Best New Mexico Car Insurance (2025)

New Mexico car insurance laws require all drivers to have a minimum of 25/50/10 to cover bodily injury and property damage. New Mexico car insurance rates average $78 per month while the best car insurance companies in New Mexico are USAA and State Farm. Because USAA is only for the military and their families, State Farm is the cheapest car insurance company in New Mexico for the general public.

Read moreFree Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active life and health insurance licenses in seven states and over 20 years of experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ...

Licensed Agent & Financial Advisor

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- New Mexico minimum car insurance requirements are 25/50/10 for bodily injury and property damage

- New Mexico auto insurance rates average $78 per month

- USAA and State Farm are the cheapest car insurance companies in New Mexico

| NEW MEXICO STATISTICS SUMMARY | DETAILS |

|---|---|

| Road Miles | Total in State: 27,435 million Vehicle Miles Driven: 69,069 million |

| Vehicles | Registered: 1,760,197 Total Stolen: 8,526 |

| Population | 2,095,428 |

| Most Popular Vehicle | Ford F-150 |

| Uninsured Motorists | 20.80% State Rank: 3rd |

| Total Driving Deaths | 2008-2017 Speeding: 1,217 Drunk Driving: 1,090 |

| Average Annual Premiums | Liability: $488 Collision: $276 Comprehensive: $172 |

| Cheapest Providers | USAA and State Farm |

New Mexico is a geographically rich state, encompassing everything from white sand dunes to deep caverns. The state is also firmly rooted in Spanish culture after the Spanish conquered the native Pueblo tribes.

In fact, some of the Pueblo’s original dwellings still stand on the side of New Mexico’s canyons.

If you are considering visiting some of these sites in your vehicle, make sure that you have the proper vehicle insurance first.

We know that researching car insurance can be overwhelming, especially with so many insurers available. If the thought of finding an insurer in New Mexico is already making your head hurt, then this guide is for you.

Our comprehensive guide makes buying car insurance easy. We will cover everything from rates and coverages to insurers’ ratings — and if you are new to New Mexico or need a refresher, we’ve dedicated a section of this guide to must-know driving and safety laws.

Keep reading to learn everything you need to know about driving in New Mexico.

Do you want to search for the best online discounts by company? Try out our free quote tools.

New Mexico Car Insurance Coverage & Rates

Two of the most important factors in picking out an insurer are rates and coverages. But since not everyone has time to get quotes from multiple insurers, we are going to streamline the process of narrowing down companies. (For more information, read our “Best Car Insurance For Drivers Who Go to Mexico“).

This way, you can get a complete overview of companies and decide which providers are the best for you.

Keep reading to learn everything you need to know about New Mexico’s coverage requirements, companies’ rate, and more.

New Mexico Minimum Coverage

New Mexico requires all drivers to have car insurance. According to the Insurance Information Institute (III), drivers need the following coverage amounts:

- $25,000 to cover bodily injury or death of one person

- $50,000 to cover bodily injury or death of more than one person

- $10,000 to cover property damage

All drivers must have these liability coverage amounts. If not, they will face fines and other penalties.

Please note that these liability amounts are the minimum amount. While they provide some protection, they may not completely cover you in an accident.

Because of this, we highly recommend purchasing more coverage than New Mexico’s minimum requirements.

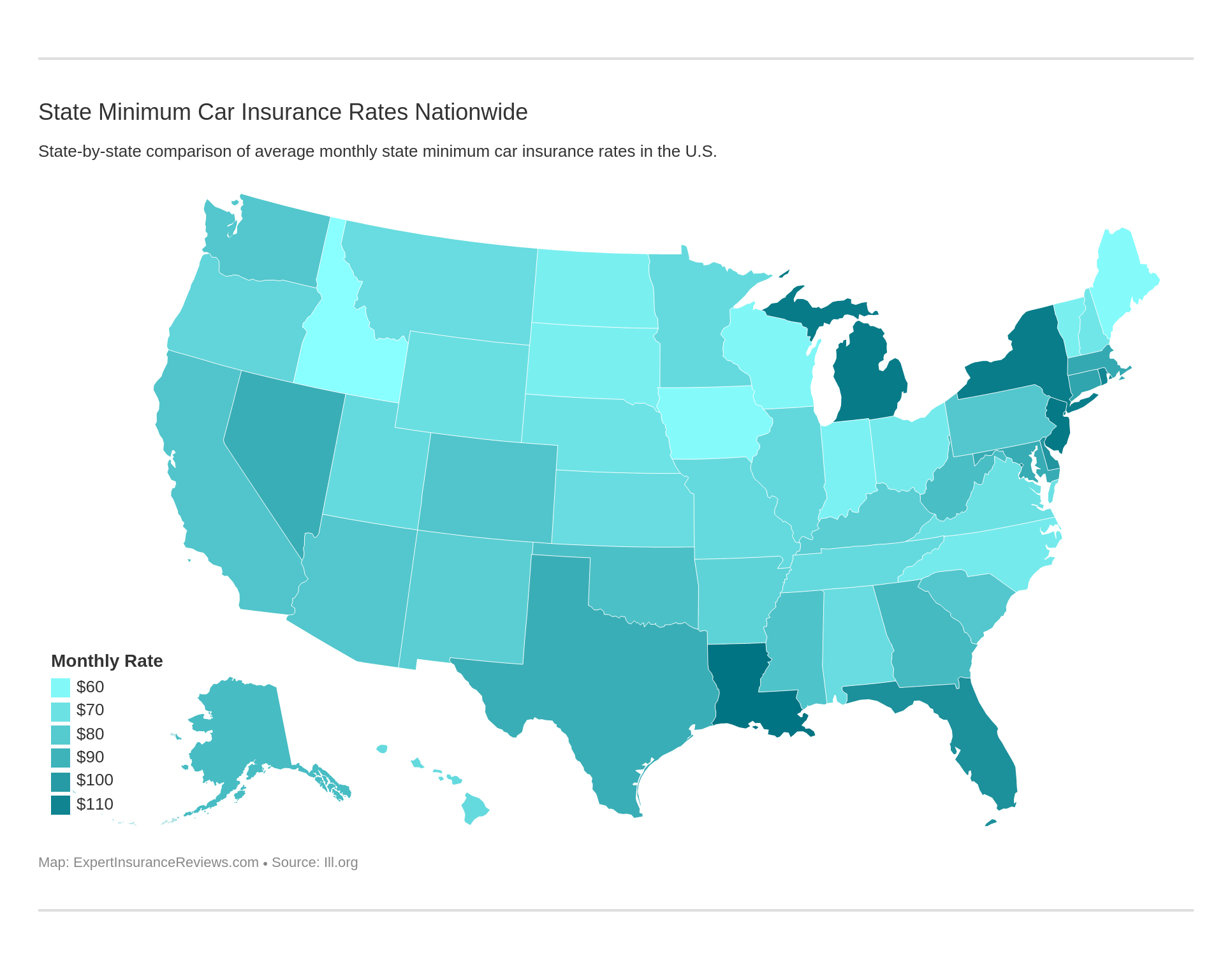

Minimum coverage costs also vary from state to state.

Forms of Financial Responsibility

So how do you prove to the officer that pulled you over that you have car insurance? According to the New Mexico Motor Vehicle Department, the following are acceptable forms of financial responsibility:

- Current insurance ID card

- Copy of current auto insurance policy

- Letter from auto insurance company (must be on company letterhead) verifying insurance coverage

Currently, New Mexico is one of the few remaining states that does not allow drivers to use electronic proof of insurance. So if you’re used to showing an electronic ID on your smartphone, you’ll have to break out a paper copy in New Mexico.

Which brings us to the question, when do you have to show proof of insurance?

- Traffic Stops

- Accidents

- Registering a Vehicle

If you don’t show proof of insurance at these times, you risk losing your right to drive and facing fines. While there is a grace period to provide proof of insurance, it’s easiest to always have proof of insurance at hand all the time.

Otherwise, you’ll have to fill out additional paperwork, which is never fun.

Premiums as a Percentage of Income

While the percentage of income going to car insurance can vary from household to household, we want to take a look at how much the average New Mexico resident is paying each year.

| Particulars | 2012 | 2013 | 2014 |

|---|---|---|---|

| Income | $32,526 | $31,573 | $33,358 |

| Full Coverage Average Premiums | $866 | $889 | $920 |

| Percentage of Income | 2.66% | 2.82% | 2.76% |

While New Mexico’s average per capita disposable income (the amount left to spend after taxes) increased, so did the price of car insurance.

As a result, the percentage of income going to car insurance increased from 2.66 percent in 2012 to 2.76 percent in 2014. This may seem like only a slight increase, but it represents almost $100.

New Mexico’s percentage has been consistently higher than the countrywide average percentage, as well. For example, the countrywide average was 2.40 percent in 2014. This is .36 percent less than New Mexico’s average percentage.

Why is this?

Because while car insurance does cost slightly more countrywide, the countrywide average income is also higher than New Mexico’s average income.

As a result, New Mexico residents have a higher percentage because their incomes are lower.

Want to calculate your percentage of income being spent on car insurance? Use our free calculator below.

CalculatorPro

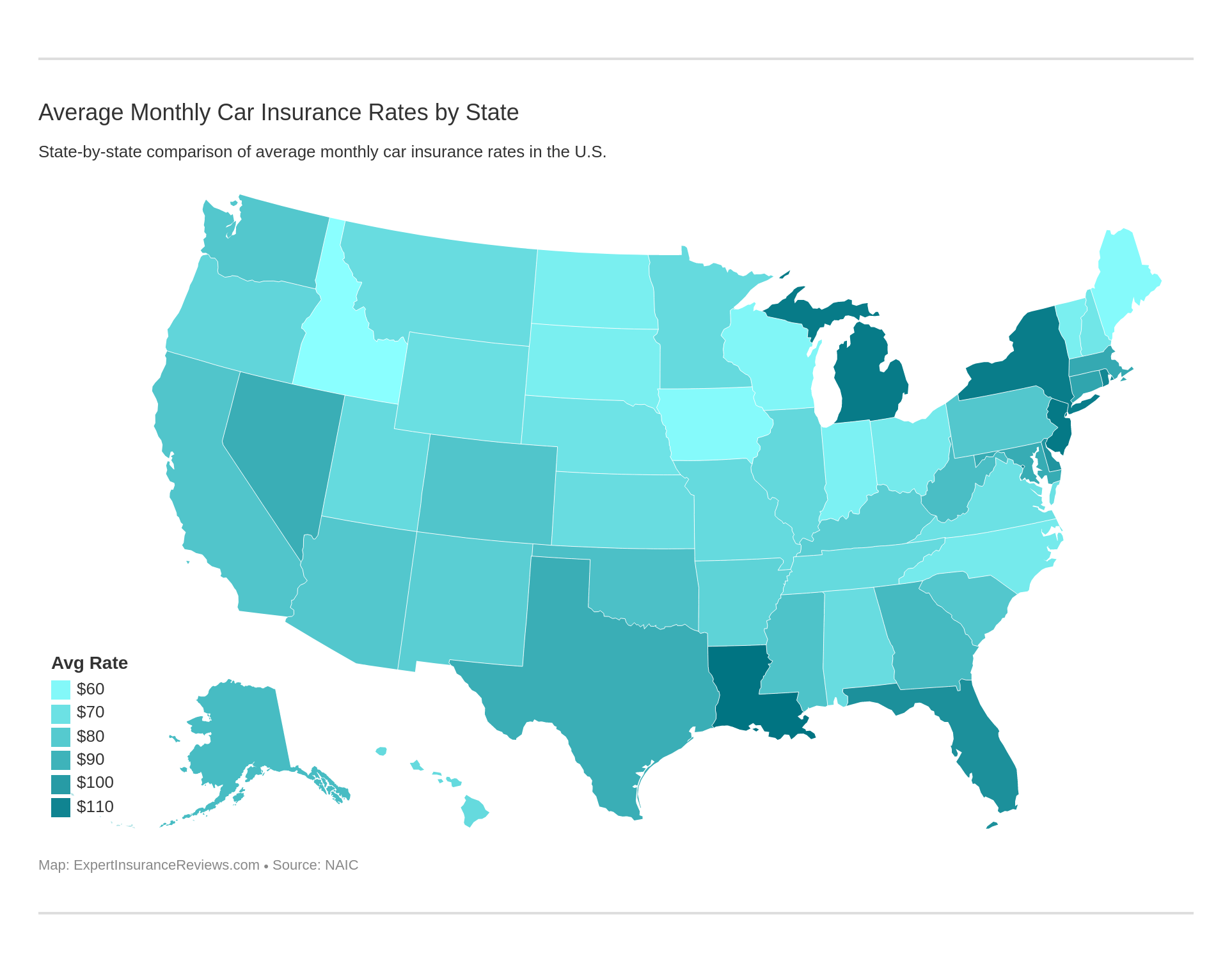

Average Monthly Car Insurance Rates in NM (Liability, Collision, Comprehensive)

We’ve covered what liability car insurance you need, but how much do core coverages cost in New Mexico? Below is the National Association of Insurance Commissioner’s (NAIC) data on New Mexico.

| New Mexico Core Car Insurance Coverage | 2015 Average Annual Premium |

|---|---|

| Liability | $488.03 |

| Collision | $276.98 |

| Comprehensive | $172.57 |

| Full Coverage | $937.59 |

The NAIC based this data on New Mexico’s minimum, which means the costs shown above are the lowest rates. As a result, car insurance will cost more if you purchase more than the state minimum.

