstate | $6,468.92 | Progressive | $4,968.81 | USAA | $2,580.44 | GEICO | $3,692.81 |

Least expensive cities in Washington D.C.:

| Rank | City | Average by City | Most Expensive Company | Most Expensive Rates | 2nd Most Expensive Company | 2nd Most Expensive Rates | Cheapest Company | Cheapest Rates | 2nd Cheapest Company | 2nd Cheapest Rates |

|---|---|---|---|---|---|---|---|---|---|---|

| 1. | Washington | $4,439.00 | Allstate | $6,468.92 | Progressive | $4,968.81 | USAA | $2,580.44 | GEICO | $3,692.81 |

| 2. | Washington Navy Yard | $4,440.79 | Allstate | $6,468.92 | Progressive | $4,979.53 | USAA | $2,580.44 | GEICO | $3,692.81 |

Other than the 20001 ZIP code, the average rates across the District of Columbia are the same.

Your one-stop online insurance guide. Get free quotes now! Secured with SHA-256 Encryption

Best Washington D.C. Car Insurance Companies

Insurance coverage types, levels, rates, how they’re derived, and how your lifestyle factors can affect those rates are all important things to know when choosing the right insurance company and coverage for your lifestyle. But there are other variables you need to consider.

When you’re considering which insurance company to buy your insurance policy from, you need to know whether they can payout on claims, as well as their track record for doing so. You may also want to consider the customer service ratings for a particular company.

The Largest Companies’ Financial Ratings

Knowing whether a company is both willing and financially stable enough to pay out on a claim if you find yourself in a situation in which you need to file one is important.

In Washington D.C., knowing that your insurance company is financially stable is especially important because of the “no-fault” system in the area. When you file for claims for any kind of damage, even if you’re not at fault, you must do so with your own insurance company.

You already know about loss ratio, which shows whether a company has a solid track record for paying out on claims. But how can you find out more about a company’s financial stability?

To enable customers to better understand the financial stability of the insurance companies in their area, A.M. Best reviews financial data for the insurance industry and reports out on their findings by rating companies’ financial stability. A.M. Best is a global credit firm that focuses specifically on the insurance industry.

Take a look at this table to find out more about the financial ratings and loss ratios for the largest insurance providers in Washington D.C.

Washington D.C. Largest Companies' Financial Rating

| Insurance Company | AM Best | Outlook | Loss Ratio |

|---|---|---|---|

| A++ | Stable | 66.84% | |

| B | Stable | 87.55% | |

| A++ | Stable | 82.44% | |

| A+ | Stable | 56.49% | |

| A+ | Stable | 48.74% | |

| A++ | Stable | 50.52% | |

| A | Stable | 47.80% |

| A+ | Stable | 52.63% |

| A+ | Stable | 75.75% |

| A+ | Stable | 54.10% |

To understand the information in the above table, you need to understand A.M. Best’s rating structure. They indicate that companies with an A- rating or better are both financially stable and have a stable outlook.

With this information in mind, you can be confident that the major insurance providers in the Washington D.C. area are all financially stable and able to pay out on claims, should you ever need to file one.

In looking at the loss ratio for the same list of companies, we can see that only two of the 10 are in the optimal 60 to 80 percent range.

However, another five are relatively close to a healthy range (within 8 percent above or below the optimal range). This is one more piece of data to consider when deciding which insurance company best suits your needs.

Companies with Best Ratings

Should you care about customer service? We think so. If the company you buy your insurance policy from has good customer service, they’ll be available when you need help, file a claim, or have questions.

How do you know if a company has good customer service? There is more than one way to determine the level and success of a company’s customer service.

In early 2019, J.D. Power conducted a study looking at the customer service ratings for U.S. insurance companies. In this study, they examined what they call the Customer Service Index Rating for insurance companies in various states and regions throughout the United States.

To see how insurance companies’ customer service ratings look in the District of Columbia, check out the table below, which shows the customer service index rating for companies in the Mid-Atlantic region.

| Insurance Company | Customer Satisfaction Index Rating | JD Power Circle Ratings |

|---|---|---|

| Erie Insurance | 852 | 5 |

| GEICO | 845 | 4 |

| The Hartford | 842 | 4 |

| Mid-Atlantic Average | 838 | 3 |

| State Farm | 834 | 3 |

| Progressive | 828 | 2 |

| Farmers | 826 | 2 |

| Plymouth Rock Assurance | 826 | 2 |

| Nationwide | 822 | 2 |

| Travelers | 821 | 2 |

| CSAA Insurance Group | 817 | 2 |

| Liberty Mutual | 817 | 2 |

| Allstate | 816 | 2 |

| USAA* | 898 | 5 |

| NJM Insurance Co** | 861 | 5 |

Read more: Plymouth Rock Assurance Insurance Review & Complaints: Auto & Home Insurance

USAA and NJM Insurance Co. have the highest ratings at 898 and 861 points respectively, on a 1,000 point scale. However, USAA is only available to members of the military and their families, while NJM is only available to residents of New Jersey with specific kinds of jobs.

The highest-rated company that anyone can buy insurance from is Erie Insurance, which has 852 points and is the ninth-largest company in the nation’s capital.

All three companies have an “among the best” in the J.D. Power Circle category. In addition, Geico and The Hartford are the next highest, with 845 and 842 points each, and power circle ratings of “better than most.” However, the remaining companies in the list all have power circle ratings of average or below.

Companies with the Most Complaints in Washington D.C.

What do complaints look like for insurance companies? Does the insurance company you’ve bought your policy from get a significant number of complaints? What does their customer service rating look like compared to the number of complaints a company receives?

The NAIC produces a complaint ratio for insurance companies throughout the country. The complaint ratio is an indicator of the number of complaints insurance companies in a given area receive. You can use this data to help you make your insurance coverage decision.

The below table includes complaint ratio data for companies in the district compared to loss ratio, direct premiums written, and market share.

