Best Mesquite, Texas Car Insurance (2025)

The cheapest Mesquite, Texas car insurance quotes and the best car insurance coverage in Mesquite, Texas comes from USAA. The cheapest zip code in Mesquite is 75150 at an average rate of $520/ mo. However many factors such as your age, gender, and driving history could help this rate go down.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed life insurance agent with 23 years of experience helping people protect their families and businesses with term life insurance. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Mesquite, TX City Summary | Stats |

|---|---|

| Population | 144,118 |

| Density | 3,047 per square mile |

| Average Cost of Car Insurance | $3,928.33 |

| Cheapest Car Insurance | $2,488.12 |

| Road Conditions | Mediocre |

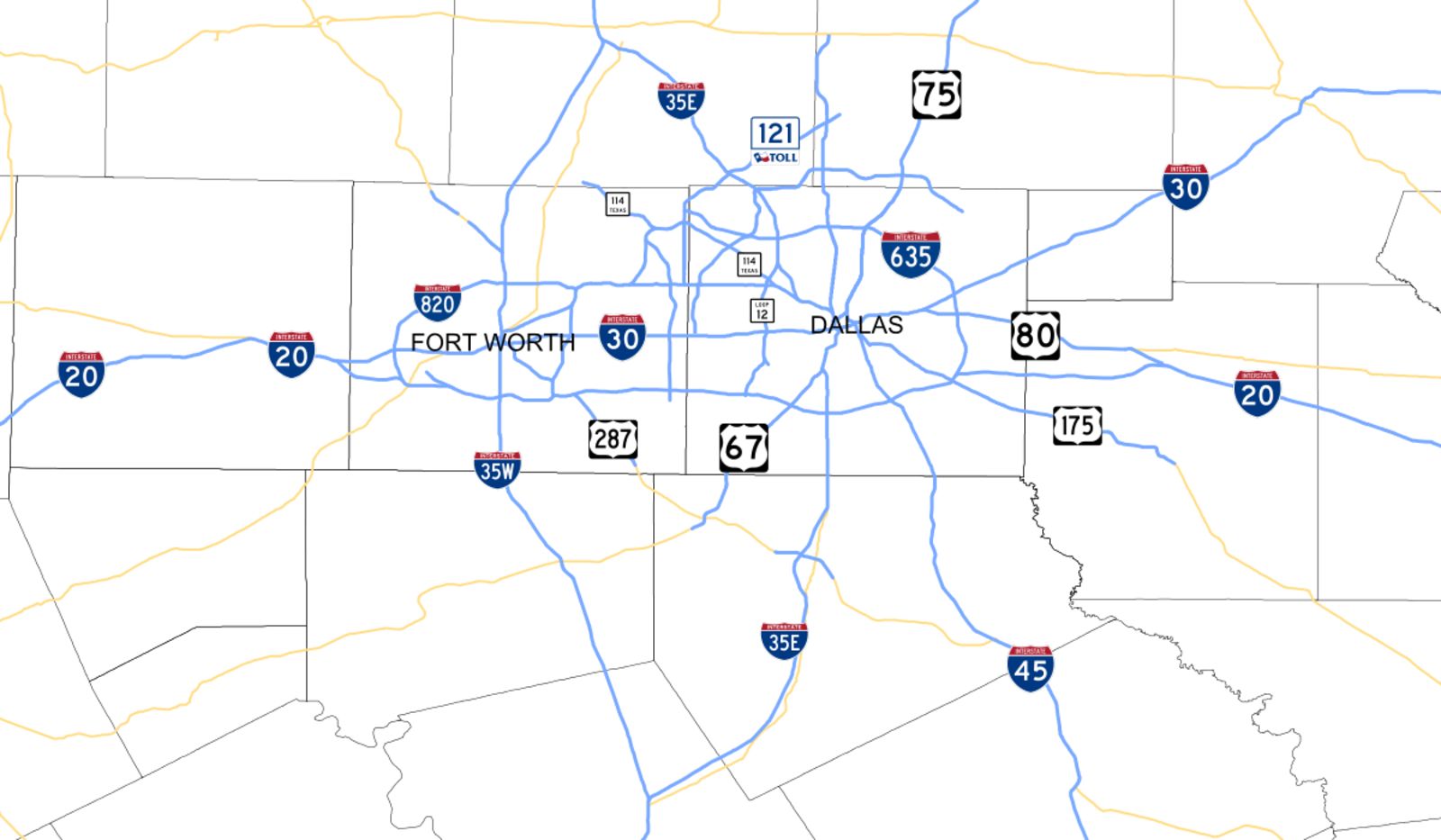

Due east about 15 miles of Dallas lies the suburban city of Mesquite. At the crossroads of four major highways in Texas, Interstates 30, 635, 20, and U.S. Route 80, locations such as downtown Dallas, Lake Ray Hubbard, Dallas Love Field, and Dallas/Fort-Worth International Airport are easily accessible.

Settled in 1878, Mesquite was home to many outlaws. One of the most well-known is Sam Bass who was infamous for train robberies in all of Texas. One robbery was said to be worth up to 60,000 dollars.

Later, in the mid to late 1900s, Mesquite became widely popular for its rodeo. The rodeo still gives Mesquite its esteem to this day, it is broadcast on ESPN yearly.

Cowboys and outlaws usually have no qualms about car insurance, but suburban Mesquite certainly does.

Car Insurance in Mesquite, Texas

Car insurance is a dramatic difference in excitement compared to the rodeo, but Mesquite like all towns, must obey the laws and be informed about what insurance is the best for what situation.

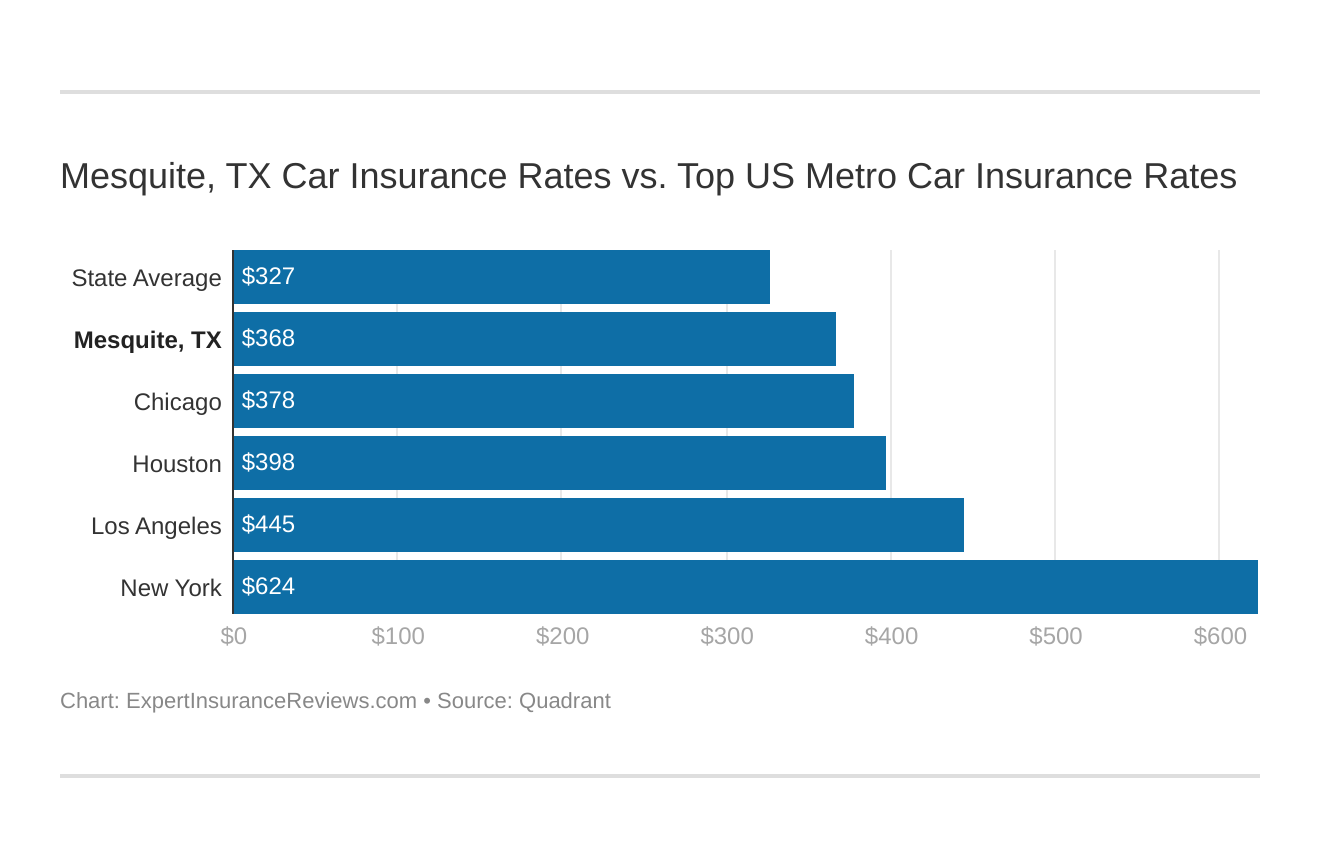

You might find yourself asking how does my Mesquite, TX stack up against other top metro auto insurance rates? We’ve got your answer below.

In this article, we’ll help to educate you on auto insurance in Mesquite and help you get to know the facts of the city just east of Dallas.

If you’re thinking of moving to be closer to the rodeo or already live there, we’ll help you understand what car insurance you must have, what rates are best, and what companies are best.

