Best Car Insurance for Grubhub Drivers in 2025 (Check Out the Top 10 Companies)

The best car insurance for Grubhub drivers starts at $49/mo. American Family is the top overall pick for its claims service, State Farm offers the cheapest rates, and Erie is known for handling claims quickly. These companies offer coverage that meets Grubhub's driver insurance requirements.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Feb 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Feb 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Grubhub Drivers

A.M. Best

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 1,883 reviews

1,883 reviewsCompany Facts

Full Coverage for Grubhub Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviewsAmerican Family, State Farm, and Erie offer the best car insurance for Grubhub drivers. State Farm has the cheapest rates at $49 per month. American Family offers the best coverage for the price while Erie makes filing claims easy.

Grubhub car insurance is something that many drivers think that they have, but in actuality, they do not.

Our Top 10 Company Picks: Best Grubhub Drivers Car Insurance

| Insurance Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A | Claims Service | American Family | |

| #2 | 17% | B | Cheap Rates | State Farm | |

| #3 | 25% | A+ | Filing Claims | Erie |

| #4 | 25% | A++ | Low Deductibles | Geico | |

| #5 | 25% | A+ | Diverse Discounts | Allstate | |

| #6 | 5% | A+ | Exclusive Benefits | The Hartford |

| #7 | 20% | A+ | Policy Perks | Nationwide |

| #8 | 20% | A | Personalized Service | Farmers | |

| #9 | 25% | A | Flexible Coverage | Liberty Mutual |

| #10 | 13% | A++ | Discount Options | Travelers |

You may need extra coverage and should look for food delivery insurance if you plan to become a driver.

Looking for a new insurance provider? Compare car insurance rates by entering your ZIP code into our free comparison tool.

- The best car insurance for Grubhub drivers must cover delivery-related risks

- State Farm has the cheapest rates for Grubhub drivers at $49 monthly

- American Family is the top pick for strong coverage options

#1 – American Family: Top Overall Pick

Pros

- Solid Coverage: American Family gives strong protection, making it a great choice for Grubhub drivers. Grubhub drivers can get minimum coverage for about $54 a month.

- Flexible Plans: Grubhub drivers can adjust their coverage to fit their needs. Check out our American Family insurance review for more details.

- Good Value: It offers a nice mix of price and coverage, so Grubhub drivers get solid protection without overpaying.

Cons

- Some States Left Out: American Family isn’t available everywhere, so some Grubhub drivers might need other options.

- Could Have More Discounts: They offer some savings, but other companies have better discounts for Grubhub drivers.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#2 – State Farm: Best for Cheap Rates

Pros

- Most Affordable: State Farm offers some of the best car insurance for Grubhub drivers, with minimum coverage starting at just $52 monthly.

- Strong Reputation: Well-known for customer service and financial stability, making claims easy for drivers. Find out more in our State Farm insurance review.

- Discount Opportunities: Drivers can save by bundling auto and home insurance or maintaining a clean driving record.

Cons

- Fewer Extras: Some add-ons, like accident forgiveness, aren’t as good as what other companies offer for Grubhub drivers.

- Prices May Vary: Prices depend on where Grubhub drivers live and their driving history, so some might pay more.

#3 – Erie: Best for Filing Claims

Pros

- Fast Claims Processing: Erie is known for handling claims quickly, a big plus for Grubhub drivers looking for the best car insurance at $56 per month.

- Intense Customer Satisfaction: Grubhub drivers praise Erie’s smooth claims process and customer service.

- Accident Forgiveness: Helps Grubhub drivers avoid rate hikes after their first accident, saving money over time. Discover more about accident forgiveness coverage.

Cons

- Limited Availability: Only available in certain states, which may not work well for all Grubhub drivers needing coverage.

- Fewer Discounts: Compared to some other top competitors, it doesn’t offer as many special discount options.

#4 – Geico: Best for Low Deductibles

Pros

- Low Deductible Options: Geico offers flexible deductibles, making it a great choice for the best car insurance for Grubhub drivers at $59 per month.