D.C. Companies with the Most Complaints

| Insurance Company | Direct Premiums Written | Complaint Ratio | Loss Ratio | Market Share |

|---|---|---|---|---|

| $125,829 | 0.68 | 66.84% | 36.22% | |

| $72,050 | 0.44 | 87.55% | 20.74% | |

| $31,477 | 0.74 | 82.44% | 9.06% | |

| $29,455 | 0.75 | 56.49% | 8.48% | |

| $23,392 | 0.5 | 48.74% | 6.73% | |

| $12,010 | 0.09 | 50.52% | 3.46% | |

| $11,876 | 5.95 | 47.80% | 3.42% |

| $11,738 | 0.28 | 52.63% | 3.38% |

| $8,358 | 0.7 | 75.75% | 2.41% |

| $5,086 | 4.68 | 54.10% | 1.46% |

The NAIC generates complaint ratios by dividing the number of complaints a company receives by the number of premiums they write. An average number of complaints is represented by the number one.

If a complaint ratio is higher than 1, the company receives more than the average number of complaints, and if the ratio is less than one, they receive less than the average number of complaints.

Of the 10 largest companies in Washington D.C., eight have a complaint ratio that indicates a below-average number of complaints. This is a good data point (and a positive sign) for when you’re shopping for insurance.

Liberty Mutual Group has the highest complaint ratio at 5.95, which is not particularly surprising when compared to their J.D. Power Customer Satisfaction Index Rating and Power Circle Rating. Liberty Mutual has 817 out of 1,000 points and a two, respectively. The Power Circle Rating of two is particularly telling, as this is a “the rest” rating.

By contrast, Traveler’s Group has the lowest complaint ratio by a significant margin, with a 0.09 complaint ratio. However, they, like Liberty Mutual, have a fairly low Customer Satisfaction Index Rating of 821 (only four points higher than Liberty Mutual), and a “the rest” Power Circle Rating.

If you ever need to file a complaint, you can do so through the Washington D.C. Department of Insurance, Securities and Banking (DISB). They offer both paper and online complaint forms for you to fill out. However, they request that you first file a complaint with the insurance company and document all your related communication.

If you find that the insurance company has not resolved your complaint in a satisfactory manner, then you can move forward with reporting your complaint to the DISB.

If you prefer to fill out a complaint form instead of using their online system, you can print the form, fill it out and then fax it to 202-345-1085, email it to [email protected], or mail it to District of Columbia Department of Insurance, Securities and Banking, 1050 First St., NE, Suite 801, Washington, DC 20002.

If you have questions or concerns, you can call 202-727-8000, send a fax to 202-345-1085, or email at [email protected].

Cheapest Companies in Washington D.C.

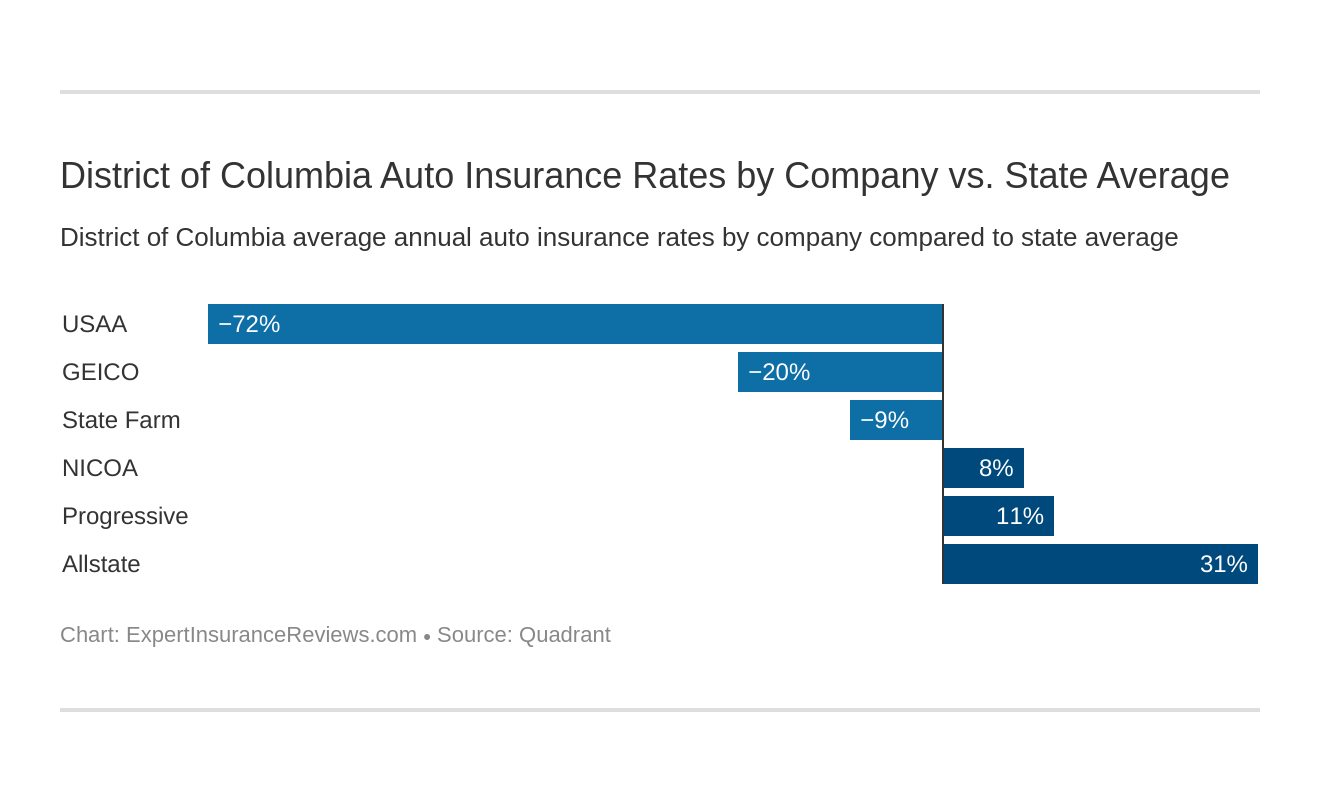

The average rate for car insurance in Washington D.C. is $4,439.24. You can see the average rates for car insurance for some of the primary insurers in the area in the table below.

Cheapest Companies in Washington DC

| Company | Annual Average | +/- Compared to State Average (Rate) | +/- Compared to State Average (%) |

|---|---|---|---|

| $2,580 | -$1,858.81 | -72.03% | |

| $3,693 | -$746.43 | -20.21% | |

| $4,074 | -$365.20 | -8.96% | |

| $4,849 | $409.74 | 8.45% |

| $4,970 | $531.01 | 10.68% | |

| $6,469 | $2,029.68 | 31.38% |

As you can see, different companies’ rates vary significantly. Allstate, for example, has the highest average rate ($6,469 per year), which is 31 percent higher than the average.

