Liberty Mutual Insurance Review & Complaints: Property & Casualty Insurance (2025)

Our Liberty Mutual insurance review covers virtually everything you would want to know. We feature a breakdown of Liberty Mutual car insurance rates by state — ranging from 58% below average in Montana to 200% above average in Delaware, North Dakota, and Minnesota — Liberty Mutual discounts, ratings, and mobile app details.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Feb 11, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Feb 11, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

hide

Liberty Mutual Insurance Overview

| Liberty Mutual Overview | Details |

|---|---|

| Year Founded | 1912 |

| Current Executives | David H. Long - Chairman, President, and CEO |

| Number of Employees | 50,000 |

| Total Assets (2017) | $142,502 million |

| HQ Address | 175 Berkeley Street Boston, MA 02116 |

| Phone Number | 1-800-290-8206 |

| Company Website | https://www.libertymutual.com |

| Premiums Written (Auto, 2017) | $11,585,976 |

| Loss Ratio | 67.16% |

| Best For | Drivers with good credit, those that prefer a large, financially stable company |

In business for more than 100 years, Liberty Mutual is among the largest property & casualty insurance companies in the United States.

With the Statue of Liberty as their symbol and logo, Liberty Mutual positions itself as an all-American multi-line insurer that can help you with all of your insurance needs. Despite the American symbol, the company has global operations with dozens of subsidiaries.

Liberty Mutual employs more than 50,000 people, sits at number 68 on the Fortune 500 list, and was the sixth-largest auto insurance company in the nation for 2017. But are they a good choice for you?

There are a lot of insurance companies out there, and they all make big promises. There is a lot of information to dig through when it comes to choosing a company to protect you on the road.

These two things combine to make researching insurance companies a long, time-consuming process. It would be a lot easier to read concise information from a trusted, unbiased source, right?

You’re in the right place. We’ve gathered everything you need to know about Liberty Mutual insurance, including a Liberty Mutual auto insurance review, and simplified it so you can decide if they’re a good fit for your needs.

Keep reading for details on Liberty Mutual’s ratings and Liberty Mutual complaints, the coverage they offer, and a look at what their policies cost. You can then see how they fare against their competition with our free online quote tool. Simply enter your ZIP code to get started.

Liberty Mutual Insurance Ratings

You have probably heard of AM Best, J.D. Power, and the other names on the list below. But what do they rate companies for and what do their ratings mean?

Take a look at Liberty Mutual’s ratings from the top consumer and financial reporting agencies, and then we’ll go over what they mean to you.

Liberty Mutual Financial Strength and Customer Satisfaction Ratings

| Ratings Agency | Liberty Mutual Ratings |

|---|---|

| A.M. Best | A |

| Better Business Bureau | A- |

| Moody's | A2 |

| S&P | A |

| NAIC Complaint Index | 6.27 |

| JD Power | Claims Satisfaction 2/5 Shopping Study 3/5 |

| Consumer Reports | 88 |

| Consumer Affairs | 2 stars/328 reviews |

First up is the AM Best rating of A, or excellent. This rating is for financial stability, which is important since it’s a measure of a company’s ability to pay claims and stay solvent. Liberty Mutual scores very well on this front.

The Better Business Bureau (BBB) gives companies a rating based on a combination of factors that include customer complaint volume, resolution of complaints, government or court actions against the company, and years in business.

The Liberty Mutual insurance reviews BBB grade is a little lower than the top ranking of A due to two recent government actions against the company.

The government actions were in San Diego, completed in 2016 and in Massachusetts, completed in 2018. In both cases, Liberty Mutual was ordered to pay a settlement.

The next two, Moody’s and Standard and Poor’s (S&P) are both financial ratings and creditworthiness ratings. Liberty Mutual performs well on both.

The National Association of Insurance Commissioners (NAIC) collects complaints data from companies across the country. Liberty Mutual’s complaint ratio of 5.43 is well above the national median, which is 1.16. That means Liberty Mutual has had more complaints compared to their market share than the average.

J.D. Power might be the most recognizable name on these ratings, as they’re well known for their consumer surveys and for handing out awards to companies that top the list.

Unfortunately, Liberty Mutual doesn’t come close to winning any awards. Of the two national surveys, they earned a below-average ranking of 2/5 for claims satisfaction and an average rating of 3/5 for insurance shopping.

J.D. Power also performs regional surveys of overall satisfaction with car insurance companies, and those ratings can vary quite a bit.

Next, we have the Consumer Reports score for Liberty Mutual, which is 88 out of 100. That’s considered “Very Good”, and is on par with competitors like Nationwide and Allstate, both of which also scored an 88.

And finally, Consumer Affairs, which is a consumer complaint website. In the past year, there were 328 reviews of Liberty Mutual auto insurance. The overall rating is a two out of five, with 89 five-star ratings and 141 one-star ratings.

Overall, Liberty Mutual scores very well on financial ratings but underperforms on most of the consumer satisfaction ratings. There is definitely some room for improvement.

Read more:

- Liberty Mutual RightTrack: Complete Guide & Review

- How long does it take for Liberty Mutual to process a car insurance claim?

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Liberty Mutual Insurance History

Liberty Mutual was founded in 1912 as a worker’s compensation insurance company under the name Massachusetts Employees Insurance Association. In 1914 they started writing auto insurance and took on the name Liberty Mutual in 1917.

Over the following decades, Liberty Mutual expanded beyond Massachusetts and acquired a number of other companies, including Safeco in 2008. They operate in 20 different countries in addition to the United States.

Liberty Mutual continues to operate as a mutual company to this day, which means it is owned by the policyholders rather than by shareholders.

In addition to car insurance, Liberty Mutual writes a variety of specialty vehicle coverage including motorcycles, home insurance, life insurance, business coverage, umbrella insurance, and more.

Liberty Mutual Market Share

In 2015, Liberty Mutual had a market share of 4.97% of the total private passenger auto insurance business in the United States.

In 2016, that share climbed to 5.01% and then stayed steady in 2017. That ranks Liberty Mutual at number six nationwide for market share. While they saw no growth between 2016 and 2017, they didn’t lose any ground either.

Liberty Mutual Sales Approach

Liberty Mutual sells its policies through local agents as well as online and over the phone.

Agents that sell Liberty Mutual products are independent rather than captive, which means they can sell products from multiple different companies.

Unlike companies like Allstate or State Farm, Liberty Mutual’s agents don’t work solely for one company. Another difference is that Liberty Mutual sells insurance directly to those that prefer not to work with an agent.

That means you have the choice – buy your insurance through an independent local agent, or buy direct either online or from a sales representative over the phone.

Read more: How to Get Car Insurance: An Expert Guide

Liberty Mutual Commercials

Liberty Mutual isn’t known for a memorable catchphrase or a famous mascot – although they did recently introduce their “Limu Emu” in new ad campaigns – but they do have a common theme and a very recognizable landmark.

