Best California Car Insurance (2024)

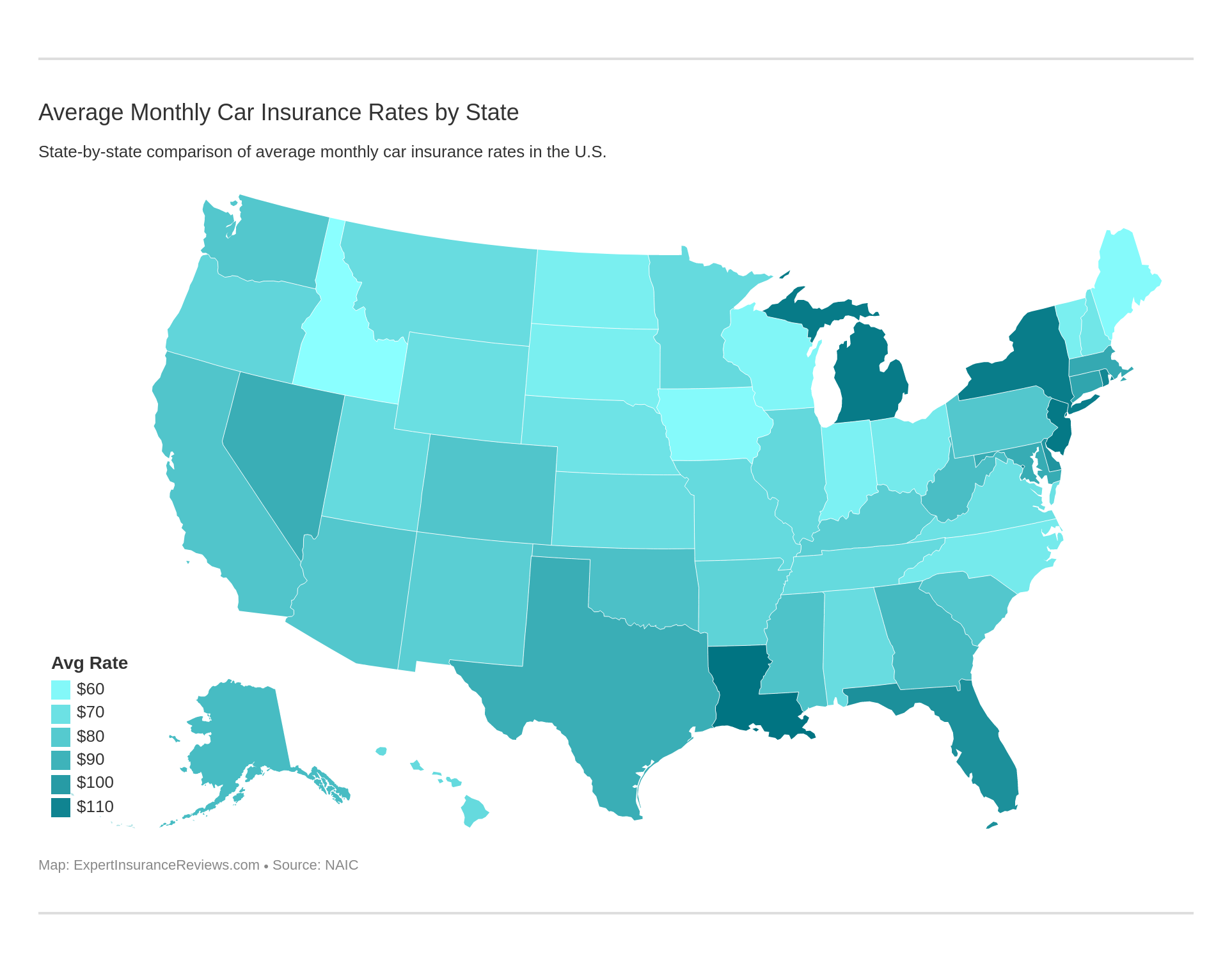

Despite a reputation for being expensive, California car insurance rates actually match the national average. At $145 per month for full coverage, finding affordable California car insurance is usually easy. Geico, Mercury, and Progressive are some of the best California car insurance companies.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Zach Fagiano

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Licensed Insurance Broker

UPDATED: Apr 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Apr 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| California Statistics Summary | Details |

|---|---|

| Road Miles | 225,531 |

| Registered Vehicles | 27,872,875 |

| Vehicle Thefts | 151,852 |

| State Population | 39,557,045 |

| Most Popular Vehicle | Honda Civic |

| Uninsured Motorists | 15.2% |

| Driving Fatalities | 3,602 |

| Full Coverage Average Annual Premiums | $986.79 |

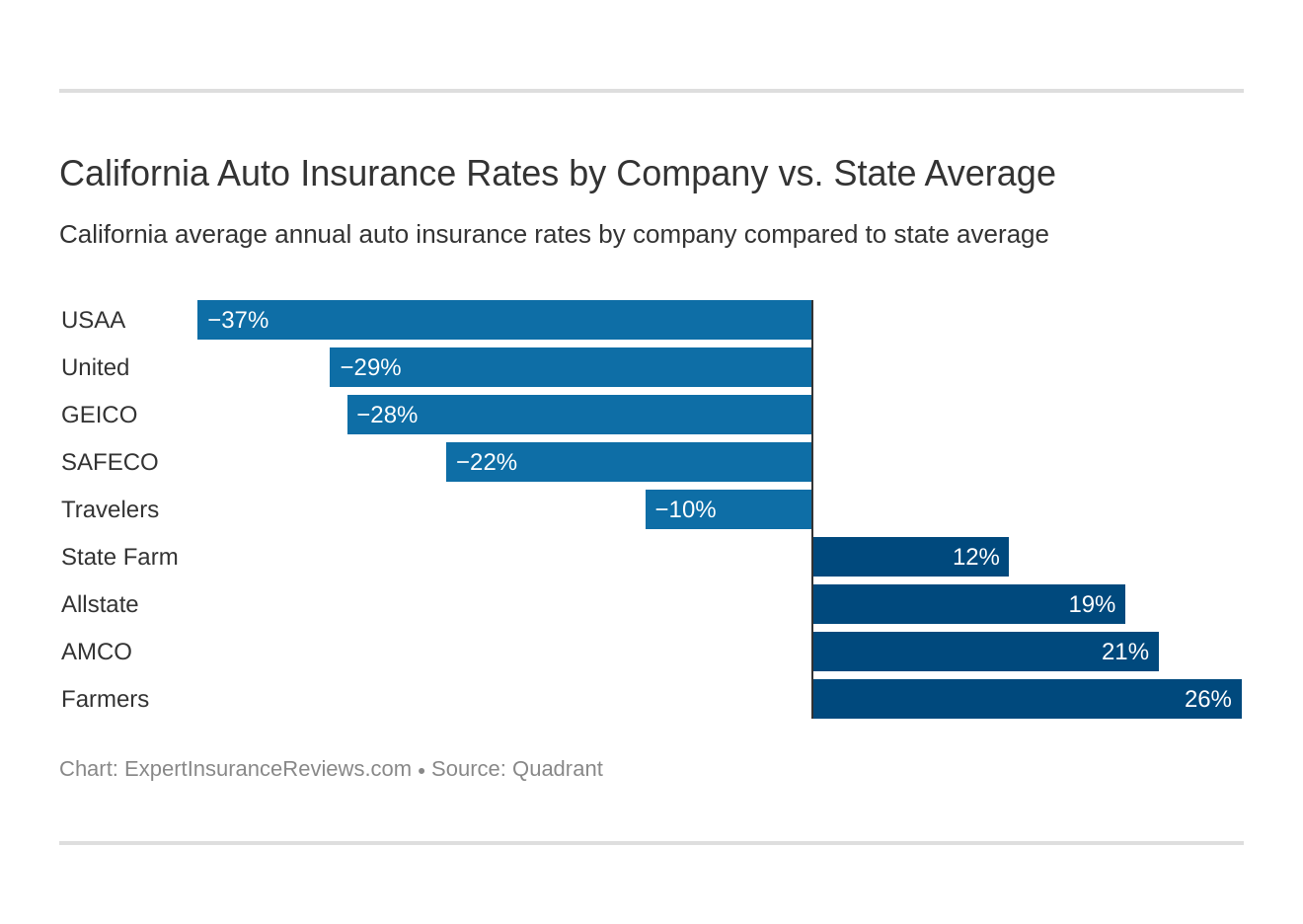

| Cheapest Provider | USAA |

- Despite having a reputation for expensive coverage, California car insurance rates actually match the national average

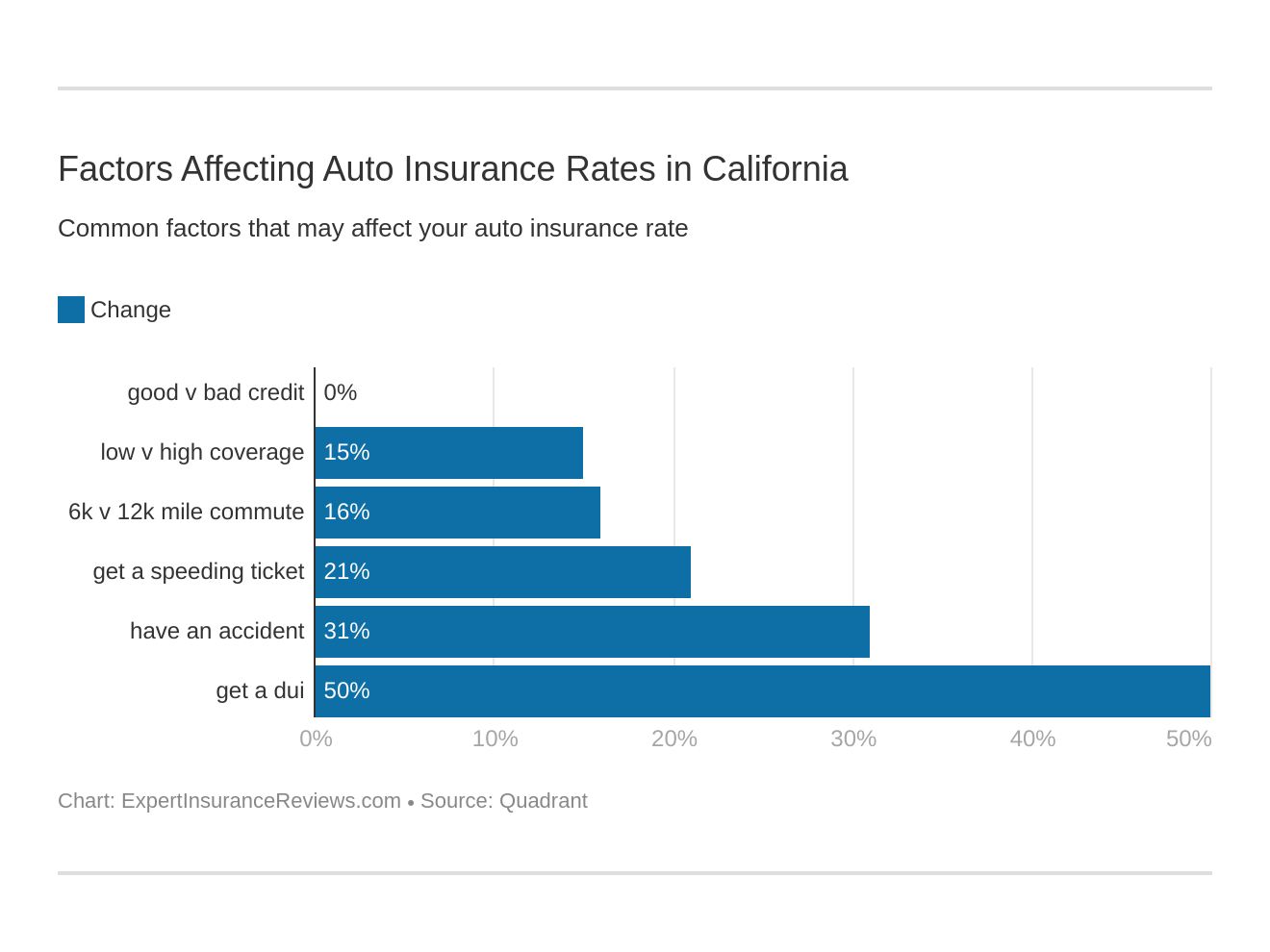

- While many factors affect car insurance prices, California rates are impacted by heavy traffic, vehicle crime rates, and accidents

- Geico, Mercury, and Progressive tend to be the cheapest California car insurance companies, but you may find a lower personalized quote elsewhere

Despite most things being expensive in the Golden State, California car insurance rates tend to be affordable. In fact, they usually match the national average for both minimum insurance and full coverage policies.

However, not all areas in California share such low rates. For example, Los Angeles residents pay closer to $200 for full coverage, while drivers in San Francisco pay an average of $166.

To find the best California car insurance prices no matter where you live, you’ll need to research your options and compare quotes. Explore everything you need to know about car insurance in California below, then compare quotes from multiple companies to find the right policy for you.

Best California Car Insurance Coverage and Rates

California requires that everyone is financially responsible for injuries and damage they might have caused in a car accident. Most car insurance policies meet this requirement, but also offer drivers a lot of other coverage options.

This is when things get confusing. Do you need comprehensive or liability? What if your car gets stolen? What if you’re at fault? These questions are tough to ask, and sometimes, the answer can be hard to find.

This section will show the majority of coverage and the best options for you. It will also assure you know what you legally have to have, and how to customize policies to fit your needs.

Unfortunately, California is on the high end for uninsured drivers.

Now, this could be a simple case of the sheer number of people in the state, but you need to be careful and choose your insurance correctly.

California Minimum Coverage

Californians are legally required to carry, at minimum, liability insurance that covers:

- $15,000 for injury/death to one person

- $30,000 for injury/death to more than one person

- $5,000 for damage to property

California is an “at fault” state. This means that drivers are responsible for anything that incurs from an accident they caused. Because of the strict financial responsibility laws, most Californians end up choosing liability coverage.

