Best New Hampshire Car Insurance (2025)

New Hampshire car insurance laws require 25/50/25 of bodily injury and property damage coverage and up to $1,000 per person for medical payments (MedPay). New Hampshire car insurance rates average $68 per month. This New Hampshire auto insurance review lists the best New Hampshire car insurance companies based on rates and coverage.

Read moreFree Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michael Leotta

Insurance Operations Specialist

Michael earned a degree in Business Management degree with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Au...

Insurance Operations Specialist

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- New Hampshire minimum auto insurance requirements are 25/50/25 for bodily injury and property damage

- New Hampshire car insurance rates average $68 per month

- To find cheap New Hampshire car insurance, compare multiple New Hampshire car insurance quotes

1859-223-New-Hampshire-Stat-Summary-2019-05-14.csv-2019-08-21.csv

| New Hampshire Statistics Summary | Details |

|---|---|

| Road Miles | Total in State: 16,132 Vehicle Miles Driven: 12,970 Million |

| Vehicles Registered | 1,234,098 |

| Population | 1,356,458 |

| Most Popular Vehicle | Silverado 1500 |

| Total Driving Related Deaths (2017) | 102 |

| Speeding-Related Fatalities (2017) | 58 |

| DUI-Related Fatalities (2017) | 27 |

| Average Premiums (Annual) | Liability: $400.56 Collision: $307.42 Comprehensive: $110.77 Combined Premium: $818.75 |

| Percentage of Motorists Uninsured | 9.9% State Rank: 35th |

| Cheapest Provider | Geico |

Currier Museum of Art, Mount Washington, and Ice Castles are just some of the endless things to do and see in New Hampshire. From the beautiful foliage to the snowy winters, New Hampshire has so much to offer residents and tourists.

If you live in New Hampshire, chances are you drive most places. Whether this driving is for work or play, you need to know the ins and outs of the roads and car insurance. Who has the time for all that research?

We do. We take facts and figures and compile them into easy tables and graphs to help you figure out the best New Hampshire car insurance and companies for your needs. So while you are enjoying the historical sites, snowy mountains, or amazing beaches, we will do the work for you.

If you already know the facts and are just looking for cheap New Hampshire auto insurance quotes, enter your zip code to use our free comparison quote tool.

New Hampshire Car Insurance Coverage & Rates

Coverage and rates are not the most exciting topics, but they are necessary to look at if you are looking to purchase car insurance. We are going to take a look at how much coverage is required and what the average New Hampshire resident pays for car insurance coverage.

New Hampshire Minimum Coverage

New Hampshire is one of the few states that does not have a law requiring insurance. While you may like that fact you do not have to pay for insurance if you do not want it, think what would happen if you were to get into an accident without any coverage.

Driving without insurance could cause financial ruin for you or someone else. You are required to pay for property damage and bodily injury if you get into an accident. So while you do not have to have insurance, we recommend it.

Not everyone gets a free pass to drive without insurance. The following convictions will require drivers to obtain insurance and show financial responsibility in New Hampshire:

- A driving while intoxicated conviction

- An at-fault accident without having insurance

- Drivers convicted of certain violations such as leaving the scene of an accident or second reckless driving offense

If you chose to carry insurance you must maintain the following minimum coverage limits:

- $25,000 – bodily injury liability for one person

- $50,000 – bodily injury liability total for multiple persons

- $25,000 – property damage

- $1,000 – medical payments

You must keep proof of insurance in your vehicle, which could be an ID card or a copy of your policy. New Hampshire also allows electronic proof of your insurance on your cellular device.

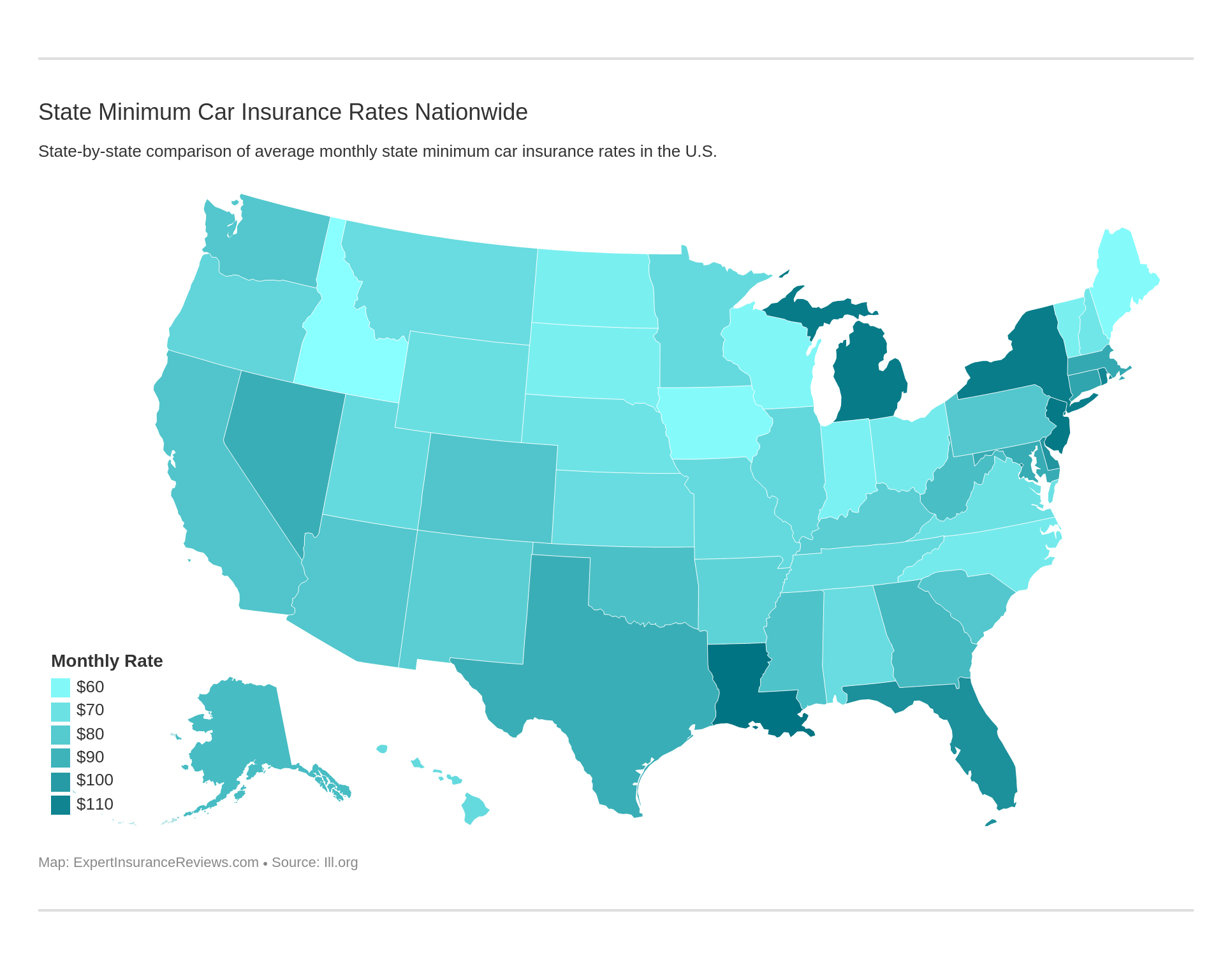

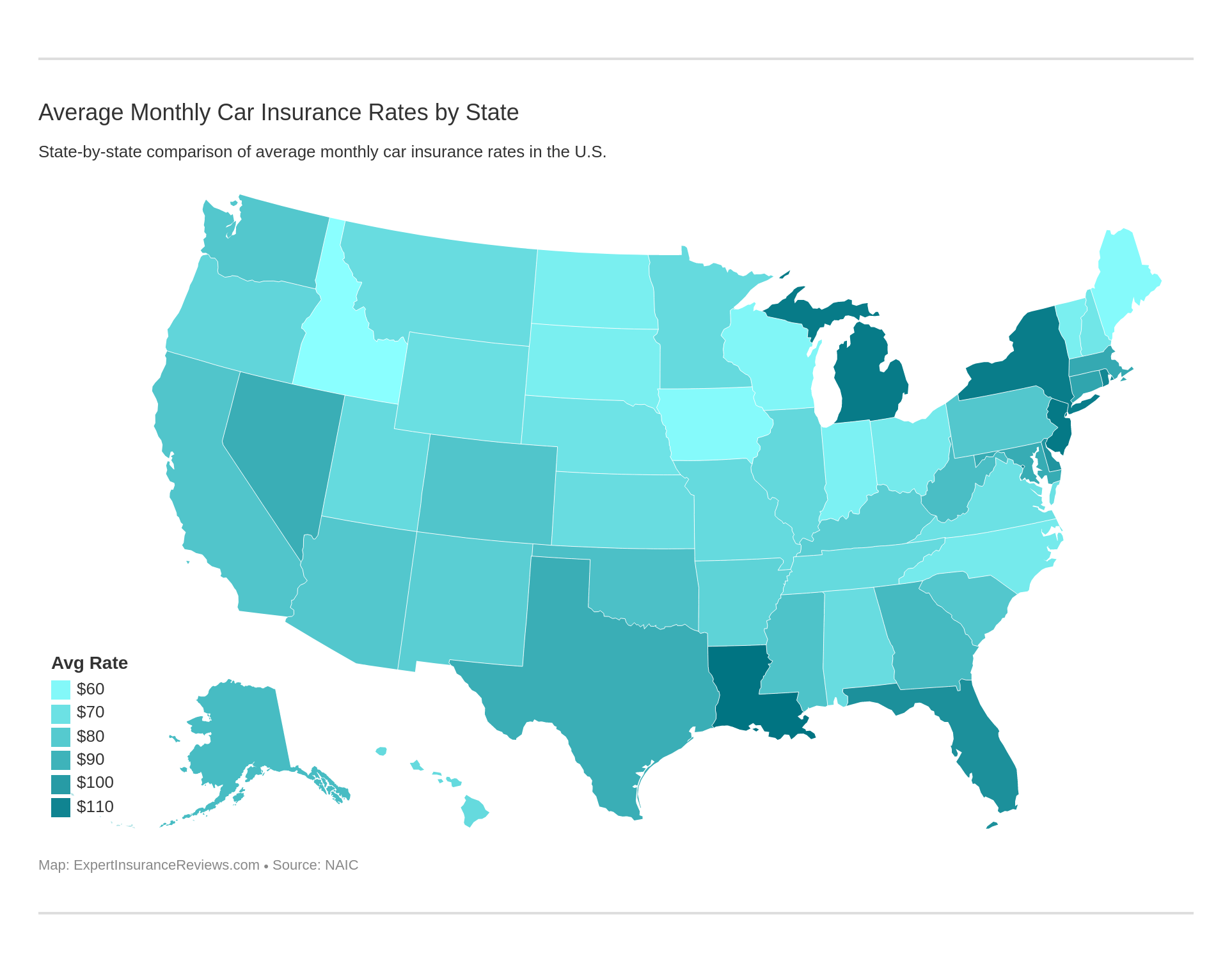

Minimum coverage costs vary from state to state.

Forms of Financial Responsibility

If you are required to have proof of financial responsibility or proof of insurance, you have two options. Since you are required to pay for bodily injury or property damage, you can deposit securities at the state treasurer’s office showing you have funds to cover damages in the event of an at-fault accident.

If you do not have funds personally to deposit, you can obtain an insurance policy with the above-listed minimum limits.

Premiums as a Percentage of Income

We took a look at the three-year trend of how much disposable income accounts for the cost of insurance premiums in New Hampshire.

New Hampshire - Income Percentage

| Full Coverage 2014 | Disposable Income 2014 | Income Percentage | Full Coverage 2013 | Disposable Income 2013 | Income Percentage | Full Coverage 2012 | Disposable Income 2012 | Income Percentage |

|---|---|---|---|---|---|---|---|---|

| $795.50 | $48,280.00 | 1.65% | $773.30 | $46,651.00 | 1.66% | $755.76 | $47,346.00 | 1.60% |

Average Monthly Car Insurance Rates in NH (Liability, Collision, Comprehensive)

The core coverages of a policy are liability car insurance, comprehensive car insurance, and collision car insurance. Liability coverage is used for the other party if you are found at fault. Comprehensive and collision car insurance coverage are used on your vehicle regardless of fault.

We took data from the National Association of Insurance Commissioners and found both the average premiums for New Hampshire and national averages. These averages are based on New Hampshire’s minimum limits.

1861-225-New-Hampshire-Rates-Compared-to-the-National-Average-2019-05-14.csv-2019-08-21.csv

| Coverage Type | National Average | New Hampshire Average |

|---|---|---|

| Full Coverage | $1009.38 | $818.75 |

| Liability | $538.73 | $400.56 |

| Collision | $322.61 | $307.42 |

| Comprehensive | $148.04 | $110.77 |

New Hampshire averages are lower on all categories.

Additional Liability

If you chose to buy insurance, you are required to have additional coverages. Medical payment coverage is used for your medical bills in the event of bodily injury. This is a required coverage in New Hampshire.

Uninsured and underinsured motorist coverage is used if you are in an accident with someone who doesn’t have insurance or doesn’t have enough to cover your loss.

