Best California Home Insurance (2025)

Average California home insurance rates are $84/mo although there are no California home insurance requirements mandated by the state. Our California home insurance guide covers the best California home insurance companies and California home insurance coverage. To find the lowest California home insurance costs, shop around for California home insurance quotes using our free tool below.

Read moreFree Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michael Vereecke

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many different insurance providers, which gives him unique insight into the insurance market...

Commercial Lines Coverage Specialist

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

California State Home Insurance Overview

| California Statistics Summary | Details |

|---|---|

| State Population | 39.2 million |

| Median Home Price | $750,000 |

| Homeownership Percentage | 55% |

| Biggest Home Insurance Company | State Farm |

| Average Annual Rate | $1,300 |

| Direct Premiums Written Annually | $12.4 billion |

| Homeowners Insurance Incurred Losses | $9.6 billion |

The California dream of endless summer and miles of beaches draws a lot of people to make their home here, raising home prices in the most popular parts of the state. To protect that investment, you need insurance.

Purchasing California home insurance can often be confusing. Every company promises something different, then there are the fine print exclusions of each policy, and to top it off, comparison shopping prices back and forth between insurance provider web pages is time-consuming.

In the end, are you even sure you have the right California homeowners insurance coverage and that it’s enough coverage? How much does California home insurance cost?

Our guide will put those worries to ease with all the information you need to make an educated decision about your California homeowners insurance provider in one place. We have done the research on coverage and rates to help you compare home insurance and buy with confidence.

If you’re ready to start comparing rates, we’ve got that covered too. Just enter your ZIP code in our easy-to-use quote box right now.

How to Get California Home Insurance Rates & Coverage

No matter where you reside, purchasing a home is a big investment and you need to make sure your investment is covered. This means you need to find an insurance provider that will meet your needs as a homeowner.

First off, though, we need to find what type of homeowners policy you need. They can range from single-family homes to insurance for renters and even insurance for manufactured homes.

The video below offers a quick refresher of the basic coverage options.

California offers a standard home insurance policy that differs little from other states. When purchasing a policy for your single-family home, make sure these big five are covered:

- Dwelling – This covers any damage or loss that happens to the physical structure.

- Attached Structures – This would cover damage or loss to any physical structure not attached to the home, like a shed or guest house.

- Personal Property – This covers the property or contents within the home, including furniture, jewelry, and appliances.

- Personal Liability – This provides coverage for any third party injured while on your property.

- Additional Living Expense Coverage – This would cover the cost of temporary living expenses if your home is uninhabitable.

Depending on the insurance carrier, the policy you choose, and your home and location, rates may vary, but these coverage options should remain the same. Additional coverage options are always available, and further details for extra coverage can be provided by your insurance provider.

Within the state of California, like most places in the United States, location is a major factor for the different costs of coverage.

California home insurance rate increases are common. In the section below, we will go into detail about policies offered, as well as sample monthly rates, so you can get a better idea of what you will be able to afford in your California residence. A California home insurance calculator can also help.

Your one-stop online insurance guide. Get free quotes now! Secured with SHA-256 Encryption

What are the average homeowners insurance rates in California?

With California being such a hot commodity and their average home prices being some of the highest in the nation, you would think they’d have higher monthly insurance rates, but this is not the case. According to the National Association of Insurance Commissioners (NAIC), California has seen only slight increases in rates and is actually well below the national average home insurance rates.

California State Home Insurance Rates: 3-Year Trend

| State | 2022 | 2023 | 2024 |

|---|---|---|---|

| California | $1,250 | $1,320 | $1,400 |

| Countrywide | $1,445 | $1,525 | $1,600 |

As seen in the chart above, the sample rates for the state have inched up each year, but we are talking slight increases on par with, or even perhaps below, the normal rate of inflation. Nothing noticeably disturbing in the form of spikes or drops in figures, which is a good sign for homeowners.

The other interesting figure to note is California’s sample rates over a three-year period remain well below the national average. That is close to $200 below the national average.

Paying $200 over a 12-month period can really add up. It may not seem like much in the short run, but these types of savings can go a long way in either paying off your mortgage or maybe just treating yourself to an extended vacation.

The average rate is higher than neighboring states Oregon, Nevada, and Arizona. However, aside from Oregon, which somehow manages to post average rates below $700, California is only around a hundred dollars extra in price.

How to Get Additional Coverage

Most standard homeowners coverage do not fully cover damage from what we in the business call catastrophes. Catastrophes would be any natural disaster that causes damage or loss to your property.

These include earthquakes, floods, and in some cases, wildfires. California is at high risk for two out of these three, earthquakes/landslides and wildfires. (For more information, read our “10 States With the Highest Wildfire Risk“).

California has a high risk for both earthquakes and landslides, both of which are not covered under standard homeowner policies.

Earthquakes are hardly preventable and can cause a lot of damage to your home and your belongings. Residents may even be forced to leave their homes while workers repair or rebuild.

Additional living expenses may pay for some of these living costs if you are removed from your home, but most of the cost regarding repairs will not be covered. In this case, the earthquake insurance product can help pay for the damages or loss.

In California, The California Earthquake Authority (CEA) provides most earthquake insurance policies that offer coverage for homeowners, mobile homeowners, condo unit owners, and renters. Ask your insurance provider for further details regarding earthquake insurance and if they are a member of the CEA.

It is important to note that earthquake insurance will not cover your entire loss, but any additional funds help out after a catastrophic earthquake. This coverage plan, which may be an endorsement or a separate policy, also includes protection for landslides, mudslides, and other earth movement-related disasters. (For more information, read our “Does car insurance cover damage caused by landslides or mudslides?“).

Wildfires will always be a bigger concern for Californians who need to protect their residences.

Fire and casualty is all covered under your standard homeowners insurance policy, so there is not much additional coverage to add on. However, be on the lookout for potential price hikes in areas recently hit by wildfires.

You may want to consider where you purchase a home based on these high-risk areas. This is so you do not lose your home to wildfire in the first place and to avoid high rates that may rise with increasing wildfires hitting an area.

Flood damage is excluded from the standard homeowners policy, but for California residents, flooding is not a major concern.

California is not a high-risk area for flooding or storm surges right now, but this may change in years to come. The state does not even make the list for top 15 Metropolitan Areas By Storm Surge Risk.

However, flood coverage is available as a separate policy from the National Flood Insurance Program (NFIP), administered by the Federal Emergency Management Agency (FEMA) operating through some private insurers. The III currently reports that California has 225,720 flood policies.

Are there any add-ons, endorsements, & riders in California?

Most standard insurance policies include a list of exclusions or limits to what they will cover. In the case of these limits, endorsements and riders, generally at an additional charge, are needed to ensure the necessary coverage is provided.

“Endorsement” and “rider” are two interchangeable terms that refer to any alteration to your existing policy. The video below further explains the basics of what an endorsement or rider is.

Additional coverage including add-ons, endorsements, and riders vary by state to state and company to company. For the most part, these will have to do with the exclusions on your policy usually caused by weather conditions or catastrophes that frequently strike around your local area of residence

The frequency of any catastrophe may determine the cost of an add-on — whether it be high, average, or low — to your existing policy.

