Best Arizona Car Insurance (2024)

At $159 per month, Arizona car insurance rates are a little cheaper than the national average. However, rates can be higher depending on your city – Phoenix has the highest Arizona car insurance quotes at $199 per month. To find the best Arizona car insurance, make sure to compare multiple quotes.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Apr 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Apr 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Arizona Statistics Summary | Details |

|---|---|

| Road Miles | Total in State: 66,122 Vehicle Miles Driven: 650.45 Billion |

| Vehicles | Registered: 5,469,509 Stolen: 16,785 |

| State Population | 7,171,646 |

| Most Popular Vehicle | F150 |

| Uninsured Motorists | 12% State Rank: 24 |

| Total Driving Fatalities | 2008-2017 Speeding: 3,032 Drunk Driving: 2,334 |

| Annual Average Premiums | Collision: $259.31 Comprehensive: $184.20 Liability: $488.59 |

| Cheapest Providers | USAA & Travelers Property Casualty |

- At $159 per month, Arizona car insurance quotes are a little lower than the national average

- Although rates are usually affordable, car insurance in Arizona in some cities is more expensive than in others

- To find the cheapest Arizona auto insurance, you can compare quotes, look for discounts, and pick the right amount of coverage

If you’re headed to work or school or road-tripping to the Grand Canyon, you need to know you have the right insurance coverage for your needs. But how do you find all the information you need to make a decision on the best insurance company and coverage mix for your lifestyle?

We know searching for all that data can be both time-consuming and exasperating. To make your life easier, we’ve done the work for you.

Keep reading to learn everything you need to know to keep you legal and safe no matter where you drive in the Grand Canyon State. To get started, use your zip code to get a free quote on car insurance in your area.

Arizona Car Insurance Coverage and Rates

Shopping for car insurance can be confusing and overwhelming. Do you need liability insurance coverage? What is collision coverage? What’s the difference between collision and comprehensive coverage? Which company is right for you?

We know this can be frustrating. To help you make the right decision for your needs, we’ve pulled together information on Arizona’s state insurance laws, coverage types, average rates, and more.

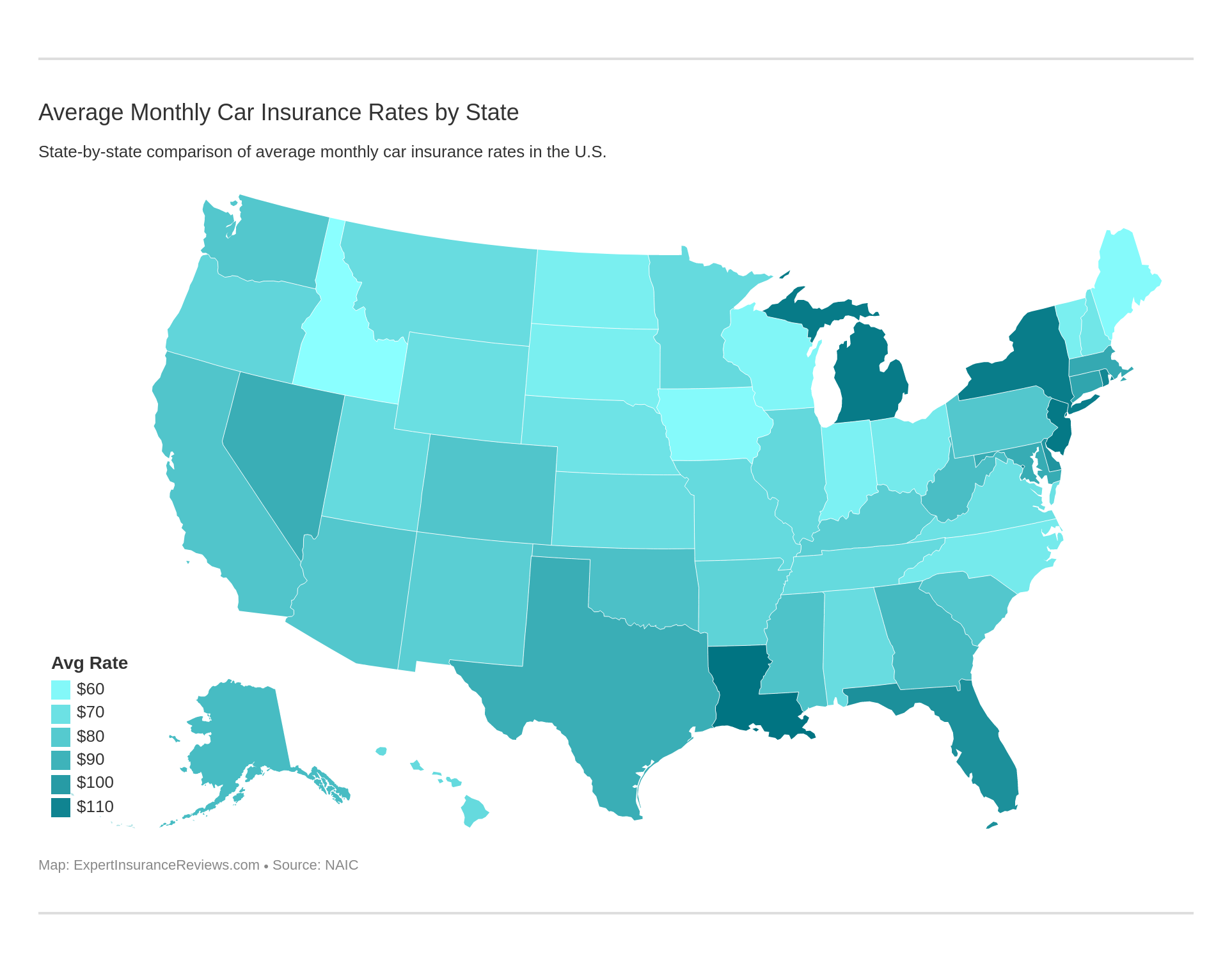

What’s the average cost of car insurance in Arizona? One of the key pieces of information you probably want to know is price. How much can you expect to pay for insurance? Check out the below table to see what the average driver in Arizona pays for insurance each year versus what average drivers across the United States pay.

| Arizona Average | National Average | Percent Difference |

|---|---|---|

| $1,103 | $1,311 | 18.86% |

Based on this table, you can see Arizona drivers pay, on average, about 19 percent less than the national average for car insurance. This is good news for your wallet.

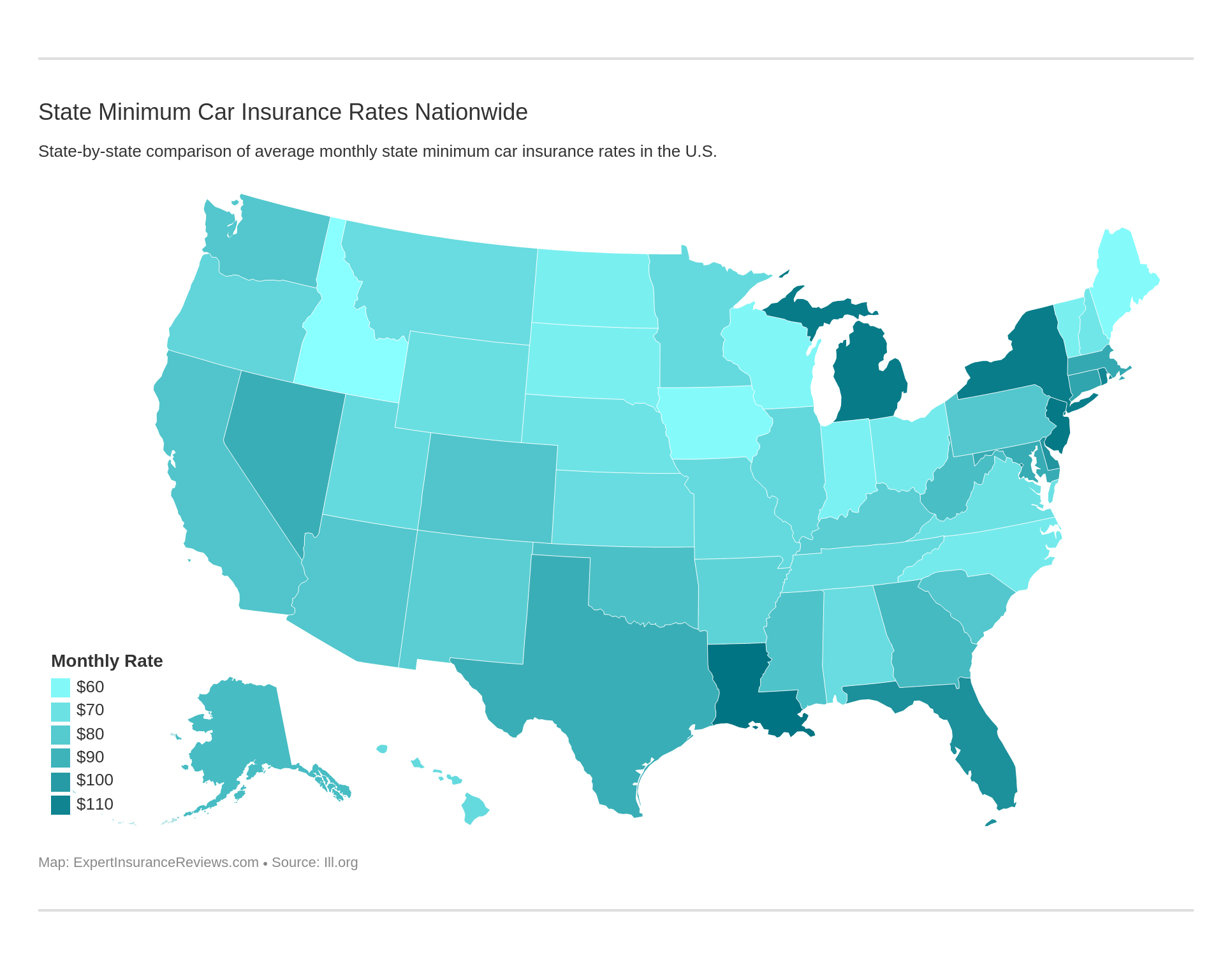

Arizona Minimum Coverage

Even though 12 percent of drivers in Arizona are currently uninsured, the state, like the rest of the country, requires every driver on the road to maintain a minimum amount of car insurance coverage.

Take a look at how the rates compare.

Arizona’s minimum liability insurance coverage requirements are listed in the below table

| Required Insurance | Minimum Limits |

|---|---|

| Bodily Injury | $15,000 per person $30,000 per accident |

| Property Damage Liability | $10,000 |

Because Arizona is a fault state, which means whoever caused the accident is financially responsible for any resulting damages, it is important to know both the minimum insurance requirements and what other coverage you can obtain to protect your financial assets. Keep reading to learn more.

Forms of Financial Responsibility

In Arizona, there are a couple of ways to provide proof of financial responsibility. If you are trying to register a vehicle, you can provide proof of insurance or you can provide a bond or certificate of deposit (cash works also) of $40,000.00.

If you are driving, proof of insurance is required to prove financial responsibility. When stopped by law enforcement, if you cannot provide proof of insurance, you will face a fine, while if you are driving uninsured, your license will likely be suspended.

It is interesting to note that Arizona is one of the 48 states that currently accept electronic proof of insurance, in addition to the traditional paper insurance card you keep in your vehicle.

Premiums as a Percentage of Income

You know insurance is required in order to drive legally on the road in the Grand Canyon State. But how much of your income can you expect to dedicate to car insurance coverage?

| Averages | 2012 | 2013 | 2014 |

|---|---|---|---|

| Arizona Average | 2.75% | 2.81% | 2.80% |

| National Average | 2.34% | 2.43% | 2.40% |

| Percent Difference | 18% | 16% | 17% |

This table shows that on average, Arizona residents spend between 2.75 and 2.8 percent of their disposable income on car insurance. This is 16 to 18 percent higher than the national average of between 2.34 and 2.43 percent of disposable income.

