Best Minnesota Car Insurance (2025)

Minnesota minimum car insurance requirements are 30/60/10 for BIL/PD and 40/25/50 for PIP/UM/UIM coverage. Minnesota car insurance rates average $73 per month. Liberty Mutual has the most expensive rates across Minnesota, while State Farm offers the cheapest Minnesota car insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michael Leotta

Insurance Operations Specialist

Michael earned a degree in Business Management degree with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Au...

Insurance Operations Specialist

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Minnesota minimum auto insurance requirements are 30/60/10 for BIL/PD and 40/25/50 for PIP/UM/UIM

- Minnesota car insurance rates average $73 per month

- Minnesota is a no-fault car insurance state

| Minnesota Statistics Summary | Details |

|---|---|

| Miles of Roadway | 138,767 |

| Vehicles | Registered: 5,032,709 Stolen: 7,981 |

| Population | 5.58 Million |

| Most Popular Vehicle | Ford F-150 |

| Uninsured Motorists | 11.50% Rank: 27 |

| Driving Related Deaths | Total: 357 Speeding: 89 DUI: 85 |

| Average Annual Premiums | Liability: $456.82 Collision: $234.40 Comprehensive: $184.27 |

| Cheapest Providers | State Farm USAA |

Lying on the coast of the great Lake Superior sits the land of 10,000 lakes. Admitted to the union in 1858, Minnesota now has a population of 5.5 million. All of whom scream “skol” for the Vikings and love their hockey more than anything.

The twin cities of Minneapolis and St. Paul make up almost 60 percent of the population. Leaving Minnesota with the perfect balance of city and country. From the suburbs of Chanhassen to downtown Minneapolis, the state has a mix of long expanding fields and skylines.

At a median age of 37.9 Minnesota has its share of every age. The average annual income in the state is about $70,000 and growing. The future looks bright for the kind-hearted souls who would offer you all their money and their leg.

If you’ve been contemplating moving to the Gopher State and need some help with auto insurance, look no further; this article will delve into the intricacies and the confusion of the auto insurance world in Minnesota. We’ll take you through the rates, coverage, and laws to get you through the meddling process of buying the best Minnesota car insurance.

Start comparing rates with our free tool above.

Minnesota Car Insurance Coverage and Rates

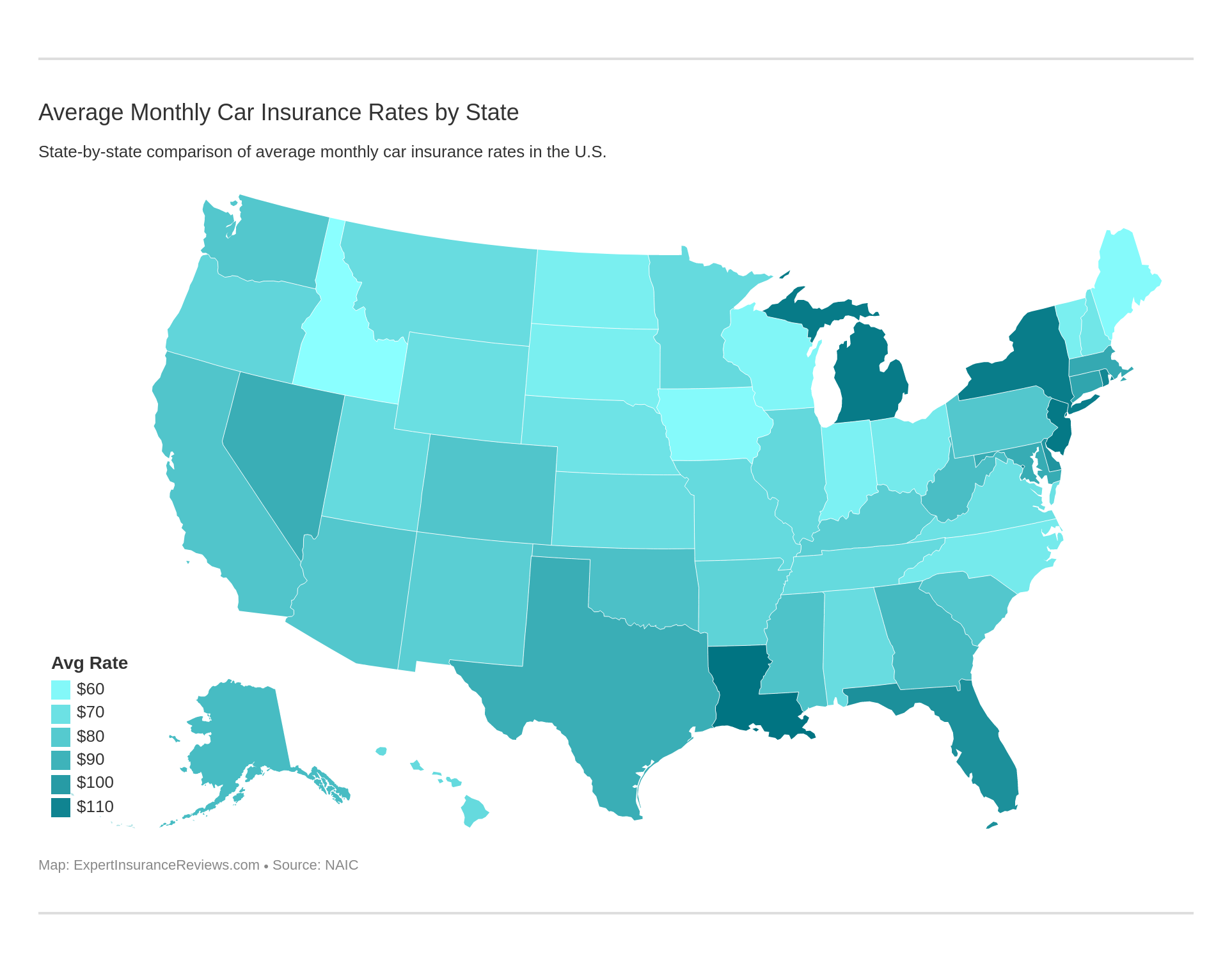

While Minnesota auto insurance has a lot of requirements for minimum coverage, their rates are surprisingly normal. The average annual rate for all of Minnesota across all companies is $4,513.50. This number is just below the nation’s average (read our “Minnesota Car Insurance Laws” for more information).

Minnesota auto insurance laws require that you carry both liability car insurance and personal injury protection coverage (PIP) that are standard with the state’s no-fault insurance requirements.

No-fault insurance means that when it comes to an accident, no matter who is at fault, insurance provides personal injury protection with no maximum for any injuries that occur.

Most states are at-fault meaning whoever is at fault pays; Instead, drivers have insurance to cover their own injuries and damage rather than insuring to pay out to the other person.

However, no-fault coverage applies only to expenses resulting from injuries sustained in an accident. It does not mean that insurance companies will cover all losses in an accident regardless of who is at fault.

The need-to-know information doesn’t stop there. Instead of spending hours and hours searching different sites and seeing different ads all claiming to be the best for you; within this article, you’ll find an abundance of data for your information, links to help you understand, and simplifications of rates, coverages, and laws in Minnesota.

Minimum Auto Insurance Coverage in Minnesota

Liability

- $30,000 for injury to one person

- $60,000 for injury to two or more people

- $10,000 for property damage

- $40,000 per person per accident, which includes $20,000 for hospital and medical expenses and $20,000 for other costs, including lost wages

- $25,000 for injury to one person for both UM and UIM

- $50,000 for injury to more than one person for UM and UIM

What all of this means is in the case of a bad accident you will not have to pay out of pocket if you have the right coverage. Minimum coverage will cover you for a good amount of issues that you may come across, but in the possibility of a bad injury, you may not be totally covered.

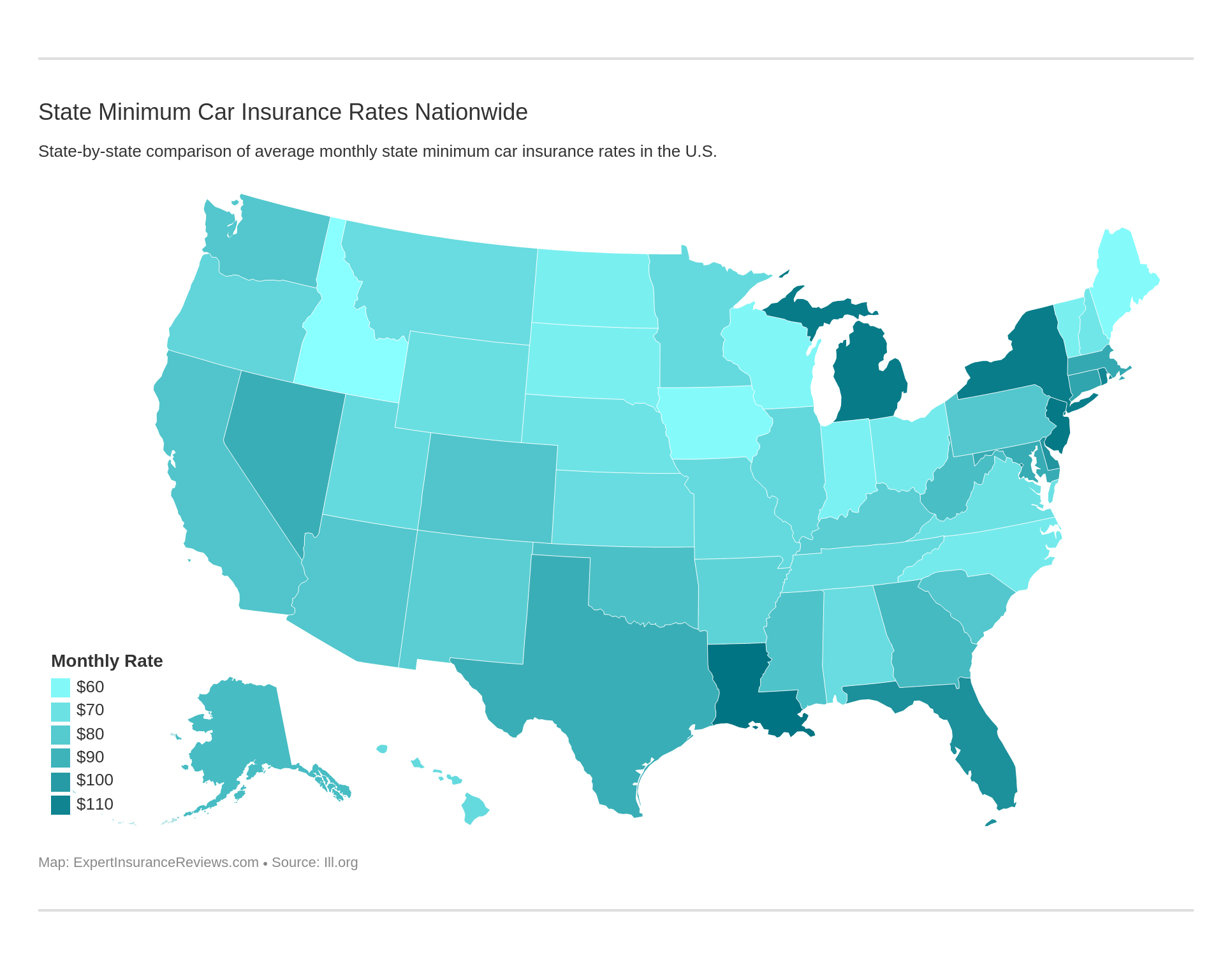

Minimum coverage varies from state to state.

Forms of Financial Responsibility

Every driver must carry evidence of financial responsibility in their motor vehicle at all times. This proof shows that you have the ability to pay for what is needed in the case of an accident.

In the U.S. alone, motor vehicle crashes in 2010 cost almost $1 trillion in loss of productivity and loss of life. Having the correct insurance can save lives and money.

In Minnesota, you are required to show proof of insurance and financial responsibility if you are pulled over. The state does allow electronic proof of insurance as well as long as it shows what your original proof of insurance did.

Premiums as a Percentage of Income

Knowing how much you’re spending on auto insurance compared to your overall income is always helpful.

| Minnesota | Full Coverage 2014 | Disposable Income 2014 | Insurance as % of Income 2014 | Full Coverage 2013 | Disposable Income 2013 | Insurance as % of Income 2013 | Full Coverage 2012 | Disposable Income 2012 | Insurance as % of Income 2012 |

|---|---|---|---|---|---|---|---|---|---|

| Cost | $856.62 | $42,516.00 | 2.01% | $823.70 | $40,905.00 | 2.01% | $800.24 | $41,491.00 | 1.93% |

As you can see from the table in 2014, Minnesotans paid 2.01 percent of their income to auto insurance premiums.

Ranking at 14 out of the 50 states, this means that you will be paying right around the nation’s average for your insurance. Compared to nearby Michigan, which is ranked last in the nation for rates, Minnesotans pay a great price.

All together in Minnesota, your auto insurance rates will be average if you have a clean record.

Average Monthly Car Insurance Rates in MN (Liability, Collision, Comprehensive)

| Coverage Type | Average Cost in Minnesota (2015) | Average Cost Nationwide (2015) |

|---|---|---|

| Liability | $456.82 | $538.73 |

| Collision | $234.40 | $322.61 |

| Comprehensive | $184.27 | $148.04 |

| Total (Full Coverage) | $875.49 | $1,009.38 |

Core coverage includes the parts of your policy that is considered full coverage. These three parts are liability car insurance, collision car insurance, and comprehensive car insurance. Combined the three make up full coverage auto insurance.

You can see in the table what the average cost for the three different types and full coverage in Minnesota compared to the averages across the whole nation. This information is gathered based on data from the National Association of Insurance Commissioners (NAIC).

Minnesota is over $100 lower than the nation’s average. This is a great sign for the whole of the state. If you’re moving to Minnesota you can rest easy that you’ll be paying a fairly low price for the insurance you choose.

Additional Liability

Sometimes on the road, you need more coverage than the minimum. This helps within the case of a bad accident, or bodily injury. In Minnesota, you are required to pay $500,000 in medical coverages. In Minnesota, you can choose from different levels of PIP (Personal Injury Protection) that are available for your peace of mind.

| Coverage Type | Minnesota Loss Ratio (2015) | National Average Loss Ratio (2015) |

|---|---|---|

| Personal Injury Protection | 68.34 | 85.76 |

| Medical Payments | 74.49 | 75.74 |

| Uninsured/Underinsured Motorist | 56.97 | 75.14 |

Loss ratios aren’t a well-known factor among buyers, but if you know the facts, they can be very important in helping you understand auto insurance better.

A loss ratio that’s too high means that insurance companies are paying out too much in claims – if the rate climbs over 100 percent they are paying out more than they’re taking in. If the company’s loss ratio is too low, it means they aren’t paying out any claims.

Both of these are important to you knowing the inner workings of the auto insurance company you choose.

