Best Illinois Car Insurance (2024)

Illinois minimum car insurance requirements are 25/50/20 for bodily injury and property damage as well as 25/50 for uninsured/underinsured motorist coverage. Illinois car insurance rates average $74 per month. Drivers can save on their Illinois auto insurance coverage by shopping around for multiple Illinois car insurance quotes.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Apr 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Apr 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Illinois Statistics Summary | Details |

|---|---|

| Roadway Miles | Miles of Roadway: 145,840 Vehicle Miles: 105,223 million |

| Vehicles | Registered: 10,249,044 Vehicle Thefts: 17,652 |

| Population | 12,741,080 |

| Most Popular Vehicle | Honda CR-V |

| Uninsured Motorist Rate | 13.70% |

| Driving-Related Deaths | Total: 1,097 Speeding: 462 DUI: 349 |

| Average Car Insurance Cost | Liability $446.72 Collision $309.71 Comprehensive $128.13 Full Coverage: $884.56 |

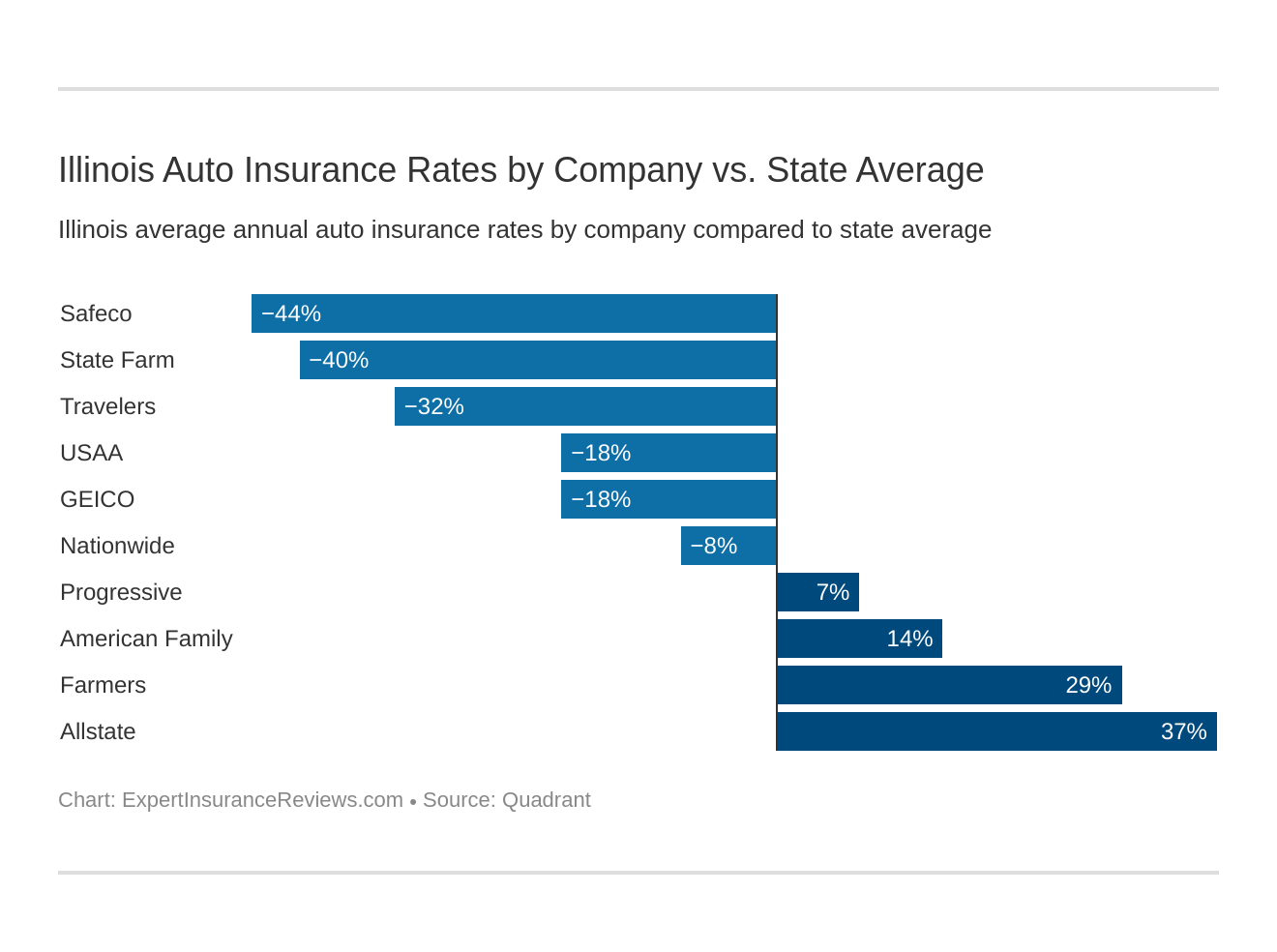

| Cheapest Provider | SafeCo |

While they take life at a different pace, all of the nearly 13 million residents of Illinois do have one thing in common. Illinois car insurance is required to be on the road.

It’s the law in The Land of Lincoln, so whether you like it or not, you are going to have to buy it. If only it wasn’t so difficult to shop for car insurance; hours of searching websites, researching companies, and trying to figure out what you need on your quote, never mind comparing rates. There should really be a better way to compare car insurance.

We can’t tell you if the Cubbies will ever take home another World Series win, but we can make buying auto insurance in Illinois easier.

You have arrived at the best place to get started shopping for your insurance needs. We’ve gathered all the Illinois state laws, insurance coverage options, and company information right here. Read on to learn everything you need to know about Illinois auto insurance.

We’ve also got your rate information. Compare the best Illinois car insurance rates quickly and easily from top insurance companies without the hassle – right here. Just enter your ZIP code above for Illinois car insurance quotes.

Illinois Car Insurance Coverage and Rates

You know that the law in Illinois requires that every driver carry a basic amount of car insurance, but beyond that choosing your insurance gets complicated. Is the basic coverage enough? Should you add on extra coverage? What is even available to you, do you really need it, and how much will it cost?

Car insurance is confusing, and there’s a lot to think about. But it doesn’t have to be difficult.

We’ve broken down all of the coverage you need to know about, from the necessary to the extras. We’ve also gathered numbers for you through Quadrant, so you can compare companies on average rates.

Illinois Minimum Car Insurance Coverage

Illinois is a fault, or tort, state, which means you need to carry liability coverage. That coverage ensures that you will be able to handle the financial responsibility of an accident in which you are found to be at fault.

Here’s what you need to carry, at the absolute minimum, under Illinois law.

| Insurance Required | Minimum Limits: |

|---|---|

| Bodily Injury Liability Coverage | $25,000 per one person $50,000 per accident |

| Property Damage Liability Coverage | $20,000 minimum |

| Uninsured/Underinsured Motorist Bodily Injury | $25,000 per person $50,000 per accident |

In Illinois, uninsured and underinsured motorist bodily injury coverage is a must on every policy and is automatically included. The limits will always match your liability limits, so if you choose a higher level of coverage for one, it will automatically apply to the other.

Allstate lists all of the states that currently allow drivers to present proof of insurance in electronic format, and fortunately for Illinois drivers, the Land of Lincoln is on that list.

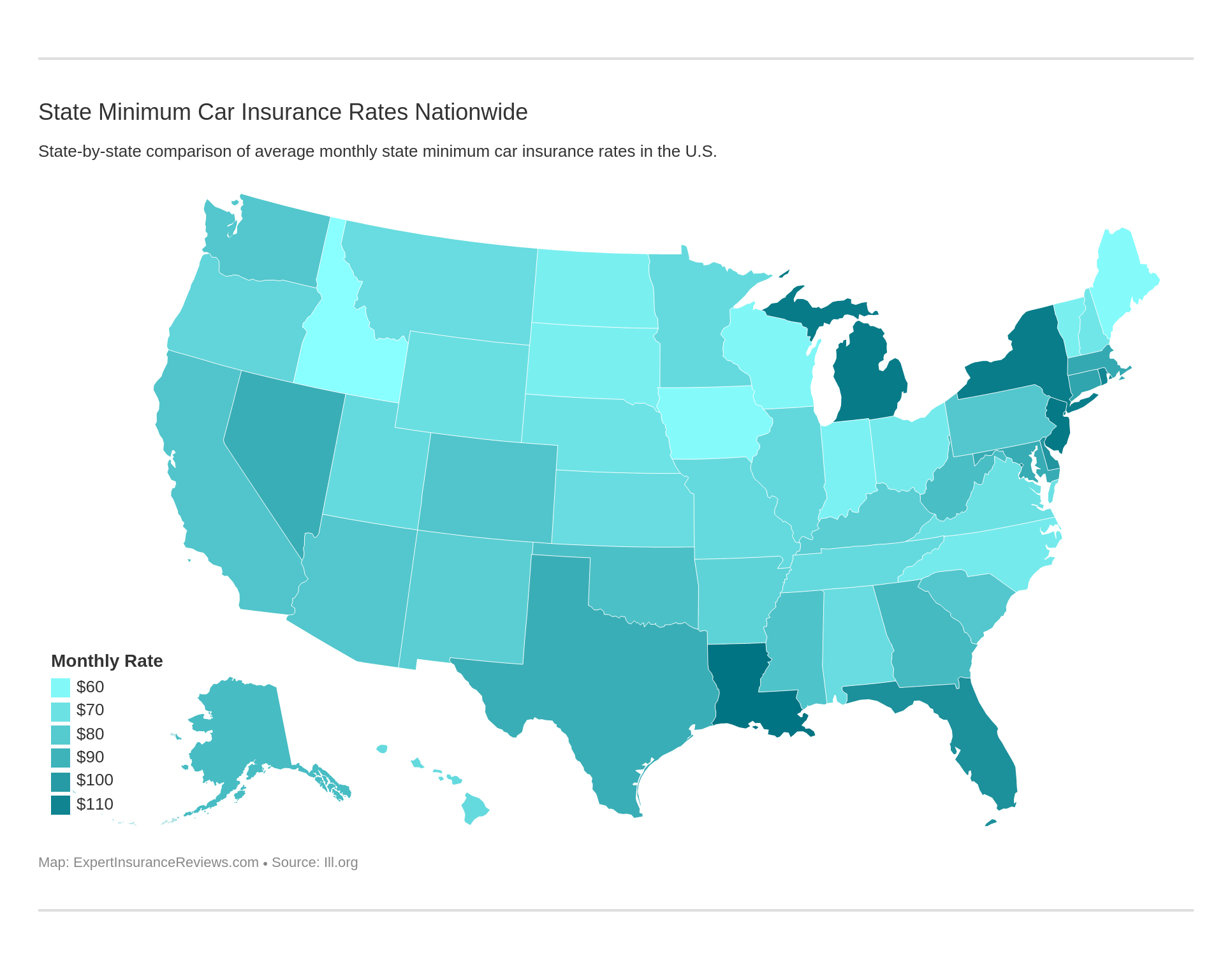

The cost of minimum coverage varies from state to state.

Forms of Financial Responsibility in Illinois

Unless you own 25 or more vehicles and therefore qualify for self-insurance, you have to carry car insurance according to Illinois car insurance law.

It is the only form of financial responsibility that is accepted in order to be in compliance with the law.

Premiums as a Percentage of Income

Your disposable income is the amount you have available to spend after taxes; out of that, you have to pay for all of life’s necessities as well as fun things like entertainment and vacations.

Among the less pleasant things that have to come out of your disposable income are your insurance premiums. What does that look like for the average person? Here’s a look at three years of data from the National Association of Insurance Commissioners (NAIC).

| Illinois Insurance and Disposable Income | 2012 (Illinois) | 2012 (National) | 2013 (Illinois) | 2014 (National) | 2014 (Illinois) | 2014 (National) |

|---|---|---|---|---|---|---|

| Disposable Income Amount (Average) | $40,143.00 | $39,473.00 | $40,619.00 | $39,192.00 | $42,256.00 | $40,859.00 |

| Full Coverage Policy Cost (Average) | $806.21 | $924.45 | $819.27 | $950.92 | $854.10 | $981.77 |

| Percent of Income Spent on Car Insurance | 2.01% | 2.34% | 2.02% | 2.43% | 2.02% | 2.40% |

You can see that Illinois is well below the national average for percent of income spent on car insurance.

Compared to neighboring states, Illinoisans spend a little more of their income on car insurance. Iowa to the west comes in at 1.72 percent, and Indiana to the east at 2.00 percent.

CalculatorPro

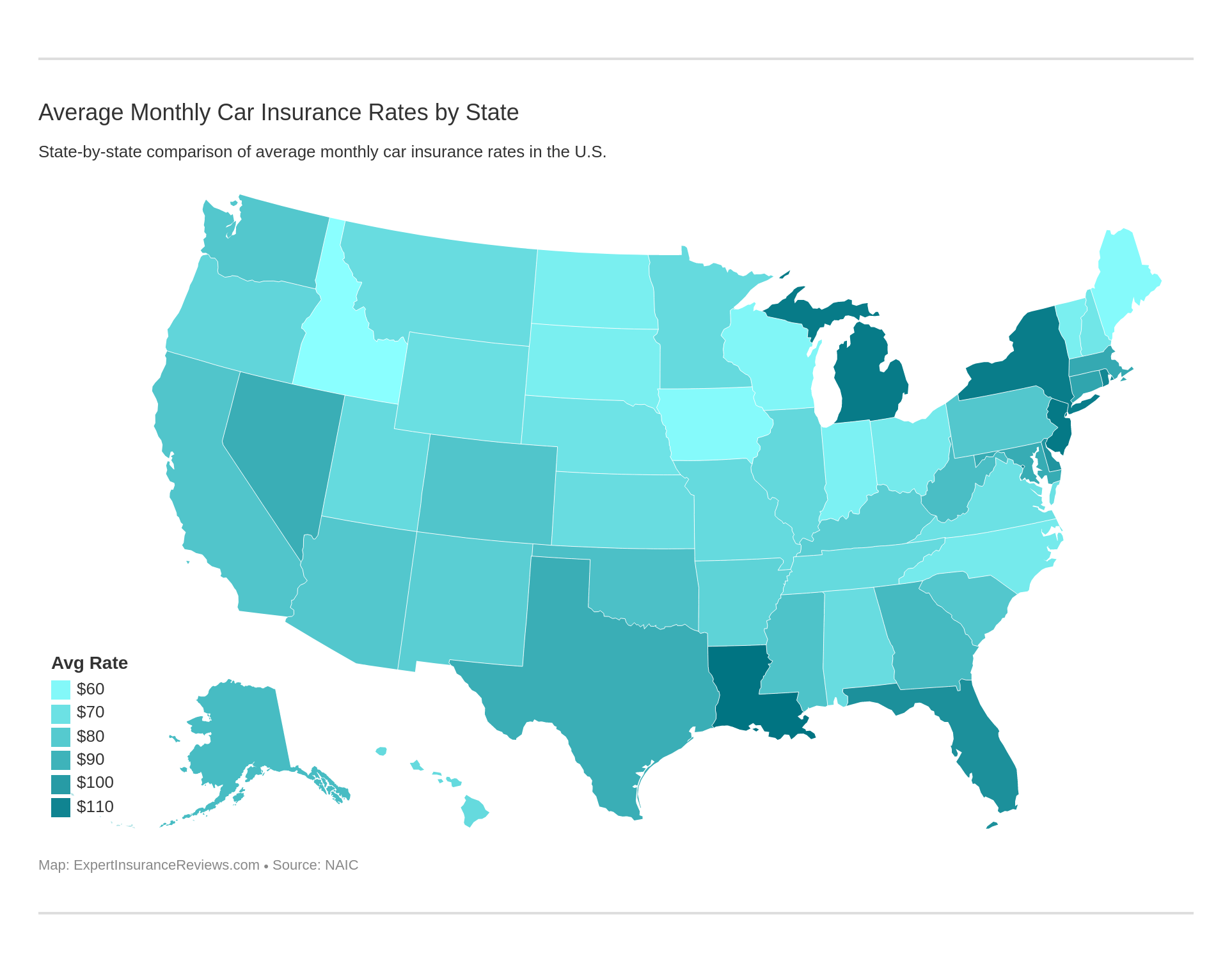

Average Monthly Car Insurance Rates in Illinois (Liability, Collision, Comprehensive)

Core coverage refers to the basics of a full coverage policy. Those are liability, collision, and comprehensive coverage.

