Best Texas Car Insurance (2024)

Texas minimum car insurance requirements are 30/60/25 for bodily injury and property damage while Texas auto insurance rates average $92 per month. State Farm and USAA offer the cheapest car insurance in Texas, but USAA is only for U.S. military and their families. Allstate has the highest car insurance rates in Texas.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed life and health insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chr...

Licensed Insurance Agent

UPDATED: Apr 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Apr 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Texas car insurance laws require all drivers to carry at least 30/60/25 for bodily injury and property damage

- The cheapest auto insurance company in Texas is State Farm

- To find the cheapest car insurance rates in Texas, make sure to compare multiple Texas car insurance quotes

| Texas Statistics Summary | Details |

|---|---|

| Road Miles | Total in State: 313,596 Vehicle Miles Driven: 243,076 Million |

| Vehicles | Registered: 20,431,631 Total Stolen: 68,546 |

| State Population | 28,701,845 |

| Most Popular Vehicle | Ford F150 |

| Uninsured Motorists | 14.10% State Rank: 16th |

| Total Driving Fatalities | 2008-2017 Speeding: 12,024 Drunk Driving: 13,450 |

| Annual Average Premiums | Liability: $528.75 Collision: $374.49 Comprehensive: $206.42 |

| Cheapest Providers | State Farm Mutual Auto and USAA |

Like Texas itself, in America, the car is a symbol of freedom and independence. Texas shows this spirit through its unique car culture, and its many roadways, which are conducive to driving long stretches alone. But, to do that, you should have adequate car insurance coverage.

That’s where we come in. In this Texas auto insurance review, we’ll cover the state-required minimum car insurance, additional coverage, the factors that set rates, laws, and everything else related.

What is the average car insurance cost in Austin, TX? Who offers the best car insurance rates in Houston? Who has the best Texas car insuranced? We have the answers you need.

So, hop on board, and let’s get started. But first, to start comparison shopping for insurance, enter your ZIP code for a FREE quote.

Texas Car Insurance Coverage & Rates

If you search for car insurance rates among different carriers, they can vary widely. You may wonder if they just charge whatever they feel like charging.

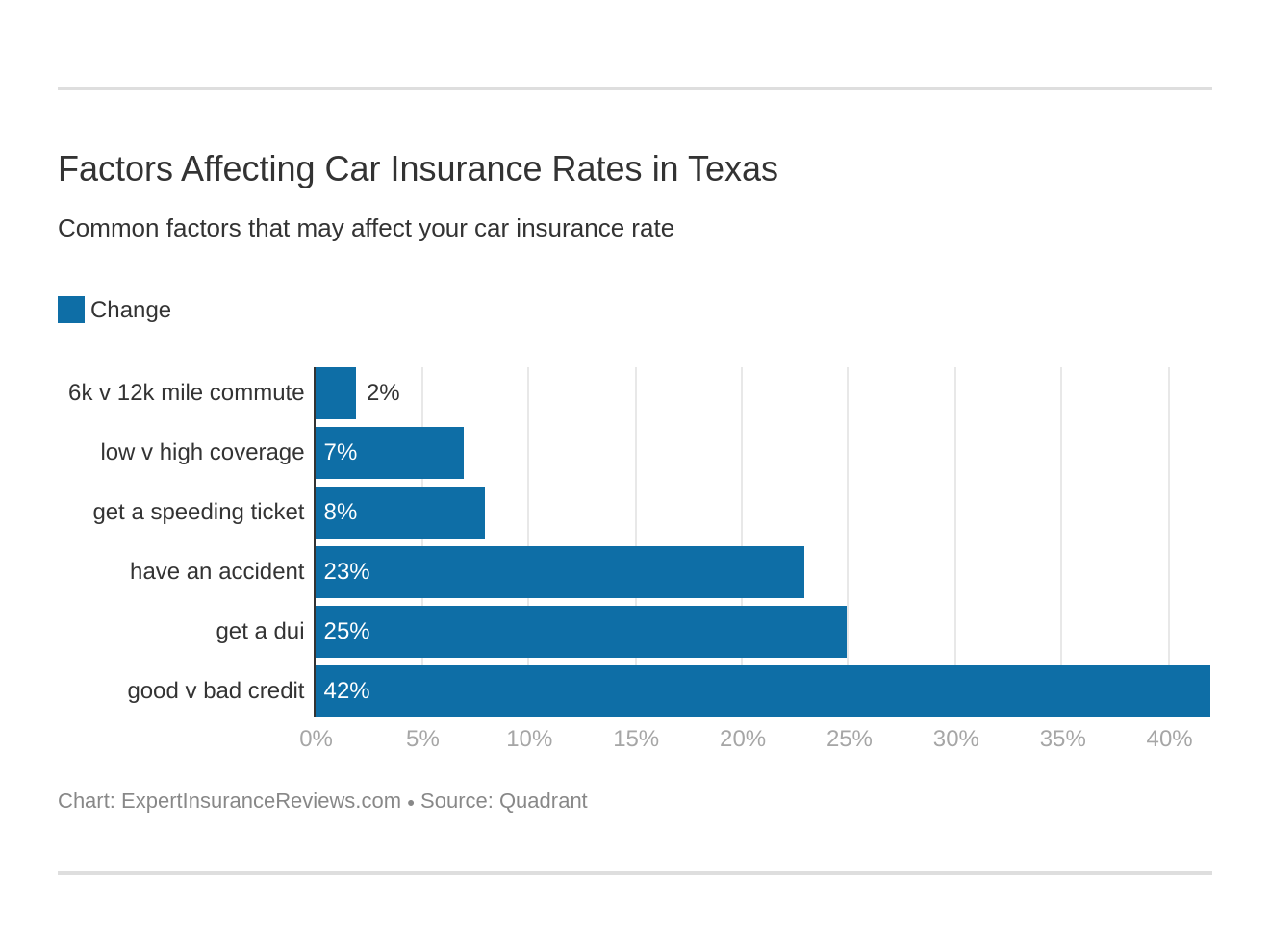

Part of rate-setting involves the type of coverage you buy, but other factors, such as your age, gender, and driving history, may be involved. Read our guide on the top 12 factors that affect car insurance rates to learn more.

Read on to find out more about your different coverage options in the Lone Star State and how they can affect your rates.

Texas Minimum Coverage

When looking for the best auto insurance in Texas, drivers must carry minimum amounts of liability insurance coverage to pay for damages and medical bills from an accident. As part of the Lone Star State’s system of assigning fault to drivers, they’re required to have insurance as proof of their ability to pay for these losses.

As such, the state has set minimum amounts of liability coverage each driver must buy:

- $30,000 in bodily injury liability per person injured in an accident you cause

- $60,000 for total bodily injury liability when two or more people are injured in an accident you cause

- $25,000 in property damage per accident you cause

But, sometimes, despite the minimum requirements, your insurance might not cover all the damage, especially if more than a few vehicles are involved. That’s why we recommend you buy more than the minimum required.

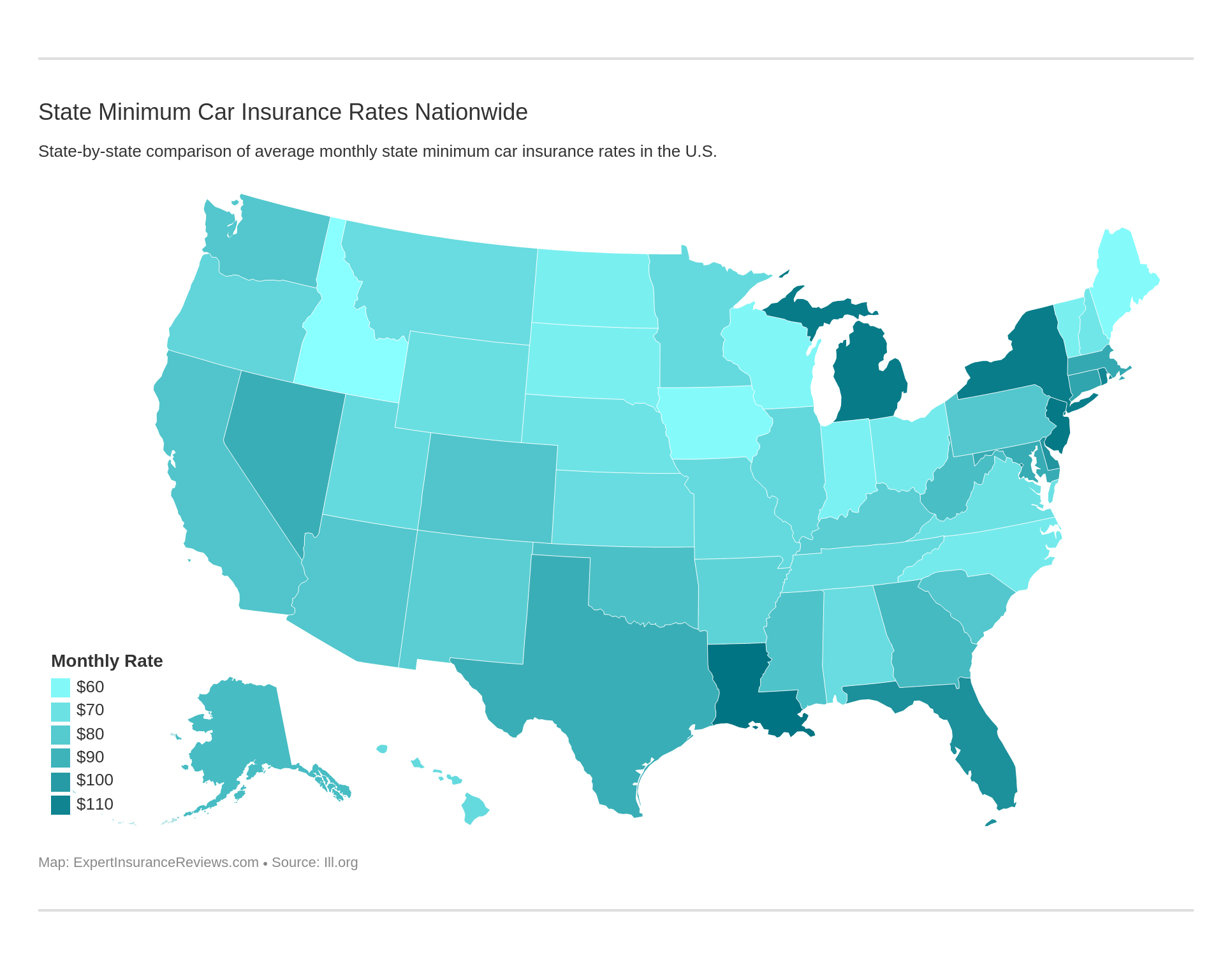

The cost of minimum coverage varies from state to state.

Forms of Financial Responsibility

A minimum liability car insurance policy in Texas serves as proof of your financial responsibility for damages from an accident. As we mentioned before, if you cause an accident in Texas, you’re legally “at fault,” or responsible, for paying the costs of personal injury and property damage.

Besides the state-required minimum coverage, below are other acceptable forms of financial responsibility:

- $55,000 in cash or a cashier’s check to be held with a county judge in the county where the car is registered

- $55,000 in cash or securities deposited with the state’s comptroller

- A self-insurance certificate from the Texas Department of Public Safety — if you own a fleet of more than 25 cars

- A surety bond from two individual sureties that own property in Texas, with the same coverage limitations as liability insurance

Drivers in Texas must carry proof of insurance with them at all times. It can take the form of the following:

- A valid liability insurance card, an electronic liability insurance card on a mobile device, or a photo of your insurance card

- A copy of your current car’s insurance policy

- A valid insurance binder (a temporary form of car insurance)

If you can’t provide proof of insurance when a law enforcement officer requests it, you’ll face penalties. They include a driver’s license suspension, fines of up to $350 for a first offense and up to $100 for subsequent offenses, and vehicle impoundment for up to 180 days.

Premiums as a Percentage of Income

In 2014, the average Texan’s annual per capita disposable income — after taxes — was $41,090.

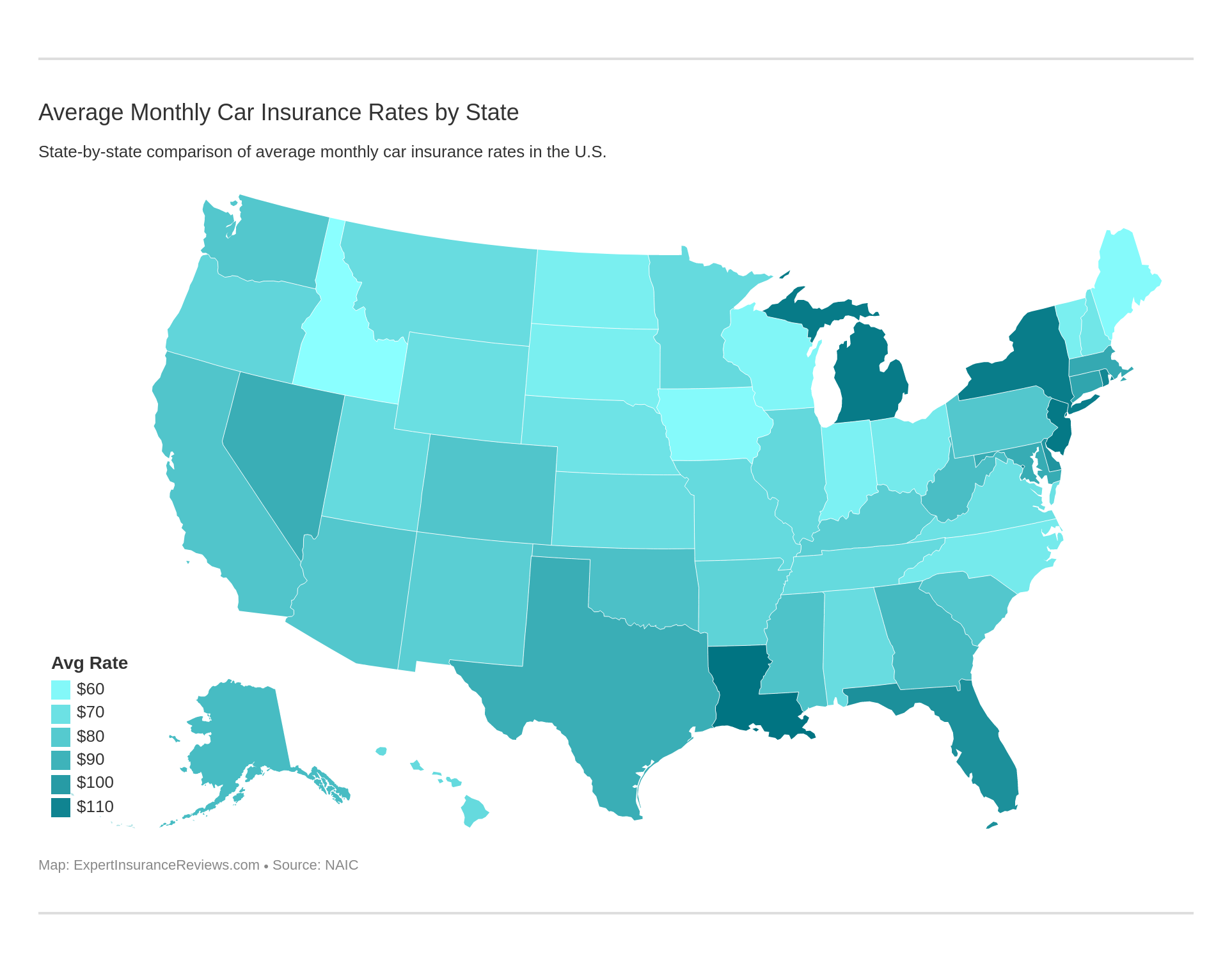

That same year, Texans paid an average of $1,066.20 for full coverage car insurance, which amounts to 2.59 percent of their income. That’s equal to an average of $88 monthly and is more than the national annual average for car insurance policies, $981.77.