Add-ons, Endorsements, and Riders

There are many different types of extra insurance coverage that you can add to your core coverage in Minnesota. These are meant to help you ease your mind on the road.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Car Insurance

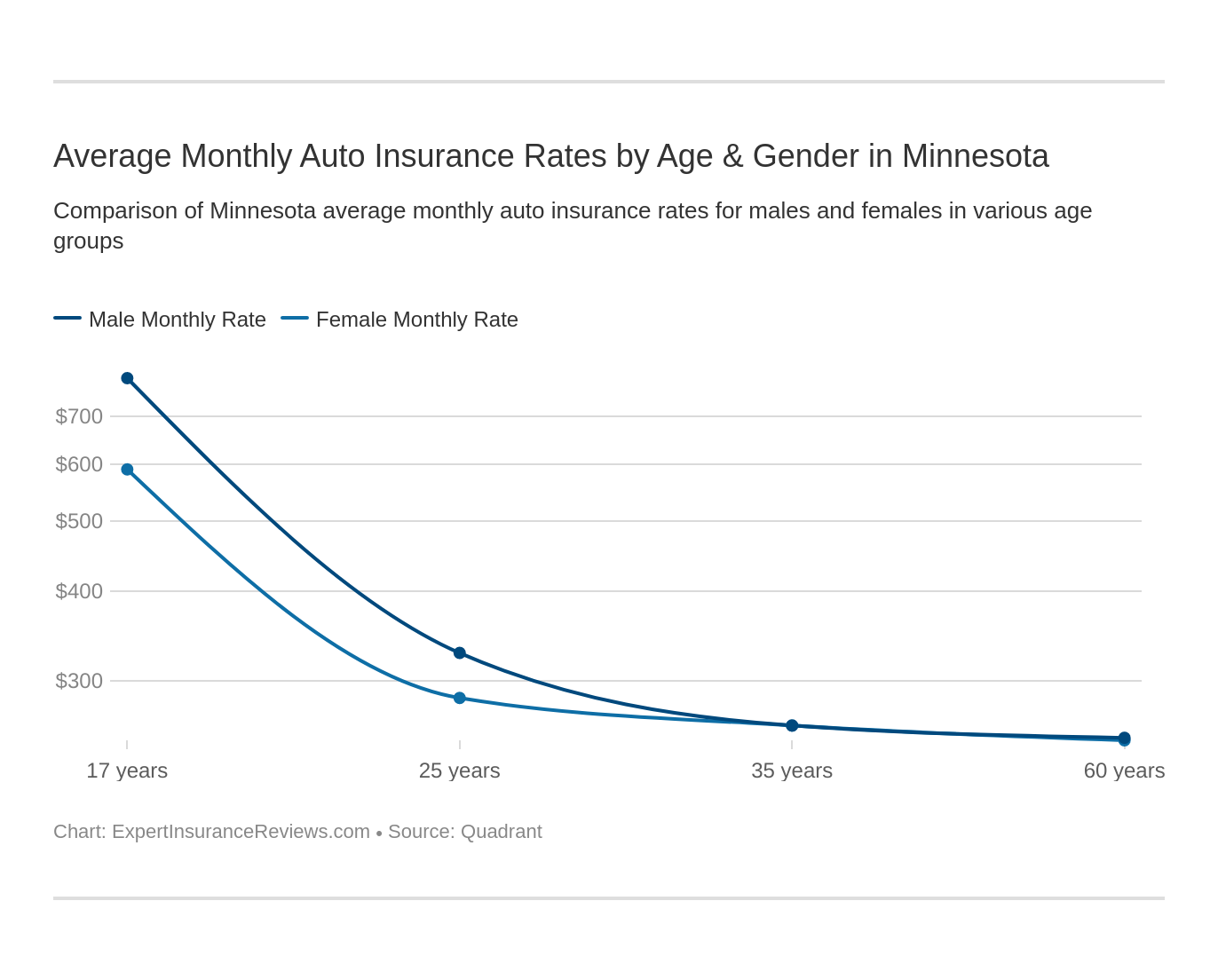

Average Car Insurance Rates by Age & Gender in MN

| Company | Married 35-year old female annual rates | Married 35-year old male annual rates | Married 60-year old female annual rates | Married 60-year old male annual rates | Single 17-year old female annual rates | Single 17-year old male annual rates | Single 25-year old female annual rates | Single 25-year old male annual rates |

|---|---|---|---|---|---|---|---|---|

| Allstate | $3,023.30 | $3,023.30 | $2,908.43 | $2,908.43 | $6,885.00 | $9,968.67 | $3,677.99 | $3,860.95 |

| American Family | $2,233.79 | $2,233.79 | $2,025.26 | $2,025.26 | $6,086.73 | $8,812.61 | $2,233.79 | $2,519.05 |

| Illinois Farmers Ins | $2,041.64 | $2,038.65 | $1,965.24 | $2,076.17 | $5,820.43 | $5,872.48 | $2,672.81 | $2,612.21 |

| Geico | $2,661.52 | $2,641.10 | $2,544.82 | $2,473.72 | $5,545.67 | $7,047.50 | $2,494.27 | $2,579.67 |

| Liberty Mutual Fire | $9,604.65 | $9,604.65 | $9,510.34 | $9,510.34 | $18,911.44 | $28,385.86 | $9,604.65 | $13,376.94 |

| AMCO Insurance | $1,970.26 | $1,978.45 | $1,753.51 | $1,860.69 | $5,026.90 | $6,105.97 | $2,312.50 | $2,403.62 |

| State Farm | $1,542.45 | $1,542.45 | $1,374.37 | $1,374.37 | $3,334.79 | $4,106.75 | $1,786.56 | $1,474.15 |

| USAA | $1,895.96 | $1,879.44 | $1,726.56 | $1,724.94 | $5,042.84 | $5,519.17 | $2,473.98 | $2,629.95 |

While some states have outlawed basing insurance rates off gender and demographic, Minnesota continues to do so.

Women are charged less in most cases. Some companies do not charge based on gender but they will be based on age.

There are two reasons women are charged less on their insurance in some cases. First, they are usually better drivers than men are. Statistics show that, in general, women are safer drivers than men. Secondly, women make a great deal less money than men do in almost every state. According to DataUSA women make around $17,000 less a year.

Teen drivers will always be charged a significant amount more than any other age bracket. This is also based on statistics. Teens are more likely to be in an accident, receive a citation, and speed than any other age.

Allstate charged almost $3000 more to teen males than teen females.