By contrast, USAA and Geico have the lowest average rates, at $2,580 and $3,693 per year, respectively. USAA is 72 percent lower than the area’s average, and Geico is 20 percent lower than the average.

Half of the six companies listed are below the average, while the remaining half are above the average.

Though the difference between the lowest and highest rates is significant (about a 150 percent increase), insurance companies typically all consider the same factors (age, gender, ZIP code, etc.) when adjusting insurance rates for their customers.

The key is to understand which companies weigh different factors more and less heavily. You can then use this information to start narrowing down your search for the best insurance company (and coverage mix) for your lifestyle.

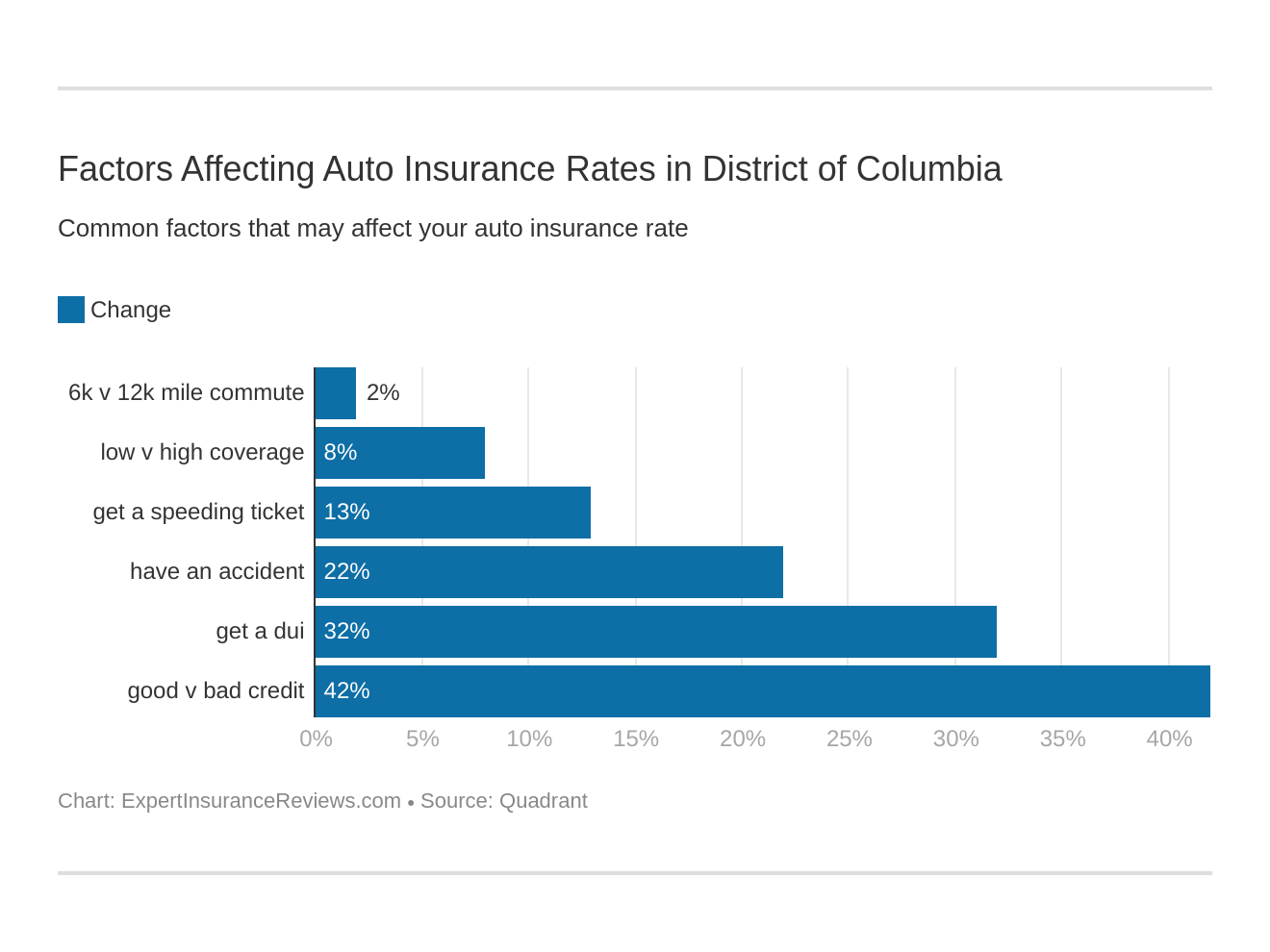

As you’ve seen already, age and gender can affect your insurance rates, though the extent to which those factors affect your rates varies from company to company. However, companies consider other variables beyond just age and gender when adjusting your rates. They also consider things like your driving record, commute distance, and credit score.

The next several sections provide more information on what you can expect from insurance companies depending on what your driving record, credit score, etc. look like.

Commute Rates by Companies

What is your typical commute like? Do you dread getting in your car every morning or when you leave work each evening, knowing you’re going to spend seemingly endless amounts of time driving? Commute distance is a common variable many car insurance companies consider when adjusting your rates.

Why?

Because the more you drive, the higher your chance of getting in a car accident. People with longer commute distances often pay higher insurance premiums than those with shorter commutes.

While this is true across the nation, it varies between states. What does this look like in Washington D.C.? The table below provides data so you can find out if your commute distance affects your insurance rates.

Washington D.C. Commute Rates by Company

| Insurance Company | 10 mile commute (6000 annual mileage average) | 25 mile commute (12000 annual mileage) | Percent Difference |

|---|---|---|---|

| $6,468.92 | $6,468.92 | 0.00% | |

| $3,626.75 | $3,758.87 | 3.64% | |

| $4,848.98 | $4,848.98 | 0.00% |

| $4,970.26 | $4,970.26 | 0.00% | |

| $3,931.51 | $4,216.58 | 7.25% | |

| $2,533.45 | $2,627.43 | 3.71% |

Some companies in the Washington D.C. area do increase their rates for longer commute times. However, as you can see, overall the rate increase is fairly low. In fact, only half of the companies listed increase their rates at all.

The remaining half only increase their rates by between 3 and 7 percent. This is good news if you commute into Washington D.C.