In California, there are different terrains and weather patterns that will affect the need and cost of any add-ons you may need in addition to your standard homeowners policy. These add-ons, however, are important as they can make the difference between being stuck with the bill for uninsured losses or being properly covered.

We have gathered a general list of add-ons listed below:

- Earthquake/Land Movement can be an endorsement or even a separate policy; it covers any damage caused by land movement.

- Sewer and Water Backup specifically targets backups due to sewer related issues. It differs from traditional water-related coverage.

- Equipment Breakdown covers extended warranty or replacement costs associated with large-scale appliances or h-vac.

- Inflation Guard/Guaranteed Replacement Cost ensures your home will be replaced/covered at its full value in case the standard coverage is less than the value of your home.

- Personal Property Replacement Cost ensures personal property, such as jewelry, is replaced at the cost of similar items, rather than based on an actual cash value.

- Home Business will cover expenses for equipment and property when running a business at home.

- Watercraft allows a homeowner to add on coverage for a small watercraft, like a boat, onto their home policy.

- Identity Theft allows homeowners to add on coverage to a homeowner policy that protects against losses incurred from identity theft, particularly any lost funds or fees for replacements.

- Personal Injury is an increased amount of coverage on top of the original personal injury coverage from a standard homeowner policy.

- Secondary Residence covers homeowners if they own more than one residence, such as a vacation home. Depending on the price tag, you may want a separate policy. Find out the best home insurance for second homes.

- Limited Term Endorsements cover a temporary risk. For example, this would provide additional coverage during renovations or remodeling while the home was vacant.

- Floaters/Riders for high-value items. This is reserved for items that may be more valuable than the original standard policy allows for. Items can include:

- Jewelry

- Firearms

- Fine arts

- Computer hardware and software

- Silverware

- Business personal property

- Antiques

- Money

- Collectibles

You can also get an add-on to cover exotic pet ownership, though California has some of the strictest exotic pet laws in the nation.

What are the California homeowners insurance exclusions?

Policies can differ by state and insurance company, so the only way to actually know what your exclusions are is to read your own policy. It is very important to read, know, and understand the exclusions in your insurance contract.

In California, earthquake, flood, mold, earth movement, and “wear and tear” are some of the perils that are usually excluded.

Insurance providers are legally obligated to offer you earthquake insurance for an additional premium when selling you a homeowners policy, but you should always ask your insurance agent about possible endorsements to extend coverage to any of your provider’s exclusions.

Endorsements add to your protection and can sometimes be the only coverage you can count on in the event of a loss.

Below is a list of California’s standard homeowner policy exclusions:

- Ordinance or Law – Demolition or construction required to bring your house up to code.

- Earth Movement – Earthquakes, sinkholes, and landslides.

- Water Damage – Floods and sewer back-ups.

- Neglect – Failed to take active measures to save your property during or after a loss.

- War – Both undeclared and civil war.

- Nuclear Hazard

- Intentional Loss – Purposeful action to cause a loss.

- Governmental Action – Destruction, confiscation, or seizure of property by any government authority.

Under California law, there are currently no breed restrictions for dogs.

It is legal for an insurance provider to deny or exclude coverage for certain pets, including dog breeds that are considered to be higher risk.

It would be on a case-by-case scenario that should be brought up with your insurance provider. In some cases, you can purchase an add-on or separate policy if your insurance provider restricts your dog breed from your standard policy.

Your one-stop online insurance guide. Get free quotes now! Secured with SHA-256 Encryption

What are the best California home insurance companies?

California is a large state with a long list of insurance providers, each promising to provide the best homeowners insurance available. You’re not just seeking the cheapest California home insurance, but the best.

We both know that this can’t be true for the majority of California insurance providers, so how do you sift through the duds and read between the promotional lies to find the right insurance provider?

That is where we come in with our detailed list reviewing the top providers in the state of California. We have done the research, verified or debunked their claims, and now are giving you a complete rundown on each provider’s financial stability as well as a review of their customer service.

Your experience with an insurance provider should be detailed, easy to understand, clear cut, and finalized with no doubts or worries. The purpose of finding the right home insurance coverage is so you do not have to worry.

We have provided a list of the best providers in California to make your decision easier. Just one more task that you will not have to worry about.

What are the largest insurance companies’ financial rating in California?

When you are putting the safety and well being of your family home in the hands of a corporation, not only do you need to ensure that your policy covers everything you need, but you also need to make sure the company is legit and fiscally solvent.

The financial standing of the top companies in California provides insight into how they conduct business on a daily basis, as well as a projection for how they may operate in the years to come.

We used A.M. Best’s ratings to start this credit check because they are the top credit ranking agency of insurance providers. Here’s a look at the A.M. Best ratings for the top 10 largest home insurance companies in the state.

California Home Insurance Top Ten Companies by A.M. Best Ratings

| Insurance Company | Rank | A.M. Best |

|---|---|---|

| #1 | B | |

| #2 | A | |

| #3 | A+ | |

| #4 | A++ | |

| #5 | A |

| #6 | A+ |

| #7 | A++ | |

| #8 | A++ | |

| #9 | A+ | |

| #10 | A+ |

A.M. Best ranks companies on a letter scale for financial strength. All of the top 10 companies rate either Excellent (A, A-) or Superior (A+, A++).

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

What are California home insurance companies with the best ratings?

Now that you have seen firsthand that each of California’s top 10 insurance providers have quality financial ratings, it is time to see how they operate on a local, more personal customer service level. A policy is only as good as the customer service provided.

What good is the best policy offered at the most affordable price if it is serviced by the worst customer service representatives?

The policy and savings may seem appealing in a pinch, but all that will come crumbling down once a real issue with a claim comes up. And in the insurance business, something always comes up.

We look to J.D. Power, a leading reviewer of customer satisfaction, to see how each of these companies operate on a customer service level.

California Top 10 Home Insurance Companies by J.D. Power Ratings

| Insurance Company | Rank | Home Insurance Study | Renters Insurance Study | Property Claims Study |

|---|---|---|---|---|

| #1 | 831 points 4/5 | 850 points 5/5 | 866 points 3/5 |

|

| #2 | 825 points 4/5 | 835 points 4/5 | 858 points 4/5 |

|

| #3 | 812 points 3/5 | 828 points 3/5 | 840 points 3/5 |

|

| #4 | 820 points 4/5 | 830 points 4/5 | 850 points 4/5 |

| #5 | 810 points 3/5 | 815 points 3/5 | 845 points 3/5 |

| #6 | 890 points 5/5 | 910 points 5/5 | 905 points 5/5 |

|

| #7 | 800 points 3/5 | 810 points 3/5 | 830 points 3/5 |

|

| #8 | 815 points 3/5 | 825 points 4/5 | 850 points 4/5 |

|

| #9 | 825 points 4/5 | 840 points 4/5 | 860 points 4/5 |

| #10 | 805 points 3/5 | 820 points 3/5 | 835 points 3/5 |

Mercury General at number eight was not included, as J.D. Power does not provide data for regional carriers. It is also important to keep in mind that these are nationwide ratings of the top California home insurance providers.

