Best Los Angeles, California Car Insurance (2025)

The average Los Angeles car insurance rates range from $453.67/mo to $710.83/mo depending on ZIP Code. Before you agree to a Los Angeles car insurance price, use our quote comparison tool to shop around with multiple Los Angeles car insurance companies.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Shawn Laib

Insurance and Finance Writer

Since graduating from the University of WA with a B.A. in English Literature, Shawn has been professionally writing in the spheres of entertainment, insurance, business, marketing, and politics. He is passionate about using his writing skills and insurance knowledge to educate the general population on everyday issues surrounding these misunderstood topics. His work has been published on SUPERJ...

Insurance and Finance Writer

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Los Angeles Summary | Stats |

|---|---|

| Population | 3,928,864 |

| Population Density | 8,527 people per square mile |

| Average Cost of Insurance | $5,443.97 |

| Cheapest Car Insurance Company | GEICO |

| Road Conditions | Poor Share: 57% Mediocre Share: 22% Fair Share: 11% Good Share: 11% |

| Vehicle Operating Costs (VOC) | $921 |

Los Angeles is one of the most illustrious cities in the world, with celebrity residents, film studios, and some of the best entertainment that draws national and international visitors every day.

A lot of things are moving in Los Angeles, and transportation can get quite expensive for motorists and commuters trying to get from one place to the next. California car insurance law requires every driver to have basic coverage, and that impacts Los Angeles car insurance rates.

We have a guide that will help you compare car insurance in Los Angeles and find a rate that’s right for you. Continue reading to get the full script of what to expect in Los Angeles. And our convenient tool will help you find the best car insurance options. Just enter your ZIP code to get Los Angeles car insurance quotes today.

The Cost of Car Insurance in Los Angeles

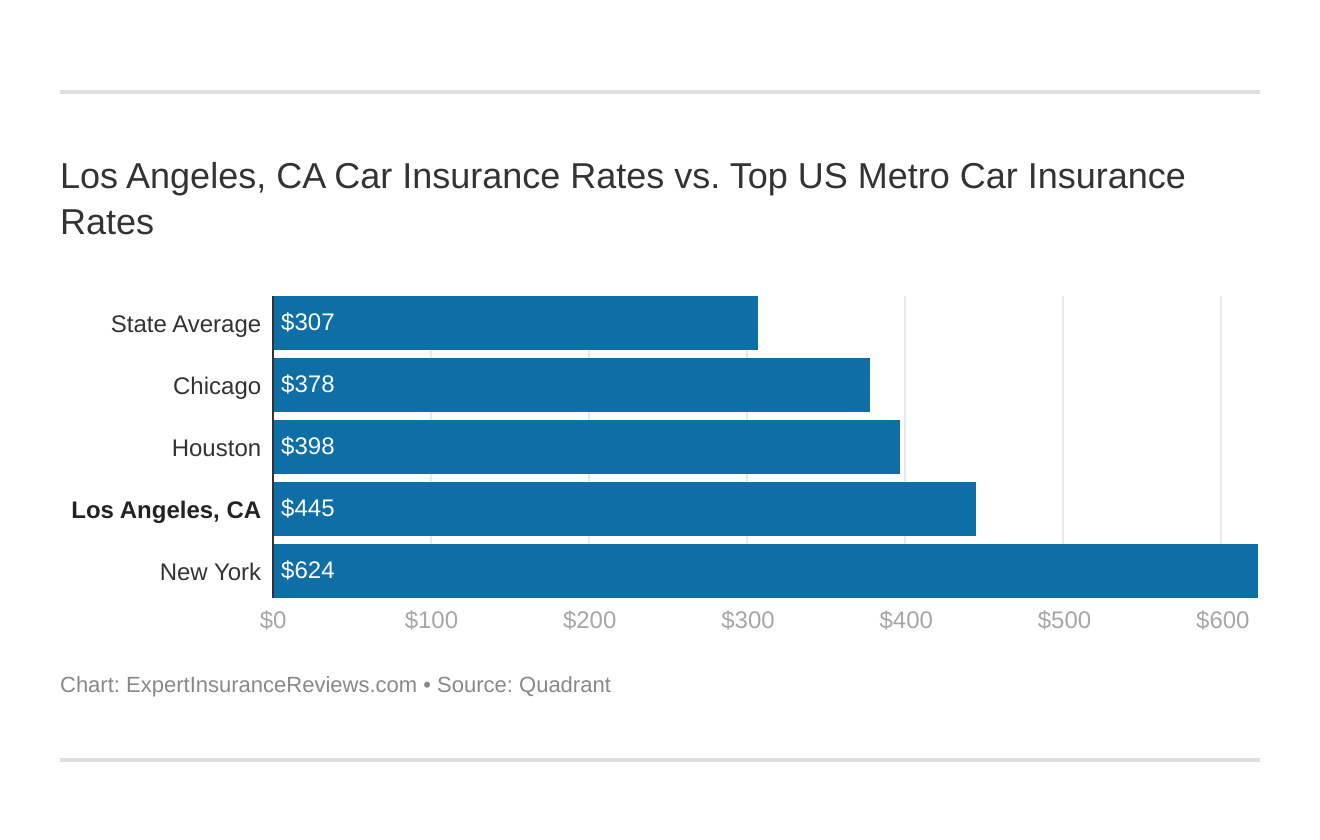

Los Angeles is a major city in California, and one of the biggest in the U.S. Los Angeles car insurance average rates are higher than the national average.

What city you reside in will impact your car insurance. That’s why it’s essential to compare Los Angeles, CA against other top US metro areas’ auto insurance costs.

However, each company carries a different annual rate you may be able to afford. This section will cover all rates as it pertains to demographic, credit, commute mileage per year, driving record, ZIP code, and coverage level.

Also, we’ll cover some additional information such as poverty numbers, income disparities, and common occupations in Los Angeles.

Male vs. Female vs. Age

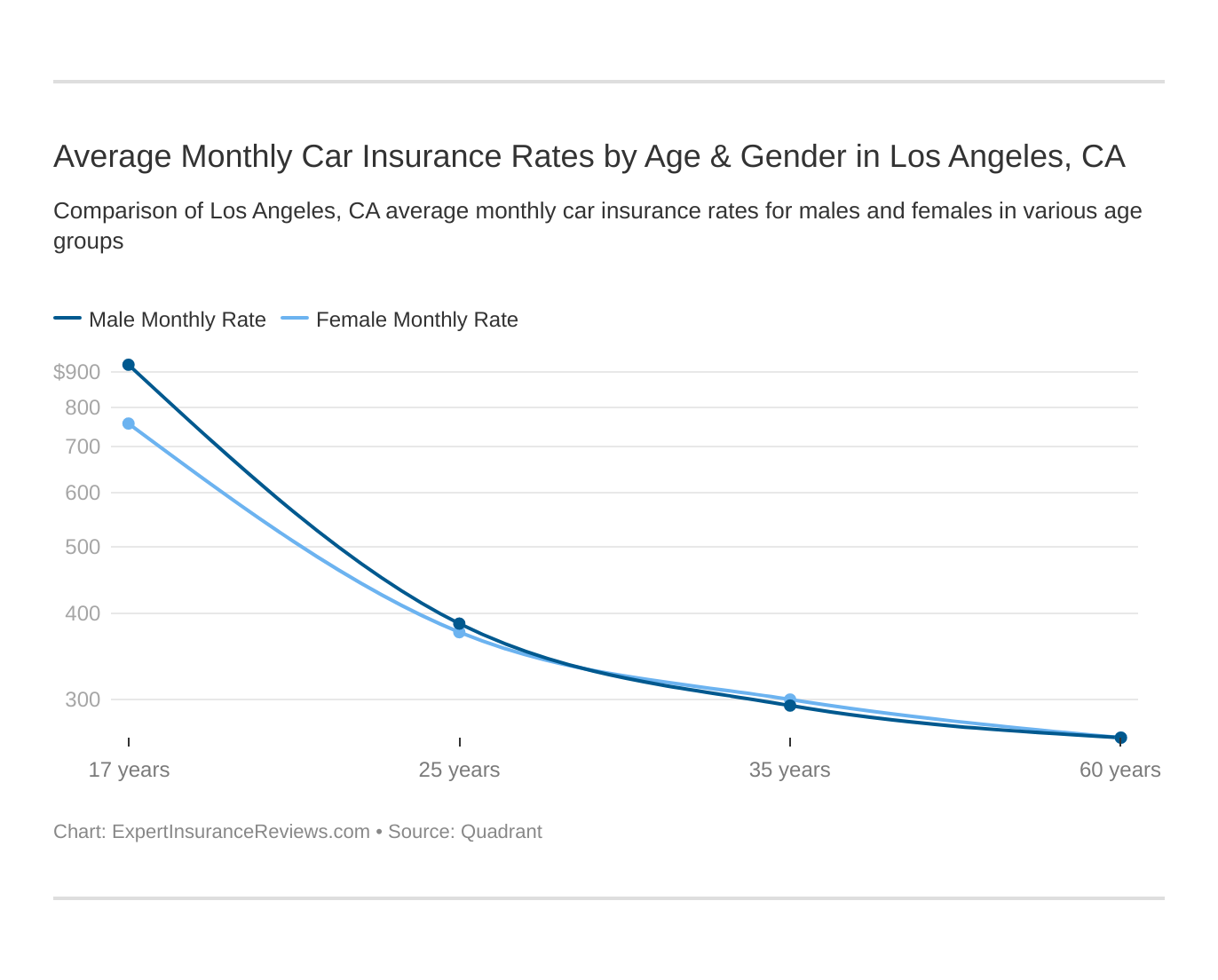

California is arguably the seventh state to ban car insurance companies from determining annual premiums based on gender. However, car insurance companies can determine your rates based on your age. Females and males of the same age will pay the same annual rate in Los Angeles.

Age is a significant factor for Los Angeles, CA car insurance rates. Young drivers are often considered high-risk. This Los Angeles, California does use gender as a car insurance factor, so check out the average monthly auto insurance rates by age and gender in Los Angeles, CA.

Let’s examine the average annual rates for motorists in Los Angeles.

| Los Angeles Motorist Age | Average Annual Rate |

|---|---|

| 17 Year Old Driver | $10,073.54 |

| 25 Year Old Driver | $4,578.97 |

| 35 Year Old Driver | $3,562.33 |

| 60 Year Old Driver | $3,164.93 |

As of 2019, parents of teen drivers will have to pay an average of $10,000 per year for car insurance regardless of gender. Even though gender-based rates are banned, car insurance companies and government officials appear to agree that determining rates based on age is reasonable.