Cheapest Rates By Zip Code

| City | Zipcode | Annual Average |

|---|---|---|

| MINNEAPOLIS | 55001 | $4,651.42 |

| SAINT PAUL | 55002 | $4,966.16 |

| SAINT PAUL | 55003 | $4,534.15 |

| SAINT PAUL | 55005 | $4,984.06 |

| MINNEAPOLIS | 55006 | $4,887.03 |

| MINNEAPOLIS | 55007 | $4,827.14 |

| SAINT PAUL | 55008 | $4,917.15 |

| MINNEAPOLIS | 55009 | $4,431.06 |

| MINNEAPOLIS | 55011 | $4,988.89 |

| MINNEAPOLIS | 55012 | $4,912.10 |

| MINNEAPOLIS | 55013 | $4,906.35 |

| MINNEAPOLIS | 55014 | $4,667.48 |

| MINNEAPOLIS | 55016 | $4,608.58 |

| SAINT PAUL | 55017 | $4,913.94 |

| MINNEAPOLIS | 55018 | $4,363.68 |

| MINNEAPOLIS | 55019 | $4,289.32 |

| MINNEAPOLIS | 55020 | $4,545.77 |

| MINNEAPOLIS | 55021 | $4,386.58 |

| MINNEAPOLIS | 55024 | $4,598.80 |

| MINNEAPOLIS | 55025 | $4,992.05 |

| SAINT PAUL | 55026 | $4,336.40 |

| SAINT PAUL | 55027 | $4,355.55 |

| MINNEAPOLIS | 55029 | $4,945.76 |

| SAINT PAUL | 55030 | $4,865.77 |

| MINNEAPOLIS | 55031 | $4,575.45 |

| SAINT PAUL | 55032 | $4,836.87 |

| MINNEAPOLIS | 55033 | $4,580.59 |

| SAINT PAUL | 55036 | $4,788.43 |

| MINNEAPOLIS | 55037 | $4,790.47 |

| SAINT PAUL | 55038 | $4,940.45 |

| SAINT PAUL | 55040 | $4,955.17 |

| SAINT PAUL | 55041 | $4,356.73 |

| MINNEAPOLIS | 55042 | $4,639.63 |

| MINNEAPOLIS | 55043 | $4,585.99 |

| MINNEAPOLIS | 55044 | $4,597.36 |

| SAINT PAUL | 55045 | $4,909.45 |

| MINNEAPOLIS | 55046 | $4,399.76 |

| WASKISH | 55047 | $4,691.45 |

| SAINT FRANCIS | 55049 | $4,323.68 |

| STACY | 55051 | $4,790.40 |

| MINNEAPOLIS | 55052 | $4,335.77 |

| LAKE GEORGE | 55053 | $4,367.13 |

| SOUTH SAINT PAUL | 55054 | $4,557.15 |

| FOREST LAKE | 55055 | $4,774.77 |

| SAINT PAUL | 55056 | $4,822.41 |

| CEDAR | 55057 | $4,312.56 |

| BETHEL | 55060 | $4,236.01 |

| MINNEAPOLIS | 55063 | $4,819.53 |

| MINNEAPOLIS | 55065 | $4,430.50 |

| WYOMING | 55066 | $4,444.19 |

| ALMELUND | 55068 | $4,598.60 |

| MINNEAPOLIS | 55069 | $4,822.58 |

| MINNEAPOLIS | 55070 | $5,003.38 |

| ISANTI | 55071 | $4,817.55 |

| GARRISON | 55072 | $4,771.67 |

| ANDOVER | 55073 | $4,914.54 |

| GRANDY | 55074 | $4,904.07 |

| SWATARA | 55075 | $4,994.42 |

| TAYLORS FALLS | 55076 | $4,645.00 |

| HUGO | 55077 | $4,604.27 |

| HILLMAN | 55079 | $5,003.33 |

| CAMBRIDGE | 55080 | $4,827.98 |

| SCANDIA | 55082 | $4,549.97 |

| DALBO | 55084 | $4,943.22 |

| CENTER CITY | 55087 | $4,271.97 |

| PIERZ | 55088 | $4,413.49 |

| LINDSTROM | 55089 | $4,473.26 |

| CHISAGO CITY | 55090 | $4,523.58 |

| MENDOTA | 55092 | $4,967.20 |

| SHAFER | 55101 | $6,547.31 |

| BOWLUS | 55102 | $6,187.71 |

| ZIMMERMAN | 55103 | $6,520.89 |

| EMILY | 55104 | $6,339.29 |

| BOWSTRING | 55105 | $5,183.40 |

| OAK PARK | 55106 | $6,563.33 |

| JACOBSON | 55107 | $6,404.50 |

| FEDERAL DAM | 55108 | $5,150.82 |

| MAX | 55109 | $4,989.75 |

| BRAHAM | 55110 | $4,574.83 |

| FIFTY LAKES | 55111 | $4,827.80 |

| MILACA | 55112 | $4,743.09 |

| PUPOSKY | 55113 | $5,070.90 |

| SPRING LAKE | 55114 | $6,200.17 |

| UPSALA | 55115 | $4,515.20 |

| CROSSLAKE | 55116 | $5,120.20 |

| FORESTON | 55117 | $5,397.29 |

| SAINT PAUL | 55118 | $4,869.43 |

| GRASSTON | 55119 | $5,132.56 |

| LAPORTE | 55120 | $4,811.26 |

| OGILVIE | 55121 | $4,694.21 |

| MINNEAPOLIS | 55122 | $4,593.60 |

| BENEDICT | 55123 | $4,569.31 |

| WIRT | 55124 | $4,505.71 |

| MINNEAPOLIS | 55125 | $4,540.30 |

| BRAINERD | 55126 | $4,682.49 |

| FLENSBURG | 55127 | $4,649.14 |

| OUTING | 55128 | $4,656.42 |

| PRINCETON | 55129 | $4,622.04 |

| PEASE | 55130 | $5,798.28 |

| REDBY | 55150 | $4,905.29 |

| BURTRUM | 55301 | $4,579.88 |

| LAKE HUBERT | 55302 | $4,637.43 |

| KELLIHER | 55303 | $4,741.50 |

| FOLEY | 55304 | $4,946.23 |

| AITKIN | 55305 | $4,586.62 |

| REDLAKE | 55306 | $4,696.22 |

| REMER | 55307 | $4,307.33 |

| HILL CITY | 55308 | $4,598.16 |

| MCGREGOR | 55309 | $4,589.35 |

| HARRIS | 55310 | $4,121.17 |

| TAMARACK | 55311 | $4,529.41 |

| BENA | 55312 | $4,233.03 |

| FORT RIPLEY | 55313 | $4,554.05 |

| PALISADE | 55314 | $4,124.46 |

| PENNINGTON | 55315 | $4,485.73 |

| BLACKDUCK | 55316 | $4,724.99 |

| LASTRUP | 55317 | $4,481.79 |

| ONAMIA | 55318 | $4,486.22 |

| PARK RAPIDS | 55319 | $4,653.44 |

| CUSHING | 55320 | $4,497.12 |

| EFFIE | 55321 | $4,578.31 |

| DEERWOOD | 55322 | $4,488.62 |

| STANCHFIELD | 55323 | $4,517.03 |

| SAINT PAUL | 55324 | $4,264.01 |

| BROOK PARK | 55325 | $4,263.16 |

| HACKENSACK | 55327 | $4,595.20 |

| TENSTRIKE | 55328 | $4,568.88 |

| PONEMAH | 55329 | $4,342.56 |

| WAHKON | 55330 | $4,773.24 |

| MINNEAPOLIS | 55331 | $4,504.94 |

| RUSH CITY | 55332 | $4,085.99 |

| NORTH BRANCH | 55333 | $4,118.98 |

| HINES | 55334 | $4,246.30 |

| ROYALTON | 55335 | $4,254.98 |

| BOCK | 55336 | $4,194.01 |

| PILLAGER | 55337 | $4,750.04 |

| PINE CITY | 55338 | $4,450.10 |

| HOPKINS | 55339 | $4,519.88 |

| SAINT PAUL PARK | 55340 | $4,639.68 |

| GREY EAGLE | 55341 | $4,638.66 |

| CROSBY | 55342 | $4,178.87 |

| SWAN RIVER | 55343 | $4,818.26 |

| FINLAYSON | 55344 | $4,673.11 |

| LITTLE FALLS | 55345 | $4,530.53 |

| SAINT PAUL | 55346 | $4,575.93 |

| MC GRATH | 55347 | $4,497.24 |

| GOODLAND | 55349 | $4,600.51 |

| KEEWATIN | 55350 | $4,166.96 |

| BIGFORK | 55352 | $4,557.66 |

| MINNEAPOLIS | 55353 | $4,462.55 |

| ALDRICH | 55354 | $4,268.36 |

| MARCELL | 55355 | $4,242.65 |

| MINNEAPOLIS | 55356 | $4,513.84 |

| SQUAW LAKE | 55357 | $4,601.17 |

| CLARISSA | 55358 | $4,615.92 |

| BAXTER | 55359 | $4,576.04 |

| AKELEY | 55360 | $4,502.69 |

| NORWOOD | 55361 | $4,538.39 |

| IRONTON | 55362 | $4,615.18 |

| ISLE | 55363 | $4,598.89 |

| MINNEAPOLIS | 55364 | $4,532.58 |

| NISSWA | 55367 | $4,521.35 |

| SWANVILLE | 55368 | $4,502.79 |

| BRUNO | 55369 | $4,586.12 |

| NEVIS | 55370 | $4,229.11 |

| DEER RIVER | 55371 | $4,857.50 |

| MOTLEY | 55372 | $4,577.08 |

| ASKOV | 55373 | $4,586.52 |

| AH GWAH CHING | 55374 | $4,576.17 |

| NIMROD | 55375 | $4,450.98 |

| HINCKLEY | 55376 | $4,582.41 |

| MORA | 55377 | $4,659.67 |

| VERNDALE | 55378 | $4,597.31 |

| CALUMET | 55379 | $4,578.31 |

| STURGEON LAKE | 55380 | $4,565.83 |

| STAPLES | 55381 | $4,255.46 |

| NASHWAUK | 55382 | $4,454.60 |

| HENRIETTE | 55384 | $4,715.67 |

| TALMOON | 55385 | $4,185.98 |

| BACKUS | 55386 | $4,522.30 |

| WILLOW RIVER | 55387 | $4,501.61 |

| PENGILLY | 55388 | $4,525.81 |

| WALKER | 55389 | $4,428.53 |

| MERRIFIELD | 55390 | $4,572.57 |

| GILMAN | 55391 | $4,554.11 |

| WARBA | 55392 | $4,499.54 |

| LONGVILLE | 55395 | $4,280.79 |

| PEQUOT LAKES | 55396 | $4,222.29 |

| SEBEKA | 55397 | $4,487.32 |

| NEWPORT | 55398 | $4,901.37 |

| ELK RIVER | 55401 | $6,221.82 |

| WEST UNION | 55402 | $6,353.00 |

| SANDSTONE | 55403 | $6,252.05 |

| MINNEAPOLIS | 55404 | $6,491.18 |

| BERTHA | 55405 | $6,320.72 |

| BOVEY | 55406 | $6,257.62 |

| HEWITT | 55407 | $6,382.19 |

| MINNEAPOLIS | 55408 | $6,370.83 |

| SOLWAY | 55409 | $6,109.20 |

| MAKINEN | 55410 | $4,823.83 |

| TACONITE | 55411 | $6,620.56 |

| BEMIDJI | 55412 | $6,434.63 |

| COLERAINE | 55413 | $6,248.33 |

| BRIMSON | 55414 | $6,254.15 |

| EAGLE BEND | 55415 | $6,385.64 |

| MARBLE | 55416 | $4,796.26 |

| PINE RIVER | 55417 | $4,973.22 |

| CASS LAKE | 55418 | $5,091.43 |

| WADENA | 55419 | $4,865.40 |

| CANYON | 55420 | $4,956.19 |

| MINNEAPOLIS | 55421 | $5,103.52 |

| MENAHGA | 55422 | $4,862.13 |

| ALBORN | 55423 | $5,002.58 |

| BURNSVILLE | 55424 | $4,675.46 |

| BROWERVILLE | 55425 | $4,961.03 |

| KERRICK | 55426 | $4,768.99 |

| SAINT PAUL | 55427 | $4,676.71 |

| ANOKA | 55428 | $4,803.63 |

| MINNEAPOLIS | 55429 | $5,152.26 |

| MINNEAPOLIS | 55430 | $5,348.66 |

| COHASSET | 55431 | $4,805.12 |

| CRANE LAKE | 55432 | $4,971.65 |

| LONG PRAIRIE | 55433 | $4,766.55 |

| BROOKSTON | 55434 | $4,741.45 |

| CHAMPLIN | 55435 | $4,686.64 |

| RANDALL | 55436 | $4,655.87 |

| MINNEAPOLIS | 55437 | $4,621.76 |

| LOMAN | 55438 | $4,591.84 |

| MEADOWLANDS | 55439 | $4,666.21 |

| SPRING PARK | 55441 | $4,665.24 |

| COTTON | 55442 | $4,551.65 |

| GRAND RAPIDS | 55443 | $5,059.67 |

| FLOODWOOD | 55444 | $5,112.07 |

| ORR | 55445 | $4,754.76 |

| BURNSVILLE | 55446 | $4,610.02 |

| HOLYOKE | 55447 | $4,467.13 |

| SAINT PAUL | 55448 | $4,739.15 |

| COOK | 55449 | $4,718.99 |

| MARINE ON SAINT CROIX | 55450 | $5,758.23 |

| ELY | 55454 | $6,394.17 |

| MINNEAPOLIS | 55455 | $6,349.43 |

| BUHL | 55554 | $4,797.58 |

| SAINT PAUL | 55602 | $4,761.70 |

| BIRCHDALE | 55603 | $4,583.38 |

| ANGORA | 55604 | $4,518.27 |

| MINNEAPOLIS | 55605 | $4,541.84 |

| WINTON | 55606 | $4,558.98 |

| MINNEAPOLIS | 55607 | $4,583.80 |

| EDEN PRAIRIE | 55609 | $4,627.10 |

| KINNEY | 55612 | $4,539.24 |

| CIRCLE PINES | 55613 | $4,536.53 |

| MINNEAPOLIS | 55614 | $4,526.03 |

| MINNEAPOLIS | 55615 | $4,471.29 |

| MELRUDE | 55616 | $4,661.57 |

| EMBARRASS | 55701 | $4,570.19 |

| TWO HARBORS | 55702 | $4,752.42 |

| SANTIAGO | 55703 | $4,677.02 |

| SAINT PAUL | 55704 | $4,792.55 |

| MINNEAPOLIS | 55705 | $4,623.34 |

| SAGINAW | 55706 | $4,642.35 |

| NORTHOME | 55707 | $4,562.16 |

| TOWER | 55708 | $4,590.97 |

| CLEAR LAKE | 55709 | $4,768.76 |

| SOUDAN | 55710 | $4,645.20 |

| DULUTH | 55711 | $4,730.87 |

| AFTON | 55712 | $4,793.39 |

| SAINT PAUL | 55713 | $4,685.24 |

| BRITT | 55716 | $4,788.94 |

| INVER GROVE HEIGHTS | 55717 | $4,758.14 |

| NETT LAKE | 55718 | $4,518.08 |

| BABBITT | 55719 | $4,590.79 |

| DULUTH | 55720 | $4,548.05 |

| HAMEL | 55721 | $4,738.28 |

| LAKE ELMO | 55722 | $4,761.85 |

| HANOVER | 55723 | $4,692.21 |

| DULUTH | 55724 | $4,715.03 |

| ANNANDALE | 55725 | $4,732.68 |

| SAWYER | 55726 | $4,616.56 |

| HOYT LAKES | 55731 | $4,688.58 |

| KNIFE RIVER | 55732 | $4,662.09 |

| FORBES | 55733 | $4,484.67 |

| AURORA | 55734 | $4,563.22 |

| SAINT PAUL | 55735 | $4,811.86 |

| MINNEAPOLIS | 55736 | $4,703.36 |

| KABETOGAMA | 55738 | $4,625.70 |

| CROMWELL | 55741 | $4,590.36 |

| MAPLE LAKE | 55742 | $4,806.78 |

| MONTICELLO | 55744 | $4,713.52 |

| MINNEAPOLIS | 55746 | $4,563.66 |

| COTTAGE GROVE | 55748 | $4,841.01 |

| INVER GROVE HEIGHTS | 55749 | $4,694.57 |

| MARGIE | 55750 | $4,628.09 |

| DULUTH | 55751 | $4,525.08 |

| TWIG | 55752 | $4,890.47 |

| LORETTO | 55753 | $4,806.41 |

| HOWARD LAKE | 55756 | $4,745.72 |

| MONTROSE | 55757 | $4,568.18 |

| FARMINGTON | 55758 | $4,668.16 |

| ROSEMOUNT | 55760 | $4,839.42 |

| BECKER | 55763 | $4,764.94 |

| LAKEVILLE | 55764 | $4,759.98 |

| SAVAGE | 55765 | $4,716.65 |

| DULUTH | 55766 | $4,662.83 |