Below you will find the average cost of each in Illinois compared to the national average.

| Coverage Type: | Average Cost, Illinois (2015) | Average Cost, Nationwide (2015) |

|---|---|---|

| Liability | $446.72 | $538.73 |

| Collision | $309.71 | $322.61 |

| Comprehensive | $128.13 | $148.04 |

| Combined | $884.56 | $1009.38 |

Illinois drivers pay less across the board for every aspect of coverage.

Additional Liability

Uninsured/Underinsured Motorist (UM/UIM) coverage for bodily injury isn’t an option in Illinois; it’s added to every policy at limits matching your bodily injury liability limits. UM/UIM property damage coverage, however, is an option that you can add.

This coverage is there to protect you from drivers that are either uninsured or whose liability limits aren’t sufficient to cover damages after a claim.

In Illinois, 13.7 percent of drivers are uninsured according to the Insurance Information Institute.

As for how many are underinsured, that’s something that can’t really be determined. You don’t know you’re underinsured until you’re in an accident where your coverage isn’t enough. Carrying only the legal minimum, however, puts drivers at a higher risk of being underinsured.

Illinois has reasonably high minimum limits at 25/50/20. But in a serious accident, those limits will be quickly exceeded. If you involved in an accident where the other driver is at fault and their limits aren’t high enough to cover the damages, your UM/UIM coverage will kick in.

You can compare the minimums in Illinois to other states courtesy of AAA’s state-by-state list of liability laws.

Another form of additional liability coverage available to Illinois drivers is Medical Payments (MedPay). this is a no-fault coverage for medical bills that benefits you and your household in the event of an injury. It helps to pay your medical bills no matter who is at fault in the accident.

We can look at how well these coverages perform in Illinois with loss ratios. Loss ratios show how much insurance companies are paying out in claims versus the amount they charge for premiums.

Loss ratios that are too high mean the company is paying out too much, potentially endangering their financial stability. If they are too low, on the other hand, they aren’t paying out as much as they should.

| Loss Ratio | Illinois | Nationwide |

|---|---|---|

| Medical Payments (Med Pay) | 78.10% | 75.74% |

| Uninsured/Underinsured Motorist | 67.53% | 69.46% |

Illinois loss ratios are pretty close to the average nationwide, and neither too high nor too low.

Add-Ons, Endorsements, and Riders

Here you’ll find a list of the various add-on options that you can tack on to your policy for additional protection. You probably don’t need all of these, but if you do need some of them, you might have to shop around. Not all insurance companies offer all of these options.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance

You have probably seen major car insurance companies advertising programs designed to help you reduce your car insurance bills by allowing the company to monitor your driving habits.

Those are considered to be usage-based programs. They calculate a discount for you based on the information that’s gathered. a number of major insurance companies and many small ones offer these programs.

Less common are pay-per-mile programs, which are available in limited areas. Currently, none of the programs are offered in Illinois.

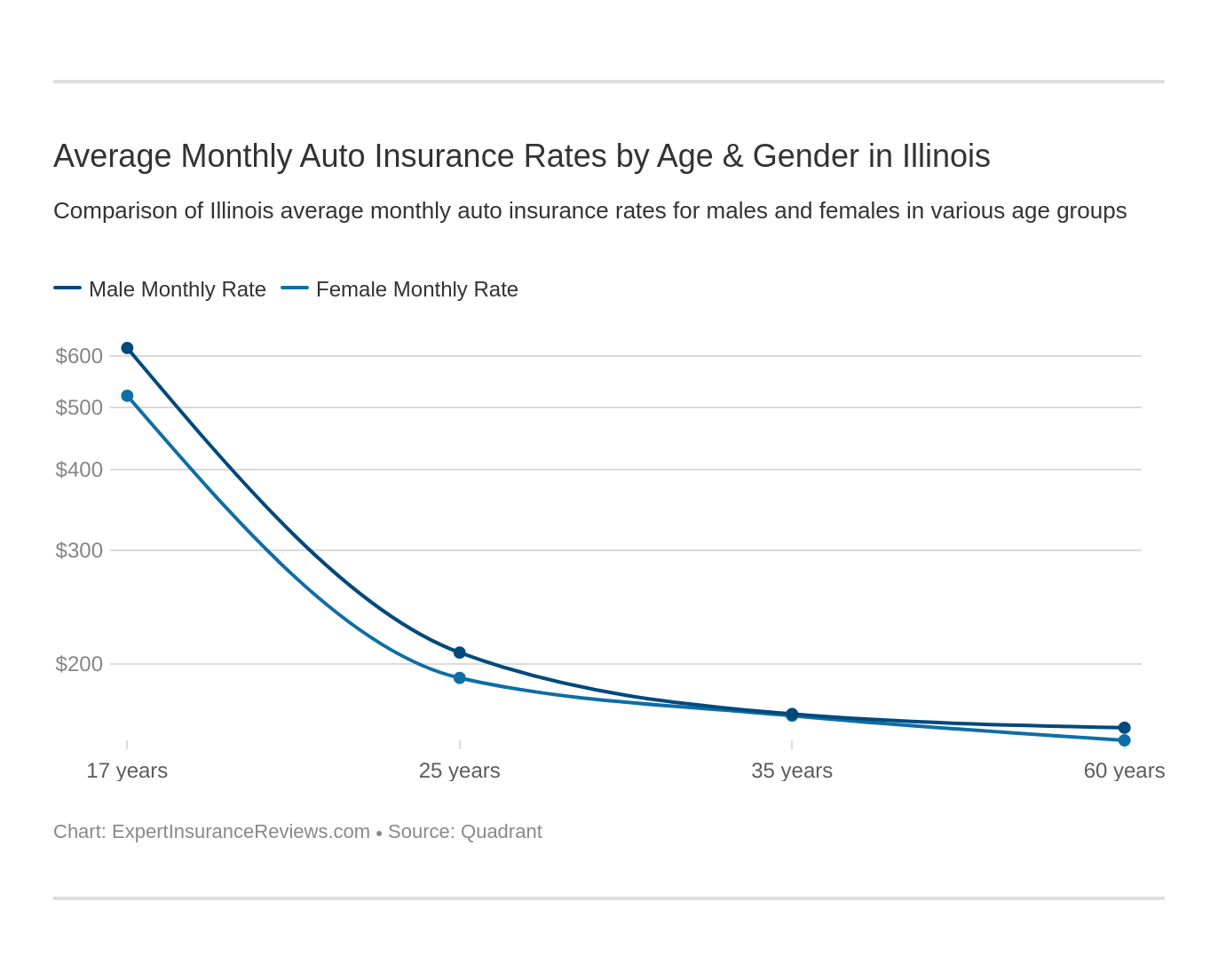

Average Car Insurance Rates by Age & Gender in Ilinois

Both your age and your gender can have an impact on your insurance rates. Statistically, the highest risk group of drivers are young males. That means they usually pay the most for their car insurance.

As you can see from the data below, that’s true in Illinois. Drivers at 17 pay the most for car insurance and males pay more than females. The difference varies a lot by insurance company; Liberty Mutual has a big rate gap and very high premiums for 17-year-old males, while State Farm has lower rates for 17-year-olds of both genders.

The rates drop by age 25, and after that, they drop further and the gender difference dissipates.

| Company | Married 35-year old female annual rates | Married 35-year old male annual rates | Married 60-year old female annual rates | Married 60-year old male annual rates | Single 17-year old female annual rates | Single 17-year old male annual rates | Single 25-year old female annual rates | Single 25-year old male annual rates |

|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $3,305.50 | $3,320.65 | $3,452.26 | $3,452.26 | $8,547.98 | $11,112.80 | $3,973.25 | $4,293.46 |

| American Family Mutual | $2,369.94 | $2,369.94 | $2,168.97 | $2,168.97 | $6,676.10 | $9,263.85 | $2,369.94 | $3,056.23 |

| Illinois Farmers Ins Co | $2,456.68 | $2,457.73 | $2,179.75 | $2,305.14 | $10,514.80 | $10,961.50 | $2,803.50 | $2,931.88 |

| Geico Cas | $1,691.91 | $1,711.59 | $1,614.70 | $1,892.49 | $5,407.10 | $5,673.56 | $2,074.22 | $2,048.08 |

| Safeco Ins Co of IL | $1,401.51 | $1,512.93 | $1,165.71 | $1,303.12 | $4,621.83 | $5,140.83 | $1,464.07 | $1,543.97 |

| Nationwide Mutual Fire | $1,926.46 | $1,960.52 | $1,713.84 | $1,816.17 | $5,285.82 | $6,786.79 | $2,242.62 | $2,429.53 |

| Progressive Northern | $2,055.34 | $1,946.27 | $1,694.99 | $1,773.48 | $7,336.88 | $8,239.12 | $2,450.28 | $2,647.61 |

| State Farm Mutual Auto | $1,454.19 | $1,454.19 | $1,299.88 | $1,299.88 | $4,229.18 | $5,361.67 | $1,643.58 | $1,887.70 |

| Travelers Standard Fire Ins Co | $1,570.87 | $1,657.44 | $1,431.81 | $1,526.42 | $4,533.18 | $5,685.41 | $1,665.85 | $1,754.69 |

| USAA | $1,647.73 | $1,676.66 | $1,532.32 | $1,509.06 | $5,332.28 | $5,880.44 | $2,170.35 | $2,385.18 |

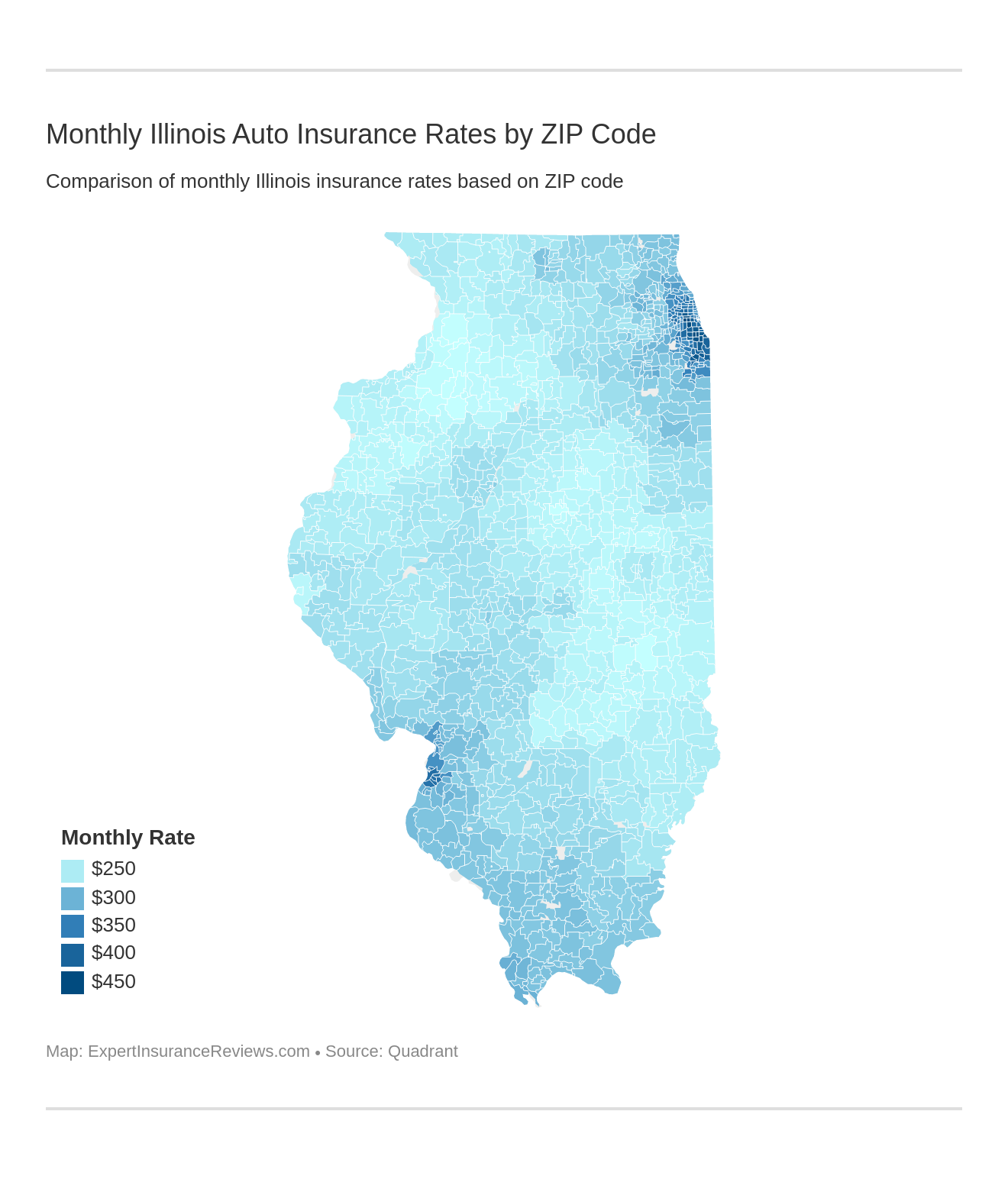

Illinois Rates By Zip Code and Carrier

Your zip code is another of the factors used in calculating insurance rates. You can search below to find your zip code and find out how top companies compare on rates.

Not surprisingly, the most expensive zip codes in Illinois are all located in Chicago.

| Zipcode | Annual Average | Allstate F&C | American Family Mutual | Illinois Farmers Ins Co | Geico Cas | Safeco Ins Co of IL | Nationwide Mutual Fire | Progressive Northern | State Farm Mutual Auto | Travelers Standard Fire Ins Co | USAA |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 60636 | $5,437.22 | $8,440.54 | $5,551.38 | $7,665.01 | $5,119.06 | $3,346.63 | $6,161.09 | $6,186.84 | $4,134.64 | $3,851.75 | $3,915.22 |

| 60623 | $5,385.12 | $8,819.04 | $5,490.47 | $7,501.83 | $5,174.40 | $3,354.15 | $5,734.05 | $6,652.26 | $3,926.23 | $3,813.32 | $3,385.42 |

| 60624 | $5,378.19 | $8,818.77 | $5,527.58 | $7,548.54 | $5,174.40 | $3,245.86 | $5,734.05 | $6,489.93 | $4,180.43 | $3,676.91 | $3,385.42 |

| 60651 | $5,361.85 | $8,563.35 | $5,527.58 | $7,548.54 | $5,174.40 | $3,354.15 | $5,734.05 | $6,760.02 | $4,024.78 | $3,802.33 | $3,129.28 |

| 60644 | $5,359.76 | $8,564.60 | $5,551.38 | $7,524.75 | $5,174.40 | $3,125.16 | $5,734.05 | $6,664.18 | $4,061.53 | $3,812.15 | $3,385.42 |

| 60621 | $5,323.19 | $8,230.54 | $5,563.16 | $7,548.54 | $5,119.06 | $3,245.74 | $6,161.09 | $5,911.99 | $3,884.45 | $3,652.09 | $3,915.22 |

| 60649 | $5,173.45 | $8,636.60 | $5,551.38 | $7,365.07 | $4,655.22 | $2,917.37 | $6,161.09 | $5,292.00 | $3,799.59 | $3,706.43 | $3,649.72 |

| 60620 | $5,156.08 | $8,225.38 | $5,490.47 | $7,378.50 | $4,655.22 | $3,139.46 | $6,161.09 | $5,734.85 | $3,561.15 | $3,694.98 | $3,519.74 |

| 60426 | $5,086.94 | $9,019.10 | $5,512.97 | $8,005.22 | $4,174.80 | $3,250.04 | $5,154.39 | $5,163.41 | $3,720.23 | $3,421.74 | $3,447.54 |

| 60639 | $5,082.84 | $8,115.39 | $5,415.09 | $6,851.93 | $5,174.40 | $3,099.53 | $5,734.05 | $5,783.65 | $3,636.16 | $3,632.80 | $3,385.42 |

| 60619 | $5,058.15 | $7,673.07 | $5,490.47 | $6,898.45 | $4,655.22 | $3,004.26 | $6,161.09 | $5,781.24 | $3,681.27 | $3,716.67 | $3,519.74 |

| 60637 | $5,047.00 | $7,672.96 | $5,309.93 | $6,886.55 | $4,927.67 | $2,999.46 | $6,161.09 | $5,490.11 | $3,730.87 | $3,641.59 | $3,649.72 |

| 60628 | $5,027.07 | $8,156.64 | $5,563.16 | $6,923.74 | $4,655.22 | $3,327.37 | $5,154.39 | $5,664.15 | $3,667.93 | $3,710.59 | $3,447.54 |

