Best Alabama Car Insurance (2025)

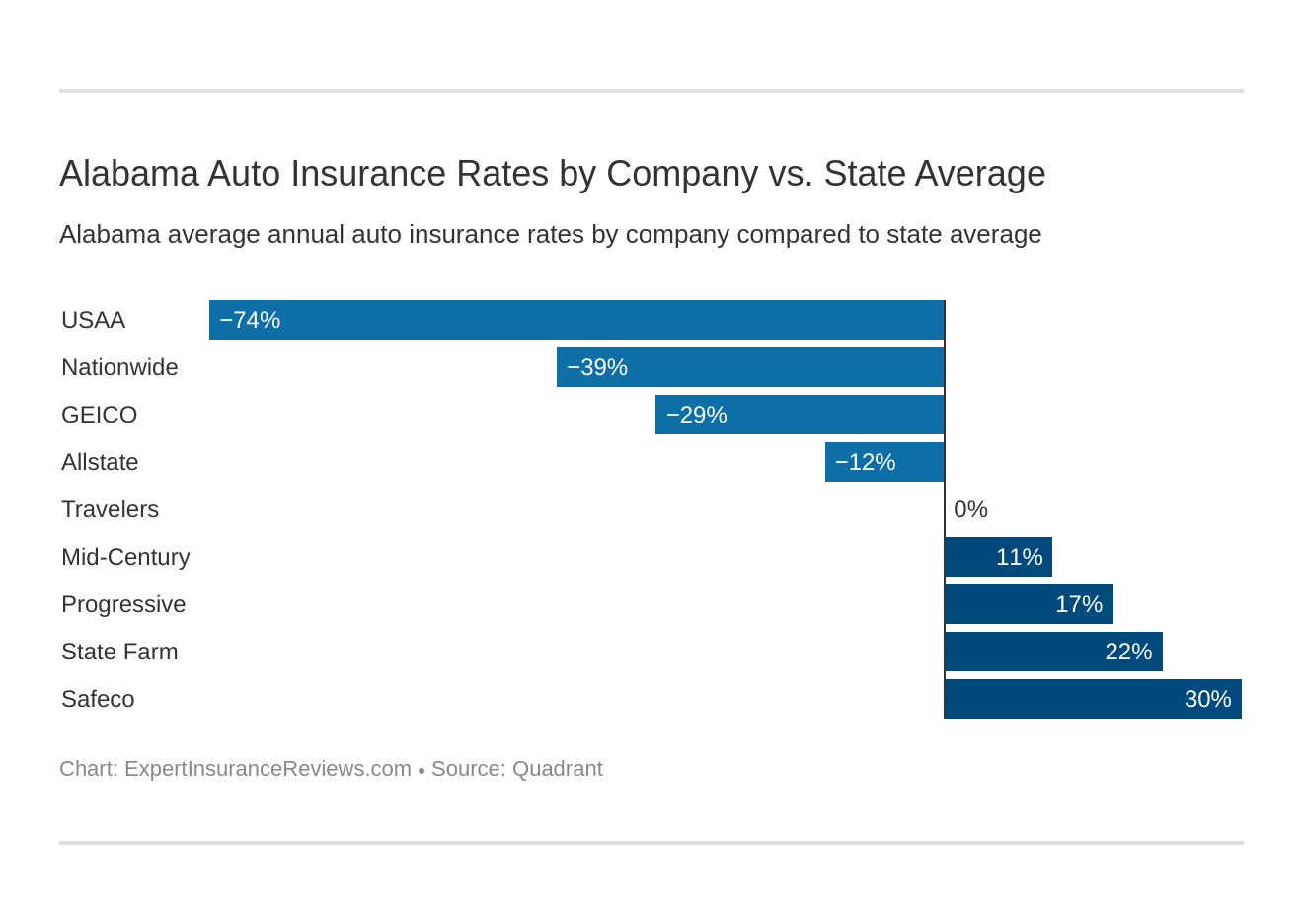

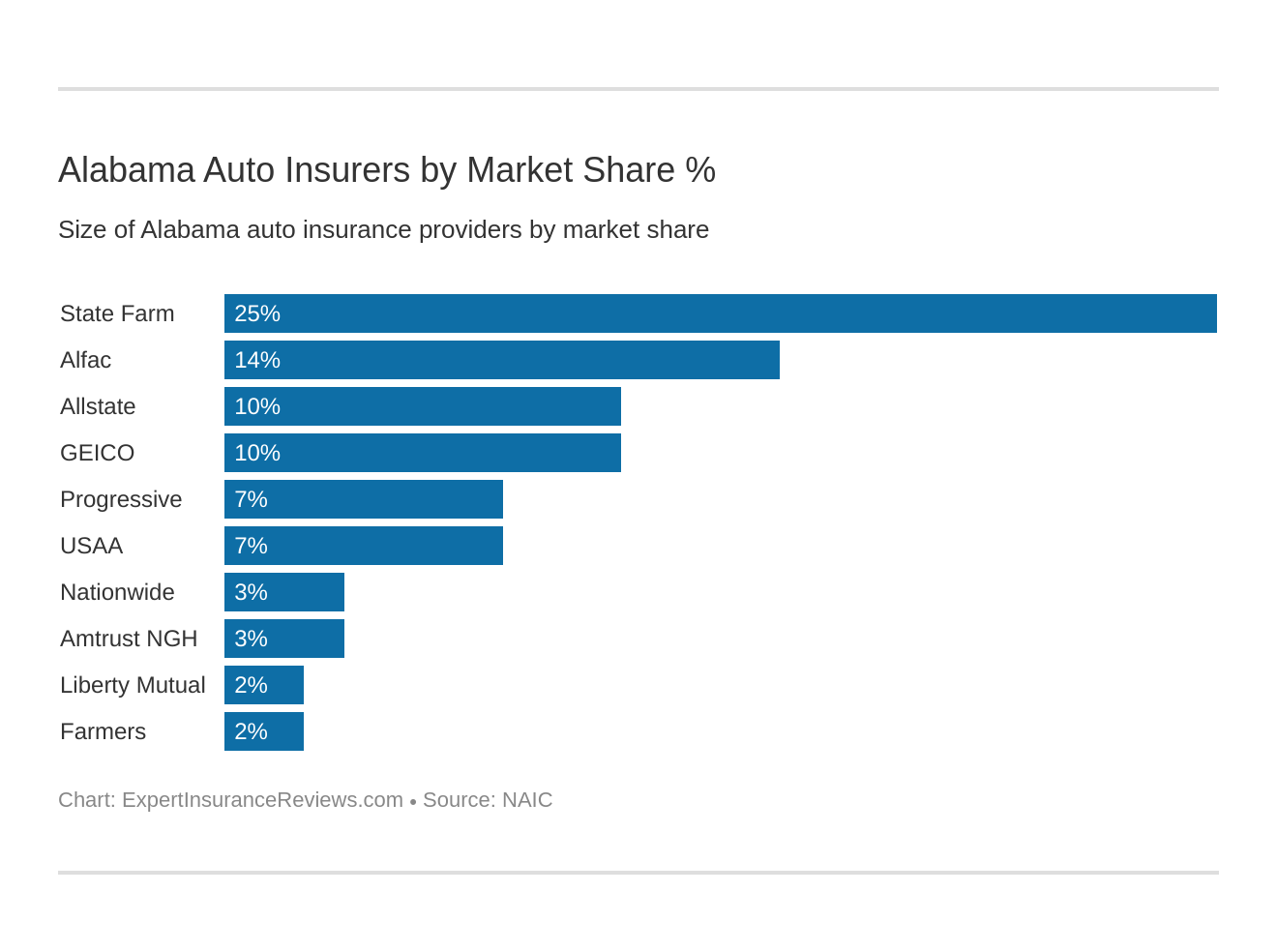

Car insurance in Alabama costs an average of $139 per month, which is cheaper than in many other states. State Farm, Allstate, and Nationwide are often the cheapest Alabama car insurance companies, but you should always compare multiple quotes to find the best Alabama car insurance rates for you.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced life insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for life insurance with the most affordable term life insurance, permanent life insurance, no medical exam life insurance, and burial insurance. Not only does he strive to provide consumers with t...

Licensed Insurance Agent

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Alabama Statistics Summary | Details |

|---|---|

| Road Miles | Total in State: 102,018 Vehicle Miles Driven: 65,667 Million |

| Registered Vehicles | 5,251,076 |

| State Population | 4,887,871 |

| Most Popular Vehicle | F150 |

| Percentage of Motorists Uninsured | 18.40% |

| Driving Deaths | Speeding (2008-2017) Total: 2,957 Drunk Driving Total: 1,038 |

| Average Premiums (Annual) | Liability: $394.21 Collision: $317.96 Comprehensive: $146.28 |

| Cheapest Provider | USAA |

- Alabama car insurance requirements include a 25/50/25 liability plan

- The typical driver pays $139 for car insurance in Alabama, which is a little lower than the national average

- To find the cheapest car insurance in Alabama, make sure to keep your driving record clean, take advantage of discounts, and compare multiple quotes

Like most states, Alabama requires all drivers to carry a minimum amount of car insurance before they can legally drive. The good news is that Alabama car insurance rates tend to be cheaper than the national average. The average driver pays $139 per month for full coverage Alabama auto insurance.

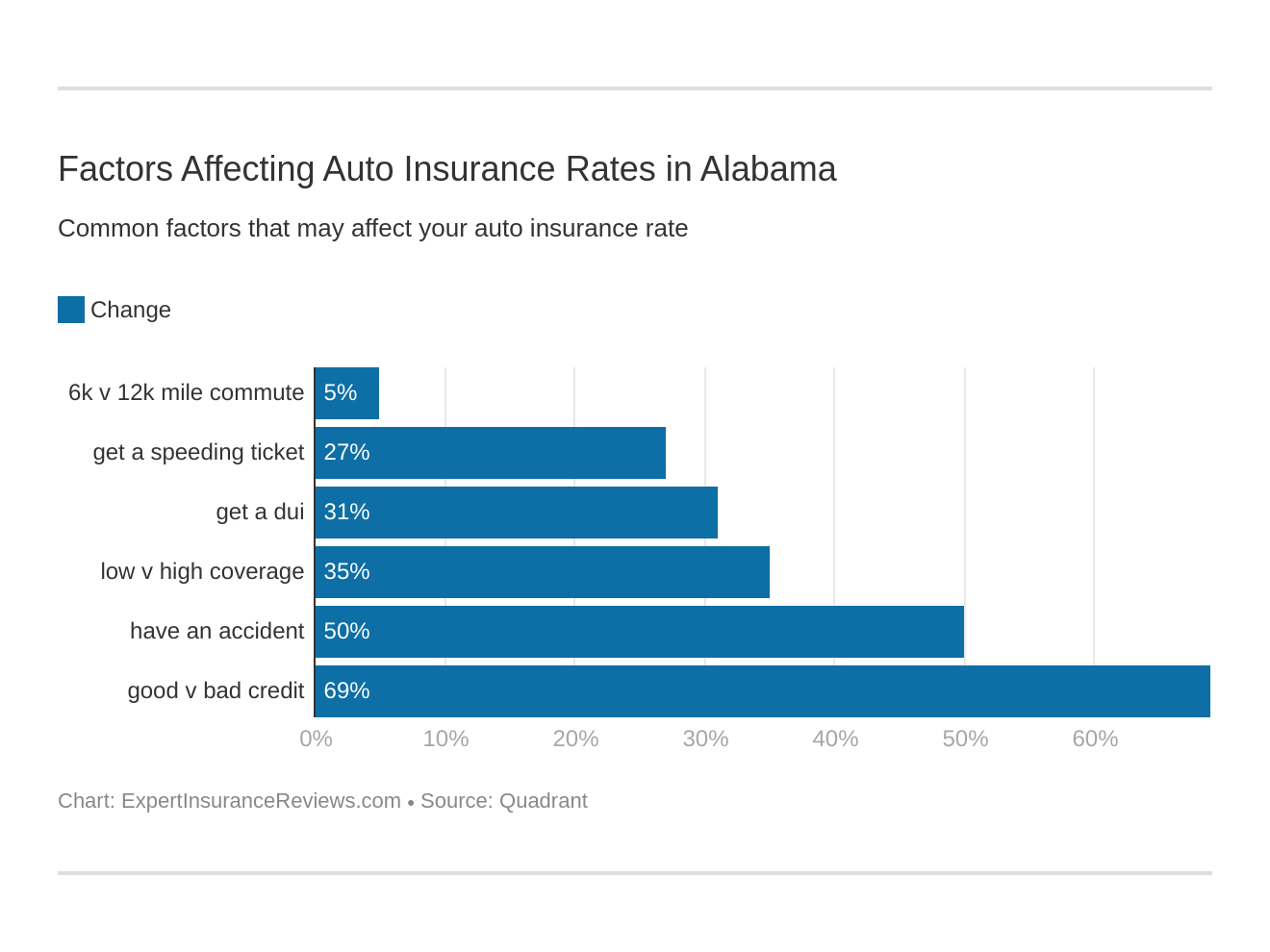

However, several factors affect Alabama car insurance quotes, including your ZIP code, age, and driving history. Finding the best Alabama car insurance requires looking for discounts, choosing the right coverage, and comparing quotes.

Read on to learn more about the best car insurance in Alabama, including which companies might be the best fit for your needs. Then, compare Alabama car insurance companies to find the lowest prices possible.

Alabama Car Insurance Coverage and Rates

Car insurance isn’t optional in Alabama; you’re required by law to carry a minimum amount. Beyond that, you may need more coverage to meet your lender’s needs if your car is financed, and there are options you can add on to better protect yourself, too.

Choosing car insurance is part meeting the requirements of the law and part making sure you’re covered no matter what might go wrong on the road.

But with all the options, different limits, and factors affecting your rate, finding that balance isn’t easy. You need a straightforward guide to the ins and outs of a good Alabama car insurance policy.

We have just that. In this section, we’ll gather all of the details on car insurance coverage in Alabama and simplify it.

We’ll look at what you need by law, what else is available, and how Alabama compares to the rest of the country for car insurance costs.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Alabama Minimum Coverage

Alabama law requires every driver to carry a minimum amount of liability insurance. This coverage will pay for injuries and property damage in an accident where you are found to be at fault.

To be legally on the road in Alabama, your insurance policy must provide:

- $25,000 in bodily injury coverage per person

- $50,000 in bodily injury coverage per incident

- $25,000 in property damage coverage

These limits are on par with most other states, but they will be woefully inadequate if you’re the one-in-three mentioned above. Carrying higher limits is the best way to protect yourself from the cost of a serious accident.

Forms of Financial Responsibility

The main form of financial responsibility is liability insurance. It’s how most Alabamians comply with the law. There are a few other ways to be in compliance without carrying insurance, however.

Alabama law allows you to use a security bond to meet the requirement. You can also place a cash deposit or securities deposit with the State Treasurer to be issued a certificate of deposit which can replace an insurance policy. This must be in the amount of $50,000.

