10 Best Car Insurance Companies for Mercedes in 2025 (Save With These Providers)

Allstate, Progressive, and Farmers have the best car insurance providers for Mercedes, offering top-tier coverage from $90 a month. Allstate excels with bespoke Mercedes plans at great rates, while Progressive and Farmers deliver affordable premiums and solid coverage, making them top choices for your luxury ride.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Mercedes

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Mercedes

A.M. Best Rating

Complaint Level

Pros & Cons

Allstate, Progressive and Farmers are top picks with superior coverage specifically designed for luxury vehicles and shine with their competitive rates and strong protection.

These three companies excel in providing optimal insurance solutions for your Mercedes, ensuring peace of mind and exceptional service.

Our Top 10 Company Picks: Best Car Insurance Companies for Mercedes

Company Rank Bundling Discounts A.M. Best Best For Jump to Pros/Cons

#1 25% A+ Safe Driving Allstate

#2 20% A+ Flexible Coverage Progressive

#3 15% A Discount Variety Farmers

#4 28% A Customizable Options Liberty Mutual

#5 19% A+ Accident Forgiveness Nationwide

#6 12% A++ Customer Service Auto-Owners

#7 17% B Comprehensive Discounts State Farm

#8 10% A+ Senior Discounts The Hartford

#9 16% A++ Coverage Options Travelers

#10 21% A+ Local Agents Erie

Explore their offerings to find the perfect match for your needs. Explore insurance savings in our full guide titled, “Car Insurance Requirements.”

Find cheap car insurance quotes by entering your ZIP code above.

- Allstate offers top coverage for Mercedes luxury vehicles

- Progressive has competitive rates for high-end car insurance

- Farmers provides strong protection for Mercedes owners

#1 – Allstate: Top Overall Pick

Pros

- Bundling Discounts: Allstate provides a 25% discount for bundling multiple Mercedes insurance plans. Learn more in our guide, “Allstate Auto Insurance Review & Complaints.”

- High A.M. Best Rating: With an A+ rating from A.M. Best, Allstate demonstrates exceptional financial strength and stability.

- Safe Driving Rewards: Allstate incentivizes safe driving with additional savings for Mercedes drivers.

Cons

- Limited Customization: In spite of its advantages, Allstate’s Mercedes coverage options might not offer the extensive flexibility found with some competitors.

- Potentially Higher Premiums: Even with the substantial discounts, Allstate’s premiums can still be relatively high in comparison to other insurers.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#2 – Progressive: Best for Flexible Coverage

Pros

- Customizable Coverage Options for Mercedes: Progressive offers flexible coverage for Mercedes vehicles. Find details in our guide, “Progressive Insurance Review & Complaints.”

- Bundling Discounts for Mercedes: Progressive grants a 20% discount for combining Mercedes insurance policies.

- Strong A.M. Best Rating: With an A+ rating from A.M. Best, Progressive exhibits robust financial stability and dependability.

Cons

- Discount Cap Limitations: While Progressive offers a significant bundling discount, it may not be as extensive as those provided by some rivals.

- Complex Policy Structures: The broad customization options offered by Progressive can sometimes result in intricate policy structures.

#3 – Farmers: Best for Discount Variety

Pros

- Diverse Discounts for Mercedes: FFarmers offers Mercedes drivers discounts, including 15% off for bundling policies. Check out our article, “Farmers Insurance Review & Complaints.”

- Varied Coverage Options: Farmers offers an extensive selection of coverage plans specifically designed for Mercedes vehicles.

- Solid A.M. Best Rating: With an A rating from A.M. Best, Farmers provides a dependable and stable insurance option.

Cons

- Lower Bundling Discount: Compared to other providers, Farmers’ bundling discount of 15% is relatively modest.

- Coverage Limitations: Although Farmers offers diverse coverage options, there may be restrictions in certain specialized areas.

#4 – Liberty Mutual: Best for Customizable Options

Pros

- High Bundling Discount for Mercedes: Liberty Mutual provides an impressive 28% discount on bundled Mercedes insurance policies.