They’ve been using the backdrop of the Statue of Liberty for several years in their television ads, a tie-in with their name and logo, and have both simple commercials that feature people talking about how much money they saved and funny commercials as well. This follows a general trend in car insurance advertising towards humor.

The main focus of their marketing is on the “Only Pay For What You Need” angle, which advertises Liberty Mutual’s policies as customizable to the specific needs of each driver. We’ll take a closer look at the coverage options they offer later to see just how personal the options are.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Liberty Mutual Community Service

Liberty Mutual gives back through both corporate initiatives and employee giving, as well as volunteer hours. The company boasts a total of $52 million in total corporate and employee giving.

The Liberty Mutual Foundation was created in 2003 and provides grants in three main areas: accessibility programs for the disabled, enrichment and education programs for families living in poverty, and homelessness programs.

The Liberty Torchbearers program is designed to help employees give back, providing volunteer opportunities and also matching 50% of all employee donations to nonprofits. The Serve With Liberty program takes place in the first two weeks of May and sees about half of the company’s employees engage in community assistance efforts.

The Safeco Insurance Fund, named for Liberty Mutual’s major subsidiary, also provides grants in the same three main areas of focus as the Liberty Mutual Foundation.

Future Outlook for Liberty Mutual

Liberty Mutual is hanging on to a pretty solid position in terms of market share and has the best-of-both-worlds approach to sales with agents and direct buy options.

Their financials are solid and there’s no reason to think this company will have any difficulty in the future.

Liberty Mutual Employee Demographics

According to Payscale, Liberty Mutual’s median employee age is 34, with an average tenure of 3.8 years at the company. 72% of employees report high job satisfaction. The company ranks at an overall 3.4 out of five for employee satisfaction, which is the same as top-two insurers Geico and State Farm.

More than 4,000 reviews from employees on Glassdoor add up to an overall rating of 3.3 out of five, similar to the Payscale rating. 52% of the reviewers would recommend working at Liberty Mutual to a friend.

According to Great Places to Work, 77% of employees surveyed reported high job satisfaction. The employee age group research shows that 15% of employees have been with the company for more than 20 years.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Liberty Mutual Awards and Accolades

Liberty Mutual has earned a number of awards and made many “best of” lists, too.

For 2018 the Human Rights Campaign awarded Liberty Mutual their 100% Corporate Equality Index designation for LGBTQ equality in the workplace.

Forbes named Liberty Mutual to their 2018 lists of Best Place to Work for New Grads as well as Best Places to Work for Women. They also counted Liberty Mutual about the Best Large Companies and Best Employers for Diversity.

Fortune and Great Places to Work also put Liberty Mutual on their Best for Diversity list in 2017.

Among their other accolades is the title of 2018 Digital Workplace of the Year, and J.D. Power’s Commercial Agent Satisfaction Award.

Liberty Mutual Car Insurance Rates

Let’s start this section by stating that Liberty Mutual doesn’t advertise itself as a low-cost insurance company exactly. While some of their advertisements have focused on saving money, for the most part, the company isn’t positioned as a budget insurer.

Insurance rates vary based on a lot of factors, which means Liberty Mutual may be a good value for one driver and incredibly expensive for another. Learn more about factors that affect car insurance rates.

In the next section, we’ll compare Liberty Mutual to other companies, look at average rates by state, and see how various factors affect the company’s premiums.

Liberty Mutual Insurance Rates by State

Here’s a look at how Liberty Mutual stacks up in all the states. Liberty Mutual’s rates come in lower than average in only seven.

Liberty Mutual Car Insurance Rates by State

| State | Average by State | Monthly Premium (Liberty Mutual) | Higher/Lower | Higher/Lower % |

|---|---|---|---|---|

| Alaska | $285 | $441 | $156 | 54.77% |

| Alabama | $297 | $334 | $37 | 12.29% |

| Arkansas | $344 | N/A | N/A | N/A |

| Arizona | $314 | N/A | N/A | N/A |

| California | $307 | $253 | -$55 | -17.74% |

| Colorado | $323 | $233 | -$90 | -27.83% |

| Connecticut | $385 | $607 | $222 | 57.67% |

| District of Columbia | $370 | N/A | N/A | N/A |

| Delaware | $499 | $1,530 | $1,031 | 206.70% |

| Florida | $390 | $447 | $57 | 14.69% |

| Georgia | $414 | $838 | $424 | 102.41% |

| Hawaii | $213 | $266 | $53 | 24.80% |

| Iowa | $248 | $368 | $120 | 48.10% |

| Idaho | $248 | $192 | -$56 | -22.74% |

| Illinois | $275 | $190 | -$86 | -31.09% |

| Indiana | $285 | $482 | $197 | 69.29% |

| Kansas | $273 | $399 | $125 | 45.88% |

| Kentucky | $433 | $494 | $61 | 14.16% |

| Louisiana | $476 | N/A | N/A | N/A |

| Maine | $246 | $361 | $115 | 46.66% |

| Maryland | $382 | $775 | $393 | 102.88% |

| Massachusetts | $223 | $362 | $138 | 61.99% |

| Michigan | $875 | $1,667 | $792 | 90.50% |

| Minnesota | $367 | $1,130 | $763 | 208.04% |

| Missouri | $277 | $377 | $99 | 35.74% |

| Mississippi | $305 | $371 | $66 | 21.60% |

| Montana | $268 | $111 | -$158 | -58.83% |

| North Carolina | $283 | $182 | -$101 | -35.67% |

| North Dakota | $347 | $1,071 | $724 | 208.53% |

| Nebraska | $274 | $520 | $246 | 90.08% |

| New Hampshire | $263 | $704 | $441 | 167.93% |

| New Jersey | $460 | $564 | $104 | 22.69% |

| New Mexico | $289 | N/A | N/A | N/A |

| Nevada | $405 | $517 | $112 | 27.56% |

| New York | $357 | $545 | $188 | 52.47% |

| Ohio | $226 | $369 | $143 | 63.48% |

| Oklahoma | $345 | $573 | $228 | 65.96% |

| Oregon | $289 | $361 | $72 | 25.00% |

| Pennsylvania | $336 | $505 | $168 | 50.09% |

| Rhode Island | $417 | $515 | $98 | 23.60% |

| South Carolina | $315 | N/A | N/A | N/A |

| South Dakota | $332 | $626 | $294 | 88.74% |

| Tennessee | $305 | $517 | $212 | 69.54% |

| Texas | $337 | N/A | N/A | N/A |

| Utah | $301 | $361 | $60 | 19.82% |

| Virginia | $196 | N/A | N/A | N/A |

| Vermont | $270 | $302 | $32 | 11.96% |

| Washington | $255 | $333 | $78 | 30.58% |

| West Virginia | $216 | $244 | $27 | 12.68% |

| Wisconsin | $301 | $563 | $263 | 87.43% |

| Wyoming | $267 | $166 | -$101 | -37.83% |

The most expensive states to choose Liberty Mutual for your car insurance are Minnesota, North Dakota, and Delaware, with rates more than 200% above average in all three states.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

How Liberty Mutual’s Average Rates Compare to the Top 10 Companies

Liberty Mutual ranks among the top 10 companies for car insurance in the nation. Here’s a look at how their average rates compare to the other nine companies on that list.