Additional Liability

There are a number of coverages that are useful to have. However, it can be frustrating if you purchase coverages and your insurer later refuses a claim.

To see what the likelihood of rejected claims is in New Mexico, we need to look at coverages’ loss ratios, because loss ratios are calculated by comparing the number of written premiums earned to the number of claims paid.

For example, a 67 percent loss ratio means $67 is lost to claims for every $100 earned in premiums. So if a company has a high loss ratio of over 100 percent, they are risking bankruptcy. A company with a low loss ratio risks losing customers by rejecting too many claims.

With this in mind, let’s look at the loss ratios in New Mexico.

| Additional Liability Coverage in New Mexico - Loss Ratios | 2013 | 2014 | 2015 |

|---|---|---|---|

| Medical Pay (Med Pay) | 75.02% | 73.52% | 68.39% |

| Uninsured/Underinsured Motorist Coverage | 74.82% | 73.12% | 66.18% |

Before we discuss the loss ratios, what do these additional coverages do?

- Medpay — Covers medical costs after an accident (both you and your passenger’s medical costs).

- Uninsured/Underinsured — Covers costs if the driver who caused the accident has poor or no insurance.

Uninsured motorist coverage and underinsured motorist coverage are important coverages to have in New Mexico. 20.8 percent of drivers in New Mexico are uninsured, resulting in New Mexico ranking as third in the U.S. for uninsured drivers.

Now that we know what these coverages mean, let’s discuss the loss ratios.

Both Medpay and uninsured/underinsured coverages’ loss ratios look great. While both of their loss ratios have dropped since 2013, neither has dropped below 60 percent.

As long as the loss ratios don’t continue to drop, there will still be a normal rate of claims being paid in New Mexico.

Add-Ons, Endorsements, & Riders

That’s right, there are even more coverages than the ones we’ve already covered. The options below are great to round out a policy.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive Insurance or Usage-Based Car Insurance

Each of these coverages is specialized to your needs, whether you have a classic car that needs insured or want extra liability coverage in case you’re sued.

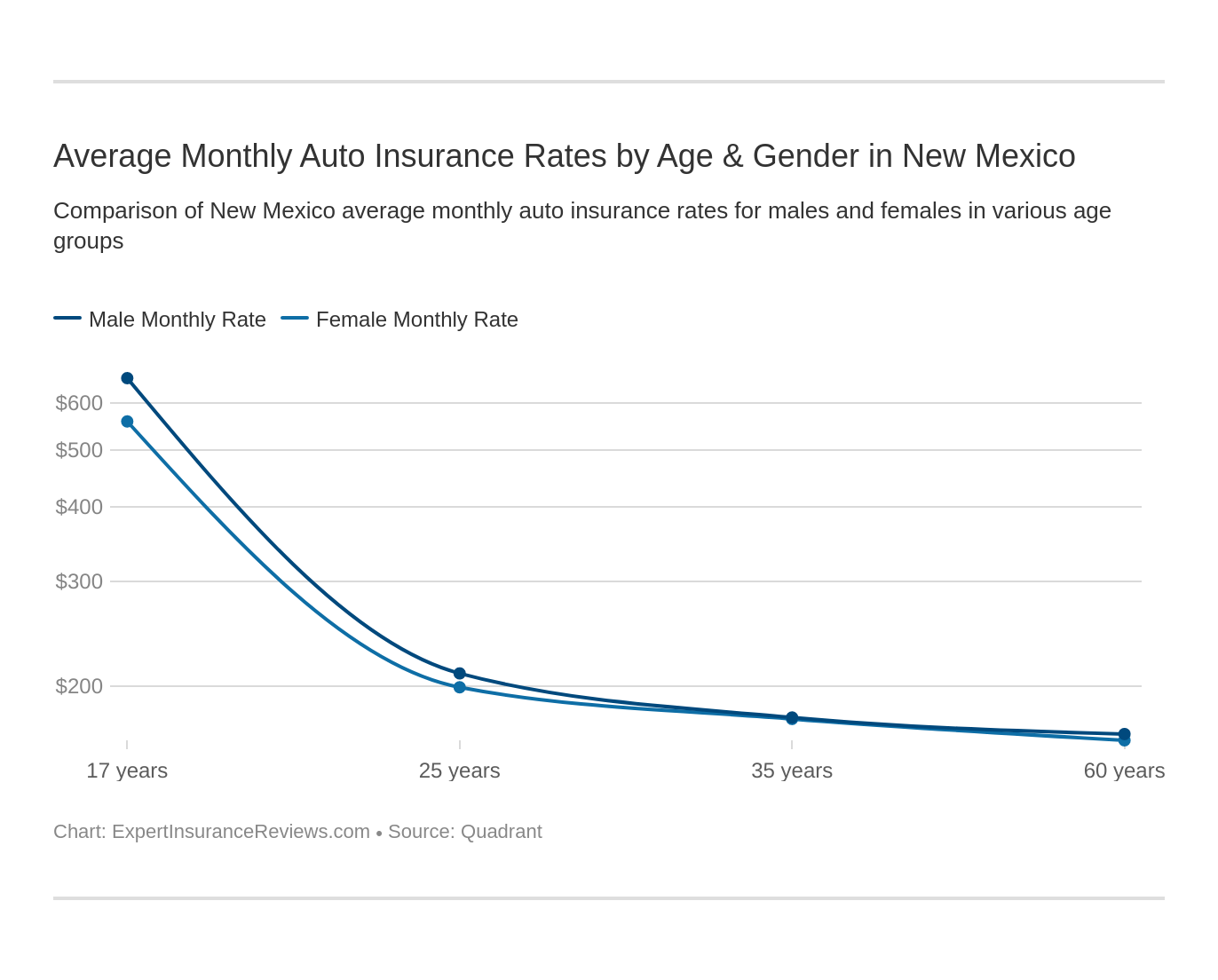

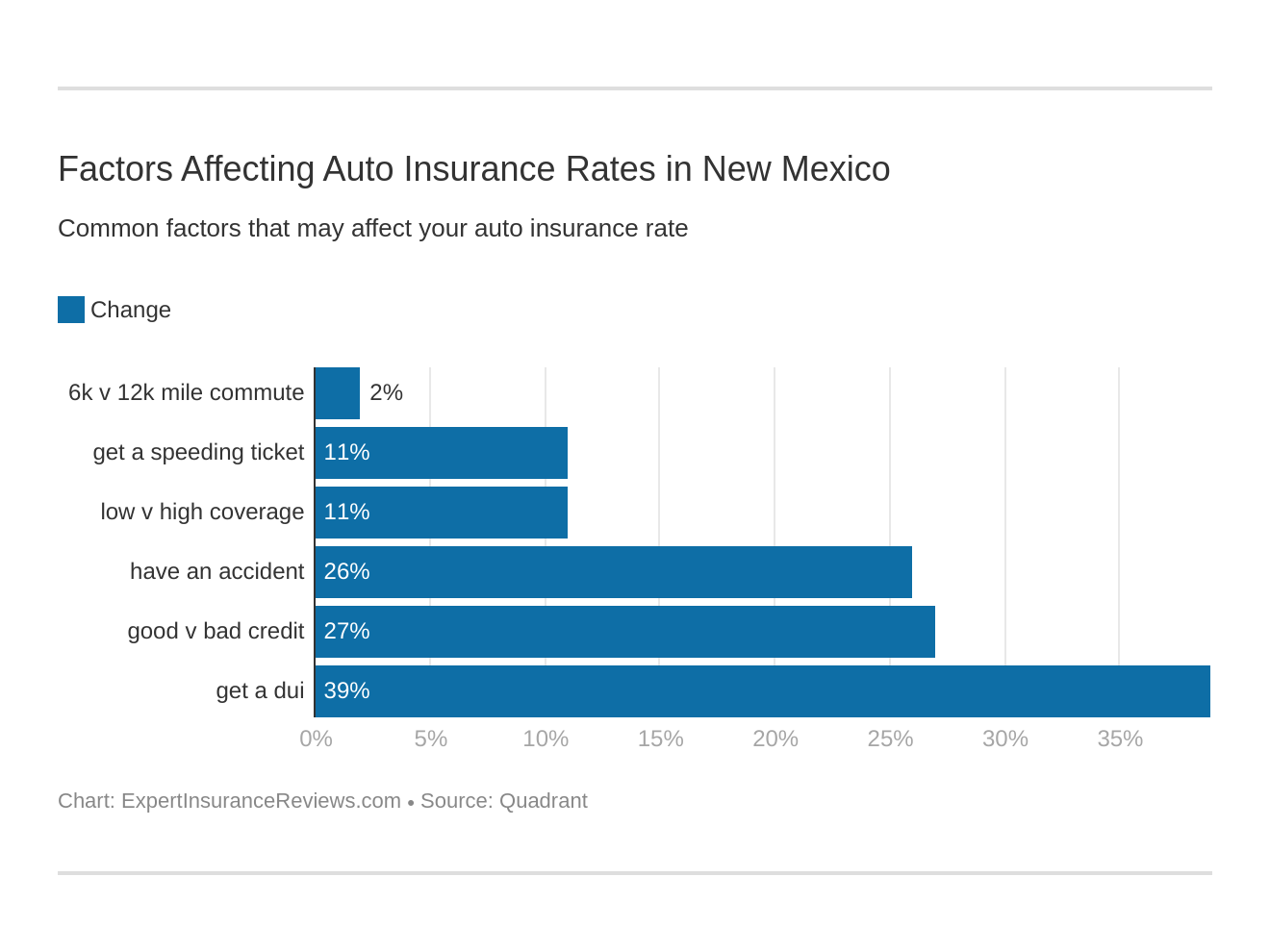

Average Car Insurance Rates by Age & Gender in NM

Now that we’ve gone over what coverages New Mexico requires, we want to see how drivers pay for coverage. We’ve partnered with Quadrant to bring you extensive data on New Mexico’s rates. We will also cover what determines these rates, from gender to driving records.

The first set of data that we want to look at is how demographics (gender and age) impact rates.

While age is a given, gender is a factor that often surprises people.

California, Hawaii, Massachusetts, Montana, Pennsylvania, North Carolina, and parts of Michigan have banned the practice of basing rates on gender.

The practice of basing rates on gender comes from years of collected accident data. Just like teens are more prone to get into accidents than adults, male drivers tend to be more prone to accidents than females.

