Travelers Insurance Review & Complaints: Home, Auto & Boat Insurance (2025)

Travelers Insurance ratings are high with the Better Business Bureau and S&P, but our review finds that customers have had some problems. Travelers Insurance claims handling rates below average with J.D. Power. Insurance rates vary by state, so compare multiple companies for the best price.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Key Info | Provider Specifics |

|---|---|

| Year Founded | 1853 |

| Current Executives | Alan D. Schnitzer (Chairman and CEO) Jay S. Benet (Vice Chairman) |

| Number of Employees | 30,000 employees 13,000 independent agents |

| Net Income (2018) Total Assets | $2.5 Billion $103.5 Billion |

| Headquarters Address | 485 Lexington Ave. New York, NY 10017 |

| Phone Number | 1 (800) 842-5075 |

| Website | Travelers.com |

| Premiums Written (2017) | $4,396,705,000 |

| Loss Ratio (2017) | 66.60% |

| Best For | Bundling Personal relationship with agent |

You don’t want to overpay for insurance coverage, and at the same time, you don’t want a low-cost, low-budget company that can’t pay its customers claims. What you want is a company that balances premiums and customer service and provides fair settlements. Is Travelers Insurance that company?

We’ll examine how Travelers stands up to the competition in our complete Travelers Insurance review. This guide will look at Travelers insurance ratings as well as customer reviews and the cost of Travelers auto insurance.

Travelers’ red umbrella has symbolized the company’s commitment to protecting its customers when they need it. By the time you finish this review, you’ll have a pretty good idea if Travelers’ protection is worth your consideration.

If you want to comampare car insurance rates to find cheap auto insurance for your needs, we can help. Before you read on to learn all about Travelers insurance, enter your ZIP code above for free car insurance quotes.

Are Travelers car insurance rates competitive?

Here’s where the rubber meets the road. How do Travelers’ rates compare to the rates from other top companies?

There is more to a company than its rates. That’s for sure. But the rates can give you a great starting point from which to do more research into other dimensions of the company.

We partnered with Quadrant Data Solutions to show you what you could expect to pay with Travelers for standard coverages compared to other car insurance companies. We’ll jump right in with the overall state average comparison.

Now, if you’re a good driver with a clean history and you fit into Travelers’ low-risk profile, you’ll probably pay significantly less than the figures below. If you have a poor driving history and you fit a high-risk profile, you’ll probably pay more than auto insurance customers with a clean driving record.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

How are Travelers rates compared to State Median?

Before we really dig into the rates, let’s look at the states where it’s available, so you may as well stop considering Travelers if they aren’t available where you live.

Travelers offers auto insurance in 42 states and the District of Columbia. It doesn’t offer coverage in Alaska, Hawaii, Louisiana, Michigan, North Dakota, South Carolina, West Virginia, and Wyoming.

Travelers Average Annual Car Insurance Rates Compared to State's Average Rates

| State | State Average Annual Rates | Travelers Average Annual Rates | Travelers +/- Average |

|---|---|---|---|

| Alabama | $3,566.96 | $3,697.80 | +$130.84 |

| Arkansas | $4,124.98 | $5,973.33 | +$1,848.35 |

| Arizona | $3,770.97 | $3,084.74 | -$686.23 |

| California | $3,688.93 | $3,349.54 | -$339.39 |

| Connecticut | $4,618.92 | $6,004.29 | $1,385.37 |

| Delaware | $5,986.32 | $4,182.36 | -$1,803.96 |

| Iowa | $2,981.28 | $5,429.38 | +$2,448.10 |

| Idaho | $2,979.09 | $3,226.29 | +$247.20 |

| Illinois | $3,305.48 | $2,499.76 | -$805.72 |

| Indiana | $3,414.97 | $3,393.75 | -$21.22 |

| Kansas | $3,279.62 | $4,341.43 | +$1,061.81 |

| Kentucky | $5,195.40 | $6,551.68 | +$1,356.28 |

| Maine | $2,953.28 | $2,252.97 | -$700.31 |

| Massachusetts | $2,678.85 | $3,537.94 | +$859.09 |

| Michigan | $10,498.64 | $8,773.97 | -$1,724.67 |

| Mississippi | $3,664.57 | $3,729.32 | +$64.75 |

| North Carolina | $3,393.11 | $3,132.66 | -$260.45 |

| New Jersey | $5,515.21 | $4,254.49 | -$1,260.72 |

| Nevada | $4,861.70 | $5,360.41 | +$498.71 |

| New York | $4,289.88 | $4,578.79 | +$288.91 |

| Ohio | $2,709.71 | $3,135.16 | +$425.45 |

| Oregon | $3,467.77 | $2,892.19 | -$575.58 |

| Pennsylvania | $4,034.50 | $7,842.47 | +$3,807.97 |

| Rhode Island | $5,003.36 | $6,909.45 | +$1,906.09 |

| Tennessee | $3,660.89 | $2,738.52 | -$922.37 |

| Median | $3,660.89 | $3,729.32 | +$68.43 |

Overall, Travelers costs about five dollars more per month than the national average. Since it’s so close to average, your unique situation will be the determining factor whether the rates are competitive for you.

What are rates for Travelers vs other companies by state?

| State | Average Annual Premiums | Allstate | American Family | Farmers | Geico | Liberty Mutual | Nationwide | Progressive | State Farm | Travelers | USAA |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Alabama | $3,566.96 | $3,311.52 | Data Not Available | $4,185.80 | $2,866.60 | $4,005.48 | $2,662.66 | $4,450.52 | $4,798.15 | $3,697.80 | $2,124.09 |

| Arkansas | $4,124.98 | $5,150.03 | Data Not Available | $4,257.87 | $3,484.63 | Data Not Available | $3,861.79 | $5,312.09 | $2,789.03 | $5,973.33 | $2,171.06 |

| Arizona | $3,770.97 | $4,904.10 | Data Not Available | $5,000.08 | $2,264.71 | Data Not Available | $3,496.08 | $3,577.50 | $4,756.25 | $3,084.74 | $3,084.29 |

| California | $3,688.93 | $4,532.96 | Data Not Available | $4,998.78 | $2,885.65 | $3,034.42 | $4,653.19 | $2,849.67 | $4,202.28 | $3,349.54 | $2,693.87 |