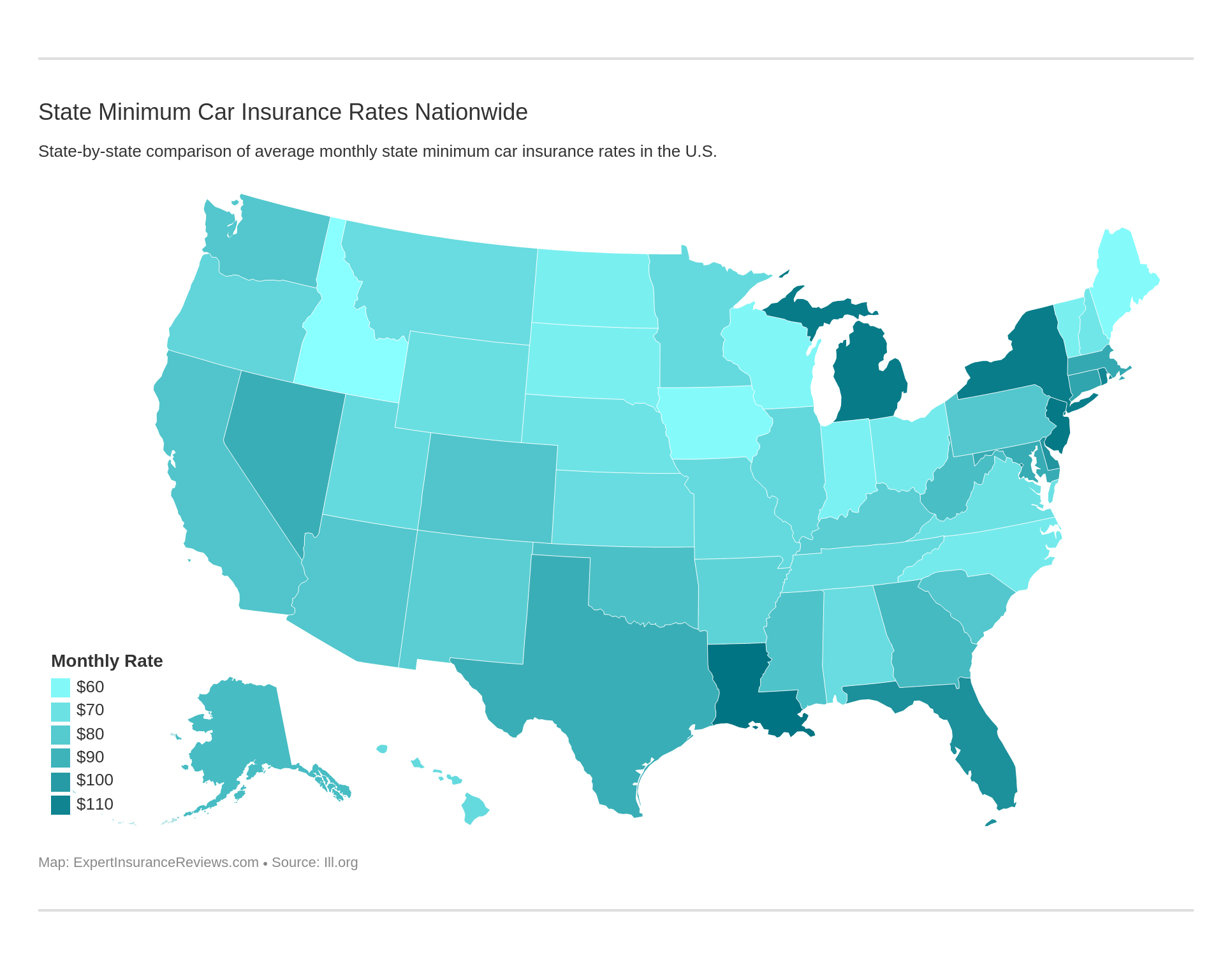

Minimum coverage costs vary from state to state.

Forms of Financial Responsibility

The California Financial Responsibility Law requires that every driver or owner of a vehicle must maintain financial responsibility (liability coverage) at all times. There are four different forms of financial obligation:

- A motor vehicle liability insurance policy

- A deposit of $35,000 with DMV

- A surety bond for $35,000 obtained from a company licensed to do business in California

- A DMV-issued self-insurance certificate.

You must possess evidence of financial responsibility whenever you drive. California is also a state where you must show your proof of insurance if you are pulled over. If you do not find one, you may have to pay a fine or have your vehicle impounded if you do not comply with this law.

California also has a weird rule when just moving to or visiting the state. Some out of state companies don’t cover anything in the state of California, so be careful if you’re visiting.

Premiums as a Percentage of Income

California car insurance is most certainly on the high end, but so is their cost of living, and annual income. Which means that your insurance policy is only around 2.16 percent of your yearly salary.

That is about the middle of the pack for the nation.

| California Average Premium & Percentage of Income | Average Annual Rates | Average Disposable Income | Insurance as Percentage of Income |

|---|---|---|---|

| 2012 | $891.68 | $42,451.00 | 2.10% |

| 2013 | $922.69 | $41,945.00 | 2.20% |

| 2014 | $951.75 | $43,978.00 | 2.16% |

Average Monthly Car Insurance Rates in CA (Liability, Collision, Comprehensive)

Core coverage is simply the basics of the type of policy you get. There are three different kinds of core coverage; liability, comprehensive, and collision. As stated before, Californians must have at least liability insurance. Here’s what you need to know.

| Core Coverage | Annual Costs 2015 (California) | Annual Costs 2015 (Nation) |

|---|---|---|

| Liability | $489.66 | $538.73 |

| Collision | $396.55 | $322.61 |

| Comprehensive | $100.54 | $148.04 |

| Combined | $986.75 | $1009.38 |

In comparison, California’s averages are about average compared to the rest of the nation. Knowing the prices can now help you figure out which is the best fit.

Additional Liability

California has a few different additional liability pieces that you can add to your coverage. They aren’t required or needed, but they certainly protect you in case of something happening. The add-ons for your coverage are uninsured motorist protection, medical payments, and personal injury protection.

All the additional liability you can purchase are important, but especially uninsured motorist protection.

Ranking 12th in the nation for uninsured motorists, California can be a dangerous place to be a driver. If you get in a wreck with someone that is uninsured, and you don’t have protection; there could be hazardous medical bills.

Add-ons, Endorsements, and Riders

Here’s a list of the many available add-ons. Not all insurance companies will offer this entire list to you. This is so that they can make more money off you in the long run. Car insurance is a delicate business; knowing everything you can have is very important.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance

Most major insurance companies offer some form of usage-based insurance program. These allow you to earn a discount based on your driving habits. Even a ten-dollar break is always nice on car insurance, so know what you need and drive safely so you can get those discounts.

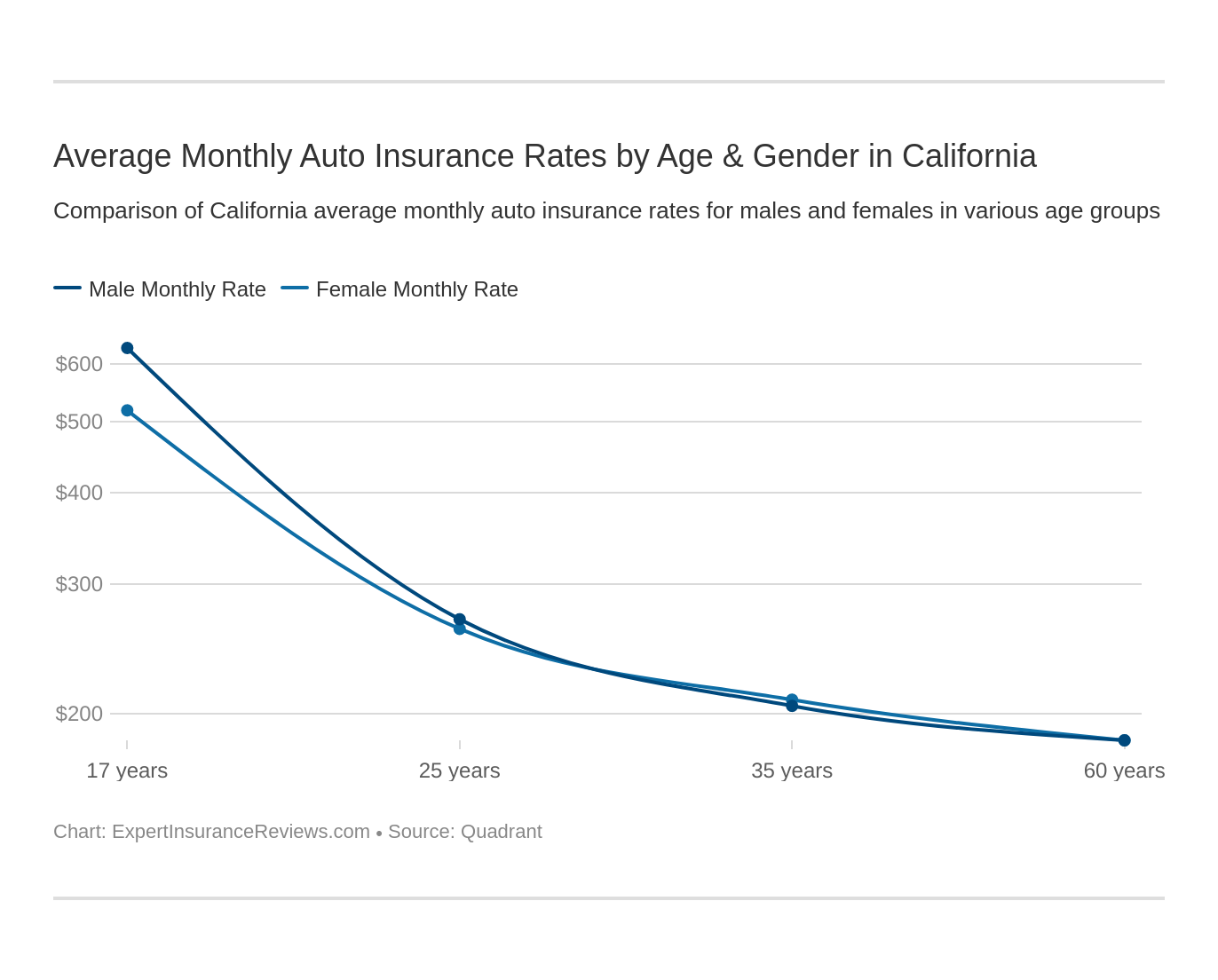

Average Car Insurance Rates by Age & Gender in CA

That old stereotype that men are better drivers than women is quickly retrieving into the past. The coverage rates for women are actually lower in almost every case.

| Company | 17 Year Old Male Annual Rates | 17 Year Old Female Annual Rates | 35 Year Old Male Annual Rates | 35 Year Old Female Annual Rates | 60 Year Old Male Annual Rates | 60 Year Old Female Annual Rates |

|---|---|---|---|---|---|---|

| Farmers | $14,189.14 | $8,667.08 | $2,715.31 | $2,715.31 | $2,451.83 | $2,451.83 |

| State Farm | $7,555.39 | $6,089.50 | $3,310.18 | $3,310.18 | $2,957.44 | $2,957.44 |

| Geico | $5,529.48 | $5,433.56 | $2,624.98 | $2,566.22 | n/a | n/a |

As you can see, no matter what age, female insurance rates are a few hundred dollars lower a year on average.

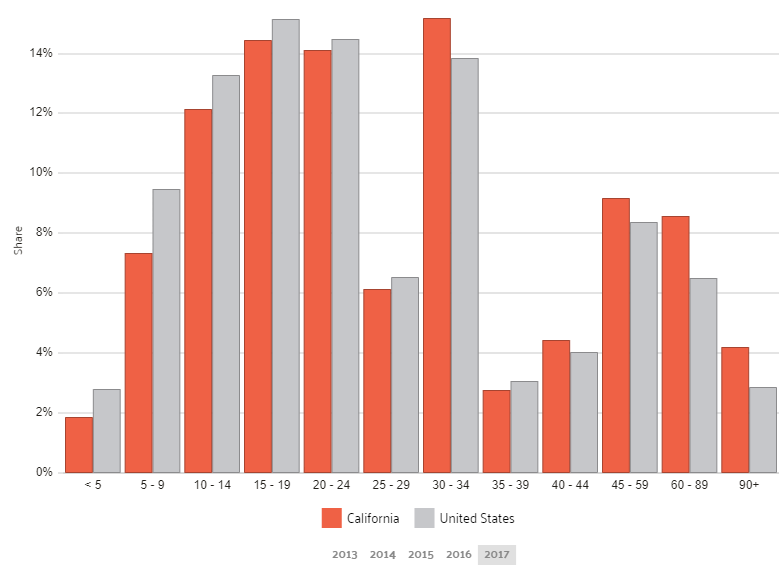

While gender doesn’t seem to matter at all, age certainly does to insurance companies. Teens and older people are always charged the most.

This is genuinely based off of statistics, though. According to the Department of Motor Vehicles, teens pay more simply because they are inexperienced and 15-20 percent more likely to get in an accident, receive a ticket, and speed.

| Company | Married 35 Year Old Male Annual Rates | Married 35 Year Old Female Annual Rates | Single 17 Year Old Male Annual Rates | Single 17 Year Old Female Annual Rates |

|---|---|---|---|---|

| Allstate | $2,923.87 | $2,924.21 | $10,188.73 | $8,098.88 |

| State Farm | $3,310.18 | $3,310.18 | $7,555.59 | $6,089.50 |

| USAA | $2,523.86 | $2,670.51 | $4,428.03 | $4,404.58 |

| Geico | $2,566.22 | $2,624.98 | $5,529.48 | $5,443.56 |

Ass you can see if you’re a 17-year-old female you are going to be paying a lot of money when you first get insurance. Be careful who you choose to go with.

Read more: Average Car Insurance Cost by Age

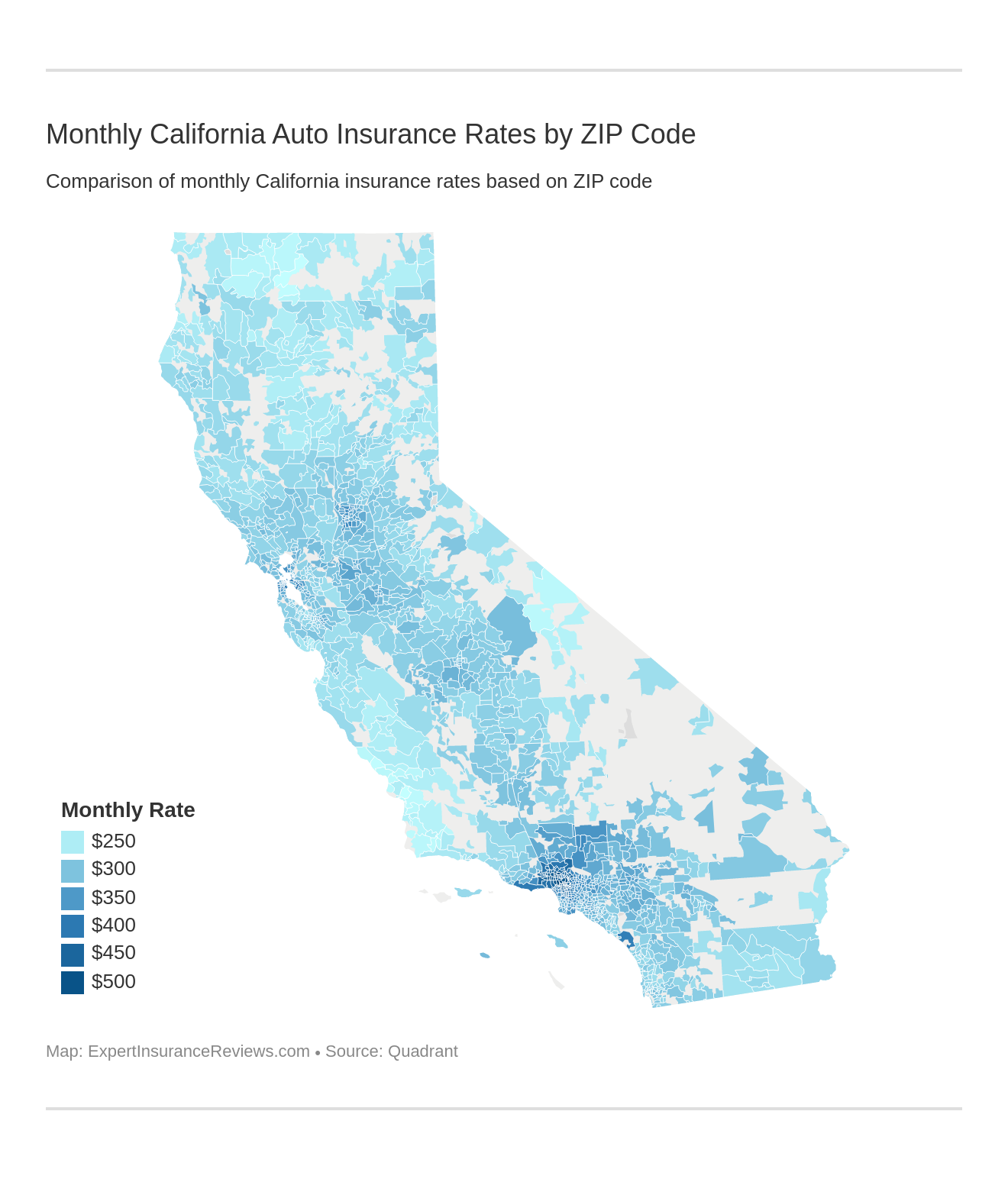

Cheapest Rates By Zip Code

California is a huge area. Bigger than all countries but 34 in the entire world. With that big of a range of zip codes and counties, the insurance ranges in prices.