Male vs. Female vs. Age

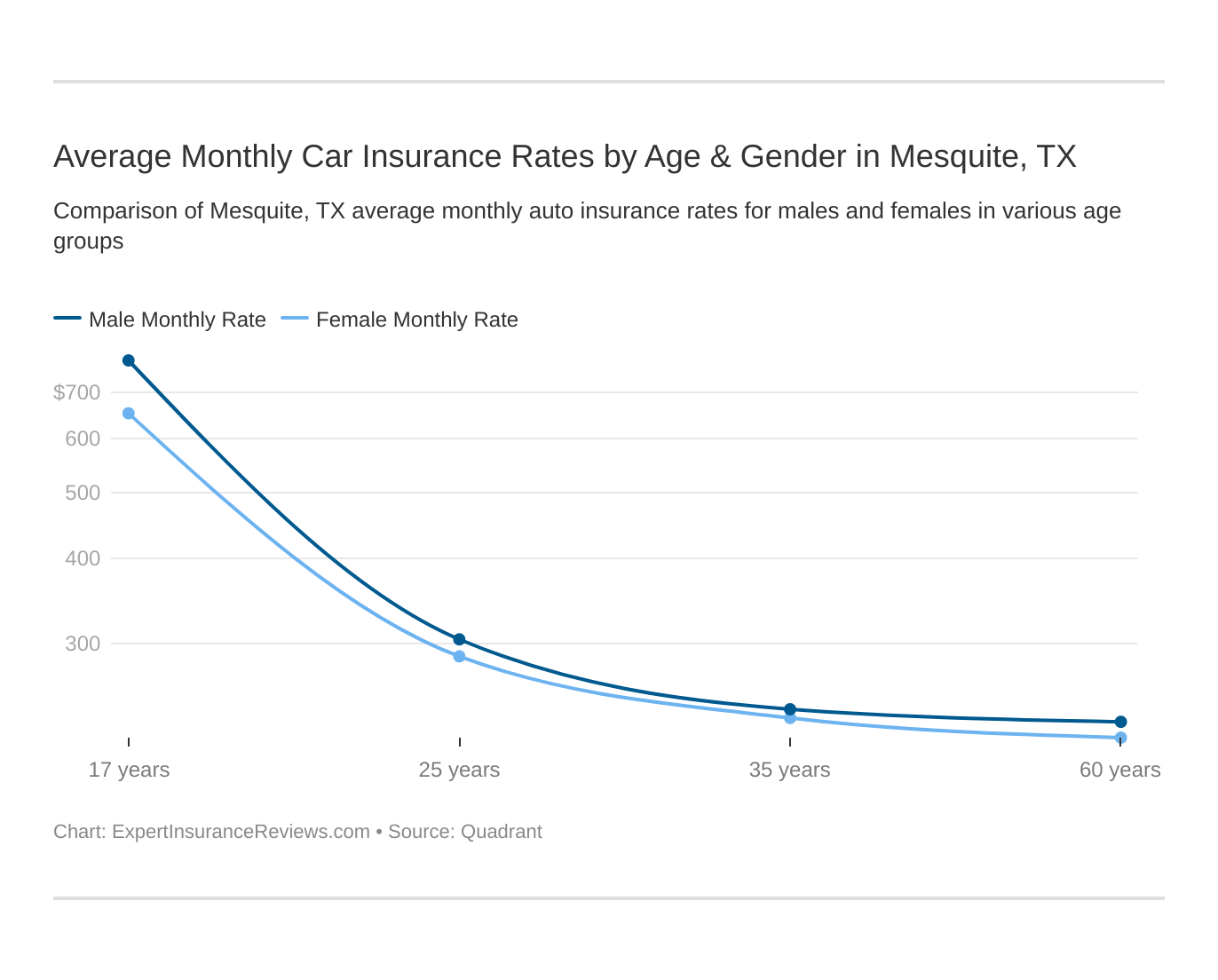

At a median age of 32.8, Mesquite is relatively young compared to the median age of the entire U.S. at 37.9.

These states no longer using gender to calculate your auto insurance rates — Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania. But age is still a significant factor because young drivers are often considered high-risk. Texas does use gender, so check out the average monthly auto insurance rates by age and gender in Mesquite, TX.

In the car insurance world, being a female above the age of 35 is the best thing you can be. Nearly every rate in the country for every insurance company charges less for women.

| Company | Married 35-year old female | Married 35-year old male | Married 60-year old female | Married 60-year old male | Single 17-year old female | Single 17-year old male | Single 25-year old female | Single 25-year old male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $3,564.65 | $3,599.14 | $3,520.01 | $3,520.01 | $9,359.61 | $11,309.20 | $4,410.14 | $4,599.76 |

| The Gen Automobile Ins Co Inc | $2,918.37 | $3,249.14 | $2,712.68 | $3,109.48 | $7,713.17 | $10,116.84 | $4,191.50 | $4,782.23 |

| Geico | $2,433.73 | $2,622.73 | $2,340.42 | $2,649.67 | $5,298.09 | $5,502.21 | $2,632.39 | $2,627.86 |

| Nationwide | $2,430.55 | $2,473.88 | $2,146.15 | $2,275.09 | $6,856.66 | $8,817.88 | $2,851.87 | $3,088.49 |

| Progressive | $2,496.28 | $2,372.24 | $2,219.05 | $2,262.84 | $10,406.29 | $11,607.15 | $2,956.93 | $2,997.99 |

| State Farm | $2,020.71 | $2,020.71 | $1,797.39 | $1,797.39 | $4,814.71 | $6,130.76 | $2,195.23 | $2,262.71 |

| USAA | $1,594.84 | $1,608.07 | $1,522.66 | $1,516.79 | $4,423.33 | $4,827.05 | $2,125.64 | $2,286.61 |

The table is broken down by women, men, and their ages. As you can see married 35 year old male and females are consistently the cheapest rate among all ages and competitive when looking at the national average.

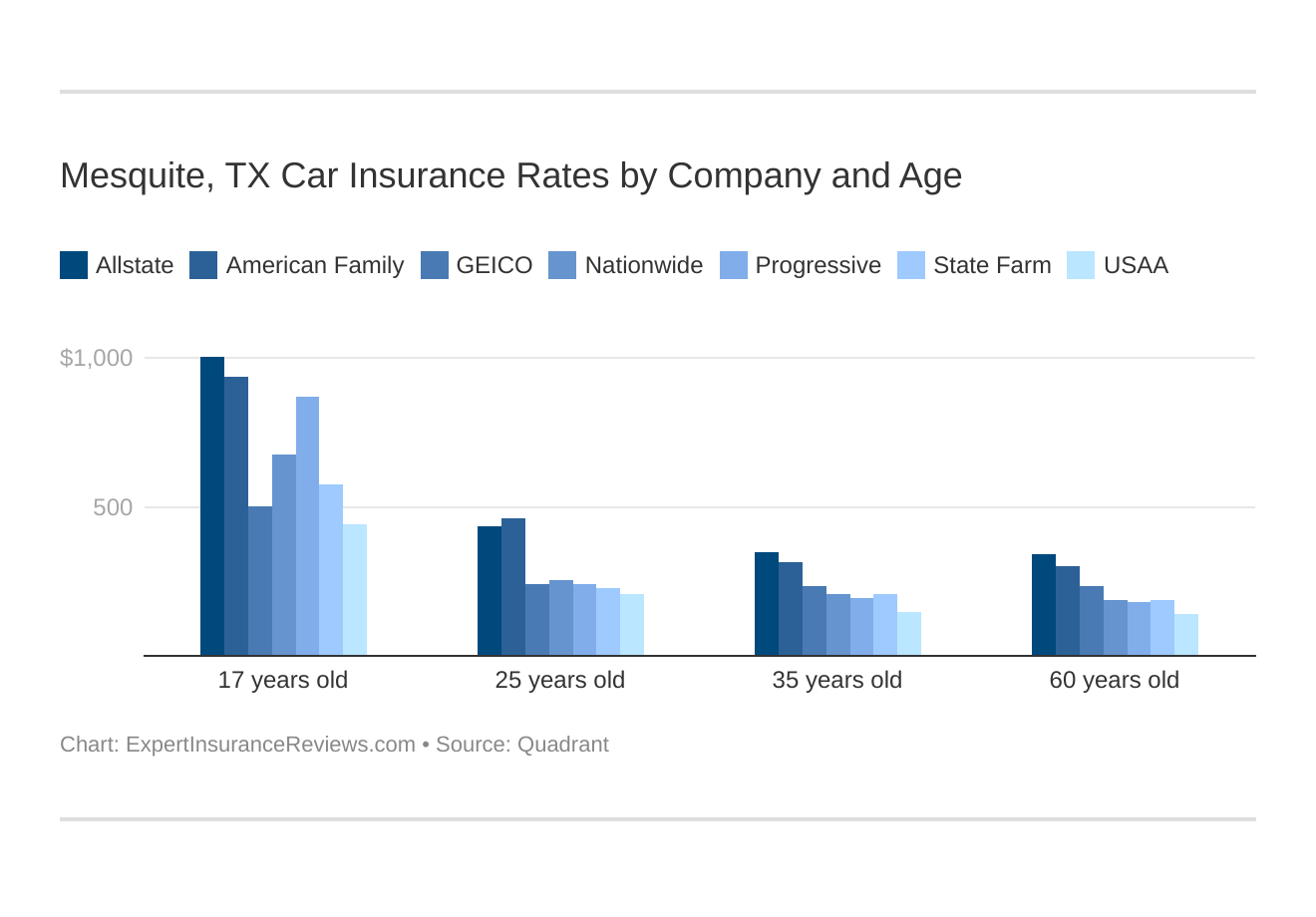

Mesquite, TX auto insurance rates by company and age is an essential comparison because the top auto insurance company for one age group may not be the best company for another age group.