Top Providers Average Monthly Premiums Compared by State

| State | U.S. Average |  |  | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Alaska | $103 | $97 | $76 | $135 | $65 | $108 | $105 | $127 | $164 | $93 |

| Alabama | $105 | $112 | $89 | $108 | $108 | $96 | $105 | $133 | $162 | $79 |

| Arkansas | $116 | $131 | $91 | $162 | $80 | $128 | $137 | $165 | $99 | $111 |

| Arizona | $112 | $84 | $65 | $180 | $81 | $116 | $114 | $135 | $178 | $104 |

| California | $140 | $132 | $101 | $199 | $108 | $142 | $138 | $167 | $216 | $122 |

| Colorado | $115 | $120 | $94 | $166 | $94 | $107 | $118 | $163 | $92 | $114 |

| Connecticut | $123 | $133 | $62 | $196 | $91 | $112 | $125 | $151 | $201 | $83 |

| District of Columbia | $129 | $115 | $69 | $241 | $111 | $172 | $115 | $139 | $180 | $102 |

| Delaware | $156 | $90 | $101 | $207 | $116 | $144 | $130 | $157 | $494 | $82 |

| Florida | $142 | $153 | $89 | $183 | $99 | $103 | $188 | $227 | $161 | $166 |

| Georgia | $132 | $115 | $61 | $165 | $107 | $152 | $124 | $149 | $263 | $110 |

| Hawaii | $83 | $78 | $59 | $118 | $64 | $84 | $82 | $99 | $128 | $72 |

| Iowa | $86 | $75 | $81 | $126 | $65 | $73 | $95 | $82 | $116 | $92 |

| Idaho | $77 | $91 | $57 | $128 | $53 | $82 | $93 | $92 | $79 | $57 |

| Illinois | $92 | $89 | $47 | $176 | $64 | $93 | $114 | $117 | $76 | $87 |

| Indiana | $92 | $69 | $63 | $140 | $71 | $97 | $107 | $79 | $183 | $69 |

| Kansas | $111 | $127 | $75 | $160 | $81 | $92 | $114 | $144 | $174 | $87 |

| Kentucky | $145 | $111 | $80 | $236 | $98 | $184 | $164 | $197 | $168 | $139 |

| Louisiana | $173 | $161 | $141 | $206 | $124 | $181 | $176 | $212 | $274 | $156 |

| Maine | $101 | $95 | $72 | $143 | $78 | $103 | $99 | $120 | $155 | $88 |

| Maryland | $129 | $121 | $135 | $201 | $107 | $106 | $116 | $140 | $181 | $103 |

| Massachusetts | $80 | $94 | $37 | $108 | $59 | $87 | $84 | $117 | $120 | $61 |

| Michigan | $238 | $152 | $99 | $406 | $209 | $257 | $204 | $335 | $424 | $183 |

| Minnesota | $124 | $101 | $90 | $160 | $67 | $87 | $93 | $108 | $375 | $94 |

| Missouri | $102 | $98 | $90 | $148 | $85 | $66 | $106 | $135 | $129 | $114 |

| Mississippi | $105 | $120 | $72 | $147 | $82 | $96 | $120 | $145 | $119 | $88 |

| Montana | $107 | $171 | $82 | $154 | $70 | $88 | $125 | $164 | $59 | $111 |

| North Carolina | $86 | $32 | $69 | $169 | $77 | $111 | $82 | $99 | $82 | $99 |

| North Dakota | $124 | $110 | $61 | $136 | $76 | $77 | $145 | $107 | $398 | $88 |

| Nebraska | $104 | $95 | $92 | $125 | $69 | $77 | $112 | $130 | $179 | $102 |

| New Hampshire | $86 | $63 | $50 | $128 | $59 | $77 | $77 | $93 | $198 | $68 |

| New Jersey | $138 | $93 | $74 | $157 | $113 | $119 | $115 | $231 | $279 | $136 |

| New Mexico | $105 | $86 | $90 | $158 | $69 | $96 | $103 | $131 | $161 | $91 |

| Nevada | $114 | $82 | $110 | $165 | $103 | $112 | $140 | $155 | $111 | $91 |

| New York | $138 | $96 | $78 | $147 | $137 | $164 | $137 | $165 | $200 | $175 |

| Ohio | $82 | $85 | $59 | $120 | $70 | $114 | $62 | $96 | $106 | $63 |

| Oklahoma | $118 | $110 | $109 | $135 | $91 | $122 | $118 | $136 | $184 | $105 |

| Oregon | $102 | $78 | $93 | $153 | $75 | $111 | $106 | $111 | $141 | $97 |

| Pennsylvania | $112 | $148 | $68 | $148 | $76 | $86 | $108 | $131 | $219 | $75 |

| Rhode Island | $143 | $116 | $125 | $189 | $76 | $190 | $151 | $183 | $235 | $103 |

| South Carolina | $117 | $105 | $79 | $133 | $88 | $118 | $118 | $166 | $185 | $105 |

| South Dakota | $109 | $105 | $57 | $136 | $67 | $76 | $151 | $113 | $230 | $97 |

| Tennessee | $102 | $92 | $78 | $144 | $72 | $118 | $102 | $86 | $184 | $88 |

| Texas | $133 | $121 | $105 | $201 | $90 | $154 | $176 | $137 | $178 | $101 |

| Utah | $96 | $95 | $73 | $117 | $103 | $93 | $105 | $115 | $119 | $88 |

| Virginia | $81 | $61 | $69 | $103 | $63 | $86 | $83 | $100 | $129 | $73 |

| Vermont | $93 | $181 | $38 | $142 | $87 | $77 | $85 | $103 | $100 | $75 |

| Washington | $80 | $60 | $75 | $114 | $69 | $70 | $91 | $102 | $92 | $81 |

| West Virginia | $94 | $94 | $62 | $123 | $58 | $226 | $63 | $109 | $84 | $72 |

| Wisconsin | $116 | $110 | $83 | $162 | $79 | $104 | $115 | $139 | $196 | $102 |

| Wyoming | $104 | $106 | $111 | $155 | $82 | $114 | $111 | $130 | $75 | $98 |

The rates for each company vary a lot by state, with Liberty Mutual a good value compared to other companies in some places and not such a great deal in others.

Read more:

- Farmers vs. Liberty Mutual Car Insurance

- Geico vs. Liberty Mutual Car Insurance

- Liberty Mutual vs. Nationwide Car Insurance

- Liberty Mutual vs. Progressive Car Insurance

- Liberty Mutual vs. Travelers Car Insurance

- Liberty Mutual vs. USAA Car Insurance

Rates by Commute

Longer commutes are generally seen as resulting in higher insurance rates, although not all companies raise rates a whole lot based on commute length. As you can see below, there is a difference at Liberty Mutual, but it’s not a huge increase.

