Best Oregon Car Insurance (2025)

Oregon drivers must carry minimum liability car insurance in the amount of 25/50/25, which costs an average of $53/mo in Oregon. However, the best Oregon car insurance is a full coverage insurance policy, which provides better protection for vehicles and drivers and costs an average of $116/mo.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- All Oregon drivers must carry liability insurance in the amount of 25/50/25

- Minimum liability insurance in Oregon is the cheapest option, costing an average of $53 per month

- Full coverage car insurance in Oregon costs more, but provides the best protection for drivers

The best Oregon car insurance will be coverage that provides full protection at a reasonable price. While you are required to carry Oregon’s required minimum car insurance, most drivers opt to carry more than that. If you aren’t sure what coverage you should get, we go over everything you need to know about buying affordable Oregon car insurance coverage, from car insurance requirements to the best car insurance companies.

If you want to start shopping for cheap Oregon car insurance quotes today, use our free quote comparison tool to find the cheapest companies in your area.

Your one-stop online insurance guide. Get free quotes now! Secured with SHA-256 Encryption

Oregon Car Insurance Coverage and Rates

Maybe you’re an Oregonian or plan to visit in the nearby future. Either way, we’ve put together a special guide with things you should know about Oregon car insurance rates and coverage

Because let’s face it, researching this stuff on your own can be a pretty laborious, right?

That’s why we’ve created a guide that contains that information. We’re talking about everything you need to know.

Look no further for cheap car insurance rates and companies with the best ratings. We’ve also got you covered on the road with state laws, rules of the road, and data on weather and speeding conditions that could help you stay safe on your journey.

Now, let’s take a little drive through the state of Oregon.

Oregon Minimum Coverage

Oregon Driver and Motor Vehicle Services outlines the minimum requirements to be insured in the state. They are the following:

- $25,000 liability coverage for bodily injury or death of one person in an accident

- $50,000 liability coverage for total bodily injury or death liability in an accident

- $25,000 liability coverage for property damage per accident

- $15,000 in personal injury protection coverage (per person)

- Uninsured motorist coverage of $25,000 per person and $50,000 total per accident

Most states require that you have bodily injury liability for a person and persons, as well as property damage in the event that you get into an accident.

Oregon is unique. In fact, there are two additional forms of coverage needed to get you on the road–personal injury protection (PIP) and uninsured motorist (UM) coverage.

PIP usually pays for medical expenses and other out-of-pocket expenses after an accident for the policyholder and its occupants.

UM coverage protects the occupants of the vehicle in the event that the at-fault driver is uninsured–while this is pretty awesome, this coverage, unfortunately, does not apply to damage to the vehicle.

Not only is one required to have these specified types of insurance while driving, but they are also required to have proof that they are insured with these minimum requirements.

These are called forms of Financial Responsibility.

Let’s take a look.

Forms of Financial Responsibility

Forms of responsibility are state requirements that prove you are insured with the minimum coverage to protect a driver in the event that there is an accident.

Your insurance card validates your claim to be insured in the event of an accident. But what other forms are necessary?

According to Oregon’s Driver and Motor Vehicle Services Division through the Secretary of State they are the following:

- A current motor vehicle insurance card issued by the insurer either a paper card or electronically

- An unexpired motor vehicle liability insurance policy for the particular vehicle that meets the standards set forth in ORS 806.080;

- An unexpired motor vehicle liability insurance binder issued by the insurance carrier or agent for the particular vehicle that meets the standards set forth in ORS 806.080

- A letter signed by a representative from an insurance carrier or its authorized agent, on letterhead, that verifies current insurance coverage;

- A certificate of self-insurance issued by the Driver and Motor Vehicle Services Division of the Department of Transportation (DMV) under ORS 806.130 naming the owner of the particular vehicle

- A displayed Oregon dealer plate unless the vehicle dealer is exempt from the requirement to file a certificate of insurance under ORS 822.033

While the list may seem exhaustive, it is extremely important. Failure to provide the necessary documentation in Oregon for your car will result in your license being suspended.

And we don’t want that.

In fact, in Oregon, if you are caught without having proof of insurance, you may be required to file an SR-22–a future financial responsibility obligation required for proof that may make your rates higher and deem you an at-risk driver to future insurers.

But we’ll get into all that later.

For now, let’s take a look at the breakdown of how much families in Oregon pay for insurance compared to their income per capita.

Premiums as a Percentage of Income

An individual’s income per capita is the amount of money one has remaining to keep and save after taxes.

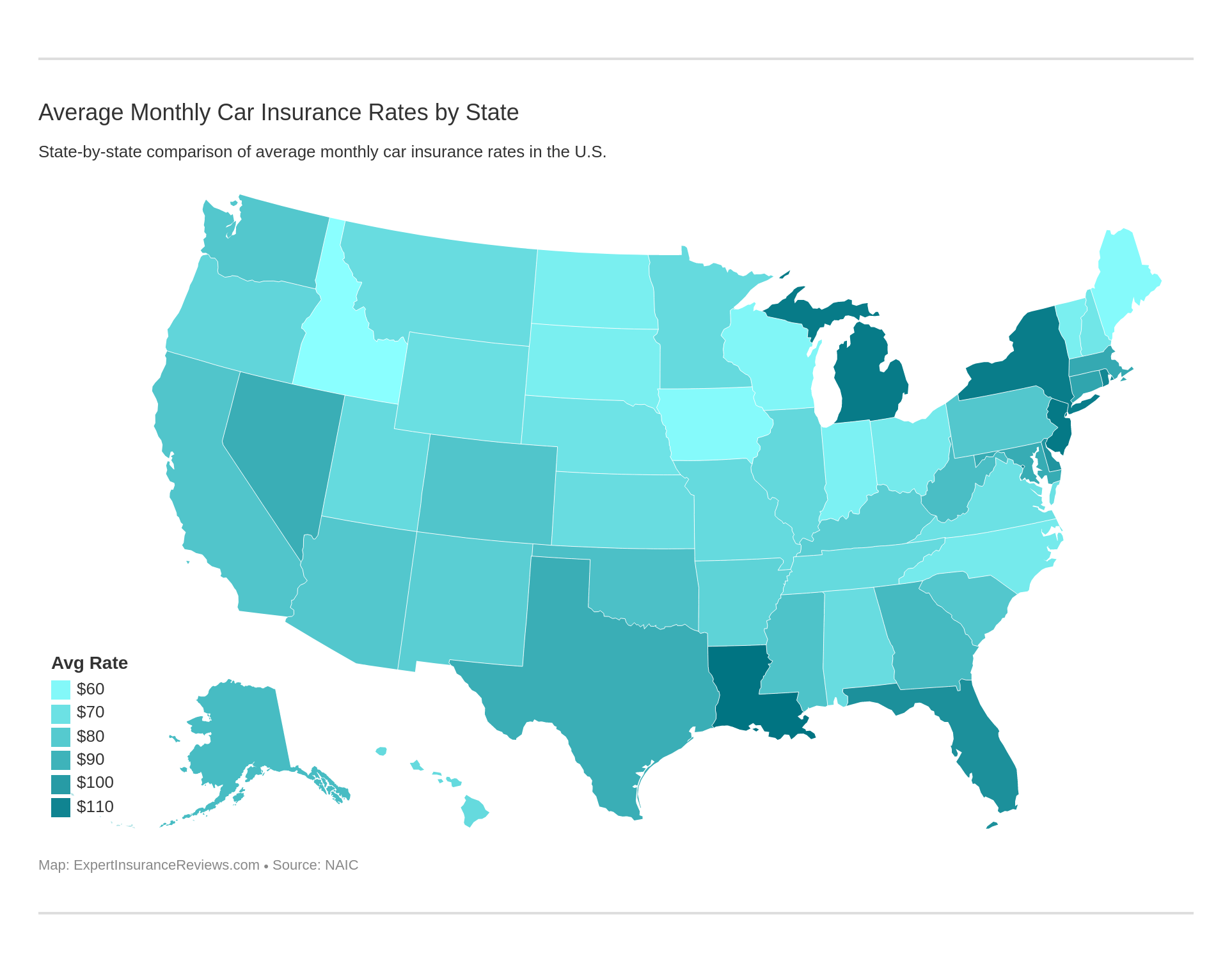

Since Oregonian drivers pay roughly $894.10 on average, that means that roughly 2.45 percent is spent on car insurance of their annual income.

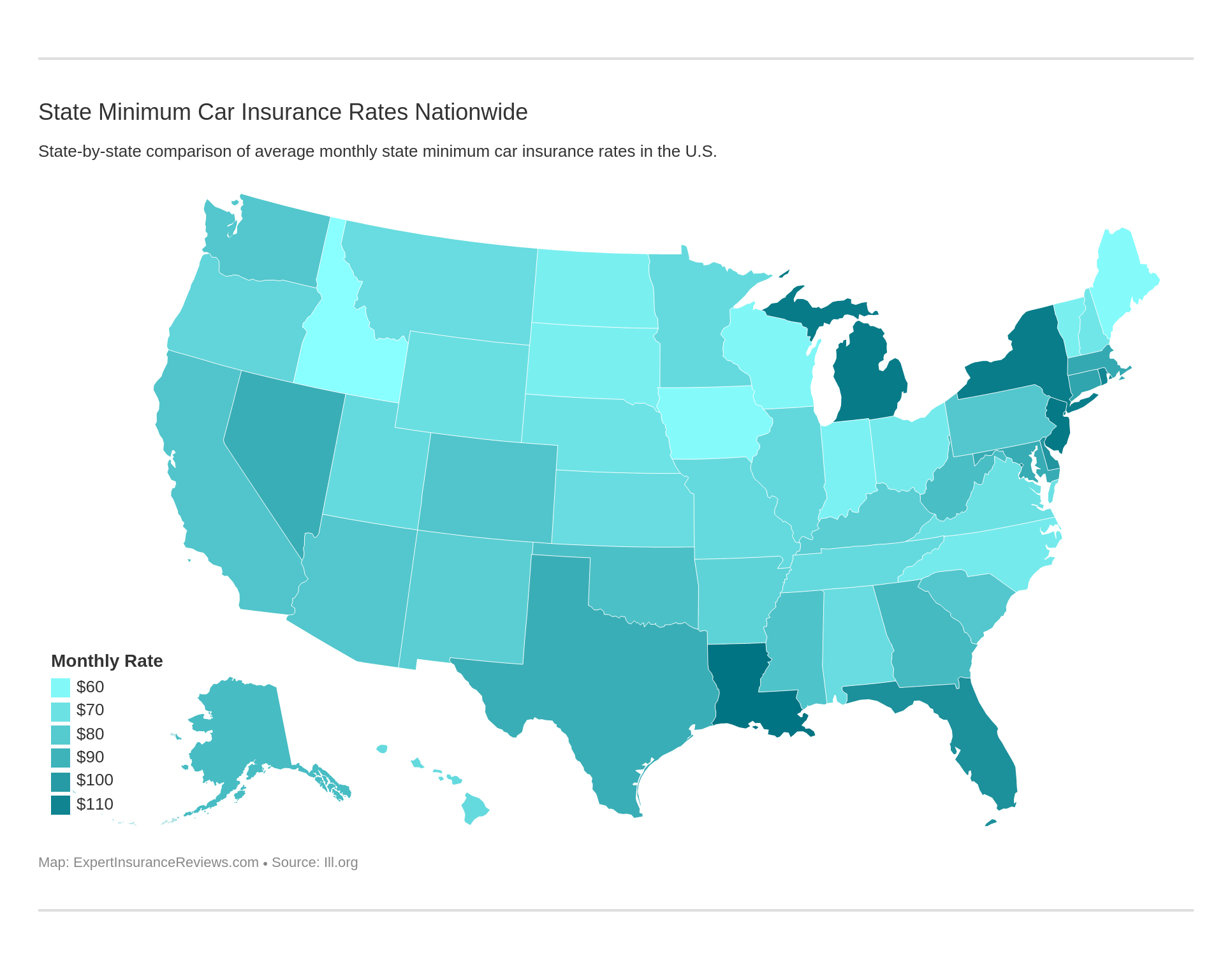

How is this fair with the rest of the nation? Oregon comes in a little over the halfway mark for the average premium per income. Paying less than Nevada it’s neighbor, who comes in the top ten most expensive, but not less than other neighboring states like Washington and Idaho.

Oregon has also sat above the national average for three consecutive years from 2012-2014, although it took a dip in percentage in 2013.

Something to keep in mind if you are living in the state.

Next, we’ll talk about the average rate for each type of coverage in the state of Oregon.

Average Monthly Car Insurance Rates in OR (Liability, Collision, Comprehensive)

Here’s a data table displaying how much, on average, Oregonians paid for their insurance coverage according to the National Association of Insurance Commissioners.

Oregon: Core Coverage

| Coverage Types | Annual Cost (2015) |

|---|---|

| Liability | $584.13 |

| Collison | $226.83 |

| Comprehensive | $93.87 |

| Combined | $904.83 |

According to the most recent auto insurance reporting, based on the state minimum, the U.S. average premium cost was $1,009 in 2015 — individuals in Oregon paid $905, $104 cheaper. While this 10 percent dip may seem like a victory, it’s neighbor Idaho paid $680 that same year, the cheapest out of all states, 33 percent below average.

So each state has its perks and downside when it comes to the amount they pay for insurance each year–something to also keep in mind.

With the data being several years old, you can expect some premiums to be on the rise and who knows, some states may have even lower minimums.

Hang on. We’re talking about additional liability next.

Additional Liability

Anything could happen.

In fact, accidents happen every day. While we talked about the minimum required coverage for the state of Oregon, there is also additional liability to ensure greater coverage in the event of an accident.

| COVERAGE TYPE | OREGON LOSS RATIO (2015) | NATIONAL AVERAGE LOSS RATIO |

|---|---|---|

| Uninsured/Underinsured Motorist | 76.53 | 75.14 |

Uninsured/Underinsured Motorist coverage is an additional type of insurance in Oregon that customers can use to bulk up their policy. It provides protection in the event that you’re in a collision with an at-fault driver who isn’t carrying liability insurance or whose limits are too low to cover damages or medical expenses.

And a loss ratio? A loss ratio shows how much a company spends on the types of claims to how much money they take in on premiums.

In the event, we have a loss ratio of 60, 60 percent, which indicates the company spent $60 on claims out of every $100 earned in premiums. So the closer the ratio is to 100, the more claims that are paid. That’s why a 60 – 70 loss ratio is considered to be in the safe zone.

Oregon’s loss ratio is only slightly above average and is considered in the safer range. Good to know when purchasing additional liability.

And with even greater reason. 12.7 percent of individuals in Oregon are uninsured drivers, making them 21st in that nation for uninsured motorists.

While this is not as serious as its neighbor California, which ranks 12th in the nation for uninsured drivers, it is always on the safer side to ensure greater coverage in the event you do get in an accident with someone who is uninsured.

Often, drivers filing a claim are surprised to find that their full coverage does not include emergency roadside service or rental reimbursement.

Going beyond the minimum coverage and getting additional liability is great–just make sure you read your policy to ensure the maximum amount of protection possible.

That’s why you’ll want to read the next section. We’ll be talking about additional add-ons and informing you about coverage that most don’t know exist outside of the standard policy.

Add-ons, Endorsements, and Riders

So far, we’ve covered the minimum required insurance standard for Oregon as well as a few add-ons like uninsured/underinsured motorist coverage.

We wanted to provide you with a few more types of insurance to keep you informed while making the best decision for you or your family.

That being said, here are some other types of insurance that you might find helpful.

Go ahead, see what appeals to you:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance (check for state-specific laws)

Now that you may have familiarized yourself with different types of coverage one could add to their standard policy, we’ll be seeing how gender, age, and marital status can affect your car insurance rates.