- User-Friendly App: Makes policy management, claims, and payments easy for Grubhub drivers who are handling everything on mobile.

- Competitive Pricing: Keeps costs low while providing reliable coverage for Grubhub drivers needing affordable protection.

Cons

- Few Local Agents: Geico is mostly online, so Grubhub drivers who like talking to someone in person might feel disappointed. Our Geico insurance review provides more info.

- Roadside Help Costs Extra: Grubhub drivers who want towing, jump-starts, lockout service, or fuel delivery will have to pay extra.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#5 – Allstate: Best for Diverse Discounts

Pros

- Plenty of Discounts: Allstate offers many discounts, making it a great choice for Grubhub drivers who want to save.

- Safe-Driving Perks: Grubhub drivers with good records can benefit from lower premiums, accident forgiveness, and extra reward programs.

- Strong Coverage Options: Provides comprehensive and collision coverage for added protection that keeps drivers better covered.

Cons

- Higher Base Rates: Even with discounts, starting rates can be more expensive for Grubhub drivers on tight budgets. Learn all the details in our Allstate insurance review.

- Mixed Customer Service Reviews: Some Grubhub drivers report inconsistent customer support experiences that can sometimes be frustrating.

#6 – The Hartford: Best for Exclusive Benefits

Pros

- Perks: This company gives members special benefits that make driving better, making it a great choice for the best car insurance for Grubhub drivers.

- Great Customer Support: Grubhub drivers trust this company because of its excellent claims process and dedicated customer service.

- Discounts for Safe Drivers: Their safe driver discount helps drivers who maintain a clean driving record save more money.

Cons

- Higher Rates: Base rates are slightly higher, which may deter cost-conscious drivers looking for more affordable options. The Hartford insurance review discusses the company’s rates in more detail.

- Lifetime Renewability: Ensures long-term coverage for qualifying drivers, providing consistent peace, security, and reliable protection for the future.

#7 – Nationwide: Best for Policy Perks

Pros

- Multi-Policy Discounts: Provides savings for bundling multiple policies, promoting greater affordability through combined risk management strategies.

- Solid Coverage Perks: Offers useful add-ons like accident forgiveness, making it one of the best car insurance for Grubhub drivers at $55 monthly.

- Vanishing Deductible: As you drive safely, your deductible gradually gets lower, and you can even snag a few extra discounts along the way.

Cons

- Slower Claims Process: Nationwide insurance reviews say that some drivers have mentioned that it takes a bit longer for claims to be settled.

- Limited Availability: Not available in every state, significantly restricting access for many potential customers.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#8 – Farmers: Best for Personalized Service

Pros

- Local Agents: They have friendly, local agents you can meet in person, so you always have someone nearby to help out.

- Safe Driver Discounts: They give you lower rates for driving safely, which means you save money just by being careful on the road.

- Customizable Plans: Farmers allows drivers to tailor coverage, making it ideal for Grubhub drivers at $50 per month. Explore our Farmers insurance review.

Cons

- Higher Premiums for Some: Base rates can be expensive for younger drivers, particularly affecting new applicants significantly.

- Limited Digital Tools: The app and online services are not as advanced as those of competitors, and they lack robust interactive user features.

#9 – Liberty Mutual: Best for Flexible Coverage

Pros

- Customizable Policies: Liberty Mutual offers flexible options for Grubhub drivers at $58 monthly for minimum coverage.

- Roadside Assistance: Provides emergency services for drivers on the go, ensuring rapid support during emergencies. Read more in our Liberty Mutual insurance review.

- Accident Forgiveness: Helps prevent sudden rate increases that might otherwise escalate after a first accident.

Cons

- Discounts Vary by State: Savings opportunities depend on location, especially in diverse local markets, making regional plans competitive.

- Higher Monthly Rates: It can be pricier than other budget-friendly providers.

#10 – Travelers: Best for Discount Options

Pros

- Lots of Discounts: Travelers provide many ways to save, making it an excellent option for Grubhub drivers to get car insurance at $57 monthly.