As a result, the majority of insurers charge male drivers more. The table below shows the price differences between demographics in New Mexico.

| Company | Single 17-year old female annual rates | Single 17-year old male annual rates | Single 25-year old female annual rates | Single 25-year old male annual rates | Married 35-year old female annual rates | Married 35-year old male annual rates | Married 60-year old female annual rates | Married 60-year old male annual rates |

|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $8,382.58 | $9,698.44 | $2,795.93 | $2,965.82 | $2,516.34 | $2,528.61 | $2,298.09 | $2,418.45 |

| Farmers Ins Co Of AZ | $9,750.62 | $10,025.51 | $2,703.37 | $2,790.84 | $2,404.81 | $2,396.01 | $2,152.83 | $2,295.21 |

| Geico General | $7,978.18 | $10,952.99 | $2,924.53 | $2,950.75 | $2,776.17 | $2,853.11 | $2,612.63 | $2,612.63 |

| AMCO Insurance | $5,818.94 | $7,338.72 | $2,714.96 | $2,908.12 | $2,405.85 | $2,446.69 | $2,185.49 | $2,293.80 |

| Progressive Direct | $6,833.07 | $7,700.89 | $2,017.17 | $2,087.52 | $1,666.84 | $1,613.98 | $1,510.13 | $1,515.71 |

| State Farm Mutual Auto | $4,131.10 | $5,189.28 | $1,704.41 | $1,881.32 | $1,523.13 | $1,523.13 | $1,383.93 | $1,383.93 |

| USAA | $3,987.84 | $4,506.45 | $1,891.06 | $2,025.18 | $1,530.57 | $1,520.66 | $1,459.73 | $1,455.56 |

Within some age groups, the price difference is slight. For example, Allstate charges 35-year-old males only $12 more than 35-year-old females.

And this gender price difference does sometimes switch to females paying more. At USAA, 35-year-old females are charged $10 more than 35-year-old males.

However, all the companies charge 17-year-old males considerably more than 17-year-old females. At some of the companies, this price gap is about $1,000.

As males age, though, this drastic price difference will decrease. So if you are a teenage male, make sure to shop around for car insurance. Going on a parent’s insurance policy can also help lower prices.

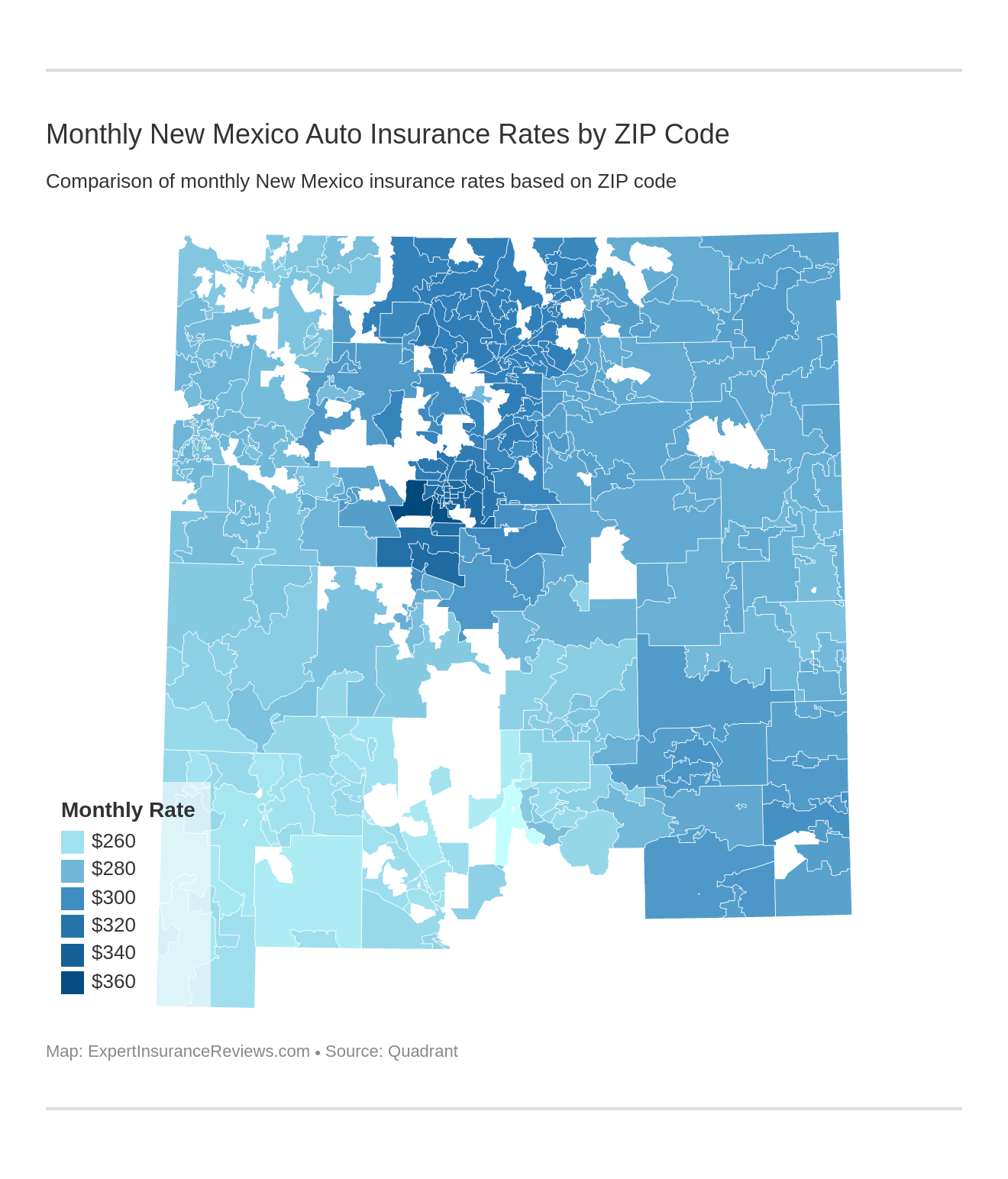

Cheapest Rates by Zip Code

Another demographic that changes insurers’ rates is zip code.

Why?

The main zipcode factors that insurers look at are chances of a crime, chances of a natural disaster, and chances of an accident. So if you live near a road that has multiple crashes every year, you’ll probably pay a little more for car insurance.

From our data, a price difference of over $1,400 exists from the most to least expensive ZIP code. This isn’t bad. In states like New York, the price difference between zip codes can cost drivers thousands of dollars.

Still, $1,400 can ruin a budget. So make sure to check out which provider is the cheapest in your area.

At zip code 88310, for example, the cheapest providers are USAA and State Farm. Picking one of these providers over Geico or Allstate can save drivers over $1,000.

Cheapest Rates by City

Thinking of moving to a new city? You’ll find that your insurance rates either decrease or increase.

The cheapest city (Alamogordo) costs $1,200 less than the most expensive city (Isleta). Once again, this is mild compared to other states’ price differences. Still, over $1,000 is a lot.

Let’s break down the table above to show the top 10 most and least expensive cities to drive in.

| Ten Most Expensive Cities | Average Annual Rates | Ten Least Expensive Cities | Average Annual Rates |

|---|---|---|---|

| ISLETA | $4,154.37 | ANIMAS | $3,091.26 |

| ALBUQUERQUE | $4,046.92 | BENT | $3,085.78 |

| KIRTLAND AFB | $4,013.99 | LA LUZ | $3,082.91 |

| TIJERAS | $4,002.49 | GARFIELD | $3,080.48 |

| CEDAR CREST | $3,979.48 | LORDSBURG | $3,080.42 |

| BELEN | $3,949.58 | SALEM | $3,064.73 |

| BOSQUE FARMS | $3,922.38 | DEMING | $3,064.14 |

| PERALTA | $3,919.14 | TULAROSA | $3,055.37 |

| LOS LUNAS | $3,893.50 | HOLLOMAN AIR FORCE BASE | $2,963.73 |

| SANDIA PARK | $3,888.99 | ALAMOGORDO | $2,948.89 |

The second-most expensive city, Albuquerque, is also the most populated city in New Mexico. Interestingly, none of the other most expensive cities are among New Mexico’s top 10 most populated cities.

For example, Alamogordo is one of the top 10 most populated cities, but it is also the cheapest city in New Mexico.

So in New Mexico, the size of a city and the population don’t seem to affect car insurance prices.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Best New Mexico Car Insurance Companies

Changing car insurance companies can be headache-inducing. But if you save hundreds or even thousands of dollars by switching, it is well worth it.

However, it can be hard to find the perfect insurer for your needs.

That’s why we are going to cover the top companies in New Mexico. So stick with us as we go through companies’ ratings and prices.

The Largest Companies’ Financial Ratings

A.M. Best is a well-known and respected corporation that rates companies’ financial standings. Its ratings look solely at creditworthiness, which determines a company’s ability to fulfill financial obligations.

At car insurance companies, financial obligations include the ability to pay claims.

So let’s take a look at what ratings the top 10 largest companies earned from A.M. Best.

| Insurance Company | AM Best Rating |

|---|---|

| State Farm Group | A++ |

| Geico | A++ |

| Progressive Group | A+ |

| Farmers Insurance Group | A |

| USAA Group | A++ |

| Allstate Insurance Group | A+ |

| Liberty Mutual Group | A |

| Hartford Fire & Casualty Group | A+ |

| Sentry Insurance Group | A+ |

| Iowa Farm Bureau Group | A |

All of the companies have A or higher ratings. This is excellent. It means all the companies have a strong or very strong ability to meet financial obligations to customers and investors.

So if the economy isn’t doing well, there is little chance of any of these companies going under.

Companies with Best Ratings

Financial strength is important, but so is customer satisfaction. J.D. Power is another company that rates companies, although instead of looking at creditworthiness, J.D. Power surveys customers.

Below are the results of J.D. Power’s 2019 study on car insurance companies in the Southwest region.

| Company | Score (out of 1,000) | JD Power Rating (Out of 5) |

|---|---|---|

| USAA (only for military members and their families) | 887 | 5-Among the Best |

| The Hartford | 832 | 5-Among the Best |

| State Farm | 831 | 5-Among the Best |

| Allstate | 826 | 3-About Average |

| American Family | 826 | 3-About Average |

| Southwest Average | 823 | 3-About Average |

| Safeco | 821 | 3-About Average |

| CSAA Insurance Group | 818 | 3-About Average |

| GEICO | 818 | 3-About Average |

| Liberty Mutual | 813 | 3-About Average |

| Farmers | 812 | 3-About Average |

| Progressive | 807 | 2-The Rest |

| Travelers | 789 | 2-The Rest |

| Nationwide | 775 | 2-The Rest |

Only USAA, The Hartford, and State Farm earned above-average ratings. The other companies were rated about average for customer satisfaction.

However, Progressive, Travelers, and Nationwide had low customer satisfaction ratings, placing them at the bottom of the pack.

Companies with Most Complaints in New Mexico

Instead of just focusing on the glowing reviews of companies, we also want to see how many customers are complaining. The National Association of Insurance Commissioners (NAIC) has great data on companies’ complaint ratios.

What is a complaint ratio? It’s the ratio of total complaints to total customers. So even if a company has over a thousand complaints, if that company has over a million customers, the complaint ratio will still be low.

| Insurance Company | Total Complaints | Complaint Ratio |

|---|---|---|

| State Farm Group | 1482 | 0.44 |

| Geico | 2 | 0 |

| Progressive Group | 120 | 0.75 |

| Farmers Insurance Group | 0 | 0 |

| USAA Group | 2 | 0 |

| Allstate Insurance Group | 163 | 0.5 |

| Liberty Mutual Group | 222 | 5.95 |

| Hartford Fire & Casualty Group | 9 | 4.68 |

| Sentry Insurance Group | 1 | 6.53 |

| Iowa Farm Bureau Group | 32 | 0.77 |

State Farm has the most complaints, but its complaint ratio is under 1 percent because it’s such a large company.

On the other hand, Sentry Insurance Group only has one complaint but a complaint ratio of over 6 percent. This is because Sentry Insurance Group is a smaller company, so even just one complaint makes an impact.