1862-238-New-Hampshire-Loss-Ratio-2019-05-14.csv-2019-08-21.csv

| Coverage | Loss Ratios |

|---|---|

| Medical Payments | 68.50% |

| Uninsured/Underinsured Motorist Coverage | 59.51% |

This table shows the loss ratio of New Hampshire insurance companies. Loss ratios show how much a company is getting in earned premium versus how much they are spending in claims. For instance, a company that made $100,000 and paid out $50,000 in claims has a 50 percent loss ratio.

If a company has a higher ratio, say 100 or over, they are not making money. If their ratio is lower, say below 50, they do not pay out in claims.

Add-Ons, Endorsements, & Riders

Insurance companies offer an array of different endorsements and additional coverages you can add to your policy. Below are some of the most commonly added coverages.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Car Insurance

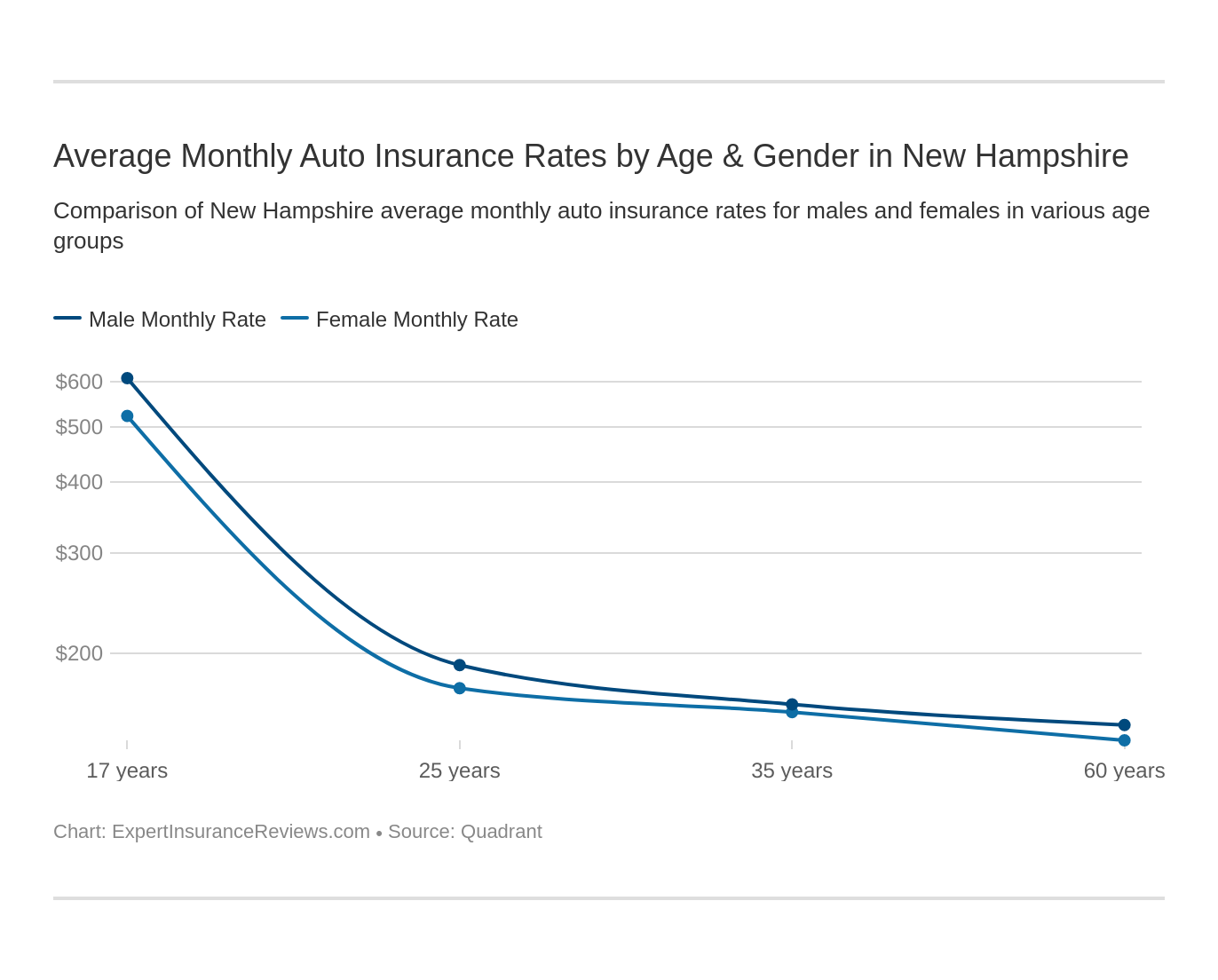

Average Car Insurance Rates by Age & Gender in NH

A lot of different factors go into getting an insurance rate. In this section, we are going to take a look at age, gender, and marital status.

| Company | Married 35-year-old female annual rates | Married 35-year-old male annual rates | Married 60-year-old female annual rates | Married 60-year-old male annual rates | Single 17-year-old female annual rates | Single 17-year-old male annual rates | Single 25-year-old female annual rates | Single 25-year-old male annual rates |

|---|---|---|---|---|---|---|---|---|

| Allstate | $1,971.11 | $2,091.82 | $2,108.93 | $2,311.91 | $4,044.64 | $5,099.29 | $2,074.05 | $2,199.82 |

| Geico | $1,057.44 | $1,046.60 | $946.66 | $946.66 | $2,567.96 | $3,560.95 | $1,102.51 | $1,664.55 |

| Safeco | $4,942.38 | $5,338.33 | $4,025.54 | $4,521.69 | $18,139.34 | $20,118.55 | $5,209.68 | $5,519.33 |

| Nationwide | $1,585.61 | $1,608.07 | $1,429.82 | $1,499.99 | $4,405.75 | $5,590.99 | $1,823.61 | $1,956.81 |

| Progressive | $1,366.59 | $1,244.66 | $1,188.47 | $1,199.26 | $6,320.20 | $6,980.91 | $1,610.65 | $1,618.31 |

| State Farm | $1,352.09 | $1,352.09 | $1,231.58 | $1,231.58 | $4,066.25 | $5,031.12 | $1,508.29 | $1,721.50 |

| USAA | $992.31 | $973.40 | $926.28 | $927.55 | $4,269.45 | $4,673.07 | $1,246.20 | $1,361.16 |

While some companies may adjust their rate based on your gender, across the board the rates are very close. The biggest factor is age. Check out those Safeco rates for young, male drivers. Yikes!

The more experience you have as a driver, the lower your rate will go.

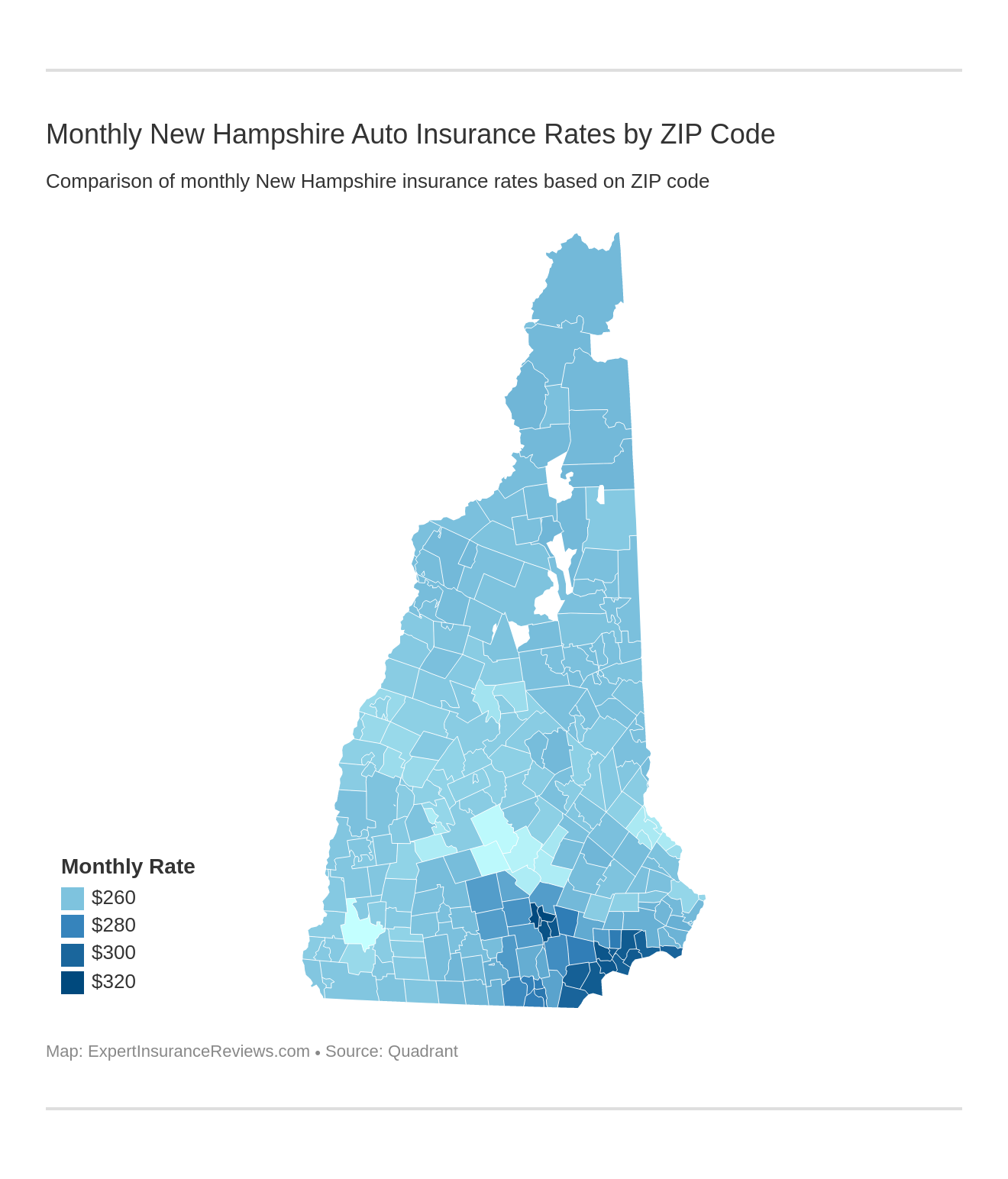

Cheapest Rates by Zip Code

You are also rated based on where your car is garaged. Zip code and the city can make an impact on your rates.

| Zipcode | Annual Average | Allstate | Geico | Safeco | Nationwide | Progressive | State Farm | USAA |

|---|---|---|---|---|---|---|---|---|

| 03104 | $3,845.88 | $3,137.78 | $1,929.49 | $10,234.44 | $3,322.91 | $3,081.80 | $2,949.61 | $2,265.12 |

| 03101 | $3,835.72 | $3,133.15 | $1,929.49 | $10,234.44 | $3,322.91 | $3,081.80 | $2,883.13 | $2,265.12 |

| 03102 | $3,825.66 | $3,002.18 | $1,878.72 | $10,234.44 | $3,322.91 | $3,081.80 | $2,994.46 | $2,265.12 |

| 03103 | $3,762.33 | $2,762.47 | $1,878.72 | $10,234.44 | $3,322.91 | $3,081.80 | $2,790.88 | $2,265.12 |

| 03841 | $3,735.99 | $3,212.02 | $1,731.34 | $9,804.60 | $2,827.31 | $3,434.34 | $2,863.76 | $2,278.55 |

| 03811 | $3,725.58 | $3,212.02 | $1,798.02 | $9,804.60 | $2,827.31 | $3,434.34 | $2,724.21 | $2,278.55 |

| 03109 | $3,720.88 | $2,787.74 | $1,747.47 | $10,234.44 | $3,322.91 | $3,081.80 | $2,606.71 | $2,265.12 |

| 03826 | $3,695.88 | $3,456.72 | $1,798.02 | $9,804.60 | $2,827.31 | $2,790.16 | $2,915.78 | $2,278.55 |

| 03858 | $3,694.35 | $3,163.14 | $1,798.02 | $9,804.60 | $2,827.31 | $3,241.23 | $2,747.63 | $2,278.55 |

| 03848 | $3,689.28 | $3,163.14 | $1,798.02 | $9,804.60 | $2,827.31 | $3,241.23 | $2,712.14 | $2,278.55 |

| 03079 | $3,678.46 | $3,132.62 | $1,762.82 | $9,646.10 | $3,153.58 | $3,289.60 | $2,363.39 | $2,401.14 |

| 03865 | $3,653.43 | $2,918.41 | $1,798.02 | $9,804.60 | $2,827.31 | $3,241.23 | $2,705.88 | $2,278.55 |

| 03087 | $3,648.72 | $3,132.62 | $1,747.47 | $9,646.10 | $3,153.58 | $2,946.89 | $2,513.28 | $2,401.14 |

| 03827 | $3,640.47 | $3,060.96 | $1,650.93 | $9,804.60 | $2,827.31 | $3,241.23 | $2,619.70 | $2,278.55 |

| 03076 | $3,611.18 | $3,103.08 | $1,747.47 | $9,646.10 | $2,528.63 | $3,289.60 | $2,562.23 | $2,401.14 |

| 03874 | $3,610.79 | $2,904.06 | $1,650.93 | $9,804.60 | $2,827.31 | $3,241.23 | $2,568.83 | $2,278.55 |