Coverage Level Rates by Companies

Are you a driver who needs a high amount of insurance coverage? Perhaps you only need a medium amount of coverage. Your lifestyle and driving choices are factors you must consider when determining the appropriate level of coverage for you.

You’ll need to compare these and other factors to the risks you face and what you can afford to determine which level of coverage provides you the most security at an affordable rate.

You already know car insurance coverage in the District of Columbia is expensive. But what do different levels of coverage look like? Typically, the greater the amount of coverage you have, the more you’ll pay. Take a look at the table below to see just how much you can expect to pay for different levels of coverage in the nation’s capital.

Washington D.C. Coverage Levels

| Insurance Company | Annual Rates with Low Coverage | Annual Rates with Medium Coverage | Annual Rates with High Coverage |

|---|---|---|---|

| $2,471.15 | $2,579.30 | $2,690.86 | |

| $3,543.02 | $3,694.22 | $3,841.20 | |

| $3,801.27 | $4,095.14 | $4,325.73 | |

| $4,718.03 | $4,982.78 | $5,209.97 | |

| $4,722.70 | $4,918.92 | $4,905.33 |

| $6,196.55 | $6,449.83 | $6,760.39 |

The different levels of coverage for companies in Washington D.C. do increase as the level of coverage increases. However, these increases are relatively minor. The highest increase between low and medium coverage is State Farm at about 8 percent, while the lowest increase is Allstate at 4 percent.

From medium to high, the highest increase is about 6 percent, also from State Farm, while Nationwide actually decreases their rates slightly (about 0.3 percent).

Credit History Rates by Companies

Do you have good credit? Poor credit? It’s important to know what your credit score is for something other than getting a loan or credit card.

Many car insurance companies consider credit score when adjusting your rates. The assumption is that if you are responsible and pay your bills on time (thereby having a good credit score), you’ll also be responsible when behind the wheel.

According to Experian, the average credit score in Washington D.C. is 670. This is just high enough to be considered a good credit score, which means if you are at or above this credit score, your insurance company may reward your responsible behavior by offering you a lower premium rate that someone with a lower credit score.

Take a look at this table to see how your credit score can affect your insurance rates in Washington D.C.

Washington D.C. Credit History Rates by Company

| Insurance Company | Annual Rates with Good Credit | Annual Rates with Fair Credit | Annual Rates with Poor Credit |

|---|---|---|---|

| USAA | $1,020.00 | $1,260.00 | $1,500.00 |

| GEICO | $1,140.00 | $1,380.00 | $1,620.00 |

| State Farm | $1,080.00 | $1,320.00 | $1,560.00 |

| Nationwide | $1,224.00 | $1,464.00 | $1,704.00 |

| Progressive | $1,176.00 | $1,416.00 | $1,656.00 |

| Allstate | $1,320.00 | $1,560.00 | $1,800.00 |

As the table shows, your credit score can have a significant effect on your insurance rates.

An example is Geico, whose rates increase by almost 50 percent if your credit score is fair rather than good, and by an additional 102 percent if your credit score is poor rather than fair.

If your credit score is fair or low, rather than good, Progressive may be a good option for you, because they have the lowest increases between fair and good and poor and fair, at 10 percent and 21 percent respectively.

Another way to look at this data is:

- Good credit (670+) = average annual premiums: $3,411.30

- Fair credit (580-669) = 9 – 49 percent increase: $4,003

- Poor credit (300-579) = 21 – 102 percent increase: $5,903.43

Driving Record Rates by Companies

Do you have a poor record on the road? Have you seen those flashing lights behind you a few too many times? As you might expect, your driving record affects your insurance rates.

The more violations you have on your record, the higher you can expect your car insurance rates to be.

This is because when you have violations on your record, insurance companies see this as a sign that you are more likely to file a claim or have a claim filed against you. Ultimately, this means you are a riskier customer for them. They charge you more so they can accept the risk.

The table below provides average rates for drivers in Washington D.C. with clean driving records and compares that to those with one speeding violation, with one DUI, and with one-car accident.

Washington D.C. Driving Record Rates by Company

| Insurance Company | Clean Record | With 1 Speeding Violation | With 1 DUI | With 1 Car Accident |

|---|---|---|---|---|

| $1,969.44 | $2,212.93 | $3,629.33 | $2,510.06 | |

| $2,255.62 | $2,813.29 | $5,869.52 | $3,832.82 | |

| $3,703.83 | $4,074.05 | $4,074.05 | $4,444.25 | |

| $3,904.62 | $4,273.26 | $6,235.08 | $4,982.97 |

| $4,332.07 | $5,091.60 | $4,978.67 | $5,478.69 | |

| $5,526.28 | $6,499.40 | $7,225.63 | $6,624.38 |

You can see by looking at the above table that your driving record definitely affects your insurance rates.

To analyze this data, however, you need to understand the percent increase for each offense. We’ve calculated the percent changes for the data in the above table and included it below.

Washington D.C. Driving Record Rates by Company

| Insurance Group | Percent Increase - With 1 Speeding Violation | Percent Increase - With 1 DUI | Percent Increase - With 1 Car Accident |

|---|---|---|---|

| 17.61% | 30.75% | 19.87% | |

| 24.72% | 160.22% | 69.92% | |

| 9.44% | 59.68% | 27.62% |

| 17.53% | 14.93% | 26.47% | |

| 10.00% | 10.00% | 19.99% | |

| 12.36% | 84.28% | 27.45% |

If you’ve recently been found guilty of speeding, Nationwide may be a good option for you, as they have the lowest percent increase for a single speeding ticket at about 9 percent. Allstate is a good option if you’ve been in a car accident. At about 20 percent, they have the lowest increase for that.

Insurance companies address DUIs in different ways. Most penalize you for a DUI by dramatically increasing your insurance rates. For example, USAA increases rates by 84 percent for a DUI, versus 12 percent for a speeding ticket. The exceptions to this are State Farm and Progressive.

State Farm’s rate increase for a DUI is equal to its rate increase for speeding, at 10 percent. Progressive actually has a lower rate increase for a DUI than they do for speeding.

If you’re insured by Progressive and are ticketed for speeding, you’ll see about an 18 percent increase in your insurance rates. However, if you’re found guilty of DUI, Progressive will increase your rates by only 15 percent.