- Customizable Coverage: Liberty Mutual offers highly adaptable coverage options. Mercedes owners can customize their policies to meet specific needs, improving insurance relevance.

- Strong A.M. Best Rating: Liberty Mutual’s A rating reflects its financial strength. Find details in our guide Liberty Mutual Insurance Review & Complaints.”

Cons

- Higher Premiums: The customizable nature of Liberty Mutual’s policies can sometimes lead to elevated premiums.

- Limited Local Support: In some areas, Liberty Mutual might provide limited local support, which could affect service accessibility for Mercedes drivers.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Accident Forgiveness

Pros

- Accident Forgiveness for Mercedes: Nationwide’s accident forgiveness keeps rates steady for Mercedes drivers. Learn more in our guide, “Nationwide Insurance Review & Complaints.”

- Moderate Bundling Discount: Nationwide offers a 19% discount on bundled policies, providing reasonable savings for those needing multiple coverages.

- Excellent A.M. Best Rating: With an A+ rating from A.M. Best, Nationwide displays strong financial stability and reliability.

Cons

- Less Competitive Discounts: Nationwide’s 19% bundling discount is lower than some competitors, potentially limiting total savings for Mercedes drivers.

- Limited Customization: The policy customization options with Nationwide may not be as extensive as those provided by other insurers.

#6 – Auto-Owners: Best for Customer Service

Pros

- Mercedes-Focused Customer Assistance: Auto-Owners is celebrated for its superior client service, especially for Mercedes enthusiasts.

- Bundling Savings: Consolidate multiple policies for a 12% discount. Learn more in our guide, “What discounts are available at Auto-Owners car insurance?“

- Elite Rating: Auto-Owners boasts an A++ rating from A.M. Best, ensuring strong financial health and stability for Mercedes drivers.

Cons

- Specialized Coverage Limitations: Auto-Owners excels in customer service but may lack coverage for premium Mercedes models’ high-end features.

- Potentially Higher Premiums: Despite discounts, Mercedes coverage with Auto-Owners might still be relatively expensive.

#7 – State Farm: Best for Comprehensive Discounts

Pros

- Generous Mercedes Bundling Savings: State Farm offers a 17% bundling discount for Mercedes. Dive into our article called “State Farm Insurance Review & Complaints.”

- Attractive Low-Mileage Reduction: State Farm rewards low-mileage drivers with a substantial discount, which benefits Mercedes owners who use their vehicles infrequently.

- Extensive Coverage Choices: State Farm provides various coverage options tailored for different Mercedes models.

Cons

- Discounts Compared to Competitors: The 17% bundling discount is attractive but may be lower than some competitors, potentially limiting savings for Mercedes owners.

- Higher Premiums for Certain Levels: State Farm’s premiums may be high despite discounts.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#8 – The Hartford: Best for Senior Discounts

Pros

- Senior-Friendly Mercedes Savings: The Hartford offers special discounts for senior Mercedes drivers, delivering competitive rates that reflect their extensive driving experience.

- Exceptional Client Support: The Hartford offers excellent support for Mercedes owners. Learn more in our guide titled, “The Hartford Insurance Review & Complaints.”

- Solid A.M. Best Rating: With an A+ rating from A.M. Best, The Hartford offers Mercedes owners confidence in its financial stability and reliable claim handling.

Cons

- Extent of Senior Discounts: The Hartford’s senior discount is beneficial but may offer less savings compared to other insurers for Mercedes drivers.

- Potential Coverage Gaps: Coverage options for Mercedes models may be more limited than with other providers, potentially affecting protection.

#9 – Travelers: Best for Coverage Options

Pros

- Wide Coverage for Mercedes: Travelers offers extensive coverage options for various Mercedes models, ensuring tailored protection for different needs.

- High Bundling Discount: A 16% discount for bundling multiple policies provides substantial savings for Mercedes owners.

