Best Home Insurance for Seniors in 2024 (Your Guide to the Top 10 Companies)

Erie, Auto-Owners, and The Hartford lead as the best home insurance for seniors, offering rates starting at just $75/month. This guide delves into why these providers excel, ensuring that seniors get exceptional value and comprehensive coverage tailored to their needs.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kalyn Johnson

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Insurance Claims Support & Sr. Adjuster

UPDATED: Oct 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Oct 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

1,814 reviews

1,814 reviewsCompany Facts

Full Coverage for Seniors

A.M. Best Rating

Complaint Level

1,814 reviews

1,814 reviews 563 reviews

563 reviewsCompany Facts

Full Coverage for Seniors

A.M. Best Rating

Complaint Level

563 reviews

563 reviews 765 reviews

765 reviewsCompany Facts

Full Coverage for Seniors

A.M. Best Rating

Complaint Level

765 reviews

765 reviewsThe top picks for the best home insurance for seniors are Erie Insurance, Auto-Owners, and The Hartford, offering excellent value with comprehensive coverage and strong customer service tailored for older adults.

After years of homeownership, seniors can expect discounts and favorable rates. Some insurance companies go the extra mile to help seniors insure their homes, so compare home insurance options before settling on a policy.

Our Top 10 Company Picks: Best Home Insurance for Seniors

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

#1 10% A+ Personalized Service Erie

#2 10% A++ Strong Coverage Auto-Owners

#3 25% A+ Senior Discounts The Hartford

#4 25% A Membership Benefits AAA

#5 25% A+ Customizable Policies Allstate

#6 20% B Financial Stability State Farm

#7 20% A+ Nationwide Coverage Nationwide

#8 20% A Family Focus American Family

#9 20% A Variety of Discounts Farmers

#10 8% A++ Comprehensive Coverage Travelers

Discover top homeowners insurance rates and policies for seniors here. Perhaps you’re wondering if AARP offers home insurance in addition to car insurance. Learn more by checking out, AARP Car Insurance: Is it right for you?

Get home insurance quotes for seniors today by using your ZIP code in our free tool. Get affordable senior home insurance quotes online today.

- Erie Insurance is the top pick for senior home insurance

- Tailored policies meet seniors’ financial and coverage needs

- Options feature discounts and benefits for older homeowners

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#1 – Erie: Top Overall Pick

Pros

- Personalized Policies: Erie offers tailored insurance solutions that cater specifically to seniors.

- Multi-Vehicle Discount: Erie provides a 10% discount for seniors who have multiple policies.

- High A.M. Best Rating: An A+ rating ensures reliable financial strength and claims support. Learn more in our “Erie Insurance Review & Complaints: Auto, Home, Life, Marine & Business Insurance.”

Cons

- Limited Availability: Erie’s services are not accessible in all states.

- Less Competitive Online Tools: Their digital resources may not be as robust as competitors’.

#2 – Auto-Owners: Best for Strong Coverage Specialist

Pros

- Top-Tier Financial Rating: Auto-Owners boasts an A++ rating from A.M. Best, indicating exceptional financial health.

- Consistent Discounts: Offers a 10% multi-policy discount which can benefit seniors looking to bundle.

- Dedication to Claims Satisfaction: Known for a strong commitment to efficient claim processing. See more details on our “Auto-Owners Insurance Review & Complaints: Auto, Home, Life, Retirement & Business Insurance.”

Cons

- Limited Digital Services: May not offer as comprehensive online services as other insurers.

- Geographic Restrictions: Coverage might not be available in all regions or states.

#3 – The Hartford: Best for Senior Discounts Champion

Pros

- Generous Senior Discounts: Offers up to a 25% discount for seniors, the highest in this group.

- Tailored to AARP Members: Provides specific products and services designed for AARP members.

- Strong A.M. Best Rating: Maintains an A+ rating, ensuring reliable financial strength. More information is available about this provider in our “The Hartford TrueLane: Complete Guide & Review.”

Cons

- AARP Membership Required: Benefits are primarily available to AARP members, limiting wider access.

- Higher Premiums for Non-members: Non-AARP members might face higher rates.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#4 – AAA: Best for Membership Benefits Leader

Pros

- Membership Extras: Provides additional benefits and discounts to AAA members.

- Substantial Discounts: Offers a 25% discount for multiple policies.

- Solid Financial Standing: An A rating from A.M. Best assures good financial health. Read up on the “AAA Insurance Review & Complaints: Auto, Home, Life, Travel & Wedding Insurance” for more information.