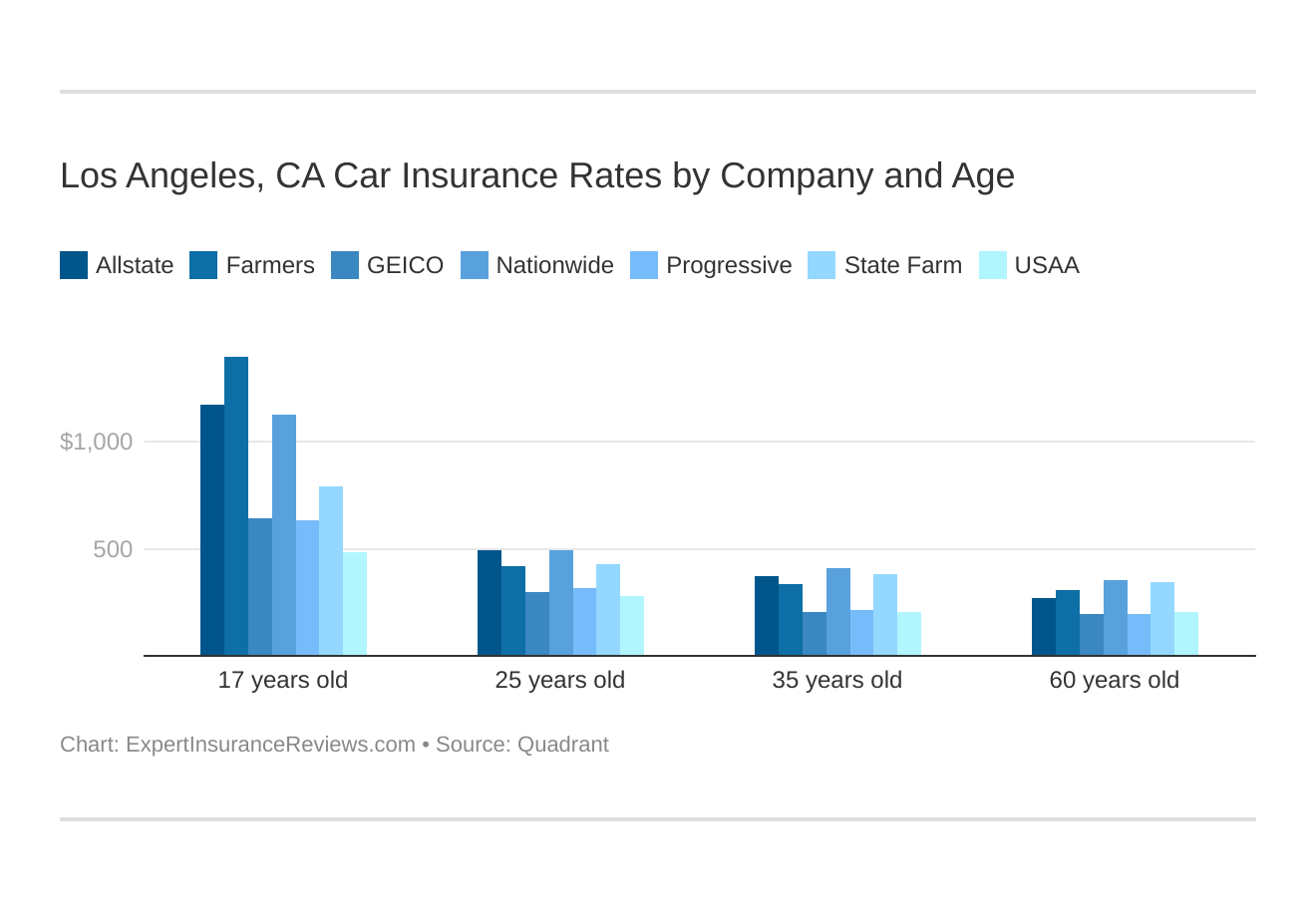

Los Angeles, CA car insurance costs by company and age is an essential comparison because the top car insurance company for one age group may not be the best provider for another age group.

Cheapest ZIP Codes in Los Angeles

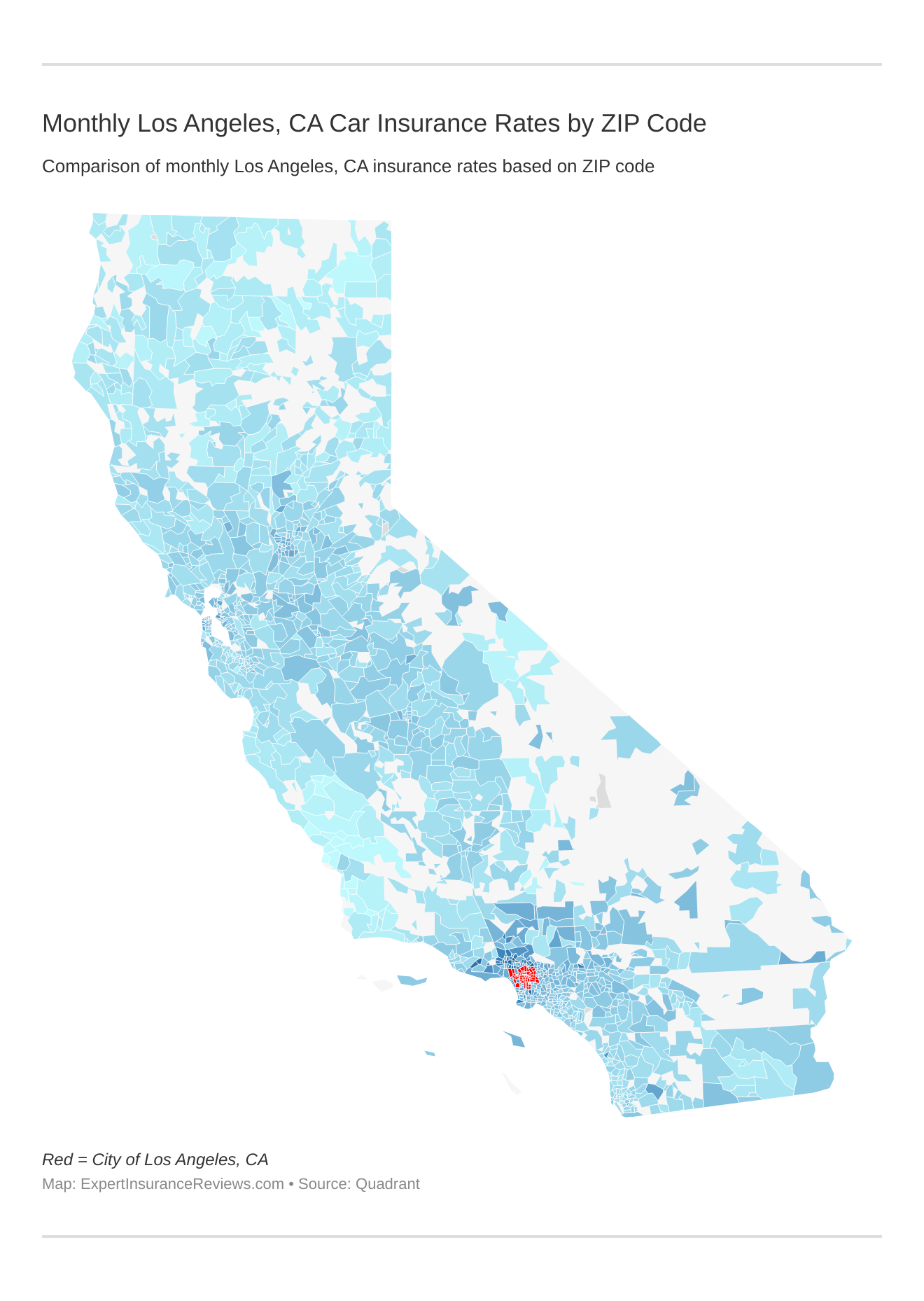

There are many different areas in Los Angeles with different economic levels. Some areas or ZIP codes in Los Angeles have lower costs of living. These differences are shown in car insurance rates, also. So, what’s car insurance like for each ZIP code in Los Angeles? The details of those average annual premiums are listed in the data below.

| Los Angeles, CA Zip Codes | Average Annual Rates |

|---|---|

| 90001 | $6,668.83 |

| 90002 | $6,880.20 |

| 90003 | $7,216.78 |

| 90004 | $8,152.00 |

| 90005 | $8,303.29 |

| 90006 | $8,008.26 |

| 90007 | $7,804.44 |

| 90008 | $7,324.43 |

| 90010 | $8,529.77 |

| 90011 | $7,015.39 |

| 90012 | $7,585.79 |

| 90013 | $7,484.92 |

| 90014 | $7,996.90 |

| 90015 | $7,984.60 |

| 90016 | $7,666.96 |

| 90017 | $8,115.53 |

| 90018 | $7,691.95 |

| 90019 | $7,892.49 |

| 90020 | $8,434.59 |

| 90021 | $7,317.97 |

| 90023 | $5,961.50 |

| 90024 | $7,859.78 |

| 90025 | $7,018.22 |

| 90026 | $7,407.32 |

| 90027 | $8,112.12 |

| 90028 | $8,339.09 |

| 90029 | $8,166.29 |

| 90031 | $6,574.62 |

| 90032 | $6,257.72 |

| 90033 | $6,641.77 |

| 90034 | $6,938.01 |

| 90035 | $7,723.27 |

| 90036 | $7,859.43 |

| 90037 | $7,442.40 |

| 90038 | $8,323.32 |

| 90039 | $6,666.43 |

| 90041 | $6,408.45 |

| 90042 | $6,342.79 |

| 90043 | $7,151.68 |

| 90044 | $7,199.59 |

| 90045 | $5,866.67 |

| 90046 | $8,322.74 |

| 90047 | $6,990.32 |

| 90048 | $8,094.05 |

| 90049 | $7,318.65 |

| 90057 | $8,100.73 |

| 90058 | $7,034.66 |

| 90059 | $6,638.38 |

| 90061 | $6,680.53 |

| 90062 | $7,554.63 |

| 90064 | $6,790.13 |

| 90065 | $6,606.33 |

| 90066 | $6,263.93 |

| 90067 | $7,924.85 |

| 90068 | $7,907.31 |

| 90071 | $7,263.26 |

| 90073 | $6,442.82 |

| 90077 | $8,095.60 |

| 90079 | $7,356.48 |

| 90089 | $7,299.04 |

| 90248 | $5,547.61 |

| 90292 | $6,639.76 |

| 90731 | $5,785.84 |

| 90732 | $5,443.97 |

| 91304 | $7,210.43 |

| 91307 | $6,911.28 |

| 91311 | $6,856.34 |

| 91330 | $7,471.96 |

| 91342 | $6,669.47 |

| 91345 | $6,711.32 |

ZIP codes will play a major role in your auto insurance rates because factors like crime and traffic are calculated by the ZIP code. Find more info about the monthly Los Angeles, CA auto insurance rates by ZIP Code below:

The cheapest annual rate in Los Angeles is $5,444, and the most expensive is $8,530. Locate the ZIP code where you live by typing your ZIP code in the search dialog box at the top right-hand corner of the data table.

