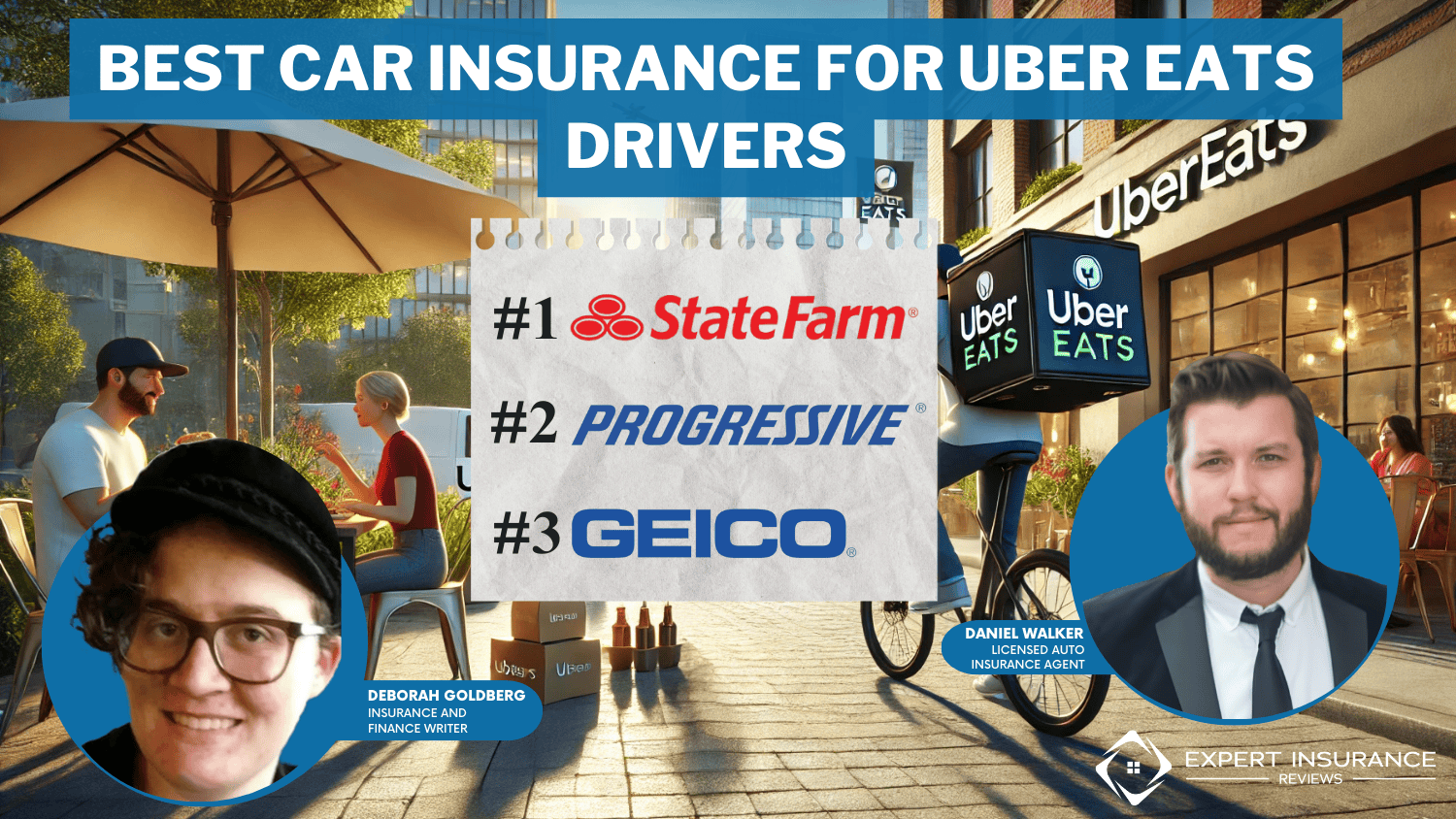

Best Car Insurance for Uber Eats Drivers in 2025 (Check Out the Top 10 Companies)

The best car insurance for Uber Eats drivers comes from State Farm, Progressive, and Geico, starting at $45/month. State Farm offers easy rideshare endorsements, Progressive has low accident deductibles, and Geico provides the cheapest delivery driver add-ons, ensuring proper Uber Eats insurance coverage.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Mar 12, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Mar 12, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Uber Eats Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Uber Eats Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsThe best car insurance for Uber Eats drivers comes from State Farm, Progressive, and Geico, with rates starting as low as $45 per month. State Farm is the top pick overall due to its affordable rideshare endorsement that extends coverage while delivering.