| 03859 | $3,512.48 | $3,163.14 | $1,798.02 | $9,804.60 | $2,421.57 | $2,790.16 | $2,689.18 | $1,920.69 |

| 03060 | $3,451.59 | $2,959.49 | $1,847.27 | $9,141.45 | $2,842.24 | $2,848.25 | $2,637.91 | $1,884.55 |

| 03819 | $3,424.28 | $2,918.41 | $1,650.93 | $9,804.60 | $2,421.57 | $2,790.16 | $2,463.63 | $1,920.69 |

| 03064 | $3,405.94 | $2,960.04 | $1,650.60 | $9,141.45 | $2,842.24 | $2,848.25 | $2,514.48 | $1,884.55 |

| 03032 | $3,404.93 | $3,132.62 | $1,747.47 | $8,513.56 | $3,153.58 | $2,923.20 | $2,403.01 | $1,961.04 |

| 03062 | $3,400.72 | $2,959.49 | $1,650.60 | $9,141.45 | $2,842.24 | $2,848.25 | $2,478.49 | $1,884.55 |

| 03038 | $3,394.58 | $2,863.36 | $1,886.80 | $8,483.24 | $3,153.58 | $2,749.60 | $2,664.42 | $1,961.04 |

| 03063 | $3,389.41 | $2,959.49 | $1,650.60 | $9,141.45 | $2,842.24 | $2,848.25 | $2,399.32 | $1,884.55 |

| 03049 | $3,331.53 | $2,936.83 | $1,689.50 | $9,141.45 | $2,469.60 | $2,785.35 | $2,336.95 | $1,961.04 |

| 03053 | $3,324.24 | $2,761.92 | $1,747.47 | $8,483.24 | $3,153.58 | $2,785.35 | $2,377.07 | $1,961.04 |

| 03073 | $3,314.36 | $3,132.62 | $1,762.82 | $8,382.59 | $2,421.57 | $3,289.60 | $2,290.65 | $1,920.69 |

| 03045 | $3,294.84 | $2,966.90 | $1,731.34 | $8,483.24 | $2,740.73 | $2,681.54 | $2,499.12 | $1,961.04 |

| 03031 | $3,277.35 | $2,959.49 | $1,689.50 | $8,483.24 | $2,740.73 | $2,785.35 | $2,322.10 | $1,961.04 |

| 03110 | $3,272.93 | $3,002.18 | $1,628.13 | $8,483.24 | $2,740.73 | $2,681.54 | $2,413.65 | $1,961.04 |

| 03873 | $3,269.18 | $3,212.02 | $1,731.34 | $8,476.40 | $2,421.57 | $2,621.90 | $2,500.32 | $1,920.69 |

| 03106 | $3,268.15 | $2,677.93 | $1,731.34 | $8,513.56 | $2,367.40 | $2,995.98 | $2,629.77 | $1,961.04 |

| 03070 | $3,263.40 | $2,886.16 | $1,731.34 | $8,476.40 | $2,740.73 | $2,736.25 | $2,352.22 | $1,920.69 |

| 03281 | $3,260.44 | $2,803.12 | $1,731.34 | $8,476.40 | $2,740.73 | $2,736.25 | $2,414.54 | $1,920.69 |

| 03051 | $3,242.99 | $2,732.39 | $1,747.47 | $8,483.24 | $2,528.63 | $2,785.35 | $2,462.81 | $1,961.04 |

| 03046 | $3,227.36 | $2,971.51 | $1,731.34 | $8,483.24 | $2,367.40 | $2,681.54 | $2,435.78 | $1,920.69 |

| 03052 | $3,214.50 | $2,761.92 | $1,747.47 | $8,483.24 | $2,528.63 | $2,785.35 | $2,233.82 | $1,961.04 |

| 03036 | $3,213.97 | $3,023.44 | $1,731.34 | $8,476.40 | $2,421.57 | $2,621.90 | $2,302.44 | $1,920.69 |

| 03054 | $3,201.58 | $2,690.79 | $1,628.13 | $8,483.24 | $2,740.73 | $2,785.35 | $2,121.76 | $1,961.04 |

| 03055 | $3,200.23 | $2,853.05 | $1,689.50 | $8,476.40 | $2,469.60 | $2,720.14 | $2,272.24 | $1,920.69 |

| 03833 | $3,197.59 | $2,897.03 | $1,650.93 | $8,433.03 | $2,583.08 | $2,834.52 | $2,196.82 | $1,787.68 |

| 03862 | $3,194.47 | $2,904.06 | $1,630.33 | $8,476.40 | $2,583.08 | $2,824.12 | $2,155.66 | $1,787.68 |

| 03033 | $3,187.78 | $2,853.05 | $1,689.50 | $8,382.59 | $2,469.60 | $2,720.14 | $2,278.87 | $1,920.69 |

| 03041 | $3,185.18 | $2,863.36 | $1,886.80 | $8,201.11 | $2,421.57 | $2,785.35 | $2,217.39 | $1,920.69 |

| 03856 | $3,180.82 | $2,904.06 | $1,650.93 | $8,288.13 | $2,583.08 | $3,007.19 | $2,044.64 | $1,787.68 |

| 03044 | $3,176.64 | $2,809.25 | $1,650.93 | $8,476.40 | $2,421.57 | $2,790.16 | $2,167.45 | $1,920.69 |

| 03842 | $3,174.72 | $2,904.06 | $1,630.33 | $8,288.13 | $2,583.08 | $2,855.08 | $2,174.70 | $1,787.68 |

| 03048 | $3,173.94 | $2,853.05 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,422.50 | $1,920.69 |

| 03885 | $3,173.12 | $2,904.06 | $1,630.33 | $8,288.13 | $2,583.08 | $2,855.08 | $2,163.51 | $1,787.68 |

| 03261 | $3,172.67 | $2,579.94 | $1,731.34 | $8,476.40 | $2,421.57 | $2,621.90 | $2,456.83 | $1,920.69 |

| 03570 | $3,170.23 | $2,776.57 | $1,619.58 | $8,382.59 | $2,398.41 | $2,878.16 | $2,199.02 | $1,937.28 |

| 03084 | $3,168.50 | $2,799.54 | $1,572.74 | $8,476.40 | $2,469.60 | $2,578.15 | $2,362.35 | $1,920.69 |

| 03590 | $3,164.31 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,310.72 | $1,918.91 |

| 03871 | $3,164.19 | $2,894.93 | $1,630.33 | $8,288.13 | $2,583.08 | $2,855.08 | $2,110.10 | $1,787.68 |

| 03844 | $3,163.02 | $2,904.06 | $1,630.33 | $8,288.13 | $2,583.08 | $2,855.08 | $2,092.76 | $1,787.68 |

| 03575 | $3,162.30 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,873.72 | $2,118.06 | $1,918.91 |

| 03586 | $3,161.98 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,871.51 | $2,118.06 | $1,918.91 |

| 03870 | $3,161.79 | $2,894.93 | $1,630.33 | $8,288.13 | $2,583.08 | $2,855.08 | $2,093.29 | $1,787.68 |

| 03034 | $3,161.67 | $2,653.66 | $1,731.34 | $8,476.40 | $2,421.57 | $2,621.90 | $2,306.11 | $1,920.69 |

| 03576 | $3,160.98 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,287.45 | $1,918.91 |

| 03071 | $3,160.05 | $2,792.98 | $1,572.74 | $8,382.59 | $2,469.60 | $2,578.15 | $2,403.60 | $1,920.69 |

| 03086 | $3,159.94 | $2,853.05 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,324.53 | $1,920.69 |

| 03579 | $3,159.78 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,279.04 | $1,918.91 |

| 03582 | $3,159.77 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,278.98 | $1,918.91 |

| 03593 | $3,156.04 | $2,776.57 | $1,619.58 | $8,382.59 | $2,398.41 | $2,878.16 | $2,118.06 | $1,918.91 |

| 03592 | $3,154.79 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,244.06 | $1,918.91 |

| 03840 | $3,153.42 | $2,894.93 | $1,630.33 | $8,288.13 | $2,583.08 | $2,855.08 | $2,034.67 | $1,787.68 |

| 03588 | $3,152.90 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,230.88 | $1,918.91 |

| 03249 | $3,151.96 | $2,516.00 | $1,677.77 | $8,697.05 | $2,497.26 | $2,597.59 | $2,157.41 | $1,920.69 |

| 03585 | $3,150.03 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,210.75 | $1,918.91 |

| 03584 | $3,149.75 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,208.83 | $1,918.91 |

| 03246 | $3,149.74 | $2,500.56 | $1,677.77 | $8,697.05 | $2,497.26 | $2,597.59 | $2,157.72 | $1,920.28 |

| 03740 | $3,149.45 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,206.70 | $1,918.91 |

| 03785 | $3,148.85 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,202.51 | $1,918.91 |

| 03244 | $3,147.66 | $2,803.12 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,288.50 | $1,920.69 |

| 03037 | $3,146.95 | $2,578.08 | $1,731.34 | $8,382.59 | $2,421.57 | $2,621.90 | $2,372.50 | $1,920.69 |

| 03468 | $3,146.12 | $2,792.98 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,287.82 | $1,920.69 |

| 03823 | $3,144.79 | $2,683.68 | $1,510.82 | $8,433.03 | $2,682.03 | $2,886.53 | $2,172.86 | $1,644.58 |

| 03082 | $3,144.30 | $2,853.05 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,215.03 | $1,920.69 |

| 03057 | $3,143.93 | $2,853.05 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,212.46 | $1,920.69 |

| 03215 | $3,143.86 | $2,732.30 | $1,667.83 | $8,476.40 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 03238 | $3,143.86 | $2,732.30 | $1,667.83 | $8,476.40 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 03234 | $3,143.33 | $2,550.40 | $1,731.34 | $8,476.40 | $2,469.60 | $2,578.15 | $2,276.70 | $1,920.69 |

| 03458 | $3,142.33 | $2,792.98 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,261.30 | $1,920.69 |

| 03852 | $3,140.95 | $2,789.42 | $1,667.83 | $8,476.40 | $2,421.57 | $2,642.42 | $2,068.33 | $1,920.69 |

| 03043 | $3,140.88 | $2,799.54 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,244.60 | $1,920.69 |

| 03242 | $3,139.93 | $2,809.29 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,228.19 | $1,920.69 |

| 03825 | $3,139.52 | $2,659.34 | $1,583.08 | $8,476.40 | $2,421.57 | $2,621.90 | $2,293.66 | $1,920.69 |

| 03583 | $3,138.79 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,132.10 | $1,918.91 |

| 03817 | $3,138.62 | $2,789.42 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 03850 | $3,138.62 | $2,789.42 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 03883 | $3,138.62 | $2,789.42 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 03890 | $3,138.62 | $2,789.42 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 03897 | $3,138.62 | $2,789.42 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 03774 | $3,138.01 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,126.64 | $1,918.91 |

| 03561 | $3,137.67 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,124.23 | $1,918.91 |

| 03263 | $3,137.04 | $2,596.74 | $1,583.08 | $8,382.59 | $2,469.60 | $2,621.90 | $2,384.70 | $1,920.69 |

| 03589 | $3,136.79 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 03597 | $3,136.79 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 03765 | $3,136.79 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 03771 | $3,136.79 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 03780 | $3,136.79 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 03832 | $3,136.79 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 03838 | $3,136.79 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 03847 | $3,136.79 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 03580 | $3,136.50 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,116.04 | $1,918.91 |

| 03824 | $3,136.38 | $2,659.34 | $1,533.81 | $8,433.03 | $2,682.03 | $2,792.35 | $2,209.50 | $1,644.58 |

| 03884 | $3,136.05 | $2,604.28 | $1,583.08 | $8,382.59 | $2,421.57 | $2,621.90 | $2,418.21 | $1,920.69 |

| 03598 | $3,135.81 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,111.26 | $1,918.91 |

| 03845 | $3,133.95 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,098.20 | $1,918.91 |

| 03846 | $3,133.18 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,092.86 | $1,918.91 |

| 03237 | $3,132.54 | $2,596.74 | $1,677.77 | $8,476.40 | $2,357.73 | $2,578.15 | $2,320.34 | $1,920.69 |

| 03442 | $3,132.50 | $2,792.98 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,192.50 | $1,920.69 |

| 03813 | $3,132.06 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,084.96 | $1,918.91 |

| 03595 | $3,131.61 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,081.82 | $1,918.91 |

| 03440 | $3,131.41 | $2,799.54 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,178.28 | $1,920.69 |

| 03259 | $3,130.46 | $2,732.30 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 03886 | $3,130.37 | $2,789.42 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,060.34 | $1,918.91 |

| 03812 | $3,130.25 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,072.29 | $1,918.91 |

| 03861 | $3,129.92 | $2,659.34 | $1,533.81 | $8,433.03 | $2,421.57 | $2,792.35 | $2,148.63 | $1,920.69 |

| 03816 | $3,129.85 | $2,789.42 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,056.66 | $1,918.91 |

| 03282 | $3,129.14 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,064.56 | $1,918.91 |

| 03875 | $3,129.12 | $2,776.95 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,063.99 | $1,918.91 |

| 03849 | $3,129.06 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,063.99 | $1,918.91 |

| 03860 | $3,127.97 | $2,776.57 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,056.33 | $1,918.91 |

| 03254 | $3,127.11 | $2,745.13 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,081.80 | $1,918.91 |