Residents in nearby states New Mexico and Arkansas paid slightly less than Texans for their car insurance, averaging less than $1,000 yearly.

Overall, car insurance costs increased a little for everyone from 2012 to 2014.

Average Monthly Car Insurance Rates in TX (Liability, Collision, Comprehensive)

Three different types of insurance make up full or core coverage: liability, collision, and comprehensive. Below is data from the National Association of Insurance Commissioners showing the average rates for core coverage in Texas.

| Coverage Type | Annual Costs (2015) |

|---|---|

| Liability | $528.75 |

| Collision | $374.49 |

| Comprehensive | $206.42 |

| Combined | $1,109.66 |

Expect rates to continue to rise in 2019 and beyond.

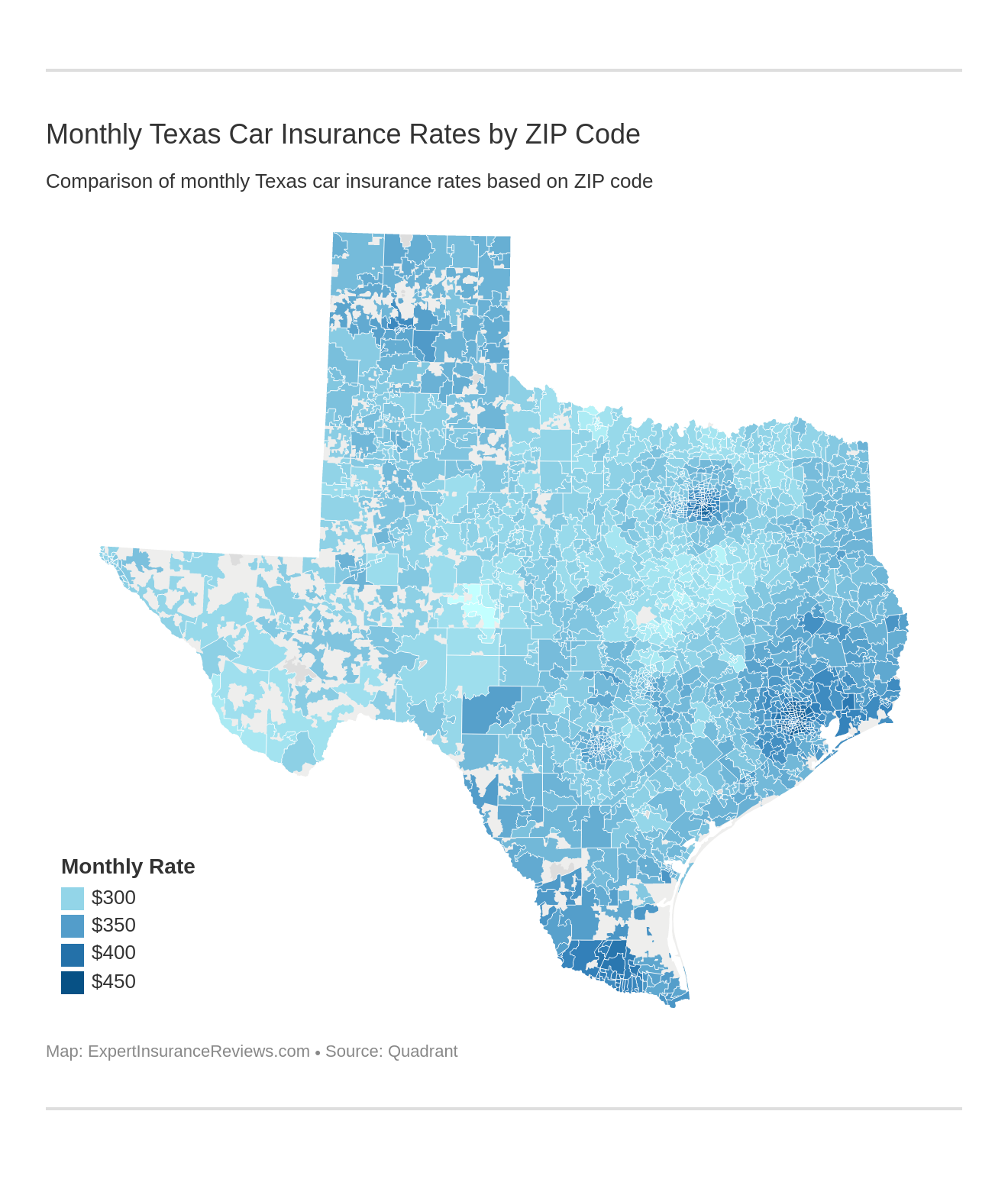

Let’s take a look at how where you live in Texas affects your rates.

The state-required minimum car insurance covers only part of the potential damage and bodily injury costs you can incur from an accident. Together with liability coverage, comprehensive and collision fill in the rest of the gaps in coverage.

Comprehensive car insurance pays for damage from “acts of God” like hailstorms, hurricanes, or floods. Collision pays for damage if you hit another object, such as a dumpster or another car. See our guide on the best collision coverage car insurance companies.

As you can see, having all three types of insurance as part of a full coverage policy offers more protection and greater peace of mind.

Next, we’ll cover more types of liability you can add to a car insurance policy.

Additional Liability

Additional liability will cover expenses beyond a standard policy. It includes the following:

- Personal injury protection – It helps cover medical costs for anyone involved in an accident, regardless of who is at fault.

- Medical payments (MedPay) coverage – It pays for medical expenses for you and anyone else listed on your policy, regardless of who is responsible.

- Uninsured/underinsured motorist coverage – It will cover damages from an accident with an uninsured or underinsured driver.

The below data from NAIC shows the average insurer’s loss ratio in Texas. A company’s loss ratio reveals how much it earns compared to the premiums it writes. A loss ratio higher than 100 percent means the company pays more in premiums and is taking losses on them. If it’s well below 100 percent, the company pays few claims.

| Loss Ratio | 2014 | 2013 | 2012 |

|---|---|---|---|

| Personal Injury Protection | 60.73% | 66.3% | 64.35% |

| Medical Payments | 69.55% | 68.78% | 65.76% |

| Uninsured/Underinsured Motorist Coverage | 64% | 61.36% | 53.54% |

The loss ratios above show that Texas car insurance companies have a good profit versus loss ratio for MedPay and uninsured/underinsured motorist coverage.

Texas currently ranks 16th nationwide for the highest number of uninsured drivers. Fourteen percent of motorists there take the wheel without coverage.

With so many uninsured drivers on the road, unfortunately, you never know what can happen. To protect yourself, your loved ones, and those around you, we recommend you buy uninsured/underinsured motorist and additional liability coverage.

Add-Ons, Endorsements, & Riders

The following are more types of coverage you can add to a basic car insurance policy in Texas:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-as-You-Drive or Usage-Based Car Insurance

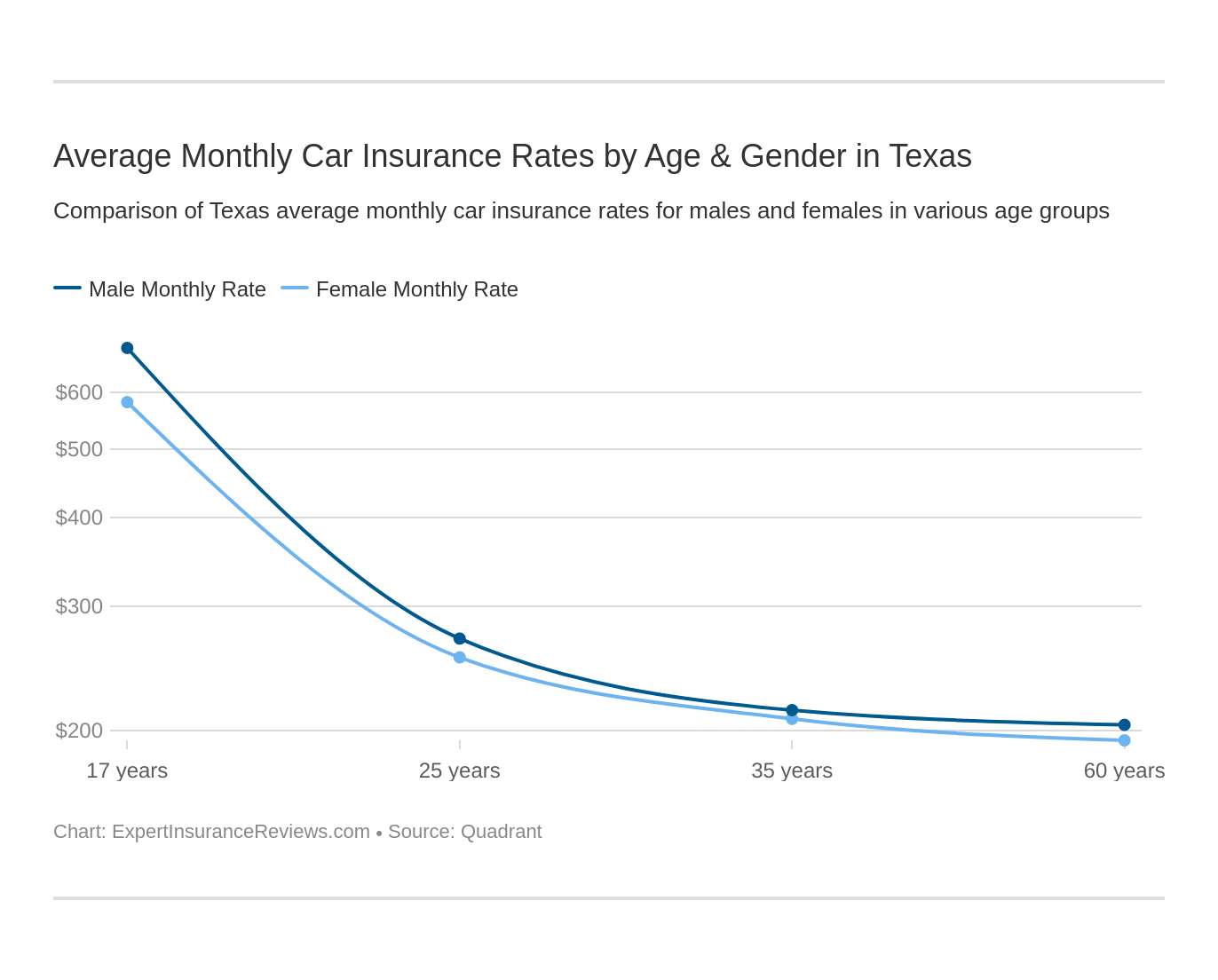

Average Car Insurance Rates by Age & Gender in TX

We’ve partnered with Quadrant to bring you the data below. It’s based on coverage the state population has purchased and includes rates for high-risk drivers and those who choose to buy more than the state minimum. It also includes other types of insurance the state doesn’t require.

Gender and age affect your car insurance rates in Texas. Let’s see how much it amounts to among the difference carriers:

| Company | Married 35-Year Old Female Annual Rates | Married 35-Year Old Male Annual Rates | Married 60-Year Old Female Annual Rates | Married 60-Year Old Male Annual Rates | Single 17-Year Old Female Annual Rates | Single 17-Year Old Male Annual Rates | Single 25-Year Old Female Annual Rates | Single 25-Year Old Male Annual Rates |

|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $3,564.65 | $3,599.14 | $3,520.01 | $3,520.01 | $9,359.61 | $11,309.20 | $4,410.14 | $4,599.76 |

| The General Automobile Ins Co Inc | $2,918.37 | $3,249.14 | $2,712.68 | $3,109.48 | $7,713.17 | $10,116.84 | $4,191.50 | $4,782.23 |

| Geico County Mutual Ins Co. | $2,433.73 | $2,622.73 | $2,340.42 | $2,649.67 | $5,298.09 | $5,502.21 | $2,632.39 | $2,627.86 |

| Nationwide CCMIC | $2,430.55 | $2,473.88 | $2,146.15 | $2,275.09 | $6,856.66 | $8,817.88 | $2,851.87 | $3,088.49 |

| Progressive Cty Mtl | $2,496.28 | $2,372.24 | $2,219.05 | $2,262.84 | $10,406.29 | $11,607.15 | $2,956.93 | $2,997.99 |

| State Farm Mutual Auto | $2,020.71 | $2,020.71 | $1,797.39 | $1,797.39 | $4,814.71 | $6,130.76 | $2,195.23 | $2,262.71 |

| USAA | $1,594.84 | $1,608.07 | $1,522.66 | $1,516.79 | $4,423.33 | $4,827.05 | $2,125.64 | $2,286.61 |

As you’ll notice above, the highest prices for both genders include the least experienced drivers, seventeen-year-olds. Their premiums cost as much as $8,000 more than for older age groups. By age 25, car insurance rates decrease, and they continue to do so for 30- to 60-year-olds.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Best Car Insurance Companies in Texas

With so many car insurance companies and different types of car insurance coverage options available, finding the right car insurance for your needs can be confusing.