Progressive stands out with low accident deductibles and a fast claims process. At the same time, Geico offers the most affordable add-ons for delivery drivers, making it a great choice for budget-conscious Uber Eats drivers. This guide explores coverage options, policy limitations, and car insurance discounts, like multi-policy savings, safe driving rewards, and pay-in-full incentives, to help drivers find the best balance of affordability and protection.

Our Top 10 Company Picks: Best Car Insurance for Uber Eats Drivers

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | B | Rideshare Coverage | State Farm | |

| #2 | 10% | A+ | Best Rates | Progressive | |

| #3 | 25% | A++ | Flexible Pricing | Geico | |

| #4 | 25% | A+ | Extra Protection | Allstate | |

| #5 | 20% | A+ | Versatile Plans | Nationwide |

| #6 | 20% | A | Custom Policies | Farmers | |

| #7 | 25% | A | Broad Options | Liberty Mutual |

| #8 | 25% | A | Family Needs | American Family | |

| #9 | 13% | A++ | Comprehensive Care | Travelers | |

| #10 | 25% | A+ | Affordable Rates | Erie |

If you need help getting Uber Eats car insurance quotes, enter your ZIP code into our free quote comparison tool.

- Uber Eats drivers need rideshare insurance to avoid denied claims

- State Farm offers the best Uber Eats coverage at $45 per month

- Progressive has low deductibles, while Geico has the cheapest add-ons

#1 – State Farm: Top Overall Pick

<strongPros

- Exclusive Rideshare Coverage: State Farm provides a unique policy for food delivery, covering every trip. Explore further in our State Farm insurance review.

- Usage-Based Discount For Lower Rates: Uber Eats drivers who use State Farm’s Drive Safe & Save program can reduce insurance costs with safe driving habits.

- Seamless Claims Processing: State Farm’s insurance claims system is efficient, helping Uber Eats drivers get back on the road quickly.

Cons

- May Need an Additional Endorsement: Uber Eats drivers must purchase a separate insurance add-on to be fully covered while making deliveries.

- While a 17% bundling discount is available, other insurers offer higher savings on insurance policies.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#2 – Progressive: Best for Best Rates

Pros

- Snapshot Program for Safe Driving: Uber Eats drivers who enroll in Progressive’s Snapshot insurance tracking can earn lower rates based on driving behavior.

- Options for Accident-Prone Drivers: Progressive offers lower rates to Uber Eats drivers with past violations or claims.

- Diverse Discount Opportunities: With bundling, paperless, and pay-in-full insurance discounts, Uber Eats drivers can significantly reduce costs.

Cons

- Premiums Fluctuate After Renewal: Depending on claims history, some Uber Eats drivers experience higher insurance rates after renewing their policy.

- Inconsistent Customer Service Reviews: While some Uber Eats drivers are assisted quickly, others report long wait times. Learn more in our Progressive insurance review.

#3 – Geico: Best for Flexible Pricing

Pros

- Customizable Plans: Uber Eats drivers can select flexible options that fit their specific driving and coverage needs. Read our Geico insurance review for more.

- Military/Federal Employee Discounts: Uber Eats-qualified drivers can enjoy exclusive insurance savings through Geico’s specialty discount programs.

- Mobile App for Managing Policies: The Geico app allows Uber Eats drivers to handle insurance claims, payments, and coverage updates instantly.

Cons

- Limited Availability for Delivery Driver Insurance: Some states do not offer Geico’s rideshare insurance, leaving Uber Eats drivers without adequate coverage.

- Strict Underwriting Criteria for New Customers: Uber Eats drivers with prior insurance coverage lapses may find it difficult to secure low rates.

#4 – Allstate: Best for Extra Protection

Pros

- Enhanced Add-Ons for Extra Protection: Uber Eats drivers can purchase accident forgiveness and deductible rewards to strengthen their insurance coverage.

- Vanishing Deductible Program: Every accident-free term reduces the insurance deductible, helping Uber Eats drivers save money over time.

- New Car Replacement: Uber Eats drivers with newer vehicles can receive full coverage for a total loss within the first two years.

Cons

- Higher Insurance Premiums: Even with discounts, Uber Eats drivers may pay more for Allstate’s coverage. Learn more in our Allstate auto insurance review.