Rates are determined by a location’s prosperity level, district lines, and a location’s likelihood of risk, so car insurance companies will have to assess these factors when issuing car insurance rates to a policyholder.

What’s the best car insurance company in Los Angeles?

The best car insurance company is up to you. Sometimes, the most affordable rate isn’t what’s best for you. Cheap rates could leave you underinsured in complicated accidents. The best car insurance company is the one that meets you in the middle in regard to annual rates and coverage.

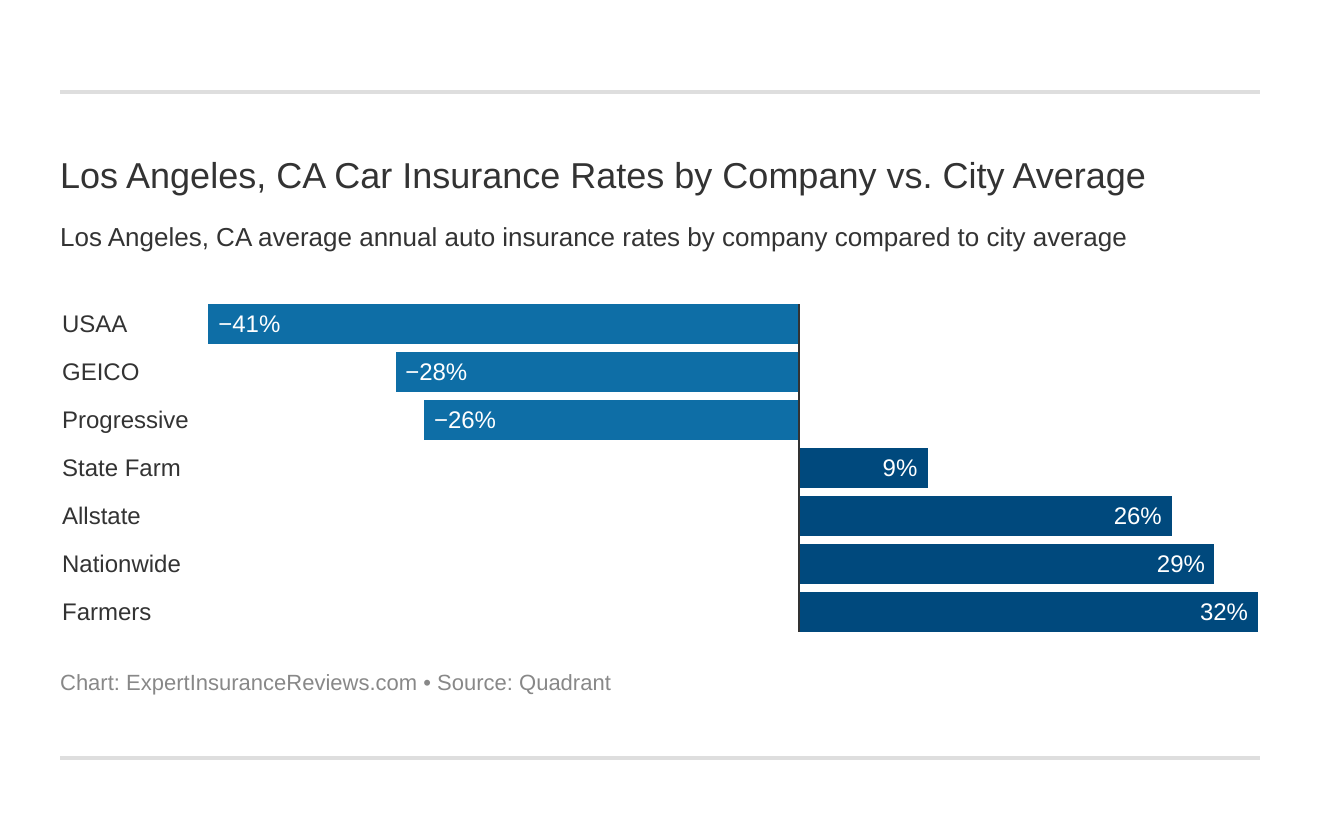

The cheapest Los Angeles, CA car insurance providers can be found below. You also might be wondering, “How do those Los Angeles, CA rates compare against the average California car insurance company rates?” We uncover that too.

As you shop for car insurance, think of your daily commute and the value of your vehicle. You’ll need an insurance policy that covers you if you’re at fault or if you need a rental when your vehicle is a total loss. Continue on through the guide to see more options.

Cheapest Car Insurance Rates by Company

If saving money is your priority, we can provide you with some information that shows car insurance companies with the cheapest rates in Los Angeles. The companies listed here are some of the biggest across the U.S. Let’s examine their average annual rates.

| Car Insurance Companies in Los Angeles, CA | Average Annual Rates |

|---|---|

| Allstate | $6,933 |

| Farmers | $7,368 |

| GEICO | $4,031 |

| Liberty Mutual | $4,175 |

| Nationwide | $7,140 |

| Progressive | $4,113 |

| State Farm | $5,846 |

| Travelers | $4,975 |

| USAA | $3,519 |

The cheapest annual rate is from USAA; however, only members of the U.S. military and their immediate families are eligible for a policy at USAA. All other companies are available. The three cheapest companies following USAA are Geico, Liberty Mutual, and Progressive.

Best Car Insurance for Commute Rates

Did you know car insurance companies can issue annual premiums based on how much you drive your car? When car insurance companies assess risk, they will estimate average commute mileage per year. We’ve put together some data to show the Los Angeles car insurance price by commute rate from major companies.

| Los Angeles, CA Companies | 10 miles commute. 6000 annual mileage. | 25 miles commute. 12000 annual mileage. |

|---|---|---|

| Allstate | $6,239.26 | $7,628.23 |

| Farmers | $6,682.86 | $8,054.91 |

| GEICO | $3,661.25 | $4,401.33 |

| Liberty Mutual | $3,826.67 | $4,523.34 |

| Nationwide | $6,289.10 | $7,991.24 |

| Progressive | $3,729.65 | $4,497.40 |

| State Farm | $5,633.47 | $6,059.06 |

| Travelers | $4,459.95 | $5,491.64 |

| USAA | $3,240.71 | $3,798.88 |

Los Angeles car insurance companies issue a higher premium if you plan on driving more than 12,000 miles or more per year.

The average motorist in Los Angeles drives approximately 13,500 miles per year.

In other states, car insurance companies would charge motorists the same amount per year regardless of how much you used your car.

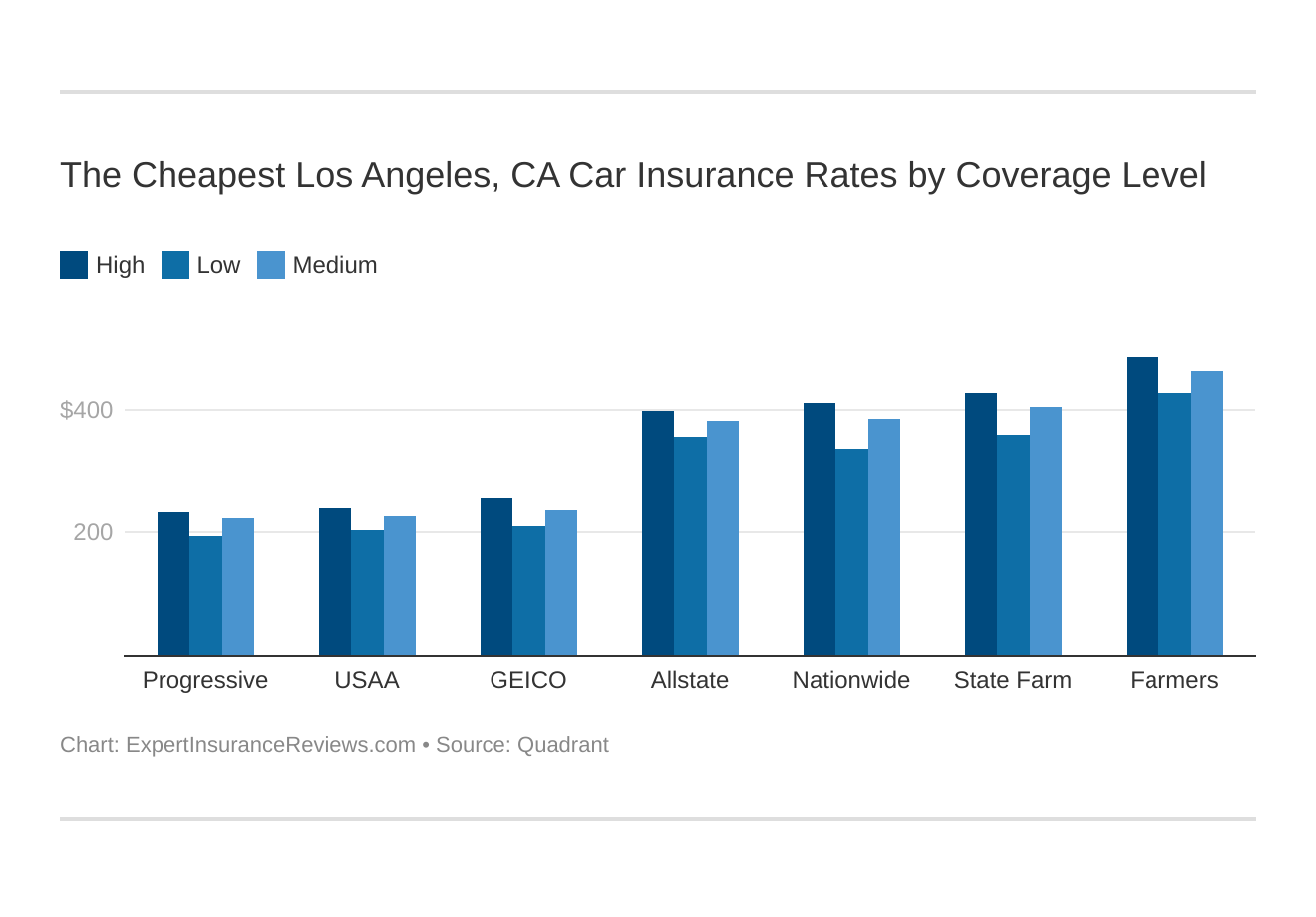

Best Car Insurance for Coverage Level Rates

Coverage levels are much different. This section of the car insurance is strictly about liability car insurance, which is the minimum car insurance required to drive on most roadways in the U.S.