Cons

- Membership Requirement: Insurance benefits require a AAA membership, which comes with a fee.

- Varied Service Quality: Service quality can vary significantly between regional clubs.

#5 – Allstate: Best for Customizable Policies Innovator

Pros

- Highly Customizable Policies: Offers a range of policy options that can be tailored to specific needs.

- Significant Discounts: Provides up to a 25% discount for bundling home and auto insurance.

- Strong Financial Rating: An A+ rating from A.M. Best underlines its financial robustness. Check out insurance savings in our complete “Allstate Auto Insurance Review & Complaints: Auto Insurance.”

Cons

- Pricing Variability: Premiums can be high depending on the area and chosen coverage.

- Customer Service Issues: Some customers report varying levels of service quality.

#6 – State Farm: Best for Financial Stability Powerhouse

Pros

- Good Customer Service: State Farm is lauded for having excellent customer service reviews.

- Considerable Low-Mileage Discount: Offers a 20% discount which is beneficial for seniors who drive less.

- Wide Coverage Options: Extensive options cater to a variety of homeowner needs. Discover more about offerings in our “State Farm Insurance Review & Complaints: Car Insurance.”

Cons

- Higher Premiums: Despite discounts, premiums can still be high for some coverage levels.

- Limited Multi-Policy Discount: The discount may not be as competitive as other insurers offer.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Nationwide Coverage Authority

Pros

- Extensive National Presence: Offers coverage in a vast majority of states.

- Consistent 20% Discount: Attractive for bundling multiple policies.

- Strong A.M. Best Rating: An A+ rating ensures financial stability and reliable claims service. Access comprehensive insights into our “Nationwide Insurance Review & Complaints: Auto, Home, Health & Pet Insurance.”

Cons

- Inconsistent Customer Service: Reports of variable customer service quality across different regions.

- Policy Cost Variations: Premiums can vary widely depending on location and coverage choices.

#8 – American Family: Best for Family Focus Advocate

Pros

- Family-Centered Policies: Tailored to meet the needs of families, including seniors.

- Strong Financial Health: An A rating from A.M. Best guarantees solid financial backing.

- Generous Discounts: Offers a 20% discount for bundling policies, which can benefit senior families. Delve into our evaluation of “American Family Insurance Review & Complaints: Auto, Home & Life Insurance.”

Cons

- Availability Issues: Not available in all states, limiting its reach.

- Limited Customization: Fewer options for policy customization compared to competitors.

#9 – Farmers: Best for Variety of Discounts Provider

Pros

- Wide Range of Discounts: Offers various discounts that can significantly lower premiums.

- Customized Coverage Options: Allows for a high degree of customization in policy features.

- Solid Financial Rating: Holds an A rating from A.M. Best, ensuring reliable claims handling. Unlock details in our “Farmers Insurance Review & Complaints: Home, Business & Auto Insurance.”

Cons

- Higher Base Rates: Basic rates can be higher before applying discounts.

- Mixed Customer Reviews: Customer satisfaction can vary depending on the region.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#10 – Travelers: Best for Comprehensive Coverage Leader

Pros

- Broad Coverage Selection: Offers extensive coverage options that cater to a wide range of needs.

- High Financial Rating: An A++ rating from A.M. Best indicates superior financial stability.

- Competitive Policy Features: Known for offering innovative and comprehensive insurance features. Discover insights in our “Travelers Insurance Review & Complaints: Home, Auto & Boat Insurance.”

Cons

- Higher Premiums: Premiums can be relatively higher, especially for comprehensive plans.

- Complex Policy Details: Some customers find their policy options and details to be overly complex.

Monthly Home Insurance Rates Comparison for Seniors

When choosing home insurance, understanding the specific coverage rates is crucial for seniors. These rates vary significantly based on the insurance provider and the level of coverage selected. The following table highlights the monthly rates for minimum and full coverage from various top-rated insurance companies, providing a clear comparison to help seniors make an informed decision.

Home Insurance Monthly Rates for Seniors by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $88 $240

Allstate $93 $255

American Family $93 $255

Auto-Owners $85 $235

Erie $75 $200

Farmers $98 $270

The Hartford $80 $215

Nationwide $88 $235

State Farm $98 $270

Travelers $93 $255

The table above presents a clear comparison of monthly home insurance rates for seniors across different insurance companies, highlighting both minimum and full coverage options. Erie Insurance offers the most affordable rates, with minimum coverage costing $75 and full coverage at $200.

Conversely, Farmers and State Farm are on the higher end, each charging $98 for minimum coverage and $270 for full coverage.