| Colorado | $3,876.39 | $5,537.17 | $3,733.02 | $5,290.24 | $3,091.69 | $2,797.74 | $3,739.47 | $4,231.92 | $3,270.77 | Data Not Available | $3,338.87 |

| Connecticut | $4,618.92 | $5,831.60 | Data Not Available | Data Not Available | $3,073.66 | $7,282.87 | $3,672.34 | $4,920.35 | $2,976.24 | $6,004.29 | $3,190.00 |

| District of Columbia | $4,439.24 | $6,468.92 | Data Not Available | Data Not Available | $3,692.81 | Data Not Available | $4,848.98 | $4,970.26 | $4,074.05 | Data Not Available | $2,580.44 |

| Delaware | $5,986.32 | $6,316.06 | Data Not Available | Data Not Available | $3,727.29 | $18,360.02 | $4,330.21 | $4,181.83 | $4,466.85 | $4,182.36 | $2,325.98 |

| Florida | $4,680.46 | $7,440.46 | Data Not Available | Data Not Available | $3,783.63 | $5,368.15 | $4,339.60 | $5,583.30 | $3,397.67 | Data Not Available | $2,850.41 |

| Georgia | $4,966.83 | $4,210.70 | Data Not Available | Data Not Available | $2,977.20 | $10,053.44 | $6,484.90 | $4,499.22 | $3,384.88 | Data Not Available | $3,157.46 |

| Iowa | $2,981.28 | $2,965.86 | $3,021.81 | $2,435.72 | $2,296.16 | $4,415.28 | $2,735.44 | $2,395.50 | $2,224.51 | $5,429.38 | $1,852.57 |

| Idaho | $2,979.09 | $4,088.76 | $3,728.79 | $3,168.28 | $2,770.68 | $2,301.51 | $3,032.19 | Data Not Available | $1,867.96 | $3,226.29 | $1,877.61 |

| Illinois | $3,305.48 | $5,204.41 | $3,815.31 | $4,605.20 | $2,779.16 | $2,277.65 | $2,711.81 | $3,536.65 | $2,344.88 | $2,499.76 | $2,770.21 |

| Indiana | $3,414.97 | $3,978.81 | $3,679.68 | $3,437.55 | $2,261.07 | $5,781.35 | Data Not Available | $3,898.00 | $2,408.94 | $3,393.75 | $1,630.86 |

| Kansas | $3,279.62 | $4,010.23 | $2,146.40 | $3,703.77 | $3,220.65 | $4,784.42 | $2,475.59 | $4,144.38 | $2,720.00 | $4,341.43 | $2,382.61 |

| Kentucky | $5,195.40 | $7,143.92 | Data Not Available | Data Not Available | $4,633.59 | $5,930.97 | $5,503.23 | $5,547.63 | $3,354.32 | $6,551.68 | $2,897.89 |

| Maine | $2,953.28 | $3,675.59 | Data Not Available | $2,770.15 | $2,823.05 | $4,331.39 | Data Not Available | $3,643.59 | $2,198.68 | $2,252.97 | $1,930.79 |

| Maryland | $4,582.70 | $5,233.17 | Data Not Available | Data Not Available | $3,832.63 | $9,297.55 | $2,915.69 | $4,094.86 | $3,960.87 | Data Not Available | $2,744.14 |

| Massachusetts | $2,678.85 | $2,708.53 | Data Not Available | Data Not Available | $1,510.17 | $4,339.35 | Data Not Available | $3,835.11 | $1,361.86 | $3,537.94 | $1,458.99 |

| Minnesota | $4,403.25 | $4,532.01 | $3,521.29 | $3,137.45 | $3,498.54 | $13,563.61 | $2,926.49 | Data Not Available | $2,066.99 | Data Not Available | $2,861.60 |

| Missouri | $3,328.93 | $4,096.15 | $3,286.90 | $4,312.19 | $2,885.33 | $4,518.67 | $2,265.35 | $3,419.14 | $2,692.91 | Data Not Available | $2,525.78 |

| Mississippi | $3,664.57 | $4,942.11 | Data Not Available | Data Not Available | $4,087.21 | $4,455.94 | $2,756.53 | $4,308.85 | $2,980.48 | $3,729.32 | $2,056.13 |

| Montana | $3,220.84 | $4,672.10 | Data Not Available | $3,907.55 | $3,602.35 | $1,326.11 | $3,478.26 | $4,330.76 | $2,417.74 | Data Not Available | $2,031.89 |

| North Carolina | $3,393.11 | $7,190.43 | Data Not Available | Data Not Available | $2,936.69 | $2,182.71 | $2,848.03 | $2,382.61 | $3,078.65 | $3,132.66 | Data Not Available |

| Nebraska | $3,283.68 | $3,198.83 | $2,215.13 | $3,997.29 | $3,837.49 | $6,241.52 | $2,603.94 | $3,758.01 | $2,438.71 | Data Not Available | $2,330.78 |

| New Hampshire | $3,151.77 | $2,725.01 | Data Not Available | Data Not Available | $1,615.02 | $8,444.41 | $2,491.10 | $2,694.45 | $2,185.46 | Data Not Available | $1,906.96 |

| New Jersey | $5,515.21 | $5,713.58 | Data Not Available | $7,617.00 | $2,754.94 | $6,766.62 | Data Not Available | $3,972.72 | $7,527.16 | $4,254.49 | Data Not Available |

| New Mexico | $3,463.64 | $4,200.65 | Data Not Available | $4,315.53 | $4,458.30 | Data Not Available | $3,514.38 | $3,119.18 | $2,340.66 | Data Not Available | $2,296.77 |

| Nevada | $4,861.70 | $5,371.62 | $5,441.18 | $5,595.56 | $3,662.09 | $6,201.55 | $3,477.14 | $4,062.57 | $5,796.34 | $5,360.41 | $3,069.07 |

| New York | $4,289.88 | $4,740.97 | Data Not Available | Data Not Available | $2,428.24 | $6,540.73 | $4,012.93 | $3,771.15 | $4,484.58 | $4,578.79 | $3,761.69 |

| Ohio | $2,709.71 | $3,197.22 | $1,515.17 | $3,423.01 | $1,867.19 | $4,429.74 | $3,300.89 | $3,436.96 | $2,507.88 | $3,135.16 | $1,478.46 |