- Paperwork-Heavy Claims Process: Some Uber Eats drivers report delays due to extensive documentation requirements when filing an insurance claim.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Versatile Plans

Pros

- Adaptable Rideshare Coverage: Nationwide offers Uber Eats drivers flexible insurance coverage during and between deliveries.

- Accident-Free Discount: Uber Eats drivers with a clean record can qualify for ongoing insurance savings through the SmartRide program.

- Home and Auto Insurance Bundling: Uber Eats drivers can unlock a 20% premium discount by combining home and car insurance policies.

Cons

- Insurance Claims Take Longer: Some Uber Eats drivers report that complex claims take more time to process than with other insurers.

- Expensive for High-Mileage Drivers: It may charge more if they exceed a set annual mileage threshold. For more information, see our Nationwide insurance review.

#6 – Farmers: Best for Custom Policies

Pros

- Rideshare Endorsement: Farmers offer a specific rideshare insurance add-on extending coverage while Uber Eats drivers deliver actively.

- Auto and Home Policy Bundling: Uber Eats drivers who bundle their auto insurance with a Farmers’ homeowners policy can receive significant discounts of up to 15%.

- Suitable for High-Mileage Drivers: Unlike some insurers, Farmers does not cap annual mileage for delivery drivers, making it ideal for full-time Uber Eats work.

Cons

- Higher Costs for Uber Eats Drivers: Compared to standard auto policies, Uber Eats drivers may face significantly higher insurance premiums than Farmers.

- Slow Claims Process: Uber Eats drivers have reported longer-than-average wait times, especially for accident-related repairs. Discover more in our Farmers insurance review.

#7 – Liberty Mutual: Best for Broad Options

Pros

- Extensive Coverage for Multiple Vehicles: Uber Eats drivers using different cars for deliveries can find insurance plans that accommodate various models.

- Telematics-Based Discounts: Liberty Mutual’s RightTrack program lets Uber Eats drivers save on insurance by monitoring their driving habits.

- Wide Range of Add-Ons: Uber Eats drivers can enhance their insurance policies with features like better car replacement and accident forgiveness.

Cons

- Rates Increase Without Notice: Some Uber Eats drivers have experienced unexpected hikes in their insurance costs after policy renewals.

- Discounts Have Strict Qualification Rules: Liberty Mutual’s best insurance discounts require meeting specific conditions not all Uber Eats drivers qualify for.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#8 – American Family: Best for Family Needs

Pros

- Family-Friendly Policies: Uber Eats drivers with dependents can benefit from American Family’s multi-driver discounts.

- Safe Driving Incentives for Teen Drivers: Uber Eats drivers with young family members can enroll in the Teen Safe Driver program for savings. Explore our American Family insurance review for more info.

- Loyalty Discounts: Uber Eats drivers who stay with American Family for several years receive lower insurance rates as a reward.

Cons

- Fewer Options for Independent Contractors: Uber Eats drivers without a personal vehicle policy may find American Family’s rideshare insurance harder to obtain.

- Higher Costs Without Bundling: Uber Eats drivers who only purchase auto insurance without home coverage may not receive the best discounts.

#9 – Travelers: Best for Comprehensive Care

Pros

- Accident Protection Coverage: Travelers offers extensive insurance plans that provide financial security for Uber Eats drivers after a crash.

- Hybrid Vehicle Discounts: Uber Eats drivers using hybrid or electric cars can qualify for lower insurance premiums with Travelers.

- Top Financial Stability Rating: With an A++ rating, Travelers ensures Uber Eats drivers have reliable insurance protection long-term.

Cons

- Complicated Claims Process: Some Uber Eats drivers report that first-time insurance claims require extensive verification steps.

- Strict Mileage Limits: According to Travelers insurance reviews, high-mileage Uber Eats drivers may face coverage restrictions with certain plans.

#10 – Erie: Best for Affordable Rates

Pros

- Budget-Friendly Rates: Uber Eats drivers who work occasionally can find cost-effective insurance options through Erie.

- Young Driver Discount: Erie offers significant savings for Uber Eats drivers under 25 who maintain a clean insurance record.

- Easy-to-Use Policy Management Platform: Uber Eats drivers can update their insurance details online without visiting a physical office. Our Erie insurance review covers more details.

Cons

- Limited Availability in Certain States: Erie does not offer coverage in every region, restricting access for some Uber Eats drivers.