What Is Senior Citizen Home Insurance

Seniors need home insurance just like everyone else — even if your home is paid off. While owning your home outright means you won’t have to provide proof of insurance to a mortgage company or meet their coverage requirements, you still need home insurance to protect your property, belongings, and finances.

Your insurance needs will vary based on the type of home you own. For example, if you have owned a single-family detached home for many years and are downsizing to a condo or townhome, you will discover that the insurance policy changes.

Attached homes with an association policy to cover the structure itself only require homeowners to purchase “walls-in” coverage — meaning it protects only those things inside (we’ll discuss this more later).

Regardless of the type of residence you choose, you will still need to carry insurance for your personal property as well as general liability. If you are downsizing and giving many items away, you may need less personal property coverage.

On the other hand, antiques and family heirlooms may actually have gone up in value over the years. It’s worth having potentially high-value items appraised so you can insure them properly, with a rider if needed.

Additionally, liability insurance is a part of every home insurance policy, and now is not the time to reduce it. Even if you feel the risk is low, liability coverage can protect the retirement savings you have worked for so many years to gather.

Keep reading to learn more about the importance of liability coverage, what it includes, basic limits for personal property coverage, additional options you can include on your policy, and more. Learn more by reading, Everything You Need to Know About Condo Insurance.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

What Kinds of Homeowners Insurance Should Senior Purchase

Your home insurance policy includes three homeowners insurance types. The first, dwelling/structure, covers the home itself. The key to this coverage is making sure the replacement cost of your home is accurate.

The second coverage type, personal belongings, covers certain contents in your home, but the value of this coverage is based on the overall coverage limit associated with your dwelling. Seniors should look for insurers that offer comprehensive policies with options like affordable homeowners insurance for seniors and specialized coverage for high-value items such as antiques and family heirlooms.

The third and final coverage type is general liability, which protects you if someone is injured on your property. The coverage helps to pay for medical bills, lawsuits, etc., that result from the injury. Additionally, considering best car and home insurance for seniors bundles can provide added savings and convenience.

It’s important to make sure you have the right amount of liability coverage to protect your finances. The minimum is usually $100,000, but it may be a good idea to consider a higher coverage amount. When shopping for seniors home insurance, it’s important to prioritize coverage for personal property, liability protection, and any unique needs related to downsizing or changing living arrangements.

Evaluating different insurance providers for their reputation, customer service, and flexibility in coverage options can help seniors find the best home insurance for senior citizens that offers both peace of mind and financial security for their retirement years.

Read more: Best Home Insurance for Older Homes

Does Homeowners Insurance for Seniors Include Home Contents Coverage

As we noted earlier, there is some coverage for your home’s contents included in a standard policy. However, there are limits to how much coverage is included for each high-value item category. Take a look at this table for some examples.

Home Contents Coverage Categories and Average Coverage Limits

| Property Type | Average Limits | Claims Limitations |

|---|---|---|

| Money, gold, coins | $200 | Not Specified |

| Jewelry, watches, furs | $1,500 | Theft-only |

| Watercraft, trailers | $1,500 | Theft-only |

| Firearms | $2,500 | Not Specified |

| Silverware | $2,500 | Not Specified |

| Business property | $2,500 | On-premises |

| Business property | $500 | Off-premises |

| Electronics | Varies | Not Specified |

These are just basic coverage levels in a homeowners policy. If you’re wondering how much home insurance you need or are concerned that something you own isn’t sufficiently covered under a standard policy, you can speak with your agent about having your items appraised and the coverage levels increased.

What Are Some Common Homeowners Insurance Policies and Features for Seniors

In addition to basic home coverage, there are some coverage options you may want to consider adding to your policy. These can include:

- Deductible Forgiveness: Under certain circumstances, and if it’s defined in terms of your contract, your deductible may be waived when your loss reaches a certain threshold.

- Protection for Full Cost: A basic home insurance policy will typically cover the replacement of losses of valuable items at actual cash value (the value at the time of the loss, which is not necessarily the amount you paid for it; often, the value is decreased over time due to deprecation). With protection for full cost, your payout will reflect the full value instead of the depreciated value.

- Identity Theft and Fraud Protection: Identify theft and fraud are both growing problems for people across the country, and often more so for senior citizens who are a specific target for both. As a senior citizen, you can add identity theft and fraud protection to your insurance policy for a nominal fee.

Many seniors also need to consider the best home insurance for second homes if they have a second home.