| BIG FALLS | 55767 | $4,533.30 |

| DAYTON | 55768 | $4,556.86 |

| SAINT PAUL | 55769 | $4,788.75 |

| MINNEAPOLIS | 55771 | $4,697.29 |

| BIWABIK | 55772 | $4,643.78 |

| CHISHOLM | 55775 | $4,782.97 |

| GILBERT | 55779 | $4,655.36 |

| BIG LAKE | 55780 | $4,636.13 |

| HOPKINS | 55781 | $4,546.30 |

| ROCKFORD | 55782 | $4,653.35 |

| OSSEO | 55783 | $4,788.90 |

| LAKELAND | 55784 | $4,812.19 |

| ISABELLA | 55785 | $4,945.15 |

| FINLAND | 55786 | $4,764.65 |

| SAINT MICHAEL | 55787 | $4,836.82 |

| MIZPAH | 55790 | $4,655.22 |

| DULUTH | 55791 | $4,602.53 |

| HASTINGS | 55792 | $4,565.76 |

| ALBERTVILLE | 55793 | $4,778.32 |

| COKATO | 55795 | $4,784.68 |

| SHAKOPEE | 55796 | $4,675.65 |

| PRIOR LAKE | 55797 | $4,527.42 |

| ROGERS | 55798 | $4,575.13 |

| MAPLE PLAIN | 55802 | $4,637.50 |

| EDEN PRAIRIE | 55803 | $4,596.48 |

| HAMPTON | 55804 | $4,563.24 |

| WRIGHT | 55805 | $4,580.88 |

| SAINT PAUL | 55806 | $4,641.43 |

| LITTLEFORK | 55807 | $4,651.81 |

| WAVERLY | 55808 | $4,603.77 |

| ADOLPH | 55810 | $4,566.95 |

| SAINT PAUL | 55811 | $4,518.61 |

| DELANO | 55812 | $4,546.88 |

| KETTLE RIVER | 55901 | $4,189.52 |

| DULUTH | 55902 | $4,245.71 |

| SILVER CREEK | 55904 | $4,254.72 |

| VIRGINIA | 55906 | $4,261.58 |

| HIBBING | 55909 | $4,194.61 |

| DULUTH | 55910 | $4,326.36 |

| EVELETH | 55912 | $4,009.81 |

| BARNUM | 55917 | $4,222.10 |

| RANIER | 55918 | $4,164.33 |

| HOVLAND | 55919 | $4,365.20 |

| GATZKE | 55920 | $4,226.74 |

| JORDAN | 55921 | $4,331.25 |

| ELKO NEW MARKET | 55922 | $4,382.72 |

| MOUNTAIN IRON | 55923 | $4,330.77 |

| WAYZATA | 55924 | $4,330.97 |

| BUFFALO | 55925 | $4,300.54 |

| MINNEAPOLIS | 55926 | $4,270.23 |

| STILLWATER | 55927 | $4,267.94 |

| CLOQUET | 55929 | $4,292.49 |

| DULUTH | 55931 | $4,336.96 |

| SIDE LAKE | 55932 | $4,274.65 |

| ELKO NEW MARKET | 55933 | $4,298.04 |

| BELLE PLAINE | 55934 | $4,259.45 |

| GRAND PORTAGE | 55935 | $4,334.69 |

| SAINT PAUL | 55936 | $4,304.01 |

| LUTSEN | 55939 | $4,302.83 |

| HALLOCK | 55940 | $4,280.34 |

| MINNETONKA BEACH | 55941 | $4,327.66 |

| SCHROEDER | 55943 | $4,321.99 |

| SOUTH INTERNATIONAL FALLS | 55944 | $4,255.74 |

| BAYPORT | 55945 | $4,327.53 |

| MOOSE LAKE | 55946 | $4,368.50 |

| MOUND | 55947 | $4,330.21 |

| MINNETONKA | 55949 | $4,327.08 |

| OSSEO | 55951 | $4,277.87 |

| WRENSHALL | 55952 | $4,332.39 |

| WARREN | 55953 | $4,131.54 |

| SILVER BAY | 55954 | $4,333.55 |

| WATERTOWN | 55955 | $4,275.27 |

| IRON | 55956 | $4,283.80 |

| WILLERNIE | 55957 | $4,335.71 |

| VICTORIA | 55959 | $4,269.61 |

| NEW GERMANY | 55960 | $4,232.47 |

| HAMBURG | 55961 | $4,333.85 |

| DULUTH | 55962 | $4,313.70 |

| GRAND MARAIS | 55963 | $4,266.93 |

| CARLTON | 55964 | $4,284.71 |

| CRYSTAL BAY | 55965 | $4,265.32 |

| GRYGLA | 55967 | $4,351.20 |

| SAINT PAUL | 55968 | $4,293.38 |

| LONG LAKE | 55969 | $4,349.11 |

| CLEARBROOK | 55970 | $4,197.09 |

| SAINT PAUL | 55971 | $4,296.06 |

| SHEVLIN | 55972 | $4,309.34 |

| EXCELSIOR | 55973 | $4,249.56 |

| INTERNATIONAL FALLS | 55974 | $4,295.72 |

| NORWOOD YOUNG AMERICA | 55975 | $4,316.24 |

| MAYER | 55976 | $4,278.88 |

| WACONIA | 55977 | $4,305.68 |

| MIDDLE RIVER | 55979 | $4,408.78 |

| NAVARRE | 55981 | $4,266.49 |

| EDEN PRAIRIE | 55982 | $4,256.13 |

| CLEARWATER | 55983 | $4,324.08 |

| HOLDINGFORD | 55985 | $4,323.64 |

| COLOGNE | 55987 | $4,017.60 |

| BAGLEY | 55988 | $4,224.79 |

| YOUNG AMERICA | 55990 | $4,359.24 |

| CHASKA | 55991 | $4,299.74 |

| CARVER | 55992 | $4,315.75 |

| LEONARD | 56001 | $4,043.77 |

| ESKO | 56003 | $4,086.66 |

| CHANHASSEN | 56007 | $3,976.80 |

| TRAIL | 56009 | $4,081.54 |

| FOSSTON | 56010 | $4,203.74 |

| WELCH | 56011 | $4,544.18 |

| GONVICK | 56013 | $4,080.22 |

| TOFTE | 56014 | $4,099.11 |

| ALBANY | 56016 | $4,116.30 |

| MINNEAPOLIS | 56017 | $4,291.20 |

| MAHNOMEN | 56019 | $4,041.92 |

| KIMBALL | 56020 | $4,157.23 |

| BEJOU | 56021 | $4,068.46 |

| EUCLID | 56022 | $4,076.33 |

| RICHMOND | 56023 | $4,121.15 |

| SOUTH HAVEN | 56024 | $4,212.38 |

| FELTON | 56025 | $4,090.76 |

| NAYTAHWAUSH | 56026 | $4,201.19 |

| SAINT BONIFACIUS | 56027 | $4,022.41 |

| HITTERDAL | 56028 | $4,285.75 |

| WAITE PARK | 56029 | $4,124.23 |

| GREEN ISLE | 56030 | $4,052.47 |

| RED WING | 56031 | $4,029.28 |

| OGEMA | 56032 | $4,146.86 |

| PONSFORD | 56033 | $4,100.45 |

| STRATHCONA | 56034 | $4,253.46 |

| CROOKSTON | 56036 | $4,046.92 |

| FREEPORT | 56037 | $4,230.64 |

| CANNON FALLS | 56039 | $4,018.95 |

| RANDOLPH | 56041 | $4,042.96 |

| GOODRIDGE | 56042 | $4,135.95 |

| WATKINS | 56043 | $4,057.13 |

| KENNEDY | 56044 | $4,329.60 |

| NEW MUNICH | 56045 | $4,146.70 |

| VIKING | 56047 | $4,082.72 |

| VINING | 56048 | $4,216.65 |

| MENTOR | 56050 | $4,222.26 |

| DONALDSON | 56051 | $4,101.92 |

| WAUBUN | 56052 | $4,339.98 |

| COLD SPRING | 56054 | $4,032.56 |

| LENGBY | 56055 | $4,190.37 |

| GARY | 56056 | $4,053.40 |

| SAINT CLOUD | 56057 | $4,317.79 |

| OSLO | 56058 | $4,292.11 |

| LANCASTER | 56060 | $4,051.00 |

| CALLAWAY | 56062 | $4,029.17 |

| STRANDQUIST | 56063 | $4,220.63 |

| WEBSTER | 56065 | $4,256.20 |

| HALMA | 56068 | $4,129.36 |

| GULLY | 56069 | $4,376.11 |

| GEORGETOWN | 56071 | $4,362.81 |

| RICE | 56072 | $4,175.60 |

| OSAGE | 56073 | $4,027.34 |

| UTICA | 56074 | $4,126.09 |

| LAKE BRONSON | 56075 | $4,036.97 |

| SAUK RAPIDS | 56078 | $4,277.23 |

| ARGYLE | 56080 | $4,235.29 |

| ERSKINE | 56081 | $4,032.94 |

| WANNASKA | 56082 | $4,100.82 |

| WINGER | 56083 | $4,167.97 |

| KARLSTAD | 56084 | $4,074.68 |

| MCINTOSH | 56085 | $4,044.59 |

| ROSCOE | 56087 | $4,029.60 |

| BORUP | 56088 | $3,983.87 |

| LONSDALE | 56089 | $4,061.51 |

| GREENBUSH | 56090 | $4,273.00 |

| OKLEE | 56091 | $4,265.33 |

| FERTILE | 56093 | $4,191.08 |

| ROCHERT | 56096 | $4,345.76 |

| PAYNESVILLE | 56097 | $4,072.70 |

| SHELLY | 56098 | $4,037.01 |

| BLUFFTON | 56101 | $4,084.45 |

| PERLEY | 56110 | $4,059.86 |

| OSAKIS | 56111 | $4,070.62 |

| NEWFOLDEN | 56113 | $4,158.12 |

| ALVARADO | 56114 | $4,153.79 |

| SAINT CLOUD | 56115 | $4,125.32 |

| CLIMAX | 56116 | $4,158.32 |

| FARIBAULT | 56117 | $4,096.38 |

| BADGER | 56118 | $4,169.33 |

| HALSTAD | 56119 | $4,092.42 |

| AVON | 56120 | $4,009.53 |

| WILLIAMS | 56121 | $4,071.04 |

| NIELSVILLE | 56122 | $4,116.77 |

| TWIN VALLEY | 56123 | $4,159.98 |

| CANTON | 56125 | $4,100.40 |

| SAUK CENTRE | 56127 | $4,029.53 |

| MELROSE | 56128 | $4,126.16 |

| ELROSA | 56129 | $4,150.50 |

| GREENWALD | 56131 | $4,107.11 |

| BROOTEN | 56132 | $4,151.54 |

| MONTGOMERY | 56134 | $4,190.83 |

| HUMBOLDT | 56136 | $4,173.52 |

| SAINT VINCENT | 56137 | $4,091.62 |

| FLOM | 56138 | $4,242.32 |

| BELGRADE | 56139 | $4,179.26 |

| BROOKS | 56140 | $4,078.77 |

| PLUMMER | 56141 | $4,220.46 |

| KENYON | 56142 | $4,148.14 |

| NERSTRAND | 56143 | $4,100.49 |

| STEPHEN | 56144 | $4,072.94 |

| AUDUBON | 56145 | $4,088.83 |

| BROWNSVILLE | 56146 | $4,168.00 |

| LAKE PARK | 56147 | $4,129.14 |

| SALOL | 56149 | $4,077.65 |

| ULEN | 56150 | $4,065.23 |

| DENNISON | 56151 | $4,071.84 |

| NOYES | 56152 | $4,118.33 |

| NEW PRAGUE | 56153 | $4,222.94 |

| SARTELL | 56155 | $4,136.96 |

| NASHUA | 56156 | $4,126.50 |

| BARNESVILLE | 56157 | $4,100.51 |

| DEER CREEK | 56158 | $4,210.11 |

| WYKOFF | 56159 | $4,014.86 |

| SAINT STEPHEN | 56160 | $4,090.22 |

| LAKE CITY | 56161 | $4,119.91 |

| SAINT CLOUD | 56162 | $4,048.38 |

| HENNING | 56164 | $4,090.80 |

| GOODHUE | 56165 | $4,145.66 |

| BELTRAMI | 56166 | $4,322.86 |

| FOXHOME | 56167 | $4,141.09 |

| WAITE PARK | 56168 | $4,105.12 |

| GLYNDON | 56169 | $4,178.89 |

| RACINE | 56170 | $4,206.13 |

| PARKERS PRAIRIE | 56171 | $4,047.15 |

| ROLLINGSTONE | 56172 | $4,162.12 |

| WOLVERTON | 56173 | $4,177.10 |

| ROSEAU | 56174 | $4,159.82 |

| WATERVILLE | 56175 | $4,116.99 |

| FISHER | 56176 | $4,091.87 |

| CLITHERALL | 56178 | $4,128.58 |

| ADA | 56180 | $4,227.56 |

| OTTERTAIL | 56181 | $4,027.96 |

| EDEN VALLEY | 56183 | $4,150.21 |

| THIEF RIVER FALLS | 56185 | $4,086.86 |

| KILKENNY | 56186 | $4,136.22 |

| EAST GRAND FORKS | 56187 | $4,082.00 |

| RICHWOOD | 56201 | $4,294.52 |

| EITZEN | 56207 | $4,124.98 |

| VERGAS | 56208 | $4,171.79 |

| FRONTENAC | 56209 | $4,268.43 |

| MORRISTOWN | 56210 | $4,130.77 |

| NEW YORK MILLS | 56211 | $4,151.87 |

| MILLVILLE | 56212 | $4,074.69 |

| FOUNTAIN | 56214 | $4,158.88 |

| DENT | 56215 | $4,187.93 |

| FRAZEE | 56216 | $4,265.23 |

| OSTRANDER | 56218 | $4,154.12 |

| MABEL | 56219 | $4,224.88 |

| SABIN | 56220 | $4,113.66 |

| LEWISTON | 56221 | $4,142.68 |

| RICHVILLE | 56222 | $4,197.70 |

| CALEDONIA | 56223 | $4,086.62 |

| CLAREMONT | 56224 | $4,149.46 |

| CHATFIELD | 56225 | $4,074.66 |

| HAWLEY | 56226 | $4,149.56 |

| LA CRESCENT | 56227 | $4,273.37 |

| BAUDETTE | 56228 | $4,208.34 |

| HENDERSON | 56229 | $4,118.22 |

| RED LAKE FALLS | 56230 | $4,101.84 |

| HOKAH | 56231 | $4,195.99 |

| KELLOGG | 56232 | $4,084.07 |

| LANESBORO | 56235 | $4,081.34 |

| BATTLE LAKE | 56236 | $4,148.48 |

| ALTURA | 56237 | $4,223.97 |

| ROOSEVELT | 56239 | $4,118.13 |

| WANAMINGO | 56240 | $4,199.63 |

| MEDFORD | 56241 | $4,096.14 |

| WEST CONCORD | 56243 | $4,235.99 |

| REVERE | 56244 | $4,065.43 |

| HOUSTON | 56245 | $4,155.48 |

| SUNBURG | 56248 | $4,248.39 |

| KENT | 56249 | $4,211.39 |

| BRECKENRIDGE | 56251 | $4,284.39 |

| LE CENTER | 56252 | $4,266.78 |

| ROTHSAY | 56253 | $4,313.41 |

| SPRING VALLEY | 56255 | $4,280.59 |

| ZUMBROTA | 56256 | $4,094.41 |

| SAINT JOSEPH | 56257 | $4,121.36 |

| HENDRUM | 56258 | $4,201.86 |

| PETERSON | 56260 | $4,143.39 |

| LAKE LILLIAN | 56262 | $4,145.40 |

| NORTHFIELD | 56263 | $4,204.95 |

| DETROIT LAKES | 56264 | $4,168.82 |

| VILLARD | 56265 | $4,187.41 |

| WARROAD | 56266 | $4,157.89 |

| PELICAN RAPIDS | 56267 | $4,073.88 |

| SAINT CHARLES | 56270 | $4,156.86 |

| SAINT HILAIRE | 56271 | $4,241.05 |

| ARLINGTON | 56273 | $4,255.41 |

| SWIFT | 56274 | $4,229.70 |

| TAOPI | 56276 | $4,154.49 |

| UNDERWOOD | 56277 | $4,117.06 |

| GRAND MEADOW | 56278 | $4,134.68 |

| HARMONY | 56279 | $4,287.80 |

| ERHARD | 56280 | $4,159.79 |

| DAKOTA | 56281 | $4,248.52 |

| ZUMBRO FALLS | 56282 | $4,221.11 |

| ANGLE INLET | 56283 | $4,219.17 |

| ELKTON | 56284 | $4,182.80 |

| RUSHFORD | 56285 | $4,103.26 |

| SPRING GROVE | 56287 | $4,158.34 |

| WILLMAR | 56288 | $4,291.58 |

| READS LANDING | 56289 | $4,319.57 |

| DOVER | 56291 | $4,236.59 |