| 60609 | $4,977.73 | $6,676.64 | $5,490.47 | $6,648.83 | $5,381.89 | $3,218.94 | $6,161.09 | $5,082.91 | $3,534.20 | $3,667.12 | $3,915.22 |

| 60629 | $4,973.03 | $7,501.04 | $5,415.09 | $6,790.94 | $4,337.86 | $2,988.43 | $6,161.09 | $5,210.68 | $3,804.76 | $3,605.20 | $3,915.22 |

| 60653 | $4,969.81 | $6,604.65 | $5,527.58 | $6,745.47 | $4,788.34 | $3,052.94 | $6,161.09 | $5,482.68 | $3,723.33 | $3,696.77 | $3,915.22 |

| 60419 | $4,916.48 | $8,376.85 | $5,512.97 | $7,307.96 | $4,174.80 | $3,196.44 | $5,154.39 | $5,250.21 | $3,654.17 | $3,272.76 | $3,264.26 |

| 60428 | $4,909.88 | $9,019.10 | $5,029.41 | $7,454.20 | $4,174.80 | $3,021.11 | $5,154.39 | $4,814.27 | $3,623.53 | $3,360.48 | $3,447.54 |

| 60612 | $4,900.57 | $6,972.00 | $5,527.58 | $6,745.47 | $4,816.17 | $2,843.41 | $5,674.12 | $5,469.88 | $3,914.01 | $3,657.65 | $3,385.42 |

| 60409 | $4,869.58 | $8,440.63 | $5,512.97 | $7,307.96 | $4,174.80 | $2,962.87 | $5,154.39 | $5,093.07 | $3,559.89 | $3,224.92 | $3,264.26 |

| 60632 | $4,865.06 | $6,824.25 | $5,224.80 | $6,624.53 | $4,337.86 | $2,988.43 | $6,161.09 | $5,315.30 | $3,598.14 | $3,660.95 | $3,915.22 |

| 60617 | $4,820.71 | $7,673.42 | $5,551.38 | $6,790.94 | $4,655.22 | $2,983.70 | $5,154.39 | $4,909.82 | $3,548.03 | $3,675.92 | $3,264.26 |

| 60827 | $4,740.34 | $7,488.91 | $5,512.97 | $7,081.87 | $3,591.27 | $3,002.60 | $5,154.39 | $5,430.99 | $3,316.77 | $3,376.05 | $3,447.54 |

| 60652 | $4,722.40 | $7,468.85 | $5,224.80 | $6,566.27 | $4,337.86 | $2,875.54 | $6,161.09 | $4,686.07 | $3,345.56 | $3,418.12 | $3,139.82 |

| 60472 | $4,713.50 | $9,019.10 | $5,029.41 | $6,950.36 | $3,591.27 | $2,977.59 | $5,154.39 | $4,799.55 | $3,318.16 | $2,847.57 | $3,447.54 |

| 60608 | $4,712.12 | $6,675.86 | $5,153.57 | $6,308.86 | $3,722.24 | $3,129.50 | $6,161.09 | $4,933.96 | $3,464.19 | $3,656.71 | $3,915.22 |

| 60638 | $4,651.57 | $6,089.80 | $5,153.57 | $6,287.37 | $4,413.32 | $3,001.07 | $6,161.09 | $5,268.45 | $3,266.56 | $3,468.26 | $3,406.25 |

| 60633 | $4,650.32 | $7,381.57 | $5,309.93 | $6,615.17 | $4,669.43 | $2,815.74 | $5,154.39 | $4,937.89 | $2,980.52 | $3,374.34 | $3,264.26 |

| 60469 | $4,648.95 | $9,019.10 | $5,029.41 | $7,307.96 | $3,591.27 | $2,373.65 | $5,154.39 | $4,400.32 | $3,379.88 | $2,785.98 | $3,447.54 |

| 60641 | $4,639.26 | $6,324.17 | $4,926.12 | $6,504.38 | $4,430.70 | $2,942.47 | $5,734.05 | $5,368.58 | $3,531.65 | $3,567.79 | $3,062.68 |

| 60643 | $4,629.76 | $6,517.43 | $5,309.93 | $6,520.80 | $4,655.22 | $2,874.82 | $5,154.39 | $5,014.51 | $3,290.05 | $3,512.94 | $3,447.54 |

| 60707 | $4,609.74 | $6,538.41 | $5,224.80 | $6,488.98 | $4,430.70 | $2,993.24 | $4,943.42 | $5,630.54 | $3,446.11 | $3,414.07 | $2,987.14 |

| 60804 | $4,606.10 | $6,824.57 | $5,029.41 | $6,298.81 | $5,174.40 | $3,025.05 | $4,478.37 | $4,895.65 | $3,543.97 | $3,279.96 | $3,510.81 |

| 60429 | $4,594.20 | $7,861.08 | $4,678.13 | $6,647.03 | $3,950.42 | $2,737.63 | $5,154.39 | $5,320.82 | $3,375.59 | $3,174.50 | $3,042.45 |

| 62201 | $4,588.98 | $6,382.05 | $5,029.41 | $8,039.42 | $3,334.81 | $3,100.46 | $5,485.22 | $5,361.50 | $3,162.19 | $2,754.83 | $3,239.95 |

| 60406 | $4,583.03 | $8,440.63 | $5,029.41 | $6,757.88 | $3,591.27 | $2,971.15 | $5,154.39 | $4,339.84 | $2,874.56 | $3,223.63 | $3,447.54 |

| 60659 | $4,582.92 | $7,118.84 | $4,855.14 | $6,635.55 | $4,018.16 | $2,875.83 | $5,309.98 | $4,901.76 | $3,499.14 | $3,474.27 | $3,140.55 |

| 60499 | $4,580.45 | $7,591.73 | $4,780.03 | $5,785.27 | $4,413.32 | $2,917.37 | $6,161.09 | $3,870.35 | $3,191.25 | $4,214.30 | $2,879.77 |

| 62071 | $4,577.82 | $6,382.05 | $5,029.41 | $8,039.42 | $3,334.81 | $2,587.59 | $5,485.22 | $5,218.01 | $2,247.47 | $4,214.30 | $3,239.95 |

| 62207 | $4,565.34 | $6,382.05 | $5,029.41 | $8,005.22 | $3,334.81 | $3,153.48 | $5,485.22 | $5,214.04 | $3,078.32 | $2,730.91 | $3,239.95 |

| 60153 | $4,548.72 | $8,209.75 | $4,967.38 | $6,548.18 | $3,869.92 | $3,007.90 | $4,382.65 | $4,659.49 | $3,362.26 | $3,272.64 | $3,207.01 |

| 60616 | $4,537.72 | $6,849.13 | $5,153.57 | $6,380.17 | $3,218.94 | $3,007.94 | $6,161.09 | $4,780.32 | $3,224.26 | $3,508.34 | $3,093.44 |

| 62204 | $4,535.89 | $6,382.05 | $4,751.81 | $8,005.22 | $3,334.81 | $3,139.02 | $5,485.22 | $5,264.66 | $3,047.56 | $2,708.62 | $3,239.95 |

| 60104 | $4,533.25 | $8,209.75 | $4,967.38 | $6,703.56 | $3,869.92 | $2,918.45 | $4,382.65 | $4,517.74 | $3,352.77 | $3,203.26 | $3,207.01 |

| 62205 | $4,525.82 | $6,382.05 | $4,751.81 | $8,005.22 | $3,334.81 | $3,129.85 | $5,485.22 | $5,079.13 | $3,157.61 | $2,692.52 | $3,239.95 |

| 62203 | $4,525.50 | $6,382.05 | $4,751.81 | $8,005.22 | $3,334.81 | $3,115.39 | $5,485.22 | $5,188.48 | $2,977.07 | $2,775.00 | $3,239.95 |

| 60634 | $4,518.20 | $6,362.61 | $4,926.12 | $6,409.53 | $4,430.70 | $2,944.34 | $4,943.42 | $5,341.78 | $3,299.82 | $3,460.99 | $3,062.68 |

| 60418 | $4,511.85 | $8,376.85 | $4,436.29 | $7,307.96 | $3,591.27 | $3,196.44 | $3,455.43 | $5,250.21 | $2,967.03 | $3,272.76 | $3,264.26 |

| 60645 | $4,510.23 | $6,797.44 | $4,855.14 | $6,519.72 | $4,018.16 | $2,777.91 | $5,309.98 | $4,747.99 | $3,470.00 | $3,569.98 | $3,036.02 |

| 60615 | $4,503.89 | $5,504.28 | $5,224.80 | $6,222.43 | $3,694.29 | $2,916.80 | $6,161.09 | $4,718.19 | $3,362.71 | $3,584.54 | $3,649.72 |

| 60626 | $4,489.74 | $6,907.89 | $4,952.00 | $6,465.64 | $4,018.16 | $2,777.91 | $5,309.98 | $4,643.06 | $3,298.63 | $3,359.77 | $3,164.34 |

| 62206 | $4,485.95 | $5,970.82 | $4,406.65 | $8,005.22 | $3,334.81 | $3,129.85 | $5,485.22 | $5,140.62 | $3,074.55 | $3,071.79 | $3,239.95 |

| 60155 | $4,458.24 | $8,209.75 | $4,967.38 | $6,309.07 | $3,869.92 | $2,915.71 | $4,382.65 | $4,279.96 | $3,409.52 | $3,031.44 | $3,207.01 |

| 60077 | $4,454.52 | $7,448.20 | $4,712.13 | $6,480.45 | $3,693.46 | $3,072.29 | $4,475.32 | $5,244.58 | $3,298.48 | $3,407.21 | $2,713.10 |

| 60160 | $4,436.01 | $8,344.93 | $4,967.38 | $6,407.21 | $3,869.92 | $2,813.31 | $4,382.65 | $4,170.58 | $3,004.47 | $3,192.62 | $3,207.01 |

| 60165 | $4,434.54 | $8,344.93 | $4,967.38 | $6,229.54 | $3,869.92 | $2,988.41 | $4,382.65 | $3,913.63 | $3,185.50 | $3,256.46 | $3,207.01 |

| 60655 | $4,424.82 | $6,616.14 | $5,153.57 | $6,059.55 | $4,044.65 | $2,950.89 | $5,154.39 | $4,484.68 | $2,988.69 | $3,254.35 | $3,541.27 |

| 60647 | $4,409.21 | $6,139.86 | $5,224.80 | $6,380.17 | $3,729.93 | $2,742.40 | $5,681.34 | $4,358.39 | $3,338.63 | $3,367.28 | $3,129.28 |

| 60642 | $4,406.94 | $6,963.01 | $5,224.80 | $6,380.17 | $3,069.13 | $2,707.40 | $5,674.12 | $4,171.32 | $3,328.75 | $3,348.58 | $3,202.16 |

| 60630 | $4,393.81 | $6,344.39 | $4,699.42 | $6,140.92 | $4,430.70 | $2,831.48 | $4,943.42 | $4,975.87 | $3,115.08 | $3,404.73 | $3,052.13 |

| 60076 | $4,389.81 | $7,448.76 | $4,712.13 | $6,480.45 | $3,305.47 | $3,007.24 | $4,475.32 | $4,864.92 | $3,328.33 | $3,562.42 | $2,713.10 |

| 60625 | $4,388.57 | $7,120.15 | $4,855.14 | $6,171.86 | $3,516.82 | $2,864.81 | $5,309.98 | $4,161.35 | $3,364.83 | $3,380.24 | $3,140.55 |

| 62059 | $4,382.97 | $6,382.05 | $5,029.41 | $8,039.42 | $3,334.81 | $3,100.46 | $5,485.22 | $4,181.96 | $2,500.14 | $2,536.30 | $3,239.95 |

| 60660 | $4,375.31 | $6,906.94 | $4,952.00 | $6,367.36 | $4,018.16 | $2,575.13 | $5,309.98 | $4,256.83 | $3,020.83 | $3,266.88 | $3,078.98 |

| 60622 | $4,373.62 | $6,972.76 | $5,153.57 | $6,207.50 | $3,069.13 | $2,737.66 | $5,674.12 | $4,164.21 | $3,294.37 | $3,260.76 | $3,202.16 |

| 62060 | $4,370.47 | $6,382.05 | $4,751.81 | $8,005.22 | $3,334.81 | $2,956.08 | $4,856.00 | $4,400.66 | $2,576.00 | $3,222.03 | $3,220.04 |

| 60701 | $4,355.08 | $6,931.49 | $4,678.13 | $6,351.33 | $3,872.25 | $2,492.06 | $4,943.42 | $4,563.90 | $3,150.54 | $3,606.54 | $2,961.18 |

| 62090 | $4,353.67 | $6,382.05 | $4,406.65 | $8,039.42 | $3,334.81 | $3,036.35 | $4,856.00 | $4,409.42 | $2,580.12 | $3,271.85 | $3,220.04 |

| 60130 | $4,338.78 | $8,209.75 | $4,600.64 | $6,020.60 | $3,869.92 | $2,658.59 | $4,382.65 | $4,243.66 | $3,067.19 | $3,127.81 | $3,207.01 |

| 60646 | $4,331.91 | $6,383.79 | $4,720.57 | $6,057.62 | $4,430.70 | $2,701.10 | $4,943.42 | $4,411.20 | $3,159.00 | $3,371.09 | $3,140.55 |

| 60712 | $4,326.97 | $7,297.09 | $4,712.13 | $6,299.72 | $3,693.46 | $2,714.25 | $4,475.32 | $4,581.64 | $3,447.61 | $3,261.69 | $2,786.78 |

| 60607 | $4,316.62 | $6,966.45 | $5,224.80 | $5,964.42 | $3,218.94 | $2,775.07 | $5,674.12 | $3,880.22 | $3,095.88 | $3,272.91 | $3,093.44 |

| 60618 | $4,307.73 | $6,324.38 | $4,952.00 | $6,035.75 | $3,516.82 | $2,719.97 | $5,681.34 | $4,244.69 | $3,249.70 | $3,290.01 | $3,062.68 |

| 60706 | $4,304.31 | $6,927.34 | $4,600.64 | $6,038.04 | $3,834.33 | $2,783.84 | $4,943.42 | $4,752.28 | $2,958.93 | $3,243.06 | $2,961.18 |

| 60171 | $4,297.14 | $7,065.87 | $4,780.03 | $6,142.36 | $3,869.92 | $2,924.63 | $4,382.65 | $4,294.23 | $3,161.54 | $3,287.46 | $3,062.68 |

| 60402 | $4,296.74 | $6,416.43 | $4,967.38 | $5,964.06 | $3,869.92 | $2,647.34 | $4,478.37 | $4,919.58 | $3,350.32 | $3,104.33 | $3,249.71 |

| 60176 | $4,272.36 | $7,052.64 | $4,600.64 | $6,203.81 | $3,834.33 | $2,591.23 | $4,382.65 | $4,458.48 | $3,350.15 | $3,295.82 | $2,953.88 |

| 60501 | $4,258.22 | $7,373.40 | $4,780.03 | $5,905.59 | $3,776.81 | $2,859.43 | $3,455.43 | $4,798.57 | $3,191.25 | $3,035.42 | $3,406.25 |

| 60640 | $4,241.63 | $6,607.75 | $4,756.99 | $5,927.97 | $3,516.82 | $2,575.13 | $5,681.34 | $4,010.40 | $3,022.37 | $3,238.54 | $3,078.98 |

| 60656 | $4,239.56 | $6,062.95 | $4,720.57 | $5,787.77 | $4,430.70 | $2,727.04 | $4,943.42 | $4,424.41 | $3,001.77 | $3,335.78 | $2,961.18 |

| 60803 | $4,230.03 | $6,676.90 | $4,600.64 | $5,915.91 | $3,591.27 | $3,023.76 | $5,154.39 | $4,426.30 | $2,872.95 | $2,898.35 | $3,139.82 |

| 60631 | $4,201.23 | $6,052.51 | $4,720.57 | $5,787.77 | $4,430.70 | $2,701.10 | $4,943.42 | $4,268.56 | $2,875.70 | $3,270.78 | $2,961.18 |

| 60458 | $4,195.41 | $7,373.40 | $4,780.03 | $6,020.17 | $3,776.81 | $2,375.13 | $3,455.43 | $4,420.64 | $3,321.60 | $3,024.69 | $3,406.25 |

| 60131 | $4,191.23 | $7,065.87 | $4,678.13 | $5,946.57 | $3,834.33 | $2,605.65 | $4,382.65 | $4,238.66 | $3,107.27 | $3,099.30 | $2,953.88 |

