10 Best Car Insurance Companies That Accept Checks in 2025

Progressive, State Farm, and Geico offer the best car insurance companies that accept checks, beginning at just $68 per month. Our commitment lies in assisting you in comparing quotes from these esteemed insurers, empowering you to discover ideal coverage and capitalize on potential discounts for your vehicle.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Companies That Accept Checks

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Companies That Accept Checks

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews

- Progressive offers competitive rates starting at $68 per month

- Prominent insurance providers provide advantages for check users

- Different discounts are available for those who use checks

#1 – Progressive: Top Overall Pick

Pros

- Versatility: Progressive offers a wide range of coverage options tailored to individual needs, ensuring comprehensive protection for drivers. Read more with our Progressive auto insurance review.

- Innovation: Progressive’s utilization of cutting-edge technology facilitates a seamless and user-friendly experience for policyholders, from obtaining quotes to managing claims.

- Affordability: Progressive’s competitive rates and various discounts make it an attractive option for budget-conscious consumers seeking quality coverage.

Cons

- Customer Service: Some customers have reported inconsistent experiences with Progressive’s customer service, citing issues with responsiveness and clarity.

- Policy Restrictions: Progressive’s policies may have certain restrictions or limitations, particularly regarding coverage add-ons and eligibility criteria.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#2 – State Farm: Best for Personalized Service

Pros

- Personalized Service: State Farm is renowned for its personalized approach to customer service, offering dedicated agents who work closely with policyholders to address their specific needs and concerns.

- Financial Stability: With its strong financial standing and long-standing reputation in the insurance industry, State Farm provides peace of mind to policyholders regarding the reliability and stability of their coverage.

- Flexibility: State Farm offers flexible policy options and customizable coverage plans, allowing policyholders to tailor their insurance solutions to match their unique circumstances and preferences. Read more with our State Farm auto insurance review for further insights.

Cons

- Premiums: While State Farm excels in customer service and reliability, its premiums may be relatively higher compared to some other insurers, potentially impacting affordability for certain demographics.

- Limited Online Tools: State Farm’s online platform and mobile app may lack some advanced features and functionalities offered by competitors, resulting in a less streamlined digital experience for tech-savvy customers.

#3 – Geico: Best for Competitive Rates

Pros

- Competitive Rates: Geico is known for its competitive pricing, often offering lower premiums compared to many other insurers, making it an attractive option for cost-conscious consumers.

- Accessibility: Geico’s user-friendly website and mobile app provide convenient access to policy management tools, claims filing, and customer support, enhancing overall customer experience and satisfaction.

- Discounts: Geico offers a variety of discounts, including those for safe driving, vehicle safety features, and multi-policy bundling, helping policyholders save money on their premiums. For further insights, check out our Geico auto insurance review.

Cons

- Limited Coverage Options: Geico’s coverage options may be more limited compared to some other insurers, potentially leaving policyholders with fewer choices for tailoring their insurance plans to their specific needs.

- Customer Service: While Geico offers accessible customer support channels, some customers have reported issues with responsiveness and satisfaction, particularly during claims processing and dispute resolution.

#4 – Liberty Mutual: Best for Extensive Coverage

Pros

- Comprehensive Coverage: Liberty Mutual offers a wide range of coverage options, including add-ons like roadside assistance and rental car reimbursement, providing comprehensive protection for policyholders.

- Discount Opportunities: Liberty Mutual provides various discounts, such as multi-policy, multi-car, and good driver discounts, helping policyholders save money on their premiums.

- Customer Service: Liberty Mutual is committed to providing excellent customer service, with dedicated agents ready to assist policyholders with their insurance needs and inquiries.

Cons

- Cost: Some customers have reported higher premiums with Liberty Mutual compared to other insurers, potentially making it less affordable for certain demographics. Check out our Liberty Mutual auto insurance review.

- Claims Process: There have been occasional complaints about delays and complications in Liberty Mutual’s claims process, leading to frustration among policyholders.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#5 – AAA: Best for Premium Services

Pros

- Member Benefits: AAA members may be eligible for additional benefits and discounts on their insurance policies, such as roadside assistance and travel perks.

- Strong Reputation: AAA is well-known for its reliable and trustworthy services, instilling confidence in policyholders regarding the quality and reliability of their coverage.

- Accessibility: AAA offers convenient access to insurance products and services through its extensive network of local branches and online platforms, ensuring policyholders can easily manage their policies.

Cons

- Limited Availability: Based on our AAA auto insurance review, AAA insurance may only be available to members of AAA clubs, restricting access for those who are not members.

- Coverage Options: Some customers have reported limited options for customization with AAA insurance policies, potentially leaving them with less flexibility in tailoring their coverage.

#6 – Farmers: Best for Customized Policies

Pros

- Customized Policies: Farmers offers customizable policies, allowing policyholders to tailor their coverage to their specific needs and preferences. Check out our Farmers auto insurance review for your guidance.

- Educational Resources: Farmers provides various educational resources and tools to help policyholders understand their coverage options and make informed decisions.

