10 Best Home Insurance Companies for Tiny Homes in 2025 (See the Top Providers Here)

State Farm, Allstate, and Nationwide rank as the best home insurance companies for tiny homes, offering strong coverage starting at just $25 per month. These home insurance companies for tiny homes offer low monthly rates, fast claims support, and reliable coverage that works whether your home stays put or travels.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Laura Berry

Former Licensed Insurance Producer

Laura Berry has experience as a licensed producer selling life, health, and property insurance coverage for both Allstate and State Farm. She has dedicated many hours to helping her clients understand the insurance marketplace so they could find the best car, home, and life insurance products for their circumstances. While she currently helps businesses take advantage of the federal R&D tax...

Former Licensed Insurance Producer

UPDATED: Jun 20, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Jun 20, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

11,638 reviews

11,638 reviewsCompany Facts

$200K Policy

A.M. Best

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 3,071 reviews

3,071 reviewsCompany Facts

$200K Policy

A.M. Best

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviewsState Farm, Allstate, and Nationwide rank among the best home insurance companies for tiny homes.

Our Top 10 Company Picks: Best Home Insurance Companies for Tiny Homes

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | B | Custom Coverage | State Farm | |

| #2 | 25% | A+ | Affordable Premiums | Allstate | |

| #3 | 20% | A+ | Home Plans | Nationwide |

| #4 | 20% | A | Flexible Policies | Farmers | |

| #5 | 10% | A+ | Easy Quotes | Progressive | |

| #6 | 10% | A++ | Military Families | USAA | |

| #7 | 25% | A | Full Coverage | Liberty Mutual |

| #8 | 25% | A+ | Local Expertise | Erie |

| #9 | 5% | A+ | Custom Coverage | The Hartford |

| #10 | 13% | A++ | Fast Claims | Travelers |

These tiny house insurance providers offer reliable coverage for both mobile and stationary setups, with flexible options that match different living styles.

Our guide breaks down how each company compares in terms of service, claims, and coverage extras. If you’re insuring a tiny home, these are the best insurance companies to start with.

- Covers mobile and stationary tiny homes with flexible protection options

- Compare the best home insurance companies for tiny homes by features

- State Farm is the top pick for tiny homes with rates starting at $25/month

Don’t settle for expensive home insurance premiums. Enter your ZIP code to find robust coverage for your dwelling at an affordable price.

Tiny Home Insurance Rates by Provider & Coverage

If you’re comparing insurance options for a tiny home, this table gives you a clear snapshot of monthly costs by provider and coverage level. USAA offers the lowest minimum coverage rate at $25 per month, while Allstate isn’t far behind at $26 and also keeps full coverage fairly affordable at $75 per month.

Tiny Homes Insurance Monthly Rates by Provider & Coverage Amount

| Insurance Company | $200k | $300k | $500k | $1M |

|---|---|---|---|---|

| $35 | $45 | $65 | $110 | |

| $33 | $42 | $63 | $105 |

| $38 | $48 | $68 | $115 | |

| $36 | $46 | $66 | $112 |

| $34 | $43 | $64 | $108 | |

| $32 | $41 | $60 | $102 | |

| $30 | $40 | $60 | $100 | |

| $39 | $50 | $70 | $120 |

| $31 | $42 | $61 | $103 | |

| $29 | $39 | $59 | $98 |

If you’re looking for full coverage and want to save, USAA again stands out with a $70 monthly rate, followed closely by Farmers at $72 a month. For those interested in bundling or additional discount options, Liberty Mutual and The Hartford tend to run higher in cost, with full coverage rates reaching $90 and $86 a month, respectively.

State Farm falls in the middle, offering solid monthly rates at $31 for minimum and $80 for full coverage insurance. If you’re searching for the best insurance for tiny house living, this breakdown can help you balance cost with coverage, especially when deciding between a stationary or mobile tiny home.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