Whatever method you choose, you’re required to carry and provide proof to law enforcement upon request, or face penalties. We’ll cover the penalties for driving uninsured a little later. Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Cost of Alabama Auto Insurance

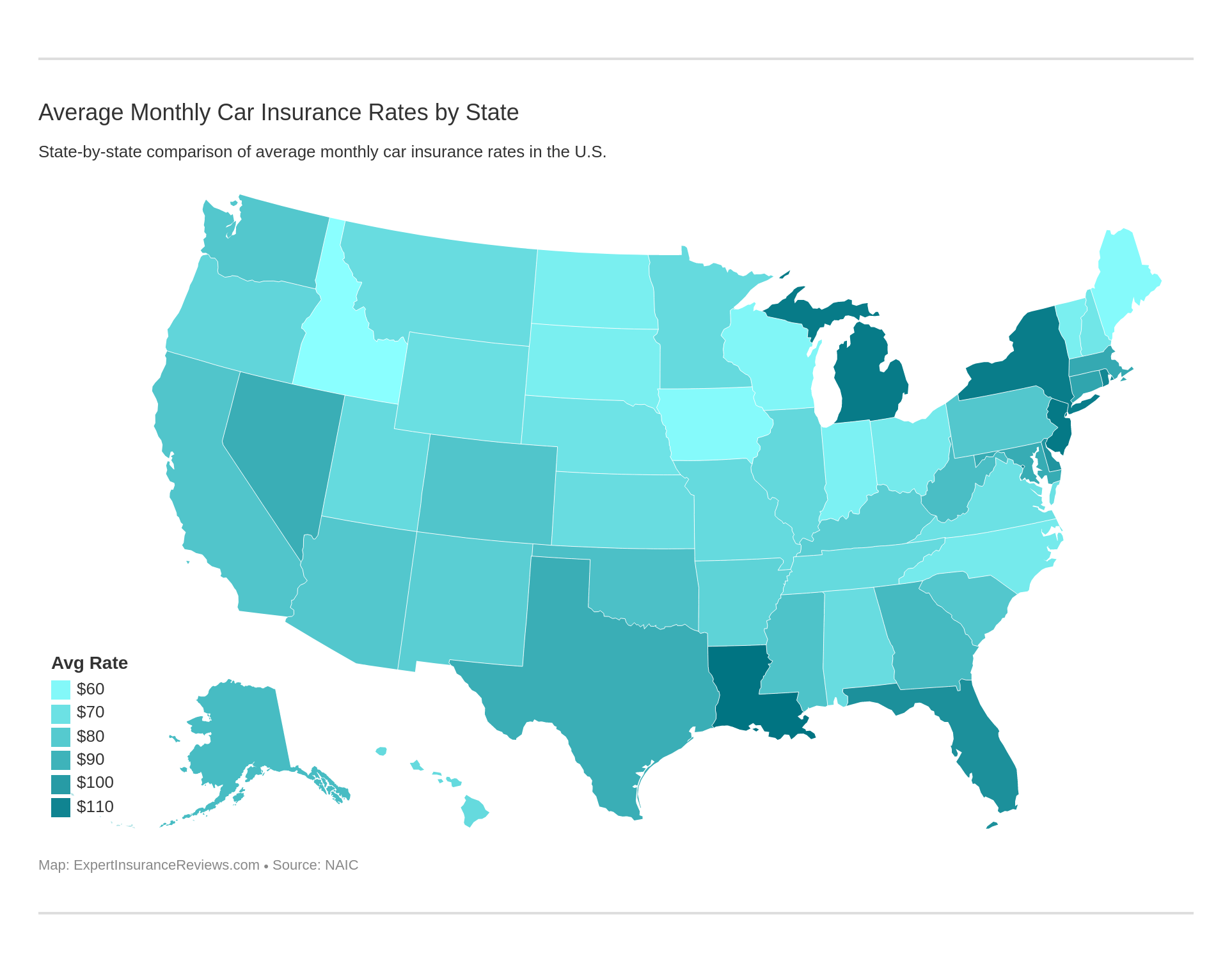

While Alabama’s average rates for car insurance are lower than the national average, so is the average disposable income. That means that Alabamians spend a larger percentage of their income on car insurance premiums compared to the rest of the country.

After an increase from 2012 to 2013, the percentage spent on car insurance stayed steady into 2014.

| State Vs. National | Insurance as % of Income 2012 | Disposable Income 2012 | Full Coverage 2012 | Insurance as % of Income 2013 | Disposable Income 2013 | Full Coverage 2013 | Insurance as % of Income 2014 | Disposable Income 2014 | Full Coverage 2014 |

|---|---|---|---|---|---|---|---|---|---|

| Alabama | 2.43% | $32,396.00 | $788.07 | 2.50% | $32,436.00 | $811.75 | 2.50% | $33,535.00 | $837.09 |

| Countrywide | 2.34% | $39,473.00 | $924.45 | 2.43% | $39,192.00 | $950.92 | 2.40% | $40,859.00 | $981.77 |

Drivers in Alabama spend less than some of their neighbors on car insurance, however. To the east Georgians spent 2.87 percent of their income on car insurance in 2014, while to the west Mississippi drivers spent 3.05 percent.

CalculatorPro

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Average Monthly Car Insurance Rates in AL (Liability, Collision, Comprehensive)

How much is car insurance in Alabama? Core coverage refers to the basics of what’s known as a full coverage insurance policy. It can be broken up into three main parts. Here’s a look at how Alabama’s rates compare to the national average.

| Coverage Type | Alabama Annual Costs (2015) | National Average (2015) |

|---|---|---|

| Liability | $394.21 | $538.73 |

| Collision | $317.96 | $322.61 |

| Comprehensive | $146.28 | $148.04 |

| Combined Total | $868.48 | $1,009.38 |

As you can see, car insurance rates in Alabama are lower than average across the board, although not by much in the comprehensive and collision departments. The much lower cost of liability makes up the difference, bringing the overall average rate in about $200 below the national average.

We’re not all average though, and a lot of things will impact what you personally pay for insurance. Some drivers will pay well under this average, and some well above. We’ll get into rates in more detail soon.

Additional Liability

In order to better protect yourself from the cost of an accident, you can add additional liability coverage to your policy. The first way to do this – and probably the most important – is to increase your liability limits beyond the state minimum.

In addition to that, you can purchase some optional coverage.

Uninsured/Underinsured Motorist (UI/UIM) coverage is available for both bodily injury and property damage. This coverage will pay for damages if you are involved in an accident with a driver who either has no insurance or whose coverage is inadequate.

Medical Payments, or MedPay, is another coverage available to Alabama drivers to help protect themselves. This coverage will pay for injuries to you or anyone in your vehicle no matter who is at fault in the accident.

| Loss Ratio | Alabama (2015) | Nationwide (2015) |

|---|---|---|

| Medical Payments (MedPay) | 70.04% | 75.72% |

| Uninsured/Underinsured Motorist Coverage (UUM) | 83.91% | 75.11% |

Above you will see the loss ratios for both types of liability. A loss ratio tells us how much insurance companies are paying out compared to how much they take in (premiums).

You want to see a number that’s neither too high nor too low – high means there’s a risk of financial problems for insurers, and low means they aren’t paying out claims as they should.

Alabama’s MedPay loss ratio is good, and little below average. The loss ratio for Uninsured/Underinsured Motorist Bodily Injury, however, is above average and on the high side. There’s a likely reason for that.

Alabama has an uninsured motorist rate of 18.4 percent, ranking them sixth in the nation for uninsured drivers.

More uninsured drivers mean more responsible drivers being forced to make claims against their UI/UIM coverage, and greater losses to insurance companies.

Add-Ons, Endorsements, and Riders

In addition to the basics of an insurance policy, here are some extras you can expect to be offered on your car insurance:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance

Car insurance companies will offer some or all of these, and the options vary.

Most major insurance companies – and many small ones – offer some sort of usage-based insurance plan designed to save you money by monitoring your driving habits. True pay-per-mile is only available from a handful of companies, and currently, none of them are available in Alabama.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

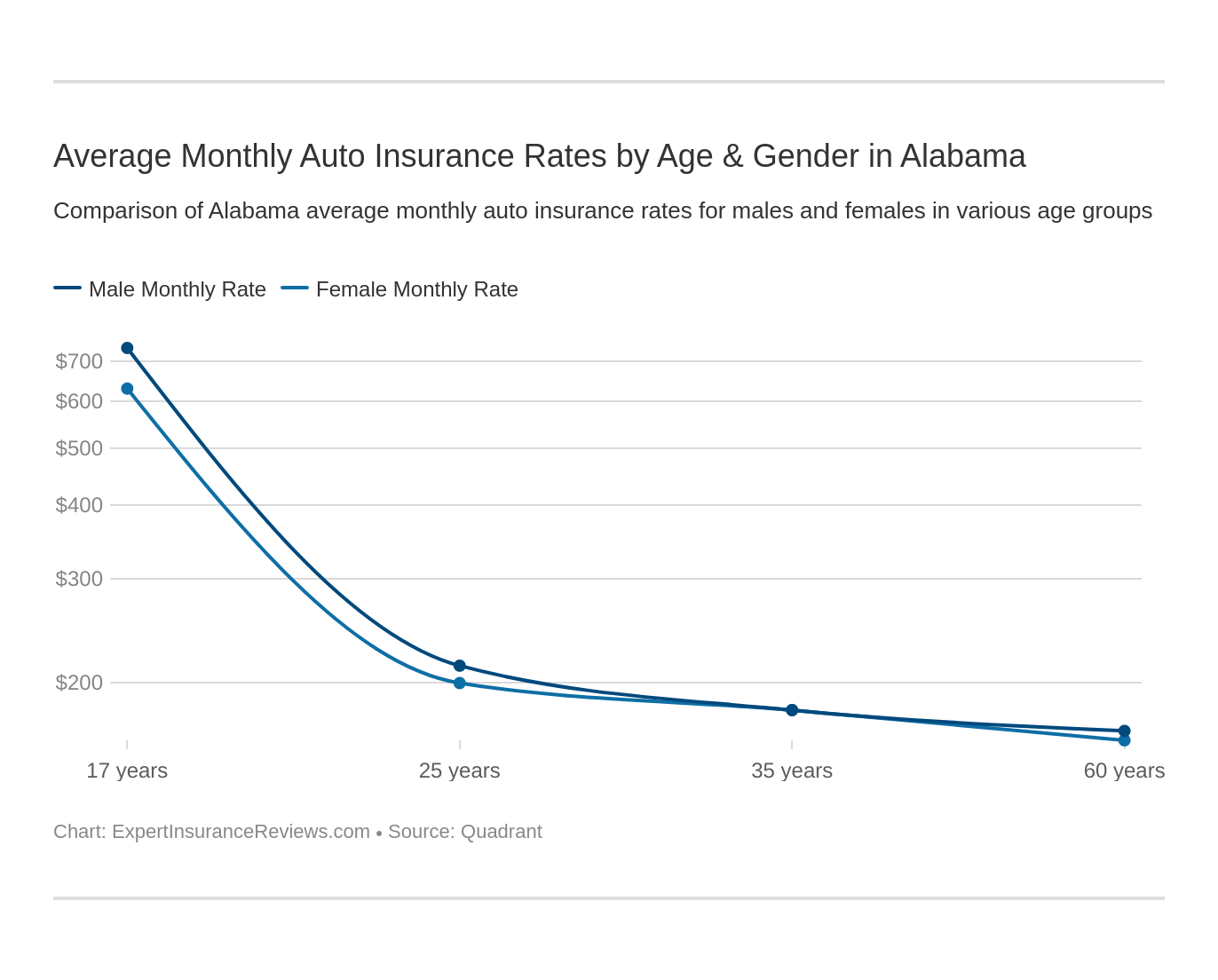

Average Car Insurance Rates by Age & Gender in AL

Two of the factors that are used to determine how much you pay for car insurance are your gender and your age.

Below we have gathered some rates for different age groups and compared them by gender; you’ll also note that marital status is included. That’s because that, too, can impact your premiums.

| Company | Married 60-year-old female annual rates | Married 60-year-old male annual rates | Married 35-year-old female annual rates | Married 35-year-old male annual rates | Single 25-year-old female annual rates | Single 25-year-old male annual rates | Single 17-year-old female annual rates | Single 17-year-old male annual rates |

|---|---|---|---|---|---|---|---|---|

| Allstate P&C | $1,810.29 | $1,845.47 | $2,003.19 | $1,911.71 | $2,248.40 | $2,300.90 | $6,912.73 | $7,426.75 |

| Geico Cas | $1,948.49 | $2,007.68 | $2,056.10 | $2,040.76 | $2,171.19 | $2,018.96 | $5,383.66 | $5,284.58 |

| Mid-Century Ins Co | $2,137.64 | $2,269.18 | $2,391.72 | $2,374.46 | $2,718.78 | $2,828.88 | $9,212.40 | $9,480.84 |

| Nationwide Mutual Fire | $1,583.95 | $1,641.07 | $1,739.15 | $1,761.83 | $1,929.78 | $2,158.89 | $4,558.03 | $5,880.92 |

| Progressive Specialty | $1,979.19 | $2,112.90 | $2,413.50 | $2,264.79 | $2,824.87 | $3,005.15 | $9,878.37 | $11,026.64 |

| Safeco Ins Co of IL | $2,530.47 | $2,830.81 | $3,086.86 | $3,335.34 | $3,289.13 | $3,504.83 | $11,250.27 | $12,511.44 |

| State Farm Mutual Auto | $2,651.27 | $2,651.27 | $2,934.88 | $2,934.88 | $3,314.66 | $3,821.44 | $8,835.43 | $11,068.85 |

| Travelers Home & Marine Ins Co | $1,407.98 | $1,403.64 | $1,501.32 | $1,524.86 | $1,422.13 | $1,631.77 | $8,037.20 | $12,641.31 |

| USAA | $1,235.40 | $1,211.80 | $1,323.02 | $1,343.67 | $1,723.56 | $1,861.50 | $3,938.27 | $4,367.32 |

The most expensive group for insurance is, not surprisingly, 17-year-olds, with males generally facing higher premiums than females. That’s because they’re statistically more likely to be involved in an accident.

By 25 years old, rates even out a lot. The differences between genders and even between age groups become minimal, which tells us it’s mainly that young, inexperienced age group that sees much higher rates.

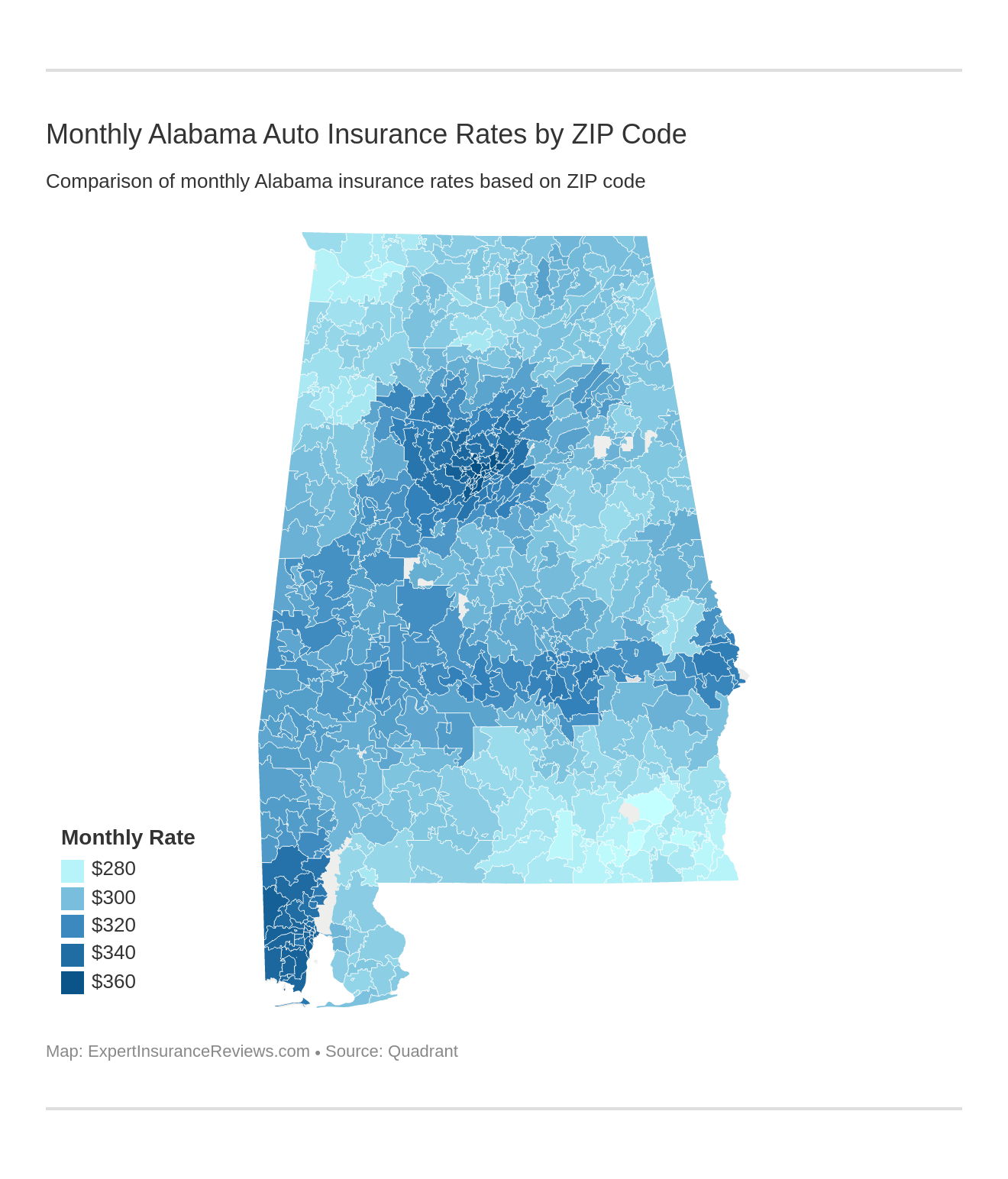

Cheapest Rates By Zip Code

Who has the cheapest car insurance in Alabama? It’s often a surprise to many to see that rates can change so much when you move from one zip code to another. Location is another one of the factors impacting rates, and it can make a big difference.