To help you find the best company for you, we’ve gathered information about the financial strength of the top carriers, reviews, and even some complaints.

Keep reading to learn more about the best car insurance companies.

The Largest Companies’ Financial Rating

A.M. Best evaluates insurance companies and ranks them based on their financial stability. Companies with a good score are more likely to be able to pay customers’ claims. These are A.M. Best’s ratings for the ten largest insurers in Texas.

| Company | AM Best Rating | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|---|

| State Farm Group | A++ | $3,563,120 | 78.29% | 16.83% |

| Geico | A++ | $2,637,489 | 88.18% | 12.46% |

| Allstate Insurance Group | A+ | $2,362,584 | 66.19% | 11.16% |

| Progressive Group | A+ | $2,041,345 | 68.91% | 9.64% |

| Farmers Insurance Group | NR | $1,842,735 | 66.07% | 8.70% |

| USAA Group | A++ | $1,712,949 | 88.30% | 8.09% |

| Liberty Mutual Group | A | $1,195,735 | 83.96% | 5.65% |

| Texas Farm Bureau Mutual Group | A- | $693,004 | 77.31% | 3.27% |

| Consumers County Mutual Insurance Co | NR | $541,825 | 86.45% | 2.56% |

| Nationwide Corp Group | A+ | $473,342 | 65.53% | 2.24% |

State Farm, Geico, and USAA achieved the highest ranking of “A++” in the Lone Star state. That’s a sign they have earned a profit over the long term and are poised for continued success.

Companies with Best Ratings

J.D. Power’s Auto Insurance Study rates the top insurance companies based on their overall customer satisfaction. These are their rankings for insurers in the Texas Region based on a 1,000-point scale.

| Insurer | Points | Power Circles |

|---|---|---|

| TX Farm Bureau | 857 | five |

| Allstate | 836 | three |

| GEICO | 836 | three |

| State Farm | 835 | three |

| Texas Average | 835 | three |

| Farmers | 834 | three |

| Auto Club of Southern California Insurance Group | 831 | three |

| Nationwide | 829 | three |

| Progressive | 816 | two |

| Liberty Mutual | 802 | two |

| USAA* | 894 | five |

“Power Circle” legend:

- five = among the best

- four = better than most

- three = above average

- two = the rest

Texas Farm Bureau topped the list in J.D. Power’s survey by earning five “Power Circles” that show it’s “among the best” insurers.

*USAA is an insurance provider open only to U.S. military and their families, and therefore, J.D. Power didn’t include it in their rankings.

Companies with the Most Complaints in Texas

Nobody’s perfect. The number of complaints a company receives reveals customer dissatisfaction, yet how they handle them tells a lot about their level of service.

The table below shows the NAIC’s most recent complaint data for the 10 largest car insurance companies in Texas.

| Company | National Median Complaint Ratio | Company Complaint Ratio 2017 | Total Complaints 2017 |

|---|---|---|---|

| State Farm Group | 1 | 0.44 | 1482 |

| Geico | 0.007 | 6 | |

| Allstate Insurance Group | 1 | 0.5 | 163 |

| Progressive Group | 1 | 0.75 | 120 |

| Farmers Insurance Group | 1 | 0.59 | 7 |

| USAA Group | 0 | 2 | |

| Liberty Mutual Group | 1 | 5.95 | 222 |

| Texas Farm Bureau Mutual Group | 1 | 0.16 | 3 |

| Consumers County Mutual Insurance Co | 1 | 0.1 | 5 |

| Nationwide Corp Group | 1 | 0.28 | 25 |

Though it has a lower market share when compared to State Farm and other insurers in Texas, Liberty Mutual has a fairly high complaint ratio of “six.” That’s above the national average of one, and in 2017 alone, the company received over 200 complaints, more than its competitors.

Cheapest Car Insurance Companies in Texas

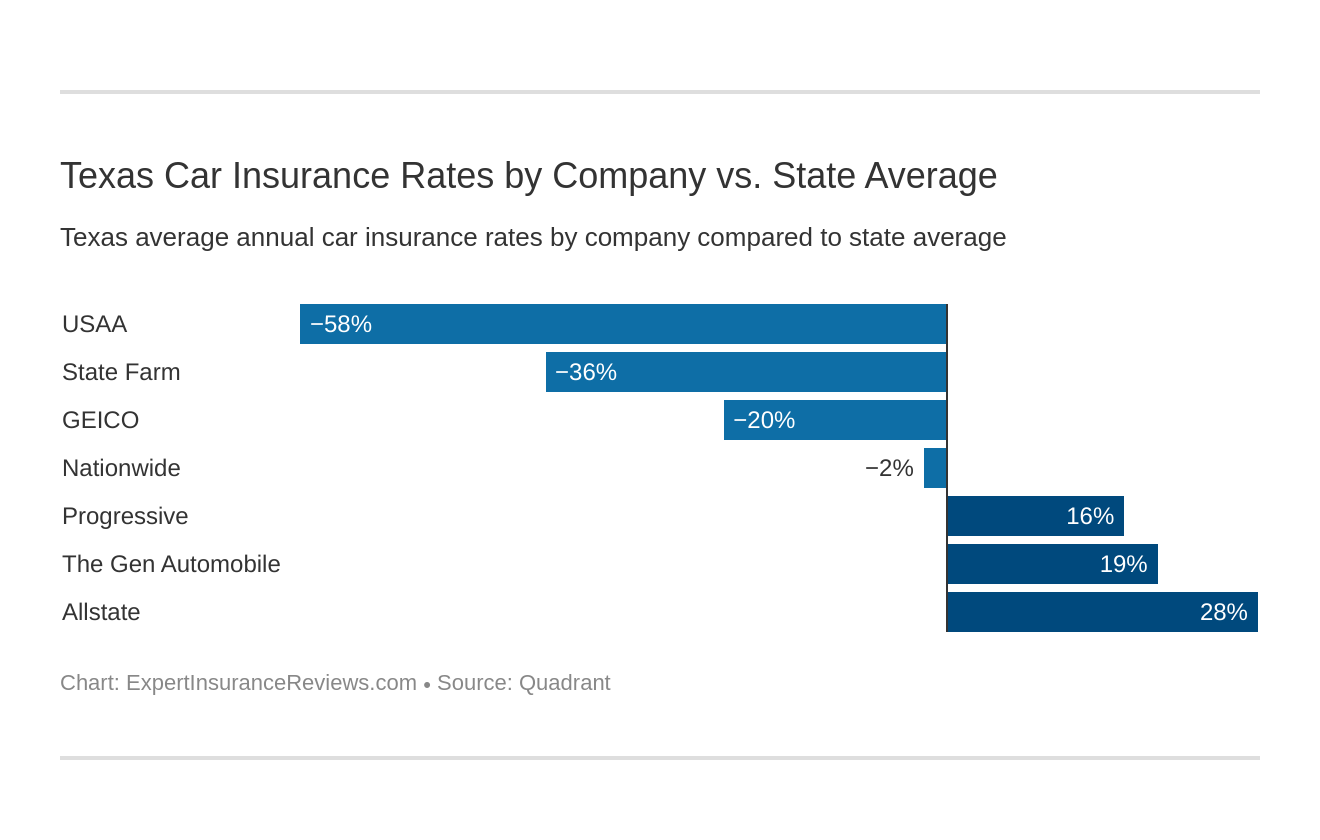

Now we’re going to explore which carriers, on average, offer the best rates statewide.

| Company | Average Annual Rates | Compared to State Average | Percentage Compared to State Average |

|---|---|---|---|

| Allstate F&C | $5,485.32 | $1,556.98 | 28.38% |

| The Gen Automobile Ins Co Inc | $4,849.18 | $920.84 | 18.99% |

| Geico County Mutual Ins Co. | $3,263.39 | -$664.95 | -20.38% |

| Nationwide CCMIC | $3,867.57 | -$60.77 | -1.57% |

| Progressive Cty Mtl | $4,664.85 | $736.51 | 15.79% |

| State Farm Mutual Auto | $2,879.95 | -$1,048.39 | -36.40% |

| USAA | $2,488.12 | -$1,440.22 | -57.88% |

Allstate F&C has the highest rates in Texas, at 28 percent above the state average.

Commute Rates by Companies

How far you drive regularly also factors into your car insurance rates. Here’s how the top carriers in the state compare for average commute distances.

| Group | 10 miles commute, 6000 annual mileage | 25 miles commute, 12000 annual mileage |

|---|---|---|

| Allstate | $5,354.10 | $5,616.53 |

| American Family | $4,849.18 | $4,849.18 |

| Geico | $3,201.27 | $3,325.50 |

| Nationwide | $3,867.57 | $3,867.57 |

| Progressive | $4,664.85 | $4,664.85 |

| State Farm | $2,879.95 | $2,879.95 |

| USAA | $2,456.42 | $2,519.83 |

Several insurers in Texas don’t increase their rates for 10- to 25-mile commutes: State Farm, Nationwide, Progressive, and American Family. Among those who do, USAA had the lowest increase between the two mileages, at roughly $63.

Commute times are not the only factor that affect your rates.

Coverage Level Rates by Companies

How much insurance you buy, whether it’s just liability, collision, or comprehensive — or all of them rolled into full coverage — also affects your premium costs. Let’s see how much they can change with each type of insurance.

| Group | Annual Rates with Low Coverage | Annual Rates with Medium Coverage | Annual Rates with High Coverage |

|---|---|---|---|

| Allstate | $5,361.24 | $5,438.89 | $5,655.81 |

| American Family | $4,517.27 | $4,672.73 | $5,357.52 |

| Geico | $3,090.73 | $3,221.75 | $3,477.68 |

| Nationwide | $4,165.19 | $3,701.00 | $3,736.52 |

| Progressive | $4,431.31 | $4,642.33 | $4,920.90 |

| State Farm | $2,729.50 | $2,870.49 | $3,039.86 |

| USAA | $2,403.46 | $2,477.96 | $2,582.94 |

State Farm, USAA, and Allstate have the lowest price differences from the lowest to the highest coverage levels — an average of $150 to $300. This means that for a few dollars more, the best protection with full coverage is affordable for some car insurance buyers.

Credit History Rates by Companies

Your credit score is another major influence on car insurance costs. Let’s see how much rates can change with poor, fair, or good credit.

| Group | Annual Rates with Good Credit | Annual Rates with Fair Credit | Annual Rates with Poor Credit |

|---|---|---|---|

| Allstate | $4,370.89 | $5,107.95 | $6,977.11 |

| American Family | $3,672.27 | $4,205.41 | $6,669.84 |

| Geico | $1,902.16 | $2,851.60 | $5,036.40 |

| Nationwide | $3,235.20 | $3,722.88 | $4,644.64 |

| Progressive | $4,201.38 | $4,536.59 | $5,256.57 |

| State Farm | $2,023.50 | $2,538.85 | $4,077.51 |

| USAA | $1,696.02 | $2,109.52 | $3,658.82 |

According to Experian, the average credit score in the state of Texas in 2017 was 656. The state was among the top 10 with the lowest credit scores. The average Texans’ credit score was about 20 points lower than the national average score of 675.

Compared to other insurers, Progressive offered the lowest price increase — only $1,000 — from poor to good credit. With several other companies, costs varied from $2,000 to $3,000 or more.

Driving Record Rates by Companies

If you have even one violation on your driving record, your rates can increase by thousands of dollars. Here’s how they can change with some common driving penalties.

| Group | Clean record | With 1 speeding violation | With 1 accident | With 1 DUI |

|---|---|---|---|---|

| Allstate | $4,270.52 | $4,270.52 | $6,562.28 | $6,837.95 |

| American Family | $4,418.84 | $4,418.84 | $5,627.66 | $4,931.37 |

| Geico | $2,769.60 | $3,570.55 | $3,651.43 | $3,061.96 |

| Nationwide | $3,351.99 | $3,789.11 | $3,351.99 | $4,977.19 |

| Progressive | $4,066.74 | $4,581.27 | $5,258.36 | $4,753.00 |

| State Farm | $2,561.35 | $2,561.35 | $2,934.63 | $3,462.47 |

| USAA | $1,858.11 | $2,132.96 | $2,737.39 | $3,224.03 |

For the most minor infraction listed, one speeding ticket, not every insurer raises rates. American Family and Allstate “forgave” drivers for this penalty and didn’t increase their premiums.