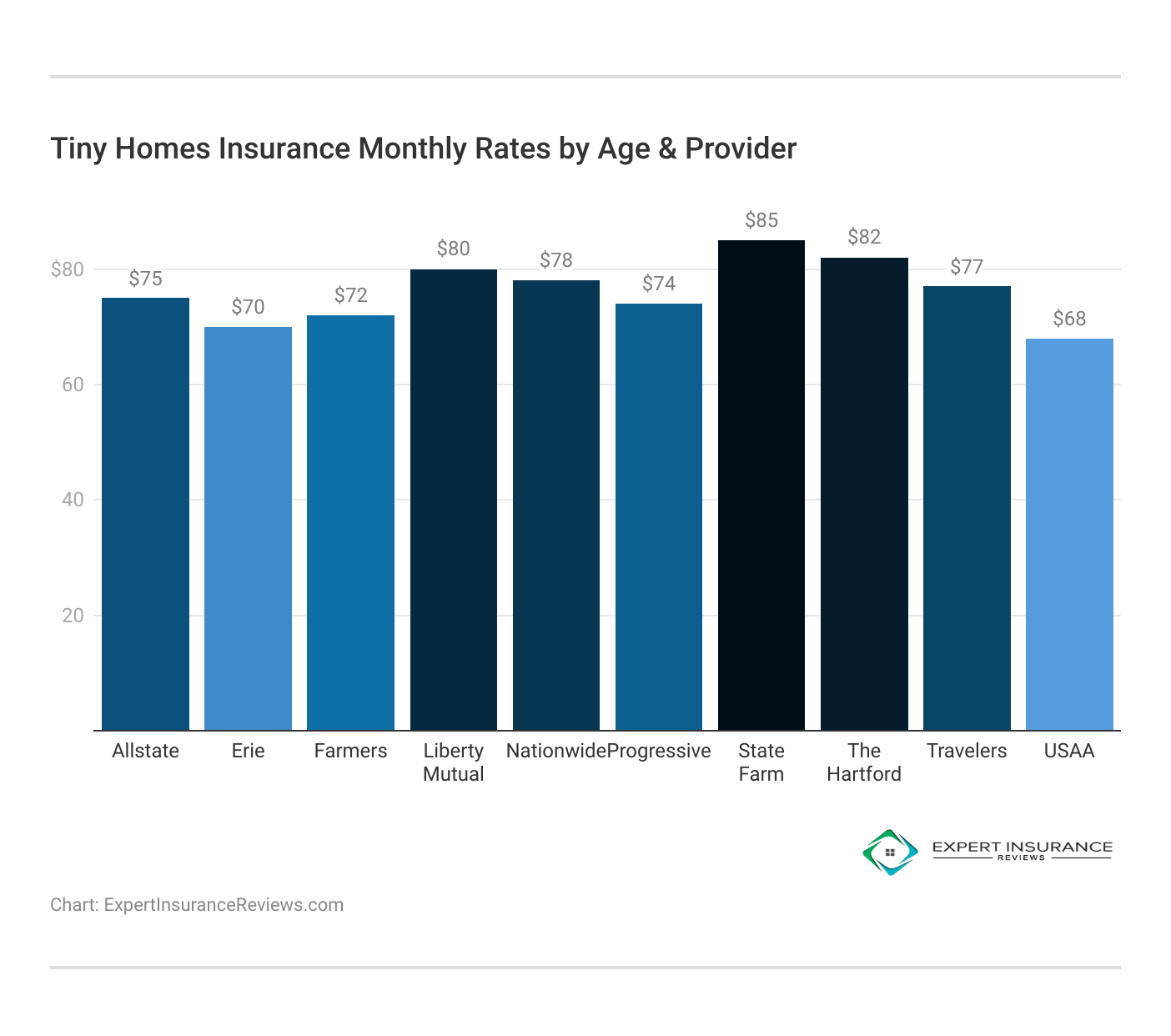

Tiny Homes Insurance Monthly Rates by Age & Provider

When insuring a tiny house, you should compare rates by age group and provider so you can quickly spot how age impacts monthly costs. For new homeowners, USAA and Erie offer some of the most affordable rates at $68 and $70 a month, respectively. State Farm is on the higher end at $85 a month.

As we move into the mid-age category, rates start climbing, with State Farm reaching $95 and Allstate and Liberty Mutual close behind at $90. Older homeowners see the biggest jump in premiums, with State Farm again the highest at $120 and USAA still offering the lowest at $98.

If you’re comparing the average cost of insurance by age, it’s clear that younger policyholders tend to pay less, but the gap widens significantly as you age. That makes it especially important to shop around. If you’re older and looking to save, USAA or Erie might offer the best value, while younger homeowners may find flexible options with Progressive or Farmers.

Tiny Home Insurance for Mobile & Manufactured Homes

Whether mobile or manufactured, tiny homes need the proper insurance to stay protected. Coverage can vary based on how and where you live, so finding a policy that fits your lifestyle is essential. This guide breaks down what you need to know to keep your home safe without overspending.