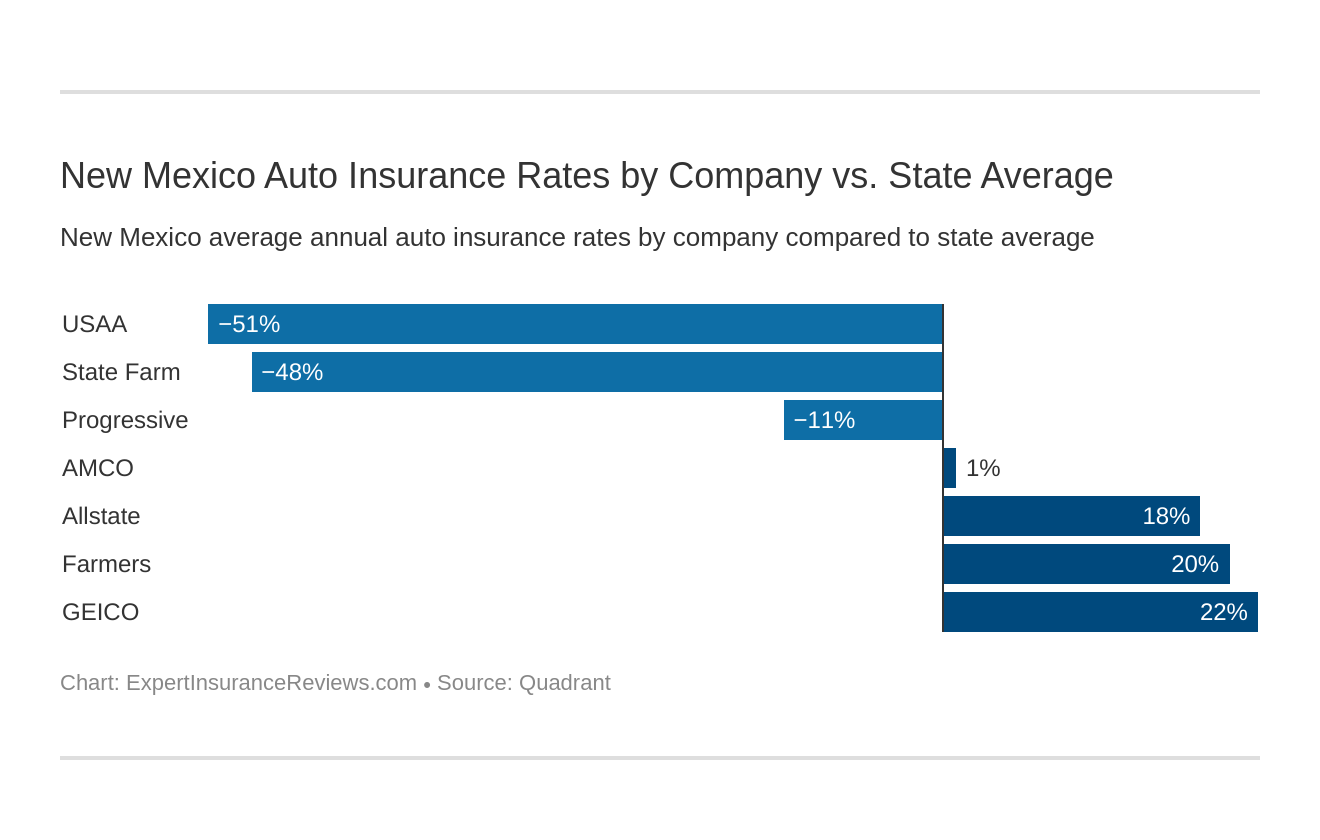

Cheapest Companies in New Mexico

We know that price is just as important as customer satisfaction. A company could have great reviews, but if its price is considerably higher than other companies’ prices, most consumers will choose a different provider.

| Insurance Company | Average Annual Rates | Compared to State Average (+/-) | Compared to State Average (%) |

|---|---|---|---|

| USAA | $2,297.13 | -$1,166.08 | -50.76% |

| State Farm Mutual Auto | $2,340.03 | -$1,123.18 | -48.00% |

| Progressive Direct | $3,118.17 | -$345.04 | -11.07% |

| AMCO Insurance | $3,514.07 | $50.86 | 1.45% |

| Allstate F&C | $4,200.53 | $737.32 | 17.55% |

| Farmers Ins Co Of AZ | $4,314.90 | $851.69 | 19.74% |

| Geico General | $4,457.62 | $994.42 | 22.31% |

USAA is the cheapest provider in New Mexico, but it is limited in what customers it accepts. Because USAA is only for the military and their families, if you are not military, State Farm is the cheapest option.

As for the most expensive option, Geico costs almost $1,000 more than the New Mexico average.

This isn’t always true of Geico (usually it’s below state averages), but this is why it’s important to check providers’ rates when you move to a new state. Otherwise, you may find yourself with a significantly higher bill.

Commute Rates by Companies

Not all companies charge customers more for a longer commute, but those who do tack on about $100 more.

| Insurance Company | 10 Miles Commute/ 6,000 Annual Mileage | 25 Miles Commute/ 12,000 Annual Mileage |

|---|---|---|

| Allstate | $4,200.53 | $4,200.53 |

| Farmers | $4,314.90 | $4,314.90 |

| Geico | $4,389.62 | $4,525.62 |

| Nationwide | $3,514.07 | $3,514.07 |

| Progressive | $3,118.17 | $3,118.17 |

| State Farm | $2,281.70 | $2,398.36 |

| USAA | $2,228.48 | $2,365.79 |

Out of the companies that charge more for an annual commute of 12,000 miles, USAA charges the most (an extra $137). Geico is close behind, charging $136 for a longer commute.

However, although companies may charge for a longer commute, the resulting rate may still be lower than those who don’t charge.

So make sure to still look at the overall rates at a company.

Coverage Level Rates by Companies

Shopping around for an economically priced provider is important. Otherwise, you may not be able to afford a high coverage policy, which is crucial in an accident.

Often, low and medium coverages result in customers having to pay the remaining balance themselves because their insurer doesn’t completely cover accident costs. With this in mind, let’s look at the coverage level rates of New Mexican companies.

| Insurance Company | Annual Rates with Low Coverage | Annual Rates with Medium Coverage | Annual Rates with High Coverage |

|---|---|---|---|

| Allstate | $4,018.38 | $4,192.35 | $4,390.87 |

| Farmers | $3,936.11 | $4,275.73 | $4,732.85 |

| Geico | $4,155.59 | $4,446.29 | $4,771.00 |

| Nationwide | $3,462.26 | $3,479.90 | $3,600.05 |

| Progressive | $2,975.51 | $3,117.04 | $3,261.94 |

| State Farm | $2,132.39 | $2,347.45 | $2,540.25 |

| USAA | $2,135.39 | $2,307.89 | $2,448.12 |

In New Mexico, the price increases from low to high coverage are fairly economical.

The most expensive company to upgrade coverage at is Farmers, where it costs $796 to upgrade from low to high coverage. This means that it costs $66 a month to upgrade. This isn’t terrible, and other companies are even lower in price.

At State Farm, for example, it costs $408 a year (or $34 a month) to go from low to high coverage.

To make sure you’re getting the best deal possible, check yearly price increases and the overall prices of multiple companies.

Credit History Rates by Companies

According to Experian’s report, the average credit score in New Mexico is 659. Unfortunately, this is lower than the U.S. average credit score of 675.

So if drivers’ credit scores are lower than New Mexico’s average, they will probably have to pay rates for poor or fair credit.

And as the table below shows, increased rates for credit scores are serious.

| Insurance Company | Annual Rates with Good Credit | Annual Rates with Fair Credit | Annual Rates with Poor Credit |

|---|---|---|---|

| Allstate | $3,685.79 | $4,028.34 | $4,887.46 |

| Farmers | $3,896.67 | $4,097.94 | $4,950.09 |

| Geico | $4,023.99 | $4,349.78 | $4,999.10 |

| Nationwide | $2,899.82 | $3,341.72 | $4,300.68 |

| Progressive | $2,884.38 | $3,049.36 | $3,420.75 |

| State Farm | $1,626.91 | $2,056.00 | $3,337.18 |

| USAA | $1,864.88 | $2,151.55 | $2,874.97 |

Generally, going from good to poor credit will cost drivers at least $1,000. However, some companies charge less. At Progressive, for example, good to poor credit costs $536. The resulting amount is also cheaper than other companies’ totals.

Driving Record Rates by Companies

If you’ve ever caused an accident, you are familiar with the monetary impact your driving record has on your premium. However, not all companies penalize drivers the same.

Below are the rate increases for DUIs, accidents, and speeding violations.

| Insurance Company | Clean record | With 1 speeding violation | With 1 accident | With 1 DUI |

|---|---|---|---|---|

| Allstate | $3,463.66 | $3,898.80 | $4,561.80 | $4,877.87 |

| Farmers | $3,646.60 | $4,334.25 | $4,694.44 | $4,584.30 |

| Geico | $2,631.09 | $2,631.09 | $4,217.02 | $8,351.31 |

| Nationwide | $2,625.87 | $2,975.73 | $3,688.87 | $4,765.82 |

| Progressive | $2,696.21 | $3,184.99 | $3,686.49 | $2,904.96 |

| State Farm | $2,197.36 | $2,387.59 | $2,387.59 | $2,387.59 |

| USAA | $1,706.19 | $1,987.15 | $2,372.97 | $3,122.21 |

The table above shows how important it is to pick a provider based on your driving record. For example, while most companies charge the most for a record with a DUI, Progressive charges more for speeding and accidents.

State Farm charges the same for all offenses. So picking a provider with the lowest rate for your offense can help lower your costs.

We also want to mention that some providers have accident forgiveness programs, where a driver’s first accident with a company won’t raise rates. Usually, drivers will either need to pay a monthly premium to join the program or be accident-free at the company for a certain amount of time.

These programs are well worth it, though, as they save money in the long run.

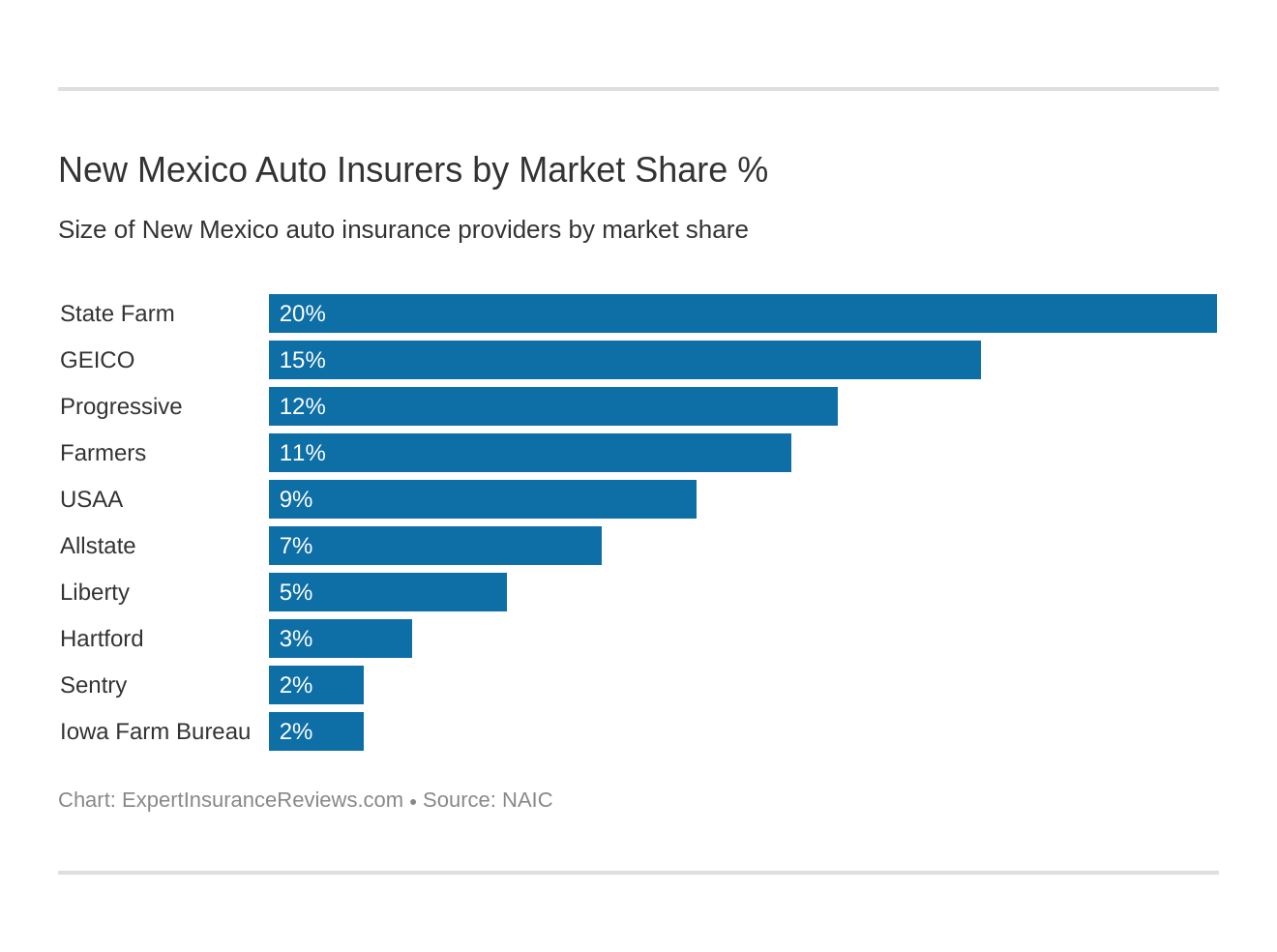

Largest Car Insurance Companies in New Mexico

Now that we’ve covered rates, let’s take a look at who dominates the insurance market in New Mexico.