Cheapest Zip Codes in Mesquite

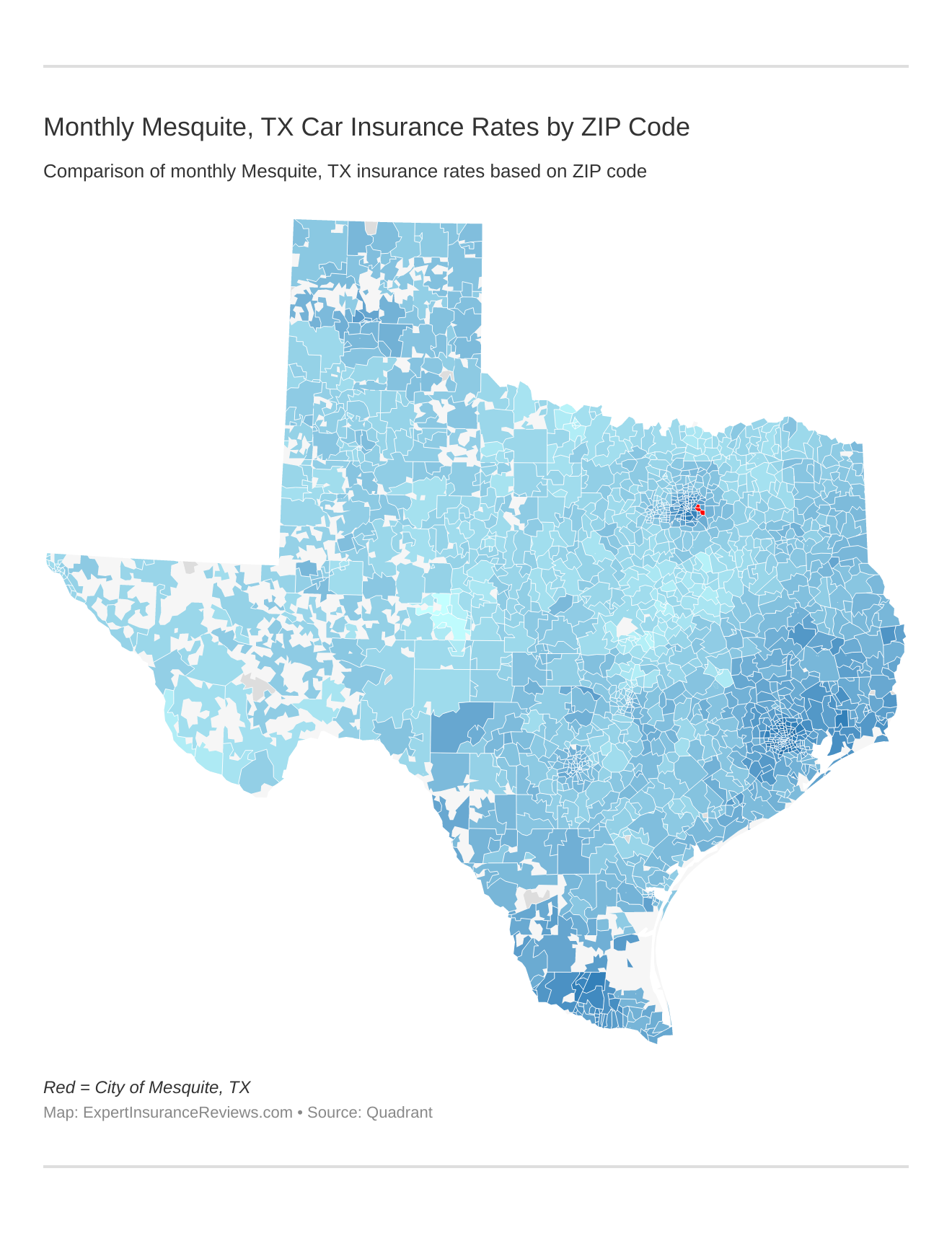

The cheapest zip code in Mesquite is 75150 at an average annual rate of $6367.63. However, rates vary in many different ways. Don’t worry if that number sounds high to you. If you have a good credit history, a clean driving record, and aren’t a teen you will have a significantly lower rate than the average.

| Zip-code in Mesquite | Average Annual Cost |

|---|---|

| 75150 | $6,367.63 |

| 75181 | $6,449.26 |

| 75149 | $6,474.22 |

Check out the monthly Mesquite, TX auto insurance rates by ZIP Code below:

If you’re thinking of moving to Mesquite, the average is sometimes skewed by the more poverty-stricken areas. Be careful which zip you move to.

Best Car Insurance

Choosing any kind of insurance is a dangerous and outright difficult game. Car insurance seems to be the trickiest of all. There are hundreds of companies that offer the same insurance at different rates and different insurance at the same rates.

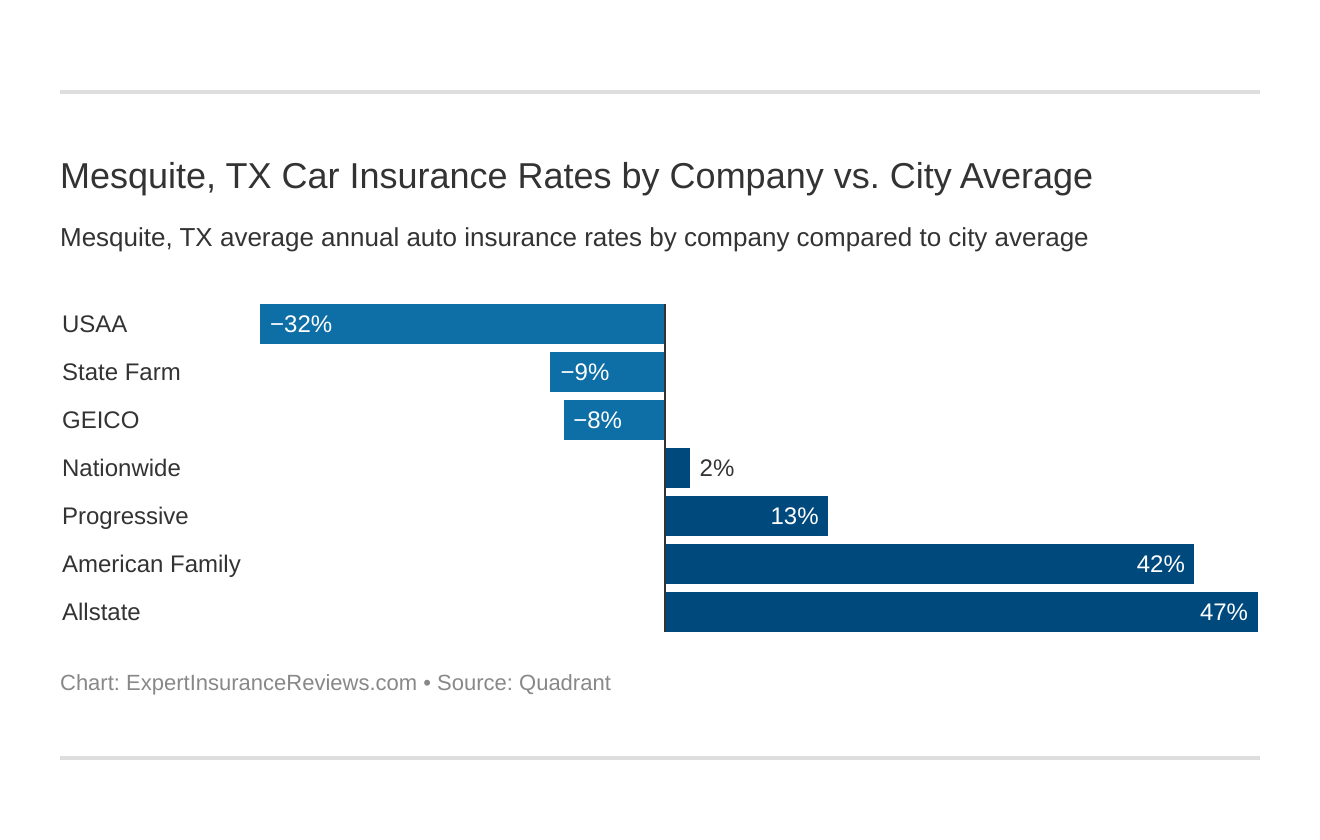

Which Mesquite, TX auto insurance company has the cheapest rates? And how do those rates compare against the average Texas auto insurance company rates? We’ve got the answers below.

It’s both confusing and overwhelming. Sometimes the best car insurance isn’t the cheapest. Low, medium, and high coverage can make or break you.

That low coverage car insurance is good on your pocketbook until you get in an at-fault accident that isn’t covered.

In this section, we’ll break down the best rates from the best companies to help you choose what coverage is the best for you and your family.

Cheapest Rates by Company

Saving money is almost always a good thing. Car insurance is no different. If you can save a buck, you’re doing something right.

Throughout this article, you will notice that USAA has the cheapest rate in almost every situation. Military gets the best rates, and rightfully so.

If you aren’t in the military, look at the second-best option.

| Group | Married 35-year old female | Married 35-year old male | Married 60-year old female | Married 60-year old male | Single 17-year old female | Single 17-year old male | Single 25-year old female | Single 25-year old male | Average |

|---|---|---|---|---|---|---|---|---|---|

| USAA | $1,797.87 | $1,798.40 | $1,727.30 | $1,703.15 | $5,126.00 | $5,548.65 | $2,386.52 | $2,534.46 | $2,827.79 |

| State Farm | $2,482.32 | $2,482.32 | $2,218.56 | $2,218.56 | $6,062.54 | $7,742.67 | $2,707.16 | $2,782.77 | $3,587.11 |

| Geico | $2,695.97 | $2,917.64 | $2,618.36 | $2,980.93 | $5,931.67 | $6,154.96 | $2,913.89 | $2,897.52 | $3,638.87 |

| Nationwide | $2,496.61 | $2,538.03 | $2,205.70 | $2,334.50 | $7,116.96 | $9,133.04 | $2,937.04 | $3,176.73 | $3,992.33 |

| Progressive | $2,425.61 | $2,314.23 | $2,147.73 | $2,195.01 | $9,889.01 | $11,026.44 | $2,875.41 | $2,925.30 | $4,474.84 |

| American Family | $3,563.81 | $3,987.15 | $3,332.96 | $3,841.79 | $9,752.64 | $12,794.08 | $5,193.40 | $5,937.31 | $6,050.39 |

| Allstate | $4,124.53 | $4,154.62 | $4,070.60 | $4,070.60 | $10,949.79 | $13,198.27 | $5,093.25 | $5,296.17 | $6,369.73 |

This table is broken down in order from cheapest to most expensive rates by each company. Again it is also broken down by age and gender. Other than USAA, Progressive and State Farm have the cheapest rates on average.

Best Car Insurance by Commute

Commuting is becoming a big part of the American workday. In some cases, it can account for more than three hours of a person’s day.

Car insurance companies can sometimes get aggressive with rates when you have a longer commute. The rule of thumb to use is, the more you are on the road the more accidents, tickets, or other insurance-related situations can happen.

Knowing this, companies try to protect themselves from heavy commuters by raising rates.

| Group | 10 miles commute. 6000 annual mileage. | 25 miles commute. 12000 annual mileage. | Average |

|---|---|---|---|

| USAA | $2,791.83 | $2,863.76 | $2,827.80 |

| State Farm | $3,587.11 | $3,587.11 | $3,587.11 |

| Geico | $3,571.51 | $3,706.22 | $3,638.87 |

| Nationwide | $3,992.32 | $3,992.32 | $3,992.32 |

| Progressive | $4,474.84 | $4,474.84 | $4,474.84 |

| American Family | $6,050.39 | $6,050.39 | $6,050.39 |

| Allstate | $6,213.20 | $6,526.26 | $6,369.73 |

As you can see from the data some companies don’t raise rates at all. The split for companies who do and do not is about half and half. So, if you know you are going to have a longer commute to work, choose the company that doesn’t raise its rates.