| LE SUEUR | 56292 | $4,238.47 |

| SPICER | 56293 | $4,144.72 |

| CLEVELAND | 56294 | $4,198.11 |

| DUNDAS | 56295 | $4,216.51 |

| PENNOCK | 56296 | $4,214.78 |

| OAK ISLAND | 56297 | $4,168.13 |

| ELYSIAN | 56301 | $4,356.53 |

| PLAINVIEW | 56303 | $4,389.00 |

| KANDIYOHI | 56304 | $4,419.01 |

| MAZEPPA | 56307 | $4,468.92 |

| WINSTED | 56308 | $4,212.93 |

| LUCAN | 56309 | $4,229.98 |

| HAYFIELD | 56310 | $4,385.04 |

| STEWARTVILLE | 56311 | $4,191.79 |

| COMSTOCK | 56312 | $4,375.28 |

| LE ROY | 56313 | $4,819.87 |

| TINTAH | 56314 | $4,901.74 |

| PEMBERTON | 56315 | $4,248.15 |

| MANTORVILLE | 56316 | $4,376.82 |

| ELGIN | 56318 | $4,851.65 |

| MILTONA | 56319 | $4,254.21 |

| CORRELL | 56320 | $4,419.96 |

| VERNON CENTER | 56323 | $4,225.59 |

| WARSAW | 56324 | $4,262.86 |

| FARWELL | 56325 | $4,377.54 |

| DEXTER | 56326 | $4,259.93 |

| MINNESOTA CITY | 56327 | $4,270.85 |

| CAMPBELL | 56328 | $4,859.74 |

| ATWATER | 56329 | $4,847.85 |

| LESTER PRAIRIE | 56330 | $4,876.46 |

| DODGE CENTER | 56331 | $4,435.28 |

| PINE ISLAND | 56332 | $4,210.69 |

| KERKHOVEN | 56333 | $4,778.70 |

| WABASHA | 56334 | $4,221.15 |

| PERHAM | 56335 | $4,377.00 |

| WALDORF | 56336 | $4,816.75 |

| PRESTON | 56338 | $4,938.79 |

| BLOMKEST | 56339 | $4,162.28 |

| DARWIN | 56340 | $4,493.67 |

| KENSINGTON | 56341 | $4,260.94 |

| DASSEL | 56342 | $4,796.69 |

| DALTON | 56343 | $4,263.66 |

| ROCHESTER | 56344 | $4,832.71 |

| HOLMES CITY | 56345 | $4,811.40 |

| FERGUS FALLS | 56347 | $4,732.32 |

| EVANSVILLE | 56349 | $4,238.35 |

| EYOTA | 56350 | $4,809.10 |

| ELIZABETH | 56352 | $4,377.75 |

| MAPLETON | 56353 | $4,885.54 |

| NELSON | 56354 | $4,273.94 |

| WALTHAM | 56355 | $4,256.16 |

| KASSON | 56356 | $4,426.16 |

| SILVER LAKE | 56357 | $4,892.50 |

| NEW LONDON | 56358 | $4,865.50 |

| GIBBON | 56359 | $4,832.24 |

| ROCHESTER | 56360 | $4,394.01 |

| CARLOS | 56361 | $4,350.07 |

| GARDEN CITY | 56362 | $4,396.48 |

| SARGEANT | 56363 | $4,854.94 |

| PRINSBURG | 56364 | $4,911.72 |

| HERMAN | 56367 | $4,410.34 |

| BRANDON | 56368 | $4,454.92 |

| GAYLORD | 56371 | $4,400.78 |

| ROCHESTER | 56373 | $4,821.27 |

| LITCHFIELD | 56374 | $4,315.46 |

| HILLS | 56375 | $4,357.18 |

| MURDOCK | 56377 | $4,362.78 |

| VESTA | 56378 | $4,379.20 |

| LOWRY | 56379 | $4,407.38 |

| TAUNTON | 56381 | $4,220.75 |

| OWATONNA | 56382 | $4,795.09 |

| GROVE CITY | 56384 | $4,878.52 |

| SAINT CLAIR | 56385 | $4,311.32 |

| BROWNTON | 56386 | $4,823.83 |

| ORONOCO | 56387 | $4,450.24 |

| GOOD THUNDER | 56388 | $4,352.71 |

| ASHBY | 56389 | $4,772.62 |

| NORCROSS | 56401 | $4,862.08 |

| PLATO | 56425 | $4,800.09 |

| WALNUT GROVE | 56430 | $4,791.62 |

| BYRON | 56431 | $4,843.78 |

| CYRUS | 56433 | $4,797.71 |

| BROWNS VALLEY | 56434 | $4,804.03 |

| STOCKTON | 56435 | $4,785.70 |

| ECHO | 56436 | $4,863.77 |

| ELBOW LAKE | 56437 | $4,768.99 |

| LEOTA | 56438 | $4,746.12 |

| WINTHROP | 56440 | $4,801.00 |

| KASOTA | 56441 | $4,814.45 |

| BLOOMING PRAIRIE | 56442 | $4,876.91 |

| GLENWOOD | 56443 | $4,830.73 |

| RAYMOND | 56444 | $4,829.69 |

| STARBUCK | 56446 | $4,760.92 |

| MADISON LAKE | 56447 | $4,900.39 |

| IONA | 56448 | $4,885.97 |

| REDWOOD FALLS | 56449 | $4,835.29 |

| JANESVILLE | 56450 | $4,948.90 |

| WATSON | 56452 | $4,826.67 |

| WHEATON | 56453 | $4,767.02 |

| ALEXANDRIA | 56455 | $4,797.26 |

| EAGLE LAKE | 56458 | $4,999.75 |

| HOLLOWAY | 56459 | $4,850.13 |

| GARFIELD | 56461 | $4,865.75 |

| MAGNOLIA | 56464 | $4,754.36 |

| COSMOS | 56465 | $4,779.25 |

| RUTHTON | 56466 | $4,792.80 |

| MILROY | 56467 | $4,793.23 |

| AMBOY | 56468 | $4,796.11 |

| DILWORTH | 56469 | $4,835.20 |

| MARSHALL | 56470 | $4,831.88 |

| ELLENDALE | 56472 | $4,774.91 |

| GRACEVILLE | 56473 | $4,819.70 |

| WANDA | 56474 | $4,759.34 |

| CLARA CITY | 56475 | $4,721.23 |

| ROSE CREEK | 56477 | $4,774.78 |

| DANVERS | 56478 | $4,791.40 |

| ADAMS | 56479 | $4,788.78 |

| GLENCOE | 56481 | $4,789.69 |

| BARRETT | 56482 | $4,758.55 |

| WASECA | 56484 | $4,780.09 |

| HARDWICK | 56501 | $4,311.75 |

| LAKE CRYSTAL | 56510 | $4,342.99 |

| ROCHESTER | 56511 | $4,366.81 |

| BENSON | 56514 | $4,359.82 |

| MOORHEAD | 56515 | $4,326.67 |

| MONTEVIDEO | 56516 | $4,455.74 |

| STEWART | 56517 | $4,355.31 |

| RENVILLE | 56518 | $4,395.19 |

| HOLLAND | 56519 | $4,400.30 |

| RUSSELL | 56520 | $4,318.42 |

| HECTOR | 56521 | $4,416.24 |

| STEEN | 56522 | $4,268.57 |

| NEW RICHLAND | 56523 | $4,386.87 |

| HENDRICKS | 56524 | $4,344.98 |

| WENDELL | 56525 | $4,278.28 |

| APPLETON | 56527 | $4,359.65 |

| BINGHAM LAKE | 56528 | $4,334.35 |

| MINNEOTA | 56529 | $4,202.68 |

| WOOD LAKE | 56531 | $4,223.50 |

| KANARANZI | 56533 | $4,257.90 |

| SANBORN | 56534 | $4,302.51 |

| HUTCHINSON | 56535 | $4,405.59 |

| BROWNSDALE | 56536 | $4,451.51 |

| HOFFMAN | 56537 | $4,260.88 |

| SLAYTON | 56540 | $4,399.04 |

| CURRIE | 56541 | $4,375.59 |

| STORDEN | 56542 | $4,479.02 |

| PORTER | 56543 | $4,355.01 |

| BELVIEW | 56544 | $4,334.00 |

| SEAFORTH | 56545 | $4,419.69 |

| BEAVER CREEK | 56546 | $4,410.87 |

| ARCO | 56547 | $4,352.20 |

| MORGAN | 56548 | $4,385.17 |

| CONGER | 56549 | $4,330.34 |

| MORTON | 56550 | $4,314.67 |

| HANLEY FALLS | 56551 | $4,355.77 |

| ODESSA | 56552 | $4,450.93 |

| BOYD | 56553 | $4,318.93 |

| AVOCA | 56554 | $4,364.61 |

| BEARDSLEY | 56556 | $4,401.20 |

| GARVIN | 56557 | $4,463.56 |

| ELLSWORTH | 56560 | $4,072.13 |

| WESTBROOK | 56562 | $4,064.68 |

| CLONTARF | 56563 | $4,187.66 |

| CLEMENTS | 56565 | $4,361.22 |

| DUMONT | 56566 | $4,450.99 |

| IVANHOE | 56567 | $4,335.76 |

| FREEBORN | 56568 | $4,384.30 |

| HOLLANDALE | 56569 | $4,441.43 |

| READING | 56570 | $4,409.31 |

| MILAN | 56571 | $4,342.58 |

| WABASSO | 56572 | $4,310.56 |

| MAYNARD | 56573 | $4,266.14 |

| CHOKIO | 56574 | $4,394.84 |

| ROUND LAKE | 56575 | $4,440.17 |

| LISMORE | 56576 | $4,331.33 |

| WOODSTOCK | 56577 | $4,339.19 |

| HARTLAND | 56578 | $4,397.32 |

| ORTONVILLE | 56579 | $4,316.31 |

| LYLE | 56580 | $4,332.58 |

| BARRY | 56581 | $4,395.89 |

| MINNESOTA LAKE | 56583 | $4,277.58 |

| KENNETH | 56584 | $4,383.17 |

| TYLER | 56585 | $4,363.83 |

| LUVERNE | 56586 | $4,304.60 |

| EDGERTON | 56587 | $4,336.79 |

| NICOLLET | 56588 | $4,424.14 |

| BALATON | 56589 | $4,423.15 |

| ALBERTA | 56590 | $4,172.19 |

| BUFFALO LAKE | 56592 | $4,404.82 |

| EMMONS | 56594 | $4,348.42 |

| MARIETTA | 56601 | $4,762.20 |

| BIRD ISLAND | 56621 | $4,488.56 |

| DELAVAN | 56623 | $4,329.95 |

| OKABENA | 56626 | $4,836.40 |

| FRANKLIN | 56627 | $4,595.81 |

| LAMBERTON | 56628 | $4,806.15 |

| COTTONWOOD | 56629 | $4,680.33 |

| GHENT | 56630 | $4,833.65 |

| OLIVIA | 56631 | $4,895.10 |

| TRACY | 56633 | $4,758.65 |

| CHANDLER | 56634 | $4,512.93 |

| CLARKS GROVE | 56636 | $4,792.84 |

| CANBY | 56637 | $4,788.11 |

| FULDA | 56639 | $4,830.48 |

| RUSHMORE | 56641 | $4,890.00 |

| SACRED HEART | 56644 | $4,472.16 |

| KIESTER | 56646 | $4,411.36 |

| DANUBE | 56647 | $4,821.93 |

| SAINT PETER | 56649 | $4,503.01 |

| LYND | 56650 | $4,848.55 |

| JACKSON | 56651 | $4,419.80 |

| FROST | 56652 | $4,484.68 |

| DOVRAY | 56653 | $4,573.28 |

| BRICELYN | 56654 | $4,716.92 |

| BIGELOW | 56655 | $4,775.60 |

| GRANITE FALLS | 56657 | $4,803.99 |

| MADISON | 56658 | $4,604.26 |

| BREWSTER | 56659 | $4,889.39 |

| TRIMONT | 56660 | $4,581.51 |

| HERON LAKE | 56661 | $4,655.25 |

| PIPESTONE | 56662 | $4,859.09 |

| EASTON | 56663 | $4,834.53 |

| ODIN | 56666 | $4,824.16 |

| JEFFERS | 56667 | $4,881.65 |

| WILMONT | 56668 | $4,561.20 |

| MANKATO | 56669 | $4,619.50 |

| CLARKFIELD | 56670 | $4,852.95 |

| FAIRFAX | 56671 | $4,841.66 |

| WINDOM | 56672 | $4,841.32 |

| DAWSON | 56673 | $4,324.90 |

| HUNTLEY | 56676 | $4,505.44 |

| WORTHINGTON | 56678 | $4,765.95 |

| ALDEN | 56679 | $4,535.30 |

| DONNELLY | 56680 | $4,881.10 |

| BLUE EARTH | 56681 | $4,802.91 |

| IHLEN | 56682 | $4,306.09 |

| LAKE BENTON | 56683 | $4,826.10 |

| DARFUR | 56684 | $4,480.55 |

| BELLINGHAM | 56685 | $5,023.66 |

| SEARLES | 56686 | $4,384.43 |

| CLINTON | 56688 | $4,862.77 |

| MORRIS | 56701 | $4,341.62 |

| JASPER | 56710 | $4,390.36 |

| WELLS | 56711 | $4,298.44 |

| MOORHEAD | 56713 | $4,406.53 |

| LAKE WILSON | 56714 | $4,386.01 |

| CEYLON | 56715 | $4,372.24 |

| ALPHA | 56716 | $4,436.69 |

| COURTLAND | 56720 | $4,423.88 |

| HANCOCK | 56721 | $4,339.81 |

| LAKEFIELD | 56722 | $4,455.42 |

| MOORHEAD | 56723 | $4,345.19 |

| TWIN LAKES | 56724 | $4,557.73 |

| ADRIAN | 56725 | $4,429.73 |

| HAYWARD | 56726 | $4,399.06 |

| LA SALLE | 56727 | $4,516.80 |

| ESSIG | 56728 | $4,539.00 |

| LEWISVILLE | 56729 | $4,412.01 |

| ORMSBY | 56731 | $4,375.63 |

| SHERBURN | 56732 | $4,401.95 |

| GLENVILLE | 56733 | $4,428.36 |

| SLEEPY EYE | 56734 | $4,408.06 |

| MANKATO | 56735 | $4,417.47 |

| HANSKA | 56736 | $4,424.12 |

| COMFREY | 56737 | $4,501.26 |

| WINNEBAGO | 56738 | $4,391.54 |

| NORTHROP | 56740 | $4,362.92 |

| SAINT JAMES | 56741 | $4,287.68 |

| LAFAYETTE | 56742 | $4,399.05 |

| SPRINGFIELD | 56744 | $4,417.49 |

| DUNNELL | 56748 | $4,371.56 |

| FAIRMONT | 56750 | $4,328.01 |

| MADELIA | 56751 | $4,346.48 |

| WELCOME | 56754 | $4,309.15 |

| NEW ULM | 56755 | $4,375.63 |

| ELMORE | 56756 | $4,364.37 |

| GRANADA | 56757 | $4,366.93 |

| WINONA | 56758 | $4,414.97 |

| MOUNTAIN LAKE | 56759 | $4,437.45 |

| AUSTIN | 56760 | $4,425.21 |

| BUTTERFIELD | 56761 | $4,405.03 |

| TRUMAN | 56762 | $4,526.26 |

| ALBERT LEA | 56763 | $4,310.94 |

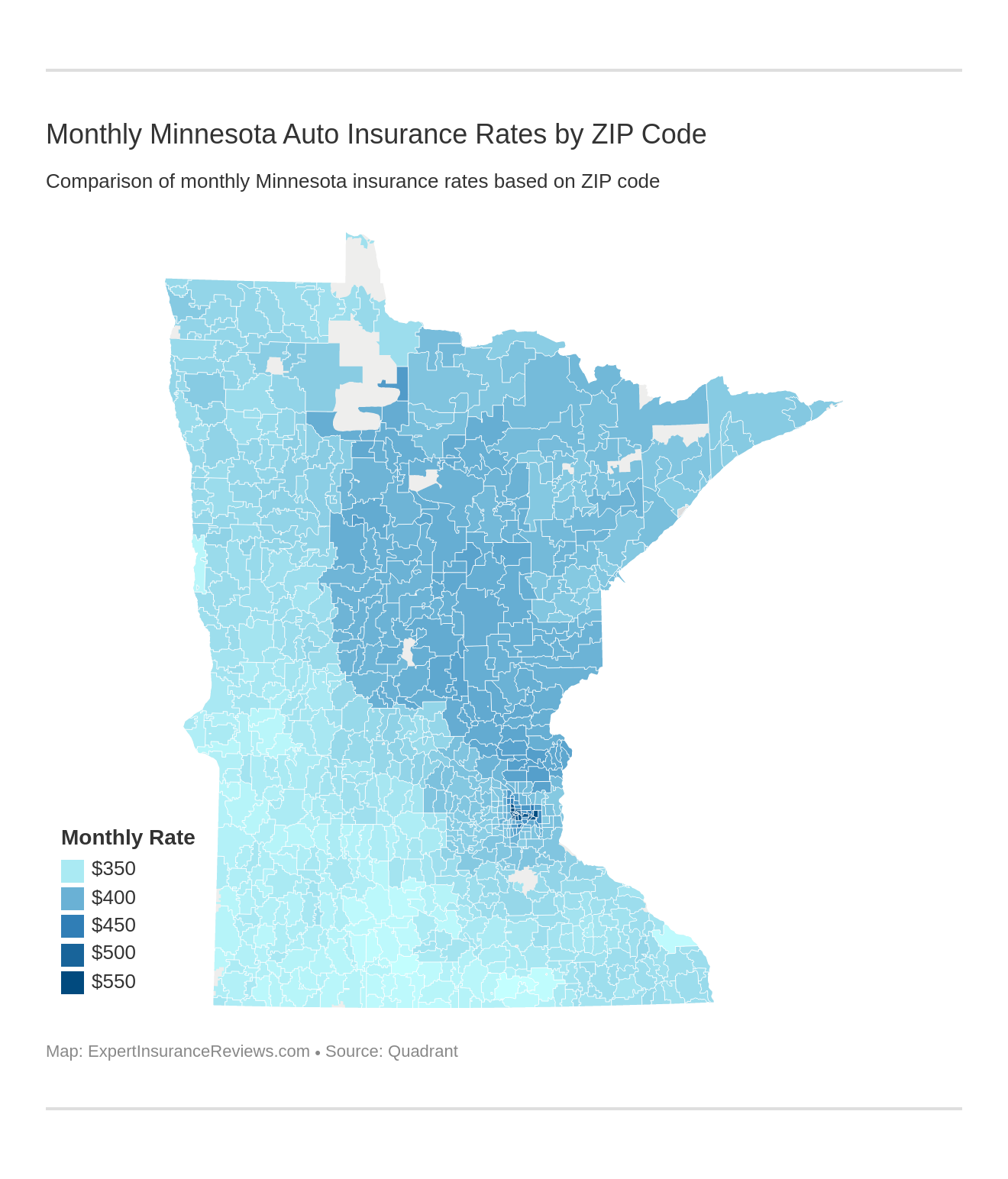

Identifying average rates by zip code can help you move to a place you want to be, but know where the better areas are so you don’t overpay on insurance. The most expensive zip-codes are all in the twin cities.

The most expensive zip-code in Minnesota is in Minneapolis at 55411 coming in at a price of $6620.56. The cheapest zip-code is in Albert Lea at 56007 for a total price of $3,976.80. A difference of nearly 3000 is hefty. Knowing which areas are the cheapest is important, but be careful.

Minneapolis and St.Paul are the most expensive because they have the most people, most traffic, and most accidents in the state. Albert Lea is a small town with low traffic congestion, but there may also be higher poverty rates in the area.

Rates by zip code are a great statistic to discover the best places to buy auto insurance. Many different factors go into why each zip code is more or less expensive than the other.