| Insurance Company | Direct Written Premiums | Loss Ratio | Market Share |

|---|---|---|---|

| State Farm Group | $277,878 | 58.73% | 20.04% |

| Geico | $207,105 | 86.73% | 14.94% |

| Progressive Group | $160,619 | 61.50% | 11.58% |

| Farmers Insurance Group | $155,049 | 60.51% | 11.18% |

| USAA Group | $127,970 | 76.06% | 9.23% |

| Allstate Insurance Group | $97,610 | 51.94% | 7.04% |

| Liberty Mutual Group | $69,048 | 60.23% | 4.98% |

| Hartford Fire & Casualty Group | $41,760 | 77.10% | 3.01% |

| Sentry Insurance Group | $32,713 | 54.68% | 2.36% |

| Iowa Farm Bureau Group | $30,209 | 68.10% | 2.18% |

State Farm holds the largest market share, which makes sense (State Farm is one of the largest providers nationwide).

If you also take a look at the loss ratios, you’ll notice that all of them are above 50 percent and below 100 percent.

These steady loss ratios are probably part of the reason these insurers have claimed their spots as the largest insurance companies. Remember, too low a loss ratio means a company isn’t paying claims, and too high a loss ratio means a company is probably going to go bankrupt.

Number of Insurers in New Mexico

While the top 10 insurers we just discussed have taken over the market, there are many more insurers in New Mexico.

| Type of Insurer | Number |

|---|---|

| Domestic | 15 |

| Foreign | 837 |

There are a total of 852 insurers in New Mexico, so there are plenty to choose from. You may be wondering, though, why there are only 15 domestic providers.

Domestic providers are in-state, local providers. Because the majority of insurers sell in multiple states, there are always fewer domestic than foreign providers.

New Mexico State Laws

Do you know all your state’s important laws? Unless you’re a lawyer, you probably don’t. However, there are some laws you should familiarize yourself with to avoid tickets and other repercussions.

We know state laws can be confusing, which is why we are going to break them down for you.

So keep reading to learn about everything from vehicle insurance laws to important rules of the road.

New Mexico Car Insurance Laws

The first set of laws we want to cover are New Mexico car insurance laws. It’s important to understand New Mexico’s requirements, as driving without insurance is risky.

That’s we are going to cover everything from how state laws are determined to automobile insurance fraud. Let’s jump right in.

How New Mexico State Laws for Insurance are Determined

Do you know the process behind how a state determines rates? According to the NAIC, in New Mexico, insurers have to file rates with the New Mexico government.

Why?

The state authorities require insurers to file rates before use to make sure rates stick to a reasonable level. Otherwise, insurers could all inflate their rates and overcharge customers.

Windshield Coverage

In New Mexico, drivers can’t have windshields that make driving unsafe. What does this mean? If a windshield has a crack or chip obstructing the view of the road, it is unsafe. (For more information, read our “Does my car insurance cover damage to my windshield?“).

While there aren’t specific regulations on what size of crack or chip is illegal, it’s still important to fix your windshield if it’s impairing your vision.

However, there isn’t a New Mexico law that requires insurers to replace or repair windshields.

Unless you have comprehensive coverage, this means that you’ll be paying out of pocket for a windshield repair. If your insurer does cover windshield replacements, though, New Mexico allows insurers to use aftermarket parts.

These aftermarket parts must be of like quality and kind to the original part on your car.

High-Risk Insurance

What makes a driver high-risk?

While it could be because of accidents, DUIs, and tickets, a lapse of insurance can also result in a high-risk label. Another reason why it’s so important to obey the law and always have insurance on your vehicle.

In New Mexico, insurers can either charge customers more or reject customers who have high-risk labels. The result? If drivers can’t find an insurer willing to insurer them, they will have to turn to New Mexico’s Automobile Insurance Plan.

This is the last resort, as you have to have proof you’ve been rejected by other insurers (you must also have a New Mexico driver license and a New Mexico registered vehicle). Once you’ve applied to the program and are accepted, though, insurers have to accept customers under the program.

Rates through this program will be high. High-risk drivers will have to pay higher premiums for a while until they are no longer deemed high-risk.

Low-Cost Insurance

The bad news is that New Mexico doesn’t have a government-sponsored program to help low-income drivers. However, the good news is that you can still keep rates low through the following tips:

- Shop around at insurers

- Keep a clean driving record

- Take advantage of discounts

Doing these things can help lower costs. For example, many insurers offer discounts for safe driving habits or taking driving courses. Ask your provider what you can do to lower your rates.

While switching a provider can lower rates, try working with your current provider first to see what they can do to cut costs.

Automobile Insurance Fraud in New Mexico

Filing false claims is common, as people are attracted to the idea of quick and easy money (just like winning a lottery).

However, this practice is also illegal.

According to the Insurance Information Institute (III), “auto insurance fraud and claim buildup added between $4.8 billion and $6.8 billion to closed auto injury claim payments in 2007.”

When insurers lose money to fraud, it impacts all customers. Insurers will have to raise rates or risk going bankrupt. So if you thought fraud doesn’t directly affect you, think again: it impacts much more than just the insurer.

Because auto insurance fraud is a crime in New Mexico, the state has a fraud bureau to catch criminals. So what counts a fraud?

- Using false information on an insurance application (such as a false SSN so insurers don’t see past credit records).

- Filing a claim for an accident that never happened or faking an accident.

- Adding extra “charges” onto a legitimate claim.

- Making false documents to support your claim.

- Making false statements on a policy to maintain compensation (such as discounts).

Bottom line? Don’t lie on an application or claim. It’s not worth having a criminal record to earn a few thousand dollars on a false claim.

Insurance fraud can also be committed by insurers. They can sell insurance but then skip out on paying claims (think of the shady door-to-door insurance salesman).

Who investigates insurance fraud in New Mexico? The main investigator is the New Mexico Office of Superintendent of Insurance (NM OSI). They handle and investigate insurance Fraud in New Mexico, making them a go-to resource for reporting insurance fraud.

If you want to report a case of fraud, you contact the NM OSI by filling out an online form on the NM OSI’s website. You can also call (855) 857-0972 for assistance.

Doing this helps the NM OSI catch insurance fraud criminals.

In fact, in 2018, the NM OSI’s report says it investigated 653 cases. The NM OSI referred 75 of these insurance fraud cases to legal prosecution.

That’s 75 people who had to deal with the courts and face possible penalties and a record.

Statute of Limitations

After an accident, you only have a certain period of time before your claims will no longer be accepted for processing. This period is known as a statute of limitations, and the clock starts ticking the day of your accident.

Below is the statute of limitations in New Mexico.

- Personal Injury: Three Years

- Property Damage: Four Years

New Mexico’s statute of limitations is fairly generous. Still, we recommend filing a claim right away.

Not only does filing right away allow you to move on quickly from the accident, but it also makes sure you can easily find witnesses who can clearly remember accident details.

State-Specific Laws

There are two state-specific laws we want to cover before leaving this section: window tint and unfair claims.

In New Mexico, drivers are allowed to have window tint. However, drivers who want tinted windows must follow New Mexico’s exact regulations.

- Drivers can’t tint their windows beyond five inches from the windshield top.

- If there are left and right outside rearview mirrors, drivers can tint side windows and rear windshields with non-reflective tinting. This tinting can’t have “a light transmission of less than 20 percent.”

This makes sure drivers don’t overly tint their windows.

Another state-specific law is New Mexico’s Unfair Claims Practices law. This law ensures that insurance providers follow ethical business practices, such as the following:

- Revealing all details of a policy to customers. This makes sure that insurers don’t “forget” benefits.

- Responding to customers’ claims. This makes sure that insurers don’t ignore customers’ claims, which is how some insurers commit fraud.

While this law is great, being familiar with your policy and your benefits will help you catch any problems.

Vehicle Licensing Laws

New Mexico has multiple licensing laws in place that ensure drivers carry valid licenses. Because these laws can vary from state to state, such as how often drivers have to renew their licenses, we are going to go over New Mexico’s laws.

Keep reading to learn about everything from REAL IDs to new resident requirements.

REAL ID

Starting October 1, 2020, people must have a form of REAL ID to enter federal buildings or fly on domestic flights. A passport counts as a form of REAL ID, but for most people, getting a REAL ID driver’s license is easier.

New Mexico does not require you to have a REAL ID, as you can use a regular driver’s license to vote and drive. However, unless you have a passport, you will not be able to fly or enter federal buildings.

The New Mexico MVD is currently issuing REAL ID cards, so you can get yours at any time.

To get a REAL ID, you need the following documentation:

- Identification Number (one document): bring an SSN card, W2 tax form, pay stub, or foreign passport.

- Proof of Identity (one document): bring U.S. passport, U.S. birth certificate, or affidavit of birth. Check the New Mexico MVD’s instructions for foreign applications.

- New Mexico Residency Proof (two documents): bring any examples of proof of residency, such as utility bills, insurance bills, or local property tax statement. However, some have to be dated within 60 days while others can be dated within the last six months. Make sure you bring the right ones so you don’t have to scrounge up more documents.

Applying for a REAL ID can be a bit of a hassle. Make sure to have the proper documents ready so you don’t have to go home and come back another day.

If you’ve had a name change, make sure to bring proof of that to the DMV, too (such as a marriage certificate).

Remember, the REAL ID law goes into effect on October 1, 2020. If you don’t have a passport, you need to get a REAL ID to fly domestically and enter federal buildings.

The last thing you want is to have to cancel a trip because you forgot to get a REAL ID in time.

Penalties for Driving Without Insurance

New Mexico makes sure drivers follow the law by putting strict penalties in place for drivers without insurance.

If drivers are caught without insurance (or a form of insurance ID), the New Mexico MVD will send drivers a notice of noncompliance.

Drivers then have 30 days to provide proof of insurance. Drivers can contact their insurer to send in proof or do it themselves. As a reminder, the following are acceptable forms of proof of insurance:

- Current insurance ID card

- Copy of current auto insurance policy

- Letter from auto insurance company (must be on company letterhead) verifying insurance coverage

If drivers do not send proof in 30 days, the New Mexico MVD will suspend vehicle registration and send drivers a Notice of Suspension of Registration letter. Drivers must then pay a $30 fine to reinstate their vehicle registration (they have to provide proof of insurance to reinstate).

If the New Mexico MVD doesn’t see a record of insurance, it will not allow drivers to reinstate their registrations. Drivers will then have 10 days to send in their vehicle registration and license plate to the New Mexico MVD.

The New Mexico MVD says that if drivers don’t comply, they “will be subject to the penalties prescribed by law, including criminal penalties.”

So how do drivers get into this situation of having to provide extra paperwork and facing possible criminal charges?

Well, if drivers don’t provide proof of insurance at traffic stops, after accidents, and when registering a vehicle, they will receive a notice of noncompliance.

So make sure to always have proof of insurance in your glovebox, as otherwise, you’ll have to deal with the headache of providing proof of insurance before your registration is revoked.