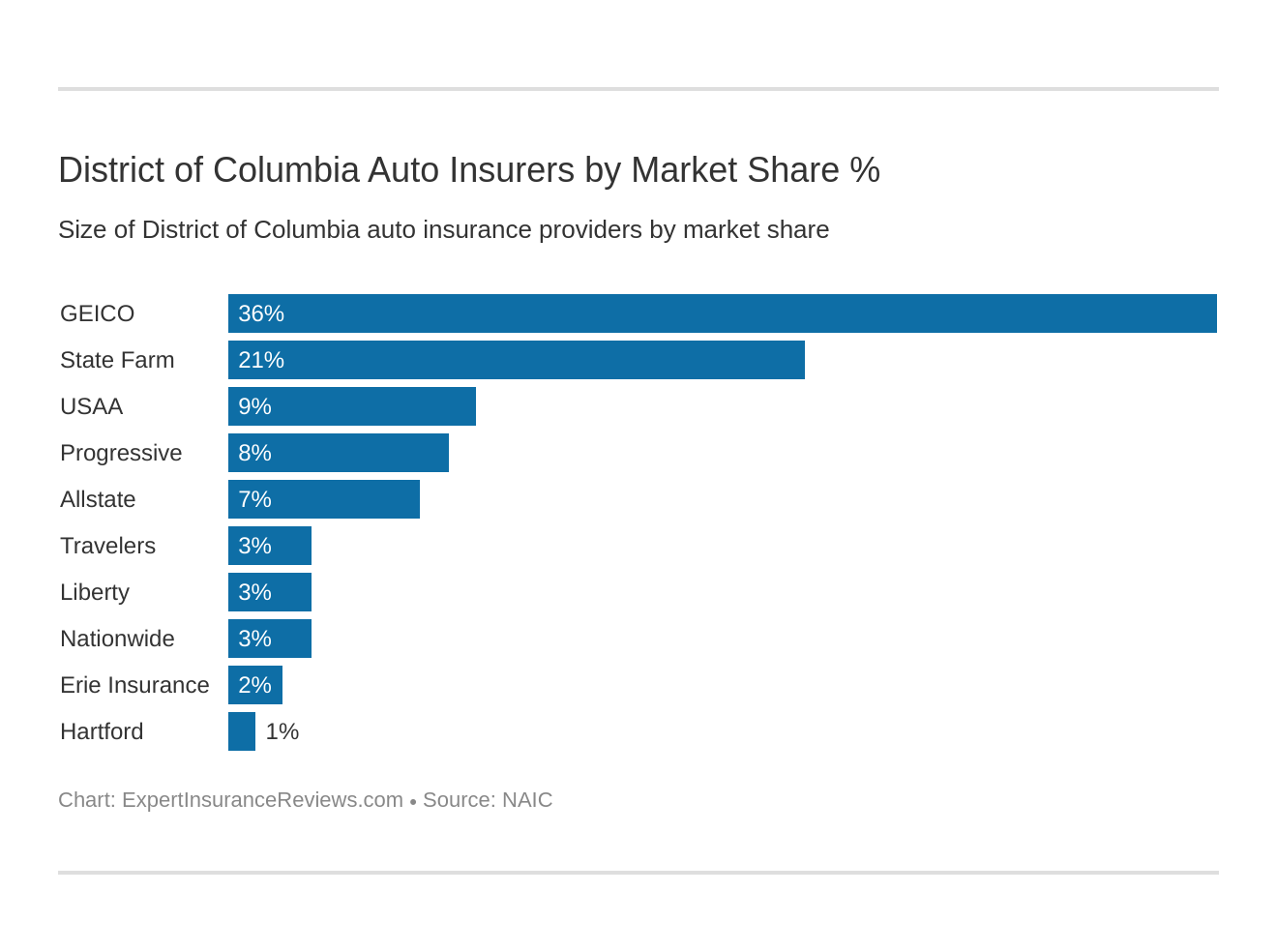

Largest Car Insurance Companies in Washington D.C.

Company size can also be a factor when you are shopping for insurance policies.

Combined with other data we’ve already looked at such as loss ratio and complaint data, you can use this information to help you determine which companies are the most stable and the most likely to both be able to pay out on claims and take a fair and balanced approach to doing so, should you ever need to file one.

This table compares the market share and direct premiums written for the largest insurance companies in Washington D.C.

Largest Car Insurance Companies in Washington D.C.

| Insurance Company | Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|

| $125,829 | 66.84% | 36.22% | |

| $72,050 | 87.55% | 20.74% | |

| $31,477 | 82.44% | 9.06% | |

| $29,455 | 56.49% | 8.48% | |

| $23,392 | 48.74% | 6.73% | |

| $12,010 | 50.52% | 3.46% | |

| $11,876 | 47.80% | 3.42% |

| $11,738 | 52.63% | 3.38% |

| $8,358 | 75.75% | 2.41% |

| $5,086 | 54.10% | 1.46% |

Number of Insurers by State

When you start shopping around for insurance in Washington D.C., you have a number of options. Those options fall into two categories: foreign and domestic.

Foreign insurers are typically incorporated somewhere besides Washington D.C., while domestic insurers are those that are incorporated within the borders of the nation’s capital. In total, there are 796 insurers in the district, six of which are domestic, while the remaining 790 are foreign.

All insurers, whether they are domestic or foreign, must follow all the insurance laws in Washington D.C., to operate legally in the area.

Washington D.C. Laws

So far we’ve discussed price, market share, financial stability of insurance companies, and more, but there’s still more information you need to make that all-important insurance policy decision.

The legal aspects of car insurance coverage are key in ensuring you’re able to make an informed decision. There are laws of which you need to be aware both from the perspective of you as a driver and those laws insurance companies must follow.

Knowing the rules of the road keeps you safe and helps you to keep your insurance premiums low (you already know if you have a poor driving record, it will affect the premiums you pay). It also helps to ensure that you don’t have to pay unexpected fees and fines and keeps your driver’s license in good standing.

Being familiar with the laws that insurance companies are subject to will help you know which questions to ask and how to be your own advocate both when you’re shopping for insurance and once you’ve bought your policy.

We know legalese can be frustrating and intimidating. Slogging through pages of text on laws probably isn’t something you have time for or want to spend time doing. That’s why we’ve done it for you.

The next several sections look at insurance laws and rules of the road so you have everything you need to know to stay safe on the road, register your vehicle in the District of Columbia, and buy the best insurance coverage for your needs.