If you live in the hills of Beverly, you might pay more than if you live in the Northern mountain ranges. If you’re thinking of moving to the California Republic, you may want to revisit where correctly in California you’re moving.

Here is every zip code in the state broken down by the average annual rate.

| California Rates by Zip-code | Annual Average |

|---|---|

| 90210 | $6,324.83 |

| 91606 | $6,219.57 |

| 90010 | $6,201.00 |

| 90211 | $6,199.34 |

| 91405 | $6,198.55 |

| 90020 | $6,132.45 |

| 91203 | $6,086.65 |

| 91401 | $6,073.88 |

| 90028 | $6,063.25 |

| 90038 | $6,048.15 |

| 90046 | $6,045.78 |

| 90212 | $6,041.05 |

| 90005 | $6,040.60 |

| 91605 | $6,034.64 |

| 91204 | $6,015.40 |

| 91205 | $5,990.19 |

| 90029 | $5,934.84 |

| 90004 | $5,928.00 |

| 90017 | $5,898.72 |

| 90027 | $5,897.67 |

| 90057 | $5,894.37 |

| 90077 | $5,878.05 |

| 90048 | $5,877.67 |

| 91201 | $5,847.26 |

| 90069 | $5,844.28 |

| 90006 | $5,830.77 |

| 91316 | $5,825.87 |

| 90014 | $5,819.12 |

| 90015 | $5,806.35 |

| 91356 | $5,798.47 |

| 90067 | $5,749.48 |

| 90019 | $5,739.39 |

| 90068 | $5,738.96 |

| 91607 | $5,718.12 |

| 90036 | $5,711.58 |

| 90024 | $5,706.63 |

| 91402 | $5,701.66 |

| 90007 | $5,679.02 |

| 91411 | $5,676.64 |

| 91601 | $5,670.35 |

| 91436 | $5,663.41 |

| 91604 | $5,649.18 |

| 91202 | $5,642.71 |

| 91406 | $5,642.30 |

| 90035 | $5,610.53 |

| 90018 | $5,597.18 |

| 91335 | $5,593.76 |

| 90016 | $5,573.32 |

| 91403 | $5,565.61 |

| 91423 | $5,558.78 |

| 90012 | $5,520.39 |

| 90062 | $5,501.76 |

| 90013 | $5,454.89 |

| 91206 | $5,447.70 |

| 91330 | $5,446.30 |

| 90037 | $5,430.76 |

| 91325 | $5,400.04 |

| 90026 | $5,393.82 |

| 91364 | $5,390.74 |

| 90079 | $5,369.47 |

| 91303 | $5,362.97 |

| 91608 | $5,348.81 |

| 90008 | $5,341.80 |

| 90021 | $5,334.90 |

| 91501 | $5,332.30 |

| 91306 | $5,326.45 |

| 90049 | $5,320.52 |

| 90089 | $5,316.97 |

| 91502 | $5,305.62 |

| 90071 | $5,300.05 |

| 91352 | $5,297.48 |

| 91302 | $5,293.70 |

| 91343 | $5,268.19 |

| 90003 | $5,266.11 |

| 90044 | $5,253.13 |

| 91304 | $5,250.62 |

| 91367 | $5,230.29 |

| 91207 | $5,223.53 |

| 90043 | $5,210.76 |

| 91324 | $5,206.37 |

| 91344 | $5,200.11 |

| 91042 | $5,190.92 |

| 91602 | $5,152.86 |

| 90272 | $5,149.35 |

| 91610 | $5,147.43 |

| 90058 | $5,132.45 |

| 90011 | $5,123.44 |

| 90402 | $5,114.26 |

| 91331 | $5,113.69 |

| 90047 | $5,102.20 |

| 90025 | $5,101.69 |

| 90290 | $5,094.64 |

| 90034 | $5,046.01 |

| 91208 | $5,044.17 |

| 91326 | $5,041.03 |

| 91307 | $5,032.92 |

| 91504 | $5,025.73 |

| 90002 | $5,023.86 |

| 90302 | $5,010.92 |

| 91311 | $4,992.36 |

| 90064 | $4,940.19 |

| 90222 | $4,902.39 |

| 91345 | $4,898.04 |

| 91371 | $4,897.70 |

| 90305 | $4,883.07 |

| 90061 | $4,877.19 |

| 90401 | $4,877.15 |

| 91342 | $4,875.37 |

| 90001 | $4,873.83 |

| 90039 | $4,857.59 |

| 90059 | $4,852.39 |

| 91214 | $4,847.27 |

| 90292 | $4,843.02 |

| 90033 | $4,833.34 |

| 91046 | $4,824.60 |

| 90065 | $4,813.03 |

| 90056 | $4,805.96 |

| 90403 | $4,800.91 |

| 94621 | $4,799.97 |

| 90404 | $4,799.60 |

| 90311 | $4,794.76 |

| 94124 | $4,789.09 |

| 90031 | $4,785.32 |

| 94134 | $4,766.35 |

| 90301 | $4,765.70 |

| 90265 | $4,759.04 |

| 91340 | $4,737.16 |

| 90073 | $4,708.31 |

| 91210 | $4,707.46 |

| 91020 | $4,696.49 |

| 90041 | $4,666.21 |

| 90291 | $4,651.08 |

| 94607 | $4,649.33 |

| 91040 | $4,643.20 |

| 94601 | $4,637.99 |

| 94612 | $4,636.75 |

| 92055 | $4,634.92 |

| 90303 | $4,630.78 |

| 90042 | $4,615.40 |

| 90232 | $4,599.58 |

| 94606 | $4,599.17 |

| 90405 | $4,598.47 |

| 94102 | $4,586.68 |

| 94132 | $4,580.68 |

| 94603 | $4,578.40 |

| 91505 | $4,576.14 |

| 90066 | $4,564.51 |

| 90032 | $4,559.47 |

| 91506 | $4,551.62 |

| 90220 | $4,548.87 |

| 91801 | $4,515.46 |

| 90221 | $4,503.89 |

| 94130 | $4,490.38 |

| 94112 | $4,484.39 |

| 91011 | $4,472.37 |

| 94103 | $4,469.22 |

| 90063 | $4,461.96 |

| 90250 | $4,456.59 |

| 94104 | $4,447.61 |

| 94108 | $4,439.54 |

| 91104 | $4,435.95 |

| 94133 | $4,435.59 |

| 90255 | $4,431.12 |

| 90230 | $4,429.05 |

| 91804 | $4,428.92 |

| 90813 | $4,427.63 |

| 91030 | $4,426.81 |

| 91103 | $4,425.07 |

| 95824 | $4,406.95 |

| 93552 | $4,406.88 |

| 91101 | $4,404.49 |

| 91776 | $4,401.03 |

| 94121 | $4,400.34 |

| 91803 | $4,397.59 |

| 95838 | $4,395.70 |

| 91107 | $4,393.61 |

| 94116 | $4,393.03 |

| 90094 | $4,390.86 |

| 91001 | $4,389.92 |

| 90262 | $4,385.00 |

| 94613 | $4,384.32 |

| 94115 | $4,381.44 |

| 90304 | $4,367.52 |

| 90023 | $4,352.96 |

| 95823 | $4,351.93 |

| 90280 | $4,348.09 |

| 91301 | $4,346.08 |

| 91732 | $4,340.65 |

| 91106 | $4,338.86 |

| 91105 | $4,338.65 |

| 91731 | $4,338.65 |

| 95828 | $4,338.56 |

| 95652 | $4,336.17 |

| 90240 | $4,328.98 |

| 90201 | $4,325.49 |

| 94118 | $4,322.88 |

| 91755 | $4,319.36 |

| 95815 | $4,316.00 |

| 94615 | $4,315.96 |

| 93550 | $4,315.73 |

| 94801 | $4,305.82 |

| 94109 | $4,304.23 |

| 90802 | $4,304.12 |

| 91006 | $4,301.82 |

| 94608 | $4,299.34 |

| 91387 | $4,295.39 |

| 90040 | $4,290.66 |

| 95660 | $4,287.56 |

| 91733 | $4,282.95 |

| 91007 | $4,282.81 |

| 92278 | $4,282.39 |

| 94110 | $4,279.74 |

| 95673 | $4,279.42 |

| 90045 | $4,279.38 |

| 94014 | $4,278.69 |

| 95832 | $4,277.63 |

| 90804 | $4,274.77 |

| 92401 | $4,271.14 |

| 90270 | $4,269.17 |

| 90241 | $4,263.42 |

| 95811 | $4,261.66 |

| 94105 | $4,261.04 |

| 91780 | $4,259.48 |

| 93535 | $4,258.11 |

| 90746 | $4,256.29 |

| 91770 | $4,255.71 |

| 90263 | $4,255.30 |

| 90249 | $4,253.47 |

| 94122 | $4,252.60 |

| 91108 | $4,251.95 |

| 91381 | $4,249.75 |

| 94111 | $4,244.75 |

| 90640 | $4,236.23 |

| 90806 | $4,232.22 |

| 90805 | $4,228.09 |

| 91748 | $4,227.15 |

| 91775 | $4,225.38 |

| 95202 | $4,225.06 |

| 90731 | $4,223.73 |

| 94617 | $4,223.16 |

| 91706 | $4,221.16 |

| 94605 | $4,216.52 |

| 95841 | $4,215.93 |

| 95814 | $4,214.23 |

| 95820 | $4,200.97 |

| 90723 | $4,198.83 |

| 91382 | $4,193.73 |

| 93591 | $4,188.52 |

| 91754 | $4,188.13 |

| 94806 | $4,185.51 |

| 94123 | $4,182.85 |

| 90293 | $4,181.04 |

| 95833 | $4,180.95 |

| 90602 | $4,177.84 |

| 90247 | $4,176.59 |

| 94127 | $4,176.42 |

| 92135 | $4,168.95 |

| 93543 | $4,168.49 |

| 94129 | $4,167.85 |

| 95834 | $4,167.11 |

| 94107 | $4,163.99 |

| 91351 | $4,162.89 |

| 91023 | $4,149.28 |

| 95829 | $4,149.26 |

| 95817 | $4,148.68 |

| 94114 | $4,145.59 |

| 95843 | $4,144.08 |

| 90022 | $4,138.48 |

| 91789 | $4,138.36 |

| 93532 | $4,133.51 |

| 91383 | $4,129.83 |

| 91746 | $4,129.77 |

| 94619 | $4,127.73 |

| 95836 | $4,126.73 |

| 92410 | $4,126.35 |

| 90706 | $4,124.97 |

| 90621 | $4,120.67 |

| 92403 | $4,116.36 |

| 91321 | $4,115.37 |

| 90242 | $4,112.14 |

| 93534 | $4,110.12 |

| 95605 | $4,106.52 |

| 95827 | $4,106.32 |

| 95842 | $4,105.87 |

| 90639 | $4,105.50 |

| 92844 | $4,101.93 |

| 94804 | $4,099.75 |

| 95825 | $4,096.55 |

| 90703 | $4,095.46 |

| 92411 | $4,094.66 |

| 90710 | $4,094.53 |

| 90747 | $4,093.73 |

| 94131 | $4,092.05 |

| 94117 | $4,091.52 |

| 95822 | $4,086.13 |

| 92377 | $4,085.76 |

| 92408 | $4,081.31 |

| 91792 | $4,080.96 |

| 90261 | $4,074.65 |

| 90701 | $4,072.71 |

| 92376 | $4,069.56 |

| 94158 | $4,068.79 |

| 90715 | $4,068.61 |

| 91377 | $4,067.68 |

| 90260 | $4,066.06 |

| 92833 | $4,065.99 |

| 95816 | $4,063.93 |

| 90660 | $4,061.71 |

| 94188 | $4,059.75 |

| 91745 | $4,059.21 |

| 92405 | $4,055.80 |

| 94710 | $4,053.03 |

| 90623 | $4,051.94 |

| 90248 | $4,050.75 |

| 90840 | $4,050.60 |

| 90831 | $4,049.11 |

| 93551 | $4,048.76 |

| 90606 | $4,048.60 |

| 90744 | $4,047.80 |

| 90716 | $4,046.97 |

| 95206 | $4,038.69 |

| 93553 | $4,034.14 |

| 94805 | $4,033.62 |

| 91123 | $4,032.01 |

| 92335 | $4,031.95 |

| 90833 | $4,031.56 |

| 90834 | $4,031.56 |

| 90835 | $4,031.56 |

| 94720 | $4,031.54 |

| 93721 | $4,030.35 |

| 91765 | $4,029.78 |

| 90601 | $4,028.30 |

| 90822 | $4,028.10 |

| 90755 | $4,027.37 |

| 91791 | $4,027.20 |

| 91722 | $4,027.00 |

| 91744 | $4,024.93 |

| 92804 | $4,021.57 |

| 91790 | $4,021.46 |

| 91708 | $4,019.29 |

| 95821 | $4,018.42 |

| 94702 | $4,015.74 |

| 91758 | $4,015.48 |

| 92841 | $4,014.24 |

| 95835 | $4,012.59 |

| 91764 | $4,010.56 |

| 95818 | $4,010.12 |

| 91768 | $4,008.57 |

| 93606 | $4,008.32 |

| 90670 | $4,007.86 |

| 91010 | $4,005.90 |

| 94609 | $4,005.74 |

| 94850 | $4,004.29 |

| 92407 | $3,993.61 |

| 90605 | $3,991.96 |

| 92325 | $3,991.83 |

| 92321 | $3,987.39 |

| 90506 | $3,985.69 |

| 92404 | $3,985.58 |