Your one-stop online insurance guide. Get free quotes now! Secured with SHA-256 Encryption

Teen Driver Laws

The Insurance Institute of Highway Safety (IIHS) lists out the details of teen license requirements. New Mexico teens can apply for a learner’s permit as young as 15 years of age.

The prices of licenses for teens are as follows:

- Learner’s Permit: $10

- Intermediate License: $18

- Adult (Unrestricted) License: $18 for four-year license or $34 for eight-year license

A learner’s permit doesn’t mean teen drivers can immediately take to the roads. Learner’s permit holders have to follow time and age requirements before they can drive without an adult in the car.

Before they can take and pass a driver’s test, teen drivers must meet the following New Mexico requirements.

| Learner Permit Requirements to Receive License/Restricted License | Details |

|---|---|

| Mandatory Holding Period | 6 months |

| Minimum Supervised Driving Time | 50 hours (10 of which must be at night) |

| Minimum Age | 15 years, 6 months |

Permit holders have to have at least six months of supervised driving time, amounting to at least 50 hours.

Once they’ve met these requirements, they can take the driver’s test. Teen drivers who pass then graduate to intermediate licenses and must continue to follow special restrictions.

| Restricted License Requirements | Details |

|---|---|

| Nighttime Restrictions | Midnight to 5 a.m. |

| Passenger Restrictions (family members excepted unless noted otherwise) | No more than 1 passenger younger than 21 |

| When Restrictions can be Lifted | Details |

| Nighttime Restrictions | 12 months or until age 18, whichever occurs first (minimum age: 16 years, 6 months) |

| Passenger Restrictions | 12 months or until age 18, whichever occurs first (minimum age: 16 years, 6 months) |

Nightime and passenger restrictions are important for parents to enforce. Why?

Because limited vision at night makes driving more dangerous for inexperienced drivers, and extra passengers result in additional distractions that can lead to crashes.

So keep teen drivers safe until they have adult licenses.

Older Driver License Renewal Procedures

Just like teens, older drivers sometimes have special license procedures. We’ve included the IIHS’s information on older driver licenses below.

| Age | Renewal Cycle | Vision Test | Mail or Online Renewal Permitted |

|---|---|---|---|

| 71 and older | 4 years for people ages 71-78 1 year for people ages 79 and older | 75 and older, every renewal | Not permitted age 75 and older |

New Mexico’s age when restrictions start is later than other states, where drivers generally become part of the older population at age 65.

After drivers turn 71, they will have to pay attention to their new license renewal procedures. Renewal times will shorten, and older drivers will need to visit in person and take a vision test.

New Residents

Drivers who are new to New Mexico will need a New Mexico driver’s license. New residents will have to bring the following to a New Mexico MVD.

- SSN card

- Current driver’s license

- Two proofs of current address

If you want to apply for a REAL ID, you’ll need to bring additional documentation to an MVD. If you are age 18 – 24, you will need to complete New Mexico’s None for the Road program, as well.

This program helps teach drivers about the risks of drunk driving, but if you are older than 24, you don’t need to take it.

In addition to getting a new license, you will also need to contact your current insurance provider, who will give you a new insurance ID card and update your coverage levels to match New Mexico’s minimums.

However, if your insurer does not cover New Mexico residents, you will need to find a new insurer before canceling your current provider.

Make sure to line up a new provider (if needed) before you move. The last thing you want is to be scrambling for a new provider in-between unpacking boxes and having to deal with a potential lapse in coverage.

License Renewal Procedures

The general population in New Mexico has to follow the requirements listed below.

| Age | Renewal Cycle | Vision Test | Mail or Online Renewal Permitted |

|---|---|---|---|

| General Population | 4 or 8 years (personal choice) | Required at renewal if doing it in person | Online/mail permitted for every other renewal. If new photo is required, then in-person |

Drivers can go eight years between license renewals, which is a long time to avoid a trip to the MVD. As well, New Mexico only requires vision tests when drivers are renewing in person.

Negligent Operator Treatment System (NOTS)

NOTS is a law that penalizes reckless or careless driving. Reckless or careless driving is any driving that endangers the driver, other drivers, or property. So speeding, sharp turns, drifting on the road, and other offenses could all fall under NOTS.

Let’s start with the penalties for careless driving in New Mexico, which is a lesser offense than reckless driving.

| Classification of Crime | Jail Time | Fines | Driving Record Points |

|---|---|---|---|

| Misdemeanor | Up to 90 days | Up to $300 | 3 points |

Drivers may have a careless driving charge if they drive in an inattentive manner that disregards curves, weather, and traffic patterns.

As for reckless driving, law enforcement may charge drivers with this if drivers drive in a way that puts others in danger. Below are New Mexico’s penalties for reckless driving charges.

| Offense | Classification of Crime | Jail Time | Fines | Driving Record Points | License Suspension |

|---|---|---|---|---|---|

| First Offense | Misdemeanor | 5 to 90 days | $25 to $100 | 6 points | Up to 90 days |

| Second and Subsequent Offenses | Misdemeanor | 10 days to 6 months | $50 to $1,000 | 6 points | Up to 90 days |

The penalties for a reckless driving charge are more serious than for careless driving. Another law that relates to NOTS is a wet reckless.

Drivers who have DUIs may try to plea bargain their DUI charge down to a reckless driving charge. A wet reckless charge is less serious than a DUI.

Rules of the Road

One of the best ways to become a safe driver is to know the rules of the road inside and out. However, moving to a new state may require learning some new laws.

So keep reading to learn New Mexico’s rules of the road, from seat belt laws to what levels of automation are permissible on roads.

Fault vs. No-Fault

In New Mexico, the driver who causes the accident is liable for injury and property damage costs. This is because New Mexico is an at-fault state.

However, sometimes one person isn’t clearly at fault in an accident. In this case, fault will be split between the two parties.

For example, if one person was only 20 percent responsible for the accident, they will only be responsible for 20 percent of the accident costs.

When there are disputes over who was at fault, the accident can be taken to court. The court will use comparative fault to assign costs to the involved parties.

In situations like this, where a driver sues another driver, extra umbrella liability insurance is helpful. This coverage provides extra protection and will help pay court costs, such as hiring a lawyer.

Seat Belt & Car Seat Laws

New Mexico requires all passengers (in all seats) to wear a seat belt. Not buckling up will result in a fine.

| Initial Effective Date | Primary Enforcement | Seat Belt Use | Maximum Fine |

|---|---|---|---|

| January 1, 1986 | Yes. Effective since January 1, 1986 | 18+ years in all seats | $25 |

The state allows primary enforcement. What does this mean?

Law enforcement can pull over anyone they see not wearing a seat belt and issue a ticket. In states where enforcement isn’t primary, law enforcement has to have a primary reason to pull someone over for not wearing a seat belt, such as running a stop sign or not using a turn signal.

Now that we know the rules for adults, let’s take a look at New Mexico’s laws to keep smaller passengers safe.

| Car Seat Type | Age/Weight |

|---|---|

| Rear-Facing Child Restraint | Younger than 1 year |

| Child Restraint | 1 to 4 years or less than 40 pounds |

| Booster Seat | 5 to 6 years or less than 60 pounds |

| Adult Seat Belt | 7 through 17 years |

| Fine | $25 |

Children younger than one year must be in a rear seat (if available). Make sure to check New Mexico’s car seat laws and follow manufacturers’ weight and height restrictions on car seats.

Doing so will ensure children are as safe as possible in a vehicle.

New Mexico also has a law on riding in the cargo areas of pickup trucks.

The state does not permit passengers under age 18 to ride in the cargo area of a pickup.

Riding in the cargo area can be dangerous, which is why New Mexico prohibits children from doing so.

Keep Right & Move Over Laws

New Mexico has a simple move over law.

Drivers who drive slower than the average speed of traffic need to keep to the right lane.

This means that passing other vehicles needs to take place in the left lane. However, there are a few exceptions that allow for passing on the right.

- The vehicle being passed is about to turn left.

- There is enough width for at least two lines of moving vehicles in each direction.

- A one-way street with enough width for at least two or more lines of moving vehicles.

We want to stress that passing on the right in these conditions can only be done if it is safe to do so. Drivers can’t drive off the roadway to pass on the right.

New Mexico’s move over law also emphasizes safety.

Drivers approaching a stationary vehicle must slow down and move over a lane. If they can’t do so, then they must slow down with the expectation of stopping.

These stationary vehicles include emergency vehicles, recovery/repair vehicles, and tow trucks. It is also good practice to move over for any stopped vehicle that has flashing hazard lights.

Doing so will help prevent injury or death. People move around parked vehicles, and the move over law makes sure drivers don’t hit anyone.

Speed Limits

Unless you’re on a racecar track, you have to abide by New Mexico’s speed limit laws.

| Road Type | Rural Interstates | Urban Interstates | Other Limited Access Roads | Other Roads |

|---|---|---|---|---|

| Speed Limit | 75 | 75 | 65 | 55 |

These speed limits are the maximum speed limits. This means New Mexico’s roads can’t post a speed limit sign higher than the ones shown above.

Still, a maximum speed of 75 mph for rural and urban interstates is higher than most states, where the norm is anywhere from 60 – 70 mph.

Ridesharing

The following providers offer rideshare insurance in New Mexico.

- Farmers

- Geico

If you don’t have rideshare insurance on your vehicle, you won’t be able to rideshare. Rideshare drivers must also meet the following requirements in New Mexico.

- Be 21 years of age

- Pass a background check

- Clean driving background

- Inspected and registered vehicle

Rideshare drivers must also have personal insurance for when they are not rideshare driving. As well, rideshare companies have a zero-tolerance policy for driving under the influence of alcohol or drugs.

Automation on the Road

While we are still a while away from self-driving cars, automated vehicles are rapidly progressing. As a result, states are beginning to pass laws regulating automated vehicles. (For more information, read our “Can I get car insurance for a self-driving car?“).

However, New Mexico doesn’t currently have any laws regulating the use of automated vehicles.

As automated vehicles advance, though, New Mexico will probably join the other states in regulating them.

Safety Laws

While states can tell drivers not to drive drunk or distracted, the only way to truly discourage dangerous driving habits is through strict laws and penalties.

While you may be thinking you’d never drive drunk or impaired, you may not realize what counts as distracted driving.

So stick with us as we guide you through important safety laws in New Mexico.

DUI Laws

Drunk driving is a major cause of accidents.

In 2017 in New Mexico, there were a total of 120 alcohol-related fatalities on the road.

New Mexico’s number of alcohol-related fatalities per 100,000 population is 5.8 deaths. This is higher than the national number of 3.4 deaths per 100,000 people.

So what law has New Mexico put in place to try and lower drunk driving fatalities?

| BAC Limit | High BAC Limit | Criminal Status by Offense | Formal Name for Offense | Look Back Period |

|---|---|---|---|---|

| 0.08 | 0.16 | 1st-3rd not classified, 4th-5th fourth degree felony, 6th+ third degree felony | Driving While Impaired (DWI) | Unlimited/lifetime |

New Mexico has an unlimited lookback period (how long a DUI stays on a record). This means that drivers could be paying increased premiums for the rest of their driving career.

What happens if drivers break the DUI law? They’ll face the following repercussions.

| Offense | License Revocation | Fine | Prison Time | Mandatory Penalty |

|---|---|---|---|---|

| First Offense (Misdemeanor) | 6 months to 1 year (if under 21 it is 1 year) | No minimum | No minimum, but up to 90 days; High BAC additional 2 days jail is mandatory | DWI school, evaluation, IID for 1 year, community service |

| Second Offense (Misdemeanor) | 2 years | $500 to $1,000 | 96 hours to 364 days; High BAC additional 4 days jail is mandatory | evaluation, community service, treatment, IID 2 years; up to 5 years probation |

| Third Offense (Misdemeanor) | 3 years | $750 to $1,000 | 30 to 364 days; High BAC additional 60 days jail is mandatory | Evaluation, treatment, community service, IID for 3 years; up to 5 years probation |

| Fourth Offense (Felony) | Lifetime revocation with 5 year court review | Up to $5,000 | 6 months to 18 months | Evaluation, treatment, lifetime IID with 5 year review |

| Fifth Offense (Felony) | Lifetime revocation with 5 year court review | Up to $5,000 | 1 to 2 years | Evaluation, treatment, lifetime IID with 5 year review |

| Sixth Offense (Felony) | Lifetime revocation with 5 year court review | Up to $5,000 | 18 to 30 months | Evaluation, treatment, lifetime IID with 5 year review |

| Seventh Offense (Felony) | Lifetime revocation with 5 year court review | Up to $5,000 | 2 to 3 years | Evaluation, treatment, lifetime IID with 5 year review |

As you can see, the penalties become more serious with each offense. So don’t have that one last drink before getting behind the wheel of a vehicle, or you’ll be stuck in the passenger seat for a while.