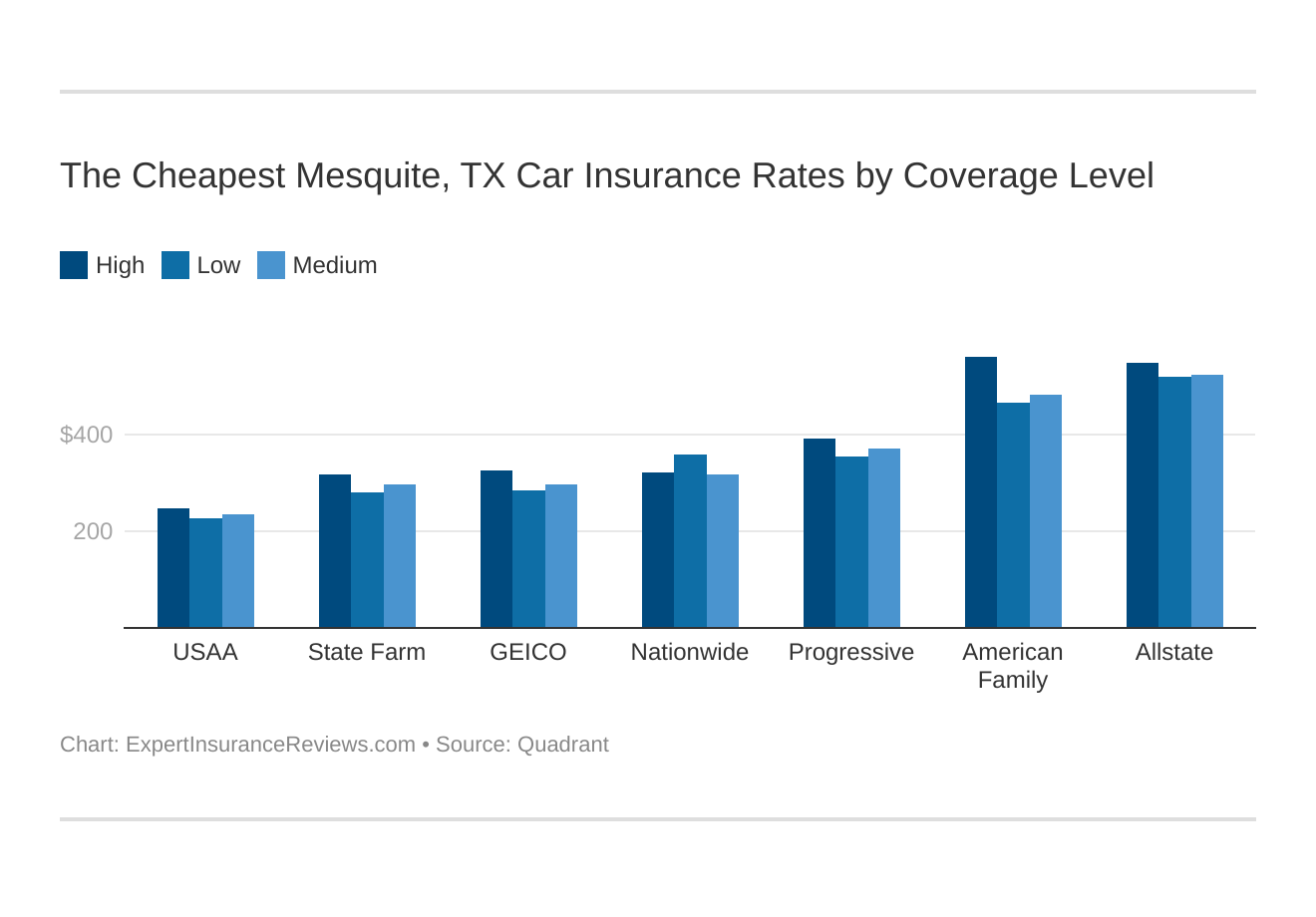

Best Car Insurance by Coverage Level

Car insurance has three different types of coverage level; low, medium, and high. Each company will cover different things within those levels but it is generally similar. Low coverage gives you the state legal minimum, which in Texas is liability coverage.

Your coverage level will play a major role in your Mesquite auto insurance rates. Find the cheapest Mesquite, TX auto insurance rates by coverage level below:

Low coverage will always be the cheapest, but if you are to get in an at-fault accident you could pay thousands out of pocket to cover the costs that your policy doesn’t cover.

The table below breaks down the different coverage levels of the top companies. Medium level coverage could be your best bet if it means only twenty extra dollars a month.

| Group | High | Low | Medium | Average |

|---|---|---|---|---|

| USAA | $2,952.36 | $2,716.17 | $2,814.86 | $2,827.80 |

| State Farm | $3,812.41 | $3,376.95 | $3,571.97 | $3,587.11 |

| Geico | $3,893.48 | $3,434.29 | $3,588.84 | $3,638.87 |

| Nationwide | $3,860.07 | $4,296.02 | $3,820.88 | $3,992.32 |

| Progressive | $4,700.84 | $4,270.16 | $4,453.54 | $4,474.85 |

| American Family | $6,738.34 | $5,602.44 | $5,810.40 | $6,050.39 |

| Allstate | $6,579.61 | $6,217.19 | $6,312.39 | $6,369.73 |

Choose carefully which level is best for you. If you have a long history of great driving then low coverage may be all you need.

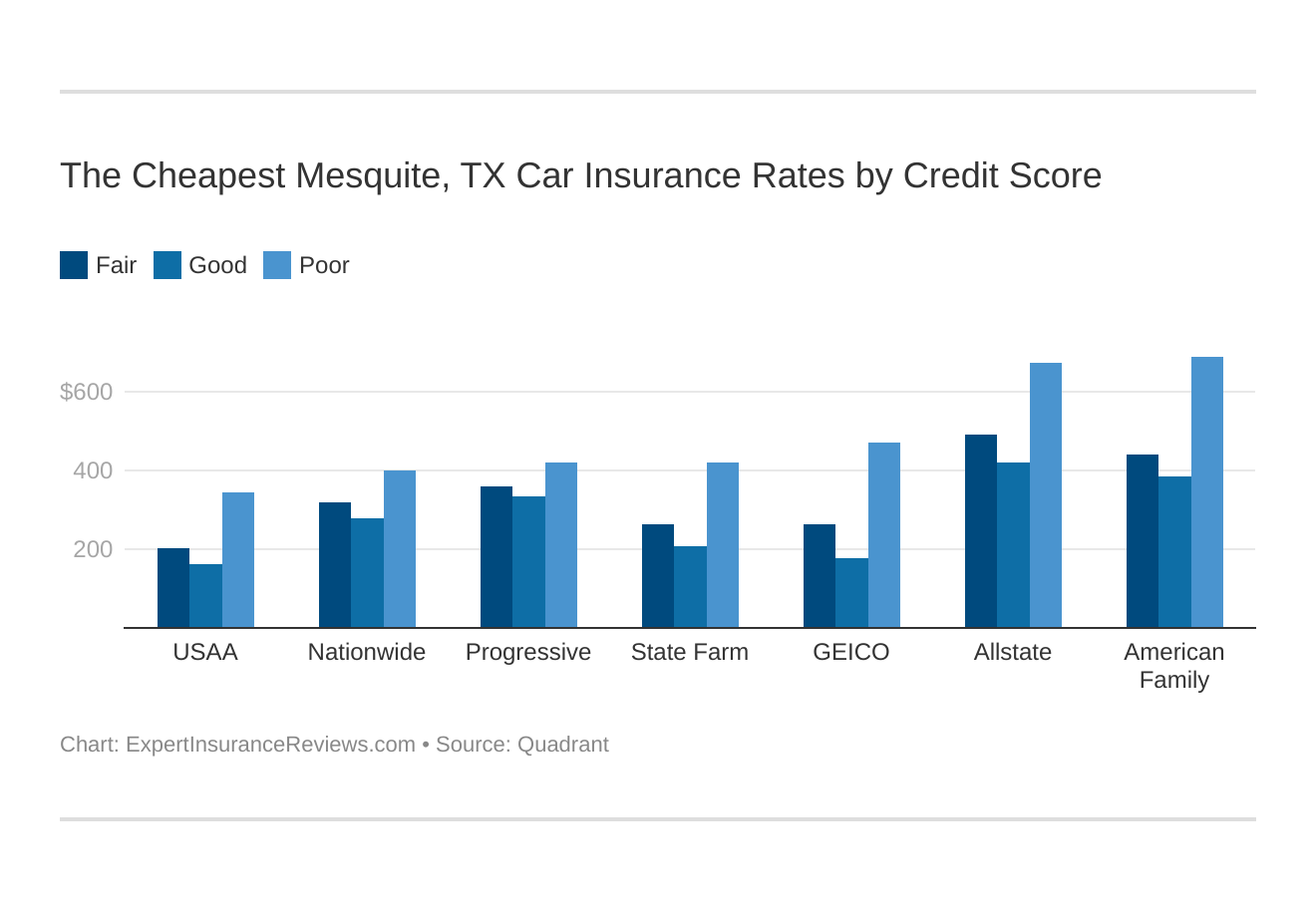

Best Car Insurance by Credit History

Above all other factors that affect your car insurance rates, credit history will ruin your rate in a heartbeat. The difference between poor and good credit is sometimes upwards of $3000 a year.

Your credit score will play a major role in your Mesquite auto insurance rates unless you live in these states where discrimination based on credit is not allowed: California, Hawaii, and Massachusetts. Find the cheapest Mesquite, TX auto insurance rates by credit score below.

In the connected world we live in, our credit score defines us above all else.

Although it is a sad reality, it can greatly benefit you if you have a good credit score.

| Group | Fair | Good | Poor | Average |

|---|---|---|---|---|

| USAA | $2,407.20 | $1,941.02 | $4,135.17 | $2,827.80 |

| State Farm | $3,163.92 | $2,524.56 | $5,072.86 | $3,587.11 |

| Geico | $3,176.51 | $2,110.41 | $5,629.69 | $3,638.87 |

| Nationwide | $3,845.76 | $3,337.63 | $4,793.59 | $3,992.33 |

| Progressive | $4,347.47 | $4,020.45 | $5,056.60 | $4,474.84 |

| American Family | $5,270.10 | $4,600.87 | $8,280.20 | $6,050.39 |

| Allstate | $5,933.00 | $5,082.02 | $8,094.17 | $6,369.73 |

Every company raises rates by thousands annually if you have a poor credit score. Allstate raises them in Mesquite more than $2000 above the average.