| 60473 | $4,157.78 | $7,100.96 | $4,751.81 | $6,034.38 | $3,400.48 | $2,741.98 | $3,304.45 | $4,808.48 | $3,164.70 | $3,006.27 | $3,264.26 |

| 60455 | $4,151.16 | $6,416.62 | $4,780.03 | $5,910.45 | $3,776.81 | $2,434.10 | $3,455.43 | $4,895.52 | $3,420.72 | $3,015.69 | $3,406.25 |

| 60699 | $4,149.81 | $5,914.17 | $4,756.99 | $6,008.51 | $3,218.94 | $2,541.94 | $5,674.12 | $3,873.57 | $3,150.54 | $3,397.69 | $2,961.63 |

| 60714 | $4,131.37 | $6,306.06 | $4,478.76 | $5,910.48 | $3,693.46 | $2,583.28 | $3,969.50 | $4,974.27 | $3,006.18 | $3,103.33 | $3,288.34 |

| 60456 | $4,129.01 | $6,443.88 | $4,780.03 | $6,008.13 | $4,044.65 | $2,420.53 | $3,455.43 | $4,619.84 | $3,282.06 | $3,095.69 | $3,139.82 |

| 60443 | $4,120.57 | $7,323.13 | $4,678.13 | $5,890.48 | $3,697.51 | $2,601.21 | $3,304.45 | $4,283.51 | $3,301.89 | $2,891.58 | $3,233.81 |

| 60478 | $4,108.34 | $6,602.45 | $4,678.13 | $5,813.88 | $3,950.42 | $2,693.82 | $3,304.45 | $4,727.96 | $3,052.43 | $2,780.22 | $3,479.68 |

| 60304 | $4,105.22 | $6,309.04 | $4,406.65 | $5,740.06 | $3,624.78 | $2,663.80 | $4,478.37 | $4,281.37 | $3,131.35 | $3,167.07 | $3,249.71 |

| 60459 | $4,103.45 | $6,443.88 | $4,780.03 | $5,785.27 | $3,776.81 | $2,492.06 | $3,455.43 | $4,805.79 | $3,266.50 | $3,088.92 | $3,139.82 |

| 60164 | $4,095.56 | $6,572.76 | $4,600.64 | $5,855.14 | $3,869.92 | $2,574.21 | $4,382.65 | $4,114.26 | $2,992.65 | $3,039.47 | $2,953.88 |

| 60805 | $4,089.62 | $6,398.36 | $4,406.65 | $5,649.81 | $4,337.86 | $2,469.68 | $3,455.43 | $4,580.73 | $2,919.73 | $3,136.65 | $3,541.27 |

| 60301 | $4,086.88 | $6,307.76 | $4,600.64 | $5,740.06 | $3,624.78 | $2,720.95 | $4,478.37 | $3,903.91 | $2,987.50 | $3,313.21 | $3,191.63 |

| 60613 | $4,084.63 | $6,609.78 | $4,699.42 | $5,654.40 | $3,069.13 | $2,526.91 | $5,681.34 | $3,944.40 | $2,705.67 | $3,168.52 | $2,786.78 |

| 60302 | $4,083.75 | $6,307.76 | $4,600.64 | $5,722.55 | $3,624.78 | $2,644.03 | $4,478.37 | $4,136.13 | $2,969.40 | $3,162.20 | $3,191.63 |

| 60053 | $4,076.50 | $6,353.48 | $4,478.76 | $5,714.29 | $3,693.46 | $2,582.52 | $3,969.50 | $4,324.88 | $3,174.71 | $3,185.03 | $3,288.34 |

| 60141 | $4,061.76 | $5,864.17 | $4,600.64 | $5,983.46 | $3,869.92 | $2,356.37 | $4,382.65 | $4,515.18 | $2,816.79 | $3,021.45 | $3,207.01 |

| 60068 | $4,059.05 | $6,353.48 | $4,478.76 | $5,763.52 | $3,872.25 | $2,532.29 | $3,969.50 | $4,240.09 | $2,991.00 | $3,101.24 | $3,288.34 |

| 60305 | $4,057.21 | $6,548.68 | $4,600.64 | $5,873.43 | $3,624.78 | $2,493.10 | $4,382.65 | $4,212.81 | $2,845.94 | $3,002.93 | $2,987.14 |

| 60603 | $4,043.59 | $6,062.15 | $4,756.99 | $5,787.77 | $3,069.13 | $2,579.56 | $5,204.90 | $3,760.93 | $2,903.71 | $3,349.15 | $2,961.63 |

| 60457 | $4,039.38 | $6,602.88 | $4,436.29 | $5,637.89 | $3,379.56 | $2,608.65 | $3,455.43 | $4,632.73 | $3,190.46 | $3,043.66 | $3,406.25 |

| 60604 | $4,037.76 | $6,062.15 | $4,756.99 | $5,737.26 | $3,218.94 | $2,569.91 | $5,204.90 | $3,642.85 | $2,903.71 | $3,319.23 | $2,961.63 |

| 60605 | $4,022.13 | $6,061.38 | $4,776.22 | $5,770.48 | $3,218.94 | $2,576.64 | $5,204.90 | $3,549.77 | $2,875.49 | $3,094.04 | $3,093.44 |

| 60163 | $4,020.88 | $6,573.54 | $4,290.36 | $5,545.49 | $3,869.92 | $2,718.26 | $4,382.65 | $4,488.56 | $2,918.13 | $2,776.98 | $2,644.93 |

| 60411 | $4,019.87 | $6,748.61 | $4,751.81 | $5,807.30 | $3,697.51 | $2,468.83 | $3,304.45 | $4,378.59 | $2,937.30 | $2,870.47 | $3,233.81 |

| 60082 | $3,996.04 | $6,353.48 | $4,288.97 | $5,641.30 | $3,693.46 | $2,468.94 | $4,475.32 | $4,456.64 | $2,975.14 | $2,996.07 | $2,611.07 |

| 60461 | $3,987.28 | $6,526.63 | $4,678.13 | $5,767.91 | $3,400.48 | $2,591.54 | $3,304.45 | $4,280.99 | $3,236.20 | $2,852.66 | $3,233.81 |

| 60016 | $3,977.64 | $6,085.01 | $4,712.13 | $5,616.04 | $3,872.25 | $2,558.90 | $3,816.03 | $4,453.14 | $2,887.39 | $3,062.41 | $2,713.10 |

| 60610 | $3,977.62 | $5,921.94 | $4,776.22 | $5,735.75 | $3,069.13 | $2,437.75 | $5,171.74 | $3,568.89 | $2,814.57 | $3,078.04 | $3,202.16 |

| 60475 | $3,977.35 | $7,295.38 | $4,406.65 | $5,592.07 | $3,697.51 | $2,596.79 | $3,304.45 | $3,779.74 | $2,926.20 | $2,940.86 | $3,233.81 |

| 60029 | $3,976.45 | $6,306.06 | $4,478.76 | $5,646.67 | $3,305.47 | $2,737.90 | $3,969.50 | $4,471.25 | $2,975.14 | $3,331.06 | $2,542.69 |

| 60482 | $3,972.90 | $6,688.87 | $4,436.29 | $5,830.48 | $3,379.56 | $2,536.33 | $3,455.43 | $4,244.04 | $3,151.14 | $2,867.08 | $3,139.82 |

| 60453 | $3,969.48 | $6,129.63 | $4,600.64 | $5,742.44 | $3,776.81 | $2,568.99 | $3,455.43 | $4,435.15 | $2,993.11 | $2,852.83 | $3,139.82 |

| 62232 | $3,967.48 | $5,177.87 | $4,278.76 | $8,039.42 | $3,021.39 | $2,596.24 | $3,899.41 | $4,535.52 | $2,509.94 | $2,857.59 | $2,758.71 |

| 60654 | $3,967.27 | $5,921.20 | $4,776.22 | $5,699.17 | $3,069.13 | $2,523.46 | $5,204.90 | $3,521.32 | $2,874.37 | $3,087.31 | $2,995.59 |

| 60415 | $3,965.04 | $6,443.88 | $4,600.64 | $5,748.69 | $3,379.56 | $2,603.79 | $3,455.43 | $4,248.08 | $3,107.03 | $2,923.43 | $3,139.82 |

| 60471 | $3,962.01 | $6,008.77 | $4,678.13 | $5,750.41 | $3,697.51 | $2,588.60 | $3,304.45 | $4,221.26 | $3,245.83 | $2,891.34 | $3,233.81 |

| 60445 | $3,959.63 | $6,689.60 | $4,436.29 | $5,683.55 | $3,591.27 | $2,758.31 | $3,455.43 | $4,081.52 | $2,605.90 | $2,814.71 | $3,479.68 |

| 62040 | $3,956.39 | $6,170.15 | $4,406.65 | $5,617.82 | $3,334.81 | $2,618.55 | $4,856.00 | $4,033.57 | $2,468.00 | $2,838.33 | $3,220.04 |

| 60018 | $3,949.32 | $6,104.69 | $4,478.76 | $5,614.02 | $3,872.25 | $2,550.78 | $3,816.03 | $4,285.76 | $3,001.52 | $3,056.26 | $2,713.10 |

| 60606 | $3,943.80 | $5,405.35 | $4,756.99 | $5,699.17 | $3,218.94 | $2,582.59 | $5,204.90 | $3,593.63 | $2,845.33 | $3,037.68 | $3,093.44 |

| 60430 | $3,933.49 | $6,855.17 | $4,678.13 | $5,750.41 | $3,400.48 | $2,509.54 | $3,304.45 | $4,001.51 | $2,962.74 | $2,830.06 | $3,042.45 |

| 60611 | $3,928.69 | $5,914.99 | $4,776.22 | $5,716.45 | $3,069.13 | $2,439.35 | $5,171.74 | $3,338.52 | $2,799.51 | $3,065.39 | $2,995.59 |

| 60464 | $3,922.60 | $6,416.62 | $4,436.29 | $5,439.82 | $4,148.59 | $2,370.65 | $3,455.43 | $3,927.77 | $2,881.21 | $2,743.42 | $3,406.25 |

| 62048 | $3,918.94 | $5,821.04 | $4,678.13 | $5,747.35 | $3,036.37 | $2,566.21 | $4,856.00 | $4,662.63 | $2,294.01 | $2,632.57 | $2,895.14 |

| 60425 | $3,908.03 | $6,242.64 | $4,678.13 | $5,540.82 | $3,697.51 | $2,628.66 | $3,304.45 | $3,903.24 | $3,137.47 | $2,904.87 | $3,042.45 |

| 60661 | $3,906.48 | $5,409.85 | $4,756.99 | $5,558.28 | $3,218.94 | $2,437.75 | $5,204.90 | $3,606.32 | $2,818.52 | $3,091.64 | $2,961.63 |

| 60602 | $3,905.11 | $5,405.35 | $4,776.22 | $5,558.28 | $3,069.13 | $2,449.03 | $5,204.90 | $3,611.39 | $2,777.39 | $3,237.80 | $2,961.63 |

| 60465 | $3,900.07 | $6,416.62 | $4,436.29 | $5,421.36 | $3,379.56 | $2,384.33 | $3,455.43 | $4,147.09 | $3,021.24 | $2,932.59 | $3,406.25 |

| 60601 | $3,893.21 | $5,406.19 | $4,756.99 | $5,704.81 | $3,069.13 | $2,508.25 | $5,204.90 | $3,384.97 | $2,754.64 | $3,180.57 | $2,961.63 |

| 60476 | $3,885.00 | $6,855.17 | $4,278.76 | $5,610.38 | $3,400.48 | $2,718.51 | $3,304.45 | $3,795.39 | $2,964.47 | $2,879.93 | $3,042.45 |

| 60026 | $3,882.69 | $6,306.06 | $4,478.76 | $5,731.58 | $3,305.47 | $2,596.40 | $3,256.83 | $4,409.60 | $3,106.90 | $3,092.64 | $2,542.69 |

| 60614 | $3,878.12 | $5,405.54 | $4,756.99 | $5,614.76 | $3,069.13 | $2,536.54 | $5,171.74 | $3,510.05 | $2,814.37 | $3,115.34 | $2,786.78 |

| 60480 | $3,876.76 | $5,755.89 | $4,436.29 | $5,417.34 | $3,379.56 | $2,359.25 | $3,926.56 | $4,629.31 | $2,699.52 | $2,757.61 | $3,406.25 |

| 60466 | $3,872.12 | $5,642.29 | $4,678.13 | $5,560.10 | $3,697.51 | $2,356.37 | $3,304.45 | $4,334.68 | $2,979.52 | $2,934.33 | $3,233.81 |

| 60025 | $3,865.02 | $6,305.94 | $4,478.76 | $5,714.29 | $3,305.47 | $2,654.35 | $3,256.83 | $4,335.11 | $2,968.98 | $3,087.77 | $2,542.69 |

| 60438 | $3,859.93 | $6,341.33 | $4,278.76 | $5,599.90 | $3,400.48 | $2,708.78 | $3,304.45 | $3,876.16 | $2,921.21 | $2,904.02 | $3,264.26 |

| 60534 | $3,856.87 | $5,979.62 | $4,436.29 | $5,414.63 | $3,312.41 | $2,408.63 | $3,926.56 | $4,435.59 | $2,974.36 | $2,767.51 | $2,913.14 |

| 60657 | $3,854.83 | $5,407.47 | $4,699.42 | $5,562.92 | $3,069.13 | $2,534.97 | $5,171.74 | $3,466.24 | $2,823.20 | $3,026.42 | $2,786.78 |

| 62002 | $3,852.75 | $5,732.52 | $4,061.48 | $5,268.97 | $3,036.37 | $2,765.58 | $4,856.00 | $4,590.94 | $2,405.65 | $2,793.41 | $3,016.55 |

| 60546 | $3,841.77 | $5,864.17 | $4,290.36 | $5,343.29 | $3,312.41 | $2,353.00 | $3,926.56 | $4,294.56 | $3,294.97 | $2,825.21 | $2,913.14 |

| 60452 | $3,834.07 | $6,601.27 | $4,113.97 | $5,451.18 | $3,379.56 | $2,481.34 | $3,455.43 | $3,907.41 | $2,777.69 | $2,693.18 | $3,479.68 |

| 60062 | $3,816.92 | $6,103.16 | $4,478.76 | $5,546.88 | $3,305.47 | $2,505.79 | $3,256.83 | $4,129.10 | $3,217.74 | $3,082.79 | $2,542.69 |

| 60203 | $3,813.25 | $5,670.34 | $4,060.57 | $5,564.18 | $3,305.47 | $2,605.74 | $3,364.20 | $4,553.76 | $3,093.81 | $3,371.73 | $2,542.69 |

| 60422 | $3,811.00 | $6,036.82 | $4,278.76 | $5,609.34 | $3,400.48 | $2,591.54 | $3,304.45 | $3,789.35 | $2,986.02 | $2,879.41 | $3,233.81 |

| 60022 | $3,799.99 | $6,103.16 | $4,478.76 | $5,714.32 | $3,054.36 | $2,390.02 | $3,364.20 | $4,326.46 | $2,976.19 | $3,049.69 | $2,542.69 |

| 62084 | $3,797.13 | $5,821.04 | $4,278.76 | $5,387.61 | $3,036.37 | $2,570.28 | $4,856.00 | $4,178.78 | $2,307.16 | $2,640.14 | $2,895.14 |

| 60043 | $3,796.50 | $6,309.42 | $4,712.13 | $5,389.32 | $3,054.36 | $2,520.43 | $3,364.20 | $4,028.87 | $2,713.73 | $3,329.90 | $2,542.69 |

| 60209 | $3,792.33 | $5,670.34 | $4,060.57 | $5,369.62 | $3,341.01 | $2,174.94 | $3,364.20 | $4,094.47 | $3,091.15 | $4,214.30 | $2,542.69 |

| 62024 | $3,785.02 | $5,821.04 | $4,278.76 | $5,224.73 | $3,036.37 | $2,794.52 | $4,856.00 | $3,968.51 | $2,397.61 | $2,577.55 | $2,895.14 |

| 60513 | $3,784.67 | $5,864.17 | $4,436.29 | $5,191.59 | $3,225.49 | $2,444.30 | $3,926.56 | $4,344.41 | $2,748.13 | $2,860.77 | $2,804.97 |

| 60484 | $3,781.55 | $5,186.68 | $4,278.76 | $5,492.21 | $3,697.51 | $2,831.48 | $3,304.45 | $4,129.24 | $3,075.10 | $2,911.79 | $2,908.25 |

| 60463 | $3,780.50 | $6,689.60 | $4,113.97 | $5,420.25 | $3,379.56 | $2,370.90 | $3,455.43 | $3,963.50 | $2,811.53 | $2,720.45 | $2,879.77 |

