Best Montana Car Insurance (2025)

Montana car insurance rates average $72 per month while USAA offers the cheapest car insurance in Montana. Drivers must meet Montana minimum auto insurance requirements of 25/50/20 for bodily injury and property damage coverage. Use our comparison tool to shop around for the best Montana car insurance quotes.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed life and health insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chr...

Licensed Insurance Agent

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Montana minimum auto insurance requirements are 25/50/20 for bodily injury and property damage

- Montana car insurance rates average $72 per month

- To find cheap Montana car insurance, compare multiple Montana car insurance quotes

| MONTANA STATISTICS SUMMARY | DETAILS |

|---|---|

| Miles of Roadway | 75,007 |

| Vehicles Registered in State | 1,447,797 |

| State Population | 1,062,305 |

| Most Popular Vehicle | Ford 150 |

| Uninsured Motorists | 9.90% |

| State Rank: 33 | |

| Driving Fatalities in 2018 | Speeding: 110 |

| DUI: 153 | |

| Total: 662 | |

| Annual Insurance Costs | Liability: $386.29 |

| Collision: $265.32 | |

| Comprehensive: $211.91 | |

| Full Coverage: $863.52 | |

| Cheapest Provider | SAFECO |

Few states are wild at heart like Montana. With its vast rolling eastern hills, and it’s mountainous West, one could get lost its beauty and elegance all day long.

Grizzlies, eagles, ranches, and agriculture are woven into the seams of this pioneering and historical state. Who can forget the Lewis and Clark expedition? Ranchers, cowboys, horses. The spirit of the Native American culture. Truly, it is deeply historic and warm

Whether you’re a Montanian or someone with great interest in traveling through the sophisticated state, we’ve compiled a guide with everything from rates and coverage to the best car insurance companies–minus the stress.

Because there are thousands of insurance companies offering various rates and packages on a daily basis. And it could be more than overwhelming.

With our guide, however, you’ll be confident when choosing the best Montana car insurance for you and your family.

Use our FREE comparison tool below to get started. Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Montana Car Insurance Coverage and Rates

So how do we even begin to get started? Knowing state-mandated laws for insurance coverage and shopping around for rates to obtain that coverage can be a bit daunting.

So first, we’ll learn about Montanan roadways and information on the types of coverage needed on those roadways.

Then, we’ll get you acquainted with some rates.

So here we go.

Let’s talk about Montana’s minimum coverage.

Minimum Auto Insurance Coverage in Montana

Every state has a minimum amount of coverage needed before one can legally get out on the road.

In Montana, that coverage is the following:

- $25,000 for bodily injury, per person per accident

- $50,000 for bodily injury, total per accident

- $20,000 for property damage per accident

Bodily injury applies to the injuries of a person or persons of the opposing party in the event that you should get into an accident, while property damage pays for any fixtures or streets one may damage in the event of an accident.

In Montana, you must carry proof of this insurance whenever you are driving. But what other forms can be accepted?

We’ll cover that next.

Forms of Financial Responsibility

What are additional forms or forms of Financial Responsibility that provide proof of insurance?

According to the Montana State Legislature, drivers can purchase SR22 insurance. This kind of insurance simply states that you’re holding up your end of the deal and meeting your state’s coverage requirements for driving over a certain amount of time.

And according to a report in accordance with the Department of Justice’s Motor Vehicle Division people can also meet proof of financial responsibility in two additional ways–by providing a bond or through self-insurance (if they have a fleet of 25 or more vehicles).

In case of an accident, self-insurance makes your responsible for your own expenses, as it is money you would’ve set aside beforehand.

A bond, on the other hand, is basically a loan that gives the borrower outside assets to back long haul ventures–usually with specific conditions. The bond demonstrates that you have the money to cover your liability in case of an impact.

So just to recap, SR22 insurance, self insurance, or a bond all count as legitimate proof of insurance coverage for the state of Montana.

While out on the road, one must have proof of insurance at all times.

Something to always keep in mind.

Premiums as a Percentage of Income

An individual’s income per capita is the amount of money one has to leftover after taxes to either spend or save.

Montanans pay roughly $868.55 on average, meaning that roughly 2.10 percent of their annual income is spent on car insurance–this is data from several years ago.

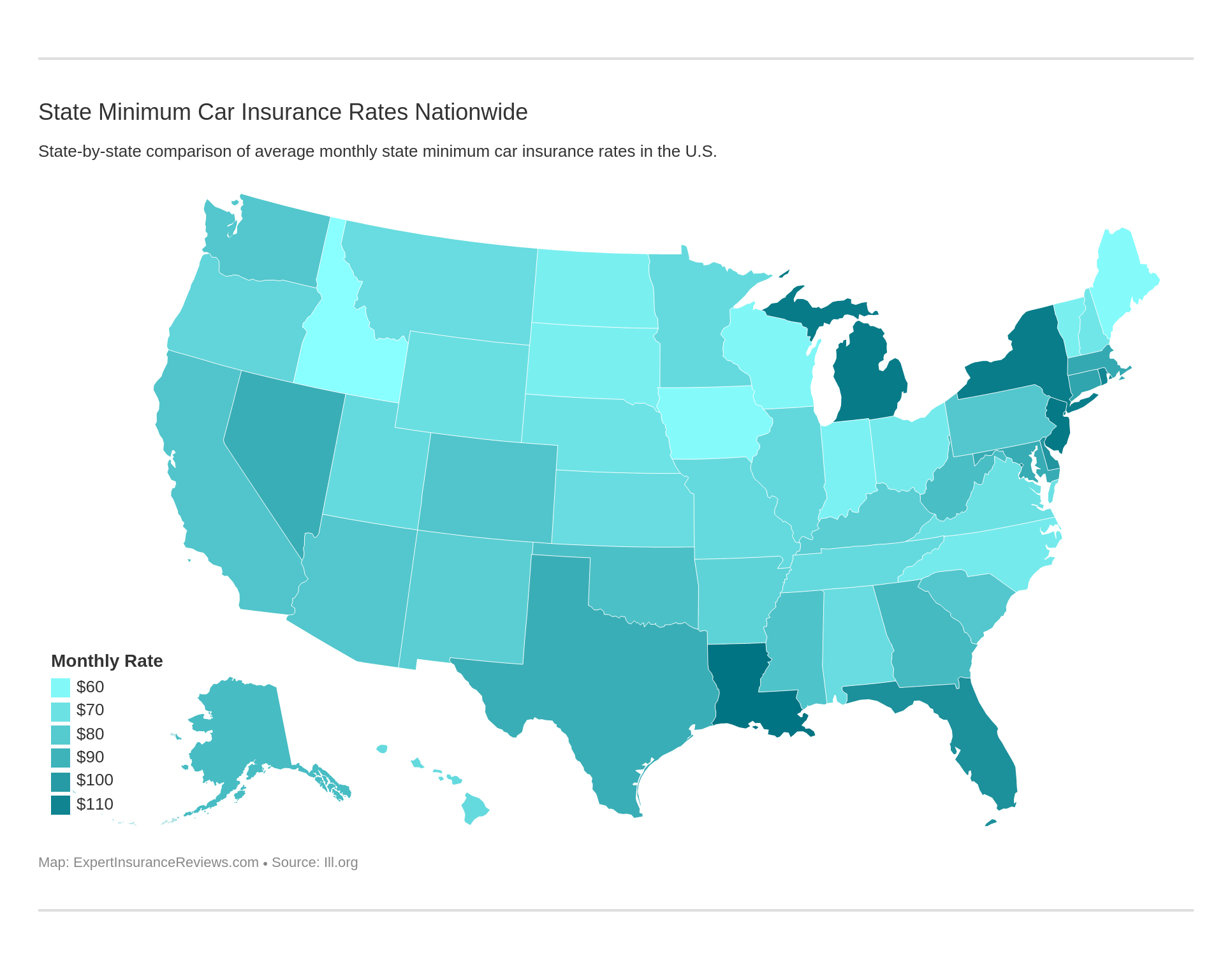

How does this fair with the rest of the nation? Montana comes in a little over the halfway mark for the average premium per income.

Its neighbor North Dakota paid the cheapest that year at 1.50 percent, with Wyoming also being in the top five at 1.69 percent. Idaho and Washington were also cheaper, coming in at 2 percent and 2.11 percent, respectively.

Montana, however, did beat the national income per capita percentage nationwide in 2012 and 2014–in 2013, it matched at 2.39 percent.

Something to keep in mind if you are living in the state.

Next, we’ll talk about the average rate for each type of coverage in the state of Montana.

CalculatorPro

Average Monthly Car Insurance Rates in MT (Liability, Collision, Comprehensive)

Montana Core Coverage

| Coverage Type | Average Cost in Montana (2015) | Average Cost Nationwide (2015) |

|---|---|---|

| Liability | $386.29 | $538.73 |

| Collision | $265.32 | $322.61 |

| Comprehensive | $211.91 | $148.04 |

| Total (full coverage) | $863.52 | $1,009.38 |

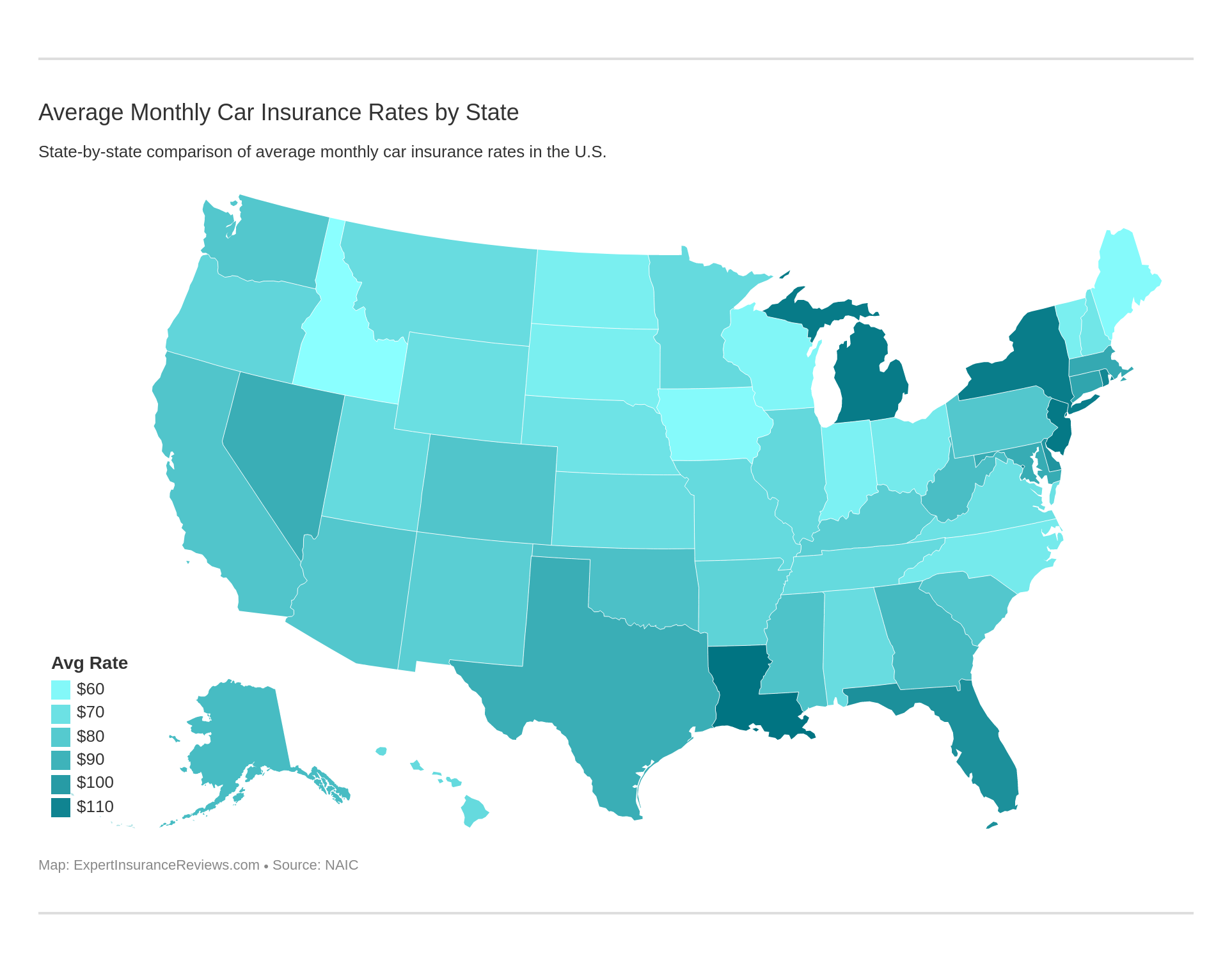

Montanans paid less than the nationwide average cost for liability and collision car insurance, however, paid a tad more for full coverage auto insurance--Montana still falls beneath the total average nationwide cost, paying less than the national average overall.

Additional Liability

Montana Additional Liability

| Coverage Type | Montana Loss Ratio (2015) | National Average Loss Ration (2015) |

|---|---|---|

| Medical Payments | 69.57 | 75.74 |

| Uninsured/Underinsured Motorist | 61.48 | 75.14 |

Med Pay and Uninsured/Underinsured Motorist insurance are additional types of liability coverages that people get to bulk up their policy.

And a loss ratio? A loss ratio shows how much a company spends on the types of claims to how much money they take in on premiums.

With a loss ratio of 60, it indicates that the company spent $60 on claims out of every $100 earned in premiums. And the closer the ratio is to 100, the more claims that are paid. So a 60 – 70 loss ratio is considered to be in the safe zone.

The national average for both Med Pay and Uninsured/Underinsured Motorist coverage is a tad bit out of the safe zone, however, Montana’s loss ratios for Med Pay and Uninsured/Underinsured Motorist insurance is in the safe zone–a fairly good thing.

Add-ons, Endorsements, and Riders

Since we’ve started, we’ve discussed insurance and several add-ons like MedPay and Uninsured/Underinsured motorist coverage. But there are additional options available and we want to make sure you’re informed as much as possible on some policies that might not be familiar to most.

With that in mind, here are some other types of insurance that might be helpful for you and your family. Click on the links below to see if any additional coverage appeals to you.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Car Insurance