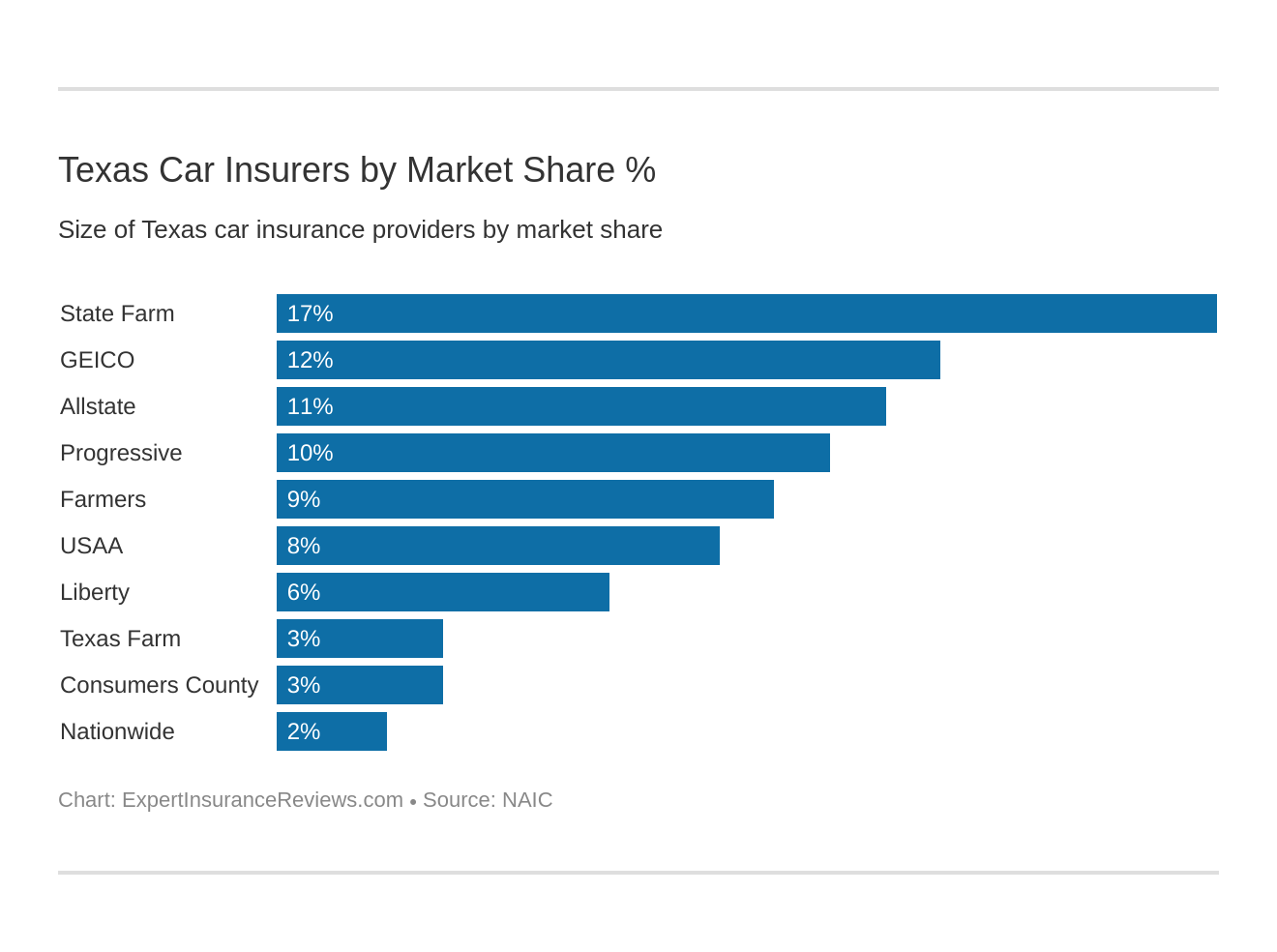

Largest Car Insurance Companies in Texas

The data below uses market share, loss ratio, and the number of direct premiums written to show which top insurers are the largest.

| Insurance Company | Direct Written Premiums | Loss Ratio | Market Share |

|---|---|---|---|

| State Farm Group | $3,563,120 | 78.29% | 16.83% |

| Geico | $2,637,489 | 88.18% | 12.46% |

| Allstate Insurance Group | $2,362,584 | 66.19% | 11.16% |

| Progressive Group | $2,041,345 | 68.91% | 9.64% |

| Farmers Insurance Group | $1,842,735 | 66.07% | 8.70% |

| USAA Group | $1,712,949 | 88.30% | 8.09% |

| Liberty Mutual Group | $1,195,735 | 83.96% | 5.65% |

| Texas Farm Bureau Mutual Group | $693,004 | 77.31% | 3.27% |

| Consumers County Mutual Insurance Co | $541,825 | 86.45% | 2.56% |

| Nationwide Corp Group | $473,342 | 65.53% | 2.24% |

With the greatest market share and amount of direct premiums written combined with a decent loss ratio, State Farm and GEICO capture a fair amount of car insurance customers in Texas.

Number of Insurers by State

Foreign companies were formed in other states but are licensed to operate in Texas, while domestic insurers were incorporated in the Lone Star State.

| Domestic | Foreign | Total Number of Licensed Insurers |

|---|---|---|

| 199 | 937 | 1136 |

Fewer than one-quarter of the insurers in Texas were founded there.

Now that we’ve covered some of the biggest factors in setting car insurance rates, we’ll go over another major influence on rates: laws.

Texas Laws

Ignorance of the law is no excuse, as they say. But it can be hard to keep track of all of the laws on the books.

Below, we’ll cover the ones you should pay the most attention to, and we’ll cover what happens if you disobey them. These include Texas car insurance laws, rules for “high-risk” drivers, windshield coverage, and more.

Are you ready to find out more? Read on.

Texas Car Insurance Laws

Many of us aren’t entirely familiar with state insurance laws, so this section will serve as a refresher.

How State Laws for Insurance are Determined

Each state determines the type of tort law and threshold (if any) that applies, the type and amount of liability insurance to require, and the system they use to approve insurer rates and forms.

Insurance companies in Texas must meet the regulations the state insurance commissioner sets per the fair competition standards of the National Association of Insurance Commissioners (NAIC). To set rates and file forms, insurers in the Lone Star State must get prior approval from the Texas Department of Insurance.

Approval can occur through a deemer provision, which indicates approval if the state commissioner doesn’t deny forms/rates within a certain number of days.

Windshield Coverage

According to CarWindshields.Info, Texas lets insurers make repairs with used and aftermarket parts if they’re “of like, kind, and quality.” The consumer also has the right to choose the repair vendor.

You may be able to get a zero-deductible with windshield coverage under a comprehensive car insurance policy. Not every carrier offers it, but you may be able to find the right policy for you. While you research plans, look at how the different insurance providers handle windshield claims.

High-Risk Insurance

High-risk insurance helps drivers who have a history of accidents or traffic violations and can’t buy coverage through a standard insurance carrier.

According to the Texas Department of Public Safety, high-risk drivers must file a Financial Responsibility Insurance Certificate (SR-22) to verify that they have liability insurance.

Texas also offers a program, the Texas Automobile Insurance Plan Association (TAIPA), to help “high-risk” drivers buy insurance. To qualify, at least two carriers must have denied them coverage within 60 days. Their insurance carrier must apply on their behalf. They don’t need proof of refusal to insure, but they must sign a statement.

TAIPA offers the state-required minimum coverage and the following types and levels:

- $2,500 Personal Injury Protection (PIP) — Medical Payments coverage not available

- $30,000/60,000/25,000 of Uninsured/Underinsured Motorist coverage

This state-administered program lets insurance companies share the risk associated with your policy among a pool of other insurers. You may, however, end up paying more for insurance compared to standard premiums. And, there is a quota, which means that each insurer must offer coverage to a limited number of high-risk drivers depending on their market share. Find out the best car insurance companies for high risk drivers.

Low-Cost Insurance

Though Texas has a program to help high-risk drivers, it doesn’t have one for low-income drivers.

California, Hawaii, and New Jersey are the only states with government-funded programs to help low-income drivers pay for their car insurance.

Automobile Insurance Fraud in Texas

Insurance fraud is the second-largest economic crime in America. It affects premium rates and the prices consumers pay for goods and services. If those fraud numbers continue to rise, it’s more likely insurers will pass some of the costs in investigating them on to you in higher premiums.

There are two types of fraud: hard and soft.

- Hard Fraud – A purposefully fabricated claim or accident

- Soft Fraud – A misrepresentation of information to the insurance company

Soft fraud is more common than hard fraud. Twenty to 40 percent of consumers admitted to lying to their insurers about one of the following:

- The number of annual miles driven

- The number of drivers in the household

- How they will use the vehicle

Even the little white lie you tell to get a lower rate has consequences. That intentional misrepresentation of facts is known as “rate evasion” and costs auto insurers $16 billion annually. They pass those costs onto consumers in the form of higher premiums.

Auto insurance fraud is a crime in Texas and includes the following penalties:

- When the claim amount is less than $50: Anything lower than $50 is considered a “Class C” misdemeanor, with a fine of $500.

- When the claim amount is more than $200,000: fines up to $10,000 and/or jail time of five to 99 years.

In 2017, the Texas fraud unit received 7,756 reports of motor vehicle insurance fraud, which made up more than 60 percent of the overall insurance fraud claims.

The Texas Department of Insurance investigates insurance fraud. You can report fraud through an online form.

Statute of Limitations

The statute of limitations is the time you have left to file a legal claim. In Texas, you have two years from the time of an accident to file a lawsuit for personal injury and property damage.

Evidence can degrade and witnesses can be hard to keep track of over time, so it’s best to file sooner rather than later.

State-Specific Laws

According to Texas traffic codes, before drivers make a U-turn, they must ensure it’s safe and legal to do so. Drivers may only make U-turns if they can see at least 500 feet in the direction of oncoming traffic. If you can’t make a turn safely, it’s illegal to do so — you risk getting a ticket for reckless driving.

If there’s no sign prohibiting a U-turn, and oncoming traffic is visible for 500 feet, a driver may make a legal U-turn under the same rules as a left turn.

Vehicle Licensing Laws

Want to know about Lone Star State vehicle licensing laws? Below, we’ll cover the requirements for getting and renewing a driver’s license and the state’s “points” system for penalties.

REAL ID

Texas complies with the federal REAL ID program slated to go into effect on Oct. 1, 2020. It requires a REAL ID for entry into federal buildings and to board domestic flights. The program stems from national security measures and federal identification standards adopted after the Sept. 11, 2001, terrorist attacks in the U.S.

In 2016, Texas started issuing REAL ID-compliant cards, which feature a gold circle with a star in the upper right-hand corner.

Those interested in getting a REAL ID driver’s license or identification card, must apply in person at their local Department of Motor Vehicles (DMV) and bring the following documents:

- An original or certified copy of a birth certificate issued by a State Bureau of Vital Statistics or equivalent Agency from a U.S. State, U.S. Territory, the District of Columbia, or an unexpired U.S. passport book or card

- Social security card

- Current Texas vehicle registration or title

- Current automobile insurance policy or an automobile insurance statement

The DMV may not accept laminated copies or photocopies.

The news report below goes into the requirements for getting a REAL ID. Senior citizens in the state may face difficulties if they don’t have birth certificates or passports:

Penalties for Driving Without Insurance

In Texas, you must show proof of insurance in the following situations:

- Whenever a police officer asks for it

- If you get into a car accident

- When you register or renew your car’s registration

- When you apply for or renew your driver’s license

- When your car undergoes an inspection

Several government agencies, including local police and sheriff departments, use the online TexasSure program to verify whether drivers have car insurance. If the system shows a driver is uninsured or there is inconsistent information regarding their insurance, they may receive the following notices:

- Unmatched notice – Drivers will get this notice if they’re on record as having car insurance, but the coverage doesn’t match the car registration.

- Uninsured notice – Drivers will get this notice if they’ve registered a vehicle without car insurance.

As we mentioned earlier, the state accepts certain proof of insurance or financial responsibility. The table below details the penalties for driving without car insurance:

| Penalties for Driving Without Insurance in Texas | Details |

|---|---|

| First Offense | - Fine: $175 to $350 fine - pay up to a $250 surcharge every year for three years (may be reduced with certain requirements) |

| Second Offense | - Fine: $350 to $1000 - pay up to a $250 surcharge every year for three years (may be reduced with certain requirements) - suspend the driver's license and vehicle registrations of the person unless the person files and maintains evidence of financial responsibility with the department until the second anniversary of the date of the subsequent conviction - Impoundment: for 180 days and cannot apply for release of car without evidence of financial responsibility and impoundment fee of $15/day |

In Texas, the penalties for driving without insurance are pretty strict, which is why you shouldn’t leave home without it.

Teen Driver Laws

Young drivers in Texas age 15 or older must pass a graduated licensing program to get a learner’s permit before they qualify for a full license. The DMV will only issue a permit to those who satisfactorily complete the classroom phase of a driver’s education course.

Below are the state requirements for getting a license.

| Requirements for Getting a License in Texas | Details |

|---|---|

| Mandatory Holding Period | 6 months |

| Minimum Supervised Driving Time | 30 hours, 10 of which must be at night |

| Minimum Age | 16 years old (the minimum license age is 18 for applicants who have not completed driver education) |

Teens can apply for a provisional or intermediate license if they’ve satisfied the requirements under the learner’s permit. These are the laws for young drivers with a restricted license.

| Restricted License Laws in Texas | Details |

|---|---|

| Nighttime restrictions | midnight-5 a.m. |

| Passenger restrictions (family members excepted unless noted otherwise) | no more than one passenger younger than 21 - secondary enforcement |

| Minimum age at which restrictions may be lifted | |

| Nighttime restrictions | until age 18 |

| Passenger restrictions | until age 18 |

Driver License Renewal Procedures

Texas has different license renewal requirements based on the driver’s age. Drivers younger than age 85 must renew their licenses every eight years. Those 85 or older must renew their licenses every two years.

Texans can renew their licenses within a year before they’re supposed to expire and up to two years after their licenses have expired. However, if two years have passed since the license expired, you must apply for a new one.

The DMV requires proof of adequate vision for drivers younger than age 79 if they renew in person. Drivers age 79 or older must provide proof of adequate vision at every renewal.

Methods of renewal: If you’re younger than age 79, you can renew your license by phone, mail, or online at every other renewal. Drivers under 18 and older than 79 must renew their licenses in person at a local DMV office.

New Residents

New Texans have 30 days from the time they move to register their vehicles and up to 90 days to apply for a new driver’s license.

Upon applying, drivers aged 18 or older must surrender any unexpired driver license from another U.S. state or territory or Canadian province. They don’t have to take knowledge or skills tests or meet driver’s education requirements.

Applicants with a driver’s license from any country other than the U.S., Canada, France, South Korea, Germany, or Taiwan must take and pass both the knowledge and skills exams.