Keep reading to find out which companies offer the best homeowners insurance for senior citizens, additional benefits, and ways to save on the insurance cost of your monthly premiums.

How to Shop for Home Insurance for Seniors

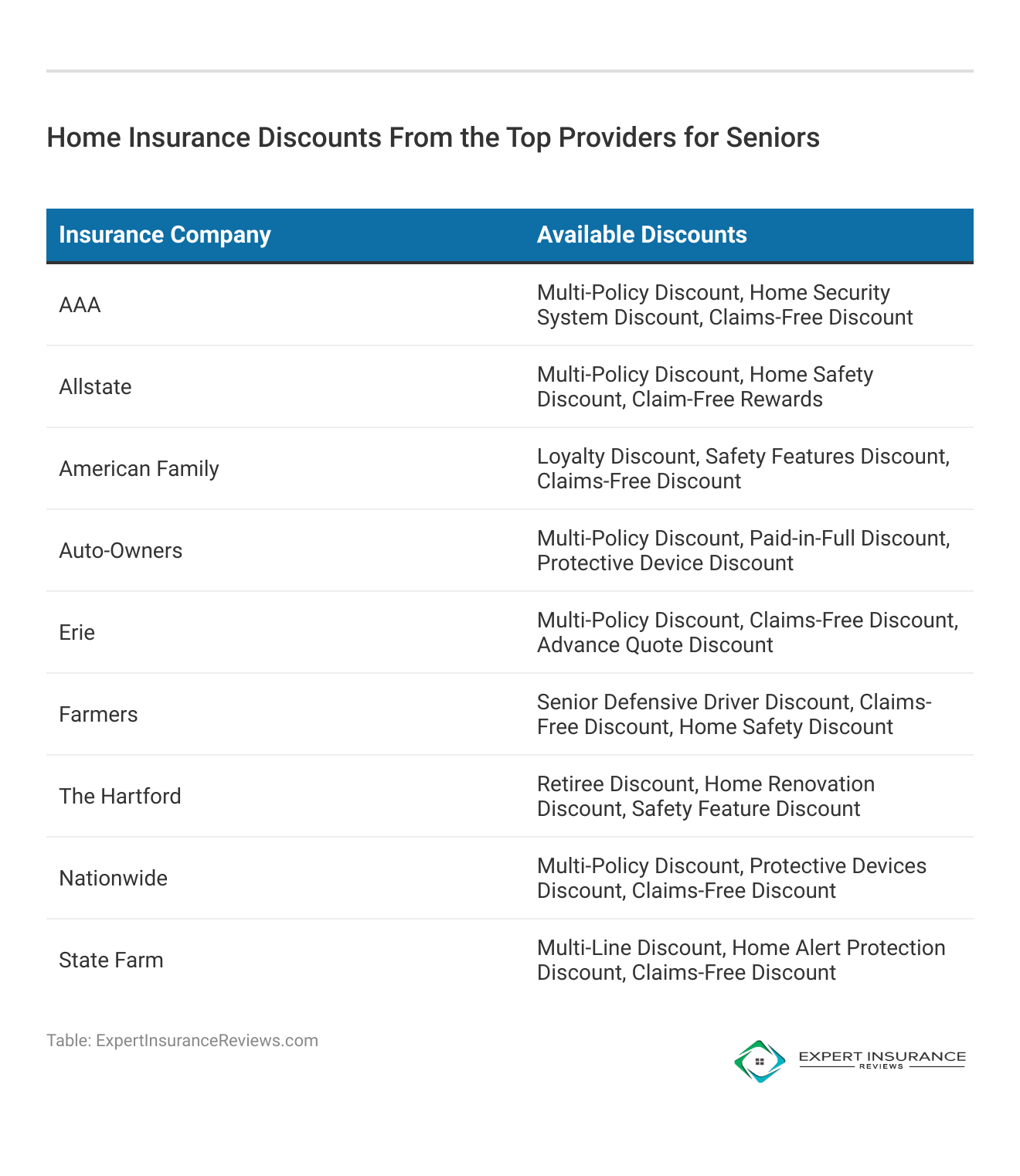

When seeking the best homeowners insurance for elderly, it’s crucial to explore insurers that specialize in serving older homeowners. Additionally, seniors should take advantage of home insurance discounts for seniors that can help reduce premiums while still providing comprehensive coverage.

By obtaining a home insurance quote for seniors from multiple insurers and comparing coverage options and discounts, elderly homeowners can find a policy that offers the protection they need at an affordable price.