- Top A.M. Best Rating: Travelers, A++ rated by A.M. Best, ensures strong support. Find out more in our guide titled, “Travelers Insurance Review & Complaints.”

Cons

- Discount Comparison: Travelers offers a good bundling discount, but it may not always be the most competitive compared to other insurers, impacting savings for Mercedes coverage.

- Premium Costs: Even with discounts, premiums for Mercedes coverage with Travelers might still be relatively high, which could be a concern for budget-conscious buyers.

#10 – Erie: Best for Local Agent

Pros

- Tailored Local Agent Service for Mercedes Owners: Erie provides personalized service for Mercedes drivers. For more details, see our guide, “Erie Insurance Review & Complaints“.

- Generous Bundling Discount: Erie offers a 21% discount for bundling multiple policies, ideal for Mercedes owners seeking maximum savings.

- Reliable A.M. Best Rating: Erie holds an A+ rating from A.M. Best, ensuring financial stability and dependable service.

Cons

- Coverage Option Limitations: Erie’s coverage for Mercedes may be less comprehensive, potentially affecting protection for high-end features.

- Potentially Elevated Premiums: Notwithstanding the bundling discount, premiums for Mercedes coverage might still be relatively high.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

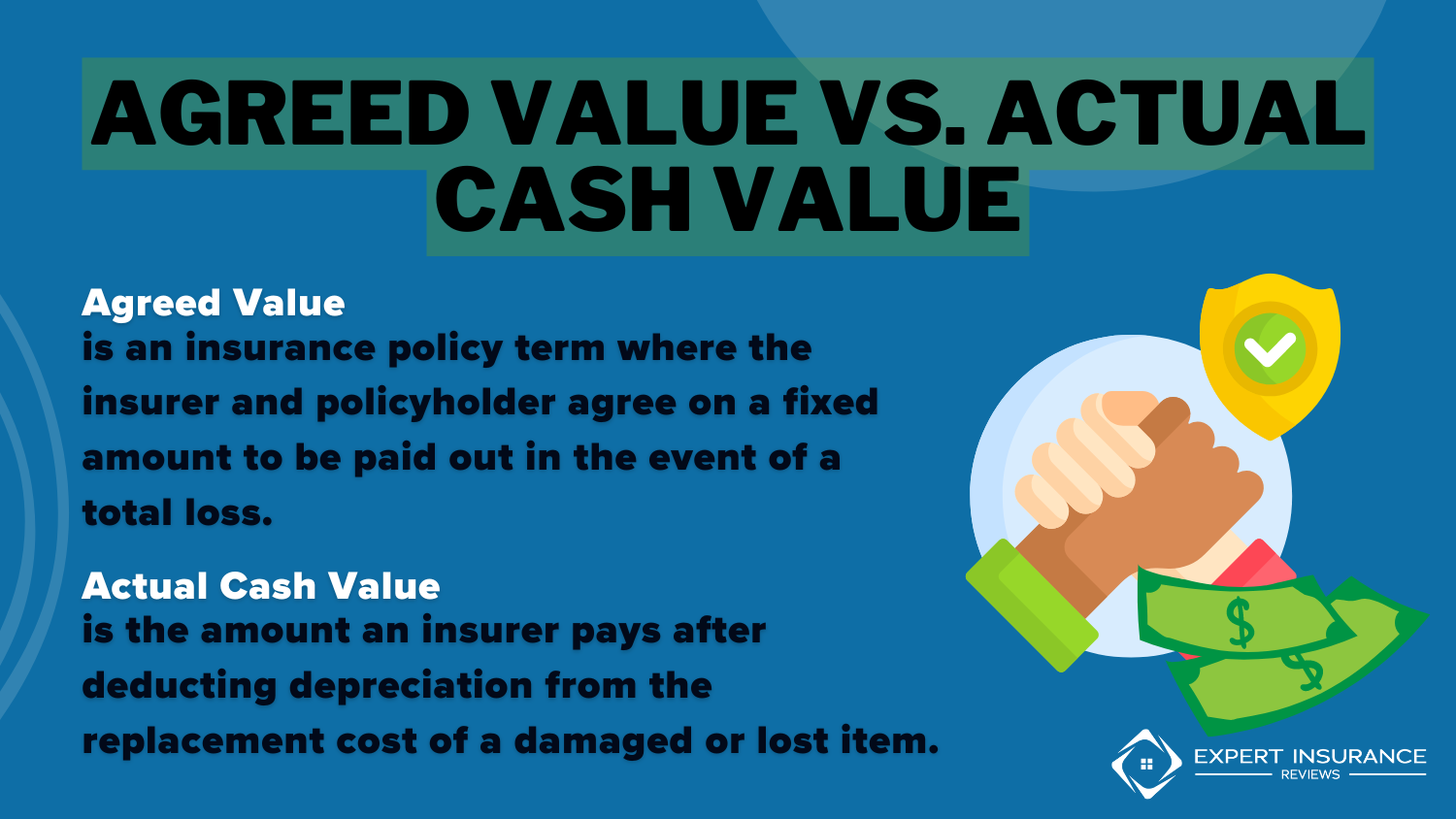

Mercedes-Benz Insurance Rates: Minimum vs. Full Coverage

When it comes to insuring your Mercedes-Benz, understanding the cost of coverage is crucial. The table below provides a snapshot of monthly insurance rates across various providers, highlighting both minimum and full coverage options.

Mercedes Car Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

$115 $210

$90 $180

$92 $180

$105 $200

$110 $215

$95 $185

$100 $190

$98 $195

$109 $205

$103 $193

The rates for Mercedes-Benz insurance vary significantly among providers. Allstate offers competitive rates, with minimum coverage starting at $115 and full coverage at $210. Auto-Owners provides the most economical minimum coverage at $90, while Liberty Mutual has the highest full coverage rate at $215.