| Oklahoma | $4,142.33 | $3,718.62 | Data Not Available | $4,142.40 | $3,437.34 | $6,874.62 | Data Not Available | $4,832.35 | $2,816.80 | Data Not Available | $3,174.15 |

| Oregon | $3,467.77 | $4,765.95 | $3,527.28 | $3,753.52 | $3,220.12 | $4,334.55 | $3,176.83 | $3,629.13 | $2,731.48 | $2,892.19 | $2,587.15 |

| Pennsylvania | $4,034.50 | $3,984.12 | Data Not Available | Data Not Available | $2,605.22 | $6,055.20 | $2,800.37 | $4,451.00 | $2,744.23 | $7,842.47 | $1,793.37 |

| Rhode Island | $5,003.36 | $4,959.45 | Data Not Available | Data Not Available | $5,602.63 | $6,184.12 | $4,409.63 | $5,231.09 | $2,406.51 | $6,909.45 | $4,323.98 |

| South Dakota | $3,982.27 | $4,723.72 | $4,047.47 | $3,768.80 | $2,940.29 | $7,515.99 | $2,737.66 | $3,752.81 | $2,306.23 | Data Not Available | Data Not Available |

| Tennessee | $3,660.89 | $4,828.85 | Data Not Available | $3,430.07 | $3,283.42 | $6,206.69 | $3,424.96 | $3,656.91 | $2,639.30 | $2,738.52 | $2,739.28 |

| Texas | $4,043.28 | $5,485.44 | $4,848.72 | Data Not Available | $3,263.28 | Data Not Available | $3,867.55 | $4,664.69 | $2,879.94 | Data Not Available | $2,487.89 |

| Utah | $3,611.89 | $3,566.42 | $3,698.77 | $3,907.99 | $2,965.57 | $4,327.76 | $2,986.57 | $3,830.10 | $4,645.83 | Data Not Available | $2,491.10 |

| Virginia | $2,357.87 | $3,386.80 | Data Not Available | Data Not Available | $2,061.53 | Data Not Available | $2,073.00 | $2,498.58 | $2,268.95 | Data Not Available | $1,858.38 |

| Vermont | $3,234.13 | $3,190.38 | Data Not Available | Data Not Available | $2,195.71 | $3,621.08 | $2,128.21 | $5,217.14 | $4,382.84 | Data Not Available | $1,903.55 |

| Washington | $3,059.32 | $3,540.52 | $3,713.02 | $2,962.00 | $2,568.65 | $3,994.73 | $2,129.84 | $3,209.52 | $2,499.78 | Data Not Available | $2,262.16 |

| Wisconsin | $3,606.06 | $4,854.41 | $1,513.27 | $3,777.49 | $3,926.20 | $6,758.85 | $5,224.99 | $3,128.91 | $2,387.53 | Data Not Available | $2,975.74 |

What are the commute rates?

| State | 10 miles commute. 6000 annual mileage. | 25 miles commute. 12000 annual mileage. |

|---|---|---|

| AL | $3,697.80 | $3,697.80 |

| AR | $5,973.33 | $5,973.33 |

| AZ | $3,084.74 | $3,084.74 |

| CA | $3,012.96 | $3,686.11 |

| CT | $6,004.29 | $6,004.29 |

| DE | $4,182.36 | $4,182.36 |

| IA | $5,429.38 | $5,429.38 |

| ID | $3,226.29 | $3,226.29 |

| IL | $2,401.58 | $2,597.93 |

| IN | $3,393.75 | $3,393.75 |

| KS | $4,341.43 | $4,341.43 |

| KY | $6,551.68 | $6,551.68 |

| MA | $3,369.82 | $3,706.05 |

| ME | $2,252.97 | $2,252.97 |

| MI | $8,723.62 | $8,824.31 |

| MS | $3,729.32 | $3,729.32 |

| NC | $3,132.66 | $3,132.66 |

| NJ | $4,254.49 | $4,254.49 |

| NV | $5,360.41 | $5,360.41 |

| NY | $4,578.79 | $4,578.79 |

| OH | $3,135.16 | $3,135.16 |

| OR | $2,776.53 | $3,007.84 |

| PA | $7,842.47 | $7,842.47 |

| RI | $6,909.45 | $6,909.45 |

| TN | $2,630.93 | $2,846.10 |

As you can see, in most states, the distance of your commute won’t make a difference in your rates with Travelers.

In California, where companies are required to base rates on factors like annual mileage, you’ll see the biggest rate difference. In fact, a person in California will pay $56 more per month on insurance for a 25-mile drive to work than a 10-mile drive.

More time on the road equates to a great risk of something bad happening. Greater risk equals higher rates…in five states, anyway.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

What are the coverage level rates for auto insurance policies?

| State | Low Coverage | Medium Coverage | High Coverage |

|---|---|---|---|

| AL | $3,515.40 | $3,771.45 | $3,806.54 |

| AR | $5,685.15 | $5,989.75 | $6,245.09 |

| AZ | $2,761.36 | $3,132.81 | $3,360.06 |

| CA | $2,923.53 | $3,439.07 | $3,686.01 |

| CT | $5,551.63 | $5,961.96 | $6,499.29 |

| DE | $3,961.39 | $4,310.79 | $4,274.89 |

| IA | $5,106.75 | $5,511.62 | $5,669.76 |

| ID | $3,172.59 | $3,273.82 | $3,232.47 |

| IL | $2,342.76 | $2,496.71 | $2,659.81 |

| IN | $3,326.81 | $3,425.41 | $3,429.02 |

| KS | $4,124.45 | $4,347.90 | $4,551.94 |

| KY | $6,207.73 | $6,578.16 | $6,869.14 |

| MA | $3,195.20 | $3,608.81 | $3,809.80 |

| ME | $2,216.71 | $2,220.77 | $2,321.44 |

| MI | $8,682.66 | $8,783.46 | $8,855.79 |

| MS | $3,539.40 | $3,752.06 | $3,896.50 |

| NC | $3,001.62 | $3,116.45 | $3,279.91 |

| NJ | $3,892.44 | $4,254.54 | $4,616.48 |

| NV | $4,820.17 | $5,378.22 | $5,882.82 |

| NY | $4,309.32 | $4,522.76 | $4,904.29 |

| OH | $3,050.20 | $3,176.78 | $3,178.51 |

| OR | $2,710.49 | $2,876.33 | $3,089.75 |

| PA | $7,896.86 | $7,848.30 | $7,782.26 |

| RI | $7,019.75 | $7,036.02 | $6,672.57 |

| TN | $2,576.37 | $2,736.50 | $2,902.69 |

You would expect that a low coverage level would be the cheapest, followed by a medium level and that the high level would be the most expensive. That’s a good assumption. However, for various reasons, that’s not always the case. Take the following states for example:

- Pennsylvania – High coverage is the cheapest followed by medium coverage and low coverage is the most expensive. If you live in Pennsylvania and go with Travelers, get a higher level of coverage.