Furthermore, reputable insurers may offer specialized home insurance for pensioners that includes benefits like enhanced medical coverage, assistance with home maintenance, and personalized customer service to address the specific needs of seniors.

Read through the next few sections for some tips on the best ways to find the right home insurance policy for senior citizens, possible discounts on insurance premiums, and more.

Read more: What does home insurance cover?

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

How to Find the Right Home Insurance Policy as a Senior

For seniors seeking the best auto & home insurance companies, it’s essential to prioritize reputable insurers that offer comprehensive coverage at competitive rates. Aside from looking into potential discounts (which we’ll discuss next), shopping for home insurance as a senior is not much different from shopping for home insurance at any other age.

It’s important to compare rates and coverage to make sure you’re getting what you need, and it’s vital to ensure you’re with a reputable homeowners insurance company. Before you decide, you should compare quotes from at least three companies to make sure you’re getting fair rates. When shopping for home insurance, it’s always a good idea to shop your car insurance around as well.

If you’ve just retired, you should be able to qualify for lower rates; not surprisingly, the companies that offer discounts to seniors on home insurance often offer them on auto as well. A bundling discount will make them an even better deal. Additionally, exploring bundling options can lead to additional savings, making it worthwhile to consider the best auto and home insurance bundle packages available.

Find more car insurance discounts here, Car Insurance Discounts: What You Need to Know.

If you are making a big retirement move to another state, for example it’s a good idea to ask around about local or regional insurance companies. By leveraging these discounts and bundling options, seniors can access the best auto and home insurance companies for seniors while maximizing savings.

In instances like Florida, a favored retirement spot yet with a challenging homeowner’s market, seeking guidance from seasoned experts becomes crucial. It’s advisable to engage a trustworthy local independent agent for assistance. This becomes particularly relevant amid discussions surrounding the departure of insurance companies from Florida.

Seniors can ensure they get the most suitable and economical home insurance for safeguarding their residences and vehicles during retirement by thoroughly assessing rates, coverage choices, and potential discounts. What is the new insurance law in Florida? Additionally, it’s crucial to consider this legislation while making insurance decisions.

Now that you know the basics, are you ready to start shopping for your home insurance coverage? read our guide, The Best Florida Home Insurance.

Is Homeowners Insurance for Seniors More Expensive

Several factors affect insurance rates for homeowners, including the value and location of your property, credit score, claims history, and more.

Your age has less of an effect on rates than the other factors we’ve noted and are described in the video, which means home insurance rates for seniors shouldn’t be higher than average. In fact, as a senior citizen, you may even qualify for some discounts that lower your rates.

See more details on our “How Much Home Insurance To Buy: An Expert Guide.”

Are There Home Insurance Discounts Available for Seniors

When searching for the cheapest home insurance for over 50s, seniors can maximize their savings by exploring various cheapest home insurance companies. While there are no specific home insurance coverage requirements or limits for senior citizens, some specific discounts may be available. If you are looking for the best house insurance for seniors, these discounts can help with your home insurance rates.

Many home insurance companies offer a 50+ discount or a discount for those that are retired. The amount of these discounts can vary by company and location, so it’s worth shopping around to see what the best deal for your particular needs is. If you bundle auto insurance for seniors with home insurance, you might get a discount.

Bundling policies, including cheapest car insurance for senior citizens, with home insurance can unlock additional savings. As a general rule, you probably won’t save as much on a senior discount as you would by staying with a company. Safety features like security systems may also entitle you to a discount.

Talk to your insurance agent and see how these discounts can help you save on your standard home insurance policy.

Still, it’s certainly worth getting a homeowners insurance quote. This is especially true if you are looking to switch all of your insurance or are interested in adding additional coverage. By consulting with insurance agents and comparing quotes from different providers, seniors can tailor their policies to their specific needs while securing the cheapest home and auto insurance bundle available.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Homeowners Insurance Companies for Seniors

In researching good options for home insurance policies for senior citizens, we made a point to select companies with good rates because we know many senior citizens have limited resources and may live on a fixed income.

In addition to good rates, we focused on companies that offer good value, great coverage, and no compromises. We were also on the lookout for senior homeowners discounts and any other benefits offered to seniors.

We looked for companies that go the extra mile when it comes to claims service. The last thing you need is to fight an insurance company to pay your claim; all our choices rank high in claims satisfaction. The same goes for good ratings when it comes to customer service. By comparing the best auto insurance companies for paying claims, you can get a good idea for how those companies handle home insurance claims.

While many local companies offer great products and services, choosing national companies makes the information useful to as many people as possible, so we focused on choosing companies with widely available products.