Cheapest Rates By City

| City | Annual Average |

|---|---|

| ALBERT LEA | $3,976.80 |

| TRUMAN | $3,983.87 |

| BUTTERFIELD | $4,009.53 |

| AUSTIN | $4,009.81 |

| MOUNTAIN LAKE | $4,014.86 |

| WINONA | $4,017.60 |

| GRANADA | $4,018.95 |

| ELMORE | $4,022.41 |

| NEW ULM | $4,027.34 |

| WELCOME | $4,027.96 |

| MADELIA | $4,029.18 |

| FAIRMONT | $4,029.28 |

| DUNNELL | $4,029.54 |

| SPRINGFIELD | $4,029.60 |

| LAFAYETTE | $4,032.56 |

| SAINT JAMES | $4,032.94 |

| NORTHROP | $4,036.97 |

| WINNEBAGO | $4,037.01 |

| COMFREY | $4,041.92 |

| HANSKA | $4,042.96 |

| SLEEPY EYE | $4,044.59 |

| GLENVILLE | $4,046.92 |

| SHERBURN | $4,047.15 |

| ORMSBY | $4,048.38 |

| LEWISVILLE | $4,051.00 |

| ESSIG | $4,052.47 |

| LA SALLE | $4,053.40 |

| HAYWARD | $4,057.13 |

| ADRIAN | $4,059.86 |

| TWIN LAKES | $4,061.51 |

| MANKATO | $4,065.23 |

| LAKEFIELD | $4,065.23 |

| HANCOCK | $4,065.43 |

| COURTLAND | $4,068.46 |

| ALPHA | $4,070.62 |

| CEYLON | $4,071.04 |

| LAKE WILSON | $4,071.84 |

| WELLS | $4,072.70 |

| JASPER | $4,072.94 |

| MORRIS | $4,073.88 |

| CLINTON | $4,074.66 |

| BELLINGHAM | $4,074.68 |

| SEARLES | $4,074.68 |

| DARFUR | $4,076.33 |

| LAKE BENTON | $4,077.65 |

| IHLEN | $4,078.77 |

| BLUE EARTH | $4,080.22 |

| DONNELLY | $4,081.35 |

| ALDEN | $4,081.54 |

| WORTHINGTON | $4,082.00 |

| HUNTLEY | $4,082.73 |

| DAWSON | $4,084.07 |

| WINDOM | $4,084.45 |

| FAIRFAX | $4,085.99 |

| CLARKFIELD | $4,086.62 |

| WILMONT | $4,086.86 |

| JEFFERS | $4,088.84 |

| ODIN | $4,090.22 |

| EASTON | $4,090.76 |

| PIPESTONE | $4,090.80 |

| HERON LAKE | $4,091.62 |

| TRIMONT | $4,091.87 |

| BREWSTER | $4,092.42 |

| MADISON | $4,094.41 |

| GRANITE FALLS | $4,096.14 |

| BIGELOW | $4,096.38 |

| BRICELYN | $4,099.11 |

| DOVRAY | $4,100.40 |

| FROST | $4,100.46 |

| JACKSON | $4,100.49 |

| LYND | $4,100.51 |

| SAINT PETER | $4,100.82 |

| DANUBE | $4,101.84 |

| KIESTER | $4,101.92 |

| SACRED HEART | $4,103.26 |

| RUSHMORE | $4,105.12 |

| FULDA | $4,107.11 |

| MOORHEAD | $4,108.16 |

| CANBY | $4,113.66 |

| CLARKS GROVE | $4,116.31 |

| CHANDLER | $4,116.77 |

| TRACY | $4,116.99 |

| OLIVIA | $4,117.06 |

| GHENT | $4,118.13 |

| COTTONWOOD | $4,118.23 |

| LAMBERTON | $4,118.33 |

| FRANKLIN | $4,118.98 |

| OKABENA | $4,119.91 |

| DELAVAN | $4,121.15 |

| BIRD ISLAND | $4,121.17 |

| MARIETTA | $4,121.36 |

| EMMONS | $4,124.23 |

| BUFFALO LAKE | $4,124.46 |

| ALBERTA | $4,124.98 |

| BALATON | $4,125.32 |

| NICOLLET | $4,126.09 |

| EDGERTON | $4,126.16 |

| LUVERNE | $4,126.50 |

| TYLER | $4,128.59 |

| KENNETH | $4,129.13 |

| MINNESOTA LAKE | $4,129.36 |

| BARRY | $4,130.77 |

| LYLE | $4,131.54 |

| ORTONVILLE | $4,134.68 |

| HARTLAND | $4,135.95 |

| WOODSTOCK | $4,136.22 |

| LISMORE | $4,136.96 |

| ROUND LAKE | $4,141.09 |

| CHOKIO | $4,142.68 |

| MAYNARD | $4,143.39 |

| WABASSO | $4,144.72 |

| MILAN | $4,145.40 |

| READING | $4,145.66 |

| HOLLANDALE | $4,146.70 |

| FREEBORN | $4,146.86 |

| IVANHOE | $4,148.14 |

| DUMONT | $4,148.48 |

| CLEMENTS | $4,149.46 |

| CLONTARF | $4,149.56 |

| WESTBROOK | $4,150.21 |

| ELLSWORTH | $4,150.50 |

| GARVIN | $4,151.54 |

| BEARDSLEY | $4,151.87 |

| AVOCA | $4,153.79 |

| BOYD | $4,154.12 |

| ODESSA | $4,154.49 |

| HANLEY FALLS | $4,155.48 |

| MORTON | $4,156.86 |

| CONGER | $4,157.23 |

| MORGAN | $4,157.89 |

| ARCO | $4,158.12 |

| BEAVER CREEK | $4,158.32 |

| SEAFORTH | $4,158.34 |

| BELVIEW | $4,158.88 |

| PORTER | $4,159.79 |

| STORDEN | $4,159.82 |

| CURRIE | $4,159.98 |

| SLAYTON | $4,162.12 |

| HOFFMAN | $4,162.28 |

| BROWNSDALE | $4,164.33 |

| HUTCHINSON | $4,166.96 |

| SANBORN | $4,167.97 |

| KANARANZI | $4,168.00 |

| WOOD LAKE | $4,168.13 |

| MINNEOTA | $4,168.82 |

| BINGHAM LAKE | $4,169.33 |

| APPLETON | $4,171.79 |

| WENDELL | $4,172.19 |

| HENDRICKS | $4,173.52 |

| NEW RICHLAND | $4,175.60 |

| STEEN | $4,177.10 |

| HECTOR | $4,178.87 |

| RUSSELL | $4,178.89 |

| HOLLAND | $4,179.26 |

| RENVILLE | $4,182.80 |

| STEWART | $4,185.98 |

| MONTEVIDEO | $4,187.41 |

| BENSON | $4,187.93 |

| LAKE CRYSTAL | $4,190.37 |

| HARDWICK | $4,190.83 |

| WASECA | $4,191.08 |

| BARRETT | $4,191.79 |

| GLENCOE | $4,194.01 |

| ADAMS | $4,194.61 |

| DANVERS | $4,195.99 |

| ROSE CREEK | $4,197.09 |

| CLARA CITY | $4,197.70 |

| WANDA | $4,198.11 |

| GRACEVILLE | $4,199.63 |

| ELLENDALE | $4,201.19 |

| MARSHALL | $4,201.86 |

| DILWORTH | $4,202.68 |

| AMBOY | $4,203.74 |

| MILROY | $4,204.95 |

| RUTHTON | $4,206.13 |

| COSMOS | $4,208.34 |

| MAGNOLIA | $4,210.11 |

| GARFIELD | $4,210.69 |

| HOLLOWAY | $4,211.39 |

| EAGLE LAKE | $4,212.38 |

| ALEXANDRIA | $4,212.93 |

| WHEATON | $4,214.78 |

| WATSON | $4,216.51 |

| JANESVILLE | $4,216.65 |

| REDWOOD FALLS | $4,219.17 |

| IONA | $4,220.46 |

| MADISON LAKE | $4,220.63 |

| STARBUCK | $4,220.75 |

| RAYMOND | $4,221.11 |

| GLENWOOD | $4,221.16 |

| BLOOMING PRAIRIE | $4,222.10 |

| KASOTA | $4,222.26 |

| WINTHROP | $4,222.29 |

| LEOTA | $4,222.94 |

| ELBOW LAKE | $4,223.50 |

| ECHO | $4,223.97 |

| STOCKTON | $4,224.79 |

| BROWNS VALLEY | $4,224.88 |

| CYRUS | $4,225.59 |

| BYRON | $4,226.74 |

| WALNUT GROVE | $4,227.56 |

| PLATO | $4,229.11 |

| NORCROSS | $4,229.70 |

| ASHBY | $4,229.98 |

| GOOD THUNDER | $4,230.64 |

| ORONOCO | $4,232.47 |

| BROWNTON | $4,233.03 |

| SAINT CLAIR | $4,235.30 |

| GROVE CITY | $4,235.99 |

| OWATONNA | $4,236.01 |

| TAUNTON | $4,236.59 |

| ROCHESTER | $4,237.88 |

| LOWRY | $4,238.35 |

| VESTA | $4,238.47 |

| MURDOCK | $4,241.05 |

| HILLS | $4,242.32 |

| LITCHFIELD | $4,242.65 |

| GAYLORD | $4,246.30 |

| BRANDON | $4,248.15 |

| HERMAN | $4,248.39 |

| PRINSBURG | $4,248.52 |

| SARGEANT | $4,249.56 |

| GARDEN CITY | $4,253.46 |

| CARLOS | $4,254.21 |

| GIBBON | $4,254.98 |

| NEW LONDON | $4,255.41 |

| SILVER LAKE | $4,255.46 |

| KASSON | $4,255.74 |

| WALTHAM | $4,256.13 |

| NELSON | $4,256.16 |

| MAPLETON | $4,256.20 |

| ELIZABETH | $4,257.90 |

| EYOTA | $4,259.45 |

| EVANSVILLE | $4,259.93 |

| FERGUS FALLS | $4,260.88 |

| HOLMES CITY | $4,260.95 |

| DALTON | $4,262.86 |

| DASSEL | $4,263.16 |

| KENSINGTON | $4,263.67 |

| DARWIN | $4,264.01 |

| BLOMKEST | $4,265.23 |

| PRESTON | $4,265.32 |

| WALDORF | $4,265.33 |

| PERHAM | $4,266.14 |

| WABASHA | $4,266.49 |

| KERKHOVEN | $4,266.78 |

| PINE ISLAND | $4,266.93 |

| DODGE CENTER | $4,267.94 |

| LESTER PRAIRIE | $4,268.36 |

| ATWATER | $4,268.43 |

| CAMPBELL | $4,268.57 |

| MINNESOTA CITY | $4,269.61 |

| DEXTER | $4,270.23 |

| FARWELL | $4,270.85 |

| WARSAW | $4,271.97 |

| VERNON CENTER | $4,273.00 |

| CORRELL | $4,273.37 |

| MILTONA | $4,273.94 |

| ELGIN | $4,274.65 |

| MANTORVILLE | $4,275.27 |

| PEMBERTON | $4,277.23 |

| TINTAH | $4,277.58 |

| LE ROY | $4,277.87 |

| COMSTOCK | $4,278.28 |

| STEWARTVILLE | $4,278.88 |

| HAYFIELD | $4,280.34 |

| LUCAN | $4,280.59 |

| WINSTED | $4,280.79 |

| MAZEPPA | $4,283.80 |

| KANDIYOHI | $4,284.39 |

| PLAINVIEW | $4,284.71 |

| ELYSIAN | $4,285.75 |

| OAK ISLAND | $4,287.68 |

| PENNOCK | $4,287.80 |

| DUNDAS | $4,289.32 |

| CLEVELAND | $4,291.20 |

| SPICER | $4,291.58 |

| LE SUEUR | $4,292.11 |

| DOVER | $4,292.49 |

| READS LANDING | $4,293.38 |

| WILLMAR | $4,294.52 |

| SPRING GROVE | $4,295.72 |

| RUSHFORD | $4,296.06 |

| ELKTON | $4,298.04 |

| ANGLE INLET | $4,298.44 |

| ZUMBRO FALLS | $4,299.74 |

| DAKOTA | $4,300.54 |

| ERHARD | $4,302.51 |

| HARMONY | $4,302.83 |

| GRAND MEADOW | $4,304.01 |

| UNDERWOOD | $4,304.60 |

| TAOPI | $4,305.68 |

| SWIFT | $4,306.09 |

| ARLINGTON | $4,307.33 |

| SAINT HILAIRE | $4,309.15 |

| SAINT CHARLES | $4,309.34 |

| PELICAN RAPIDS | $4,310.56 |

| WARROAD | $4,310.94 |

| VILLARD | $4,311.32 |

| DETROIT LAKES | $4,311.75 |

| NORTHFIELD | $4,312.56 |

| LAKE LILLIAN | $4,313.41 |

| PETERSON | $4,313.69 |

| HENDRUM | $4,314.68 |

| SAINT JOSEPH | $4,315.46 |

| ZUMBROTA | $4,315.75 |

| SPRING VALLEY | $4,316.24 |

| ROTHSAY | $4,316.31 |

| LE CENTER | $4,317.79 |

| BRECKENRIDGE | $4,318.42 |

| KENT | $4,318.93 |

| SUNBURG | $4,319.57 |

| HOUSTON | $4,322.00 |

| REVERE | $4,322.86 |

| WEST CONCORD | $4,323.64 |

| MEDFORD | $4,323.68 |

| WANAMINGO | $4,324.08 |

| ROOSEVELT | $4,324.90 |

| ALTURA | $4,326.36 |

| BATTLE LAKE | $4,326.67 |

| LANESBORO | $4,327.08 |

| KELLOGG | $4,327.53 |

| HOKAH | $4,327.66 |

| RED LAKE FALLS | $4,328.01 |

| HENDERSON | $4,329.60 |

| BAUDETTE | $4,329.95 |

| LA CRESCENT | $4,330.21 |

| HAWLEY | $4,330.34 |

| CHATFIELD | $4,330.77 |

| CLAREMONT | $4,330.97 |

| CALEDONIA | $4,331.25 |

| RICHVILLE | $4,331.33 |

| LEWISTON | $4,332.39 |

| SABIN | $4,332.59 |

| MABEL | $4,333.55 |

| OSTRANDER | $4,333.85 |

| FRAZEE | $4,334.00 |

| DENT | $4,334.35 |

| FOUNTAIN | $4,334.69 |

| MILLVILLE | $4,335.71 |

| NEW YORK MILLS | $4,335.76 |

| MORRISTOWN | $4,335.77 |

| FRONTENAC | $4,336.40 |

| VERGAS | $4,336.79 |

| EITZEN | $4,336.96 |

| RICHWOOD | $4,339.20 |

| EAST GRAND FORKS | $4,339.81 |

| KILKENNY | $4,339.98 |

| THIEF RIVER FALLS | $4,341.62 |

| EDEN VALLEY | $4,342.56 |

| OTTERTAIL | $4,342.58 |

| ADA | $4,342.99 |

| CLITHERALL | $4,344.98 |

| FISHER | $4,345.19 |

| WATERVILLE | $4,345.76 |

| ROSEAU | $4,346.48 |

| WOLVERTON | $4,348.42 |

| ROLLINGSTONE | $4,349.11 |

| PARKERS PRAIRIE | $4,350.07 |

| RACINE | $4,351.20 |

| GLYNDON | $4,352.20 |

| FOXHOME | $4,355.01 |

| BELTRAMI | $4,355.31 |

| GOODHUE | $4,355.55 |

| HENNING | $4,355.77 |

| LAKE CITY | $4,356.73 |

| SAINT STEPHEN | $4,357.18 |

| WYKOFF | $4,359.24 |

| DEER CREEK | $4,359.65 |

| BARNESVILLE | $4,359.82 |

| NASHUA | $4,361.22 |

| SARTELL | $4,362.78 |

| NEW PRAGUE | $4,362.81 |

| NOYES | $4,362.92 |

| DENNISON | $4,363.68 |

| ULEN | $4,363.83 |

| SALOL | $4,364.37 |

| LAKE PARK | $4,364.61 |

| BROWNSVILLE | $4,365.20 |

| AUDUBON | $4,366.81 |

| STEPHEN | $4,366.93 |

| NERSTRAND | $4,367.13 |

| KENYON | $4,368.50 |

| PLUMMER | $4,371.56 |

| BROOKS | $4,372.24 |

| BELGRADE | $4,375.28 |

| FLOM | $4,375.59 |

| HUMBOLDT | $4,375.63 |

| SAINT VINCENT | $4,375.63 |

| MONTGOMERY | $4,376.11 |

| BROOTEN | $4,376.82 |

| GREENWALD | $4,377.00 |

| ELROSA | $4,377.54 |

| MELROSE | $4,377.75 |

| SAUK CENTRE | $4,379.20 |

| CANTON | $4,382.72 |