The right insurance protects your tiny home, whether you stay in one place or take it on the road. Reputable tiny home insurance companies make it easier to explore your options, find the best home insurance coverage, and enjoy tiny living without worry.

Allstate stands out for its reliable coverage and competitive rates, earning a solid 92% customer satisfaction rating.

Ty Stewart Licensed Insurance Agent

Tiny home insurance isn’t just about protection—it’s about peace of mind. Whether you’re parking your home in a new spot or hitting the road for an adventure, having the right coverage ensures you’re ready for anything, from natural disasters to accidents.

If your home stays in one place, make sure you’re looking into insurance for stationary tiny homes to get the right kind of long-term protection. With the right policy, you can focus on what matters most—enjoying your tiny living experience.

Best Home Insurance Discounts for Tiny Homes

If you’re buying home insurance for a tiny home, this discount comparison is a great place to start. State Farm really stands out with some of the biggest savings, offering up to 20% off for bundling, 24% for being claims-free, and a generous 17% discount for having safety devices installed.

Top Home Insurance Discounts for Tiny Homes

| Insurance Company | Bundling | Claims-Free | Home Security | Loyalty | Safety Device |

|---|---|---|---|---|---|

| 15% | 20% | 10% | 8% | 10% | |

| 12% | 12% | 20% | 6% | 10% |

| 12% | 25% | 14% | 7% | 10% | |

| 14% | 20% | 9% | 6% | 10% |

| 11% | 18% | 10% | 9% | 10% | |

| 16% | 21% | 11% | 10% | 10% | |

| 20% | 24% | 15% | 12% | 17% | |

| 15% | 14% | 22% | 6% | 10% |

| 13% | 16% | 7% | 8% | 10% | |

| 10% | 23% | 12% | 11% | 10% |

Progressive and USAA also deliver strong claims-free discounts at 21% and 23%, respectively, while Farmers leads the pack with a 25% claims-free incentive. If you’ve invested in home security, The Hartford offers the highest discount at 22%. For buyers who value loyalty perks, State Farm again shines with 12%, followed by USAA at 11%.

While every provider offers a standard 10% discount for safety devices, the combined savings really vary. If you’re focused on maximizing savings on homeowners insurance, look closely at how many categories each provider rewards—State Farm, Farmers, and Progressive seem to offer the most well-rounded discounts.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Types of Insurance Coverage for Tiny Houses

This table clearly answers what home insurance covers for tiny homes. It includes protection for the structure itself, your belongings inside, and liability if someone is injured on your property. If your tiny home is on wheels, trip collision coverage is essential for transport damage. Coverage for off-grid systems like solar panels and composting toilets is also available if listed.

Tiny Homes Insurance Coverage Levels

| Coverage Type | What It Covers |

|---|---|

| Dwelling Coverage | Damage to the tiny home's structure. |

| Personal Property | Belongings inside the home. |

| Liability Coverage | Injuries or damage you're responsible for. |

| Medical Payments to Others | Guest injury costs regardless of fault. |

| Loss of Use | Living costs if home is unlivable. |

| Trip Collision Coverage | Damage during home transport. |

| Attached Structures | Decks, porches, or stairs. |

| Off-Grid Systems | Solar, compost toilets, rain systems (if listed). |

Some policies include attached structures such as decks or stairs, and loss of use coverage helps pay for living expenses if the home becomes unlivable. When comparing the types of insurance for tiny homes, focus on which providers offer these specific protections—not all companies cover everything listed.

What Impacts Tiny Home Insurance Costs

This table outlines the key factors that affect tiny home insurance rates and eligibility. Insurers look at home age, with newer homes often qualifying for lower premiums. Square footage impacts replacement costs, especially for homes between 100 and 400 square feet.

Tiny Home Characteristics That Impact Insurance

| Characteristic | Description |

|---|---|

| Home Age | Year built; newer homes may get lower rates and qualify for more coverage. |

| Square Footage | Most tiny homes are 100–400 sq. ft.; affects replacement cost and contents. |

| Home Type | Stationary (on foundation) or mobile (on trailer/RV-certified). |

| Location | ZIP code risk (weather, crime, fire zone) and zoning compliance. |

| Construction Material | Wood, metal, SIPs, or prefabricated kits—impacts durability and fire risk. |

| Roof Type | Metal, shingle, or flat; influences hail/fire resistance and premiums. |

| Foundation Type | Permanent (slab/pier) vs. wheels/trailer; impacts policy type eligibility. |

| Utilities Setup | On-grid or off-grid (solar, composting, water tank); may require endorsements. |

| Builder Type | Professionally built or DIY; insurers often require certification for DIY builds. |

| Security Features | Locks, alarms, cameras; may qualify for safety discounts. |

Whether the home is mobile or on a foundation affects the type of policy offered. ZIP code influences pricing due to weather, crime, or fire risk. Construction material and roof type affect durability and resistance to damage. The foundation type determines policy eligibility, while on-grid or off-grid utilities may require additional endorsements.