- Fewer Bundling Discounts: While Erie provides savings, its bundling insurance discount percentage is lower than some of its competitors.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Uber Eats Car Insurance Costs by Provider and Coverage Level

Uber Eats drivers pay varying car insurance rates depending on their provider and coverage level. Basic liability policies start at around $45 per month, while full coverage options, including comprehensive and collision, typically range from $100 to over $200 per month.

Factors such as driving history, location, and vehicle type influence the final cost, with higher-risk drivers generally paying more.

Uber Eats Drivers Car Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $55 | $140 | |

| $51 | $132 | |

| $47 | $125 |

| $60 | $150 | |

| $48 | $130 | |

| $58 | $145 |

| $52 | $138 |

| $50 | $135 | |

| $45 | $120 | |

| $53 | $137 |

State Farm offers a rideshare endorsement for about $50 per month, ensuring coverage extends during food deliveries. Progressive’s policies range from $60 to $180 monthly, featuring low accident deductibles and optional add-ons for additional protection.

Geico provides one of the lowest-cost delivery driver add-ons, starting at approximately $55 monthly for eligible drivers with a clean record.

Uber Eats drivers should look for a policy with a rideshare endorsement or commercial auto insurance to avoid coverage gaps while delivering.

Jeff Root Licensed Insurance Agent

Each provider structures pricing and coverage options differently based on risk assessment and policy features. Understanding full coverage car insurance helps Uber Eats drivers compare multiple quotes and policy terms to ensure they receive sufficient coverage.

Best Car Insurance Discounts for Uber Eats Drivers

Uber Eats drivers can use multiple car insurance discounts to reduce costs. Multi-policy discounts from Allstate, Erie, and Farmers help drivers save money by bundling auto insurance with home, renters, or life insurance policies.

Progressive and State Farm offer pay-in-full discounts, allowing drivers to lower their rates by paying their policy upfront instead of in monthly installments.

Car Insurance Discounts From the Top Providers for Uber Eats Drivers

| Insurance Company | Available Discounts |

|---|---|

| Multi-Policy, Safe Driving Club, Anti-Theft Device, New Car, Early Signing, Paperless, Smart Student | |

| Multi-Policy, Loyalty, Teen Safe Driver, Defensive Driving, Low Mileage, Young Volunteer, AutoPay | |

| Multi-Policy, Safe Driving Record, Reduced Usage, New Car, Young Driver, Accident Prevention Course, Vehicle Recovery |

| Multi-Policy, Signal Program, Good Student, Affinity Discounts, Homeowner, New Car, Pay-in-Full | |

| Multi-Policy, Good Driver, Military, Defensive Driving, Vehicle Equipment, Membership & Employee, Federal Employee | |

| Multi-Policy, Hybrid/Electric Vehicle, Online Quote, Anti-Theft Device, Good Student, New Graduate, Military |

| Multi-Policy, SmartRide Program, Accident-Free, Defensive Driving, Affinity Group, Automatic Payment, Anti-Theft Device |

| Multi-Policy, Snapshot Program, Continuous Insurance, Homeowner, Teen Driver, Paperless, Pay-in-Full | |

| Multi-Policy, Safe Driver, Usage-Based, Rideshare Discount, Good Student, Anti-Theft Device, Accident-Free | |

| Multi-Policy, IntelliDrive, Homeownership, Good Payer, New Car, Hybrid/Electric Vehicle, Continuous Coverage |

Safe driving programs help Uber Eats drivers lower their insurance costs by tracking driving behavior. Progressive’s Snapshot and State Farm’s Drive Safe & Save monitor acceleration, braking, and speed, offering discounts for safe habits. Nationwide’s SmartRide and Travelers’ IntelliDrive analyze real-time data over a set period, reducing rates for consistent, low-risk driving. These programs benefit delivery drivers who drive frequently by rewarding safe practices with lower premiums.

Geico, Liberty Mutual, and Travelers provide savings for drivers with hybrid or electric vehicles, anti-theft devices, and continuous coverage history. Military members, federal employees, and students may also qualify for special rate reductions, ensuring that Uber Eats drivers can maximize their savings by choosing a provider that aligns with their personal and professional circumstances.

Insurance Requirements for Uber Eats Drivers

To become an Uber Eats delivery driver, you must already have personal car insurance. The Uber Eats insurance requirements obligate drivers to upload proof of their personal car insurance policy.