| 90502 | $3,984.57 |

| 92337 | $3,983.08 |

| 91354 | $3,981.34 |

| 92801 | $3,979.88 |

| 91702 | $3,979.80 |

| 90680 | $3,979.60 |

| 90732 | $3,979.48 |

| 91350 | $3,976.35 |

| 95608 | $3,975.13 |

| 94602 | $3,974.43 |

| 91767 | $3,973.75 |

| 90275 | $3,968.88 |

| 95351 | $3,967.55 |

| 91024 | $3,967.50 |

| 94590 | $3,966.90 |

| 91724 | $3,963.81 |

| 90501 | $3,960.43 |

| 95830 | $3,956.83 |

| 91766 | $3,954.79 |

| 90650 | $3,954.26 |

| 90810 | $3,954.16 |

| 93701 | $3,953.92 |

| 91384 | $3,952.94 |

| 91008 | $3,952.86 |

| 92553 | $3,952.02 |

| 92301 | $3,951.96 |

| 92378 | $3,951.55 |

| 94128 | $3,949.75 |

| 95234 | $3,944.68 |

| 91390 | $3,944.53 |

| 92336 | $3,942.61 |

| 95354 | $3,941.59 |

| 92683 | $3,940.70 |

| 92843 | $3,940.42 |

| 94578 | $3,939.87 |

| 94703 | $3,939.79 |

| 92655 | $3,938.55 |

| 91362 | $3,936.75 |

| 93510 | $3,936.03 |

| 92318 | $3,935.10 |

| 95864 | $3,934.15 |

| 92317 | $3,933.59 |

| 95122 | $3,933.18 |

| 90745 | $3,931.94 |

| 90604 | $3,931.68 |

| 91016 | $3,931.46 |

| 92391 | $3,928.38 |

| 94015 | $3,928.29 |

| 95210 | $3,927.63 |

| 90630 | $3,926.92 |

| 91355 | $3,926.48 |

| 95205 | $3,926.17 |

| 95610 | $3,925.05 |

| 94803 | $3,924.80 |

| 95742 | $3,920.74 |

| 95837 | $3,920.72 |

| 92316 | $3,919.82 |

| 91723 | $3,917.78 |

| 95111 | $3,917.57 |

| 93544 | $3,915.29 |

| 90807 | $3,913.08 |

| 95121 | $3,912.30 |

| 90712 | $3,911.24 |

| 92571 | $3,908.75 |

| 95192 | $3,908.71 |

| 92570 | $3,907.66 |

| 92382 | $3,907.59 |

| 95113 | $3,907.37 |

| 92507 | $3,905.07 |

| 92394 | $3,904.96 |

| 92802 | $3,903.92 |

| 94544 | $3,903.74 |

| 94704 | $3,902.05 |

| 90274 | $3,901.33 |

| 92551 | $3,900.74 |

| 95670 | $3,900.73 |

| 94592 | $3,899.04 |

| 92840 | $3,897.91 |

| 90638 | $3,897.72 |

| 93536 | $3,896.09 |

| 92703 | $3,893.37 |

| 95655 | $3,889.43 |

| 92395 | $3,887.86 |

| 92358 | $3,887.04 |

| 94541 | $3,886.40 |

| 94509 | $3,884.23 |

| 95624 | $3,883.84 |

| 95621 | $3,881.74 |

| 94575 | $3,881.39 |

| 94066 | $3,880.13 |

| 90504 | $3,879.43 |

| 92504 | $3,879.40 |

| 92501 | $3,878.39 |

| 91730 | $3,878.08 |

| 92503 | $3,877.62 |

| 91762 | $3,875.49 |

| 90631 | $3,875.02 |

| 90717 | $3,874.95 |

| 92555 | $3,873.47 |

| 92352 | $3,870.66 |

| 93563 | $3,869.22 |

| 93702 | $3,867.24 |

| 95628 | $3,867.20 |

| 92258 | $3,866.55 |

| 92392 | $3,865.49 |

| 92521 | $3,863.34 |

| 92557 | $3,862.92 |

| 94564 | $3,862.78 |

| 92134 | $3,862.45 |

| 90603 | $3,858.74 |

| 95358 | $3,858.56 |

| 92704 | $3,858.40 |

| 92805 | $3,858.27 |

| 92324 | $3,858.26 |

| 94589 | $3,855.08 |

| 95148 | $3,854.89 |

| 95212 | $3,853.85 |

| 92354 | $3,852.23 |

| 92341 | $3,851.76 |

| 90814 | $3,851.56 |

| 94920 | $3,851.21 |

| 95116 | $3,850.63 |

| 90620 | $3,850.41 |

| 91709 | $3,849.91 |

| 91743 | $3,849.45 |

| 94080 | $3,849.12 |

| 92322 | $3,846.19 |

| 93706 | $3,844.44 |

| 92505 | $3,842.38 |

| 90245 | $3,841.79 |

| 92262 | $3,839.73 |

| 95356 | $3,838.78 |

| 95328 | $3,835.62 |

| 95207 | $3,834.48 |

| 94957 | $3,834.05 |

| 90278 | $3,833.14 |

| 91739 | $3,832.82 |

| 92385 | $3,831.59 |

| 92345 | $3,831.58 |

| 95357 | $3,830.84 |

| 92240 | $3,829.35 |

| 95203 | $3,828.63 |

| 95826 | $3,827.76 |

| 91361 | $3,826.56 |

| 91763 | $3,824.78 |

| 92369 | $3,824.16 |

| 95626 | $3,820.30 |

| 91759 | $3,818.08 |

| 91740 | $3,817.64 |

| 92582 | $3,817.47 |

| 94610 | $3,815.58 |

| 95355 | $3,814.89 |

| 94705 | $3,814.73 |

| 93064 | $3,814.66 |

| 95758 | $3,812.97 |

| 92831 | $3,812.36 |

| 92346 | $3,811.30 |

| 95231 | $3,811.08 |

| 91786 | $3,810.82 |

| 95693 | $3,808.09 |

| 90505 | $3,804.62 |

| 91761 | $3,804.59 |

| 95319 | $3,804.18 |

| 92305 | $3,803.81 |

| 91701 | $3,803.15 |

| 94501 | $3,802.88 |

| 92509 | $3,800.69 |

| 90277 | $3,800.09 |

| 92518 | $3,799.72 |

| 94577 | $3,799.21 |

| 94591 | $3,797.88 |

| 94904 | $3,797.86 |

| 94547 | $3,796.39 |

| 95211 | $3,795.38 |

| 92657 | $3,794.73 |

| 93703 | $3,794.36 |

| 92236 | $3,794.13 |

| 92530 | $3,793.69 |

| 93605 | $3,792.74 |

| 94963 | $3,792.37 |

| 91737 | $3,790.19 |

| 94611 | $3,790.02 |

| 94964 | $3,788.67 |

| 95209 | $3,788.31 |

| 93726 | $3,786.19 |

| 94542 | $3,785.01 |

| 94502 | $3,783.50 |

| 95204 | $3,782.33 |

| 95350 | $3,781.03 |

| 92140 | $3,779.90 |

| 95819 | $3,777.59 |

| 93628 | $3,777.52 |

| 90503 | $3,777.44 |

| 90266 | $3,775.94 |

| 94565 | $3,774.19 |

| 91741 | $3,772.99 |

| 91714 | $3,771.65 |

| 92701 | $3,771.08 |

| 92821 | $3,770.96 |

| 92707 | $3,770.93 |

| 92832 | $3,770.83 |

| 91773 | $3,770.38 |

| 94587 | $3,769.34 |

| 94970 | $3,768.84 |

| 92344 | $3,768.07 |

| 95215 | $3,767.16 |

| 92806 | $3,767.09 |

| 95127 | $3,766.85 |

| 91716 | $3,765.80 |

| 95691 | $3,765.18 |

| 93063 | $3,764.91 |

| 95112 | $3,763.82 |

| 92323 | $3,763.76 |

| 92508 | $3,763.47 |

| 91710 | $3,762.88 |

| 92339 | $3,759.02 |

| 92708 | $3,758.48 |

| 93725 | $3,756.61 |

| 93662 | $3,756.01 |

| 92105 | $3,755.01 |

| 92799 | $3,754.96 |

| 94005 | $3,753.04 |

| 90803 | $3,752.55 |

| 92059 | $3,752.27 |

| 92706 | $3,751.14 |

| 93301 | $3,750.98 |

| 92386 | $3,748.50 |

| 95387 | $3,748.13 |

| 94709 | $3,747.30 |

| 95307 | $3,747.25 |

| 92532 | $3,744.73 |

| 90254 | $3,744.18 |

| 92350 | $3,743.49 |

| 94531 | $3,741.49 |

| 92879 | $3,739.96 |

| 94561 | $3,739.51 |

| 92883 | $3,739.40 |

| 92811 | $3,737.89 |

| 91784 | $3,737.22 |

| 91715 | $3,736.21 |

| 95639 | $3,735.62 |

| 92371 | $3,735.08 |

| 95110 | $3,731.37 |

| 92880 | $3,730.94 |

| 90713 | $3,727.05 |

| 93065 | $3,726.76 |

| 94901 | $3,726.12 |

| 91711 | $3,725.77 |

| 93042 | $3,724.63 |

| 95757 | $3,722.76 |

| 92835 | $3,720.63 |

| 94511 | $3,719.47 |

| 93304 | $3,717.88 |

| 92823 | $3,717.52 |

| 90742 | $3,717.15 |

| 92567 | $3,716.91 |

| 94924 | $3,716.52 |

| 92887 | $3,714.94 |

| 93305 | $3,712.66 |

| 95831 | $3,712.21 |

| 95253 | $3,711.50 |

| 92314 | $3,710.90 |

| 92899 | $3,706.86 |

| 95367 | $3,706.52 |

| 94533 | $3,706.46 |

| 93624 | $3,705.79 |

| 92809 | $3,704.89 |

| 92307 | $3,704.52 |

| 92304 | $3,704.48 |

| 94512 | $3,701.72 |

| 91750 | $3,700.21 |

| 93607 | $3,698.36 |

| 91752 | $3,697.81 |

| 92397 | $3,697.20 |

| 95391 | $3,696.61 |

| 92881 | $3,696.56 |

| 92282 | $3,696.24 |

| 93722 | $3,695.95 |

| 93705 | $3,695.35 |

| 95407 | $3,693.45 |

| 93652 | $3,692.61 |

| 93668 | $3,691.90 |

| 94938 | $3,690.86 |

| 92359 | $3,690.30 |

| 92625 | $3,689.79 |

| 93220 | $3,688.28 |

| 94516 | $3,687.71 |

| 95662 | $3,687.52 |

| 93033 | $3,687.11 |

| 92870 | $3,686.78 |

| 92612 | $3,685.53 |

| 94572 | $3,685.47 |

| 93626 | $3,683.02 |

| 94950 | $3,682.90 |

| 92660 | $3,680.61 |

| 94946 | $3,680.39 |

| 95368 | $3,680.08 |

| 94974 | $3,678.88 |

| 94579 | $3,677.68 |

| 93625 | $3,677.49 |

| 93307 | $3,677.42 |

| 92254 | $3,677.31 |

| 94585 | $3,676.65 |

| 93616 | $3,675.78 |

| 94569 | $3,675.74 |

| 92313 | $3,675.66 |

| 95341 | $3,675.04 |

| 93741 | $3,675.00 |

| 93634 | $3,674.71 |

| 95133 | $3,673.99 |

| 90815 | $3,672.56 |

| 93727 | $3,671.87 |

| 93041 | $3,671.52 |

| 95219 | $3,671.13 |

| 92868 | $3,670.96 |

| 92663 | $3,670.60 |

| 90743 | $3,669.97 |

| 94505 | $3,669.69 |

| 95363 | $3,669.59 |

| 91360 | $3,669.55 |

| 93609 | $3,668.90 |

| 94010 | $3,668.12 |

| 92603 | $3,667.22 |

| 93040 | $3,666.68 |

| 93627 | $3,666.37 |

| 94030 | $3,666.12 |

| 93728 | $3,666.00 |

| 93030 | $3,664.96 |

| 92807 | $3,664.05 |

| 94965 | $3,662.60 |

| 95303 | $3,662.56 |

| 92590 | $3,661.71 |

| 93203 | $3,661.69 |

| 92338 | $3,661.61 |

| 94933 | $3,661.56 |

| 94401 | $3,660.99 |

| 95638 | $3,660.90 |

| 90808 | $3,660.70 |

| 92647 | $3,658.31 |

| 94580 | $3,655.72 |

| 95380 | $3,654.25 |

| 92308 | $3,654.17 |

| 94545 | $3,649.85 |

| 94706 | $3,649.85 |

| 92583 | $3,648.11 |

| 95138 | $3,647.99 |

| 92648 | $3,647.53 |

| 92886 | $3,647.44 |

| 92374 | $3,646.07 |

| 92113 | $3,645.52 |

| 95126 | $3,644.31 |

| 92545 | $3,643.64 |

| 94562 | $3,643.43 |

| 93650 | $3,642.65 |

| 92315 | $3,641.04 |

| 92584 | $3,640.66 |

| 92241 | $3,640.46 |

| 93241 | $3,639.84 |

| 94525 | $3,639.01 |

| 94941 | $3,638.85 |

| 92649 | $3,638.12 |

| 93640 | $3,637.90 |

| 92264 | $3,637.60 |

| 94530 | $3,636.69 |

| 92368 | $3,636.24 |

| 92230 | $3,633.34 |

| 92651 | $3,633.16 |

| 95615 | $3,633.06 |

| 92808 | $3,633.02 |

| 95601 | $3,631.32 |

| 92548 | $3,631.12 |

| 92585 | $3,630.76 |

| 94939 | $3,630.61 |

| 94573 | $3,630.13 |

| 92862 | $3,629.70 |