- Diverse Coverage Options: Farmers offers a wide range of coverage options, including specialized policies for unique needs such as classic cars, ensuring policyholders can find the right coverage for their vehicles.

Cons

- Cost: Farmers’ premiums may be higher compared to some other insurers, potentially impacting affordability for certain demographics.

- Customer Service: There have been occasional complaints about Farmers’ customer service, including issues with responsiveness and communication.

#7 – Allstate: Best for Strong Reputation

Pros

- Innovative Features: Allstate offers innovative features like Drivewise, which rewards safe driving behavior with discounts, and QuickFoto Claim, allowing policyholders to file claims quickly and easily.

- Strong Reputation: Allstate is well-known for its long-standing reputation and financial stability, providing peace of mind to policyholders regarding the reliability of their coverage.

- Flexible Payment Options: Allstate offers flexible payment options, including electronic fund transfer and automatic billing, making it convenient for policyholders to manage their payments.

Cons

- Premiums: Allstate’s premiums may be relatively higher compared to some other insurers, potentially making it less affordable for certain demographics.

- Claims Process: Some customers have reported dissatisfaction with Allstate’s claims process, citing delays and difficulties in resolving claims. Read more with our Allstate auto insurance review.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#8 – Nationwide: Best for Nationwide Coverage

Pros

- Nationwide Coverage: Nationwide offers coverage options in all 50 states, providing flexibility and convenience for policyholders who may relocate or travel frequently.

- Discount Opportunities: Nationwide provides various discounts, such as bundling, safe driver, and accident forgiveness discounts, helping policyholders save money on their premiums.

- Customized Solutions: Nationwide offers customizable coverage options, allowing policyholders to tailor their insurance plans to their specific needs and budget, ensuring they get the right level of protection.

Cons

- Customer Service: Based on our Nationwide auto insurance review, there have been occasional complaints about Nationwide’s customer service, including issues with responsiveness and clarity.

- Policy Options: Some customers have reported limited options for customization with Nationwide insurance policies, potentially leaving them with less flexibility in tailoring their coverage.

#9 – Travelers: Best for Global Reach

Pros

- Global Reach: Travelers offers coverage options for international travel, providing peace of mind to policyholders who may travel abroad frequently. Read more with our Travelers auto insurance review.

- Financial Stability: Travelers is known for its strong financial standing and long-standing reputation in the insurance industry, ensuring reliability and stability for policyholders.

- Claims Satisfaction: Travelers consistently receives high ratings for claims satisfaction, with efficient claims processing and responsive customer service, providing reassurance to policyholders during stressful situations.

Cons

- Limited Discounts: Travelers may offer fewer discounts compared to some other insurers, potentially reducing opportunities for policyholders to save money on their premiums.

- Policy Features: Some customers have reported limitations in policy features and add-ons with Travelers, potentially leaving them with less comprehensive coverage options.

#10 – American Family: Best for Family Focus

Pros

- Family Focus: American Family offers coverage options tailored to families, including discounts for bundling multiple policies and coverage for young drivers.

- Community Involvement: American Family is actively involved in community initiatives and charitable efforts, fostering a sense of trust and loyalty among policyholders.

- Personalized Service: American Family agents provide personalized service, taking the time to understand each policyholder’s unique needs and circumstances, ensuring they receive the right level of coverage and support.

Cons

- Cost: American Family’s premiums may be relatively higher compared to some other insurers, potentially impacting affordability for certain demographics. Read more with our American Family auto insurance review.

- Claims Process: There have been occasional complaints about delays and difficulties in American Family’s claims process, leading to frustration among policyholders.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