Search by zip code below to see how your area fares. You can also compare rates in your zip code by company.

| Zipcode | Average Annual Rates | Allstate P&C Annual Rate | Mid-Century Ins Co Annual Rates | Geico Cas Annual Rates | Safeco Ins Co of IL Annual Rates | Nationwide Mutual Fire Annual Rates | Progressive Specialty Annual Rates | State Farm Mutual Auto Annual Rates | Travelers Home & Marine Ins Co Annual Rates | USAA Annual Rates |

|---|---|---|---|---|---|---|---|---|---|---|

| 35218 | $4,428.60 | $3,554.61 | $4,693.67 | $3,404.06 | $6,257.81 | $2,873.57 | $5,535.74 | $6,719.51 | $4,621.25 | $2,197.21 |

| 35214 | $4,352.20 | $3,554.61 | $4,648.55 | $3,404.06 | $5,972.65 | $2,856.39 | $5,653.47 | $6,009.25 | $4,801.42 | $2,269.43 |

| 35208 | $4,327.78 | $3,554.61 | $4,693.67 | $3,404.06 | $6,119.17 | $2,873.57 | $5,595.19 | $6,749.79 | $3,762.77 | $2,197.21 |

| 35217 | $4,326.47 | $3,563.77 | $4,729.50 | $3,212.83 | $6,000.76 | $2,860.41 | $5,540.69 | $6,910.35 | $3,895.78 | $2,224.19 |

| 35207 | $4,325.57 | $3,529.63 | $4,729.50 | $3,404.06 | $6,153.00 | $2,856.39 | $5,372.12 | $6,491.25 | $4,169.98 | $2,224.19 |

| 35204 | $4,313.01 | $3,673.35 | $4,693.67 | $3,404.06 | $6,212.13 | $2,850.02 | $5,426.10 | $6,444.99 | $3,881.58 | $2,231.20 |

| 35211 | $4,304.81 | $3,658.74 | $4,693.67 | $3,404.06 | $6,212.13 | $2,905.60 | $5,472.86 | $6,506.10 | $3,692.87 | $2,197.21 |

| 35206 | $4,301.59 | $3,529.63 | $4,498.85 | $3,091.61 | $6,181.77 | $2,860.41 | $5,633.71 | $6,519.64 | $4,242.76 | $2,155.97 |

| 35249 | $4,288.29 | $3,615.18 | $4,631.67 | $3,091.61 | $6,096.21 | $2,850.02 | $6,888.87 | $5,642.79 | $3,655.67 | $2,122.64 |

| 35228 | $4,281.12 | $3,554.61 | $4,534.48 | $3,404.06 | $6,119.17 | $2,873.57 | $5,349.60 | $5,832.84 | $4,664.55 | $2,197.21 |

| 35020 | $4,276.93 | $3,696.01 | $4,534.48 | $3,404.06 | $6,229.71 | $2,905.60 | $5,349.60 | $5,801.95 | $4,373.75 | $2,197.21 |

| 35064 | $4,264.43 | $3,554.61 | $4,534.48 | $3,404.06 | $6,147.30 | $2,873.57 | $5,256.77 | $6,063.58 | $4,348.35 | $2,197.21 |

| 35224 | $4,249.02 | $3,554.61 | $4,648.55 | $3,404.06 | $5,834.03 | $2,856.39 | $5,598.62 | $5,831.78 | $4,243.73 | $2,269.43 |

| 35221 | $4,226.77 | $3,658.74 | $4,534.48 | $3,404.06 | $6,257.81 | $2,873.57 | $5,602.74 | $5,454.42 | $4,057.92 | $2,197.21 |

| 35203 | $4,223.99 | $3,637.49 | $4,693.67 | $3,091.61 | $6,096.21 | $2,850.02 | $5,161.60 | $6,357.26 | $3,896.86 | $2,231.20 |

| 35215 | $4,220.08 | $3,516.24 | $4,608.45 | $3,212.83 | $5,919.67 | $2,851.73 | $5,423.45 | $6,226.47 | $3,947.42 | $2,274.46 |

| 35234 | $4,217.90 | $3,529.63 | $4,693.67 | $3,404.06 | $6,257.81 | $2,850.02 | $5,076.32 | $6,219.94 | $3,773.69 | $2,155.97 |

| 36615 | $4,216.38 | $3,516.03 | $4,915.70 | $3,062.37 | $5,975.78 | $2,892.99 | $5,289.88 | $5,597.24 | $4,334.98 | $2,362.45 |

| 36568 | $4,216.23 | $3,677.49 | $4,919.59 | $3,249.49 | $5,707.92 | $2,892.99 | $5,418.79 | $5,288.47 | $4,334.98 | $2,456.32 |

| 35061 | $4,215.19 | $3,554.61 | $4,608.45 | $3,404.06 | $5,552.87 | $2,873.57 | $5,647.51 | $5,786.74 | $4,239.44 | $2,269.43 |

| 35118 | $4,207.95 | $3,591.86 | $4,648.55 | $3,404.06 | $5,490.63 | $2,854.65 | $5,695.97 | $5,719.65 | $4,291.08 | $2,175.10 |

| 35254 | $4,202.26 | $3,707.50 | $4,534.48 | $3,404.06 | $6,212.13 | $2,850.02 | $5,426.10 | $5,833.15 | $3,655.67 | $2,197.21 |

| 36587 | $4,201.84 | $3,494.60 | $4,640.33 | $3,249.49 | $5,849.24 | $2,892.99 | $5,447.10 | $5,451.50 | $4,334.98 | $2,456.32 |

| 35212 | $4,190.95 | $3,651.02 | $4,693.67 | $3,091.61 | $6,212.13 | $2,860.41 | $5,202.88 | $5,977.25 | $3,873.61 | $2,155.97 |

| 36605 | $4,190.04 | $3,516.03 | $4,878.21 | $3,062.37 | $5,991.29 | $2,892.99 | $5,098.26 | $5,573.78 | $4,334.98 | $2,362.45 |

| 35060 | $4,185.44 | $3,651.02 | $4,648.55 | $3,247.98 | $5,618.17 | $2,856.39 | $5,235.40 | $5,902.61 | $4,239.44 | $2,269.43 |

| 36617 | $4,184.82 | $3,516.03 | $4,878.21 | $3,249.49 | $6,008.19 | $2,892.99 | $5,081.08 | $5,320.08 | $4,334.98 | $2,382.32 |

| 36688 | $4,184.32 | $3,598.00 | $4,878.21 | $3,062.37 | $5,876.64 | $3,021.90 | $5,367.90 | $5,288.47 | $4,334.98 | $2,230.38 |

| 36604 | $4,184.12 | $3,621.12 | $4,669.83 | $3,249.49 | $6,008.19 | $2,892.99 | $5,081.08 | $5,418.70 | $4,333.35 | $2,382.32 |

| 36602 | $4,179.17 | $3,607.57 | $4,915.70 | $3,062.37 | $5,916.81 | $2,892.99 | $5,081.08 | $5,418.70 | $4,334.98 | $2,382.32 |

| 36608 | $4,178.01 | $3,598.00 | $4,915.70 | $3,062.37 | $5,707.92 | $3,021.90 | $5,367.90 | $5,812.39 | $3,885.53 | $2,230.38 |

| 36582 | $4,176.36 | $3,677.49 | $4,919.59 | $3,062.37 | $5,689.68 | $2,892.99 | $5,698.79 | $5,039.98 | $4,334.98 | $2,271.38 |

| 35205 | $4,172.91 | $3,741.65 | $4,770.48 | $3,091.61 | $5,949.35 | $2,850.02 | $5,464.58 | $5,548.48 | $3,908.86 | $2,231.20 |

| 36606 | $4,172.03 | $3,621.12 | $4,878.21 | $3,062.37 | $5,748.12 | $2,892.99 | $5,446.71 | $5,320.18 | $4,334.98 | $2,243.58 |

| 36603 | $4,169.53 | $3,516.03 | $4,878.21 | $3,062.37 | $6,043.35 | $2,892.99 | $5,081.08 | $5,334.42 | $4,334.98 | $2,382.32 |

| 36544 | $4,168.74 | $3,677.49 | $4,919.59 | $3,062.37 | $5,689.68 | $2,892.99 | $5,418.79 | $5,055.28 | $4,531.11 | $2,271.38 |

| 35235 | $4,158.43 | $3,512.16 | $4,608.45 | $3,212.83 | $5,570.13 | $2,851.73 | $5,296.88 | $6,066.96 | $4,169.87 | $2,136.84 |

| 36618 | $4,154.22 | $3,598.00 | $4,878.21 | $3,062.37 | $5,691.03 | $2,892.99 | $5,058.90 | $5,426.23 | $4,334.98 | $2,445.27 |

| 36619 | $4,150.27 | $3,656.05 | $4,915.70 | $3,062.37 | $5,700.16 | $2,983.06 | $5,108.56 | $5,320.18 | $4,334.98 | $2,271.38 |

| 35127 | $4,149.20 | $3,554.61 | $4,645.42 | $3,091.61 | $5,645.78 | $2,854.65 | $5,348.07 | $6,096.92 | $3,836.36 | $2,269.43 |

| 36607 | $4,144.17 | $3,494.60 | $4,878.21 | $3,062.37 | $5,991.29 | $2,892.99 | $5,353.71 | $5,515.20 | $3,865.62 | $2,243.58 |

| 36523 | $4,143.95 | $3,609.66 | $4,919.59 | $3,062.37 | $5,499.30 | $2,892.99 | $5,698.79 | $5,081.40 | $4,260.04 | $2,271.38 |

| 36509 | $4,140.91 | $3,609.66 | $4,919.59 | $3,062.37 | $5,699.74 | $2,892.99 | $5,698.79 | $5,005.78 | $4,107.90 | $2,271.38 |

| 35233 | $4,138.11 | $3,637.49 | $4,729.50 | $3,091.61 | $6,096.21 | $2,850.02 | $5,049.03 | $5,642.79 | $3,915.11 | $2,231.20 |

| 35073 | $4,137.24 | $3,519.62 | $4,685.26 | $3,247.98 | $5,618.17 | $2,932.70 | $5,261.02 | $5,941.80 | $3,853.53 | $2,175.10 |

| 36695 | $4,134.67 | $3,565.10 | $4,915.70 | $3,062.37 | $5,707.92 | $3,021.90 | $5,476.40 | $5,365.48 | $3,881.57 | $2,215.59 |

| 35005 | $4,132.10 | $3,591.86 | $4,665.18 | $3,247.98 | $5,618.17 | $2,856.39 | $5,212.13 | $5,887.35 | $3,934.78 | $2,175.10 |

| 35119 | $4,131.09 | $3,633.56 | $4,648.55 | $3,247.98 | $5,610.66 | $2,864.25 | $5,065.85 | $5,642.79 | $4,291.08 | $2,175.10 |

| 36541 | $4,129.30 | $3,609.66 | $4,919.59 | $3,062.37 | $5,689.68 | $2,892.99 | $5,542.78 | $5,067.38 | $4,107.90 | $2,271.38 |

| 35229 | $4,120.43 | $3,705.92 | $4,608.45 | $3,091.61 | $5,640.09 | $2,857.91 | $4,936.24 | $5,442.31 | $4,664.55 | $2,136.84 |

| 35142 | $4,115.23 | $3,615.18 | $4,608.45 | $3,247.98 | $5,926.94 | $2,905.60 | $4,983.39 | $5,642.79 | $3,984.08 | $2,122.64 |

| 36575 | $4,113.44 | $3,598.00 | $4,640.33 | $3,249.49 | $5,691.03 | $2,892.99 | $5,174.47 | $5,174.24 | $4,334.98 | $2,265.40 |

| 35294 | $4,111.40 | $3,615.18 | $4,648.55 | $3,247.98 | $6,096.21 | $2,850.02 | $5,049.03 | $5,642.79 | $3,655.67 | $2,197.21 |

| 36612 | $4,104.59 | $3,598.00 | $4,878.21 | $3,062.37 | $5,991.29 | $2,892.99 | $4,808.54 | $4,918.65 | $4,334.98 | $2,456.32 |

| 36521 | $4,104.58 | $3,481.04 | $4,640.33 | $3,249.49 | $5,756.28 | $2,892.99 | $5,029.75 | $5,230.84 | $4,204.17 | $2,456.32 |

| 35068 | $4,101.89 | $3,517.95 | $4,621.93 | $3,247.98 | $5,619.12 | $2,864.25 | $5,079.74 | $5,807.06 | $3,934.78 | $2,224.19 |

| 35222 | $4,092.50 | $3,581.03 | $4,693.67 | $3,091.61 | $5,718.84 | $2,850.02 | $5,161.60 | $5,732.08 | $3,847.71 | $2,155.97 |

| 35062 | $4,089.71 | $3,557.73 | $4,534.15 | $3,247.98 | $5,814.99 | $2,932.70 | $5,494.68 | $5,642.79 | $3,407.31 | $2,175.10 |

| 36609 | $4,086.83 | $3,621.12 | $4,878.21 | $3,062.37 | $5,748.12 | $2,983.06 | $5,108.56 | $5,414.44 | $3,767.38 | $2,198.19 |

| 36610 | $4,083.01 | $3,481.04 | $4,713.32 | $3,249.49 | $6,026.46 | $2,892.99 | $4,808.54 | $4,798.68 | $4,320.23 | $2,456.32 |

| 36613 | $4,080.85 | $3,481.04 | $4,763.96 | $3,249.49 | $5,640.36 | $2,892.99 | $4,844.05 | $5,075.54 | $4,334.98 | $2,445.27 |

| 35139 | $4,079.32 | $3,519.62 | $4,648.55 | $3,247.98 | $5,618.17 | $2,864.25 | $5,065.85 | $5,642.79 | $3,984.08 | $2,122.64 |

| 35048 | $4,066.38 | $3,512.16 | $4,648.55 | $3,247.98 | $5,570.13 | $2,847.87 | $5,058.35 | $5,642.79 | $3,845.39 | $2,224.19 |

| 36571 | $4,049.36 | $3,402.57 | $4,640.33 | $3,249.49 | $5,615.01 | $2,892.99 | $5,058.23 | $4,794.29 | $4,334.98 | $2,456.32 |

| 35117 | $4,045.42 | $3,540.24 | $4,685.26 | $3,247.98 | $5,610.66 | $2,864.25 | $5,120.09 | $5,400.37 | $3,715.77 | $2,224.19 |

| 35181 | $4,043.51 | $3,540.24 | $4,810.07 | $3,247.98 | $5,610.66 | $2,864.25 | $5,120.09 | $5,642.79 | $3,432.84 | $2,122.64 |

| 35015 | $4,039.87 | $3,548.00 | $4,608.45 | $3,212.83 | $5,384.22 | $2,855.30 | $4,536.30 | $5,642.79 | $4,373.75 | $2,197.21 |

| 35173 | $4,038.18 | $3,512.16 | $4,591.49 | $3,247.98 | $5,620.37 | $2,847.87 | $4,867.85 | $5,702.74 | $3,830.56 | $2,122.64 |

| 35071 | $4,038.03 | $3,482.09 | $4,685.26 | $3,247.98 | $5,610.66 | $2,864.25 | $5,065.85 | $5,730.03 | $3,533.56 | $2,122.64 |

| 36693 | $4,037.91 | $3,656.05 | $4,669.83 | $3,062.37 | $5,707.92 | $2,983.06 | $4,894.38 | $5,247.77 | $3,885.53 | $2,234.24 |

| 35172 | $4,034.95 | $3,604.88 | $4,810.07 | $3,247.98 | $5,414.75 | $2,595.36 | $4,894.04 | $5,399.93 | $4,209.37 | $2,138.20 |

| 35123 | $4,033.80 | $3,512.16 | $4,648.55 | $3,247.98 | $5,570.13 | $2,847.87 | $5,377.04 | $5,642.79 | $3,335.06 | $2,122.64 |

| 35006 | $4,029.50 | $3,696.44 | $4,648.55 | $3,091.61 | $5,667.72 | $2,932.70 | $4,817.78 | $5,373.04 | $3,862.52 | $2,175.10 |

| 36522 | $4,028.88 | $3,571.37 | $4,577.64 | $3,249.49 | $5,671.94 | $2,892.99 | $4,512.51 | $5,048.04 | $4,279.66 | $2,456.32 |

| 36611 | $4,023.94 | $3,434.41 | $4,878.21 | $3,249.49 | $5,691.03 | $2,892.99 | $4,594.37 | $4,683.70 | $4,334.98 | $2,456.32 |

| 35126 | $4,022.93 | $3,512.16 | $4,810.07 | $3,212.83 | $5,570.13 | $2,847.87 | $5,377.04 | $5,418.58 | $3,335.06 | $2,122.64 |

| 36512 | $4,011.75 | $3,533.43 | $4,577.64 | $3,249.49 | $5,671.94 | $2,892.99 | $4,512.51 | $5,288.47 | $4,107.90 | $2,271.38 |

| 36560 | $4,009.11 | $3,533.43 | $4,577.64 | $3,249.49 | $5,671.94 | $2,892.99 | $4,512.51 | $5,019.74 | $4,167.89 | $2,456.32 |

| 35130 | $4,007.76 | $3,545.41 | $4,534.15 | $3,247.98 | $5,474.76 | $2,953.04 | $4,883.34 | $5,214.19 | $3,984.08 | $2,232.86 |

| 35210 | $4,007.43 | $3,548.00 | $4,334.22 | $3,212.83 | $5,384.22 | $2,855.30 | $4,838.55 | $5,931.24 | $3,839.84 | $2,122.64 |