Marijuana-Impaired Driving Laws

Driving under the influence of marijuana is also illegal. However, New Mexico does not have a specific law about marijuana-impaired driving.

Instead, drivers who drive while high will face charges of impaired driving.

An impaired driving charge will have many of the same penalties as a DUI: fines, license suspension, and possible jail time. Drivers may also have to take a drug and alcohol class.

Distracted Driving Laws

New Mexico has banned texting and regulated cellphone use to help limit distracted driving. Below are the exact details on New Mexico’s cellphone law.

| Hand-Held Ban | Young Drivers All Cellphone Ban | Texting Ban | Enforcement |

|---|---|---|---|

| No | Learner's permit and intermediate license holders | All drivers | Primary |

Like New Mexico’s seat belt law, the enforcement of the cell phone law is primary. So don’t text in the car. Otherwise, you’ll be pulled over and ticketed.

Drivers with intermediate and learner’s licenses can’t use cellphones at all.

Driving in New Mexico

While we’ve covered road rules and safety laws, we want to look deeper into driving around New Mexico. Mainly, we want to look at what risks you face on the road.

Being prepared for accidents will help, so stick with us as we go through New Mexico’s vehicle thefts, fatalities, and traffic patterns.

Let’s jump right into it.

Vehicle Theft in New Mexico

We hope you’ve never gone through the experience of having your vehicle stolen. If you own one of the following cars in New Mexico, though, you may have a higher chance of experiencing vehicle theft.

| Rank | Make and Model | Most Popular Vehicle Year | Number of Thefts |

|---|---|---|---|

| 1 | Honda Civic | 1998 | 572 |

| 2 | Ford Pickup (Full Size) | 2006 | 557 |

| 3 | Honda Accord | 1994 | 545 |

| 4 | Chevrolet Pickup (Full Size) | 2006 | 483 |

| 5 | Dodge Pickup (Full Size) | 2003 | 269 |

| 6 | GMC Pickup (Full Size) | 2006 | 180 |

| 7 | Jeep Cherokee/Grand Cherokee | 1994 | 149 |

| 8 | Toyota Camry | 1999 | 128 |

| 9 | Chevrolet Pickup (Small Size) | 1998 | 101 |

| 10 | Chevrolet Impala | 2005 | 90 |

So what does this data mean? Let’s take a look at the first ranked vehicle.

In one year, there were 572 stolen Honda Civics. Out of the 572 stolen Honda Civics, the model from the year 1998 was stolen the most.

Pickups seem to be the most popular type of car stolen in New Mexico. If you remember, practical vehicles and pickups are the most popular vehicles in New Mexico, so it makes sense they rank high on the most stolen vehicle list.

Now that we know what types of vehicles are stolen, let’s take a look at what areas are the worst for vehicle theft. Below is the FBI’s 2017 report on vehicle theft in New Mexico’s cities.

| State | Motor Vehicle Theft |

|---|---|

| Alamogordo | 81 |

| Albuquerque | 7,684 |

| Angel Fire | 2 |

| Anthony | 9 |

| Artesia | 13 |

| Aztec | 8 |

| Bayard | 7 |

| Belen | 80 |

| Bernalillo | 50 |

| Bloomfield | 9 |

| Bosque Farms | 20 |

| Capitan | 0 |

| Carlsbad | 118 |

| Carrizozo | 0 |

| Cimarron | 0 |

| Clayton | 0 |

| Cloudcroft | 0 |

| Clovis | 142 |

| Corrales | 4 |

| Cuba | 3 |

| Deming | 54 |

| Dexter | 0 |

| Edgewood | 7 |

| Espanola | 33 |

| Estancia | 0 |

| Eunice | 5 |

| Farmington | 153 |

| Gallup | 191 |

| Grants | 21 |

| Hatch | 1 |

| Hobbs | 93 |

| Hope | 0 |

| Hurley | 0 |

| Jal | 6 |

| Las Vegas | 23 |

| Logan | 3 |

| Lordsburg | 3 |

| Los Alamos | 2 |

| Los Lunas | 128 |

| Magdalena | 2 |

| Mesilla | 1 |

| Moriarty | 14 |

| Peralta | 40 |

| Portales | 35 |

| Questa | 2 |

| Raton | 23 |

| Red River | 0 |

| Rio Rancho | 224 |

| Roswell | 98 |

| Ruidoso | 13 |

| Ruidoso Downs | 5 |

| Santa Clara | 1 |

| Santa Fe | 214 |

| Santa Rosa | 5 |

| San Ysidro | 0 |

| Socorro | 21 |

| Springer | 1 |

| Taos | 40 |

| Taos Ski Valley | 0 |

| Tatum | 0 |

| Texico | 1 |

| Truth or Consequences | 9 |

| Tularosa | 6 |

Albuquerque is by far the worst city for vehicle theft, beating out other cities by over 7,000 thefts. So if you live in Albuquerque, comprehensive car insurance will be a good investment.

Comprehensive coverage protects you in cases of vehicle theft and vandalism, as well as animal collisions and natural disasters.

Road Fatalities in New Mexico

Now that you know what risks your vehicle faces in New Mexico, we want to discuss what risks you face on the road. We’ve collected data on crash fatalities from the National Highway Traffic Safety Administration (NHTSA).

So stick with us to see what the most dangerous conditions and situations are in New Mexico.

Most Fatal Highway in New Mexico

According to Geotab, the most fatal highway in New Mexico is I-40.

I-40 has more than 34 fatal crashes every year. This high number of crashes has given I-40 a crash rating of 1.4. In the history of I-40, there have been 344 crashes and 395 fatalities. So take care when driving on New Mexico’s I-40.

Fatal Crashes by Weather Condition & Light Condition

Depending on what state you live in, the weather conditions you have to contend with will be different, such as rain versus snow, or dust storms versus winter storms.

Let’s see when most accidents happen in New Mexico.

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 150 | 51 | 93 | 18 | 1 | 313 |

| Rain | 5 | 4 | 3 | 1 | 1 | 14 |

| Snow/Sleet | 0 | 0 | 0 | 1 | 0 | 1 |

| Other | 4 | 0 | 1 | 2 | 0 | 7 |

| Unknown | 0 | 0 | 4 | 0 | 1 | 5 |

| Total | 159 | 55 | 101 | 22 | 3 | 340 |

The majority of crashes in New Mexico occur during normal conditions. Only a few fatalities were caused by inclement weather conditions.

So if you live in New Mexico, having to drive in snow or sleet will be a rare occurrence.

Fatalities (All Crashes) by County

Now that we’ve covered what weather and light conditions are the worst to drive in, let’s dive into the NHTSA’s data on which New Mexico counties are the most dangerous.

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Bernalillo County | 52 | 69 | 64 | 100 | 91 |

| Catron County | 6 | 1 | 0 | 0 | 1 |

| Chaves County | 9 | 7 | 12 | 14 | 6 |

| Cibola County | 14 | 7 | 11 | 17 | 13 |

| Colfax County | 6 | 7 | 4 | 5 | 4 |

| Curry County | 4 | 4 | 2 | 7 | 4 |

| Debaca County | 2 | 0 | 3 | 5 | 0 |

| Dona Ana County | 14 | 19 | 18 | 24 | 29 |

| Eddy County | 15 | 16 | 10 | 7 | 17 |

| Grant County | 5 | 2 | 2 | 3 | 10 |

| Guadalupe County | 6 | 7 | 8 | 12 | 9 |

| Harding County | 1 | 2 | 0 | 2 | 0 |

| Hidalgo County | 1 | 9 | 4 | 3 | 12 |

| Lea County | 12 | 31 | 13 | 13 | 16 |

| Lincoln County | 5 | 5 | 2 | 7 | 6 |

| Los Alamos County | 0 | 2 | 0 | 0 | 0 |

| Luna County | 6 | 1 | 6 | 12 | 2 |

| Mckinley County | 26 | 48 | 23 | 22 | 30 |

| Mora County | 3 | 4 | 2 | 4 | 2 |

| Otero County | 8 | 13 | 10 | 3 | 6 |

| Quay County | 6 | 11 | 11 | 4 | 2 |

| Rio Arriba County | 13 | 8 | 12 | 11 | 8 |

| Roosevelt County | 4 | 2 | 5 | 5 | 6 |

| San Juan County | 27 | 39 | 31 | 32 | 34 |

| San Miguel County | 7 | 3 | 4 | 7 | 3 |

| Sandoval County | 18 | 14 | 5 | 16 | 16 |

| Santa Fe County | 9 | 19 | 14 | 23 | 16 |

| Sierra County | 4 | 2 | 3 | 3 | 7 |

| Socorro County | 8 | 8 | 4 | 16 | 2 |

| Taos County | 6 | 10 | 2 | 8 | 9 |

| Torrance County | 11 | 5 | 8 | 12 | 5 |

| Union County | 1 | 1 | 0 | 1 | 1 |

| Valencia County | 2 | 10 | 5 | 7 | 12 |

Bernalillo County consistently has the highest number of fatalities in New Mexico. Incidentally, Bernalillo County is also the most populated county in the state.

Traffic Fatalities

Depending on how heavily populated a state is (and other factors) either rural or urban roads may have more fatalities. Let’s take a look at which road type is more dangerous in New Mexico.

| Type of Road | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Rural | 265 | 258 | 265 | 273 | 259 | 215 | 248 | 176 | 229 | 195 |

| Urban | 101 | 103 | 84 | 77 | 106 | 96 | 133 | 119 | 172 | 179 |

| Total | 366 | 361 | 349 | 350 | 366 | 311 | 386 | 298 | 405 | 379 |

Rural roads have seen more crashes than urban roads. This could be because New Mexico has more rural roads than urban roads, or because of wildlife collisions and speeding on rural roads.

Fatalities by Person Type

We now know where crashes occur, so let’s take a look at who is involved in these fatal crashes.

| Person Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Passenger Car | 81 | 106 | 79 | 116 | 93 |

| Light Truck - Pickup | 55 | 65 | 50 | 73 | 62 |

| Light Truck - Utility | 46 | 38 | 45 | 72 | 59 |

| Light Truck - Van | 5 | 20 | 5 | 6 | 9 |

| Light Truck - Other | 2 | 2 | 3 | 2 | 1 |

| Large Truck | 16 | 17 | 12 | 6 | 17 |

| Bus | 2 | 0 | 0 | 0 | 0 |

| Other/Unknown Occupants | 8 | 12 | 5 | 2 | 5 |

| Total Occupants | 215 | 260 | 199 | 277 | 246 |

| Total Motorcyclists | 41 | 46 | 38 | 47 | 53 |

| Pedestrian | 49 | 75 | 54 | 74 | 74 |

| Bicyclist and Other Cyclist | 4 | 5 | 7 | 4 | 2 |

| Other/Unknown Nonoccupants | 2 | 0 | 0 | 3 | 4 |

| Total Nonoccupants | 55 | 80 | 61 | 81 | 80 |

| Total | 311 | 386 | 298 | 405 | 379 |

There has been a number of pedestrian deaths in New Mexico. Unfortunately, the high number of pedestrian deaths has yet to decrease.

Fatalities by Crash Type

Do you know what types of crashes are the most dangerous?

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Single Vehicle | 193 | 246 | 194 | 248 | 205 |

| Involving a Large Truck | 54 | 72 | 46 | 40 | 70 |

| Involving Speeding | 122 | 132 | 130 | 146 | 141 |

| Involving a Rollover | 128 | 129 | 115 | 169 | 118 |

| Involving a Roadway Departure | 137 | 182 | 150 | 207 | 176 |

| Involving an Intersection (or Intersection Related) | 63 | 54 | 66 | 75 | 94 |

| Total Fatalities (All Crashes) | 311 | 386 | 298 | 405 | 379 |

The deadliest crash types in New Mexico (in 2017) were single vehicle, roadway departure, and speeding crashes.