| 92780 | $3,628.82 |

| 93021 | $3,628.33 |

| 92650 | $3,628.31 |

| 93313 | $3,628.27 |

| 94903 | $3,627.87 |

| 92506 | $3,625.18 |

| 92333 | $3,625.15 |

| 92614 | $3,625.05 |

| 93218 | $3,624.16 |

| 92661 | $3,624.04 |

| 93723 | $3,623.97 |

| 93660 | $3,623.01 |

| 95337 | $3,622.16 |

| 95329 | $3,621.74 |

| 95430 | $3,621.19 |

| 93711 | $3,620.89 |

| 92604 | $3,620.82 |

| 95330 | $3,620.43 |

| 92626 | $3,619.63 |

| 92596 | $3,618.88 |

| 95679 | $3,618.28 |

| 92372 | $3,618.25 |

| 92366 | $3,618.18 |

| 93704 | $3,616.97 |

| 94708 | $3,616.52 |

| 95747 | $3,616.15 |

| 92646 | $3,615.56 |

| 93608 | $3,615.30 |

| 95654 | $3,614.91 |

| 93740 | $3,614.89 |

| 92091 | $3,614.79 |

| 93649 | $3,614.74 |

| 92364 | $3,614.66 |

| 94707 | $3,613.44 |

| 95236 | $3,612.48 |

| 95480 | $3,611.89 |

| 92620 | $3,611.34 |

| 92347 | $3,611.23 |

| 94520 | $3,610.09 |

| 93661 | $3,609.78 |

| 92845 | $3,609.67 |

| 95471 | $3,608.65 |

| 92882 | $3,608.32 |

| 94929 | $3,608.07 |

| 95132 | $3,607.48 |

| 94514 | $3,607.18 |

| 92539 | $3,606.83 |

| 94503 | $3,606.06 |

| 95326 | $3,604.83 |

| 95606 | $3,604.49 |

| 95135 | $3,604.33 |

| 93309 | $3,603.97 |

| 93737 | $3,603.90 |

| 95680 | $3,603.75 |

| 93036 | $3,602.45 |

| 95699 | $3,601.90 |

| 92222 | $3,601.59 |

| 95546 | $3,599.94 |

| 93905 | $3,599.92 |

| 92061 | $3,599.21 |

| 93311 | $3,599.11 |

| 94940 | $3,598.92 |

| 93306 | $3,598.73 |

| 90720 | $3,598.57 |

| 91320 | $3,598.50 |

| 92356 | $3,598.41 |

| 94973 | $3,598.31 |

| 95676 | $3,597.57 |

| 94539 | $3,597.54 |

| 95625 | $3,597.35 |

| 95401 | $3,597.02 |

| 92705 | $3,596.66 |

| 95386 | $3,595.80 |

| 92867 | $3,595.66 |

| 95033 | $3,595.55 |

| 92234 | $3,594.46 |

| 95131 | $3,592.02 |

| 95365 | $3,591.79 |

| 93648 | $3,591.38 |

| 95304 | $3,590.86 |

| 94930 | $3,590.75 |

| 95664 | $3,590.29 |

| 93630 | $3,589.01 |

| 94538 | $3,588.66 |

| 93612 | $3,588.45 |

| 95674 | $3,588.26 |

| 94063 | $3,588.02 |

| 95376 | $3,586.63 |

| 95377 | $3,585.63 |

| 95486 | $3,583.42 |

| 95136 | $3,581.29 |

| 95336 | $3,580.92 |

| 90740 | $3,579.41 |

| 92114 | $3,578.08 |

| 92373 | $3,577.64 |

| 95419 | $3,577.44 |

| 95373 | $3,576.28 |

| 92861 | $3,575.80 |

| 95343 | $3,575.43 |

| 94555 | $3,574.15 |

| 95632 | $3,573.95 |

| 94037 | $3,573.25 |

| 92587 | $3,573.18 |

| 92543 | $3,570.99 |

| 93603 | $3,569.00 |

| 93225 | $3,568.74 |

| 94534 | $3,568.31 |

| 94618 | $3,567.67 |

| 92060 | $3,567.16 |

| 92865 | $3,566.65 |

| 93673 | $3,566.26 |

| 94925 | $3,566.13 |

| 92595 | $3,565.42 |

| 95762 | $3,564.93 |

| 95735 | $3,564.82 |

| 95364 | $3,564.04 |

| 95128 | $3,563.83 |

| 95227 | $3,563.60 |

| 95007 | $3,563.29 |

| 94513 | $3,562.22 |

| 92201 | $3,560.86 |

| 95661 | $3,560.62 |

| 94044 | $3,558.99 |

| 95320 | $3,558.46 |

| 93206 | $3,557.87 |

| 93223 | $3,556.70 |

| 93243 | $3,556.66 |

| 95612 | $3,556.45 |

| 91935 | $3,554.83 |

| 95117 | $3,554.71 |

| 93276 | $3,553.90 |

| 92065 | $3,553.61 |

| 92609 | $3,553.22 |

| 94999 | $3,552.65 |

| 95101 | $3,552.37 |

| 91931 | $3,552.10 |

| 94956 | $3,551.83 |

| 92102 | $3,551.26 |

| 92869 | $3,551.25 |

| 91932 | $3,550.57 |

| 95683 | $3,549.73 |

| 94960 | $3,548.62 |

| 95630 | $3,548.52 |

| 94560 | $3,548.48 |

| 95230 | $3,548.23 |

| 95053 | $3,548.06 |

| 92342 | $3,547.37 |

| 93631 | $3,547.31 |

| 95659 | $3,546.90 |

| 93621 | $3,546.72 |

| 95465 | $3,546.33 |

| 94303 | $3,546.16 |

| 95656 | $3,546.13 |

| 95651 | $3,546.02 |

| 93261 | $3,545.78 |

| 95668 | $3,545.75 |

| 91950 | $3,545.70 |

| 92544 | $3,545.64 |

| 92637 | $3,544.06 |

| 92586 | $3,544.06 |

| 92082 | $3,543.77 |

| 92618 | $3,543.52 |

| 92563 | $3,542.93 |

| 94508 | $3,542.50 |

| 95382 | $3,542.46 |

| 94546 | $3,542.04 |

| 94576 | $3,541.63 |

| 92606 | $3,541.54 |

| 94971 | $3,540.92 |

| 95613 | $3,540.37 |

| 95404 | $3,539.67 |

| 92182 | $3,539.19 |

| 95237 | $3,539.16 |

| 95006 | $3,539.09 |

| 95258 | $3,538.99 |

| 92617 | $3,538.36 |

| 92256 | $3,538.29 |

| 93222 | $3,537.16 |

| 92627 | $3,536.81 |

| 94536 | $3,535.85 |

| 95681 | $3,534.77 |

| 95123 | $3,533.50 |

| 92277 | $3,533.01 |

| 93282 | $3,531.14 |

| 95240 | $3,530.76 |

| 93226 | $3,530.59 |

| 95323 | $3,529.62 |

| 95991 | $3,529.14 |

| 95042 | $3,529.03 |

| 95305 | $3,528.69 |

| 95678 | $3,528.52 |

| 92093 | $3,527.86 |

| 95317 | $3,525.30 |

| 95140 | $3,524.17 |

| 92067 | $3,523.90 |

| 92270 | $3,523.29 |

| 91977 | $3,522.99 |

| 93647 | $3,522.73 |

| 92549 | $3,522.65 |

| 94552 | $3,522.54 |

| 95044 | $3,521.79 |

| 95641 | $3,521.60 |

| 95361 | $3,521.22 |

| 95316 | $3,521.13 |

| 95141 | $3,521.06 |

| 95950 | $3,520.12 |

| 95645 | $3,519.89 |

| 92070 | $3,519.86 |

| 92697 | $3,519.19 |

| 91917 | $3,519.18 |

| 94074 | $3,518.51 |

| 92679 | $3,516.88 |

| 95637 | $3,516.80 |

| 93201 | $3,515.38 |

| 95385 | $3,515.34 |

| 95487 | $3,514.35 |

| 93666 | $3,513.37 |

| 93654 | $3,513.04 |

| 95636 | $3,513.01 |

| 95635 | $3,512.77 |

| 93035 | $3,512.70 |

| 92021 | $3,511.83 |

| 92782 | $3,511.73 |

| 92003 | $3,511.43 |

| 95315 | $3,510.94 |

| 95724 | $3,510.90 |

| 95233 | $3,510.86 |

| 93066 | $3,509.66 |

| 94521 | $3,509.50 |

| 91978 | $3,508.71 |

| 91911 | $3,508.68 |

| 95348 | $3,508.58 |

| 95118 | $3,508.16 |

| 95962 | $3,506.20 |

| 94567 | $3,506.00 |

| 95675 | $3,504.98 |

| 94972 | $3,504.98 |

| 93263 | $3,504.90 |

| 93258 | $3,504.71 |

| 93314 | $3,504.39 |

| 92101 | $3,504.36 |

| 94020 | $3,503.42 |

| 93646 | $3,502.73 |

| 95672 | $3,502.42 |

| 95369 | $3,502.03 |

| 92019 | $3,500.78 |

| 93641 | $3,500.53 |

| 94586 | $3,500.22 |

| 95439 | $3,499.99 |

| 93619 | $3,499.81 |

| 93106 | $3,499.46 |

| 95614 | $3,499.42 |

| 92602 | $3,499.02 |

| 94558 | $3,498.93 |

| 95684 | $3,498.20 |

| 92108 | $3,498.12 |

| 95366 | $3,496.57 |

| 95461 | $3,496.52 |

| 94519 | $3,495.94 |

| 92860 | $3,494.54 |

| 94563 | $3,494.31 |

| 92866 | $3,493.89 |

| 95405 | $3,493.15 |

| 95607 | $3,492.61 |

| 93633 | $3,492.55 |

| 94085 | $3,491.74 |

| 92562 | $3,490.61 |

| 92311 | $3,488.25 |

| 93657 | $3,488.18 |

| 95953 | $3,487.79 |

| 93247 | $3,487.75 |

| 95442 | $3,487.47 |

| 94518 | $3,487.36 |

| 94515 | $3,486.70 |

| 92092 | $3,486.69 |

| 93280 | $3,486.66 |

| 95139 | $3,486.56 |

| 93012 | $3,485.70 |

| 95313 | $3,485.30 |

| 94928 | $3,484.63 |

| 92068 | $3,484.54 |

| 92037 | $3,484.33 |

| 95064 | $3,483.46 |

| 93670 | $3,483.17 |

| 95312 | $3,483.14 |

| 92025 | $3,482.61 |

| 95050 | $3,482.22 |

| 93611 | $3,481.75 |

| 95686 | $3,480.93 |

| 94922 | $3,480.77 |

| 93287 | $3,479.56 |

| 95450 | $3,479.46 |

| 93270 | $3,479.46 |

| 93720 | $3,478.50 |

| 95648 | $3,478.07 |

| 92676 | $3,477.68 |

| 93636 | $3,476.56 |

| 95993 | $3,476.08 |

| 95347 | $3,475.84 |

| 93250 | $3,475.65 |

| 95120 | $3,474.89 |

| 92561 | $3,474.51 |

| 95220 | $3,474.38 |

| 93560 | $3,474.04 |

| 95409 | $3,473.99 |

| 95690 | $3,473.91 |

| 94559 | $3,473.60 |

| 95134 | $3,473.08 |

| 95692 | $3,472.85 |

| 92653 | $3,472.32 |

| 92332 | $3,471.32 |

| 95667 | $3,470.81 |

| 94027 | $3,470.18 |

| 95224 | $3,469.49 |

| 94061 | $3,469.37 |

| 92054 | $3,469.31 |

| 93643 | $3,468.97 |

| 92399 | $3,468.61 |

| 92027 | $3,467.90 |

| 94038 | $3,467.84 |

| 92327 | $3,467.60 |

| 91948 | $3,466.65 |

| 95650 | $3,466.38 |

| 95640 | $3,466.31 |

| 93308 | $3,465.71 |

| 93518 | $3,465.00 |

| 95446 | $3,465.00 |

| 92115 | $3,464.74 |

| 93208 | $3,464.58 |

| 95646 | $3,464.37 |

| 95914 | $3,464.30 |

| 95982 | $3,464.29 |

| 93667 | $3,464.06 |

| 93615 | $3,462.66 |

| 92253 | $3,462.43 |

| 92592 | $3,462.01 |

| 94506 | $3,461.14 |

| 93645 | $3,459.96 |

| 95986 | $3,459.13 |

| 92629 | $3,458.07 |

| 95560 | $3,458.03 |

| 92106 | $3,457.75 |

| 92109 | $3,457.37 |

| 91906 | $3,457.35 |

| 93610 | $3,457.20 |

| 93710 | $3,457.13 |

| 92536 | $3,456.33 |

| 92591 | $3,455.79 |

| 95981 | $3,455.74 |

| 93292 | $3,455.73 |

| 95633 | $3,455.53 |

| 95403 | $3,453.97 |

| 92020 | $3,453.76 |

| 95225 | $3,453.63 |

| 92260 | $3,453.00 |

| 92276 | $3,452.55 |

| 95687 | $3,451.67 |

| 94403 | $3,451.57 |

| 93638 | $3,451.50 |

| 93637 | $3,451.14 |

| 94949 | $3,450.42 |

| 92154 | $3,450.14 |

| 95720 | $3,450.09 |

| 96009 | $3,449.80 |

| 95119 | $3,448.96 |

| 94517 | $3,448.90 |

| 93237 | $3,448.80 |

| 95930 | $3,448.44 |

| 91945 | $3,447.45 |

| 92203 | $3,447.28 |

| 95360 | $3,447.18 |

| 95013 | $3,447.13 |

| 95035 | $3,447.12 |

| 92677 | $3,447.06 |

| 93602 | $3,446.82 |