| 03830 | $3,127.00 | $2,789.42 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,036.71 | $1,918.91 |

| 03289 | $3,126.81 | $2,500.56 | $1,497.18 | $8,476.40 | $2,357.73 | $2,917.70 | $2,217.39 | $1,920.69 |

| 03047 | $3,126.80 | $2,792.98 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,152.63 | $1,920.69 |

| 03743 | $3,126.71 | $2,796.76 | $1,497.71 | $8,463.32 | $2,387.99 | $2,763.09 | $2,057.38 | $1,920.69 |

| 03864 | $3,126.70 | $2,789.42 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,034.60 | $1,918.91 |

| 03814 | $3,126.34 | $2,789.42 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,032.10 | $1,918.91 |

| 03872 | $3,126.15 | $2,789.42 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,030.78 | $1,918.91 |

| 03227 | $3,126.14 | $2,732.30 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,087.78 | $1,918.91 |

| 03882 | $3,125.99 | $2,789.42 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,029.63 | $1,918.91 |

| 03773 | $3,125.79 | $2,796.76 | $1,497.71 | $8,463.32 | $2,387.99 | $2,893.76 | $1,972.39 | $1,868.58 |

| 03836 | $3,125.50 | $2,789.42 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,026.25 | $1,918.91 |

| 03574 | $3,125.16 | $2,732.30 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,080.98 | $1,918.91 |

| 03279 | $3,124.58 | $2,732.30 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,076.87 | $1,918.91 |

| 03818 | $3,124.54 | $2,738.86 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,070.03 | $1,918.91 |

| 03820 | $3,124.15 | $2,649.28 | $1,533.81 | $8,433.03 | $2,682.03 | $2,792.35 | $2,134.00 | $1,644.58 |

| 03290 | $3,124.15 | $2,657.49 | $1,583.08 | $8,476.40 | $2,421.57 | $2,621.90 | $2,187.95 | $1,920.69 |

| 03262 | $3,123.89 | $2,732.30 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,072.05 | $1,918.91 |

| 03255 | $3,120.94 | $2,799.15 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,105.44 | $1,920.69 |

| 03449 | $3,120.67 | $2,792.98 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,109.67 | $1,920.69 |

| 03447 | $3,118.97 | $2,799.15 | $1,572.74 | $8,476.40 | $2,387.99 | $2,578.15 | $2,097.66 | $1,920.69 |

| 03285 | $3,118.72 | $2,732.30 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,035.90 | $1,918.91 |

| 03251 | $3,118.08 | $2,732.30 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,031.37 | $1,918.91 |

| 03225 | $3,117.31 | $2,579.94 | $1,497.18 | $8,476.40 | $2,357.73 | $2,578.15 | $2,411.05 | $1,920.69 |

| 03470 | $3,113.18 | $2,799.15 | $1,572.74 | $8,476.40 | $2,387.99 | $2,578.15 | $2,057.16 | $1,920.69 |

| 03857 | $3,112.71 | $2,659.34 | $1,533.81 | $8,433.03 | $2,583.08 | $2,792.35 | $1,999.69 | $1,787.68 |

| 03749 | $3,112.22 | $2,458.89 | $1,497.18 | $8,476.40 | $2,398.41 | $2,917.70 | $2,118.06 | $1,918.91 |

| 03887 | $3,111.28 | $2,540.34 | $1,667.83 | $8,476.40 | $2,421.57 | $2,642.42 | $2,109.74 | $1,920.69 |

| 03603 | $3,109.13 | $2,796.76 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $2,106.76 | $1,920.69 |

| 03602 | $3,108.89 | $2,799.15 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $2,102.66 | $1,920.69 |

| 03601 | $3,108.67 | $2,796.76 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $2,103.54 | $1,920.69 |

| 03451 | $3,108.29 | $2,799.15 | $1,572.74 | $8,476.40 | $2,387.99 | $2,578.15 | $2,022.88 | $1,920.69 |

| 03465 | $3,107.78 | $2,799.15 | $1,572.74 | $8,476.40 | $2,387.99 | $2,578.15 | $2,019.35 | $1,920.69 |

| 03461 | $3,107.24 | $2,792.98 | $1,572.74 | $8,382.59 | $2,387.99 | $2,578.15 | $2,115.56 | $1,920.69 |

| 03224 | $3,106.71 | $2,500.56 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,304.41 | $1,920.69 |

| 03456 | $3,105.83 | $2,799.15 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $2,081.28 | $1,920.69 |

| 03040 | $3,103.42 | $2,653.66 | $1,731.34 | $8,201.11 | $2,421.57 | $2,578.15 | $2,217.39 | $1,920.69 |

| 03218 | $3,103.25 | $2,545.54 | $1,583.08 | $8,476.40 | $2,357.73 | $2,621.90 | $2,217.39 | $1,920.69 |

| 03896 | $3,103.04 | $2,540.34 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 03815 | $3,102.44 | $2,569.88 | $1,583.08 | $8,382.59 | $2,421.57 | $2,621.90 | $2,217.39 | $1,920.69 |

| 03605 | $3,102.34 | $2,796.76 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $2,059.25 | $1,920.69 |

| 03441 | $3,101.79 | $2,799.15 | $1,572.74 | $8,476.40 | $2,387.99 | $2,578.15 | $1,977.43 | $1,920.69 |

| 03452 | $3,101.63 | $2,799.15 | $1,572.74 | $8,476.40 | $2,387.99 | $2,578.15 | $1,976.30 | $1,920.69 |

| 03609 | $3,101.57 | $2,796.76 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $2,053.80 | $1,920.69 |

| 03231 | $3,100.58 | $2,471.42 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,290.65 | $1,920.69 |

| 03233 | $3,099.14 | $2,461.29 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,290.65 | $1,920.69 |

| 03581 | $3,098.48 | $2,776.57 | $1,619.58 | $7,932.06 | $2,398.41 | $2,878.16 | $2,147.33 | $1,937.28 |

| 03462 | $3,098.02 | $2,799.15 | $1,572.74 | $8,476.40 | $2,387.99 | $2,578.15 | $1,951.03 | $1,920.69 |

| 03464 | $3,097.91 | $2,799.15 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $2,025.79 | $1,920.69 |

| 03769 | $3,097.73 | $2,503.17 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 03779 | $3,097.73 | $2,503.17 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 03855 | $3,097.12 | $2,540.34 | $1,497.18 | $8,476.40 | $2,421.57 | $2,578.15 | $2,245.51 | $1,920.69 |

| 03608 | $3,094.82 | $2,796.76 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $2,006.57 | $1,920.69 |

| 03777 | $3,094.76 | $2,503.17 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,097.27 | $1,918.91 |

| 03240 | $3,094.36 | $2,461.29 | $1,667.83 | $8,476.40 | $2,398.41 | $2,695.12 | $2,042.55 | $1,918.91 |

| 03894 | $3,094.29 | $2,540.34 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,056.80 | $1,918.91 |

| 03752 | $3,092.66 | $2,796.76 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,991.46 | $1,920.69 |

| 03266 | $3,091.88 | $2,503.17 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,077.16 | $1,918.91 |

| 03241 | $3,091.74 | $2,461.29 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 03443 | $3,091.00 | $2,799.15 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,977.43 | $1,920.69 |

| 03457 | $3,091.00 | $2,799.15 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,977.43 | $1,920.69 |

| 03604 | $3,091.00 | $2,799.15 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,977.43 | $1,920.69 |

| 03607 | $3,091.00 | $2,799.15 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,977.43 | $1,920.69 |

| 03751 | $3,090.66 | $2,796.76 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,977.43 | $1,920.69 |

| 03853 | $3,090.41 | $2,496.07 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,073.93 | $1,918.91 |

| 03448 | $3,090.10 | $2,799.15 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,971.16 | $1,920.69 |

| 03217 | $3,089.85 | $2,467.84 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,098.25 | $1,918.91 |

| 03220 | $3,089.09 | $2,500.56 | $1,497.18 | $8,476.40 | $2,497.26 | $2,578.15 | $2,153.42 | $1,920.69 |

| 03745 | $3,089.09 | $2,796.76 | $1,497.18 | $8,463.32 | $2,387.99 | $2,578.15 | $1,979.53 | $1,920.69 |

| 03746 | $3,088.79 | $2,796.76 | $1,497.18 | $8,463.32 | $2,387.99 | $2,578.15 | $1,977.43 | $1,920.69 |

| 03768 | $3,087.85 | $2,503.17 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,048.92 | $1,918.91 |

| 03222 | $3,087.63 | $2,467.84 | $1,667.83 | $8,382.59 | $2,398.41 | $2,695.12 | $2,082.71 | $1,918.91 |

| 03467 | $3,087.03 | $2,796.76 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,952.01 | $1,920.69 |

| 03223 | $3,086.71 | $2,732.30 | $1,667.83 | $8,382.59 | $2,398.41 | $2,444.07 | $2,062.84 | $1,918.91 |

| 03455 | $3,085.99 | $2,792.98 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,948.52 | $1,920.69 |

| 03445 | $3,085.58 | $2,799.15 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,939.47 | $1,920.69 |

| 03256 | $3,085.51 | $2,461.67 | $1,497.18 | $8,476.40 | $2,497.26 | $2,578.15 | $2,167.23 | $1,920.69 |

| 03837 | $3,085.25 | $2,516.00 | $1,497.18 | $8,476.40 | $2,357.73 | $2,578.15 | $2,250.59 | $1,920.69 |

| 03809 | $3,084.47 | $2,516.00 | $1,497.18 | $8,476.40 | $2,357.73 | $2,578.15 | $2,245.12 | $1,920.69 |

| 03782 | $3,084.02 | $2,796.76 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,931.00 | $1,920.69 |

| 03077 | $3,083.74 | $2,657.49 | $1,583.08 | $8,201.11 | $2,421.57 | $2,602.73 | $2,199.49 | $1,920.69 |

| 03276 | $3,083.36 | $2,498.70 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,142.81 | $1,920.69 |

| 03253 | $3,082.56 | $2,471.73 | $1,497.18 | $8,476.40 | $2,497.26 | $2,578.15 | $2,136.54 | $1,920.69 |

| 03466 | $3,082.21 | $2,799.15 | $1,497.18 | $8,382.59 | $2,387.99 | $2,578.15 | $2,009.74 | $1,920.69 |

| 03278 | $3,081.47 | $2,471.42 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,156.84 | $1,920.69 |

| 03851 | $3,081.10 | $2,540.34 | $1,497.18 | $8,476.40 | $2,421.57 | $2,578.15 | $2,133.37 | $1,920.69 |

| 03444 | $3,081.03 | $2,799.15 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,907.65 | $1,920.69 |

| 03268 | $3,079.41 | $2,476.03 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,137.85 | $1,920.69 |

| 03754 | $3,077.33 | $2,796.76 | $1,497.71 | $8,382.59 | $2,387.99 | $2,578.15 | $1,977.43 | $1,920.69 |

| 03770 | $3,077.25 | $2,796.76 | $1,497.18 | $8,382.59 | $2,387.99 | $2,578.15 | $1,977.43 | $1,920.69 |

| 03042 | $3,074.73 | $2,652.33 | $1,583.08 | $8,201.11 | $2,421.57 | $2,602.73 | $2,141.64 | $1,920.69 |

| 03269 | $3,073.67 | $2,461.67 | $1,497.18 | $8,476.40 | $2,497.26 | $2,578.15 | $2,084.32 | $1,920.69 |

| 03835 | $3,072.68 | $2,569.88 | $1,667.83 | $7,743.08 | $2,682.03 | $2,873.72 | $2,327.62 | $1,644.58 |

| 03741 | $3,071.72 | $2,461.29 | $1,667.83 | $8,382.59 | $2,398.41 | $2,642.42 | $2,030.57 | $1,918.91 |

| 03781 | $3,070.81 | $2,796.76 | $1,497.18 | $8,382.59 | $2,387.99 | $2,578.15 | $1,932.30 | $1,920.69 |

| 03243 | $3,070.38 | $2,461.67 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,088.96 | $1,920.69 |

| 03307 | $3,070.22 | $2,544.83 | $1,497.18 | $8,476.40 | $2,469.60 | $2,210.05 | $2,372.83 | $1,920.69 |

| 03216 | $3,070.06 | $2,471.42 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,076.98 | $1,920.69 |

| 03235 | $3,068.97 | $2,504.87 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,035.91 | $1,920.69 |

| 03784 | $3,068.10 | $2,458.89 | $1,497.18 | $8,382.59 | $2,398.41 | $2,917.70 | $1,903.04 | $1,918.91 |

| 03257 | $3,066.31 | $2,461.29 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,060.85 | $1,920.69 |

| 03810 | $3,066.17 | $2,516.00 | $1,497.18 | $8,382.59 | $2,357.73 | $2,578.15 | $2,210.87 | $1,920.69 |

| 03750 | $3,065.88 | $2,458.89 | $1,497.18 | $8,382.59 | $2,387.99 | $2,917.70 | $1,897.91 | $1,918.91 |

| 03450 | $3,064.85 | $2,799.15 | $1,497.18 | $8,382.59 | $2,387.99 | $2,578.15 | $1,888.17 | $1,920.69 |

| 03252 | $3,064.63 | $2,498.70 | $1,497.18 | $8,382.59 | $2,357.73 | $2,578.15 | $2,217.39 | $1,920.69 |