Car Insurance Discounts From the Top Providers for Mercedes

| Insurance Company | Available Discounts |

|---|---|

| Safe Driver, Multi-Policy (Bundling), New Car, Anti-Theft Device, Early Signing, Good Student, Senior, Autopay, Full-Pay, Paperless, Anti-Lock Brake System | |

| Multi-Policy (Bundling), Multi-Car, Paid-in-Full, Good Student, Safety Features, Anti-Theft, Paperless, Auto-Pay, Good Driver, Green Vehicle | |

| Safe Driver, Multi-Policy (Bundling), Multi-Car, Paid-in-Full, First Accident Forgiveness, Young Driver, Age 55+, Safety Features, Anti-Theft, Reduced Usage |

| Safe Driver, Multi-Policy (Bundling), Multi-Car, Good Student, Mature Driver, Homeowner, Occupation-Based, Alternative Fuel, Affinity Group, Paid-in-Full, Signal App | |

| Safe Driver, Multi-Policy (Bundling), Multi-Car, New Car Replacement, Better Car Replacement, Early Shopper, Affinity Group, Anti-Theft, Good Student, RightTrack, Military, Autopay |

| Safe Driver, Multi-Policy (Bundling), Multi-Car, Accident-Free, Good Student, Anti-Theft, Paperless, Automatic Payments, SmartRide Program, Defensive Driving, Affinity Group |

| Safe Driver, Multi-Policy (Bundling), Multi-Car, Continuous Insurance, Snapshot Program, Homeowner, Good Student, Paperless, Pay-in-Full, Online Quote, Automatic Payment | |

| Safe Driver, Multi-Policy (Bundling), Multi-Car, Good Student, Steer Clear, Drive Safe & Save, Defensive Driving, Anti-Theft, Passive Restraint, Accident-Free | |

| Safe Driver, Multi-Policy (Bundling), Multi-Car, AARP Member, Defensive Driver, Vehicle Safety, Anti-Theft, Hybrid Vehicle, Paid-in-Full, New Car Replacement, RecoverCare, Good Student |

| Safe Driver, Multi-Policy (Bundling), Multi-Car, Hybrid/Electric Vehicle, Continuous Insurance, New Car, Good Payer, IntelliDrive, Good Student, Home Ownership, Early Quote |

Other notable options include Farmers at $105 for minimum and $200 for full coverage, and Progressive at $100 for minimum and $190 for full coverage. Obtain detailed insights by reading our guide titled, “Full Coverage Car Insurance: An Expert Guide.”