| 35022 | $4,005.51 | $3,448.99 | $4,503.06 | $3,091.61 | $5,926.94 | $2,905.60 | $5,099.63 | $5,425.62 | $3,374.12 | $2,274.00 |

| 36525 | $4,004.48 | $3,190.40 | $4,640.33 | $2,775.18 | $5,642.66 | $2,892.99 | $4,951.90 | $5,288.47 | $4,202.08 | $2,456.32 |

| 35023 | $4,001.36 | $3,660.16 | $4,334.22 | $3,091.61 | $5,552.87 | $2,854.65 | $4,942.97 | $5,555.28 | $3,845.39 | $2,175.10 |

| 35041 | $3,999.82 | $3,519.62 | $4,199.09 | $2,755.36 | $5,618.17 | $2,932.70 | $5,261.02 | $5,642.79 | $3,845.39 | $2,224.19 |

| 35094 | $3,995.03 | $3,459.76 | $4,523.15 | $3,091.61 | $5,469.62 | $2,855.30 | $5,131.48 | $5,476.74 | $3,824.99 | $2,122.64 |

| 35579 | $3,990.41 | $3,583.18 | $4,238.96 | $3,101.95 | $5,535.04 | $2,953.04 | $4,871.23 | $5,303.75 | $4,093.71 | $2,232.86 |

| 35148 | $3,983.16 | $3,557.73 | $4,534.15 | $3,101.95 | $5,474.76 | $2,953.04 | $4,978.11 | $5,002.09 | $4,013.79 | $2,232.86 |

| 35580 | $3,976.23 | $3,432.59 | $4,238.96 | $3,101.95 | $5,474.76 | $2,953.04 | $4,856.82 | $5,405.78 | $4,089.28 | $2,232.86 |

| 36528 | $3,970.94 | $3,563.02 | $4,737.95 | $2,617.82 | $5,499.30 | $2,892.99 | $5,091.22 | $5,009.16 | $4,055.61 | $2,271.38 |

| 36572 | $3,967.29 | $3,267.65 | $4,640.33 | $2,775.18 | $5,691.03 | $2,892.99 | $4,863.53 | $4,892.36 | $4,226.20 | $2,456.32 |

| 35244 | $3,962.55 | $3,615.18 | $4,631.67 | $3,091.61 | $5,190.02 | $2,840.75 | $5,022.45 | $5,492.93 | $3,655.67 | $2,122.64 |

| 35091 | $3,961.19 | $3,404.70 | $4,648.55 | $3,247.98 | $5,562.46 | $2,932.70 | $5,065.85 | $4,878.54 | $3,787.31 | $2,122.64 |

| 36505 | $3,957.62 | $3,325.34 | $4,640.33 | $2,775.18 | $5,473.96 | $2,892.99 | $4,951.90 | $4,949.29 | $4,153.31 | $2,456.32 |

| 35038 | $3,956.68 | $3,545.41 | $4,685.26 | $3,101.95 | $5,814.99 | $2,953.04 | $4,883.34 | $4,968.55 | $3,424.68 | $2,232.86 |

| 35550 | $3,956.37 | $3,514.90 | $4,238.96 | $3,101.95 | $5,474.76 | $2,953.04 | $5,245.53 | $5,189.43 | $3,655.93 | $2,232.86 |

| 35213 | $3,953.73 | $3,685.18 | $4,268.83 | $3,091.61 | $4,987.80 | $2,857.91 | $5,208.19 | $5,663.07 | $3,684.17 | $2,136.84 |

| 35584 | $3,947.74 | $3,458.44 | $4,238.96 | $3,101.95 | $5,474.76 | $2,953.04 | $5,011.88 | $4,968.55 | $4,089.28 | $2,232.86 |

| 35063 | $3,945.94 | $3,458.44 | $4,238.96 | $3,247.98 | $5,474.76 | $2,953.04 | $5,016.08 | $4,995.27 | $3,896.05 | $2,232.86 |

| 35209 | $3,945.67 | $3,615.18 | $4,243.28 | $3,091.61 | $5,409.57 | $2,857.91 | $4,936.24 | $5,671.12 | $3,549.24 | $2,136.84 |

| 35504 | $3,942.26 | $3,610.49 | $4,238.96 | $3,101.95 | $5,474.76 | $2,953.04 | $5,058.39 | $5,202.01 | $3,607.86 | $2,232.86 |

| 35133 | $3,940.36 | $3,493.81 | $4,332.33 | $3,247.98 | $5,414.75 | $2,595.36 | $5,054.07 | $5,467.48 | $3,719.24 | $2,138.20 |

| 36064 | $3,940.09 | $3,216.53 | $4,561.69 | $3,056.47 | $5,225.30 | $2,909.52 | $4,688.36 | $5,495.74 | $4,090.61 | $2,216.59 |

| 36105 | $3,933.57 | $3,209.35 | $4,400.23 | $3,056.47 | $5,323.33 | $2,928.11 | $4,674.85 | $5,554.84 | $3,993.25 | $2,261.66 |

| 35116 | $3,931.34 | $3,348.22 | $4,648.55 | $3,247.98 | $5,562.46 | $2,864.25 | $5,256.35 | $4,920.37 | $3,411.29 | $2,122.64 |

| 36870 | $3,922.85 | $3,052.20 | $4,621.38 | $2,884.28 | $5,479.62 | $2,682.45 | $4,940.91 | $5,747.55 | $3,587.07 | $2,310.15 |

| 36875 | $3,920.70 | $3,052.20 | $4,317.68 | $2,884.28 | $5,507.74 | $2,682.45 | $4,887.49 | $5,593.56 | $3,939.66 | $2,421.23 |

| 35216 | $3,920.62 | $3,615.18 | $4,245.86 | $3,091.61 | $4,987.80 | $2,857.91 | $4,832.16 | $5,861.92 | $3,656.28 | $2,136.84 |

| 35226 | $3,918.93 | $3,615.18 | $4,294.05 | $3,091.61 | $4,987.80 | $2,857.91 | $5,063.15 | $5,545.74 | $3,678.05 | $2,136.84 |

| 36869 | $3,914.93 | $3,052.20 | $4,317.68 | $2,884.28 | $5,507.74 | $2,682.45 | $4,933.87 | $5,571.30 | $3,974.67 | $2,310.15 |

| 35503 | $3,914.26 | $3,292.71 | $4,238.96 | $3,101.95 | $5,474.76 | $2,953.04 | $4,949.63 | $5,162.89 | $3,821.58 | $2,232.86 |

| 36104 | $3,910.30 | $3,209.35 | $4,380.23 | $3,056.47 | $5,472.87 | $2,856.56 | $4,979.88 | $4,870.40 | $4,088.66 | $2,278.29 |

| 36856 | $3,907.19 | $3,052.20 | $4,576.15 | $2,884.28 | $5,507.74 | $2,682.45 | $4,887.49 | $5,381.56 | $3,893.89 | $2,299.01 |

| 35587 | $3,899.61 | $3,493.34 | $4,238.96 | $2,636.68 | $5,535.04 | $2,953.04 | $4,955.59 | $4,919.38 | $4,131.61 | $2,232.86 |

| 36107 | $3,894.76 | $3,239.70 | $4,359.10 | $2,962.82 | $5,303.77 | $2,856.56 | $4,979.88 | $5,115.33 | $4,033.99 | $2,201.66 |

| 36115 | $3,890.82 | $3,216.53 | $4,359.10 | $3,056.47 | $5,472.87 | $2,856.56 | $4,979.88 | $4,902.81 | $3,919.83 | $2,253.37 |

| 36013 | $3,888.33 | $3,216.53 | $4,561.69 | $2,963.81 | $5,250.70 | $2,909.52 | $4,658.26 | $5,349.37 | $3,823.41 | $2,261.66 |

| 35043 | $3,885.38 | $3,636.41 | $4,292.87 | $3,091.61 | $5,104.70 | $2,665.04 | $4,836.58 | $5,908.31 | $3,275.51 | $2,157.43 |

| 35490 | $3,885.23 | $3,524.63 | $4,317.03 | $2,960.05 | $5,406.19 | $2,618.93 | $4,729.05 | $5,323.74 | $3,919.32 | $2,168.09 |

| 35478 | $3,884.24 | $3,660.16 | $4,317.03 | $2,897.24 | $5,406.19 | $2,618.93 | $4,729.05 | $5,012.07 | $4,208.26 | $2,109.23 |

| 35560 | $3,883.92 | $3,432.59 | $4,238.96 | $3,101.95 | $5,474.76 | $2,953.04 | $4,856.82 | $4,968.55 | $3,695.77 | $2,232.86 |

| 36785 | $3,883.80 | $3,249.56 | $4,177.51 | $2,972.02 | $5,527.95 | $2,622.52 | $4,717.00 | $5,148.37 | $4,397.45 | $2,141.81 |

| 36111 | $3,882.16 | $3,239.70 | $4,359.10 | $2,962.82 | $5,185.26 | $2,928.11 | $4,447.33 | $5,604.60 | $3,963.53 | $2,248.96 |

| 36109 | $3,880.38 | $3,216.53 | $4,344.26 | $3,056.47 | $5,233.16 | $2,856.56 | $4,979.88 | $5,081.84 | $3,901.35 | $2,253.37 |

| 36069 | $3,879.71 | $3,052.20 | $4,177.51 | $2,963.81 | $5,602.11 | $2,909.52 | $4,923.25 | $5,187.20 | $3,840.11 | $2,261.66 |

| 35444 | $3,878.89 | $3,660.16 | $4,317.03 | $2,897.24 | $5,456.85 | $2,618.93 | $4,689.38 | $5,048.29 | $4,054.03 | $2,168.09 |

| 36113 | $3,878.03 | $3,209.35 | $4,302.36 | $3,056.47 | $5,379.98 | $2,909.52 | $4,601.50 | $5,184.98 | $4,183.58 | $2,074.50 |

| 35180 | $3,877.21 | $3,440.55 | $4,810.07 | $3,212.83 | $5,562.46 | $2,595.36 | $4,957.34 | $4,745.21 | $3,432.84 | $2,138.20 |

| 35243 | $3,876.35 | $3,705.92 | $4,123.35 | $3,091.61 | $4,987.80 | $2,857.91 | $5,006.43 | $5,343.93 | $3,647.52 | $2,122.64 |

| 36775 | $3,872.71 | $3,615.40 | $4,177.51 | $2,898.22 | $5,522.62 | $2,624.62 | $4,823.23 | $5,278.57 | $3,743.65 | $2,170.56 |

| 35501 | $3,872.52 | $3,562.60 | $4,238.96 | $2,636.68 | $5,474.76 | $2,953.04 | $4,949.63 | $5,238.92 | $3,565.24 | $2,232.86 |

| 36043 | $3,868.13 | $3,180.37 | $4,561.69 | $2,936.53 | $5,032.33 | $2,909.52 | $4,483.24 | $5,288.09 | $4,159.72 | $2,261.66 |

| 35223 | $3,867.41 | $3,599.41 | $4,123.35 | $3,091.61 | $4,987.80 | $2,857.91 | $4,970.44 | $5,448.17 | $3,591.12 | $2,136.84 |

| 35111 | $3,863.15 | $3,573.57 | $4,030.06 | $3,091.61 | $5,406.19 | $2,618.93 | $4,705.15 | $5,411.81 | $3,762.98 | $2,168.09 |

| 36867 | $3,862.49 | $3,052.20 | $4,580.54 | $2,884.28 | $5,479.62 | $2,682.45 | $4,875.38 | $5,391.70 | $3,530.92 | $2,285.31 |

| 36851 | $3,860.41 | $3,052.20 | $4,576.15 | $2,931.23 | $5,507.74 | $2,682.45 | $4,522.52 | $5,278.55 | $3,893.89 | $2,299.01 |

| 36114 | $3,859.64 | $3,239.70 | $4,344.26 | $3,056.47 | $5,157.85 | $2,856.56 | $4,839.37 | $5,058.73 | $3,930.48 | $2,253.37 |

| 35242 | $3,856.80 | $3,615.18 | $4,587.11 | $3,091.61 | $5,308.19 | $2,840.75 | $4,840.95 | $5,031.07 | $3,273.68 | $2,122.64 |

| 36859 | $3,856.76 | $3,052.20 | $4,384.52 | $2,884.28 | $5,507.74 | $2,682.45 | $4,405.70 | $5,278.55 | $4,094.20 | $2,421.23 |

| 36052 | $3,854.44 | $3,052.20 | $4,218.25 | $2,963.81 | $5,644.35 | $2,909.52 | $4,519.96 | $5,193.66 | $3,926.60 | $2,261.66 |

| 36783 | $3,851.47 | $3,455.87 | $4,366.98 | $2,972.02 | $5,361.21 | $2,622.52 | $4,756.03 | $4,981.99 | $3,931.51 | $2,215.10 |

| 36871 | $3,850.86 | $3,052.20 | $4,576.15 | $2,884.28 | $5,507.74 | $2,682.45 | $4,522.52 | $5,368.66 | $3,642.51 | $2,421.23 |

| 35578 | $3,850.04 | $3,292.71 | $4,238.96 | $3,101.95 | $5,535.04 | $2,953.04 | $4,310.59 | $5,048.88 | $3,936.38 | $2,232.86 |

| 36108 | $3,847.58 | $3,209.35 | $4,271.95 | $3,056.47 | $5,343.43 | $2,928.11 | $4,515.94 | $5,242.25 | $3,862.56 | $2,198.20 |

| 35487 | $3,845.15 | $3,660.16 | $4,277.31 | $2,897.24 | $5,215.04 | $2,618.93 | $4,852.09 | $5,012.07 | $3,964.24 | $2,109.23 |

| 35476 | $3,840.92 | $3,526.58 | $4,317.03 | $2,897.24 | $5,130.67 | $2,618.93 | $4,841.19 | $4,919.20 | $4,208.26 | $2,109.23 |

| 36119 | $3,839.41 | $3,239.70 | $4,400.23 | $3,056.47 | $5,157.85 | $2,550.07 | $4,839.37 | $5,349.37 | $3,805.82 | $2,155.78 |

| 36116 | $3,838.77 | $3,239.12 | $4,400.23 | $3,056.47 | $5,332.58 | $2,550.07 | $4,657.98 | $5,578.95 | $3,581.64 | $2,151.89 |

| 36039 | $3,837.76 | $3,052.20 | $4,576.15 | $2,963.81 | $5,423.26 | $2,599.58 | $4,714.67 | $5,278.55 | $3,664.25 | $2,267.37 |

| 35079 | $3,837.67 | $3,434.60 | $4,332.33 | $3,247.98 | $5,414.75 | $2,595.36 | $4,678.21 | $5,303.52 | $3,394.10 | $2,138.20 |

| 36752 | $3,836.08 | $3,180.37 | $4,177.51 | $2,936.53 | $5,443.59 | $2,622.52 | $4,578.27 | $5,046.68 | $4,397.45 | $2,141.81 |

| 35124 | $3,836.01 | $3,666.55 | $4,292.87 | $3,091.61 | $5,173.23 | $2,623.47 | $4,754.24 | $5,463.59 | $3,258.69 | $2,199.84 |

| 36858 | $3,835.00 | $3,052.20 | $4,576.15 | $2,785.30 | $5,507.74 | $2,682.45 | $4,404.41 | $4,991.34 | $4,094.20 | $2,421.23 |

| 36767 | $3,831.99 | $3,550.61 | $4,177.51 | $2,898.22 | $5,353.71 | $2,624.62 | $4,823.23 | $5,145.81 | $3,743.65 | $2,170.56 |

| 35470 | $3,829.30 | $3,455.87 | $4,220.93 | $2,844.25 | $5,533.73 | $2,622.52 | $4,425.42 | $4,415.88 | $4,717.10 | $2,228.03 |

| 35097 | $3,828.59 | $3,515.79 | $4,332.33 | $3,101.95 | $5,414.75 | $2,595.36 | $4,885.59 | $4,968.55 | $3,504.77 | $2,138.20 |

| 35033 | $3,828.49 | $3,436.86 | $4,233.77 | $3,247.98 | $5,504.90 | $2,618.81 | $4,880.00 | $4,951.04 | $3,424.68 | $2,158.36 |

| 36553 | $3,828.41 | $3,539.53 | $4,140.62 | $3,249.49 | $5,797.51 | $2,622.52 | $4,338.76 | $4,786.18 | $3,798.79 | $2,182.34 |

| 36112 | $3,827.36 | $3,209.35 | $4,340.83 | $3,056.47 | $5,360.00 | $2,856.56 | $4,627.27 | $5,058.73 | $3,862.56 | $2,074.50 |

| 35176 | $3,826.60 | $3,480.38 | $4,292.87 | $2,755.36 | $5,431.07 | $2,638.17 | $4,509.96 | $5,050.31 | $4,102.43 | $2,178.84 |