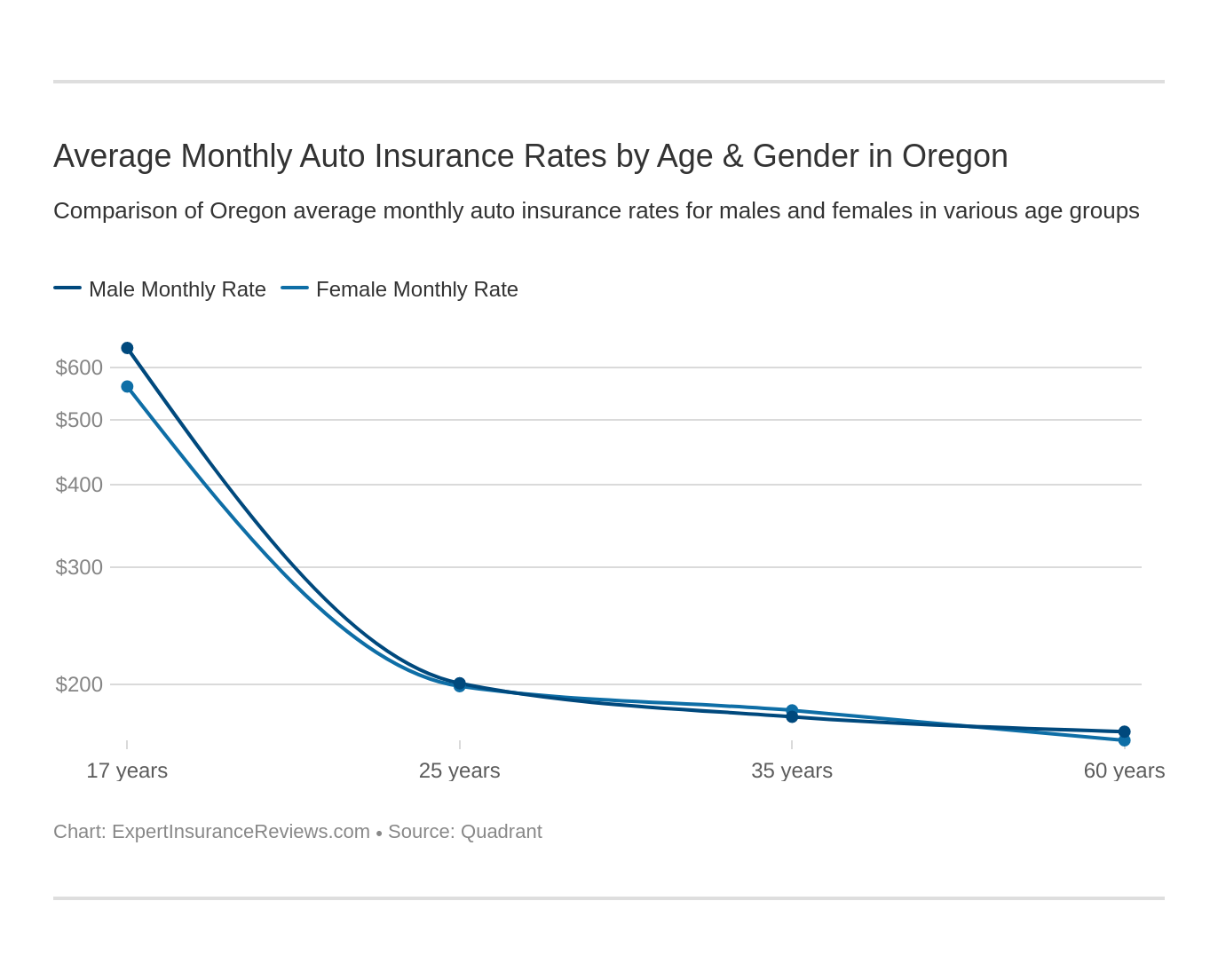

Average Car Insurance Rates by Age & Gender in OR

Yes, one’s rate can be influenced based on your gender, age, and marital status.

It’s true.

Simply look at the chart below to see how rates are affected by one’s circumstance.

Oregon Male & Female Rates

| Insurance Company | Age 17 Female Annual Rates | Age 17 Male Annual Rates | Age 25 Female Annual Rates | Age 25 Male Annual Rates | Age 35 Female Annual Rates | Age 35 Male Annual Rates | Age 60 Female Annual Rates | Age 60 Male Annual Rates |

|---|---|---|---|---|---|---|---|---|

| $9,332.73 | $10,401.52 | $3,262.94 | $3,277.55 | $3,116.60 | $2,896.79 | $2,841.32 | $2,868.61 | |

| $5,697.93 | $8,930.71 | $2,304.32 | $2,413.79 | $2,304.32 | $2,304.32 | $2,054.19 | $2,054.19 | |

| $8,559.72 | $8,752.78 | $2,317.92 | $2,376.37 | $2,069.68 | $2,024.02 | $1,829.43 | $1,945.91 | |

| $6,189.22 | $5,642.07 | $2,548.10 | $2,200.85 | $2,392.62 | $2,311.56 | $2,226.68 | $2,240.44 | |

| $8,850.63 | $9,545.05 | $2,670.62 | $2,692.84 | $2,776.95 | $2,928.21 | $2,411.66 | $2,679.41 | |

| NICOA | $5,087.37 | $6,359.30 | $2,592.14 | $2,729.36 | $2,222.89 | $2,212.78 | $1,980.76 | $2,071.14 |

| $8,277.50 | $9,124.21 | $2,301.66 | $2,177.58 | $1,926.67 | $1,745.84 | $1,672.83 | $1,722.85 | |

| $5,136.09 | $6,447.93 | $1,836.59 | $2,105.82 | $1,618.73 | $1,618.73 | $1,481.05 | $1,481.05 | |

| Standard | $5,296.68 | $6,424.93 | $1,969.94 | $2,002.27 | $1,887.50 | $1,902.25 | $1,699.83 | $1,768.58 |

| $4,886.29 | $5,247.50 | $2,068.24 | $2,149.86 | $1,608.07 | $1,560.55 | $1,590.69 | $1,535.96 |

American, for instance, charges $3,000+ more if you’re a male rather than female.

Rates are also much higher if you are younger–as those individuals have less experience on the road. Progressive and Farmers charge over $8000 if you are 17 years old, but drops that price to $2000s+ when individuals turn 25.

It is also interesting to note that companies like Farmers drop their rates a tad for married couples when they become elderly, as they have more experience behind the wheel most likely.

Next, we’ll show you cheaper rates by ZIP codes, as where you live can also affect your rate.

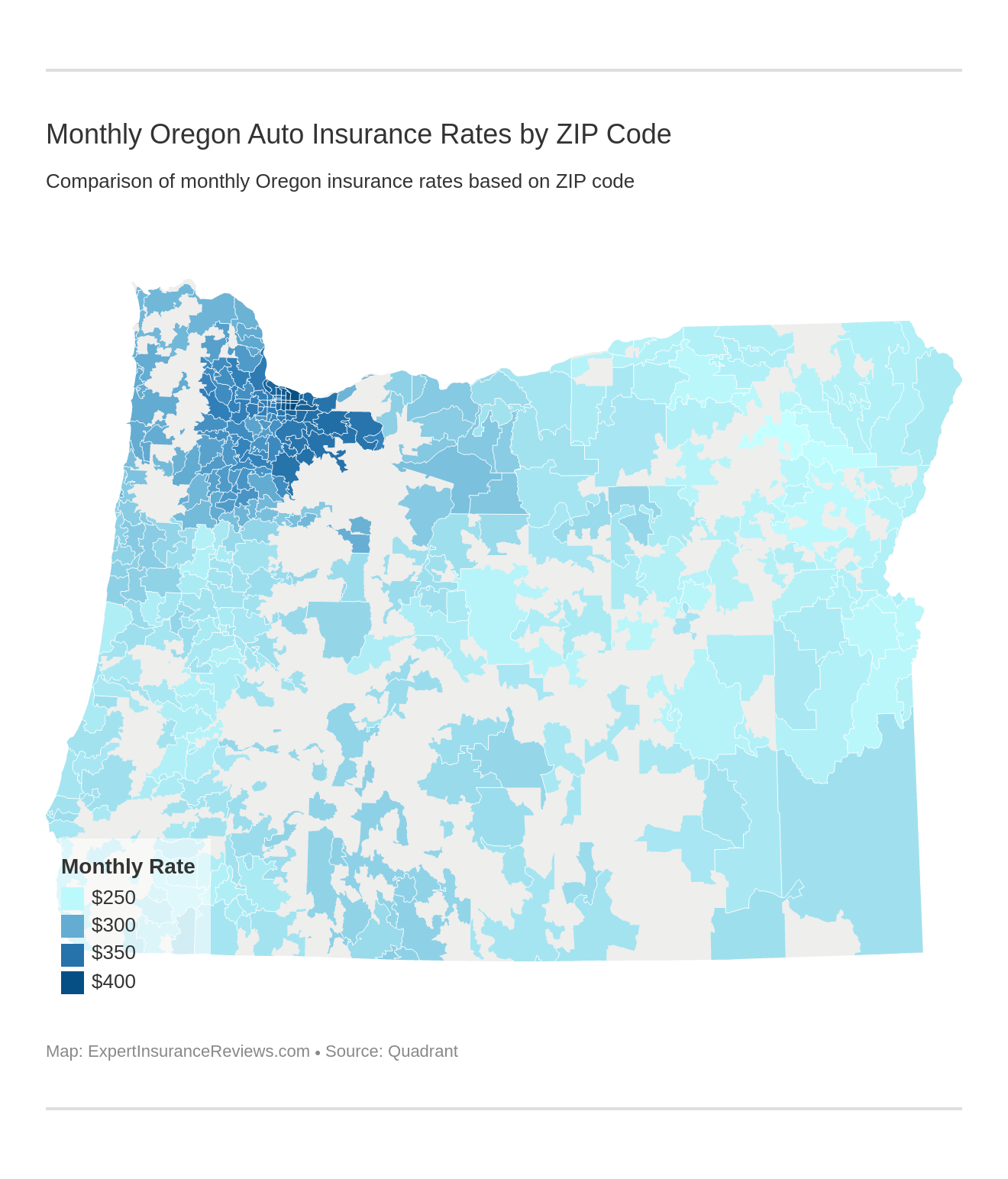

Cheapest Rates by ZIP Code

Some companies charge more, or less, depending on where you live in the state of Oregon.

Feel free to type in your ZIP code to check your rates.

| Zipcode | Average Annual Rates | Allstate | American | Farmers | GEICO | Safeco | NICOA | Progressive | State Farm | Standard | USAA |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 97236 | $4,908.54 | $5,782.60 | $5,326.48 | $5,376.51 | $4,370.90 | $5,661.06 | $5,036.22 | $5,486.64 | $4,528.37 | $4,519.76 | $2,996.88 |

| 97233 | $4,879.89 | $5,474.80 | $5,326.48 | $5,251.69 | $4,394.08 | $5,703.38 | $5,105.65 | $5,210.57 | $4,494.55 | $4,474.48 | $3,363.24 |

| 97266 | $4,879.16 | $5,465.51 | $5,318.32 | $5,345.08 | $4,394.08 | $5,712.95 | $5,251.94 | $5,257.92 | $4,539.23 | $4,418.67 | $3,087.87 |

| 97230 | $4,798.10 | $5,857.67 | $5,326.48 | $5,339.08 | $4,268.95 | $5,741.60 | $4,624.56 | $5,229.07 | $4,023.41 | $4,295.28 | $3,274.95 |

| 97216 | $4,786.62 | $5,707.26 | $5,318.32 | $5,361.05 | $4,222.74 | $5,710.85 | $5,075.73 | $5,038.92 | $4,301.85 | $4,100.87 | $3,028.60 |

| 97220 | $4,750.30 | $5,578.29 | $5,326.48 | $5,361.05 | $4,344.61 | $5,698.92 | $5,075.73 | $4,960.71 | $4,096.71 | $4,031.94 | $3,028.60 |

| 97218 | $4,666.61 | $5,626.35 | $5,318.32 | $4,943.01 | $3,826.42 | $5,754.02 | $5,075.73 | $4,899.96 | $3,962.87 | $3,969.86 | $3,289.55 |

| 97206 | $4,660.64 | $5,669.04 | $4,716.52 | $5,463.28 | $3,832.06 | $5,773.06 | $4,773.67 | $5,039.10 | $4,065.50 | $4,057.18 | $3,216.99 |

| 97211 | $4,562.34 | $5,851.02 | $4,873.36 | $5,067.82 | $3,767.19 | $5,742.16 | $4,685.27 | $4,579.23 | $4,043.05 | $3,980.46 | $3,033.79 |

| 97215 | $4,538.22 | $5,841.08 | $4,528.47 | $5,479.25 | $4,124.43 | $5,752.02 | $4,751.85 | $4,284.34 | $3,765.55 | $3,806.06 | $3,049.18 |

| 97030 | $4,530.67 | $5,865.83 | $4,433.42 | $5,220.35 | $4,083.54 | $5,505.50 | $4,390.77 | $4,852.73 | $3,821.03 | $3,979.24 | $3,154.31 |

| 97080 | $4,516.29 | $5,782.60 | $4,433.42 | $5,128.79 | $3,944.10 | $5,483.47 | $4,856.69 | $4,661.68 | $3,951.01 | $3,958.63 | $2,962.46 |

| 97213 | $4,466.19 | $5,851.02 | $4,528.47 | $5,067.82 | $3,725.49 | $5,658.97 | $4,751.85 | $4,434.05 | $3,758.25 | $3,836.80 | $3,049.18 |

| 97203 | $4,447.21 | $5,800.34 | $4,873.36 | $5,067.82 | $3,725.49 | $5,316.10 | $4,302.97 | $4,505.69 | $4,142.73 | $3,731.64 | $3,005.93 |

| 97024 | $4,436.31 | $5,857.67 | $4,499.65 | $5,099.18 | $4,059.96 | $5,522.75 | $4,131.60 | $4,376.09 | $3,782.98 | $3,878.87 | $3,154.31 |

| 97086 | $4,429.53 | $5,503.60 | $4,453.15 | $5,031.01 | $3,771.34 | $5,703.12 | $4,283.99 | $4,948.33 | $3,712.10 | $3,891.82 | $2,996.88 |

| 97217 | $4,413.23 | $5,800.34 | $4,873.36 | $5,010.00 | $3,450.53 | $5,181.26 | $4,685.27 | $4,265.45 | $4,032.26 | $3,727.52 | $3,106.33 |

| 97212 | $4,371.73 | $5,851.02 | $4,334.82 | $5,067.82 | $3,765.67 | $5,703.36 | $4,130.58 | $4,163.64 | $3,814.72 | $3,839.02 | $3,046.69 |

| 97202 | $4,353.56 | $5,841.08 | $4,334.82 | $5,463.28 | $3,734.01 | $5,321.89 | $3,957.29 | $4,273.22 | $3,797.42 | $3,789.98 | $3,022.62 |

| 97060 | $4,342.93 | $5,814.37 | $4,433.42 | $4,925.94 | $3,874.31 | $5,413.34 | $4,131.60 | $4,313.67 | $3,642.90 | $3,838.81 | $3,040.93 |

| 97227 | $4,322.28 | $5,851.02 | $4,528.47 | $4,840.09 | $3,430.64 | $5,496.16 | $4,130.58 | $4,192.50 | $4,073.04 | $3,707.51 | $2,972.83 |

| 97089 | $4,310.96 | $5,503.60 | $4,499.65 | $5,017.98 | $3,595.29 | $4,854.52 | $4,283.99 | $4,641.73 | $3,860.66 | $3,889.68 | $2,962.46 |

| 97010 | $4,298.84 | $5,865.83 | $4,042.92 | $4,977.25 | $4,122.23 | $5,248.54 | $3,782.67 | $4,102.43 | $3,312.38 | $4,673.28 | $2,860.84 |

| 97055 | $4,281.70 | $5,865.83 | $4,038.16 | $4,842.10 | $4,281.59 | $5,008.93 | $3,782.67 | $4,590.12 | $3,537.30 | $3,844.61 | $3,025.65 |