Uber Eats Deliver Driver Requirements

| Driver Requirements | Uber Eats Requirements |

|---|---|

| Age | At least 19 |

| Driving Experience | Valid driver's license and at least 1 year of licensed driving experience |

| Auto Insurance | Valid and meets state minimum requirements |

| Personal Record | Clean driving record with no major violations for the past 7 years and msut be able to pass a background check |

| Smartphone | Not Listed |

| Vehicle | 2 or 4-door vehicle at least newer than 1998 |

You will also need to upload a copy of a valid driver’s license if you do not have a license or personal car insurance. Find the best car insurance companies here.

Read more:

- Can I buy car insurance without a driver’s license?

- How to Get Car Insurance Without a License: An Expert Guide

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Uber Eats Provides Car Insurance

Uber Eats provides top-tier car insurance for its drivers, with coverage depending on your delivery status. If you’re available on the Uber Eats app but not actively making a delivery, Uber offers third-party liability coverage if your insurance doesn’t apply.

This includes up to $50,000 for bodily injury per person, $100,000 per accident, and $25,000 for property damage. When you’re on an active delivery—whether picking up or dropping off—Uber provides $1,000,000 in third-party liability coverage.

Additionally, if you have your policy, Uber partners with the best comprehensive coverage car insurance company and the best collision coverage car insurance company to cover your vehicle’s full value with a $2,500 deductible.

To report an accident, open the Uber Eats app, go to “Help,” select “Trip Issues and Adjustments,” and choose “I was in an accident.”

Uber Eats Drivers May Need Additional Coverage

Your car insurance will usually not cover you while driving for business. Therefore, if you’re in an accident while making a delivery, your car insurance will likely deny the claim. Understanding the types of insurance coverage available can help determine whether you need additional protection.

A few companies may allow you to have coverage if the miles you drive to deliver food do not exceed a specific percentage of the total number of miles you drive.

Regardless of whether your car insurance will provide coverage for delivery driving, you should still let your insurance company know that you drive for work or business purposes. If you don’t, the insurance company could end up canceling your policy altogether.

Case Studies: What to Know & How to Save With Uber Eats Car Insurance

Case studies provide valuable information on how Uber Eats drivers approach insurance issues and surprise claims. Most drivers think their car insurance covers them while making deliveries, only to find holes that expose them financially. Analyzing actual situations can give you a sense of when and why extra coverage is needed to prevent expensive out-of-pocket payments.

Drivers can decide the best ways to protect their cars fully by comparing different insurance policies and their limitations. Specific drivers minimize risks by buying rideshare or commercial coverage, while Uber’s limited insurance packages favor others. Proof of insurance for the right coverage helps drivers comply with legal requirements while avoiding unexpected financial obligations.

Case Study 1: Mark’s Experience With Uber Eats Car Insurance

Mark decided to become an Uber Eats driver and started delivering orders using his personal car. He was aware that his personal car insurance might not provide coverage during deliveries, so he looked into additional Uber Eats car insurance options.

Mark decided to purchase delivery or rideshare insurance to ensure he had the necessary coverage while making deliveries. This extra insurance gave him peace of mind and protected him in case of an accident during his Uber Eats trips. (For more information, read about “Best Car Insurance for Rideshare Drivers“).

Case Study 2: Sarah’s Decision to Add a Business Use Endorsement

Sarah became an Uber Eats driver and asked, “Can I get car insurance for a car used for business purposes?” After researching, she added a business use endorsement to her policy for proper coverage.

This endorsement extended her coverage to include business activities, such as making deliveries for Uber Eats. Sarah found this to be a cost-effective solution as it provided the necessary coverage while keeping her overall insurance costs manageable.

Case Study 3: John’s Choice of Commercial Car Insurance

John decided to pursue Uber Eats delivery as a full-time job and wanted comprehensive coverage for his vehicle. He opted for commercial car insurance coverage, which provided extensive protection for his business activities.

Although this option came with a higher premium, John valued its added security and peace of mind. With commercial car insurance coverage, he felt confident that he had the proper protection against any potential accidents or incidents that could occur during his deliveries.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Buying Uber Eats Car Insurance

Driving for Uber Eats without insurance is very risky. Even though Uber offers some of the best car insurance for delivery drivers, it may still leave gaps in coverage while you are making deliveries.