Now that you’ve looked at the percentage of disposable income spent on car insurance for Arizona compared to the national average, how does Arizona compare to neighboring states?

| State | 2012 | 2013 | 2014 |

|---|---|---|---|

| California | 2.10% | 2.20% | 2.14% |

| Utah | 2.52% | 2.55% | 2.54% |

| New Mexico | 2.66% | 2.82% | 2.76% |

| Arizona | 2.75% | 2.81% | 2.80% |

| Nevada | 2.97% | 3.01% | 2.88% |

Arizona residents spend more of their disposable income on car insurance than three out of four of their neighboring states’ residents. Only Nevada residents spend more of their income on car insurance coverage than Arizona drivers.

CalculatorPro

Average Monthly Car Insurance Rates in AZ (Liability, Collision, Comprehensive)

While liability insurance coverage helps pay for damages for others involved in an accident, it does not cover any damages or injuries you experience. There are additional coverage options you can obtain to help cover costs for any of your damages or injuries. But how much will this cost you? What are your choices?

Learn more about the types of car insurance coverage you can obtain.

The core coverage types and their average costs for drivers in Arizona are listed in the below table.

| Coverage Type | 2011-2015 Average Cost in Arizona |

|---|---|

| Liability | $488.59 |

| Collision | $259.31 |

| Comprehensive | $184.20 |

| Combined | $932.10 |

It is important to keep in mind that the National Association of Insurance Commissioners (NAIC) rates in the above table are based on Arizona’s minimum insurance coverage requirements.

These numbers can be used as a baseline to help you start gauging what coverage levels you need and how much you might pay for it.

Additional Liability

With 12 percent of drivers on the road in Arizona uninsured, the state ranks 24th in the nation for uninsured drivers. What happens if you are in an accident with one of those uninsured drivers? Unfortunately, if they are uninsured, you may be responsible for the cost of damages and injuries. However, there is something you can do to offset this.

Additional liability coverage helps protect you financially in the event of an accident with an uninsured driver. This is called Uninsured/Underinsured Motorist coverage. Find out the best uninsured motorist coverage car insurance companies.

There are two other forms of additional liability coverage of which you should be aware:

- Personal Injury Protection (PIP) – provides additional coverage for medical costs (this includes everyone involved in an accident, regardless of who is at fault)

- Medical Payments (MedPay) – provides additional coverage for medical costs (this is only for you and anyone else listed on your policy)

All this extra coverage is great, but if insurance companies can’t or won’t pay out claims, should you ever need to file, it doesn’t do you any good.

So how do you know if an insurance company is paying out on claims? The NAIC collects data on what is referred to as loss ratio. Loss ratio is a number that represents the percentage of claims an insurance company pays out compared to their premiums.

Good loss ratio numbers are in the 60 to 80 percent range. Lower, and it means insurance companies are not paying out enough claims. Higher (particularly above 100 percent), and insurance companies are paying out too many claims, which means they are losing money.

While the NAIC does not currently offer loss ratio data for PIP coverage in Arizona, the below table includes loss ratios for both MedPay and Uninsured/Underinsured Motorist coverage.

| Loss Ratio | 2013 | 2014 | 2015 |

|---|---|---|---|

| MedPay | 79% | 72% | 70% |

| Uninsured/Underinsured Motorist | 84% | 82% | 81% |

In looking at this NAIC data, we can infer that Arizona drivers are in good shape if and when they need to file claims for both MedPay and Uninsured/Underinsured Motorists because the loss ratios for both show the insurance companies have good records for paying claims while still maintaining financial stability.

Add-ons, Endorsements, and Riders

If you feel you need more than the core coverage options described above, you can talk with your insurance agent about other add-ons, endorsements, and riders, which include:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance

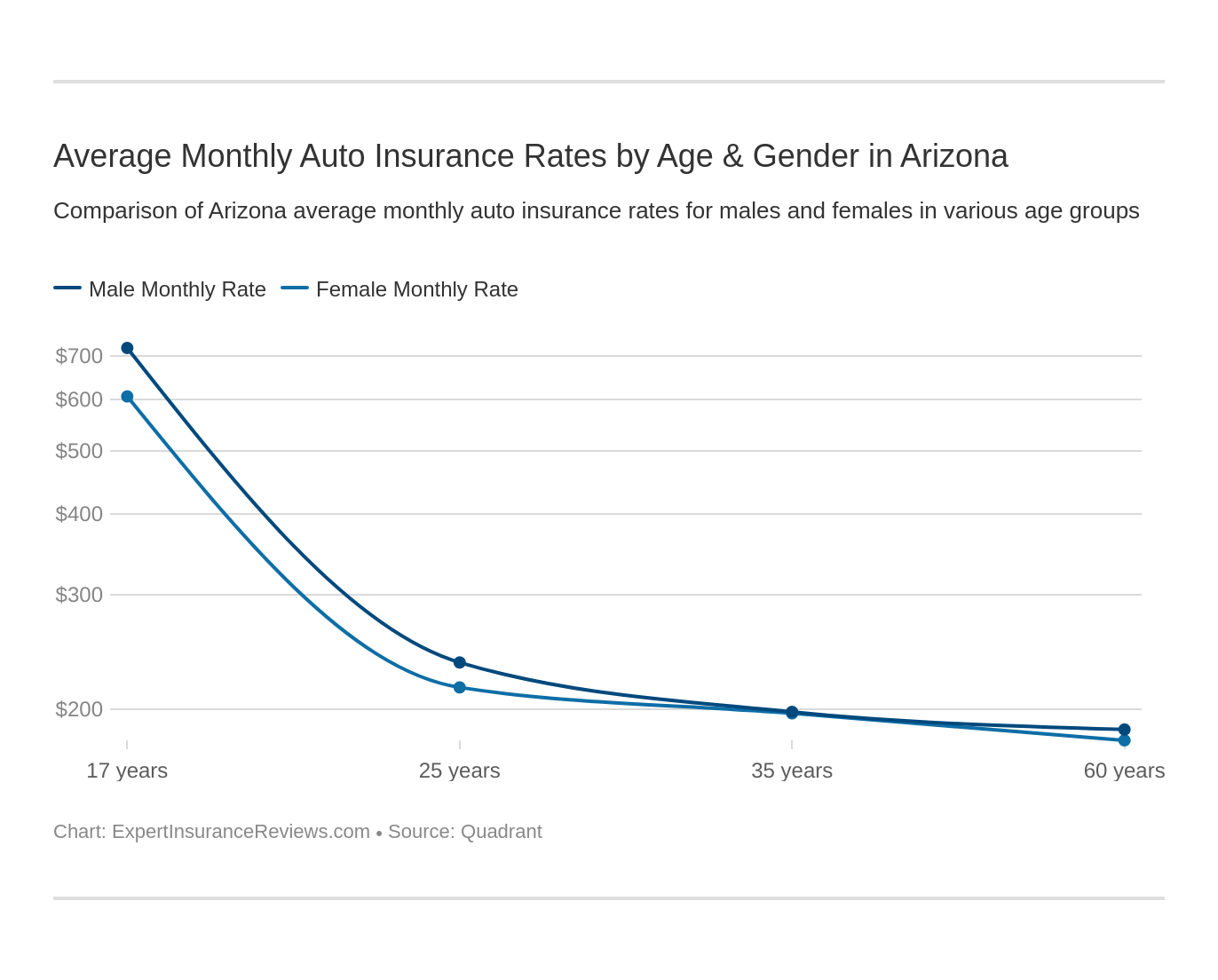

Average Car Insurance Rates by Age & Gender in AZ

Arizona still allows insurance companies to use gender as a variable in adjusting rates, unlike states like California and Hawaii.

What does this mean for male and female drivers in Arizona? Is gender a significant factor in adjusting rates? Check out the data below to learn more.

| Company | Single 17-year old female annual rates | Single 17-year old male annual rates | Single 25-year old female annual rates | Single 25-year old male annual rates | Married 35-year old female annual rates | Married 35-year old male annual rates | Married 60-year old female annual rates | Married 60-year old male annual rates |

|---|---|---|---|---|---|---|---|---|

| Farmers Ins Co of AZ | $11,538.29 | $11,976.04 | $3,034.99 | $3,144.34 | $2,679.47 | $2,677.67 | $2,381.02 | $2,534.04 |

| State Farm Mutual Auto | $8,933.99 | $11,220.20 | $3,098.04 | $3,919.15 | $2,878.25 | $2,878.25 | $2,538.55 | $2,538.55 |

| Progressive Advance Ins | $8,119.66 | $9,061.45 | $2,128.03 | $2,116.05 | $1,977.89 | $1,731.84 | $1,776.60 | $1,687.27 |

| Allstate F&C | $7,562.62 | $9,796.63 | $3,890.24 | $4,230.29 | $3,475.85 | $3,475.85 | $3,384.12 | $3,384.12 |

| American Family Mutual | $7,241.04 | $9,439.65 | $2,748.94 | $3,227.56 | $2,748.94 | $2,748.94 | $2,524.19 | $2,524.19 |

| USAA | $6,306.70 | $7,232.99 | $2,216.43 | $2,377.31 | $1,682.06 | $1,686.88 | $1,569.71 | $1,589.18 |

| NICOA | $5,791.09 | $7,418.71 | $2,714.31 | $2,934.32 | $2,354.06 | $2,397.60 | $2,105.21 | $2,230.55 |

| Travelers Property Casualty | $5,643.46 | $7,078.41 | $2,057.04 | $2,162.23 | $1,942.75 | $2,042.96 | $1,800.08 | $1,912.79 |

| GEICO Cas | $4,418.49 | $4,657.44 | $1,408.73 | $1,388.68 | $1,544.04 | $1,721.95 | $1,303.63 | $1,659.36 |

Younger drivers feel the pain more when looking at rates for male versus female drivers. At 17 male drivers pay, on average, 19 percent more in insurance than female drivers, compared to eight percent more at 25 and only one percent more at 35.

It is also interesting to note that some companies appear to weigh gender more than others in adjusting rates, and age is a key factor for both male and female drivers.

For example, Farmers has the smallest percent difference at around three percent across the age range (with men actually paying slightly less than women at 35). By contrast, for 17 and 25-year-old drivers, State Farm charges about 25 percent more for male drivers’ coverage than for female, while at 35, rates are the same for men and women.

This data, obtained and compiled by Quadrant, is generated using actual, purchased coverage by Arizona drivers. It includes rates for high-risk drivers, drivers who purchase more than the state minimum coverage, and drivers who purchase liability coverage.