| 60162 | $3,778.42 | $5,979.62 | $4,113.97 | $5,203.26 | $3,312.41 | $2,669.98 | $3,926.56 | $4,224.03 | $2,957.28 | $2,752.16 | $2,644.93 |

| 60525 | $3,776.74 | $5,979.62 | $3,954.88 | $5,186.39 | $3,312.41 | $2,541.94 | $3,926.56 | $4,323.67 | $2,861.97 | $2,875.02 | $2,804.97 |

| 60202 | $3,772.61 | $5,670.45 | $4,060.57 | $5,397.75 | $3,341.01 | $2,597.85 | $3,364.20 | $4,550.02 | $3,020.79 | $3,010.41 | $2,713.10 |

| 62095 | $3,769.64 | $5,821.04 | $4,290.36 | $5,161.30 | $3,036.37 | $2,570.28 | $4,856.00 | $4,089.87 | $2,320.78 | $2,655.27 | $2,895.14 |

| 60091 | $3,750.04 | $6,309.42 | $4,478.76 | $5,372.93 | $3,305.47 | $2,564.46 | $3,364.20 | $3,800.33 | $2,765.61 | $2,996.57 | $2,542.69 |

| 60090 | $3,742.95 | $5,977.98 | $4,288.97 | $5,502.36 | $3,305.47 | $2,566.40 | $3,038.11 | $4,073.83 | $3,121.39 | $2,943.88 | $2,611.07 |

| 60089 | $3,727.14 | $5,977.98 | $4,199.44 | $5,576.28 | $3,305.47 | $2,521.88 | $3,038.11 | $4,011.28 | $2,952.40 | $3,066.03 | $2,622.54 |

| 60093 | $3,724.81 | $6,309.42 | $4,478.76 | $5,558.77 | $3,054.36 | $2,414.12 | $3,364.20 | $3,741.05 | $2,819.08 | $2,965.65 | $2,542.69 |

| 62239 | $3,717.80 | $5,970.82 | $3,955.39 | $5,030.25 | $3,021.39 | $2,520.13 | $3,899.41 | $4,556.07 | $2,373.50 | $3,225.24 | $2,625.85 |

| 62018 | $3,716.00 | $5,821.04 | $3,960.66 | $5,185.07 | $3,036.37 | $2,574.80 | $4,856.00 | $3,964.27 | $2,415.41 | $2,451.21 | $2,895.14 |

| 60154 | $3,713.40 | $5,979.62 | $4,087.29 | $5,185.75 | $3,312.41 | $2,400.19 | $3,926.56 | $4,154.70 | $2,649.90 | $2,792.67 | $2,644.93 |

| 62087 | $3,712.23 | $4,974.59 | $4,278.76 | $4,944.42 | $3,036.37 | $2,677.00 | $4,856.00 | $4,557.11 | $2,237.03 | $2,665.92 | $2,895.14 |

| 60526 | $3,711.91 | $5,864.17 | $4,087.29 | $5,151.59 | $3,312.41 | $2,394.85 | $3,926.56 | $4,087.74 | $2,648.18 | $2,733.17 | $2,913.14 |

| 60201 | $3,696.59 | $5,670.34 | $4,060.57 | $5,369.62 | $3,341.01 | $2,427.89 | $3,364.20 | $3,802.14 | $2,945.67 | $3,271.35 | $2,713.10 |

| 60070 | $3,695.36 | $5,925.14 | $4,029.21 | $5,576.28 | $3,305.47 | $2,570.08 | $3,038.11 | $4,031.62 | $2,945.94 | $2,920.70 | $2,611.07 |

| 60433 | $3,677.43 | $6,324.11 | $4,046.71 | $5,616.81 | $3,243.82 | $2,526.01 | $2,323.89 | $4,058.04 | $3,110.57 | $2,787.89 | $2,736.42 |

| 60558 | $3,667.07 | $5,864.17 | $4,087.29 | $5,151.59 | $3,312.41 | $2,305.32 | $3,926.56 | $3,887.68 | $2,670.12 | $2,705.25 | $2,760.35 |

| 60056 | $3,661.28 | $5,924.95 | $4,029.21 | $5,231.37 | $3,305.47 | $2,512.01 | $3,038.11 | $4,260.09 | $2,711.38 | $2,887.13 | $2,713.10 |

| 60015 | $3,657.34 | $5,712.15 | $4,020.15 | $5,509.26 | $3,305.47 | $2,548.86 | $2,949.10 | $4,104.98 | $2,827.20 | $2,973.68 | $2,622.54 |

| 62223 | $3,653.22 | $5,632.55 | $4,278.76 | $5,030.25 | $3,021.39 | $2,531.25 | $3,899.41 | $4,175.56 | $2,456.86 | $2,785.49 | $2,720.68 |

| 60035 | $3,649.62 | $5,712.81 | $4,020.15 | $5,330.72 | $3,305.47 | $2,574.25 | $3,003.81 | $4,034.80 | $2,890.78 | $3,000.91 | $2,622.54 |

| 62957 | $3,641.89 | $5,581.05 | $3,932.71 | $4,741.32 | $2,981.93 | $2,217.69 | $4,238.95 | $4,822.93 | $2,371.34 | $2,716.90 | $2,814.06 |

| 60040 | $3,636.50 | $5,515.29 | $4,020.15 | $5,173.40 | $3,176.84 | $2,568.13 | $3,003.81 | $4,254.01 | $2,669.93 | $3,360.92 | $2,622.54 |

| 60527 | $3,632.23 | $5,825.48 | $4,060.57 | $5,195.89 | $3,312.41 | $2,470.87 | $3,102.70 | $3,896.48 | $2,896.43 | $2,756.54 | $2,804.97 |

| 62240 | $3,631.17 | $5,092.30 | $3,955.39 | $4,874.41 | $3,021.39 | $2,613.56 | $3,899.41 | $4,520.44 | $2,418.06 | $3,290.92 | $2,625.85 |

| 62259 | $3,626.34 | $5,103.71 | $3,985.11 | $4,648.65 | $2,981.93 | $2,339.56 | $3,754.85 | $4,222.56 | $2,339.88 | $4,214.30 | $2,672.80 |

| 60133 | $3,612.70 | $6,071.02 | $4,029.21 | $5,407.83 | $3,269.41 | $2,494.56 | $2,694.23 | $3,665.05 | $2,905.58 | $2,789.63 | $2,800.49 |

| 62914 | $3,608.65 | $5,581.05 | $3,932.71 | $4,688.23 | $2,981.93 | $2,236.98 | $4,238.95 | $4,760.97 | $2,343.48 | $2,508.17 | $2,814.06 |

| 62962 | $3,607.54 | $5,581.05 | $3,985.11 | $4,820.66 | $2,981.93 | $2,167.32 | $4,238.95 | $4,833.25 | $2,337.61 | $2,315.50 | $2,814.06 |

| 60462 | $3,604.89 | $5,985.27 | $4,046.71 | $5,259.51 | $3,379.56 | $2,260.10 | $2,736.01 | $4,091.57 | $2,791.99 | $2,618.38 | $2,879.77 |

| 62990 | $3,603.17 | $5,581.05 | $3,932.71 | $4,599.94 | $2,981.93 | $2,236.98 | $4,238.95 | $4,906.88 | $2,346.81 | $2,392.36 | $2,814.06 |

| 62026 | $3,600.97 | $4,806.02 | $4,061.48 | $4,532.04 | $3,036.37 | $2,570.28 | $3,899.41 | $3,602.48 | $2,392.14 | $4,214.30 | $2,895.14 |

| 62220 | $3,599.04 | $5,071.22 | $4,290.36 | $4,952.13 | $3,021.39 | $2,510.51 | $3,899.41 | $4,243.41 | $2,558.48 | $2,749.61 | $2,693.86 |

| 62841 | $3,594.30 | $5,103.71 | $3,901.13 | $4,813.16 | $2,981.93 | $2,102.64 | $4,260.26 | $3,537.28 | $2,337.61 | $4,214.30 | $2,690.99 |

| 62973 | $3,591.85 | $5,581.05 | $3,932.71 | $4,617.43 | $2,981.93 | $2,167.32 | $4,238.95 | $3,033.17 | $2,337.61 | $4,214.30 | $2,814.06 |

| 62208 | $3,589.62 | $5,029.64 | $4,061.48 | $5,160.43 | $3,021.39 | $2,575.47 | $3,899.41 | $3,975.20 | $2,605.22 | $2,809.24 | $2,758.71 |

| 60103 | $3,584.02 | $6,071.02 | $3,903.20 | $5,407.83 | $3,270.74 | $2,473.63 | $2,694.23 | $3,876.45 | $2,910.45 | $2,704.36 | $2,528.30 |

| 60037 | $3,578.18 | $5,515.29 | $3,903.20 | $4,877.59 | $3,176.84 | $2,428.17 | $3,003.81 | $4,325.15 | $2,933.12 | $2,996.07 | $2,622.54 |

| 60523 | $3,576.14 | $5,825.48 | $4,029.21 | $5,228.67 | $3,312.41 | $2,370.97 | $3,102.70 | $3,846.91 | $2,789.56 | $2,723.27 | $2,532.27 |

| 60192 | $3,570.61 | $5,911.94 | $4,060.57 | $5,352.36 | $3,015.00 | $2,379.99 | $2,197.15 | $4,326.59 | $2,842.70 | $2,819.27 | $2,800.49 |

| 62988 | $3,568.92 | $5,581.05 | $3,932.71 | $4,599.94 | $2,981.93 | $2,236.98 | $4,238.95 | $4,728.58 | $2,352.54 | $2,222.44 | $2,814.06 |

| 62971 | $3,567.04 | $5,110.48 | $3,878.89 | $4,595.54 | $2,981.93 | $2,243.56 | $4,260.26 | $3,142.18 | $2,429.16 | $4,214.30 | $2,814.06 |

| 60064 | $3,563.63 | $6,005.09 | $4,060.57 | $5,510.70 | $3,116.00 | $2,243.29 | $3,005.23 | $3,665.76 | $2,785.45 | $2,706.31 | $2,537.93 |

| 60440 | $3,562.54 | $5,562.52 | $3,903.20 | $5,402.98 | $3,277.47 | $2,279.16 | $2,524.54 | $4,079.29 | $3,007.78 | $2,711.95 | $2,876.55 |

| 60432 | $3,560.24 | $5,603.13 | $3,954.88 | $5,407.22 | $3,243.82 | $2,340.56 | $2,323.89 | $4,054.93 | $3,196.23 | $2,741.35 | $2,736.42 |

| 60069 | $3,559.86 | $5,515.29 | $3,842.90 | $5,358.88 | $3,176.84 | $2,490.92 | $3,003.81 | $3,884.72 | $2,846.13 | $2,856.57 | $2,622.54 |

| 62909 | $3,556.17 | $4,745.94 | $3,979.53 | $4,529.15 | $2,981.93 | $2,167.32 | $4,238.95 | $3,552.95 | $2,337.61 | $4,214.30 | $2,814.06 |

| 60490 | $3,555.73 | $5,480.73 | $3,900.29 | $5,364.07 | $3,271.25 | $2,200.39 | $2,524.54 | $4,017.25 | $3,273.60 | $2,648.64 | $2,876.55 |

| 62840 | $3,553.06 | $5,103.71 | $3,720.69 | $4,650.61 | $2,981.93 | $2,026.15 | $4,260.26 | $3,517.50 | $2,337.61 | $4,214.30 | $2,717.83 |

| 60107 | $3,552.63 | $5,761.69 | $4,060.57 | $5,380.47 | $3,015.00 | $2,451.92 | $2,694.23 | $3,805.56 | $2,794.86 | $2,761.55 | $2,800.49 |

| 60169 | $3,551.98 | $5,998.85 | $4,029.21 | $5,352.36 | $2,860.06 | $2,468.85 | $2,767.00 | $3,631.49 | $2,801.83 | $2,809.67 | $2,800.49 |

| 60096 | $3,546.36 | $5,949.99 | $3,900.29 | $5,238.03 | $3,116.00 | $2,485.98 | $2,639.13 | $3,611.25 | $2,752.55 | $2,995.06 | $2,775.36 |

| 62856 | $3,543.30 | $5,103.71 | $3,666.63 | $4,580.66 | $2,981.93 | $2,295.53 | $4,260.26 | $3,274.57 | $2,337.61 | $4,214.30 | $2,717.83 |

| 60439 | $3,542.62 | $5,972.26 | $4,046.71 | $5,193.36 | $3,215.73 | $2,323.27 | $2,542.83 | $3,843.90 | $2,665.99 | $2,732.52 | $2,889.57 |

| 60075 | $3,541.81 | $5,338.99 | $3,778.96 | $4,816.32 | $3,116.00 | $2,669.98 | $2,639.13 | $3,765.21 | $2,584.99 | $4,214.30 | $2,494.21 |

| 60193 | $3,540.94 | $5,761.69 | $4,029.21 | $5,231.37 | $2,860.06 | $2,428.17 | $2,694.23 | $4,217.08 | $2,773.00 | $2,707.37 | $2,707.24 |

| 60477 | $3,539.74 | $5,695.11 | $4,113.97 | $5,128.92 | $3,379.56 | $2,276.82 | $2,736.01 | $3,898.59 | $2,711.84 | $2,576.85 | $2,879.77 |

| 60487 | $3,537.73 | $5,626.98 | $4,046.71 | $5,053.12 | $3,379.56 | $2,326.31 | $2,736.01 | $4,090.08 | $2,683.93 | $2,554.78 | $2,879.77 |

| 60436 | $3,531.42 | $5,657.37 | $3,903.20 | $5,185.98 | $3,243.82 | $2,499.00 | $2,323.89 | $4,045.10 | $2,831.05 | $2,769.01 | $2,855.84 |

| 60194 | $3,530.07 | $5,998.85 | $4,029.21 | $5,214.96 | $3,015.00 | $2,533.93 | $2,767.00 | $3,586.10 | $2,740.31 | $2,708.15 | $2,707.24 |

| 60139 | $3,529.03 | $6,278.22 | $3,903.20 | $5,191.59 | $3,050.36 | $2,365.27 | $2,462.51 | $3,863.69 | $2,721.12 | $2,605.13 | $2,849.24 |

| 60467 | $3,527.46 | $5,572.34 | $4,029.21 | $5,031.08 | $3,151.53 | $2,268.46 | $2,736.01 | $4,123.73 | $2,884.70 | $2,597.74 | $2,879.77 |

| 62967 | $3,526.18 | $5,110.48 | $4,014.11 | $4,748.55 | $2,981.93 | $2,286.85 | $4,238.95 | $4,048.87 | $2,406.13 | $2,611.86 | $2,814.06 |

| 61104 | $3,524.84 | $5,410.45 | $3,954.88 | $5,292.21 | $2,733.07 | $2,272.32 | $2,416.44 | $4,898.69 | $2,936.23 | $2,570.02 | $2,764.05 |

| 60088 | $3,524.41 | $6,005.09 | $3,900.29 | $5,305.86 | $3,116.00 | $2,295.67 | $3,005.23 | $3,635.60 | $2,658.80 | $2,783.66 | $2,537.93 |

| 62256 | $3,522.38 | $4,744.46 | $4,065.74 | $4,691.85 | $2,844.43 | $2,450.40 | $3,754.85 | $3,641.51 | $2,267.09 | $4,214.30 | $2,549.19 |

| 62260 | $3,518.99 | $5,092.30 | $4,061.48 | $4,639.23 | $2,844.43 | $2,492.79 | $3,899.41 | $4,524.87 | $2,223.31 | $2,786.29 | $2,625.85 |

| 60431 | $3,518.87 | $5,814.84 | $3,903.20 | $5,013.16 | $3,271.25 | $2,518.18 | $2,355.39 | $4,066.11 | $2,663.20 | $2,727.54 | $2,855.84 |

| 62295 | $3,518.31 | $5,092.30 | $4,061.48 | $4,691.85 | $2,844.43 | $2,477.36 | $3,754.85 | $4,076.48 | $2,341.95 | $2,798.30 | $3,044.07 |

| 60449 | $3,517.64 | $5,186.68 | $4,113.97 | $5,223.30 | $3,065.78 | $2,360.62 | $2,619.01 | $3,836.52 | $3,102.34 | $2,759.89 | $2,908.25 |

| 60195 | $3,512.98 | $5,998.85 | $4,029.21 | $5,231.37 | $3,015.00 | $2,476.24 | $2,767.00 | $3,571.11 | $2,710.91 | $2,719.06 | $2,611.07 |