| 03230 | $3,063.98 | $2,461.29 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,044.53 | $1,920.69 |

| 03287 | $3,063.82 | $2,461.29 | $1,497.18 | $8,476.40 | $2,469.60 | $2,578.15 | $2,043.45 | $1,920.69 |

| 03226 | $3,057.79 | $2,461.67 | $1,497.18 | $8,476.40 | $2,357.73 | $2,578.15 | $2,112.73 | $1,920.69 |

| 03280 | $3,055.34 | $2,503.17 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $2,023.80 | $1,920.69 |

| 03260 | $3,052.95 | $2,471.42 | $1,497.18 | $8,382.59 | $2,469.60 | $2,578.15 | $2,051.05 | $1,920.69 |

| 03854 | $3,049.39 | $2,894.93 | $1,535.71 | $7,669.32 | $2,556.64 | $2,728.12 | $2,159.45 | $1,801.58 |

| 03801 | $3,046.47 | $2,894.93 | $1,535.71 | $7,669.32 | $2,556.64 | $2,728.12 | $2,138.99 | $1,801.58 |

| 03748 | $3,039.66 | $2,458.89 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,958.34 | $1,920.69 |

| 03272 | $3,038.38 | $2,799.15 | $1,497.18 | $7,713.25 | $2,469.60 | $2,578.15 | $2,290.65 | $1,920.69 |

| 03446 | $3,037.08 | $2,799.15 | $1,533.97 | $8,476.40 | $2,340.52 | $2,587.81 | $1,909.36 | $1,612.39 |

| 03284 | $3,033.79 | $2,503.17 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,872.95 | $1,920.69 |

| 03755 | $3,032.36 | $2,458.89 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,907.21 | $1,920.69 |

| 03766 | $3,030.03 | $2,458.89 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,890.89 | $1,920.69 |

| 03245 | $3,029.02 | $2,467.84 | $1,667.83 | $7,986.70 | $2,398.41 | $2,695.12 | $2,068.34 | $1,918.91 |

| 03869 | $3,028.86 | $2,649.28 | $1,533.81 | $7,743.08 | $2,682.03 | $2,836.64 | $2,112.63 | $1,644.58 |

| 03753 | $3,023.42 | $2,503.17 | $1,497.18 | $8,382.59 | $2,387.99 | $2,578.15 | $1,894.16 | $1,920.69 |

| 03291 | $3,013.06 | $2,657.49 | $1,583.08 | $7,669.32 | $2,421.57 | $2,621.90 | $2,217.39 | $1,920.69 |

| 03264 | $2,994.72 | $2,461.29 | $1,667.83 | $7,986.70 | $2,398.41 | $2,444.07 | $2,085.85 | $1,918.91 |

| 03258 | $2,993.83 | $2,631.15 | $1,731.34 | $7,713.25 | $2,469.60 | $2,210.05 | $2,280.73 | $1,920.69 |

| 03273 | $2,991.56 | $2,471.42 | $1,497.18 | $7,713.25 | $2,469.60 | $2,578.15 | $2,290.65 | $1,920.69 |

| 03839 | $2,986.51 | $2,569.88 | $1,510.82 | $7,743.08 | $2,682.03 | $2,540.02 | $2,215.18 | $1,644.58 |

| 03867 | $2,980.81 | $2,569.88 | $1,510.82 | $7,743.08 | $2,682.03 | $2,540.02 | $2,175.29 | $1,644.58 |

| 03868 | $2,980.81 | $2,569.88 | $1,510.82 | $7,743.08 | $2,682.03 | $2,540.02 | $2,175.29 | $1,644.58 |

| 03878 | $2,978.65 | $2,649.28 | $1,510.82 | $7,743.08 | $2,682.03 | $2,540.02 | $2,080.76 | $1,644.58 |

| 03274 | $2,977.73 | $2,503.17 | $1,497.18 | $7,713.25 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 03221 | $2,967.97 | $2,799.15 | $1,497.18 | $7,713.25 | $2,469.60 | $2,210.05 | $2,165.89 | $1,920.69 |

| 03275 | $2,962.53 | $2,658.84 | $1,626.68 | $7,713.25 | $2,367.40 | $2,396.82 | $2,265.95 | $1,708.76 |

| 03304 | $2,960.07 | $2,572.77 | $1,731.34 | $7,713.25 | $2,367.40 | $2,324.36 | $2,302.61 | $1,708.76 |

| 03301 | $2,935.65 | $2,577.37 | $1,626.68 | $7,713.25 | $2,367.40 | $2,324.36 | $2,231.73 | $1,708.76 |

| 03303 | $2,919.52 | $2,469.86 | $1,626.68 | $7,713.25 | $2,367.40 | $2,324.36 | $2,226.33 | $1,708.76 |

| 03229 | $2,913.60 | $2,509.52 | $1,497.18 | $7,713.25 | $2,367.40 | $2,324.36 | $2,274.75 | $1,708.76 |

| 03435 | $2,901.99 | $2,799.15 | $1,533.97 | $7,369.92 | $2,340.52 | $2,722.03 | $1,935.95 | $1,612.39 |

| 03431 | $2,887.77 | $2,799.15 | $1,533.97 | $7,369.92 | $2,340.52 | $2,633.58 | $1,924.88 | $1,612.39 |

Cheapest & Most Expensive Rates by City

1865-246-New-Hampshire-Least-and-Most-Expensive-Cities-2019-05-14.csv-2019-08-21.csv

| Least Expensive | Average Annual Rates | Most Expensive | Average Annual Rates |

|---|---|---|---|

| KEENE | $2,894.88 | MANCHESTER | $3,798.09 |

| CONTOOCOOK | $2,913.60 | HAMPSTEAD | $3,735.99 |

| CONCORD | $2,927.59 | ATKINSON | $3,725.58 |

| BOW | $2,960.07 | EAST HAMPSTEAD | $3,695.88 |

| SUNCOOK | $2,962.53 | NEWTON | $3,694.35 |

| BRADFORD | $2,967.97 | KINGSTON | $3,689.28 |

| STINSON LAKE | $2,977.73 | SALEM | $3,678.46 |

| SOMERSWORTH | $2,978.65 | PLAISTOW | $3,653.43 |

| ROCHESTER | $2,982.71 | WINDHAM | $3,648.72 |

| SOUTH SUTTON | $2,991.56 | EAST KINGSTON | $3,640.47 |

| CHICHESTER | $2,993.83 | PELHAM | $3,611.18 |

| PLYMOUTH | $2,994.72 | SEABROOK | $3,610.79 |

| WEST NOTTINGHAM | $3,013.06 | NEWTON JUNCTION | $3,512.48 |

| GRANTHAM | $3,023.42 | DANVILLE | $3,424.29 |

| ROLLINSFORD | $3,028.86 | NASHUA | $3,411.92 |

| HOLDERNESS | $3,029.02 | AUBURN | $3,404.93 |

| LEBANON | $3,030.03 | DERRY | $3,394.58 |

| HANOVER | $3,032.36 | HOLLIS | $3,331.53 |

| SPRINGFIELD | $3,033.79 | LONDONDERRY | $3,324.24 |

| SWANZEY | $3,037.08 | NORTH SALEM | $3,314.36 |

| SOUTH NEWBURY | $3,038.38 | GOFFSTOWN | $3,294.84 |

| ENFIELD | $3,039.66 | AMHERST | $3,277.35 |

| PORTSMOUTH | $3,046.47 | BEDFORD | $3,272.93 |

| NEW CASTLE | $3,049.39 | SANDOWN | $3,269.18 |

| NORTH SUTTON | $3,052.95 | HOOKSETT | $3,268.15 |

| WASHINGTON | $3,055.34 | NEW BOSTON | $3,263.40 |

| CENTER HARBOR | $3,057.79 | WEARE | $3,260.44 |

| WILMOT | $3,063.82 | HUDSON | $3,242.99 |

| DANBURY | $3,063.98 | DUNBARTON | $3,227.36 |

| LOCHMERE | $3,064.63 | LITCHFIELD | $3,214.50 |

| HARRISVILLE | $3,064.85 | CHESTER | $3,213.97 |

| ETNA | $3,065.88 | MERRIMACK | $3,201.58 |

| ALTON BAY | $3,066.17 | MILFORD | $3,200.23 |

| NEW LONDON | $3,066.31 | EXETER | $3,197.58 |

| WEST LEBANON | $3,068.10 | NORTH HAMPTON | $3,194.47 |

| FRANKLIN | $3,068.97 | BROOKLINE | $3,187.78 |

| ANDOVER | $3,070.06 | EAST DERRY | $3,185.18 |

| LOUDON | $3,070.22 | NEWFIELDS | $3,180.82 |

| HILL | $3,070.38 | FREMONT | $3,176.64 |

| PLAINFIELD | $3,070.81 | HAMPTON | $3,174.72 |

| CANAAN | $3,071.72 | GREENVILLE | $3,173.94 |

| FARMINGTON | $3,072.68 | STRATHAM | $3,173.12 |

| SANBORNTON | $3,073.67 | NORTHWOOD | $3,172.67 |

| EPPING | $3,074.74 | BERLIN | $3,170.23 |

| MERIDEN | $3,077.25 | TEMPLE | $3,168.50 |

| GUILD | $3,077.33 | NORTH STRATFORD | $3,164.31 |

| SALISBURY | $3,079.41 | RYE BEACH | $3,164.19 |

| DUBLIN | $3,081.03 | HAMPTON FALLS | $3,163.02 |

| MILTON | $3,081.10 | BRETTON WOODS | $3,162.30 |

| WARNER | $3,081.47 | SUGAR HILL | $3,161.99 |

It is no surprise that New Hampshire’s two largest cities, Manchester and Nashua, are also top of the list for the most expensive cities for insurance.

Your one-stop online insurance guide. Get free quotes now! Secured with SHA-256 Encryption

Best New Hampshire Car Insurance Companies

So you want insurance, but where should you get it? We are going to take a look at some of the biggest and best insurance companies New Hampshire has to offer.

We compared rates of some of the top companies and looked at the biggest factors that determine your rates. If you have a bad driving record or bad credit, we can direct you to the company that will have the best rates for your needs.

Let’s dig in and see what these companies have to offer.

The Largest Companies’ Financial Rating

AM Best has a great description of what they do on their website:

AM Best is the only global credit rating agency with a unique focus on the insurance industry. Best’s Credit Ratings, which are issued through AM Best Rating Services, Inc., are a recognized indicator of insurer financial strength and creditworthiness.

AM Best is also a trusted source of insurance data and market intelligence, covering thousands of companies worldwide through analytical resources and news coverage that provide a critical perspective for informed business decisions.

So how do the top 10 insurance companies rate?

1866-248-New-Hampshire-AM-Best-Ratings-2019-05-14.csv-2019-08-21.csv

| Company | AM Best Rating |

|---|---|

| A++ | |

| A++ | |

| A+ | |

| A |

| A+ | |

| A++ | |

| A+ | |

| A++ | |

| A | |

| A++ |

They all get A ratings or higher. It is no surprise as these large companies have excellent financial standings in the insurance world.

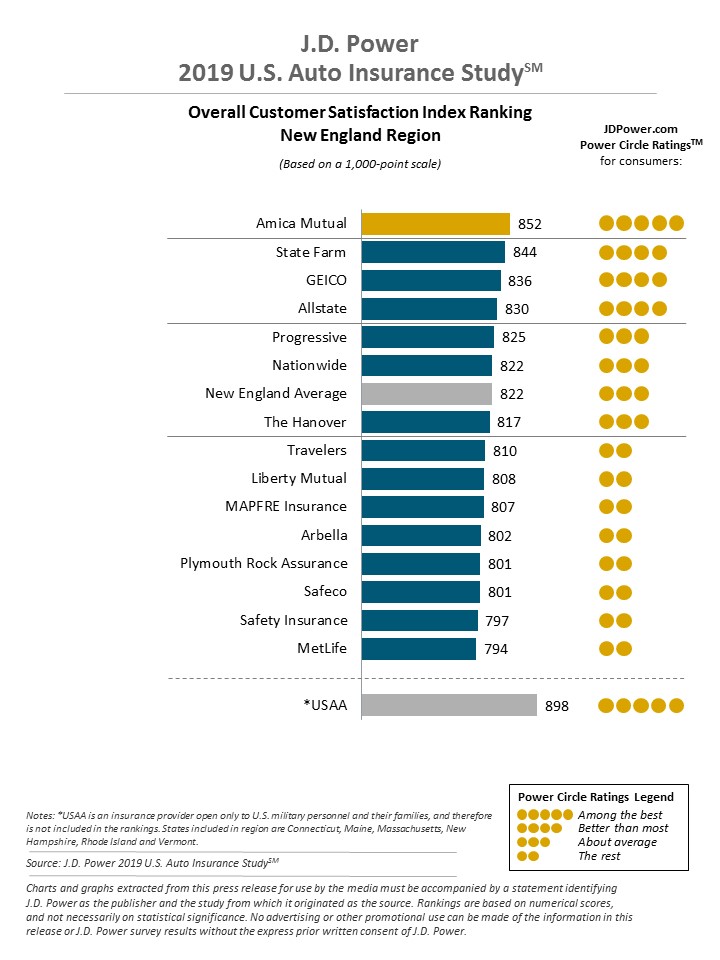

Companies with Best Ratings

Financial standing is not the only rating we want to look at. While you want a company you know is solid and can pay out if a claim arises, you also want a company with good customer service.