Your coverage level will play a major role in your Los Angeles, CA car insurance costs. Find the cheapest Los Angeles, CA car insurance costs by coverage level below:

Los Angeles minimum requirements for liability insurance follow California’s state minimum requirements, which are $15,000 for Bodily Injury per individual, $30,000 for Bodily Injury of two or more people in an accident, and $5,000 for Property Damage per accident.

This is referred to as the 15/30/5 regulation, which is the lowest coverage in California.

Residency in a city with a high cost of living like Los Angeles may require more coverage considering most vehicles are worth more than $5,000.

Therefore, it’s necessary to enroll in a higher coverage level. The coverage level that is available in California is the 15/30/5 rule (low coverage level), the 50/100/25 rule (medium coverage level), and the 100/300/100 rule (high coverage level).

Here are the average annual rates for each coverage level in Los Angeles.

| Companies in Los Angeles | Low | Medium | High |

|---|---|---|---|

| Allstate | $6,518.17 | $6,999.88 | $7,283.19 |

| Farmers | $6,802.49 | $7,434.30 | $7,869.87 |

| GEICO | $3,579.19 | $4,080.91 | $4,433.77 |

| Liberty Mutual | $3,835.18 | $4,215.28 | $4,474.55 |

| Nationwide | $6,366.35 | $7,268.81 | $7,785.36 |

| Progressive | $3,648.91 | $4,243.53 | $4,448.14 |

| State Farm | $5,242.92 | $5,951.74 | $6,344.14 |

| Travelers | $4,268.80 | $5,122.16 | $5,536.42 |

| USAA | $3,176.34 | $3,591.24 | $3,791.79 |

Aside from USAA, Geico, and Progressive have the cheapest rates per year. It may be more beneficial to enroll in medium coverage. This will ensure that another motorist covered in case your in an accident where you are at fault.

Best Car Insurance for Credit History Rates

Your car insurance payments and your credit score can determine how much you pay for car insurance per year. When we mention car insurance payments, we mean how timely you pay for car insurance. If you have a record of canceled policies due to nonpayment of premiums, car insurance companies may charge you more per year.

Also, your credit scores will determine how much you pay, as well. The lower your credit score, the more money you’re likely to pay to car insurance companies.

In Los Angeles and any other city in California, your car insurance rates will not be determined by credit score.

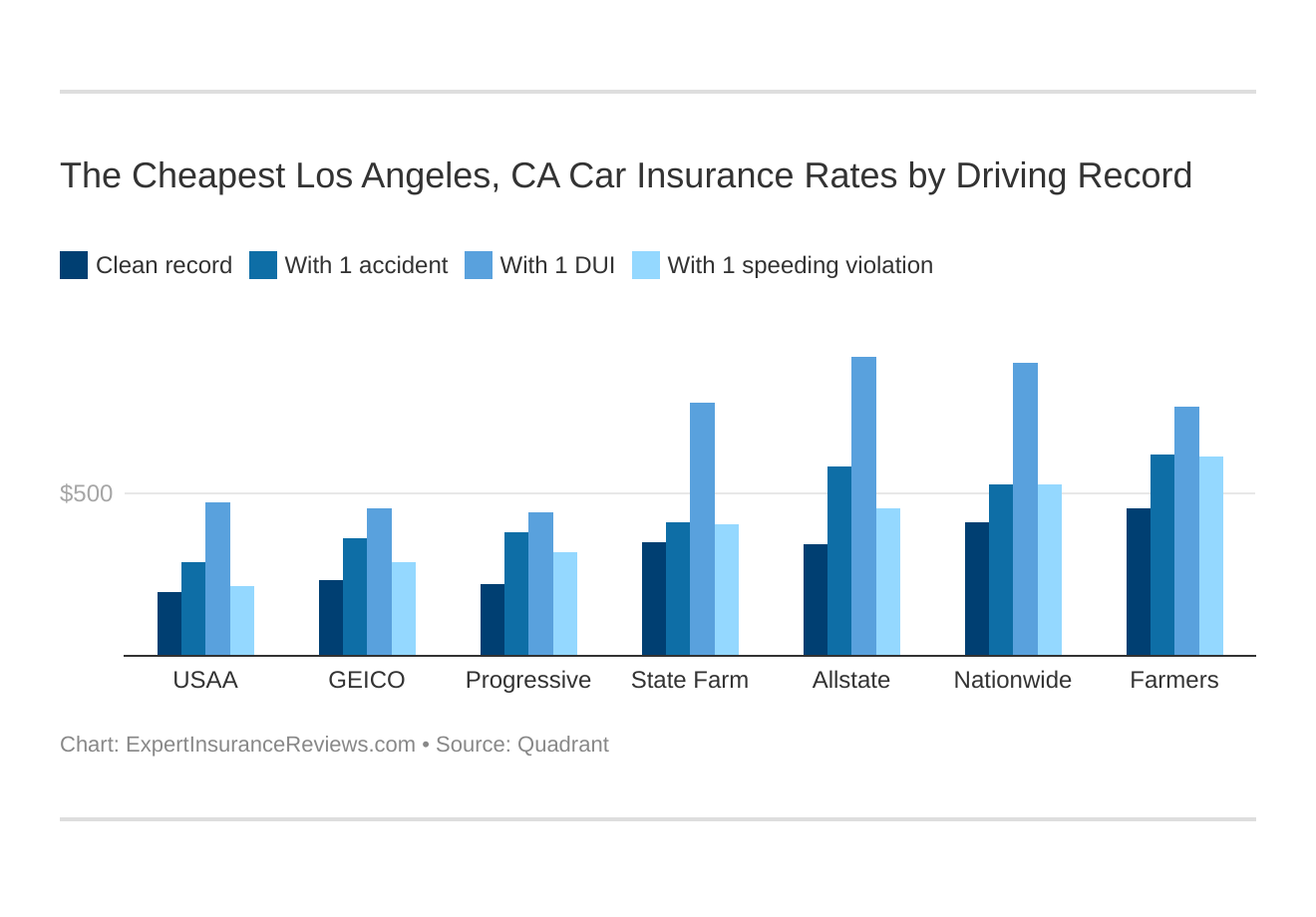

Best Car Insurance for Driving Record Rates

Having a good driving record could help you save money on car insurance. Accidents and traffic violations can increase your annual rates. Car insurance companies may cancel your policy if you have multiple accidents and traffic violations.

Your driving record will affect your Los Angeles, CA car insurance costs. For example, a Los Angeles, California DUI may increase your car insurance costs 40 to 50 percent. Find the cheapest Los Angeles, California car insurance costs by driving record.

For now, let’s look at some car insurance rates based on driving records with one accident, one speeding violation, and one DUI conviction.

| Companies in Los Angeles | Clean record | With 1 speeding violation | With 1 accident | With 1 DUI |

|---|---|---|---|---|

| Allstate | $4,149.84 | $5,465.62 | $7,025.57 | $11,093.95 |

| Farmers | $5,457.32 | $7,366.05 | $7,424.13 | $9,228.04 |

| GEICO | $2,811.80 | $3,489.34 | $4,369.58 | $5,454.45 |

| Liberty Mutual | $3,624.85 | $3,841.35 | $4,850.21 | $4,383.60 |

| Nationwide | $4,967.15 | $6,379.89 | $6,379.89 | $10,833.75 |

| Progressive | $2,674.38 | $3,864.37 | $4,583.08 | $5,332.27 |

| State Farm | $4,174.95 | $4,843.42 | $4,977.11 | $9,389.60 |

| Travelers | $3,235.94 | $4,891.24 | $5,455.96 | $6,320.04 |

| USAA | $2,330.45 | $2,555.44 | $3,485.00 | $5,708.26 |

DUI convictions have the highest annual average in regard to driving records. Allstate and Nationwide drive their rates up to the $10,000s for DUI convictions.

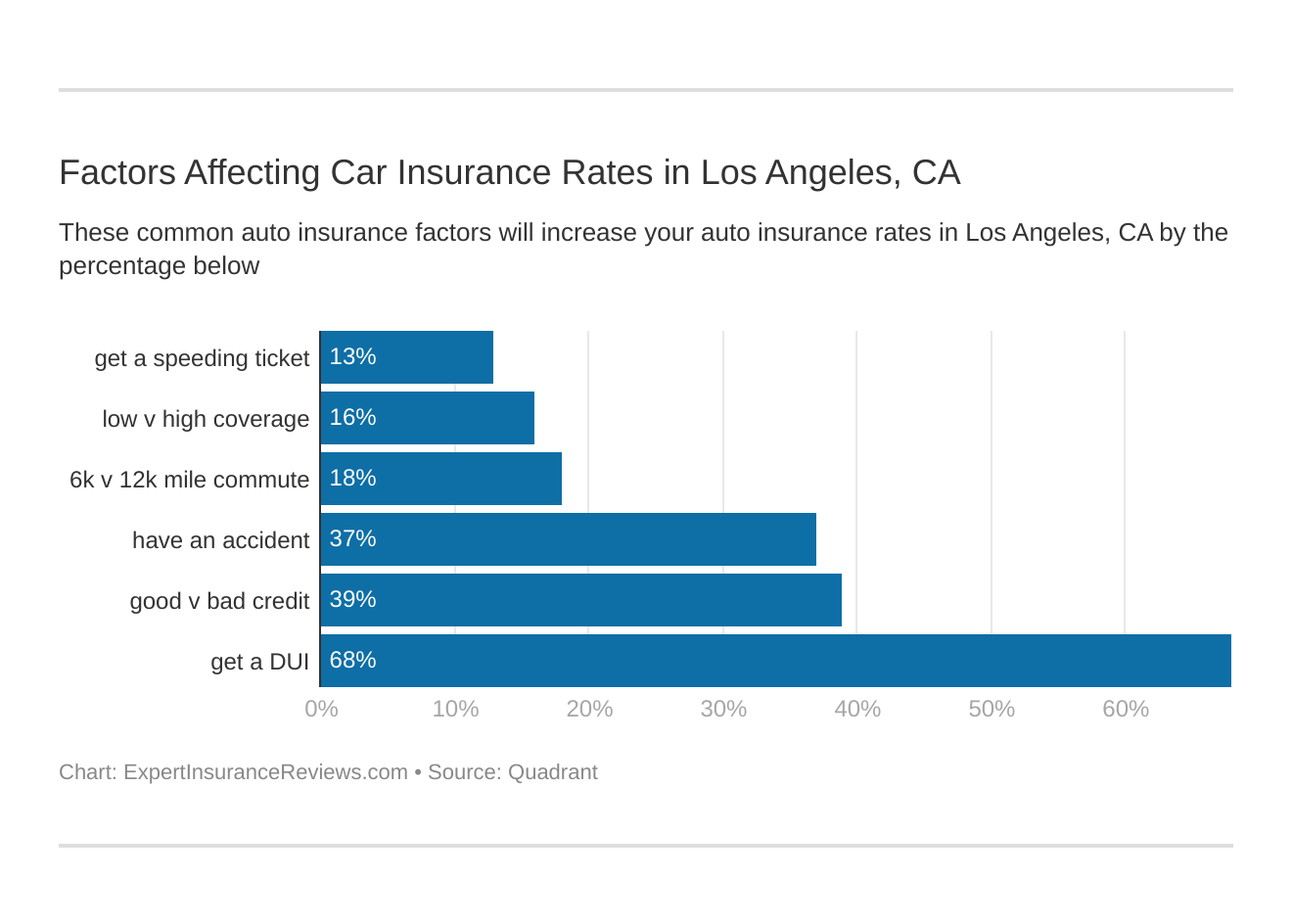

Car Insurance Factors in Los Angeles

Commute mileage, coverage level, and driving records aren’t the only factors that determine car insurance. Prosperity, growth, annual income, homeownership, poverty, wages, and employment are factors in which car insurance considers annual coverage rates.