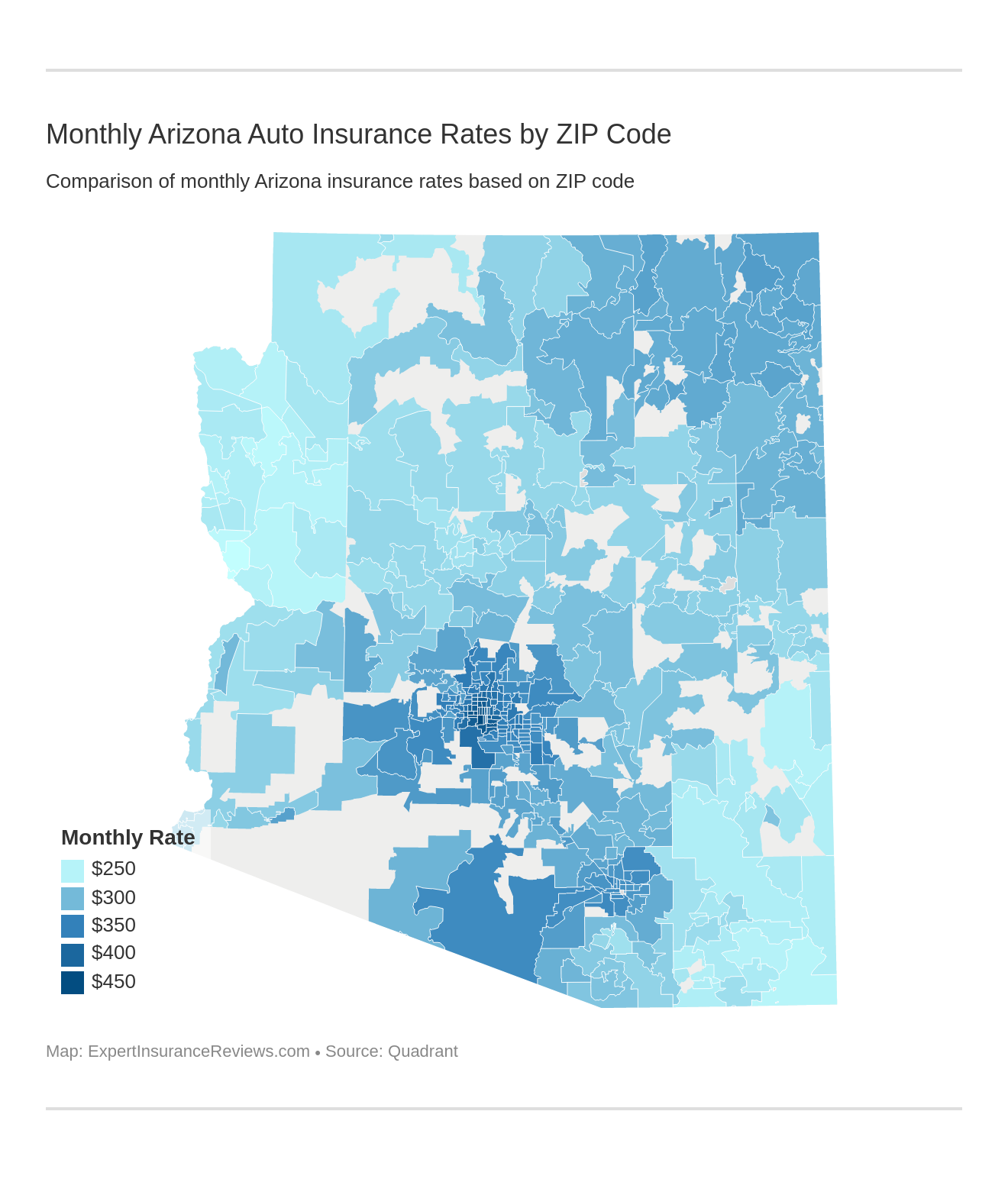

Cheapest Rates by Zip Code

In addition to age and gender, companies also look at where you live when adjusting rates.

It is interesting to note that even in the same city, rates can vary widely by zip code. In Phoenix, if you live in the 85123 zip code, you will pay, on average, $3,726.25, while if you live in the 85009 zip code, you can expect to pay an average of $5,479.07 per year. This is a $1,752.82 difference in the same city.

Cheapest Rates by City

Now that we’ve looked at the average annual cost of insurance by zip code, let’s take a look at rates by city. Who has the cheapest car insurance in Arizona?

It is interesting to note that Phoenix ranks both as the number one most expensive city for car insurance and 124th in the rank of most expensive (out of a total of 420 data points).

The ten largest cities and their average premiums (calculated by averaging the rates for every zip code in the city) in Arizona are listed below.

| Rank | City/Town | Annual Average |

|---|---|---|

| 1 | Phoenix | $4,790.32 |

| 2 | Tuscon | $3,988.09 |

| 3 | Mesa | $4,190.52 |

| 4 | Chandler | $4,074.31 |

| 5 | Glendale | $4,649.73 |

| 6 | Scottsdale | $4,218.33 |

| 7 | Gilbert | $4,101.13 |

| 8 | Tempe | $4,232.43 |

| 9 | Peoria | $4,334.05 |

| 10 | Surprise | $4,041.94 |

While the largest city in the state, Phoenix, is also the most expensive city, on average, for car insurance, the cheapest is actually Tucson, which is ranked the second-largest city in the state.

Your one-stop online insurance guide. Get free quotes now! Secured with SHA-256 Encryption

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Best Arizona Car Insurance Companies

Now that we’ve taken some time to look at pricing (we will return to this topic later), let’s consider what other factors you should be looking at in determining the best insurance coverage for your needs.

How do you know which companies are the best at what they do? Which ones are most likely to remain in business (and be able to pay your claim, should you ever need to file one)? How do rates for companies compare to the state average?

Keep reading to learn more about Arizona insurance companies and their financial and customer service ratings.

The Largest Companies Financial Rating

Financial stability is a key data point in your search for the best car insurance company for your needs. You need to know that the company you choose has the financial stability and longevity to stay in business as well as payout claims.

AM Best is a global credit firm. They look at the credit and financial stability of companies in the insurance market. Using the data they gather, they rate companies’ financial stability and provide an associated financial outlook for each.

Check out this table to see AM Best’s ratings for the ten largest insurance providers in the Grand Canyon State.

| Insurance Company | Rating | Outlook |

|---|---|---|

| State Farm Group | A++ | Stable |

| GEICO | A++ | Stable |

| Progressive Group | A+ | Stable |

| Farmers Insurance Group | NR | - |

| Allstate Insurance Group | A+ | Stable |

| USAA Group | A++ | Stable |

| Liberty Mutual Group | A | Stable |

| American Family Insurance Group | A | Stable |

| Hartford Fire & Casualty Group | A+ | Stable |

| CSAA Insurance Group | A | Stable |

AM Best’s rating structure is such that companies with an A-minus or better are considered financially stable and have a consistent loss ratio.

Looking at the above table, Arizona drivers have a number of good choices for insurance coverage, based on companies’ financial stability and outlook.

Companies with Best Ratings

What about customer service? If you plan to purchase something that includes an ongoing service, you want to know you can call the company for help. Customer service is a key piece of the decision-making process when you are looking at insurance providers.

According to a recent JD Power study, customer satisfaction in insurance providers is at an all-time high.

JD Power’s customer satisfaction ratings for the primary insurance companies in the Southwest region (which Arizona falls within) are in the below image.

Companies with Most Complaints in Arizona

While customer satisfaction is high, that does not mean that insurance companies are perfect. Customers file complaints regularly for a variety of reasons. How many complaints are filed against insurance providers in Arizona? Check out this table to see how companies compare.

| Insurance Company | Direct Premiums Written | Complaint Ratio | Loss Ratio | Market Share |

|---|---|---|---|---|

| State Farm Group | $818,982 | 0.44 | 70.94% | 16.87% |

| GEICO | $723,482 | 0.68 | 74.55% | 14.91% |

| Progressive Group | $513,333 | 0.75 | 60.14% | 10.58% |

| Farmers Insurance Group | $393,157 | 0 | 61.16% | 8.10% |

| Allstate Insurance Group | $369,153 | 0.5 | 56.51% | 7.61% |

| USAA Group | $362,766 | 0.74 | 78.78% | 7.47% |

| Liberty Mutual Group | $279,343 | 5.95 | 71.23% | 5.76% |

| American Family Insurance Group | $276,833 | 0.79 | 71.39% | 5.70% |

| Hartford Fire & Casualty Group | $109,174 | 4.68 | 66.10% | 2.25% |

| CSAA Insurance Group | $100,187 | 3.97 | 63.00% | 2.06% |

The complaint ratio compares the number of complaints a company receives against what is considered an average number of complaints.

In this case, the average is represented by the number one. This means companies with a ratio higher than one receive more than the average number of complaints, while companies with a ratio lower than one receive less than the average number of complaints.

Looking at the above table, companies in Arizona mostly receive less than the average number of complaints.

Liberty Mutual, Hartford Fire & Casualty Group, and CSAA Insurance Group all received much higher than the average number of complaints. However, they also have very small portions of the Arizona insurance market.

This means the number of complaints is restricted to a very small piece of the market, rather than being spread across a larger market share (like some of the other companies).

Should you need to file a complaint against an insurance provider in Arizona, you can do so by submitting through the Arizona Department of Insurance online consumer complaint system.

If you have questions or need clarification on whether or not you should file a complaint, you can call them at 602-364-2499 or 800-325-2548 or email them at [email protected].

Cheapest Companies in Arizona

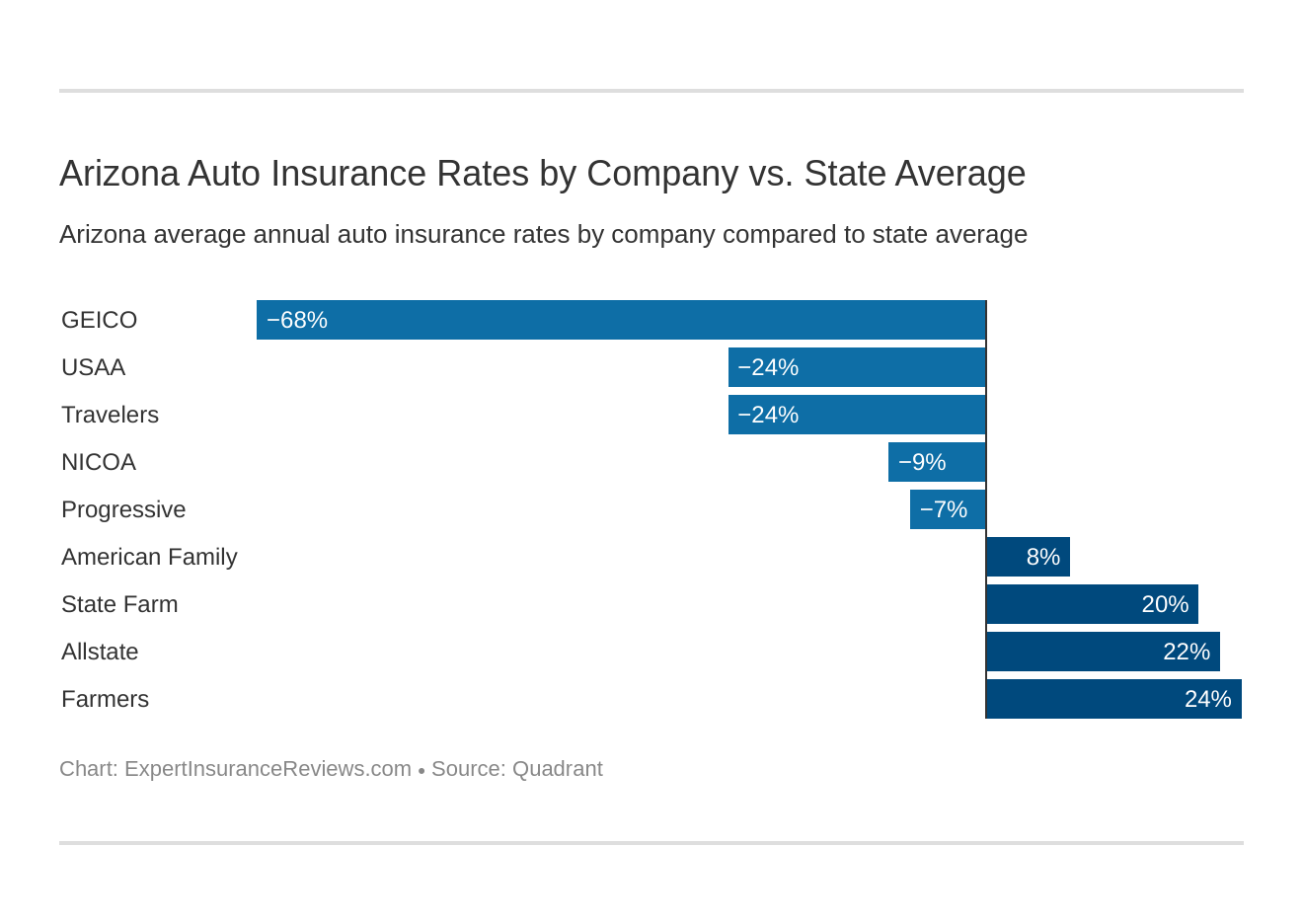

As promised, we now return to pricing. This table looks at the average rates for the largest car insurance providers in the Grand Canyon State, so you can see which companies offer the best rates for your needs.

| Company | Annual Average | +/- Compared to State Average (Rate) | +/- Compared to State Average (%) |

|---|---|---|---|

| GEICO Cas | $2,262.79 | -$1,547.24 | -68.38% |

| Travelers Property Casualty | $3,079.96 | -$730.06 | -23.70% |

| USAA | $3,082.66 | -$727.37 | -23.60% |

| NICOA | $3,493.23 | -$316.80 | -9.07% |

| Progressive Advance Ins | $3,574.85 | -$235.18 | -6.58% |

| American Family Mutual | $4,150.43 | $340.40 | 8.20% |

| State Farm Mutual Auto | $4,750.62 | $940.60 | 19.80% |

| Allstate F&C | $4,899.96 | $1,089.94 | 22.24% |

| Farmers Ins Co of AZ | $4,995.73 | $1,185.70 | 23.73% |

The average rate for Arizona is $3,810.03. The data in this table compares the state average against the average for each of the listed companies.