Liberty Mutual Commute Average Rates

| Commute Type | Monthly Rates |

|---|---|

| 10-Mile, 6,000 Miles Annually | $500 |

| 25-Mile, 12,000 Miles Annually | $513 |

Rates by Coverage Level

The main reason people choose to carry a lower level of coverage on their car insurance is the cost. Here’s a look at the average rates from Liberty Mutual for three levels of coverage.

Liberty Mutual Car Insurance Average Rates by Coverage Level

| Coverage Level | Monthly Rates |

|---|---|

| Low | $484 |

| Medium | $505 |

| High | $530 |

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Rates by Credit History

Credit is one of the factors insurance companies can use to calculate your rates. A driver with poor credit will usually pay the highest rate. At Liberty Mutual, the average rate doubles between good credit and poor credit, with fair credit falling right about in the middle.

Liberty Mutual Average Monthly Car Insurance Rates by Credit History

| Credit History | Monthly Rates |

|---|---|

| Poor | $734 |

| Fair | $467 |

| Good | $366 |

Read more: How does your credit score affect car insurance rates?

Rates by Driving Record

A clean driving record is always going to earn you the lowest rate, no matter which company carries your insurance. But each company weights things like a ticket or an accident differently.

Below are Liberty Mutual’s rates for several common situations. At Liberty Mutual, a DUI will cost you the most, while a speeding ticket carries the lowest rate increase.

Liberty Mutual Average Monthly Car Insurance Rates by Driving Record

| Credit History | Monthly Rates |

|---|---|

| Poor | $734 |

| Fair | $467 |

| Good | $366 |

| One DUI | $634 |

Read more: Will my insurance rates go up if I file a car insurance claim with Liberty Mutual?

Liberty Mutual Insurance Coverages Offered

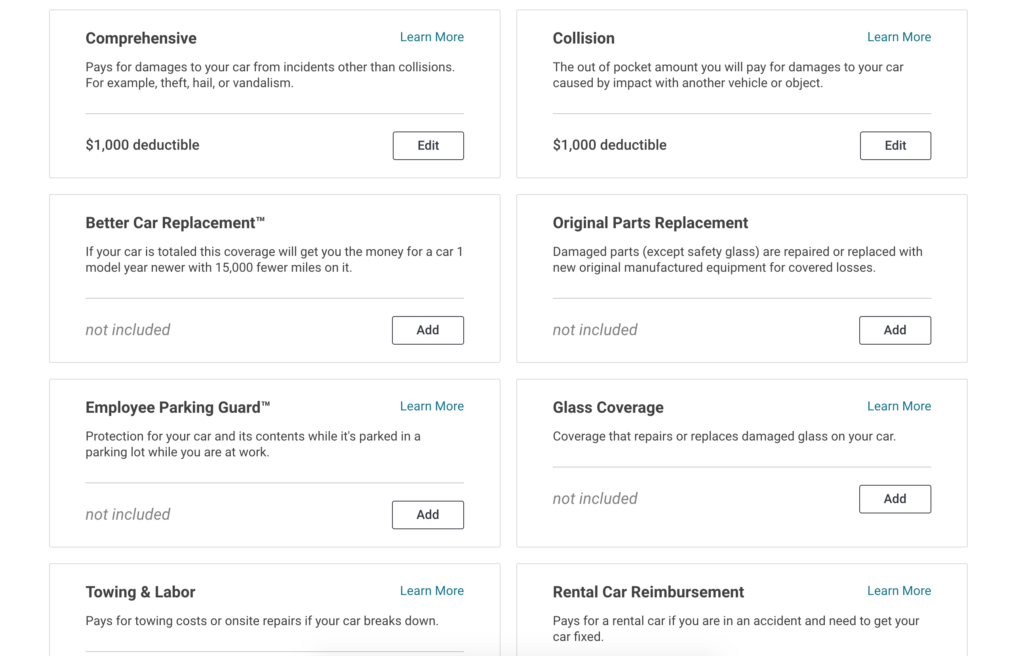

Liberty Mutual writes full-coverage auto insurance policies with a lot of options. They advertise their approach to insurance as being a “pay for only what you need” customized policy, but selecting from add-ons and endorsements is the norm at most insurance companies.

In this next section we’ll take a look at what Liberty Mutual offers for coverage and how, if at all, it differs from the other options out there.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Types of Coverage Offered

Liberty Mutual’s auto policy starts with the basics – liability coverage to meet your state’s minimum requirements. Depending on your state, this will include some or all of the following:

- Bodily Injury Liability

- Property Damage Liability

- Personal Injury Protection (PIP)

- Medical Payments (MedPay) (See our article, What is medical payments coverage in car insurance? for details.)

- Uninsured/Underinsured Motorist (UM/UIM) Bodily Injury

- Uninsured/Underinsured Motorist Property Damage

Your liability package can include just what the state requires, or you can add on the options you want to provide extra protection. After choosing liability, Liberty Mutual allows you to choose from several other options that are designed to provide extended financial protection for your car and more. Here’s a list of the options.

- Collision

- Comprehensive

- Towing and Labor

- Rental Car Reimbursement

- Loan/Lease Gap Protection

- Original Parts Replacement

- New Car Replacement

- Better Car Replacement

Most of these are options we see from other insurance companies, although Better Car Replacement is unusual. This coverage replaces a totaled car with one that is one model year newer and has 15,000 fewer miles.

It differs from New Car Replacement, which only applies to cars under a year old and with less than 15,000 miles.

Overall, a Liberty Mutual policy is built in much the same way as most other insurance companies; you can pick and choose the coverage you need and leave off what you don’t.

Worth noting about Liberty Mutual’s coverage is that they guarantee your rate for 12 months.

While a six-month policy with possible rate changes at the time of renewal is standard at most companies, you won’t see rate increases for 12 months with Liberty Mutual.

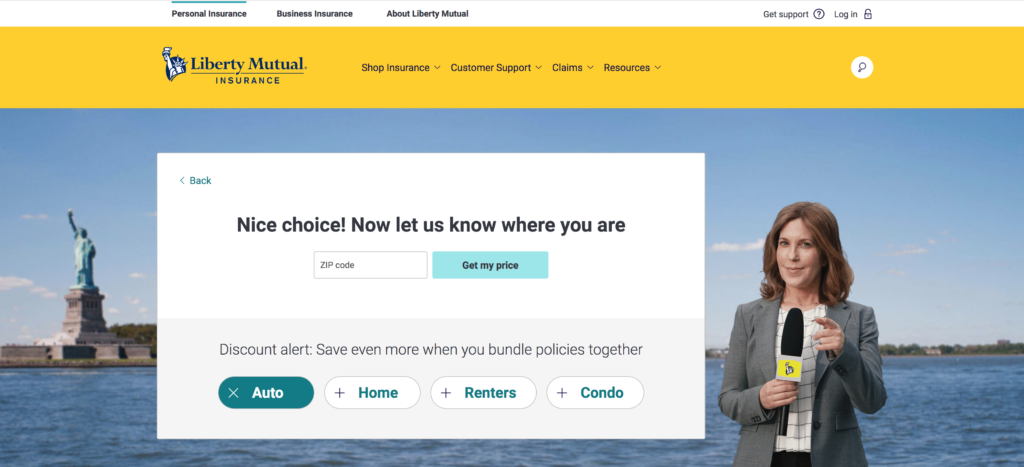

Liberty Mutual Bundling

Liberty Mutual offers bundles for their auto and home insurance policies that will earn you a discount on both. The bundling doesn’t only apply to a homeowners insurance policy, but also to renters and condo owners.