| 93531 | $3,446.52 |

| 94556 | $3,445.83 |

| 95421 | $3,445.31 |

| 93675 | $3,444.70 |

| 93651 | $3,444.68 |

| 95721 | $3,444.47 |

| 93656 | $3,444.12 |

| 96143 | $3,441.07 |

| 95125 | $3,441.04 |

| 93622 | $3,440.99 |

| 92274 | $3,440.24 |

| 95698 | $3,439.40 |

| 93272 | $3,439.31 |

| 94402 | $3,438.60 |

| 95311 | $3,438.32 |

| 95226 | $3,438.14 |

| 95697 | $3,437.89 |

| 95444 | $3,437.33 |

| 95765 | $3,437.30 |

| 92662 | $3,436.66 |

| 96148 | $3,436.25 |

| 95776 | $3,435.96 |

| 95228 | $3,435.75 |

| 94019 | $3,435.27 |

| 95467 | $3,435.09 |

| 93207 | $3,434.94 |

| 95623 | $3,434.80 |

| 92365 | $3,434.30 |

| 95254 | $3,433.99 |

| 92056 | $3,433.89 |

| 93242 | $3,433.07 |

| 93015 | $3,432.45 |

| 94597 | $3,432.13 |

| 91902 | $3,431.60 |

| 92630 | $3,431.57 |

| 94574 | $3,430.74 |

| 93730 | $3,430.51 |

| 93267 | $3,430.26 |

| 95054 | $3,429.37 |

| 95746 | $3,429.26 |

| 92083 | $3,429.13 |

| 91916 | $3,429.08 |

| 95032 | $3,428.95 |

| 95051 | $3,428.74 |

| 93274 | $3,427.78 |

| 96123 | $3,427.22 |

| 95452 | $3,426.28 |

| 94937 | $3,426.12 |

| 92220 | $3,425.42 |

| 92066 | $3,425.09 |

| 95374 | $3,424.61 |

| 95426 | $3,424.49 |

| 95324 | $3,424.30 |

| 95545 | $3,424.21 |

| 95242 | $3,424.18 |

| 92692 | $3,424.12 |

| 94062 | $3,423.86 |

| 92610 | $3,423.61 |

| 95252 | $3,422.94 |

| 95070 | $3,421.81 |

| 95682 | $3,421.55 |

| 95925 | $3,421.42 |

| 95627 | $3,421.36 |

| 94507 | $3,421.29 |

| 91910 | $3,421.21 |

| 94089 | $3,421.14 |

| 95537 | $3,421.02 |

| 93239 | $3,420.95 |

| 92268 | $3,420.87 |

| 94002 | $3,419.93 |

| 95901 | $3,419.75 |

| 93249 | $3,419.49 |

| 95677 | $3,419.38 |

| 92139 | $3,417.48 |

| 94595 | $3,417.11 |

| 94404 | $3,416.89 |

| 91905 | $3,416.85 |

| 95249 | $3,416.50 |

| 92309 | $3,415.68 |

| 91934 | $3,415.64 |

| 94528 | $3,415.24 |

| 92110 | $3,414.96 |

| 92029 | $3,414.86 |

| 95257 | $3,414.13 |

| 92107 | $3,413.09 |

| 95736 | $3,412.63 |

| 95443 | $3,411.64 |

| 93524 | $3,411.45 |

| 95388 | $3,411.30 |

| 93906 | $3,410.38 |

| 93312 | $3,408.80 |

| 94931 | $3,408.46 |

| 94535 | $3,408.28 |

| 94523 | $3,408.25 |

| 94086 | $3,408.13 |

| 92121 | $3,407.70 |

| 95002 | $3,407.29 |

| 95715 | $3,407.02 |

| 95026 | $3,405.66 |

| 94582 | $3,405.24 |

| 96146 | $3,404.19 |

| 92118 | $3,404.15 |

| 95712 | $3,404.09 |

| 93614 | $3,404.01 |

| 91980 | $3,403.98 |

| 95436 | $3,403.87 |

| 90704 | $3,403.64 |

| 95340 | $3,403.61 |

| 93664 | $3,403.06 |

| 94947 | $3,402.71 |

| 95008 | $3,402.03 |

| 92104 | $3,401.91 |

| 93010 | $3,401.86 |

| 93620 | $3,401.82 |

| 92036 | $3,401.77 |

| 94510 | $3,401.76 |

| 92197 | $3,401.51 |

| 92199 | $3,401.51 |

| 92026 | $3,401.14 |

| 93235 | $3,400.59 |

| 95694 | $3,400.15 |

| 92675 | $3,400.12 |

| 92673 | $3,400.11 |

| 95903 | $3,399.83 |

| 92223 | $3,399.45 |

| 92691 | $3,399.26 |

| 95301 | $3,399.06 |

| 95334 | $3,399.00 |

| 95511 | $3,398.75 |

| 92398 | $3,398.71 |

| 92028 | $3,398.61 |

| 94945 | $3,397.42 |

| 94571 | $3,395.42 |

| 92086 | $3,395.40 |

| 92057 | $3,395.09 |

| 95124 | $3,394.77 |

| 95030 | $3,394.48 |

| 95629 | $3,394.36 |

| 95129 | $3,393.13 |

| 94553 | $3,392.48 |

| 95559 | $3,389.43 |

| 95472 | $3,389.13 |

| 94065 | $3,388.64 |

| 95325 | $3,388.19 |

| 95915 | $3,387.61 |

| 95980 | $3,387.29 |

| 93291 | $3,387.05 |

| 95462 | $3,387.01 |

| 92007 | $3,386.85 |

| 95476 | $3,386.84 |

| 95977 | $3,386.62 |

| 95075 | $3,386.08 |

| 95309 | $3,385.46 |

| 95932 | $3,384.10 |

| 93907 | $3,384.08 |

| 91963 | $3,383.32 |

| 93642 | $3,383.03 |

| 95972 | $3,382.17 |

| 95327 | $3,381.36 |

| 92363 | $3,380.82 |

| 93219 | $3,380.40 |

| 95248 | $3,380.39 |

| 92014 | $3,379.84 |

| 94526 | $3,379.19 |

| 92084 | $3,377.70 |

| 93260 | $3,377.34 |

| 92123 | $3,377.27 |

| 92694 | $3,377.22 |

| 93108 | $3,377.09 |

| 95726 | $3,376.66 |

| 92173 | $3,376.01 |

| 95468 | $3,375.22 |

| 95232 | $3,375.08 |

| 95229 | $3,375.04 |

| 95978 | $3,374.72 |

| 93286 | $3,374.57 |

| 95448 | $3,374.16 |

| 95960 | $3,373.50 |

| 96132 | $3,373.49 |

| 94021 | $3,373.33 |

| 95538 | $3,373.08 |

| 95130 | $3,373.07 |

| 93635 | $3,372.84 |

| 95318 | $3,372.80 |

| 94028 | $3,371.98 |

| 94070 | $3,371.95 |

| 93558 | $3,371.14 |

| 93285 | $3,370.42 |

| 92239 | $3,370.14 |

| 92058 | $3,369.97 |

| 95923 | $3,369.53 |

| 94954 | $3,368.42 |

| 92310 | $3,367.95 |

| 93669 | $3,367.63 |

| 94599 | $3,367.62 |

| 95728 | $3,367.45 |

| 92011 | $3,367.09 |

| 96142 | $3,366.75 |

| 92024 | $3,366.54 |

| 92284 | $3,366.16 |

| 93204 | $3,365.08 |

| 93262 | $3,365.08 |

| 95619 | $3,365.07 |

| 92275 | $3,364.55 |

| 95571 | $3,363.97 |

| 95644 | $3,363.93 |

| 95019 | $3,363.75 |

| 95412 | $3,363.75 |

| 92081 | $3,363.36 |

| 92064 | $3,362.61 |

| 91913 | $3,361.61 |

| 95974 | $3,360.97 |

| 92009 | $3,360.61 |

| 92285 | $3,360.53 |

| 93022 | $3,360.49 |

| 91901 | $3,360.15 |

| 95935 | $3,356.97 |

| 92656 | $3,356.24 |

| 95514 | $3,356.00 |

| 92075 | $3,355.33 |

| 95389 | $3,354.72 |

| 92672 | $3,354.29 |

| 94952 | $3,353.38 |

| 95634 | $3,352.54 |

| 95345 | $3,352.47 |

| 92688 | $3,351.60 |

| 93234 | $3,351.57 |

| 95429 | $3,351.47 |

| 96140 | $3,351.42 |

| 94060 | $3,351.31 |

| 94951 | $3,351.20 |

| 92211 | $3,350.87 |

| 92127 | $3,350.75 |

| 92040 | $3,350.61 |

| 95553 | $3,349.53 |

| 95717 | $3,349.47 |

| 95669 | $3,349.37 |

| 96119 | $3,349.07 |

| 95585 | $3,348.72 |

| 95929 | $3,348.36 |

| 93618 | $3,347.67 |

| 95492 | $3,347.36 |

| 95961 | $3,347.22 |

| 94598 | $3,346.99 |

| 92283 | $3,346.75 |

| 93205 | $3,346.12 |

| 96046 | $3,344.95 |

| 95714 | $3,344.60 |

| 95658 | $3,344.26 |

| 95937 | $3,344.17 |

| 94549 | $3,344.00 |

| 93256 | $3,343.77 |

| 96061 | $3,343.74 |

| 95941 | $3,342.81 |

| 95221 | $3,342.62 |

| 96110 | $3,342.49 |

| 93277 | $3,341.92 |

| 92122 | $3,340.87 |

| 95435 | $3,340.45 |

| 93215 | $3,339.53 |

| 95005 | $3,339.40 |

| 92624 | $3,339.21 |

| 93268 | $3,338.54 |

| 93653 | $3,337.69 |

| 96136 | $3,336.94 |

| 92096 | $3,336.93 |

| 91914 | $3,336.65 |

| 95957 | $3,334.97 |

| 91915 | $3,333.88 |

| 92130 | $3,333.50 |

| 92210 | $3,332.77 |

| 95014 | $3,331.24 |

| 95333 | $3,331.10 |

| 95603 | $3,330.75 |

| 95488 | $3,329.48 |

| 94024 | $3,329.07 |

| 96029 | $3,328.81 |

| 95017 | $3,328.70 |

| 95701 | $3,327.50 |

| 95703 | $3,327.31 |

| 95490 | $3,326.73 |

| 92117 | $3,326.72 |

| 95631 | $3,326.56 |

| 93240 | $3,326.38 |

| 95663 | $3,325.95 |

| 95685 | $3,325.91 |

| 92120 | $3,325.86 |

| 94022 | $3,325.43 |

| 95424 | $3,325.30 |

| 95910 | $3,325.20 |

| 93554 | $3,324.34 |

| 95310 | $3,324.01 |

| 94301 | $3,323.59 |

| 92111 | $3,323.53 |

| 95335 | $3,323.05 |

| 94588 | $3,322.75 |

| 95709 | $3,321.94 |

| 96068 | $3,321.91 |

| 92280 | $3,321.33 |

| 95020 | $3,318.47 |

| 93501 | $3,318.18 |

| 95245 | $3,316.97 |

| 95987 | $3,316.58 |

| 95423 | $3,315.87 |

| 94025 | $3,314.83 |

| 95428 | $3,314.54 |

| 96129 | $3,314.12 |

| 94087 | $3,311.46 |

| 94923 | $3,311.42 |

| 93244 | $3,310.96 |

| 95012 | $3,309.86 |

| 92266 | $3,308.23 |

| 94304 | $3,307.94 |

| 96095 | $3,306.22 |

| 95422 | $3,306.10 |

| 95322 | $3,306.07 |

| 95039 | $3,306.01 |

| 93212 | $3,305.85 |

| 95642 | $3,304.97 |

| 93410 | $3,304.78 |

| 95076 | $3,304.67 |

| 93257 | $3,304.62 |

| 93266 | $3,304.59 |

| 93623 | $3,304.37 |

| 92069 | $3,303.71 |

| 95589 | $3,303.18 |

| 92116 | $3,302.21 |

| 94596 | $3,301.28 |

| 94568 | $3,300.45 |

| 94583 | $3,300.41 |

| 95346 | $3,299.88 |

| 92320 | $3,298.96 |

| 95688 | $3,298.36 |

| 95944 | $3,298.36 |

| 95695 | $3,297.82 |

| 95602 | $3,297.45 |

| 92126 | $3,297.18 |

| 93604 | $3,297.16 |

| 92243 | $3,297.11 |

| 95432 | $3,296.84 |

| 95046 | $3,295.83 |

| 93283 | $3,295.19 |

| 95485 | $3,294.17 |

| 92257 | $3,294.06 |

| 93252 | $3,293.58 |

| 92233 | $3,292.71 |

| 96076 | $3,291.61 |

| 96084 | $3,291.51 |

| 95984 | $3,291.28 |

| 95618 | $3,290.96 |

| 92129 | $3,289.21 |

| 95665 | $3,288.74 |

| 95922 | $3,288.14 |

| 93519 | $3,288.00 |

| 95620 | $3,287.93 |

| 95912 | $3,287.67 |

| 95427 | $3,287.65 |

| 95417 | $3,286.91 |

| 95949 | $3,285.82 |

| 95558 | $3,285.70 |

| 95469 | $3,285.44 |

| 96031 | $3,285.11 |

| 92252 | $3,285.04 |

| 95979 | $3,284.75 |

| 94566 | $3,284.70 |

| 93943 | $3,282.97 |

| 95464 | $3,282.25 |

| 93245 | $3,282.04 |

| 95918 | $3,281.28 |

| 95942 | $3,280.74 |

| 95246 | $3,279.44 |

| 94040 | $3,278.92 |

| 91942 | $3,278.47 |

| 95666 | $3,278.34 |

| 93001 | $3,278.06 |