The table shows two rankings for each company: total points awarded on a 1,000-point scale and a rating out of five. These are J.D. Power’s Power Circle Ratings®, which are released to consumers. The legend for these ratings is as follows:

- Five Circles – Among the best

- Four Circles – Better than the rest

- Three Circles – About average

- Two Circles – Below Average

USAA would seem to be a top contender in all categories, but the insurance is limited to veteran and active-duty military personnel. Read our USAA insurance review to learn more about the company.

State Farm and Farmers would be the next likely runner ups, both receiving top marks with point totals above 800 for homeowners and renters. State Farm does edge out Farmers in the Power Circle ratings, indicating their customer service is more attentive.

Which companies have the most complaints in California?

To round out our customer review process, we looked to the California Department of Insurance, which tracks the number of justified complaints placed for the top insurance providers by year. This data combined with the sections above should give you a full picture of each provider’s level of customer service.

California Department of Insurance Justified Complaints by Year

| Insurance Company | 2022 | 2023 | 2024 |

|---|---|---|---|

| 76 | 84 | 89 | |

| 20 | 22 | 24 | |

| 82 | 90 | 95 | |

| 68 | 72 | 75 |

| 55 | 60 | 63 |

| 89 | 94 | 100 | |

| 95 | 102 | 108 | |

| 30 | 34 | 36 |

| 52 | 56 | 59 | |

| 45 | 48 | 50 |

State Farm had been looking pretty solid earlier on, but they, along with Liberty Mutual, are the biggest offenders in the complaint category. It is important to keep in mind that State Farm does more volume in business and therefore would naturally have more complaints.

The past two years saw a sharp decrease — by half — from the concerning high of 154 in 2016. Liberty Mutual draws concern in the middle of the pack, though, with complaints rising each year.

This chart also does not take into account the efficiency of resolution to the complaint. It simply measures justifiable complaints.

We would suggest looking back at the J.D. Power section to see how each provider performs in the complaint department.

With that in mind, State Farm has the highest complaints, but the best customer service rating in resolving those complaints. Farmers, in the number two spot, is looking just as good when comparing data. Read more: Farmers Insurance review & complaints.

You can find the Best Online Insurance Discounts by Company by entering your ZIP code below.

What are the largest home insurance companies in California?

Size can meet a lot when purchasing your policy. Smaller companies may offer a more intimate experience, but the larger ones generally provide more security and often better deals.

Here is a look at the largest home insurance providers by number of premiums written and their corresponding percentage share of the market.

You can find the Best Online Insurance Discounts by Company by entering your ZIP code below.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

What are the Largest Home Insurance Companies in California?

Size can meet a lot when purchasing your policy. Smaller companies may offer a more intimate experience, but the larger ones generally provide more security and often better deals.

Here is a look at the largest home insurance providers by number of premiums written and their corresponding percentage share of the market.

California Top 10 Home Insurance Companies by Market Share

| Insurance Company | Premiums Written | Market Share |

|---|---|---|

| $1.9 billion | 16% | |

| $1.5 billion | 12% | |

| $1.3 billion | 11% | |

| $1.1 billion | 9% |

| $950 million | 8% |

| $900 million | 7% | |

| $850 million | 7% |

| $700 million | 6% | |

| $600 million | 5% | |

| $550 million | 4% |

Both State Farm and Farmers hold a commanding lead. State Farm’s figures are on par with its national average, but Farmers is far exceeding their reach as compared to their national percentage of market share.

The over-performance of Farmers may be something to look into as California residences are seeking them out just as much as the number one in the nation, State Farm.

What is the number of insurers in California?

Two types of insurers are allowed to operate in the state of California; those are domestic insurance providers that have their headquarters within the state, and foreign, with headquarters operating outside of the state.

In California’s case, there are currently 99 property and casualty insurance providers that are domestic and 671 that are foreign.

The advantages and disadvantages of foreign and domestic are arguable. Having a local insurance provider headquartered within your state may provide some insider information.

This can benefit areas prone to particular weather patterns and a particular insight into insuring homeowners within the area. However, this is definitely not a guarantee and only works with smaller providers.

For the most part, even foreign insurance providers now have the reach, capability, and workforce to provide local attention even when it is from another state.

Your one-stop online insurance guide. Get free quotes now! Secured with SHA-256 Encryption

What are the California homeowners insurance laws?

Every state has their own particular laws that apply to homeowners insuring their largest investment. Some are in place to assist homeowners when insurers may try to back out of contracts, while others work to the advantage of insurance providers.

For the most part, California laws are in place to protect the consumer, ensuring that policies are upheld and people feel safe.

As far as laws pertaining to the insurer, we have collected the particular laws so you can make sure you do not find yourself on the wrong side of them. It is made very apparent that you need California car insurance to be on the road.

But what about laws pertaining to insuring your home? And is it a necessity in California that you purchase flood or earthquake insurance?

Knowing your state laws is important but can often be confusing. We have gone through the list and compiled a thorough review of California laws pertaining to homeownership and insuring your investment.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

What are the home insurance laws in California?

California does not require homeowners to take out an insurance policy on their homes; however, lenders or any homeowner with a mortgage are required to purchase a home insurance policy.

You are usually, as stipulated by your mortgage, mandated to take out an insurance policy on your home. This stipulation does not extend to earthquake or flood insurance.

If you do not meet the requirements of your mortgage contract by purchasing a policy, you will be force-placed with an insurance plan in the state of California.

This type of insurance policy is taken out by the bank and only covers their interest, the physical dwelling, and they can and will legally make you pay for it. With force-placed insurance, neither you or your belongings in the home will be covered.

Standard homeowners insurance does not cover flood damage, and homeowners are not legally obligated to purchase any flood policy.

The same force-placed policy extends to flood insurance if you live in a high-risk area for flooding, so you need to be aware of the insurance options available to you in case you need protection from damage or loss caused by flooding. Read: What does home insurance cover?

The amount of coverage and exact policy can be purchased by homeowners residing in National Flood Insurance Program (NFIP) communities through California licensed property and casualty insurance agents.

There is also a program run through private insurance companies for flood insurance, known as Write Your Own (WYO). Keep in mind most flood insurance does not go into effect until 30 days after purchase.

Examples of excluded flood-related damages include:

- Overflow of inland or tidal waters

- Unusual and rapid accumulation or runoff of surface waters from any source

- Mudflow which is a river of liquid and flowing mud on the surfaces of normally dry land (i.e. landslide or saturated soil movement are not considered mudflows)

Your standard homeowner’s insurance policy does not cover earthquake damage, and California does not require you to purchase earthquake insurance. Examples of excluded earth movement include:

- Earthquake

- Landslide

- Land subsidence

- Sinkholes

- Destabilization or movement of land resulting from accumulation of water

- Gradual erosion

As mentioned previously, you are not legally required to purchase earthquake insurance, but given the high risk for them in California, you may want to ask your insurance provider about your options.

Your insurance provider is required by law to offer earthquake insurance when you purchase your standard homeowner’s policy.

This offer must come in written form detailing the amounts covered, the insurance deductible, and the premium for the additional earthquake insurance. You have 30 days to reply.

It is important to know that any form of an earthquake insurance policy will not cover the entirety of your property damage following an earthquake or other land-movement catastrophe.