We found no indication that there are bundling discounts for any of the other types of insurance offered by Liberty Mutual.

Liberty Mutual Insurance Area of Operation

Liberty Mutual writes car insurance in all 50 states and the District of Columbia.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Liberty Mutual Insurance Additional Options

Liberty Mutual has some other options that can be added to your car insurance policy for extra benefits and savings. The availability and details can vary from state to state.

Accident Forgiveness was a big trend in car insurance a while back, and most major insurers offer it today. Liberty Mutual offers this coverage only to those that have been accident-free and have had no violations in the past five years.

This applies to current customers and new ones, as long as they meet the criteria. Accident Forgiveness isn’t available in California.

Liberty Mutual Deductible Fund is an unusual option that acts as something of a savings account for your deductible. Each year, you can contribute $30 to your fund, and the company will kick in another $70, for a total of $100.

The fund can continue to grow each year, and in the event of a claim where you are responsible for paying a deductible, the fund can be used to pay it either in full or up to the amount you have available.

So, if your deductible is $500 and you have contributed for five years, it will be paid in full. You’ll have put in $150, and Liberty Mutual will have paid the rest. Or, if you look at it from another angle, you will have put $150 in a savings account, and Liberty Mutual has reduced your deductible to that amount.

Lifetime Repair Guarantee is Liberty Mutual’s repair program that guarantees the work on your car for as long as you own it if you have the repairs done through one of their approved shops. This is included automatically with every policy.

Teacher’s Auto Insurance is a special program for teachers that provides additional coverage at no extra cost. The program adds vandalism coverage with a $0 deductible if the damage happens on school property, $2,000 in coverage for school-related personal property, and a $0 deductible for collisions when driving on school business. (For more information, read our article, Car Insurance Discounts for Teachers).

RightTrack is Liberty Mutual’s usage-based program. It uses a small device that attaches to the car’s windshield and connects with a mobile app. The device records driving habits such as hard braking, rapid acceleration, and time of day driven.

After a 90-day monitoring period, a discount is calculated and applied to your policy. Liberty Mutual advertises a discount of up to 30% for the program.

Liberty Mutual also offers a Vehicle Service Plan, which is essentially an extended warranty for your car.

Liberty Mutual Insurance Discounts

As you can see from the table below, Liberty Mutual has a lot of available discounts – but they don’t provide much information in terms of how much you can save. There’s no amount listed for most of the discounts.

| Discount | Percentage Off (up to) | Details/Requirements |

|---|---|---|

| Advanced Safety Features | Not stated | Vehicles with anti-lock brakes, electronic stability control, adaptive headlights |

| Anti-theft Device | Not stated | Vehicles equipped with qualifying anti-theft device |

| Alternative Energy | Not stated | Hybrid or electric vehicles |

| Homeowner | Not stated | Own a home |

| Early Shopper Discount | 45% | Sign before previous policy expires |

| Military | Not stated | For active, retired, or reserve members of the military |

| Good Student | Not stated | Maintain a B average or better |

| Student Away | Not stated | Students away at school without a vehicle |

| Accident Free | Not stated | No accidents |

| Violation Free | Not stated | No violations on record |

| RightTrack | 30% | Must install and use the RightTrack device for 90 days |

| Paperless Policy | Not stated | Sign up for online policy management |

| Full Pay | Not stated | Pay full term premium up front or in two payments |

| Preferred Payment | Not stated | Enroll in automatic payments |

| Online Purchase | 12% | Purchase your policy online |

| Auto and Home | Not stated | Have both auto and home in force with Liberty Mutual |

| Multi-car | Not stated | Insure more than one car with Liberty Mutual |

| Group membership | 10% | Members of one of 14,000 groups and alumni associations, as well as employees of affiliated companies |

Read more: Liberty Mutual RightTrack: Complete Guide & Review

Liberty Mutual is one of a handful of major insurance companies to offer a military discount and also stands out for its green car discount.

We didn’t see any discounts listed on the company website for 55-plus drivers or defensive driving courses. It’s possible these are offered by not listed but leaves us to wonder why they wouldn’t provide that information upfront.

Liberty Mutual Homeowners Insurance

Our Liberty Mutual homeowners insurance reviews found that the company customizes the following policy types:

- Personal property coverage

- Liability coverage

- Other coverages such as hurricane damage, inflation protection, and water backup

Liberty Mutual also offers several discount opportunities. You can save up to 10% when you buy home insurance online. And by bundling your home insurance with your auto insurance, you could save over $950.

The company also has discounts for being claims-free for five years or more, resigning before your current policy expires, buying a new home, renovating, getting a new roof, and qualifying for construction features that mitigate wind damage.

Our Liberty Mutual renters insurance reviews found that policyholders can pay as little as $5 a month. Liberty Mutual also offers several discounts to renters and will customize the following policy types:

- Personal liability and medical payments to others

- Personal property coverage

- Blanket jewelry coverage

Liberty Mutual home insurance reviews rate the company as above average, but one downside is that it’s not available in all states, such as California.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Liberty Mutual Life Insurance

Our Liberty Mutual life insurance reviews found that Liberty Mutual partners with TruStage to offer three types of life insurance:

- Term life

- Whole life

- Guaranteed acceptance whole life (Our article on understanding guaranteed life insurance provides details.)

No medical exam is needed for any of Liberty Mutual’s life insurance policies.

As far as cost, the company notes a healthy 30-year-old male can get a term life insurance policy for slightly over $13 a month. The company offers an online quote tool to help you quickly receive an estimated rate.

Life insurance policies through TruStae are rated A (Excellent) by A.M. Best and have excellent customer ratings.

Liberty Mutual Pet Insurance

Liberty Mutual offers pet insurance for dogs and cats.

They have three types of policies:

- Accident coverage

- Accident & Illness coverage

- Accident, Illness, & Wellness coverage

They promote no cancellation due to age and offer flexibility to use any vet.

Liberty Mutual notes its pet insurance policies are affordable, starting at less than $1 a day. With stackable discounts, You can save up to 20% on your pet insurance rate. To start the process of getting a pet insurance quote, go to pet.libertymutual.com.

Liberty Mutual didn’t start offering pet insurance until 2017, but its coverage is competitive with top pet insurance companies such as Pets Best and Spot. If you’re already a Liberty Mutual customer, you can receive up to a 10% discount on pet insurance and an additional 10% discount for multiple pets.