| 62046 | $3,512.54 | $4,974.59 | $4,065.74 | $4,844.26 | $2,844.43 | $2,481.24 | $3,899.41 | $4,227.29 | $2,314.69 | $2,578.62 | $2,895.14 |

| 60561 | $3,511.36 | $5,655.90 | $4,020.15 | $4,929.25 | $3,215.73 | $2,241.39 | $3,102.70 | $3,871.93 | $2,664.76 | $2,618.64 | $2,793.15 |

| 62221 | $3,510.60 | $5,177.87 | $3,960.66 | $4,906.79 | $2,844.43 | $2,482.97 | $3,899.41 | $3,882.16 | $2,474.41 | $2,783.44 | $2,693.86 |

| 60173 | $3,508.58 | $5,998.85 | $4,029.21 | $5,335.93 | $2,860.06 | $2,372.49 | $2,767.00 | $3,684.67 | $2,681.99 | $2,744.53 | $2,611.07 |

| 62226 | $3,508.23 | $4,557.10 | $4,061.48 | $4,904.95 | $2,844.43 | $2,564.34 | $3,899.41 | $4,239.43 | $2,506.56 | $2,810.73 | $2,693.86 |

| 60120 | $3,493.26 | $5,409.19 | $3,903.20 | $5,315.24 | $3,057.65 | $2,515.60 | $2,197.15 | $4,126.50 | $2,897.83 | $2,709.71 | $2,800.49 |

| 62953 | $3,492.70 | $5,581.05 | $4,087.29 | $4,821.02 | $2,981.93 | $2,217.69 | $4,238.95 | $3,304.30 | $2,337.61 | $2,543.14 | $2,814.06 |

| 60101 | $3,489.97 | $5,636.97 | $4,029.21 | $5,169.10 | $3,208.12 | $2,343.75 | $2,462.51 | $3,935.83 | $2,831.18 | $2,688.36 | $2,594.68 |

| 62035 | $3,489.13 | $5,159.79 | $3,955.39 | $4,791.16 | $3,036.37 | $2,442.80 | $3,386.68 | $3,904.97 | $2,441.07 | $2,756.54 | $3,016.55 |

| 62010 | $3,488.01 | $4,740.39 | $4,061.48 | $4,766.73 | $3,036.37 | $2,420.02 | $3,899.41 | $3,991.83 | $2,423.45 | $2,645.27 | $2,895.14 |

| 62969 | $3,485.13 | $5,581.05 | $3,932.71 | $4,688.23 | $2,981.93 | $2,236.98 | $4,238.95 | $3,672.37 | $2,344.21 | $2,360.82 | $2,814.06 |

| 60087 | $3,484.27 | $6,005.09 | $3,749.02 | $5,265.49 | $3,116.00 | $2,459.35 | $2,639.13 | $3,553.20 | $2,563.99 | $2,795.41 | $2,695.99 |

| 60099 | $3,482.47 | $5,949.99 | $3,778.96 | $5,190.47 | $3,116.00 | $2,356.75 | $2,639.13 | $3,601.66 | $2,692.59 | $2,723.77 | $2,775.36 |

| 62067 | $3,478.63 | $4,974.59 | $4,065.74 | $4,728.38 | $2,844.43 | $2,420.02 | $3,899.41 | $4,135.11 | $2,386.37 | $2,437.16 | $2,895.14 |

| 62234 | $3,478.37 | $4,740.39 | $3,955.39 | $4,558.22 | $3,036.37 | $2,496.75 | $3,899.41 | $4,283.58 | $2,384.53 | $2,670.35 | $2,758.71 |

| 60106 | $3,477.58 | $5,651.00 | $3,954.88 | $5,185.98 | $3,208.12 | $2,337.92 | $2,462.51 | $3,837.82 | $2,683.18 | $2,776.72 | $2,677.63 |

| 62963 | $3,477.19 | $5,581.05 | $3,979.53 | $4,593.59 | $2,981.93 | $2,236.98 | $4,238.95 | $3,612.62 | $2,268.48 | $2,464.76 | $2,814.06 |

| 60170 | $3,474.85 | $5,464.55 | $3,550.25 | $5,352.36 | $3,057.65 | $2,568.99 | $2,039.71 | $3,631.49 | $2,325.07 | $4,214.30 | $2,544.15 |

| 60521 | $3,474.67 | $5,825.48 | $3,903.20 | $4,986.09 | $2,944.30 | $2,395.03 | $3,102.70 | $3,657.52 | $2,657.06 | $2,743.07 | $2,532.27 |

| 62960 | $3,473.92 | $5,581.05 | $3,932.71 | $4,617.43 | $2,981.93 | $2,217.69 | $4,238.95 | $3,350.91 | $2,386.58 | $2,617.88 | $2,814.06 |

| 62993 | $3,473.30 | $5,581.05 | $3,932.71 | $4,599.94 | $2,981.93 | $2,167.32 | $4,238.95 | $3,672.37 | $2,337.61 | $2,407.06 | $2,814.06 |

| 60435 | $3,472.15 | $5,472.43 | $3,765.61 | $5,065.00 | $3,243.82 | $2,506.70 | $2,323.89 | $3,982.22 | $2,763.36 | $2,742.65 | $2,855.84 |

| 62922 | $3,469.78 | $5,110.48 | $3,901.13 | $4,648.65 | $2,981.93 | $2,217.69 | $4,238.95 | $3,936.91 | $2,359.88 | $2,584.35 | $2,717.83 |

| 62025 | $3,466.83 | $4,740.39 | $4,065.74 | $4,532.04 | $3,036.37 | $2,481.24 | $3,899.41 | $3,910.45 | $2,482.99 | $2,624.52 | $2,895.14 |

| 62992 | $3,466.61 | $5,581.05 | $3,932.71 | $4,617.43 | $2,981.93 | $2,236.98 | $4,238.95 | $3,712.24 | $2,279.87 | $2,270.85 | $2,814.06 |

| 60559 | $3,465.27 | $5,656.73 | $3,842.90 | $4,986.09 | $3,215.73 | $2,340.95 | $3,102.70 | $3,711.43 | $2,435.58 | $2,598.43 | $2,762.17 |

| 62941 | $3,465.21 | $5,581.05 | $3,932.71 | $4,617.43 | $2,981.93 | $2,217.69 | $4,238.95 | $3,525.31 | $2,277.13 | $2,465.87 | $2,814.06 |

| 62975 | $3,464.07 | $5,110.48 | $3,878.89 | $4,746.04 | $2,981.93 | $2,229.18 | $4,238.95 | $3,718.21 | $2,429.16 | $2,493.80 | $2,814.06 |

| 62952 | $3,461.98 | $5,110.48 | $3,878.89 | $4,872.47 | $2,981.93 | $2,217.69 | $4,238.95 | $3,770.03 | $2,387.83 | $2,347.48 | $2,814.06 |

| 62236 | $3,460.66 | $5,092.30 | $4,087.29 | $4,650.68 | $2,844.43 | $2,452.91 | $3,899.41 | $3,656.09 | $2,238.69 | $2,640.76 | $3,044.07 |

| 62942 | $3,460.59 | $5,110.48 | $3,932.71 | $4,781.00 | $2,981.93 | $2,290.64 | $4,260.26 | $3,640.75 | $2,437.37 | $2,356.70 | $2,814.06 |

| 60047 | $3,459.80 | $5,977.98 | $3,842.90 | $4,951.74 | $3,176.84 | $2,487.53 | $2,690.85 | $3,753.14 | $2,532.71 | $2,690.11 | $2,494.21 |

| 60199 | $3,459.10 | $6,278.22 | $3,735.89 | $5,065.00 | $2,980.38 | $2,268.63 | $2,358.88 | $3,585.89 | $2,669.76 | $2,758.82 | $2,889.57 |

| 60516 | $3,458.21 | $5,554.56 | $3,765.61 | $4,928.15 | $3,215.73 | $2,328.21 | $2,963.75 | $3,845.80 | $2,515.33 | $2,702.76 | $2,762.17 |

| 60544 | $3,455.76 | $5,479.52 | $3,735.89 | $5,194.26 | $3,271.25 | $2,547.01 | $2,355.39 | $3,792.50 | $2,929.76 | $2,684.85 | $2,567.22 |

| 62278 | $3,454.52 | $5,103.71 | $4,065.74 | $4,635.24 | $2,981.93 | $2,450.40 | $3,754.85 | $3,863.00 | $2,391.76 | $2,625.81 | $2,672.80 |

| 60901 | $3,454.41 | $5,752.90 | $3,584.16 | $4,987.55 | $3,073.62 | $2,302.57 | $3,300.61 | $3,922.51 | $2,306.64 | $2,585.78 | $2,727.84 |

| 62970 | $3,453.95 | $5,581.05 | $3,932.71 | $4,580.48 | $2,981.93 | $2,217.69 | $4,238.95 | $3,630.20 | $2,337.61 | $2,224.83 | $2,814.06 |

| 60403 | $3,453.73 | $5,313.70 | $3,778.96 | $5,048.58 | $3,243.82 | $2,349.92 | $2,323.89 | $4,116.69 | $2,738.77 | $2,767.17 | $2,855.84 |

| 60085 | $3,453.48 | $6,005.09 | $3,900.29 | $5,184.86 | $3,116.00 | $2,286.47 | $2,639.13 | $3,530.65 | $2,557.58 | $2,776.75 | $2,537.93 |

| 62910 | $3,452.11 | $5,443.83 | $3,932.71 | $4,823.74 | $2,981.93 | $2,217.69 | $3,066.25 | $3,790.82 | $2,575.21 | $2,874.84 | $2,814.06 |

| 60514 | $3,451.10 | $5,825.48 | $3,765.61 | $4,954.95 | $2,944.30 | $2,361.48 | $3,102.70 | $3,414.09 | $2,634.70 | $2,714.51 | $2,793.15 |

| 60045 | $3,451.01 | $5,515.29 | $3,765.61 | $5,002.75 | $3,176.84 | $2,440.98 | $3,003.81 | $3,399.57 | $2,713.09 | $2,869.64 | $2,622.54 |

| 62998 | $3,450.67 | $5,110.48 | $3,901.13 | $4,732.54 | $2,981.93 | $2,212.86 | $4,238.95 | $3,709.02 | $2,398.70 | $2,407.06 | $2,814.06 |

| 62943 | $3,448.40 | $5,110.48 | $3,932.71 | $4,661.58 | $2,981.93 | $2,217.69 | $4,238.95 | $3,905.01 | $2,337.61 | $2,284.01 | $2,814.06 |

| 62956 | $3,448.27 | $5,581.05 | $3,932.71 | $4,617.43 | $2,981.93 | $2,217.69 | $4,238.95 | $3,596.32 | $2,262.43 | $2,240.16 | $2,814.06 |

| 62058 | $3,446.68 | $4,974.59 | $4,065.74 | $4,844.26 | $2,844.43 | $2,531.25 | $3,483.32 | $4,227.29 | $2,210.22 | $2,312.71 | $2,972.99 |

| 62959 | $3,445.73 | $5,110.48 | $3,901.13 | $4,677.10 | $2,981.93 | $2,295.53 | $4,260.26 | $3,634.76 | $2,297.01 | $2,608.09 | $2,690.99 |

| 62976 | $3,444.50 | $5,581.05 | $3,979.53 | $4,593.59 | $2,981.93 | $2,236.98 | $4,238.95 | $3,544.73 | $2,273.36 | $2,200.78 | $2,814.06 |

| 62277 | $3,444.11 | $5,103.71 | $4,065.74 | $4,635.24 | $2,981.93 | $2,415.15 | $3,754.85 | $3,954.92 | $2,321.15 | $2,535.64 | $2,672.80 |

| 62964 | $3,444.10 | $5,581.05 | $3,932.71 | $4,580.48 | $2,981.93 | $2,217.69 | $4,238.95 | $3,565.16 | $2,242.26 | $2,286.70 | $2,814.06 |

| 62294 | $3,443.91 | $5,095.43 | $3,882.75 | $4,602.35 | $2,844.43 | $2,393.96 | $3,899.41 | $4,053.77 | $2,300.48 | $2,607.77 | $2,758.71 |

| 62244 | $3,442.99 | $5,092.30 | $4,065.74 | $4,691.85 | $2,844.43 | $2,450.40 | $3,754.85 | $3,961.42 | $2,304.44 | $2,715.32 | $2,549.19 |

| 62972 | $3,442.28 | $5,110.48 | $3,901.13 | $4,674.68 | $2,981.93 | $2,217.69 | $4,238.95 | $3,822.46 | $2,337.61 | $2,323.82 | $2,814.06 |

| 62097 | $3,441.01 | $4,974.59 | $4,065.74 | $4,691.85 | $2,844.43 | $2,196.37 | $3,483.32 | $4,578.81 | $2,230.86 | $2,448.99 | $2,895.14 |

| 60020 | $3,440.05 | $5,411.22 | $3,903.20 | $5,046.14 | $3,220.89 | $2,332.13 | $2,641.11 | $3,792.72 | $2,713.10 | $2,610.47 | $2,729.53 |

| 62062 | $3,439.89 | $4,806.02 | $3,955.39 | $4,526.43 | $3,036.37 | $2,475.41 | $3,899.41 | $4,008.69 | $2,298.31 | $2,667.19 | $2,725.71 |

| 62261 | $3,438.09 | $5,103.71 | $4,114.28 | $4,661.73 | $2,981.93 | $2,393.96 | $3,754.85 | $3,813.41 | $2,339.88 | $2,544.34 | $2,672.80 |

| 62940 | $3,437.96 | $5,110.48 | $3,745.79 | $4,710.20 | $2,981.93 | $2,167.47 | $4,260.26 | $3,653.77 | $2,429.16 | $2,506.42 | $2,814.06 |

| 62995 | $3,435.13 | $5,110.48 | $3,878.89 | $4,529.15 | $2,981.93 | $2,217.69 | $4,238.95 | $3,877.87 | $2,413.79 | $2,288.47 | $2,814.06 |

| 62217 | $3,434.64 | $5,103.71 | $4,114.28 | $4,661.73 | $2,981.93 | $2,417.30 | $3,754.85 | $3,777.39 | $2,388.79 | $2,473.58 | $2,672.80 |

| 60586 | $3,434.11 | $4,996.60 | $3,646.48 | $5,002.37 | $3,271.25 | $2,545.43 | $2,355.39 | $4,354.27 | $2,593.61 | $2,682.23 | $2,893.50 |

| 62996 | $3,432.77 | $5,581.05 | $3,745.79 | $4,593.59 | $2,981.93 | $2,243.17 | $4,238.95 | $3,555.70 | $2,248.28 | $2,325.18 | $2,814.06 |

| 62001 | $3,431.86 | $4,974.59 | $4,065.74 | $4,691.85 | $2,844.43 | $2,204.25 | $3,483.32 | $4,533.34 | $2,242.36 | $2,305.68 | $2,972.99 |

| 62951 | $3,431.34 | $5,110.48 | $3,901.13 | $4,677.10 | $2,981.93 | $2,216.94 | $4,260.26 | $3,523.11 | $2,392.72 | $2,558.72 | $2,690.99 |

| 60417 | $3,430.62 | $5,186.68 | $3,954.88 | $5,041.64 | $3,065.78 | $2,360.62 | $2,619.01 | $3,787.52 | $2,725.80 | $2,655.99 | $2,908.25 |

| 62965 | $3,429.81 | $5,110.48 | $3,878.89 | $4,541.66 | $2,981.93 | $2,212.86 | $3,066.25 | $3,140.04 | $2,337.61 | $4,214.30 | $2,814.06 |

| 62061 | $3,429.79 | $4,974.59 | $4,065.74 | $4,650.68 | $2,844.43 | $2,204.25 | $3,483.32 | $4,357.13 | $2,218.08 | $2,526.74 | $2,972.99 |

| 62280 | $3,429.10 | $5,103.71 | $3,878.89 | $4,648.65 | $2,981.93 | $2,223.00 | $4,260.26 | $3,907.14 | $2,339.88 | $2,274.79 | $2,672.80 |

| 60083 | $3,428.65 | $5,740.47 | $3,735.89 | $4,949.46 | $3,176.84 | $2,412.17 | $2,707.03 | $3,598.79 | $2,565.96 | $2,682.41 | $2,717.46 |

| 60401 | $3,427.99 | $5,444.48 | $4,087.29 | $4,769.15 | $3,065.78 | $2,173.91 | $3,128.77 | $3,784.22 | $2,466.54 | $2,631.93 | $2,727.84 |