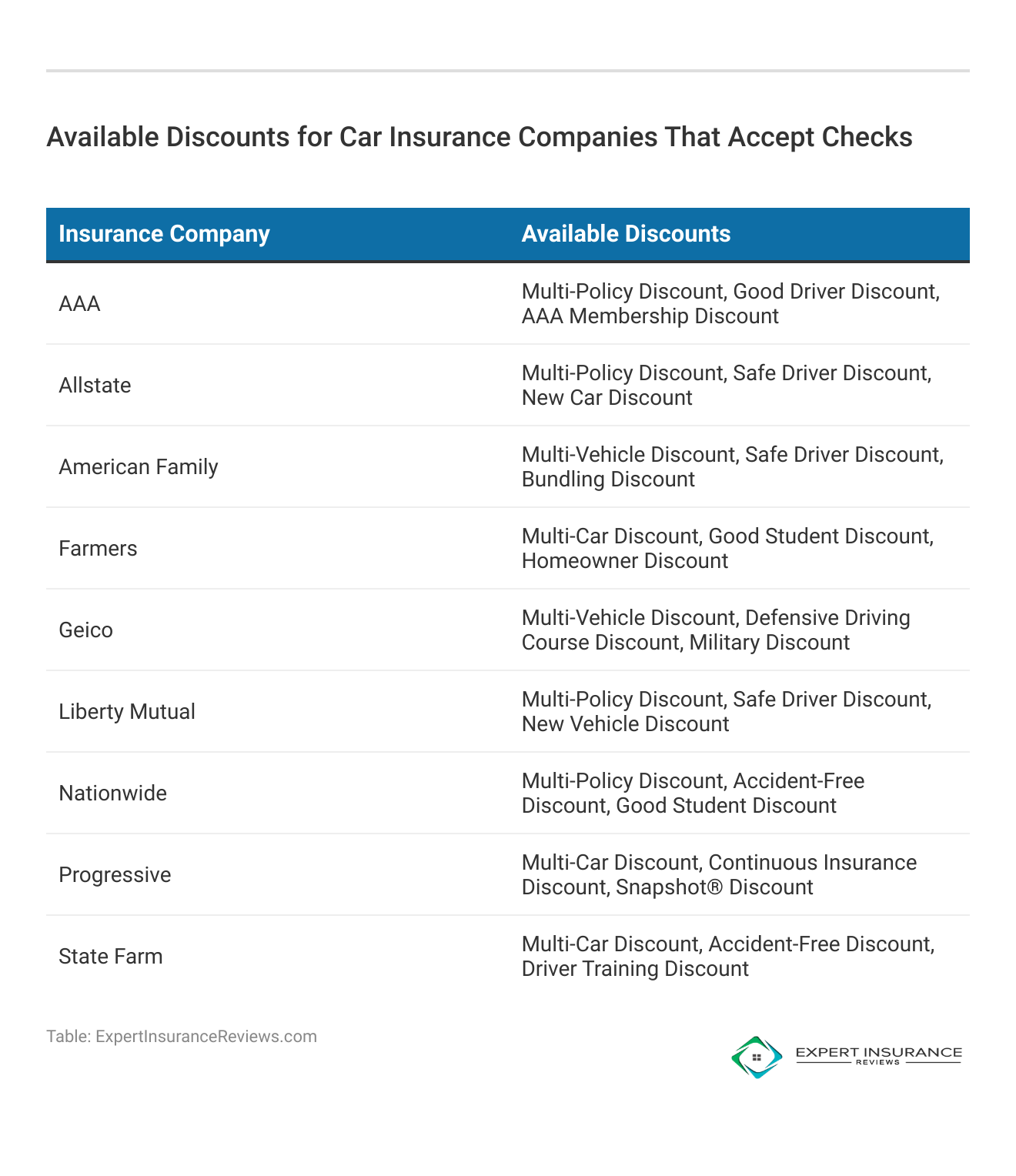

Best Car Insurance Companies That Accept Checks

Types of Checks Accepted by Insurance Companies

Comparing Car Insurance Companies That Accept Checks

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Case Studies: Best Car Insurance Companies That Accept Checks

From convenient paper checks to automated electronic payments, discover how they navigated their insurance choices to find the perfect fit while managing their car insurance premiums.

- Case Study 1: Convenient Paper Check Payments: Emily sought an insurer that accepts check payments for her new car. She opted for Liberty Mutual for their competitive rates and convenient paper check payment option.

- Case Study 2: Automated Electronic Check Payments: Michael desired an insurer accepting electronic checks for his monthly payments. He chose State Farm for their stellar customer service and automated payment setup through his checking account.

- Case Study 3: Seamless Check Payment Process for Veterans: Sarah, a military veteran, preferred check payments for her car insurance. USAA met her needs with competitive rates and a seamless check payment process.

In conclusion, these case studies illustrate how individuals like Emily, Michael, and Sarah found tailored solutions for their car insurance needs, all while utilizing their preferred payment method to manage their car insurance premiums. Enter your ZIP code now.

Frequently Asked Questions

What are the best car insurance companies that accept checks?

The best car insurance companies that accept checks are Liberty Mutual, State Farm, Progressive, and USAA.

Are there any car insurance companies that don’t accept checks?

It is unlikely that you will come across a car insurance company that doesn’t accept checks. Enter your ZIP code now to begin comparing.

Do insurance companies accept any type of check (electronic, paper, and cashier’s)?

Can I buy car insurance online with my checking account number?

Yes, many insurance providers allow you to sign up and make payments entirely online using your checking account number.

What car insurance companies accept checks for down payments?

Down payments can generally be made via checks (electronic, paper, or cashier’s) with any major car insurance company. Enter your ZIP code now to start.

Can insurance companies still look at my credit score if I pay using a check?

How does Progressive stand out among other insurers in terms of coverage options and affordability?

Progressive stands out for its diverse coverage options tailored to individual needs and its competitive rates, making it appealing for budget-conscious consumers.

What innovative features does Allstate offer to enhance the insurance experience for policyholders?

Allstate offers innovative features like Drivewise and QuickFoto Claim to improve the insurance experience, providing discounts for safe driving behavior and facilitating quick claims filing. Enter your ZIP code now to start.

What are some potential drawbacks reported by customers regarding Geico’s service and coverage options?

How does State Farm differentiate itself in the insurance market, particularly in terms of customer service and financial stability?

State Farm differentiates itself with its personalized customer service approach, dedicated agents, and strong financial stability, instilling confidence in policyholders regarding the reliability of their coverage.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.