- Strong Customer Support: Offers 24/7 customer service and claims assistance with consistent and caring support.

- Good Coverage Options: Provides solid protection, including comprehensive and collision coverage, while ensuring emergency protection.

Cons

- Higher Starting Rates: Base rates may be slightly higher before applying discounts, limiting overall affordability. Learn everything in our Travelers insurance review.

- Limited Availability: Certain policy benefits may not be available in all states, reducing the overall value significantly.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

The Truth About Grubhub Car Insurance

Technically speaking, Grubhub car insurance does not exist. Grubhub does not provide any insurance to its drivers, but it requires each driver to have their own auto insurance before signing up. This means drivers are responsible for maintaining personal coverage that meets state requirements.

Grubhub Drivers Car Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $54 | $138 | |

| $49 | $125 | |

| $56 | $140 |

| $50 | $135 | |

| $59 | $136 | |

| $58 | $142 |

| $55 | $131 |

| $52 | $130 | |

| $60 | $145 |

| $57 | $139 |

Grubhub and other companies like it have liability insurance that protects the other party in an accident caused by the driver while on an active delivery. This means if a Grubhub driver causes an accident while working, the company’s insurance may cover damages to the other driver or their property, and some insurers may offer a discount for drivers with additional coverage.

However, this liability coverage does not extend to the Grubhub driver, their vehicle, or any medical bills unless the company explicitly states otherwise. If a Grubhub driver is injured or their car is damaged, they will likely have to rely on their insurance, which may not always cover accidents while working for a delivery service.

Car Insurance Discounts From the Top Providers for Grubhub Drivers

| Insurance Company | Available Discounts |

|---|---|

| Drivewise, Multi-Policy, Safe Driver, New Car, Good Student, Pay-in-Full, Early Quote, Anti-Theft, Hybrid Vehicle | |

| Multi-Policy, Safe Driver, Pay-in-Full, Anti-Theft, Homeowner, Vehicle Safety, Hybrid Vehicle, Paperless Billing | |

| Multi-Policy, Safe Driver, Good Student, Homeowner, Pay-in-Full, Anti-Theft, Paperless Billing, Defensive Driving |

| Multi-Policy, Safe Driver, Homeowner, Good Student, Bundling, Pay-in-Full, Anti-Theft, Low Mileage, Early Quote | |

| Multi-Policy, Safe Driver, Military, Good Student, Anti-Theft, Pay-in-Full, Emergency Road Service, Paperless Billing | |

| Multi-Policy, Safe Driver, Claim-Free, Homeowner, New Car Replacement, Vehicle Safety, Defensive Driving, Paperless Billing |

| Multi-Policy, Safe Driver, Good Student, Accident-Free, Defensive Driving, Paid-in-Full, Paperless Billing, Low Mileage |

| Multi-Policy, Safe Driver, Defensive Driving, Vehicle Safety, Bundling, Accident-Free, Low Mileage, Good Student | |

| Multi-Policy, Safe Driver, Paid-in-Full, Good Student, Low Mileage, Defensive Driving, Payment History |

| Multi-Policy, Safe Driver, Homeowner, Hybrid Vehicle, Early Quote, Paid-in-Full, Paperless Billing, Anti-Theft, Good Student |

Some insurance companies require drivers to have a rideshare or commercial policy for complete protection, so Grubhub drivers must check their policy, ensure they have the right coverage, and confirm their Grubhub ZIP code. Compare car insurance rates now.

Handling an Accident While Working for Grubhub

You could take a significant risk if you deliver food with a personal car insurance policy. Regular car insurance doesn’t cover work-related driving. If you get into an accident while on a delivery, your insurance company might not pay for damages. That could leave you with repair, medical, or even legal fees.

That’s why having the right insurance matters. Grubhub insurance claims are important for drivers using their cars for work. Commercial auto insurance helps cover accidents on the job, paying for damages, medical bills, and liability costs.