| 93060 | $3,277.86 |

| 93920 | $3,277.70 |

| 95457 | $3,277.60 |

| 95004 | $3,277.46 |

| 93561 | $3,277.09 |

| 95916 | $3,275.92 |

| 93255 | $3,275.84 |

| 95463 | $3,275.74 |

| 95913 | $3,275.39 |

| 93221 | $3,275.23 |

| 95569 | $3,274.48 |

| 95919 | $3,274.31 |

| 95454 | $3,274.19 |

| 96150 | $3,273.16 |

| 95713 | $3,272.80 |

| 95445 | $3,272.73 |

| 96063 | $3,271.60 |

| 96116 | $3,271.56 |

| 94306 | $3,271.13 |

| 95955 | $3,271.13 |

| 92267 | $3,268.96 |

| 93530 | $3,266.83 |

| 96017 | $3,266.11 |

| 95552 | $3,265.97 |

| 96090 | $3,265.28 |

| 95251 | $3,265.24 |

| 95968 | $3,265.01 |

| 93271 | $3,264.97 |

| 95494 | $3,264.80 |

| 92103 | $3,263.60 |

| 96141 | $3,263.56 |

| 95459 | $3,262.84 |

| 93023 | $3,262.13 |

| 93522 | $3,261.24 |

| 93516 | $3,259.26 |

| 95493 | $3,259.06 |

| 93003 | $3,258.93 |

| 96011 | $3,257.51 |

| 93202 | $3,257.07 |

| 95501 | $3,254.60 |

| 91962 | $3,254.57 |

| 93210 | $3,252.21 |

| 96024 | $3,251.99 |

| 93644 | $3,251.67 |

| 92119 | $3,251.57 |

| 93562 | $3,250.05 |

| 94305 | $3,249.73 |

| 92124 | $3,247.15 |

| 95321 | $3,246.38 |

| 95023 | $3,246.32 |

| 95223 | $3,245.52 |

| 92010 | $3,245.17 |

| 93251 | $3,245.01 |

| 95936 | $3,243.84 |

| 95441 | $3,243.57 |

| 91941 | $3,243.45 |

| 95689 | $3,242.78 |

| 95470 | $3,242.27 |

| 92249 | $3,241.90 |

| 93265 | $3,241.64 |

| 93004 | $3,241.63 |

| 93962 | $3,241.31 |

| 95526 | $3,239.86 |

| 95958 | $3,239.03 |

| 93224 | $3,238.80 |

| 93109 | $3,238.29 |

| 95306 | $3,237.73 |

| 92071 | $3,237.05 |

| 95379 | $3,237.04 |

| 95255 | $3,233.80 |

| 93601 | $3,233.04 |

| 93101 | $3,232.83 |

| 95410 | $3,232.19 |

| 96120 | $3,231.80 |

| 92128 | $3,231.66 |

| 94551 | $3,231.42 |

| 92242 | $3,230.62 |

| 95456 | $3,230.19 |

| 92384 | $3,229.42 |

| 96145 | $3,229.22 |

| 92131 | $3,228.23 |

| 95595 | $3,227.24 |

| 95527 | $3,225.94 |

| 95542 | $3,220.41 |

| 96108 | $3,220.25 |

| 95568 | $3,219.96 |

| 94041 | $3,219.96 |

| 96074 | $3,219.93 |

| 96161 | $3,219.60 |

| 92251 | $3,218.25 |

| 92008 | $3,217.05 |

| 95587 | $3,216.85 |

| 92078 | $3,215.10 |

| 95554 | $3,213.33 |

| 95956 | $3,212.99 |

| 95497 | $3,212.89 |

| 95722 | $3,212.19 |

| 95338 | $3,211.43 |

| 92231 | $3,210.69 |

| 93103 | $3,210.64 |

| 95966 | $3,210.39 |

| 95556 | $3,210.15 |

| 95222 | $3,209.47 |

| 96092 | $3,208.32 |

| 95548 | $3,207.51 |

| 92273 | $3,205.55 |

| 93238 | $3,204.41 |

| 95616 | $3,204.18 |

| 95564 | $3,203.90 |

| 93901 | $3,202.95 |

| 95451 | $3,202.22 |

| 95983 | $3,201.74 |

| 92328 | $3,201.47 |

| 95934 | $3,200.80 |

| 96121 | $3,199.89 |

| 95037 | $3,199.47 |

| 96112 | $3,198.53 |

| 95947 | $3,195.45 |

| 95449 | $3,195.23 |

| 93549 | $3,194.29 |

| 93067 | $3,193.14 |

| 93517 | $3,192.17 |

| 95549 | $3,192.04 |

| 95482 | $3,191.36 |

| 92281 | $3,190.91 |

| 93230 | $3,190.62 |

| 93505 | $3,189.48 |

| 96111 | $3,187.26 |

| 96128 | $3,185.89 |

| 92004 | $3,185.83 |

| 95959 | $3,185.18 |

| 95920 | $3,185.09 |

| 95073 | $3,184.80 |

| 95018 | $3,184.46 |

| 95939 | $3,183.70 |

| 95370 | $3,183.50 |

| 95503 | $3,183.37 |

| 96106 | $3,183.26 |

| 93955 | $3,182.86 |

| 93925 | $3,182.64 |

| 93954 | $3,182.50 |

| 95555 | $3,182.28 |

| 95425 | $3,180.22 |

| 93407 | $3,179.82 |

| 96075 | $3,179.32 |

| 96091 | $3,178.28 |

| 94550 | $3,178.04 |

| 96041 | $3,175.73 |

| 93926 | $3,169.29 |

| 96135 | $3,167.60 |

| 95965 | $3,165.24 |

| 95247 | $3,165.13 |

| 95003 | $3,164.10 |

| 95045 | $3,163.74 |

| 93928 | $3,163.41 |

| 95563 | $3,162.72 |

| 95948 | $3,161.21 |

| 92389 | $3,160.28 |

| 92250 | $3,159.91 |

| 95951 | $3,159.87 |

| 96070 | $3,156.82 |

| 95420 | $3,156.41 |

| 93528 | $3,154.68 |

| 95945 | $3,153.99 |

| 96033 | $3,153.75 |

| 94043 | $3,151.89 |

| 95970 | $3,150.37 |

| 93542 | $3,149.66 |

| 93923 | $3,148.06 |

| 95437 | $3,147.87 |

| 92227 | $3,147.45 |

| 96071 | $3,146.99 |

| 96126 | $3,146.97 |

| 93933 | $3,145.27 |

| 96065 | $3,144.43 |

| 93110 | $3,141.82 |

| 95466 | $3,140.93 |

| 93105 | $3,140.65 |

| 93924 | $3,138.63 |

| 93013 | $3,138.63 |

| 93908 | $3,136.35 |

| 95573 | $3,134.88 |

| 96035 | $3,134.23 |

| 96048 | $3,132.02 |

| 95551 | $3,131.78 |

| 96047 | $3,130.50 |

| 96059 | $3,126.91 |

| 92259 | $3,126.07 |

| 95415 | $3,125.14 |

| 93960 | $3,124.30 |

| 93546 | $3,123.64 |

| 95453 | $3,123.03 |

| 95565 | $3,122.33 |

| 95528 | $3,122.23 |

| 96056 | $3,122.01 |

| 96114 | $3,120.81 |

| 96010 | $3,120.51 |

| 96019 | $3,120.25 |

| 93921 | $3,118.58 |

| 95562 | $3,118.34 |

| 93927 | $3,118.16 |

| 96124 | $3,117.93 |

| 96113 | $3,116.20 |

| 95372 | $3,114.72 |

| 93529 | $3,112.42 |

| 96069 | $3,109.45 |

| 96054 | $3,108.60 |

| 95060 | $3,108.51 |

| 93461 | $3,108.43 |

| 96062 | $3,108.17 |

| 93435 | $3,105.90 |

| 93541 | $3,105.68 |

| 95383 | $3,105.12 |

| 96020 | $3,104.62 |

| 95458 | $3,103.54 |

| 93523 | $3,102.78 |

| 96028 | $3,102.11 |

| 96137 | $3,094.68 |

| 96006 | $3,093.73 |

| 96007 | $3,093.05 |

| 96016 | $3,089.75 |

| 95928 | $3,088.15 |

| 95540 | $3,087.93 |

| 92225 | $3,087.32 |

| 96015 | $3,083.87 |

| 95917 | $3,083.27 |

| 95043 | $3,083.14 |

| 96002 | $3,082.44 |

| 95547 | $3,081.37 |

| 93555 | $3,081.28 |

| 93527 | $3,079.41 |

| 95946 | $3,079.30 |

| 95460 | $3,078.68 |

| 95010 | $3,077.40 |

| 96022 | $3,076.19 |

| 93451 | $3,074.55 |

| 96117 | $3,071.88 |

| 96085 | $3,071.51 |

| 96021 | $3,070.94 |

| 96109 | $3,069.95 |

| 96040 | $3,069.27 |

| 96133 | $3,067.05 |

| 95954 | $3,066.60 |

| 96130 | $3,065.74 |

| 93254 | $3,065.68 |

| 95550 | $3,065.22 |

| 96008 | $3,063.06 |

| 95062 | $3,060.55 |

| 96105 | $3,059.92 |

| 93117 | $3,059.83 |

| 96104 | $3,058.31 |

| 95943 | $3,057.63 |

| 96125 | $3,054.94 |

| 96055 | $3,054.41 |

| 96118 | $3,054.05 |

| 96087 | $3,053.60 |

| 96013 | $3,051.04 |

| 96039 | $3,050.44 |

| 95926 | $3,049.16 |

| 95973 | $3,045.57 |

| 96058 | $3,045.26 |

| 95065 | $3,044.91 |

| 96115 | $3,043.52 |

| 96003 | $3,041.92 |

| 95963 | $3,040.85 |

| 95536 | $3,039.78 |

| 96086 | $3,038.15 |

| 96023 | $3,037.08 |

| 93460 | $3,036.97 |

| 95543 | $3,036.56 |

| 96037 | $3,035.96 |

| 93545 | $3,035.04 |

| 96103 | $3,034.60 |

| 96052 | $3,029.68 |

| 93512 | $3,027.83 |

| 95969 | $3,026.55 |

| 95524 | $3,025.61 |

| 96001 | $3,024.39 |

| 96122 | $3,022.16 |

| 96014 | $3,021.85 |

| 96088 | $3,019.47 |

| 96050 | $3,016.14 |

| 95066 | $3,013.78 |

| 95971 | $3,013.22 |

| 96096 | $3,012.31 |

| 93429 | $3,011.21 |

| 93446 | $3,010.75 |

| 95521 | $3,010.74 |

| 95570 | $3,010.16 |

| 93940 | $3,009.22 |

| 95531 | $3,008.25 |

| 93111 | $3,002.91 |

| 95938 | $3,000.11 |

| 93932 | $2,995.22 |

| 93405 | $2,989.76 |

| 96044 | $2,988.38 |

| 95988 | $2,988.25 |

| 96051 | $2,987.85 |

| 96134 | $2,987.75 |

| 93526 | $2,985.01 |

| 95975 | $2,982.24 |

| 95525 | $2,981.61 |

| 93450 | $2,981.31 |

| 96080 | $2,980.14 |

| 96034 | $2,974.96 |

| 93453 | $2,974.63 |

| 95567 | $2,973.54 |

| 96073 | $2,971.51 |

| 93426 | $2,970.81 |

| 96101 | $2,966.71 |

| 96057 | $2,965.51 |

| 95519 | $2,965.05 |

| 96038 | $2,963.95 |

| 93458 | $2,963.67 |

| 93424 | $2,960.99 |

| 93440 | $2,953.66 |

| 93930 | $2,953.55 |

| 93434 | $2,951.92 |

| 96107 | $2,948.57 |

| 93950 | $2,942.34 |

| 93465 | $2,934.93 |

| 96093 | $2,932.87 |

| 93513 | $2,926.37 |

| 93454 | $2,921.40 |

| 93953 | $2,920.03 |

| 93445 | $2,897.95 |

| 96025 | $2,891.51 |

| 96032 | $2,885.83 |

| 96027 | $2,882.83 |

| 93455 | $2,877.52 |

| 93422 | $2,865.26 |

| 93432 | $2,862.60 |

| 93463 | $2,861.18 |

| 93452 | $2,858.30 |

| 93430 | $2,850.58 |

| 93444 | $2,843.90 |

| 93436 | $2,843.64 |

| 96097 | $2,843.29 |

| 96064 | $2,840.77 |

| 93441 | $2,840.56 |

| 93514 | $2,837.87 |

| 93433 | $2,834.19 |

| 93449 | $2,829.93 |

| 93420 | $2,824.43 |

| 93402 | $2,821.16 |

| 93442 | $2,807.96 |

| 93427 | $2,807.43 |

| 93437 | $2,804.27 |

| 96067 | $2,777.89 |

| 93428 | $2,774.88 |

| 96094 | $2,752.73 |

| 93401 | $2,731.32 |

In the beautiful 90210, the most expensive average annual rate, the cost is $6324.83. A huge four thousand dollar difference. Be careful where you want to live.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Cheapest Rates by City

With San Francisco, Los Angeles, and Beverly Hills are in the same state, They will certainly have some expensive cities for car insurance.

Obviously, the higher your city income is, the higher your insurance rates will be. In the table below, the average annual rates are broken down by city.