While six of the listed companies are below the state average, the remaining four offer rates well above the state average.

To better understand this data, and be able to use it more effectively in determining which insurance provider and coverage mix is right for you, we need to look at how the rates are derived.

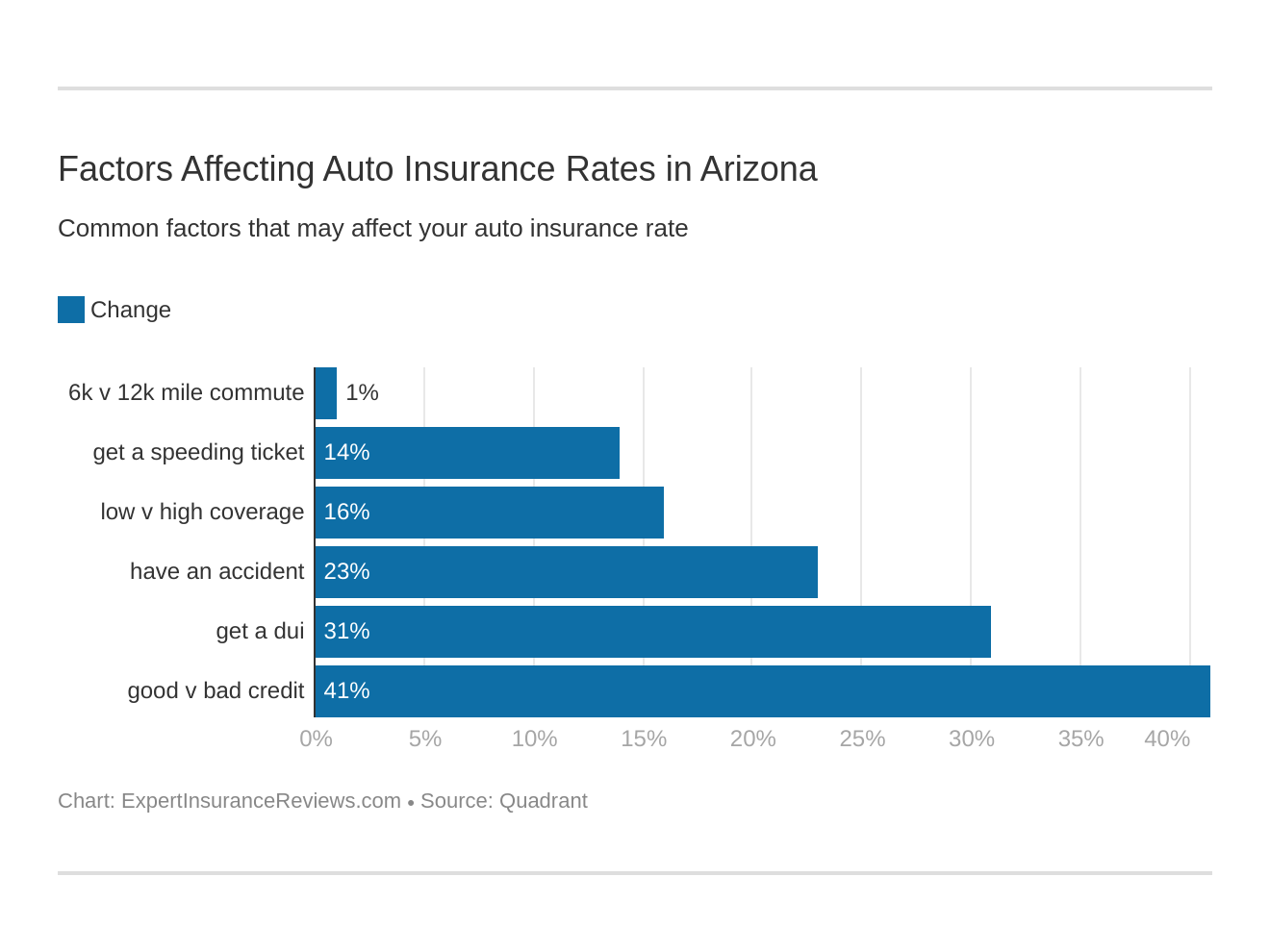

You already know many insurance companies consider age and gender as variables when adjusting your rates. But did you know they often also adjust your rates based on your credit score, commute, and driving record?

Check out the next few sections to see how these factors can affect your rates.

Commute Rates by Companies

How much time do you spend commuting each day? Unfortunately, the longer your commute, the higher some companies may adjust your rates. Why? The longer you spend on the road, the higher your chance of getting in a car accident.

This table looks at daily commutes of ten miles versus 25 miles to see how various insurance companies in the Grand Canyon state adjust rates.

| Company | 10 Mile Commute (6,000 annual mileage) | 25 Mile Commute (12,000 annual mileage) | Percent Increase |

|---|---|---|---|

| Farmers | $4,995.73 | $4,995.73 | 0.00% |

| Allstate | $4,899.96 | $4,899.96 | 0.00% |

| State Farm | $4,631.04 | $4,870.20 | 5.16% |

| American Family | $4,110.32 | $4,190.54 | 1.95% |

| Progressive | $3,574.85 | $3,574.85 | 0.00% |

| Nationwide | $3,493.23 | $3,493.23 | 0.00% |

| Travelers | $3,079.97 | $3,079.97 | 0.00% |

| USAA | $3,049.29 | $3,116.03 | 2.19% |

| GEICO | $2,224.53 | $2,301.06 | 3.44% |

Some companies consider commute distance more than others. Farmers, for example, has the highest rates but does not increase at all based on commute. State Farm, however, has the third-highest rates and increases their premiums by five percent when your daily commute increases from 10 miles to 25 miles. Learn more about State Farm in our State Farm insurance review.

Commute times are not the only factor that will affect your rates.

Coverage Level Rates by Companies

How much coverage do you need? Low, medium, or high? Choosing different levels will affect your rates. As you might expect, low coverage costs less than medium or high coverage. The below table compares average rates for different levels of coverage in Arizona.

| Insurance Company | Annual Rates with Low Coverage | Annual Rates with Medium Coverage | Annual Rates with High Coverage |

|---|---|---|---|

| GEICO | $1,907.11 | $2,295.09 | $2,586.17 |

| Travelers | $2,757.50 | $3,127.90 | $3,354.49 |

| USAA | $2,840.93 | $3,125.01 | $3,282.03 |

| Progressive | $3,154.96 | $3,639.87 | $3,929.72 |

| Nationwide | $3,347.36 | $3,529.03 | $3,603.30 |

| American Family | $3,995.23 | $4,282.99 | $4,173.07 |

| Farmers | $4,259.36 | $5,047.56 | $5,680.28 |

| State Farm | $4,275.90 | $4,837.71 | $5,138.26 |

| Allstate | $4,584.99 | $4,926.32 | $5,188.57 |

Like the other choices and factors we’ve considered so far, different companies charge more or less for different levels of coverage than others. For example, GEICO increased their average rates by 20 percent for medium, rather than low, coverage. High coverage from GEICO results in a 36 percent increase over the average cost of their low coverage.

On the other hand, Nationwide’s rate increases for medium and high coverage are significantly lower, at 5 percent for medium and 8 percent for high coverage.

Credit History Rates by Companies

What’s your credit score? Didn’t expect that question for car insurance, did you? Fortunately or unfortunately (depending on your credit score), many car insurance companies consider credit when adjusting your rates.

“Why?” you may ask. Some insurance companies correlate good credit to responsible driving. In other words, they expect that if you are fiscally responsible, you will also be responsible in other areas of your life, like driving.

Experian notes that at an average credit score of 669, Arizona residents have just under a good credit score (670 is typically considered good, while Arizona residents have a fair score).

What does this mean for you? Check out this table to see what good, fair, and poor credit can do to your insurance rates.

| Insurance Company | Annual Rates with Good Credit | Annual Rates with Fair Credit | Annual Rates with Poor Credit |

|---|---|---|---|

| GEICO | $1,640.02 | $2,039.68 | $3,108.67 |

| State Farm | $2,124.14 | $3,387.26 | $8,740.46 |

| USAA | $2,357.49 | $2,833.38 | $4,057.11 |

| Travelers | $2,430.80 | $3,058.12 | $3,750.98 |

| Nationwide | $2,930.12 | $3,345.92 | $4,203.65 |

| Progressive | $3,253.11 | $3,482.51 | $3,988.93 |

| American Family | $3,347.92 | $3,885.37 | $5,217.99 |

| Allstate | $3,969.73 | $4,462.15 | $6,268.01 |

| Farmers | $4,531.43 | $4,764.49 | $5,691.27 |

Put another way:

- Good Credit (670+) = average annual premiums: $2,953.86

- Fair Credit (580-669) = 5 – 59 percent increase: $3,473.21

- Poor Credit (300-579) = 14 – 158 percent increase: $5,003.01

Driving Record Rates by Companies

Do you exceed the speed limit on a regular basis? Have you had a couple of car accidents? These, along with DUIs, negatively affect your driving record. It should not come as a surprise that car insurance companies will take this into account when adjusting your rates. If you have a track record of reckless driving, you will pay higher insurance rates.

This table compares the average rates for a clean driving record against average rates for drivers with one speeding violation, one DUI, and one accident. This can be used as a baseline for you to determine how your driving record can affect your premiums.

| Insurance Company | Clean Record | 1 Speeding Violation | 1 DUI | 1 Accident |

|---|---|---|---|---|

| GEICO | $1,755.11 | $1,755.11 | $3,170.22 | $2,370.73 |

| USAA | $2,242.13 | $2,639.09 | $4,237.25 | $3,212.15 |

| Travelers | $2,464.33 | $3,072.34 | $3,572.38 | $3,210.80 |

| American Family | $2,939.21 | $3,414.84 | $5,673.56 | $4,574.11 |

| Nationwide | $2,955.75 | $3,306.90 | $4,602.36 | $3,107.91 |

| Progressive | $3,153.69 | $3,663.97 | $3,328.96 | $4,152.77 |

| Allstate | $3,924.91 | $5,078.95 | $5,631.44 | $4,964.56 |

| Farmers | $4,219.77 | $5,006.52 | $5,312.44 | $5,444.19 |

| State Farm | $4,321.08 | $4,750.62 | $4,750.62 | $5,180.16 |

If speed is your thing, GEICO may be worth some additional consideration, as they do not increase their rates at all for a single speeding violation.

We’ve also calculated the percent increase for each road violation type in the below table.

| Insurance Company | Percent Increase - Speeding Ticket | Percent Increase - DUI | Percent Increase - Accident |

|---|---|---|---|

| GEICO | 0.00% | 80.63% | 35.08% |

| State Farm | 9.94% | 9.94% | 19.88% |

| Nationwide | 11.88% | 55.71% | 5.15% |

| American Family | 16.18% | 93.03% | 55.62% |

| Progressive | 16.18% | 5.56% | 31.68% |

| USAA | 17.70% | 88.98% | 43.26% |

| Farmers | 18.64% | 25.89% | 29.02% |

| Travelers | 24.67% | 44.96% | 30.29% |

| Allstate | 29.40% | 43.48% | 26.49% |

In looking at the above table, we can see some interesting trends for different insurance companies. For example, most companies have a much more significant rate increase for DUIs than they do for speeding violations.