Best Homeowners Insurance Companies for Seniors

When you’re shopping for home insurance as a senior citizen, you want to make sure you’re getting the best coverage from one of the best homeowners insurance companies in the country, based on your needs. Securing affordable car insurance for senior citizens is essential, especially when exploring affordable home and car insurance options tailored to seniors’ needs.

When looking for affordable home and car insurance for seniors, prioritize quality coverage and reliable service. Thorough seniors home insurance reviews ensure you find a reputable insurer with competitive rates. With the right company, you can secure affordable house insurance for seniors while enjoying peace of mind.

These three companies provide great service and comprehensive policies for seniors (while Geico home insurance offers decent protection, they didn’t make our list of the top three for seniors). Find out more here: Geico Insurance Review & Complaints.

The Hartford/AARP Home Insurance

The AARP-branded home insurance products through The Hartford are designed specifically for seniors’ needs, putting them at the top of our list. AARP homeowners insurance rates are already discounted for seniors, and they also offer a retiree credit to decrease them further.

You can also take advantage of the AARP-branded auto program for another discount, putting them at the top of the list for the best auto and home insurance for seniors. When it comes to finding the best home insurance for seniors, AARP insurance plans through The Hartford stand out as an exceptional choice. Tailored specifically to seniors’ needs, AARP insurance homeowners policies offer discounted rates and additional benefits aimed at providing comprehensive coverage.

The Hartford is a solid company that generally ranks well in customer satisfaction. According to J.D. Power, a company that conducts customer satisfaction research in a variety of industries, The Hartford has a score of 806 out of 1,000 on its customer satisfaction index ranking and a three out of five for the J.D. Power Circle Rating (which translates to “about average”).

You will need to be an AARP member to get in on these products, but that comes with a whole array of other benefits that makes it well worth joining. The Hartford’s solid reputation and high customer satisfaction ratings, as evidenced by AARP insurance reviews and J.D. Power’s research, make it a reliable option for seniors seeking peace of mind and quality service.

Bundling with the AARP insurance quote for auto coverage can further maximize savings, making it a top contender in the realm of home insurance for seniors. Read more: AARP Auto Insurance Program from The Hartford Review

Allstate

Allstate offers a truly impressive line of discounts, which includes up to 10 percent off for 55+ retirees. Other discounts you could qualify for are a claim-free discount, a new home purchase, and even a discount just for being a new customer 10 percent off for the first two years. Allstate recognizes the unique needs of seniors and offers specialized coverage, including Allstate discounts for seniors.

One notable advantage is the Allstate bundle discount, which allows seniors to combine multiple insurance policies, such as home and auto insurance, into a single package, resulting in significant savings. Allstate’s captive agent approach means you will always have someone you trust to talk to about your insurance, and their home insurance policies are comprehensive and full of included benefits.

Additionally, Allstate discounts for homeowners can appreciate, ensuring that seniors receive comprehensive coverage at competitive rates. For those residing in condos, Allstate condo insurance quote services offer tailored solutions to protect their valuable assets, providing peace of mind during their golden years.

That same J.D. Power study indicates that Allstate received an 814 out of 1,000 on the customer satisfaction index, while the company also received a three out of five for the J.D. Power Circle Rating.

Allstate competes very well in our rate comparison tests, and with those added discounts, they offer a good value.

Read more:

- Allstate Home Insurance Review & Complaints: Home Insurance.

- Best Home Insurance for New Home Builds

Amica Mutual

Amica Mutual is the only company on our list that does not offer a specific discount to seniors. Still, Amica’s home insurance rates are excellent, and they can’t be touched for customer service. When seniors seek Amica home insurance quotes, they are met with a company known for its reliability and customer-centric policies.

Amica home insurance review consistently highlights its comprehensive coverage options tailored to the needs of retirees. For those residing in a Amica retirement home, the peace of mind provided by Amica’s policies is invaluableAmica won J.D. Power’s top award for both property claims satisfaction and homeowner claims satisfaction in 2017. If you’re looking to bundle with your car insurance, they also won that claims satisfaction award.

Beyond safeguarding physical assets, Amica extends its protection to encompass digital security with Amica identity theft protection, recognizing the vulnerabilities that seniors may face in the digital age. With Amica, seniors can rest assured that their homes and identities are shielded with the utmost care and expertise.

Amica has an excellent homeowner’s insurance program that includes many products as standard that are add-ons elsewhere. For seniors that value great service on a great policy above all else, Amica is a great option.