| TWIN VALLEY | $4,383.17 |

| NIELSVILLE | $4,384.30 |

| WILLIAMS | $4,384.43 |

| AVON | $4,385.04 |

| HALSTAD | $4,385.17 |

| BADGER | $4,386.01 |

| FARIBAULT | $4,386.58 |

| CLIMAX | $4,386.87 |

| SAINT CLOUD | $4,388.18 |

| ALVARADO | $4,390.36 |

| NEWFOLDEN | $4,391.54 |

| OSAKIS | $4,394.01 |

| PERLEY | $4,394.84 |

| BLUFFTON | $4,395.19 |

| SHELLY | $4,395.89 |

| PAYNESVILLE | $4,396.48 |

| ROCHERT | $4,397.32 |

| FERTILE | $4,399.04 |

| OKLEE | $4,399.05 |

| GREENBUSH | $4,399.06 |

| LONSDALE | $4,399.76 |

| BORUP | $4,400.30 |

| ROSCOE | $4,400.78 |

| MCINTOSH | $4,401.20 |

| WAITE PARK | $4,401.48 |

| KARLSTAD | $4,401.95 |

| WINGER | $4,404.82 |

| WANNASKA | $4,405.03 |

| ERSKINE | $4,405.59 |

| ARGYLE | $4,406.53 |

| SAUK RAPIDS | $4,407.38 |

| LAKE BRONSON | $4,408.06 |

| UTICA | $4,408.78 |

| OSAGE | $4,409.31 |

| RICE | $4,410.34 |

| GEORGETOWN | $4,410.87 |

| GULLY | $4,411.36 |

| HALMA | $4,412.01 |

| WEBSTER | $4,413.49 |

| STRANDQUIST | $4,414.97 |

| CALLAWAY | $4,416.24 |

| LANCASTER | $4,417.47 |

| OSLO | $4,417.49 |

| GARY | $4,419.69 |

| LENGBY | $4,419.81 |

| COLD SPRING | $4,419.96 |

| WAUBUN | $4,423.15 |

| DONALDSON | $4,423.88 |

| MENTOR | $4,424.12 |

| VINING | $4,424.14 |

| VIKING | $4,425.21 |

| NEW MUNICH | $4,426.16 |

| KENNEDY | $4,428.36 |

| WATKINS | $4,428.53 |

| GOODRIDGE | $4,429.72 |

| RANDOLPH | $4,430.50 |

| CANNON FALLS | $4,431.06 |

| FREEPORT | $4,435.28 |

| CROOKSTON | $4,436.69 |

| STRATHCONA | $4,437.45 |

| PONSFORD | $4,440.18 |

| OGEMA | $4,441.43 |

| RED WING | $4,444.19 |

| GREEN ISLE | $4,450.10 |

| HITTERDAL | $4,450.93 |

| SAINT BONIFACIUS | $4,450.98 |

| NAYTAHWAUSH | $4,450.99 |

| FELTON | $4,451.51 |

| SOUTH HAVEN | $4,454.60 |

| RICHMOND | $4,454.92 |

| EUCLID | $4,455.42 |

| BEJOU | $4,455.74 |

| KIMBALL | $4,462.55 |

| MAHNOMEN | $4,463.56 |

| ALBANY | $4,468.92 |

| TOFTE | $4,471.29 |

| GONVICK | $4,472.16 |

| WELCH | $4,473.26 |

| FOSSTON | $4,479.02 |

| TRAIL | $4,480.55 |

| CHANHASSEN | $4,481.79 |

| ESKO | $4,484.67 |

| LEONARD | $4,484.68 |

| CARVER | $4,485.73 |

| CHASKA | $4,486.22 |

| YOUNG AMERICA | $4,487.32 |

| BAGLEY | $4,488.56 |

| COLOGNE | $4,488.62 |

| HOLDINGFORD | $4,493.67 |

| CLEARWATER | $4,497.12 |

| NAVARRE | $4,499.54 |

| MIDDLE RIVER | $4,501.26 |

| WACONIA | $4,501.61 |

| MAYER | $4,502.69 |

| NORWOOD YOUNG AMERICA | $4,502.79 |

| INTERNATIONAL FALLS | $4,503.01 |

| EXCELSIOR | $4,504.94 |

| SHEVLIN | $4,505.44 |

| CLEARBROOK | $4,512.93 |

| LONG LAKE | $4,513.84 |

| GRYGLA | $4,516.80 |

| CRYSTAL BAY | $4,517.03 |

| CARLTON | $4,518.08 |

| GRAND MARAIS | $4,518.27 |

| HAMBURG | $4,519.88 |

| NEW GERMANY | $4,521.35 |

| VICTORIA | $4,522.30 |

| WILLERNIE | $4,523.58 |

| IRON | $4,525.08 |

| WATERTOWN | $4,525.81 |

| SILVER BAY | $4,526.03 |

| WARREN | $4,526.26 |

| WRENSHALL | $4,527.42 |

| MINNETONKA | $4,530.52 |

| MOUND | $4,532.58 |

| MOOSE LAKE | $4,533.30 |

| BAYPORT | $4,534.15 |

| SOUTH INTERNATIONAL FALLS | $4,535.30 |

| SCHROEDER | $4,536.53 |

| MINNETONKA BEACH | $4,538.39 |

| HALLOCK | $4,539.00 |

| LUTSEN | $4,539.24 |

| GRAND PORTAGE | $4,541.84 |

| BELLE PLAINE | $4,544.18 |

| SIDE LAKE | $4,546.30 |

| CLOQUET | $4,548.05 |

| STILLWATER | $4,549.97 |

| ELKO NEW MARKET | $4,551.46 |

| BUFFALO | $4,554.05 |

| WAYZATA | $4,554.11 |

| MOUNTAIN IRON | $4,556.86 |

| JORDAN | $4,557.66 |

| GATZKE | $4,557.73 |

| OSSEO | $4,557.76 |

| HOVLAND | $4,558.98 |

| RANIER | $4,561.20 |

| BARNUM | $4,562.16 |

| EVELETH | $4,563.22 |

| HIBBING | $4,563.66 |

| VIRGINIA | $4,565.77 |

| SILVER CREEK | $4,565.83 |

| KETTLE RIVER | $4,568.18 |

| DELANO | $4,568.88 |

| ADOLPH | $4,570.20 |

| WAVERLY | $4,572.57 |

| LITTLEFORK | $4,573.28 |

| WRIGHT | $4,575.13 |

| HAMPTON | $4,575.45 |

| MAPLE PLAIN | $4,576.04 |

| ROGERS | $4,576.17 |

| PRIOR LAKE | $4,577.08 |

| COKATO | $4,578.31 |

| SHAKOPEE | $4,578.31 |

| ALBERTVILLE | $4,579.88 |

| HASTINGS | $4,580.59 |

| MIZPAH | $4,581.51 |

| EDEN PRAIRIE | $4,582.09 |

| SAINT MICHAEL | $4,582.41 |

| FINLAND | $4,583.38 |

| ISABELLA | $4,583.80 |

| LAKELAND | $4,585.99 |

| ROCKFORD | $4,586.52 |

| BIG LAKE | $4,589.35 |

| GILBERT | $4,590.36 |

| DULUTH | $4,590.76 |

| CHISHOLM | $4,590.79 |

| BIWABIK | $4,590.97 |

| DAYTON | $4,595.20 |

| BIG FALLS | $4,595.81 |

| SAVAGE | $4,597.31 |

| LAKEVILLE | $4,597.36 |

| BECKER | $4,598.15 |

| ROSEMOUNT | $4,598.60 |

| FARMINGTON | $4,598.80 |

| MONTROSE | $4,598.89 |

| HOWARD LAKE | $4,600.51 |

| LORETTO | $4,601.17 |

| TWIG | $4,602.53 |

| MARGIE | $4,604.26 |

| COTTAGE GROVE | $4,608.58 |

| MONTICELLO | $4,615.18 |

| MAPLE LAKE | $4,615.92 |

| CROMWELL | $4,616.56 |

| KABETOGAMA | $4,619.51 |

| AURORA | $4,623.34 |

| INVER GROVE HEIGHTS | $4,624.64 |

| FORBES | $4,625.70 |

| KNIFE RIVER | $4,627.10 |

| HOYT LAKES | $4,628.09 |

| SAWYER | $4,636.13 |

| ANNANDALE | $4,637.43 |

| HANOVER | $4,638.66 |

| LAKE ELMO | $4,639.63 |

| HAMEL | $4,639.68 |

| BABBITT | $4,642.35 |

| NETT LAKE | $4,643.78 |

| BRITT | $4,645.20 |

| AFTON | $4,651.42 |

| SOUDAN | $4,653.35 |

| CLEAR LAKE | $4,653.44 |

| TOWER | $4,655.22 |

| NORTHOME | $4,655.25 |

| SAGINAW | $4,655.36 |

| SANTIAGO | $4,659.67 |

| TWO HARBORS | $4,661.57 |

| EMBARRASS | $4,662.09 |

| MELRUDE | $4,662.83 |

| CIRCLE PINES | $4,667.48 |

| KINNEY | $4,668.16 |

| WINTON | $4,675.65 |

| ANGORA | $4,677.02 |

| BIRCHDALE | $4,680.33 |

| BUHL | $4,685.24 |

| ELY | $4,688.58 |

| MARINE ON SAINT CROIX | $4,691.45 |

| COOK | $4,692.21 |

| HOLYOKE | $4,694.57 |

| ORR | $4,697.29 |

| HOPKINS | $4,702.44 |

| FLOODWOOD | $4,703.36 |

| GRAND RAPIDS | $4,713.52 |

| COTTON | $4,715.03 |

| SPRING PARK | $4,715.67 |

| MEADOWLANDS | $4,716.65 |

| LOMAN | $4,716.92 |

| RANDALL | $4,721.23 |

| BURNSVILLE | $4,723.13 |

| CHAMPLIN | $4,724.99 |

| BROOKSTON | $4,730.87 |

| LONG PRAIRIE | $4,732.32 |

| CRANE LAKE | $4,732.68 |

| COHASSET | $4,738.28 |

| ANOKA | $4,741.50 |

| KERRICK | $4,745.72 |

| BROWERVILLE | $4,746.12 |

| ALBORN | $4,752.42 |

| MENAHGA | $4,754.37 |

| CANYON | $4,758.14 |

| WADENA | $4,758.56 |

| CASS LAKE | $4,758.65 |

| PINE RIVER | $4,759.34 |

| MARBLE | $4,759.98 |

| EAGLE BEND | $4,760.92 |

| BRIMSON | $4,761.70 |

| COLERAINE | $4,761.85 |

| BEMIDJI | $4,762.21 |

| TACONITE | $4,764.65 |

| MAKINEN | $4,764.94 |

| SOLWAY | $4,765.95 |

| HEWITT | $4,767.02 |

| BOVEY | $4,768.76 |

| BERTHA | $4,768.99 |

| SANDSTONE | $4,771.67 |

| WEST UNION | $4,772.62 |

| ELK RIVER | $4,773.24 |

| NEWPORT | $4,774.77 |

| SEBEKA | $4,774.78 |

| PEQUOT LAKES | $4,774.91 |

| LONGVILLE | $4,775.60 |

| WARBA | $4,778.32 |

| GILMAN | $4,778.71 |

| MERRIFIELD | $4,779.25 |

| WALKER | $4,780.10 |

| PENGILLY | $4,782.97 |

| WILLOW RIVER | $4,784.68 |

| BACKUS | $4,785.70 |

| TALMOON | $4,788.11 |

| HENRIETTE | $4,788.43 |

| NASHWAUK | $4,788.75 |

| STAPLES | $4,788.78 |

| STURGEON LAKE | $4,788.90 |

| CALUMET | $4,788.94 |

| VERNDALE | $4,789.69 |

| MORA | $4,790.40 |

| HINCKLEY | $4,790.47 |

| NIMROD | $4,791.40 |

| AH GWAH CHING | $4,791.62 |

| ASKOV | $4,792.55 |

| MOTLEY | $4,792.80 |

| DEER RIVER | $4,792.84 |

| NEVIS | $4,793.23 |

| BRUNO | $4,793.38 |

| SWANVILLE | $4,795.09 |

| NISSWA | $4,796.11 |

| ISLE | $4,796.69 |

| IRONTON | $4,797.26 |

| NORWOOD | $4,797.58 |

| AKELEY | $4,797.71 |

| BAXTER | $4,800.09 |

| CLARISSA | $4,801.01 |

| SQUAW LAKE | $4,802.91 |

| MARCELL | $4,803.99 |

| ALDRICH | $4,804.03 |

| BIGFORK | $4,806.15 |

| KEEWATIN | $4,806.41 |

| GOODLAND | $4,806.78 |

| MC GRATH | $4,809.10 |

| LITTLE FALLS | $4,811.40 |

| FINLAYSON | $4,811.86 |

| SWAN RIVER | $4,812.19 |

| CROSBY | $4,814.45 |

| GREY EAGLE | $4,816.75 |

| SAINT PAUL PARK | $4,817.55 |

| PINE CITY | $4,819.53 |

| PILLAGER | $4,819.70 |

| BOCK | $4,819.87 |

| ROYALTON | $4,821.27 |

| HINES | $4,821.93 |

| NORTH BRANCH | $4,822.41 |

| RUSH CITY | $4,822.58 |

| WAHKON | $4,823.84 |

| PONEMAH | $4,824.16 |

| TENSTRIKE | $4,826.09 |

| HACKENSACK | $4,826.67 |

| BROOK PARK | $4,827.14 |

| STANCHFIELD | $4,827.98 |

| DEERWOOD | $4,829.69 |

| EFFIE | $4,830.48 |

| CUSHING | $4,830.73 |

| PARK RAPIDS | $4,831.88 |

| ONAMIA | $4,832.24 |

| LASTRUP | $4,832.71 |

| BLACKDUCK | $4,833.65 |

| PENNINGTON | $4,834.53 |

| PALISADE | $4,835.20 |

| FORT RIPLEY | $4,835.29 |

| BENA | $4,836.40 |

| TAMARACK | $4,836.82 |

| HARRIS | $4,836.87 |

| MCGREGOR | $4,839.42 |

| HILL CITY | $4,841.01 |

| REMER | $4,841.32 |

| REDLAKE | $4,841.66 |

| AITKIN | $4,843.78 |

| FOLEY | $4,847.85 |

| KELLIHER | $4,848.55 |

| LAKE HUBERT | $4,850.13 |

| BURTRUM | $4,851.65 |

| REDBY | $4,852.95 |

| PEASE | $4,854.94 |

| PRINCETON | $4,857.50 |

| OUTING | $4,859.09 |

| FLENSBURG | $4,859.74 |

| BRAINERD | $4,862.07 |

| WIRT | $4,862.77 |

| BENEDICT | $4,863.77 |

| OGILVIE | $4,865.50 |

| LAPORTE | $4,865.75 |

| GRASSTON | $4,865.77 |

| FORESTON | $4,876.46 |

| CROSSLAKE | $4,876.91 |

| UPSALA | $4,878.52 |

| SPRING LAKE | $4,881.10 |

| PUPOSKY | $4,881.65 |

| MILACA | $4,885.54 |

| FIFTY LAKES | $4,885.97 |

| BRAHAM | $4,887.03 |

| MAX | $4,889.39 |

| FEDERAL DAM | $4,890.00 |

| JACOBSON | $4,890.47 |

| OAK PARK | $4,892.50 |

| BOWSTRING | $4,895.10 |

| EMILY | $4,900.38 |

| ZIMMERMAN | $4,901.37 |

| BOWLUS | $4,901.74 |

| SHAFER | $4,904.07 |

| MENDOTA | $4,905.29 |

| CHISAGO CITY | $4,906.35 |

| LINDSTROM | $4,909.45 |

| PIERZ | $4,911.72 |

| CENTER CITY | $4,912.10 |

| DALBO | $4,913.94 |

| SCANDIA | $4,914.54 |

| CAMBRIDGE | $4,917.15 |

| HILLMAN | $4,938.79 |

| HUGO | $4,940.45 |

| TAYLORS FALLS | $4,943.22 |

| SWATARA | $4,945.15 |

| GRANDY | $4,945.76 |

| ANDOVER | $4,946.23 |

| GARRISON | $4,948.90 |

| ISANTI | $4,955.17 |

| ALMELUND | $4,966.16 |

| WYOMING | $4,967.20 |

| BETHEL | $4,984.06 |

| CEDAR | $4,988.89 |

| FOREST LAKE | $4,992.05 |

| SOUTH SAINT PAUL | $4,994.42 |

| LAKE GEORGE | $4,999.75 |

| STACY | $5,003.33 |

| SAINT FRANCIS | $5,003.38 |

| WASKISH | $5,023.66 |

| SAINT PAUL | $5,215.37 |

| MINNEAPOLIS | $5,318.64 |

Once again, Albert Lea comes in as the cheapest, and Minneapolis is at the top of the list.