Even when your premium may go up, insureds appreciate good service and will stay, even with a rate increase. So we looked to J.D. Power for customer satisfaction ratings for New England insurance companies.

Companies with Most Complaints in New Hampshire

With all the good things, there are also bad. Which companies get the most complaints? Take a look.

1882-New-Hampshire-complaint-ratio-2019-08-22.csv

| Insurance Company | Complaint Ratio | Total Complaints |

|---|---|---|

| 0.68 | 333 | |

| 0.44 | 1482 | |

| 0.75 | 120 | |

| 5.95 | 222 |

| 0.5 | 163 | |

| 0.74 | 296 | |

| 0.46 | 52 | |

| 0.53 | 31 | |

| Metropolitan Group | 1.3 | 70 |

| 0.09 | 2 |

The National Association of Insurance Commissioners takes complaints on companies and tracks them.

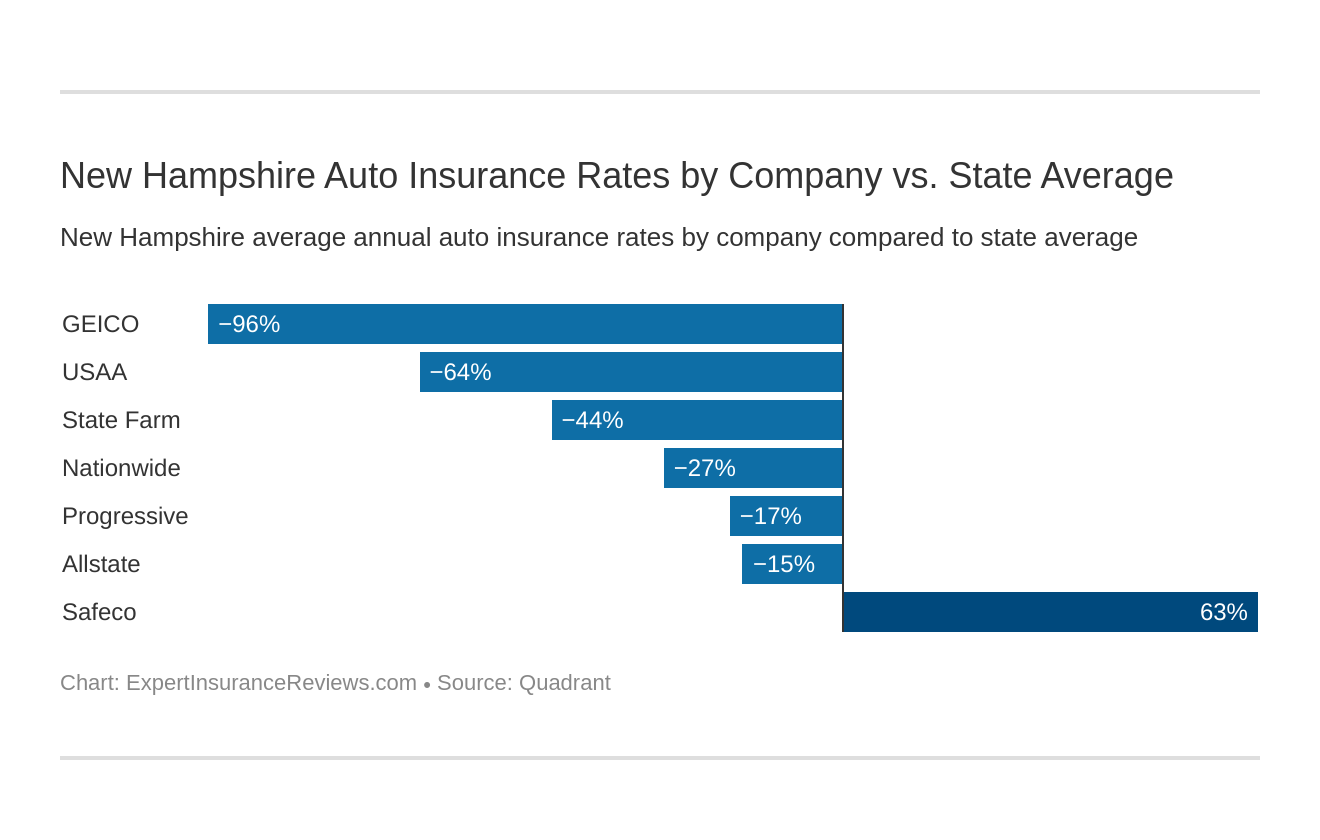

Cheapest Insurance Companies in New Hampshire

You want a good, solid company to get rates for your insurance, but at the end of the day, money can affect your decision.

New Hampshire - Cheapest Compared to the State Average

| Company | Average Annual Rates | Compared to State Average | Percentage |

|---|---|---|---|

| $2,737.70 | -$421.29 | -15.39% | |

| $1,611.67 | -$1,547.32 | -96.01% | |

| $8,476.85 | $5,317.87 | 62.73% | |

| $2,487.58 | -$671.41 | -26.99% |

| $2,691.13 | -$467.86 | -17.39% | |

| $2,186.81 | -$972.18 | -44.46% | |

| $1,921.18 | -$1,237.81 | -64.43% |

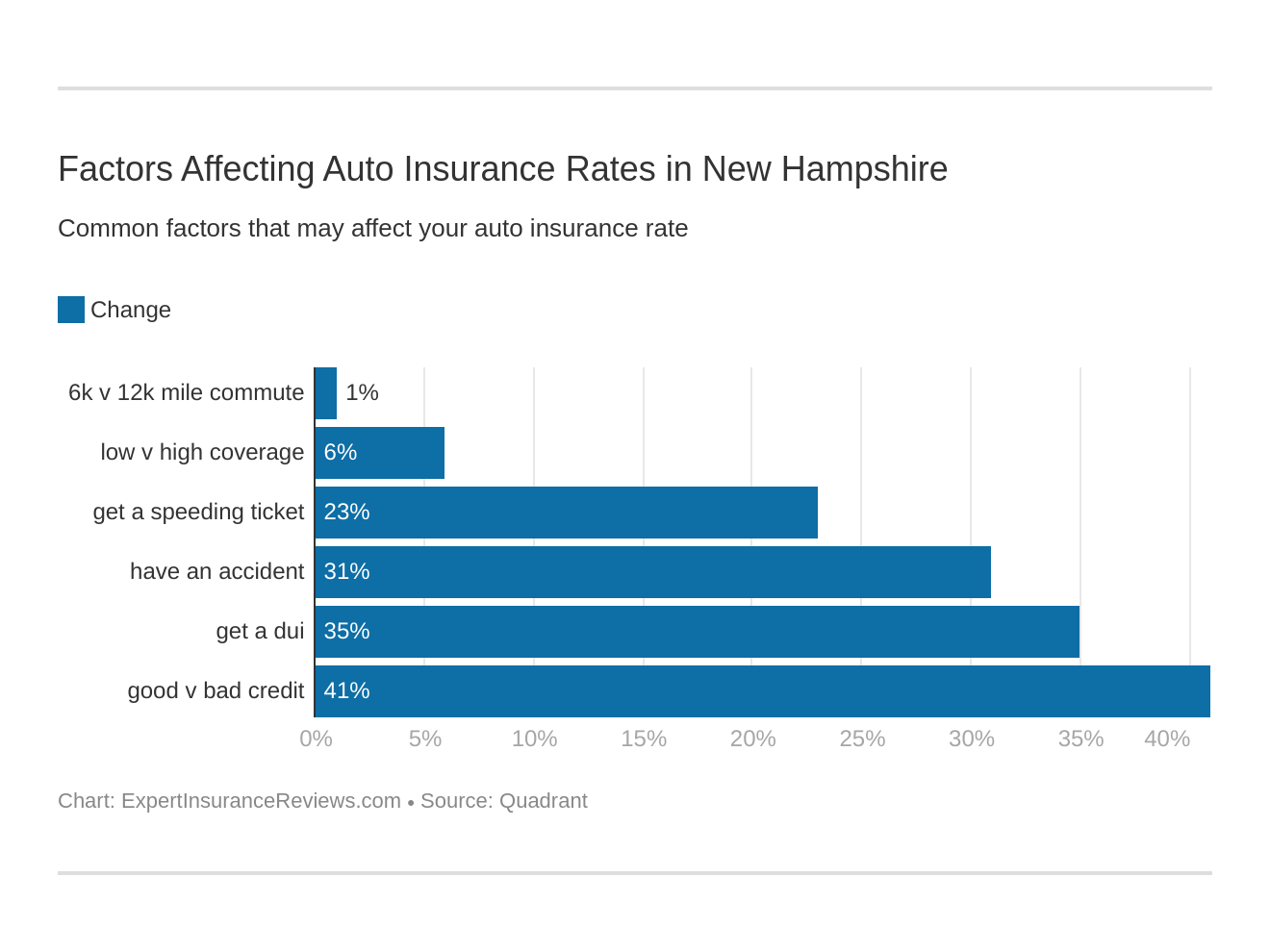

Geico is significantly lower than other companies in New Hampshire, while Safeco has higher rates. Why are rates so different at different companies? We are going to look at some of the biggest factors that go into getting your rate with a carrier.

Commute Rates by Companies

Do you commute to work every day? If you do, you can see which companies rate that factor higher than others.

1867-301-New-Hampshire-commute-rates-2019-05-14.csv-2019-08-21.csv

| Company | 10-mile-per-day commute (6000 miles annually) | 20-mile-per-day commute (1200 miles annually) |

|---|---|---|

| $8,477 | $8,477 |

| $2,700 | $2,775 | |

| $2,691 | $2,691 | |

| $2,488 | $2,488 |

| $2,137 | $2,236 | |

| $1,902 | $1,940 | |

| $1,598 | $1,625 |

Liberty Mutual and Nationwide are good options for drivers with longer commutes.

Coverage Level Rates by Companies

You may not want to only buy the minimum state limits. You are now faced with how much you are going to pay for more coverage. The results may surprise you.

1868-348-New-Hampshire-Rates-by-Coverage-Level-2019-05-14.csv-2019-08-21.csv

| Company | Coverage Level | Annual Average |

|---|---|---|

| High | $8,836.00 |

| Medium | $8,450.00 |

| Low | $8,144.00 |

| High | $2,817.35 | |

| Medium | $2,734.45 | |

| Low | $2,661.29 | |

| High | $2,797.82 | |

| Medium | $2,691.20 | |

| Low | $2,584.38 | |

| High | $2,356.75 |

| Medium | $2,453.07 |

| Low | $2,652.92 |

| High | $2,282.92 | |

| Medium | $2,189.03 | |

| Low | $2,088.49 | |

| High | $1,997.66 | |

| Medium | $1,917.96 | |

| Low | $1,847.91 | |

| High | $1,695.58 | |

| Medium | $1,602.39 | |

| Low | $1,537.03 |

Companies like Geico and USAA offer higher coverage for almost the same price as they do lower coverage. There are also companies, Nationwide for instance, that offer more coverage for cheaper rates.

It is always a great idea to quote which insurance you would like to have, even if you think it may be too expensive.

Credit History Rates by Companies

Credit history follows you for major purchases like a home or car. It can also lower your interest rate on credit cards and loans. Does it affect your insurance?

1869-349-New-Hampshire-Rates-by-Credit-Score-2019-05-14.csv-2019-08-21.csv

| Company | Credit Rating | Average Annual Rates |

|---|---|---|

| Poor | $3,368.00 | |

| Fair | $2,492.26 | |

| Good | $2,352.43 | |

| Poor | $1,907.34 | |

| Fair | $1,564.33 | |

| Good | $1,363.32 | |

| Poor | $12,169.00 |

| Fair | $7,441.00 |

| Good | $5,821.00 |

| Poor | $2,896.14 |

| Fair | $2,374.92 |

| Good | $2,191.67 |

| Poor | $2,986.88 | |

| Fair | $2,624.47 | |

| Good | $2,462.05 | |

| Poor | $3,096.59 | |

| Fair | $1,927.69 | |

| Good | $1,536.16 | |

| Poor | $2,606.19 | |

| Fair | $1,714.14 | |

| Good | $1,443.21 |

The answer is a resounding yes. Take a look at Liberty Mutual. The rates for someone with poor credit are more than double.

If you do struggle with your credit, look to companies such as Progressive or Nationwide. Both companies do not have a great rate increase for credit history.

Driving Record Rates by Companies

The most obvious factor to affect your driving rate is your driving record. It is no surprise companies take into consideration how you drive and rate you on any violations.

The best rate will always be given to someone with a clean driving record. Following state laws and being a cautious driver will help you keep a clean record and get the best rate.