Are There Other Types of Insurance for Seniors

Let’s say as a part of your retirement that you’ve downsized from a traditional home to a condo or a rental. Do you still need coverage? The answer is yes. Read the next few sections to learn more about “walls in” coverage. Access comprehensive insights into our “Best Home Insurance for Seniors.”

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

What Kind of Condo Insurance Is Available for Seniors

If you live in a condo, even if the property is managed by a homeowner’s association (HOA), you’ll still need insurance. Condo insurance provides coverage similar to traditional homeowners insurance, but it’s often much less expensive.

This can be for several reasons, but primarily because it only covers your unit and not any of the rest of the property.

Anything considered community or shared property is usually managed and covered by the HOA.

Coverage like fire and smoke damage, weather damage, theft, and vandalism are all included, but earthquake damage, flood damage, intentional damage, nuclear hazards, and routine wear and tear are typically not included in a standard condo insurance policy.

If you live in a newly built condo, you may want to look into the best new build home insurance.

What Kind of Renters Insurance Is Available for Seniors

If you don’t own your property, you won’t need homeowners or condo insurance, but you’ll still need renters insurance. This coverage will still protect your personal property, but not the dwelling, which means your rates may be much lower than they would be for homeowners’ insurance.

It will also provide liability protection if someone is injured in your home.

If you live in a retirement home or assisted living facility, you should purchase renters insurance and protection for your personal property (which comes with similar coverage limits to the personal property coverage included in a homeowners insurance policy).

Read about insuring short-term rentals here: Best Home Insurance for Short Term Rentals.

Case Studies: Exploring Home Insurance for Seniors

Selecting the right home insurance as a senior can be crucial for protecting one’s property and peace of mind during retirement. Here are three fictional case studies that explore how different seniors navigated their choices to find insurance that best met their unique needs.

- Case Study #1– The Smiths: The Smiths, a retired couple, recently downsized from a single-family home to a condominium. They purchased a seniors’ home insurance policy that provided “walls-in” coverage for their attached home. They insured their personal property, including antiques and heirlooms, and chose higher liability coverage to protect their retirement savings.

- Case Study #2– Mr. Johnson: Mr. Johnson, a senior homeowner, wanted to find the best rates on homeowners insurance. He compared quotes from multiple insurance companies and discovered that The Hartford/AARP offered competitive rates for seniors. He was able to secure affordable coverage for his home and its contents, including high-value items, by customizing his policy.

- Case Study #3– Mrs. Anderson: Mrs. Anderson, a senior homeowner, was concerned about the cost of monthly premiums. She explored various ways to save on her home insurance. By bundling her home and auto insurance policies with the same provider, she qualified for a discount. She found a budget-friendly insurance policy that met her needs and took advantage of senior discounts.

These scenarios demonstrate that with the right approach and information, seniors can effectively find home insurance solutions that offer both financial protection and value. Whether downsizing, seeking competitive rates, or exploring discounts, there are numerous options available to meet the diverse needs of senior homeowners.

More information is available about this provider in our “Home Insurance Coverage: An Expert Guide.”

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

What’s the Bottom Line for Best Home Insurance for Seniors

As a senior, you have earned your upcoming years of relaxing, low-stress living. Your home insurance should give you the peace of mind to do just that. Choose an insurance company known for taking good care of its customers, seniors included and you won’t have to worry about what happens if something goes wrong at home.

We can help you to buy the best home insurance for seniors today. Enter your ZIP code in our free rate tool to get great quotes on homeowners insurance for seniors today. Learn more in our “Best Insurance Companies.”

Frequently Asked Questions

What is senior citizen home insurance?

Senior Citizen Home Insurance offers coverage specifically for seniors’ residences, safeguarding their property, belongings, and finances. Even if the mortgage is fully paid, home insurance remains crucial for comprehensive protection. Additionally, understanding auto insurance rates for seniors and exploring options for auto insurance for seniors over 70 is essential for overall financial security

What kinds of home insurance should senior purchase?

Seniors should look into acquiring three key types of homeowners insurance: dwelling/structure coverage for the house itself, personal belongings coverage for items within the home, and general liability coverage to protect against injuries on the property. Additionally, for those searching for the best auto insurance for seniors or the best auto insurance for seniors in Florida, it’s crucial to consider these coverage options.

Does homeowners insurance for seniors include home contents coverage?

Yes, homeowners insurance for seniors typically covers home contents, but there are limits on high-value items like jewelry, watches, firearms, and electronics. It’s advisable to consult with your insurance agent to ensure adequate coverage for these valuables. For those considering auto insurance for seniors in Texas or wondering if home insurance rates are going up, it’s essential to stay informed and review your policies regularly.