| 35049 | $3,826.48 | $3,398.74 | $4,332.33 | $3,105.37 | $5,414.75 | $2,595.36 | $4,555.58 | $5,367.92 | $3,530.10 | $2,138.20 |

| 35053 | $3,823.63 | $3,484.76 | $4,233.77 | $3,101.95 | $5,504.90 | $2,618.81 | $4,783.45 | $4,740.65 | $3,786.02 | $2,158.36 |

| 35468 | $3,819.86 | $3,660.16 | $4,196.47 | $2,897.24 | $5,456.85 | $2,618.93 | $4,729.05 | $5,012.07 | $3,639.84 | $2,168.09 |

| 36106 | $3,819.81 | $3,209.94 | $4,359.10 | $2,962.82 | $5,157.15 | $2,856.56 | $4,774.17 | $4,749.49 | $4,107.44 | $2,201.66 |

| 36061 | $3,819.04 | $3,052.20 | $4,561.69 | $2,607.81 | $5,310.78 | $2,682.45 | $4,715.50 | $5,278.55 | $3,895.01 | $2,267.37 |

| 36117 | $3,817.86 | $3,216.53 | $4,400.23 | $3,056.47 | $5,157.85 | $2,550.07 | $4,839.37 | $5,178.64 | $3,805.82 | $2,155.78 |

| 36040 | $3,815.86 | $3,314.36 | $4,177.51 | $2,936.53 | $5,527.95 | $2,622.52 | $4,220.14 | $5,004.44 | $4,397.45 | $2,141.81 |

| 36756 | $3,810.75 | $3,440.87 | $4,196.47 | $2,931.23 | $5,071.51 | $2,624.62 | $4,972.32 | $4,417.66 | $4,413.98 | $2,228.03 |

| 35477 | $3,809.78 | $3,415.68 | $4,220.93 | $2,931.23 | $5,207.79 | $2,622.52 | $4,425.42 | $4,519.33 | $4,717.10 | $2,228.03 |

| 35462 | $3,808.03 | $3,281.68 | $4,351.51 | $2,844.25 | $5,203.93 | $2,624.62 | $4,386.49 | $4,613.30 | $4,738.44 | $2,228.03 |

| 36513 | $3,807.68 | $3,533.43 | $4,366.98 | $2,898.22 | $5,616.27 | $2,622.52 | $4,338.76 | $4,836.01 | $3,874.58 | $2,182.34 |

| 36773 | $3,807.33 | $3,550.61 | $4,177.51 | $2,898.22 | $5,385.89 | $2,624.62 | $5,076.65 | $4,638.22 | $3,743.65 | $2,170.56 |

| 36075 | $3,806.79 | $3,216.53 | $4,576.15 | $2,936.53 | $5,277.56 | $2,599.58 | $4,714.67 | $5,008.43 | $3,664.25 | $2,267.37 |

| 36901 | $3,806.44 | $3,455.87 | $4,092.02 | $2,931.23 | $5,533.73 | $2,622.52 | $4,386.67 | $4,381.38 | $4,626.52 | $2,228.03 |

| 35406 | $3,805.38 | $3,660.16 | $4,218.97 | $2,897.24 | $5,046.32 | $2,618.93 | $4,843.95 | $5,435.45 | $3,388.74 | $2,138.68 |

| 35482 | $3,805.01 | $3,660.16 | $4,196.47 | $2,897.24 | $5,147.57 | $2,618.93 | $4,580.30 | $5,012.07 | $3,964.24 | $2,168.09 |

| 35080 | $3,803.91 | $3,666.55 | $4,292.87 | $3,091.61 | $5,173.23 | $2,623.47 | $4,376.45 | $5,305.07 | $3,505.71 | $2,200.21 |

| 35453 | $3,803.77 | $3,660.16 | $4,317.03 | $2,960.05 | $5,063.21 | $2,618.93 | $4,695.31 | $4,811.25 | $3,939.86 | $2,168.09 |

| 36907 | $3,803.30 | $3,455.87 | $4,092.02 | $2,844.25 | $5,533.73 | $2,622.52 | $4,512.78 | $4,314.01 | $4,626.52 | $2,228.03 |

| 36874 | $3,802.31 | $3,052.20 | $4,208.27 | $2,785.30 | $5,479.62 | $2,682.45 | $4,796.23 | $5,313.16 | $3,482.30 | $2,421.23 |

| 35474 | $3,801.81 | $3,449.61 | $4,196.47 | $2,960.05 | $5,063.00 | $2,618.93 | $4,518.34 | $5,273.69 | $3,968.12 | $2,168.09 |

| 35147 | $3,800.81 | $3,480.38 | $4,292.87 | $2,755.36 | $5,209.14 | $2,638.17 | $4,895.21 | $4,870.49 | $3,886.84 | $2,178.84 |

| 36703 | $3,798.48 | $3,615.40 | $4,177.51 | $2,972.02 | $5,527.95 | $2,624.62 | $4,389.64 | $4,965.00 | $3,743.65 | $2,170.56 |

| 35146 | $3,798.26 | $3,375.23 | $4,332.33 | $3,247.98 | $5,465.43 | $2,595.36 | $4,565.58 | $4,833.80 | $3,683.73 | $2,084.91 |

| 36556 | $3,797.40 | $3,539.53 | $4,366.98 | $2,898.22 | $5,797.51 | $2,622.52 | $4,338.76 | $4,638.22 | $3,792.56 | $2,182.34 |

| 35456 | $3,795.05 | $3,696.44 | $4,317.03 | $2,960.05 | $5,063.21 | $2,618.93 | $4,493.03 | $4,905.65 | $3,933.06 | $2,168.09 |

| 35443 | $3,794.25 | $3,455.87 | $4,351.51 | $2,844.25 | $5,533.73 | $2,624.62 | $4,746.44 | $4,497.83 | $3,865.93 | $2,228.03 |

| 36083 | $3,793.50 | $3,052.20 | $4,576.15 | $2,963.81 | $5,277.56 | $2,599.58 | $4,456.11 | $4,856.85 | $4,091.85 | $2,267.37 |

| 36922 | $3,792.98 | $3,455.87 | $4,576.15 | $2,844.25 | $5,508.40 | $2,622.52 | $4,474.03 | $4,519.33 | $3,921.13 | $2,215.10 |

| 35121 | $3,792.21 | $3,332.54 | $4,332.33 | $3,247.98 | $5,414.75 | $2,595.36 | $4,408.27 | $4,976.70 | $3,683.73 | $2,138.20 |

| 36036 | $3,789.68 | $3,186.19 | $4,218.25 | $2,643.85 | $5,516.80 | $2,909.52 | $4,342.42 | $5,365.08 | $3,663.40 | $2,261.66 |

| 35452 | $3,789.00 | $3,562.86 | $4,317.03 | $2,897.24 | $5,147.57 | $2,618.93 | $4,601.54 | $4,823.17 | $3,964.58 | $2,168.09 |

| 36722 | $3,788.01 | $3,455.87 | $4,366.98 | $2,972.02 | $5,248.20 | $2,622.52 | $4,931.24 | $4,632.69 | $3,647.51 | $2,215.10 |

| 35480 | $3,787.66 | $3,473.60 | $4,369.22 | $2,960.05 | $5,159.51 | $2,618.93 | $4,363.21 | $5,012.07 | $3,964.24 | $2,168.09 |

| 35906 | $3,787.01 | $3,390.37 | $4,429.42 | $2,815.70 | $5,183.26 | $2,757.55 | $4,486.66 | $5,406.93 | $3,553.59 | $2,059.65 |

| 36860 | $3,786.34 | $3,052.20 | $4,576.15 | $2,785.30 | $5,479.47 | $2,682.45 | $4,053.81 | $4,932.26 | $4,094.20 | $2,421.23 |

| 35078 | $3,785.96 | $3,461.36 | $4,292.87 | $2,659.13 | $5,386.29 | $2,638.17 | $4,196.43 | $5,169.02 | $4,091.51 | $2,178.84 |

| 36728 | $3,785.12 | $3,455.87 | $4,366.98 | $2,898.22 | $5,290.43 | $2,622.52 | $4,931.24 | $4,638.22 | $3,647.51 | $2,215.10 |

| 36088 | $3,784.70 | $3,052.20 | $4,515.78 | $2,963.81 | $5,277.56 | $2,599.58 | $4,359.09 | $4,893.27 | $4,133.66 | $2,267.37 |

| 36701 | $3,784.65 | $3,550.61 | $4,177.51 | $2,972.02 | $5,274.89 | $2,624.62 | $4,603.82 | $4,944.22 | $3,743.65 | $2,170.56 |

| 36529 | $3,784.45 | $3,484.57 | $4,140.62 | $2,898.22 | $5,616.27 | $2,622.52 | $4,416.67 | $4,772.38 | $3,926.47 | $2,182.34 |

| 35549 | $3,783.91 | $3,359.76 | $4,238.96 | $2,636.68 | $5,535.04 | $2,953.04 | $4,594.75 | $4,808.34 | $3,695.77 | $2,232.86 |

| 36721 | $3,782.52 | $3,422.61 | $4,366.98 | $2,898.22 | $5,300.26 | $2,622.52 | $4,931.24 | $4,638.22 | $3,647.51 | $2,215.10 |

| 36738 | $3,781.32 | $3,423.01 | $4,366.98 | $2,931.23 | $5,177.96 | $2,622.52 | $4,721.40 | $4,651.43 | $3,922.30 | $2,215.10 |

| 35184 | $3,780.63 | $3,647.52 | $3,930.21 | $2,931.23 | $5,566.93 | $2,542.09 | $4,737.49 | $4,697.63 | $3,826.85 | $2,145.70 |

| 35404 | $3,779.59 | $3,660.16 | $4,182.34 | $2,897.24 | $5,215.04 | $2,618.93 | $4,881.62 | $4,962.41 | $3,538.14 | $2,060.39 |

| 36759 | $3,778.13 | $3,597.55 | $4,177.51 | $2,972.02 | $5,100.67 | $2,624.62 | $4,570.09 | $5,046.51 | $3,743.65 | $2,170.56 |

| 36786 | $3,777.11 | $3,556.99 | $4,074.02 | $2,972.02 | $5,177.96 | $2,624.62 | $5,217.04 | $4,610.87 | $3,532.45 | $2,228.03 |

| 36740 | $3,775.30 | $3,423.01 | $4,351.51 | $2,931.23 | $5,252.56 | $2,624.62 | $4,663.74 | $4,494.03 | $4,009.01 | $2,228.03 |

| 35475 | $3,774.43 | $3,583.18 | $4,317.03 | $2,897.24 | $5,147.57 | $2,618.93 | $4,580.30 | $5,154.63 | $3,599.58 | $2,071.41 |

| 35440 | $3,773.77 | $3,524.63 | $4,218.97 | $2,897.24 | $5,406.19 | $2,618.93 | $4,729.05 | $5,012.07 | $3,388.74 | $2,168.09 |

| 36584 | $3,772.83 | $3,484.57 | $4,140.62 | $2,898.22 | $5,616.27 | $2,622.52 | $4,338.76 | $4,745.70 | $3,926.47 | $2,182.34 |

| 36110 | $3,771.10 | $3,144.50 | $4,340.83 | $2,962.82 | $5,287.20 | $2,856.56 | $4,706.95 | $4,816.73 | $3,546.07 | $2,278.29 |

| 36782 | $3,771.01 | $3,382.06 | $4,366.98 | $2,898.22 | $5,356.37 | $2,622.52 | $4,432.37 | $4,701.21 | $3,964.31 | $2,215.10 |

| 35905 | $3,768.91 | $3,270.71 | $4,429.42 | $2,755.36 | $5,127.03 | $2,757.55 | $4,391.40 | $5,361.85 | $3,785.19 | $2,041.69 |

| 36766 | $3,767.54 | $3,550.61 | $4,366.98 | $2,898.22 | $5,328.38 | $2,622.52 | $4,638.93 | $4,638.22 | $3,648.95 | $2,215.10 |

| 35473 | $3,766.66 | $3,449.61 | $4,206.72 | $2,897.24 | $5,046.32 | $2,618.93 | $4,914.53 | $5,145.80 | $3,530.14 | $2,090.63 |

| 36921 | $3,766.40 | $3,382.06 | $4,366.98 | $2,898.22 | $5,399.79 | $2,622.52 | $4,421.30 | $4,422.86 | $4,168.81 | $2,215.10 |

| 35052 | $3,766.37 | $3,446.22 | $4,238.96 | $3,101.95 | $5,516.49 | $2,595.36 | $4,589.08 | $4,718.11 | $3,603.34 | $2,087.80 |

| 35463 | $3,764.66 | $3,449.61 | $4,244.31 | $2,960.05 | $4,978.65 | $2,618.93 | $4,599.42 | $4,917.33 | $3,945.50 | $2,168.09 |

| 36748 | $3,763.27 | $3,455.87 | $4,366.98 | $2,972.02 | $5,215.80 | $2,622.52 | $4,432.37 | $4,666.45 | $3,922.30 | $2,215.10 |

| 36741 | $3,763.08 | $3,550.61 | $4,366.98 | $2,898.22 | $5,328.38 | $2,622.52 | $4,600.17 | $4,638.22 | $3,647.51 | $2,215.10 |

| 35954 | $3,762.75 | $3,296.28 | $4,429.42 | $2,815.70 | $5,158.14 | $2,757.55 | $4,486.66 | $5,193.35 | $3,668.00 | $2,059.65 |

| 36768 | $3,757.98 | $3,550.61 | $4,366.98 | $2,898.22 | $5,328.38 | $2,622.52 | $4,600.17 | $4,590.88 | $3,648.95 | $2,215.10 |

| 35098 | $3,756.62 | $3,356.75 | $4,233.77 | $3,105.37 | $5,504.90 | $2,618.81 | $4,475.28 | $4,551.59 | $3,804.72 | $2,158.36 |

| 36583 | $3,755.66 | $3,285.53 | $4,140.62 | $2,898.22 | $5,616.27 | $2,622.52 | $4,338.76 | $4,842.07 | $3,874.58 | $2,182.34 |

| 36518 | $3,755.29 | $3,285.53 | $4,140.62 | $2,898.22 | $5,616.27 | $2,622.52 | $4,405.18 | $4,772.38 | $3,874.58 | $2,182.34 |

| 36916 | $3,753.57 | $3,455.87 | $4,366.98 | $2,844.25 | $5,418.05 | $2,622.52 | $4,508.66 | $4,429.55 | $3,921.13 | $2,215.10 |

| 36727 | $3,752.99 | $3,382.06 | $4,031.54 | $2,898.22 | $5,229.18 | $2,622.52 | $4,624.05 | $4,638.22 | $4,168.81 | $2,182.34 |

| 36720 | $3,752.86 | $3,496.40 | $4,366.98 | $2,898.22 | $5,385.89 | $2,622.52 | $4,347.08 | $4,796.02 | $3,647.51 | $2,215.10 |

| 35904 | $3,752.36 | $3,254.15 | $4,539.13 | $2,815.70 | $5,158.14 | $2,606.85 | $4,389.30 | $5,440.43 | $3,507.88 | $2,059.65 |

| 36585 | $3,751.59 | $3,285.53 | $4,140.62 | $3,249.49 | $5,508.08 | $2,622.52 | $4,338.76 | $4,638.22 | $3,798.79 | $2,182.34 |

| 35541 | $3,751.00 | $3,417.69 | $4,011.17 | $3,101.95 | $5,504.90 | $2,953.04 | $4,664.19 | $4,551.60 | $3,427.65 | $2,126.79 |

| 36913 | $3,750.76 | $3,382.06 | $4,366.98 | $2,898.22 | $5,399.79 | $2,622.52 | $4,421.30 | $4,519.33 | $3,931.51 | $2,215.10 |

| 35469 | $3,749.98 | $3,426.68 | $4,351.51 | $2,960.05 | $5,243.84 | $2,624.62 | $4,492.24 | $4,519.33 | $3,903.48 | $2,228.03 |

| 36754 | $3,749.73 | $3,455.87 | $4,366.98 | $2,972.02 | $5,341.09 | $2,622.52 | $4,488.27 | $4,638.22 | $3,647.51 | $2,215.10 |

| 35457 | $3,749.70 | $3,526.58 | $4,317.03 | $2,897.24 | $5,187.39 | $2,618.93 | $4,030.98 | $5,012.07 | $3,988.94 | $2,168.09 |

| 36904 | $3,749.12 | $3,382.06 | $4,366.98 | $2,844.25 | $5,418.05 | $2,622.52 | $4,421.30 | $4,413.80 | $4,058.02 | $2,215.10 |

| 36769 | $3,748.75 | $3,382.06 | $4,366.98 | $2,898.22 | $5,283.35 | $2,622.52 | $4,678.09 | $4,671.90 | $3,620.55 | $2,215.10 |

| 35446 | $3,748.37 | $3,449.61 | $4,317.03 | $2,897.24 | $5,147.57 | $2,618.93 | $4,601.54 | $4,574.28 | $3,961.04 | $2,168.09 |