However, State Farm increases rates for speeding and DUI violations equally and Progressive actually has a higher increase for a speeding violation than they do for a DUI.

Find out the best auto insurance after a DUI.

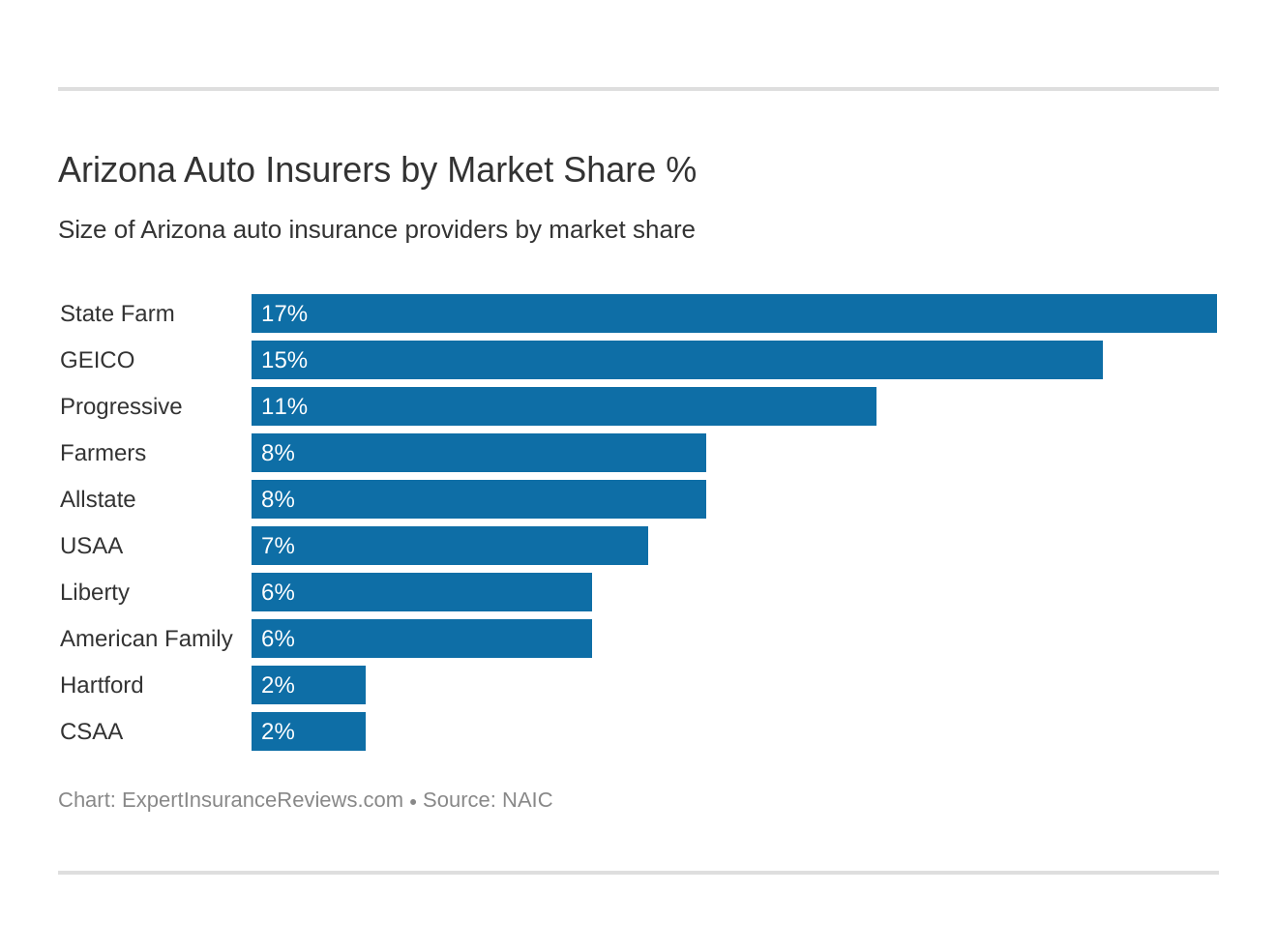

Largest Car Insurance Companies in Arizona

What about company size? Is this something you should consider? The answer is yes. The size of a company and its market share, along with the loss ratio and complaint data we’ve already mentioned, are key factors when considering which car insurance company best suits your needs.

These factors can help indicate companies’ ability to pay claims, in the event you ever need to file one.

The below table provides market share and premiums written data for some of the largest insurance providers in Arizona.

| Insurance Company | Direct Premiums Written | Market Share |

|---|---|---|

| State Farm Group | $818,982.00 | 16.87% |

| GEICO | $723,482.00 | 14.91% |

| Progressive Group | $513,333.00 | 10.58% |

| Farmers Insurance Group | $393,157.00 | 8.10% |

| Allstate Insurance Group | $369,153.00 | 7.61% |

| USAA Group | $362,766.00 | 7.47% |

| Liberty Mutual Group | $279,343.00 | 5.76% |

| American Family Insurance Group | $276,833.00 | 5.70% |

| Hartford Fire & Casualty Group | $109,174.00 | 2.25% |

| CSAA Insurance Group | $100,187.00 | 2.06% |

Number of Insurers by Arizona

There are two primary kinds of insurers in most states: domestic and foreign. This is not as exotic as it sounds.

- Domestic insurers are those that are incorporated in Arizona

- Foreign insurers are those that are incorporated in a state other than Arizona but do business in the state

It is important to note that both domestic and foreign insurers are required to follow Arizona’s insurance laws in order to operate within the borders of the Grand Canyon State.

In Arizona, you have a lot of options for insurance companies. There are a total of 983, 40 of which are domestic and the remaining 943 are foreign insurance providers.

Arizona Laws

In order to legally drive in Arizona, you know there are a number of laws you have to follow. But figuring out what the laws are, which apply to you, and how to follow them can be aggravating. No one likes reading “legalese.”

However, it is important to know these so you can avoid tickets, fines, and even suspension of your driver’s license and driving privileges.

We’ve pulled together information on a variety of key laws in Arizona to make sure you have what you need to stay safe and legal on the road, without the frustration of having to do the research yourself.

Keep reading to learn more insurance laws that may apply to you, important information about how to register your vehicle, and rules of the road you must follow.

Car Insurance Laws

First off, car insurance laws you should be aware of to make sure you are appropriately insured when driving in Arizona.

You already know that the Grand Canyon State requires you maintain minimum liability insurance. But what about other insurance-related laws? What happens if your driving record inhibits your ability to obtain car insurance?

If you get a chip in your windshield, what does the state law say about how you and your insurance company must address this?

Keep reading to find out the answers to these questions, and more.

How State Laws for Insurance are Determined

Most states follow similar processes for enacting laws, and Arizona is no exception. The first step is for a bill to be put together. Once this is done, it is put before the state legislature.

The legislature reviews the bill to determine its benefits and whether or not they consider it to be necessary. If they agree it is both beneficial and necessary, the legislature signs it into law.

Check out the following sections to learn more about insurance laws you need to follow in Arizona.

Windshield Coverage

Have you ever gotten a chip in your windshield when driving down the highway? Most drivers have experienced both the startling sound of a rock or pebble hitting the windshield and the resulting frustration when it chips or cracks.

What can you do to make the repair process as painless as possible?

In Arizona, you have the option of adding “full glass” or “safety equipment” coverage to your insurance policy. This coverage pays for any necessary repairs to your windshield without you having to meet a deductible first.

State law allows insurance companies to pay for aftermarket parts (rather than original manufacturer parts), as long as they provide notice of this decision in writing.

The law also allows you as the insured the ability to choose who you want to perform any necessary repairs. In some cases, you also have the option to choose whether you have your windshield repaired or replaced.

High-Risk Insurance

Unfortunately, if you have a poor driving record and are considered a high-risk driver, it may be difficult for you to obtain car insurance coverage.

If this is the case, the Grand Canyon State has a solution. The Arizona Automobile Insurance Plan (AZ AIP) is a program that helps high-risk drivers obtain insurance coverage by matching them with insurance companies.

Any insurance company operating in Arizona is required to accept a certain percentage of drivers through AZ AIP. This percentage is commensurate with its market share in the state.

For example, State Farm, which has the largest market share in the state at almost 17 percent, must insure 17 percent of the drivers who apply to and qualify for AZ AIP.

You must have a valid Arizona driver’s license and be able to certify and prove at least one insurance provider has rejected your coverage application to qualify for AZ AIP.

Despite the law that states all insurance companies must insure drivers matched with them through AZ AIP, providers still have the ability to reject your application if:

- You owe an outstanding premium payment to a car insurance company

- Your insurance coverage was canceled sometime in the preceding 12 months because you did not bring your vehicle in for inspection by a company representative

Additionally, if you own a vehicle that is more than 25 years old and/or worth more than $25,000, AZ AIP can choose not to match you with companies.

If you apply for and are able to obtain insurance through AZ AIP, you will receive three years of coverage. However, your minimum liability insurance coverage requirements will be significantly higher than those levied on average (non-high-risk) drivers in the Grand Canyon State, as shown in the below table.

| Required Insurance | State Minimum Limits | AZ AIP Minimum Limits |

|---|---|---|

| Bodiliy Injury Liability | $15,000 per person $30,000 per accident | $100,000 per person $300,000 per accident |

| Poperty Damage Liability | $10,000.00 | $50,000 |

In addition to the minimum liability coverage requirement, you can opt for additional coverage like collision, comprehensive, and uninsured/underinsured motorist coverage. These rates too will be higher for you than for non-high-risk drivers. Find out the best auto insurance companies for high-risk drivers.

In order to apply for AZ AIP, you can reach out to an insurance agent for a quote. They can also fill out and submit an electronic application for you.

If you have questions about the AZ AIP, you can call the Arizona Department of Insurance at 602-364-2449.

What if you do not have a valid Arizona driver’s license (which, as noted above, is required in order to apply for AZ AIP)?

If your license has been suspended for any reason, you will be required to obtain an SR-22 form in order to start the license reinstatement process. Other reasons you may be required to obtain an SR-22 form:

- DUI

- Driving without insurance

- Numerous unpaid tickets

- Multiple less severe offenses (ex. speeding tickets)

- Too many points on your license

Insurance companies send SR-22 forms to the motor vehicle department (MVD) as proof that you have insurance coverage.

If you need an SR-22, you have a couple of options:

- If your current insurance provider maintains your coverage despite a suspended license/serious offense, you can have them add an SR-22 to your policy

- If your current insurance provider cancels your policy as a result of a suspended license/serious offense, you can reach out to other insurance companies for quotes

It is important to note that you will pay significantly higher premiums if you have an SR-22 form requirement. Another item to remember is that some insurance companies do not include SR-22 coverage as an option.

You typically will be required to maintain the SR-22 for three years before you can have it removed from your policy.

Low-Cost Insurance

While Arizona offers options for high-risk drivers struggling to obtain insurance, they do not currently have a similar program to provide assistance to low-income drivers.

At this time, only California, Hawaii, and New Jersey offer some kind of government-funded program to assist low-income families in maintaining their car insurance coverage.

Automobile Insurance Fraud in Arizona

Insurance fraud is a growing problem in the United States that ultimately results in you paying higher premiums. According to the Insurance Information Institute, fraud causes about 10 percent of insurance companies’ losses each year.

As a result, many states are taking fraud more seriously than ever. This means prosecuting it as a crime and in many cases, standing up divisions focused entirely on fraud investigation.