| 97009 | $4,251.54 | $5,548.53 | $4,499.65 | $5,033.00 | $3,949.29 | $4,868.47 | $4,080.08 | $4,413.35 | $3,369.54 | $3,892.60 | $2,860.84 |

| 97017 | $4,233.81 | $5,647.51 | $4,320.49 | $4,942.03 | $4,266.35 | $4,710.89 | $3,855.97 | $4,628.10 | $3,522.84 | $3,485.31 | $2,958.61 |

| 97214 | $4,224.43 | $5,841.08 | $4,334.82 | $5,013.26 | $3,485.13 | $5,399.11 | $3,983.31 | $3,993.18 | $3,631.52 | $3,553.31 | $3,009.57 |

| 97015 | $4,220.48 | $5,270.25 | $4,453.15 | $5,164.30 | $3,617.63 | $4,936.77 | $4,283.99 | $4,216.98 | $3,582.78 | $3,716.48 | $2,962.46 |

| 97204 | $4,215.32 | $5,800.34 | $4,528.47 | $5,067.48 | $3,755.81 | $5,247.96 | $4,130.58 | $3,957.64 | $3,591.13 | $3,404.92 | $2,668.88 |

| 97022 | $4,214.68 | $5,358.66 | $4,065.17 | $5,115.68 | $4,164.40 | $5,207.17 | $3,782.67 | $4,255.28 | $3,547.67 | $3,805.14 | $2,844.93 |

| 97232 | $4,210.99 | $5,851.02 | $4,334.82 | $4,885.20 | $3,635.41 | $5,176.48 | $3,983.31 | $4,058.16 | $3,656.75 | $3,668.15 | $2,860.65 |

| 97023 | $4,200.61 | $5,673.25 | $4,038.16 | $4,920.48 | $4,109.05 | $5,173.44 | $3,782.67 | $4,237.32 | $3,570.65 | $3,640.25 | $2,860.84 |

| 97067 | $4,186.59 | $5,865.83 | $3,768.22 | $4,990.88 | $4,308.54 | $4,938.51 | $3,855.97 | $4,376.13 | $3,155.29 | $3,745.66 | $2,860.84 |

| 97011 | $4,182.88 | $5,865.83 | $4,038.16 | $4,838.29 | $4,178.15 | $4,752.53 | $3,855.97 | $4,365.48 | $3,312.38 | $3,761.21 | $2,860.84 |

| 97078 | $4,179.70 | $5,248.56 | $4,148.04 | $4,702.32 | $3,758.52 | $5,074.55 | $3,874.44 | $4,304.32 | $3,312.38 | $4,673.28 | $2,700.61 |

| 97222 | $4,174.20 | $5,137.74 | $4,277.56 | $5,177.68 | $3,822.03 | $4,925.81 | $3,873.02 | $4,227.45 | $3,895.88 | $3,490.77 | $2,914.03 |

| 97209 | $4,174.18 | $5,821.18 | $4,334.82 | $5,074.71 | $3,447.78 | $5,283.70 | $4,130.58 | $3,981.61 | $3,531.17 | $3,390.94 | $2,745.34 |

| 97019 | $4,173.94 | $5,440.20 | $4,042.92 | $4,888.82 | $4,122.23 | $5,237.54 | $3,782.67 | $4,411.20 | $3,319.12 | $3,633.90 | $2,860.84 |

| 97038 | $4,171.20 | $5,410.11 | $4,320.49 | $4,926.99 | $4,135.98 | $4,807.62 | $3,855.97 | $4,286.12 | $3,557.37 | $3,452.72 | $2,958.61 |

| 97049 | $4,162.53 | $5,865.83 | $3,768.22 | $4,920.48 | $4,178.15 | $4,825.83 | $3,855.97 | $4,516.52 | $3,126.15 | $3,707.36 | $2,860.84 |

| 97004 | $4,160.37 | $5,615.43 | $4,065.17 | $5,029.45 | $4,216.23 | $4,980.73 | $3,782.67 | $4,306.48 | $3,318.55 | $3,444.12 | $2,844.93 |

| 97042 | $4,149.58 | $5,725.75 | $4,065.17 | $5,080.44 | $4,085.85 | $4,709.78 | $3,782.67 | $4,236.29 | $3,514.76 | $3,336.50 | $2,958.61 |

| 97258 | $4,126.60 | $5,821.18 | $4,044.80 | $4,894.24 | $3,755.81 | $5,170.99 | $3,659.76 | $4,279.72 | $3,312.38 | $3,528.16 | $2,798.95 |

| 97221 | $4,110.62 | $5,682.63 | $4,044.80 | $4,824.45 | $3,391.76 | $5,125.95 | $3,986.01 | $4,082.44 | $3,645.18 | $3,451.40 | $2,871.54 |

| 97239 | $4,105.91 | $5,821.18 | $4,044.80 | $5,067.48 | $3,527.45 | $4,916.79 | $3,763.65 | $4,124.69 | $3,432.63 | $3,561.50 | $2,798.95 |

| 97205 | $4,095.58 | $5,800.34 | $4,334.82 | $5,002.15 | $3,587.62 | $4,929.07 | $3,659.76 | $4,047.33 | $3,418.14 | $3,507.67 | $2,668.88 |

| 97045 | $4,078.83 | $5,548.53 | $4,065.17 | $4,878.97 | $3,563.65 | $4,792.18 | $3,876.08 | $4,333.62 | $3,485.43 | $3,399.72 | $2,844.93 |

| 97210 | $4,073.20 | $5,847.34 | $4,044.80 | $5,067.48 | $3,344.82 | $5,300.40 | $3,659.76 | $4,120.51 | $3,169.37 | $3,432.20 | $2,745.34 |

| 97036 | $4,059.09 | $5,503.60 | $3,935.03 | $4,797.85 | $3,609.30 | $4,823.25 | $3,477.16 | $3,729.98 | $3,312.38 | $4,673.28 | $2,729.08 |

| 97267 | $4,058.14 | $5,137.74 | $4,453.15 | $5,088.29 | $3,609.30 | $4,797.23 | $3,873.02 | $3,873.69 | $3,381.23 | $3,328.53 | $3,039.25 |

| 97201 | $4,052.09 | $5,682.63 | $4,044.80 | $4,949.87 | $3,371.95 | $5,170.99 | $3,659.76 | $3,993.66 | $3,295.64 | $3,533.48 | $2,818.14 |

| 97231 | $4,049.19 | $5,343.21 | $4,044.80 | $4,855.58 | $3,649.22 | $4,771.07 | $3,807.98 | $4,186.51 | $3,712.58 | $3,321.46 | $2,799.54 |

| 97005 | $4,046.83 | $5,456.89 | $4,065.17 | $4,597.68 | $3,758.52 | $5,027.12 | $3,717.83 | $4,148.11 | $3,480.07 | $3,458.95 | $2,757.98 |

| 97008 | $4,041.00 | $5,351.12 | $4,148.04 | $4,626.38 | $3,587.75 | $5,240.91 | $3,717.83 | $4,102.10 | $3,447.09 | $3,370.46 | $2,818.31 |

| 97007 | $4,028.66 | $5,231.84 | $4,148.04 | $4,442.88 | $3,728.19 | $4,963.09 | $3,874.44 | $4,175.98 | $3,451.69 | $3,451.11 | $2,819.30 |

| 97225 | $4,023.26 | $5,603.04 | $4,158.59 | $4,672.49 | $3,323.47 | $5,091.58 | $3,725.10 | $3,925.20 | $3,444.15 | $3,417.43 | $2,871.54 |

| 97027 | $4,014.25 | $5,137.74 | $4,453.15 | $4,775.56 | $3,563.65 | $4,813.85 | $3,460.63 | $3,937.45 | $3,599.04 | $3,362.22 | $3,039.25 |

| 97219 | $3,999.01 | $5,458.21 | $4,044.80 | $4,872.49 | $3,417.44 | $4,670.42 | $3,696.71 | $4,076.03 | $3,609.00 | $3,346.11 | $2,798.95 |

| 97119 | $3,982.34 | $5,667.18 | $4,320.49 | $4,373.16 | $3,767.64 | $4,457.48 | $3,630.20 | $4,156.64 | $3,400.93 | $3,306.00 | $2,743.69 |

| 97123 | $3,979.32 | $5,497.47 | $4,158.59 | $4,405.74 | $3,530.91 | $4,779.60 | $3,750.71 | $4,105.79 | $3,381.18 | $3,380.26 | $2,802.93 |

| 97223 | $3,976.16 | $5,380.44 | $4,148.04 | $4,805.67 | $3,369.87 | $4,777.88 | $3,545.06 | $4,227.14 | $3,356.87 | $3,326.51 | $2,824.12 |

| 97229 | $3,971.40 | $5,030.37 | $4,065.17 | $4,575.71 | $3,327.80 | $4,974.32 | $4,037.26 | $4,198.46 | $3,438.86 | $3,285.09 | $2,780.93 |

| 97133 | $3,970.33 | $5,324.27 | $4,158.59 | $4,515.56 | $3,746.91 | $4,893.81 | $3,477.15 | $4,023.25 | $3,430.13 | $3,334.13 | $2,799.54 |

| 97113 | $3,953.95 | $5,354.77 | $4,058.46 | $4,477.63 | $3,667.31 | $4,798.33 | $3,630.20 | $4,047.58 | $3,478.00 | $3,283.56 | $2,743.69 |

| 97006 | $3,950.08 | $5,231.84 | $4,148.04 | $4,682.49 | $3,452.80 | $4,657.25 | $3,777.43 | $3,925.13 | $3,516.36 | $3,373.16 | $2,736.29 |

| 97071 | $3,948.02 | $5,147.46 | $4,320.49 | $4,581.62 | $3,517.23 | $4,703.20 | $3,855.97 | $4,083.73 | $3,345.72 | $3,178.04 | $2,746.74 |

| 97028 | $3,933.31 | $4,937.35 | $3,768.22 | $4,401.74 | $4,178.15 | $4,599.12 | $3,855.97 | $3,857.28 | $3,312.38 | $3,562.05 | $2,860.84 |

| 97137 | $3,929.26 | $5,324.24 | $4,042.92 | $4,486.68 | $3,588.24 | $4,786.90 | $3,583.80 | $4,127.54 | $3,343.76 | $3,261.77 | $2,746.74 |

| 97034 | $3,924.13 | $5,499.00 | $3,935.03 | $4,601.86 | $3,521.49 | $4,823.25 | $3,477.16 | $4,015.72 | $3,352.81 | $3,273.04 | $2,741.95 |

| 97373 | $3,922.67 | $5,119.70 | $4,042.92 | $4,340.35 | $3,509.64 | $4,638.26 | $3,144.93 | $3,961.72 | $3,049.14 | $4,673.28 | $2,746.74 |

| 97117 | $3,915.47 | $6,052.93 | $4,042.92 | $4,188.83 | $3,326.97 | $4,739.16 | $3,630.20 | $4,134.11 | $3,090.38 | $3,315.28 | $2,633.91 |

| 97013 | $3,880.58 | $5,301.79 | $4,038.16 | $4,517.20 | $3,432.30 | $4,612.89 | $3,533.07 | $4,237.13 | $3,145.60 | $3,252.78 | $2,734.84 |

| 97003 | $3,876.56 | $5,301.79 | $4,148.04 | $4,835.62 | $3,209.83 | $4,475.83 | $3,777.43 | $3,829.28 | $3,312.38 | $3,199.89 | $2,675.53 |

| 97144 | $3,870.06 | $5,237.62 | $3,768.22 | $4,134.92 | $3,713.29 | $4,781.74 | $3,630.20 | $4,138.00 | $3,312.38 | $3,184.68 | $2,799.54 |

| 97125 | $3,859.88 | $5,237.62 | $3,768.22 | $4,346.51 | $3,309.60 | $5,075.40 | $3,477.15 | $4,021.08 | $3,312.38 | $3,251.30 | $2,799.54 |

| 97115 | $3,859.82 | $5,324.24 | $3,770.38 | $4,398.09 | $3,352.71 | $5,031.61 | $3,583.80 | $3,944.44 | $3,195.33 | $3,280.03 | $2,717.61 |

| 97132 | $3,855.03 | $5,459.91 | $3,770.38 | $4,296.99 | $3,224.30 | $4,977.67 | $3,597.68 | $3,870.83 | $3,249.18 | $3,275.08 | $2,828.28 |

| 97032 | $3,855.01 | $5,147.46 | $4,042.92 | $4,607.87 | $3,477.25 | $4,555.04 | $3,621.17 | $4,012.57 | $3,185.89 | $3,165.14 | $2,734.84 |

| 97026 | $3,850.18 | $5,256.21 | $4,042.92 | $4,429.70 | $3,443.95 | $4,713.00 | $3,621.17 | $3,975.59 | $3,174.64 | $3,097.87 | $2,746.74 |

| 97116 | $3,848.75 | $5,237.62 | $4,042.92 | $4,338.64 | $3,471.40 | $4,646.96 | $3,630.20 | $4,012.55 | $3,122.95 | $3,240.53 | $2,743.69 |

| 97035 | $3,847.27 | $5,236.21 | $3,935.03 | $4,436.89 | $3,471.92 | $4,693.29 | $3,477.16 | $4,068.91 | $3,345.82 | $3,078.39 | $2,729.08 |

| 97109 | $3,847.23 | $5,588.40 | $3,768.22 | $4,245.57 | $3,257.68 | $4,705.14 | $3,477.15 | $4,008.62 | $3,312.38 | $3,309.64 | $2,799.54 |

| 97375 | $3,846.72 | $5,403.31 | $4,042.92 | $4,299.68 | $3,975.48 | $4,704.39 | $3,144.93 | $4,055.05 | $2,857.18 | $3,180.34 | $2,803.92 |

| 97301 | $3,844.72 | $4,960.42 | $3,967.10 | $4,317.00 | $3,304.71 | $4,708.06 | $3,815.88 | $4,060.46 | $3,404.61 | $3,099.96 | $2,809.04 |

| 97106 | $3,842.81 | $5,237.62 | $3,768.22 | $4,338.64 | $3,257.68 | $5,086.31 | $3,477.15 | $4,035.75 | $3,170.25 | $3,256.94 | $2,799.54 |

| 97020 | $3,839.34 | $5,119.70 | $4,038.16 | $4,711.94 | $3,523.44 | $4,499.43 | $3,583.80 | $3,912.74 | $3,049.14 | $3,201.60 | $2,753.43 |

| 97127 | $3,831.65 | $5,305.21 | $3,770.38 | $4,577.85 | $3,446.82 | $5,008.63 | $3,583.80 | $3,633.60 | $3,086.56 | $3,186.00 | $2,717.61 |

| 97124 | $3,824.80 | $5,240.89 | $4,158.59 | $4,315.99 | $3,155.82 | $4,651.36 | $3,520.04 | $3,791.78 | $3,422.68 | $3,285.00 | $2,705.83 |

| 97111 | $3,823.00 | $5,324.24 | $3,770.38 | $4,339.18 | $3,824.99 | $4,558.45 | $3,583.80 | $3,949.01 | $2,976.34 | $3,186.04 | $2,717.61 |

| 97068 | $3,821.38 | $5,606.13 | $3,935.03 | $4,333.97 | $3,370.59 | $4,451.79 | $3,491.99 | $3,847.06 | $3,324.61 | $3,229.63 | $2,623.02 |

| 97148 | $3,821.29 | $5,152.93 | $3,872.81 | $4,339.18 | $3,631.74 | $4,746.90 | $3,583.80 | $3,951.55 | $3,035.27 | $3,181.14 | $2,717.61 |

| 97002 | $3,797.78 | $5,301.79 | $4,038.16 | $4,471.25 | $3,209.83 | $4,475.83 | $3,583.80 | $4,012.28 | $2,950.18 | $3,199.89 | $2,734.84 |