Justin Wright Licensed Insurance Agent

Liberty Mutual pet insurance reviews are mostly favorable, noting customizable plans, stackable discounts, a short waiting period for hip dysplasia (14 days), no cancellation due to age, and a 30-day money-back guarantee. However, they are criticized for having a 30-day waiting period for any reimbursements.

Liberty Mutual Insurance Online Quoting

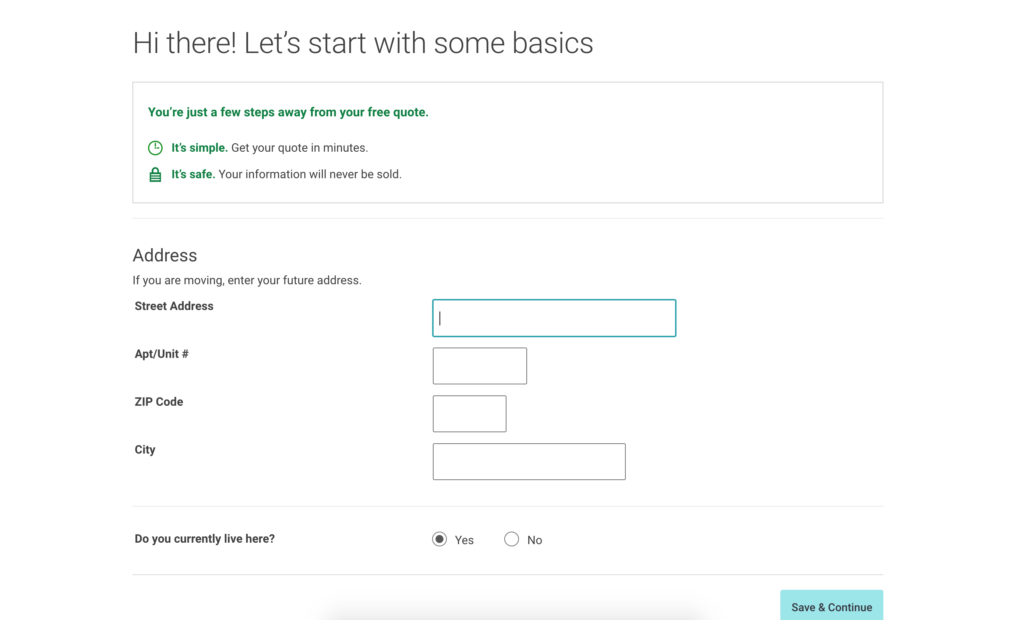

Liberty Mutual allows customers to complete the entire process from quoting to buying a policy online.

From the main page of the website, you can select the type of Liberty Mutual quote you’d like to obtain, and they’ll also give you the option to get a bundling quote by adding a home policy to the quote as well. The first step is to enter your zip code.

On the next page, you will need to enter your full home address. That’s followed by your name, date of birth, and email address.

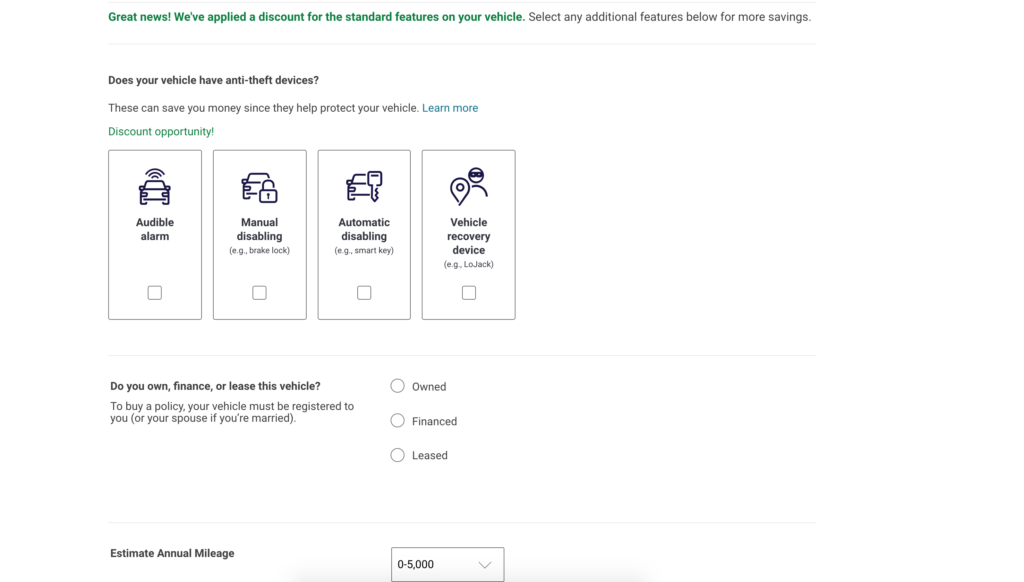

With this information, Liberty Mutual will search for vehicles associated with your name and address, and auto-fill the vehicle information in the next section. Select the vehicles from the list, or add new vehicles manually. You’ll then answer basic questions about the vehicle.

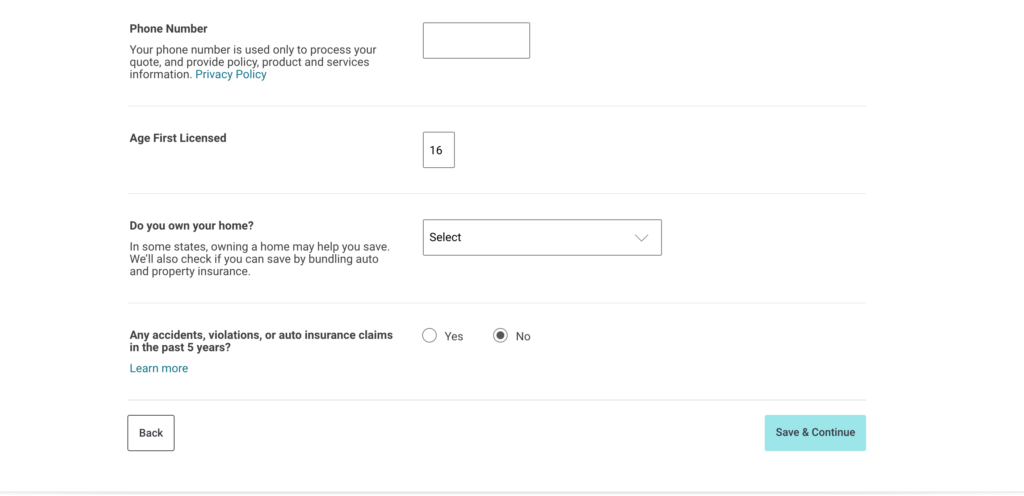

The next step covers the drivers, and you’ll answer some basic questions here as well. It’s at this step that the system will ask you for a phone number. It’s likely that this number will be used to follow up on the quote and attempt to sell you a policy, which might deter some insurance shoppers looking to avoid solicitation.