If you have homeowners insurance in California, your company must offer to sell you earthquake insurance. It must offer this every other year.

How to Get High-Risk Insurance in California

Areas like California that have an increased risk of wildfires and earthquakes run into the problem of insurance providers backing out and not providing coverage to homeowners residing in those areas.

To continue to protect California residents and ensure coverage options are available, The California Fair Access to Insurance Requirements (FAIR) Plan was established.

FAIR Plan home policies currently only offer coverage up to $1.5 million without the inclusion of liability or theft.

Recent legal orders will allow California’s FAIR Plan to begin offering a comprehensive homeowners (HO-3) coverage in addition to its current dwelling fire-only coverage. This is to take effect by June 1, 2020.

The comprehensive policy would then include traditional homeowner insurance features, such as coverage for personal liability, water damage, and theft.

Viewed as a last resort, residents should only turn to the FAIR Plan for a policy after making every attempt to purchase a policy in the current insurance market.

These FAIR Plan policies do sometimes come at a high price.

If you are interested in a FAIR Plan policy or just are looking for more info, you can learn more about applying online on the California FAIR plan website.

What is the valued policy law in California?

California has valued policy law that covers buildings from all perils covered by the standard property policy. But what exactly is Valued Policy Law?

In the most general terms, valued policy laws require an insurer to pay the face amount of the full policy limit in the event of a total loss to a structure.

If your home were destroyed and the value of your house was worth less than your coverage amount of $350,000, the insurance provider would still have to pay you $350,000.

This works for personal property limits, as well. So if you have that same $350,000 coverage on the physical dwelling and an additional $100,000 in personal property coverage, your provider would have to pay out your claim to the sum of $450,000.

Your one-stop online insurance guide. Get free quotes now! Secured with SHA-256 Encryption

Is there a home insurance fraud in California?

Investopedia defines insurance fraud as a deliberate deception by either insurance provider or the policyholder, generally for the purpose of financial gain. Insurance fraud involves the falsifying of information to get a larger payout than either party deserves.

That being said, the mission of the California Fraud Division is “To protect the public and prevent economic loss through the detection, investigation, and arrest of insurance fraud offenders.”

The California Fraud Division oversees five programs that include Automobile Insurance Fraud, Automobile Fraud Activity, Disability and Healthcare Fraud Program, Workers’ Compensation Fraud Program, and Property, Life and Casualty Fraud Program.

The Property, Life, and Causality Fraud Program handles criminal investigations for a variety of fraudulent activities including commercial/residential burglaries, fake natural disaster claims, and falsified slip and fall claims.

The FBI estimates that the total cost of insurance fraud (excluding health insurance) is more than $40 billion per year. Insurance fraud costs the average U.S. family between $400 and $700 per year. Over the five-year period from 2013–2017, property/casualty fraud has been estimated to around $30 billion each year.

Between 2016 and 2017, the California Fraud Division reported 4,406 suspected homeowners insurance claims of fraud resulting in 41 arrests saving a potential loss amounting to $664,832,882.

If you suspect fraudulent activity, please contact the California Department of Insurance’s Consumer Hotline at 1-800-927- 4357.

All suspected insurance fraud tips will be forwarded to the Fraud Division, and all of this can be done anonymously. Check out CDI’s website for more information on insurance fraud and how to report it.

Notification of these types of fraud can be made in person or mailed to:

The California Department of Insurance

Post Office Box 277320

Fraud Division Intake Unit

Sacramento, CA 95827-7320

Call: 1-800-927-4357

Telecommunication Device for the Deaf dial 1-800-482-4TTY. Telephone lines are open from 8 a.m. to 5 p.m. Pacific Time, Monday through Friday, excluding holidays

What are California-specific laws?

California has some of the most laws and regulations for the insurance game of any state — some protecting policyholders, others more in favor of insurance providers, but all in an effort to conduct business in a fair and honest manner so that all contracts are honored appropriately.

Fair Claim Handling Regulations are a detailed list that provides information on how insurance providers need to conduct business with you when selling a homeowners insurance policy.

They list out a series of deadlines and regulations, holding insurance providers and their agents to a measured standard of good practice. This includes a series of deadlines for responding to letters and phone calls, deadlines for your insurer to pay or deny your claim, as well as the information your insurance provider is legally obligated to give you.

The second California-specific law is the somewhat broad “good faith” clause. The law specifies that your insurance provider must conduct business with you in “good faith” at all times.

This means your insurer must consider your needs as a policy holder and remain truthful and honest with all transactions relating to any claims. The flip side is that you are also legally obligated by the same “good faith” clause.

A complete list of all the particulars of California insurance law can be found by clicking here.

Your one-stop online insurance guide. Get free quotes now! Secured with SHA-256 Encryption

What are the California home insurance risks?

The whole purpose of finding an insurance policy is to safeguard your investment against damage or loss. But what if you are not entirely familiar with the home safety risks within a given state?

You may find the right policy, but how much coverage and which categories are you more likely to need? Should you invest in earthquake insurance or is flood insurance more of an issue?

In this next section, we will detail the risks to home safety so you can make a more informed decision. This section will help you select not only what type of policy but how much homeowners insurance coverage you may need based on an area’s particular home safety risks.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

What is the number of property crimes in California?

The FBI gathers data on a variety of crimes, including burglary. Below you will find a table of data you can search to see how many burglaries took place in your city in 2018.