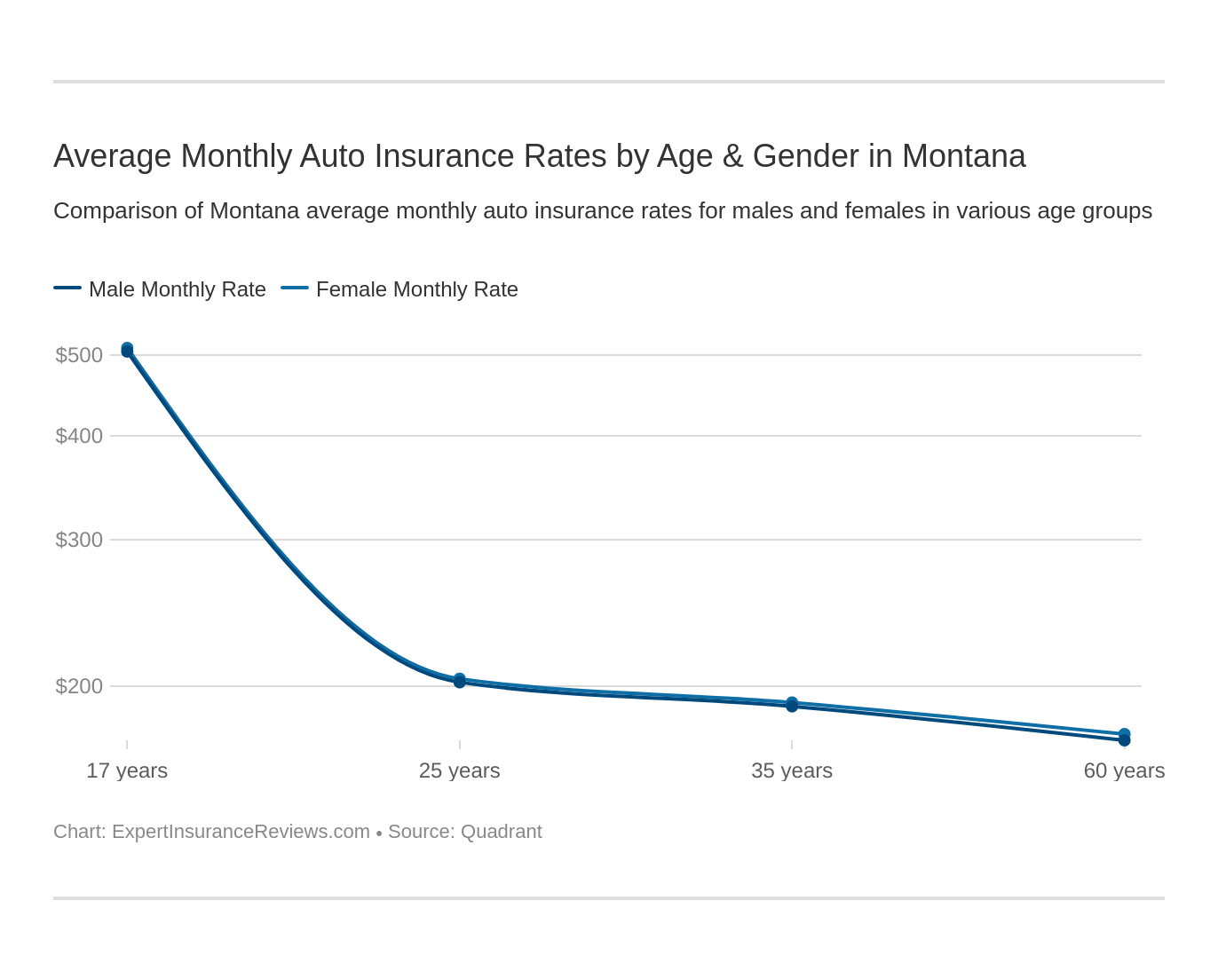

Average Monthly Car Insurance Rates by Age & Gender in MT

Montana Male vs. Female Rates

| Insurance Company | Age 17 Female Annual Rates | Age 17 Male Annual Rates | Age 25 Female Annual Rates | Age 25 Male Annual Rates | Age 35 Female Annual Rates | Age 35 Male Annual Rates | Age 60 Female Annual Rates | Age 60 Male Annual Rates |

|---|---|---|---|---|---|---|---|---|

| $10,484.90 | $10,484.90 | $2,955.90 | $2,955.90 | $2,740.02 | $2,740.02 | $2,507.60 | $2,507.60 | |

| Mid-Century | $7,395.41 | $7,395.41 | $3,016.88 | $3,016.88 | $2,755.44 | $2,755.44 | $2,462.45 | $2,462.45 |

| $6,926.07 | $6,445.87 | $2,434.84 | $2,218.97 | $2,840.18 | $2,653.99 | $2,771.26 | $2,527.59 | |

| $2,064.28 | $2,064.28 | $1,218.77 | $1,218.77 | $1,021.71 | $1,021.71 | $999.67 | $999.67 | |

| Depositors | $5,640.58 | $5,640.58 | $2,952.88 | $2,952.88 | $2,785.97 | $2,785.97 | $2,533.60 | $2,533.60 |

| $7,548.71 | $7,548.71 | $3,642.19 | $3,642.19 | $3,231.09 | $3,231.09 | $2,901.06 | $2,901.06 | |

| $4,814.65 | $4,814.65 | $1,776.55 | $1,776.55 | $1,640.33 | $1,640.33 | $1,439.41 | $1,439.41 | |

| $4,103.59 | $4,103.59 | $1,603.83 | $1,603.83 | $1,280.16 | $1,280.16 | $1,139.97 | $1,139.97 |

It is known that females tend to have lower rates than males because they get into fewer accidents and have fewer DUIs. Surprisingly, however, most companies play it fair when it comes to males and female rates across the board. Geico, on the other hand, charges females a higher rate across all spectrums moving away from the standard.

Companies also charge less as one grows older–Allstate, for example, drops their rate nearly $8,000 when a younger driver turns 25.

Rates also drop when married couples get older–supporting the theory that drivers who are older are more experienced and less likely to get into incidents on the road.

Cheapest Rates by ZIP Code

Rates can also change depending on which area you’re located in. Enter your ZIP code to find your rate.

Montana ZIP CODES rates

| Zipcode | Average | Mid-Century | Depositors | ||||||

|---|---|---|---|---|---|---|---|---|---|

| 59089 | $3,457.80 | $4,578.75 | $4,625.59 | $3,977.81 | $1,365.50 | $3,677.86 | $5,024.35 | $2,354.73 | $2,057.85 |

| 59853 | $3,440.51 | $5,135.42 | $4,012.32 | $3,414.38 | $1,416.63 | $3,655.44 | $5,138.66 | $2,715.52 | $2,035.70 |

| 59035 | $3,436.52 | $4,578.75 | $4,625.59 | $3,977.81 | $1,365.50 | $3,677.86 | $4,854.09 | $2,354.73 | $2,057.85 |

| 59050 | $3,433.47 | $4,578.75 | $4,625.59 | $3,977.81 | $1,365.50 | $3,677.86 | $4,819.82 | $2,364.60 | $2,057.85 |

| 59075 | $3,433.31 | $4,578.75 | $4,625.59 | $3,977.81 | $1,365.50 | $3,677.86 | $4,778.12 | $2,405.02 | $2,057.85 |

| 59417 | $3,420.37 | $5,135.42 | $3,762.10 | $4,038.88 | $1,402.99 | $3,542.04 | $4,845.55 | $2,578.17 | $2,057.85 |

| 59068 | $3,414.03 | $4,873.58 | $4,107.10 | $3,977.81 | $1,370.30 | $3,677.86 | $4,688.65 | $2,559.13 | $2,057.85 |

| 59448 | $3,408.40 | $5,135.42 | $3,762.10 | $4,038.88 | $1,432.38 | $3,542.04 | $4,776.08 | $2,522.46 | $2,057.85 |

| 59007 | $3,399.96 | $4,873.58 | $4,107.10 | $3,977.81 | $1,370.30 | $3,677.86 | $4,780.44 | $2,354.73 | $2,057.85 |

| 59070 | $3,398.91 | $4,873.58 | $4,107.10 | $3,977.81 | $1,370.30 | $3,677.86 | $4,677.66 | $2,449.16 | $2,057.85 |

| 59008 | $3,398.10 | $4,873.58 | $4,107.10 | $3,977.81 | $1,370.30 | $3,677.86 | $4,765.56 | $2,354.73 | $2,057.85 |

| 59920 | $3,391.20 | $5,135.42 | $4,012.32 | $3,414.38 | $1,407.93 | $3,655.44 | $4,687.47 | $2,677.71 | $2,138.93 |

| 59932 | $3,389.23 | $5,135.42 | $4,012.32 | $3,414.38 | $1,435.44 | $3,655.44 | $4,605.65 | $2,716.26 | $2,138.93 |

| 59411 | $3,387.91 | $5,135.42 | $3,762.10 | $4,038.88 | $1,386.23 | $3,542.04 | $4,826.09 | $2,354.73 | $2,057.85 |

| 59930 | $3,387.14 | $5,135.42 | $4,012.32 | $3,414.38 | $1,374.40 | $3,655.44 | $4,765.25 | $2,704.18 | $2,035.70 |

| 59844 | $3,386.85 | $5,135.42 | $4,012.32 | $3,414.38 | $1,421.88 | $3,655.44 | $4,684.86 | $2,734.77 | $2,035.70 |

| 59935 | $3,386.28 | $5,135.42 | $4,012.32 | $3,414.38 | $1,374.40 | $3,655.44 | $4,774.42 | $2,688.15 | $2,035.70 |

| 59925 | $3,378.26 | $5,135.42 | $4,012.32 | $3,414.38 | $1,388.39 | $3,655.44 | $4,574.15 | $2,707.08 | $2,138.93 |

| 59931 | $3,377.84 | $5,135.42 | $4,012.32 | $3,414.38 | $1,383.14 | $3,420.37 | $4,793.59 | $2,707.79 | $2,155.75 |

| 59066 | $3,377.49 | $4,578.75 | $4,107.10 | $3,977.81 | $1,365.50 | $3,677.86 | $4,854.09 | $2,400.97 | $2,057.85 |

| 59033 | $3,376.50 | $4,884.10 | $4,107.10 | $3,977.81 | $1,300.92 | $3,606.86 | $4,722.68 | $2,354.73 | $2,057.85 |

| 59001 | $3,374.37 | $4,873.58 | $4,107.10 | $3,977.81 | $1,307.54 | $3,606.86 | $4,654.62 | $2,409.60 | $2,057.85 |

| 59922 | $3,374.36 | $5,135.42 | $4,012.32 | $3,414.38 | $1,407.22 | $3,655.44 | $4,505.10 | $2,726.07 | $2,138.93 |

| 59917 | $3,372.37 | $5,135.42 | $4,012.32 | $3,414.38 | $1,378.70 | $3,655.44 | $4,642.83 | $2,704.18 | $2,035.70 |

| 59011 | $3,372.28 | $4,884.10 | $4,107.10 | $3,977.81 | $1,223.45 | $3,606.86 | $4,759.65 | $2,361.40 | $2,057.85 |

| 59434 | $3,372.07 | $5,135.42 | $3,762.10 | $4,038.88 | $1,462.61 | $3,542.04 | $4,488.48 | $2,489.16 | $2,057.85 |

| 59427 | $3,372.00 | $5,135.42 | $4,063.40 | $4,038.88 | $1,257.99 | $3,542.04 | $4,441.89 | $2,438.53 | $2,057.85 |

| 59014 | $3,371.67 | $4,873.58 | $4,107.10 | $3,977.81 | $1,322.88 | $3,677.86 | $4,507.80 | $2,448.52 | $2,057.85 |

| 59874 | $3,365.74 | $5,135.42 | $4,012.32 | $3,414.38 | $1,416.63 | $3,655.44 | $4,590.85 | $2,665.19 | $2,035.70 |

| 59074 | $3,365.74 | $4,884.10 | $3,837.90 | $3,977.81 | $1,304.40 | $3,606.86 | $4,835.94 | $2,421.07 | $2,057.85 |

| 59923 | $3,364.97 | $5,135.42 | $4,012.32 | $3,414.38 | $1,369.21 | $3,655.44 | $4,607.65 | $2,689.60 | $2,035.70 |

| 59873 | $3,364.34 | $5,135.42 | $4,012.32 | $3,414.38 | $1,407.85 | $3,655.44 | $4,596.09 | $2,657.54 | $2,035.70 |

| 59460 | $3,364.22 | $4,723.48 | $4,060.88 | $4,038.88 | $1,396.82 | $3,649.16 | $4,631.98 | $2,354.73 | $2,057.85 |

| 59317 | $3,364.13 | $4,648.48 | $4,037.31 | $3,977.81 | $1,335.20 | $3,677.86 | $4,594.36 | $2,584.18 | $2,057.85 |

| 59071 | $3,362.59 | $4,682.42 | $4,107.10 | $3,977.81 | $1,383.04 | $3,677.86 | $4,659.95 | $2,354.73 | $2,057.85 |

| 59484 | $3,362.14 | $5,135.42 | $3,989.15 | $4,038.88 | $1,275.05 | $3,542.04 | $4,504.01 | $2,354.73 | $2,057.85 |

| 59486 | $3,361.11 | $4,906.02 | $4,063.40 | $4,038.88 | $1,296.43 | $3,542.04 | $4,622.91 | $2,361.40 | $2,057.85 |

| 59057 | $3,359.10 | $4,757.41 | $4,107.10 | $3,977.81 | $1,466.82 | $3,606.86 | $4,481.08 | $2,417.85 | $2,057.85 |

| 59077 | $3,359.05 | $4,457.30 | $4,343.67 | $3,977.81 | $1,327.29 | $3,681.58 | $4,672.19 | $2,354.73 | $2,057.85 |

| 59467 | $3,358.68 | $4,964.52 | $3,603.61 | $4,038.88 | $1,384.48 | $3,649.16 | $4,816.25 | $2,354.73 | $2,057.85 |

| 59019 | $3,357.26 | $4,757.41 | $4,107.10 | $3,977.81 | $1,416.09 | $3,606.86 | $4,537.18 | $2,397.80 | $2,057.85 |

| 59012 | $3,354.42 | $4,648.48 | $4,037.31 | $3,977.81 | $1,363.71 | $3,677.86 | $4,717.62 | $2,354.73 | $2,057.85 |

| 59524 | $3,354.13 | $4,214.64 | $3,848.17 | $4,038.88 | $1,453.31 | $3,681.58 | $5,055.80 | $2,482.82 | $2,057.85 |

| 59466 | $3,352.80 | $4,906.02 | $3,989.15 | $4,038.88 | $1,215.92 | $3,542.04 | $4,717.79 | $2,354.73 | $2,057.85 |

| 59921 | $3,351.97 | $5,135.42 | $4,012.32 | $3,414.38 | $1,462.61 | $3,471.08 | $4,551.35 | $2,629.71 | $2,138.93 |

| 59029 | $3,351.51 | $4,873.58 | $4,107.10 | $3,977.81 | $1,359.93 | $3,677.86 | $4,332.72 | $2,425.28 | $2,057.85 |

| 59063 | $3,351.41 | $4,948.60 | $4,107.10 | $3,977.81 | $1,224.39 | $3,606.86 | $4,525.72 | $2,362.93 | $2,057.85 |

| 59918 | $3,351.38 | $5,135.42 | $4,012.32 | $3,414.38 | $1,378.70 | $3,655.44 | $4,549.33 | $2,629.71 | $2,035.70 |

| 59933 | $3,351.38 | $5,135.42 | $4,012.32 | $3,414.38 | $1,378.70 | $3,655.44 | $4,549.33 | $2,629.71 | $2,035.70 |

| 59934 | $3,351.38 | $5,135.42 | $4,012.32 | $3,414.38 | $1,378.70 | $3,655.44 | $4,549.33 | $2,629.71 | $2,035.70 |

| 59067 | $3,351.27 | $4,884.10 | $4,107.10 | $3,977.81 | $1,254.44 | $3,606.86 | $4,533.36 | $2,388.68 | $2,057.85 |

| 59078 | $3,350.96 | $4,884.10 | $3,837.90 | $3,977.81 | $1,298.44 | $3,606.86 | $4,789.99 | $2,354.73 | $2,057.85 |

| 59028 | $3,349.80 | $4,873.58 | $3,861.16 | $3,977.81 | $1,307.54 | $3,606.86 | $4,654.36 | $2,459.28 | $2,057.85 |

| 59013 | $3,348.69 | $4,873.58 | $4,107.10 | $3,977.81 | $1,359.93 | $3,677.86 | $4,380.71 | $2,354.73 | $2,057.85 |

| 59026 | $3,348.69 | $4,873.58 | $4,107.10 | $3,977.81 | $1,359.93 | $3,677.86 | $4,380.71 | $2,354.73 | $2,057.85 |

| 59859 | $3,348.30 | $5,135.42 | $3,928.29 | $3,414.38 | $1,388.39 | $3,655.44 | $4,597.12 | $2,631.63 | $2,035.70 |

| 59025 | $3,348.11 | $4,578.75 | $4,165.55 | $3,977.81 | $1,254.40 | $3,677.86 | $4,717.93 | $2,354.73 | $2,057.85 |

| 59916 | $3,347.79 | $5,135.42 | $4,012.32 | $3,414.38 | $1,462.61 | $3,471.08 | $4,517.84 | $2,629.71 | $2,138.93 |

| 59055 | $3,347.37 | $4,884.10 | $4,107.10 | $3,977.81 | $1,160.97 | $3,606.86 | $4,629.54 | $2,354.73 | $2,057.85 |

| 59482 | $3,345.49 | $4,906.02 | $3,989.15 | $4,038.88 | $1,268.06 | $3,542.04 | $4,618.30 | $2,343.63 | $2,057.85 |

| 59085 | $3,342.87 | $4,948.60 | $3,752.50 | $3,977.81 | $1,282.79 | $3,606.86 | $4,761.87 | $2,354.73 | $2,057.85 |

| 59052 | $3,342.41 | $4,884.10 | $3,808.61 | $3,977.81 | $1,320.09 | $3,606.86 | $4,729.22 | $2,354.73 | $2,057.85 |

| 59061 | $3,342.03 | $4,948.60 | $3,861.16 | $3,977.81 | $1,378.71 | $3,606.86 | $4,550.52 | $2,354.73 | $2,057.85 |

| 59062 | $3,341.41 | $4,648.48 | $4,037.31 | $3,977.81 | $1,363.71 | $3,677.86 | $4,613.56 | $2,354.73 | $2,057.85 |

| 59914 | $3,340.71 | $5,135.42 | $4,012.32 | $3,414.38 | $1,338.40 | $3,420.37 | $4,619.30 | $2,629.71 | $2,155.75 |