- Delaware and Idaho – Low coverage is the cheapest, but high coverage costs less than medium coverage

- Rhode Island – High coverage is significantly cheaper than low coverage. Medium coverage is the most expensive.

For the states that follow the pattern you’d expect, here’s a visualization of the difference in cost depending on the level of coverage:

Even in the states where you pay more for high coverage, it may be well worth it for you to purchase it because of how much better the protection is.

What are the credit history rates?

The credit scores that insurance companies use aren’t exactly the same as your raw credit score. They use the same credit report, but they pull only certain factors and base your insurance credit score on those.

| State | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| AL | $3,563.85 | $3,497.17 | $4,032.37 |

| AR | $5,345.75 | $5,719.88 | $6,854.36 |

| AZ | $2,434.67 | $3,062.83 | $3,756.74 |

| CA | $3,349.54 | $3,349.54 | $3,349.54 |

| CT | $5,517.46 | $5,680.07 | $6,815.35 |

| DE | $4,028.81 | $3,851.51 | $4,666.75 |

| IA | $4,968.28 | $5,213.94 | $6,105.91 |

| ID | $2,876.79 | $3,107.83 | $3,694.26 |

| IL | $1,994.34 | $2,454.97 | $3,049.97 |

| IN | $3,199.97 | $3,202.25 | $3,779.03 |

| KS | $3,921.25 | $4,082.52 | $5,020.52 |

| KY | $6,160.53 | $6,182.66 | $7,311.83 |

| MA | $3,537.94 | $3,537.94 | $3,537.94 |

| ME | $1,934.81 | $2,172.46 | $2,651.65 |

| MI | $8,609.77 | $8,720.07 | $8,992.07 |

| MS | $3,502.17 | $3,452.81 | $4,232.97 |

| NC | $3,001.11 | $3,043.96 | $3,352.92 |

| NJ | $2,856.24 | $4,186.30 | $5,720.93 |

| NV | $4,962.59 | $5,256.01 | $5,862.62 |

| NY | $3,395.01 | $3,944.57 | $6,396.79 |

| OH | $2,849.59 | $3,050.60 | $3,505.29 |

| OR | $2,228.52 | $2,833.30 | $3,614.74 |

| PA | $7,282.50 | $7,710.22 | $8,534.70 |

| RI | $6,726.05 | $6,752.96 | $7,249.34 |

| TN | $1,996.22 | $2,735.47 | $3,483.87 |

If you’re like many others, you may be thinking, “Why in the world would credit affect my car insurance risk?” It’s a hotly debated subject, and some states and companies have moved away from using credit to formulate insurance rates.

Notice that the rates in California and Massachusetts stay the same regardless of credit score. Insurers in California are not allowed to use credit score and Massachusetts rate filings will not be approved if the credit score is part of the calculation.

The argument for using credit scores is that people with poor credit are statistically at a higher risk for filing a claim and higher risk individuals should pay more for insurance.

The argument against using credit scores is that credit shouldn’t affect driving.

There are a few states where Travelers rates will leave you scratching your head. In Alabama, Delaware, and Mississippi, your best rates are with a fair credit score. A good score will actually cost you a bit more than a fair score.

Nationwide, the average credit score (not insurance credit score…we don’t actually know what that is) is 675. Minnesota wins for the highest average score of 709 while Mississippi has the lowest average score of 647.

What are the driving record rates?

This rating factor just makes sense. If you have a history of accidents and violations, it makes sense that an auto insurance company would view you as a higher risk. And where insurance is involved, risk equals rates. High risk means high rates.

| State | Clean Record | After One Speeding Ticket | After One Accident | After One DUI |

|---|---|---|---|---|

| AL | $3,079.85 | $3,750.88 | $3,231.91 | $4,728.55 |

| AR | $5,005.97 | $6,145.34 | $5,171.93 | $7,570.08 |

| AZ | $2,468.10 | $3,077.01 | $3,215.76 | $3,578.10 |

| CA | $2,233.29 | $3,288.90 | $3,642.70 | $4,233.25 |

| CT | $4,833.25 | $6,327.84 | $5,235.67 | $7,620.42 |

| DE | $3,563.54 | $3,744.85 | $3,573.78 | $5,847.26 |

| IA | $3,957.29 | $5,418.41 | $5,276.31 | $7,065.50 |

| ID | $1,990.40 | $3,169.07 | $2,832.53 | $4,913.17 |

| IL | $1,988.49 | $2,494.84 | $2,606.50 | $2,909.21 |

| IN | $2,882.78 | $3,092.74 | $3,562.60 | $4,036.88 |

| KS | $3,174.28 | $4,381.05 | $4,130.07 | $5,680.32 |

| KY | $5,703.08 | $6,120.50 | $5,868.49 | $8,514.63 |

| MA | $2,757.80 | $3,501.20 | $3,813.46 | $4,079.29 |

| ME | $1,878.74 | $2,432.18 | $2,087.92 | $2,613.05 |

| MI | $5,936.51 | $7,020.08 | $8,478.53 | $13,660.75 |

| MS | $3,259.64 | $3,557.99 | $3,412.73 | $4,686.91 |

| NC | $1,844.98 | $2,400.64 | $2,448.95 | $5,836.08 |

| NJ | $3,268.35 | $4,188.00 | $4,864.10 | $4,697.50 |

| NV | $3,833.89 | $4,614.16 | $5,716.35 | $7,277.22 |

| NY | $3,901.71 | $4,552.21 | $4,896.91 | $4,964.33 |

| OH | $2,308.77 | $2,683.62 | $3,009.00 | $4,539.26 |

| OR | $2,343.22 | $2,858.79 | $2,997.78 | $3,368.96 |

| PA | $5,566.16 | $7,914.42 | $7,914.42 | $9,974.88 |

| RI | $6,191.60 | $7,053.75 | $6,403.21 | $7,989.23 |

| TN | $2,220.52 | $2,731.56 | $2,851.81 | $3,150.18 |

Travelers doesn’t formulate its rates the same way in every state. In 11 out of the 25 states where Travelers offers car insurance, a speeding ticket will increase your rates higher than an accident. In the other 14 states, an accident will lead to higher rates than a speeding ticket.