| 35114 | $3,747.76 | $3,340.91 | $4,292.87 | $2,755.36 | $5,173.23 | $2,623.47 | $4,834.89 | $5,085.47 | $3,318.09 | $2,305.52 |

| 36915 | $3,747.35 | $3,382.06 | $4,366.98 | $2,844.25 | $5,399.79 | $2,622.52 | $4,421.30 | $4,401.26 | $4,072.92 | $2,215.10 |

| 35070 | $3,747.17 | $3,317.44 | $4,332.33 | $3,101.95 | $5,414.75 | $2,618.81 | $4,410.35 | $4,968.55 | $3,418.89 | $2,141.48 |

| 36912 | $3,746.66 | $3,382.06 | $4,366.98 | $2,844.25 | $5,558.64 | $2,622.52 | $4,474.03 | $4,495.12 | $3,761.28 | $2,215.10 |

| 36581 | $3,746.14 | $3,285.53 | $4,366.98 | $2,898.22 | $5,508.08 | $2,622.52 | $4,338.76 | $4,638.22 | $3,874.58 | $2,182.34 |

| 35441 | $3,744.24 | $3,335.89 | $4,196.47 | $2,844.25 | $5,243.84 | $2,624.62 | $4,659.08 | $4,730.50 | $3,835.51 | $2,228.03 |

| 35074 | $3,744.03 | $3,573.57 | $4,220.93 | $2,931.23 | $5,406.19 | $2,542.09 | $4,668.43 | $4,300.73 | $3,907.37 | $2,145.70 |

| 36736 | $3,743.87 | $3,382.06 | $4,366.98 | $2,972.02 | $5,341.09 | $2,622.52 | $4,488.27 | $4,659.32 | $3,647.51 | $2,215.10 |

| 36539 | $3,742.90 | $3,285.53 | $4,140.62 | $2,898.22 | $5,616.27 | $2,622.52 | $4,338.76 | $4,727.28 | $3,874.58 | $2,182.34 |

| 35178 | $3,742.76 | $3,446.22 | $4,292.87 | $2,755.36 | $5,386.29 | $2,638.17 | $4,343.63 | $5,069.66 | $3,573.80 | $2,178.84 |

| 36753 | $3,742.74 | $3,422.61 | $4,366.98 | $2,898.22 | $5,300.26 | $2,622.52 | $4,600.17 | $4,638.22 | $3,620.55 | $2,215.10 |

| 35972 | $3,741.51 | $3,317.41 | $4,429.42 | $2,637.11 | $5,158.14 | $2,606.85 | $4,482.20 | $5,236.96 | $3,745.84 | $2,059.65 |

| 35401 | $3,740.48 | $3,449.61 | $4,163.32 | $2,897.24 | $5,215.04 | $2,618.93 | $4,852.09 | $4,636.87 | $3,722.03 | $2,109.23 |

| 36919 | $3,738.70 | $3,285.53 | $4,366.98 | $2,898.22 | $5,399.79 | $2,622.52 | $4,421.30 | $4,564.30 | $3,874.58 | $2,215.10 |

| 36764 | $3,737.02 | $3,455.87 | $4,366.98 | $2,898.22 | $5,356.37 | $2,622.52 | $4,432.37 | $4,638.22 | $3,647.51 | $2,215.10 |

| 36910 | $3,736.20 | $3,382.06 | $4,366.98 | $2,844.25 | $5,367.79 | $2,622.52 | $4,386.67 | $4,519.33 | $3,921.13 | $2,215.10 |

| 35031 | $3,735.97 | $3,251.23 | $4,332.33 | $3,105.37 | $5,414.75 | $2,595.36 | $4,499.51 | $4,877.24 | $3,409.77 | $2,138.20 |

| 36723 | $3,735.33 | $3,496.40 | $4,366.98 | $2,898.22 | $5,385.89 | $2,622.52 | $4,347.08 | $4,638.22 | $3,647.51 | $2,215.10 |

| 36732 | $3,735.08 | $3,510.07 | $4,366.98 | $2,844.25 | $5,215.80 | $2,622.52 | $4,349.12 | $4,482.84 | $4,009.01 | $2,215.10 |

| 35748 | $3,734.45 | $3,597.76 | $4,143.90 | $2,637.11 | $4,934.36 | $2,640.07 | $4,825.81 | $5,308.49 | $3,422.07 | $2,100.45 |

| 36765 | $3,734.23 | $3,382.82 | $4,196.47 | $2,931.23 | $5,298.52 | $2,624.62 | $5,076.55 | $4,440.01 | $3,429.86 | $2,228.03 |

| 36524 | $3,733.75 | $3,318.68 | $4,031.54 | $2,898.22 | $5,458.89 | $2,622.52 | $4,504.30 | $4,712.70 | $3,874.58 | $2,182.34 |

| 36025 | $3,732.96 | $3,209.94 | $3,989.17 | $2,936.53 | $5,249.81 | $2,725.13 | $4,585.95 | $4,862.06 | $3,924.11 | $2,113.98 |

| 36538 | $3,730.26 | $3,285.53 | $4,140.62 | $2,898.22 | $5,508.08 | $2,622.52 | $4,504.30 | $4,638.22 | $3,792.56 | $2,182.34 |

| 35137 | $3,729.96 | $3,340.91 | $4,292.87 | $2,755.36 | $5,228.06 | $2,566.07 | $4,325.82 | $5,249.97 | $3,631.75 | $2,178.84 |

| 35144 | $3,729.96 | $3,340.91 | $4,292.87 | $2,755.36 | $5,228.06 | $2,566.07 | $4,325.82 | $5,249.97 | $3,631.75 | $2,178.84 |

| 35131 | $3,729.90 | $3,411.49 | $4,238.96 | $2,815.70 | $5,516.49 | $2,595.36 | $4,907.94 | $4,651.00 | $3,347.27 | $2,084.91 |

| 35182 | $3,729.36 | $3,375.23 | $4,238.96 | $3,101.95 | $5,516.49 | $2,595.36 | $4,356.58 | $4,718.11 | $3,573.80 | $2,087.80 |

| 35135 | $3,729.34 | $3,352.04 | $4,238.96 | $2,815.70 | $5,516.49 | $2,595.36 | $4,807.95 | $4,546.40 | $3,603.34 | $2,087.80 |

| 35458 | $3,728.83 | $3,289.18 | $4,271.36 | $2,897.24 | $5,026.93 | $2,618.93 | $4,286.76 | $5,012.07 | $3,988.94 | $2,168.09 |

| 36558 | $3,727.90 | $3,285.53 | $4,140.62 | $2,898.22 | $5,508.08 | $2,622.52 | $4,395.96 | $4,725.24 | $3,792.56 | $2,182.34 |

| 35007 | $3,726.05 | $3,340.91 | $4,292.87 | $2,755.36 | $5,228.06 | $2,566.07 | $4,325.82 | $5,212.41 | $3,571.74 | $2,241.21 |

| 36742 | $3,725.76 | $3,423.01 | $4,140.62 | $2,972.02 | $5,215.80 | $2,622.52 | $4,527.64 | $4,492.81 | $3,922.30 | $2,215.10 |

| 35554 | $3,725.20 | $3,292.71 | $4,048.88 | $3,101.95 | $5,340.46 | $2,953.04 | $4,069.16 | $4,791.94 | $3,695.77 | $2,232.86 |

| 36744 | $3,724.76 | $3,382.82 | $4,196.47 | $2,931.23 | $5,303.16 | $2,624.62 | $4,953.30 | $4,473.38 | $3,429.86 | $2,228.03 |

| 35143 | $3,723.89 | $3,353.98 | $4,292.87 | $2,755.36 | $5,025.80 | $2,566.07 | $4,796.02 | $4,914.35 | $3,631.75 | $2,178.84 |

| 35004 | $3,723.64 | $3,389.77 | $4,238.96 | $2,755.36 | $5,516.49 | $2,595.36 | $4,465.85 | $4,914.29 | $3,544.46 | $2,092.24 |

| 35077 | $3,723.33 | $3,317.44 | $4,233.77 | $3,105.37 | $5,414.75 | $2,618.81 | $4,410.35 | $4,832.20 | $3,418.89 | $2,158.36 |

| 36761 | $3,722.74 | $3,249.56 | $4,177.51 | $2,972.02 | $5,328.38 | $2,624.62 | $4,600.17 | $4,638.22 | $3,743.65 | $2,170.56 |

| 35405 | $3,721.09 | $3,660.16 | $4,218.97 | $2,960.05 | $5,046.32 | $2,618.93 | $4,672.60 | $4,487.17 | $3,742.86 | $2,082.72 |

| 36877 | $3,717.86 | $3,052.20 | $4,208.27 | $2,884.28 | $5,479.62 | $2,611.94 | $4,772.56 | $4,799.56 | $3,462.33 | $2,189.94 |

| 36745 | $3,717.74 | $3,455.87 | $4,196.47 | $2,844.25 | $5,215.80 | $2,622.52 | $4,349.12 | $4,638.22 | $3,922.30 | $2,215.10 |

| 36066 | $3,716.90 | $3,209.94 | $3,989.17 | $2,936.53 | $5,249.81 | $2,725.13 | $4,800.91 | $4,792.61 | $3,649.95 | $2,098.01 |

| 36762 | $3,716.70 | $3,382.06 | $4,177.51 | $2,898.22 | $5,248.20 | $2,622.52 | $4,432.37 | $4,638.22 | $3,868.86 | $2,182.34 |

| 35460 | $3,716.61 | $3,455.87 | $4,220.93 | $2,844.25 | $5,252.56 | $2,622.52 | $4,425.42 | $4,519.33 | $3,880.58 | $2,228.03 |

| 35185 | $3,716.20 | $3,480.38 | $4,292.87 | $2,755.36 | $5,209.14 | $2,638.17 | $4,343.63 | $5,249.97 | $3,297.45 | $2,178.84 |

| 36020 | $3,716.18 | $3,209.94 | $3,989.17 | $2,962.82 | $5,249.81 | $2,725.13 | $4,585.95 | $4,885.51 | $3,723.27 | $2,113.98 |

| 36763 | $3,715.97 | $3,455.87 | $4,177.51 | $2,898.22 | $5,356.37 | $2,622.52 | $4,432.37 | $4,638.22 | $3,647.51 | $2,215.10 |

| 36092 | $3,715.41 | $3,186.17 | $3,989.17 | $2,936.53 | $5,249.81 | $2,725.13 | $4,587.65 | $4,974.24 | $3,651.38 | $2,138.63 |

| 35901 | $3,714.71 | $3,333.81 | $4,429.42 | $2,815.70 | $5,158.14 | $2,606.85 | $4,547.00 | $5,132.58 | $3,367.24 | $2,041.69 |

| 35186 | $3,708.88 | $3,613.67 | $4,292.87 | $2,755.36 | $5,105.11 | $2,638.17 | $4,471.59 | $5,026.85 | $3,297.45 | $2,178.84 |

| 36908 | $3,708.52 | $3,318.68 | $4,366.98 | $2,898.22 | $5,399.79 | $2,622.52 | $4,421.30 | $4,401.26 | $3,732.81 | $2,215.10 |

| 36751 | $3,708.23 | $3,382.06 | $4,366.98 | $2,898.22 | $5,283.35 | $2,622.52 | $4,347.08 | $4,638.22 | $3,620.55 | $2,215.10 |

| 36006 | $3,707.94 | $3,209.35 | $3,989.17 | $2,659.13 | $5,533.93 | $2,647.23 | $4,511.11 | $4,863.69 | $3,795.74 | $2,162.16 |

| 36925 | $3,707.74 | $3,455.87 | $4,092.02 | $2,844.25 | $5,533.73 | $2,622.52 | $4,386.67 | $4,312.92 | $3,893.64 | $2,228.03 |

| 35491 | $3,707.73 | $3,281.68 | $4,317.03 | $2,844.25 | $5,203.93 | $2,624.62 | $4,386.49 | $4,519.33 | $3,964.24 | $2,228.03 |

| 36749 | $3,707.24 | $3,575.19 | $3,989.17 | $2,936.53 | $5,274.89 | $2,647.23 | $4,288.43 | $4,773.65 | $3,717.95 | $2,162.16 |

| 35464 | $3,706.92 | $3,281.68 | $4,220.93 | $2,844.25 | $5,252.56 | $2,622.52 | $4,512.78 | $4,518.92 | $3,880.58 | $2,228.03 |

| 35459 | $3,703.09 | $3,415.68 | $4,220.93 | $2,844.25 | $5,252.56 | $2,622.52 | $4,425.42 | $4,437.87 | $3,880.58 | $2,228.03 |

| 36726 | $3,702.75 | $3,422.61 | $4,366.98 | $2,898.22 | $5,300.26 | $2,622.52 | $4,347.08 | $4,531.44 | $3,620.55 | $2,215.10 |

| 35013 | $3,701.11 | $3,332.54 | $4,332.33 | $3,101.95 | $5,414.75 | $2,595.36 | $4,399.81 | $4,968.55 | $3,026.49 | $2,138.20 |

| 36022 | $3,701.09 | $3,209.35 | $3,989.17 | $2,936.53 | $5,249.81 | $2,725.13 | $4,748.18 | $4,880.32 | $3,457.33 | $2,113.98 |

| 36067 | $3,699.31 | $3,209.35 | $3,989.17 | $2,936.53 | $5,249.81 | $2,647.23 | $4,549.68 | $4,897.16 | $3,652.72 | $2,162.16 |

| 35187 | $3,696.93 | $3,463.78 | $4,292.87 | $2,755.36 | $5,040.03 | $2,566.07 | $4,427.98 | $5,249.97 | $3,297.45 | $2,178.84 |

| 35907 | $3,696.13 | $3,390.37 | $4,429.42 | $2,755.36 | $5,127.03 | $2,606.85 | $4,486.66 | $5,187.84 | $3,239.98 | $2,041.69 |

| 36776 | $3,695.24 | $3,281.68 | $4,196.47 | $2,931.23 | $5,303.16 | $2,624.62 | $4,767.50 | $4,494.57 | $3,429.86 | $2,228.03 |

| 36569 | $3,695.21 | $3,285.53 | $4,140.62 | $2,898.22 | $5,508.08 | $2,622.52 | $4,338.76 | $4,851.13 | $3,429.73 | $2,182.34 |

| 35051 | $3,692.57 | $3,505.45 | $4,292.87 | $2,755.36 | $5,017.58 | $2,566.07 | $4,471.59 | $5,186.42 | $3,258.96 | $2,178.84 |

| 36866 | $3,690.24 | $3,039.98 | $4,351.51 | $2,785.30 | $5,277.56 | $2,599.58 | $3,767.65 | $5,031.23 | $4,092.01 | $2,267.37 |

| 36435 | $3,688.90 | $3,422.61 | $4,366.98 | $2,898.22 | $5,283.35 | $2,622.52 | $4,218.53 | $4,552.22 | $3,620.55 | $2,215.10 |

| 36784 | $3,688.64 | $3,382.06 | $4,031.54 | $2,898.22 | $5,248.20 | $2,622.52 | $4,432.37 | $4,474.16 | $3,893.64 | $2,215.10 |

| 35903 | $3,688.00 | $3,270.71 | $4,429.42 | $2,755.36 | $5,158.14 | $2,757.55 | $3,939.67 | $5,285.91 | $3,553.59 | $2,041.69 |

| 36045 | $3,687.38 | $3,186.77 | $3,989.17 | $2,936.53 | $5,277.56 | $2,725.13 | $4,160.92 | $4,863.69 | $3,932.68 | $2,113.98 |

| 35083 | $3,687.24 | $3,242.65 | $4,233.77 | $3,105.37 | $5,121.52 | $2,618.81 | $4,427.80 | $4,695.87 | $3,597.91 | $2,141.48 |

| 35766 | $3,686.67 | $3,571.18 | $4,067.29 | $2,824.15 | $5,425.99 | $2,550.07 | $4,257.07 | $4,660.19 | $3,885.02 | $1,939.09 |

| 36051 | $3,685.25 | $3,186.17 | $3,989.17 | $2,936.53 | $5,249.81 | $2,647.23 | $4,356.23 | $4,724.66 | $3,932.68 | $2,144.81 |

| 35546 | $3,685.23 | $3,584.18 | $4,048.88 | $2,636.68 | $5,202.76 | $2,563.18 | $4,677.98 | $4,691.29 | $3,625.98 | $2,136.15 |

| 36008 | $3,683.06 | $3,209.35 | $3,989.17 | $2,936.53 | $5,249.81 | $2,647.23 | $4,293.91 | $4,863.69 | $3,795.74 | $2,162.16 |

| 35956 | $3,678.04 | $3,332.54 | $4,429.42 | $2,815.70 | $5,166.59 | $2,606.85 | $4,452.91 | $4,732.11 | $3,506.61 | $2,059.65 |