| 97305 | $3,796.73 | $5,141.55 | $3,967.10 | $4,207.11 | $3,295.98 | $4,838.96 | $3,592.09 | $3,855.21 | $3,135.07 | $3,125.20 | $2,809.04 |

| 97362 | $3,792.61 | $5,328.61 | $4,042.92 | $4,179.37 | $3,509.64 | $4,649.83 | $3,144.93 | $3,961.72 | $3,098.37 | $3,263.98 | $2,746.74 |

| 97317 | $3,789.68 | $5,119.70 | $3,701.05 | $4,066.31 | $3,731.31 | $4,723.94 | $3,592.09 | $3,962.71 | $3,051.54 | $3,139.10 | $2,809.04 |

| 97224 | $3,788.16 | $5,248.56 | $3,731.75 | $4,525.94 | $3,337.29 | $4,511.36 | $3,545.06 | $3,784.78 | $3,155.52 | $3,312.26 | $2,729.08 |

| 97302 | $3,760.15 | $5,373.16 | $3,920.28 | $4,211.55 | $3,154.35 | $4,822.68 | $3,437.63 | $3,860.51 | $3,045.85 | $3,078.20 | $2,697.32 |

| 97062 | $3,756.23 | $5,322.89 | $3,731.75 | $4,272.13 | $3,237.80 | $4,559.59 | $3,382.24 | $3,824.32 | $3,358.44 | $3,172.49 | $2,700.61 |

| 97114 | $3,752.55 | $5,324.24 | $3,770.38 | $4,402.90 | $3,583.85 | $4,454.81 | $3,583.80 | $3,468.88 | $3,082.66 | $3,136.39 | $2,717.61 |

| 97304 | $3,745.33 | $5,212.50 | $3,770.38 | $4,135.76 | $3,335.99 | $4,947.40 | $3,349.67 | $3,749.41 | $3,112.74 | $3,117.27 | $2,722.23 |

| 97056 | $3,743.89 | $5,394.62 | $3,830.54 | $4,084.88 | $3,089.15 | $5,052.79 | $3,477.15 | $3,980.18 | $2,898.77 | $2,962.60 | $2,668.23 |

| 97303 | $3,733.30 | $5,089.26 | $3,920.28 | $4,276.93 | $3,239.55 | $4,699.44 | $3,349.67 | $3,706.98 | $3,128.67 | $3,113.21 | $2,809.04 |

| 97101 | $3,733.08 | $5,305.21 | $3,770.38 | $4,579.95 | $3,412.93 | $4,442.80 | $3,583.80 | $3,569.81 | $2,941.19 | $3,044.92 | $2,679.86 |

| 97306 | $3,727.43 | $5,539.82 | $3,701.05 | $4,186.28 | $3,070.08 | $4,788.69 | $3,437.63 | $3,714.55 | $3,048.15 | $3,065.80 | $2,722.23 |

| 97070 | $3,724.35 | $5,199.08 | $3,731.75 | $4,384.40 | $3,298.50 | $4,347.50 | $3,535.07 | $3,702.55 | $3,129.69 | $3,180.16 | $2,734.84 |

| 97384 | $3,723.32 | $5,119.70 | $3,768.22 | $3,933.83 | $3,253.59 | $3,944.15 | $3,144.93 | $3,542.39 | $3,049.14 | $4,673.28 | $2,803.92 |

| 97064 | $3,699.94 | $5,394.62 | $3,852.69 | $3,656.00 | $3,404.55 | $4,667.44 | $3,477.15 | $4,078.01 | $2,820.90 | $2,942.77 | $2,705.22 |

| 97371 | $3,692.71 | $4,918.57 | $3,770.38 | $3,909.92 | $3,231.16 | $5,067.08 | $3,390.68 | $3,708.45 | $3,049.14 | $3,022.32 | $2,859.43 |

| 97057 | $3,684.94 | $5,923.89 | $3,243.47 | $3,762.05 | $2,982.56 | $4,484.28 | $3,037.43 | $3,812.67 | $2,530.21 | $4,673.28 | $2,399.56 |

| 97128 | $3,682.35 | $5,068.06 | $3,770.38 | $4,245.18 | $3,483.27 | $4,372.96 | $3,402.80 | $3,820.82 | $2,922.75 | $3,057.39 | $2,679.86 |

| 97018 | $3,682.31 | $5,394.62 | $3,731.75 | $4,254.46 | $3,195.55 | $4,891.59 | $3,477.15 | $3,546.48 | $2,703.92 | $2,872.65 | $2,754.97 |

| 97140 | $3,668.90 | $4,597.22 | $3,731.75 | $4,296.99 | $3,347.47 | $4,482.39 | $3,351.06 | $3,705.55 | $3,137.71 | $3,285.47 | $2,753.43 |

| 97053 | $3,650.38 | $5,394.62 | $3,731.75 | $4,135.41 | $3,105.92 | $4,730.83 | $3,477.15 | $3,531.50 | $2,826.18 | $2,902.21 | $2,668.23 |

| 97134 | $3,636.73 | $5,313.22 | $3,830.67 | $3,958.90 | $3,375.70 | $4,472.17 | $3,036.00 | $4,157.90 | $2,703.92 | $2,989.57 | $2,529.24 |

| 97051 | $3,631.11 | $4,949.96 | $3,731.75 | $4,300.24 | $3,195.55 | $4,738.55 | $3,477.15 | $3,624.27 | $2,805.52 | $2,819.86 | $2,668.23 |

| 97122 | $3,627.58 | $5,200.36 | $3,598.25 | $3,865.75 | $3,755.78 | $4,604.03 | $3,113.74 | $4,177.52 | $2,703.92 | $2,727.18 | $2,529.24 |

| 97118 | $3,626.83 | $5,313.22 | $3,852.69 | $3,651.93 | $3,375.70 | $4,442.88 | $3,036.00 | $4,201.90 | $2,885.14 | $2,972.19 | $2,536.65 |

| 97381 | $3,615.04 | $5,141.55 | $3,768.22 | $4,079.11 | $3,078.31 | $4,498.50 | $3,144.93 | $3,848.64 | $3,070.69 | $2,716.52 | $2,803.92 |

| 97141 | $3,614.92 | $4,860.69 | $3,830.67 | $3,865.67 | $3,557.55 | $4,473.68 | $3,036.00 | $4,091.51 | $2,856.94 | $3,047.27 | $2,529.24 |

| 97378 | $3,612.64 | $4,666.20 | $3,770.38 | $4,346.26 | $3,290.23 | $4,684.21 | $3,390.68 | $3,531.14 | $2,770.76 | $2,996.68 | $2,679.86 |

| 97054 | $3,610.68 | $5,313.22 | $3,731.75 | $3,604.42 | $3,413.61 | $4,737.02 | $3,477.15 | $3,697.28 | $2,636.48 | $2,790.66 | $2,705.22 |

| 97351 | $3,609.43 | $5,167.56 | $3,770.38 | $4,091.58 | $2,869.48 | $4,604.07 | $3,390.68 | $3,544.42 | $2,971.80 | $2,954.39 | $2,730.01 |

| 97107 | $3,606.60 | $5,313.22 | $3,852.69 | $3,739.32 | $3,375.70 | $4,363.24 | $3,036.00 | $4,021.78 | $2,853.15 | $2,974.26 | $2,536.65 |

| 97136 | $3,606.22 | $5,313.22 | $3,852.69 | $3,740.37 | $3,375.70 | $4,453.86 | $3,036.00 | $3,976.99 | $2,822.85 | $2,953.86 | $2,536.65 |

| 97131 | $3,604.27 | $5,313.22 | $3,852.69 | $3,666.12 | $3,375.70 | $4,453.86 | $3,036.00 | $4,163.12 | $2,862.67 | $2,782.63 | $2,536.65 |

| 97112 | $3,602.98 | $5,200.36 | $3,852.69 | $3,625.68 | $3,491.05 | $4,602.50 | $3,113.74 | $4,112.25 | $2,802.95 | $2,699.36 | $2,529.24 |

| 97108 | $3,600.10 | $5,200.36 | $3,852.69 | $3,740.37 | $3,451.40 | $4,395.09 | $3,113.74 | $3,994.40 | $2,703.92 | $3,019.81 | $2,529.24 |

| 97130 | $3,597.67 | $5,313.22 | $3,852.69 | $3,740.37 | $3,375.70 | $4,453.86 | $3,036.00 | $4,120.81 | $2,822.85 | $2,724.53 | $2,536.65 |

| 97344 | $3,588.52 | $4,668.26 | $3,770.38 | $3,831.47 | $3,377.81 | $4,543.97 | $3,390.68 | $3,625.86 | $3,049.14 | $2,768.23 | $2,859.43 |

| 97135 | $3,588.35 | $5,200.36 | $3,852.69 | $3,784.58 | $3,491.05 | $4,604.03 | $3,113.74 | $3,952.87 | $2,703.92 | $2,651.03 | $2,529.24 |

| 97350 | $3,587.15 | $4,685.15 | $3,768.22 | $3,886.38 | $3,812.91 | $4,316.15 | $3,144.93 | $3,587.13 | $3,049.14 | $2,817.60 | $2,803.92 |

| 97102 | $3,584.37 | $5,313.22 | $3,852.69 | $3,667.33 | $3,375.70 | $4,271.65 | $3,036.00 | $4,162.67 | $2,703.92 | $2,923.92 | $2,536.65 |

| 97147 | $3,581.97 | $5,313.22 | $3,852.69 | $3,651.93 | $3,375.70 | $4,425.96 | $3,036.00 | $4,156.04 | $2,703.92 | $2,767.64 | $2,536.65 |

| 97145 | $3,572.32 | $5,313.22 | $3,852.69 | $3,695.91 | $3,375.70 | $4,157.09 | $3,036.00 | $3,922.76 | $2,793.49 | $2,913.83 | $2,662.49 |

| 97342 | $3,569.17 | $4,416.61 | $3,768.22 | $3,963.37 | $3,812.91 | $4,305.63 | $3,144.93 | $3,619.95 | $3,049.14 | $2,806.98 | $2,803.92 |

| 97396 | $3,560.19 | $4,975.32 | $3,770.38 | $4,160.77 | $3,242.55 | $4,416.26 | $3,390.68 | $3,279.29 | $2,809.66 | $2,877.15 | $2,679.86 |

| 97048 | $3,554.47 | $5,313.22 | $3,830.67 | $3,735.54 | $3,140.41 | $4,848.14 | $3,036.00 | $3,618.91 | $2,669.95 | $2,646.66 | $2,705.22 |

| 97110 | $3,547.13 | $5,313.22 | $3,852.69 | $3,553.11 | $3,375.70 | $4,160.75 | $3,036.00 | $3,811.05 | $2,772.80 | $2,933.45 | $2,662.49 |

| 97392 | $3,543.36 | $4,972.35 | $3,701.05 | $4,011.18 | $3,251.16 | $4,202.26 | $3,144.93 | $3,565.74 | $2,810.03 | $3,017.03 | $2,757.89 |

| 97014 | $3,542.26 | $5,865.83 | $3,243.47 | $3,580.67 | $3,073.51 | $5,123.03 | $3,131.45 | $3,685.86 | $2,767.54 | $2,574.78 | $2,376.52 |

| 97016 | $3,537.81 | $4,860.69 | $3,852.69 | $3,642.33 | $3,404.55 | $4,719.26 | $3,036.00 | $3,752.46 | $2,713.25 | $2,691.64 | $2,705.22 |

| 97325 | $3,531.77 | $4,972.35 | $3,768.22 | $3,940.91 | $3,260.71 | $4,356.83 | $3,144.93 | $3,535.17 | $2,647.59 | $2,933.05 | $2,757.89 |

| 97388 | $3,531.20 | $4,663.76 | $3,598.25 | $3,408.48 | $3,175.56 | $4,096.54 | $3,113.74 | $3,293.94 | $2,640.04 | $4,673.28 | $2,648.46 |

| 97338 | $3,520.03 | $4,863.62 | $3,770.38 | $3,948.00 | $2,855.68 | $4,581.89 | $3,390.68 | $3,269.94 | $2,873.10 | $2,878.79 | $2,768.24 |

| 97121 | $3,518.94 | $5,313.22 | $3,852.69 | $3,452.03 | $3,134.88 | $4,237.41 | $3,036.00 | $3,913.42 | $2,667.57 | $3,076.64 | $2,505.55 |

| 97138 | $3,517.50 | $4,860.69 | $3,852.69 | $3,578.88 | $3,375.70 | $4,201.23 | $3,036.00 | $3,854.64 | $2,728.82 | $3,033.26 | $2,653.07 |

| 97103 | $3,516.95 | $5,313.22 | $3,830.67 | $3,539.44 | $3,134.88 | $4,128.02 | $3,036.00 | $3,813.02 | $2,707.03 | $3,127.31 | $2,539.90 |

| 97346 | $3,512.11 | $4,985.28 | $3,395.84 | $4,011.20 | $3,782.38 | $4,307.00 | $3,037.43 | $3,390.94 | $2,653.45 | $2,753.62 | $2,803.92 |

| 97146 | $3,501.89 | $5,313.22 | $3,852.69 | $3,407.03 | $3,134.88 | $4,237.41 | $3,036.00 | $3,771.61 | $2,667.57 | $3,092.93 | $2,505.55 |

| 97385 | $3,498.17 | $4,985.28 | $3,768.22 | $3,937.68 | $3,007.40 | $4,041.60 | $3,144.93 | $3,683.78 | $2,732.09 | $2,876.80 | $2,803.92 |

| 97347 | $3,494.84 | $4,514.04 | $3,872.81 | $3,991.42 | $3,377.81 | $4,452.02 | $3,113.74 | $3,294.92 | $2,850.27 | $2,713.16 | $2,768.24 |

| 97361 | $3,489.50 | $5,205.28 | $3,770.38 | $3,236.83 | $2,849.77 | $4,365.85 | $3,390.68 | $3,384.19 | $2,917.57 | $2,915.01 | $2,859.43 |

| 97149 | $3,469.83 | $4,693.43 | $3,598.25 | $3,636.47 | $3,235.27 | $4,625.97 | $3,113.74 | $3,915.02 | $2,697.37 | $2,653.58 | $2,529.24 |

| 97364 | $3,466.38 | $4,514.04 | $3,598.25 | $3,504.93 | $3,002.69 | $5,043.98 | $3,113.74 | $3,765.70 | $2,703.92 | $2,728.18 | $2,688.33 |

| 97360 | $3,463.85 | $4,985.28 | $3,221.11 | $3,984.36 | $3,782.38 | $3,972.44 | $3,037.43 | $3,420.69 | $2,663.55 | $2,767.34 | $2,803.92 |

| 97352 | $3,458.52 | $5,303.08 | $3,768.22 | $3,388.61 | $2,925.09 | $4,266.12 | $3,144.93 | $3,341.19 | $2,886.57 | $2,803.54 | $2,757.89 |

| 97383 | $3,454.02 | $4,985.28 | $3,768.22 | $3,937.68 | $3,203.44 | $4,162.51 | $3,144.93 | $3,056.86 | $2,733.17 | $2,744.16 | $2,803.92 |

| 97037 | $3,439.71 | $4,937.35 | $3,243.47 | $3,868.83 | $3,498.23 | $4,446.69 | $3,037.43 | $3,710.73 | $2,576.72 | $2,678.14 | $2,399.56 |

| 97368 | $3,428.60 | $4,929.76 | $3,598.25 | $3,362.89 | $3,232.84 | $4,474.91 | $3,113.74 | $3,582.48 | $2,612.30 | $2,730.41 | $2,648.46 |

| 97335 | $3,425.52 | $4,476.64 | $3,395.84 | $3,495.87 | $3,073.13 | $4,148.95 | $2,753.58 | $3,235.60 | $2,450.63 | $4,673.28 | $2,551.66 |