| 62021 | $3,427.05 | $4,974.59 | $4,065.74 | $4,742.36 | $2,844.43 | $2,407.90 | $3,386.68 | $4,196.15 | $2,247.47 | $2,510.06 | $2,895.14 |

| 62074 | $3,426.70 | $4,974.59 | $4,065.74 | $4,564.07 | $2,844.43 | $2,263.94 | $3,483.32 | $4,535.80 | $2,230.79 | $2,331.29 | $2,972.99 |

| 60108 | $3,426.62 | $5,651.72 | $3,842.90 | $5,124.57 | $3,050.36 | $2,422.82 | $2,462.51 | $3,899.71 | $2,562.94 | $2,604.45 | $2,644.21 |

| 62242 | $3,426.29 | $5,103.71 | $4,114.28 | $4,661.73 | $2,981.93 | $2,415.15 | $3,754.85 | $3,826.21 | $2,328.69 | $2,403.57 | $2,672.80 |

| 60073 | $3,426.06 | $5,395.28 | $3,729.62 | $5,023.64 | $3,220.89 | $2,476.92 | $2,641.11 | $3,658.61 | $2,662.42 | $2,705.37 | $2,746.72 |

| 62034 | $3,425.36 | $4,740.39 | $3,882.75 | $4,537.67 | $3,036.37 | $2,539.17 | $3,899.41 | $3,893.60 | $2,371.50 | $2,627.05 | $2,725.71 |

| 62907 | $3,425.22 | $5,103.71 | $3,878.89 | $4,648.65 | $2,981.93 | $2,229.18 | $4,260.26 | $3,707.01 | $2,402.29 | $2,367.52 | $2,672.80 |

| 61101 | $3,424.55 | $5,478.72 | $3,815.53 | $4,891.02 | $2,733.07 | $2,350.54 | $2,416.44 | $4,494.34 | $2,780.45 | $2,521.38 | $2,764.05 |

| 62958 | $3,424.46 | $4,745.94 | $3,901.13 | $4,653.22 | $2,981.93 | $2,195.25 | $4,260.26 | $3,653.80 | $2,533.54 | $2,505.47 | $2,814.06 |

| 60404 | $3,422.31 | $5,524.02 | $3,900.29 | $5,070.63 | $3,271.25 | $2,230.87 | $2,355.39 | $3,589.77 | $2,684.95 | $2,740.07 | $2,855.84 |

| 60522 | $3,421.53 | $5,048.35 | $3,903.20 | $4,686.12 | $3,312.41 | $2,302.57 | $3,102.70 | $3,992.13 | $2,669.76 | $2,665.80 | $2,532.27 |

| 60046 | $3,420.99 | $5,740.47 | $3,729.62 | $4,928.02 | $3,176.84 | $2,388.21 | $2,707.03 | $3,523.48 | $2,630.00 | $2,639.56 | $2,746.72 |

| 60505 | $3,420.88 | $5,598.11 | $3,749.02 | $5,218.95 | $3,155.21 | $2,361.17 | $2,568.14 | $3,585.68 | $2,821.01 | $2,642.51 | $2,508.97 |

| 62966 | $3,420.58 | $5,110.48 | $3,901.13 | $4,701.75 | $2,981.93 | $2,301.25 | $4,260.26 | $3,360.03 | $2,424.93 | $2,491.28 | $2,672.80 |

| 62298 | $3,420.36 | $5,092.30 | $4,061.48 | $4,650.68 | $2,844.43 | $2,426.95 | $3,754.85 | $3,579.79 | $2,269.07 | $2,479.97 | $3,044.07 |

| 61103 | $3,418.86 | $5,410.45 | $3,749.02 | $5,021.03 | $2,733.07 | $2,173.86 | $2,416.44 | $4,650.30 | $2,718.68 | $2,551.69 | $2,764.05 |

| 60191 | $3,416.97 | $5,307.99 | $3,903.20 | $5,030.62 | $3,269.41 | $2,310.14 | $2,462.51 | $3,840.63 | $2,676.56 | $2,691.04 | $2,677.63 |

| 62248 | $3,416.10 | $5,092.30 | $4,065.74 | $4,649.77 | $2,844.43 | $2,450.40 | $3,754.85 | $3,892.37 | $2,267.09 | $2,594.85 | $2,549.19 |

| 62241 | $3,415.92 | $5,103.71 | $4,114.28 | $4,661.73 | $2,981.93 | $2,306.40 | $3,754.85 | $3,793.71 | $2,367.95 | $2,401.88 | $2,672.80 |

| 60074 | $3,415.67 | $5,526.55 | $3,900.29 | $5,108.19 | $2,860.06 | $2,512.29 | $2,383.05 | $3,765.21 | $2,691.91 | $2,798.06 | $2,611.07 |

| 62939 | $3,414.38 | $5,110.48 | $3,745.79 | $4,529.15 | $2,981.93 | $2,200.01 | $4,238.95 | $3,730.99 | $2,292.11 | $2,596.55 | $2,717.83 |

| 62948 | $3,413.00 | $5,110.48 | $3,901.13 | $4,641.71 | $2,981.93 | $2,252.98 | $4,260.26 | $3,617.17 | $2,240.58 | $2,432.83 | $2,690.99 |

| 62901 | $3,412.88 | $4,793.39 | $3,882.75 | $4,684.41 | $2,981.93 | $2,301.25 | $4,260.26 | $3,378.25 | $2,472.78 | $2,559.68 | $2,814.06 |

| 60010 | $3,412.18 | $5,899.94 | $3,900.29 | $5,228.67 | $2,929.59 | $2,427.03 | $2,069.57 | $3,727.88 | $2,692.90 | $2,751.71 | $2,494.21 |

| 60423 | $3,411.86 | $5,220.03 | $3,954.88 | $4,794.42 | $3,151.53 | $2,468.94 | $2,736.01 | $3,786.92 | $2,478.53 | $2,619.13 | $2,908.25 |

| 60441 | $3,411.64 | $5,411.14 | $3,778.96 | $4,793.46 | $3,271.25 | $2,469.62 | $2,542.83 | $3,704.19 | $2,590.48 | $2,698.68 | $2,855.84 |

| 62013 | $3,411.35 | $5,141.03 | $3,745.79 | $4,599.94 | $2,568.13 | $2,334.27 | $3,386.68 | $4,676.75 | $2,321.92 | $2,588.87 | $2,750.09 |

| 60446 | $3,410.08 | $5,479.52 | $3,646.48 | $5,142.42 | $3,271.25 | $2,253.29 | $2,355.39 | $3,646.45 | $2,801.30 | $2,615.10 | $2,889.57 |

| 62288 | $3,409.76 | $5,103.71 | $3,985.11 | $4,508.55 | $2,981.93 | $2,354.67 | $3,754.85 | $3,933.89 | $2,358.97 | $2,443.09 | $2,672.80 |

| 60517 | $3,409.70 | $5,554.56 | $3,623.47 | $4,764.14 | $3,031.04 | $2,370.19 | $2,963.75 | $3,781.60 | $2,602.74 | $2,643.36 | $2,762.17 |

| 62908 | $3,409.34 | $4,745.94 | $3,932.71 | $4,493.74 | $2,981.93 | $2,217.69 | $4,238.95 | $3,886.39 | $2,374.92 | $2,407.06 | $2,814.06 |

| 62950 | $3,408.99 | $5,110.48 | $3,878.89 | $4,582.44 | $2,981.93 | $2,223.00 | $4,260.26 | $3,651.10 | $2,378.29 | $2,350.70 | $2,672.80 |

| 62254 | $3,408.90 | $4,744.46 | $3,955.39 | $4,576.93 | $2,844.43 | $2,455.16 | $3,899.41 | $4,077.51 | $2,232.68 | $2,687.42 | $2,615.64 |

| 62916 | $3,408.11 | $5,103.71 | $3,878.89 | $4,508.55 | $2,981.93 | $2,200.20 | $4,260.26 | $3,690.93 | $2,501.12 | $2,282.75 | $2,672.80 |

| 62932 | $3,404.81 | $5,103.71 | $3,901.13 | $4,648.65 | $2,981.93 | $2,243.56 | $4,260.26 | $3,624.62 | $2,304.44 | $2,262.00 | $2,717.83 |

| 62030 | $3,404.21 | $5,656.65 | $3,559.06 | $4,423.51 | $2,568.13 | $3,139.02 | $3,386.68 | $3,764.96 | $2,206.69 | $2,549.40 | $2,788.03 |

| 62258 | $3,404.19 | $4,744.46 | $4,014.11 | $4,647.72 | $2,844.43 | $2,313.63 | $3,754.85 | $4,222.56 | $2,209.13 | $2,629.53 | $2,661.51 |

| 62028 | $3,402.24 | $5,656.65 | $3,720.69 | $4,653.22 | $2,568.13 | $2,468.60 | $3,386.68 | $3,589.19 | $2,336.71 | $2,854.51 | $2,788.03 |

| 60048 | $3,402.23 | $5,348.59 | $3,729.62 | $4,877.39 | $3,176.84 | $2,492.14 | $2,675.33 | $3,831.50 | $2,642.48 | $2,754.25 | $2,494.21 |

| 62812 | $3,401.64 | $5,103.71 | $3,666.63 | $4,539.39 | $2,981.93 | $2,295.53 | $4,260.26 | $3,697.87 | $2,256.65 | $2,496.64 | $2,717.83 |

| 60491 | $3,401.51 | $5,313.63 | $3,679.46 | $4,756.27 | $3,271.25 | $2,342.27 | $2,542.83 | $3,870.35 | $2,829.88 | $2,672.75 | $2,736.42 |

| 60061 | $3,401.24 | $5,371.58 | $3,729.62 | $4,951.74 | $3,176.84 | $2,511.35 | $2,675.33 | $3,748.11 | $2,688.46 | $2,665.16 | $2,494.21 |

| 62923 | $3,400.20 | $4,745.94 | $3,979.53 | $4,506.84 | $2,981.93 | $2,217.69 | $4,238.95 | $3,847.24 | $2,358.57 | $2,311.25 | $2,814.06 |

| 62286 | $3,400.01 | $5,103.71 | $3,985.11 | $4,508.55 | $2,981.93 | $2,354.67 | $3,754.85 | $3,751.48 | $2,414.56 | $2,472.50 | $2,672.80 |

| 62036 | $3,399.85 | $5,141.03 | $3,745.79 | $4,599.94 | $2,568.13 | $2,334.27 | $3,386.68 | $4,697.14 | $2,206.69 | $2,568.71 | $2,750.09 |

| 62938 | $3,399.24 | $5,443.83 | $3,878.89 | $4,749.87 | $2,981.93 | $2,232.17 | $3,066.25 | $4,078.08 | $2,419.17 | $2,328.16 | $2,814.06 |

| 60060 | $3,398.41 | $5,371.51 | $3,649.35 | $4,882.38 | $3,176.84 | $2,403.87 | $2,675.33 | $4,116.42 | $2,527.25 | $2,686.93 | $2,494.21 |

| 60041 | $3,398.07 | $5,395.28 | $3,765.61 | $5,001.03 | $3,220.89 | $2,424.66 | $2,641.11 | $3,682.78 | $2,644.52 | $2,710.64 | $2,494.21 |

| 60157 | $3,397.60 | $5,637.86 | $3,900.29 | $5,030.62 | $3,269.41 | $2,203.89 | $2,462.51 | $3,760.46 | $2,506.18 | $2,610.16 | $2,594.68 |

| 62233 | $3,397.36 | $5,103.71 | $3,985.11 | $4,648.65 | $2,981.93 | $2,354.67 | $3,754.85 | $3,712.47 | $2,314.74 | $2,444.65 | $2,672.80 |

| 60002 | $3,397.28 | $5,411.22 | $3,765.61 | $4,869.83 | $3,220.89 | $2,356.75 | $2,707.03 | $3,705.36 | $2,569.32 | $2,620.10 | $2,746.72 |

| 62279 | $3,396.35 | $5,092.30 | $4,065.74 | $4,684.41 | $2,981.93 | $2,415.15 | $3,754.85 | $3,641.51 | $2,267.09 | $2,511.38 | $2,549.19 |

| 62933 | $3,395.99 | $4,793.39 | $3,901.13 | $4,613.26 | $2,981.93 | $2,252.98 | $4,260.26 | $3,857.03 | $2,204.31 | $2,404.60 | $2,690.99 |

| 62297 | $3,395.89 | $5,103.71 | $4,114.28 | $4,661.73 | $2,981.93 | $2,154.87 | $3,754.85 | $3,937.97 | $2,339.88 | $2,236.92 | $2,672.80 |

| 62994 | $3,395.21 | $5,103.71 | $3,745.79 | $4,595.54 | $2,981.93 | $2,290.64 | $4,260.26 | $3,606.73 | $2,398.78 | $2,295.88 | $2,672.80 |

| 62905 | $3,394.48 | $4,745.94 | $3,745.79 | $4,719.45 | $2,981.93 | $2,236.98 | $4,238.95 | $3,806.97 | $2,337.61 | $2,317.10 | $2,814.06 |

| 62076 | $3,391.58 | $5,267.04 | $3,559.06 | $4,304.55 | $2,568.13 | $2,496.75 | $3,386.68 | $3,129.72 | $2,142.07 | $4,214.30 | $2,847.48 |

| 62926 | $3,390.70 | $4,740.86 | $3,878.89 | $4,661.58 | $2,981.93 | $2,217.69 | $4,238.95 | $3,724.31 | $2,351.93 | $2,296.80 | $2,814.06 |

| 62903 | $3,389.73 | $4,793.39 | $3,810.91 | $4,759.13 | $2,981.93 | $2,243.56 | $4,260.26 | $3,219.25 | $2,515.20 | $2,499.64 | $2,814.06 |

| 62819 | $3,388.15 | $5,103.71 | $3,666.63 | $4,539.39 | $2,981.93 | $2,295.53 | $4,260.26 | $3,636.91 | $2,281.06 | $2,398.25 | $2,717.83 |

| 62264 | $3,387.78 | $5,092.30 | $4,114.28 | $4,642.19 | $2,844.43 | $2,516.50 | $3,754.85 | $3,500.87 | $2,292.51 | $2,570.64 | $2,549.19 |

| 62920 | $3,387.75 | $4,745.94 | $3,745.79 | $4,719.45 | $2,981.93 | $2,236.98 | $4,238.95 | $3,676.12 | $2,378.46 | $2,339.78 | $2,814.06 |

| 60004 | $3,387.71 | $5,433.44 | $3,900.29 | $4,968.15 | $2,860.06 | $2,311.67 | $2,520.60 | $3,802.40 | $2,785.40 | $2,684.06 | $2,611.07 |

| 62896 | $3,386.75 | $4,793.39 | $3,720.69 | $4,650.61 | $2,981.93 | $2,295.53 | $4,260.26 | $3,505.05 | $2,452.57 | $2,516.52 | $2,690.99 |

| 62924 | $3,386.69 | $4,793.39 | $3,745.79 | $4,555.94 | $2,981.93 | $2,195.25 | $4,260.26 | $3,656.90 | $2,475.45 | $2,484.22 | $2,717.83 |

| 62912 | $3,386.35 | $4,745.94 | $3,878.89 | $4,529.15 | $2,981.93 | $2,217.69 | $4,238.95 | $3,884.61 | $2,308.36 | $2,263.96 | $2,814.06 |

| 62285 | $3,385.63 | $5,092.30 | $4,065.74 | $4,639.23 | $2,844.43 | $2,413.98 | $3,754.85 | $3,476.76 | $2,300.55 | $2,642.64 | $2,625.85 |

| 62070 | $3,383.03 | $5,141.03 | $3,745.79 | $4,529.15 | $2,568.13 | $2,322.88 | $2,812.28 | $5,218.01 | $2,206.69 | $2,536.30 | $2,750.09 |

| 62947 | $3,382.97 | $5,443.83 | $3,878.89 | $4,617.43 | $2,981.93 | $2,212.86 | $3,066.25 | $3,991.07 | $2,416.35 | $2,407.06 | $2,814.06 |

| 62999 | $3,382.54 | $5,110.48 | $3,666.63 | $4,580.46 | $2,981.93 | $2,252.98 | $4,260.26 | $3,572.55 | $2,301.27 | $2,381.06 | $2,717.83 |

| 62949 | $3,382.00 | $5,110.48 | $3,745.79 | $4,585.98 | $2,981.93 | $2,195.25 | $4,260.26 | $3,537.28 | $2,276.44 | $2,408.74 | $2,717.83 |