Determining Auto Insurance Costs for a Mercedes-Benz

Auto insurance companies use many of the same variables to calculate your rates, including your age, gender, driving record, and the kind of car you drive. Luxury vehicles, like Mercedes-Benz, cost more to insure because they cost more to repair or replace if stolen.

Learn more about the offerings in our guide titled, “Average Cost of Car Insurance by Age.”

Luxury auto insurance costs around $250 per month, over $100 more than the standard monthly rate. You can expect to pay around this much or more for insurance if you drive a Mercedes.

Other factors that affect Mercedes auto insurance rates include:

The Model of the Vehicle: Convertibles cost more than sedans and SUVs.

The Class of the Vehicle: S-Class and G-Class rates, especially the G63 AMG insurance costs, are among the most expensive of the models.

Where You Park the Vehicle: If you don’t have a garage or live in a city with high auto theft rates, you will pay more for insurance.

However, if your Mercedes is over 20 years old, you may qualify for classic auto insurance. Auto insurance for classic cars provides coverage that protects the vehicle’s true value, but it may not allow for everyday use. Find out if your old car is considered classic and compare rates from multiple companies for collector car insurance before buying a policy.

Car Insurance for a Mercedes

Is Mercedes-Benz insurance expensive? When compared to the national average, Mercedes-Benz insurance costs anywhere between $20 and $100 more per month.

If you drive a Mercedes, you will likely pay between $180-$250 or more for auto insurance coverage based on your ZIP code and individual factors.

How much you pay for Mercedes auto insurance will also depend on the model you drive and the age of the vehicle. For example, the Mercedes S-Class models come with the highest monthly rates for full coverage, around $40 more per month than the other models.

Read the article called “Compare Car Insurance” for additional insights.

This is why it’s important to compare auto insurance rates by vehicle. The Mercedes-Benz S450 and SL450 have the highest average rates, at $201 and $194, respectively. The cheapest Mercedes to insure is the E300 at $160 per month.

Mercedes-Benz C-Class Car Insurance Rates

Mercedes-Benz C-Class insurance costs are cheaper than other Mercedes models at only $165 per month. Other C-Class models also come with affordable rates, with monthly Mercedes-Benz CLA-Class insurance quotes averaging between $150 and $178.

However, through PRNewswire, Mercedes announced that it will stop producing some of the current C-Class models in favor of a hybrid engine model, with more electric vehicles planned for 2025 and onwards.

If you drive a C-Class, you will still be able to buy auto insurance coverage, but you may have a hard time finding replacement parts if you damage your vehicle.

Mercedes-Benz E-Class Car Insurance Rates

The Mercedes-Benz E-Class vehicles have some of the lowest insurance rates due to their lower MSRP. For example, the Mercedes E300 car insurance rates are around $10,000 more than the C300 and enjoys the same low insurance rates.

Insurance for a Mercedes-Benz E300 costs around $160 per month, which is on par with the national average for auto insurance.

Mercedes-Benz G-Class Car Insurance Rates

Mercedes-Benz G-class car insurance quotes are generally higher than average, including the GLA250, GLE300, and GLC300.

When comparing the best car insurance for a Mercedes GLE350, you might initially see lower rates if you drive an older model. However, new cars come with higher insurance rates, and quotes for a brand-new Mercedes-Benz may be double what you normally pay.

Mercedes-Benz S-Class Car Insurance Rates

As the sportiest trim and often sold as a soft-top convertible, Mercedes-Benz S-Class vehicles have the highest insurance costs on average.