A low deductible helps Grubhub drivers avoid high upfront costs after an accident, making it easier to afford repairs and keep working without financial strain.

Scott W. Johnson Licensed Insurance Agent

Food delivery companies offer some coverage, but it may not be enough. If there are gaps, you could pay thousands out of pocket. It’s wise to look into commercial car insurance to avoid that risk. Knowing you’re covered every time you hit the road for work gives you peace of mind.

Even a minor accident could become a significant financial problem without the right insurance. Grubhub driver reviews show that repairs aren’t cheap, medical bills add up fast, and legal fees could be a considerable expense if another driver sues you.

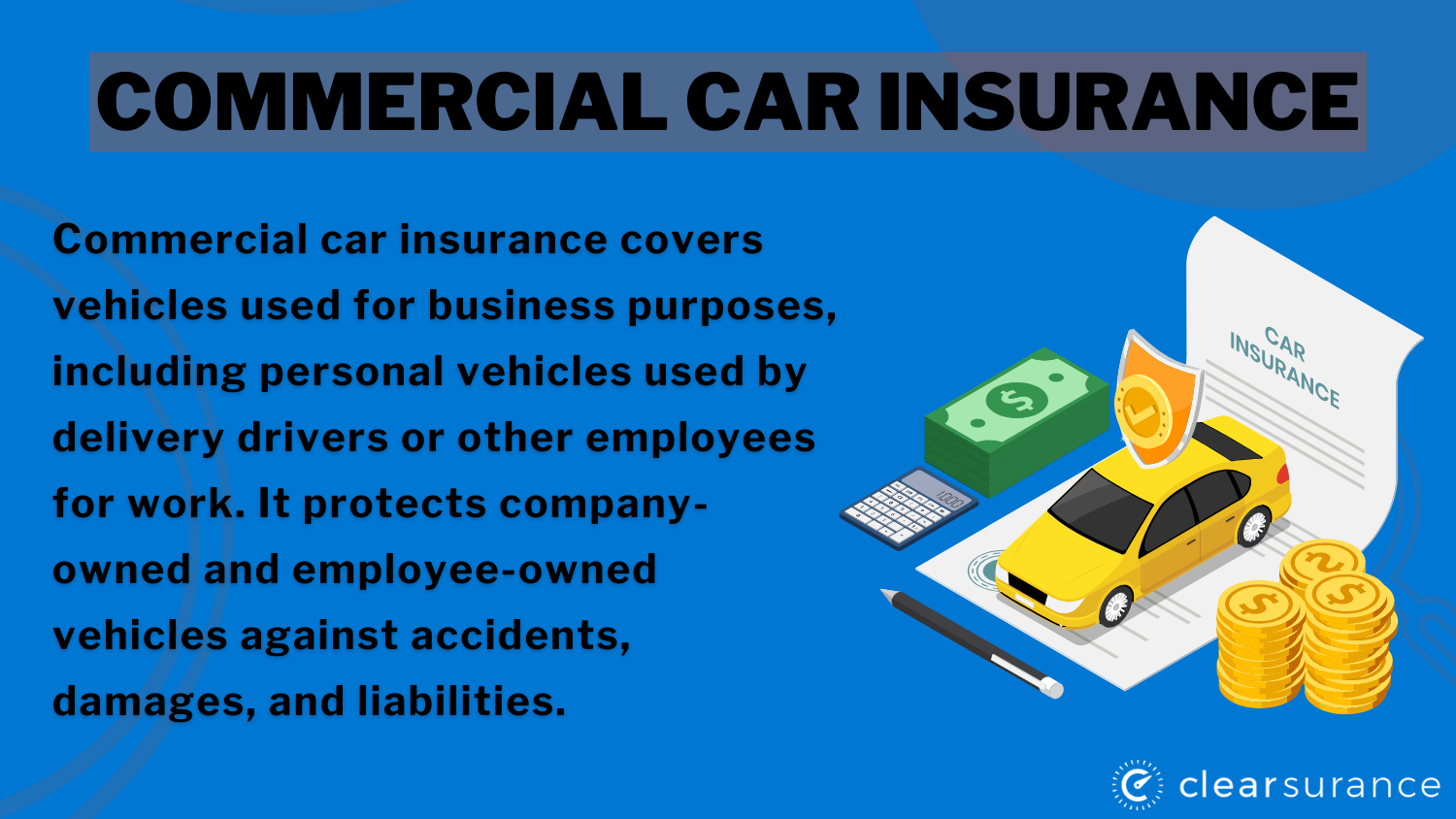

Commercial auto insurance makes sure you’re not left paying for everything yourself. It’s designed for drivers who use their cars for business, so you get the protection you need while working. Whether delivering food, driving passengers, or running errands for a company, the right policy keeps you covered and helps you avoid surprise costs.

Read more: How To Correctly Handle a Car Accident

The Difference Between Personal and Commercial Car Insurance

Most people have personal car insurance. It covers you when doing day-to-day tasks like getting groceries, traveling to visit family and friends, or driving to work. A commercial car insurance policy is designed to protect you when driving for your job. This can be delivery drivers or someone who travels as part of their duties.

Sometimes filing a claim can feel like a scavenger hunt. But with the Liberty Mobile app, it’s easy. https://t.co/UT82PG2IBV pic.twitter.com/kx5wrkwitf

— Liberty Mutual (@LibertyMutual) May 24, 2023

Commercial car policies take into account totally different circumstances when configuring their rates than personal insurance policies do. There is a good reason for these considerations. According to the Insurance Information Institute, aggressive driving is one of the leading causes of fatal car crashes.

If you use a car for work, you will be driving more, perhaps in more stressful situations, and this will all come into effect when calculating the policy’s cost and the types of coverage it provides under Grubhub driver requirements.

Commercial insurance also usually covers more than just the driver. It can include employees, rented or leased vehicles, and even liability for goods transported. This makes it more complex than personal car insurance, which mainly focuses on protecting the car owner and their vehicle.