DIY builds often need certification, and security features like alarms or cameras can reduce premiums. If you’re using a review directory to compare providers, understanding these details helps explain rate differences.

10 Best Home Insurance Companies for Tiny Homes

This section breaks down the top 10 home insurance companies for tiny homes, highlighting what each does best and where they fall short. Whether you need affordable premiums, strong claims support, or tailored coverage for your tiny house setup, you’ll get quick takeaways here to help you choose with confidence.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Save on Safety Upgrades: Installing security systems and smoke detectors in tiny homes can help reduce your insurance premiums, as many providers offer safety-related discounts.

- Reliable Tiny Home Coverage: Get protection for your structure, personal belongings, and liability—essential coverage tailored to the unique risks of tiny homes.

- Helpful Local Agents: State Farm offers easy access to local support for tiny homes. Read our State Farm Insurance review for full details.

Cons

- Rates Can Be Pricey in Some Areas: Insurance costs for tiny homes may be higher based on location, mobility, and build type.

- Limited Online Policy Management: For tiny homes, some updates or claims may still need to go through an agent, even if quotes start online.

#2 – Allstate: Best for Affordable Premiums

Pros

- Significant Savings on Bundles: Allstate offers bundling discounts that can lower insurance costs for tiny homes, especially when combined with auto or other policies.

- Coverage That Fits: Allstate offers flexible policy options tailored for tiny homes. Learn more in our Allstate home insurance review.

- Dependable Claims Support: For tiny homes, strong financial backing helps ensure fast and reliable claim payouts when you need them most.

Cons

- Limited Availability: Some states offer fewer tiny homes insurance options or limit eligibility.

- Restrictions on Tiny Homes: Certain tiny home types may not qualify for full coverage.

#3 – Nationwide: Best for Home Plans

Pros

- Extra Savings for Tiny Homes: Earn discounts for adding security systems, smoke alarms, and other safety features.

- Solid Coverage for Tiny Homes: One policy protects your structure, personal items, and liability.

- Smooth Claims Process: Nationwide offers fast payouts and dependable support for tiny homeowners, and see more in our Nationwide home insurance review.

Cons

- Pricey in Some Areas: Insurance for tiny homes can cost more based on location and local risk factors.

- Fewer Customization Options: Some insurers offer limited flexibility for tailoring tiny homes coverage.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#4 – Farmers: Best for Flexible Policies

Pros

- Significant Savings for New Tiny Homes: Farmers Insurance offers discounts for newly built or updated tiny homes, helping reduce premiums. See full details in our Farmers Insurance review.

- Coverage That Fits Tiny Homes: Policies can be tailored to cover the structure, liability, and belongings specific to tiny homes.

- Easy Claims Process: Farmers delivers fast payment, assisting small homeowners in getting back on their feet without delays.

Cons

- Limited In-Person Support: Tiny homes insurance may offer less face-to-face help due to fewer local agents.

- Pricey in Some Locations: Insurance rates for tiny homes can be higher in areas with greater risk or limited provider options.

#5 – Progressive: Best for Easy Quotes

Pros

- Significant Savings on Bundles: Save by bundling tiny home and auto insurance, and earn extra discounts through Progressive Snapshot based on your safe driving habits.

- Coverage That Fits Tiny Homes: Customize protection for your structure, personal items, and liability to match how your tiny home is used.

- Quick Online Quotes: Get a fast estimate tailored to tiny homes without needing to call an agent.

Cons

- Can Be Pricey: Insurance premiums may be higher based on your tiny home’s location, mobility, or custom features.

- Not All Tiny Homes Qualify for Coverage: Some insurers exclude certain tiny home types, like DIY builds or homes without foundations.

#6 – USAA: Best for Military Families

Pros

- Made for Military Families: USAA offers coverage tailored to service members living in tiny homes, with benefits that match their lifestyle and mobility needs.