Applicants with a valid, unexpired learner’s license from another U.S. state or territory, Canada, France, South Korea, Germany, or Taiwan, and who are applying for a Texas learner’s permit can skip the knowledge exam. Once they get a full driver’s license, they must complete the Impact Texas Driver course and pass the skills exam.

New residents under the age of 25 must also complete driver education.

Applicants must provide the following documents:

- Proof of identity (a valid out of state license can count as a supporting document)

- Proof of residency

- Proof of citizenship or lawful presence

- Social security number

- Evidence of Texas Vehicle Registration for each vehicle you own. Registration must be current. (New Residents who are surrendering an out-of-state driver’s license only.)

- Proof of insurance for each vehicle you own or a signed statement that you don’t own a car.

Proof of insurance must meet minimum coverage requirements of $30,000 per injured person, up to a total of $60,000 for everyone injured in an accident, and $25,000 for property damage.

Negligent Operator Treatment System (NOTS)

According to the Texas Department of Public Safety, as of September 1, 2019, the state repealed its Driver Responsibility Program. As it states:

“The Department of Public Safety has reinstated all driver privileges that were previously suspended solely for having unpaid surcharges. If your license was suspended for other offenses, you may check the status of your driver license and determine any reinstatement requirements by visiting our License Eligibility page.

Additional information on the repeal of the program may be found at Driver Responsibility Program (Surcharge) Repeal FAQs.”

Drivers will still be responsible for any other suspensions, fines, or fees on their driving records.

Rules of the Road

We’ve covered licensing laws. Next, we’ll go over more regulations that affect your safety on the road.

Fault vs. No-Fault

As we mentioned before, Texas is an “at-fault” state. Drivers who cause an accident there must pay for personal injury and property damage costs.

If the “at-fault” driver has insurance, their insurer will pay for those losses up to the policy limits, and the driver will likely pay the rest.

In deciding responsibility or negligence for an accident claim or a lawsuit, the state follows a law of comparative fault in assigning a percentage of blame for damage awards.

The state uses a “51 percent rule.” This means that an injured victim (plaintiff) can’t get compensation if a judge or jury finds them to be 51 percent or more at fault for causing a crash.

Victims who are 50 percent or less at fault for an accident will receive compensation reduced to their level of responsibility. For example, if another driver rear-ended the plaintiff and the plaintiff was found to be 30 percent at fault, while the other driver was 70 percent responsible, the plaintiff would get $70,000 out of $100,000 in damages.

Seat Belt & Car Seat Laws

The table below contains data from the Insurance Institute for Highway Safety about Texas safety belt laws.

| Safety Belt Laws in Texas | Details |

|---|---|

| Effective Since | September 1, 1985 |

| Primary Enforcement | yes; effective 09/01/85 |

| Age/Seats Applicable | 7 years and younger who are 57 inches or taller; 8+ years in all seats |

| 1st Offense Max Fine | $200 |

And these are the child seat laws:

| Type of Car Seat Required | Age |

|---|---|

| Must be in child safety seat | 7 years and younger and less than 57 inches |

| Preference for rear seat | law states no preference for rear seat |

| Adult Belt Permissible | not permissible |

| Maximum base fine 1st offense, additional fees may apply | $25 minimum; maximum unlisted |

For a first-time car seat law offense, you can pay a fine of $45 plus fees.

Regarding cargo areas of pick up trucks, the Lone Star State restricts who can ride in them. It’s illegal for children to ride there, but the law doesn’t apply to riders aged 18 and older. It applies in the following situations:

- Vehicles that are the only ones that members of the household own

- Pickup trucks in parades, hayrides, or on beaches

- Vehicles in farm operations used to transport people from field to field or on a farm

- A pickup being used in an emergency

Keep Right & Move Over Laws

Texas’s “keep right” law requires drivers who are driving slower than the traffic around them to stay in the right lane. The state allows passing on the right on one-way roads or in other conditions.

The “move over” law requires motorists to slow down and maneuver to the closest lane if they approach a stationary emergency vehicle — including Texas DMV vehicles and tow trucks — using approved visual signals and traveling in the same direction.

Speed Limits

These are the speed limits on various Texas roads.

| Type of Roadway | Speed Limit |

|---|---|

| Rural Interstates | 75; 80 or 85 on specified segments of road |

| Urban Interstates | 75 mph |

| Other Limited Access Roads | 75 mph |

| Other Roads | 75 mph |

Ridesharing

In 2017, Texas established statewide standards for Transportation Network Companies (TNC), also known as ridesharing companies.

State law requires rideshare drivers to undergo criminal background checks yearly and carry the minimum auto insurance coverage. The state prohibits sex offenders from rideshare driving.

The liability insurance required for ridesharing drivers is $1 million for bodily injury and property damage total for each incident.

The following providers offer rideshare insurance in Texas:

- Allstate

- Farmers

- Geico

- Liberty Mutual

- Metlife

- Progressive

- USAA

Automation on the Road

The Insurance Institute for Highway Safety has provided the following data on automated vehicle laws in Texas.

| What type of driving automation on public roads does the law/provision permit? | Require an operator to be licensed? | Require an operator to be in the vehicle? | Require liability insurance? |

|---|---|---|---|

| Deployment | No | No | Yes |

The state has also formed a Connected and Autonomous Vehicle (CAV) Task Force to test self-driving cars.

Safety Laws

In this section, we’ll go over safe driving laws in Texas regarding DUI, marijuana, and distracted driving.

DUI Laws

The Texas Department of Transportation reports that every 20 minutes in the Lone Star State, someone is hurt or killed in an alcohol-related crash. With the high incidence of Driving While Intoxicated (DWI), it’s no wonder the state has strict laws, which appear below:

| DUI Laws in Texas | Details |

|---|---|

| Name for Offense | Driving under the influence (DUI) |

| BAC Limit | 0.08 |

| High BAC Limit | 0.15 |

| Criminal Status | 1st class B misdemeanor, 2nd in 5 years class A misdemeanor, 3rd+ third degree felonies |

| Look Back Period | unlimited/lifetime for sentencing; 5 years for 2nd+ when determining need for ID |

These are the penalties for drunk driving in Texas:

| Number of Offense | ALS or Revocation | Imprisonment | Fine | Other |

|---|---|---|---|---|

| 1st Offense | 90 days - 1 year, may be eligible for hardship permit | 72 hours - 6 months | no minimum, but up to $2000 +conviction based surcharge of $1000 for three consecutive years; if HBAC, surcharge is $1500 for three consecutive years | 24-100 hours community service; required evaluation, DUI education, and victim impact panel; possible ID |

| 2nds Offense | 180 days - 2 years, may be eligible for hardship permit | 30 days - 1 year | no minimum, but up to $4000 +conviction based surcharge of $1500 for three consecutive years; HBAC surcharge $2000 for three consecutive years | 80-200 hours community service; required evaluation, DUI education, and victim impact panel; required ID |

| 3rd Offense | 180 days - 2 years, may be eligible for hardship permit | 2-10 years | no minimum, but up to $10,000 | 160-600 hours community service; evaluation, DUI education, victim impact panel and ID required |

| 4th Offense | same as 3rd |

Also, did you know some Texas car insurance companies offer a discount to drivers who take a state-approved drug and alcohol awareness and/or defensive driving course? DWI offenders who must take the drug and alcohol awareness course also qualify for the discount.

The best way to avoid getting a DWI violation on your driving record is not to drink and drive. If you drink, designate a driver, call a cab, or spend the night where you are, if possible. Find out the best auto insurance after DUI.

Marijuana-Impaired Driving Laws

According to the Marijuana Policy Project, Texas allowed the first sales of low-THC medical cannabis in early 2018 under its Compassionate Use Program.

The law places a 0.5 percent cap on the level of THC prescribed to medical marijuana patients. Only patients with certain conditions can use it: intractable epilepsy, multiple sclerosis, ALS, terminal cancer, autism, spasticity, and incurable neurodegenerative diseases.

The state also allows the use of CBD oil. It hasn’t decriminalized marijuana use, and there are currently no laws in Texas that regulate driving under the influence of marijuana.

Distracted Driving Laws

Besides drug and alcohol use, distracted driving — regardless of the cause — is a major factor in car crashes.

These are the laws in Texas regarding distracted driving:

| Cell Phone Laws in Texas | Details |

|---|---|

| Hand-Held Ban | drivers in school crossing zones and on public school property during the time the reduced speed limit applies |

| Text Ban | all drivers |

| Young drivers all cellphone ban | drivers younger than 18 |

| Enforcement | primary |

Primary enforcement means that a law enforcement officer can pull you over if they catch you texting or committing other distracted driving violations.

Driving in Texas

With the many miles of Texas roadway, you have the freedom to go where you please. It can take hours to travel from one end of the state to the other, and you can run into some hazards along the way.

In this section, we’ll cover some of the biggest risks of car ownership — vehicle thefts and fatal accidents. The sobering statistics we present from the National Highway Traffic Safety Administration (NHTSA) serve as a reminder to drive safely at all times.

Keep reading to find out how these risks affect Texas drivers.

Vehicle Theft in Texas

The table below shows the top 10 stolen vehicles in Texas, together with the most popular model year.

| Make/Model | Year of Vehicle | Number of Thefts |

|---|---|---|

| Ford Pickup (Full Size) | 2006 | 7,897 |

| Chevrolet Pickup (Full Size) | 2004 | 6,158 |

| Dodge Pickup (Full Size) | 2004 | 2,898 |

| Honda Accord | 1997 | 1,626 |

| GMC Pickup (Full Size) | 2015 | 1,450 |

| Honda Civic | 2000 | 1,371 |

| Chevrolet Tahoe | 2004 | 1,148 |

| Toyota Camry | 2014 | 1,030 |

| Nissan Altima | 2012 | 957 |

| Chevrolet Impala | 2007 | 898 |

The 2006 Ford pickup was the most-stolen vehicle in the Lone Star State.

Vehicle Theft by City

These Federal Bureau of Investigation (FBI) statistics show vehicle thefts in 2017 by city.

| STATE | MOTOR VEHICLE THEFT |

|---|---|

| Amarillo | 990 |

| Mesquite | 849 |

| Garland | 810 |

| El Paso | 800 |

| Corpus Christi | 731 |

| Irving | 711 |

| Killeen | 566 |

| Grand Prairie | 495 |

| Beaumont | 405 |

| Pasadena | 379 |

| Plano | 339 |

| Baytown | 326 |

| Denton | 298 |

| Galveston | 284 |

| Odessa | 273 |

| San Angelo | 272 |

| Abilene | 260 |

| Longview | 242 |

| Lancaster | 240 |

| Temple | 238 |

| Wichita Falls | 238 |

| Lewisville | 229 |

| Carrollton | 227 |

| Midland | 220 |

| Waco | 191 |

| Richardson | 189 |

| Conroe | 176 |

| Humble | 176 |

| Laredo | 170 |

| Duncanville | 169 |

| San Marcos | 169 |

| DeSoto | 158 |

| McKinney | 155 |

| Port Arthur | 153 |

| Haltom City | 150 |

| New Braunfels | 148 |

| Balch Springs3 | 146 |

| Tyler | 146 |

| Brownsville | 141 |

| Euless | 140 |

| Bryan | 123 |

| Texas City | 123 |

| Texarkana | 121 |

| College Station | 117 |

| Victoria | 110 |

| Edinburg | 108 |

| South Houston3 | 106 |

| Bedford | 102 |

| North Richland Hills | 101 |

| Cedar Hill | 98 |

| Addison | 97 |

| League City | 93 |

| Farmers Branch | 92 |

| Harlingen | 91 |

| Huntsville | 88 |

| Big Spring | 85 |

| Grapevine | 85 |

| Frisco | 84 |

| Lufkin | 83 |

| Webster | 81 |

| Seagoville | 79 |

| Sherman | 77 |

| Mission | 74 |

| Rowlett | 71 |

| Denison | 70 |

| Waxahachie | 70 |

| Missouri City | 69 |

| Hurst | 68 |

| Burleson | 67 |

| Terrell | 67 |

| Greenville | 65 |

| Marshall | 65 |

| La Marque | 64 |

| Round Rock | 64 |

| Leon Valley | 62 |

| Pharr | 62 |

| Kyle | 61 |

| Alvin | 60 |

| Rosenberg | 59 |

| Saginaw | 59 |

| Schertz | 57 |

| Sugar Land | 56 |

| Stafford | 54 |

| Allen | 52 |

| Harker Heights | 52 |

| Alamo | 51 |

| Cedar Park | 51 |

| Cleburne | 51 |

| Rockwall | 51 |

| San Juan | 51 |

| Weslaco | 50 |

| La Porte | 49 |

| Plainview | 49 |

| White Settlement | 49 |

| Paris | 48 |

| Converse | 47 |

| Dickinson | 47 |

| Donna3 | 47 |

| Orange | 47 |

| McAllen | 46 |

| Pflugerville3 | 45 |

| Universal City | 45 |

| Balcones Heights | 42 |

| Kirby | 42 |

| Mansfield | 42 |

| The Colony | 42 |

| Tomball | 40 |

| Live Oak | 39 |

| Rio Grande City | 39 |

| Weatherford | 39 |

| Alice | 38 |

| Corsicana | 37 |

| Borger3 | 36 |

| Forest Hill | 36 |

| Katy | 36 |

| Nederland | 36 |

| Ennis | 35 |

| Georgetown | 35 |

| Jacinto City | 35 |

| Copperas Cove | 34 |

| Deer Park | 34 |

| Vidor | 34 |

| Eagle Pass | 33 |

| Mercedes | 33 |

| Taylor | 33 |

| Jersey Village | 32 |

| Levelland | 31 |

| Cleveland | 30 |

| Windcrest | 30 |

| Boerne | 29 |

| Groves | 29 |

| Kilgore | 29 |

| Pleasanton | 29 |

| Bellmead3 | 28 |

| Dumas | 28 |

| Palestine3 | 28 |

| Richland Hills | 28 |

| Wylie | 28 |

| Athens | 27 |

| Nacogdoches | 27 |

| Port Aransas | 27 |

| Seguin | 27 |

| Selma | 27 |

| Little Elm | 26 |

| Port Neches | 26 |

| Sweetwater3 | 26 |

| Kingsville | 25 |

| San Benito | 25 |

| Shenandoah3 | 25 |

Read more:

- Best Amarillo, Texas Car Insurance

- Best Frisco, Texas Car Insurance

- Best Mesquite, Texas Car Insurance

Generally, cities with higher populations, such as Austin, saw more thefts than smaller ones, like Abilene.