New Hampshire - rates by driving record

| Company | Clean Record | One Speeding Violation | One Accident | One DUI |

|---|---|---|---|---|

| $2,276.40 | $2,655.21 | $3,095.98 | $2,923.20 | |

| $1,437.50 | $1,437.50 | $1,590.83 | $1,980.83 | |

| $5,324.37 | $9,084.16 | $9,624.42 | $9,874.47 |

| $1,914.01 | $2,129.05 | $2,657.49 | $3,249.78 |

| $2,312.48 | $2,711.71 | $3,190.12 | $2,550.23 | |

| $2,013.89 | $2,013.89 | $2,157.23 | $2,562.23 | |

| $1,483.03 | $1,724.12 | $1,996.60 | $2,480.96 |

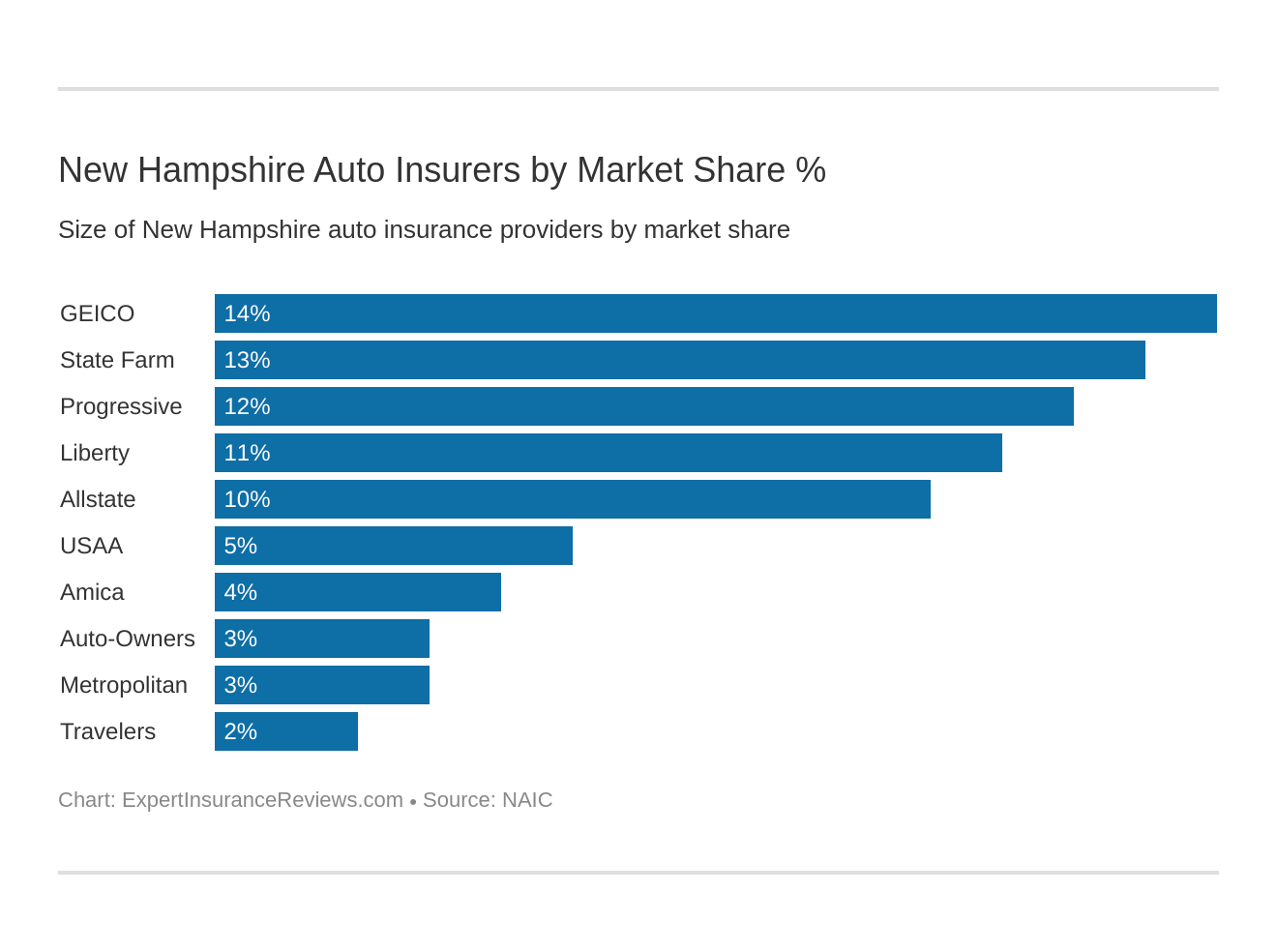

Largest Car Insurance Companies in New Hampshire

| Company | Direct Premium Written | Loss Ratio | Market Share |

|---|---|---|---|

| Geico | $114,977 | 72.49% | 13.59% |

| State Farm Group | $106,434 | 52.06% | 12.58% |

| Progressive Group | $103,823 | 61.53% | 12.28% |

| Liberty Mutual Group | $97,114 | 58.48% | 11.48% |

| Allstate Insurance Group | $84,945 | 54.95% | 10.04% |

| USAA Group | $44,555 | 72.58% | 5.27% |

| Amica Mutual Group | $29,976 | 65.49% | 3.54% |

| Auto-Owners Group | $27,987 | 60.58% | 3.31% |

| Metropolitan Group | $25,318 | 54.20% | 2.99% |

| Travelers Group | $20,099 | 59.55% | 2.38% |

Geico, State Farm, and Progressive hold a major market share of insurance providers in New Hampshire.

Number of Insurers by State

New Hampshire has almost 700 insurers to choose from. We separate insurers into two categories: domestic and foreign. Domestic insurers are in-state insurers, while foreign are companies made out-of-state.

| Insurer Type | Number |

|---|---|

| Domestic | 50 |

| Foreign | 647 |

New Hampshire Laws

Each state has different laws unique to their state. If you are new to New Hampshire, you may not know some of the different laws regarding licensing, insurance, and safety laws.

First up, let’s take a look at car insurance laws.

Car Insurance Laws

Car insurance is driven by certain state laws. Minimum limits, car insurance requirements, and fraud laws are all driven by the state.

How State Laws for Insurance are Determined

The state regulates how companies can rate and change their rates. New Hampshire insurance companies have to file their rate changes in an approved time frame.

The National Association of Insurance Commissioners breaks down how laws are made and what is expected from insurance companies.

Windshield Coverage

When you are driving down the interstate and hear the rock hit your windshield, you hope to not see a crack. If you do have a crack, you may need your windshield replaced.

New Hampshire allows after-market parts as long as it is detailed in the quote. The consumer also has the right to choose which repair shop to take their vehicle.

Although New Hampshire has no law stating an insurance company must pay for windshield repairs, most companies do have coverage if you have comprehensive added to your policy. Check your policy or with an agent to verify coverage.

High-Risk Insurance

While New Hampshire may not require insurance for every driver, certain offenses can cause you to file SR-22 insurance.

SR-22 is the mandatory filing of insurance, usually done by your insurance company.

Below is a list from the New Hampshire Department of Safety of violations that will land you an SR-22 filing:

- DWI – (1st, 2nd, Subsequent, Aggravated).

- Underage DWI – (1st, 2nd, Subsequent, Aggravated).

- Leaving Scene of Accident.

- Conduct After Accident.

- Subsequent (2nd) Offense Reckless Operation.

Automobile Insurance Fraud in New Hampshire

In 1993, the New Hampshire legislature created the New Hampshire Fraud Unit. Any type of insurance fraud is illegal and should be reported immediately.

You can report insurance fraud to the below:

- Email: [email protected]

Fax: (603) 271-7062

Fraud can come in two different ways, hard or soft. Hard fraud is a deliberate falsification of a claim to obtain funds for something that never happened. Soft fraud is when you may have a claim, but you add false information to make the claim bigger than what it may be.

Statute of Limitations

Statute of limitations is the time frame you have from when a claim occurs to when you must report it. In New Hampshire, you have three years for property damage or bodily injury.

Vehicle Licensing Laws

We have covered a lot about car insurance and laws, but now we are going to look at driver laws. Let’s look at renewing your license, getting a new resident driver’s license, and teen drivers.

Real ID

In 2005, Congress passed the REAL ID Act. This act made stricter licensing guidelines for states when issuing state driver’s licenses.

New Hampshire is compliant with the REAL ID Act; therefore, drivers can use their license as a form of identification to enter commercial flights and federal buildings.

Penalties for Driving Without Insurance

Since New Hampshire drivers are not mandated to buy insurance, there are no penalties for driving without it.

As we discussed earlier, some drivers must file an SR-22 and show financial responsibility by showing proof of insurance. If you do not obtain an SR-22 filing, your license and registration will be suspended.

Teen Driver Laws (IIHS)

We saw earlier how teen drivers can cause quite a spike in your insurance premium. Teens must follow licensing laws and driving restrictions mandated in New Hampshire.

1870-354-New-Hampshire-Teen-driving-laws-2019-05-14.csv-2019-08-21.csv

| Type of License | Minimum Age Requirement | Driving Requirement | Time Restriction | Passenger Restriction |

|---|---|---|---|---|

| Permit | 15 years 6 months | Must have a licensed adult over 25 years old supervising in the passenger seat | No restrictions | May not have more passengers than seat belts |

| Restricted License | 16 years | Must have completed 40 hours driving, 10 of which at night and passed an approved Driver Education Program | No driving between 1 a.m. and 4 a.m. | No more than one passenger younger than 25 (excluding family members) May not have more passengers than seat belts |

| Unrestricted License | Age after holding a restricted license six months (minimum 16 years 6 months) or 18 years, whichever occurs first | Must have held a restricted license six months or be 18 years old | No restrictions | No restrictions |

Older Driver License Renewal Procedures

Older drivers renew their licenses the same way all drivers renew. See below for the renewal process.

New Residents

Welcome to New Hampshire! Once you have established residency, you have 60 days to transfer your license and registration.

Fees depend on the type of vehicle, so contact your local Department of Motor Vehicles for the exact cost. You must surrender your out-of-state license when you obtain your New Hampshire license.

License Renewal Procedures

New Hampshire license renewal is every five years. You can do so in person or you may mail or electronically submit your renewal every other year.

Rules of the Road

To keep drivers safe, you need to follow the rules of the road for New Hampshire. If you are new to the state, you may not know all these rules, so we will break them down for you. Even if you have lived here for a while, you may still need to refresh yourself on these laws.

Fault vs. No-Fault

New Hampshire is an at-fault state. This is important in determining who’s insurance is filed and paying for the claim. Being an at-fault state means whoever is at fault for causing the accident is the one to file insurance and payout for the claim.

– Seat Belt & Car Seat Laws

New Hampshire is one of the few states that does not require insurance, but that’s not all — New Hampshire does not have seat belt laws for passengers or drivers eighteen-years-old or over.

They do have safety laws for passengers or drivers under eighteen.

| Child Restraint Law | Details |

|---|---|

| Must be in child restraint | 6 years and younger who are less than 57 inches |

| Adult safety belt permissible | 7 through 17 years; younger than 7 who are at least 57 inches tall |

| Maximum fine 1st offense | $50 |

New Hampshire also has no law concerning riding in cargo areas of pickup trucks.

Keep Right & Move Over Laws

State laws require slower-moving traffic to remain in the right lane.

There is also a law that requires drivers to vacate the lane closest to emergency vehicles when safe to do so. Any vehicle with flashing lights or any maintenance vehicle falls under this category.

Speed Limits

All states have mandated speed limits. Below are New Hampshire speed limits.

| Type of Roadway | Speed Limit |

|---|---|

| Rural interstates (mph) | 65; 70 on specified segments of road |

| Urban interstates (mph) | 65 |

| Other limited access roads (mph) | 55 |

| Other roads (mph) | 55 |

Remember, speed limits are subject to change, especially in construction zones.

Ridesharing

Ridesharing has become a popular mode of transportation, but it has also become a side job for many drivers.

It is important to check with your company, like Uber or Lyft, to verify any coverages you may have through them. The following companies have ridesharing coverages available in New Hampshire:

- USAA

– Automation on the Road

Automated cars are no longer a thing of the future. Many cars are being made that can drive themselves with no driver present.

Currently, other states are creating laws around automated cars; New Hampshire is not one of these states. Due to a death involving automated vehicles, New Hampshire has banned the testing of all automated cars.

Safety Laws

Lastly, we are going to look at safety laws. Driving under the influence and distracted driving are two major safety concerns drivers face. We are going to look at laws prohibiting both.

DUI Laws

| Type of Penalty | First Offense | Second Offense | Third Offense | Fourth and Subsequent Offenses |

|---|---|---|---|---|

| Driver's License Suspension | Nine months - six years. Six months of the sentence may be suspended for enrollment in 20 hour Impaired Driver Intervention Program | Three years minimum | Lifetime - may be reinstated after five years | Lifetime - may be reinstated after seven years |

| Imprisonment | No minimum | 30 days (mandatory minimum) - one year | 180 days - one year | 30 days - seven years, minimum six months deferred jail time |

| Fine | $500 minimum | $750 minimum | $750 minimum | $930 minimum |

| Other | N/A | IID required for one - two years after license reinstatement; Seven-day Multiple Offender Program (MOP) required | IID required one - two years after license reinstatement; 28 day MOP required | IID required one - two years after license reinstatement; 28 day MOP required |

If you are convicted of driving under the influence, you will have some major penalties to face. Jail time, fines, and loss of your license are a few of the penalties. If you have three or more convictions, you could be facing years without a license.

Marijuana-Impaired Driving Laws

Marijuana is legal for medical purposes and there are no specific laws for marijuana-impaired driving. That doesn’t mean you are off the hook for driving while impaired.