In New Jersey, a person with an accident on their record will pay more than a person with a DUI. Everywhere else, a DUI will increase your rates higher than the other violations we researched.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

What coverage options are offered?

Travelers is a major player in the car insurance market, but auto insurance makes up less than 20 percent of their property and casualty options. They offer all the following types of personal insurance coverage options:

- Homeowners insurance

- Personal auto insurance

- Renters insurance

- Condo insurance

- Boat and Yacht

- Landlord

- Umbrella

- Jewelry and Valuable Items

- Wedding and Special Events

They also have a huge lineup of commercial insurance options.

With all that Travelers offers, they have the potential to be your one-stop-shop for all your insurance needs. If you do purchase more than auto insurance from Travelers, you could save up to 13 percent.

For example, if you pay $100 dollars a month for your Travelers car insurance policy, and then you purchase home insurance from Travelers, your auto policy could drop to $87 per month.

If you’re considering Travelers for auto insurance, it just makes sense to see what bundling other types of coverage could do for you.

What types of car insurance are offered?

Within the realm of car insurance, there are many options for coverage. Travelers covers anything the average person would be looking for. This is no surprise for a company in the top 10 car insurers.

These are the basic types of car insurance Travelers offers:

- Liability Coverage

- Comprehensive Coverage

- Collision Coverage

- Personal Injury Protection

- Uninsured/Underinsured Motorist Coverage

- Medical Payments Coverage

They also offer these options:

- Loan/Lease GAP Insurance

- Rental Coverage

- Roadside Assistance

- New Car Replacement

- Accident Forgiveness

- Ride Sharing

Ridesharing is a popular service and a lot of drivers have questions about coverage. Travelers is just entering that market and currently only offers limited coverage in Colorado and Illinois.

In those two states, drivers with the ride-sharing endorsement can have coverage while the ride-sharing app is open but before connecting with a customer. This limited coverage leaves some gaps so if you’re a driver for a ride-share company, Travelers may not be your best option.

Read more: Does Travelers offer coverage for rental cars?

What auto insurance discounts are offered?

You may be surprised when you find out how many discounts you are eligible for and how much you can save.

| Discount Type | Up-to Savings |

|---|---|

| Multi-Policy Discount | 13% |

| MultiCar Discount | 8% |

| Home Ownership Discount | 5% |

| Safe Driver Discount | 10% (three years clean driving) 23% (five years clean driving) |

| Continuous Coverage Discount | 15% |

| Hybrid/Electric Vehicle Discount | n/a |

| New Car Discount | 10% |

| EFT (Electronic Funds Transfer) Discount | 2-3% |

| Paid in Full Discount | 7.5% |

| Good Payer Discount | 15% |

| Early Quote Discount | 3-10% (depending on how early you get a quote before you current policy expires) |

| Good Student Discount | 8% (B average or better) |

| Student Away at School Discount | 7% |

| Driver Training Discount | 8% |

| Low Mileage Discount | n/a |

| Affinity Program | n/a |

| IntelliDrive Program | 20% |

Most of these discounts are fairly standard for car insurance companies to offer. Some less offered discounts Travelers offers are the green vehicle discount and the on-time-payment discount.

Travelers IntelliDrive can get you up to 20 percent off of your monthly premiums, so it’s worth looking deeper into it. It’s available in these states:

- Alabama

- Arizona

- Colorado

- Connecticut

- Florida – saving is up to 15%

- Georgia

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Maine

- Maryland – riskier driving habits will not result in a higher premium

- Minnesota

- Mississippi

- Missouri

- Montana – riskier driving habits will not result in a higher premium

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- Ohio

- Oklahoma

- Oregon

- Pennsylvania – riskier driving habits will not result in a higher premium

- South Carolina

- Tennessee

- Texas

- Utah

- Vermont

- Virginia – riskier driving habits will not result in a higher premium

- Washington

- Washington DC – riskier driving habits will not result in a higher premium

- Wisconsin

Once you enroll in IntelliDrive, your driving habits will be monitored by an app on your smartphone for 90 days. Good driving habits could get you a discount of 20 percent of your premium. (For more information, read our “Travelers IntelliDrive: Complete Guide & Review“).

It’s not a win-win, though. You might now want to enroll in the program if you don’t practice the driving habits the monitoring app is looking for. If you evidence riskier driving behavior, your rates could increase (except in the states where prohibited – see list above).

With a name like Travelers, you’d just expect that they have a developed travel insurance program. They do not. However, chances are pretty good that your independent Travelers agent can help you get set up with travel insurance from another insurer when you need it

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Are Travelers’ consumer & financial ratings positive?

Ratings can tell you a lot about a company, so it’s important you investigate the major rating sites for company financial ratings and consumer ratings to find out what works best for you.

A.M. Best Rating – A++

A.M. Best offers the gold standard of financial ratings. An A++ rating indicates a superior financial standing.

What does that mean for you, as a consumer? It means that Travelers has shown consistent wise use of assets and will have the ability to pay your claim, even if you make a claim with thousands of other customers following a natural disaster.

Better Business Bureau – A+

The Better Business Bureau (BBB) has ratings on many local Travelers offices. If you want to find out how the office you would work with is rated, simply search the BBB website for the Travelers office in your city.

For this rating, we looked at the largest office, located in Hartford, CT. They received the BBB’s highest rating of A+. The BBB determines a company’s grade based heavily on customer complaints and how the company handles them.

Moody’s – A2

Moody’s assigns scores based on financial stability, similarly to the ratings AM Best assigns. An A2 rating indicates the Travelers has a solid financial footing with a stable outlook.