Road Fatalities in Texas

Weather, light condition, impaired drivers, and speed are among the biggest causes of deaths on the highways.

Let’s look at how many have occurred throughout the Lone Star State.

Most Fatal Highway in Texas

Geotab reports that US-83 (also known as the Texas Vietnam Veterans Memorial Highway), running north and south, is the most fatal highway. It has averaged 26 crash deaths every year for the past decade.

To determine the most dangerous highway in each state, Geotab calculates a Fatal Crash Rate based on the annual number of NHTSA road fatality and fatal crash statistics. They adjust them for the average daily traffic counts the Federal Highway Administration provides.

Fatal Crashes by Weather Condition & Light Condition

Let’s explore how weather and light conditions can influence crash deaths in Texas.

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 1,316 | 664 | 930 | 94 | 8 | 3,012 |

| Rain | 91 | 53 | 85 | 9 | 0 | 238 |

| Snow/Sleet | 9 | 0 | 1 | 0 | 0 | 10 |

| Other | 17 | 18 | 32 | 4 | 0 | 71 |

| Unknown | 3 | 0 | 3 | 0 | 6 | 12 |

| TOTAL | 1,436 | 735 | 1,051 | 107 | 14 | 3,343 |

Most deaths occurred under normal daylight conditions. Texas also sees a lot of extreme weather phenomena. For instance, the Lone Star State is one of the states most affected by tornadoes and hurricanes.

Fatalities (All Crashes) by County

Below is NHTSA Crash Report data on road fatalities in Texas by county from 2013 to 2017.

| County | Fatalities 2013 | 2014 | 2015 | 2016 | 2017 | Fatalities Per 100K Population 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Anderson County | 9 | 10 | 8 | 12 | 10 | 15.53 | 17.29 | 13.88 | 20.85 | 17.32 |

| Andrews County | 12 | 11 | 14 | 1 | 16 | 71.48 | 63.04 | 77.38 | 5.61 | 90.28 |

| Angelina County | 19 | 18 | 18 | 20 | 16 | 21.75 | 20.55 | 20.48 | 22.77 | 18.22 |

| Aransas County | 3 | 3 | 2 | 3 | 4 | 12.55 | 12.2 | 8.05 | 11.87 | 15.64 |

| Archer County | 7 | 5 | 0 | 4 | 2 | 79.61 | 56.59 | 0 | 45.59 | 22.7 |

| Armstrong County | 6 | 0 | 0 | 1 | 1 | 309.28 | 0 | 0 | 53.88 | 53.22 |

| Atascosa County | 7 | 17 | 17 | 6 | 9 | 14.89 | 35.64 | 35.16 | 12.33 | 18.37 |

| Austin County | 6 | 8 | 5 | 10 | 3 | 20.94 | 27.64 | 16.98 | 33.74 | 10.07 |

| Bailey County | 2 | 0 | 1 | 2 | 1 | 28.18 | 0 | 13.89 | 27.86 | 14.13 |

| Bandera County | 10 | 8 | 8 | 2 | 7 | 48.64 | 38.44 | 37.83 | 9.21 | 31.32 |

| Bastrop County | 21 | 14 | 20 | 37 | 26 | 27.67 | 17.97 | 24.94 | 44.71 | 30.67 |

| Baylor County | 7 | 3 | 6 | 0 | 1 | 195.69 | 84.1 | 164.43 | 0 | 27.93 |

| Bee County | 4 | 8 | 5 | 8 | 3 | 12.19 | 24.36 | 15.33 | 24.36 | 9.21 |

| Bell County | 36 | 34 | 40 | 42 | 57 | 11 | 10.3 | 11.9 | 12.31 | 16.39 |

| Bexar County | 189 | 184 | 189 | 226 | 164 | 10.38 | 9.91 | 9.97 | 11.72 | 8.37 |

| Blanco County | 5 | 9 | 4 | 8 | 3 | 47.01 | 83.3 | 36.24 | 70.54 | 25.8 |

| Borden County | 1 | 1 | 1 | 1 | 0 | 154.8 | 150.15 | 152.44 | 151.52 | 0 |

| Bosque County | 5 | 4 | 4 | 2 | 5 | 27.99 | 22.58 | 22.39 | 11.1 | 27.28 |

| Bowie County | 25 | 18 | 14 | 22 | 16 | 26.75 | 19.27 | 14.99 | 23.43 | 17.02 |

| Brazoria County | 45 | 30 | 42 | 48 | 43 | 13.63 | 8.88 | 12.15 | 13.57 | 11.86 |

| Brazos County | 15 | 14 | 22 | 20 | 28 | 7.35 | 6.71 | 10.19 | 9.11 | 12.57 |

| Brewster County | 3 | 1 | 1 | 0 | 0 | 32.29 | 10.93 | 10.95 | 0 | 0 |

| Briscoe County | 0 | 0 | 0 | 2 | 0 | 0 | 0 | 0 | 134.59 | 0 |

| Brooks County | 8 | 6 | 3 | 1 | 1 | 110.18 | 82.69 | 41.45 | 13.77 | 13.82 |

| Brown County | 2 | 2 | 6 | 5 | 3 | 5.32 | 5.33 | 15.91 | 13.14 | 7.88 |

| Burleson County | 3 | 4 | 4 | 11 | 5 | 17.4 | 23.05 | 22.78 | 61.76 | 27.76 |

| Burnet County | 8 | 20 | 11 | 9 | 16 | 18.35 | 45.48 | 24.56 | 19.6 | 34.19 |

| Caldwell County | 4 | 15 | 12 | 9 | 11 | 10.2 | 37.79 | 29.72 | 21.89 | 25.98 |

| Calhoun County | 7 | 3 | 1 | 1 | 1 | 32.21 | 13.76 | 4.57 | 4.56 | 4.6 |

| Callahan County | 12 | 4 | 6 | 7 | 10 | 88.92 | 29.63 | 44.18 | 50.81 | 71.71 |

| Cameron County | 39 | 26 | 25 | 41 | 40 | 9.35 | 6.21 | 5.96 | 9.72 | 9.44 |

| Camp County | 2 | 4 | 1 | 1 | 3 | 16.08 | 31.69 | 7.9 | 7.83 | 23.34 |

| Carson County | 1 | 3 | 9 | 6 | 3 | 16.71 | 49.73 | 149.83 | 98.25 | 49.73 |

| Cass County | 7 | 3 | 14 | 4 | 10 | 23.15 | 9.96 | 46.45 | 13.3 | 33.32 |

| Castro County | 2 | 4 | 1 | 0 | 1 | 24.75 | 50.58 | 12.82 | 0 | 12.75 |

| Chambers County | 13 | 20 | 15 | 22 | 9 | 34.81 | 52.24 | 38.4 | 54.61 | 21.72 |

| Cherokee County | 15 | 13 | 8 | 9 | 10 | 29.36 | 25.4 | 15.51 | 17.34 | 19.14 |

| Childress County | 2 | 0 | 1 | 2 | 3 | 28.35 | 0 | 14.2 | 28.19 | 42.45 |

| Clay County | 6 | 2 | 1 | 0 | 6 | 57.4 | 19.28 | 9.66 | 0 | 57.58 |

| Cochran County | 0 | 2 | 0 | 1 | 0 | 0 | 68.17 | 0 | 34.35 | 0 |

| Coke County | 1 | 5 | 5 | 4 | 1 | 31.46 | 155.52 | 155.04 | 122.59 | 30.25 |

| Coleman County | 1 | 4 | 4 | 6 | 1 | 11.73 | 47.53 | 48.11 | 71.25 | 11.86 |

| Collin County | 41 | 47 | 37 | 50 | 68 | 4.78 | 5.31 | 4.05 | 5.31 | 7.01 |

| Collingsworth County | 0 | 0 | 3 | 0 | 0 | 0 | 0 | 99.67 | 0 | 0 |

| Colorado County | 15 | 5 | 14 | 8 | 10 | 72.44 | 24.17 | 66.95 | 38.05 | 47.1 |

| Comal County | 21 | 20 | 17 | 24 | 17 | 17.71 | 16.24 | 13.21 | 17.89 | 12.06 |

| Comanche County | 5 | 2 | 4 | 8 | 7 | 36.93 | 14.86 | 29.92 | 59.17 | 51.57 |

| Concho County | 4 | 1 | 0 | 0 | 4 | 97.7 | 24.6 | 0 | 0 | 147.22 |

| Cooke County | 3 | 20 | 13 | 6 | 10 | 7.81 | 51.69 | 33.28 | 15.29 | 25.07 |

| Coryell County | 7 | 5 | 13 | 14 | 9 | 9.12 | 6.56 | 17.05 | 18.68 | 12.01 |

| Cottle County | 0 | 1 | 0 | 0 | 0 | 0 | 70.03 | 0 | 0 | 0 |

| Crane County | 2 | 3 | 2 | 0 | 1 | 42.35 | 61.15 | 39.94 | 0 | 21.1 |

| Crockett County | 5 | 5 | 3 | 4 | 7 | 132.94 | 132.07 | 80.39 | 109.5 | 196.41 |

| Crosby County | 0 | 1 | 4 | 5 | 1 | 0 | 17.17 | 67.61 | 84.5 | 16.95 |

| Culberson County | 2 | 6 | 12 | 3 | 3 | 86.77 | 263.16 | 533.1 | 135.2 | 134.47 |

| Dallam County | 1 | 8 | 1 | 4 | 3 | 14.08 | 111.06 | 13.77 | 55.13 | 41.62 |

| Dallas County | 225 | 238 | 259 | 315 | 282 | 9.06 | 9.45 | 10.14 | 12.17 | 10.77 |

| Dawson County | 4 | 6 | 4 | 4 | 2 | 30.3 | 44.66 | 30.81 | 30.67 | 15.61 |

| Deaf Smith County | 2 | 3 | 2 | 3 | 3 | 10.44 | 15.71 | 10.64 | 15.92 | 15.93 |

| Delta County | 2 | 0 | 2 | 6 | 0 | 39.08 | 0 | 38.78 | 116.6 | 0 |

| Denton County | 40 | 37 | 38 | 49 | 49 | 5.49 | 4.91 | 4.87 | 6.06 | 5.86 |

| Dewitt County | 9 | 7 | 3 | 5 | 5 | 44.16 | 34.12 | 14.54 | 24.25 | 24.72 |

| Dickens County | 0 | 0 | 1 | 1 | 4 | 0 | 0 | 45.41 | 45.43 | 181.08 |

| Dimmit County | 10 | 13 | 8 | 2 | 3 | 91.7 | 117.96 | 72.85 | 18.55 | 28.8 |

| Donley County | 1 | 4 | 0 | 2 | 2 | 28.04 | 114.22 | 0 | 58.96 | 60.4 |

| Duval County | 5 | 3 | 6 | 4 | 6 | 43.15 | 26.04 | 52.9 | 34.94 | 53.22 |

| Eastland County | 8 | 9 | 8 | 6 | 6 | 43.77 | 49.35 | 44.05 | 32.78 | 32.59 |

| Ector County | 59 | 48 | 54 | 34 | 48 | 39.43 | 31.05 | 33.78 | 21.58 | 30.56 |

| Edwards County | 0 | 0 | 3 | 1 | 1 | 0 | 0 | 157.07 | 52.14 | 51.2 |

| El Paso County | 60 | 66 | 62 | 81 | 58 | 7.23 | 7.92 | 7.44 | 9.68 | 6.9 |

| Ellis County | 19 | 24 | 25 | 28 | 33 | 12.18 | 15.08 | 15.31 | 16.63 | 19.01 |

| Erath County | 10 | 15 | 18 | 13 | 10 | 25.06 | 37 | 43.67 | 31.37 | 23.83 |

| Falls County | 8 | 7 | 4 | 7 | 3 | 46.4 | 40.68 | 23.22 | 40.39 | 17.2 |

| Fannin County | 6 | 5 | 8 | 15 | 14 | 17.89 | 14.87 | 23.9 | 44.31 | 40.64 |

| Fayette County | 9 | 9 | 16 | 9 | 17 | 36.41 | 36.31 | 64.08 | 35.9 | 67.27 |

| Fisher County | 1 | 6 | 2 | 2 | 2 | 25.85 | 154.92 | 51.67 | 51.53 | 51.55 |

| Floyd County | 2 | 2 | 0 | 1 | 2 | 32.03 | 33.64 | 0 | 17.02 | 34.16 |

| Foard County | 2 | 1 | 0 | 1 | 1 | 155.28 | 78.31 | 0 | 82.58 | 81.83 |

| Fort Bend County | 52 | 36 | 39 | 37 | 39 | 7.97 | 5.26 | 5.46 | 4.99 | 5.1 |

| Franklin County | 2 | 4 | 4 | 10 | 0 | 18.85 | 37.87 | 37.76 | 93.82 | 0 |

| Freestone County | 5 | 8 | 11 | 14 | 8 | 25.52 | 40.7 | 55.8 | 71.26 | 40.76 |

| Frio County | 7 | 1 | 9 | 3 | 3 | 38.08 | 5.28 | 46.73 | 15.48 | 15.31 |

| Gaines County | 11 | 5 | 10 | 5 | 3 | 58.53 | 25.88 | 49.47 | 24.41 | 14.54 |

| Galveston County | 23 | 35 | 44 | 45 | 40 | 7.5 | 11.16 | 13.69 | 13.67 | 11.94 |

| Garza County | 1 | 8 | 0 | 1 | 2 | 15.69 | 124.84 | 0 | 15.52 | 30.64 |

| Gillespie County | 6 | 4 | 5 | 7 | 11 | 23.7 | 15.71 | 19.26 | 26.61 | 41.28 |

| Glasscock County | 4 | 4 | 6 | 2 | 3 | 316.46 | 303.72 | 438.28 | 148.15 | 222.55 |