The next steps will ask a few more basic questions regarding previous insurance and then lead to the offer of signing up for the RightTrack program. After that, the system will provide you with a quote. On the final quote page, you can adjust things like deductibles and coverage options to change your rate and protection level.

The quote system is easy and smooth and provides a lot of options to adjust the final price as well. It’s far from the most invasive quote system we have seen in terms of personal information requirements.

| Information | Required/Not Required |

|---|---|

| Driver's License Number | Not required |

| Social Security Number | Not required |

| Phone Number | Required |

| Email Address | Required |

| Vehicle Identification Number | Not required |

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Liberty Mutual’s Website and App Review

Liberty Mutual has a well-organized website that provides easy access to information about products and services, quotes, claims information, and company information.

In addition to products and services, they have a section dedicated to helping people with common problems called Master This. It includes helpful information on basic car repair, choosing a mechanic, and a long list of other subjects.

The resource section of the site also includes calculators to help you determine what coverage you need and what limits you should consider.

Mobile devices are a major part of most people’s lives these days, and insurance companies are in a rush to take advantage of this technology. Not too long ago, a mobile app was an extra perk offered by a handful of companies but rarely used.

Now, it seems that a sleek mobile app is a necessity for any big-name company trying to keep up with the competition. Liberty Mutual is no different.

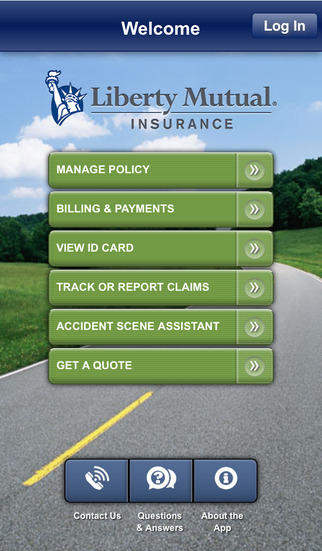

The Liberty Mutual mobile app does most everything its website can, plus a little bit more.

Read more: Liberty Mutual Mobile App: Complete Guide & Review

Device Availability

The app is available on any Apple or Android device, including your iPhone, iPad, and tablets supporting the Android platform. Simply check the appropriate app store for your device.

User experience will be similar across devices.

App Features

Some insurance apps are designed for a wide audience, and marketed to anyone who might want to download them. Liberty Mutual is much more tightly focused on the needs of existing customers.

The app allows you to do most of the things you would do from the customer portal on the main website, including:

- Paying your bill

- Viewing your policy and ID cards

- Updating your information

- Swap to paperless billing

- Check on the status of a claim

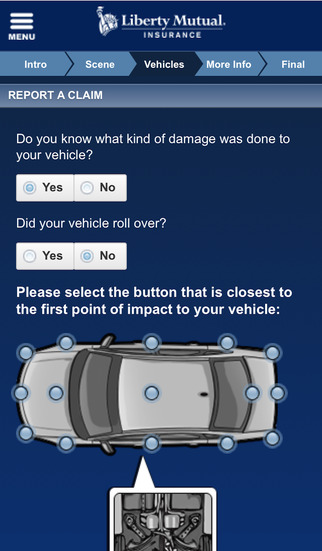

- Report a new claim

There are also a few mobile-only options that you may find useful:

- Sign up to receive text message notifications about your claim status

- GPS for mapping your location

- Gather contact information and take damaged photos after an accident

- Locate nearby repair shops

As you can see, most of the app’s features are based on claims. These features are most useful in the event you are reporting a claim right from the scene of an accident since you’ll be able to record information, take photos, and submit them timely.

Google Play / iTunes / Amazon Reviews

Google Play users give it a 3.6 review, which is pretty consistent with its results from other app stores.

There are a few bugs commonly reported with the app, the most frustrating of which is that it will often lose information, causing you to need to re-enter some things. If this bug hasn’t been dealt with, it’s a crippling flaw as no one who’s just been in an accident needs the added frustration of an app that doesn’t work.

Other users say that the app runs slowly or freezes intermittently at the load screen, often after several times of it working just fine.

These bug complaints were still being made as recently as November 2014, for the latest version (2.1.1.1), so they are likely still an issue for at least some users.

Pros:

- Easy access to your policy and proof of insurance

- Ability to file a claim

- Ability to collect all necessary claim information like location, contact info, photos etc.

- Ability to pay your bill on mobile

Cons:

- App has reports of lag

Additional Apps

Liberty Mutual has gone a bit “app crazy,” offering seven apps in total. Aside from its primary mobile app, it also offers:

- CarZen: A car-shopping app for the iPad, allows you to research a new vehicle before buying one.

- Training Zone: A sports-game app with skiing and soccer mini-games. You can share your results with Facebook friends and earn various coins and upgrades like you would with any other casual social game.

- HomeGallery: A personal inventory app that allows you to keep track of all of your belongings in the event you need to file a homeowner’s claim.

- FuelQ: An app that monitors your driving habits and provides fuel efficiency analysis and tips for reducing fuel costs.

These apps are available to anyone, not just Liberty Mutual customers, and they’re clearly meant to create some additional buzz or interactivity with the company. By and large, though, they don’t offer anything that you couldn’t get elsewhere.

It seems it would make more sense if the HomeGallery app were bundled with the regular mobile app to add some extra usefulness, or even if the mini-games from Training Zone were incorporated in the main app to get people to use it more often. Having so many separate apps to potentially take up space on your device just doesn’t make sense from a customer perspective.

Liberty Mutual Insurance Claims Review

Ease of Filing a Claim

When it comes to filing a claim with Liberty Mutual Insurance, policyholders have multiple convenient options at their disposal. The insurance company offers a user-friendly online claims submission process, allowing customers to initiate a claim from the comfort of their homes.

Additionally, claims can be filed over the phone for those who prefer a more personalized approach. Liberty Mutual also provides a mobile app that streamlines the claims process, offering policyholders the flexibility to submit and track claims on their mobile devices. This multi-channel approach makes it easy for customers to report incidents and start the claims process promptly.

Read more: What is Liberty Mutual’s policy on rental car coverage during the claims process?

Average Claim Processing Time

The speed at which insurance claims are processed is a crucial factor for policyholders. Liberty Mutual strives to provide efficient claim processing services. However, the actual claim processing time may vary depending on various factors, including the complexity of the claim, the availability of necessary documentation, and the specific circumstances of the incident.

To obtain precise information regarding the average claim processing time, it is advisable for customers to contact Liberty Mutual directly or consult their policy documents for relevant details.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback plays a vital role in assessing an insurance company’s performance in handling claims. Is Liberty Mutual good at paying claims?

Liberty Mutual Insurance has received mixed reviews from customers regarding claim resolutions and payouts. It scored 866 out of 1,000 points in the J.D. Power 2023 U.S. Auto Claims Satisfaction Study, 12 points below the industry average

While the company excels in financial stability and the ability to pay claims, it has faced criticism in terms of customer satisfaction with claim resolutions. Some customers have reported dissatisfaction with the speed and fairness of claim settlements.