Arizona is one such state. Insurance fraud is considered a crime in the Grand Canyon State. In addition, the Arizona Department of Insurance has put together a fraud bureau to investigate and handle insurance fraud. There are two divisions:

- The Insurance Fraud Unit, which is focused on investigating and reducing fraud perpetrated by individuals against insurance providers

- The Administrative Enforcement Section, which is focused on investigating fraud and theft perpetrated by various types of insurance providers

According to the Arizona Department of Insurance website, there are two kinds of insurance fraud:

- Hard, which refers to when an individual or group intentionally fakes or exaggerates an accident, injury, etc. to obtain additional money from insurance companies

- Soft, which refers to when an individual provides false information to their insurance provider to reduce their rates (ex. providing lower-than-actual commute information)

There are a couple of ways for you to report suspected fraud to the state:

- Fraud against insurance companies: fill out and submit a fraud referral form

- Fraud against insurance consumers: file a complaint or email the Arizona Insurance Department at [email protected]

For questions, you can reach out to the Insurance Fraud Unit by calling 602-364-2140.

Statute of Limitations

There is a statute of limitations of two years in Arizona for filing injury and property damage claims.

State Specific Laws

While some laws are fairly standard from state to state, like it being illegal to speed, others are specific to individual states.

For example, as we discussed earlier, Arizona allows residents to provide a certificate of deposit with the Office of the Arizona State Treasurer of $40,000 in lieu of proof of liability insurance and/or proof of financial responsibility. If this is of interest to you, you can call the Arizona State Treasurer’s office at 602-542-7800 for more information.

Another law specific to the Grand Canyon State relates to driving through parking lots. It is illegal to drive through a parking lot in order to avoid traffic.

Vehicle Licensing Laws

Making sure your vehicle is registered is an important step in avoiding fees and possible suspension of your license.

Registering a new vehicle in Arizona requires you go to the MVD in person. After purchase, you will need to obtain a permit that allows you to drive for a few days prior to registration. This will enable you to get your vehicle emissions tested, inspected, etc.

When you register your vehicle, you have the option for one, two, and five-year registrations (five-year registrations are only an option if your vehicle is not subject to the emissions test requirement).

If you need to renew your registration, you can do so online through the ServiceArizona website managed by the Arizona Department of Transportation. This process allows you to submit the necessary information and payment online.

You can also renew your registration over the phone by calling 1-888-713-3013.

You may be required to provide proof that your vehicle meets the state emissions test requirement.

For additional questions, you can call the MVD at:

- 602-255-0072 (if you live in Phoenix)

- 520-629-9808 (if you live in Tucson)

- 800-251-5866 (if you live anywhere else in Arizona)

Real ID

Do you plan to fly commercially in the next couple of years? Does your job require you to visit federal military installations or nuclear power plants? If so, the REAL ID Act is relevant for you.

According to the Department of Homeland Security (DHS), the REAL ID Act is a process by which your identification indicates you are who you say you are.

REAL ID-complaint identification will be required for commercial air travel and access to military installations and nuclear power plants (however, for the last two, you will also need a reason for access; just having the REAL ID does not guarantee you access) starting in October of 2020.

DHS confirms that Arizona is one of the 47 states currently in compliance with the REAL ID Act.

In order to obtain an Arizona Travel ID (the REAL ID-compliant identification document in the state), you will need to visit the MVD in-person. When you visit, you will need to bring:

- Proof of identity

- Proof of Social Security Number

- Two proofs of Arizona state residence

- Legal proof of name change (if applicable)

Like many states, Arizona signifies an ID or driver’s license is REAL ID-compliant through a gold circle with a start in the middle in the upper right-hand corner of the document.

If you choose not to obtain an Arizona Travel ID the next time your license is up for renewal, your new license will be considered a non-travel license and will state “Not for Federal Identification” on the front.

For more information on obtaining an Arizona Travel ID, you can visit the Arizona Department of Transportation Travel ID page.

Penalties for Driving Without Insurance

As we’ve noted a few times, minimum liability insurance is required when driving in Arizona. The Grand Canyon State accepts both paper and digital copies of your proof of insurance.

But what happens if you are found to be driving without insurance in the Grand Canyon State?

| Penalty | First Offense | Second Offense |

|---|---|---|

| Fine | Minimum $500 | Minimum $750 |

| License Suspension | 3 month suspension of license, registration, and license plate | 6 month suspension of license, registration, and license plate |

Teen Driver Laws

If you are a teenager just learning to drive in Arizona, you will be required to meet several requirements beyond a driver education course in order to obtain your full driver’s license.

You can apply for a graduated instruction permit at 15 years and six months old. You will be required to hold this license for a minimum of six months. During that time period, you must complete a minimum of 30 hours of supervised driving. At least ten of those 30 hours must be at night.

At 16, after you have met the graduated instruction permit requirements, you can apply for a graduated driver’s license. For the first six months that you hold the graduated driver’s license, you will not be permitted to drive unsupervised between the hours of midnight and 5:00 a.m.

You will also not be allowed to have more than one passenger in your vehicle who is under the age of 18.

After either six months of holding the graduated driver’s license or turning 18 (whichever comes first), the nighttime driving and under-18 passenger limitation restrictions will be lifted.

Find out the best auto insurance for young adults.

Older Driver License Renewal Procedures

In Arizona, there are specific license renewal procedures and requirements for older drivers. If you are 65 or older, you are required to renew your license every five years in the Grand Canyon State (compared to every 12 years for anyone 64 and younger).

However, both the general and older populations are required to provide proof of adequate vision at every renewal, and neither are allowed to renew their license online or through the mail. In-person driver’s license renewal is required for all drivers in Arizona.

New Residents

If you’ve recently moved to Arizona, you will be required to obtain an Arizona driver’s license as soon as you achieve residence.

You will need to apply for an in-state license in-person at the MVD. Before you visit, get prepared by filling out the online application form. When you visit the MVD, you will need to bring the following documents with you:

- Proof of identity

- Proof of Social Security Number

- Two proofs of Arizona state residence

- Legal proof of name change (if applicable)

You will also need to relinquish your out-of-state license and pass a vision test.

There are fees associated with obtaining your license, which vary based on your age. The older you are, the less it costs to obtain a driver’s license in the state.

License Renewal Procedures

Drivers 64 and younger in the state of Arizona must renew their driver’s license at least once every 12 years. You can renew your license as early as six months before your current license expires.

This must be done in-person either at the MVD or at an authorized third-party driver’s license provider. The first step is to fill out and submit the online application. While you are at the MVD, you will be required to take a new photo and pass a vision test.

You will also need to bring two forms of identification with you when you visit the MVD to renew your license. Your current license qualifies as one form of identification. The second can be chosen from a list provided on the Arizona Department of Transportation website.

The Arizona Department of Transportation encourages drivers to consider obtaining a Travel ID (REAL ID-compliant driver’s license) at their next renewal.

Negligent Operator Treatment System (NOTS)

Like many states, Arizona has a points system that is attached to your driver’s license every time you are convicted of a traffic violation. Too many points and you face serious consequences.

If you end up with eight points (or more) within a 12-month period, your license can be suspended for a year and you will also likely be required to attend traffic survival school (TSS).

This table, from the Arizona Department of Transportation, outlines the points associated with each moving traffic violation.

| Violation | Points |

|---|---|

| DUI | 8 |

| Extreme DUI | 8 |

| Reckless Driving | 8 |

| Aggressive Driving | 8 |

| Hit & Run | 6 |

| Failure to stop for traffic signal, stop sign, or right-of-way yield that results in death | 6 |

| Failure to stop for traffic signal, stop sign, or right-of-way yield that results in serious injury | 4 |

| Speeding | 3 |

| Driving Over/Parking in a Gore Area | 3 |

| All Other Moving Violations | 2 |

Rules of the Road

Ready to get on the road? How do you keep your driving record clean, thereby keeping your insurance rates low?

There are a number of rules of the road that you need to be aware of to keep you safe and avoid racking up points against your driver’s license.

We’ve collected information on a number of these, including seat belt laws, speed limits, and what Arizona is doing to keep you safe when using ridesharing services and sharing the road with autonomous vehicles. Keep reading to learn more.

Fault vs. No-Fault

What are fault and no-fault systems?

- Fault systems are structured such that whoever is responsible, or “at fault,” for an accident is also financially responsible for any resulting damages. In other words, if you are in an accident, and the other driver is at fault, their insurance company will cover the resulting damages.

- No-fault systems are structured so that each party involved in a car accident must file for damages with their own insurance company, no matter who was at fault.

Arizona is a fault system. However, under Arizona law, comparative negligence also applies. This means that if you are partially (but not completely) at fault for an accident, you can still receive some compensation, but only for the portion of the accident that is deemed the other driver’s fault.

For example, if you are 20 percent at-fault for an accident, you will receive 80 percent of the compensation for your damages, and the other driver will receive 20 percent of the compensation for their damages.

Seat belt and car seat laws

To keep you and your passengers safe when driving on the road in the Grand Canyon State, there are explicit laws defining who must wear what kinds of seat belts.

Any child age four or younger must be properly secured in an appropriate child safety seat. At age five (up through age seven), children must either be properly secured in an appropriate child safety seat if they are less than 57 inches tall or be properly secured with an adult seat belt if they are more than 57 inches tall.

Anyone age eight and older must be properly secured using an adult seat belt at all times.

If you or one of your passengers is not properly seat belted, this is considered a secondary offense in Arizona. This means that while a law enforcement officer cannot pull you over for the seat belt violation. If they pull you over for something else that qualifies as a primary offense (like speeding), they can also ticket you for the seat belt violation.

Arizona does not currently have any laws that address riding in the back of a pickup truck, according to the Insurance Institute for Highway Safety.

Keep Right and Move Over Laws

If you are on the road in Arizona and you see a vehicle stopped on the side of the road, you are required to move over (away) as soon as it is safe to do so.

Additionally, if you are driving more slowly than surrounding traffic, you should move to the right where it is possible and safe to do so.

Speed Limits

Arizona considers speeding to be a serious violation. As you saw earlier, a speeding conviction will result in three points being attached to your driver’s license.

If you get three speeding tickets in a 12-month period (with no other moving traffic violations), you will end up with nine points on your driver’s license. Remember, it only takes eight points to have your license suspended.

To avoid getting a ticket while driving in the Grand Canyon State, you should be aware of the maximum speed limits on various road types.

- Rural interstates: 75 MPH

- Urban interstates: 65 MPH

- Local residential and business district streets: 25 MPH

Within the maximum ranges, speeds can be set based on traffic patterns.

When driving, always pay attention to and follow the posted speed limit. If, for some reason, you are in a section of road without a posted speed limit sign, the state’s Basic Speed Law should be followed. This states that all drivers must drive at a “reasonable and prudent” speed for the current road conditions and area in which you are driving.

Ridesharing

If you ever catch a ride with Uber, Lyft, or other transportation network companies (TNCs), you should know the rules and regulations Arizona mandates they must follow to keep you safe.

In order to operate in Arizona, all ridesharing services must require their drivers to have background checks.

TNC drivers are required to maintain liability insurance coverage of $50,000 for injury to a single person, $100,000 for injury to multiple people, and $30,000 for property damage for any time their app is open but they are not currently providing a ride to a customer.

Drivers must also maintain an additional $250,000 in liability coverage. This coverage will only apply when a driver is providing a ride through a ridesharing application, not when he or she is using their vehicle for personal use. During that time, the driver’s own insurance policy will provide coverage.

Currently, Allstate, Farmers, GEICO, Mercury, and USAA provide ridesharing insurance coverage.

Automation on the Road

Can autonomous vehicles operate on the road in Arizona? The answer is yes. The Grand Canyon State has been at the forefront of the autonomous vehicle market, particularly for testing, for several years.

However, in 2018, the state imposed some limitations to keep residents safe and allow the state to gather information on how many driver-less vehicles are on the road.

All companies that plan to release autonomous vehicles on the road must register those vehicles with the state within the first 60 days of road-testing.