| Goliad County | 3 | 3 | 4 | 4 | 1 | 40.26 | 39.98 | 53.26 | 53.18 | 13.22 |

| Gonzales County | 11 | 13 | 15 | 13 | 12 | 54.62 | 63.86 | 73.04 | 62.31 | 57.44 |

| Gray County | 3 | 4 | 6 | 5 | 6 | 13.05 | 17.07 | 25.81 | 21.99 | 26.78 |

| Grayson County | 27 | 19 | 26 | 24 | 22 | 22.08 | 15.38 | 20.71 | 18.72 | 16.78 |

| Gregg County | 21 | 22 | 26 | 21 | 32 | 17.05 | 17.88 | 20.99 | 16.99 | 25.94 |

| Grimes County | 10 | 5 | 16 | 8 | 11 | 37.32 | 18.51 | 58.54 | 29.01 | 39.17 |

| Guadalupe County | 16 | 15 | 19 | 24 | 19 | 11.2 | 10.22 | 12.62 | 15.52 | 11.9 |

| Hale County | 1 | 8 | 4 | 3 | 4 | 2.8 | 23.2 | 11.73 | 8.77 | 11.72 |

| Hall County | 3 | 0 | 2 | 0 | 1 | 94.85 | 0 | 64.68 | 0 | 32.56 |

| Hamilton County | 4 | 7 | 7 | 0 | 3 | 48.61 | 85.89 | 86.74 | 0 | 35.62 |

| Hansford County | 2 | 2 | 3 | 0 | 2 | 36.13 | 36.13 | 53.49 | 0 | 36.72 |

| Hardeman County | 2 | 4 | 1 | 2 | 2 | 49.21 | 100.3 | 25.56 | 50.11 | 50.08 |

| Hardin County | 11 | 13 | 9 | 11 | 12 | 19.89 | 23.42 | 16.14 | 19.55 | 21 |

| Harris County | 369 | 417 | 391 | 447 | 456 | 8.48 | 9.37 | 8.59 | 9.68 | 9.8 |

| Harrison County | 22 | 14 | 26 | 16 | 17 | 33.21 | 21.01 | 38.95 | 23.98 | 25.5 |

| Hartley County | 4 | 3 | 8 | 5 | 5 | 66.74 | 49.68 | 140.99 | 87.63 | 87.86 |

| Haskell County | 3 | 6 | 4 | 2 | 4 | 50.8 | 103.47 | 68.76 | 34.69 | 69.61 |

| Hays County | 23 | 18 | 17 | 39 | 30 | 13.07 | 9.74 | 8.74 | 19.09 | 13.99 |

| Hemphill County | 1 | 3 | 1 | 1 | 0 | 24.14 | 71.86 | 23.3 | 24.24 | 0 |

| Henderson County | 12 | 12 | 17 | 11 | 16 | 15.26 | 15.14 | 21.4 | 13.74 | 19.74 |

| Hidalgo County | 65 | 65 | 67 | 75 | 60 | 7.95 | 7.84 | 7.98 | 8.82 | 6.97 |

| Hill County | 16 | 14 | 16 | 13 | 10 | 45.91 | 40.26 | 45.92 | 36.96 | 27.89 |

| Hockley County | 6 | 7 | 5 | 7 | 4 | 25.64 | 29.84 | 21.45 | 30.3 | 17.33 |

| Hood County | 5 | 8 | 3 | 15 | 11 | 9.45 | 14.86 | 5.42 | 26.43 | 18.88 |

| Hopkins County | 7 | 8 | 9 | 9 | 13 | 19.83 | 22.42 | 25.03 | 24.86 | 35.62 |

| Houston County | 8 | 6 | 8 | 14 | 10 | 35.08 | 26.32 | 35.19 | 61.17 | 43.44 |

| Howard County | 12 | 6 | 12 | 8 | 9 | 33.19 | 16.44 | 32.32 | 21.85 | 24.97 |

| Hudspeth County | 14 | 15 | 7 | 12 | 14 | 419.54 | 460.41 | 203.73 | 294.62 | 317.6 |

| Hunt County | 15 | 18 | 22 | 28 | 26 | 17.15 | 20.3 | 24.53 | 30.45 | 27.7 |

| Hutchinson County | 6 | 8 | 6 | 5 | 0 | 27.4 | 36.53 | 27.55 | 23.18 | 0 |

| Irion County | 2 | 10 | 3 | 0 | 0 | 124.15 | 635.32 | 194.43 | 0 | 0 |

| Jack County | 3 | 5 | 6 | 3 | 1 | 33.71 | 56.43 | 67.88 | 34.22 | 11.32 |

| Jackson County | 6 | 5 | 10 | 6 | 3 | 41.07 | 33.97 | 67.6 | 40.4 | 20.26 |

| Jasper County | 8 | 5 | 12 | 7 | 8 | 22.47 | 14.12 | 34.04 | 19.77 | 22.5 |

| Jeff Davis County | 3 | 2 | 0 | 0 | 2 | 134.47 | 90.09 | 0 | 0 | 87.72 |

| Jefferson County | 23 | 32 | 27 | 37 | 37 | 9.09 | 12.66 | 10.59 | 14.46 | 14.44 |

| Jim Hogg County | 1 | 6 | 1 | 3 | 0 | 19.01 | 112.78 | 18.93 | 57.21 | 0 |

| Jim Wells County | 14 | 10 | 15 | 4 | 7 | 33.6 | 24.11 | 36.17 | 9.73 | 17.13 |

| Johnson County | 19 | 23 | 22 | 23 | 21 | 12.3 | 14.67 | 13.8 | 14.12 | 12.55 |

| Jones County | 7 | 5 | 8 | 5 | 9 | 34.94 | 25.19 | 40.03 | 25.01 | 45.04 |

| Karnes County | 11 | 7 | 9 | 5 | 4 | 74.72 | 47.19 | 59.03 | 32.76 | 26.34 |

| Kaufman County | 12 | 24 | 18 | 27 | 31 | 11.08 | 21.64 | 15.77 | 22.87 | 25.23 |

| Kendall County | 8 | 5 | 9 | 5 | 4 | 21.53 | 13.02 | 22.52 | 11.91 | 9.09 |

| Kenedy County | 2 | 0 | 2 | 2 | 2 | 459.77 | 0 | 461.89 | 467.29 | 479.62 |

| Kent County | 0 | 1 | 0 | 0 | 1 | 0 | 133.69 | 0 | 0 | 131.06 |

| Kerr County | 16 | 15 | 8 | 11 | 3 | 32.15 | 29.84 | 15.76 | 21.44 | 5.8 |

| Kimble County | 4 | 0 | 9 | 12 | 7 | 89.61 | 0 | 204.92 | 271 | 158.73 |

| King County | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 352.11 | 0 | 0 |

| Kinney County | 2 | 0 | 2 | 2 | 0 | 55.08 | 0 | 55.66 | 54.95 | 0 |

| Kleberg County | 5 | 7 | 3 | 11 | 5 | 15.62 | 21.98 | 9.55 | 35.09 | 16.08 |

| Knox County | 1 | 1 | 1 | 1 | 1 | 26.87 | 26.31 | 26.37 | 26.74 | 26.95 |

| La Salle County | 9 | 17 | 4 | 1 | 7 | 120.97 | 227.3 | 52.33 | 13.13 | 92.3 |

| Lamar County | 7 | 14 | 8 | 10 | 6 | 14.26 | 28.34 | 16.21 | 20.18 | 12.1 |

| Lamb County | 8 | 4 | 4 | 4 | 2 | 58.58 | 29.66 | 30.15 | 30.25 | 15.14 |

| Lampasas County | 3 | 1 | 6 | 5 | 6 | 14.9 | 4.97 | 29.39 | 24.2 | 28.53 |

| Lavaca County | 4 | 5 | 7 | 4 | 7 | 20.38 | 25.28 | 35.15 | 20.09 | 34.89 |

| Lee County | 8 | 10 | 15 | 9 | 3 | 48.33 | 60.12 | 88.85 | 52.95 | 17.46 |

| Leon County | 12 | 10 | 8 | 12 | 7 | 72.18 | 59.76 | 46.97 | 69.78 | 40.6 |

| Liberty County | 23 | 16 | 18 | 22 | 39 | 29.94 | 20.51 | 22.63 | 27.03 | 46.62 |

| Limestone County | 4 | 8 | 5 | 4 | 3 | 17.09 | 34.04 | 21.33 | 17 | 12.75 |

| Lipscomb County | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 28.11 | 0 | 0 |

| Live Oak County | 14 | 18 | 8 | 6 | 10 | 118.49 | 149.45 | 65.8 | 49.91 | 82.14 |

| Llano County | 4 | 3 | 2 | 9 | 3 | 20.51 | 15.28 | 9.97 | 43.75 | 14.14 |

| Loving County | 0 | 2 | 2 | 3 | 1 | 0 | 2247.19 | 1680.67 | 2608.7 | 746.27 |

| Lubbock County | 32 | 42 | 40 | 43 | 42 | 11.05 | 14.26 | 13.4 | 14.22 | 13.76 |

| Lynn County | 1 | 0 | 6 | 4 | 4 | 17.46 | 0 | 104.42 | 69.03 | 68.27 |

| Madison County | 7 | 12 | 6 | 10 | 7 | 50.72 | 86.69 | 43.05 | 70.95 | 49.22 |

| Marion County | 7 | 1 | 6 | 2 | 9 | 68.14 | 9.85 | 59.25 | 19.83 | 89.43 |

| Martin County | 3 | 9 | 11 | 6 | 5 | 56.88 | 164.47 | 193.8 | 105.49 | 88.87 |

| Mason County | 2 | 0 | 0 | 1 | 3 | 48.72 | 0 | 0 | 24.03 | 71.06 |

| Matagorda County | 8 | 4 | 13 | 10 | 10 | 21.91 | 10.96 | 35.36 | 26.94 | 27.14 |

| Maverick County | 5 | 8 | 8 | 10 | 9 | 8.86 | 14.03 | 13.87 | 17.24 | 15.46 |

| Mcculloch County | 0 | 9 | 4 | 2 | 0 | 0 | 110.4 | 48.47 | 24.63 | 0 |

| Mclennan County | 35 | 39 | 30 | 28 | 44 | 14.5 | 16.04 | 12.23 | 11.31 | 17.51 |

| Mcmullen County | 0 | 9 | 4 | 1 | 0 | 0 | 1132.08 | 482.51 | 122.7 | 0 |

| Medina County | 11 | 3 | 9 | 14 | 17 | 23.27 | 6.27 | 18.6 | 28.46 | 33.96 |

| Menard County | 1 | 0 | 1 | 0 | 1 | 46.84 | 0 | 46.93 | 0 | 47.08 |

| Midland County | 44 | 47 | 33 | 25 | 50 | 28.89 | 30.02 | 20.37 | 15.29 | 30.29 |

| Milam County | 4 | 10 | 3 | 5 | 17 | 16.61 | 41.41 | 12.31 | 20.21 | 67.86 |

| Mills County | 1 | 5 | 1 | 2 | 3 | 20.54 | 102.73 | 20.46 | 40.87 | 60.96 |

| Mitchell County | 1 | 4 | 5 | 3 | 5 | 11.11 | 44.12 | 56.46 | 35.38 | 59.05 |

| Montague County | 3 | 4 | 4 | 3 | 6 | 15.47 | 20.64 | 20.75 | 15.44 | 30.71 |

| Montgomery County | 51 | 53 | 60 | 76 | 54 | 10.23 | 10.26 | 11.21 | 13.71 | 9.46 |

| Moore County | 17 | 8 | 4 | 6 | 5 | 76.77 | 36.33 | 18.28 | 27.35 | 22.63 |

| Morris County | 2 | 4 | 2 | 6 | 4 | 15.77 | 31.7 | 16.14 | 48.04 | 32.08 |

| Motley County | 1 | 1 | 0 | 0 | 0 | 83.89 | 87.03 | 0 | 0 | 0 |

| Nacogdoches County | 16 | 11 | 16 | 13 | 13 | 24.55 | 16.87 | 24.44 | 19.8 | 19.82 |

| Navarro County | 13 | 10 | 11 | 5 | 14 | 27.07 | 20.87 | 22.84 | 10.34 | 28.75 |

| Newton County | 2 | 7 | 4 | 5 | 3 | 13.95 | 48.96 | 28.23 | 35.25 | 21.5 |

| Nolan County | 10 | 6 | 2 | 10 | 16 | 66.42 | 39.7 | 13.3 | 66.81 | 108.33 |

| Nueces County | 32 | 37 | 42 | 45 | 51 | 9.07 | 10.38 | 11.65 | 12.45 | 14.12 |

| Ochiltree County | 4 | 9 | 2 | 1 | 0 | 37.49 | 84.23 | 18.7 | 9.71 | 0 |

| Oldham County | 7 | 5 | 8 | 3 | 5 | 335.09 | 241.55 | 387.6 | 144.65 | 236.52 |

| Orange County | 13 | 28 | 19 | 22 | 23 | 15.7 | 33.64 | 22.64 | 26.03 | 27.04 |

| Palo Pinto County | 11 | 8 | 10 | 8 | 8 | 39.47 | 28.56 | 35.77 | 28.44 | 28 |

| Panola County | 11 | 11 | 10 | 13 | 6 | 46.25 | 46.33 | 42.27 | 55.46 | 25.81 |

| Parker County | 18 | 15 | 18 | 21 | 20 | 15.03 | 12.28 | 14.33 | 16.3 | 14.99 |

| Parmer County | 1 | 4 | 3 | 2 | 2 | 10.04 | 40.27 | 30.61 | 20.37 | 20.32 |

| Pecos County | 7 | 17 | 12 | 9 | 19 | 44.71 | 107.34 | 74.92 | 56.69 | 121.53 |

| Polk County | 12 | 13 | 15 | 12 | 15 | 26.36 | 28.37 | 32.18 | 25.14 | 30.51 |

| Potter County | 30 | 26 | 20 | 29 | 32 | 24.57 | 21.32 | 16.51 | 24.06 | 26.57 |