If a business uses personal insurance instead of a commercial policy, claims might get denied in the event of an accident. Insurance companies can refuse coverage if they find out the vehicle was used for work purposes beyond what the personal policy allows. This is why it’s essential to have the right coverage for the way a car is being used.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Best Places to Get Commercial Car Insurance

Almost every major insurance provider will offer commercial vehicle insurance. However, not all commercial car insurance policies are the same, nor do they cost the same. For many insurance companies, when you are looking for food delivery insurance, you will have to sign up for an entirely separate policy.

This can be a high cost, especially if the purpose of your job with Grubhub is to earn extra money. To avoid making food delivery untenable, look for companies that will either add on to your personal policy or have separate insurance for food delivery drivers.

These policies, often called rideshare policies, cover those doing food delivery service and meet Grubhub driver insurance requirements, as well as other driving services like Uber and Lyft, and may also help with Grubhub health insurance needs.

One company that offers this style of policy is Geico commercial auto insurance. Their rideshare policy acts as both personal and commercial insurance, so you don’t have to sign up for separate commercial coverage. Geico insurance reviews will tell you all you need to know about this company.

Other companies will offer rideshare coverage as an add-on to the existing coverage, like Progressive. When you are searching for commercial insurance, make sure to contact as many companies as possible to check if they meet Grubhub driver car requirements.

Compare rates and the extent of coverage offered to ensure you are protected and not paying more than you should. Look at different plans from multiple providers to find the best deal. Make sure the policy covers everything your business needs.

Are you ready to look for affordable car insurance quotes? Enter your ZIP code below, and we will pull up car insurance rates in your area to help you find the right car insurance company for you.

Case Studies: Highlighting the Importance of Grubhub Car Insurance

Driving for Grubhub means spending a lot of time on the road, which increases the chance of accidents. The right insurance helps cover repairs, medical bills, and lost income, so you don’t have to pay out of pocket. These real stories show how having good coverage can keep drivers on the road without financial stress.