For a comprehensive understanding of Liberty Mutual’s claim resolution and payout experiences, potential customers are encouraged to research Liberty Mutual customer reviews, consult consumer advocacy organizations, and consider their unique needs and circumstances before making a decision.

Digital and Technological Features of Liberty Mutual Insurance

Mobile App Features and Functionality

Liberty Mutual offers a mobile app designed to enhance the customer experience. The app provides a range of features and functionalities, including the ability to file and track claims, view policy details, pay bills, access ID cards, and contact customer support.

It is a valuable tool for policyholders who prefer the convenience of managing their insurance policies on their mobile devices. Liberty Mutual’s mobile app aims to streamline insurance-related tasks and provide customers with easy access to essential services.

Online Account Management Capabilities

Liberty Mutual’s online account management platform empowers policyholders with comprehensive self-service options. Through their online accounts, customers can manage policies, make updates, review coverage, and access important documents.

This digital convenience allows customers to maintain control over their insurance policies and make necessary adjustments without the need for extensive paperwork or phone calls.

Digital Tools and Resources

In addition to its mobile app and online account management capabilities, Liberty Mutual provides policyholders with a range of digital tools and resources.

These tools may include educational materials, calculators, and resources to help customers understand their insurance needs and make informed decisions. By leveraging technology, Liberty Mutual aims to provide customers with the information and resources necessary to navigate the complex world of insurance effectively.

Overall, Liberty Mutual Insurance combines digital and technological features to offer policyholders convenience, accessibility, and control over their insurance experience. These digital tools and resources complement the company’s commitment to providing comprehensive insurance coverage and efficient claims processing.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Liberty Mutual Mobile App: The Final Word

Comparably this Liberty Mutual app performs at least as well if not better than most other insurance applications we have reviewed. It provides useful functionality and added features not available on the website. In the event of an incident, the Liberty Mutual app seems as though it provides true value. Aside from their main insurance and claims app, the others seem gimmicky while providing no tangible benefit. Stick with the one Liberty Mutual app and you should be just fine.

Liberty Mutual Review: The Bottom Line

Is Liberty Mutual insurance good? Is Liberty a good insurance company? Now that we have gone over Liberty Mutual as a company, looked at rates and coverage, and examined discounts and claims, what’s the bottom line? Here are the main Liberty Mutual pros and cons for insurance.

| Pros | Cons |

|---|---|

| Good list of discounts that are easy to qualify for | Above average pricing in most states, very expensive in some. |

| Choice of working with an agent or direct buy | Consumer satisfaction ratings are not as high as competitors |

| Easy online quoting and buying process | Limited bundling options |

Now that you have a better idea of Liberty Mutual reviews, especially Liberty Mutual car insurance reviews, compare their rates to other insurance providers by entering your ZIP code into our free quote tool.

Your one-stop online insurance guide. Get free quotes now! Secured with SHA-256 Encryption

Frequently Asked Questions

Why is Liberty Mutual insurance so cheap?

While Liberty Mutual does not position itself as a low-cost insurance company, its insurance can be considered cheap by taking advantage of its safe driving program RightTrack and its many other discounts, such as for military members, homeowners, and good students.

Rates vary based on several factors, and the company’s rates may be a good value for some drivers and expensive for others. It’s recommended to compare quotes and consider individual circumstances. An easy way to do that is to enter your ZIP code into our free quote comparison tool.

Is Liberty Mutual a good insurance company?

Yes, Liberty Mutual has received various awards and accolades, including being named a Best Place to Work for New Grads, Best Places to Work for Women, and Best Large Companies and Best Employers for Diversity by Forbes. It has also received the Human Rights Campaign’s 100% Corporate Equality Index designation.

What are employee demographics?

The median employee age at Liberty Mutual is 34, with an average tenure of 3.8 years. Employee satisfaction is high, with a rating of 3.4 out of 5. According to reviews on Glassdoor, 52% of employees would recommend working at Liberty Mutual to a friend.

What’s the future outlook?

Liberty Mutual is expected to maintain a solid position in the market due to its market share and diverse sales approach. The company has solid financials and is well-positioned for the future.

Do they do community service?

Yes, Liberty Mutual engages in community service through corporate initiatives, employee giving, and volunteer hours. The company has a foundation that provides grants in areas such as accessibility programs, enrichment and education programs, and homelessness programs.

What is its market share?

Liberty Mutual had a market share of 5.01% in 2017, making it the sixth-largest auto insurance company in the United States.

What can I do with the Liberty Mutual mobile app?

With the Liberty Mutual mobile app, you can perform various tasks such as paying bills, viewing policy and ID cards, updating information, and making claims.

You can also sign up for text message notifications about your claim status, use GPS for mapping your location, gather contact information, take damage photos after an accident, and locate nearby repair shops.

Is the Liberty Mutual mobile app available on both iOS and Android devices?

Yes, the Liberty Mutual mobile app is available on any Apple or Android device, including iPhones, iPads, and Android tablets. You can download the app from your device’s app store.

Can I access my insurance policy features through the Liberty Mutual mobile app?

Yes, the app allows you to access your insurance policy features, providing a customer experience preferred by most policyholders.

What are the pros of using the Liberty Mutual mobile app for claims?

The app offers easy access to your policy and proof of insurance, the ability to file a claim, and the ability to collect all necessary claim information like location, contact info, and photos. It also allows you to pay your bill conveniently on your mobile device.

Read more in our article, How do I file a car insurance claim with Liberty Mutual?

What are the additional apps offered by Liberty Mutual?

Aside from the main mobile app, Liberty Mutual offers several other apps, including CarZen for car shopping, Training Zone for sports games, HomeGallery for personal inventory, and FuelQ for monitoring driving habits and fuel efficiency analysis. These apps are available to anyone, not just Liberty Mutual customers.

Should I use multiple Liberty Mutual apps or stick with the main one?

It’s recommended to stick with the main Liberty Mutual app as it provides useful functionality and added features. The additional apps may offer some novelty or interactivity, but they don’t provide significant benefits. Bundling certain features into the main app could enhance its usefulness.

Does Liberty Mutual offer rideshare insurance?

No, however, Liberty Mutual will not cancel you if you drive for a rideshare company; they simply won’t cover the vehicle during the time that it’s being used for that purpose. They also require that you have more than one car on the policy, and not only the vehicle used for ridesharing.

Can using RightTrack increase my rates?

No. Our Liberty Mutual car insurance review found that although some usage-based car insurance programs can result in increased premiums based on the data gathered, Liberty Mutual uses it only to calculate a discount.

How do I know if I qualify for a group membership discount?

Liberty Mutual offers discounts of up to 10% to members of certain groups, employees of affiliated companies, and alumni associations. To find out if you qualify, you’ll need to speak with a sales representative since there’s no list online.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.