| 97336 | $3,409.42 | $4,411.50 | $3,221.11 | $3,378.32 | $2,921.56 | $4,343.57 | $2,753.58 | $3,388.94 | $2,450.63 | $4,673.28 | $2,551.66 |

| 97001 | $3,395.09 | $5,923.89 | $3,243.47 | $3,514.76 | $3,144.51 | $4,051.45 | $3,037.43 | $3,490.42 | $2,530.21 | $2,615.22 | $2,399.56 |

| 97464 | $3,391.22 | $4,412.71 | $3,243.47 | $3,386.60 | $3,022.76 | $3,991.75 | $2,749.74 | $3,573.81 | $2,441.79 | $4,673.28 | $2,416.26 |

| 97029 | $3,386.35 | $5,923.89 | $3,057.94 | $3,579.60 | $3,454.14 | $4,469.65 | $2,771.12 | $3,309.85 | $2,330.62 | $2,567.12 | $2,399.56 |

| 97407 | $3,384.73 | $4,384.65 | $3,243.47 | $3,287.97 | $2,892.00 | $4,025.94 | $3,050.61 | $3,393.05 | $2,345.81 | $4,673.28 | $2,550.53 |

| 97358 | $3,382.94 | $4,985.28 | $3,768.22 | $3,500.05 | $3,253.59 | $3,966.15 | $3,037.43 | $3,283.20 | $2,505.05 | $2,726.54 | $2,803.92 |

| 97063 | $3,382.43 | $4,632.09 | $3,243.47 | $3,862.78 | $3,454.14 | $4,340.14 | $3,037.43 | $3,648.47 | $2,588.35 | $2,617.87 | $2,399.56 |

| 97761 | $3,377.11 | $4,937.35 | $3,243.47 | $3,581.63 | $3,099.90 | $4,312.44 | $3,037.43 | $3,911.09 | $2,527.96 | $2,720.27 | $2,399.56 |

| 97902 | $3,376.72 | $4,267.33 | $3,057.94 | $3,720.59 | $3,042.57 | $4,274.00 | $2,771.12 | $3,372.81 | $2,280.15 | $4,673.28 | $2,307.45 |

| 97491 | $3,375.44 | $4,412.71 | $3,243.47 | $3,264.30 | $3,022.76 | $4,019.65 | $2,749.74 | $3,376.18 | $2,441.79 | $4,673.28 | $2,550.53 |

| 97058 | $3,374.75 | $4,632.09 | $3,243.47 | $3,506.93 | $3,634.12 | $4,510.79 | $3,131.45 | $3,303.18 | $2,680.85 | $2,579.66 | $2,524.93 |

| 97391 | $3,371.07 | $4,663.76 | $3,598.25 | $3,636.47 | $3,175.56 | $4,132.64 | $3,064.84 | $3,483.26 | $2,690.31 | $2,617.14 | $2,648.46 |

| 97357 | $3,365.35 | $4,802.91 | $3,598.25 | $3,572.73 | $3,175.56 | $4,113.01 | $3,113.74 | $3,517.58 | $2,703.92 | $2,674.45 | $2,381.32 |

| 97367 | $3,362.12 | $4,514.04 | $3,598.25 | $3,498.49 | $3,175.56 | $4,271.85 | $3,113.74 | $3,443.87 | $2,641.78 | $2,715.22 | $2,648.46 |

| 97494 | $3,349.14 | $4,281.81 | $3,243.47 | $3,314.67 | $2,799.46 | $3,951.57 | $2,994.63 | $3,523.13 | $2,345.81 | $4,673.28 | $2,363.60 |

| 97021 | $3,347.39 | $4,632.09 | $3,243.47 | $3,628.06 | $3,634.12 | $4,442.45 | $3,037.43 | $3,255.11 | $2,678.07 | $2,523.53 | $2,399.56 |

| 97033 | $3,346.23 | $5,923.89 | $3,057.94 | $3,720.71 | $3,049.59 | $4,469.65 | $2,771.12 | $3,341.22 | $2,280.15 | $2,448.45 | $2,399.56 |

| 97380 | $3,345.54 | $4,625.93 | $3,598.25 | $3,358.95 | $3,175.56 | $4,113.01 | $3,113.74 | $3,462.07 | $2,658.48 | $2,700.95 | $2,648.46 |

| 97409 | $3,345.17 | $4,206.75 | $3,261.57 | $3,331.62 | $2,920.70 | $4,010.87 | $2,948.50 | $3,169.27 | $2,345.81 | $4,673.28 | $2,583.38 |

| 97533 | $3,344.62 | $4,179.49 | $3,243.47 | $3,295.17 | $2,956.02 | $3,999.29 | $2,904.70 | $3,485.66 | $2,441.79 | $4,673.28 | $2,267.30 |

| 97343 | $3,342.00 | $4,663.76 | $3,481.36 | $3,500.35 | $3,086.88 | $4,141.44 | $3,064.84 | $3,765.68 | $2,747.74 | $2,586.62 | $2,381.32 |

| 97633 | $3,337.61 | $4,926.89 | $3,243.47 | $3,638.22 | $3,147.66 | $4,120.78 | $3,041.46 | $3,623.87 | $2,666.18 | $2,541.80 | $2,425.80 |

| 97341 | $3,333.95 | $4,663.76 | $3,598.25 | $3,408.48 | $3,175.56 | $4,070.47 | $3,113.74 | $3,294.05 | $2,670.13 | $2,696.64 | $2,648.46 |

| 97627 | $3,329.71 | $4,882.14 | $3,243.47 | $3,345.79 | $3,118.93 | $4,399.28 | $3,041.46 | $3,632.39 | $2,530.21 | $2,633.78 | $2,469.69 |

| 97040 | $3,328.30 | $4,632.09 | $3,243.47 | $3,745.65 | $3,062.95 | $4,481.29 | $3,131.45 | $3,320.19 | $2,669.94 | $2,596.45 | $2,399.58 |

| 97041 | $3,328.27 | $4,937.35 | $3,243.47 | $3,522.94 | $3,062.95 | $4,440.96 | $3,037.43 | $3,405.22 | $2,565.24 | $2,667.58 | $2,399.58 |

| 97626 | $3,324.61 | $4,882.14 | $3,243.47 | $3,490.14 | $3,092.90 | $4,266.86 | $3,041.46 | $3,623.87 | $2,530.21 | $2,605.42 | $2,469.69 |

| 97366 | $3,323.94 | $4,663.76 | $3,598.25 | $3,408.48 | $3,022.62 | $4,118.00 | $3,064.84 | $3,428.37 | $2,722.94 | $2,563.70 | $2,648.46 |

| 97390 | $3,321.81 | $4,690.38 | $3,598.25 | $3,670.87 | $2,913.93 | $4,118.00 | $3,064.84 | $3,201.31 | $2,703.92 | $2,628.01 | $2,628.63 |

| 97731 | $3,320.14 | $4,882.14 | $3,243.47 | $3,245.27 | $3,244.38 | $4,218.72 | $3,000.29 | $3,622.26 | $2,530.21 | $2,730.17 | $2,484.51 |

| 97432 | $3,317.38 | $4,281.81 | $3,243.47 | $3,174.26 | $2,799.46 | $4,000.42 | $2,994.63 | $3,297.09 | $2,345.81 | $4,673.28 | $2,363.60 |

| 97369 | $3,317.28 | $4,663.76 | $3,598.25 | $3,493.66 | $2,925.09 | $4,116.17 | $3,113.74 | $3,293.94 | $2,703.92 | $2,615.84 | $2,648.46 |

| 97634 | $3,316.24 | $4,926.89 | $3,243.47 | $3,396.34 | $3,233.85 | $4,139.16 | $3,151.07 | $3,623.87 | $2,530.21 | $2,491.79 | $2,425.80 |

| 97639 | $3,315.65 | $4,926.89 | $3,243.47 | $3,345.79 | $3,064.18 | $4,265.73 | $3,041.46 | $3,588.77 | $2,651.26 | $2,591.33 | $2,437.64 |

| 97031 | $3,315.02 | $4,910.83 | $3,243.47 | $3,605.47 | $3,036.02 | $4,435.49 | $3,131.45 | $3,191.22 | $2,591.03 | $2,628.70 | $2,376.52 |

| 97365 | $3,313.48 | $4,663.76 | $3,598.25 | $3,446.38 | $2,933.29 | $4,118.00 | $3,113.74 | $3,334.42 | $2,709.91 | $2,568.58 | $2,648.46 |

| 97632 | $3,311.37 | $4,926.89 | $3,243.47 | $3,409.50 | $3,270.43 | $4,120.78 | $3,041.46 | $3,544.56 | $2,589.91 | $2,540.95 | $2,425.80 |

| 97623 | $3,309.15 | $4,926.89 | $3,243.47 | $3,396.34 | $3,129.48 | $4,121.89 | $3,041.46 | $3,617.66 | $2,611.49 | $2,565.17 | $2,437.64 |

| 97624 | $3,308.11 | $4,926.89 | $3,243.47 | $3,402.71 | $3,092.90 | $4,264.62 | $3,041.46 | $3,607.85 | $2,489.02 | $2,542.46 | $2,469.69 |

| 97394 | $3,307.88 | $4,690.38 | $3,481.36 | $3,472.21 | $3,022.62 | $3,985.47 | $3,064.84 | $3,361.44 | $2,806.03 | $2,546.05 | $2,648.46 |

| 97498 | $3,307.58 | $4,690.38 | $3,481.36 | $3,603.32 | $2,905.48 | $3,970.83 | $3,064.84 | $3,364.26 | $2,811.41 | $2,555.26 | $2,628.63 |

| 97604 | $3,305.13 | $4,882.14 | $3,243.47 | $3,182.54 | $3,179.79 | $4,179.04 | $3,000.29 | $3,608.34 | $2,530.21 | $2,761.02 | $2,484.51 |

| 97324 | $3,304.85 | $5,567.18 | $3,221.11 | $3,448.78 | $2,849.18 | $4,277.18 | $2,753.58 | $3,224.53 | $2,442.76 | $2,635.59 | $2,628.63 |

| 97536 | $3,304.79 | $5,055.91 | $3,243.47 | $3,377.74 | $3,179.79 | $4,112.95 | $3,000.29 | $3,668.85 | $2,441.79 | $2,587.93 | $2,379.20 |

| 97621 | $3,302.78 | $4,926.89 | $3,243.47 | $3,333.91 | $3,158.18 | $4,120.78 | $3,041.46 | $3,608.34 | $2,530.21 | $2,626.97 | $2,437.64 |

| 97376 | $3,301.16 | $4,663.76 | $3,481.36 | $3,408.54 | $2,849.77 | $4,118.00 | $3,064.84 | $3,441.97 | $2,777.97 | $2,556.94 | $2,648.46 |

| 97625 | $3,299.27 | $4,926.89 | $3,243.47 | $3,467.36 | $3,233.85 | $4,084.18 | $3,041.46 | $3,465.18 | $2,530.21 | $2,562.48 | $2,437.64 |

| 97601 | $3,296.42 | $4,409.66 | $3,243.47 | $3,396.34 | $3,233.85 | $4,355.42 | $3,041.46 | $3,596.17 | $2,611.19 | $2,662.82 | $2,413.80 |

| 97622 | $3,292.47 | $4,926.89 | $3,243.47 | $3,220.21 | $3,158.18 | $4,120.78 | $3,041.46 | $3,617.66 | $2,530.21 | $2,628.22 | $2,437.64 |

| 97544 | $3,291.54 | $5,288.60 | $3,243.47 | $3,239.54 | $3,163.95 | $3,926.87 | $2,929.38 | $3,869.35 | $2,295.88 | $2,584.39 | $2,373.93 |

| 97374 | $3,285.35 | $4,972.35 | $3,395.84 | $3,272.08 | $3,073.13 | $4,148.95 | $2,753.58 | $3,350.74 | $2,380.53 | $2,702.35 | $2,803.92 |

| 97733 | $3,284.70 | $5,320.64 | $3,193.92 | $3,119.87 | $3,158.18 | $3,991.34 | $3,000.29 | $3,517.53 | $2,553.72 | $2,506.95 | $2,484.51 |

| 97461 | $3,284.36 | $4,639.40 | $3,261.57 | $3,330.15 | $3,002.95 | $4,159.68 | $2,948.50 | $3,542.39 | $2,621.87 | $2,737.19 | $2,599.95 |

| 97326 | $3,282.11 | $4,664.05 | $3,598.25 | $3,557.68 | $3,082.94 | $4,126.80 | $3,064.84 | $3,278.64 | $2,545.64 | $2,520.92 | $2,381.32 |

| 97413 | $3,281.80 | $4,056.98 | $3,261.57 | $3,409.70 | $3,273.34 | $4,318.53 | $2,948.50 | $3,595.03 | $2,700.65 | $2,657.40 | $2,596.30 |

| 97329 | $3,281.74 | $4,411.50 | $3,221.11 | $3,581.65 | $3,019.52 | $4,545.00 | $3,037.43 | $3,217.19 | $2,450.63 | $2,529.42 | $2,803.92 |

| 97447 | $3,264.59 | $4,981.22 | $3,243.47 | $3,354.38 | $2,971.52 | $4,243.58 | $3,000.29 | $3,652.81 | $2,345.81 | $2,489.20 | $2,363.60 |

| 97864 | $3,261.01 | $5,090.37 | $3,057.94 | $3,363.26 | $3,148.73 | $4,182.96 | $2,771.12 | $3,739.37 | $2,304.61 | $2,488.89 | $2,462.90 |

| 97641 | $3,260.36 | $5,043.90 | $3,112.56 | $3,231.63 | $3,113.87 | $4,028.44 | $2,771.12 | $3,673.18 | $2,553.50 | $2,590.87 | $2,484.51 |

| 97488 | $3,257.69 | $4,352.31 | $3,261.57 | $3,234.80 | $3,271.13 | $4,174.02 | $2,948.50 | $3,519.31 | $2,719.35 | $2,499.63 | $2,596.30 |

| 97322 | $3,250.87 | $4,444.73 | $3,395.84 | $3,251.01 | $2,855.68 | $4,752.28 | $3,043.48 | $3,180.00 | $2,564.21 | $2,643.12 | $2,378.31 |

| 97603 | $3,245.60 | $4,409.66 | $3,243.47 | $3,396.34 | $3,032.78 | $4,138.05 | $3,151.07 | $3,442.95 | $2,574.87 | $2,640.98 | $2,425.80 |

| 97480 | $3,243.49 | $4,384.65 | $3,243.47 | $3,445.16 | $3,002.95 | $4,282.09 | $2,948.50 | $3,432.51 | $2,476.27 | $2,590.73 | $2,628.63 |

| 97874 | $3,241.80 | $5,090.37 | $3,112.56 | $3,446.72 | $3,148.73 | $4,100.84 | $2,771.12 | $3,540.36 | $2,280.15 | $2,386.68 | $2,540.44 |

| 97707 | $3,240.36 | $3,953.28 | $3,193.92 | $3,336.63 | $3,280.08 | $4,358.11 | $3,062.28 | $3,569.06 | $2,705.39 | $2,460.37 | $2,484.51 |

| 97711 | $3,240.31 | $4,210.49 | $3,243.47 | $3,663.54 | $3,211.03 | $3,972.57 | $3,037.43 | $3,479.45 | $2,530.21 | $2,514.49 | $2,540.44 |

| 97419 | $3,239.43 | $4,269.72 | $3,261.57 | $3,657.58 | $3,002.95 | $4,010.87 | $2,948.50 | $3,442.06 | $2,575.44 | $2,625.70 | $2,599.95 |

| 97861 | $3,239.13 | $4,745.62 | $3,057.94 | $3,533.23 | $3,141.68 | $4,291.78 | $2,771.12 | $3,540.36 | $2,280.15 | $2,488.93 | $2,540.44 |

| 97050 | $3,237.01 | $4,389.27 | $3,057.94 | $3,618.40 | $3,454.14 | $4,620.77 | $2,771.12 | $3,327.58 | $2,280.15 | $2,451.18 | $2,399.56 |