| City | Annual Average |

|---|---|

| WEED | $2,752.73 |

| CAMBRIA | $2,774.88 |

| MOUNT SHASTA | $2,777.88 |

| BUELLTON | $2,807.43 |

| MORRO BAY | $2,807.96 |

| LOS OSOS | $2,821.16 |

| LOMPOC | $2,823.96 |

| ARROYO GRANDE | $2,824.43 |

| PISMO BEACH | $2,829.93 |

| GROVER BEACH | $2,834.19 |

| BISHOP | $2,837.87 |

| LOS OLIVOS | $2,840.56 |

| MONTAGUE | $2,840.77 |

| YREKA | $2,843.29 |

| NIPOMO | $2,843.90 |

| CAYUCOS | $2,850.58 |

| SAN SIMEON | $2,858.30 |

| SOLVANG | $2,861.18 |

| CRESTON | $2,862.60 |

| ATASCADERO | $2,865.26 |

| ETNA | $2,882.83 |

| FORT JONES | $2,885.83 |

| DUNSMUIR | $2,891.51 |

| OCEANO | $2,897.95 |

| PEBBLE BEACH | $2,920.03 |

| SANTA MARIA | $2,920.86 |

| BIG PINE | $2,926.37 |

| WEAVERVILLE | $2,932.87 |

| TEMPLETON | $2,934.93 |

| PACIFIC GROVE | $2,942.33 |

| COLEVILLE | $2,948.57 |

| GUADALUPE | $2,951.92 |

| KING CITY | $2,953.55 |

| LOS ALAMOS | $2,953.66 |

| AVILA BEACH | $2,960.99 |

| GRENADA | $2,963.95 |

| MCKINLEYVILLE | $2,965.05 |

| MCCLOUD | $2,965.51 |

| ALTURAS | $2,966.71 |

| BRADLEY | $2,970.81 |

| PALO CEDRO | $2,971.51 |

| SMITH RIVER | $2,973.54 |

| SANTA MARGARITA | $2,974.63 |

| GAZELLE | $2,974.96 |

| RED BLUFF | $2,980.13 |

| SAN ARDO | $2,981.31 |

| BLUE LAKE | $2,981.61 |

| ROUGH AND READY | $2,982.24 |

| INDEPENDENCE | $2,985.01 |

| TULELAKE | $2,987.75 |

| LAKEHEAD | $2,987.85 |

| WILLOWS | $2,988.25 |

| HORNBROOK | $2,988.38 |

| LOCKWOOD | $2,995.22 |

| DURHAM | $3,000.11 |

| CRESCENT CITY | $3,008.25 |

| TRINIDAD | $3,010.16 |

| ARCATA | $3,010.74 |

| PASO ROBLES | $3,010.75 |

| CASMALIA | $3,011.21 |

| WHITMORE | $3,012.31 |

| QUINCY | $3,013.22 |

| SCOTTS VALLEY | $3,013.78 |

| KLAMATH RIVER | $3,016.14 |

| SHINGLETOWN | $3,019.47 |

| CALLAHAN | $3,021.85 |

| PORTOLA | $3,022.16 |

| BAYSIDE | $3,025.61 |

| PARADISE | $3,026.55 |

| BENTON | $3,027.83 |

| LEWISTON | $3,029.68 |

| BLAIRSDEN-GRAEAGLE | $3,034.60 |

| LONE PINE | $3,035.03 |

| GREENVIEW | $3,035.96 |

| GASQUET | $3,036.56 |

| SANTA YNEZ | $3,036.97 |

| DORRIS | $3,037.08 |

| SEIAD VALLEY | $3,038.15 |

| FERNDALE | $3,039.78 |

| ORLAND | $3,040.85 |

| LAKE CITY | $3,043.53 |

| MACDOEL | $3,045.26 |

| REDDING | $3,049.58 |

| HAPPY CAMP | $3,050.44 |

| BURNEY | $3,051.04 |

| SAN LUIS OBISPO | $3,051.42 |

| SHASTA | $3,053.60 |

| LOYALTON | $3,054.05 |

| LOS MOLINOS | $3,054.41 |

| SIERRA CITY | $3,054.94 |

| GLENN | $3,057.63 |

| CEDARVILLE | $3,058.32 |

| GOLETA | $3,059.83 |

| CHILCOOT | $3,059.92 |

| BELLA VISTA | $3,063.06 |

| KORBEL | $3,065.22 |

| NEW CUYAMA | $3,065.68 |

| SUSANVILLE | $3,065.74 |

| MAGALIA | $3,066.59 |

| TOPAZ | $3,067.05 |

| HAT CREEK | $3,069.27 |

| DOYLE | $3,069.95 |

| CORNING | $3,070.94 |

| SCOTT BAR | $3,071.51 |

| LITCHFIELD | $3,071.88 |

| SAN MIGUEL | $3,074.55 |

| COTTONWOOD | $3,076.19 |

| CAPITOLA | $3,077.40 |

| MENDOCINO | $3,078.68 |

| PENN VALLEY | $3,079.30 |

| INYOKERN | $3,079.41 |

| RIDGECREST | $3,081.28 |

| HYDESVILLE | $3,081.37 |

| PAICINES | $3,083.14 |

| BIGGS | $3,083.27 |

| CANBY | $3,083.87 |

| BLYTHE | $3,087.32 |

| FORTUNA | $3,087.93 |

| CASSEL | $3,089.75 |

| ANDERSON | $3,093.05 |

| ADIN | $3,093.73 |

| WESTWOOD | $3,094.68 |

| FALL RIVER MILLS | $3,102.11 |

| LUCERNE | $3,103.54 |

| CHESTER | $3,104.62 |

| TWAIN HARTE | $3,105.12 |

| LEE VINING | $3,105.68 |

| HARMONY | $3,105.90 |

| MILLVILLE | $3,108.17 |

| SHANDON | $3,108.43 |

| LOOKOUT | $3,108.60 |

| OAK RUN | $3,109.45 |

| JUNE LAKE | $3,112.42 |

| SOULSBYVILLE | $3,114.72 |

| HERLONG | $3,116.19 |

| CALPINE | $3,117.92 |

| GREENFIELD | $3,118.16 |

| RIO DELL | $3,118.34 |

| CARMEL BY THE SEA | $3,118.58 |

| SHASTA LAKE | $3,120.25 |

| BIG BAR | $3,120.51 |

| JANESVILLE | $3,120.81 |

| MCARTHUR | $3,122.01 |

| CARLOTTA | $3,122.23 |

| SCOTIA | $3,122.33 |

| LAKEPORT | $3,123.03 |

| MAMMOTH LAKES | $3,123.64 |

| SOLEDAD | $3,124.30 |

| BOONVILLE | $3,125.14 |

| OCOTILLO | $3,126.07 |

| MANTON | $3,126.91 |

| IGO | $3,130.50 |

| LOLETA | $3,131.78 |

| JUNCTION CITY | $3,132.02 |

| CHICO | $3,132.81 |

| GERBER | $3,134.23 |

| WILLOW CREEK | $3,134.88 |

| CARMEL VALLEY | $3,138.63 |

| CARPINTERIA | $3,138.63 |

| PHILO | $3,140.93 |

| MONTGOMERY CREEK | $3,144.43 |

| MARINA | $3,145.27 |

| MONTEREY | $3,146.09 |

| SIERRAVILLE | $3,146.97 |

| OLD STATION | $3,146.99 |

| BRAWLEY | $3,147.45 |

| FORT BRAGG | $3,147.87 |

| CARMEL | $3,148.06 |

| LITTLE LAKE | $3,149.67 |

| PRINCETON | $3,150.37 |

| FRENCH GULCH | $3,153.75 |

| JOHANNESBURG | $3,154.68 |

| CASPAR | $3,156.41 |

| OBRIEN | $3,156.82 |

| HAMILTON CITY | $3,159.87 |

| HOLTVILLE | $3,159.91 |

| TECOPA | $3,160.28 |

| GRIDLEY | $3,161.21 |

| SALYER | $3,162.72 |

| JOLON | $3,163.41 |

| SAN JUAN BAUTISTA | $3,163.75 |

| APTOS | $3,164.10 |

| MURPHYS | $3,165.13 |

| VINTON | $3,167.60 |

| GONZALES | $3,169.29 |

| SANTA CRUZ | $3,174.36 |

| HAYFORK | $3,175.73 |

| TRINITY CENTER | $3,178.28 |

| PAYNES CREEK | $3,179.32 |

| CLOVERDALE | $3,180.22 |

| ORICK | $3,182.28 |

| SAN LUCAS | $3,182.50 |

| CHUALAR | $3,182.64 |

| SEASIDE | $3,182.86 |

| CLIO | $3,183.26 |

| SONORA | $3,183.50 |

| ELK CREEK | $3,183.70 |

| FELTON | $3,184.46 |

| SOQUEL | $3,184.80 |

| BUTTE CITY | $3,185.09 |

| NEVADA CITY | $3,185.19 |

| BORREGO SPRINGS | $3,185.83 |

| STANDISH | $3,185.89 |

| FLORISTON | $3,187.26 |

| OROVILLE | $3,187.82 |

| CALIFORNIA CITY | $3,189.48 |

| HANFORD | $3,190.62 |

| WESTMORLAND | $3,190.91 |

| UKIAH | $3,191.36 |

| KNEELAND | $3,192.04 |

| BRIDGEPORT | $3,192.17 |

| SUMMERLAND | $3,193.14 |

| OLANCHA | $3,194.29 |

| HOPLAND | $3,195.23 |

| GREENVILLE | $3,195.46 |

| FORT BIDWELL | $3,198.53 |

| MORGAN HILL | $3,199.47 |

| MILFORD | $3,199.89 |

| CRESCENT MILLS | $3,200.80 |

| DEATH VALLEY | $3,201.48 |

| TAYLORSVILLE | $3,201.74 |

| KELSEYVILLE | $3,202.22 |

| SAMOA | $3,203.90 |

| KERNVILLE | $3,204.41 |

| LIVERMORE | $3,204.73 |

| SEELEY | $3,205.55 |

| KLAMATH | $3,207.51 |

| VINA | $3,208.33 |

| ANGELS CAMP | $3,209.48 |

| ORLEANS | $3,210.15 |

| CALEXICO | $3,210.69 |

| MARIPOSA | $3,211.43 |

| MEADOW VISTA | $3,212.20 |

| THE SEA RANCH | $3,212.89 |

| MEADOW VALLEY | $3,212.99 |

| MYERS FLAT | $3,213.33 |

| PIERCY | $3,216.85 |

| MOUNTAIN VIEW | $3,216.92 |

| IMPERIAL | $3,218.24 |

| EUREKA | $3,218.99 |

| TRUCKEE | $3,219.60 |

| GRASS VALLEY | $3,219.91 |

| PASKENTA | $3,219.93 |

| SOMES BAR | $3,219.96 |

| DAVIS CREEK | $3,220.25 |

| GARBERVILLE | $3,220.41 |

| BURNT RANCH | $3,225.94 |

| ZENIA | $3,227.24 |

| TAHOE CITY | $3,229.22 |

| SHOSHONE | $3,229.42 |

| LITTLE RIVER | $3,230.19 |

| SANTA BARBARA | $3,230.46 |

| EARP | $3,230.62 |

| MARKLEEVILLE | $3,231.80 |

| ALBION | $3,232.20 |

| AHWAHNEE | $3,233.04 |

| WEST POINT | $3,233.80 |

| TUOLUMNE | $3,237.04 |

| SANTEE | $3,237.05 |

| CATHEYS VALLEY | $3,237.73 |

| FELLOWS | $3,238.80 |

| NELSON | $3,239.03 |

| BRIDGEVILLE | $3,239.86 |

| SPRECKELS | $3,241.31 |

| SPRINGVILLE | $3,241.64 |

| HEBER | $3,241.90 |

| REDWOOD VALLEY | $3,242.27 |

| VOLCANO | $3,242.78 |

| GEYSERVILLE | $3,243.57 |

| DOWNIEVILLE | $3,243.84 |

| MC KITTRICK | $3,245.01 |

| ARNOLD | $3,245.52 |

| HOLLISTER | $3,246.32 |

| GROVELAND | $3,246.38 |

| DAVIS | $3,247.57 |

| STANFORD | $3,249.73 |

| TRONA | $3,250.05 |

| OAKHURST | $3,251.67 |

| DOUGLAS CITY | $3,251.99 |

| COALINGA | $3,252.21 |

| PINE VALLEY | $3,254.57 |

| ARMONA | $3,257.07 |

| EDWARDS | $3,257.12 |

| BIG BEND | $3,257.51 |

| WITTER SPRINGS | $3,259.06 |

| BORON | $3,259.26 |

| VENTURA | $3,259.54 |

| LA MESA | $3,260.96 |

| DARWIN | $3,261.24 |

| OJAI | $3,262.13 |

| MANCHESTER | $3,262.84 |

| HOMEWOOD | $3,263.56 |

| YORKVILLE | $3,264.80 |

| THREE RIVERS | $3,264.97 |

| PALERMO | $3,265.01 |

| VALLECITO | $3,265.25 |

| TEHAMA | $3,265.29 |

| MAD RIVER | $3,265.97 |

| CASTELLA | $3,266.11 |

| KEELER | $3,266.83 |

| PARKER DAM | $3,268.96 |

| MAXWELL | $3,271.13 |

| LIKELY | $3,271.56 |

| MINERAL | $3,271.60 |

| GUALALA | $3,272.73 |

| COLFAX | $3,272.80 |

| SOUTH LAKE TAHOE | $3,273.16 |

| LAYTONVILLE | $3,274.18 |

| BROWNSVILLE | $3,274.31 |

| REDCREST | $3,274.48 |

| EXETER | $3,275.23 |

| ARTOIS | $3,275.39 |

| NAVARRO | $3,275.74 |

| ONYX | $3,275.84 |

| BERRY CREEK | $3,275.92 |

| TEHACHAPI | $3,277.09 |

| AROMAS | $3,277.46 |

| LOWER LAKE | $3,277.60 |

| BIG SUR | $3,277.70 |

| SANTA PAULA | $3,277.86 |

| PIONEER | $3,278.34 |

| MOUNTAIN RANCH | $3,279.44 |

| FOREST RANCH | $3,280.74 |

| BROWNS VALLEY | $3,281.28 |

| LEMOORE | $3,282.04 |

| NICE | $3,282.25 |

| STONYFORD | $3,284.75 |

| JOSHUA TREE | $3,285.04 |

| FORKS OF SALMON | $3,285.11 |

| SAN MARCOS | $3,285.25 |

| POTTER VALLEY | $3,285.44 |

| PETROLIA | $3,285.70 |

| BRANSCOMB | $3,286.91 |

| COMPTCHE | $3,287.65 |

| ARBUCKLE | $3,287.67 |

| DIXON | $3,287.93 |

| CANTIL | $3,288.00 |

| CAMPTONVILLE | $3,288.14 |

| PINE GROVE | $3,288.74 |

| TWAIN | $3,291.28 |

| ROUND MOUNTAIN | $3,291.51 |

| PLATINA | $3,291.60 |

| CALIPATRIA | $3,292.71 |

| MARICOPA | $3,293.58 |

| NILAND | $3,294.06 |

| UPPER LAKE | $3,294.17 |

| WELDON | $3,295.19 |

| SAN MARTIN | $3,295.83 |

| ELK | $3,296.84 |

| EL CENTRO | $3,297.11 |

| BASS LAKE | $3,297.16 |

| CARLSBAD | $3,297.48 |

| GOODYEARS BAR | $3,298.36 |

| CALIMESA | $3,298.96 |

| MI WUK VILLAGE | $3,299.88 |

| DUBLIN | $3,300.45 |

| WHITETHORN | $3,303.18 |

| PLEASANTON | $3,303.73 |

| FISH CAMP | $3,304.37 |

| STRATFORD | $3,304.59 |

| WATSONVILLE | $3,304.67 |

| JACKSON | $3,304.97 |

| CORCORAN | $3,305.85 |

| MOSS LANDING | $3,306.01 |

| GUSTINE | $3,306.07 |

| CLEARLAKE | $3,306.10 |

| WHISKEYTOWN | $3,306.22 |

| PALO VERDE | $3,308.23 |

| CASTROVILLE | $3,309.86 |

| LEMON COVE | $3,310.96 |

| BODEGA BAY | $3,311.42 |

| AUBURN | $3,314.10 |

| BECKWOURTH | $3,314.12 |

| COVELO | $3,314.54 |

| MENLO PARK | $3,314.83 |

| CLEARLAKE OAKS | $3,315.87 |

| WILLIAMS | $3,316.58 |

| MOKELUMNE HILL | $3,316.96 |

| MOJAVE | $3,318.18 |

| GILROY | $3,318.47 |

| VIDAL | $3,321.34 |

| NUBIEBER | $3,321.91 |

| CAMINO | $3,321.94 |

| LONG BARN | $3,323.05 |

| COLUMBIA | $3,324.01 |

| RANDSBURG | $3,324.34 |

| ALLEGHANY | $3,325.20 |

| CLEARLAKE PARK | $3,325.30 |

| SUTTER CREEK | $3,325.91 |

| PENRYN | $3,325.95 |

| LAKE ISABELLA | $3,326.38 |

| FORESTHILL | $3,326.56 |

| WILLITS | $3,326.73 |

| LOS ALTOS | $3,327.25 |

| APPLEGATE | $3,327.31 |

| ALTA | $3,327.50 |

| DAVENPORT | $3,328.70 |

| FLOURNOY | $3,328.81 |

| WESTPORT | $3,329.47 |

| LE GRAND | $3,331.10 |

| CUPERTINO | $3,331.24 |

| INDIAN WELLS | $3,332.77 |

| MERIDIAN | $3,334.96 |

| WENDEL | $3,336.94 |

| RAYMOND | $3,337.69 |

| TAFT | $3,338.54 |

| CAPISTRANO BEACH | $3,339.21 |

| BEN LOMOND | $3,339.40 |

| DELANO | $3,339.54 |

| FINLEY | $3,340.45 |

| EAGLEVILLE | $3,342.49 |

| ALTAVILLE | $3,342.63 |

| FORBESTOWN | $3,342.81 |

| MILL CREEK | $3,343.74 |

| PIXLEY | $3,343.77 |

| LAFAYETTE | $3,344.00 |

| DUNNIGAN | $3,344.17 |

| NEWCASTLE | $3,344.26 |

| DUTCH FLAT | $3,344.60 |

| HYAMPOM | $3,344.94 |

| BODFISH | $3,346.12 |

| SALINAS | $3,346.74 |

| WINTERHAVEN | $3,346.75 |

| OLIVEHURST | $3,347.22 |

| WINDSOR | $3,347.37 |

| DINUBA | $3,347.67 |

| LEGGETT | $3,348.72 |

| MADELINE | $3,349.07 |

| PLYMOUTH | $3,349.37 |

| GOLD RUN | $3,349.47 |

| MIRANDA | $3,349.53 |

| LAKESIDE | $3,350.61 |

| PENNGROVE | $3,351.20 |

| PESCADERO | $3,351.31 |

| CARNELIAN BAY | $3,351.42 |

| DOS RIOS | $3,351.47 |

| HURON | $3,351.57 |

| RANCHO SANTA MARGARITA | $3,351.60 |

| MIDPINES | $3,352.47 |

| GEORGETOWN | $3,352.54 |

| SAN RAMON | $3,352.83 |

| YOSEMITE NATIONAL PARK | $3,354.72 |

| SOLANA BEACH | $3,355.33 |

| BLOCKSBURG | $3,356.00 |

| ALISO VIEJO | $3,356.24 |

| DOBBINS | $3,356.97 |

| ALPINE | $3,360.15 |

| OAK VIEW | $3,360.49 |

| LANDERS | $3,360.53 |

| RICHVALE | $3,360.97 |

| PALO ALTO | $3,362.21 |

| POWAY | $3,362.61 |

| ANNAPOLIS | $3,363.75 |

| FREEDOM | $3,363.75 |

| KIT CARSON | $3,363.93 |

| WEOTT | $3,363.97 |