For example, rates for the Mercedes S450 are over $200 per month, while insurance for the SLC300 — a hard-top convertible — is a little cheaper at $178 per month.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Understanding Your Coverage Options

As a Mercedes-Benz owner, you have exclusive access to the Mercedes-Benz Financial Services (MBFS) program. It offers insurance coverage and financial services to Mercedes-Benz owners and retailers. MBFS will also help you find local Mercedes-Benz dealerships and leasing opportunities.

With rates as low as $115 monthly, Allstate offers unmatched protection for Mercedes owners.

Ty Stewart Licensed Insurance Agent

It’s not possible to compare MBFS insurance quotes online without first being a member, but you can call customer service at 1-800-654-6222 to learn more.

Be aware that MBFS is very competitive and does not offer insurance to high-risk drivers. Drivers will also not qualify for an auto loan through MBFS without a credit score of 700 or above.

Access detailed insights in our guide titled, “Best Car Insurance Company for Drivers With Accidents.”

Strategies for Reducing Costs on Mercedes-Benz Insurance

Mercedes-Benz is not among the cheapest cars to insure, but you can still lock in affordable rates when you shop around and compare multiple companies and coverage options.

Follow these tips to find cheap insurance for a Mercedes-Benz:

Sign up for Usage-Based Insurance Program: Telematics insurance tracks your habits and offers lower rates to safe drivers who drive less than 10,000 miles per year.

Install Additional Safety Features: Installing GPS tracking or carving the VIN into the window can lower your monthly Mercedes insurance rates.

Park in a Garage: Parking your Mercedes in a garage or safe area will protect it from damage and theft, which lowers your insurance rates.

Ask for Discounts: Safe drivers qualify for the most savings, but you can also earn discounts through your employer and by bundling multiple policies with one company.

Discounts and eligibility will vary by company, so check out our guide to car insurance discounts to see where you qualify for the most savings.

Finding Cheap Car Insurance for a Mercedes-Benz

It’s not impossible to find affordable Mercedes-Benz auto insurance — you can get cheap rates by comparison shopping now with our free quote tool below.

However, your rates will be higher than the national average because Mercedes is considered a luxury vehicle. Luxury cars are more expensive to replace, and insurance companies charge higher monthly rates to make up for the increased risk. For more information, read our “Best Car Insurance for Luxury Cars“.

Remember, personal factors like your driving record and claims history can also raise your rates. You can buy cheap Mercedes auto insurance if you’re a safe driver who avoids accidents and speeding tickets.

By entering your ZIP code below, you can get instant car insurance quotes from top providers.

Frequently Asked Questions

Are Mercedes expensive to insure?

Yes, Mercedes-Benz insurance costs are higher than average. You can expect to pay around $100 more per month than you would with a standard vehicle.

For additional details, explore our comprehensive resource titled, “Car Insurance by Driver.”

What are the insurance rates for a Mercedes-Benz?

If you’re wondering how much Mercedes insurance costs, monthly rates average between $180 and $250, depending on the model you drive.

Is Mercedes a luxury or premium vehicle?

Mercedes is considered the most popular luxury car on the market, and insurance companies charge Mercedes drivers higher luxury auto insurance rates.

How is car insurance for a Mercedes-Benz calculated?

Mercedes-Benz car insurance rates depend on factors like age, gender, driving record, and model. Luxury vehicles, such as Mercedes, often have higher costs due to expensive repairs and theft risks. Additional factors include vehicle type, class, and parking location. For cars over 20 years old, classic auto insurance may be an option, though it usually limits daily use.

Can I get a Mercedes-Benz insurance quote online?

You can get Mercedes-Benz insurance quotes online, but some programs like Mercedes-Benz Financial Services may need membership or a call. Use comparison tools for personalized quotes. Insurance costs are higher due to pricey repairs, vehicle type, class, and location. Classic auto insurance might be an option for Mercedes models over 20 years old.

To find out more, explore our guide titled, “What states require drivers to have Car Insurance?”

Do Mercedes-Benz auto insurance rates vary by location?