Controlling these risk factors will ensure you have the cheapest Los Angeles, California car insurance. Factors affecting car insurance rates in Los Angeles, CA may include your commute, coverage level, tickets, DUIs, and credit.

This sub-section covers all the factors that may have gone unnoticed. We’ll summarize each factor in a few blurbs of information.

Metro Report – Growth & Prosperity

A prosperous city could mean average motorists or average residents are doing well economically. With prosperity comes job growth and more affordability for goods created domestically and internationally. More prosperity can increase rates, but it could lower the percentage deducted from your income.

The Brooking Institute, a nonprofit research group in the U.S., measures job growth and economic prosperity every year detailing the performance of every major city in the U.S. Listed below are the results for the Los Angeles, California, area.

The percentages represent the increase over time, and the ratings represent the performance of the city. The ratings are from one to 100, where one to 20 is the best performance, and 81 to 100 is the worst performance.

| 1-Year Change (2016-17) | Percentage | Brooking Rating Overall Prosperity: 13 out of 100 Overall Growth: 54 out of 100 |

|---|---|---|

| Percentage change in productivity | +1.3% | 37 out of 100 |

| Percentage change in standard of living | +2.4% | 17 out of 100 |

| Percentage change in average annual wage | +2.5% | 6 out of 100 |

| Percentage change in jobs | +1.2% | 55 out of 100 |

| Percentage change in GMP | +2.6% | 42 out of 100 |

| Percentage change in jobs at young firms | +2.9% | 58 out of 100 |

From 2016 to 2017, Los Angeles performed well in prosperity growth. This may be due to ever-constant industries such as sports and entertainment. Los Angeles performed moderately within that year, with a rating of 54 out of 100.

But how did Los Angeles perform within the last decade? Let’s look at those numbers.

| 10-Year Change (2007-17) | Percentage | Brooking Rating Overall Prosperity: 34 out of 100 Overall Growth: 59 out of 100 |

|---|---|---|

| Percentage change in productivity | +6.7% | 38 out of 100 |

| Percentage change in standard of living | +6.3% | 29 out of 100 |

| Percentage change in average annual wage | +6.4% | 38 out of 100 |

| Percentage change in jobs | +5.3% | 55 out of 100 |

| Percentage change in GMP | +12.4% | 50 out of 100 |

| Percentage change in jobs at young firms | -20.2% | 67 out of 100 |

Los Angeles has maintained a good rating for the past 10 years. The percent change in jobs was the only bad rating in Los Angeles.

Median Household Income

The average household income in Los Angeles is $65,000. Los Angeles’s average annual income is over $4,000 more than the national annual average, which is $60,336.

How does car insurance affect household income?

Car insurance rates affect a percentage of your household income.

Let’s use the average household income from Data USA and the average annual car insurance rate of Los Angeles. When you divide the average annual rate for car insurance ($5,444) into the average household income ($65,006), you’ll get 0.0837.

If you move the decimal over two places, it’ll be 8.37, which is the percentage of income that’s affected by car insurance each year.

Try it out for yourself. Use the free tool provided in the Calculator Pro box below. Type in an annual income and the average annual rate of car insurance, and the tool will calculate the percentage of income that’s affected by car insurance.

CalculatorPro

Homeownership in Los Angeles

Approximately 46 percent of households in Los Angeles is owned by a resident of the city. Los Angeles’s average homeownership is lower than the national average, which is 64 percent. The median household value is $588,700.

Does homeownership affect car insurance rates?

Homeowners are likely to pay more for car insurance.

According to the Insurance Information Institute, homeowners will pay more for car insurance, but homeowners will receive a discount if they insure their home with the same company that insures their motor vehicles.

With 46 percent of residents occupying the homes they own, there’s roughly 54 percent of Los Angeles residents renting their households.

Education in Los Angeles

Over 169,429 degrees were awarded to students in Los Angeles in 2016. The female student population towers over the male population, with 421,132 women and 347,741 men enrolled in college or universities.

More than 40 percent of Hispanics or Latinos graduated from Los Angeles colleges in 2017. That’s 13 percent more than white students, 24 percent more than Asian students, and 33 percent more than black students.

Universities that awarded the most degrees within the last few years have been the University of Southern California, the University of California-Los Angeles, and the California State University-Northridge.

Most industries in Los Angeles require a four-year degree. Some of the most common college majors, such as Liberal Arts and Sciences and General Business Administration and Management, are within industries that are booming in Los Angeles.

Wage by Race & Ethnicity in Common Jobs

How does car insurance affect motorists of certain ethnicities? Wage disparities between ethnicities are very real. Car insurance rates as a percent of income are different for each ethnicity in Los Angeles. We compared common job salaries in Los Angeles and how they differ by race and ethnicity.

| WAGE BY RACE AND ETHNICITY IN COMMON JOBS | MISCELLANEOUS MANAGERS | CAR INSURANCE AS % OF INCOME (MM) | ELEMENTARY & MIDDLE SCHOOL TEACHERS | CAR INSURANCE AS % OF INCOME (E&M TEACHERS) | RETAIL SALESPERSON | CAR INSURANCE AS % OF INCOME (RETAIL) | DRIVERS/SALES WORKERS & TRUCK DRIVERS | CAR INSURANCE AS % OF INCOME (DRIVERS) | CASHIERS | CAR INSURANCE AS % OF INCOME (CASHIERS) |

|---|---|---|---|---|---|---|---|---|---|---|

| American Indian | $87,447 | 6.23% | $53,588 | 10.15% | $21,277 | 25.59% | $43,823 | 12.43% | $20,573 | 26.46% |

| Asian | $118,884 | 4.58% | $56,743 | 9.59% | $29,399 | 18.51% | $36,337 | 14.98% | $19,950 | 27.29% |

| Black | $76,262 | 7.14% | $52,620 | 10.35% | $22,711 | 23.97% | $39,488 | 13.79% | $18,318 | 29.72% |

| Native Hawaiin and Other Pacific Islander | $128,245 | 4.24% | $48,953 | 11.12% | $25,712 | 21.17% | $42,284 | 12.87% | $17,167 | 31.71% |

| Other | $65,067 | 8.37% | $46,471 | 11.71% | $22,688 | 24% | $41,319 | 13.23% | $15,971 | 34.09% |

| Other Native American | $0 | 0% | $72,969 | 7.46% | $16,935 | 32.15% | $40,539 | 13.43% | $6,238 | 87.27% |

| Two or More Races | $110,079 | 4.95% | $52,813 | 10.31% | $26,840 | 20.28% | $38,941 | 13.98% | $15,090 | 36.08% |

| White | $114,249 | 4.77% | $58,917 | 9.24% | $31,081 | 17.52% | $42,982 | 12.67% | $17,132 | 31.78% |

The wage disparities between ethnicities and common jobs are incredible. Of course, the more you earn per year will lower the car insurance rate as a percent of income. Native Hawaiin individuals are paid the most in miscellaneous management positions, but other Native American individuals had some of the lowest annual incomes.

Wage by Gender in Common Jobs

Let’s broaden our view and look at common jobs by gender to see the wage disparity between men and women.

| WAGE BY COMMON JOBS SUMMARY | MALE STATS | CAR INSURANCE AS % OF INCOME (MALE) | FEMALE STATES | CAR INSURANCE AS % OF INCOME (FEMALE) |

|---|---|---|---|---|

| Miscellaneous Managers | $125,706 | 4.33% | $94,699 | 5.75% |

| Elementary & Middle School Teachers | $68,823 | 7.91% | $63,657 | 8.55% |

| Retail Salespersons | $47,957 | 11.35% | $35,791 | 15.21% |

| Drivers/Sales Workers & Truck Drivers | $46,287 | 11.76% | $32,578 | 16.71% |

| Cashiers | $27,490 | 19.80% | $26,863 | 20.26% |

Though California has outlawed car insurance companies from using gender to determine car insurance rates, women still pay more as a percent of income.

Poverty by Age & Gender

Speaking of gender, how does gender disparities look when we mention poverty — are men more likely to be in poverty than women? Let’s have another look at a data table that describes the poverty disparity between men and women.

| POVERTY BY AGE & GENDER | MALES IN POVERTY | FEMALES IN POVERTY |

|---|---|---|

| Younger than 5 | 4.47% | 4.37% |

| 5 Years Old | 0.93% | 0.86% |

| 6 to 11 Years Old | 5.54% | 5.26% |

| 12 to 14 Years Old | 2.59% | 2.59% |

| 15 Years Old | 0.83% | 0.91% |

| 16 to 17 Years Old | 1.82% | 1.73% |

| 18 to 24 Years Old | 5.95% | 6.72% |

| 25 to 34 Years Old | 5.77% | 7.92% |

| 35 to 44 Years Old | 5.22% | 7.35% |

| 45 to 54 Years Old | 4.81% | 5.73% |

| 55 to 64 Years Old | 3.96% | 4.84% |

| 65 to 74 Years Old | 2.07% | 2.95% |

| 75 Years and Older | 1.54% | 3.26% |

The peak of poverty of both genders occurs from 18 to 44. However, the data shows that women are 2 percent more likely to encounter poverty than men.