- Plenty of Ways to Save: USAA offers discounts for bundling, staying claims-free, and adding safety features to your tiny home. Explore the benefits in our USAA Insurance review.

- Trusted Support: USAA delivers fast claims processing and strong customer service, making tiny home insurance simple to manage.

Cons

- Limited to Military Families: USAA coverage for tiny homes is only available to military members, veterans, and their families.

- Fewer In-Person Options: While USAA’s support is reliable, tiny homeowners may find limited local office access for face-to-face help.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for Full Coverage

Pros

- Significant Savings: Bundling discounts for home and auto insurance helps tiny homeowners reduce their overall costs.

- Flexible Coverage: Liberty Mutual offers protection for your tiny home, personal belongings, and liability. Discover specific details in our Liberty Mutual insurance review.

- Reliable Support: Liberty Mutual offers reliable claims processing and a fast payout process for tiny house policies.

Cons

- May Be Costly: Premiums are higher in some locations, which affects affordability for modest homeowners.

- Tiny Home Restrictions Apply: Not all tiny homes qualify for coverage, especially if they’re mobile, off-grid, or non-certified, so review policy terms carefully.

#8 – Erie: Best for Local Expertise

Pros

- Extra Savings: Erie offers discounts for tiny houses with smoke alarms, security systems, and other safety features.

- Comprehensive Coverage for Tiny Homes: Erie policies cover the structure, belongings, and liability, offering broad protection for tiny homeowners.

- Support You Can Count On: Erie is also known for its attentive service and painless claims process, which is advantageous for tiny home coverage.

Cons

- Not Available Everywhere: Erie’s coverage is only offered in select states, which may limit options for tiny homeowners. Learn more in our Erie insurance review.

- No Instant Quotes: You’ll need to contact an agent to get pricing for tiny homes, which can slow down the comparison process if you’re looking for quick estimates.

#9 – The Hartford: Best for Custom Coverage

Pros

- Exclusive Perks for AARP Members: Eligible AARP members can access special discounts that make tiny home insurance more affordable.

- Comprehensive Protection: Coverage includes the structure, personal belongings, and liability to help keep tiny homeowners financially protected.

- Strong Support: The Hartford is known for responsive claims handling and dependable service. Learn more in our The Hartford Insurance review.

Cons

- Limited Availability for Tiny Homes: Coverage is mainly offered to AARP members, so not all tiny homeowners are eligible.

- Higher Rates for Certain Tiny Homes: Premiums can be more expensive based on your tiny home’s location, mobility, or construction type.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#10 – Travelers: Best for Fast Claims

Pros

- Flexible Coverage for Tiny Homes: Travelers allows you to customize coverage based on your tiny home’s size, build, and features.

- Bundling Discounts: Save more by combining tiny home insurance with auto or other policies.

- Reliable Claims Support: Travelers is known for fast, fair claims handling, giving tiny homeowners dependable service when it matters most.

Cons

- Higher Costs in Some Areas: Premiums can be more expensive if your tiny home is in a high-risk zone. See more in our Travelers insurance review.

- Not Specifically Designed for Tiny Homes: Travelers coverage is flexible, but insuring tiny homes may require added customization to match their unique needs.

How to Get the Right Insurance for Your Tiny House

Finding the right insurance for your tiny home doesn’t have to be complicated. Whether you’re settled in one place or living on wheels, the top providers we covered, like State Farm, Allstate, and Nationwide, offer strong coverage options at rates that won’t wreck your budget.

If your tiny home is mobile, make sure your policy includes trip collision coverage. Many skip it, but it’s essential for protecting your home while on the move.

Rachel Bodine Insurance Feature Writer

The key is knowing what kind of protection your setup really needs and comparing home insurance that specializes in covering those details. Tiny home insurance is a niche product, but when you shop smart and think about what matters most—structure, belongings, liability, and mobility—you’ll land a policy that fits without paying for things you don’t need.

Protecting your home doesn’t have to be expensive. Enter your ZIP code into our free tool to find affordable homeowners insurance today.

Frequently Asked Questions

What’s the best insurance company for tiny houses based on price and flexibility?

State Farm is one of the best insurance companies for tiny houses because it offers affordable rates starting at around $40 per month and works well for stationary homes. Allstate provides competitive bundling options, while Nationwide stands out for flexible coverage that adapts to unique home structures.

Can you insure a tiny house through a mainstream insurer like State Farm or Allstate?