California FBI Property Annual Crime Data

| City | Robbery | Property |

|---|---|---|

| Adelanto | 35 | 1,500 |

| Agoura Hills | 15 | 420 |

| Alameda | 40 | 1,100 |

| Albany | 10 | 350 |

| Alhambra | 80 | 1,900 |

| Aliso Viejo | 20 | 600 |

| Alturas | 5 | 180 |

| American Canyon | 25 | 750 |

| Anaheim | 180 | 6,500 |

| Anderson | 30 | 650 |

| Angels Camp | 10 | 120 |

| Antioch | 150 | 2,700 |

| Apple Valley | 55 | 1,200 |

| Arcadia | 65 | 1,100 |

| Arcata | 35 | 560 |

| Arroyo Grande | 15 | 340 |

| Artesia | 30 | 600 |

| Arvin | 25 | 450 |

| Atascadero | 20 | 500 |

| Atherton | 5 | 120 |

| Atwater | 40 | 750 |

| Auburn | 25 | 560 |

| Avalon | 2 | 90 |

| Avenal | 10 | 300 |

| Azusa | 60 | 1,300 |

| Bakersfield | 350 | 10,000 |

| Baldwin Park | 120 | 2,300 |

| Banning | 50 | 1,200 |

| Barstow | 55 | 1,100 |

| Bear Valley | 5 | 150 |

| Beaumont | 40 | 980 |

| Bell | 70 | 1,800 |

| Bellflower | 90 | 2,200 |

| Bell Gardens | 80 | 2,000 |

| Belmont | 20 | 420 |

| Belvedere | 2 | 90 |

| Benicia | 25 | 500 |

| Berkeley | 120 | 2,600 |

| Beverly Hills | 150 | 2,200 |

| Big Bear | 10 | 250 |

| Biggs | 2 | 70 |

| Bishop | 15 | 220 |

| Blythe | 20 | 450 |

| Bradbury | 1 | 60 |

| Brawley | 30 | 600 |

| Brea | 50 | 1,000 |

| Brentwood | 40 | 1,100 |

| Brisbane | 15 | 320 |

| Broadmoor | 5 | 110 |

| Buellton | 10 | 180 |

| Buena Park | 100 | 2,100 |

| Burbank | 130 | 2,500 |

| Burlingame | 20 | 540 |

| Calabasas | 25 | 620 |

| Calexico | 40 | 900 |

| California City | 25 | 400 |

| Calimesa | 10 | 260 |

| Calistoga | 5 | 130 |

| Camarillo | 45 | 980 |

| Campbell | 60 | 1,500 |

| Canyon Lake | 15 | 240 |

| Capitola | 20 | 500 |

| Carlsbad | 80 | 1,600 |

| Carmel | 10 | 210 |

| Carpinteria | 10 | 300 |

| Carson | 90 | 2,300 |

| Cathedral City | 55 | 1,200 |

| Central Marin | 25 | 500 |

| Ceres | 75 | 1,500 |

| Cerritos | 50 | 1,300 |

| Chico | 100 | 2,000 |

| Chino | 90 | 2,100 |

| Chino Hills | 40 | 1,200 |

| Chowchilla | 20 | 480 |

| Chula Vista | 180 | 4,500 |

| Citrus Heights | 75 | 1,700 |

| Claremont | 30 | 520 |

| Clayton | 15 | 230 |

| Clearlake | 35 | 600 |

| Cloverdale | 10 | 200 |

| Clovis | 85 | 1,900 |

| Coachella | 40 | 1,100 |

| Coalinga | 15 | 340 |

| Colma | 5 | 90 |

| Colton | 60 | 1,200 |

| Colusa | 8 | 180 |

| Commerce | 70 | 1,900 |

| Compton | 180 | 4,200 |

| Concord | 120 | 2,400 |

| Corcoran | 25 | 420 |

| Corning | 15 | 300 |

| Corona | 110 | 2,500 |

| Coronado | 10 | 300 |

| Costa Mesa | 95 | 2,300 |

| Cotati | 10 | 200 |

| Covina | 50 | 1,100 |

| Crescent City | 10 | 200 |

| Cudahy | 40 | 800 |

| Culver City | 85 | 1,800 |

| Cupertino | 30 | 700 |

| Cypress | 60 | 1,500 |

| Daly City | 150 | 1,200 |

| Dana Point | 45 | 500 |

| Danville | 30 | 400 |

| Davis | 120 | 1,000 |

| Delano | 200 | 1,500 |

| Del Mar | 20 | 250 |

| Del Rey Oaks | 15 | 150 |

| Desert Hot Springs | 180 | 1,800 |

| Diamond Bar | 40 | 600 |

| Dinuba | 75 | 800 |

| Dixon | 30 | 350 |

| Dorris | 5 | 50 |

| Dos Palos | 25 | 300 |

| Downey | 300 | 3,200 |

| Duarte | 60 | 700 |

| Dublin | 85 | 900 |

| Dunsmuir | 8 | 100 |

| East Palo Alto | 250 | 2,700 |

| Eastvale | 35 | 500 |

| El Cajon | 220 | 2,500 |

| El Centro | 150 | 1,600 |

| El Cerrito | 90 | 1,000 |

| Elk Grove | 180 | 1,900 |

| El Monte | 300 | 3,000 |

| El Segundo | 40 | 400 |

| Emeryville | 200 | 2,100 |

| Encinitas | 50 | 600 |

| Escalon | 15 | 200 |

| Escondido | 180 | 2,000 |

| Etna | 5 | 50 |

| Eureka | 160 | 1,800 |

| Exeter | 20 | 250 |

| Fairfax | 25 | 300 |

| Fairfield | 250 | 2,800 |

| Farmersville | 40 | 400 |

| Ferndale | 10 | 100 |

| Fillmore | 30 | 350 |

| Firebaugh | 20 | 200 |

| Folsom | 70 | 750 |

| Fontana | 300 | 3,100 |

| Fort Bragg | 15 | 180 |

| Fort Jones | 5 | 50 |

| Fortuna | 35 | 400 |

| Foster City | 25 | 350 |

| Fountain Valley | 50 | 600 |

| Fowler | 15 | 200 |

| Fremont | 260 | 3,000 |

| Fresno | 650 | 7,500 |

| Fullerton | 300 | 3,200 |

| Galt | 20 | 500 |

| Gardena | 75 | 1,200 |

| Garden Grove | 150 | 2,800 |

| Gilroy | 40 | 750 |

| Glendale | 200 | 3,500 |

| Glendora | 30 | 900 |

| Goleta | 15 | 300 |

| Gonzales | 5 | 120 |

| Grand Terrace | 8 | 180 |

| Grass Valley | 10 | 250 |

| Greenfield | 12 | 160 |

| Gridley | 7 | 140 |

| Grover Beach | 6 | 180 |

| Guadalupe | 4 | 110 |

| Gustine | 3 | 90 |

| Hanford | 25 | 1,000 |

| Hawaiian Gardens | 12 | 210 |

| Hawthorne | 150 | 2,600 |

| Hayward | 220 | 4,200 |

| Healdsburg | 5 | 160 |

| Hemet | 120 | 2,000 |

| Hercules | 10 | 300 |

| Hermosa Beach | 15 | 350 |

| Hesperia | 80 | 1,500 |

| Hidden Hills | 2 | 50 |

| Highland | 70 | 1,300 |

| Hillsborough | 3 | 100 |

| Hollister | 15 | 320 |

| Holtville | 4 | 80 |

| Hughson | 5 | 90 |

| Huntington Beach | 180 | 3,800 |

| Huntington Park | 130 | 2,700 |

| Huron | 6 | 130 |

| Imperial | 8 | 170 |

| Imperial Beach | 20 | 420 |

| Indian Wells | 3 | 70 |

| Indio | 85 | 1,900 |

| Industry | 50 | 1,000 |

| Inglewood | 200 | 4,000 |

| Ione | 5 | 120 |

| Irvine | 40 | 1,500 |

| Irwindale | 10 | 220 |

| Isleton | 2 | 60 |

| Jackson | 5 | 110 |

| Jurupa Valley | 25 | 1,230 |

| Kensington | 2 | 95 |

| Kerman | 3 | 115 |

| King City | 7 | 210 |

| Kingsburg | 4 | 150 |

| La Canada Flintridge | 1 | 70 |

| Lafayette | 6 | 180 |

| Laguna Beach | 12 | 230 |

| Laguna Hills | 8 | 190 |

| Laguna Niguel | 10 | 210 |

| Laguna Woods | 1 | 80 |

| La Habra | 20 | 780 |

| La Habra Heights | 3 | 110 |

| Lake Elsinore | 18 | 920 |

| Lake Forest | 14 | 710 |

| Lakeport | 5 | 130 |

| Lake Shastina | 2 | 50 |

| Lakewood | 30 | 1,430 |

| La Mesa | 28 | 1,210 |

| La Mirada | 15 | 640 |

| Lancaster | 50 | 2,500 |

| La Palma | 4 | 160 |

| La Puente | 22 | 1,140 |

| La Quinta | 12 | 410 |

| La Verne | 10 | 220 |

| Lawndale | 18 | 940 |