| 59527 | $3,339.71 | $4,314.17 | $3,848.17 | $4,038.88 | $1,389.27 | $3,681.58 | $4,940.55 | $2,447.25 | $2,057.85 |

| 59929 | $3,339.12 | $5,135.42 | $4,012.32 | $3,414.38 | $1,395.37 | $3,420.37 | $4,549.66 | $2,629.71 | $2,155.75 |

| 59022 | $3,338.39 | $4,387.59 | $4,412.62 | $3,977.81 | $1,294.16 | $3,677.86 | $4,578.02 | $2,321.20 | $2,057.85 |

| 59454 | $3,336.91 | $4,906.02 | $3,989.15 | $4,038.88 | $1,251.06 | $3,542.04 | $4,555.54 | $2,354.73 | $2,057.85 |

| 59318 | $3,336.70 | $4,457.30 | $4,178.34 | $3,977.81 | $1,262.00 | $3,681.58 | $4,723.99 | $2,354.73 | $2,057.85 |

| 59911 | $3,336.07 | $5,135.42 | $4,012.32 | $3,414.38 | $1,424.06 | $3,420.37 | $4,427.66 | $2,698.60 | $2,155.75 |

| 59036 | $3,335.54 | $4,948.60 | $3,752.50 | $3,977.81 | $1,282.79 | $3,606.86 | $4,679.70 | $2,378.19 | $2,057.85 |

| 59926 | $3,335.52 | $5,135.42 | $4,012.32 | $3,414.38 | $1,368.82 | $3,471.08 | $4,513.53 | $2,629.71 | $2,138.93 |

| 59936 | $3,335.52 | $5,135.42 | $4,012.32 | $3,414.38 | $1,368.82 | $3,471.08 | $4,513.53 | $2,629.71 | $2,138.93 |

| 59003 | $3,335.42 | $4,648.48 | $4,037.31 | $3,977.81 | $1,363.71 | $3,677.86 | $4,508.24 | $2,412.12 | $2,057.85 |

| 59901 | $3,334.32 | $5,135.42 | $4,012.32 | $3,414.38 | $1,368.82 | $3,471.08 | $4,505.53 | $2,628.09 | $2,138.93 |

| 59913 | $3,332.19 | $5,135.42 | $4,012.32 | $3,414.38 | $1,368.82 | $3,471.08 | $4,513.53 | $2,603.05 | $2,138.93 |

| 59848 | $3,331.29 | $5,135.42 | $4,012.32 | $3,414.38 | $1,316.71 | $3,655.44 | $4,450.59 | $2,629.71 | $2,035.70 |

| 59912 | $3,331.09 | $5,135.42 | $4,012.32 | $3,414.38 | $1,377.44 | $3,471.08 | $4,486.90 | $2,612.24 | $2,138.93 |

| 59432 | $3,330.49 | $4,906.02 | $3,762.10 | $4,038.88 | $1,296.43 | $3,542.04 | $4,685.93 | $2,354.73 | $2,057.85 |

| 59034 | $3,330.35 | $4,387.59 | $4,412.62 | $3,977.81 | $1,255.37 | $3,677.86 | $4,610.76 | $2,262.99 | $2,057.85 |

| 59064 | $3,330.28 | $4,578.75 | $4,107.10 | $3,977.81 | $1,190.01 | $3,627.21 | $4,687.96 | $2,415.54 | $2,057.85 |

| 59006 | $3,329.98 | $4,578.75 | $4,107.10 | $3,977.81 | $1,224.83 | $3,627.21 | $4,650.73 | $2,415.54 | $2,057.85 |

| 59069 | $3,329.76 | $4,692.92 | $4,107.10 | $3,977.81 | $1,229.78 | $3,606.86 | $4,611.02 | $2,354.73 | $2,057.85 |

| 59337 | $3,328.66 | $4,457.30 | $4,265.89 | $3,977.81 | $1,305.27 | $3,681.58 | $4,462.17 | $2,421.42 | $2,057.85 |

| 59016 | $3,327.72 | $4,387.59 | $4,165.55 | $3,977.81 | $1,283.71 | $3,677.86 | $4,712.35 | $2,359.08 | $2,057.85 |

| 59530 | $3,326.42 | $4,747.98 | $3,790.22 | $4,038.88 | $1,407.06 | $3,649.16 | $4,565.46 | $2,354.73 | $2,057.85 |

| 59928 | $3,326.39 | $5,135.42 | $4,012.32 | $3,414.38 | $1,464.63 | $3,471.08 | $4,344.62 | $2,629.71 | $2,138.93 |

| 59444 | $3,325.35 | $4,906.02 | $3,989.15 | $4,038.88 | $1,224.62 | $3,542.04 | $4,489.53 | $2,354.73 | $2,057.85 |

| 59927 | $3,324.68 | $5,135.42 | $4,012.32 | $3,414.38 | $1,385.34 | $3,471.08 | $4,413.27 | $2,626.67 | $2,138.93 |

| 59002 | $3,324.24 | $4,387.59 | $4,107.10 | $3,977.81 | $1,312.86 | $3,627.21 | $4,691.91 | $2,431.61 | $2,057.85 |

| 59345 | $3,324.17 | $4,648.48 | $4,037.31 | $3,977.81 | $1,323.14 | $3,677.86 | $4,516.17 | $2,354.73 | $2,057.85 |

| 59919 | $3,323.94 | $5,135.42 | $4,012.32 | $3,414.38 | $1,368.82 | $3,471.08 | $4,447.52 | $2,603.05 | $2,138.93 |

| 59915 | $3,323.40 | $5,019.22 | $4,012.32 | $3,414.38 | $1,326.21 | $3,420.37 | $4,549.24 | $2,689.75 | $2,155.75 |

| 59545 | $3,322.39 | $4,759.64 | $3,989.15 | $4,038.88 | $1,282.02 | $3,542.04 | $4,554.82 | $2,354.73 | $2,057.85 |

| 59419 | $3,322.24 | $4,964.52 | $3,603.61 | $4,038.88 | $1,384.48 | $3,649.16 | $4,524.71 | $2,354.73 | $2,057.85 |

| 59456 | $3,322.02 | $4,906.02 | $3,989.15 | $4,038.88 | $1,268.06 | $3,542.04 | $4,419.42 | $2,354.73 | $2,057.85 |

| 59529 | $3,320.76 | $4,214.64 | $3,790.22 | $4,038.88 | $1,329.18 | $3,681.58 | $4,966.21 | $2,487.49 | $2,057.85 |

| 59314 | $3,319.09 | $4,648.48 | $4,037.31 | $3,977.81 | $1,323.14 | $3,677.86 | $4,475.58 | $2,354.73 | $2,057.85 |

| 59522 | $3,318.83 | $4,759.64 | $3,989.15 | $4,038.88 | $1,407.06 | $3,542.04 | $4,488.74 | $2,267.31 | $2,057.85 |

| 59531 | $3,318.09 | $4,759.64 | $3,989.15 | $4,038.88 | $1,407.06 | $3,542.04 | $4,395.39 | $2,354.73 | $2,057.85 |

| 59521 | $3,317.89 | $4,556.83 | $3,790.22 | $4,038.88 | $1,347.89 | $3,649.16 | $4,718.26 | $2,384.02 | $2,057.85 |

| 59520 | $3,316.98 | $4,747.98 | $3,790.22 | $4,038.88 | $1,363.58 | $3,649.16 | $4,443.60 | $2,444.59 | $2,057.85 |

| 59845 | $3,316.19 | $5,135.42 | $4,012.32 | $3,414.38 | $1,316.71 | $3,655.44 | $4,301.96 | $2,657.61 | $2,035.70 |

| 59341 | $3,313.92 | $4,214.64 | $4,353.38 | $3,977.81 | $1,378.70 | $3,681.58 | $4,492.68 | $2,354.73 | $2,057.85 |

| 59343 | $3,313.86 | $4,648.48 | $4,037.31 | $3,977.81 | $1,335.20 | $3,677.86 | $4,421.69 | $2,354.73 | $2,057.85 |

| 59351 | $3,312.70 | $4,648.48 | $4,087.57 | $3,977.81 | $1,232.84 | $3,677.86 | $4,464.49 | $2,354.73 | $2,057.85 |

| 59447 | $3,311.62 | $4,948.60 | $3,533.31 | $3,977.81 | $1,402.68 | $3,649.16 | $4,568.81 | $2,354.73 | $2,057.85 |

| 59542 | $3,311.40 | $4,214.64 | $3,848.17 | $4,038.88 | $1,329.18 | $3,681.58 | $4,966.21 | $2,354.73 | $2,057.85 |

| 59856 | $3,310.72 | $5,135.42 | $3,772.02 | $3,414.38 | $1,388.39 | $3,655.44 | $4,454.66 | $2,629.71 | $2,035.70 |

| 59469 | $3,310.68 | $4,948.60 | $3,533.31 | $3,977.81 | $1,375.91 | $3,649.16 | $4,588.09 | $2,354.73 | $2,057.85 |

| 59435 | $3,310.63 | $4,906.02 | $3,989.15 | $4,038.88 | $1,207.93 | $3,542.04 | $4,388.48 | $2,354.73 | $2,057.85 |

| 59087 | $3,310.52 | $4,387.59 | $4,343.67 | $3,977.81 | $1,262.00 | $3,681.58 | $4,358.92 | $2,414.77 | $2,057.85 |

| 59461 | $3,310.25 | $4,759.64 | $3,989.15 | $4,038.88 | $1,378.70 | $3,542.04 | $4,361.06 | $2,354.73 | $2,057.85 |

| 59526 | $3,309.36 | $4,214.64 | $3,790.22 | $4,038.88 | $1,330.93 | $3,681.58 | $4,939.89 | $2,420.88 | $2,057.85 |

| 59031 | $3,309.23 | $4,387.59 | $4,165.55 | $3,977.81 | $1,275.17 | $3,677.86 | $4,577.29 | $2,354.73 | $2,057.85 |

| 59937 | $3,309.17 | $5,135.42 | $4,012.32 | $3,414.38 | $1,385.34 | $3,471.08 | $4,321.29 | $2,594.63 | $2,138.93 |

| 59474 | $3,308.81 | $4,906.02 | $3,989.15 | $4,038.88 | $1,207.93 | $3,542.04 | $4,514.72 | $2,213.94 | $2,057.85 |

| 59547 | $3,307.56 | $4,314.17 | $3,790.22 | $4,038.88 | $1,339.63 | $3,681.58 | $4,883.43 | $2,354.73 | $2,057.85 |

| 59015 | $3,305.39 | $4,462.60 | $4,107.10 | $3,977.81 | $1,282.30 | $3,627.21 | $4,512.73 | $2,415.54 | $2,057.85 |

| 59537 | $3,305.30 | $4,214.64 | $3,848.17 | $4,038.88 | $1,387.52 | $3,681.58 | $4,859.07 | $2,354.73 | $2,057.85 |

| 59535 | $3,304.56 | $4,556.83 | $3,790.22 | $4,038.88 | $1,344.86 | $3,681.58 | $4,611.54 | $2,354.73 | $2,057.85 |

| 59043 | $3,304.24 | $4,578.75 | $4,037.31 | $3,977.81 | $1,273.39 | $3,677.86 | $4,408.97 | $2,421.98 | $2,057.85 |

| 59546 | $3,304.18 | $4,214.64 | $3,848.17 | $4,038.88 | $1,403.22 | $3,681.58 | $4,834.40 | $2,354.73 | $2,057.85 |

| 59322 | $3,303.97 | $4,387.59 | $4,353.38 | $3,977.81 | $1,309.86 | $3,681.58 | $4,309.00 | $2,354.73 | $2,057.85 |

| 59462 | $3,299.50 | $4,948.60 | $3,533.31 | $3,977.81 | $1,331.95 | $3,649.16 | $4,542.65 | $2,354.73 | $2,057.85 |

| 59525 | $3,299.01 | $4,556.83 | $3,790.22 | $4,038.88 | $1,285.72 | $3,649.16 | $4,646.66 | $2,366.75 | $2,057.85 |

| 59058 | $3,296.35 | $4,457.30 | $4,092.08 | $3,977.81 | $1,327.29 | $3,681.58 | $4,422.21 | $2,354.73 | $2,057.85 |

| 59532 | $3,293.80 | $4,556.83 | $3,790.22 | $4,038.88 | $1,342.69 | $3,649.16 | $4,560.07 | $2,354.73 | $2,057.85 |

| 59479 | $3,293.44 | $4,948.60 | $3,533.31 | $3,977.81 | $1,309.65 | $3,649.16 | $4,544.61 | $2,326.56 | $2,057.85 |

| 59041 | $3,291.92 | $4,873.58 | $4,107.10 | $3,977.81 | $1,359.93 | $3,293.06 | $4,289.13 | $2,376.88 | $2,057.85 |

| 59452 | $3,290.91 | $4,948.60 | $3,533.31 | $3,977.81 | $1,311.39 | $3,649.16 | $4,494.42 | $2,354.73 | $2,057.85 |

| 59010 | $3,290.70 | $4,387.59 | $4,037.31 | $3,977.81 | $1,309.86 | $3,677.86 | $4,522.58 | $2,354.73 | $2,057.85 |

| 59425 | $3,288.25 | $4,759.64 | $3,989.15 | $4,038.88 | $1,400.07 | $3,542.04 | $4,304.65 | $2,213.73 | $2,057.85 |

| 59450 | $3,288.19 | $4,919.78 | $3,533.31 | $4,038.88 | $1,439.64 | $3,649.16 | $4,312.22 | $2,354.73 | $2,057.85 |

| 59088 | $3,287.69 | $4,578.75 | $4,107.10 | $3,977.81 | $1,114.06 | $3,627.21 | $4,473.76 | $2,364.96 | $2,057.85 |

| 59540 | $3,286.64 | $4,556.83 | $3,790.22 | $4,038.88 | $1,332.25 | $3,649.16 | $4,536.83 | $2,331.14 | $2,057.85 |

| 59538 | $3,286.47 | $4,214.64 | $3,848.17 | $4,038.88 | $1,439.36 | $3,681.58 | $4,625.32 | $2,385.97 | $2,057.85 |

| 59544 | $3,283.26 | $4,214.64 | $3,782.14 | $4,038.88 | $1,382.89 | $3,681.58 | $4,753.36 | $2,354.73 | $2,057.85 |

| 59259 | $3,282.47 | $4,214.64 | $4,140.01 | $3,977.81 | $1,301.82 | $3,681.58 | $4,531.37 | $2,354.73 | $2,057.85 |

| 59046 | $3,281.67 | $4,323.08 | $4,107.10 | $3,977.81 | $1,299.19 | $3,606.86 | $4,526.80 | $2,354.73 | $2,057.85 |

| 59863 | $3,279.47 | $5,019.22 | $3,790.01 | $3,414.38 | $1,382.19 | $3,420.37 | $4,424.16 | $2,629.71 | $2,155.75 |

| 59910 | $3,278.43 | $5,019.22 | $4,012.32 | $3,414.38 | $1,247.03 | $3,420.37 | $4,328.69 | $2,629.71 | $2,155.75 |

| 59528 | $3,277.83 | $4,556.83 | $3,790.22 | $4,038.88 | $1,332.25 | $3,649.16 | $4,442.74 | $2,354.73 | $2,057.85 |

| 59349 | $3,273.91 | $4,214.64 | $4,353.38 | $3,977.81 | $1,310.51 | $3,681.58 | $4,178.89 | $2,416.65 | $2,057.85 |

| 59326 | $3,273.41 | $4,214.64 | $4,353.38 | $3,977.81 | $1,280.92 | $3,681.58 | $4,266.42 | $2,354.73 | $2,057.85 |

| 59319 | $3,273.36 | $4,214.64 | $4,037.31 | $3,977.81 | $1,323.14 | $3,677.86 | $4,543.55 | $2,354.73 | $2,057.85 |

| 59824 | $3,273.13 | $5,019.22 | $3,840.23 | $3,414.38 | $1,428.47 | $3,420.37 | $4,336.11 | $2,570.52 | $2,155.75 |

| 59311 | $3,272.57 | $4,214.64 | $4,037.31 | $3,977.81 | $1,323.14 | $3,677.86 | $4,537.23 | $2,354.73 | $2,057.85 |

| 59831 | $3,272.40 | $5,019.22 | $3,790.01 | $3,414.38 | $1,438.97 | $3,655.44 | $4,195.80 | $2,629.71 | $2,035.70 |

| 59215 | $3,271.34 | $4,214.64 | $4,062.68 | $3,977.81 | $1,294.25 | $3,681.58 | $4,457.63 | $2,424.30 | $2,057.85 |