| 36024 | $3,677.93 | $3,120.73 | $3,989.17 | $2,936.53 | $5,249.67 | $2,725.13 | $4,160.92 | $4,953.49 | $3,780.05 | $2,185.63 |

| 36054 | $3,677.47 | $3,209.94 | $3,989.17 | $2,936.53 | $5,249.81 | $2,725.13 | $4,573.28 | $4,768.65 | $3,546.67 | $2,098.01 |

| 35035 | $3,677.10 | $3,647.52 | $3,930.21 | $2,931.23 | $5,566.93 | $2,542.09 | $4,155.12 | $4,300.73 | $3,874.40 | $2,145.70 |

| 36003 | $3,676.73 | $3,116.40 | $3,989.17 | $2,936.53 | $5,274.89 | $2,647.23 | $4,432.27 | $4,858.53 | $3,673.40 | $2,162.16 |

| 35120 | $3,674.05 | $3,385.01 | $4,238.96 | $2,755.36 | $5,516.49 | $2,595.36 | $4,317.70 | $4,748.19 | $3,424.46 | $2,084.91 |

| 35054 | $3,673.28 | $3,327.16 | $4,238.96 | $2,755.36 | $5,516.49 | $2,595.36 | $4,502.81 | $4,432.27 | $3,603.34 | $2,087.80 |

| 36029 | $3,670.62 | $3,052.20 | $3,798.78 | $2,963.81 | $5,423.26 | $2,682.45 | $4,183.09 | $5,159.35 | $3,505.31 | $2,267.37 |

| 36854 | $3,670.32 | $3,052.20 | $4,351.51 | $2,940.95 | $5,218.01 | $2,611.94 | $4,081.49 | $4,620.94 | $3,941.43 | $2,214.37 |

| 35183 | $3,670.24 | $3,400.95 | $4,196.47 | $2,659.13 | $5,464.76 | $2,611.94 | $4,086.65 | $4,587.91 | $3,912.23 | $2,112.08 |

| 35188 | $3,669.48 | $3,573.57 | $3,930.21 | $2,931.23 | $5,406.19 | $2,542.09 | $4,596.73 | $4,778.36 | $3,121.29 | $2,145.70 |

| 35057 | $3,669.46 | $3,242.65 | $4,233.77 | $3,105.37 | $5,374.55 | $2,618.81 | $4,314.58 | $4,653.34 | $3,323.74 | $2,158.36 |

| 36093 | $3,669.40 | $3,121.34 | $3,989.17 | $2,936.53 | $5,249.81 | $2,725.13 | $4,670.32 | $4,799.07 | $3,430.13 | $2,103.13 |

| 35034 | $3,668.76 | $3,562.86 | $3,930.21 | $2,931.23 | $5,702.59 | $2,542.09 | $4,523.87 | $3,863.14 | $3,817.13 | $2,145.70 |

| 36274 | $3,668.39 | $3,039.98 | $4,351.51 | $2,940.95 | $5,267.85 | $2,611.94 | $4,176.38 | $4,640.67 | $3,945.39 | $2,040.81 |

| 35577 | $3,667.48 | $3,132.56 | $4,153.63 | $2,636.68 | $5,535.04 | $2,953.04 | $4,295.32 | $4,337.85 | $3,836.38 | $2,126.79 |

| 35125 | $3,666.80 | $3,375.23 | $4,238.96 | $2,755.36 | $5,516.49 | $2,595.36 | $4,356.58 | $4,659.85 | $3,415.56 | $2,087.80 |

| 36201 | $3,665.82 | $3,350.37 | $4,021.79 | $2,755.36 | $5,127.03 | $2,793.59 | $4,188.94 | $4,707.24 | $4,001.70 | $2,046.33 |

| 35448 | $3,663.66 | $3,281.68 | $3,931.74 | $2,931.23 | $5,203.93 | $2,624.62 | $4,386.49 | $4,519.33 | $3,865.93 | $2,228.03 |

| 36436 | $3,662.01 | $3,318.68 | $4,031.54 | $2,898.22 | $5,283.35 | $2,622.52 | $4,211.71 | $4,623.36 | $3,786.42 | $2,182.34 |

| 35447 | $3,661.46 | $3,313.18 | $4,196.47 | $2,844.25 | $5,207.79 | $2,563.18 | $4,293.54 | $4,557.55 | $3,840.99 | $2,136.15 |

| 36047 | $3,661.35 | $3,186.19 | $4,177.51 | $2,936.53 | $5,218.19 | $2,622.52 | $4,360.27 | $4,656.96 | $3,652.14 | $2,141.81 |

| 35953 | $3,661.06 | $3,411.49 | $4,332.33 | $2,815.70 | $5,439.32 | $2,595.36 | $4,492.31 | $4,592.21 | $3,185.90 | $2,084.91 |

| 35575 | $3,660.21 | $3,132.56 | $4,153.63 | $2,636.68 | $5,535.04 | $2,953.04 | $4,156.78 | $4,411.01 | $3,836.38 | $2,126.79 |

| 36792 | $3,660.02 | $3,519.51 | $3,930.21 | $2,931.23 | $5,517.04 | $2,542.09 | $4,214.16 | $4,271.19 | $3,869.06 | $2,145.70 |

| 36053 | $3,658.61 | $3,052.20 | $3,766.72 | $2,963.81 | $5,113.95 | $2,682.45 | $4,234.98 | $4,951.04 | $3,895.01 | $2,267.37 |

| 35442 | $3,657.22 | $3,313.18 | $4,196.47 | $2,844.25 | $5,207.79 | $2,563.18 | $4,425.42 | $4,320.16 | $3,908.39 | $2,136.15 |

| 36276 | $3,655.41 | $3,039.98 | $4,351.51 | $2,940.95 | $5,338.08 | $2,611.94 | $3,923.95 | $4,479.95 | $4,171.54 | $2,040.81 |

| 36548 | $3,655.11 | $3,285.53 | $4,140.62 | $2,898.22 | $5,170.67 | $2,622.52 | $4,338.76 | $4,827.62 | $3,429.73 | $2,182.34 |

| 35751 | $3,653.69 | $3,320.26 | $4,067.29 | $2,704.15 | $5,425.99 | $2,550.07 | $4,101.21 | $4,864.95 | $3,910.21 | $1,939.09 |

| 36855 | $3,653.08 | $3,039.98 | $4,351.51 | $2,940.95 | $5,267.85 | $2,611.94 | $3,956.70 | $4,641.88 | $3,852.53 | $2,214.37 |

| 36758 | $3,652.61 | $3,552.02 | $4,085.26 | $2,931.23 | $5,224.64 | $2,624.62 | $4,472.71 | $4,746.41 | $3,066.00 | $2,170.56 |

| 35810 | $3,652.13 | $3,181.92 | $3,887.93 | $2,704.15 | $5,011.74 | $2,692.23 | $4,552.98 | $5,465.89 | $3,233.77 | $2,138.54 |

| 36091 | $3,651.26 | $3,186.17 | $4,030.06 | $2,936.53 | $5,474.82 | $2,592.92 | $4,574.38 | $4,121.22 | $3,799.56 | $2,145.70 |

| 36559 | $3,650.79 | $3,085.80 | $4,081.48 | $2,775.18 | $5,534.88 | $2,480.83 | $4,531.94 | $4,253.49 | $4,205.32 | $1,908.19 |

| 36515 | $3,649.65 | $3,285.53 | $4,031.54 | $2,898.22 | $5,170.67 | $2,622.52 | $4,260.82 | $4,638.22 | $3,757.02 | $2,182.34 |

| 36046 | $3,649.44 | $3,186.19 | $4,218.25 | $2,963.81 | $5,218.19 | $2,622.52 | $4,236.28 | $4,555.97 | $3,701.95 | $2,141.81 |

| 36526 | $3,648.19 | $3,222.23 | $4,081.48 | $2,775.18 | $5,534.88 | $2,480.83 | $4,531.94 | $4,434.28 | $3,824.53 | $1,948.38 |

| 36260 | $3,648.11 | $3,270.71 | $4,021.79 | $2,659.13 | $5,127.03 | $2,793.59 | $4,424.78 | $5,048.98 | $3,440.66 | $2,046.33 |

| 36862 | $3,647.72 | $3,039.98 | $4,351.51 | $2,940.95 | $5,132.68 | $2,611.94 | $3,898.30 | $4,818.52 | $3,821.19 | $2,214.37 |

| 35808 | $3,646.68 | $3,223.94 | $3,922.05 | $2,590.69 | $4,893.46 | $2,805.90 | $4,514.57 | $5,253.16 | $3,612.14 | $2,004.19 |

| 35540 | $3,645.79 | $3,133.40 | $4,011.17 | $3,101.95 | $5,223.73 | $2,953.04 | $4,399.58 | $4,444.33 | $3,418.11 | $2,126.79 |

| 35545 | $3,644.56 | $3,337.06 | $4,323.33 | $2,931.23 | $5,202.76 | $2,563.18 | $4,161.99 | $4,519.33 | $3,625.98 | $2,136.15 |

| 36451 | $3,644.53 | $3,318.68 | $4,031.54 | $2,898.22 | $5,170.67 | $2,622.52 | $4,211.71 | $4,578.70 | $3,786.42 | $2,182.34 |

| 36863 | $3,643.15 | $3,052.20 | $4,351.51 | $2,940.95 | $5,218.01 | $2,611.94 | $3,986.23 | $4,554.55 | $3,858.61 | $2,214.37 |

| 35471 | $3,642.90 | $3,337.06 | $4,220.93 | $2,931.23 | $5,207.79 | $2,563.18 | $4,230.57 | $4,519.33 | $3,639.84 | $2,136.15 |

| 36206 | $3,641.86 | $3,306.98 | $4,021.79 | $2,755.36 | $5,127.03 | $2,793.59 | $4,152.26 | $4,543.40 | $4,080.35 | $1,996.00 |

| 36790 | $3,641.83 | $3,615.40 | $4,030.06 | $2,931.23 | $5,224.64 | $2,592.92 | $4,316.94 | $4,300.73 | $3,618.89 | $2,145.70 |

| 35741 | $3,640.76 | $3,541.81 | $3,956.49 | $2,590.69 | $4,703.46 | $2,640.07 | $4,786.49 | $5,498.93 | $2,948.43 | $2,100.45 |

| 36527 | $3,639.31 | $3,299.48 | $4,081.48 | $2,775.18 | $5,458.89 | $2,480.83 | $4,520.00 | $4,443.16 | $3,691.25 | $2,003.52 |

| 35745 | $3,639.24 | $3,264.30 | $4,067.29 | $2,704.15 | $5,425.99 | $2,550.07 | $4,257.07 | $4,660.19 | $3,885.02 | $1,939.09 |

| 35461 | $3,639.22 | $3,313.18 | $4,048.88 | $2,636.68 | $5,207.79 | $2,563.18 | $4,230.57 | $4,690.03 | $3,926.47 | $2,136.15 |

| 36750 | $3,639.07 | $3,179.77 | $4,030.06 | $2,931.23 | $5,533.93 | $2,592.92 | $4,279.17 | $4,394.64 | $3,664.25 | $2,145.70 |

| 35776 | $3,638.67 | $3,320.26 | $4,067.29 | $2,824.15 | $5,425.99 | $2,550.07 | $3,984.35 | $4,974.12 | $3,662.74 | $1,939.09 |

| 36545 | $3,638.39 | $3,285.53 | $3,769.25 | $2,898.22 | $5,170.67 | $2,622.52 | $4,260.82 | $5,126.45 | $3,429.73 | $2,182.34 |

| 35764 | $3,638.32 | $3,597.76 | $4,067.29 | $2,637.11 | $5,425.99 | $2,550.07 | $4,101.21 | $4,660.19 | $3,766.20 | $1,939.09 |

| 35760 | $3,636.44 | $3,597.76 | $4,143.90 | $2,637.11 | $4,919.30 | $2,640.07 | $4,596.39 | $4,843.98 | $3,248.96 | $2,100.45 |

| 35055 | $3,634.26 | $3,308.87 | $4,233.77 | $3,105.37 | $5,121.52 | $2,618.81 | $4,126.35 | $4,890.04 | $3,162.10 | $2,141.48 |

| 36062 | $3,634.09 | $3,186.19 | $3,732.17 | $2,643.85 | $5,132.81 | $2,622.52 | $4,752.53 | $4,638.22 | $3,856.71 | $2,141.81 |

| 36253 | $3,634.08 | $3,270.71 | $4,021.79 | $2,940.95 | $5,127.03 | $2,793.59 | $4,424.78 | $4,608.14 | $3,503.40 | $2,016.36 |

| 36793 | $3,631.67 | $3,179.77 | $3,930.21 | $2,931.23 | $5,207.75 | $2,542.09 | $4,578.52 | $4,300.73 | $3,869.06 | $2,145.70 |

| 35816 | $3,631.10 | $3,237.32 | $3,887.93 | $2,590.69 | $5,005.13 | $2,692.23 | $4,691.79 | $5,254.51 | $3,220.62 | $2,099.65 |

| 35952 | $3,629.68 | $3,332.54 | $4,022.72 | $2,637.11 | $5,040.16 | $2,595.36 | $4,608.69 | $4,823.35 | $3,468.96 | $2,138.20 |

| 35045 | $3,629.66 | $3,452.85 | $4,030.06 | $2,659.13 | $5,474.82 | $2,592.92 | $4,409.67 | $4,172.75 | $3,729.06 | $2,145.70 |

| 35768 | $3,629.57 | $3,470.90 | $4,067.29 | $2,824.15 | $5,370.73 | $2,550.07 | $3,891.21 | $4,720.83 | $3,831.87 | $1,939.09 |

| 36089 | $3,628.39 | $3,052.20 | $3,766.72 | $2,963.81 | $5,113.95 | $2,682.45 | $4,121.09 | $5,001.80 | $3,686.10 | $2,267.37 |

| 35042 | $3,627.65 | $3,562.86 | $3,930.21 | $2,931.23 | $5,566.93 | $2,542.09 | $4,077.61 | $3,984.89 | $3,907.37 | $2,145.70 |

| 35466 | $3,627.25 | $3,337.06 | $4,196.47 | $2,844.25 | $5,207.79 | $2,563.18 | $4,318.39 | $4,402.15 | $3,639.84 | $2,136.15 |

| 36482 | $3,627.18 | $3,318.68 | $4,031.54 | $2,898.22 | $4,948.66 | $2,622.52 | $4,133.77 | $4,722.51 | $3,786.42 | $2,182.34 |

| 36425 | $3,626.77 | $3,359.23 | $4,010.45 | $2,898.22 | $5,300.26 | $2,622.52 | $4,197.46 | $4,627.12 | $3,443.37 | $2,182.34 |

| 36078 | $3,626.57 | $3,121.34 | $3,989.17 | $2,936.53 | $5,277.56 | $2,611.94 | $4,160.92 | $4,560.15 | $3,877.29 | $2,104.25 |

| 35128 | $3,626.26 | $3,446.22 | $4,238.96 | $2,755.36 | $5,516.49 | $2,595.36 | $4,356.58 | $4,477.65 | $3,161.96 | $2,087.80 |

| 35044 | $3,624.71 | $3,363.43 | $3,931.74 | $2,659.13 | $5,432.14 | $2,611.94 | $4,230.16 | $4,793.81 | $3,524.04 | $2,076.01 |

| 36032 | $3,624.47 | $3,186.19 | $4,218.25 | $2,692.64 | $5,218.19 | $2,622.52 | $4,321.33 | $4,567.13 | $3,652.14 | $2,141.81 |

| 36268 | $3,623.03 | $3,363.43 | $3,931.74 | $2,659.13 | $5,179.09 | $2,611.94 | $4,307.13 | $4,699.27 | $3,785.75 | $2,069.83 |

| 36480 | $3,622.89 | $3,285.53 | $4,010.45 | $2,898.22 | $5,018.05 | $2,622.52 | $4,195.99 | $4,706.53 | $3,686.35 | $2,182.34 |

| 36439 | $3,622.23 | $3,359.23 | $4,384.52 | $2,898.22 | $4,995.51 | $2,622.52 | $4,076.15 | $4,638.22 | $3,443.37 | $2,182.34 |

| 36865 | $3,622.00 | $3,052.20 | $4,092.02 | $2,931.23 | $5,353.58 | $2,534.30 | $3,974.25 | $4,519.33 | $3,941.43 | $2,199.67 |

| 35040 | $3,618.28 | $3,377.17 | $4,199.09 | $2,755.36 | $4,989.46 | $2,566.07 | $4,467.45 | $4,979.24 | $3,015.09 | $2,215.58 |

| 35774 | $3,617.96 | $3,320.26 | $4,067.29 | $2,704.15 | $5,425.99 | $2,550.07 | $3,984.35 | $4,660.19 | $3,910.21 | $1,939.09 |

| 36262 | $3,617.21 | $3,104.00 | $3,931.74 | $2,940.95 | $5,257.77 | $2,611.94 | $4,111.73 | $4,421.87 | $4,134.09 | $2,040.81 |