Travelers has been around for a long time and their finances are in good shape to continue a long time.

S&P – AA

Travelers gets another stellar rating, this time from S&P. This is a financial rating and indicates a solid standing and positive outlook.

NAIC Complaint Ratio – 0.09

The median insurance company has a complaint ratio of 1.0. The fact that Travelers’ ratio is not even 10 percent of that indicates that their customers have far fewer complaints than customers of most other companies.

This matters to you because if fewer people are complaining, it’s because most people have nothing to complain about. If you have to make a claim with your insurer, you want the process to be as easy and pain-free as possible.

Having to file a complaint on top of making a claim is a hassle you’d like to avoid.

Consumer Affairs – 2 out of 5 Stars

Where did this rating come from? Travelers has earned high ratings from the other agencies so far. Consumer Affairs bases their ratings on customer reviews. Travelers had 53 customer reviews posted this year on Consumer Affairs, and clearly, most of them were negative.

JD Power – 3 out of 5 Stars for Claims Satisfaction

JD Power compiled data from customers regarding claims satisfaction. Travelers performed “about average”, coming in eighth out of 23 companies in the survey. Out of a possible 1000 points, they got 866 which put them right after The Hartford and ahead of State Farm.

Here is a summary of all the ratings listed above:

Travelers Company Ratings

| Agency | Rating |

|---|---|

| AM Best | A++ |

| Better Business Bureau (Hartford, CT - Travelers' largest office) | A+ |

| Moody's | Aa2 |

| S&P | AA |

| NAIC Complaint Index (2017) | 0.09 (below the national average of 1.0) |

| JD Power | 3 out of 5 stars for overall claims satisfaction |

| Consumer Affairs | 2 out of 5 stars based on 56 ratings |

Where can I find Travelers agents?

Travelers uses a network of nearly 14,000 independent insurance agents.

While some companies offer web-based coverage where you rarely have personal dealings, and when you do, it’s not with someone local, and some companies have local offices with captive agents who sell only their company’s insurance, this insurer uses independent agents.

Independent agents sell several brands of insurance. The pros of using an independent agent are that they know and work with numerous companies, and they can help you find which company is best for your situation.

Which Travelers commercials are most popular?

In recent years, their ad campaign hasn’t been as aggressive as those of other car insurers. Travelers signature umbrella was first used in 1870. In 2008, the company repurchased the rights to the red umbrella.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Does the company do community service?

Travelers boasts that they have contributed more than $218 million to their employees’ communities in the past ten years. In 2018 alone, employees donated 120,000 hours of time to important causes.

Travelers employees donated their time, too:

- 8,500 hours to build homes for Habitat for Humanity

- 1,500 hours to teach basic economics in schools

- 1,000 hours to build playgrounds in Texas and Georgia

What is Travelers’ position for the future?

With steady growth, positive financial outlooks and recent company acquisitions, Travelers is poised to continue to be a major player in the auto insurance market.

Their annual report details their strategies for continued value for their shareholders:

- Deliver superior returns on equity by leveraging our competitive advantages;

- Generate earnings and capital substantially in excess of our growth needs; and

- Thoughtfully rightsize capital and grow book value per share over time.

Who is the average employee?

When compared to the average starting wage for specific positions nationwide, Travelers employees tend to start earning lower than average to average salaries.

For example, based on 182 salaries examined, an account executive with Travelers could expect to start at just over $86K. The nationwide range is $55K-$121K. An account manager could expect to start around $53K a year compared to the nationwide range of $45K-$83K.

The account executive starts near the middle of the starting range while an account manager starts at the lower end of the range. Employees rate Travelers four out of five stars with 76 percent saying they would recommend working there to a friend.

Overall, Travelers is a good place to work and many employees listed the benefits as one of the pros of their job. There are a range of options for Travelers careers.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

What are Travelers’ awards and accolades?

Travelers’ website lists their significant awards as follows:

- Military Friendly® Company, VIQTORY, 2018-2019

- Military Friendly® Employer, VIQTORY, 2007-2019

- Military Friendly® Brand, VIQTORY, 2017-2019

- Military Friendly® Supplier Diversity Program, VIQTORY, 2018-2019

- Best for Vets, Military Times, 2010-2011, 2014-2018

- Military Times Best for VETS Index, 2017-2019

- Top Veteran-Friendly Company, U.S. Veterans Magazine, 2014 and 2017

- America’s Best Employers, Forbes, 2015-2018

- America’s Best Employers for Diversity, Forbes, 2019

- America’s Best Employers for Women, Forbes, 2019

- Best Place to Work for LGBTQ Equality, Human Rights Campaign Foundation, 2016-2019

- Best Place to Work for Disability Inclusion, Disability:IN and American Association of People with Disabilities, 2018

- Clear Assured Bronze Standard for Inclusive Best Practices (UK), Clear Company, 2019

- Employer of the Year, Lifeworks, 2019

- Best Place to Work, Glassdoor, 2018-2019

How many policies have been written?