| Presidio County | 0 | 1 | 1 | 1 | 1 | 0 | 13.91 | 14.18 | 13.95 | 13.97 |

| Rains County | 2 | 2 | 1 | 4 | 1 | 18.14 | 18.17 | 8.99 | 35.38 | 8.5 |

| Randall County | 13 | 14 | 14 | 14 | 7 | 10.26 | 10.88 | 10.74 | 10.57 | 5.21 |

| Reagan County | 4 | 5 | 6 | 0 | 1 | 110.19 | 132 | 157.52 | 0 | 26.95 |

| Real County | 3 | 2 | 5 | 3 | 2 | 90.39 | 59.74 | 151.65 | 88.31 | 58.33 |

| Red River County | 4 | 1 | 4 | 4 | 4 | 32.01 | 8.03 | 32.35 | 32.74 | 32.71 |

| Reeves County | 17 | 12 | 21 | 14 | 15 | 119.81 | 82.71 | 140.88 | 92.91 | 98.16 |

| Refugio County | 7 | 14 | 3 | 3 | 7 | 96.25 | 190.37 | 40.98 | 41.14 | 96.9 |

| Roberts County | 1 | 5 | 0 | 1 | 4 | 108.81 | 547.05 | 0 | 109.17 | 426.44 |

| Robertson County | 7 | 1 | 4 | 7 | 4 | 42.62 | 6.08 | 23.97 | 41.52 | 23.25 |

| Rockwall County | 8 | 3 | 4 | 12 | 13 | 9.44 | 3.45 | 4.44 | 12.85 | 13.43 |

| Runnels County | 1 | 8 | 2 | 4 | 1 | 9.82 | 77.93 | 19.31 | 39.01 | 9.74 |

| Rusk County | 25 | 14 | 15 | 19 | 17 | 46.87 | 26.33 | 28.34 | 35.95 | 32.18 |

| Sabine County | 4 | 5 | 2 | 3 | 5 | 38.38 | 47.95 | 19.14 | 28.89 | 47.8 |

| San Augustine County | 6 | 3 | 4 | 4 | 10 | 69.25 | 35.41 | 47.96 | 48.29 | 121.17 |

| San Jacinto County | 9 | 8 | 6 | 14 | 5 | 33.66 | 29.57 | 21.93 | 50.44 | 17.69 |

| San Patricio County | 12 | 16 | 7 | 8 | 15 | 18.14 | 24.01 | 10.43 | 11.89 | 22.32 |

| San Saba County | 3 | 2 | 0 | 1 | 0 | 52.72 | 34.39 | 0 | 17.03 | 0 |

| Schleicher County | 5 | 0 | 0 | 0 | 0 | 156.79 | 0 | 0 | 0 | 0 |

| Scurry County | 4 | 6 | 4 | 1 | 2 | 23.17 | 34.48 | 22.74 | 5.74 | 11.73 |

| Shackelford County | 3 | 2 | 1 | 1 | 1 | 88.78 | 60.17 | 29.9 | 29.73 | 30.05 |

| Shelby County | 6 | 12 | 8 | 7 | 11 | 23.09 | 46.75 | 31.37 | 27.16 | 43.12 |

| Sherman County | 2 | 1 | 1 | 0 | 0 | 65.17 | 32.59 | 32.68 | 0 | 0 |

| Smith County | 29 | 43 | 61 | 57 | 46 | 13.4 | 19.59 | 27.43 | 25.3 | 20.2 |

| Somervell County | 6 | 4 | 2 | 2 | 9 | 70.1 | 46.77 | 23.22 | 23.04 | 101.75 |

| Starr County | 13 | 7 | 2 | 3 | 3 | 20.87 | 11.13 | 3.15 | 4.69 | 4.65 |

| Stephens County | 2 | 1 | 2 | 2 | 1 | 21.37 | 10.71 | 21.32 | 21.26 | 10.71 |

| Sterling County | 0 | 2 | 3 | 0 | 0 | 0 | 149.81 | 225.39 | 0 | 0 |

| Stonewall County | 3 | 1 | 0 | 0 | 1 | 211.57 | 72.1 | 0 | 0 | 72.05 |

| Sutton County | 6 | 3 | 4 | 3 | 3 | 150.72 | 75.78 | 102.67 | 77.62 | 79.64 |

| Swisher County | 3 | 1 | 1 | 1 | 1 | 38.88 | 13.24 | 13.37 | 13.44 | 13.31 |

| Tarrant County | 144 | 145 | 157 | 167 | 180 | 7.53 | 7.45 | 7.91 | 8.26 | 8.76 |

| Taylor County | 20 | 26 | 28 | 17 | 15 | 14.94 | 19.29 | 20.6 | 12.5 | 11.01 |

| Terrell County | 1 | 1 | 0 | 1 | 0 | 112.23 | 110.25 | 0 | 122.25 | 0 |

| Terry County | 7 | 3 | 3 | 1 | 2 | 55.14 | 23.47 | 23.52 | 7.8 | 15.73 |

| Throckmorton County | 0 | 0 | 0 | 0 | 2 | 0 | 0 | 0 | 0 | 130.98 |

| Titus County | 5 | 7 | 11 | 4 | 6 | 15.33 | 21.57 | 33.62 | 12.26 | 18.23 |

| Tom Green County | 15 | 15 | 17 | 7 | 11 | 13.08 | 12.89 | 14.46 | 5.94 | 9.32 |

| Travis County | 112 | 95 | 145 | 120 | 120 | 9.98 | 8.25 | 12.31 | 9.96 | 9.78 |

| Trinity County | 5 | 4 | 4 | 9 | 2 | 34.62 | 28.02 | 27.57 | 62.01 | 13.64 |

| Tyler County | 10 | 8 | 11 | 4 | 2 | 46.52 | 37.3 | 51.49 | 18.66 | 9.29 |

| Upshur County | 5 | 6 | 9 | 13 | 5 | 12.58 | 14.91 | 22.29 | 31.81 | 12.11 |

| Upton County | 1 | 8 | 3 | 2 | 0 | 29.55 | 229.95 | 82.19 | 54.1 | 0 |

| Uvalde County | 8 | 5 | 3 | 2 | 15 | 29.8 | 18.48 | 11.14 | 7.38 | 55.29 |

| Val Verde County | 8 | 4 | 8 | 3 | 1 | 16.32 | 8.2 | 16.36 | 6.13 | 2.03 |

| Van Zandt County | 22 | 10 | 12 | 18 | 15 | 42.05 | 18.96 | 22.47 | 33.1 | 27.18 |

| Victoria County | 13 | 13 | 17 | 13 | 15 | 14.44 | 14.29 | 18.46 | 14.07 | 16.29 |

| Walker County | 11 | 22 | 9 | 25 | 23 | 15.84 | 31.43 | 12.73 | 34.87 | 31.84 |

| Waller County | 19 | 11 | 7 | 7 | 24 | 41.84 | 23.51 | 14.39 | 13.98 | 46.78 |

| Ward County | 6 | 19 | 10 | 9 | 12 | 53.52 | 164.1 | 85.92 | 77.66 | 104.6 |

| Washington County | 4 | 13 | 11 | 13 | 9 | 11.7 | 37.78 | 31.55 | 37.33 | 25.68 |

| Webb County | 29 | 16 | 21 | 47 | 25 | 10.99 | 5.99 | 7.78 | 17.25 | 9.1 |

| Wharton County | 10 | 9 | 14 | 6 | 6 | 24.33 | 21.91 | 33.83 | 14.41 | 14.3 |

| Wheeler County | 2 | 6 | 2 | 3 | 9 | 34.97 | 105.23 | 35.29 | 54.07 | 167.97 |

| Wichita County | 15 | 16 | 7 | 15 | 13 | 11.35 | 12.07 | 5.35 | 11.42 | 9.85 |

| Wilbarger County | 2 | 5 | 6 | 7 | 5 | 15.17 | 38.55 | 45.98 | 54.29 | 39.17 |

| Willacy County | 2 | 2 | 2 | 11 | 5 | 9.08 | 9.11 | 9.14 | 50.55 | 23.17 |

| Williamson County | 23 | 47 | 44 | 45 | 38 | 4.89 | 9.62 | 8.67 | 8.53 | 6.94 |

| Wilson County | 10 | 14 | 4 | 7 | 4 | 22.11 | 30.34 | 8.48 | 14.53 | 8.11 |

| Winkler County | 5 | 4 | 8 | 2 | 6 | 65.52 | 51.18 | 100.06 | 25.41 | 79.22 |

| Wise County | 10 | 14 | 21 | 19 | 21 | 16.39 | 22.68 | 33.41 | 29.47 | 31.73 |

| Wood County | 11 | 12 | 12 | 7 | 10 | 25.94 | 28.03 | 27.76 | 15.97 | 22.57 |

| Yoakum County | 2 | 4 | 1 | 3 | 2 | 24.37 | 47.72 | 11.6 | 34.78 | 23.34 |

| Young County | 2 | 3 | 2 | 4 | 4 | 10.89 | 16.42 | 11.02 | 22.13 | 22.25 |

| Zapata County | 2 | 0 | 4 | 2 | 0 | 13.9 | 0 | 27.56 | 13.84 | 0 |

| Zavala County | 3 | 5 | 6 | 6 | 2 | 24.62 | 40.86 | 48.8 | 49.62 | 16.74 |

Bexar, Dallas, and Harris counties had the most crash deaths. Of those counties, only Bexar saw a decrease in fatalities in 2017 — the other two experienced increases throughout the five-year period.

Traffic Fatalities

These were the urban and rural traffic fatalities in Texas from 2013 to 2017.

| Area | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Rural | 1,761 | 1,652 | 1,462 | 1,464 | 1,696 | 1,663 | 1,780 | 1,622 | 1,590 | 1,504 |

| Urban | 1,629 | 1,437 | 1,546 | 1,582 | 1,711 | 1,726 | 1,750 | 1,948 | 2,205 | 2,205 |

| Unknown | 86 | 15 | 15 | 8 | 1 | 0 | 6 | 12 | 2 | 13 |

| Total | 3,476 | 3,104 | 3,023 | 3,054 | 3,408 | 3,389 | 3,536 | 3,582 | 3,797 | 3,722 |

From 2015 to 2017, urban areas had hundreds of more crash deaths than rural areas. In total, they increased from 2008 to 2017.

Fatalities by Person Type

These are the number of fatalities for 2013 to 2017 based on the type of person and vehicle.

| Person Type | 2013 | 2014 | 2015 | 2016 | 2017 | |

|---|---|---|---|---|---|---|

| Occupants | Passenger Car | 1,067 | 1,137 | 1,171 | 1,219 | 1,252 |

| Light Truck - Pickup | 606 | 693 | 626 | 636 | 588 | |

| Light Truck - Utility | 441 | 480 | 483 | 441 | 457 | |

| Light Truck - Van | 95 | 87 | 88 | 87 | 64 | |

| Light Truck - Other | 1 | 1 | 1 | 11 | 8 | |

| Large Truck | 111 | 114 | 100 | 109 | 129 | |

| Bus | 7 | 2 | 17 | 10 | 16 | |

| Other/Unknown Occupants | 23 | 21 | 23 | 27 | 31 | |

| Total Occupants | 2,351 | 2,535 | 2,509 | 2,540 | 2,545 | |

| Motorcyclists | Total Motorcyclists | 493 | 451 | 452 | 495 | 490 |

| Nonoccupants | Pedestrian | 480 | 479 | 549 | 675 | 607 |

| Bicyclist and Other Cyclist | 48 | 50 | 52 | 65 | 59 | |

| Other/Unknown Nonoccupants | 17 | 21 | 20 | 22 | 21 | |

| Total Nonoccupants | 545 | 550 | 621 | 762 | 687 | |

| Total | Total | 3,389 | 3,536 | 3,582 | 3,797 | 3,722 |

Overall, vehicle occupant deaths were higher than non-occupant fatalities (people outside of a vehicle). The highest number of deaths were among passenger car occupants, followed by pedestrians. Again, unfortunately, the numbers increased from 2013 to 2017.

Fatalities by Crash Type

Here is more information about the types of vehicles and the accidents that led to fatalities from 2013 to 2017.

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Total Fatalities (All Crashes) | 3,389 | 3,536 | 3,582 | 3,797 | 3,722 |

| (1) Single Vehicle | 1,815 | 1,913 | 1,848 | 1,982 | 1,914 |

| (2) Involving a Large Truck | 535 | 553 | 567 | 558 | 649 |

| (3) Involving Speeding | 1,181 | 1,277 | 1,125 | 1,076 | 1,029 |

| (4) Involving a Rollover | 1,011 | 1,091 | 983 | 1,020 | 942 |

| (5) Involving a Roadway Departure | 1,836 | 1,912 | 1,800 | 1,860 | 1,832 |

| (6) Involving an Intersection (or Intersection Related) | 668 | 667 | 709 | 719 | 724 |

Most of the crash deaths involved single vehicles and roadway departures — another reminder to drive safely at all times and in all conditions.

Five-Year Trend For the Top 10 Counties

These are the numbers of fatalities in the most populated Texas counties from 2013 to 2017.

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Harris County | 369 | 417 | 391 | 447 | 456 |

| Dallas County | 225 | 238 | 259 | 315 | 282 |

| Tarrant County | 144 | 145 | 157 | 167 | 180 |

| Bexar County | 189 | 184 | 189 | 226 | 164 |

| Travis County | 112 | 95 | 145 | 120 | 120 |

| Collin County | 41 | 47 | 37 | 50 | 68 |

| Hidalgo County | 65 | 65 | 67 | 75 | 60 |

| El Paso County | 60 | 66 | 62 | 81 | 58 |

| Bell County | 36 | 34 | 40 | 42 | 57 |

| Montgomery County | 51 | 53 | 60 | 76 | 54 |

Harris County had the highest amount of crash deaths, and unfortunately, for the most part, the numbers increased overall among the counties.

Fatalities Involving Speeding by County