Case 1: American Family’s Low Deductible Prevented a Major Financial Setback

A Grubhub driver, Jake, got into a minor accident while delivering food. Since he had a low deductible with American Family, he paid only $250 instead of $1,000. His insurance covered the rest, so he could return to work fast without worrying about high costs.

Case 2: State Farm’s Affordable Coverage Kept a Driver Protected

Lisa had trouble paying for insurance but found a $49 monthly plan with State Farm. It was affordable and gave her the coverage without costing too much. When she had a minor accident, her insurance helped pay for the damage, so she didn’t have to worry about high costs and could keep working.

Case 3: Erie’s Fast Claims Process Kept a Driver on the Road

Carlos’s car was hit while he was picking up an order, and the other driver took off. Erie made the claims process easy, and his car was fixed fast. He didn’t have to wait long or pay a considerable amount out of pocket, so he returned to work in just a few days.

The right car insurance helps Grubhub drivers avoid high costs and lost income. With low rates, quick claims, and good coverage, drivers can stay on the road and keep earning without worry.

The Right Insurance Keeps Grubhub Drivers Covered

If you drive for Grubhub, having the right insurance is a must to protect your income. Accidents and repairs can happen anytime, but good coverage and car insurance discounts help you avoid big money problems and stay on the road. Whether it’s a low deductible, affordable rates, or a fast claims process, the right policy can make all the difference.

These stories show how insurance helps drivers stay on the road without stress. Choosing a policy that fits your needs means you can focus on your job without worrying about high repair costs or lost income. With the right protection, Grubhub drivers can keep delivering with confidence, knowing they’re covered when it matters most.

Start comparing affordable insurance options by entering your ZIP code into our free quote comparison tool today.

Frequently Asked Questions

Does Grubhub provide auto insurance?

No, Grubhub insurance for drivers does not include auto coverage, meaning drivers must buy their own policy for full protection against accidents, damages, and liability while delivering food to ensure they meet legal requirements and avoid financial risks.

What are the Grubhub insurance requirements?

Grubhub vehicle requirements state that drivers must have personal auto insurance meeting state laws, ensuring legal compliance and coverage for accidents while driving.

What kind of Grubhub driver insurance do I need?

Grubhub driver insurance must include a personal auto policy meeting state requirements, and some insurers, like Geico pizza delivery insurance, offer specialized delivery coverage to help protect drivers during food deliveries and unexpected accidents on the road.

Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code.

Does Grubhub require insurance?

Yes, Grubhub requires all drivers to have valid Grubhub auto insurance before they can start delivering on the platform, ensuring proper coverage for accidents, damages, and liabilities while working. This helps protect both drivers and customers, keeping deliveries safe and secure.

Do you need insurance for Grubhub deliveries?

Yes, you need Grubhub insurance for drivers to protect yourself financially in case of an accident, vehicle damage, medical bills, lost wages, legal fees, or any other unexpected situation while driving, such as theft, weather damage, or passenger injuries.

Does Grubhub offer driver health insurance?

No, Grubhub driver health insurance is not provided, so drivers must purchase their own health insurance to cover medical expenses and emergencies while working, ensuring they have coverage for doctor visits, prescriptions, and accidents.

Read more: Best Personal Injury Protection (PIP) Car Insurance Company

Does Grubhub require proof of insurance?

Yes, Grubhub requires proof of insurance before drivers start making deliveries, meaning they must upload valid documents showing active coverage during the signup process to ensure compliance with regulations and protect both drivers and customers. Affordable car insurance rates are just a click away. Enter your ZIP code into our free quote tool to find the best policy for you.

What are the requirements for Grubhub drivers?

The requirements for Grubhub drivers include being at least 18 years old, having a valid driver’s license and auto insurance, and passing a background check before working.

Read more: Best Car Insurance for a New Driver

What time does Grubhub stop delivering?

The Grubhub delivery time depends on the restaurant’s hours, but many locations offer late-night delivery, sometimes operating past midnight for customers, especially in busy cities and popular dining areas.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.