Yes, you can insure a tiny house with major providers like State Farm and Allstate, but only if the home meets certain conditions. The home must be stationary, built to residential codes, and typically placed on a foundation. State Farm tiny house insurance does not extend to mobile homes or houses on trailers.

The best way to get affordable home insurance rates is to enter your ZIP code into our free comparison tool.

What is the typical tiny home insurance cost for full coverage?

State Farm is one of the best insurance companies for tiny houses because it offers affordable rates starting at around $40 per month and works well for stationary homes.

If you’re unsure how much home insurance to buy, Allstate provides competitive bundling options, and Nationwide offers flexible coverage that adapts to unique home structures.

What type of insurance policy do you need for a tiny home on wheels if the home is uncertified?

If your tiny home lacks formal RV certification, you may need a specialty policy from companies like Strategic Insurance Agency. These insurers offer flexible plans designed for unconventional homes, though they may have stricter underwriting guidelines and higher premiums.

Which tiny house insurance companies cover short-term rentals or Airbnb use?

Proper Insurance and Strategic Insurance Agency are two of the most reliable tiny house insurance companies for short-term rentals. Their policies are designed to protect tiny homes rented through platforms like Airbnb, offering enhanced liability and loss-of-income coverage.

Which companies provide insurance for a tiny house on wheels that qualifies as an RV?

Progressive is a leading provider of insurance for a tiny house on wheels that meets RVIA certification or similar standards. Their RV insurance policies include coverage for travel, accidents, weather-related damage, and full-time living, and can help clarify how car insurance covers trailers in certain situations.

Can mobile home insurance be used to cover a tiny house?

Mobile home insurance can sometimes be applied to a tiny house if the structure was built in a factory and meets HUD guidelines. Providers like Foremost may offer coverage under mobile home policies, but most tiny homes require specialized evaluation before acceptance.

Can you insure a shed home that’s been converted into a livable tiny house?

You can insure a shed home only if it has been properly converted into a legal residence with plumbing, electrical systems, and building code compliance. Most insurance companies will require documentation showing the home meets residential standards before offering coverage.

What does tiny house insurance cover in a standard policy?

A standard tiny house insurance policy generally covers the structure against fire, wind, and vandalism, personal property inside the home, and liability protection if someone is injured on your property. These are common types of home insurance coverage, with optional endorsements available for travel protection or loss-of-rent.

Are there tiny homes for sale that come with insurance?

Tiny homes for sale typically do not include insurance. Buyers are responsible for securing their own policy, which should be done before occupying or transporting the home. Builders may refer clients to preferred insurance partners but do not usually provide coverage themselves.

Is RV insurance always required for tiny homes on trailers?

RV insurance is required for any tiny home that is towed on public roads and registered as a recreational vehicle. If your tiny house does not qualify as an RV, you’ll need a nonstandard policy through a provider that covers custom or mobile dwellings.

How does tiny home insurance work if the house is regularly moved?

When a tiny home is mobile, the insurance functions similarly to RV insurance. To stay protected, you’ll need RV insurance coverage that includes travel risks, road liability, and personal property. This type of policy stays active whether your tiny home is parked or on the move.

What is a strategic insurance policy for a tiny house, and who should consider it?

It refers to coverage offered by Strategic Insurance Agency. These plans are suited for tiny homes that don’t qualify under traditional home or RV policies, including mobile or off-grid units, short-term rentals, and non-certified structures.

How does insurance for a tiny house on wheels compare to insuring a stationary home?

Insurance for a tiny house on wheels is typically more expensive due to higher risks associated with movement and road travel. Stationary homes often qualify for homeowners or manufactured home insurance at lower rates, while mobile units need specialized RV or travel policies.

Make sure your home is protected by entering your ZIP code into our home insurance comparison tool today.

What insurance do you need if you rent out your tiny house occasionally?

If you rent out your tiny house even part-time, you’ll need home insurance for short-term rentals that includes rental coverage. Proper Insurance offers tailored plans that protect against guest-caused damage, liability claims, and rental income loss—coverage that standard homeowners policies often exclude.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Laura Berry

Former Licensed Insurance Producer

Laura Berry has experience as a licensed producer selling life, health, and property insurance coverage for both Allstate and State Farm. She has dedicated many hours to helping her clients understand the insurance marketplace so they could find the best car, home, and life insurance products for their circumstances. While she currently helps businesses take advantage of the federal R&D tax...

Former Licensed Insurance Producer

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.