| 62906 | $3,381.71 | $4,745.94 | $3,810.91 | $4,666.30 | $2,981.93 | $2,232.17 | $4,238.95 | $3,610.27 | $2,393.49 | $2,323.06 | $2,814.06 |

| 62902 | $3,380.50 | $4,793.39 | $3,882.75 | $4,569.03 | $2,981.93 | $2,195.25 | $4,260.26 | $3,351.89 | $2,423.93 | $2,532.53 | $2,814.06 |

| 60564 | $3,379.52 | $4,996.29 | $3,623.47 | $4,880.59 | $3,271.25 | $2,256.36 | $3,010.11 | $4,005.10 | $2,708.76 | $2,524.62 | $2,518.66 |

| 62243 | $3,379.07 | $4,744.46 | $3,955.39 | $4,568.42 | $2,844.43 | $2,379.39 | $3,754.85 | $4,119.61 | $2,314.31 | $2,560.64 | $2,549.19 |

| 60183 | $3,374.40 | $5,464.55 | $3,598.36 | $4,576.92 | $2,889.63 | $2,359.45 | $2,039.71 | $3,747.72 | $2,325.07 | $4,214.30 | $2,528.30 |

| 60144 | $3,373.93 | $5,464.55 | $3,679.46 | $4,599.22 | $2,381.53 | $2,481.34 | $2,707.67 | $3,342.06 | $2,325.07 | $4,214.30 | $2,544.15 |

| 60147 | $3,373.93 | $5,464.55 | $3,679.46 | $4,599.22 | $2,381.53 | $2,481.34 | $2,707.67 | $3,342.06 | $2,325.07 | $4,214.30 | $2,544.15 |

| 62931 | $3,373.74 | $5,443.83 | $3,932.71 | $4,688.23 | $2,981.93 | $2,212.86 | $3,066.25 | $3,846.02 | $2,453.07 | $2,298.42 | $2,814.06 |

| 62918 | $3,371.71 | $4,793.39 | $3,882.75 | $4,599.86 | $2,981.93 | $2,252.98 | $4,260.26 | $3,486.97 | $2,261.83 | $2,479.28 | $2,717.83 |

| 62822 | $3,371.49 | $5,103.71 | $3,720.69 | $4,534.45 | $2,981.93 | $2,252.98 | $4,260.26 | $3,542.18 | $2,272.72 | $2,328.20 | $2,717.83 |

| 60123 | $3,371.06 | $5,289.22 | $3,735.89 | $5,036.71 | $3,057.65 | $2,378.88 | $2,197.15 | $3,976.63 | $2,845.19 | $2,665.01 | $2,528.30 |

| 60910 | $3,369.97 | $5,752.90 | $3,624.10 | $4,962.92 | $2,694.70 | $2,229.52 | $3,128.77 | $3,501.22 | $2,562.94 | $2,514.78 | $2,727.84 |

| 60126 | $3,369.74 | $5,605.21 | $3,735.89 | $4,686.12 | $3,312.41 | $2,283.96 | $2,793.85 | $3,429.79 | $2,573.72 | $2,598.81 | $2,677.63 |

| 60181 | $3,369.32 | $5,335.78 | $3,735.89 | $4,770.59 | $3,208.12 | $2,348.38 | $2,793.85 | $3,630.08 | $2,614.00 | $2,551.33 | $2,705.21 |

| 62865 | $3,368.17 | $5,103.71 | $3,666.63 | $4,539.39 | $2,981.93 | $2,195.25 | $4,260.26 | $3,658.32 | $2,289.22 | $2,269.12 | $2,717.83 |

| 62982 | $3,368.15 | $5,443.83 | $3,878.89 | $4,688.23 | $2,981.93 | $2,212.86 | $3,066.25 | $3,836.15 | $2,466.92 | $2,292.37 | $2,814.06 |

| 60044 | $3,367.45 | $5,348.50 | $3,649.35 | $4,934.24 | $3,176.84 | $2,263.00 | $3,005.23 | $3,406.65 | $2,571.34 | $2,781.47 | $2,537.93 |

| 62272 | $3,365.34 | $5,103.71 | $4,014.11 | $4,521.65 | $2,981.93 | $2,134.67 | $3,754.85 | $3,833.57 | $2,368.24 | $2,267.85 | $2,672.80 |

| 62921 | $3,364.07 | $4,745.94 | $3,901.13 | $4,489.02 | $2,981.93 | $2,252.98 | $4,260.26 | $3,537.28 | $2,337.61 | $2,416.72 | $2,717.83 |

| 62928 | $3,364.02 | $5,443.83 | $3,745.79 | $4,617.43 | $2,981.93 | $2,238.35 | $3,066.25 | $4,070.20 | $2,337.61 | $2,324.77 | $2,814.06 |

| 62289 | $3,363.97 | $5,092.30 | $3,955.39 | $4,647.72 | $2,844.43 | $2,216.07 | $3,899.41 | $3,682.89 | $2,247.47 | $2,438.35 | $2,615.64 |

| 62884 | $3,363.40 | $5,103.71 | $3,745.79 | $4,473.17 | $2,981.93 | $2,252.98 | $4,260.26 | $3,538.97 | $2,307.55 | $2,251.86 | $2,717.83 |

| 60964 | $3,363.05 | $5,675.57 | $3,624.10 | $4,830.02 | $2,694.70 | $2,229.52 | $3,128.77 | $3,500.12 | $2,658.23 | $2,561.65 | $2,727.84 |

| 60515 | $3,362.94 | $5,237.55 | $3,582.86 | $4,702.31 | $3,312.41 | $2,245.64 | $2,963.75 | $3,735.94 | $2,512.76 | $2,630.94 | $2,705.21 |

| 60956 | $3,362.76 | $5,313.70 | $3,624.10 | $4,475.16 | $2,694.70 | $2,004.23 | $3,128.77 | $3,229.18 | $2,075.25 | $4,214.30 | $2,868.24 |

| 62919 | $3,362.57 | $5,443.83 | $3,932.71 | $4,688.23 | $2,981.93 | $2,212.86 | $3,066.25 | $3,784.76 | $2,419.90 | $2,281.19 | $2,814.06 |

| 60067 | $3,362.26 | $5,479.10 | $4,060.57 | $4,898.80 | $2,860.06 | $2,392.83 | $2,383.05 | $3,789.20 | $2,696.01 | $2,626.81 | $2,436.14 |

| 62292 | $3,361.77 | $5,103.71 | $3,985.11 | $4,808.84 | $2,981.93 | $2,354.67 | $3,483.32 | $3,641.51 | $2,244.38 | $2,341.39 | $2,672.80 |

| 62237 | $3,361.76 | $5,031.58 | $4,114.28 | $4,389.20 | $2,981.93 | $2,335.40 | $3,483.32 | $3,813.06 | $2,322.68 | $2,473.31 | $2,672.80 |

| 62022 | $3,361.09 | $5,669.14 | $3,607.90 | $4,555.94 | $2,568.13 | $2,383.38 | $3,386.68 | $3,591.08 | $2,317.72 | $2,742.90 | $2,788.03 |

| 60914 | $3,359.38 | $5,752.90 | $3,550.25 | $4,918.69 | $3,073.62 | $2,269.34 | $3,300.61 | $3,167.07 | $2,351.30 | $2,482.20 | $2,727.84 |

| 62983 | $3,357.79 | $4,793.39 | $3,666.63 | $4,520.53 | $2,981.93 | $2,252.98 | $4,260.26 | $3,724.36 | $2,231.89 | $2,428.05 | $2,717.83 |

| 62037 | $3,354.48 | $5,656.65 | $3,720.69 | $4,520.79 | $2,568.13 | $2,383.38 | $3,386.68 | $3,653.19 | $2,298.65 | $2,606.58 | $2,750.09 |

| 60585 | $3,353.80 | $5,035.13 | $3,735.89 | $4,812.35 | $3,271.25 | $2,547.01 | $2,355.39 | $3,852.50 | $2,665.98 | $2,695.31 | $2,567.22 |

| 60031 | $3,353.58 | $5,348.61 | $3,649.35 | $4,859.87 | $3,176.84 | $2,487.30 | $2,763.97 | $3,577.73 | $2,524.95 | $2,652.95 | $2,494.21 |

| 62252 | $3,352.40 | $4,407.16 | $3,720.69 | $4,228.98 | $2,981.93 | $2,492.79 | $3,483.32 | $3,108.53 | $2,134.29 | $4,214.30 | $2,752.01 |

| 62954 | $3,348.70 | $5,443.83 | $3,932.71 | $4,529.15 | $2,981.93 | $2,212.86 | $3,066.25 | $3,759.27 | $2,339.88 | $2,407.06 | $2,814.06 |

| 60042 | $3,347.34 | $5,338.99 | $3,646.48 | $4,933.00 | $3,176.84 | $2,476.77 | $2,625.54 | $3,396.25 | $2,617.15 | $2,583.53 | $2,678.84 |

| 60421 | $3,343.61 | $5,313.70 | $3,775.09 | $4,683.68 | $3,065.78 | $2,343.25 | $2,632.39 | $3,726.48 | $2,549.14 | $2,618.76 | $2,727.84 |

| 62974 | $3,343.10 | $5,110.48 | $3,901.13 | $4,628.63 | $2,981.93 | $2,245.90 | $3,066.25 | $3,782.84 | $2,439.30 | $2,583.60 | $2,690.99 |

| 60143 | $3,343.10 | $5,309.18 | $3,765.61 | $4,950.66 | $3,269.41 | $2,274.75 | $2,462.51 | $3,766.84 | $2,421.83 | $2,615.54 | $2,594.68 |

| 62955 | $3,342.82 | $5,581.05 | $3,985.11 | $4,688.23 | $2,981.93 | $2,140.96 | $3,066.25 | $3,524.65 | $2,337.61 | $2,308.33 | $2,814.06 |

| 60008 | $3,342.55 | $5,435.12 | $4,060.57 | $4,886.69 | $2,860.06 | $2,432.66 | $2,383.05 | $3,567.23 | $2,581.60 | $2,607.47 | $2,611.07 |

| 62006 | $3,341.97 | $5,141.03 | $3,745.79 | $4,529.15 | $2,568.13 | $2,334.27 | $2,812.28 | $4,697.34 | $2,220.49 | $2,621.10 | $2,750.09 |

| 62225 | $3,341.34 | $4,744.46 | $3,882.75 | $4,559.61 | $2,844.43 | $2,587.59 | $3,754.85 | $3,415.78 | $2,347.82 | $2,766.80 | $2,509.28 |

| 62984 | $3,341.27 | $5,443.83 | $3,932.71 | $4,661.58 | $2,981.93 | $2,232.17 | $3,066.25 | $3,689.03 | $2,308.76 | $2,282.34 | $2,814.06 |

| 62065 | $3,339.99 | $5,141.03 | $3,985.11 | $4,529.15 | $2,568.13 | $2,322.88 | $2,812.28 | $4,679.66 | $2,206.69 | $2,404.92 | $2,750.09 |

| 61102 | $3,339.72 | $5,182.15 | $3,921.53 | $4,908.35 | $2,733.07 | $2,350.54 | $2,416.44 | $3,808.10 | $2,802.97 | $2,510.00 | $2,764.05 |

| 60084 | $3,339.58 | $5,339.38 | $3,729.62 | $4,585.25 | $3,176.84 | $2,402.50 | $2,625.54 | $3,730.12 | $2,433.07 | $2,879.29 | $2,494.21 |

| 62255 | $3,339.51 | $4,744.46 | $4,114.28 | $4,564.07 | $2,844.43 | $2,477.36 | $3,754.85 | $3,642.72 | $2,247.47 | $2,456.26 | $2,549.19 |

| 62282 | $3,339.31 | $5,092.30 | $4,014.11 | $4,609.09 | $2,844.43 | $2,313.63 | $3,754.85 | $3,519.77 | $2,247.47 | $2,448.23 | $2,549.19 |

| 60468 | $3,338.12 | $5,445.07 | $3,775.09 | $4,769.15 | $2,694.70 | $2,173.91 | $3,128.77 | $3,569.20 | $2,456.51 | $2,640.95 | $2,727.84 |

| 62047 | $3,337.29 | $5,141.03 | $3,745.79 | $4,529.15 | $2,568.13 | $2,363.18 | $2,812.28 | $4,784.07 | $2,177.30 | $2,501.90 | $2,750.09 |

| 62045 | $3,336.33 | $5,141.03 | $3,720.69 | $4,529.15 | $2,568.13 | $2,322.88 | $2,812.28 | $4,841.60 | $2,206.69 | $2,470.77 | $2,750.09 |

| 60148 | $3,334.98 | $5,206.36 | $3,623.47 | $4,595.34 | $3,312.41 | $2,268.60 | $2,793.85 | $3,597.48 | $2,524.82 | $2,578.21 | $2,849.24 |

| 60030 | $3,334.50 | $5,339.28 | $3,623.47 | $4,800.29 | $3,176.84 | $2,460.33 | $2,641.11 | $3,610.13 | $2,532.99 | $2,666.36 | $2,494.21 |

| 60172 | $3,334.17 | $5,307.99 | $3,900.29 | $4,996.30 | $2,860.06 | $2,422.82 | $2,462.51 | $3,664.65 | $2,508.30 | $2,574.59 | $2,644.21 |

| 60110 | $3,332.57 | $5,467.04 | $3,661.54 | $4,845.28 | $3,057.65 | $2,420.22 | $2,135.56 | $4,060.52 | $2,635.48 | $2,597.32 | $2,445.08 |

| 62098 | $3,332.45 | $5,141.03 | $3,578.19 | $4,227.75 | $2,568.13 | $2,305.84 | $2,812.28 | $3,614.93 | $2,111.94 | $4,214.30 | $2,750.09 |

| 60005 | $3,332.14 | $5,433.02 | $3,900.29 | $4,928.15 | $2,860.06 | $2,316.51 | $2,520.60 | $3,680.43 | $2,483.88 | $2,587.42 | $2,611.07 |

| 60915 | $3,327.87 | $5,752.90 | $3,598.36 | $4,715.79 | $3,073.62 | $2,269.34 | $3,300.61 | $3,036.26 | $2,342.32 | $2,461.65 | $2,727.84 |

| 62979 | $3,327.37 | $5,443.83 | $3,985.11 | $4,661.58 | $2,981.93 | $2,212.86 | $3,066.25 | $3,702.66 | $2,246.79 | $2,158.66 | $2,814.06 |

| 62825 | $3,326.15 | $5,103.71 | $3,666.63 | $4,588.14 | $2,981.93 | $2,026.15 | $4,260.26 | $3,274.57 | $2,337.61 | $2,304.66 | $2,717.83 |

| 61108 | $3,326.09 | $5,496.48 | $3,582.86 | $4,697.90 | $2,733.07 | $2,269.95 | $2,416.44 | $4,292.47 | $2,493.06 | $2,515.18 | $2,763.53 |

| 62917 | $3,324.68 | $5,110.48 | $3,878.89 | $4,661.58 | $2,981.93 | $2,295.30 | $3,066.25 | $3,707.77 | $2,373.59 | $2,356.98 | $2,814.06 |

| 62703 | $3,324.43 | $5,576.49 | $3,661.54 | $4,701.01 | $2,882.06 | $2,155.84 | $2,705.48 | $3,709.19 | $2,424.83 | $2,715.45 | $2,712.42 |

| 62874 | $3,324.18 | $4,745.94 | $3,720.69 | $4,547.04 | $2,981.93 | $2,295.53 | $4,260.26 | $3,274.57 | $2,337.61 | $2,387.30 | $2,690.99 |

| 62249 | $3,321.23 | $4,974.59 | $3,955.39 | $4,519.91 | $2,844.43 | $2,271.82 | $3,483.32 | $3,589.27 | $2,215.69 | $2,384.88 | $2,972.99 |

| 62257 | $3,320.16 | $4,744.46 | $4,014.11 | $4,564.07 | $2,844.43 | $2,477.36 | $3,754.85 | $3,555.68 | $2,264.24 | $2,433.26 | $2,549.19 |

| 60081 | $3,319.78 | $5,419.87 | $3,749.02 | $5,029.60 | $2,614.10 | $2,206.65 | $2,617.63 | $3,465.69 | $2,623.70 | $2,742.03 | $2,729.53 |

| 60448 | $3,318.75 | $5,186.68 | $3,749.02 | $4,604.07 | $3,151.53 | $2,284.30 | $2,736.01 | $3,539.24 | $2,561.12 | $2,589.11 | $2,786.39 |