Yes, auto insurance rates for Mercedes-Benz vehicles can vary depending on your location. Factors such as local traffic conditions, accident rates, crime rates, and the prevalence of luxury vehicles in your area can impact insurance premiums. Insurance companies take these factors into account when calculating rates, so it’s essential to compare quotes from multiple local companies to find the best price for your specific location.

What is the Mercedes insurance cost?

The Mercedes insurance cost varies by model and provider but typically starts around $90 per month for basic coverage.

What is the most trusted car insurance company for Mercedes?

Amica and Geico are highly trusted for car insurance, offering tailored plans, while Auto-Owners and Nationwide are budget-friendly with strong discounts. For Mercedes owners, Safeco, Travelers, and USAA offer personalized coverage that addresses the specific needs of luxury cars.

Does owning a Mercedes affect car insurance costs?

Yes, insuring a Mercedes typically costs more due to the high value and expensive repair parts of the vehicle, making comprehensive coverage essential to protect against significant financial loss.

To learn more, explore our comprehensive resource on, “Does car insurance cover non-accident repairs?”

Are Mercedes vehicles more expensive to insure than other brands?

Mercedes models generally have higher insurance premiums compared to non-luxury brands, as insurers factor in the vehicle’s high repair costs and advanced technology when determining rates.

Which type of car insurance is best for a Mercedes?

Comprehensive car insurance is recommended for Mercedes owners, as it provides extensive coverage for both third-party liabilities and damages to your vehicle, which is crucial given the high repair costs of luxury cars.

By entering your ZIP code below, you can get instant car insurance quotes from top providers.

Why is car insurance higher for Mercedes models?

Car insurance for Mercedes tends to be higher due to the brand’s luxury status, costly parts, and advanced features, which drive up the cost of repairs and replacements, leading to increased insurance premiums.

How much does Mercedes insurance cost monthly?

Monthly Mercedes insurance costs range from $90 to $215, depending on the coverage level and provider.

Learn more by reading our guide titled, “Best Car Insurance Discounts.”

Are there specific car insurance providers best suited for Mercedes?

Yes, Allstate, Progressive, and Farmers are often top choices for Mercedes insurance due to their competitive rates, comprehensive coverage options, and tailored plans that cater to the needs of luxury vehicle owners.

Can I get cheaper insurance for my Mercedes?

To lower your Mercedes insurance costs, consider bundling policies, opting for higher deductibles, maintaining a clean driving record, and utilizing discounts offered by insurers like Geico or Nationwide, which cater to luxury vehicle owners.

What factors affect Mercedes insurance rates?

Factors influencing Mercedes insurance rates include the model, age of the vehicle, your driving record, where you park, and the specific coverage limits you select. High-end models or those with advanced technology typically have higher premiums.

Do all insurance companies cover Mercedes vehicles?

While most major insurance companies provide coverage for Mercedes vehicles, not all may offer the best rates or specialized coverage options suited to luxury cars. It’s advisable to compare quotes from providers like Amica, USAA, and Safeco to find the best fit for your needs.

Access comprehensive insights into our guide titled, “Best Car Insurance Quotes by Vehicle.”

How does the model of my Mercedes impact insurance premiums?

The specific Mercedes model significantly impacts insurance premiums, with higher-end models like the S-Class or G-Class often costing more to insure due to their value, performance, and expensive replacement parts.

Are Mercedes vehicles more expensive to insure compared to other brands?

Yes, insuring a Mercedes is generally more expensive than insuring standard vehicles because of the luxury status, high repair costs, and the advanced technology featured in Mercedes models. Premiums vary by model but tend to be higher for luxury brands.

What is the average monthly insurance cost for a Mercedes?

The average monthly insurance cost for a Mercedes varies by model and coverage level, but it typically ranges from $90 for minimum coverage to over $210 for full coverage. Rates can differ significantly between providers like Allstate, Auto-Owners, and State Farm.

Ready to shop around for the best car insurance company? Enter your ZIP code below and see which one offers the coverage you need.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.