| 97638 | $3,236.60 | $5,043.90 | $3,112.56 | $3,304.42 | $3,113.87 | $4,000.55 | $2,771.12 | $3,673.18 | $2,280.15 | $2,581.80 | $2,484.51 |

| 97345 | $3,235.40 | $4,411.50 | $3,221.11 | $3,466.49 | $3,005.10 | $4,343.57 | $3,037.43 | $3,367.23 | $2,366.12 | $2,539.20 | $2,596.30 |

| 97065 | $3,233.30 | $4,389.27 | $3,112.56 | $3,528.35 | $3,454.14 | $4,482.45 | $2,771.12 | $3,364.17 | $2,349.25 | $2,482.15 | $2,399.56 |

| 97739 | $3,232.52 | $4,085.33 | $3,243.47 | $3,409.01 | $3,201.13 | $4,358.11 | $3,062.28 | $3,453.21 | $2,637.49 | $2,390.63 | $2,484.51 |

| 97637 | $3,229.19 | $4,727.79 | $3,112.56 | $3,323.54 | $3,042.57 | $3,989.54 | $2,771.12 | $4,048.68 | $2,280.15 | $2,558.36 | $2,437.64 |

| 97759 | $3,228.38 | $4,311.68 | $3,243.47 | $3,315.64 | $3,211.03 | $3,973.28 | $3,062.28 | $3,519.58 | $2,534.87 | $2,587.01 | $2,524.93 |

| 97541 | $3,224.20 | $4,606.56 | $3,243.47 | $3,126.05 | $3,133.23 | $4,134.67 | $3,000.29 | $3,608.91 | $2,650.19 | $2,465.09 | $2,273.57 |

| 97735 | $3,221.01 | $5,043.90 | $3,057.94 | $3,264.77 | $3,113.87 | $4,038.72 | $2,771.12 | $3,627.37 | $2,280.15 | $2,527.73 | $2,484.51 |

| 97534 | $3,220.46 | $4,412.71 | $3,243.47 | $3,603.47 | $3,163.95 | $3,938.85 | $2,749.74 | $3,644.06 | $2,530.65 | $2,543.76 | $2,373.93 |

| 97487 | $3,218.96 | $4,177.76 | $3,261.57 | $3,512.26 | $3,096.90 | $4,147.60 | $2,948.50 | $3,276.00 | $2,588.64 | $2,580.44 | $2,599.95 |

| 97489 | $3,217.86 | $4,048.16 | $3,261.57 | $3,373.88 | $3,244.47 | $4,175.13 | $2,948.50 | $3,358.84 | $2,681.30 | $2,490.43 | $2,596.30 |

| 97640 | $3,217.19 | $4,727.79 | $3,112.56 | $3,223.77 | $3,113.87 | $4,364.11 | $2,771.12 | $3,625.12 | $2,280.15 | $2,515.75 | $2,437.64 |

| 97386 | $3,216.56 | $4,509.31 | $3,221.11 | $3,473.30 | $2,970.73 | $4,343.57 | $2,753.58 | $3,388.94 | $2,366.12 | $2,542.61 | $2,596.30 |

| 97476 | $3,215.81 | $4,384.65 | $3,243.47 | $3,284.67 | $3,158.85 | $4,126.05 | $2,749.74 | $3,601.54 | $2,398.63 | $2,660.02 | $2,550.53 |

| 97484 | $3,215.16 | $4,457.36 | $3,243.47 | $3,372.84 | $3,178.54 | $3,875.74 | $3,000.29 | $3,564.75 | $2,350.09 | $2,744.88 | $2,363.60 |

| 97522 | $3,214.89 | $4,702.89 | $3,243.47 | $3,079.35 | $3,133.23 | $3,869.13 | $3,000.29 | $3,738.06 | $2,565.00 | $2,438.33 | $2,379.20 |

| 97730 | $3,214.18 | $4,210.49 | $3,243.47 | $3,287.42 | $3,211.03 | $3,865.21 | $3,037.43 | $3,615.06 | $2,530.21 | $2,741.92 | $2,399.56 |

| 97370 | $3,213.52 | $4,905.68 | $3,221.11 | $3,370.69 | $2,910.08 | $4,134.35 | $3,033.91 | $3,128.61 | $2,468.03 | $2,581.42 | $2,381.32 |

| 97438 | $3,209.80 | $4,690.58 | $3,261.57 | $3,443.82 | $3,157.12 | $3,995.18 | $2,948.50 | $3,173.78 | $2,485.33 | $2,458.48 | $2,483.62 |

| 97449 | $3,208.39 | $4,384.65 | $3,243.47 | $3,095.56 | $2,985.79 | $4,056.30 | $3,050.61 | $3,608.27 | $2,470.46 | $2,528.42 | $2,660.41 |

| 97539 | $3,207.32 | $4,430.57 | $3,243.47 | $3,477.07 | $2,916.31 | $4,010.19 | $3,100.05 | $3,517.62 | $2,631.84 | $2,472.50 | $2,273.57 |

| 97710 | $3,205.48 | $4,727.79 | $3,112.56 | $3,542.68 | $3,042.57 | $4,367.48 | $2,771.12 | $3,400.45 | $2,280.15 | $2,440.15 | $2,369.88 |

| 97741 | $3,202.29 | $4,000.88 | $3,243.47 | $3,472.73 | $3,211.03 | $3,985.05 | $3,021.48 | $3,579.56 | $2,415.50 | $2,693.70 | $2,399.56 |

| 97760 | $3,201.32 | $4,575.25 | $3,243.47 | $3,328.39 | $3,079.34 | $3,860.22 | $3,013.36 | $3,238.45 | $2,508.52 | $2,732.94 | $2,433.24 |

| 97453 | $3,200.72 | $4,384.65 | $3,243.47 | $3,410.75 | $3,002.95 | $4,209.75 | $2,948.50 | $3,385.35 | $2,372.50 | $2,548.66 | $2,500.61 |

| 97458 | $3,197.94 | $4,384.65 | $3,243.47 | $3,204.46 | $3,158.85 | $4,014.91 | $3,050.61 | $3,418.24 | $2,426.46 | $2,527.26 | $2,550.53 |

| 97414 | $3,196.93 | $4,384.65 | $3,243.47 | $3,095.56 | $3,158.85 | $4,078.34 | $3,050.61 | $3,566.47 | $2,345.81 | $2,495.01 | $2,550.53 |

| 97331 | $3,195.82 | $4,287.84 | $3,221.11 | $3,675.54 | $3,005.31 | $4,149.06 | $3,033.91 | $3,240.48 | $2,363.30 | $2,625.24 | $2,356.41 |

| 97463 | $3,195.01 | $4,097.21 | $3,261.57 | $3,073.08 | $3,173.18 | $4,259.90 | $2,948.50 | $3,539.81 | $2,440.35 | $2,560.19 | $2,596.30 |

| 97910 | $3,194.30 | $4,267.33 | $3,057.94 | $3,689.15 | $3,042.57 | $4,274.00 | $2,771.12 | $3,200.71 | $2,462.26 | $2,870.46 | $2,307.45 |

| 97734 | $3,189.69 | $4,210.49 | $3,243.47 | $3,381.86 | $3,211.03 | $3,875.02 | $3,021.48 | $3,271.15 | $2,480.73 | $2,802.17 | $2,399.56 |

| 97756 | $3,188.32 | $4,157.30 | $3,243.47 | $3,359.12 | $3,079.34 | $4,068.80 | $3,013.36 | $3,248.29 | $2,390.39 | $2,798.17 | $2,524.93 |

| 97823 | $3,185.67 | $4,745.62 | $3,057.94 | $3,332.45 | $3,565.28 | $3,959.59 | $2,771.12 | $3,295.28 | $2,293.12 | $2,295.90 | $2,540.44 |

| 97492 | $3,183.77 | $4,097.21 | $3,261.57 | $3,246.46 | $3,173.18 | $4,023.28 | $2,948.50 | $3,523.13 | $2,345.81 | $2,622.31 | $2,596.30 |

| 97635 | $3,183.70 | $4,727.79 | $3,057.94 | $3,222.44 | $3,085.16 | $4,011.55 | $2,771.12 | $3,684.84 | $2,280.15 | $2,558.36 | $2,437.64 |

| 97039 | $3,183.58 | $4,203.28 | $3,057.94 | $3,669.72 | $3,565.28 | $4,117.64 | $2,771.12 | $3,237.17 | $2,280.15 | $2,533.91 | $2,399.56 |

| 97454 | $3,183.39 | $4,282.72 | $3,261.57 | $3,443.82 | $3,007.52 | $4,042.12 | $2,948.50 | $3,234.08 | $2,516.42 | $2,500.85 | $2,596.30 |

| 97437 | $3,182.79 | $4,206.75 | $3,261.57 | $3,298.55 | $2,918.77 | $4,138.21 | $2,948.50 | $3,206.53 | $2,650.85 | $2,598.19 | $2,599.95 |

| 97737 | $3,181.86 | $4,097.21 | $3,243.47 | $3,119.87 | $3,113.87 | $3,992.46 | $3,000.29 | $3,679.05 | $2,530.21 | $2,557.62 | $2,484.51 |

| 97636 | $3,179.96 | $4,727.79 | $3,057.94 | $3,304.42 | $3,113.87 | $3,989.54 | $2,771.12 | $3,639.02 | $2,280.15 | $2,478.15 | $2,437.64 |

| 97355 | $3,177.76 | $4,061.02 | $3,395.84 | $3,350.75 | $2,989.60 | $4,241.84 | $2,753.58 | $3,399.44 | $2,397.07 | $2,636.79 | $2,551.66 |

| 97327 | $3,176.69 | $4,509.31 | $3,395.84 | $3,154.05 | $2,921.56 | $4,271.74 | $2,753.58 | $3,284.66 | $2,363.03 | $2,561.46 | $2,551.66 |

| 97503 | $3,176.52 | $4,137.74 | $3,243.47 | $3,166.75 | $3,000.57 | $4,267.30 | $3,100.05 | $3,388.66 | $2,594.44 | $2,486.99 | $2,379.20 |

| 97450 | $3,176.43 | $4,384.65 | $3,243.47 | $3,158.32 | $3,158.85 | $4,175.91 | $2,749.74 | $3,423.84 | $2,441.79 | $2,477.24 | $2,550.53 |

| 97410 | $3,175.94 | $4,457.36 | $3,243.47 | $3,194.88 | $3,113.64 | $4,015.42 | $3,000.29 | $3,428.22 | $2,247.85 | $2,694.71 | $2,363.60 |

| 97469 | $3,175.59 | $3,965.44 | $3,243.47 | $3,278.92 | $3,178.54 | $4,030.13 | $3,000.29 | $3,609.25 | $2,286.07 | $2,712.85 | $2,450.88 |

| 97441 | $3,174.57 | $4,384.65 | $3,243.47 | $3,180.14 | $3,020.40 | $3,960.39 | $3,064.84 | $3,468.79 | $2,345.81 | $2,576.62 | $2,500.61 |

| 97420 | $3,174.09 | $4,384.65 | $3,243.47 | $3,097.20 | $2,841.80 | $4,027.06 | $3,050.61 | $3,411.17 | $2,455.43 | $2,569.13 | $2,660.41 |

| 97477 | $3,173.83 | $4,079.15 | $3,166.56 | $3,340.67 | $2,922.09 | $4,077.13 | $3,244.87 | $3,311.08 | $2,513.87 | $2,501.02 | $2,581.87 |

| 97538 | $3,171.86 | $4,179.49 | $3,243.47 | $3,287.71 | $3,163.95 | $4,110.39 | $2,749.74 | $3,496.21 | $2,532.78 | $2,580.98 | $2,373.93 |

| 97448 | $3,171.74 | $4,269.72 | $3,261.57 | $3,385.92 | $2,920.70 | $4,032.87 | $2,948.50 | $3,121.18 | $2,611.94 | $2,565.03 | $2,599.95 |

| 97493 | $3,171.60 | $4,384.65 | $3,243.47 | $3,213.57 | $3,002.95 | $4,070.77 | $3,064.84 | $3,376.18 | $2,345.81 | $2,513.13 | $2,500.61 |

| 97377 | $3,170.00 | $4,755.12 | $3,395.84 | $3,263.35 | $2,537.36 | $4,119.39 | $2,753.58 | $3,208.79 | $2,450.29 | $2,664.57 | $2,551.66 |

| 97497 | $3,168.00 | $4,450.03 | $3,243.47 | $3,259.50 | $3,165.05 | $3,911.23 | $3,000.29 | $3,483.87 | $2,305.70 | $2,593.59 | $2,267.30 |

| 97722 | $3,167.99 | $4,727.79 | $3,057.94 | $3,378.48 | $3,042.57 | $4,267.72 | $2,771.12 | $3,263.51 | $2,421.95 | $2,378.98 | $2,369.88 |

| 97486 | $3,167.74 | $4,384.65 | $3,243.47 | $3,133.46 | $2,971.52 | $3,945.37 | $2,994.63 | $3,680.80 | $2,345.81 | $2,477.05 | $2,500.61 |

| 97520 | $3,166.69 | $4,398.15 | $3,243.47 | $3,185.88 | $2,905.96 | $4,120.37 | $2,928.23 | $3,342.87 | $2,560.27 | $2,607.63 | $2,374.03 |

| 97451 | $3,166.66 | $4,628.77 | $3,261.57 | $3,330.15 | $3,002.95 | $3,963.27 | $2,948.50 | $3,231.06 | $2,345.81 | $2,453.95 | $2,500.61 |

| 97446 | $3,166.43 | $4,275.59 | $3,221.11 | $3,301.31 | $2,976.64 | $4,072.16 | $2,753.58 | $3,330.66 | $2,571.45 | $2,610.13 | $2,551.66 |

| 97473 | $3,165.87 | $4,059.21 | $3,243.47 | $3,213.57 | $3,020.40 | $4,038.91 | $3,064.84 | $3,502.70 | $2,345.81 | $2,669.21 | $2,500.61 |

| 97620 | $3,164.60 | $4,727.79 | $3,112.56 | $3,142.31 | $3,042.57 | $4,075.80 | $2,771.12 | $3,620.18 | $2,280.15 | $2,435.94 | $2,437.64 |

| 97348 | $3,164.29 | $4,665.02 | $3,395.84 | $3,201.68 | $2,815.61 | $4,162.74 | $2,753.58 | $3,082.77 | $2,384.57 | $2,629.40 | $2,551.66 |

| 97429 | $3,163.93 | $3,933.63 | $3,243.47 | $3,095.56 | $3,163.82 | $3,964.90 | $3,000.29 | $3,833.04 | $2,345.81 | $2,695.21 | $2,363.60 |

| 97417 | $3,163.80 | $4,281.81 | $3,243.47 | $3,175.67 | $3,043.59 | $4,016.20 | $3,000.29 | $3,502.45 | $2,282.85 | $2,728.13 | $2,363.60 |

| 97434 | $3,162.62 | $4,105.88 | $3,261.57 | $3,487.30 | $3,098.39 | $3,875.46 | $2,948.50 | $3,419.69 | $2,353.39 | $2,479.74 | $2,596.30 |

| 97406 | $3,160.07 | $3,819.71 | $3,243.47 | $3,318.64 | $3,022.76 | $4,046.47 | $2,749.74 | $4,032.26 | $2,441.79 | $2,509.66 | $2,416.26 |

| 97530 | $3,159.72 | $4,882.81 | $3,243.47 | $3,057.77 | $3,029.40 | $3,970.02 | $2,929.38 | $3,287.43 | $2,470.82 | $2,465.08 | $2,261.03 |

| 97830 | $3,159.51 | $4,099.46 | $3,112.56 | $3,383.00 | $3,565.28 | $4,030.77 | $2,771.12 | $3,397.04 | $2,322.97 | $2,372.49 | $2,540.44 |