Poverty by Race & Ethnicity

What about poverty that affects ethnicities in Los Angeles? Data USA provided those numbers, and we’ve summarized them in a table for your convenience.

| POVERTY BY RACE & ETHNICITY | % OF PEOPLE IN POVERTY |

|---|---|

| Hispanic | 37.80% |

| White | 29.10% |

| Other | 17.40% |

| Black | 6.79% |

| Asian | 6.43% |

| Two or More | 1.82% |

| Native American | 0.52% |

| Pacific Islander | 0.13% |

The highest percentage of poverty in Los Angeles is the Latino community.

Employment by Occupations

The film, sports, and other forms of entertainment industries aren’t the only available jobs in Los Angeles. From 2016 to 2017, Los Angeles’s employment grew from 4.89 million to 4.97 million workers. That’s a 1.8 percent increase in job growth.

Common jobs in Los Angeles are Office & Administrative Support Occupations, Sales & Related Occupations, and Management Occupations were part of that growth and shares most of the city’s percentage of workers. Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Driving in Los Angeles

Now that you’ve seen car insurance rates and factors that determine car insurance, what is it like to drive in the city of Los Angeles? This section covers facts and data related to Los Angeles roadways, highways, crime data, transportation facts, and other miscellaneous information that’ll help you understand how to drive through the City of Angels.

Roads in Los Angeles

Let’s start with roadways in Los Angeles. What are the conditions of the roads in Los Angeles? Many U.S. and abroad tourists visit the city, so what are some of the popular sites in the city? We’ll ride through these details in this sub-section to give you an idea of what you can expect in Los Angeles.

Major Highways in Los Angeles

California has an estimated 2,457 miles of highway. Nine highways travel to and from Los Angeles. Six of those highways are exclusively in California. We’ve summarized highway data from the Los Angeles Almanac.

| ROUTE | TYPE OF HIGHWAY | TOTAL MILEAGE ACROSS THE U.S. | NICKNAME(S) | YEAR OPENED |

|---|---|---|---|---|

| I-5 | Interstate | 1,381 miles | Santa Ana (south of Downtown L.A.); Golden State (north of Downtown L.A.) | 1945-1958 (south of Downtown L.A.); 1956-1975 (north of Downtown L.A.) |

| I-10 | Interstate | 2,460 miles | San Bernardino (east of Downtown L.A.), formerly Ramona; Santa Monica (west of Downtown L.A.), formerly Olympic | 1943-1957 (east of Downtown L.A.); 1961-1966 (west of Downtown L.A.) |

| I-105 | Interstate | 17 miles (California) | Glenn Anderson or Century | 1993 |

| I-110 (south of Jct. U.S. 101) | Interstate | 20 miles (California) | Harbor | 1952-1970 |

| I-210 | Interstate | 49 miles (California) | Foothill | 1955-2003 |

| I-405 | Interstate | 72 miles (California) | San Diego, formerly Sepulveda | 1957-1969 |

| I-605 | Interstate | 27 miles (California) | San Gabriel River | 1964-1971 |

| I-710 | Interstate | 20 miles (California) | Long Beach, formerly Los Angeles River | 1952-1965 |

| US-101 | U.S. Highway | 1,540 miles | Hollywood (south of Cahuenga); Ventura (north of Cahuenga), formerly Riverside (along the L.A. River) | 1940-1948 (south of Cahuenga); 1955-1974 (north of Cahuega) |

Interstate-10’s West End is in Santa Monica, CA, and the East End is in Jacksonville, FL, totaling 2,460 miles across the U.S. It’s a major interstate due to its use from Los Angeles residents and traveling commuters who have to pass through the city.

What about toll roads? There are six toll transponders in Los Angeles. They are 10/110 Express Lanes, Future 405 Express Lanes, The Toll Roads of Orange County, 15 Express Lanes & 125 Expressway, 91 Express Lanes, and Future 10 & 15 Express Lanes.

To find the costs of toll roads within Orange County, visit Los Angeles’s FasTrak service.

Popular Road Trips/Sites

Los Angeles is full of things to do. The most popular sites reside in Los Angeles. Check out this short video to get an extensive visual of Los Angeles’s most popular tourist extractions.

Road Conditions

Earlier in the guide, we showed data related to road conditions in Los Angeles. Road conditions in Los Angeles were reported to be mostly poor. To be more thorough, 57 percent of Los Angeles roadways are in poor condition.

Only 22 percent of Los Angeles roadways are considered fair or good, while the other 22 percent is considered mediocre conditioned roadways.

Does Los Angeles use speeding or red light cameras?

Los Angeles does have speed and/or red light cameras. For the past few years, there has been a controversy surrounding red lights. The complexity of the red light/speed camera debate is whether it’s preventing accidents.

Also, some motorists in Los Angeles ignore red light/speed camera tickets. Motorists do have an option to ignore the ticket; however, if the red light/speed camera ticket is reported to the DMV, a motorist will have to pay the ticket’s price.

Unreported tickets from red light/speed camera officials will not affect your car insurance. Once the ticket(s) is reported, an unpaid ticket can affect your car insurance, and your license could be suspended.

Here’s a short video explaining how to deal with red light/speed camera tickets in Los Angeles.

Vehicles in Los Angeles

If you are driving through Los Angeles, you’ll see a plethora of vehicles. From foreign to domestic, Los Angeles roadways are populated with fuel-efficient and luxury vehicles across the city. This sub-section will explore Los Angeles’s most popular vehicles, cars per household, speed traps, and vehicle theft.

Most Popular Vehicles Owned

According to CBS Los Angeles, the most popular vehicle in Los Angeles is the SUV.

The Dodge Durango is one of the most popular cars in the City of Angeles. Motorists who own this vehicle travel an estimated 12,800 miles per year. The second most popular is the Cadillac Escalade. Reports say motorists who own this vehicle travel approximately 12,626 miles per year.

SUVs are flex-fueled vehicles but require a lot of gas.

Are SUVs safe? Well, that will depend on the driver of the vehicle. SUVs are much larger than vans and sedans, so motorists operating SUVs should take extra caution on roadways.

How Many Cars Per Household

Data USA estimates that most residents of Los Angeles own two cars per household, which is the same as the national average. About 37 percent of Los Angeles residents own two vehicles. Twenty-one percent of residents own one car, and about 20 percent of people own three cars.

Households Without a Car

Roughly 4 percent of people in Los Angeles do not own a car, which accounts for about 186,000 people.

Speed Traps in Los Angeles

As populated as Los Angeles is, it doesn’t make the top 10 list for speed traps in California. Let’s look at a short video that describes speed traps in California.

Vehicle Theft in Los Angeles

After reviewing data from the FBI, Los Angeles had the most vehicle thefts in California, with over 17,300 thefts in 2018. Los Angeles has more vehicle thefts than Oakland and Fresno.

Safest Neighborhood in Los Angeles

The top three safest neighborhoods in Los Angeles, according to Neighborhood Scout, are Victory Boulevard/Balboa Boulevard, Topanga Canyon Boulevard/South Topanga Canyon Boulevard, and Mulholland Drive/Sepulveda Boulevard.

Safe neighborhoods are a subjective thought because there are areas with a higher crime rate that are considered safe to them and not to others. No community is immune to crime. Let’s take a look at some crime statistics to show you the likelihood of crime in Los Angeles.

Eight out of 1,000 people in Los Angeles are victims of violent crime. In the entire state of California, however, five out of 1,000 are victims of violent crime. Both are higher than the U.S. average, which is four out of 1,000 people who are victims of violent crime.

The Neighborhood Scout rates Los Angeles as 14 in the crime index, where one is the most dangerous and 100 as the safest.

Let’s have a final look at crime data with a summarized view of annual crimes in Los Angeles.

| LOS ANGELES CRIME SUMMARY | VIOLENT CRIMES | PROPERTY CRIMES | TOTAL CRIMES |

|---|---|---|---|

| Number of Crimes | 30,809 | 103,554 | 134,363 |

| Crime Rate (per 1,000 residents) | 8 | 26 | 34 |

Based on the information provided, Los Angeles residents are likely to be victims of property crime than violent crime.

Traffic

The traffic navigation video you saw earlier in the guide is likely the sight you’ll see in Los Angeles traffic. Looking ahead, we’ll talk about traffic congestion in Los Angeles by referencing a traffic agency that records traffic levels in real-time. Also, we’ll look at some common methods of travel and the busiest highway in Los Angeles.

Traffic Congestion in Los Angeles

Traffic can be a challenge if you’re not accustomed to it. New residents in Los Angeles will have to battle with morning and evening peak traffic times, with extended commute times longer than the U.S. average.

INIRIX, an agency that broadcasts the traffic forecast throughout the year, shows how these commute times in hours per year and explains how money a motorist is estimated to spend in traffic congestion.

| URBAN AREA | 2018 IMPACT RANK (2017) | HOURS LOST IN CONGESTION | YEAR OVER YEAR CHANGE | COST OF CONGESTION (PER DRIVER) | INNER CITY TRAVEL TIME (MINUTES) | INNER CITY LAST MILE SPEED (MPH) |

|---|---|---|---|---|---|---|

| Los Angeles, CA | 47 (48) | 128 (76) | 0% | $1,788 | 4 | 14 |

A driver in Los Angeles will spend about $1,800 in traffic congestion. A portion of that money is spent in gas for the vehicle and other maintenance costs. Also, the hours you’ll spend in Los Angeles traffic per year is approximately 128 hours.

Here’s a report from CBS Los Angeles explaining the challenges of Los Angeles traffic.

Transportation

As you’ve seen in the CBS News report, Los Angeles has some of the worst traffic in the U.S. Their commute times, according to Data USA, is clocked 30 minutes. That’s four minutes higher than the national average. An estimated 75 percent of motorists in Los Angeles drive alone to work, 9 percent carpool to work, and 6 percent use public transportation for commutes to work.

Busiest Highways

Now that we’ve mentioned traffic, let’s examine the busiest highways in Los Angeles.

| URBAN AREA | ROUTE | LANES |

|---|---|---|

| Los Angeles-Long Beach-Santa Ana | I-405 | 14 |

| Los Angeles-Long Beach-Santa Ana | I-5 | 12 |

| Los Angeles-Long Beach-Santa Ana | Highway 91 | 12 |

| Los Angeles-Long Beach-Santa Ana | I-110 | 12 |

During peak hours such as 8 a. m. and 5 p. m., these highways will fill up in no time at all.

How safe are Los Angeles streets & roads?

Crime and traffic aren’t the factors that could make a commute troublesome for motorists. Fatalities plague motorists anywhere there’s a roadway. As much as government officials, law enforcement, and activists try to prevent them, they often occur when no one expects them.