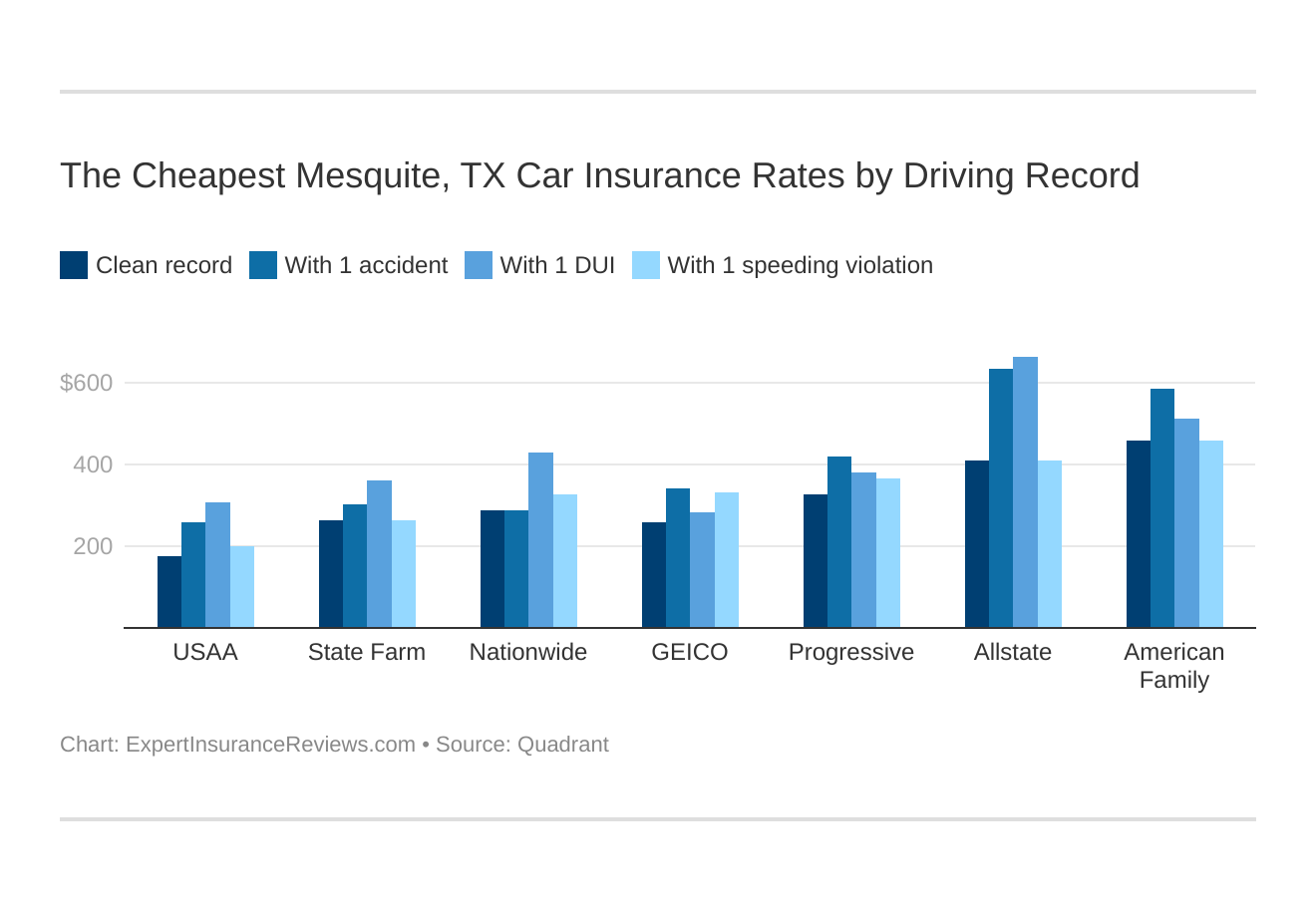

Best Car Insurance by Driving Record

Among the many factors that give you the best rate you can find is your driving record. While credit history is the most important, your driving record will always haunt you.

Your driving record will play a major role in your Mesquite auto insurance rates. For example, other factors aside, a Mesquite, TX DUI may increase your auto insurance rates 40 to 50 percent. Find the cheapest Mesquite, TX auto insurance rates by driving record.

A DUI will guarantee a rise in rates by at least $1000 annually.

| Group | Clean record | With 1 accident | With 1 DUI | With 1 speeding violation | Average |

|---|---|---|---|---|---|

| USAA | $2,098.78 | $3,123.13 | $3,678.15 | $2,411.13 | $2,966.69 |

| Geico | $3,084.79 | $4,091.27 | $3,401.42 | $3,977.98 | $3,525.83 |

| State Farm | $3,173.39 | $3,657.70 | $4,343.96 | $3,173.39 | $3,725.02 |

| Nationwide | $3,463.09 | $3,463.09 | $5,131.44 | $3,911.67 | $4,019.21 |

| Progressive | $3,905.02 | $5,025.59 | $4,565.86 | $4,402.91 | $4,498.82 |

| American Family | $5,503.19 | $7,037.92 | $6,157.26 | $5,503.19 | $6,232.79 |

| Allstate | $4,925.67 | $7,648.88 | $7,978.70 | $4,925.67 | $6,851.08 |

A simple parking ticket three years ago could buy you a few hundred dollars extra a year on your rate. A clean record will save you a lot of money a year though. Good drivers get rewarded.

Some companies have accident forgiveness. If you know you have an accident on your record, those companies could be the best for you.

Car Insurance Factors in Mesquite

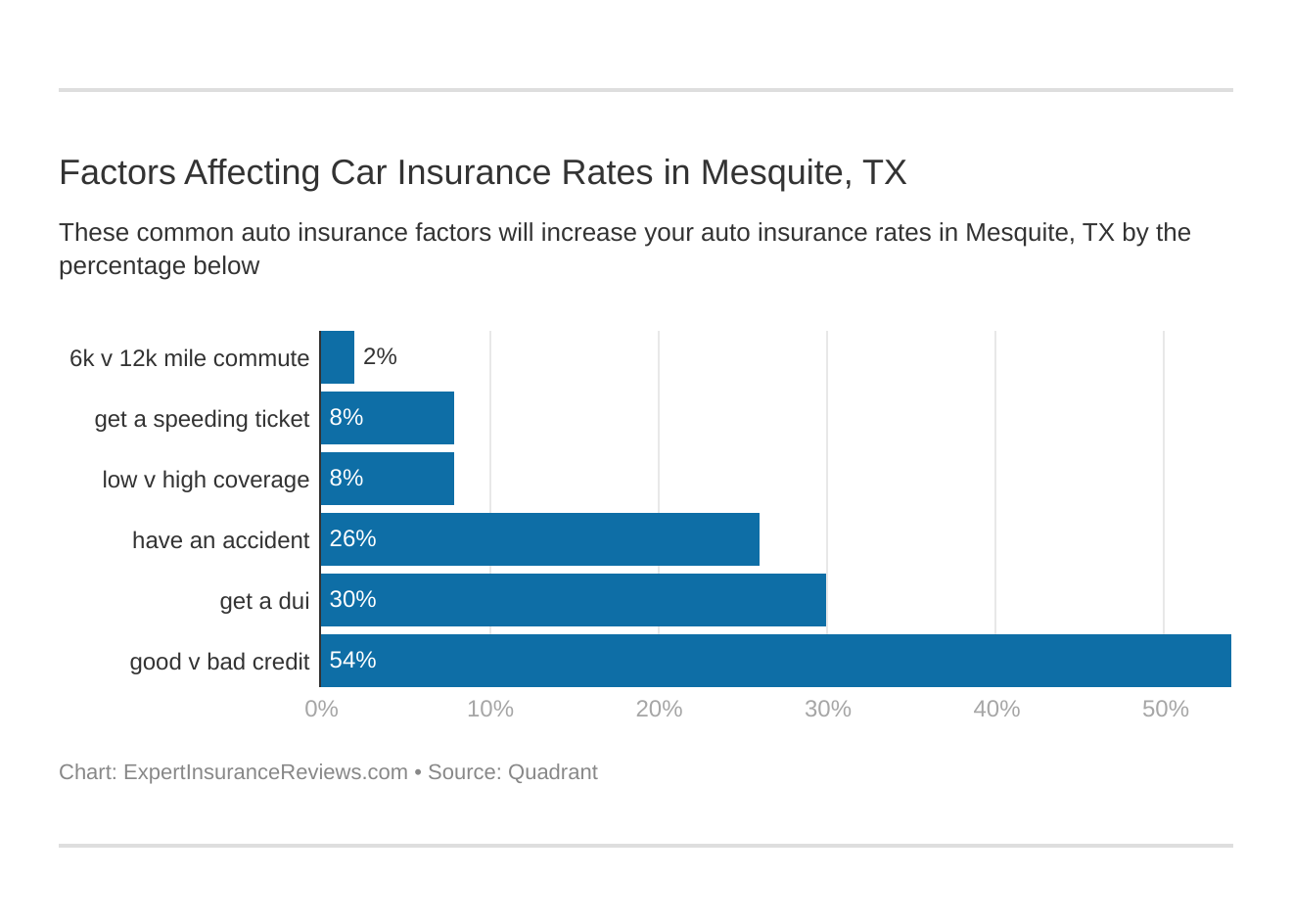

Many different variables go into determining auto insurance rates. We’ve discussed the things that you do that affect them such as credit history and commute times.

Factors affecting auto insurance rates in Mesquite, TX may include your commute, coverage level, tickets, DUIs, and credit. Controlling these factors will help you maintain cheap Mesquite, Texas auto insurance.

However, there are some things your city and metropolitan area do that can affect your personal rates as well.

Everything from average household income to poverty can change your rates significantly. In this section, we’ll delve into what makes insurance tick.

Growth & Prosperity

Mesquite itself is too small to have data on only themselves. The Dallas/Fort-Worth area (which includes Mesquite) does have data on how the metro area is growing.

According to the Metro Monitor from 2010 to 2015, the metropolitan area of Dallas/Fort Worth is ranked 11th in growth and 15th in prosperity. This is an excellent sign for everyone in the city. But could also mean a bit of a hike in insurance prices.

Median Household Income

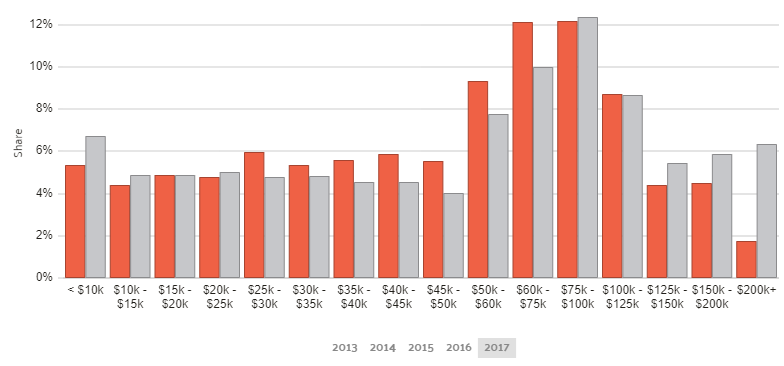

According to DataUSA in 2017, the median household income of the 46,000 households in Mesquite grew to $52,167.