Additionally, they will be required to ensure every vehicle includes a clearly posted federal certification label and will have built-in safety features that will stop the vehicle if any portion of the autonomous technology fails or errors.

The state is still developing plans of action for how law enforcement is expected to handle citations involving driverless cars. However, if a citation is required, the company that owns the vehicle will be responsible for payment.

All autonomous vehicles must carry a minimum liability insurance coverage of $2 million.

Arizona is also partnering with Intel Corporation to create research institute whose purpose will be to both advance autonomous vehicle technology and ensure the appropriate policies are in place at the correct times to keep residents safe.

Safety Laws

Beyond wearing your seat belt and following posted speed limits, Arizona has a number of laws focused specifically on keeping you and other drivers on the road safe as you traverse the state.

One such law relates to acceptable windshield tinting, which sets the maximum tint percentage for vehicles in the state, to ensure to you have the visibility necessary to drive safely.

For sedans, SUVs, and vans,

- Windshield: non-reflective tint can be placed above the manufacturer’s AS-1 line

- Front side windows: a minimum of 34 percent of outside lighting must filter into the vehicle and tint reflection cannot be more than 35 percent reflective

- Rear side windows: any darkness is permitted and tint reflection cannot be more than 35 percent reflective

- Rear window: any darkness is permitted and tint reflection cannot be more than 35 percent reflective

Additionally, if any back or rear windows are tinted, dual side mirrors are required, and red and amber tinting are prohibited on all windows of a vehicle.

We take a look at other safety-related laws, including those related to driving under the influence and distracted driving, in the following sections.

DUI Laws

Driving while under the influence is illegal, and comes with potentially serious consequences both for you and others on the road. If you are caught driving under the influence, not only will you face fines, jail time, suspension of your license, and more, you run the risk of injuring and even killing someone else while you are behind the wheel.

The blood alcohol (BAC) limit in Arizona is 0.08, and a high BAC (HBAC) is 0.15-0.2. Responsibility.org reports that in 2017, 278 people died in driving incidents involving alcohol impairment. This works out to four alcohol-related driving fatalities per 100,000 population, compared to the national average of 3.4 for the same time period.

Driving while under the influence is not worth the risk. Take a look at this table to see what penalties you may face if you make the dangerous decision to do so.

| Penalty | 1st DUI | 2nd DUI | 3rd DUI |

|---|---|---|---|

| Fine | $250 base fine | 1 year | 1 year |

| Jail Time | min. 1-10 days | min 30-90 days | min 4 months |

| License Revoked | 90-360 days | $500 base fine | $750 base fine |

In Arizona, if you are convicted of DUI, it will remain on your record for seven years.

As you saw in an earlier section, for most insurance companies, DUIs result in severely increased premiums.

Any time you decide to let loose and have a little fun, plan ahead. Choose a designated driver, or take advantage of the many ridesharing options you have in the state. Don’t drink and drive. Period.

Marijuana-Impaired Driving Laws

Unlike many states, Arizona does have specific marijuana-impaired driving laws on the books. Specifically, the state has zero-tolerance for THC and metabolites.

This means if you are caught driving under the influence of marijuana (i.e. you test positive for any amount of THC and/or metabolites), you will face a suspension of your driver’s license, and if you are convicted of three offenses, you will receive a felony DUI.

Distracted Driving Laws

Have you ever looked at or answered a text while driving? In Arizona, this, along with any hand-holding of your phone, is illegal for all drivers. Additionally, if you are considered a young driver (age 16, or have held an intermediate license for six months or less), all cell phone usage is banned.

Texting and hand-held cell phone usage are primary offenses, which means a law enforcement officer can pull you over and cite you specifically because of your illegal cell phone usage.

Driving Safely in Arizona

While we’ve given you information on laws the Grand Canyon State has put in place to keep you safe, accidents, tragedies, and crimes still occur.

In the following sections, we take a look at places where vehicle theft occurs most often (and what vehicles are most at risk for theft), as well as types and locations of road fatalities in the state.

This information can help you maintain awareness and understand which crime and safety-related factors you may need to consider when looking at your insurance coverage mix.

Vehicle Theft in Arizona

Have you or someone you know ever had a vehicle stolen? The frustration, violation, and hassle you experience in this situation can be overwhelming.

Is vehicle theft a problem in Arizona? What vehicles are most at risk for theft?

This table looks at the top ten most stolen vehicles in the state. Number one is a Honda Accord.

| Rank | Make/Model | Year of Vehicle | Thefts |

|---|---|---|---|

| 1 | Honda Accord | 1997 | 1,072 |

| 2 | Honda Civic | 1998 | 1,016 |

| 3 | Chevrolet Pickup (Full Size) | 2004 | 850 |

| 4 | Ford Pickup (Full Size) | 2006 | 772 |

| 5 | Dodge Pickup (Full Size) | 2001 | 428 |

| 6 | Nissan Altima | 2015 | 269 |

| 7 | GMC Pickup (Full Size) | 2015 | 246 |

| 8 | Toyota Camry | 1999 | 210 |

| 9 | Jeep Cherokee/Grand Cherokee | 1994 | 207 |

| 10 | Nissan Sentra | 2014 | 200 |

If your vehicle made the list, this can be important information to discuss with your insurance company, as they can help you determine what kind of options you may have for additional coverage.

In looking at the above table, keep in mind that the year of the vehicle indicates that in 2016 (the year this data was collected), that year model was the most commonly stolen vehicle in Arizona.

What about vehicle theft across the Grand Canyon State? The FBI collects data on vehicle theft by city and town, which we’ve compiled in the below table.

| City/Town | Population | Thefts |

|---|---|---|

| Apache Junction | 40,672 | 101 |

| Avondale | 84,041 | 234 |

| Buckeye | 67,147 | 64 |

| Bullhead City | 40,039 | 148 |

| Camp Verde | 11,299 | 29 |

| Chandler | 249,355 | 372 |

| Clarkdale | 4,304 | 8 |

| Coolidge | 12,645 | 27 |

| Cottonwood | 12,116 | 24 |

| Douglas | 16,443 | 14 |

| Eagar | 5,001 | 1 |

| El Mirage | 35,611 | 104 |

| Eloy | 17,552 | 28 |

| Flagstaff | 72,388 | 82 |

| Florence | 25,623 | 9 |

| Gilbert | 242,090 | 135 |

| Glendale | 249,273 | 1,163 |

| Globe | 7,349 | 56 |

| Goodyear | 79,419 | 117 |

| Holbrook | 5,077 | 16 |

| Jerome | 457 | 0 |

| Kearny | 2,096 | 3 |

| Kingman | 29,181 | 89 |

| Lake Havasu City | 53,937 | 71 |

| Marana | 45,123 | 38 |

| Maricopa | 47,466 | 44 |

| Mesa | 492,268 | 884 |

| Miami | 1,774 | 6 |

| Nogales | 19,878 | 120 |

| Oro Valley | 44,251 | 14 |

| Page | 7,632 | 18 |

| Paradise Valley | 14,629 | 4 |

| Parker | 3,022 | 9 |

| Patagonia | 872 | 0 |

| Payson | 15,504 | 36 |

| Peoria | 165,889 | 237 |

| Phoenix | 1,644,177 | 7,653 |

| Pima | 2,527 | 3 |

| Pinetop-Lakeside | 4,392 | 5 |

| Prescott | 42,975 | 25 |

| Prescott Valley | 43,891 | 18 |

| Safford | 9,617 | 17 |

| Sahuarita | 29,373 | 15 |

| San Luis | 32,823 | 76 |

| Scottsdale | 251,840 | 246 |

| Show Low | 11,163 | 16 |

| Sierra Vista | 42,859 | 64 |

| Snowflake-Taylor | 10,025 | 16 |

| Somerton | 15,082 | 25 |

| Springerville | 2,000 | 1 |

| St. Johns | 3,581 | 1 |

| Superior | 3,026 | 3 |

| Surprise | 135,345 | 175 |

| Tempe | 186,086 | 473 |

| Thatcher | 5,054 | 0 |

| Tolleson | 7,289 | 70 |

| Tucson | 532,323 | 2,407 |

| Wickenburg | 6,979 | 15 |

| Willcox | 3,471 | 6 |

| Williams | 3,181 | 0 |

| Winslow | 9,764 | 40 |

| Yuma | 95,522 | 219 |

Road Fatalities in Arizona

Despite all the laws enacted to prevent tragedies from occurring, the worst still sometimes happens. This can be the result of a number of factors, including driving under the influence, distracted driving, and even weather and road conditions.

To find out more information about when and where you should be extra prepared on the road, keep reading.

Most fatal highway in Arizona

With an average of around 25 vehicle fatalities each year, I-40 is the most fatal highway in Arizona.

Fatal Crashes by Weather Condition and Light Condition

Weather and light conditions can dramatically affect road safety conditions. Both can be unpredictable and can negatively impact your and other drivers’ visibility, which can have serious consequences.

This table pulls together data to show you how much weather can light conditions can affect driving fatality rates in Arizona (these numbers are from 2017).

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 690 | 140 | 448 | 44 | 1 | 1,323 |

| Rain | 44 | 7 | 39 | 2 | 0 | 92 |

| Snow/Sleet | 3 | 0 | 1 | 0 | 0 | 4 |

| Other | 3 | 1 | 14 | 1 | 0 | 19 |

| Unknown | 1 | 0 | 1 | 0 | 0 | 2 |

| TOTAL | 741 | 148 | 503 | 47 | 1 | 1,440 |

To reduce your chances of being involved in a crash, pay attention to your surroundings and stay focused on the road. Always drive defensively, and make sure to follow the Arizona Basic Speed Law and adjust your speed accordingly when road conditions change.

Fatalities (All Crashes) by County

The NHTSA Crash Report for Arizona provides data on vehicle-caused fatalities by county for 2013 through 2017.

| County | Fatalities 2013 | 2014 | 2015 | 2016 | 2017 | Fatalities per 100K Population 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Apache County | 26 | 18 | 32 | 25 | 24 | 35.97 | 25.08 | 45.08 | 35.03 | 33.52 |

| Cochise County | 13 | 10 | 6 | 21 | 13 | 10.05 | 7.87 | 4.76 | 16.75 | 10.42 |

| Coconino County | 34 | 28 | 41 | 39 | 25 | 24.92 | 20.41 | 29.56 | 27.84 | 17.76 |

| Gila County | 19 | 12 | 18 | 11 | 22 | 35.86 | 22.64 | 34 | 20.64 | 41.12 |

| Graham County | 1 | 4 | 5 | 2 | 6 | 2.67 | 10.51 | 13.23 | 5.3 | 16.01 |

| Greenlee County | 4 | 1 | 0 | 1 | 1 | 44.98 | 10.73 | 0 | 10.39 | 10.58 |

| La Paz County | 9 | 6 | 13 | 12 | 10 | 43.95 | 29.35 | 63.91 | 58.47 | 48.54 |

| Maricopa County | 197 | 206 | 200 | 258 | 246 | 4.92 | 5.05 | 4.81 | 6.09 | 5.71 |

| Mohave County | 31 | 20 | 29 | 24 | 25 | 15.27 | 9.84 | 14.18 | 11.69 | 12.07 |

| Navajo County | 26 | 34 | 17 | 18 | 32 | 24.28 | 31.59 | 15.81 | 16.62 | 29.37 |

| Pima County | 67 | 52 | 62 | 61 | 78 | 6.74 | 5.2 | 6.17 | 6.02 | 7.63 |

| Pinal County | 36 | 20 | 33 | 39 | 31 | 9.37 | 5.08 | 8.17 | 9.39 | 7.21 |

| Santa Cruz County | 4 | 6 | 3 | 3 | 5 | 8.54 | 12.91 | 6.49 | 6.51 | 10.82 |

| Yavapai County | 22 | 26 | 27 | 17 | 33 | 10.27 | 11.95 | 12.24 | 7.58 | 14.46 |

| Yuma County | 15 | 19 | 11 | 10 | 15 | 7.43 | 9.36 | 5.4 | 4.87 | 7.23 |

For all five years, Maricopa County had the highest number of fatalities by a significant margin. However, this is not particularly surprising, given that it is also the most populated county in the state, with over half of the state’s population residing there.