Listed below is a list of comprehensive data tables that reflect the motor vehicle fatalities of counties in Los Angeles. The total column listed in the tables is the total number of fatalities in a five-year trend.

The first fatality numbers are for Los Angeles’s total crashes in 2017.

| LOS ANGELES COUNTIES TOTAL FATALITIES | 2017 | TOTAL |

|---|---|---|

| Los Angeles | 658 | 3410 |

| Orange | 178 | 924 |

| San Bernardino | 271 | 1351 |

| Riverside | 294 | 1307 |

| Ventura | 47 | 272 |

Los Angeles County had the most fatalities in 2017.

Next, let’s examine DUI fatalities in 2017.

| LOS ANGELES COUNTIES ALCOHOL-IMPAIRED FATALITIES | 2017 | TOTAL |

|---|---|---|

| Los Angeles | 192 | 940 |

| Orange | 47 | 243 |

| Riverside | 95 | 415 |

| San Bernardino | 76 | 386 |

| Ventura | 20 | 75 |

The highest fatality numbers are once again taken by Los Angeles County.

There were a number of single-vehicle crashes in Los Angeles. Here’s a view of the single-vehicle crashes in 2017.

| LOS ANGELES COUNTIES SINGLE VEHICLE FATALITIES | 2017 | TOTAL |

|---|---|---|

| Los Angeles | 368 | 1967 |

| Orange | 82 | 554 |

| Riverside | 169 | 734 |

| San Bernardino | 155 | 747 |

| Ventura | 19 | 157 |

In a five-year trend, Los Angeles County had over 1,900 fatalities.

What fatalities related to speeding? We’ve provided some statistics regarding speeding fatalities in 2017.

| LOS ANGELES COUNTIES SPEEDING FATALITIES | 2017 | TOTAL |

|---|---|---|

| Los Angeles | 214 | 1238 |

| Orange | 60 | 282 |

| Riverside | 84 | 425 |

| San Bernardino | 88 | 424 |

| Ventura | 14 | 70 |

Los Angeles County had more fatalities related to speeding than all other counties in the city combined.

Roadway departure fatalities are accidents where a vehicle has left the roadway as a result of an accident. Roadway departure fatalities in 2017 are listed below.

| LOS ANGELES COUNTIES ROADWAY DEPARTURE FATALITIES | 2017 | TOTAL |

|---|---|---|

| Los Angeles | 189 | 1055 |

| Orange | 49 | 302 |

| San Bernardino | 129 | 652 |

| Riverside | 135 | 622 |

| Ventura | 25 | 143 |

Although Los Angeles County had the most fatalities in roadway departure, it was nearly overtaken by Riverside County which had 135 fatalities in roadway departure.

Let’s look at intersection fatalities in 2017.

| LOS ANGELES COUNTIES INTERSECTION-RELATED FATALITIES | 2017 | TOTAL |

|---|---|---|

| Los Angeles | 234 | 1235 |

| Orange | 61 | 302 |

| Riverside | 85 | 305 |

| San Bernardino | 48 | 269 |

| Ventura | 13 | 55 |

Los Angeles County had the most fatalities than any other county in the city. The lowest fatalities were in Ventura County.

How many passenger cars were affected by traffic fatalities in Los Angeles? Here are the stats for 2017.

| LOS ANGELES COUNTY PASSENGER CAR RELATED FATALITIES | 2017 | TOTAL |

|---|---|---|

| Los Angeles | 183 | 1048 |

| Orange | 59 | 285 |

| Riverside | 113 | 483 |

| San Bernardino | 92 | 489 |

| Ventura | 24 | 108 |

Orange County and Ventura County had the lowest fatality rate regarding passenger car fatalities in 2017.

Sometimes, other vehicles are not involved in an accident. Pedestrians are often injured or even killed during traffic accidents. Let’s look at some pedestrian fatalities in 2017.

| LOS ANGELES COUNTY PEDESTRIAN FATALITIES | 2017 | TOTAL |

|---|---|---|

| Los Angeles | 235 | 1140 |

| Orange | 50 | 273 |

| San Bernardino | 68 | 301 |

| Riverside | 64 | 252 |

| Ventura | 5 | 48 |

Once again, Los Angeles County has the highest fatalities in pedestrians killed in traffic.

Like pedestrians, pedalcyclists or cyclists are affected by traffic fatalities. We’ve collected some data and summarized it in our 2017 pedalcyclists fatalities table.

| LOS ANGELES COUNTIES PEDALCYCLIST FATALITIES | 2017 | TOTAL |

|---|---|---|

| Los Angeles | 29 | 153 |

| Orange | 9 | 58 |

| Riverside | 8 | 45 |

| San Bernardino | 5 | 33 |

| Ventura | 0 | 12 |

Los Angeles County has over 100 more fatalities than San Bernardino.

Railway incidents occur less often than other traffic accidents, but they do occur. Here’s a record of those accidents.

| HIGHWAY USER SPEED | CALENDAR YEAR | COUNTY | HIGHWAY | HIGHWAY USER TYPE | RAIL EQUIPMENT TYPE | NON-SUICIDE FATALITY | NON-SUICIDE INJURY |

|---|---|---|---|---|---|---|---|

| unknown | 2012 | LOS ANGELES | 103 RD STREET | Pedestrian | Psgr Train | 1 | 0 |

| 45 | 2012 | LOS ANGELES | 92 ND STREET | Pedestrian | Psgr Train | 0 | 0 |

| unknown | 2012 | LOS ANGELES | IMPERIAL | Pedestrian | Psgr Train | 0 | 0 |

| 0 | 2012 | LOS ANGELES | FRONT STREET | Pick-up truck | B | 0 | 0 |

| unknown | 2012 | LOS ANGELES | STOCKWELL | Pedestrian | Psgr Train | 1 | 0 |

| 0 | 2013 | LOS ANGELES | SUNLAND BOULEVARD | Automobile | C | 0 | 0 |

| 0 | 2014 | LOS ANGELES | VAN NUYS BLVD. | Pedestrian | Freight Train | 0 | 0 |

| 25 | 2014 | LOS ANGELES | NORTH MAIN STREET | Automobile | B | 0 | 0 |

| 15 | 2015 | LOS ANGELES | ALCOA AVENUE | Automobile | Yard/Switch | 0 | 0 |

| 20 | 2015 | LOS ANGELES | N. HENRY FORD AVE. | Automobile | Freight Train | 0 | 0 |

| 0 | 2016 | LOS ANGELES | DE SOTO ST | Automobile | Psgr Train | 0 | 0 |

| 30 | 2016 | LOS ANGELES | 37TH & ALAMEDA ST | Truck-trailer | Yard/Switch | 0 | 0 |

| unknown | 2016 | LOS ANGELES | 48TH PLACE | Pedestrian | Freight Train | 1 | 0 |

| unknown | 2016 | LOS ANGELES | TAMPA AVE | Pedestrian | Psgr Train | 0 | 1 |

| 0 | 2016 | LOS ANGELES | NADEAU | Automobile | Freight Train | 0 | 0 |

Based on the table, more pedestrians were involved in fatal incidents involving railways than vehicles.

Allstate America’s Best Drivers Report

What’s the overall performance of drivers living in Los Angeles? Allstate conducts an annual study to grade cities across the U.S. on their driving performance.

| 2018 Best Drivers Report Ranking | City | Average Years Between Claims | Relative Claim Likelihood (Compared to National Average) | 2018 Drivewise® Hard-Braking Events Per 1 1,000 Miles | 2017 Best Drivers Report Ranking | Change in Ranking From 2017 to 2018 | 2018 Ranking After Controlling for Population Density | 2018 Ranking After Controlling for Average Annual Precipitation |

|---|---|---|---|---|---|---|---|---|

| 194 | Los Angeles, CA | 5.5 | 81.40% | N/A | 193 | -1 | 188 | 194 |

Data from hard braking has been omitted from the Allstate report, but they do report that the average years between claims are about six years per claim.

Ridesharing

Ridesharing is all over the state of California, and it’s definitely populated with more than two ridesharing services in Los Angeles. RideGuru lists a number of these ridesharing services.

The most popular among the ridesharing services such as Lyft and Uber are in Los Angeles. Although Uber and Lyft offer different levels of service, services like BlackLane provide luxury vehicle ridesharing exclusively.

E-star Repair Shops

If you’re thinking of using ridesharing services because your car is damaged from an accident, we can give you some quick reference to repair shops in the Los Angeles area. Check out their contact information below.

| E-STAR REPAIR SHOPS | ADDRESS | CONTACT INFORMATION |

|---|---|---|

| AGC COLLISION CENTER | 3424 W SUNSET BLVD LOS ANGELES CA 90026 | email: [email protected] P: (323) 663-8076 F: (323) 663-1675 |

| ALL CITY COLLISION BURBANK | 1020 S. VICTORY BLVD. BURBANK CA 91502 | email: [email protected] P: (818) 343-9999 |

| AUTO-TECH COLLISION CENTER_CF | 1116 W WASHINGTON BLVD LOS ANGELES CA 90015 | email: [email protected] P: (213) 748-8228 F: (213) 748-8789 |

| BELLWOOD AUTO BODY | 4625 GAGE AVE BELL CA 90201 | email: [email protected] P: (323) 771-3429 F: (323) 771-6464 |

| CALIBER - GLENDALE | 3829 SAN FERNANDO RD GLENDALE CA 91204 | email: [email protected] P: (818) 243-3206 |

| HARRY'S AUTO COLLISION CENTER | 1013 S. LA BREA AVE. LOS ANGELES CA 90019 | email: [email protected] P: (323) 933-5824 F: (323) 935-7054 |

| NOAH'S COLLISION CENTER | 5235 YORK BLVD LOS ANGELES CA 90042 | email: [email protected] P: (323) 258-4000 |

| PACIFIC ELITE - LOS ANGELES | 4610 CRENSHAW BLVD LOS ANGELES CA 90043 | email: [email protected] P: (323) 298-6282 F: (323) 296-0804 |

| SERVICE KING MONTEREY PARK | 999 S. MONTEREY PASS RD. MONTEREY PARK CA 91754 | email: [email protected] P: (323) 262-7415 F: (323) 262-7418 |

| WESTERN COLLISION | 709 N GRAMERCY PLACE LOS ANGELES CA 90038 | email: [email protected] P: (323) 465-7126 F: (323) 957-0975 |

These repair shops showed up as the top 10 repair shops around the Los Angeles area. Be sure to alert your car insurance company when you have an estimate.