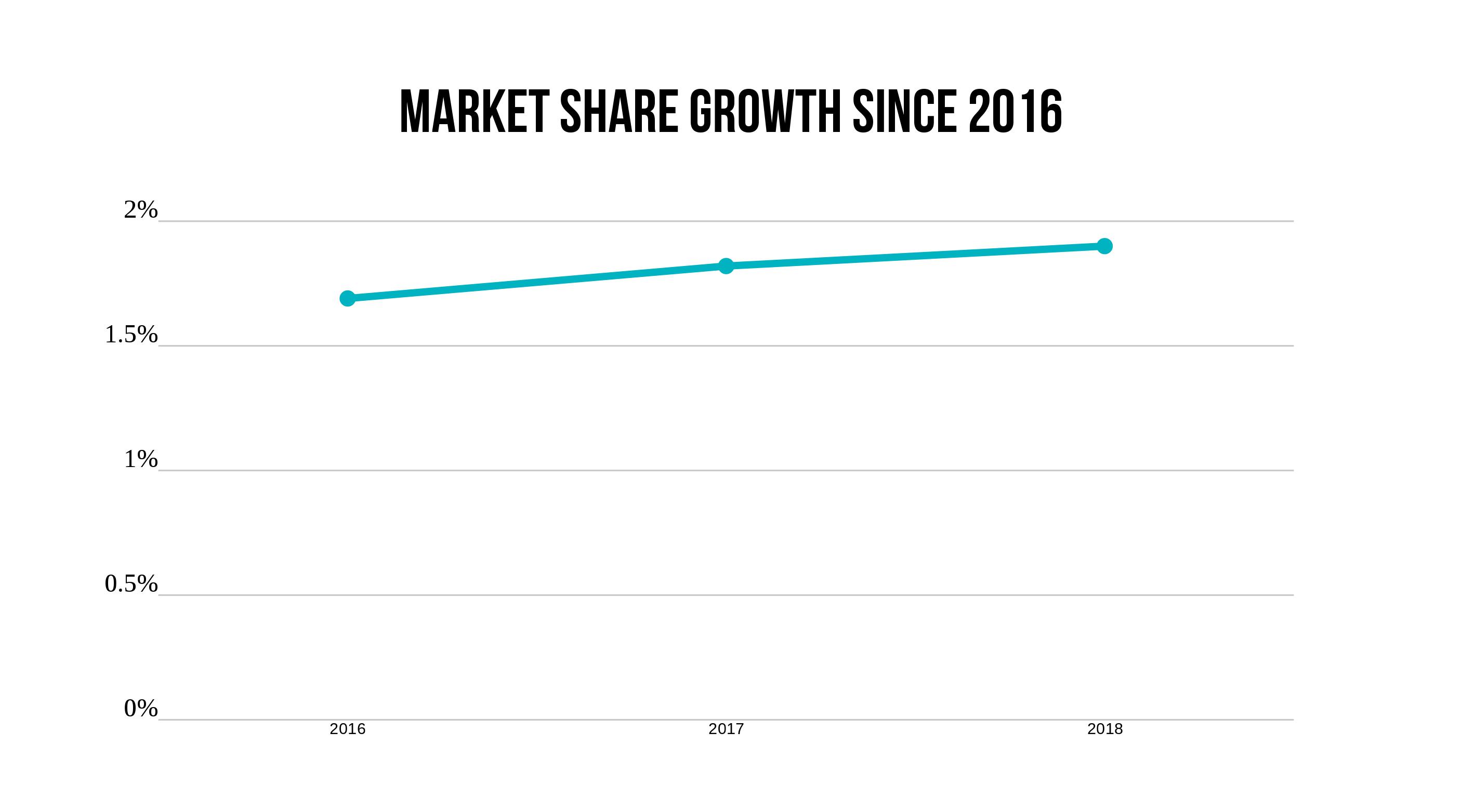

As Travelers’ market share has been steadily increasing, their policies written naturally follow the same trend.

- 2015 – $3,377,404,000

- 2016 – $3,896,786,000

- 2017 – $4,396,705,000

What is the loss ratio?

Loss ratio is important because it shows how much is paid on claims to how much is earned in insurance premiums.

Travelers’ loss ratio for 2017 is about 67 percent. That means that for every $100 they earned in premiums, they paid out $67. The other $33 went to overhead, which includes employees, offices, mailings, etc.

In the auto insurance market in 2017, after claims were paid, Travelers had about $1.5 billion to work with.

- 2015 – 56.48%

- 2016 – 65.45%

- 2017 – 66.60%

The range of these loss ratios is solid and not concerning. What they take in to what they pay out is in a safe range where you can expect their ability to pay claims to continue.

If the loss ratio were lower, we may have concerns that they are charging too much for premiums and are stingy with paying claims.

If the loss ratio were higher, we may be worried they would not have funds available to pay claims.

Where they are is good.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

How can I get a quote online?

It’s simple and the Travelers website will walk you through the entire process. You’ll just fill in the blanks.

Go to Travelers.com. Enter your zip code in the box that says, “ZIP Code.” Then click “Start Quote.”. Answer whether you’re already a Travelers customer, then click, “Continue Quote.” You’ll need to fill in the blanks about your personal information.

You will continue filling out information regarding the following:

- your vehicle(s)

- other members of your household

- your driving and insurance history

Once you’ve finished, you’ll receive your quote. When you view quote details, you’ll see the breakdown of discounts they’ve added along with the level and types of coverage and how much each costs.

Here’s the information you’ll need to have ready:

- VIN – You may not need this as Travelers automatically pulls up the vehicles registered to your address, but if you’re adding a vehicle that’s not in the system yet, you’ll need the VIN

- Your current level of insurance coverage

The rest of the required information you should know by heart, like your birthday and your address, so those two items above are the only ones you might need to find.

What is Travelers’ history?

In 2004, Travelers Insurance Group and Saint Paul Fire and Marine Insurance Company merged to form St. Paul Travelers. After some drama and broken promises, “St. Paul” was dropped and the company became known just as Travelers.

Saint Paul Fire and Marine was founded in 1853 and Travelers (later Travelers Insurance Group), a company offering insurance to railroad travelers, began in 1864. Present-day Travelers proudly traces their history back to 1853.

A lot has happened in the 160+ years since Saint Paul Fire and Marine sold its first policy. What’s most relevant to consumers today is how Travelers has been performing for the past few years.

Let’s check out their recent growth, first.

What is the Company’s market share?

As you can see, Travelers auto insurance has been maintaining a slow and steady growth in private passenger auto market share. In such a competitive market, this growth is a very good sign of a company’s stability.

In fact, Travelers moved from the 10th largest provider of insurance for private passenger cars to the ninth-largest in 2017.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

What are the pros and cons of the mobile app?

Pros:

- Compatible with older devices

- Easy-to-use interface

- Walks you through all of the information you need to gather

Cons:

- No additional features

- App does not sync with your Travelers Insurance account

Travelers was a fairly early adopter of app technology, publishing its app in early 2013. It hasn’t done much to keep up with the times since, though. Two years ago, it was okay, even revolutionary, to offer an app that only supported claims. Today, customers expect more.

An insurance app cannot hope to remain viable unless it doubles as a mobile ID card and offers bill-pay functionality. These are features a driver will use on a regular basis.