| 59084 | $3,271.07 | $4,948.60 | $3,533.31 | $3,977.81 | $1,262.00 | $3,681.58 | $4,352.71 | $2,354.73 | $2,057.85 |

| 59241 | $3,270.91 | $4,214.64 | $3,987.04 | $4,038.88 | $1,272.96 | $3,681.58 | $4,559.63 | $2,354.73 | $2,057.85 |

| 59273 | $3,269.32 | $4,214.64 | $3,987.04 | $4,038.88 | $1,378.70 | $3,681.58 | $4,441.18 | $2,354.73 | $2,057.85 |

| 59250 | $3,268.86 | $4,214.64 | $3,918.61 | $4,038.88 | $1,272.96 | $3,681.58 | $4,611.62 | $2,354.73 | $2,057.85 |

| 59253 | $3,268.30 | $4,214.64 | $3,918.61 | $4,038.88 | $1,295.21 | $3,681.58 | $4,584.95 | $2,354.73 | $2,057.85 |

| 59332 | $3,268.10 | $4,214.64 | $4,037.31 | $3,977.81 | $1,323.14 | $3,677.86 | $4,475.58 | $2,380.63 | $2,057.85 |

| 59244 | $3,267.58 | $4,214.64 | $3,918.61 | $4,038.88 | $1,272.96 | $3,681.58 | $4,601.43 | $2,354.73 | $2,057.85 |

| 59420 | $3,267.53 | $4,723.48 | $3,560.98 | $4,038.88 | $1,488.36 | $3,649.16 | $4,220.60 | $2,400.97 | $2,057.85 |

| 59424 | $3,267.24 | $4,757.41 | $3,533.31 | $3,977.81 | $1,307.87 | $3,649.16 | $4,499.76 | $2,354.73 | $2,057.85 |

| 59347 | $3,266.20 | $4,457.30 | $4,087.57 | $3,977.81 | $1,244.92 | $3,677.86 | $4,271.57 | $2,354.73 | $2,057.85 |

| 59442 | $3,265.94 | $4,723.48 | $3,601.08 | $4,038.88 | $1,409.99 | $3,649.16 | $4,263.52 | $2,383.55 | $2,057.85 |

| 59039 | $3,265.79 | $4,457.30 | $4,065.38 | $3,977.81 | $1,337.63 | $3,677.86 | $4,197.80 | $2,354.73 | $2,057.85 |

| 59430 | $3,264.98 | $4,757.41 | $3,533.31 | $3,977.81 | $1,300.98 | $3,649.16 | $4,488.57 | $2,354.73 | $2,057.85 |

| 59024 | $3,264.17 | $4,578.75 | $3,647.10 | $3,977.81 | $1,320.23 | $3,627.21 | $4,488.90 | $2,415.54 | $2,057.85 |

| 59821 | $3,263.80 | $5,019.22 | $3,790.01 | $3,414.38 | $1,382.19 | $3,420.37 | $4,279.34 | $2,649.16 | $2,155.75 |

| 59243 | $3,262.80 | $4,214.64 | $3,920.54 | $3,977.81 | $1,280.92 | $3,681.58 | $4,614.33 | $2,354.73 | $2,057.85 |

| 59865 | $3,262.24 | $5,019.22 | $3,790.01 | $3,414.38 | $1,366.32 | $3,420.37 | $4,355.35 | $2,576.50 | $2,155.75 |

| 59223 | $3,262.14 | $4,214.64 | $3,987.04 | $4,038.88 | $1,295.21 | $3,681.58 | $4,467.24 | $2,354.73 | $2,057.85 |

| 59079 | $3,262.08 | $4,387.59 | $4,107.10 | $3,977.81 | $1,148.92 | $3,627.21 | $4,411.37 | $2,378.82 | $2,057.85 |

| 59446 | $3,261.37 | $4,723.48 | $3,533.31 | $4,038.88 | $1,373.08 | $3,649.16 | $4,309.41 | $2,405.84 | $2,057.85 |

| 59038 | $3,260.74 | $4,457.30 | $4,087.57 | $3,977.81 | $1,309.86 | $3,677.86 | $4,158.17 | $2,359.51 | $2,057.85 |

| 59231 | $3,258.89 | $4,214.64 | $3,987.04 | $4,038.88 | $1,295.21 | $3,681.58 | $4,441.18 | $2,354.73 | $2,057.85 |

| 59217 | $3,258.06 | $4,214.64 | $3,920.54 | $3,977.81 | $1,301.82 | $3,681.58 | $4,555.50 | $2,354.73 | $2,057.85 |

| 59230 | $3,257.57 | $4,214.64 | $3,987.04 | $4,038.88 | $1,295.21 | $3,681.58 | $4,494.97 | $2,290.45 | $2,057.85 |

| 59860 | $3,255.76 | $5,019.22 | $4,012.32 | $3,414.38 | $1,247.03 | $3,420.37 | $4,205.88 | $2,571.10 | $2,155.75 |

| 59261 | $3,255.03 | $4,214.64 | $3,832.55 | $4,038.88 | $1,332.90 | $3,681.58 | $4,527.10 | $2,354.73 | $2,057.85 |

| 59221 | $3,254.48 | $4,214.64 | $3,920.54 | $3,977.81 | $1,320.64 | $3,681.58 | $4,544.91 | $2,317.91 | $2,057.85 |

| 59468 | $3,252.94 | $4,684.55 | $3,664.12 | $4,038.88 | $1,411.79 | $3,649.16 | $4,129.00 | $2,388.21 | $2,057.85 |

| 59083 | $3,252.49 | $4,457.30 | $4,065.38 | $3,977.81 | $1,337.63 | $3,677.86 | $4,091.34 | $2,354.73 | $2,057.85 |

| 59248 | $3,251.97 | $4,214.64 | $3,987.04 | $4,038.88 | $1,295.21 | $3,681.58 | $4,445.56 | $2,295.03 | $2,057.85 |

| 59523 | $3,251.82 | $4,214.64 | $3,790.22 | $4,038.88 | $1,339.63 | $3,681.58 | $4,533.39 | $2,358.38 | $2,057.85 |

| 59412 | $3,251.80 | $4,919.78 | $3,664.12 | $3,038.10 | $1,426.41 | $3,649.16 | $4,735.63 | $2,644.82 | $1,936.37 |

| 59422 | $3,251.00 | $4,964.52 | $3,560.98 | $4,038.88 | $1,314.10 | $3,649.16 | $4,063.87 | $2,358.65 | $2,057.85 |

| 59037 | $3,251.00 | $4,578.75 | $4,107.10 | $3,428.48 | $1,272.70 | $3,627.21 | $4,538.26 | $2,397.64 | $2,057.85 |

| 59324 | $3,250.85 | $4,214.64 | $4,114.20 | $3,977.81 | $1,323.14 | $3,677.86 | $4,264.58 | $2,376.71 | $2,057.85 |

| 59262 | $3,249.90 | $4,214.64 | $4,062.68 | $3,977.81 | $1,301.82 | $3,681.58 | $4,362.67 | $2,340.21 | $2,057.85 |

| 59354 | $3,249.43 | $4,214.64 | $4,101.78 | $3,977.81 | $1,378.70 | $3,677.86 | $4,232.09 | $2,354.73 | $2,057.85 |

| 59076 | $3,248.89 | $4,457.30 | $4,087.57 | $3,977.81 | $1,259.83 | $3,677.86 | $4,118.21 | $2,354.73 | $2,057.85 |

| 59312 | $3,247.75 | $4,387.59 | $4,101.78 | $3,977.81 | $1,244.92 | $3,677.86 | $4,179.52 | $2,354.73 | $2,057.85 |

| 59240 | $3,247.55 | $4,214.64 | $3,918.61 | $4,038.88 | $1,272.96 | $3,681.58 | $4,441.18 | $2,354.73 | $2,057.85 |

| 59260 | $3,247.44 | $4,214.64 | $3,918.61 | $4,038.88 | $1,272.96 | $3,681.58 | $4,440.28 | $2,354.73 | $2,057.85 |

| 59453 | $3,247.34 | $4,462.60 | $3,640.54 | $3,977.81 | $1,315.56 | $3,606.86 | $4,562.82 | $2,354.73 | $2,057.85 |

| 59501 | $3,247.27 | $4,556.83 | $3,790.22 | $4,038.88 | $1,280.47 | $3,649.16 | $4,269.05 | $2,335.69 | $2,057.85 |

| 59054 | $3,246.91 | $4,387.59 | $4,065.38 | $3,977.81 | $1,304.40 | $3,681.58 | $4,145.98 | $2,354.73 | $2,057.85 |

| 59316 | $3,245.95 | $4,214.64 | $4,037.31 | $3,977.81 | $1,323.14 | $3,677.86 | $4,324.30 | $2,354.73 | $2,057.85 |

| 59338 | $3,245.19 | $4,214.64 | $4,101.78 | $3,977.81 | $1,319.44 | $3,677.86 | $4,257.45 | $2,354.73 | $2,057.85 |

| 59864 | $3,244.78 | $5,019.22 | $3,928.29 | $3,414.38 | $1,303.80 | $3,420.37 | $4,202.46 | $2,513.96 | $2,155.75 |

| 59433 | $3,241.90 | $4,713.34 | $3,560.98 | $4,038.88 | $1,394.07 | $3,649.16 | $4,166.19 | $2,354.73 | $2,057.85 |

| 59072 | $3,241.63 | $4,387.59 | $3,837.90 | $3,977.81 | $1,332.39 | $3,681.58 | $4,298.95 | $2,359.00 | $2,057.85 |

| 59214 | $3,241.41 | $4,214.64 | $4,062.11 | $3,977.81 | $1,282.10 | $3,681.58 | $4,300.45 | $2,354.73 | $2,057.85 |

| 59301 | $3,239.85 | $4,457.30 | $4,101.78 | $3,977.81 | $1,232.84 | $3,677.86 | $4,029.44 | $2,383.95 | $2,057.85 |

| 59213 | $3,239.69 | $4,214.64 | $3,918.61 | $3,977.81 | $1,295.21 | $3,681.58 | $4,417.10 | $2,354.73 | $2,057.85 |

| 59416 | $3,239.42 | $4,713.34 | $3,529.37 | $4,038.88 | $1,400.07 | $3,542.04 | $4,279.12 | $2,354.73 | $2,057.85 |

| 59441 | $3,239.30 | $4,462.60 | $3,533.31 | $3,977.81 | $1,256.67 | $3,649.16 | $4,622.31 | $2,354.73 | $2,057.85 |

| 59489 | $3,237.77 | $4,462.60 | $3,584.24 | $3,977.81 | $1,291.31 | $3,649.16 | $4,524.48 | $2,354.73 | $2,057.85 |

| 59211 | $3,237.68 | $4,214.64 | $3,918.61 | $3,977.81 | $1,314.30 | $3,681.58 | $4,381.98 | $2,354.73 | $2,057.85 |

| 59258 | $3,235.69 | $4,214.64 | $3,918.61 | $3,977.81 | $1,314.30 | $3,681.58 | $4,366.04 | $2,354.73 | $2,057.85 |

| 59418 | $3,235.45 | $4,462.60 | $3,533.31 | $3,977.81 | $1,315.56 | $3,649.16 | $4,532.57 | $2,354.73 | $2,057.85 |

| 59436 | $3,234.64 | $4,667.91 | $3,664.12 | $4,038.88 | $1,305.38 | $3,649.16 | $4,086.30 | $2,407.55 | $2,057.85 |

| 59218 | $3,233.90 | $4,214.64 | $3,977.97 | $3,977.81 | $1,295.21 | $3,681.58 | $4,287.40 | $2,378.78 | $2,057.85 |

| 59225 | $3,233.71 | $4,214.64 | $3,918.61 | $4,038.88 | $1,295.21 | $3,681.58 | $4,285.16 | $2,377.76 | $2,057.85 |

| 59257 | $3,233.59 | $4,214.64 | $3,918.61 | $3,977.81 | $1,314.30 | $3,681.58 | $4,349.26 | $2,354.73 | $2,057.85 |

| 59339 | $3,232.92 | $4,214.64 | $4,062.11 | $3,977.81 | $1,301.82 | $3,681.58 | $4,212.81 | $2,354.73 | $2,057.85 |

| 59252 | $3,231.83 | $4,214.64 | $3,918.61 | $3,977.81 | $1,322.99 | $3,681.58 | $4,326.48 | $2,354.73 | $2,057.85 |

| 59336 | $3,230.76 | $4,214.64 | $4,101.78 | $3,977.81 | $1,304.67 | $3,677.86 | $4,156.75 | $2,354.73 | $2,057.85 |

| 59201 | $3,230.57 | $4,214.64 | $3,977.97 | $3,977.81 | $1,265.36 | $3,681.58 | $4,291.10 | $2,378.31 | $2,057.85 |

| 59344 | $3,230.42 | $4,214.64 | $4,101.78 | $3,977.81 | $1,343.56 | $3,677.86 | $4,115.17 | $2,354.73 | $2,057.85 |

| 59274 | $3,229.80 | $4,214.64 | $3,977.97 | $3,977.81 | $1,301.82 | $3,681.58 | $4,272.00 | $2,354.73 | $2,057.85 |

| 59451 | $3,228.63 | $4,462.60 | $3,533.31 | $3,977.81 | $1,291.49 | $3,649.16 | $4,502.09 | $2,354.73 | $2,057.85 |

| 59276 | $3,228.04 | $4,214.64 | $3,918.61 | $4,038.88 | $1,293.46 | $3,681.58 | $4,264.62 | $2,354.73 | $2,057.85 |

| 59256 | $3,226.98 | $4,214.64 | $3,918.61 | $3,977.81 | $1,322.99 | $3,681.58 | $4,287.66 | $2,354.73 | $2,057.85 |

| 59315 | $3,226.51 | $4,214.64 | $4,062.68 | $3,977.81 | $1,301.82 | $3,681.58 | $4,206.40 | $2,309.30 | $2,057.85 |

| 59255 | $3,224.91 | $4,214.64 | $3,977.97 | $3,977.81 | $1,265.36 | $3,681.58 | $4,262.71 | $2,361.40 | $2,057.85 |

| 59101 | $3,224.44 | $4,578.75 | $4,107.10 | $3,428.48 | $1,299.85 | $3,293.06 | $4,507.69 | $2,441.46 | $2,139.15 |

| 59867 | $3,221.49 | $5,135.42 | $3,772.02 | $3,038.10 | $1,311.37 | $3,655.44 | $4,539.85 | $2,383.39 | $1,936.37 |

| 59222 | $3,219.91 | $4,214.64 | $3,918.61 | $4,038.88 | $1,293.46 | $3,681.58 | $4,199.56 | $2,354.73 | $2,057.85 |

| 59313 | $3,219.31 | $4,214.64 | $4,101.78 | $3,977.81 | $1,274.97 | $3,677.86 | $4,102.43 | $2,347.17 | $2,057.85 |

| 59275 | $3,218.65 | $4,214.64 | $3,918.61 | $3,977.81 | $1,314.30 | $3,681.58 | $4,337.49 | $2,246.97 | $2,057.85 |

| 59102 | $3,218.22 | $4,578.75 | $4,048.68 | $3,428.48 | $1,278.66 | $3,404.92 | $4,388.90 | $2,478.23 | $2,139.15 |

| 59480 | $3,217.35 | $4,898.03 | $3,664.12 | $3,038.10 | $1,426.41 | $3,649.16 | $4,482.38 | $2,644.21 | $1,936.37 |

| 59106 | $3,217.29 | $4,578.75 | $4,107.10 | $3,428.48 | $1,250.80 | $3,404.92 | $4,360.16 | $2,469.01 | $2,139.15 |

| 59353 | $3,217.20 | $4,214.64 | $4,062.11 | $3,977.81 | $1,355.13 | $3,681.58 | $4,096.83 | $2,291.68 | $2,057.85 |

| 59866 | $3,217.11 | $5,135.42 | $3,772.02 | $3,038.10 | $1,311.37 | $3,655.44 | $4,420.08 | $2,468.07 | $1,936.37 |

| 59464 | $3,216.18 | $4,462.60 | $3,533.31 | $3,977.81 | $1,325.00 | $3,649.16 | $4,368.97 | $2,354.73 | $2,057.85 |

| 59327 | $3,213.52 | $4,387.59 | $4,087.57 | $3,977.81 | $1,259.83 | $3,677.86 | $3,959.70 | $2,299.96 | $2,057.85 |