Driving under the influence of any substance is illegal, whether that be alcohol or marijuana. If you are convicted of driving under the influence of marijuana, you must complete an Impaired Driver Education Program.

Distracted Driving Laws

It seems like everyone has a cellular device, both the older and younger generations. We all have heard of the distractions and dangers cell phone use poses to drivers. New Hampshire has strict laws against the use of cell phones; there is a hand-held ban and a texting ban.

| Cell Phone and Texting Restrictions | Details |

|---|---|

| Hand-held ban | all drivers |

| Young drivers all cellphone ban | drivers younger than 18 |

| Texting ban | all drivers |

| Enforcement | primary |

Driving in New Hampshire

We have looked at all the laws, companies, regulations, licensing, and rules of the road. Now we are going to take a look at vehicle theft, fatalities, and transportation.

We share this information to help drivers know when and where theft and fatalities occur, hoping to prevent them in the future.

Vehicle Theft in New Hampshire

Honda, both Civic and Accord, are the top two choices for theft. The Honda Civic has the top spot, with 1997 being the most-popular year stolen.

| Vehicle | Year of Vehicle | Thefts |

|---|---|---|

| Honda Civic | 1997 | 34 |

| Honda Accord | 1996 | 20 |

| Chevrolet Pickup (Full Size) | 2002 | 19 |

| Ford Pickup (Full Size) | 2002 | 17 |

| Dodge Caravan | 2003 | 16 |

| Ford Focus | 2007 | 14 |

| Toyota Camry | 1999 | 13 |

| Jeep Cherokee/Grand Cherokee | 2000 | 11 |

| GMC Pickup (Full Size) | 2007 | 9 |

| Toyota Corolla | 1999 | 9 |

We also took a look at the top cities for car theft. Did your city make the list?

| City | Motor vehicle theft |

|---|---|

| Manchester | 159 |

| Nashua | 68 |

| Salem | 35 |

| Derry | 27 |

| Rochester | 24 |

| Claremont | 20 |

| Portsmouth | 20 |

| Laconia | 19 |

| Keene | 17 |

| Belmont | 15 |

| Hampton | 15 |

| Plaistow | 15 |

You can watch this short video showing how you can protect your car from thieves.

Road Fatalities in New Hampshire

Sadly, road fatalities occur even to the most cautious drivers. We have compiled data to show you when, where, how, and to whom these fatalities happen.

– Most Fatal Highway in New Hampshire

Interstate 93 is the most fatal highway in New Hampshire. An average of five to six fatalities happens on this stretch of road in a year.

Fatal Crashes by Weather Condition and Light Condition

Daylight hours and normal weather conditions see more fatalities than any other time or condition.

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 50 | 6 | 20 | 5 | 0 | 81 |

| Rain | 5 | 0 | 1 | 0 | 0 | 6 |

| Snow/Sleet | 3 | 2 | 4 | 1 | 0 | 10 |

| Other | 0 | 0 | 1 | 0 | 0 | 1 |

| Unknown | 0 | 0 | 0 | 0 | 0 | 0 |

| TOTAL | 58 | 8 | 26 | 6 | 0 | 98 |

Traffic Fatalities

Rural roads often see more fatalities than urban roads.

| Type of Roadway | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|

| Rural | 60 | 87 | 48 | 66 | 75 | 51 |

| Urban | 48 | 48 | 47 | 48 | 61 | 51 |

Fatalities by Person Type

This next table shows the person type — like occupant, motorcyclists, or pedestrian.

| Occupant/Nonoccupant | Person Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|

| Occupants | Passenger Car | 58 | 42 | 49 | 57 | 46 |

| – | Light Truck - Pickup | 14 | 6 | 10 | 23 | 9 |

| – | Light Truck - Utility | 15 | 8 | 12 | 14 | 12 |

| – | Light Truck - Van | 4 | 2 | 3 | 1 | 3 |

| – | Light Truck - Other | 0 | 0 | 0 | 1 | 0 |

| – | Large Truck | 1 | 2 | 0 | 0 | 1 |

| – | Other/Unknown Occupants | 2 | 2 | 1 | 1 | 2 |

| – | Total Occupants | 94 | 62 | 75 | 97 | 73 |

| Motorcyclists | Total Motorcyclists | 24 | 17 | 26 | 19 | 15 |

| Nonoccupants | Pedestrian | 12 | 12 | 8 | 17 | 11 |

| – | Bicyclist and Other Cyclist | 4 | 3 | 3 | 2 | 2 |

| – | Other/Unknown Nonoccupants | 1 | 1 | 2 | 1 | 1 |

| – | Total Nonoccupants | 17 | 16 | 13 | 20 | 14 |

| Combined | Total Persons | 135 | 95 | 114 | 136 | 102 |

Fatalities by Crash Type

Roadway departure sees more fatalities than other categories.

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Total Fatalities (All Crashes)* | 135 | 95 | 114 | 136 | 102 |

| Single Vehicle | 86 | 60 | 70 | 100 | 64 |

| Involving a Large Truck | 13 | 12 | 6 | 5 | 13 |

| Involving Speeding | 66 | 47 | 56 | 77 | 58 |

| Involving a Rollover | 31 | 18 | 23 | 39 | 25 |

| Involving a Roadway Departure | 111 | 66 | 79 | 95 | 70 |

| Involving an Intersection (or Intersection Related) | 21 | 21 | 15 | 15 | 14 |

Five-Year Trend For The Top 10 Counties

We took a look at the top 10 counties in New Hampshire and what their five-year trend is for fatalities.

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Hillsborough County | 28 | 27 | 24 | 27 | 20 |

| Rockingham County | 30 | 18 | 29 | 28 | 16 |

| Merrimack County | 7 | 13 | 16 | 13 | 12 |

| Strafford County | 16 | 9 | 12 | 15 | 12 |

| Belknap County | 10 | 4 | 6 | 8 | 11 |

| Cheshire County | 17 | 7 | 2 | 11 | 10 |

| Coos County | 5 | 3 | 7 | 6 | 7 |

| Carroll County | 7 | 6 | 6 | 10 | 6 |

| Grafton County | 10 | 4 | 9 | 14 | 5 |

| Sullivan County | 5 | 4 | 3 | 4 | 3 |

Fatalities Involving Speeding by County

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Belknap | 4 | 3 | 5 | 6 | 7 |

| Carroll | 3 | 1 | 2 | 6 | 4 |

| Cheshire | 8 | 3 | 0 | 9 | 7 |

| Coos | 4 | 0 | 3 | 3 | 4 |

| Grafton | 4 | 3 | 3 | 8 | 4 |

| Hillsborough | 11 | 11 | 12 | 13 | 6 |

| Merrimack | 2 | 7 | 8 | 4 | 8 |

| Rockingham | 16 | 11 | 17 | 18 | 9 |

| Strafford | 10 | 4 | 4 | 7 | 7 |

| Sullivan | 4 | 4 | 2 | 3 | 2 |

Fatalities in Crashes Involving an Alcohol-Impaired Driver by County

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Belknap | 6 | 3 | 3 | 2 | 3 |

| Carroll | 1 | 1 | 1 | 3 | 4 |

| Cheshire | 7 | 2 | 0 | 4 | 6 |

| Coos | 1 | 0 | 3 | 2 | 2 |

| Grafton | 0 | 1 | 2 | 6 | 0 |

| Hillsborough | 5 | 8 | 9 | 5 | 4 |

| Merrimack | 1 | 1 | 3 | 3 | 1 |

| Rockingham | 13 | 10 | 9 | 12 | 3 |

| Strafford | 8 | 3 | 2 | 3 | 2 |

| Sullivan | 3 | 0 | 0 | 0 | 2 |

Teen Drinking & Driving

Underage drinking is strictly against the law in New Hampshire. Any blood alcohol content level of 0.02 or more is considered underage drinking.

Possession of alcohol could result in a suspended driver’s license.

Statistically, age groups of 12 – 15 and 18 – 25 have a higher binge drinking rate in New Hampshire than most Americans.

EMS Response Time

If you are in an accident, you want emergency medical services to get to you quickly. In both urban and rural areas, EMS can get to you and transport you to a local hospital in under an hour.

| Crash Location | Time of Crash to EMS Notification (minutes) | EMS Notification to EMS Arrival (minutes) | EMS Arrival at Scene to Hospital Arrival (minutes) | Time of Crash to Hospital Arrival (minutes) |

|---|---|---|---|---|

| Rural | 1.27 | 12 | 31 | 45.58 |

| Urban | 0.71 | 10 | 24 | 35.05 |

Transportation

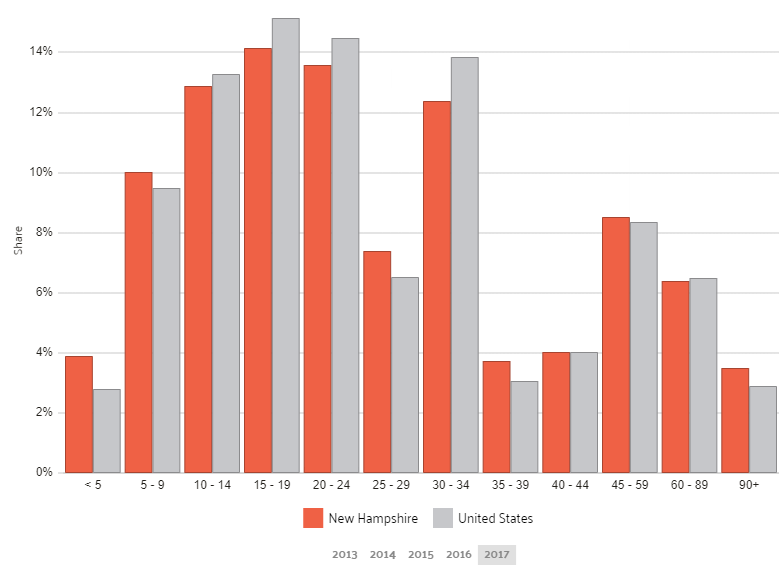

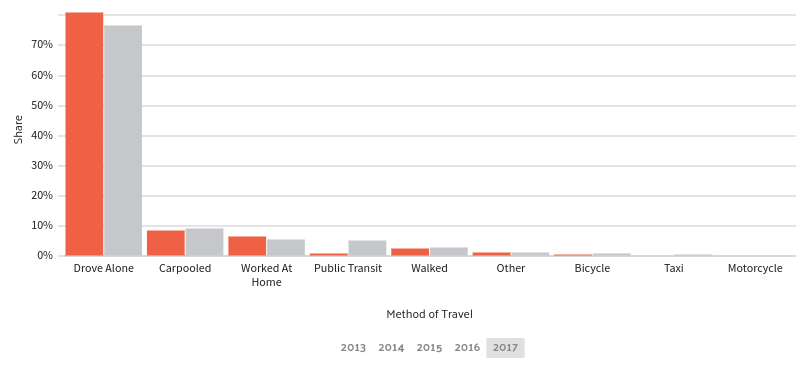

How do New Hampshire residents get to work, and how long is their commute? In this next section, we took information and graphs from Data USA. The orange is the average New Hampshire driver and the gray is the average American driver.

Car Ownership

Most American families own at least two cars. New Hampshire is no different from the majority of households in the nation.

Commute Time

The average worker drives a little over 25 minutes to work every day.

Commuter Transportation

Like most Americans, New Hampshire drivers prefer to drive to work alone.

Traffic Congestion in New Hampshire

New Hampshire doesn’t score the best in traffic congestion and car maintenance cost, ranking 46th out of 50.

While no specific cities were listed on traffic indexes, the New England Compass is a great resource to view New Hampshire traffic, construction, and road closures. So before you hit the road, you can check out how long you may be stuck in traffic and the best route to take.

We hope this helps you as you start your journey to finding the cheapest car insurance for your needs. Please our FREE quote tool to start comparing rates today.

Frequently Asked Questions

Is car insurance mandatory in New Hampshire?

No, New Hampshire is one of the few states that does not have a law requiring insurance. However, it is highly recommended to have car insurance to protect yourself financially in case of an accident.

When am I required to have insurance in New Hampshire?

You are required to have insurance and show financial responsibility in New Hampshire if you have a driving while intoxicated conviction, an at-fault accident without insurance, or if you are convicted of certain violations such as leaving the scene of an accident or a second reckless driving offense.

What are the minimum coverage requirements in New Hampshire?

If you choose to carry insurance in New Hampshire, the minimum coverage limits are:

- $25,000 bodily injury liability for one person

- $50,000 bodily injury liability total for multiple persons

- $25,000 property damage

- $1,000 medical payments

Can I provide electronic proof of insurance in New Hampshire?

Yes, New Hampshire allows electronic proof of insurance on your cellular device. You can keep a digital copy of your insurance ID card or policy.

How much do car insurance premiums cost in New Hampshire?

The average monthly car insurance rates in New Hampshire for liability, collision, and comprehensive coverage are as follows:

- Liability: $400.56

- Collision:$307.42

- Comprehensive: $110.77

Which car insurance company is the cheapest in New Hampshire?

According to the information provided, Geico is mentioned as the cheapest provider in New Hampshire. However, it is always recommended to compare car insurance quotes from multiple insurance companies to find the best rate for your specific needs.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Michael Leotta

Insurance Operations Specialist

Michael earned a degree in Business Management degree with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Au...

Insurance Operations Specialist

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.