Car Insurance Laws

At this point, the only law we’ve discussed is the minimum liability insurance requirement. You know that in the District of Columbia. you must maintain specific levels of minimum coverage to drive legally on the road.

However, there are a number of other laws and law-related information of which you should be aware. These include fraud, how it is defined, and how to report it, as well as how to buy insurance if you are considered high-risk.

Other laws you should be familiar with include those your insurance company must follow if you experience specific kinds of damage as a result of an accident (what they must cover).

Take a few minutes to read through the next few sections to find out more about these and other key laws you need to know.

Read more: Washington Car Insurance Laws

Windshield Coverage

When driving on the highway, have you ever heard that dreaded sound that means a rock or some other piece of road debris hit your windshield?

When you see that chip or spiderweb crack in your windshield, what do you do? In general, you can’t just point to a specific vehicle and with confidence state that the crack in your windshield was that driver’s fault.

Every state has different laws regarding how insurance companies must handle the chipped and cracked windshields of their insureds. Some don’t have specific laws that require insurance companies to respond in a particular manner when car owners need windshield repair or replacement.

Washington D.C. is one of the locations in the United States that does NOT have specific insurance laws that define how an insurance company must respond in this situation. This means that it’s up to the insurance company.

Most will offer windshield coverage as part of a full/comprehensive insurance coverage policy. However, how the company chooses to handle replacement/repair (original manufacturer vs. aftermarket parts and insured or insurer choosing the repair company) is up to the individual insurance companies.

High-Risk Insurance

You already know what a poor driving record can do to the cost of your insurance policy.

However, if your record is poor enough that you are considered a high-risk driver, you may not even be able to get insurance coverage because insurance companies will see you as too risky to cover. Since you need insurance coverage to drive in Washington D.C., this is a problem.

To help you out, Washington D.C. has had a program in place since 1982 called the District of Columbia Automobile Insurance Plan to help you get insurance if you’ve been unable to do so through traditional means.

This program is considered a last resort, but if you qualify, you’ll have insurance coverage for a guaranteed three years, at which point you can reevaluate and determine if you still need DC AIP assistance or if your driving record has improved enough that you can get insurance through the typical application process.

The DC AIP is not an insurance company. Instead, it is an organization that matches high-risk drivers with insurers in the area. All insurers in the nation’s capital must participate in this program.

The amount of drivers companies must insure through the DC AIP is determined by their market share. This means that USAA, for example, which has 9 percent of the market share in the District of Columbia, must sell insurance policies to 9 percent of the drivers who apply and qualify for DC AIP assistance.

How do you apply for insurance through DC AIP? You must be able to do the following:

- Certify that you have been unable to get car insurance through traditional means in the previous 60 days or that the quote for the insurance premiums you received is higher than the cost you would have to pay under DC AIP.

- Have a valid driver’s license.

- Have a vehicle that is registered in good standing in Washington D.C.

- Complete your application fully and accurately.

When you are ready, you can complete your application by working with a licensed car insurance agent in the district. They can help you fill out and submit your DC AIP application.

With DC AIP, you’ll be able to buy the same kind of coverage you could if you got an insurance policy through typical means. However, you should expect your costs under DC AIP will be quite a bit higher. This includes costs associated with minimum liability coverage (as well as the amount of liability coverage you’ll have to buy).

Take a look at this table to see the minimum liability coverage requirements for high-risk drivers versus average, non-high-risk drivers.

DC AIP Minimum Liability Coverage Requirements

| Required Insurance | D.C. Minimum Limit | D.C. AIP Minimum Limit |

|---|---|---|

| Bodily Injury | $25,000 per person $50,000 per accident | $100,000 per person $300,000 per accident |

| Property Damage Liability | $10,000 | $100,000 per accident |

| Uninsured Motorist Bodily Injury | $25,000 per person $50,000 per accident | $100,000 per person $300,000 per accident |

| Uninsured Motorist Property Damage | $5,000 per accident | $25,000 per accident |

Based on the data in the above table, we calculate that as a high-risk driver in Washington D.C. you’ll have to buy minimum liability coverage that is between 300 and 900 percent higher than the minimum liability coverage requirements for average drivers.

If you want additional coverage (and can afford to pay for it under DC AIP), you can also buy core coverage, additional liability coverage, and more. Similar to the minimum liability coverage, the amount you must buy and the cost of the policy will both be higher if you are high-risk and must do so through DC AIP.

If you have questions or would like to learn more about the DC AIP, you can contact the Washington D.C. Department of Insurance, Securities and Banking by calling 202-727-8000. You can also visit the DC AIP website.

Low-Cost Insurance

While Washington D.C. helps high-risk drivers get insurance coverage through the DC AIP, they do not have a similar program in place for low-income drivers in the area.

However, this is a trend that may grow in the future. Three states (California, Hawaii, and New Jersey) offer government-funded assistance programs to help their low-income residents buy and maintain car insurance policies.

Automobile Insurance Fraud in Washington D.C.

Insurance fraud is a big problem across the United States. The Insurance Information Institute (III) reports that nearly 10 percent of all losses insurance companies absorb are the result of insurance fraud. This is not a victimless crime, and the result of this widespread insurance fraud is an additional cost to you as the insured.

What is insurance fraud? According to the Washington D.C. Department of Insurance, Securities and Banking (DISB):

“Insurance fraud occurs when an insurance company, agent, adjuster or consumer commits a deliberate deception in order to obtain an illegitimate gain. It can occur during the process of buying, using, selling or underwriting insurance.”

You can file a complaint regarding suspected fraud online by calling 202-727-8000 or in person at the District of Columbia Department of Insurance, Securities and Banking, 1050 First St. NE, Suite 801, Washington, DC 20002.

If at any point you are unsure about the legitimacy of a company you are considering purchasing an insurance policy from, you should stop before you sign paperwork or spend any money.

You should immediately call the DISB at 202-727-8000 or check their website to make sure the company you are working with is both legitimate and licensed in the nation’s capital.

Statute of Limitations

If you are in a car accident and believe you need to file a claim for the resulting damages, the statute of limitations in Washington D.C. is three years for both personal injury and property damage. This three-year timeframe starts on the date of your car accident.

Washington D.C. Specific Laws

Many laws in the District of Columbia are standard across the U.S. with some minor variations. The minimum liability coverage requirement is one example of this.