| 59212 | $3,213.21 | $4,214.64 | $3,977.97 | $3,977.81 | $1,293.46 | $3,681.58 | $4,147.63 | $2,354.73 | $2,057.85 |

| 59263 | $3,213.04 | $4,214.64 | $3,918.61 | $4,038.88 | $1,263.63 | $3,681.58 | $4,143.19 | $2,385.97 | $2,057.85 |

| 59242 | $3,212.08 | $4,214.64 | $3,918.61 | $3,977.81 | $1,295.21 | $3,681.58 | $4,196.24 | $2,354.73 | $2,057.85 |

| 59059 | $3,211.85 | $4,387.59 | $3,624.90 | $3,977.81 | $1,304.40 | $3,681.58 | $4,305.92 | $2,354.73 | $2,057.85 |

| 59826 | $3,211.81 | $4,964.52 | $3,996.44 | $2,983.05 | $1,334.59 | $3,540.86 | $4,573.25 | $2,342.75 | $1,959.03 |

| 59270 | $3,210.99 | $4,214.64 | $3,920.54 | $3,977.81 | $1,285.58 | $3,681.58 | $4,244.26 | $2,305.70 | $2,057.85 |

| 59330 | $3,209.70 | $4,214.64 | $4,062.11 | $3,977.81 | $1,329.69 | $3,681.58 | $4,136.49 | $2,217.47 | $2,057.85 |

| 59323 | $3,209.30 | $4,387.59 | $4,037.31 | $3,977.81 | $1,244.92 | $3,677.86 | $3,968.00 | $2,323.07 | $2,057.85 |

| 59226 | $3,208.77 | $4,214.64 | $3,977.97 | $3,977.81 | $1,316.03 | $3,681.58 | $4,147.20 | $2,297.05 | $2,057.85 |

| 59872 | $3,206.64 | $5,135.42 | $3,790.01 | $3,038.10 | $1,305.16 | $3,655.44 | $4,359.57 | $2,433.06 | $1,936.37 |

| 59333 | $3,205.98 | $4,214.64 | $4,087.57 | $3,977.81 | $1,244.92 | $3,677.86 | $4,032.46 | $2,354.73 | $2,057.85 |

| 59219 | $3,204.38 | $4,214.64 | $3,918.61 | $3,977.81 | $1,314.30 | $3,681.58 | $4,115.57 | $2,354.73 | $2,057.85 |

| 59032 | $3,204.36 | $4,462.60 | $3,533.31 | $3,977.81 | $1,246.33 | $3,649.16 | $4,353.13 | $2,354.73 | $2,057.85 |

| 59830 | $3,202.42 | $5,135.42 | $3,772.02 | $3,038.10 | $1,311.37 | $3,655.44 | $4,387.26 | $2,383.39 | $1,936.37 |

| 59842 | $3,202.42 | $5,135.42 | $3,772.02 | $3,038.10 | $1,311.37 | $3,655.44 | $4,387.26 | $2,383.39 | $1,936.37 |

| 59105 | $3,201.49 | $4,578.75 | $4,107.10 | $3,428.48 | $1,276.88 | $3,404.92 | $4,293.54 | $2,383.15 | $2,139.15 |

| 59254 | $3,201.06 | $4,214.64 | $3,918.61 | $3,977.81 | $1,322.99 | $3,681.58 | $4,170.95 | $2,264.04 | $2,057.85 |

| 59471 | $3,201.01 | $4,462.60 | $3,533.31 | $3,977.81 | $1,281.76 | $3,649.16 | $4,300.25 | $2,345.37 | $2,057.85 |

| 59414 | $3,192.53 | $5,160.84 | $3,664.12 | $3,026.50 | $1,341.86 | $3,699.21 | $4,081.00 | $2,649.21 | $1,917.48 |

| 59457 | $3,191.21 | $4,462.60 | $3,533.31 | $3,977.81 | $1,281.01 | $3,649.16 | $4,245.68 | $2,322.24 | $2,057.85 |

| 59401 | $3,190.43 | $5,149.20 | $3,618.03 | $3,026.50 | $1,338.93 | $3,699.21 | $4,084.07 | $2,690.01 | $1,917.48 |

| 59247 | $3,185.91 | $4,214.64 | $3,918.61 | $3,977.81 | $1,295.21 | $3,681.58 | $4,095.60 | $2,246.04 | $2,057.85 |

| 59463 | $3,185.83 | $4,948.60 | $3,533.31 | $3,038.10 | $1,359.15 | $3,649.16 | $4,356.10 | $2,665.85 | $1,936.37 |

| 59701 | $3,185.56 | $4,540.86 | $3,771.54 | $3,353.26 | $1,291.93 | $3,805.95 | $4,100.60 | $2,679.60 | $1,940.75 |

| 59750 | $3,185.34 | $4,540.86 | $3,771.54 | $3,353.26 | $1,382.85 | $3,805.95 | $4,013.81 | $2,673.69 | $1,940.75 |

| 59820 | $3,181.40 | $5,135.42 | $3,790.01 | $3,038.10 | $1,272.99 | $3,655.44 | $4,139.63 | $2,483.24 | $1,936.37 |

| 59483 | $3,177.95 | $4,667.91 | $3,664.12 | $3,038.10 | $1,342.36 | $3,649.16 | $4,459.72 | $2,665.85 | $1,936.37 |

| 59404 | $3,174.69 | $5,160.84 | $3,664.12 | $3,026.50 | $1,341.86 | $3,699.21 | $3,895.75 | $2,691.75 | $1,917.48 |

| 59421 | $3,164.99 | $5,144.19 | $3,664.12 | $3,038.10 | $1,362.27 | $3,649.16 | $3,987.86 | $2,537.83 | $1,936.37 |

| 59440 | $3,163.46 | $4,935.73 | $3,664.12 | $3,026.50 | $1,471.88 | $3,649.16 | $4,147.70 | $2,354.73 | $2,057.85 |

| 59065 | $3,161.32 | $4,884.10 | $3,980.57 | $3,038.10 | $1,313.97 | $3,091.61 | $4,511.26 | $2,383.39 | $2,087.57 |

| 59868 | $3,156.10 | $5,002.57 | $3,790.01 | $2,983.05 | $1,384.64 | $3,540.86 | $4,143.77 | $2,444.88 | $1,959.03 |

| 59405 | $3,155.69 | $5,149.20 | $3,664.12 | $3,026.50 | $1,371.17 | $3,575.77 | $3,818.61 | $2,722.71 | $1,917.48 |

| 59402 | $3,155.30 | $5,149.20 | $3,664.12 | $3,026.50 | $1,371.17 | $3,575.77 | $3,872.32 | $2,665.85 | $1,917.48 |

| 59465 | $3,153.30 | $4,948.60 | $3,533.31 | $3,038.10 | $1,359.15 | $3,649.16 | $4,095.85 | $2,665.85 | $1,936.37 |

| 59485 | $3,148.50 | $4,919.09 | $3,664.12 | $3,038.10 | $1,362.27 | $3,649.16 | $4,026.92 | $2,610.88 | $1,917.48 |

| 59030 | $3,147.92 | $4,948.60 | $3,980.57 | $3,038.10 | $1,301.76 | $3,091.61 | $4,230.68 | $2,504.51 | $2,087.57 |

| 59472 | $3,141.25 | $4,919.78 | $3,664.12 | $3,038.10 | $1,371.17 | $3,575.77 | $3,958.86 | $2,665.85 | $1,936.37 |

| 59487 | $3,141.11 | $4,667.91 | $3,664.12 | $3,038.10 | $1,391.06 | $3,699.21 | $4,186.66 | $2,564.31 | $1,917.48 |

| 59410 | $3,140.66 | $4,947.88 | $3,664.12 | $3,038.10 | $1,382.07 | $3,649.16 | $4,087.76 | $2,419.86 | $1,936.37 |

| 59082 | $3,133.14 | $4,919.78 | $3,808.61 | $3,038.10 | $1,330.09 | $3,091.61 | $4,406.00 | $2,383.39 | $2,087.57 |

| 59477 | $3,129.08 | $4,689.90 | $3,664.12 | $3,038.10 | $1,362.27 | $3,649.16 | $4,026.92 | $2,665.85 | $1,936.37 |

| 59018 | $3,128.77 | $4,919.78 | $3,723.20 | $3,038.10 | $1,255.04 | $3,091.61 | $4,397.01 | $2,517.84 | $2,087.57 |

| 59044 | $3,127.14 | $4,578.75 | $4,107.10 | $3,428.48 | $1,200.11 | $3,293.06 | $3,917.83 | $2,352.62 | $2,139.15 |

| 59443 | $3,124.90 | $4,667.91 | $3,664.12 | $3,038.10 | $1,411.79 | $3,649.16 | $4,097.56 | $2,534.17 | $1,936.37 |

| 59081 | $3,122.05 | $4,948.60 | $3,980.57 | $3,038.10 | $1,301.76 | $3,091.61 | $4,144.85 | $2,383.39 | $2,087.57 |

| 59730 | $3,121.79 | $4,884.10 | $3,980.57 | $3,038.10 | $1,267.96 | $3,091.61 | $4,259.04 | $2,365.39 | $2,087.57 |

| 59743 | $3,112.93 | $4,855.28 | $4,019.61 | $3,353.26 | $1,400.30 | $3,020.18 | $3,930.68 | $2,383.39 | $1,940.75 |

| 59086 | $3,112.29 | $4,855.28 | $3,723.20 | $3,038.10 | $1,255.04 | $3,091.61 | $4,343.91 | $2,503.63 | $2,087.57 |

| 59748 | $3,112.23 | $4,525.51 | $3,771.54 | $3,353.26 | $1,396.78 | $3,020.18 | $4,234.89 | $2,654.93 | $1,940.75 |

| 59823 | $3,111.40 | $4,978.05 | $3,790.01 | $2,983.05 | $1,334.75 | $3,540.86 | $3,933.34 | $2,372.09 | $1,959.03 |

| 59639 | $3,108.68 | $4,525.51 | $3,790.01 | $3,038.10 | $1,341.57 | $3,649.16 | $4,101.61 | $2,487.11 | $1,936.37 |

| 59716 | $3,108.61 | $4,894.43 | $3,980.57 | $3,038.10 | $1,267.96 | $3,091.61 | $4,154.44 | $2,354.22 | $2,087.57 |

| 59020 | $3,104.72 | $4,757.41 | $4,033.11 | $3,038.10 | $1,301.76 | $3,091.61 | $4,144.85 | $2,383.39 | $2,087.57 |

| 59053 | $3,096.84 | $4,919.78 | $3,502.59 | $3,038.10 | $1,292.26 | $3,020.18 | $4,682.09 | $2,383.39 | $1,936.37 |

| 59854 | $3,096.75 | $4,947.88 | $3,790.01 | $3,038.10 | $1,367.63 | $3,020.18 | $4,290.45 | $2,383.39 | $1,936.37 |

| 59751 | $3,096.48 | $4,540.86 | $3,723.20 | $3,038.10 | $1,376.91 | $3,091.61 | $4,558.21 | $2,506.63 | $1,936.37 |

| 59027 | $3,092.38 | $4,948.60 | $3,980.57 | $3,038.10 | $1,324.53 | $3,091.61 | $3,884.72 | $2,383.39 | $2,087.57 |

| 59758 | $3,092.38 | $4,894.43 | $3,980.57 | $3,038.10 | $1,262.76 | $3,091.61 | $3,954.64 | $2,429.39 | $2,087.57 |

| 59711 | $3,091.89 | $4,540.86 | $3,913.81 | $3,038.10 | $1,382.56 | $3,535.88 | $4,017.00 | $2,370.52 | $1,936.37 |

| 59047 | $3,089.78 | $4,884.10 | $3,723.20 | $3,038.10 | $1,330.09 | $3,091.61 | $4,053.39 | $2,510.16 | $2,087.57 |

| 59648 | $3,086.19 | $4,525.51 | $3,664.12 | $3,038.10 | $1,412.73 | $3,649.16 | $4,011.55 | $2,452.02 | $1,936.37 |

| 59741 | $3,077.05 | $4,855.28 | $3,723.20 | $3,038.10 | $1,369.63 | $3,091.61 | $4,033.70 | $2,417.29 | $2,087.57 |

| 59846 | $3,068.77 | $5,135.42 | $3,790.01 | $2,983.05 | $1,438.97 | $2,695.46 | $4,129.72 | $2,418.49 | $1,959.03 |

| 59633 | $3,063.99 | $4,525.51 | $3,748.90 | $3,038.10 | $1,301.78 | $3,649.16 | $3,928.76 | $2,383.39 | $1,936.37 |

| 59647 | $3,062.67 | $4,978.01 | $3,771.54 | $3,038.10 | $1,417.92 | $3,020.18 | $3,955.85 | $2,383.39 | $1,936.37 |

| 59724 | $3,062.28 | $4,765.96 | $3,980.57 | $3,038.10 | $1,311.54 | $3,020.18 | $4,043.37 | $2,402.16 | $1,936.37 |

| 59870 | $3,060.84 | $4,660.48 | $3,764.79 | $3,038.10 | $1,316.95 | $3,020.18 | $4,268.84 | $2,481.03 | $1,936.37 |

| 59739 | $3,059.80 | $4,765.96 | $3,980.57 | $3,038.10 | $1,297.27 | $3,020.18 | $4,056.60 | $2,383.39 | $1,936.37 |

| 59710 | $3,059.37 | $4,765.96 | $3,980.57 | $3,038.10 | $1,325.69 | $3,091.61 | $3,953.30 | $2,383.39 | $1,936.37 |

| 59638 | $3,058.40 | $4,671.88 | $3,913.81 | $3,038.10 | $1,309.68 | $3,020.18 | $4,231.29 | $2,345.90 | $1,936.37 |

| 59714 | $3,057.10 | $4,855.28 | $3,723.20 | $3,038.10 | $1,335.70 | $3,091.61 | $3,916.62 | $2,408.72 | $2,087.57 |

| 59747 | $3,056.23 | $4,501.72 | $3,980.57 | $3,038.10 | $1,270.03 | $3,091.61 | $4,248.08 | $2,383.39 | $1,936.37 |

| 59834 | $3,055.89 | $5,135.42 | $3,790.01 | $2,983.05 | $1,345.40 | $2,695.46 | $4,156.34 | $2,382.38 | $1,959.03 |

| 59720 | $3,055.56 | $4,894.43 | $3,980.57 | $3,038.10 | $1,283.34 | $3,091.61 | $3,836.67 | $2,383.39 | $1,936.37 |

| 59727 | $3,053.49 | $4,540.86 | $3,771.54 | $3,353.26 | $1,400.30 | $3,020.18 | $4,017.67 | $2,383.39 | $1,940.75 |

| 59718 | $3,053.16 | $4,855.28 | $3,723.20 | $3,038.10 | $1,272.88 | $3,183.51 | $3,963.06 | $2,301.69 | $2,087.57 |

| 59715 | $3,052.10 | $4,855.28 | $3,723.20 | $3,038.10 | $1,244.56 | $3,183.51 | $3,902.97 | $2,381.62 | $2,087.57 |

| 59640 | $3,051.21 | $4,525.51 | $3,748.90 | $3,038.10 | $1,301.78 | $3,649.16 | $3,826.47 | $2,383.39 | $1,936.37 |

| 59749 | $3,050.90 | $4,540.86 | $3,980.57 | $3,038.10 | $1,325.69 | $3,091.61 | $3,996.34 | $2,497.63 | $1,936.37 |

| 59833 | $3,047.96 | $4,848.33 | $3,764.79 | $3,038.10 | $1,290.37 | $3,020.18 | $4,074.63 | $2,388.25 | $1,959.03 |

| 59760 | $3,046.10 | $4,865.64 | $3,723.20 | $3,038.10 | $1,340.51 | $3,091.61 | $3,838.79 | $2,383.39 | $2,087.57 |

| 59754 | $3,046.03 | $4,540.86 | $3,980.57 | $3,038.10 | $1,354.15 | $3,091.61 | $3,919.09 | $2,507.50 | $1,936.37 |

| 59759 | $3,043.29 | $4,540.86 | $3,762.24 | $3,038.10 | $1,333.51 | $3,020.18 | $4,310.54 | $2,404.56 | $1,936.37 |

| 59736 | $3,043.02 | $4,540.86 | $4,028.89 | $3,038.10 | $1,359.98 | $3,020.18 | $4,036.42 | $2,383.39 | $1,936.37 |

| 59740 | $3,041.85 | $4,669.32 | $3,980.57 | $3,038.10 | $1,282.19 | $3,091.61 | $3,953.30 | $2,383.39 | $1,936.37 |