Finding a food delivery car insurance is relatively easy, as major car insurance companies recognize the growth in ridesharing and delivery driving as side gigs. Many of the biggest insurers now offer rideshare and delivery insurance that can provide coverage for Uber Eats drivers. Another option is to add an endorsement to your car insurance policy covering business use.

If you drive full-time, you may benefit from something with more coverage, such as commercial car insurance. Talk with your insurance provider to determine your best options.

Top Insights for the Best Car Insurance for Uber Eats Drivers

Uber Eats drivers need proper insurance because personal auto policies often exclude business-related accidents. Commercial auto insurance is the best option for full-time drivers, while part-time drivers can use rideshare endorsements from companies like State Farm, Progressive, and Geico.

Insurance rates vary based on the provider, coverage level, and driver history. State Farm offers a rideshare endorsement for around $50 per month, while Progressive’s policies range from $60 to $180 per month, and Geico provides delivery driver add-ons starting at $55 per month.

Drivers can reduce costs through discounts and safe driving programs. Progressive’s Snapshot and State Farm’s Drive Safe & Save offer lower rates for cautious driving, while multi-policy discounts from Allstate and Erie help drivers save on Commercial Auto Insurance.

Enter your ZIP code into our free quote comparison tool below to find affordable Uber Eats car insurance rates in your area.

Frequently Asked Questions

Does driving for Uber Eats increase car insurance premiums, and why?

Yes, it can increase premiums because personal auto policies typically exclude business use, requiring a rideshare endorsement or commercial insurance. To find cheap insurance for Uber Eats, drivers should compare quotes from companies like Geico, Progressive, and State Farm, which offer specific coverage options for delivery drivers.

What insurance do you need for Uber Eats?

Uber Eats drivers must meet Uber Eats driver insurance requirements, which include having a personal auto insurance policy that complies with state laws.

How does Michigan handle car accidents involving Uber Eats drivers, and what insurance applies?

Michigan’s no-fault system requires Uber Eats drivers to file claims with their best Personal Injury Protection (PIP) coverage for medical expenses and lost wages. Uber Eats provides up to $1 million in third-party liability coverage while actively delivering. Still, drivers need personal comprehensive and collision car insurance from Uber Eats for vehicle damage protection.

What specific insurance options are available for Uber Eats drivers to avoid coverage gaps?

Drivers can choose from rideshare endorsements (State Farm, Progressive, Allstate), commercial auto insurance, or Uber Eats’ limited coverage, which includes a $2,500 collision deductible. Rideshare or commercial insurance is recommended to avoid denials and high out-of-pocket costs and to prevent issues with Uber Eats claims.

Do I need rideshare insurance for Uber Eats?

Uber Eats does not require rideshare insurance, but most personal policies exclude delivery work, leaving drivers at risk. Without insurance for food delivery Uber Eats, insurers may deny claims, increase premiums, or cancel policies after an accident.

How does Uber Eats vehicle insurance differ from regular personal auto insurance?

Uber Eats’ insurance only covers liability, which means it won’t pay for damage to your car unless you have comprehensive collision coverage. Understanding comprehensive car insurance coverage is essential because most personal auto policies don’t cover delivery driving. To stay fully protected, you might need to add an Uber Eats insurance endorsement or switch to a commercial policy.

What are Uber Eats’ official car insurance requirements for delivery drivers?

Drivers must have state-minimum personal auto insurance and upload proof of coverage to Uber Eats. However, Uber’s insurance only applies in limited situations, so drivers may need additional coverage, such as Geico Uber insurance, for complete protection.

Enter your ZIP code to get the best auto insurance quotes for Uber Eats drivers.

Which insurance companies offer the best policies for Uber Eats drivers, and why?

State Farm, Progressive, Geico, Allstate, and Farmers offer rideshare or delivery endorsements to cover food delivery. State Farm Uber Eats insurance provides a seamless rideshare endorsement, preventing coverage gaps at a lower cost than full commercial auto insurance.

Can my insurance company find out if I drive for Uber Eats?

The best car insurance companies can find out through accident claims, vehicle tracking, or underwriting reviews. Using fake insurance for Uber Eats or failing to disclose delivery driving may result in denied claims or policy cancellation.

What type of insurance coverage does Uber Eats provide for its drivers?

Uber Eats provides up to $1 million in third-party liability coverage while actively delivering contingent collision and comprehensive coverage if the driver has personal insurance. Some drivers choose Uber Eats insurance pay-as-you-gos, which offers flexible, usage-based coverage during deliveries.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.