Five-Year Trend for the Top 10 Counties

So what are the worst counties for fatalities?

| New Mexico Counties by 2017 Ranking | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Bernalillo County | 52 | 69 | 64 | 100 | 91 |

| San Juan County | 27 | 39 | 31 | 32 | 34 |

| Mckinley County | 26 | 48 | 23 | 22 | 30 |

| Dona Ana County | 14 | 19 | 18 | 24 | 29 |

| Eddy County | 15 | 16 | 10 | 7 | 17 |

| Lea County | 12 | 31 | 13 | 13 | 16 |

| Sandoval County | 18 | 14 | 5 | 16 | 16 |

| Santa Fe County | 9 | 19 | 14 | 23 | 16 |

| Cibola County | 14 | 7 | 11 | 17 | 13 |

| Hidalgo County | 1 | 9 | 4 | 3 | 12 |

| Top Ten Counties | 202 | 279 | 209 | 277 | 274 |

| All Other Counties | 109 | 107 | 89 | 128 | 105 |

| All Counties | 311 | 386 | 298 | 405 | 379 |

If you live in one of these counties, be aware that there are more traffic deaths than the average and drive carefully.

Fatalities Involving Speeding by County

Because speeding a top reason for fatal crashes, we want to have a section dedicated solely to speeding accidents.

| County Name | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Bernalillo County | 16 | 23 | 34 | 40 | 31 |

| Catron County | 1 | 0 | 0 | 0 | 0 |

| Chaves County | 5 | 5 | 6 | 4 | 3 |

| Cibola County | 4 | 3 | 8 | 5 | 7 |

| Colfax County | 2 | 1 | 0 | 4 | 1 |

| Curry County | 1 | 2 | 1 | 3 | 3 |

| Debaca County | 1 | 0 | 1 | 2 | 0 |

| Dona Ana County | 5 | 9 | 12 | 5 | 7 |

| Eddy County | 9 | 3 | 3 | 1 | 10 |

| Grant County | 2 | 1 | 0 | 1 | 5 |

| Guadalupe County | 1 | 1 | 0 | 5 | 1 |

| Harding County | 0 | 1 | 0 | 0 | 0 |

| Hidalgo County | 0 | 0 | 0 | 0 | 2 |

| Lea County | 3 | 5 | 5 | 8 | 6 |

| Lincoln County | 2 | 2 | 0 | 1 | 4 |

| Los Alamos County | 0 | 2 | 0 | 0 | 0 |

| Luna County | 1 | 0 | 3 | 3 | 1 |

| Mckinley County | 11 | 15 | 11 | 5 | 14 |

| Mora County | 1 | 2 | 0 | 1 | 0 |

| Otero County | 2 | 6 | 6 | 1 | 2 |

| Quay County | 2 | 1 | 2 | 2 | 1 |

| Rio Arriba County | 7 | 3 | 10 | 4 | 2 |

| Roosevelt County | 3 | 2 | 2 | 1 | 1 |

| San Juan County | 9 | 13 | 8 | 14 | 12 |

| San Miguel County | 1 | 2 | 1 | 2 | 0 |

| Sandoval County | 11 | 8 | 2 | 5 | 10 |

| Santa Fe County | 4 | 5 | 1 | 4 | 3 |

| Sierra County | 3 | 2 | 1 | 3 | 2 |

| Socorro County | 6 | 1 | 2 | 7 | 0 |

| Taos County | 1 | 3 | 2 | 4 | 3 |

| Torrance County | 5 | 2 | 5 | 6 | 2 |

| Union County | 1 | 1 | 0 | 1 | 1 |

| Valencia County | 2 | 8 | 4 | 4 | 7 |

Counties who strictly enforce speeding limits will usually have less crashes.

Fatalities in Crashes Involving an Alcohol-Impaired Driver (BAC = .08) by County

Another major cause of fatalities is impaired driving.

| County Name | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Bernalillo County | 14 | 17 | 30 | 34 | 29 |

| Catron County | 2 | 1 | 0 | 0 | 0 |

| Chaves County | 3 | 4 | 4 | 3 | 2 |

| Cibola County | 3 | 1 | 6 | 4 | 4 |

| Colfax County | 1 | 3 | 1 | 0 | 0 |

| Curry County | 1 | 1 | 2 | 2 | 2 |

| Debaca County | 0 | 0 | 0 | 1 | 0 |

| Dona Ana County | 6 | 7 | 6 | 6 | 8 |

| Eddy County | 2 | 3 | 0 | 1 | 5 |

| Grant County | 0 | 0 | 1 | 1 | 4 |

| Guadalupe County | 0 | 1 | 1 | 0 | 2 |

| Harding County | 0 | 0 | 0 | 0 | 0 |

| Hidalgo County | 0 | 2 | 0 | 0 | 2 |

| Lea County | 5 | 7 | 2 | 5 | 5 |

| Lincoln County | 5 | 3 | 2 | 1 | 2 |

| Los Alamos County | 0 | 0 | 0 | 0 | 0 |

| Luna County | 2 | 0 | 2 | 2 | 1 |

| Mckinley County | 9 | 14 | 10 | 4 | 15 |

| Mora County | 0 | 2 | 1 | 1 | 0 |

| Otero County | 3 | 7 | 4 | 1 | 3 |

| Quay County | 1 | 2 | 1 | 2 | 0 |

| Rio Arriba County | 4 | 1 | 5 | 6 | 4 |

| Roosevelt County | 1 | 1 | 1 | 1 | 1 |

| San Juan County | 13 | 13 | 9 | 14 | 11 |

| San Miguel County | 2 | 2 | 0 | 3 | 1 |

| Sandoval County | 5 | 4 | 1 | 8 | 2 |

| Santa Fe County | 3 | 6 | 1 | 9 | 6 |

| Sierra County | 2 | 1 | 1 | 1 | 2 |

| Socorro County | 2 | 2 | 2 | 4 | 0 |

| Taos County | 3 | 4 | 2 | 3 | 5 |

| Torrance County | 5 | 2 | 0 | 4 | 0 |

| Union County | 0 | 1 | 0 | 1 | 0 |

| Valencia County | 0 | 5 | 3 | 0 | 4 |

Once again, Bernalillo County has the highest number of fatalities. However, a few counties, like Catron County, have had zero fatalities for a few years.

Teen Drinking & Driving

Teen drinking and driving has contributed to a high fatality rate in New Mexico.

In New Mexico, there are 2.6 underage drunk driving fatalities per 100,000 population. This is higher than the national average of 1.2 underage drunk driving fatalities per 100,000 population.

New Mexico has the third-highest fatality rate for teen drunk driving in the U.S. Only Alabama and South Dakota have higher fatality rates.

Now that we know New Mexico has problems with underage drinking and driving, let’s take a look at the number of arrests law enforcement has made.

| DUI Arrest (Under 18 Years Old) | DUI Arrests (Under 18 Years Old) Total Per Million People | Rank |

|---|---|---|

| 62 | 126.36 | 15 |

New Mexico ranks 15th in the U.S. for its number of underage arrests. So while it does have a high number of fatalities, the arrest record shows that New Mexico law enforcement is actively working to reduce underage drinking and driving.

EMS Response Time

Now that we’ve covered fatalities, we want to see how quickly help will arrive after a crash.

| Type of Road | Time of Crash to EMS Notification | EMS Notification to EMS Arrival | EMS Arrival at Scene to Hospital Arrival | Time of Crash to Hospital Arrival | Total Fatal Crashes |

|---|---|---|---|---|---|

| Rural | 7.71 min | 18.57 min | 51.72 min | 55.67 min | 169 |

| Urban | 5.92 min | 7.12 min | 26.68 min | 37.96 min | 166 |

New Mexico’s response times are normal. Naturally, it takes longer for help to arrive in rural areas, but the time from the accident to the hospital arrival is still under one hour.

Transportation

The last thing we want to cover before ending this guide is transportation. While we no longer rely on carriages to transport us, we still have to deal with a whole set of transportation issues.

One major transportation issue is traffic congestion, which is why we are going to cover commute time and traffic.

So stick with us as we go through transportation in New Mexico.

Car Ownership

Car ownership is an important step to independence. Below is Data USA’s information on car ownership in New Mexico.

| Number of Cars | New Mexico Percentage of Car Ownership | U.S. Percentage of Car Ownership |

|---|---|---|

| 0 | 1.92% | 4.25% |

| 1 | 20.5% | 20.3% |

| 2 | 39.1% | 40.5% |

| 3 | 23.2% | 21.4% |

| 4 | 10.1% | 9.08% |

| 5+ | 5.3% | 4.47% |

The highest percentage of cars owned in New Mexico is two cars.

Commute Time

According to Data USA, the average commute time in New Mexico is 21.1 minutes (or 42.2 minutes a day).

This isn’t bad, as it is less than the average commute time in the U.S. (25.5 minutes).

Let’s take a look at other commute times in New Mexico.

| Commute Time | New Mexico Percentage |

|---|---|

| <5 minutes | 4.1% |

| 5-9 minutes | 13.1% |

| 10-14 minutes | 16% |

| 15-19 minutes | 18.3% |

| 20-24 minutes | 14.9% |

| 25-29 minutes | 5.57% |

| 30-34 minutes | 12.1% |

| 35-39 minutes | 2.23% |

| 40-44 minutes | 2.27% |

| 45-59 minutes | 5.7% |

| 60-89 minutes | 3.94% |

| 90+ minutes | 1.77% |

A small percentage of New Mexican residents are stuck with an unfortunate commute of 90+ minutes. This means that some residents drive over three hours a day.

Commuter Transportation

Now that we know how long it takes most residents to get to work, let’s see how residents transport. Below is Data USA’s information on the main methods of commuter transportation in New Mexico.

- Driving alone: 79.4 percent

- Carpooling: 10.6 percent

- Working at home: 5.09 percent

Other methods, such as walking to work or using a taxi, only make up a minuscule portion of commuters.

Traffic Congestion in New Mexico

While we know the average commute time is less than average in New Mexico, this doesn’t mean all areas in New Mexico will be traffic-free.

Below is Inrix’s data on the worst city for traffic in New Mexico.

| City | Hours Lost in Congestion | Year Over Year Change | Cost of Congestion (Per Driver) | Inner City Travel Time (Minutes) | Inner City Last Mile Speed |

|---|---|---|---|---|---|

| Albuquerque | 57 (186) | -5% | $792 | 4 | 16 mph |

Albuquerque is the worst city for traffic, so make sure to leave early for work.

We’ve now reached the end of our comprehensive guide. Did we miss anything? Hopefully, you feel prepared to find an insurer and drive around New Mexico.

Want to search the best online discounts by company today? Check out our reviews and free tools.

Frequently Asked Questions

What are the minimum car insurance requirements in New Mexico?

In New Mexico, drivers are required to have the following minimum car insurance coverage:

- $25,000 for bodily injury or death of one person

- $50,000 for bodily injury or death of more than one person

- $10,000 for property damage.

What forms of financial responsibility are accepted in New Mexico?

The acceptable forms of financial responsibility in New Mexico include:

- Current insurance ID card

- Copy of current auto insurance policy

- Letter from auto insurance company (on company letterhead) verifying insurance coverage. Please note that electronic proof of insurance is not allowed in New Mexico.

When do I need to show proof of insurance in New Mexico?

You need to show proof of insurance in the following situations:

- Traffic stops

- Accidents

- Registering a vehicle. Failure to provide proof of insurance may result in fines and the suspension of your driving privileges.

What are the average monthly car insurance rates in New Mexico?

The average annual premiums for core car insurance coverages in New Mexico are as follows:

- Liability: $488.03

- Collision: $276.98

- Comprehensive: $172.57

- Full Coverage: $937.59. These rates can vary based on individual factors such as driving history, vehicle type, and location.

Can you recommend the cheapest car insurance companies in New Mexico?

USAA and State Farm are among the cheapest car insurance providers in New Mexico. However, it’s important to compare quotes from multiple companies to find the best rates and coverage for your specific needs.