Remember, these are also averages, if you have good credit and good driving history, you could pay less than Albert Lea’s average while living in Minneapolis. Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Best Car Insurance Companies in Minnesota

You always want to save money when it comes to insurance, but if you pay a little more and get better coverage it’s worth it. Sometimes the cheapest isn’t the best.

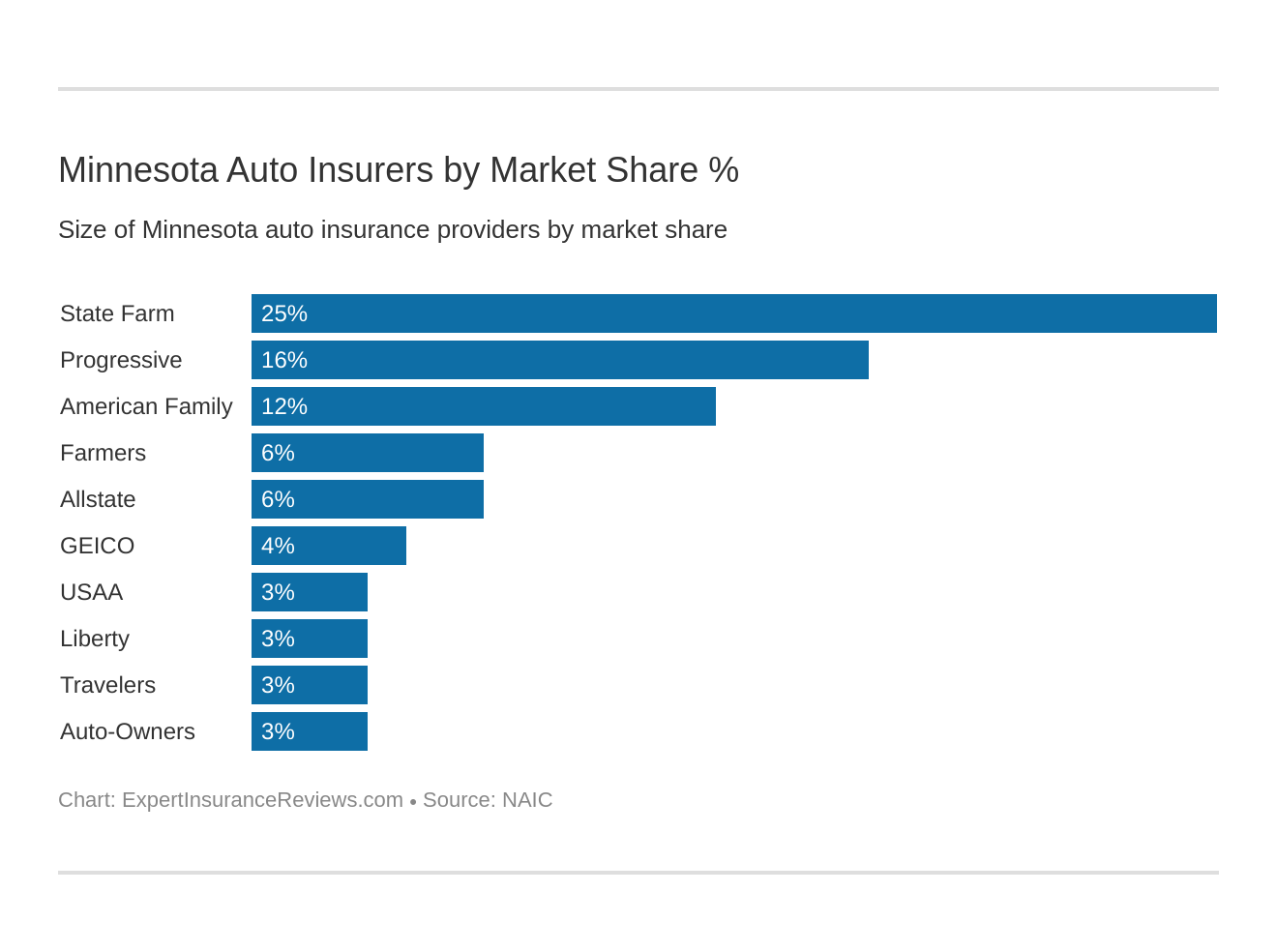

There are thousands of auto insurance companies in Minnesota and a million more in the United States. Choosing between them can be a tough task even with the correct information.

In this section, we’ll break down the top companies in Minnesota and you can decide for yourself which is best for you. Instead of searching for hours on the internet you can find all your data in one place. Making your search for the right company short and sweet.

We’ll give you all the data for the companies with the best ratings, most complaints, and cheapest rates. This will help you understand and choose which company you want to buy from.

The Largest Companies’ Financial Rating

Each year AM Best releases a set of ratings that determine the top companies in the auto insurance game. They give a grade to each company which can help you choose from the best.

Companies with high ratings pay claims more often and quicker. They also have better customer service and rates in most cases.

| Company | AM Rating | Loss Ratio |

|---|---|---|

| State Farm | A++ | 63.70% |

| Erie Insurance | A+ | 64.93% |

| Allstate | A+ | 55.64% |

| Progressive | A+ | 58.55% |

| Nationwide | A+ | 59.96% |

| Geico | A++ | 74.24% |

| Liberty Mutual | A | 61.06% |

| Travelers | A++ | 62.41% |

| USAA | A++ | 72.05% |

This table shows some of the top-used companies in Minnesota and what their ratings are. an A++ is the best rating you can get. This means that the company is paying a good amount of claims, not too many or too few, they have good customer support, and great rates.

These ratings can help a lot so use them to your advantage.

Companies With The Best Ratings

JD Power is the most trusted name in insurance ratings and many other fields. They release awards yearly to the best insurance companies in each state and the entire nation.

The north-central region of the United States has many different insurance companies. The best rates in every region are usually USAA, but since that’s only for military members, JD Power separates them.

Westfield Insurance Company is the top-rated company in the north-central region with a score of 855.

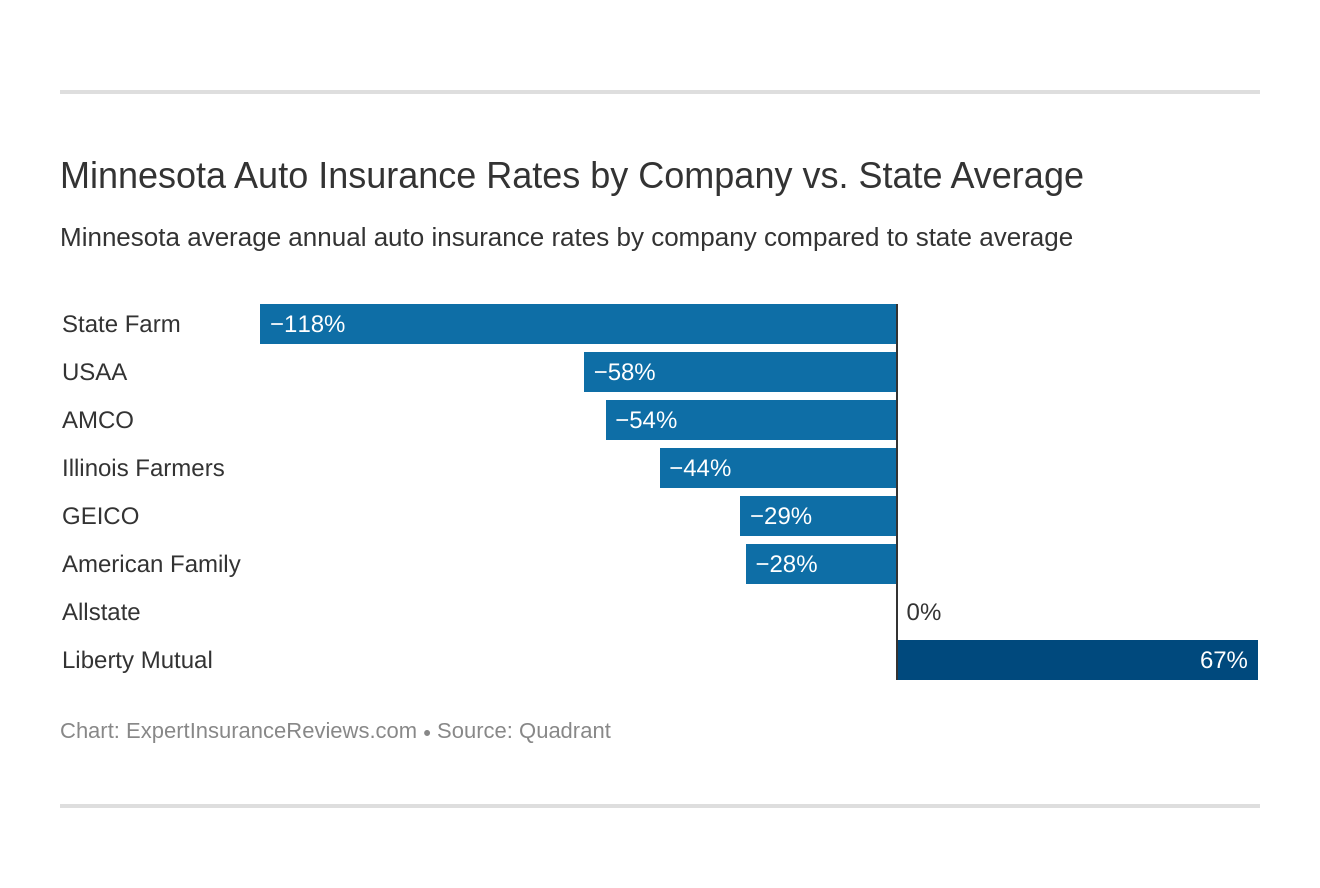

Cheapest Companies in Minnesota

Rates are the most essential part of the insurance buying process. Knowing which companies give you the best rates but still, the best coverage is important.

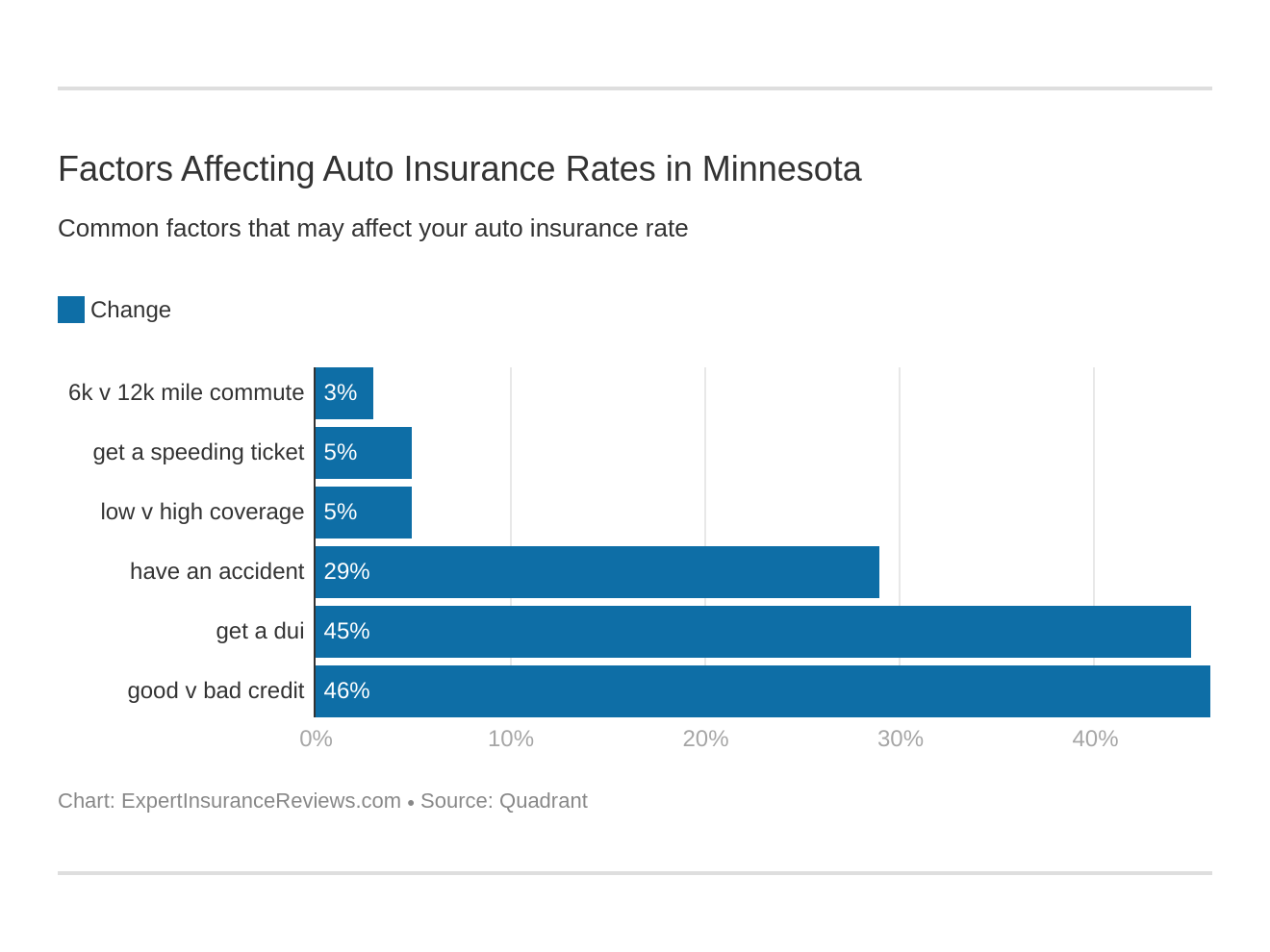

In the following sections, we’ll break down the rates in Minnesota by coverage level, credit history, driving record and more. Using this information you should be able to determine the best rates for you.

Commute Rates By Company

Sometimes auto insurance companies give you the run around if you have longer commute times. If you have a long commute it means a few different things to companies.

You are on the road more, meaning more possibility for any insurance-related incident.

Knowing the statistics on your commute they may gauge rates to protect themselves. If you live in downtown Minneapolis and drive to work you may be charged more than if you live in a remote area.

Traffic varies so you may not have to worry about a long commute at all. But if you do have an extensive commute, this data could help you assure you aren’t overpaying.

| Group | Commute Time | Annual Average |

|---|---|---|

| Liberty Mutual | 25 miles commute. 12000 annual mileage. | $13,961.85 |

| Liberty Mutual | 10 miles commute. 6000 annual mileage. | $13,165.37 |

| Allstate | 10 miles commute. 6000 annual mileage. | $4,532.01 |

| Allstate | 25 miles commute. 12000 annual mileage. | $4,532.01 |

| American Family | 25 miles commute. 12000 annual mileage. | $3,562.51 |

| GEICO | 25 miles commute. 12000 annual mileage. | $3,544.87 |

| American Family | 10 miles commute. 6000 annual mileage. | $3,480.06 |

| GEICO | 10 miles commute. 6000 annual mileage. | $3,452.20 |

| Farmers | 10 miles commute. 6000 annual mileage. | $3,137.45 |

| Farmers | 25 miles commute. 12000 annual mileage. | $3,137.45 |

| Nationwide | 10 miles commute. 6000 annual mileage. | $2,926.49 |

| Nationwide | 25 miles commute. 12000 annual mileage. | $2,926.49 |

| USAA | 25 miles commute. 12000 annual mileage. | $2,899.06 |