What are Travelers pros and cons?

| Pros | Cons |

|---|---|

| Growing market share | Not available in every state |

| Strong financial rating | Can't purchase coverage online |

| Good discounts and programs | Mediocre customer satisfaction ratings |

| Multiple lines of insurance available | Limited availability of ride share coverage |

Travelers Insurance: Navigating Excellence in Claims Processing

Ease of Filing a Claim (Online, Over the Phone, Mobile Apps)

Travelers Insurance offers multiple options for filing a claim, ensuring convenience for its policyholders. You can file a claim online through their website, over the phone by contacting their customer service, or by using their mobile app. This flexibility allows you to choose the method that suits you best, making the claims process more accessible and user-friendly.

Average Claim Processing Time

The speed at which an insurance company processes claims is crucial to customers who are seeking prompt resolution. While specific processing times can vary depending on the nature of the claim and other factors, Travelers Insurance aims to efficiently handle claims. However, the actual processing time may differ based on the complexity of the claim.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback provides valuable insights into an insurance company’s claim resolution process. Travelers Insurance has received mixed reviews in this regard. Some customers have reported positive experiences with fair settlements, while others have encountered challenges during the claims process.

It’s essential to consider these customer opinions when evaluating Travelers’ claim resolution and payout practices.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Travelers Insurance: Elevating Protection With Advanced Digital and Technological Features

Mobile App Features and Functionality

Travelers Insurance offers a mobile app that provides policyholders with convenient access to their insurance information and various features. The app allows users to manage their policies, file claims, and access important documents on the go. It may also include features like bill payment and accident assistance, enhancing the overall customer experience.

Online Account Management Capabilities

Online account management is a fundamental aspect of modern insurance services. Travelers Insurance provides policyholders with robust online account management capabilities through their website. This platform enables users to view and update policy details, track claims, and access billing information. Easy-to-use online tools enhance the efficiency of managing insurance policies.

Digital Tools and Resources

In addition to mobile apps and online account management, Travelers Insurance may offer various digital tools and resources to assist policyholders. These could include educational resources, risk assessment tools, and coverage calculators to help customers make informed decisions about their insurance needs.

Such digital resources can empower policyholders to better understand and optimize their insurance coverage.

What’s the Bottom Line?

Travelers has a strong financial foundation and their outlook for continued financial stability is positive. That’s a big deal when it comes to being able to pay claims.

Travelers agents are encouraged to be active in their communities and working with an agent who lives and works in your neighborhood will help make for a personal and helpful experience.

One of the best things about Travelers is that they offer so many different lines of insurance, so it’s possible and likely they offer every different type of coverage you need.

With every company, there will be pros and cons. The bottom line is that Travelers has been doing a good job providing insurance for over 160 years and they definitely deserve your consideration today. If you feel that it’s time to cancel a car insurance policy with Travelers, contacting your local agent or the company’s customer service team directly is the recommended first step to ensure the process is handled efficiently.

How do I get discounts on my Travelers policy?

Many of the applicable insurance discounts are added automatically. You can view your policy online or on the app to see what discounts have been applied. If you believe you’re eligible for more discounts, call your local agent and see what else could be added.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

How can I get a quote for another line of insurance with Travelers?

If you’re getting a car insurance quote, the process will bring you to a point where you can add quotes for other possible lines of insurance or additional coverage. If you’re simply looking for a quote for another line, the online quote section features a dropdown menu where you can choose what type of insurance you’d like to search.

How does IntelliDrive work?

It runs through an app, and it monitors your driving habits such as speed, acceleration, and braking. After 90 days, the data collection will be complete. Good habits could equate to a 20 percent discount. Bad habits could cause a rate of increase.

Does Travelers insurance offer travel insurance?

No, not currently, but it may be available through an affiliated company.

Now that you know all about Travelers Insurance, are you ready to get the best price on car insurance?

Enter your ZIP code now to compare rates from multiple companies.

Frequently Asked Questions

What is Travelers Insurance?

Travelers Insurance is a leading insurance company that offers a wide range of insurance products and services, including home, auto, boat, and many other types of insurance coverage. They have been in operation for over 160 years and are known for their strong financial stability and excellent customer service.

What types of insurance does Travelers offer?

Travelers Insurance offers a variety of insurance options to meet the needs of individuals and businesses. Some of the main insurance products they provide include:

- Home Insurance: Coverage for your house and personal belongings against damage or theft.

- Auto Insurance: Protection for your car, truck, or motorcycle against accidents, theft, and other incidents.

- Boat Insurance: Insurance coverage for various types of boats, including yachts, sailboats, and personal watercraft.

- Renters Insurance: Coverage for personal belongings and liability for individuals who rent their homes or apartments.

- Business Insurance: Insurance solutions tailored to meet the needs of businesses, including property, liability, and workers’ compensation coverage.

How can I get a quote for Travelers Insurance?

To obtain a quote for Travelers Insurance, you have a few options:

- Online: Visit the official Travelers Insurance website and navigate to the quote section. Fill out the required information and receive an online quote.

- Phone: Contact Travelers Insurance directly by phone and speak with a representative who will guide you through the quote process and answer any questions you may have.

- Local Agent: Locate a local Travelers Insurance agent near you and schedule an appointment to discuss your insurance needs and receive a personalized quote.

How can I file a claim with Travelers Insurance?

If you need to file a claim with Travelers Insurance, follow these general steps:

- Contact Travelers Insurance: Notify them of the incident as soon as possible. You can usually find the contact information on your insurance policy or their website.

- Provide necessary information: Gather all relevant details about the incident, including date, time, location, and any supporting documents or evidence.

- Work with a claims representative: Travelers Insurance will assign a claims representative to guide you through the claims process. They will provide instructions, answer your questions, and assist you in gathering the required documentation.

- Follow the claims process: Submit any necessary forms or documents as requested by the claims representative. Be sure to keep copies of all communications and documentation for your records.

- Resolution: Travelers Insurance will assess your claim and provide a resolution based on your policy coverage and the circumstances of the incident.

How do I contact Travelers Insurance customer service?

To contact Travelers Insurance customer service, you can use the following methods:

- Phone: Look for the contact number provided on your insurance policy documents or visit the official Travelers Insurance website for their customer service helpline.

- Online: Many insurance companies, including Travelers, provide online support through their website. Look for a “Contact Us” or “Customer Service” section where you can find options for email or live chat support.

- Local Agent: If you have a local Travelers Insurance agent, you can contact them directly for assistance or to get in touch with customer service on your behalf.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.