This table shows Mesquite in red and the U.S. average in grey. At 12 percent of all the household incomes, 60,000-75,000 is the most common income in Mesquite.

Median household income gives insurance companies a base value of what the area can afford. Above all other factors, this will noticeably change car insurance rates.

Below you can use an insurance cost calculator to see what you can afford based on your income.

CalculatorPro

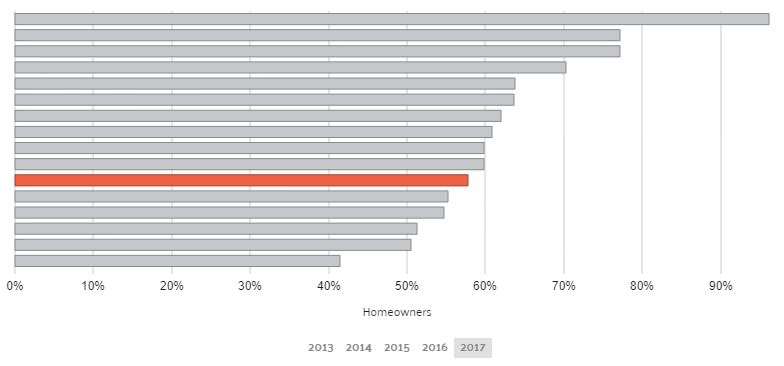

Homeownership

57.7 percent of the housing units in Mesquite were occupied by their owner in 2017. This is below the average for the United States at 63.9 percent. Homeownership is taking a hit due to the new generation but insurance companies still use it to develop policy rates.

This means that a lot of the houses that you may live around are being rented out. Which in turn, means a headache for insurance companies. The more people who rent, the less likely they are to have multiple cars, a high income, etc.

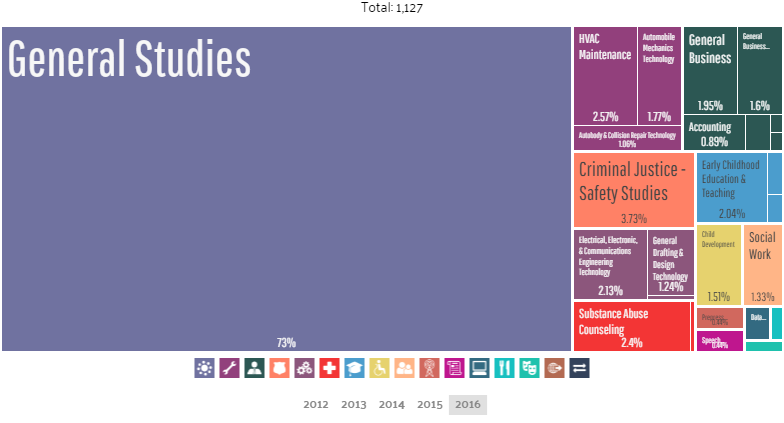

Education

In 2016, universities in Mesquite awarded 2,196 degrees. The student population is skewed towards women, with 6,031 male students and 9,308 female students totaling out at 1,127 students. Of those 1,127 students, 73 percent of them majored in General Studies, followed by Criminal justice at 4 percent.

There are a few different colleges within the city of Mesquite. Eastfield college makes up the highest amount of students at 86 percent and Carrington College makes up 8 percent of the student population.

Student populations correlate with the age of drivers. Most students are in the age bracket of below 25. Remember, this age pays the most for car insurance. These statistics are based on them being the most reckless driving age. On average teens speed, text and drive, and drive distracted more often than any other age.

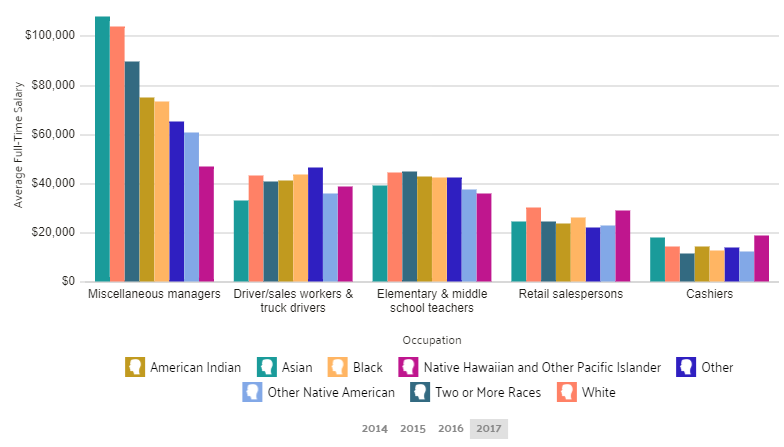

Wage by Race & Ethnicity

As in most areas of the United States, the Asian demographic in Mesquite has the highest wages, followed by whites, then following them American Indians.

The reason this is worth mentioning is based purely off the average income of people in the city. If you are looking for car insurance and do not have a high income, you will be forced to choose a lower coverage plan.

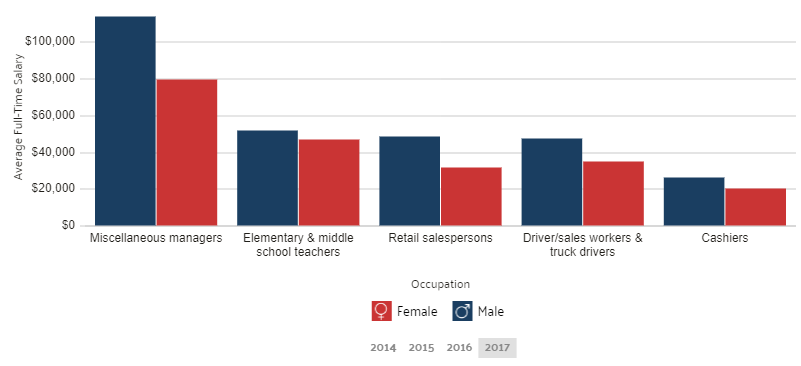

Wage by Gender

Gender is a significant factor in car insurance, so knowing how the different genders are weighing against each other is a great asset.

As mentioned before, almost every car insurance company charges less to female drivers. This is due to female drivers being significantly safer in virtually every statistic line, and males making a higher wage in most jobs.

On average men in Mesquite make almost 20,000 dollars more a year than women. That gap is enormous.

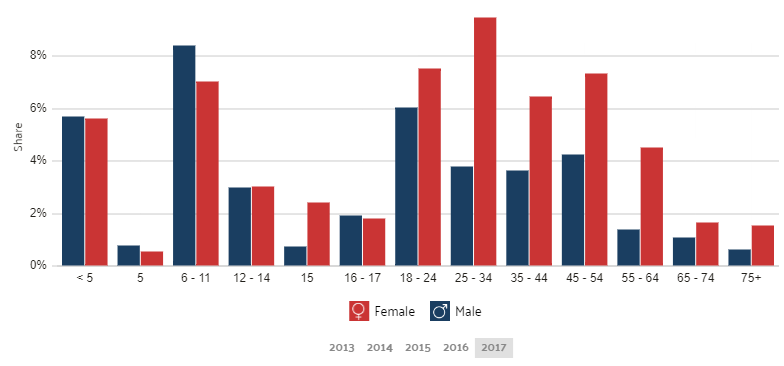

Poverty by Age & Gender

Poverty runs rampant in every city of every state in the entire nation. Mesquite is no exception.

As mentioned previously, based on demographics and ethnicity insurance companies determine what the base rate will be for you.

Women above the age of 25 pay the least on their auto insurance rates, which is a curious fact since according to Data USA women between the age of 24-35 make-up, the largest portion of the demographic. This includes single mothers and pregnant wives in most cases.

In Mesquite, 14.3 percent of the poverty line is made up of females between 24-35.

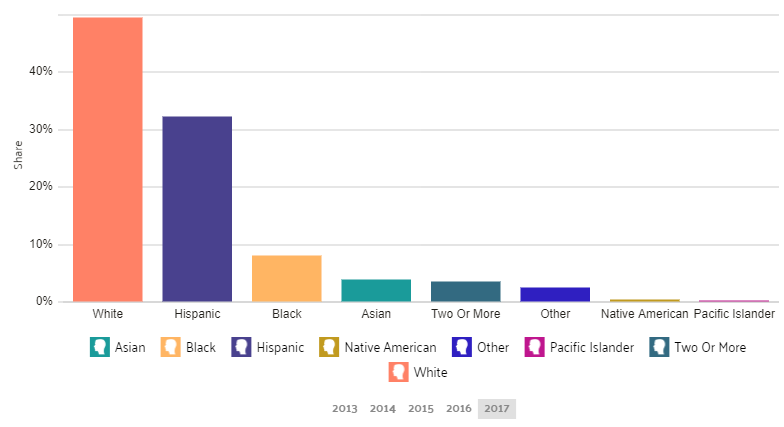

Poverty by Race & Ethnicity

As you can see in the table above, whites and Hispanics make up the largest percentage of poverty in Mesquite. The same races make up a majority of the population as well, so that has a large factor on these numbers.

When choosing auto insurance, see if you can find any discounts that may tend to minorities, or those living in poverty-stricken areas. You never know what you could come across.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Driving in Mesquite

In the next few sections, we’ll dissect the roads, safety, and traffic congestion. Auto insurance companies look at the same factors as they decide how high or low average rates will be in each zip code. It is best to know the facts and questions to ask when deciding on insurance.

Roads in City

Roads are a huge part of the rates you receive from company to company. If there is a lot of construction and poor road conditions in the city, the rates will be hiked up.

Major Highways

Highways are extremely important when it comes to determining those auto insurance rates. Mainly due to the traffic factors. The more highways there are through your city the more traffic there will be.

Mesquite is positioned directly at the crossroads of four major highways. Interstates 30, 635, 20, and U.S. Route 80. Making it a tough place to get around traffic.

Popular Road Trips/Sites

Texas is a huge place which makes road trips all the more exciting. There are huge cities with skyscrapers, vast deserts, and overgrown canyons.