Nearly every state in the country requires some amount of minimum liability insurance coverage for residents to be able to drive on the road. It varies in the exact requirements and specifics, like the uninsured motorist coverage requirement in D.C.

However, most states in the country have certain laws specific to that area only, and Washington D.C. is no exception. For example, in the nation’s capital, you can receive a parking ticket if your car is not fully in your driveway. It is also illegal to stand in the road to try and get a car to stop so you can ask for a ride.

Vehicle Licensing Laws

To drive legally in Washington D.C. you must meet other requirements beyond having the minimum insurance coverage. One of these requirements is related to your vehicle registration. Driving an unregistered vehicle in the nation’s capital is illegal.

If you are caught doing so, your license may be suspended and you must pay fees for reinstatement of both your license and your registration.

In addition, all residents of Washington D.C. must register their vehicles with the District of Columbia. The only exception to this is when your vehicle includes a reciprocity sticker, which you can only get through the DC Department of Motor Vehicles (DC DMV).

If you don’t qualify for a reciprocity sticker, you must register your vehicle at the DC DMV within 30 calendar days of moving to a district address (you must also get a district driver’s license).

When you are ready to register a vehicle in the District of Columbia, you must first ensure that you have paid any outstanding tickets, delinquent child support payments, and other debts you may owe to the district’s government.

You must register your vehicle in person at the DC DMV. As a part of this process, you’ll need to bring the following documents (which must be originals, not copies) with you:

- Proof of District of Columbia residency

- Proof of vehicle inspection

- Proof of title

- Bille of sale

- Proof of odometer reading

- Lien contract or lease agreement, if applicable

- Proof of identity (i.e. valid district driver’s license, permit, etc.)

- Proof of vehicle insurance

To confirm all the documentation you need for your specific case, you can use the DISB’s online document verification guide, which will walk you through all the steps to ensure that you have what you need before you visit the DMV.

If you need to renew a vehicle registration, the DC DMV will send you a notification either by U.S. mail or email regarding your renewal 60 days before the expiration of your current registration.

You can renew your vehicle online or through the mail. Your registration will be valid for either one or two years (the choice is yours) before you’ll need to renew again.

If at any point your registration and inspection expire, you can get a one-time five-day temporary registration from the DC DMV. This will provide a brief grace period to get your vehicle inspected and renew your registration.

In Washington D.C. you can also keep an electronic registration sticker and card on your smartphone. This can be used at traffic stops and is accepted by law enforcement, should you be asked to provide proof of registration.

REAL ID

The Department of Homeland Security (DHS) reports that Washington D.C. is compliant with the REAL ID Act of 2005.

What is the REAL ID Act?

It is a law that was enacted in the wake of the 9/11 tragedies to reduce the chances of something like that ever again taking place. Essentially it requires people to prove that they are who they say they are.

Ultimately it means that anyone who wishes to fly commercially using a driver’s license or ID card as the form of identification must be REAL ID-compliant.

This will be enforced starting in October 2020. In addition to flying, anyone who needs access to certain government facilities (such as military installations) and nuclear power plants will be required to have a REAL ID-compliant form of identification.

While this law has been somewhat controversial and has taken some time to come to fruition (it was enacted in 2005, and it will have taken 15 years to fully enforce by the time October 2020 rolls around), 47 states are compliant, with the remaining three either under review or having an extension.

If you’re ready to get your REAL ID-compliant driver’s license, you’ll need to visit the DC DMV in person. Be prepared to give your current license to the DC DMV as a part of the process of getting a REAL ID-compliant driver’s license. When you visit the DC DMV you’ll need to bring the following documents:

- Proof of identity

- Proof of lawful presence

- Proof of Social Security number

- Two proofs of current District of Columbia residency

- Proof of ability to drive

- Medical/eye form, if applicable

You’ll also need to print out and complete the driver’s license/identification card application form. You’ll present this form to the DC DMV when you visit. While you are at the DC DMV you’ll also need to pass a vision screening test and pass a knowledge test. Finally, you must pay a fee, the amount of which varies depending on your specific situation.

Once you have a REAL ID-complaint driver’s license, your license will have a star in the upper right-hand corner, indicating that you’re in compliance with the act.

Penalties for Driving Without Insurance

If you’re caught driving without insurance, you can face serious consequences in Washington D.C. In addition, even if you have insurance but can’t provide an acceptable form of proof, you can expect repercussions. Electronic proof of insurance is not acceptable in the district.

Washington D.C. separates driving without insurance into two categories: owning an uninsured vehicle and operating an uninsured vehicle. If you’re without insurance when driving in the nation’s capital, the following table outlines what you can expect if you’re caught.

https://www.valuepenguin.com/auto-insurance/DC/penalties-driving-without-insurance

| Penalty | First Offense for Owning an Uninsured Vehicle | Further Offenses For Owning an Uninsured Vehicle | First Offense for Operating an Uninsured vehicle | Further Offenses for Operating an Uninsured Vehicle |

|---|---|---|---|---|

| Civil Fine | - | $150 plus $7 for every day after the first 30 after the notice is received; can be up to $2500 | $500 | 50% increase for each additional offense |

| License Suspension | 30 days | 60 days | 30 days | 60 days |

| Fine | $30 for failure/refusal to present insurance when asked by law enforcement | $30 for failure/refusal to present insurance when asked by law enforcement | $30 for failure/refusal to present insurance when asked by law enforcement | $30 for failure/refusal to present insurance when asked by law enforcement |

| Reinstatement Fee | $98 | $98 | $98 | $98 |

Teen Driver Laws

When you’re ready to start learning to drive in the District of Columbia, you have to be at least 16 to apply for your learner’s permit. Formal driver’s education is not required in the nation’s capital, but the DC DMV offers a course if you’re interested.

You’ll have to hold this permit for at least six months, during which time you’ll need to log 40 hours of driving time. While you hold your learner’s permit, you can’t drive between the hours of 9 p.m. and 6 a.m. Before you can get your provisional license, you must pass a road skills test and be at least 16.5 years old.

You’ll then graduate to the intermediate stage in which you’ll need to log an additional 10 hours of nighttime driving. You’ll need to hold this provisional license for at least six months or until you turn 21, whichever comes first. However, you’ll need to be at least 18 years old to get your full, unrestricted license.