What are some common homeowners insurance policies and features for seniors?

In addition to basic home coverage, seniors may want to add optional features to their policy, such as deductible forgiveness, protection for the full value of valuable items, and identity theft and fraud protection. If you’re looking for auto and home insurance companies near me, it’s essential to consider these options. Understanding these additions can help you better assess the average home insurance cost in your area.

What benefits do AARP home and auto insurance provide?

AARP home and auto insurance provides significant bundling discounts, exclusive to AARP members, along with custom coverage options that cater to the specific needs of seniors.

What is the seniors first Initiative homeowners insurance?

The Seniors First Initiative Homeowners Insurance program provides specialized coverage and discounts to help seniors effectively manage their insurance costs. This program also highlights citizens insurance discounts and offers car insurance options for retired people.

What is the best bundled insurance for seniors?

The best personal property insurance or best bundle for seniors often includes discounts for bundling home and auto policies. Companies such as Erie and The Hartford offer competitive rates and comprehensive coverage for auto insurance seniors.

What are the features of the 2024 seniors first initiative homeowners insurance?

The 2024 Seniors First Initiative Homeowners Insurance offers expanded coverage options, superior customer service specifically designed for seniors, and potential premium discounts that account for seniors’ lower risk levels. Be sure to compare home and contents insurance and consider assisted living rental insurance for a comprehensive assessment.

What is the best home and car insurance for seniors?

The best home and car insurance for seniors often comes from providers like The Hartford/AARP, which offers significant discounts and tailored policies for older adults.

How do you shop for home insurance for seniors?

When shopping for home insurance as a senior, it’s important to compare rates and coverage from multiple companies. It’s also beneficial to explore potential discounts, bundle home and auto insurance, and consider local or regional insurance companies for personalized assistance.

How can I get an AARP homeowners insurance quote?

You can get an AARP homeowners insurance quote by visiting their website or calling their customer service, where you’ll need to provide details about your home and insurance needs.

Finding affordable premiums for home insurance is easy with our free quote comparison tool. Just enter your ZIP code below to find cheap coverage for your home.

What does AARP house insurance cover?

AARP house insurance covers all standard perils, including fire, theft, and natural disasters, with options for additional coverage like flood or earthquake insurance tailored to seniors.

Which company offers the best homeowner insurance for seniors?

Erie Insurance is highly recommended for seniors seeking homeowner insurance due to its affordable rates and exceptional customer service tailored to senior needs.

Where can I find affordable home insurance for seniors?

Affordable home insurance for seniors can be found with providers like Erie and The Hartford, which offer tailored discounts and coverage options for seniors looking to reduce their insurance expenses.

What should I look for in the best home and auto insurance for seniors?

When looking for the best home and auto insurance for seniors, prioritize companies that offer discounts for bundling, have a strong reputation for customer service and claims handling, and provide policies that address the specific needs of senior drivers and homeowners.

What is the best homeowners insurance for seniors?

Here are six top homeowners insurance providers for older homes: Liberty Mutual, notable for discounts; Allstate, recommended for extended coverage; Progressive, best for bundling options; Farmers, outstanding for customizable coverage; American Family, preferred for online resources; and Travelers, excellent for deductible savings.

Which insurance company is best for home insurance?

In our comprehensive review of the top homeowners insurance companies, Allstate emerged as our best overall choice. We also highlighted State Farm for its cost-effective coverage options and American Family for its valuable online resources.

Which homeowners insurance company has the highest customer satisfaction?

According to a J.D. Power study in 2024, Amica, AIG, and Erie Insurance are at the forefront for consumer satisfaction regarding property claims. Conversely, Travelers and Homesite have received lower ratings for customer service during claims processes.

What is the cheapest home insurance for seniors?

According to our study, Erie and Auto-Owners are the most affordable home insurance providers for the average consumer, including seniors. The yearly national average cost for an Erie home insurance policy stands at $1,284, while Auto-Owners averages $1,406 per year, as of January 22, 2024.

What insurance is the most commonly purchased homeowners insurance?

The HO-3 policy is the most prevalent form of homeowners insurance. It provides broader coverage compared to HO-2 policies, protecting the structure of your home from all perils except those explicitly excluded in your policy, such as earthquakes and floods.

Find cheap car insurance quotes by entering your ZIP code below.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Kalyn Johnson

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Insurance Claims Support & Sr. Adjuster

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.