Mesquite is best known for its Rodeo Championships held every year. But besides Mesquite, there are loads of places to visit right around the neighborhood. Downton Dallas has all the sports venues you can ask for, and Frisco has the biggest stars in music.

The video above will show you some of the best places to visit in the great state of Texas.

Road Conditions

Road conditions are important in determining rates for insurance companies. If you live in a small town with a lot of bad roads and old potholes that have cursed the town for generations; you will be paying a little more on rates.

We’ve all been plagued by bad roads a time or two. A popped tire because you didn’t have the heart to ask for directions.

If you live in a city with brand new roads in most areas, you will pay less. Safety and precautions are the main reason for this insurance adjustment. If your city has a high probability of blown tires, broken axels, and ruined alignment insurance companies will charge more.

Read more: Does my car insurance cover damage caused by a blown tire?

Each large area containing more than 500,000 people has statistics on how their pavement/road rates. The Dallas/Fort Worth area has as follows:

- Poor Roads – 21 percent

- Mediocre Roads – 31 percent

- Fair Roads – 20 percent

- Good Roads – 28 percent

These statistics are used by companies to determine some of the things they will cover. Twenty-one percent of poor roads is an average number so most companies will cover accidents, injuries, etc. due to poor road conditions.

Each metro area over 500,000 people also has extra vehicle costs called VOC’s, which averages out how much you may have to spend on your vehicle due to road conditions. This does not include gas and other obvious things every car must have, instead, it refers to blown-out tires, ruined suspension, or a bad axel.

The Dallas/Fort Worth area has a VOC of $609. This is just about the middle of the road with the rest of America.

Insurance companies take a look at all of these small factors.

Speeding or Red Light Cameras?

On June 2nd, 2019, Texas Governor Greg Abbott signed a law that outlawed the use of speeding and red-light cameras in all of Texas.

Mesquite no longer issues or enforces photographic citations. Speeding and red light cameras are now only used as warnings to be aware.

This new law could save you a lot of money in rises in car insurance rates. As mentioned before, just one traffic citation can raise your rates by hundreds of dollars.

Vehicles in City

Every city has it’s most popular vehicles, it’s favorite spots for a speed-trap and amount of cars. This section will walk you through some different aspects of vehicles in Mesquite and Texas.

Classic cars, motorcycles, buses, and public transits are all some different ways to get around. The type of vehicle you drive can drastically affect your insurance rates.

Classic car insurance is often double the average cost of regular car insurance. Motorcycle insurance is often a lot lower. If you have a souped-up red sports car that attracts the attention of every police officer in the county; you can guarantee your insurance will be higher than the average soccer mom van.

Most Popular Vehicles

Everything is bigger in Texas. Surprisingly the most popular car is not an oversize pickup with Longhorns glued to the hood. It’s a Dodge Challenger.

The Challenger will raise those insurance prices because it’s a sports car, and due to safety issues. When a car can go as fast as Challengers do, it’s an issue for insurance companies. It creates higher liability for them.

More accidents happen the higher rate of speed a car is going.

Texas is known for being the heart of America. The epitome of what it means to be American. In the Dallas/Fort Worth area, 47 percent of cars are American made.

Cars Per Household

These statistics matter simply because of the number of people on the road. If a city has an average of three cars per household, that means there are many more cars on the road.

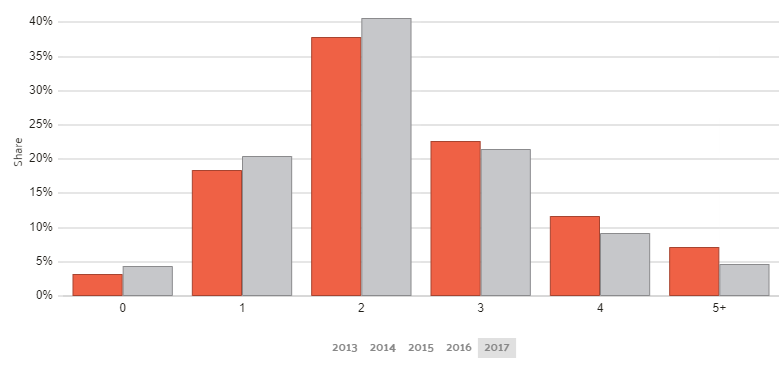

In Mesquite, around 38 percent of households have two cars, and 22 percent of households have three cars.

As you can see in the table above most households in Mesquite, have two cars. This is consistent with most cities in the United States. Much of those two cars per household are shared as well.

Households Without a Car

In Mesquite, only 1.7 percent of households do not own a vehicle at all. This is a very low number, which is both good and bad for you. It’s bad because this means there are more cars on the road, but it’s good because it means there isn’t a lot of poverty.

In other places like Chicago, where there is a lot of poverty, those numbers can reach upwards of 10 percent.

Speed-Traps

Stay in tune with speed traps and where they may be, or just go the speed limit.

In Dallas, there were a reported seven speed traps in the past five years. This probably sounds like a very small number, but they aren’t referring to single police officers hiding in dark alleys.

A speed-trap is referring to when an entire police station comes together in a certain area to catch a lot of different violators. Sometimes these will also be tied in with DUI checkpoints.

Vehicle Theft

Rates of theft are growing as the costs of living rise. The FBI has found this has been a consistent trend in the past decades. According to the FBI, there were an estimated 765,484 thefts of motor vehicles nationwide in 2016. That left the rate to about 236 thefts per 100,000 people.

Of the 144,000 people in Mesquite, there were a reported 766 vehicle thefts according to the FBI.

The safest neighborhoods in Mesquite are located on Lawson Road, Berry Road, and Tripp Road. If you live in these areas your rates for theft are extremely low.

Auto insurance companies will use theft information and your zip code to determine the probability of your car being stolen. This will determine the insurance policy rate for you. If you live in a poverty-stricken area, theft may be higher, and in turn, your insurance may urge you to get more coverage.

Traffic

In every city in the U.S., you will deal with traffic, unless you live in the mountains and get in a jam behind a tractor.

In downtown Mesquite, traffic won’t be your biggest issue. But your commute to work if you work in Dallas will be a huge pain. Being aware of patterns always helps, so pay attention to the news before you leave.

Insurance companies adjust rates based on the amount of traffic, and the congestion it causes. The longer people are on the road, the more chance they have of getting in some driving incident. Therefore, shorter commutes may provide the cheapest auto insurance rates to drivers. In this section, we’ll show what areas have the worst amount of traffic, and where the busiest highways run.

Traffic Congestion in Texas

There are a few cities in Texas that before even mentioning them you will know are the worst for traffic.

Mesquite itself will not be a leader in any traffic category, but the neighboring metro area certainly is.

Mesquite is just a few miles outside the Dallas/Fort Worth area, so let’s take a look at facts about congestion in that area of Texas.

Dallas has been rated as one of the most congested city in the entire world. It is in the top 25 most congested cities in the U.S. Mesquite will surely get some run-off from this but mainly on the major highways. If you live in Mesquite and work in Dallas, plan for a nightmarish drive.

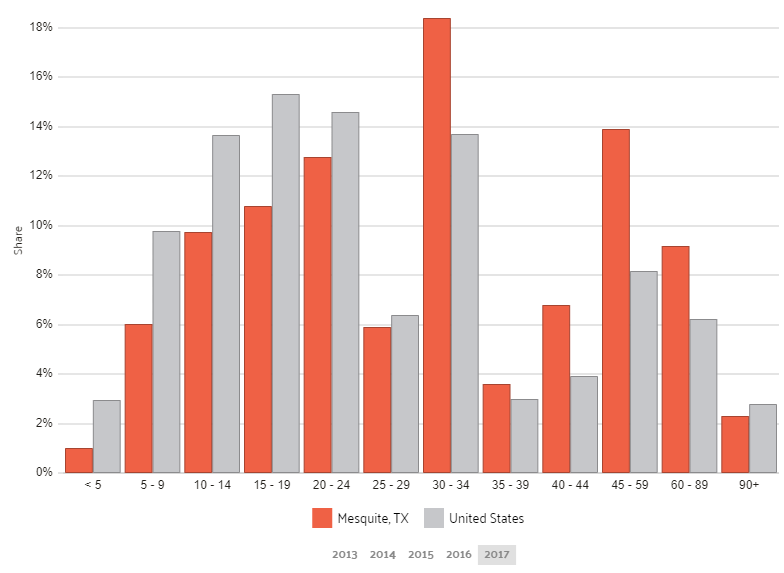

As you can see 18 percent of people in Mesquite have over 30-minute drives. Followed by 14 percent have 45 to 60-minute drives.

During the morning and evening rush hour times, the average speed of travel is only 33 mph. The Dallas area is known for some of the worst traffic in the state and the entire nation. Super-commutes are also a big part of life in the Dallas metro.

Houston and Austin will be the next cities with the most traffic. Houston and Dallas are neck and neck when it comes to traffic problems. With four huge highways in the surrounding area, it is no wonder why Dallas is so heavy in traffic.

In terms of car insurance, companies will know all these statistics. Knowing them yourself will only benefit you. Each year it is estimated that $1,065 is spent per driver on congestion issues.

Transportation

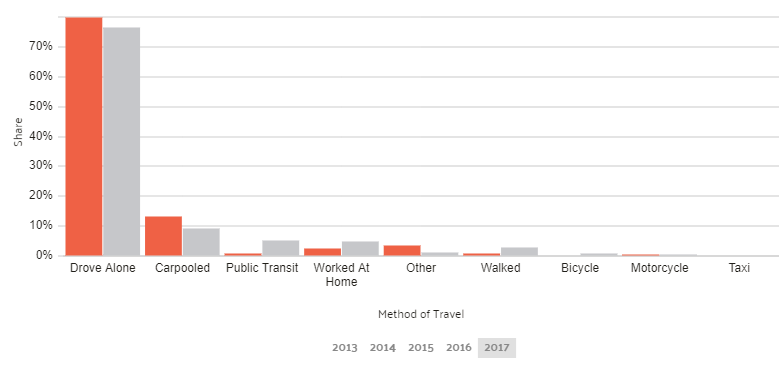

In 2017, the most common method of travel for workers in Mesquite was diving by themselves, followed by those who carpooled with others.

As mentioned before, the average commute for Mesquite is over 30 minutes. Of those commuters, almost 80 percent of them travel alone to work. This is a very high number but is only a little higher than the nation’s average.

Driving alone is a beautiful thing for insurance companies. The fewer people in the car, the less liable the insurance company may be in the case of a bad incident.