| 59755 | $3,041.29 | $4,765.96 | $3,980.57 | $3,038.10 | $1,331.95 | $3,091.61 | $3,802.42 | $2,383.39 | $1,936.37 |

| 59631 | $3,041.19 | $4,496.72 | $3,913.81 | $3,038.10 | $1,309.68 | $3,020.18 | $4,231.29 | $2,383.39 | $1,936.37 |

| 59645 | $3,040.78 | $4,978.01 | $3,502.59 | $3,038.10 | $1,352.33 | $3,020.18 | $4,131.23 | $2,367.47 | $1,936.37 |

| 59634 | $3,038.94 | $4,671.88 | $3,913.81 | $3,038.10 | $1,309.68 | $3,020.18 | $4,057.41 | $2,383.39 | $1,917.09 |

| 59745 | $3,038.56 | $4,501.72 | $3,980.57 | $3,038.10 | $1,282.19 | $3,091.61 | $4,094.54 | $2,383.39 | $1,936.37 |

| 59729 | $3,037.95 | $4,894.43 | $3,980.57 | $3,038.10 | $1,263.07 | $3,091.61 | $3,767.46 | $2,331.99 | $1,936.37 |

| 59733 | $3,031.96 | $4,671.88 | $3,887.07 | $3,038.10 | $1,304.90 | $3,020.18 | $4,013.79 | $2,383.39 | $1,936.37 |

| 59725 | $3,030.63 | $4,540.86 | $3,980.57 | $3,038.10 | $1,346.16 | $3,020.18 | $4,039.29 | $2,343.52 | $1,936.37 |

| 59832 | $3,029.57 | $4,806.85 | $3,790.01 | $3,038.10 | $1,303.01 | $3,020.18 | $3,954.24 | $2,387.83 | $1,936.37 |

| 59643 | $3,029.11 | $4,540.86 | $3,762.24 | $3,038.10 | $1,374.82 | $3,020.18 | $4,176.95 | $2,383.39 | $1,936.37 |

| 59827 | $3,027.92 | $4,540.86 | $3,887.07 | $3,038.10 | $1,359.52 | $3,020.18 | $3,983.67 | $2,457.56 | $1,936.37 |

| 59843 | $3,027.26 | $4,671.88 | $3,790.01 | $3,038.10 | $1,377.16 | $3,020.18 | $3,987.50 | $2,396.85 | $1,936.37 |

| 59858 | $3,026.79 | $4,540.86 | $3,887.07 | $3,038.10 | $1,373.87 | $3,020.18 | $4,006.37 | $2,411.53 | $1,936.37 |

| 59722 | $3,025.76 | $4,687.26 | $3,913.81 | $3,038.10 | $1,382.56 | $3,020.18 | $3,873.47 | $2,354.34 | $1,936.37 |

| 59829 | $3,023.61 | $4,540.86 | $3,887.07 | $3,038.10 | $1,324.84 | $3,020.18 | $4,026.76 | $2,414.69 | $1,936.37 |

| 59825 | $3,019.22 | $4,660.48 | $3,790.01 | $2,983.05 | $1,255.56 | $3,540.86 | $3,680.56 | $2,284.19 | $1,959.03 |

| 59837 | $3,018.48 | $4,671.88 | $3,887.07 | $3,038.10 | $1,373.87 | $3,020.18 | $3,837.02 | $2,383.39 | $1,936.37 |

| 59752 | $3,017.23 | $4,501.72 | $3,723.20 | $3,038.10 | $1,340.51 | $3,091.61 | $3,972.67 | $2,382.49 | $2,087.57 |

| 59871 | $3,013.66 | $4,540.86 | $3,771.54 | $3,038.10 | $1,382.46 | $3,020.18 | $4,036.42 | $2,383.39 | $1,936.37 |

| 59761 | $3,011.68 | $4,540.86 | $3,771.54 | $3,038.10 | $1,359.98 | $3,020.18 | $3,952.02 | $2,474.39 | $1,936.37 |

| 59731 | $3,011.23 | $4,525.51 | $3,887.07 | $3,038.10 | $1,318.84 | $3,020.18 | $3,980.41 | $2,383.39 | $1,936.37 |

| 59732 | $3,009.30 | $4,540.86 | $3,980.57 | $3,038.10 | $1,346.16 | $3,020.18 | $3,828.82 | $2,383.39 | $1,936.37 |

| 59746 | $3,009.30 | $4,540.86 | $3,980.57 | $3,038.10 | $1,346.16 | $3,020.18 | $3,828.82 | $2,383.39 | $1,936.37 |

| 59644 | $3,007.52 | $4,525.51 | $3,771.54 | $3,038.10 | $1,323.03 | $3,020.18 | $4,040.00 | $2,405.41 | $1,936.37 |

| 59840 | $3,004.49 | $4,540.86 | $3,887.07 | $3,038.10 | $1,307.12 | $3,020.18 | $3,941.46 | $2,364.80 | $1,936.37 |

| 59721 | $3,002.37 | $4,512.06 | $3,723.20 | $3,038.10 | $1,270.03 | $3,020.18 | $4,135.68 | $2,383.39 | $1,936.37 |

| 59762 | $3,001.95 | $4,540.86 | $3,771.54 | $3,038.10 | $1,377.68 | $3,020.18 | $3,947.49 | $2,383.39 | $1,936.37 |

| 59632 | $3,000.45 | $4,496.72 | $3,771.54 | $3,038.10 | $1,403.98 | $3,020.18 | $3,970.10 | $2,366.65 | $1,936.37 |

| 59735 | $2,998.46 | $4,501.72 | $3,723.20 | $3,038.10 | $1,270.03 | $3,091.61 | $3,911.91 | $2,514.71 | $1,936.37 |

| 59642 | $2,997.30 | $4,496.72 | $3,723.20 | $3,038.10 | $1,388.77 | $3,020.18 | $3,991.72 | $2,383.39 | $1,936.37 |

| 59875 | $2,996.83 | $4,525.51 | $3,764.79 | $3,038.10 | $1,340.67 | $3,020.18 | $3,972.53 | $2,376.53 | $1,936.37 |

| 59835 | $2,996.26 | $4,540.86 | $3,887.07 | $3,038.10 | $1,307.12 | $3,020.18 | $3,856.98 | $2,383.39 | $1,936.37 |

| 59841 | $2,996.26 | $4,540.86 | $3,887.07 | $3,038.10 | $1,307.12 | $3,020.18 | $3,856.98 | $2,383.39 | $1,936.37 |

| 59847 | $2,995.39 | $5,019.22 | $3,790.01 | $2,983.05 | $1,332.64 | $2,695.46 | $3,816.45 | $2,367.27 | $1,959.03 |

| 59728 | $2,993.81 | $4,525.51 | $3,913.81 | $3,038.10 | $1,318.84 | $3,020.18 | $3,814.31 | $2,383.39 | $1,936.37 |

| 59828 | $2,990.63 | $4,675.85 | $3,887.07 | $3,038.10 | $1,307.12 | $3,020.18 | $3,695.60 | $2,364.80 | $1,936.37 |

| 59851 | $2,988.25 | $4,978.05 | $3,790.01 | $2,983.05 | $1,212.87 | $2,695.46 | $3,940.69 | $2,346.86 | $1,959.03 |

| 59641 | $2,988.11 | $4,496.72 | $3,771.54 | $3,038.10 | $1,403.98 | $3,020.18 | $3,854.58 | $2,383.39 | $1,936.37 |

| 59713 | $2,979.79 | $4,525.51 | $3,790.01 | $3,038.10 | $1,318.84 | $3,020.18 | $3,814.31 | $2,395.02 | $1,936.37 |

| 59804 | $2,976.54 | $4,872.84 | $3,790.01 | $2,983.05 | $1,244.09 | $2,695.46 | $3,890.59 | $2,377.27 | $1,959.03 |

| 59801 | $2,963.80 | $4,872.84 | $3,749.16 | $2,983.05 | $1,252.05 | $2,695.46 | $3,840.76 | $2,358.08 | $1,959.03 |

| 59812 | $2,963.16 | $4,872.84 | $3,790.01 | $2,983.05 | $1,252.05 | $2,695.46 | $3,806.01 | $2,346.86 | $1,959.03 |

| 59802 | $2,952.56 | $4,848.33 | $3,790.01 | $2,983.05 | $1,212.87 | $2,695.46 | $3,778.60 | $2,353.13 | $1,959.03 |

| 59808 | $2,950.55 | $4,872.84 | $3,790.01 | $2,983.05 | $1,260.48 | $2,695.46 | $3,638.62 | $2,404.93 | $1,959.03 |

| 59803 | $2,941.55 | $4,848.33 | $3,790.01 | $2,983.05 | $1,242.35 | $2,695.46 | $3,682.81 | $2,331.37 | $1,959.03 |

| 59625 | $2,907.72 | $4,525.51 | $3,734.61 | $2,890.21 | $1,201.94 | $2,908.69 | $3,910.86 | $2,172.87 | $1,917.09 |

| 59636 | $2,887.70 | $4,525.51 | $3,734.61 | $2,890.21 | $1,276.30 | $2,908.69 | $3,676.27 | $2,172.87 | $1,917.09 |

| 59601 | $2,883.49 | $4,525.51 | $3,775.68 | $2,890.21 | $1,201.94 | $2,908.69 | $3,693.98 | $2,154.86 | $1,917.09 |

| 59626 | $2,878.40 | $4,525.51 | $3,734.61 | $2,890.21 | $1,201.94 | $2,908.69 | $3,676.27 | $2,172.87 | $1,917.09 |

| 59602 | $2,877.23 | $4,525.51 | $3,775.68 | $2,890.21 | $1,276.30 | $2,908.69 | $3,531.18 | $2,193.17 | $1,917.09 |

| 59635 | $2,866.45 | $4,525.51 | $3,775.68 | $2,890.21 | $1,209.86 | $2,908.69 | $3,589.05 | $2,115.51 | $1,917.09 |

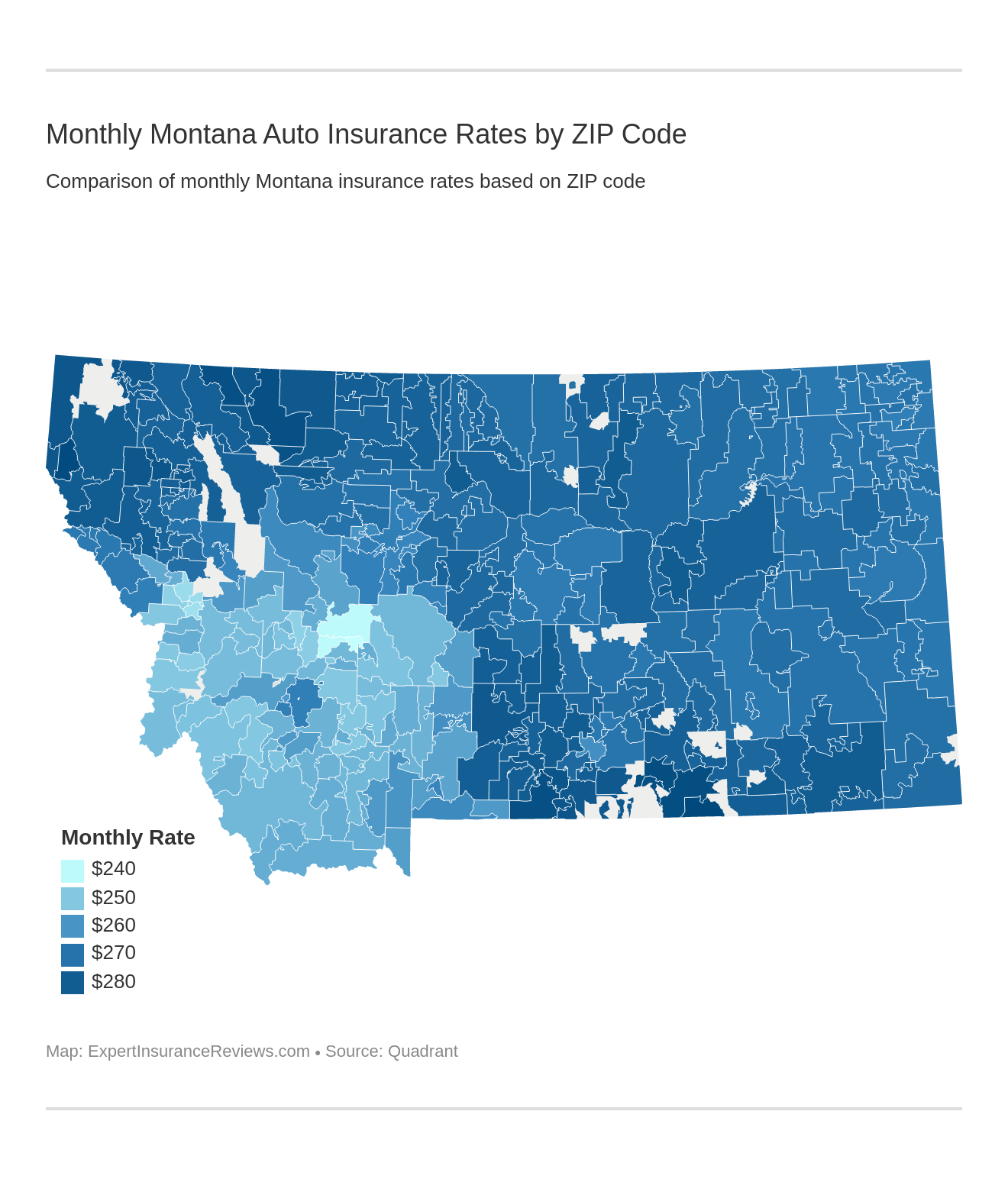

Usually, populous places rake up insurance rates, however, that is not the case with Montana, whose top ZIP codes land in Helena–the city capitol.

And is it such a surprise that land like Noxon, Fort Smith, Lodge Grass, and Saint Xavier end up with the most expensive rates? No, no surprise at all, as they are surrounded by scenic bodies of luscious water–take Fort Smith, for example, home to Big Horn Canyon National Recreation Area, whose land contains towering cliffs, roaming horses, and ranches.

Wyola, the most expensive, is also surrounded by a body of water and ten miles from thriving Wyoming–which could also be the reason rates are so high there.

Cheapest Rates by City

Your city can also have something to do with higher or lower rates. If you enter your city, you can search for rates specific to your city.