| Lemon Grove | 16 | 860 |

| Lemoore | 7 | 270 |

| Lincoln | 6 | 310 |

| Lindsay | 3 | 120 |

| Livermore | 9 | 520 |

| Livingston | 4 | 130 |

| Lodi | 13 | 740 |

| Loma Linda | 5 | 280 |

| Lomita | 7 | 350 |

| Lompoc | 15 | 630 |

| Long Beach | 500 | 12,000 |

| Los Alamitos | 3 | 180 |

| Los Altos | 2 | 120 |

| Los Altos Hills | 1 | 60 |

| Los Angeles | 4,000 | 120,000 |

| Los Banos | 8 | 380 |

| Los Gatos | 6 | 260 |

| Lynwood | 40 | 2,200 |

| Madera | 85 | 1,200 |

| Malibu | 30 | 450 |

| Mammoth Lakes | 10 | 150 |

| Manhattan Beach | 40 | 500 |

| Manteca | 95 | 1,350 |

| Marina | 25 | 400 |

| Martinez | 45 | 600 |

| Marysville | 50 | 700 |

| Maywood | 60 | 800 |

| McFarland | 15 | 200 |

| Mendota | 20 | 250 |

| Menifee | 70 | 1,100 |

| Menlo Park | 35 | 500 |

| Merced | 100 | 1,450 |

| Mill Valley | 20 | 300 |

| Milpitas | 60 | 900 |

| Mission Viejo | 40 | 600 |

| Modesto | 250 | 3,500 |

| Monrovia | 25 | 350 |

| Montague | 5 | 70 |

| Montclair | 80 | 1,100 |

| Montebello | 90 | 1,300 |

| Monterey | 45 | 600 |

| Monterey Park | 70 | 1,000 |

| Monte Sereno | 2 | 30 |

| Moorpark | 15 | 200 |

| Moraga | 10 | 100 |

| Moreno Valley | 150 | 2,000 |

| Morgan Hill | 35 | 500 |

| Morro Bay | 10 | 100 |

| Mountain View | 60 | 900 |

| Mount Shasta | 5 | 60 |

| Murrieta | 45 | 600 |

| Napa | 55 | 750 |

| National City | 120 | 1,600 |

| Needles | 15 | 150 |

| Nevada City | 8 | 100 |

| Newark | 65 | 850 |

| Newman | 20 | 200 |

| Newport Beach | 45 | 700 |

| Norco | 30 | 400 |

| Norwalk | 130 | 1,700 |

| Novato | 25 | 300 |

| Oakdale | 20 | 250 |

| Oakland | 650 | 9,000 |

| Oakley | 40 | 500 |

| Oceanside | 120 | 1,500 |

| Ojai | 10 | 80 |

| Ontario | 180 | 2,200 |

| Orange | 85 | 1,000 |

| Orange Cove | 8 | 70 |

| Orinda | 6 | 60 |

| Orland | 10 | 100 |

| Oroville | 35 | 400 |

| Oxnard | 140 | 1,900 |

| Pacifica | 12 | 146 |

| Pacific Grove | 8 | 102 |

| Palmdale | 45 | 765 |

| Palm Desert | 30 | 540 |

| Palm Springs | 25 | 610 |

| Palo Alto | 15 | 405 |

| Palos Verdes Estates | 5 | 112 |

| Paradise | 3 | 85 |

| Paramount | 42 | 789 |

| Parlier | 18 | 224 |

| Pasadena | 53 | 924 |

| Paso Robles | 14 | 298 |

| Patterson | 9 | 160 |

| Perris | 47 | 710 |

| Petaluma | 12 | 350 |

| Pico Rivera | 33 | 622 |

| Piedmont | 4 | 93 |

| Pinole | 10 | 216 |

| Pismo Beach | 7 | 134 |

| Pittsburg | 37 | 760 |

| Placentia | 18 | 365 |

| Placerville | 11 | 145 |

| Pleasant Hill | 15 | 312 |

| Pleasanton | 20 | 498 |

| Pomona | 68 | 1,275 |

| Porterville | 24 | 450 |

| Port Hueneme | 6 | 190 |

| Poway | 14 | 276 |

| Rancho Cordova | 31 | 690 |

| Rancho Cucamonga | 54 | 1,010 |

| Rancho Mirage | 5 | 185 |

| Rancho Palos Verdes | 7 | 122 |

| Rancho Santa Margarita | 9 | 168 |

| Red Bluff | 21 | 430 |

| Redding | 50 | 865 |

| Redlands | 23 | 540 |

| Redondo Beach | 16 | 410 |

| Redwood City | 20 | 525 |

| Reedley | 14 | 340 |

| Rialto | 45 | 890 |

| Richmond | 66 | 1,145 |

| Ridgecrest | 12 | 265 |

| Rio Dell | 4 | 80 |

| Rio Vista | 2 | 67 |

| Ripon | 5 | 110 |

| Riverbank | 7 | 180 |

| Riverside | 72 | 1,420 |

| Rocklin | 8 | 200 |

| Rohnert Park | 16 | 335 |

| Rolling Hills | 1 | 34 |

| Rolling Hills Estates | 3 | 78 |

| Rosemead | 25 | 490 |

| Roseville | 22 | 540 |

| Ross | 2 | 45 |

| Sacramento | 85 | 1,845 |

| Salinas | 60 | 1,130 |

| San Bernardino | 96 | 1,890 |

| San Bruno | 13 | 345 |

| San Clemente | 10 | 286 |

| Sand City | 4 | 125 |

| San Diego | 125 | 2,200 |

| San Dimas | 6 | 170 |

| San Fernando | 14 | 312 |

| San Francisco | 155 | 3,150 |

| San Gabriel | 11 | 285 |

| Sanger | 10 | 240 |

| San Jacinto | 19 | 425 |

| San Jose | 140 | 2,650 |

| San Juan Capistrano | 9 | 198 |

| San Leandro | 50 | 1,050 |

| San Luis Obispo | 24 | 490 |

| San Marcos | 18 | 375 |

| San Marino | 3 | 85 |

| San Mateo | 17 | 410 |

| San Pablo | 28 | 625 |

| San Rafael | 22 | 515 |

| San Ramon | 10 | 210 |

| Santa Ana | 62 | 1,210 |

| Santa Barbara | 30 | 685 |

| Santa Clara | 45 | 850 |

| Santa Clarita | 40 | 920 |

| Santa Cruz | 34 | 710 |

| Santa Fe Springs | 21 | 480 |

| Santa Maria | 27 | 665 |

| Santa Monica | 38 | 810 |

| Santa Paula | 11 | 195 |

| Santa Rosa | 50 | 1,025 |

| Santee | 15 | 345 |

| Saratoga | 4 | 88 |

| Sausalito | 6 | 100 |

| Scotts Valley | 3 | 76 |

| Seal Beach | 9 | 135 |

| Seaside | 13 | 320 |

| Sebastopol | 5 | 90 |

| Selma | 14 | 340 |

| Shafter | 7 | 180 |

| Sierra Madre | 2 | 55 |

| Signal Hill | 16 | 390 |

| Simi Valley | 12 | 310 |

| Solana Beach | 3 | 70 |

| Soledad | 6 | 155 |

| Solvang | 2 | 45 |

| Sonoma | 4 | 85 |

| Sonora | 8 | 175 |

| South El Monte | 18 | 390 |

| South Gate | 49 | 1,050 |

| South Lake Tahoe | 13 | 305 |

| South Pasadena | 9 | 210 |

| South San Francisco | 21 | 510 |

| Stallion Springs | 1 | 35 |

| Stanton | 19 | 425 |

| St. Helena | 3 | 65 |

| Stockton | 82 | 1,700 |

| Suisun City | 12 | 265 |

| Sunnyvale | 15 | 345 |

| Susanville | 9 | 210 |

| Sutter Creek | 2 | 55 |

| Taft | 15 | 120 |

| Tehachapi | 20 | 250 |

| Temecula | 40 | 1,150 |

| Temple City | 25 | 330 |

| Thousand Oaks | 30 | 550 |

| Tiburon | 5 | 60 |

| Torrance | 95 | 1,300 |

| Tracy | 50 | 850 |

| Truckee | 10 | 70 |

| Tulare | 65 | 980 |

| Tulelake | 2 | 30 |

| Turlock | 85 | 1,200 |

| Tustin | 60 | 1,100 |

| Twentynine Palms | 18 | 300 |

| Ukiah | 40 | 400 |

| Union City | 70 | 900 |

| Upland | 75 | 950 |

| Vacaville | 50 | 880 |

| Vallejo | 110 | 1,500 |

| Ventura | 95 | 1,250 |

| Vernon | 5 | 40 |

| Victorville | 120 | 1,600 |

| Villa Park | 3 | 25 |

| Visalia | 100 | 1,400 |

| Vista | 85 | 1,200 |

| Walnut | 25 | 220 |

| Walnut Creek | 30 | 300 |

| Waterford | 10 | 150 |

| Watsonville | 45 | 480 |

| Weed | 8 | 90 |

| West Covina | 120 | 1,100 |

| West Hollywood | 85 | 1,400 |