| 97431 | $3,159.46 | $4,241.46 | $3,261.57 | $3,385.98 | $3,098.39 | $4,043.11 | $2,948.50 | $3,300.57 | $2,455.69 | $2,375.75 | $2,483.62 |

| 97412 | $3,159.28 | $3,807.18 | $3,261.57 | $3,273.74 | $3,002.95 | $4,136.60 | $2,948.50 | $3,137.98 | $2,569.44 | $2,826.21 | $2,628.63 |

| 97848 | $3,158.23 | $4,267.33 | $3,057.94 | $3,348.79 | $3,148.73 | $4,169.02 | $2,771.12 | $3,680.69 | $2,280.15 | $2,488.69 | $2,369.88 |

| 97630 | $3,156.63 | $4,727.79 | $3,057.94 | $3,049.05 | $3,085.16 | $4,047.88 | $2,771.12 | $3,631.88 | $2,296.16 | $2,461.71 | $2,437.64 |

| 97411 | $3,154.51 | $4,384.65 | $3,243.47 | $3,133.46 | $2,841.80 | $4,054.61 | $3,050.61 | $3,457.54 | $2,343.38 | $2,485.10 | $2,550.53 |

| 97490 | $3,154.31 | $3,812.60 | $3,261.57 | $3,381.46 | $3,002.95 | $4,167.75 | $2,948.50 | $3,335.57 | $2,345.81 | $2,786.31 | $2,500.61 |

| 97812 | $3,152.95 | $4,267.33 | $3,057.94 | $3,400.73 | $3,141.68 | $4,291.78 | $2,771.12 | $3,288.89 | $2,270.47 | $2,499.16 | $2,540.44 |

| 97873 | $3,151.09 | $4,267.33 | $3,057.94 | $3,104.42 | $2,971.33 | $4,394.27 | $2,771.12 | $3,918.47 | $2,280.15 | $2,375.99 | $2,369.88 |

| 97478 | $3,149.62 | $4,048.16 | $3,166.56 | $3,353.41 | $2,922.09 | $4,019.00 | $3,244.87 | $3,198.43 | $2,447.71 | $2,514.14 | $2,581.87 |

| 97423 | $3,149.17 | $4,384.65 | $3,243.47 | $3,078.09 | $2,905.40 | $3,875.37 | $3,050.61 | $3,336.38 | $2,417.53 | $2,539.76 | $2,660.41 |

| 97443 | $3,148.71 | $4,626.21 | $3,243.47 | $3,095.56 | $2,878.99 | $4,066.70 | $3,000.29 | $3,423.08 | $2,276.90 | $2,512.31 | $2,363.60 |

| 97452 | $3,147.04 | $4,143.78 | $3,261.57 | $3,356.39 | $2,861.41 | $3,967.09 | $2,948.50 | $3,369.89 | $2,511.88 | $2,453.55 | $2,596.30 |

| 97535 | $3,146.17 | $4,137.74 | $3,193.92 | $3,181.39 | $2,885.47 | $4,706.98 | $3,071.06 | $3,107.30 | $2,439.33 | $2,551.14 | $2,187.34 |

| 97540 | $3,145.58 | $4,559.12 | $3,243.47 | $3,185.88 | $2,885.47 | $4,098.44 | $2,928.23 | $3,187.81 | $2,437.84 | $2,555.54 | $2,374.03 |

| 97531 | $3,145.23 | $4,179.49 | $3,243.47 | $3,347.00 | $3,163.95 | $3,938.85 | $2,749.74 | $3,485.66 | $2,441.79 | $2,528.46 | $2,373.93 |

| 97836 | $3,144.99 | $4,267.33 | $3,057.94 | $3,315.42 | $3,035.54 | $4,038.23 | $2,771.12 | $3,562.86 | $2,422.05 | $2,439.00 | $2,540.44 |

| 97457 | $3,144.51 | $4,281.81 | $3,243.47 | $3,175.67 | $3,043.59 | $4,030.13 | $2,994.63 | $3,373.98 | $2,326.40 | $2,611.85 | $2,363.60 |

| 97465 | $3,144.35 | $4,384.65 | $3,243.47 | $3,045.93 | $3,023.88 | $3,977.10 | $2,749.74 | $3,573.81 | $2,416.66 | $2,477.68 | $2,550.53 |

| 97736 | $3,143.89 | $4,727.79 | $3,057.94 | $3,316.27 | $3,042.57 | $4,267.72 | $2,771.12 | $3,263.51 | $2,280.15 | $2,342.01 | $2,369.88 |

| 97523 | $3,143.74 | $3,847.06 | $3,243.47 | $3,489.76 | $3,163.95 | $3,946.26 | $2,749.74 | $3,519.36 | $2,527.41 | $2,576.48 | $2,373.93 |

| 97455 | $3,142.63 | $4,389.61 | $3,166.56 | $3,443.82 | $2,987.19 | $4,176.46 | $2,776.44 | $3,164.83 | $2,375.44 | $2,462.37 | $2,483.62 |

| 97543 | $3,142.12 | $4,405.72 | $3,243.47 | $3,166.75 | $3,028.96 | $4,029.68 | $2,749.74 | $3,404.73 | $2,441.79 | $2,576.42 | $2,373.93 |

| 97712 | $3,140.81 | $4,069.35 | $3,243.47 | $3,239.34 | $3,086.37 | $4,101.05 | $2,771.12 | $3,372.81 | $2,530.21 | $2,509.89 | $2,484.51 |

| 97750 | $3,138.52 | $4,099.46 | $3,057.94 | $3,429.01 | $3,148.73 | $4,011.01 | $2,771.12 | $3,493.76 | $2,280.15 | $2,553.62 | $2,540.44 |

| 97467 | $3,135.34 | $3,883.39 | $3,243.47 | $3,204.46 | $2,985.79 | $3,957.48 | $3,064.84 | $3,523.38 | $2,418.71 | $2,571.28 | $2,500.61 |

| 97758 | $3,134.50 | $4,727.79 | $3,057.94 | $3,123.20 | $3,042.57 | $4,081.07 | $2,771.12 | $3,549.32 | $2,280.15 | $2,342.01 | $2,369.88 |

| 97702 | $3,133.62 | $3,953.28 | $3,193.92 | $3,441.14 | $2,979.07 | $4,054.09 | $2,848.64 | $3,338.36 | $2,504.91 | $2,538.29 | $2,484.51 |

| 97721 | $3,133.35 | $4,727.79 | $3,057.94 | $3,210.85 | $3,042.57 | $4,267.72 | $2,771.12 | $3,263.51 | $2,280.15 | $2,342.01 | $2,369.88 |

| 97466 | $3,132.93 | $3,969.50 | $3,243.47 | $3,209.25 | $3,158.85 | $4,018.76 | $2,749.74 | $3,481.96 | $2,392.29 | $2,554.93 | $2,550.53 |

| 97442 | $3,132.51 | $3,965.44 | $3,243.47 | $3,139.53 | $2,978.67 | $4,038.19 | $3,000.29 | $3,637.85 | $2,235.37 | $2,635.44 | $2,450.88 |

| 97504 | $3,132.38 | $4,137.74 | $3,243.47 | $3,181.39 | $2,740.61 | $4,307.70 | $3,071.06 | $3,062.61 | $2,690.18 | $2,506.79 | $2,382.32 |

| 97436 | $3,131.09 | $4,059.21 | $3,243.47 | $3,245.53 | $2,942.52 | $4,038.91 | $2,994.63 | $3,511.02 | $2,308.43 | $2,466.55 | $2,500.61 |

| 97405 | $3,130.41 | $3,908.08 | $3,087.22 | $3,397.10 | $3,084.25 | $3,976.04 | $2,776.44 | $3,335.39 | $2,614.40 | $2,548.31 | $2,576.93 |

| 97415 | $3,129.17 | $3,847.06 | $3,243.47 | $3,238.53 | $3,028.96 | $4,067.38 | $2,749.74 | $3,594.26 | $2,433.83 | $2,672.21 | $2,416.26 |

| 97321 | $3,128.34 | $4,048.72 | $3,395.84 | $3,367.96 | $2,655.07 | $4,233.41 | $2,878.87 | $3,155.53 | $2,539.14 | $2,630.57 | $2,378.31 |

| 97911 | $3,127.02 | $4,727.79 | $3,057.94 | $3,417.90 | $3,042.57 | $3,871.06 | $2,771.12 | $3,370.74 | $2,280.15 | $2,423.49 | $2,307.45 |

| 97481 | $3,126.64 | $4,281.81 | $3,243.47 | $3,255.04 | $2,799.46 | $3,923.38 | $2,994.63 | $3,370.12 | $2,345.81 | $2,552.08 | $2,500.61 |

| 97839 | $3,126.50 | $4,267.33 | $3,057.94 | $3,440.77 | $3,035.54 | $3,937.74 | $2,771.12 | $3,422.43 | $2,386.22 | $2,405.47 | $2,540.44 |

| 97444 | $3,125.83 | $4,412.71 | $3,243.47 | $3,095.68 | $3,022.76 | $4,009.36 | $2,749.74 | $3,511.57 | $2,355.99 | $2,440.72 | $2,416.26 |

| 97402 | $3,125.73 | $4,007.28 | $3,166.56 | $3,339.27 | $2,922.09 | $4,090.51 | $2,833.82 | $3,256.00 | $2,598.82 | $2,549.47 | $2,493.53 |

| 97524 | $3,125.08 | $4,137.74 | $3,243.47 | $3,079.35 | $2,911.89 | $4,162.98 | $3,100.05 | $3,157.75 | $2,601.61 | $2,476.76 | $2,379.20 |

| 97456 | $3,124.16 | $3,948.07 | $3,221.11 | $3,348.03 | $2,976.64 | $4,069.27 | $2,753.58 | $3,261.25 | $2,419.65 | $2,644.02 | $2,599.95 |

| 97751 | $3,124.12 | $4,267.33 | $3,112.56 | $3,348.79 | $3,042.57 | $4,057.53 | $2,771.12 | $3,245.46 | $2,280.15 | $2,575.27 | $2,540.44 |

| 97856 | $3,124.09 | $4,267.33 | $3,057.94 | $3,199.00 | $3,077.48 | $4,012.80 | $2,771.12 | $3,576.92 | $2,280.15 | $2,535.29 | $2,462.90 |

| 97459 | $3,122.59 | $3,883.39 | $3,243.47 | $3,097.20 | $2,892.00 | $4,083.16 | $3,050.61 | $3,301.59 | $2,466.25 | $2,547.81 | $2,660.41 |

| 97753 | $3,120.23 | $4,254.67 | $3,243.47 | $3,359.12 | $3,090.03 | $3,684.14 | $2,723.56 | $3,479.57 | $2,265.17 | $2,669.34 | $2,433.24 |

| 97404 | $3,120.13 | $4,007.28 | $3,166.56 | $3,397.85 | $2,626.12 | $4,102.54 | $2,833.82 | $3,223.69 | $2,818.93 | $2,530.99 | $2,493.53 |

| 97389 | $3,119.84 | $4,664.05 | $3,221.11 | $3,370.69 | $2,529.14 | $4,096.09 | $2,753.58 | $3,116.62 | $2,494.29 | $2,605.00 | $2,347.87 |

| 97842 | $3,118.00 | $4,267.33 | $3,057.94 | $3,630.16 | $2,971.33 | $4,011.13 | $2,639.80 | $3,414.57 | $2,280.15 | $2,406.75 | $2,500.80 |

| 97501 | $3,117.54 | $4,398.15 | $3,243.47 | $3,166.75 | $2,885.47 | $4,009.11 | $3,071.06 | $3,110.86 | $2,578.60 | $2,524.58 | $2,187.34 |

| 97408 | $3,114.96 | $4,021.92 | $3,166.56 | $3,281.94 | $2,627.51 | $4,086.13 | $2,948.50 | $3,164.17 | $2,732.59 | $2,536.92 | $2,583.38 |

| 97920 | $3,113.77 | $4,727.79 | $3,112.56 | $3,247.29 | $2,971.33 | $3,861.27 | $2,771.12 | $3,244.44 | $2,280.15 | $2,551.92 | $2,369.88 |

| 97843 | $3,110.27 | $4,267.33 | $3,057.94 | $3,385.41 | $3,035.54 | $3,940.36 | $2,771.12 | $3,293.62 | $2,373.56 | $2,437.40 | $2,540.44 |

| 97825 | $3,106.94 | $4,267.33 | $3,057.94 | $3,142.31 | $3,148.73 | $4,036.31 | $2,771.12 | $3,485.42 | $2,280.15 | $2,510.23 | $2,369.88 |

| 97496 | $3,106.90 | $4,281.81 | $3,243.47 | $3,139.42 | $2,799.46 | $4,009.19 | $2,994.63 | $3,297.09 | $2,309.23 | $2,543.82 | $2,450.88 |

| 97495 | $3,106.81 | $4,281.81 | $3,243.47 | $3,289.39 | $2,799.46 | $3,951.57 | $2,994.63 | $3,315.69 | $2,345.81 | $2,482.72 | $2,363.60 |

| 97416 | $3,104.56 | $3,964.70 | $3,243.47 | $3,297.27 | $2,799.46 | $3,943.52 | $3,000.29 | $3,384.92 | $2,345.81 | $2,565.58 | $2,500.61 |

| 97403 | $3,104.01 | $3,922.37 | $3,087.22 | $3,413.10 | $3,084.25 | $4,087.08 | $2,732.66 | $3,234.51 | $2,469.07 | $2,543.20 | $2,466.68 |

| 97813 | $3,100.88 | $4,267.33 | $3,057.94 | $3,442.08 | $2,971.33 | $3,864.96 | $2,639.80 | $3,473.59 | $2,444.29 | $2,462.81 | $2,384.65 |

| 97701 | $3,099.05 | $4,076.48 | $3,243.47 | $3,209.32 | $2,979.07 | $4,016.66 | $2,848.64 | $3,298.03 | $2,471.86 | $2,595.32 | $2,251.64 |

| 97537 | $3,098.17 | $4,381.45 | $3,243.47 | $3,057.77 | $3,002.90 | $4,007.95 | $2,929.38 | $3,288.85 | $2,310.01 | $2,486.37 | $2,273.57 |

| 97424 | $3,097.69 | $4,241.46 | $3,261.57 | $3,260.59 | $3,063.77 | $3,869.87 | $2,948.50 | $3,162.00 | $2,344.35 | $2,341.16 | $2,483.62 |

| 97703 | $3,096.62 | $3,953.28 | $3,243.47 | $3,209.32 | $2,979.07 | $4,054.09 | $2,848.64 | $3,206.49 | $2,530.21 | $2,538.29 | $2,403.32 |

| 97752 | $3,094.87 | $4,267.33 | $3,057.94 | $3,184.54 | $3,086.37 | $3,856.26 | $2,771.12 | $3,206.17 | $2,395.23 | $2,583.34 | $2,540.44 |

| 97470 | $3,093.39 | $4,384.65 | $3,243.47 | $3,139.42 | $2,892.00 | $3,952.36 | $2,994.63 | $3,196.44 | $2,258.70 | $2,508.62 | $2,363.60 |

| 97430 | $3,093.10 | $3,122.69 | $3,243.47 | $3,489.91 | $3,002.95 | $4,125.63 | $2,948.50 | $3,254.72 | $2,345.81 | $2,768.68 | $2,628.63 |

| 97526 | $3,091.58 | $4,273.66 | $3,243.47 | $3,312.81 | $2,889.91 | $3,929.19 | $2,904.70 | $3,289.27 | $2,241.75 | $2,557.44 | $2,273.57 |

| 97532 | $3,089.37 | $4,179.49 | $3,243.47 | $3,126.05 | $3,163.95 | $3,831.35 | $2,904.70 | $3,320.03 | $2,288.65 | $2,568.70 | $2,267.30 |