Montana Rates via CITY

| City | Average Annual Rates |

|---|---|

| WYOLA | $3,374.37 |

| NOXON | $3,324.24 |

| FORT SMITH | $3,335.42 |

| LODGE GRASS | $3,329.98 |

| SAINT XAVIER | $3,399.96 |

| BROWNING | $3,398.10 |

| RED LODGE | $3,290.70 |

| HEART BUTTE | $3,372.28 |

| BEARCREEK | $3,354.42 |

| ROBERTS | $3,348.69 |

| BELFRY | $3,371.67 |

| KILA | $3,305.39 |

| SOMERS | $3,327.72 |

| BABB | $3,128.77 |

| REXFORD | $3,357.26 |

| HERON | $3,104.72 |

| TROY | $3,338.39 |

| MARION | $3,264.17 |

| ROLLINS | $3,348.11 |

| PRYOR | $3,348.69 |

| GREYCLIFF | $3,092.38 |

| ABSAROKEE | $3,349.80 |

| LAKESIDE | $3,351.51 |

| EUREKA | $3,147.92 |

| BIG TIMBER | $3,309.23 |

| EAST GLACIER PARK | $3,204.36 |

| CUT BANK | $3,376.50 |

| BRIDGER | $3,330.35 |

| TROUT CREEK | $3,436.52 |

| RYEGATE | $3,335.54 |

| LIBBY | $3,251.00 |

| THOMPSON FALLS | $3,260.74 |

| LOMA | $3,265.79 |

| BROADUS | $3,291.92 |

| ROSCOE | $3,304.24 |

| SWEET GRASS | $3,127.14 |

| VALIER | $3,281.67 |

| MOLT | $3,089.78 |

| SAND SPRINGS | $3,433.47 |

| PENDROY | $3,342.41 |

| COLUMBUS | $3,096.84 |

| BIRNEY | $3,246.91 |

| DODSON | $3,347.37 |

| OILMONT | $3,359.10 |

| LAKE MC DONALD | $3,296.35 |

| FROMBERG | $3,211.85 |

| PARK CITY | $3,342.03 |

| FORTINE | $3,341.41 |

| STRYKER | $3,351.41 |

| TREGO | $3,330.28 |

| RAPELJE | $3,161.32 |

| SHAWMUT | $3,377.49 |

| FISHTAIL | $3,351.27 |

| BOYD | $3,414.03 |

| EDGAR | $3,329.76 |

| PLAINS | $3,398.91 |

| DECKER | $3,362.59 |

| ESSEX | $3,241.63 |

| MELVILLE | $3,365.74 |

| SUNBURST | $3,433.31 |

| TWO DOT | $3,248.89 |

| MC LEOD | $3,359.05 |

| NYE | $3,350.96 |

| OTTER | $3,262.08 |

| DAYTON | $3,122.05 |

| HAYS | $3,133.14 |

| PROCTOR | $3,252.49 |

| CROW AGENCY | $3,271.07 |

| KEVIN | $3,342.87 |

| BRUSETT | $3,112.29 |

| BIGFORK | $3,310.52 |

| HARLOWTON | $3,287.69 |

| MARTIN CITY | $3,457.80 |

| WEST GLACIER | $3,224.44 |

| ASHLAND | $3,218.22 |

| KALISPELL | $3,201.49 |

| CORAM | $3,217.29 |

| LONEPINE | $3,230.57 |

| COLUMBIA FALLS | $3,237.68 |

| DUPUYER | $3,213.21 |

| HARDIN | $3,239.69 |

| POMPEYS PILLAR | $3,241.41 |

| BALLANTINE | $3,271.34 |

| REED POINT | $3,258.06 |

| JORDAN | $3,233.90 |

| BUSBY | $3,204.38 |

| INVERNESS | $3,254.48 |

| POLEBRIDGE | $3,219.91 |

| GALATA | $3,262.14 |

| OLNEY | $3,233.71 |

| ACTON | $3,208.77 |

| POWDERVILLE | $3,257.57 |

| HUNGRY HORSE | $3,258.89 |

| ELMO | $3,247.55 |

| WHITLASH | $3,270.91 |

| BYNUM | $3,212.08 |

| LEDGER | $3,262.80 |

| HOGELAND | $3,267.58 |

| BIDDLE | $3,185.91 |

| CHESTER | $3,251.97 |

| JOPLIN | $3,268.86 |

| BOX ELDER | $3,231.83 |

| BIG SANDY | $3,268.30 |

| HOT SPRINGS | $3,201.06 |

| MILDRED | $3,224.91 |

| OLIVE | $3,226.98 |

| VOLBORG | $3,233.59 |

| GEYSER | $3,235.69 |

| TURNER | $3,282.47 |

| PARADISE | $3,247.44 |

| RAYNESFORD | $3,255.03 |

| ETHRIDGE | $3,249.90 |

| WINNETT | $3,213.04 |

| LOTHAIR | $3,210.99 |

| HARLEM | $3,269.32 |

| GARRYOWEN | $3,229.80 |

| WHITEFISH | $3,218.65 |

| SHELBY | $3,228.04 |

| ZURICH | $3,239.85 |

| BROADVIEW | $3,272.57 |

| LORING | $3,247.75 |

| LLOYD | $3,219.31 |

| LAME DEER | $3,319.09 |

| ZORTMAN | $3,226.51 |

| COHAGEN | $3,245.95 |

| MOCCASIN | $3,364.13 |

| GILDFORD | $3,336.70 |

| MOSBY | $3,273.36 |

| KREMLIN | $3,303.97 |

| STANFORD | $3,209.30 |

| JOLIET | $3,250.85 |

| HOBSON | $3,273.41 |

| BIGHORN | $3,213.52 |

| CONRAD | $3,209.70 |

| HIGHWOOD | $3,268.10 |

| WORDEN | $3,205.98 |

| RUDYARD | $3,230.76 |

| MALTA | $3,328.66 |

| WHITEWATER | $3,245.19 |

| RICHEY | $3,232.92 |

| LAVINA | $3,313.92 |

| RAVALLI | $3,313.86 |

| BIG ARM | $3,230.42 |

| HINGHAM | $3,324.17 |

| TERRY | $3,266.20 |

| FALLON | $3,273.91 |

| CAPITOL | $3,312.70 |

| CHARLO | $3,217.20 |

| ALZADA | $3,249.43 |

| DIXON | $3,190.43 |

| CIRCLE | $3,155.30 |

| TEIGEN | $3,174.69 |

| HINSDALE | $3,155.69 |

| VANDALIA | $3,140.66 |

| OPHEIM | $3,387.91 |

| PEERLESS | $3,251.80 |

| HAMMOND | $3,192.53 |

| LARSLAN | $3,239.42 |

| CARTER | $3,420.37 |

| COFFEE CREEK | $3,235.45 |

| ROSEBUD | $3,322.24 |

| FORT BENTON | $3,267.53 |

| INGOMAR | $3,164.99 |

| DENTON | $3,251.00 |

| CUSTER | $3,267.24 |

| ARLEE | $3,288.25 |

| LAMBERT | $3,372.00 |

| SAINT IGNATIUS | $3,264.98 |

| FORT PECK | $3,330.49 |

| SHEPHERD | $3,241.90 |

| GERALDINE | $3,372.07 |

| HYSHAM | $3,310.63 |

| SAINT MARIE | $3,234.64 |

| CRANE | $3,163.46 |

| GLASGOW | $3,239.30 |

| POLSON | $3,265.94 |

| SACO | $3,124.90 |

| FAIRVIEW | $3,325.35 |

| POWER | $3,261.37 |

| SUMATRA | $3,311.62 |

| NASHUA | $3,408.40 |

| CHINOOK | $3,288.19 |

| BELT | $3,228.63 |

| CHOTEAU | $3,290.91 |

| HUNTLEY | $3,247.34 |

| EKALAKA | $3,336.91 |

| SAVAGE | $3,322.02 |

| WILLARD | $3,191.21 |

| SANDERS | $3,364.22 |

| ANGELA | $3,310.25 |

| GLENTANA | $3,299.50 |

| RICHLAND | $3,185.83 |

| JUDITH GAP | $3,216.18 |

| HAVRE | $3,153.30 |

| MELSTONE | $3,352.80 |

| BOYES | $3,358.68 |

| KINSEY | $3,252.94 |

| RONAN | $3,310.68 |

| DUTTON | $3,201.01 |

| ROUNDUP | $3,141.25 |

| BROCKWAY | $3,308.81 |

| MILES CITY | $3,129.08 |

| BROCKTON | $3,293.44 |

| BRADY | $3,217.35 |

| FOREST GROVE | $3,345.49 |

| WINIFRED | $3,177.95 |

| ANTELOPE | $3,362.14 |

| RESERVE | $3,148.50 |

| BUFFALO | $3,361.11 |

| FAIRFIELD | $3,141.11 |

| CULBERTSON | $3,237.77 |

| FRAZER | $3,247.27 |

| REDSTONE | $3,316.98 |

| LINDSAY | $3,317.89 |

| OUTLOOK | $3,318.83 |

| ISMAY | $3,251.82 |

| WOLF POINT | $3,354.13 |

| PLEVNA | $3,299.01 |

| VIDA | $3,309.36 |

| HILGER | $3,339.71 |

| WHITETAIL | $3,277.83 |

| RAYMOND | $3,320.76 |

| BLOOMFIELD | $3,326.42 |

| POPLAR | $3,318.09 |

| BILLINGS | $3,293.80 |

| SALTESE | $3,304.56 |

| FLAXVILLE | $3,305.30 |

| BAKER | $3,286.47 |

| WESTBY | $3,286.64 |

| BILLINGS | $3,311.40 |

| STOCKETT | $3,283.26 |

| BILLINGS | $3,322.39 |

| WIBAUX | $3,304.18 |

| SAINT REGIS | $3,307.56 |

| MOORE | $2,883.49 |

| FORSYTH | $2,877.23 |

| BAINVILLE | $2,907.72 |

| SCOBEY | $2,878.40 |

| HOMESTEAD | $3,041.19 |

| MUSSELSHELL | $3,000.45 |

| CONDON | $3,063.99 |

| SIDNEY | $3,038.94 |

| GLENDIVE | $2,866.45 |

| COLSTRIP | $2,887.70 |

| FROID | $3,058.40 |

| SUPERIOR | $3,108.68 |

| HATHAWAY | $3,051.21 |

| DAGMAR | $2,988.11 |

| GRASS RANGE | $2,997.30 |

| DE BORGIA | $3,029.11 |

| HAUGAN | $3,007.52 |

| BILLINGS | $3,040.78 |

| PLENTYWOOD | $3,062.67 |

| ROY | $3,086.19 |

| BLACK EAGLE | $3,185.56 |

| LEWISTOWN | $3,059.37 |

| GREAT FALLS | $3,091.89 |

| MEDICINE LAKE | $2,979.79 |

| MONARCH | $3,057.10 |

| BUTTE | $3,052.10 |

| BUTTE | $3,108.61 |

| ALBERTON | $3,053.16 |

| SUN RIVER | $3,055.56 |

| GREAT FALLS | $3,002.37 |

| CASCADE | $3,025.76 |

| FLOWEREE | $3,062.28 |

| PRAY | $3,030.63 |

| SEELEY LAKE | $3,053.49 |

| GREAT FALLS | $2,993.81 |

| MALMSTROM A F B | $3,037.95 |

| NEIHART | $3,121.79 |

| ULM | $3,011.23 |

| GARDINER | $3,009.30 |

| SAND COULEE | $3,031.96 |

| VAUGHN | $2,998.46 |

| AUGUSTA | $3,043.02 |

| SPRINGDALE | $3,059.80 |

| SIMMS | $3,041.85 |

| CLYDE PARK | $3,077.05 |

| LAUREL | $3,112.93 |

| FORT SHAW | $3,038.56 |

| SILVER GATE | $3,009.30 |

| GALLATIN GATEWAY | $3,056.23 |

| MELROSE | $3,112.23 |

| WILSALL | $3,050.90 |

| RAMSAY | $3,185.34 |

| BONNER | $3,096.48 |

| LINCOLN | $3,017.23 |

| BIG SKY | $3,046.03 |

| COOKE CITY | $3,041.29 |

| MARTINSDALE | $3,092.38 |

| OVANDO | $3,043.29 |

| SILVER STAR | $3,046.10 |

| EMIGRANT | $3,011.68 |

| WEST YELLOWSTONE | $3,001.95 |

| ANACONDA | $2,963.80 |

| LIVINGSTON | $2,952.56 |

| WOLF CREEK | $2,941.55 |

| MANHATTAN | $2,976.54 |

| HUSON | $2,950.55 |

| CANYON CREEK | $2,963.16 |

| WINSTON | $3,181.40 |

| DELL | $3,263.80 |

| STEVENSVILLE | $3,111.40 |

| LIMA | $3,273.13 |

| ALDER | $3,019.22 |

| JEFFERSON CITY | $3,211.81 |

| BELGRADE | $3,027.92 |

| PONY | $2,990.63 |

| FRENCHTOWN | $3,023.61 |

| CAMERON | $3,202.42 |

| DIVIDE | $3,272.40 |

| BOZEMAN | $3,029.57 |

| BOZEMAN | $3,047.96 |

| MARYSVILLE | $3,055.89 |

| SHERIDAN | $2,996.26 |

| FLORENCE | $3,018.48 |

| WILLOW CREEK | $3,004.49 |

| TWIN BRIDGES | $2,996.26 |

| WHITEHALL | $3,202.42 |

| JACKSON | $3,027.26 |

| MC ALLISTER | $3,386.85 |

| VIRGINIA CITY | $3,316.19 |

| BASIN | $3,068.77 |

| WHITE SULPHUR SPRINGS | $2,995.39 |

| CLANCY | $3,331.29 |

| NORRIS | $2,988.25 |

| ENNIS | $3,440.51 |

| GOLD CREEK | $3,096.75 |

| DILLON | $3,310.72 |

| DRUMMOND | $3,026.79 |

| TOSTON | $3,348.30 |

| CONNER | $3,255.76 |

| HELMVILLE | $3,279.47 |

| PHILIPSBURG | $3,244.78 |

| DEER LODGE | $3,262.24 |

| DARBY | $3,217.11 |

| CLINTON | $3,221.49 |

| HALL | $3,156.10 |

| THREE FORKS | $3,060.84 |

| SULA | $3,013.66 |

| WISDOM | $3,206.64 |

| GARRISON | $3,364.34 |

| GLEN | $3,365.74 |

| POLARIS | $2,996.83 |

| TOWNSEND | $3,334.32 |

| HAMILTON | $3,278.43 |

| CARDWELL | $3,336.07 |

| WISE RIVER | $3,331.09 |

| BOULDER | $3,332.19 |

| HARRISON | $3,340.71 |

| RINGLING | $3,323.40 |

| VICTOR | $3,347.79 |

| GRANTSDALE | $3,372.37 |

| PINESDALE | $3,351.38 |

| LOLO | $3,323.94 |

| ELLISTON | $3,391.20 |

| CORVALLIS | $3,351.97 |

| MILLTOWN | $3,374.36 |

| RADERSBURG | $3,364.97 |

| AVON | $3,378.26 |

| MISSOULA | $3,335.52 |

| MISSOULA | $3,324.68 |

| MISSOULA | $3,326.39 |

| MISSOULA | $3,339.12 |

| MISSOULA | $3,387.14 |

| MISSOULA | $3,377.84 |

| HELENA | $3,389.23 |

| FORT HARRISON | $3,351.38 |

| HELENA | $3,351.38 |

| HELENA | $3,386.28 |

| HELENA | $3,335.52 |

| EAST HELENA | $3,309.17 |

The cheapest rates in Montana by city are Glendive, Forsyth, Scobey, Moore, and Colstrip–populations ranging between 161 to 2,214 individuals.

The most expensive? Martin City, Ennis, Trout Creek, Sand Springs, and Sunburst.

These cities are also small, with populations ranging from 90-838, however, wilderness and hiking make areas like Martin City attractive (and thus higher rates) as well as Sand Springs, whose population was 90 in the 2010 census, however, contains life-giving springs that make it more appealing.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Best Car Insurance Companies in Montana

While cheap is certainly good, you also want to make sure you’re getting the best value.

Again, we come to the question–how do you know which company is offering the best policies?

That’s what we’re here for.

In this section, we will take a look at how the household names in Montana compare to one another so you can have a greater perspective.

We’ll cover ratings from the most trusted sources, customer reviews (both good and bad), and we’ll also look at rates to see which companies give you a break when it comes to everyday practical matters like credit history, driving record, and even commutes.

Let’s get started.