| Westlake Village | 15 | 130 |

| Westminster | 110 | 1,000 |

| Westmorland | 5 | 50 |

| West Sacramento | 90 | 900 |

| Wheatland | 6 | 70 |

| Whittier | 100 | 950 |

| Wildomar | 12 | 150 |

| Williams | 7 | 80 |

| Willits | 15 | 140 |

| Windsor | 18 | 200 |

| Winters | 5 | 60 |

| Woodlake | 10 | 100 |

| Woodland | 70 | 700 |

| Yorba Linda | 30 | 320 |

| Yountville | 3 | 40 |

| Yreka | 15 | 160 |

| Yuba City | 90 | 950 |

| Yucaipa | 50 | 480 |

| Yucca Valley | 35 | 350 |

The data in the table above is regarding all burglaries and robberies, so it is not a straight representation of potential crimes in your neighborhood. But it does present a general idea.

Also, keep in mind that the FBI reports that 67 percent of burglaries occur in residential homes, so a little over half of the number presented under burglaries were related to residential homes.

With the information provided in the table above, you can increase or decrease your personal property amount based on the degree of crime in your neighborhood.

You may also want to look into umbrella insurance for higher-priced items, all of which can be discussed further with an insurance agent.

What is the number of home fires in California?

Recent flares of wildfires in California have become the highest risk natural catastrophe for homeowners in the state, even more so than earthquakes. Given California’s unusually high risk for earthquakes, that is saying something. Home insurance in California high fire risk areas can be harder to obtain.

Rightfully so, California has placed fire safety initiatives as a priority throughout the state, spreading awareness and advocating safety measures for before and after a potential wildfire event.

Be sure to check out California’s Office of the State Fire Marshal (OSFM) website as well as their CalFire affiliate site, both of which provide detailed information on fire safety tips, incident reports, and areas more prone to wildfires.

One page that is particularly helpful is the incident link on CalFire’s front page that provides a more visual perspective on areas prone to wildfire risk.

If you want to avoid sifting through numerous web pages to find info, the OSFM also releases a quarterly report for more up-to-date information regarding fire safety in California.

California Home Insurance Fire Statistics

| Category | Value |

|---|---|

| Structures Damaged or Destroyed | 3,500 |

| Fire-Related Fatalities | 65 |

| Number of Fire Departments | 850 |

As you can see from the data gathered in the table above, more than 100 people were killed and over 24,000 structures were damaged. Of those 24,000, it is estimated that 17,000 were homes that were destroyed; the state’s 893 fire departments responded to more than 8,000 fires last year.

The California Insurance Commissioner’s Office reports that it only took three of the 2018 wildfires, the Camp Fire, Hill Fire, and Woolsey Fire, to rack up over $9 billion in damages from 28,500 insurance claims. Some have even placed total estimates for costs of damage from the wildfires between 2017–2018 at around $36 billion.

What are the catastrophic risks in California?

Catastrophes amount to billions of dollars in damages that insurance providers must pay to honor current policies.

In essence, this is why an insurance provider and homeowners policy is necessary. But generally, catastrophes hit an area hard, and no insurance provider is built to withstand the high number of claims and necessary payouts year after year.

Multiple catastrophes that hit a single area can result in a depletion of funds for any insurance provider. And although the FAIR Plan’s open practice in California prevents insurance providers from backing out of existing policies, it cannot stop them from not providing new policies.

When moving into an area, you may want to look at a location that is not catastrophe prone.

For California, it is surprisingly not earthquakes but wildfires that present the biggest risk for insurers and homeowners. According to III, California ranks number one in amount lost to catastrophic wildfires for 2018, with $15,094,900,000 from a total of 87,050 claims.

Some good news for California residents is that only 10 percent of the total claim payments from 2009–2013 came from a catastrophic event claim.

With the bad news out of the way, let’s break down each potential catastrophe, measure the risk factor, and give you a better idea of which poses the most risk and how you can act accordingly when purchasing home insurance.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Is there a flooding in California?

Flooding is not a huge priority in California and does not add to the high catastrophe numbers. With recent droughts, some may argue that it is not enough water that is an issue.

However, large periods of droughts lead to heavier downpours, which could increase risk for flooding in future years. Currently, though, flooding is on the backburner for high-risk catastrophes.

To give you a better idea of how rare flooding is in California, the last major flood event was in 1978, according to the National Weather Service.

What is the number of wildfires in California?

The biggest concern, especially as of late, is wildfires in California. Although they are not ranked number one by the III (that spot is reserved for Texas), they do place second in the Top 10 States for Wildfires Ranked by Number of Fires and By Number of Acres Burned, 2018.

According to States At Risk, California faces the second-largest wildfire threat compared to other states, but it has also taken the strongest actions toward increasing its preparedness for future wildfires. In California alone, more than 11.2 million people are at risk of wildfires.

Roughly 30 percent of California’s total population is at high risk from wildfires.