Road Safety

Texas Traffic Safety Facts

| Texas Traffic Safety Stats 2017 | Amount |

|---|---|

| Fatalities (All Crashes) | 3,722 |

| Fatalities (Drunk Driving Cases) | 1,468 |

| Fatalities (Single Vehicle Crashes) | 1,914 |

| Fatalities (Speeding Crashes) | 1,029 |

| Pedestrian Fatalities | 607 |

| Motorcycle Fatalities | 490 |

It is as clear as it can be. America is a dangerous place to be on the road. Some things are unavoidable due to the sheer amount of people in the country, but how do we keep our roads safer?

It’s a question that has an easy answer, but a difficult solution that begins with each individual driver. We, as a whole, are a distracted bunch of people.

In the table above, you can see how many traffic fatalities there were in Texas in 2017. Almost every case involves distracted driving in some manner.

The easy answer is this; don’t drink and drive. Put down your cell phone. Slow down to the speed limit. Those main tips would save countless lives.

Allstate America’s Best Drivers Report

Every year Allstate comes out with their Best Drivers Report. This shows the best drivers based on cities in America. They take into account many different things, but the main three are as follows:

- Years between claims (per driver)

- Likelihood of claims

- Hard-Braking incidents

The Dallas/Fort Worth Metro area is ranked 139th among all U.S. cities. That is neither good nor bad. But it could be better. Allstate found that drivers in the area file a claim every 8.4 years on average.

If you’re thinking of moving to the Dallas metropolitan, you may want to consider the Best-Drivers Report. It can show you how hard the drivers drive in the area.

Ridesharing

Ridesharing is becoming a huge epidemic in the United States and the whole world. Uber and Lyft are creating a new wave of people who aren’t even buying cars. This tactic does save you a ton of money as long as you aren’t taking multiple rides a day, doing a lot of driving.

Be careful whose car you get into though, some Uber drivers may not have insurance that covers you if you were to get in an accident.

Some auto policies do not automatically cover every person who is in a car. A driver may have the most minimal insurance required. As an alternative, taking the bus is just as a cost-effective mode of transportation if you’re on a budget. It is also one of the safest ways to travel.

EStar Repair Shops

EStar is a system developed by Esurance to be a sort of repair/customer service shop. You can find the locations of them in many places throughout the U.S.

Esurance loves making your life easier. That’s where the idea came from. You can file a claim and find a repair shop within miles, all through your cell phone.

Car insurance can get tough; this is Esurance’s tactic to help you out.

Weather

Mesquite sits in an odd spot in the geography of the United States in terms of weather patterns. It can reach unbearably hot temperatures sometimes reaching 100 degrees. But it will also get very cold with temperatures occasionally dipping into the twenties.

The average yearly temperatures are mostly fair in the surrounding metro of Dallas. The average temperatures for the area are around 77 degrees for the high and 51 degrees for the low. Remember these are averages so be prepared for much worse than that.

Natural disasters can play a role in life in Mesquite. Most of which are tornado issues. Being just below tornado alley is never a good thing. There will hardly ever be a hurricane that makes it that far up Texas.

There were 13 natural disasters in 2016, which is on par for the nation’s average. Being aware of the daily weather will keep you safe. Knowing if a natural disaster is coming is half the battle.

Weather directly correlates with how your car lasts. In the harsh winters of the Midwest, cars break down much more frequently. In the sunshine state of Florida, cars will last a long time. The fair temperature in Texas will lead auto insurance companies to overlook the weather aspect when determining your auto insurance premium.

Public Transit

The absolute best way to get anywhere quickly in Mesquite is by car. As mentioned before, traffic isn’t the worst within the city walls, but the metro area of Dallas has some of the worst in the country.

However, not everyone can afford to buy a car, so public transit is available.

Dallas has one of the best bus systems in America called DART or Dallas Area Rapid Transit. It has as many buses as New York City has cabs.

DART will have buses that reach all the way to Mesquite for your convenience. Most of the public modes of transportation will be that bus system. This may cost you a few dollars a day for an all-day pass to as far as the bus will go.

The Dallas downtown area does have a rail system as well. It does not stack up to that of Boston and America’s biggest cities, but it is slowly growing and can take you places in a timely manner.

If you’re not looking to buy a car or insurance, the bus may be your best bet.

Alternate Transportation

Many people drive motorcycles but, new means of transportation are popping up everywhere. Mesquite itself may not have many, but the downtown Dallas metro area undoubtedly will. Scooters and bikes are available for rent to get you from one place to another much faster than walking.

If you’re living in Mesquite and are eager to catch a Dallas Cowboys game, then Uber to just outside the city, and find yourself a scooter the rest of the way. Its an enjoyable time for any age.

In the downtown area, there are some places to rent a scooter, which only costs a few dollars. Of course, the best mode of transportation is always by car. Cars eliminate all the difficult parts of finding rides and making sure you’re on time for each and every stop.

Finding a good parking spot may be the trickiest part of your day though.

Parking in Metro Areas

The metro area of Dallas/Fort-Worth is a popular place to visit. Irving has one of the most popular music venues in the nation. Fort-Worth is one of the biggest military facilities in the U.S. Dallas, of course, holds the states best sports teams.

With all this hustle and bustle parking will always be a pain.

But the Dallas/Fort Worth Metro seems to be doing as best as they can. Most parking lots are monitored and are ran by Online App Meters so they can be paid through your phone. Some more outer areas may still be pay change by meter on the street, which can leave your car at risk.

Air Quality

We all know how important the earth is to us. We call it our home and it deserves to be taken care of. That ship is starting steer back on course. The more cars on the road, the less clean the air is going to be. Vehicle emissions account for a lot of the air pollution we put out into the atmosphere.

Mesquite and the Dallas/Fort-Worth area are one of the top metro areas in the nation for quality of air.

According to the EPA’s Air Quality Index Report, this year, there have been 99 perfect days for Mesquite. Again, some of the highest in the country. According to the American Lung Association, it is Ranked 17 out of 228 for high ozone days.

Hats off to the neighboring areas around Dallas for creating a clean environment. The cleaner we are the fewer insurance companies can hike up prices due to pollution.

Military/Veterans

In Texas, the military and its veterans are honored greatly. Remember, USAA has the lowest insurance rates across the board in the city of Mesquite. From the Arlington National Cemetery to the Presidents who have come from Texas, there is a rich history of military.

Lyndon B. Johnson, George W. Bush, and Dwight D. Eisenhower stood for something. They represented Texas proudly and carried the honor of the military with them everywhere they walked. Mesquite follows those footsteps, and so do car insurance companies.

Companies other than USAA also offer military and veteran discounts. With the Fort Worth Base Camp just miles from Irving, it is a popular area for veterans and current military personnel.

If you’re prior or, the current military makes sure to check out which insurance companies offer a discount if you choose not to go with USAA.

Unique City Laws

Mesquite doesn’t seem to have any hilarious laws that stand out in the crowd. But the Dallas/Fort Worth area is chock-full of quirky laws. Some that make no sense and some that are plain ridiculous. Here are some of the oddest we could muster up:

In Fort Worth, you are only allowed one garage sale sign, and it must be on your property. So the question is; How do you make any money if only your neighbors know?

In Irving, you can only smoke inside nine buildings. No wonder the air is so nice. In the entire city of over 236,000 people, there are only nine buildings to smoke inside.

In Fort Worth, if you don’t use your parking brake every single time you park, you can be ticketed up to $185.

Weird laws are everywhere, but these seem to be very weird, and oddly, there is a lot more than just these.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Mesquite Car Insurance FAQs

How much insurance does Texas require?

Texas state law states that every driver must have at least liability coverage, known as minimum liability insurance requirements.

How do I lower my auto insurance costs?

A clean driving record, good credit score, and old age are the best ways to get lower rates. These factors will affect the cost of auto insurance for your situation.

Why do insurance companies use my prior insurance information?

Insurance companies use this information to see what kind of customer you have been. They look at how many claims you may have had and how many incidents you may have had. This information factors into their pricing of your auto insurance quote.

What kinds of discounts are available in Texas?

There are discounts for loads of things. If you took drivers-ed in high school, you get a discount. Military personnel gets a discount. Safe driving gets you a refund. Asking your company is the best way to know.

How do I compare auto insurance quotes?

Some sites will compare quotes from many different companies based on where you want to buy. Lucky for you, you’re already on one of those sites. Enter your ZIP code in our FREE comparison tool.

No matter if you’re visiting for the esteemed rodeo or the beautiful Lake Hubbard, Mesquite is a great place to visit. If you’re lucky enough to call it home, you no doubt know the beauty of it.

Car insurance isn’t always beautiful, but now you know the key factors that determine your rates, your coverage, and liability.

Frequently Asked Questions

Can I purchase car insurance online in Mesquite, Texas?

Yes, you can typically purchase car insurance online in Mesquite, Texas. Many insurance companies provide the option to obtain quotes, compare coverage options, and even complete the entire purchase process online. However, if you have specific questions or prefer a more personalized experience, you may also choose to contact local insurance agents or brokers directly.

Are there any discounts available for car insurance in Mesquite, Texas?

Yes, many car insurance companies offer various discounts that may help you save on your premiums in Mesquite, Texas. Common discounts include safe driver discounts, multi-vehicle discounts, bundling auto and home insurance, good student discounts, and discounts for certain safety features in your vehicle. It’s recommended to inquire with insurance providers about the discounts they offer to determine which ones you may qualify for.

How can I find the best car insurance providers in Mesquite, Texas?

To find the best car insurance providers in Mesquite, Texas, you can start by researching and comparing different companies. Consider factors such as coverage options, pricing, customer reviews and ratings, financial strength, and available discounts. It’s also helpful to consult with local agents or brokers who have knowledge of the area and can provide personalized advice based on your specific needs.

Are there any specific car insurance requirements in Mesquite, Texas?

Yes, Mesquite, Texas, like other areas in the state, has specific car insurance requirements. As of my knowledge cutoff in September 2021, drivers in Texas are required to have liability coverage with at least the following minimum limits: $30,000 for bodily injury per person, $60,000 for bodily injury per accident involving more than one person, and $25,000 for property damage.

How can I determine the coverage options I need for my car insurance in Mesquite, Texas?

The coverage options you need for your car insurance in Mesquite, Texas depend on various factors. These include your budget, the value of your vehicle, your driving habits, and any legal requirements set by the state. Generally, it’s recommended to have liability coverage (including bodily injury and property damage) to meet legal obligations, and you may also want to consider comprehensive, collision, and uninsured/underinsured motorist coverage for added protection.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed life insurance agent with 23 years of experience helping people protect their families and businesses with term life insurance. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.