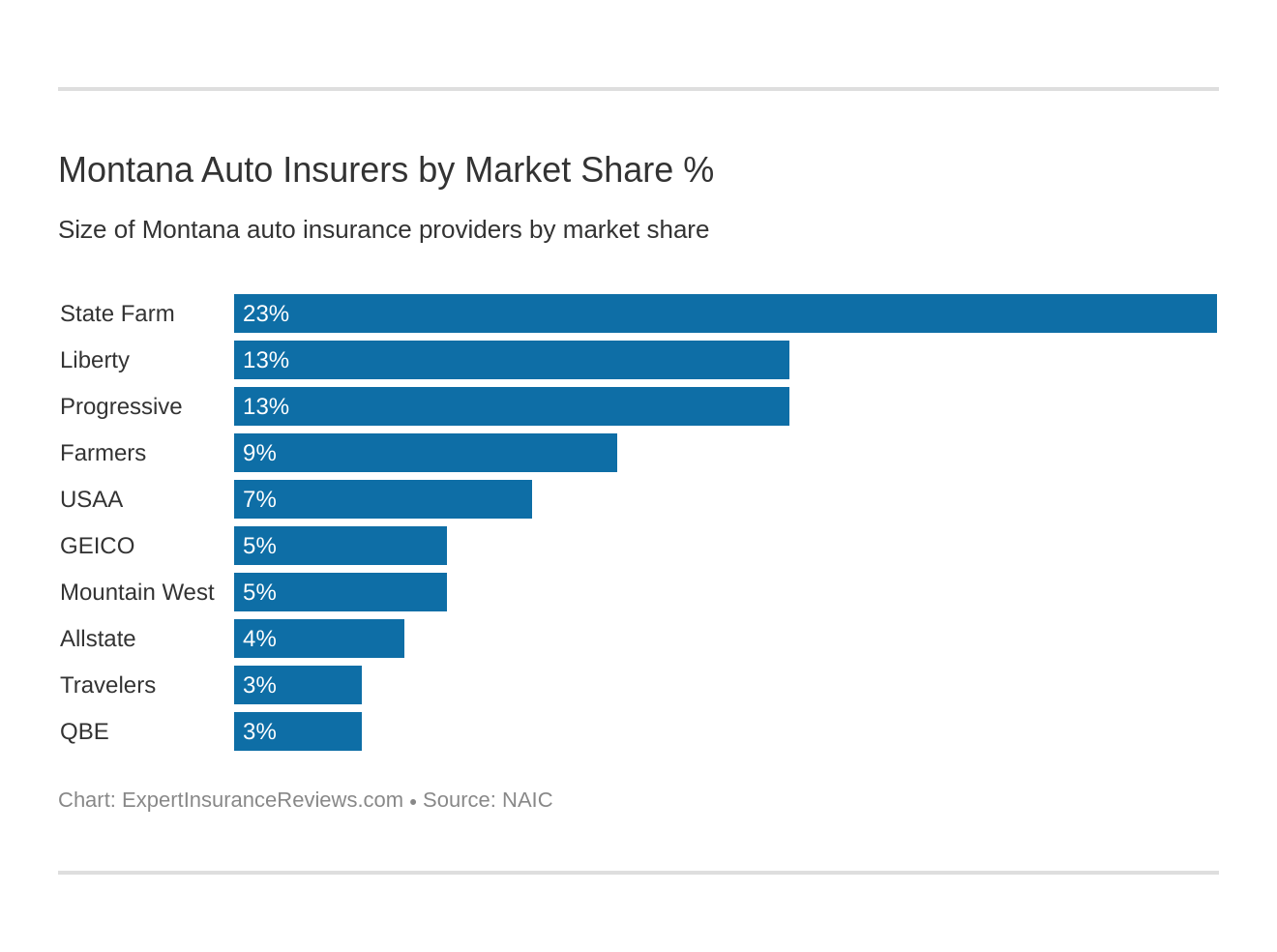

The Largest Companies Financial Rating

Montana AM Best Rating

| Insurance Company | A.M. Best |

|---|---|

| A+ | |

| A | |

| A++ | |

| A |

| Mountain West | A- |

| A+ | |

| QBE | A |

| B | |

| A++ | |

| A++ |

A lot of work goes into a company’s AM rating. Conducted by A.M. Best, it can display a company’s strength or unfortunately, lack thereof.

Good news! All of the largest companies in Montana have a great AM rating, something to keep in mind as you consider other factors when choosing your insurance carrier.

But what about customer satisfaction? We’ll take a look at that next.

Companies with Best Ratings

JD Power NORTH CENTRAL region

| Insurance Company | Points | Power Circle |

|---|---|---|

| 891 | 5-Among the best | |

| Westfield | 855 | 5-Among the best |

| IN Farm Bureau | 854 | 5-Among the best |

| 852 | 5-Among the best |

| Country Financial | 846 | 4-Better than most |

| 841 | 4-Better than most | |

| 839 | 4-Better than most |

| MI Farm Bureau | 839 | 4-Better than most |

| Auto-Owners Insurance | 836 | 3-About average |

| 836 | 3-About average | |

| Cincinnati Insurance | 832 | 3-About average |

| North Central Average | 830 | 3-About average |

| Grange Insurance | 828 | 3-About average |

| 828 | 3-About average | |

| 822 | 3-About average | |

| 820 | 3-About average | |

| Esurance | 818 | 3-About average |

| 818 | 3-About average | |

| The Hanover | 807 | 2-The Rest |

| 803 | 2-The Rest | |

| 802 | 2-The Rest |

| Automobile Club Group | 801 | 2-The Rest |

| Metlife | 794 | 2-The Rest |

| 788 | 2-The Rest |

J.D. Power is one of the most trusted companies when it comes to ratings.

This chart displays input based on customer satisfaction. This is important, because the experience of your peers and fellow residents could also help you make an important decision in regards to the type of insurance settle on.

Westfield, IN Farm Bureau, and Erie insurance company had ratings that were among the best in Montana, beating out other giants that had a greater A.M. rating.

Interesting isn’t it?

We also have data for complaints as well, which can also factor into your decision-making process.

Read more: Grange Association Insurance Review & Complaints: Auto, Home & Farm Insurance

Companies with Most Complaints in Montana

| Providers | Company Complaint Ratio (2017) | Total Number of Complaints |

|---|---|---|

| Allstate | 0.5 | 163 |

| Farmers Insurance | 0.59 | 7 |

| Geico | 0.68 | 333 |

| Liberty Mutual | 5.95 | 222 |

| Mountain West | 1.47 | 10 |

| Progressive | 0.75 | 120 |

| QBE Insurance | 32.86 | 4 |

| State Farm | 0.44 | 1482 |

| Travelers | 0.09 | 2 |

| USAA | 0.74 | 296 |

For the major ten organizations in Montana, these are the number of customer complaints and ratio of complaints per 1,000 autos from 2017.

A record of 1 is normal, so the lower the number, the better the organization is contrasted with its rivals.

So given this present data, companies with complaint ratios like State Farm, Travelers, and GEICO are among the best insurance companies in Montana.

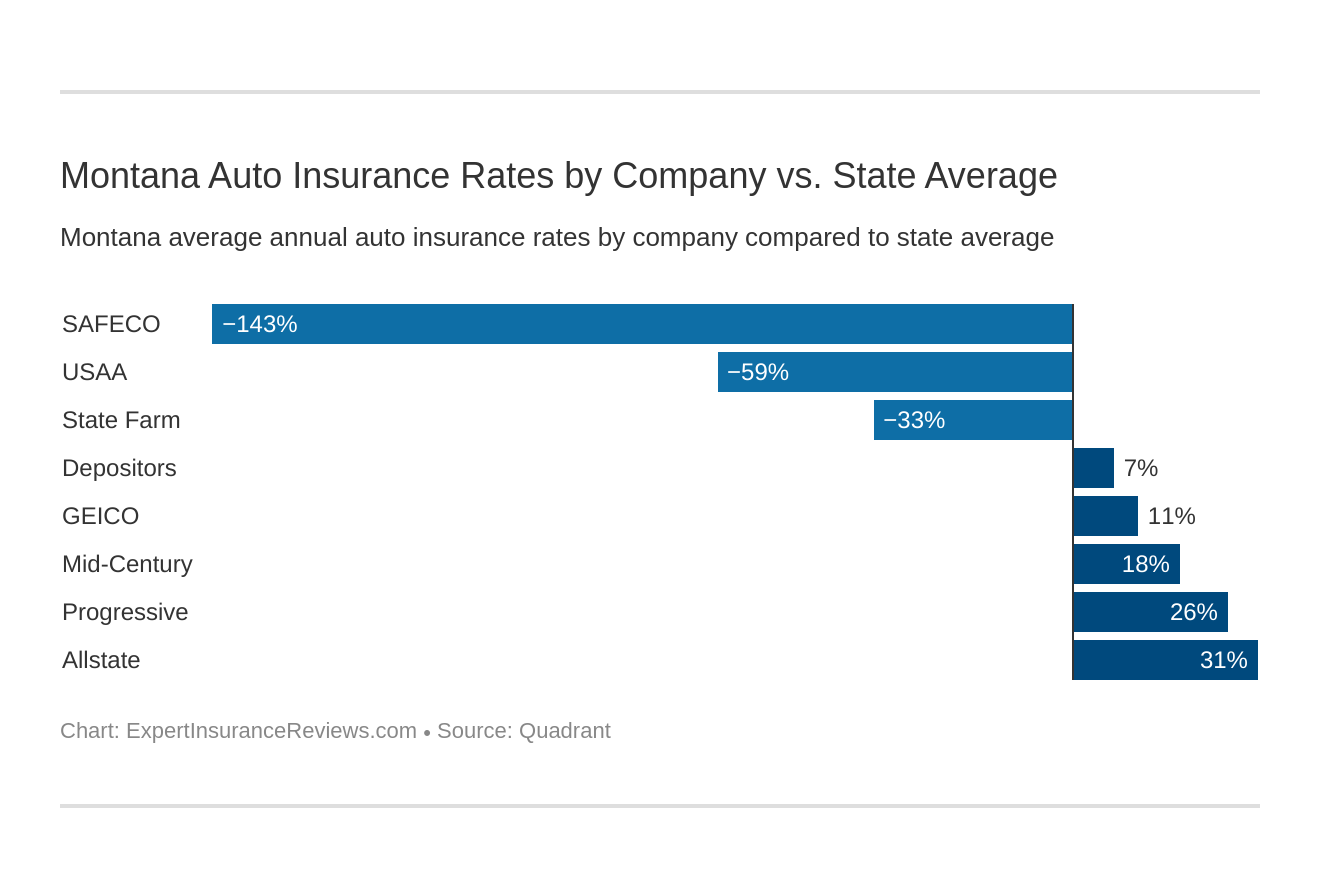

Cheapest Insurance Companies in Montana

Next we’ll look at something appealing to most–the cheapest companies in the state of Montana.

Montana: CHEAPEST Rates

| Company | Average Annual Rates | Compared to State Average | Percentage Compared to State Average |

|---|---|---|---|

| $1,326.11 | -$1,894.73 | -142.88% | |

| $2,031.89 | -$1,188.96 | -58.51% | |

| $2,417.73 | -$803.11 | -33.22% | |

| Depositors | $3,478.26 | $257.41 | 7.40% |

| $3,602.35 | $381.50 | 10.59% | |

| Mid-Century | $3,907.55 | $686.70 | 17.57% |

| $4,330.76 | $1,109.92 | 25.63% | |

| $4,672.10 | $1,451.26 | 31.06% |

From the chart, we can see that companies like SafeCo fall far below the state average, followed by USAA and StateFarm respectively.

Allstate and Progressive are among the higher rates in the state.

Commute Rates by Companies

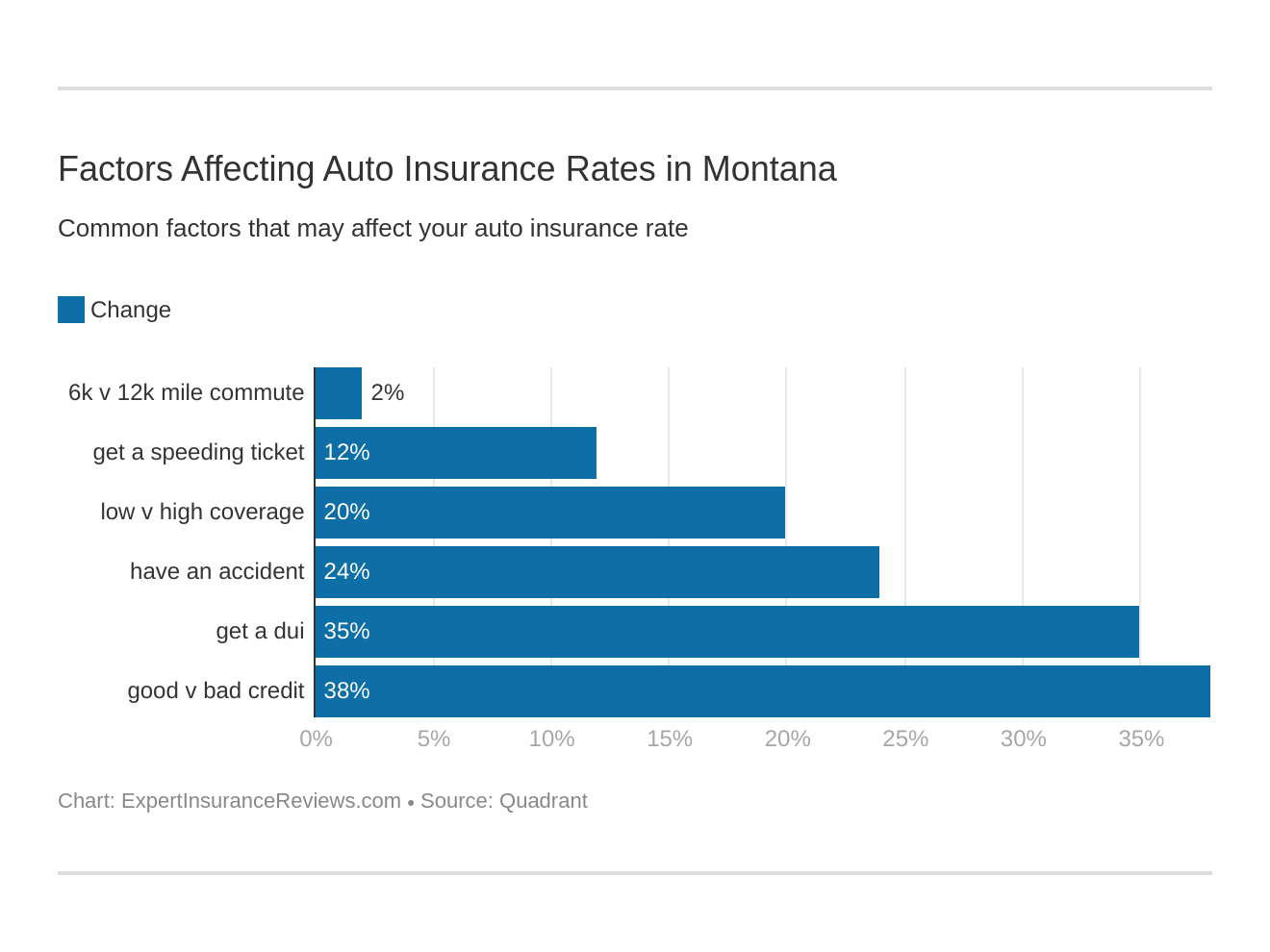

Did you know the duration of your commute also plays a part in a company’s insurance rates?

Montana: Rates via Commute

| Insurance Company | 10 miles commute, 6000 annual mileage. | 25 miles commute, 12000 annual mileage. |

|---|---|---|

| $4,561.46 | $4,782.74 | |

| $4,330.76 | $4,330.76 | |

| $3,907.55 | $3,907.55 | |

| $3,538.49 | $3,666.20 | |

| $3,478.26 | $3,478.26 |

| $2,346.26 | $2,489.21 | |

| $2,007.49 | $2,056.29 | |

| $1,326.11 | $1,326.11 |

Companies like Progressive and Farmers give their people a break, whereas companies like Allstate and GEICO bump their prices for longer commutes.

Next, we’ll look at coverage levels.

Coverage Level Rates by Companies

While everyone starts off at the basic amount of coverage, increasing can be an option. But sometimes it comes at a cost.

Let’s take a look.

Montana: Rates via Coverage

| Insurance Company | Annual Rate with Low Coverage | Annual Rate with Medium Coverage | Annual Rate with High Coverage |

|---|---|---|---|

| $4,449.47 | $4,661.15 | $4,905.69 | |

| $3,630.98 | $3,903.65 | $4,188.01 | |

| $3,460.99 | $3,577.02 | $3,769.03 | |

| $1,231.99 | $1,329.79 | $1,416.55 |

| $2,678.46 | $3,706.80 | $4,049.52 |

| $4,090.20 | $4,318.46 | $4,583.63 | |

| $2,289.67 | $2,407.88 | $2,555.66 | |

| $1,943.70 | $2,021.60 | $2,130.37 |

Geico and USAA bump their prices up the lowest, at 8.9 percent and 9.6 percent respectively. Nationwide, on the other hand, penalizes their customers by 51.19 percent if they want to extend their coverage.

Credit History Rates by Companies

Do you have good credit? Fair? Or poor? Sometimes insurance companies alter their rates accordingly. Look at the chart below.

Montana: Rates via Credit History

| Insurance Company | Annual Rate with Good Credit | Annual Rate with Fair Credit | Annual Rate with Poor Credit |

|---|---|---|---|

| $3,848.58 | $4,519.28 | $5,648.45 | |

| $3,453.72 | $3,661.37 | $4,607.55 | |

| $2,106.77 | $3,025.06 | $5,675.22 | |

| $1,326.11 | $1,326.11 | $1,326.11 |

| $2,866.07 | $3,172.44 | $4,396.26 |

| $2,866.07 | $3,172.44 | $4,396.26 | |

| $1,660.31 | $2,116.08 | $3,476.81 | |

| $1,500.57 | $1,854.79 | $2,740.31 |

Companies like Liberty Mutual don’t penalize their customers at all for having poor credit. GEICO and State Farm are less forgiving, upping their rates 169.38 percent and 109.41 percent respectively.

Driving Record Rates by Companies

And what about your driving record? Companies factor that into their rates as well.

Montana: Rates via Driving Record

| Insurance Company | Clean record | With 1 Speeding | With 1 Accident | With 1 DUI |

|---|---|---|---|---|

| $3,925.26 | $4,485.46 | $4,642.32 | $5,635.38 | |