In 2018, California had 8,054 fires that burned over 1,823,153 acres

Luckily, California is preparing for the worst with active enrollment in programs like Firewise. Firewise USA™ is a national recognition program that provides instructional resources to inform people how to adapt to living with the wildfire threat and encourages neighbors to work together and take action to reduce their wildfire risk.

You can find more information about Firewise and how to better protect your home by clicking here.

What is the number of earthquakes in California?

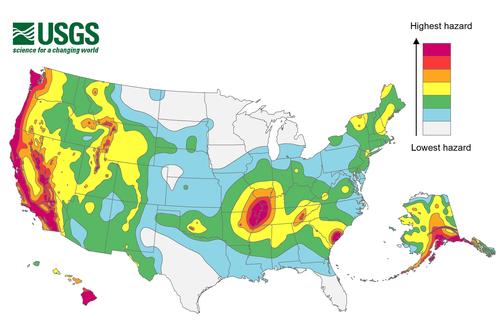

The 2018 Long-Term National Seismic Hazard Map shows that much of California, if not all, is in high risk of experiencing severe to moderate earthquakes.

There is a little less risk when you move inland, but then again, there is high-risk territory wherever you reach any of the borders of California, either toward the ocean or inland to the east, north, and south.

According to the U.S. Geological Survey government website, California’s risk for earthquakes stays on constant alert, never dipping below the medium threat level.

The majority of the state is measured at the highest degree of possible hazard, so you may want to think twice before passing on the purchase of earthquake insurance.

How is the weather in California?

According to researchers at Swain University and their UCLA colleagues, life is about to become increasingly uncomfortable for 40 million people in California.

Their report in the journal Nature Climate Change predicts simulations for potential weather patterns in the years to come, and the biggest takeaway is that increased extremes in weather will have resulting extreme effects.

A massive drought will result in unexpected downpours that could increase the risk of flooding and land/mudslides.

The recent four-year drought from 2012 to 2016 arguably resulted in a winter of flooding in the following year, where almost 250,000 people were evacuated from their homes.

Climate change or not, extreme weather patterns are unpredictable, and you need to make sure you have the preventative care to survive any storm.

What does this signal for California residence? That there is never a better time to find the right homeowners policy at an affordable price from an insurance provider you can trust.

Your one-stop online insurance guide. Get free quotes now! Secured with SHA-256 Encryption

What is the percentage of homeownership in California?

Homeownership in California comes at a bit of a higher cost than the national average, but residents more than make up for it with an average income that far exceeds the national average. There is a bit of a give and take, economically speaking.

The population skews a little young, with residents making an average annual income of $75,277, which is significantly more than the median annual income of $61,937 across the entire United States.

Houses, however, do come with a higher price tag, and with a shortage in housing for metropolitan areas, we suspect home values will continue to rise or at least remain around the $500,000 mark.

According to Zillow, it may be these factors that have their home market listed as only warm. With home values expected to continue to rise, this back and forth may keep the home market in check.

That is not to say you cannot find an affordable home. But when you do, you will definitely be on the lookout for the best home insurance policy. Our suggestion? Buy while the market is still hot — as soon as possible, before prices skyrocket to unreasonable amounts.

Here is a quick run-down of California state statistics on homeownership.

What do the homeownership statistics indicate?

According to DataUSA, the median property value in California was $546,800 in 2018, which is 2.38 times larger than the national average of $229,700.

Between 2017 and 2018 the median property value increased from $509,400 to $546,800, a 7.34 percent increase. The homeownership rate in California is 54.8 percent, which is lower than the national average of 63.9 percent.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

What is the average home price in California?

Statistics from Experian suggest that the median sales price for a home in California runs $492,080. No neighboring states slightly compare save for Oregon. Both Nevada and Arizona are closer to the national average of $200,000 to $300,000 with the median mortgage closer to the two.

The most expensive county in California is San Francisco County:

- Median home value – $1,272,168

- Median monthly housing costs w/ mortgage – $3,332

- Homes valued at $1 million (2017) – 42.8 percent

- Housing units built in 2000 or later – 8.6 percent

- Median household income – $96,265

What is the average mortgage in California?

From Experian, the average mortgage debt for 2019 is $363,537. The California average homeowner mortgage debt, according to Experian, is $356,892 in 2018 up 1.9 percent from 2017 figure of $363,537.

What is the average property tax in California?

Based on an Assessed Home Value of $250,000, the average property tax (Los Angeles County) for your home would be around $1,888 (annual). The quick takeaway from this figure is that California property taxes are below the national average.

The average effective property tax rate in California is 0.77 percent, whereas the national average for a property tax rate sits somewhere around 1.08 percent.

The national average is around $2,700 which is significantly more than California’s. So the homes may be pricier, but California makes up for it in savings in their lower property tax rate.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

California home insurance: What’s the bottom line?

California may be a more expensive state to live in, but there is an increase in wages compared to national averages. If you can afford the home, the insurance plans made available are reasonable if not below national averages.

The main catastrophe that needs to be watched for at this moment are wildfires; you should be aware of the risk of wildfires in your area, but they have programs in place as last resort to ensure you get the insurance you need.

The bottom line is home prices are higher, but property tax and home insurance costs are lower. With higher-than-national-average incomes, the savings even out the potential higher cost of living.

If you have heard enough and got your bags packed, just enter your new home’s ZIP code below and we will guide you through our free online quote option.

Frequently Asked Questions

Why is it important to have home insurance in California?

Home insurance is essential in California to protect your investment in your property. California is prone to natural disasters such as earthquakes, wildfires, and floods, which can cause significant damage to your home and property. Home insurance can provide financial protection against these risks and also cover your liability in case someone is injured on your property.

What are some of the best home insurance companies in California?

Some of the best home insurance companies in California include State Farm, Allstate, Nationwide, Farmers, and Liberty Mutual. However, the best home insurance company for you depends on your individual needs and circumstances.

What should I look for when shopping for home insurance in California?

When shopping for home insurance in California, you should consider:

- the level of coverage you need

- the price of the policy

- the insurance company’s financial stability and reputation

- the insurance company’s customer service and support

- discounts and savings opportunities

- any additional features or benefits that may be important to you

How much does home insurance cost in California?

The cost of home insurance in California varies depending on several factors such as the location, size and age of your home, the level of coverage you choose, and your claims history. On average, California homeowners pay around $1,000 to $2,000 per year for home insurance.

What types of coverage are included in California home insurance policies?

California home insurance policies typically include coverage for the structure of your home, personal property, liability, and additional living expenses. You may also be able to add additional coverage options such as earthquake insurance or flood insurance depending on your location and risks.

Are there any discounts available on California home insurance policies?

Yes, many California home insurance companies offer discounts and savings opportunities to their customers. You may be able to save money by:

- bundling your home and auto insurance policies

- installing security systems or fire alarms in your home

- having a good credit score

- maintaining a claims-free record

How can I file a complaint against a California home insurance company?

If you have a complaint against a California home insurance company, you can contact the California Department of Insurance, which regulates insurance companies in the state. They can provide guidance and assistance in resolving your complaint and may take action against the insurance company if necessary.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Michael Vereecke

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many different insurance providers, which gives him unique insight into the insurance market...

Commercial Lines Coverage Specialist

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.