| 97837 | $3,088.23 | $4,267.33 | $3,057.94 | $3,290.99 | $2,971.33 | $3,874.82 | $2,771.12 | $3,610.33 | $2,280.15 | $2,295.43 | $2,462.90 |

| 97886 | $3,087.80 | $4,267.33 | $3,057.94 | $3,476.54 | $2,971.33 | $3,664.25 | $2,639.80 | $3,455.62 | $2,481.27 | $2,479.26 | $2,384.65 |

| 97826 | $3,087.19 | $4,267.33 | $3,057.94 | $3,548.11 | $2,964.31 | $3,738.08 | $2,771.12 | $3,192.44 | $2,399.02 | $2,408.39 | $2,525.16 |

| 97439 | $3,086.34 | $3,883.39 | $3,243.47 | $3,217.14 | $3,002.95 | $3,932.43 | $3,064.84 | $3,206.72 | $2,329.63 | $2,482.26 | $2,500.61 |

| 97462 | $3,086.05 | $4,059.21 | $3,243.47 | $3,107.40 | $2,942.52 | $4,058.28 | $2,994.63 | $3,452.90 | $2,249.90 | $2,388.56 | $2,363.60 |

| 97527 | $3,085.99 | $4,253.40 | $3,243.47 | $3,225.41 | $2,956.02 | $3,966.22 | $2,904.70 | $3,267.31 | $2,218.52 | $2,563.88 | $2,261.03 |

| 97401 | $3,083.63 | $3,922.37 | $3,166.56 | $3,551.03 | $2,627.51 | $4,108.13 | $2,732.66 | $3,121.99 | $2,558.62 | $2,503.31 | $2,544.08 |

| 97862 | $3,080.50 | $4,267.33 | $3,057.94 | $3,386.65 | $2,971.33 | $3,693.54 | $2,639.80 | $3,379.33 | $2,549.59 | $2,474.89 | $2,384.65 |

| 97502 | $3,079.63 | $4,137.74 | $3,243.47 | $3,166.75 | $2,761.07 | $4,113.08 | $3,071.06 | $3,080.48 | $2,463.72 | $2,404.83 | $2,354.13 |

| 97499 | $3,078.68 | $4,059.21 | $3,193.92 | $3,185.62 | $3,077.85 | $3,854.73 | $2,994.63 | $3,384.27 | $2,239.96 | $2,296.00 | $2,500.61 |

| 97904 | $3,078.65 | $4,727.79 | $3,057.94 | $3,222.44 | $3,042.57 | $3,829.55 | $2,771.12 | $3,236.82 | $2,280.15 | $2,248.29 | $2,369.88 |

| 97835 | $3,077.80 | $4,267.33 | $3,112.56 | $3,490.78 | $2,971.33 | $3,802.68 | $2,639.80 | $3,362.27 | $2,280.15 | $2,466.50 | $2,384.65 |

| 97333 | $3,077.41 | $3,856.80 | $3,221.11 | $3,500.61 | $2,832.43 | $3,934.07 | $3,033.91 | $3,145.57 | $2,301.38 | $2,591.82 | $2,356.41 |

| 97828 | $3,077.15 | $4,267.33 | $3,057.94 | $3,199.00 | $2,971.33 | $4,027.53 | $2,639.80 | $3,214.50 | $2,471.03 | $2,422.26 | $2,500.80 |

| 97906 | $3,075.59 | $4,267.33 | $3,112.56 | $3,443.97 | $3,042.57 | $3,861.27 | $2,771.12 | $3,183.71 | $2,280.15 | $2,485.77 | $2,307.45 |

| 97875 | $3,073.79 | $4,267.33 | $3,057.94 | $3,490.78 | $2,964.31 | $3,738.08 | $2,639.80 | $3,205.66 | $2,443.92 | $2,404.96 | $2,525.16 |

| 97840 | $3,072.47 | $4,267.33 | $3,057.94 | $3,342.34 | $2,971.33 | $3,884.16 | $2,639.80 | $3,376.85 | $2,280.15 | $2,441.94 | $2,462.90 |

| 97907 | $3,071.82 | $4,267.33 | $3,057.94 | $3,582.95 | $2,971.33 | $3,848.77 | $2,639.80 | $3,174.22 | $2,228.98 | $2,483.95 | $2,462.90 |

| 97525 | $3,071.76 | $4,381.45 | $3,243.47 | $3,225.41 | $2,761.07 | $3,959.84 | $2,929.38 | $3,097.95 | $2,353.14 | $2,492.30 | $2,273.57 |

| 97435 | $3,069.31 | $4,059.21 | $3,193.92 | $3,363.57 | $2,945.62 | $3,776.33 | $2,994.63 | $3,227.19 | $2,315.86 | $2,316.21 | $2,500.61 |

| 97846 | $3,069.20 | $4,267.33 | $3,057.94 | $3,224.28 | $2,971.33 | $3,914.08 | $2,639.80 | $3,286.83 | $2,386.44 | $2,443.18 | $2,500.80 |

| 97868 | $3,067.78 | $4,267.33 | $3,057.94 | $3,261.39 | $2,971.33 | $3,648.13 | $2,771.12 | $3,494.89 | $2,223.47 | $2,457.05 | $2,525.16 |

| 97732 | $3,067.50 | $4,727.79 | $3,057.94 | $3,085.29 | $3,042.57 | $3,843.50 | $2,771.12 | $3,154.72 | $2,280.15 | $2,342.01 | $2,369.88 |

| 97810 | $3,067.44 | $4,267.33 | $3,057.94 | $3,361.38 | $2,971.33 | $3,864.96 | $2,639.80 | $3,401.82 | $2,252.80 | $2,472.42 | $2,384.65 |

| 97471 | $3,066.63 | $3,994.96 | $3,243.47 | $3,139.42 | $2,735.56 | $3,973.19 | $2,994.63 | $3,293.21 | $2,304.80 | $2,486.41 | $2,500.61 |

| 97817 | $3,066.33 | $4,267.33 | $3,057.94 | $3,222.44 | $2,971.33 | $3,969.23 | $2,771.12 | $3,219.85 | $2,280.15 | $2,441.03 | $2,462.90 |

| 97865 | $3,065.35 | $4,267.33 | $3,057.94 | $3,142.31 | $3,042.57 | $3,741.91 | $2,771.12 | $3,515.77 | $2,297.28 | $2,447.43 | $2,369.88 |

| 97838 | $3,064.88 | $4,267.33 | $3,057.94 | $3,472.85 | $2,964.31 | $3,738.08 | $2,639.80 | $3,116.79 | $2,504.11 | $2,362.46 | $2,525.16 |

| 97917 | $3,064.28 | $4,267.33 | $3,057.94 | $3,427.44 | $3,042.57 | $3,819.39 | $2,771.12 | $3,236.82 | $2,280.15 | $2,370.20 | $2,369.88 |

| 97908 | $3,064.09 | $4,267.33 | $3,057.94 | $3,302.68 | $2,971.33 | $3,817.28 | $2,771.12 | $3,289.82 | $2,280.15 | $2,513.35 | $2,369.88 |

| 97885 | $3,063.55 | $4,267.33 | $3,057.94 | $3,354.70 | $2,971.33 | $3,675.22 | $2,639.80 | $3,360.63 | $2,332.06 | $2,475.65 | $2,500.80 |

| 97901 | $3,063.22 | $4,267.33 | $3,057.94 | $3,450.80 | $2,971.33 | $3,683.98 | $2,771.12 | $3,111.60 | $2,280.15 | $2,730.48 | $2,307.45 |

| 97426 | $3,060.79 | $4,241.46 | $3,166.56 | $3,339.27 | $2,568.78 | $3,943.08 | $2,948.50 | $3,126.56 | $2,319.45 | $2,470.65 | $2,483.62 |

| 97330 | $3,058.98 | $4,441.33 | $2,976.49 | $3,463.72 | $2,631.83 | $3,931.44 | $2,772.75 | $2,981.54 | $2,430.30 | $2,604.01 | $2,356.41 |

| 97884 | $3,057.49 | $4,267.33 | $3,057.94 | $3,378.48 | $2,971.33 | $3,817.28 | $2,771.12 | $3,304.11 | $2,280.15 | $2,264.24 | $2,462.90 |

| 97857 | $3,057.35 | $4,267.33 | $3,057.94 | $3,316.27 | $2,971.33 | $3,697.21 | $2,639.80 | $3,342.87 | $2,280.15 | $2,499.76 | $2,500.80 |

| 97844 | $3,056.74 | $4,267.33 | $3,057.94 | $3,385.41 | $2,964.31 | $3,916.55 | $2,639.80 | $3,177.15 | $2,414.28 | $2,357.81 | $2,386.79 |

| 97869 | $3,055.16 | $4,267.33 | $3,057.94 | $3,268.67 | $2,971.33 | $3,969.23 | $2,771.12 | $3,195.00 | $2,269.07 | $2,412.08 | $2,369.88 |

| 97903 | $3,054.87 | $4,267.33 | $3,057.94 | $3,306.01 | $2,971.33 | $3,861.27 | $2,771.12 | $3,193.01 | $2,280.15 | $2,470.65 | $2,369.88 |

| 97882 | $3,053.74 | $3,890.50 | $3,112.56 | $3,498.11 | $2,964.31 | $3,807.40 | $2,639.80 | $3,283.28 | $2,504.11 | $2,450.57 | $2,386.79 |

| 97845 | $3,050.46 | $4,267.33 | $3,112.56 | $3,268.67 | $2,971.33 | $3,671.23 | $2,771.12 | $3,394.48 | $2,269.07 | $2,408.98 | $2,369.88 |

| 97720 | $3,047.48 | $4,727.79 | $3,057.94 | $3,104.42 | $3,042.57 | $3,851.55 | $2,771.12 | $3,116.02 | $2,196.29 | $2,237.17 | $2,369.88 |

| 97909 | $3,047.01 | $4,267.33 | $3,057.94 | $3,400.73 | $2,971.33 | $3,720.33 | $2,771.12 | $3,223.08 | $2,280.15 | $2,470.65 | $2,307.45 |

| 97834 | $3,046.41 | $4,267.33 | $3,057.94 | $3,224.28 | $2,971.33 | $3,890.44 | $2,639.80 | $3,272.75 | $2,380.44 | $2,296.88 | $2,462.90 |

| 97479 | $3,044.45 | $3,933.63 | $3,243.47 | $3,040.18 | $2,907.91 | $3,946.48 | $2,994.63 | $3,351.82 | $2,219.39 | $2,443.38 | $2,363.60 |

| 97827 | $3,044.26 | $4,267.33 | $3,057.94 | $3,469.79 | $2,971.33 | $3,689.90 | $2,639.80 | $3,392.00 | $2,146.14 | $2,307.56 | $2,500.80 |

| 97818 | $3,043.38 | $4,267.33 | $3,057.94 | $3,330.57 | $2,964.31 | $3,848.36 | $2,639.80 | $3,071.02 | $2,327.10 | $2,386.93 | $2,540.44 |

| 97738 | $3,041.62 | $4,727.79 | $3,057.94 | $3,104.42 | $3,042.57 | $3,748.20 | $2,771.12 | $3,150.98 | $2,191.69 | $2,251.62 | $2,369.88 |

| 97754 | $3,041.45 | $3,589.44 | $3,193.92 | $3,163.37 | $3,090.03 | $3,688.59 | $2,723.56 | $3,374.71 | $2,332.45 | $2,718.00 | $2,540.44 |

| 97905 | $3,040.55 | $4,267.33 | $3,057.94 | $3,438.23 | $2,971.33 | $3,848.77 | $2,639.80 | $3,174.22 | $2,280.15 | $2,264.88 | $2,462.90 |

| 97877 | $3,038.46 | $4,267.33 | $3,112.56 | $3,142.31 | $2,971.33 | $3,900.47 | $2,771.12 | $3,182.38 | $2,280.15 | $2,294.11 | $2,462.90 |

| 97833 | $3,036.74 | $4,267.33 | $3,057.94 | $3,516.44 | $2,964.31 | $3,773.47 | $2,771.12 | $3,123.43 | $2,224.38 | $2,206.06 | $2,462.90 |

| 97870 | $3,033.13 | $4,267.33 | $3,057.94 | $3,199.00 | $2,971.33 | $3,884.16 | $2,639.80 | $3,219.90 | $2,310.69 | $2,318.29 | $2,462.90 |

| 97880 | $3,030.50 | $4,267.33 | $3,057.94 | $3,236.12 | $2,971.33 | $3,648.13 | $2,771.12 | $3,312.94 | $2,280.15 | $2,234.80 | $2,525.16 |

| 97819 | $3,030.22 | $4,267.33 | $3,057.94 | $3,203.32 | $2,971.33 | $3,874.82 | $2,771.12 | $3,135.24 | $2,280.15 | $2,278.06 | $2,462.90 |

| 97876 | $3,029.90 | $4,267.33 | $3,112.56 | $3,442.12 | $2,971.33 | $3,667.90 | $2,639.80 | $3,322.86 | $2,146.14 | $2,228.17 | $2,500.80 |

| 97820 | $3,025.33 | $4,267.33 | $3,057.94 | $3,142.31 | $2,971.33 | $3,639.63 | $2,771.12 | $3,371.23 | $2,280.15 | $2,382.36 | $2,369.88 |

| 97841 | $3,025.25 | $4,267.33 | $3,057.94 | $3,442.12 | $2,971.33 | $3,645.90 | $2,639.80 | $3,394.83 | $2,115.80 | $2,216.69 | $2,500.80 |

| 97867 | $3,018.90 | $4,267.33 | $3,057.94 | $3,516.44 | $2,964.31 | $3,748.20 | $2,771.12 | $3,172.71 | $2,187.18 | $2,178.01 | $2,325.80 |

| 97913 | $3,016.37 | $4,267.33 | $3,057.94 | $3,318.77 | $2,971.33 | $3,765.91 | $2,639.80 | $3,132.25 | $2,224.92 | $2,478.03 | $2,307.45 |

| 97859 | $3,015.05 | $4,267.33 | $3,057.94 | $3,411.91 | $2,971.33 | $3,585.86 | $2,639.80 | $3,134.90 | $2,280.15 | $2,276.14 | $2,525.16 |

| 97801 | $3,011.07 | $4,267.33 | $3,057.94 | $3,290.99 | $2,964.31 | $3,563.87 | $2,639.80 | $3,106.19 | $2,229.13 | $2,465.98 | $2,525.16 |

| 97824 | $3,010.45 | $4,267.33 | $3,057.94 | $3,428.94 | $2,964.31 | $3,647.03 | $2,639.80 | $3,269.41 | $2,126.04 | $2,202.86 | $2,500.80 |

| 97918 | $3,009.25 | $4,267.33 | $3,057.94 | $3,275.43 | $2,971.33 | $3,764.81 | $2,639.80 | $3,146.58 | $2,217.80 | $2,444.02 | $2,307.45 |

| 97914 | $3,007.22 | $4,267.33 | $3,057.94 | $3,432.54 | $2,971.33 | $3,758.49 | $2,639.80 | $2,959.98 | $2,238.81 | $2,438.53 | $2,307.45 |

| 97814 | $3,001.96 | $4,267.33 | $3,057.94 | $3,249.54 | $2,971.33 | $3,778.56 | $2,639.80 | $3,026.42 | $2,168.88 | $2,396.87 | $2,462.90 |

| 97883 | $2,977.42 | $4,267.33 | $3,057.94 | $3,290.99 | $2,964.31 | $3,645.90 | $2,639.80 | $3,242.17 | $2,106.65 | $2,233.29 | $2,325.80 |

| 97850 | $2,953.60 | $4,267.33 | $3,057.94 | $3,290.99 | $2,964.31 | $3,689.90 | $2,639.80 | $3,039.05 | $2,090.46 | $2,170.40 | $2,325.80 |

Companies usually charge less in rural settings. Malheur, Oregon, which appears in the top five cheapest ZIP codes, is in the 94 percent range.