| 35096 | $3,616.74 | $3,327.16 | $3,931.74 | $2,755.36 | $5,516.49 | $2,611.94 | $4,316.90 | $4,410.60 | $3,610.69 | $2,069.83 |

| 35755 | $3,616.12 | $3,399.91 | $4,067.29 | $2,824.15 | $5,341.65 | $2,550.07 | $3,992.73 | $4,660.19 | $3,770.03 | $1,939.09 |

| 36023 | $3,615.98 | $3,055.95 | $3,989.17 | $2,931.23 | $5,277.80 | $2,611.94 | $4,332.80 | $4,519.33 | $3,734.13 | $2,091.46 |

| 35046 | $3,615.70 | $3,400.95 | $4,030.06 | $2,659.13 | $5,474.82 | $2,592.92 | $4,501.41 | $4,180.03 | $3,556.29 | $2,145.70 |

| 35136 | $3,613.92 | $3,424.95 | $4,196.47 | $2,659.13 | $5,384.27 | $2,611.94 | $4,173.14 | $4,314.38 | $3,648.95 | $2,112.08 |

| 35805 | $3,613.86 | $3,237.61 | $3,887.93 | $2,590.69 | $4,996.67 | $2,805.90 | $4,274.15 | $5,189.97 | $3,352.73 | $2,189.09 |

| 35481 | $3,613.32 | $3,313.18 | $4,196.47 | $2,636.68 | $5,207.79 | $2,563.18 | $4,171.18 | $4,539.11 | $3,756.12 | $2,136.15 |

| 35087 | $3,612.70 | $3,363.45 | $4,233.77 | $2,637.11 | $5,121.52 | $2,618.81 | $4,593.96 | $4,625.37 | $3,178.81 | $2,141.48 |

| 35032 | $3,612.62 | $3,363.43 | $3,931.74 | $2,931.23 | $5,366.20 | $2,611.94 | $4,230.16 | $4,478.85 | $3,524.04 | $2,076.01 |

| 35553 | $3,611.80 | $3,132.56 | $4,153.63 | $2,636.68 | $5,504.90 | $2,953.04 | $4,253.04 | $4,327.44 | $3,418.11 | $2,126.79 |

| 35987 | $3,611.64 | $3,317.41 | $4,332.33 | $2,637.11 | $5,158.14 | $2,595.36 | $4,253.44 | $4,788.59 | $3,337.43 | $2,084.91 |

| 36203 | $3,611.20 | $3,306.98 | $4,021.79 | $2,659.13 | $5,127.03 | $2,793.59 | $4,274.89 | $4,816.96 | $3,454.11 | $2,046.33 |

| 35572 | $3,610.49 | $3,132.56 | $4,153.63 | $2,636.68 | $5,223.73 | $2,953.04 | $4,253.04 | $4,535.18 | $3,479.79 | $2,126.79 |

| 36207 | $3,610.24 | $3,290.43 | $4,021.79 | $2,659.13 | $5,127.03 | $2,793.59 | $4,334.82 | $4,794.70 | $3,460.44 | $2,010.24 |

| 36257 | $3,610.07 | $3,290.43 | $4,021.79 | $2,940.95 | $5,127.03 | $2,793.59 | $4,188.94 | $4,608.14 | $3,503.40 | $2,016.36 |

| 36250 | $3,607.96 | $3,270.71 | $4,021.79 | $2,755.36 | $5,127.03 | $2,793.59 | $4,268.42 | $4,714.94 | $3,503.40 | $2,016.36 |

| 36277 | $3,607.93 | $3,254.15 | $4,021.79 | $2,755.36 | $5,127.03 | $2,793.59 | $4,212.88 | $4,568.66 | $3,721.53 | $2,016.36 |

| 36026 | $3,607.88 | $3,186.17 | $4,196.47 | $2,936.53 | $5,169.30 | $2,611.94 | $4,086.26 | $4,438.08 | $3,734.13 | $2,112.08 |

| 36080 | $3,607.39 | $3,186.17 | $3,989.17 | $2,659.13 | $5,249.81 | $2,725.13 | $4,491.92 | $4,743.05 | $3,283.51 | $2,138.63 |

| 36271 | $3,606.63 | $3,386.63 | $4,021.79 | $2,815.70 | $5,127.03 | $2,793.59 | $4,336.05 | $4,557.34 | $3,405.15 | $2,016.36 |

| 36852 | $3,605.78 | $3,052.20 | $4,351.51 | $2,940.95 | $5,218.01 | $2,611.94 | $3,939.57 | $4,445.06 | $3,693.15 | $2,199.67 |

| 35576 | $3,604.46 | $3,268.80 | $4,048.88 | $2,636.68 | $5,207.79 | $2,563.18 | $4,086.17 | $4,584.07 | $3,908.38 | $2,136.15 |

| 35542 | $3,604.43 | $3,406.21 | $4,048.88 | $2,636.68 | $5,202.76 | $2,563.18 | $4,195.70 | $4,624.33 | $3,625.98 | $2,136.15 |

| 35966 | $3,604.09 | $3,181.78 | $4,017.75 | $2,824.15 | $5,303.18 | $2,550.07 | $4,291.36 | $4,466.29 | $3,827.07 | $1,975.20 |

| 35115 | $3,602.92 | $3,463.78 | $4,199.09 | $2,755.36 | $5,040.03 | $2,566.07 | $4,395.75 | $4,721.86 | $2,978.83 | $2,305.52 |

| 35759 | $3,602.90 | $3,541.81 | $3,956.49 | $2,590.69 | $4,927.69 | $2,692.23 | $4,654.70 | $5,199.41 | $2,882.43 | $1,980.68 |

| 35171 | $3,601.57 | $3,116.40 | $4,030.06 | $2,931.23 | $5,517.04 | $2,592.92 | $4,262.29 | $4,313.99 | $3,504.51 | $2,145.70 |

| 35763 | $3,600.93 | $3,293.28 | $4,011.47 | $2,637.11 | $4,723.55 | $2,640.07 | $4,786.49 | $5,464.13 | $2,751.87 | $2,100.45 |

| 35179 | $3,600.91 | $3,085.50 | $4,233.77 | $2,637.11 | $5,093.39 | $2,618.81 | $4,161.65 | $4,820.10 | $3,599.47 | $2,158.36 |

| 36454 | $3,600.27 | $3,359.23 | $4,149.96 | $2,898.22 | $4,995.51 | $2,622.52 | $4,128.91 | $4,638.22 | $3,427.52 | $2,182.34 |

| 36473 | $3,600.27 | $3,359.23 | $4,149.96 | $2,898.22 | $4,995.51 | $2,622.52 | $4,128.91 | $4,638.22 | $3,427.52 | $2,182.34 |

| 36850 | $3,599.67 | $3,039.98 | $4,351.51 | $2,785.30 | $5,353.58 | $2,611.94 | $3,896.93 | $4,434.49 | $3,819.05 | $2,104.25 |

| 35085 | $3,598.47 | $3,424.14 | $4,030.06 | $2,931.23 | $5,517.04 | $2,592.92 | $4,433.13 | $4,190.73 | $3,121.29 | $2,145.70 |

| 35958 | $3,598.35 | $3,181.78 | $4,067.29 | $2,824.15 | $5,303.18 | $2,550.07 | $4,089.51 | $4,603.04 | $3,827.07 | $1,939.09 |

| 35772 | $3,596.90 | $3,181.78 | $4,067.29 | $2,824.15 | $5,303.18 | $2,550.07 | $4,068.71 | $4,701.44 | $3,736.36 | $1,939.09 |

| 36269 | $3,596.87 | $3,039.20 | $3,931.74 | $2,940.95 | $5,257.77 | $2,611.94 | $3,936.51 | $4,478.85 | $4,134.09 | $2,040.81 |

| 35643 | $3,596.44 | $3,070.16 | $4,054.05 | $2,637.11 | $5,197.04 | $2,513.84 | $4,217.10 | $4,584.58 | $3,967.28 | $2,126.79 |

| 35765 | $3,596.27 | $3,181.78 | $4,017.75 | $2,824.15 | $5,303.18 | $2,550.07 | $4,237.10 | $4,661.03 | $3,652.26 | $1,939.09 |

| 36540 | $3,595.48 | $3,285.53 | $4,031.54 | $2,898.22 | $5,058.24 | $2,622.52 | $4,213.02 | $4,638.22 | $3,429.73 | $2,182.34 |

| 35899 | $3,595.37 | $3,237.32 | $3,887.93 | $2,590.69 | $5,005.13 | $2,692.23 | $4,691.79 | $5,005.64 | $3,243.45 | $2,004.19 |

| 35959 | $3,594.82 | $3,110.79 | $4,017.75 | $2,824.15 | $5,363.34 | $2,550.07 | $3,814.31 | $4,347.40 | $4,350.35 | $1,975.20 |

| 35744 | $3,593.72 | $3,174.98 | $4,067.29 | $2,824.15 | $5,303.18 | $2,550.07 | $4,100.82 | $4,630.35 | $3,753.58 | $1,939.09 |

| 36279 | $3,593.66 | $3,350.37 | $4,021.79 | $2,755.36 | $5,127.03 | $2,793.59 | $4,369.79 | $4,587.85 | $3,387.16 | $1,950.00 |

| 35761 | $3,592.36 | $3,541.81 | $4,143.90 | $2,704.15 | $4,961.79 | $2,640.07 | $4,436.37 | $4,797.24 | $3,132.04 | $1,973.89 |

| 35019 | $3,592.16 | $3,242.65 | $4,233.77 | $2,637.11 | $5,121.52 | $2,618.81 | $4,367.20 | $4,481.14 | $3,485.81 | $2,141.48 |

| 35618 | $3,590.76 | $3,070.16 | $4,054.05 | $2,637.11 | $5,253.27 | $2,513.84 | $4,197.86 | $4,463.01 | $4,000.79 | $2,126.79 |

| 35771 | $3,590.24 | $3,290.45 | $4,017.75 | $2,824.15 | $5,447.70 | $2,550.07 | $3,936.59 | $4,552.76 | $3,753.58 | $1,939.09 |

| 35650 | $3,589.54 | $3,132.56 | $4,054.05 | $2,637.11 | $5,197.04 | $2,513.84 | $4,295.21 | $4,623.59 | $3,725.70 | $2,126.79 |

| 36481 | $3,589.51 | $3,359.23 | $4,010.45 | $2,898.22 | $4,976.78 | $2,622.52 | $4,197.46 | $4,615.20 | $3,443.37 | $2,182.34 |

| 36027 | $3,588.61 | $3,049.88 | $4,218.25 | $2,963.81 | $5,046.57 | $2,547.96 | $4,105.70 | $4,501.59 | $3,743.65 | $2,120.05 |

| 36445 | $3,586.64 | $3,359.23 | $4,010.45 | $2,898.22 | $4,995.51 | $2,622.52 | $4,128.91 | $4,639.19 | $3,443.37 | $2,182.34 |

| 35746 | $3,585.84 | $3,332.42 | $4,067.29 | $2,824.15 | $5,425.99 | $2,550.07 | $4,068.71 | $4,588.41 | $3,476.47 | $1,939.09 |

| 35979 | $3,585.70 | $3,181.78 | $3,913.45 | $2,824.15 | $5,303.18 | $2,550.07 | $4,072.31 | $4,660.19 | $3,827.07 | $1,939.09 |

| 35976 | $3,584.39 | $3,372.02 | $4,018.67 | $2,637.11 | $5,040.16 | $2,494.29 | $4,151.69 | $5,194.43 | $3,270.45 | $2,080.64 |

| 35089 | $3,584.34 | $3,120.73 | $4,196.47 | $2,936.53 | $5,328.03 | $2,611.94 | $3,837.90 | $4,283.08 | $3,852.89 | $2,091.46 |

| 35750 | $3,584.13 | $3,541.81 | $4,143.90 | $2,704.15 | $4,928.91 | $2,640.07 | $4,436.37 | $4,662.12 | $3,148.96 | $2,050.91 |

| 35574 | $3,582.98 | $3,313.18 | $4,048.88 | $2,636.68 | $5,207.79 | $2,563.18 | $4,217.92 | $4,510.29 | $3,612.76 | $2,136.15 |

| 36041 | $3,582.78 | $3,186.19 | $3,766.72 | $2,643.85 | $5,218.19 | $2,622.52 | $4,360.27 | $4,582.65 | $3,722.80 | $2,141.81 |

| 36542 | $3,582.29 | $3,119.74 | $4,049.14 | $2,617.82 | $5,214.18 | $2,480.83 | $4,348.30 | $4,221.16 | $4,205.32 | $1,984.13 |

| 36471 | $3,582.02 | $3,359.23 | $4,010.45 | $2,898.22 | $4,993.67 | $2,622.52 | $4,090.16 | $4,638.22 | $3,443.37 | $2,182.34 |

| 36205 | $3,581.98 | $3,290.43 | $4,021.79 | $2,659.13 | $5,067.91 | $2,793.59 | $4,126.94 | $4,470.82 | $3,796.95 | $2,010.24 |

| 36256 | $3,580.87 | $3,056.54 | $3,931.74 | $2,940.95 | $5,338.08 | $2,611.94 | $3,801.67 | $4,499.35 | $3,956.13 | $2,091.46 |

| 35151 | $3,579.90 | $3,400.95 | $4,196.47 | $2,659.13 | $5,384.27 | $2,611.94 | $4,050.80 | $4,538.59 | $3,300.97 | $2,076.01 |

| 35962 | $3,578.55 | $3,181.78 | $3,913.45 | $2,824.15 | $5,194.63 | $2,550.07 | $4,147.97 | $4,793.40 | $3,626.27 | $1,975.20 |

| 36444 | $3,578.38 | $3,359.23 | $4,010.45 | $2,898.22 | $4,976.78 | $2,622.52 | $4,133.77 | $4,578.77 | $3,443.37 | $2,182.34 |

| 36071 | $3,577.53 | $3,112.38 | $3,766.72 | $2,643.85 | $5,218.19 | $2,622.52 | $4,197.34 | $4,638.22 | $3,856.71 | $2,141.81 |

| 35960 | $3,576.57 | $3,104.00 | $4,017.75 | $2,824.15 | $5,363.34 | $2,550.07 | $3,987.96 | $4,347.40 | $4,019.25 | $1,975.20 |

| 35058 | $3,576.38 | $3,242.65 | $4,233.77 | $2,637.11 | $5,121.52 | $2,618.81 | $3,981.35 | $5,037.83 | $3,172.90 | $2,141.48 |

| 35767 | $3,574.42 | $3,237.32 | $3,732.22 | $2,637.11 | $4,730.87 | $2,692.23 | $4,148.97 | $5,005.64 | $3,885.02 | $2,100.45 |

| 36853 | $3,573.41 | $3,039.98 | $4,351.51 | $2,785.30 | $5,277.80 | $2,611.94 | $3,801.67 | $4,204.26 | $3,984.00 | $2,104.25 |

| 35980 | $3,571.76 | $3,332.54 | $4,018.67 | $2,637.11 | $5,040.16 | $2,595.36 | $4,151.69 | $4,886.00 | $3,346.11 | $2,138.20 |

| 35975 | $3,570.97 | $3,150.90 | $3,913.45 | $2,824.15 | $5,447.70 | $2,550.07 | $3,984.30 | $4,507.23 | $3,785.75 | $1,975.20 |

| 35983 | $3,570.93 | $3,254.15 | $4,017.75 | $2,824.15 | $5,363.34 | $2,550.07 | $4,097.28 | $4,331.00 | $3,725.44 | $1,975.20 |

| 36049 | $3,570.88 | $3,186.19 | $3,766.72 | $2,643.85 | $5,132.81 | $2,622.52 | $4,334.00 | $4,453.32 | $3,856.71 | $2,141.81 |

| 36475 | $3,569.80 | $3,359.23 | $4,149.96 | $2,692.64 | $4,995.51 | $2,622.52 | $4,128.91 | $4,553.75 | $3,443.37 | $2,182.34 |

| 36429 | $3,569.72 | $3,359.23 | $4,149.96 | $2,692.64 | $4,995.51 | $2,622.52 | $4,059.58 | $4,638.22 | $3,427.52 | $2,182.34 |

| 36264 | $3,569.53 | $3,104.00 | $3,931.74 | $2,940.95 | $5,191.83 | $2,611.94 | $4,124.78 | $4,457.61 | $3,722.11 | $2,040.81 |

| 36460 | $3,568.48 | $3,359.23 | $4,010.45 | $2,898.22 | $4,995.51 | $2,622.52 | $4,076.15 | $4,528.58 | $3,443.37 | $2,182.34 |

| 36449 | $3,568.02 | $3,359.23 | $4,031.54 | $2,898.22 | $4,995.51 | $2,622.52 | $3,941.26 | $4,638.22 | $3,443.37 | $2,182.34 |