Weather

| LOS ANGELES WEATHER CONDITIONS | TEMPS & OTHER STATS |

|---|---|

| Average High Temperature | 71.7°F |

| Average Low Temperature | 55.9°F |

| Average Temperature | 63.8°F |

| Average Annual Rainfall | 18.67 inches |

The national average for natural disasters is 13, but for Los Angeles, the average for natural disasters is around 50. Los Angeles residents are likely to encounter wildfires, winter storms, flooding, and landslides.

Los Angeles residents should consider talking to their car insurance company about comprehensive coverage. Some comprehensive coverages will cover damage from natural disasters. Be sure to ask about it whenever you’re discussing your policy, also.

Public Transit

Want to curve the commute rates of car insurance? You can always use public transportation instead of driving 30 minutes every day to work. But how much does it cost?

We’ve collected fare information from Los Angeles’s transit system, called Metro. Here is the cost of fares in Los Angeles.

| TYPE OF PASS | COST OF FARE |

|---|---|

| 1-Way | $1.75 |

| 1-Day Pass | $7 |

| 7-Day Pass | $25 |

| 30-Day Pass | $100 |

| LIFE 30-Day Pass (low-income) | $76 |

If you’re using cash, be sure to use the exact amount. For those with low-income or who are elderly or disabled will be offered a discount for the Metro.

Check out this video for details on Metro transit options in Los Angeles.

Alternate Transportation

Los Angeles Magazine lists a few options residents can take as alternative methods of transportation in Los Angeles.

Residents can use BlueLA, a taxi service that costs five dollars per month plus 20 cents per minute, or residents can use Bird and Lime, which are scooter-share services in Los Angeles. They cost $1 plus 15 cents per minute of use.

Perhaps you want to bike as a means of transportation. Every service is different, according to Los Angeles Magazine, but they range from one to seven dollars per hour.

Parking in Metro Areas

General parking and meter parking is available across Los Angeles. However, there are places you can park. ParkMobile, an app that alerts motorists about available parking, lists a few locations of specialty parking. We’ve summarized their locations in the data table below.

These are the parking locations for event parking around Los Angeles.

| LOCATION | ADDRESS |

|---|---|

| 405 Airport Parking | 9800 S La Cienega Blvd , Los Angeles, CA, 90301 |

| Banc of California Stadium | 3939 S Figueroa St , Los Angeles, CA 90037 |

| Galen Center | 3400 South Figueroa Street , Los Angeles, CA 90007 |

| Greek Theatre | 2700 N Vermont Ave , Los Angeles, CA 90027 |

| Los Angeles Memorial Coliseum | 3911 South Figueroa Street , Los Angeles, CA 90037 |

The cost may vary. Event parking usually subscription-based. College parking is free for students and some alumni. Consult event organizers for details on event parking.

Public parking comes with a price right away. Here are some locations residents of Los Angeles can use.

| LOCATION | ADDRESS | PARKING DURATION | RESERVE PARKING COST |

|---|---|---|---|

| 208 E 6th Street Garage | 208 E 6th St, Los Angeles, CA, 90014 | 3 hours | $6.53 |

| 3660 Wilshire Lot | 3660 Wilshire, Los Angeles, CA, 90010 | 3 hours | $17.42 |

| 11340 Olympic Blvd Parking Garage | 11340 Olympic Blvd, Los Angeles , CA, 90064 | 3 hours | $11.90 |

| Central Plaza Garage | 3440-70 Wilshire Blvd, Los Angeles, CA, 90010 | 3 hours | $4.33 |

| Crowne Plaza (6' 4'' Clearance) | 625 S Olive St, Los Angeles , CA, 90014 | 3 hours | $6.53 |

| Kimpton Everly Hotel | 1800 Argyle Ave, Los Angeles, CA, 90028 | 3 hours | $54.00 |

| Westin Bonaventure Garage | 404 S. Figueroa St, Los Angeles, CA, 90071 | 3 hours | $23.18 |

Major metropolitan areas often have higher price tags for parking. The lowest price so far is just under seven dollars.

Air Quality in Los Angeles

The U.S. Environment Protection Agency reports air quality indexes annually. How many days per year does Los Angeles have good air quality? Find out by examining the table below.

| LOS ANGELES AIR QUALITY DATA | # OF DAYS OF AIR QUALITY |

|---|---|

| Days with AQI | 182 |

| Good Air Quality Days | 56 |

| Moderate Air Quality Days | 108 |

| Unhealthy Air Quality Days for Sensitive Groups | 15 |

| Unhealthy Air Quality Days for All Groups | 3 |

Los Angeles had more moderate air quality days than any other condition. There were only three days of unhealthy air quality in Los Angeles.

Military/Veterans

A total of 87,716 veterans who were in the Vietnam conflict live in Los Angeles.

There are three military facilities around Los Angeles. From Los Angeles, a motorist can get to either of these facilities within an hour, especially if they are going to these military bases outside of peak morning and evening times.

| MILITARY BASE | ADDRESS | ESTIMATED TIME VIA INTERSTATE | TRANSIT TIME OF ARRIVAL |

|---|---|---|---|

| Los Angeles Air Force Base | 482 N Aviation Blvd, El Segundo, CA 90245 | 37 minutes | 50-57 minutes |

| Los Angeles County Military | 11301 Wilshire Blvd, Los Angeles, CA 90073 | 32 minutes | 1 hour 15 minutes-1 hour 21 minutes |

| U.S. Army Reserve Facility-Holder Hall | 1250 Federal Ave, Los Angeles, CA 90025 | 27 minutes | 1 hour 16 minutes-1 hour 38 minutes |

We’ve included public transit time, as well. They are a little over an hour for some commutes.

You’ve probably seen USAA annual premiums throughout the guide. USAA premiums are generally much lower than average annual rate. Remember, USAA is car insurance eligible only to military members and their immediate families. However, there are other car insurance companies that offer military discounts.

As you shop for car insurance, be sure to ask agents about military discounts. Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Unique City Laws

There a few strange laws in Los Angeles. Did you know it’s illegal to cry on the witness stand in Los Angeles? In Long Beach, cars are the only motor vehicles allowed in a garage. Also, it is illegal to drive more than 2,000 sheep down Hollywood Boulevard.

In 1995, Los Angeles lawmakers passed a law against washing your car in the street.

The best one of all is that peacocks have the right of way on roadways and driveways.

Parking laws are self-explanatory. If you park illegally on Los Angeles roadways, parking decks, or meters, you will receive a ticket. Fines can be as high $500, and if these offenses go unpaid, your license may be revoked.

Hands-free law dictates drivers are banned from using devices that distract them while driving. In Los Angeles, California, hands-free violations are a primary offense, and police are allowed to pull you over for distracted driving. The first offense is a $20 fine.

The second and subsequent offense comes with a $50 fine.

Tiny Homes are taking the U.S. by storm as more and more residents are seeking to minimize costs and be more efficient. Tiny Homes are in districts outside of the Los Angeles metropolitan area.

Take a look at this report for more details.

For those who aspire to own a food truck in Los Angeles, there are a number of laws that you’ll have to follow in addition to receiving your business license. Los Angeles Business Portal provides a checklist for you to make it easier for you to start your food trucks.

Watch this short video on how to begin that process.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Los Angeles Car Insurance FAQs

There are several things we may have missed. This section is dedicated to quick questions you may have that we may have missed in the sections above.

Does Los Angeles have low-income insurance?

Yes. California is one of three states that offer government-sponsored car insurance. If the voluntary market rates are too expensive, go to your local Los Angeles DMV and request information regarding low-income car insurance.

You can find more information about California’s low-income insurance on their government website.

What are the minimum requirements for car insurance in Los Angeles?

Los Angeles has a 15/30/5 rule, which means the minimum coverage for car insurance is $15,000 for Bodily Injury per person in an accident, $30,000 for Bodily Injury for two or more people in an accident, and $5,000 for property damage.

It’s highly recommended that motorists in Los Angeles go with medium cover to ensure they have enough coverage in case they are at fault in an accident.

Which Los Angeles DMV is the least busy?

Every DMV location has its rush moments. Someone will need to renew their license, get registration, or something related to their driving information. Expect wait times to be more than 30 minutes. Be patient with DMV officials. There are a lot of motorists to get to.

What is the minimum wage in Los Angeles?

The minimum wage in Los Angeles is $12.

Why is Los Angeles called the City of Angels?

The actual name of Los Angeles is Spanish for “The Angels.” Many believe it’s called this because of all the celebrities that live there, along with some of America’s richest people.

The guide’s overall purpose is to inform you of all the options you can take when searching for car insurance. We want to stress that we cannot say which company is best. That’s judgment is up to you. If you need to, reread some parts of the guide to see what car insurance company can meet your needs. The cheapest isn’t always the best for you.

Compare Los Angeles car insurance rates right now. Just enter your ZIP code to begin.

Frequently Asked Questions

What factors should I consider when searching for the best car insurance in Los Angeles, California?

When looking for the best car insurance in Los Angeles, California, consider factors such as coverage options, price, customer service, financial stability of the insurance company, discounts offered, and the ease of filing claims.

Are there any specific coverage options I should prioritize in Los Angeles, California?

In Los Angeles, California, it is essential to prioritize liability coverage, uninsured/underinsured motorist coverage, and comprehensive coverage due to the high number of vehicles on the road and the risk of accidents, theft, and natural disasters.

Which car insurance companies are known for providing reliable coverage in Los Angeles, California?

Several car insurance companies are known for providing reliable coverage in Los Angeles, California. Some popular options include State Farm, GEICO, Progressive, Allstate, Farmers Insurance, and Mercury Insurance. However, it’s important to compare quotes and policies from multiple insurers to find the best fit for your specific needs.

Are there any local car insurance companies that specialize in coverage for Los Angeles, California?

Yes, there are some local car insurance companies that specialize in coverage for Los Angeles, California. Examples include Wawanesa Insurance, which is headquartered in California and offers coverage in Los Angeles, and AAA Southern California, which provides insurance and other services to its members.

What steps can I take to lower my car insurance premiums in Los Angeles, California?

To lower your car insurance premiums in Los Angeles, California, you can consider the following steps:

- Maintain a clean driving record and avoid traffic violations.

- Choose a higher deductible, but ensure you can afford it if you need to make a claim.

- Bundle your car insurance with other policies, such as homeowners or renters insurance, to qualify for multi-policy discounts.

- Take advantage of any available discounts, such as those for safe driving, installing anti-theft devices, or completing defensive driving courses.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Shawn Laib

Insurance and Finance Writer

Since graduating from the University of WA with a B.A. in English Literature, Shawn has been professionally writing in the spheres of entertainment, insurance, business, marketing, and politics. He is passionate about using his writing skills and insurance knowledge to educate the general population on everyday issues surrounding these misunderstood topics. His work has been published on SUPERJ...

Insurance and Finance Writer

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.