Traffic Fatalities

The NHTSA Crash site pulls together data on the number of fatal crashes in rural versus urban areas for the same 2013-2017 time frame. This information is provided below.

| Traffic Fatalities | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Rural | 337 | 289 | 343 | 335 | 352 |

| Urban | 509 | 482 | 550 | 612 | 647 |

| Total | 846 | 771 | 893 | 947 | 999 |

While it is clear that more crashes occur in urban areas than in rural ones, it is important to always maintain situational awareness when you are driving. Tragedies can happen anywhere.

Fatalities by Person Type

The NHTSA Crash site provides fatality data for Arizona by vehicle occupant type, which is listed in the below table.

| Person Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Passenger Car Occupant | 209 | 216 | 254 | 265 | 250 |

| Light Truck - Pickup Occupant | 116 | 74 | 103 | 101 | 111 |

| Light Truck - Utility Occupant | 100 | 81 | 105 | 113 | 105 |

| Light Truck - Van Occupant | 24 | 20 | 33 | 30 | 22 |

| LIght Truck - Other | 2 | 1 | 0 | 2 | 2 |

| Large Truck | 11 | 9 | 17 | 16 | 19 |

| Other/Unknown Occupants | 46 | 56 | 56 | 55 | 64 |

| Bus Occupant | 0 | 1 | 0 | 0 | 2 |

| Motorcyclists | 151 | 130 | 137 | 146 | 163 |

| Pedestrian | 151 | 142 | 155 | 186 | 216 |

| Bicyclist and Other Cyclist | 31 | 29 | 28 | 31 | 32 |

| Other/Unknown Nonoccupants | 8 | 14 | 9 | 7 | 14 |

| Total | 849 | 773 | 897 | 952 | 1000 |

Fatalities by Crash Type

Arizona data on crash type for 2013 through 2017 is provided by the NHTSA Crash Report.

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Single Vehicle | 506 | 462 | 499 | 542 | 566 |

| Involving a Large Truck | 63 | 67 | 91 | 83 | 94 |

| Involving Speeding | 293 | 255 | 315 | 325 | 299 |

| Involving a Rollover | 259 | 218 | 268 | 294 | 262 |

| Involving a Roadway Departure | 377 | 301 | 379 | 388 | 371 |

| Involving an Intersection (or Intersection Related) | 239 | 212 | 248 | 269 | 272 |

| Total Fatalities (All Crashes) | 849 | 773 | 897 | 952 | 1,000 |

As you can see, speeding can be a big problem, as it is in the top three crash types for the highest number of fatalities.

Five-Year Trend For The Top 10 Counties

The NHTSA Crash Report for Arizona also provides data for the same five years on fatalities in the top ten counties in the Grand Canyon State.

| Rank | County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|

| 1 | Maricopa County | 398 | 367 | 405 | 478 | 471 |

| 2 | Pima County | 96 | 88 | 93 | 111 | 114 |

| 3 | Pinal County | 59 | 45 | 55 | 62 | 71 |

| 4 | Yavapai County | 41 | 42 | 47 | 41 | 55 |

| 5 | Navajo County | 34 | 39 | 43 | 31 | 48 |

| 6 | Coconino County | 40 | 45 | 58 | 50 | 47 |

| 7 | Mohave County | 55 | 29 | 49 | 53 | 44 |

| 8 | Apache County | 28 | 26 | 49 | 35 | 42 |

| 9 | Gila County | 23 | 17 | 31 | 19 | 27 |

| 10 | Yuma County | 24 | 33 | 16 | 18 | 26 |

As you can see, about half of the counties in Arizona experienced an increase in fatalities over the five-year timeframe. The remaining counties either had a decrease in the number of fatalities for the five years or remained about the same, with some spikes in 2015 and 2017.

Fatalities Involving Speeding by County

You already know speeding is a problem and can have tragic consequences. The Arizona NHTSA Crash Report takes a look at speeding fatalities between 2013 and 2017.

| County | Fatalities 2013 | 2014 | 2015 | 2016 | 2017 | Fatalities per 100K Population 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Apache County | 13 | 3 | 18 | 12 | 6 | 17.98 | 4.18 | 25.36 | 16.81 | 8.38 |

| Cochise County | 9 | 6 | 6 | 11 | 4 | 6.96 | 4.72 | 4.76 | 8.78 | 3.21 |

| Coconino County | 11 | 18 | 17 | 18 | 10 | 8.06 | 13.12 | 12.26 | 12.85 | 7.1 |

| Gila County | 11 | 7 | 13 | 8 | 8 | 20.76 | 13.21 | 24.56 | 15.01 | 14.95 |

| Graham County | 1 | 7 | 2 | 2 | 4 | 2.67 | 18.39 | 5.29 | 5.3 | 10.68 |

| Greenlee County | 2 | 1 | 0 | 1 | 0 | 22.49 | 10.73 | 0 | 10.39 | 0 |

| La Paz County | 4 | 3 | 12 | 5 | 8 | 19.53 | 14.68 | 58.99 | 24.36 | 38.83 |

| Maricopa County | 111 | 111 | 132 | 148 | 128 | 2.77 | 2.72 | 3.18 | 3.5 | 2.97 |

| Mohave County | 28 | 9 | 26 | 21 | 17 | 13.79 | 4.43 | 12.71 | 10.22 | 8.2 |

| Navajo County | 13 | 15 | 10 | 5 | 21 | 12.14 | 13.94 | 9.3 | 4.62 | 19.27 |

| Pima County | 38 | 27 | 33 | 45 | 36 | 3.82 | 2.7 | 3.28 | 4.44 | 3.52 |

| Pinal County | 24 | 17 | 16 | 24 | 21 | 6.25 | 4.31 | 3.96 | 5.78 | 4.88 |

| Santa Cruz County | 5 | 5 | 0 | 2 | 2 | 10.67 | 10.76 | 0 | 4.34 | 4.33 |

| Yavapai County | 14 | 14 | 22 | 17 | 25 | 6.54 | 6.44 | 9.97 | 7.58 | 10.96 |

| Yuma County | 9 | 12 | 8 | 6 | 9 | 4.46 | 5.91 | 3.93 | 2.92 | 4.34 |

You should always follow the posted speed limits, but you should be especially focused on driving defensively in Maricopa County.

Fatalities in Crashes Involving an Alcohol-Impaired Driver by County

The Arizona NHTSA Crash Report provides data on alcohol-related vehicle fatalities for 2013 through 2017.

| County | Fatalities 2013 | 2014 | 2015 | 2016 | 2017 | Fatalities per 100K Population 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Apache County | 11 | 7 | 22 | 15 | 14 | 15.22 | 9.75 | 31 | 21.02 | 19.55 |

| Cochise County | 6 | 5 | 6 | 5 | 8 | 4.64 | 3.94 | 4.76 | 3.99 | 6.41 |

| Coconino County | 10 | 17 | 15 | 8 | 18 | 7.33 | 12.39 | 10.82 | 5.71 | 12.79 |

| Gila County | 7 | 5 | 11 | 4 | 9 | 13.21 | 9.43 | 20.78 | 7.51 | 16.82 |

| Graham County | 2 | 4 | 2 | 5 | 2 | 5.34 | 10.51 | 5.29 | 13.24 | 5.34 |

| Greenlee County | 2 | 0 | 0 | 1 | 1 | 22.49 | 0 | 0 | 10.39 | 10.58 |

| La Paz County | 2 | 1 | 2 | 3 | 3 | 9.77 | 4.89 | 9.83 | 14.62 | 14.56 |

| Maricopa County | 97 | 77 | 115 | 128 | 131 | 2.42 | 1.89 | 2.77 | 3.02 | 3.04 |

| Mohave County | 12 | 6 | 12 | 14 | 14 | 5.91 | 2.95 | 5.87 | 6.82 | 6.76 |

| Navajo County | 11 | 10 | 15 | 7 | 14 | 10.27 | 9.29 | 13.95 | 6.46 | 12.85 |

| Pima County | 29 | 25 | 32 | 24 | 33 | 2.92 | 2.5 | 3.18 | 2.37 | 3.23 |

| Pinal County | 14 | 18 | 18 | 16 | 14 | 3.64 | 4.57 | 4.45 | 3.85 | 3.25 |

| Santa Cruz County | 3 | 3 | 1 | 0 | 1 | 6.4 | 6.46 | 2.16 | 0 | 2.16 |

| Yavapai County | 10 | 10 | 10 | 5 | 9 | 4.67 | 4.6 | 4.53 | 2.23 | 3.94 |

| Yuma County | 7 | 11 | 5 | 5 | 6 | 3.47 | 5.42 | 2.46 | 2.43 | 2.89 |

As with speeding, the county in which you should pay the most attention is Maricopa.

Teen Drinking and Driving

It is not legal to drink in Arizona until you turn 21. That doesn’t mean residents under the age of 21 don’t drink, however. On average, there are 1.6 underage alcohol-related driving fatalities per 100,000 people.

According to the FBI, Arizona ranks 14th in the nation for teen drinking and driving, with an average of 211 DUI arrests for drivers under the age of 18.

Arizona practices a zero-tolerance policy for underage drinking and driving. While the legal BAC is 0.08, if an underage driver is stopped by law enforcement on suspicion of drinking and driving and is found to have any amount of alcohol in their system, they can be cited for DUI.

If an underage driver is convicted of DUI, a first offense comes with at least 24 hours in jail (all the way up to 10 days), a $1,600 fine, and a driver’s license suspension of between 90 and 360 days.

A second offense will result in at least 30 days in jail, a fine of $2,500, and a driver’s license suspension of one year.

EMS Response Time

If tragedy does strike, you’ll want to know the emergency response will be onsite in time. The NHTSA Traffic Safety report provides information on average rural and urban response times in Arizona.

| Region Type | Average Time of crash to EMS notification | Average EMS notification to EMS arrival | Average EMS arrival at scene to hospital arrival | average time of crash to hospital arrival | total fatal crashes |

|---|---|---|---|---|---|

| Rural | 3.47 | 16.1 | 54.39 | 67.33 | 304 |

| Urban | 1.69 | 6.02 | 22.99 | 30.21 | 614 |

The rural response times are at least twice as long as those for urban areas. For the initial response, the average for urban areas is 1.69 minutes, compared to rural areas where the average is 3.47 minutes.

However, it is important to note that these response times are dependent on a number of factors including coverage area, weather, and road conditions.

Transportation in Arizona

Do Arizona drivers spend more time in personal vehicles or using alternative forms of transportation? How much time do residents spend on their commute everyday? These, as you already know, are among some of the key factors insurance companies consider when adjusting rates.

Let’s take a look at statewide data, compared to national data, for car ownership, commute times, and transportation types in Arizona, as well as the kind of traffic congestion you can expect when you drive in the state.

Car Ownership

According to Data USA, Arizona residents owned an average of two vehicles, which is equal to the national average.

This graph depicts Arizona averages in orange, while the grey represents averages across the nation. This allows you to compare how residents of Arizona stack up against people across the United States.

Commute Time

In Arizona, drivers spend an average of 24 minutes commuting each day, which is 1.5 minutes less than the national average of 25.5 minutes for commuting.

Commuter Transportation

What does transportation look like in the Grand Canyon State? Do residents prefer alternative transportation, or would they rather drive alone?

Like much of the United States, Arizona drivers love the independence of driving their own vehicles, with 76.5 percent choosing to drive alone (the national average is 76.4 percent), as compared to only 11 percent choosing to carpool, 6.28 percent working at home, and 1.8 percent making use of public transportation.

Traffic Congestion

Traffic is the bane of every driver’s existence. Everyone deals with it, but no one likes it.