While you hold your provisional license, you can’t drive with any passengers, and you’ll have restrictions for when you can drive unsupervised.

- From September through June, you can’t drive unsupervised between the hours of 11 p.m. and 6 a.m. from Sunday through Thursday

- From September through June, you can’t drive unsupervised between the hours of 12:01 a.m. and 6 a.m. on Saturday and Sunday

- From July through August, you can’t drive between the hours of 12:01 a.m. and 6 a.m.

Older Driver License Renewal Procedures

Washington D.C. is one of many places in the United States that has different renewal laws for the general population versus the older population of drivers.

Both the general population and the older population renew their license every eight years and are required to provide proof of adequate vision every time they renew their license.

However, while the general population of the District of Columbia drivers is permitted to alternate renewing online and through the mail with in-person visits to the DC DMV, drivers 70 and older are not permitted to do this. They are required to renew their licenses in person every time.

New Residents

If you’ve recently moved to Washington D.C., you must get a driver’s license within the first 30 days of establishing residency, unless you qualify for reciprocity.

This is also key because you must register your vehicles within 30 days of moving to the District of Columbia, and you must have your district driver’s license before you can register your vehicle.

You can use the Washington D.C. Department of Motor Vehicles’ Document Verification Guide to find out what documents you must bring when you visit a DC DMV location to get your District of Columbia driver’s license.

To qualify for reciprocity, you’ll need to apply through the DC DMV. However, if you are not one of the following, you likely will not be eligible for reciprocity:

- Student

- Diplomat

- Active military member

- Part-time resident

- Member of Congress

- Presidential appointee

License renewal procedures

If you have a Washington D.C. driver’s license, the expiration date will always be on your birthday. You’ll need to renew your license every eight years.

You’ll be notified that your license will be expiring 60 days before the expiration date. Depending on the information you have provided to the DC DMV, you may receive that notification through the mail, email, or a text message.

At every other renewal, you can renew either online or by mail. On the opposite renewal dates, you’ll need to do so in-person at a DC DMV location.

You’ll need to take and pass a knowledge test if your license has been expired for at least a year. If your license has been expired for more than a year and a half, you’ll need to take and pass both a knowledge test and a road skills test.

At every renewal, you’ll have to either pass a vision test or provide proof that you have adequate vision. If you’re renewing online, you’ll also need to certify that your medical status has not changed since your last renewal.

Negligent Operator Treatment System (NOTS)

To decrease reckless driving, many states have a points-based program that affects your driving eligibility. Typically, if you are found guilty of a moving violation or receive a traffic ticket, some number of points (the exact number is related to the severity of the offense) will be added to your driver’s license.

Your license and driving privileges will be suspended if you accumulate a set number of points (typically somewhere between 10 and 15) within a defined time frame (often a year).

On top of the license suspension, you may also be required to pay a fine. In California, this program is known as the Negligent Operator Treatment System (NOTS).

In general, only moving violations result in points being added to your license. But what is a moving violation, and what is a non-moving violation?

- Moving violation – occurs when you violate a traffic law while your vehicle is in motion. These include speeding, running a red light, driving under the influence and more.

- Non-moving violation – any violation (when your vehicle is stationary or in motion) that is not reported to your licensing department, Department of Motor Vehicles, or insurance company. These include distracted driving and driving without a seat belt.

In Washington D.C., the Driver Points System was put in place to curb reckless driving. If you incur too many points (10 or 11 in the District of Columbia), your license will be suspended and your driving privileges revoked for 90 days.

If you incur 12 points or more, your license will be revoked and all driving privileges will be removed until the DMV agrees to reinstate your driver’s license (which will be at least six months post-revocation).

This table outlines some of the violations that can add points to your license and how many points you may get if you are caught doing any of these.

| Moving Violation | Points |

|---|---|

| Follow another vehicle too closely | 2 |

| Operate a vehicle with an improper class of license | 2 |

| Operate a vehicle with a license expired less than 90 days | 2 |

| Fail to comply with seatbelt law | 3 |

| Commit violations that contribute to an accident | 3 |

| Commit a misdemeanor crime involving a motor vehicle | 3 |

| Speed 11-15 MPH above speed limit | 3 |

| Speed 16-20 MPH above the speed limit | 4 |

| Fail to stop for school vehicle with alternately flashing lights | 4 |

| Operate a motor vehicle in violation of a restriction on your license | 4 |

| Operate a vehicle with a learner's permit unaccompanied by a licensed driver | 5 |

| Speed 21 MPH or more above speed limit | 5 |

| Fail to yield to an emergency vehicle | 6 |

| Reckless driving | 6 |

| Hit and run when no personal injury occurs | 8 |

| Turn off headlights to avoid ID by law enforcement | 8 |

Take a look at the table below to see some of the moving violations that will result in an automatic license suspension.

| Moving Violation | Points |

|---|---|

| Hit and run in which personal injury occurs | 12 |

| Flee/attempt to elude law enforcement | 12 |

| Aggravated reckless driving | 12 |

| Operate a vehicle after driver's license has been suspended/revoked | 12 |

| Use someone else's driver's license | 12 |

| Be convicted of assault or homicide using motor vehicle | 12 |

| Operate a vehicle while under the influence | 12 |

| Operate a vehicle with any measurable amount of alcohol when under 21 | 12 |

| Commit felony crime involving use of a motor vehicle | 12 |

Rules of the Road

As we’ve already noted, there are a number of laws that apply to you (rather than to insurance companies) that you should be aware of.

They are in place to keep you and other drivers safe while on the road. Being familiar with these laws and following them will also help keep the points on your driver’s license to a minimum and your insurance rates low.

To help you out, we’ve pulled together key information on a number of rules of the road in Washington D.C. in the next few sections. We’ll be looking at information on post speed limits, seat belt and car seat laws, and more.

Keep reading to find out more about the rules of the road you need to be following. We’ve also included some information on more insurance laws that are relevant to you. This includes insurance requirements for ridesharing services, autonomous vehicles, and more.

Fault vs. No-Fault

As we noted earlier, Washington D.C. maintains a no-fault insurance system. This means that fault does not need to be determined for your insurance company to compensate you for damages.

However, unlike states with a fault system, this means each driver’s insurance company covers their customer’s damages, rather than the at-fault driver’s insurance company providing compensation. The result is that there are limitations on the kind and amount of monetary compensation you can receive from your insurance company.